- Industry Development

- Workforce Development

- Member Login

- Corporate Network

- News & Media

- Annual Reviews

- Subscribe to Newsletter

- Accreditation

- Accessible Tourism program

- Camp and Adventure Accreditation program

- Risk Management program

- Star Ratings program

- Tourism Emissions Reduction program

- Committees & Advisory Groups

- Policy & Research

- Tourism Week

- Salute to Excellence Awards

- DestinationQ

- Destination IQ

- Indigenous Tourism

- First Nations Tourism Plan

- Indigenous Champions Network

- Queensland First Nations Tourism Council

- Best Practice Guide for Working with First Nations Tourism

- Business Capability Programs

- Business Resources

- Tourism Business Digital Adaption Program

- Sustainability & Resilience

- Grants Gateway

- Letter of support request

- Queensland Tourism Awards

- Australian Tourism Awards

- Previous Award Winners

- Gala Awards Ceremony

- How to Enter

- Award Categories

- Tourism Careers

- Initiatives and Resources

- Regional Tourism Careers Roadshow

- Registered Trade Skills Pathway program

- Industry Workforce Advisor

- Young Professionals Mentoring Program

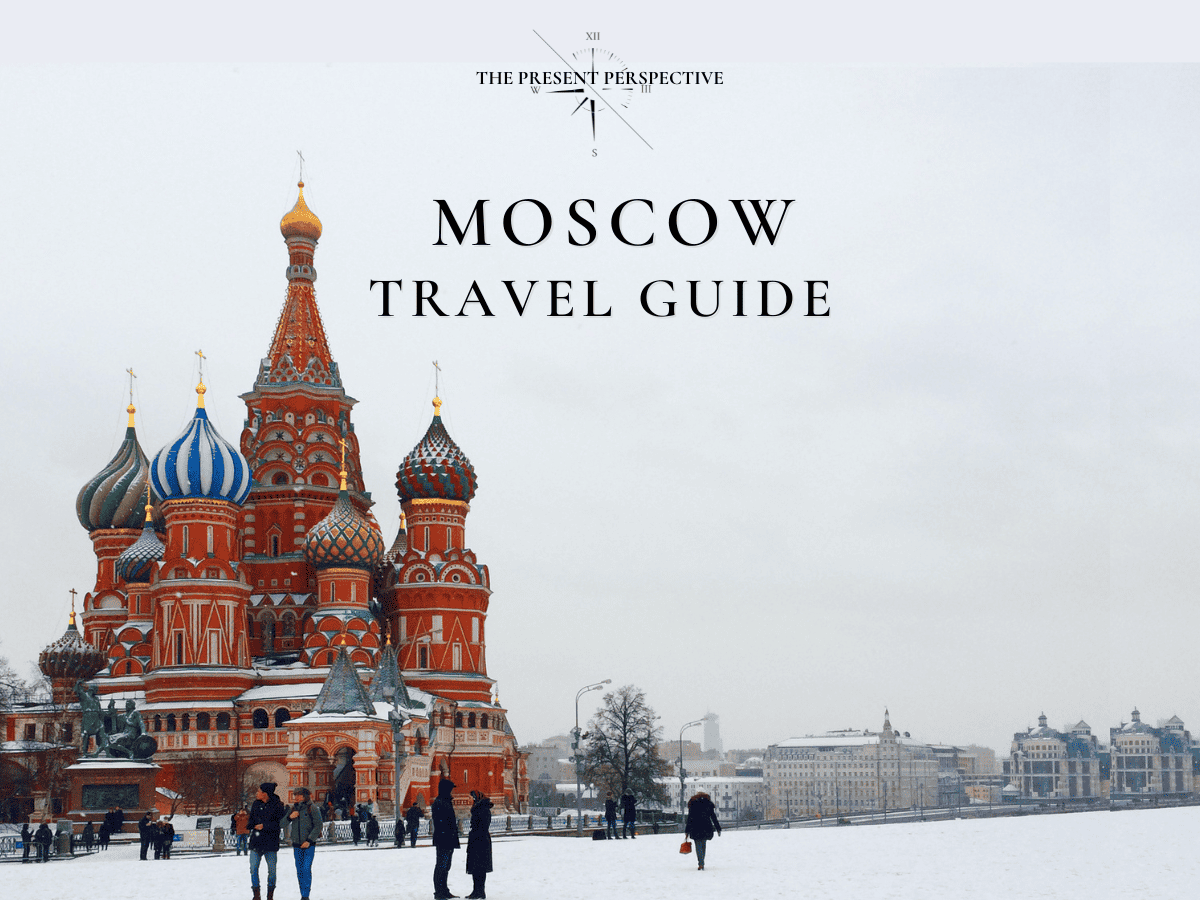

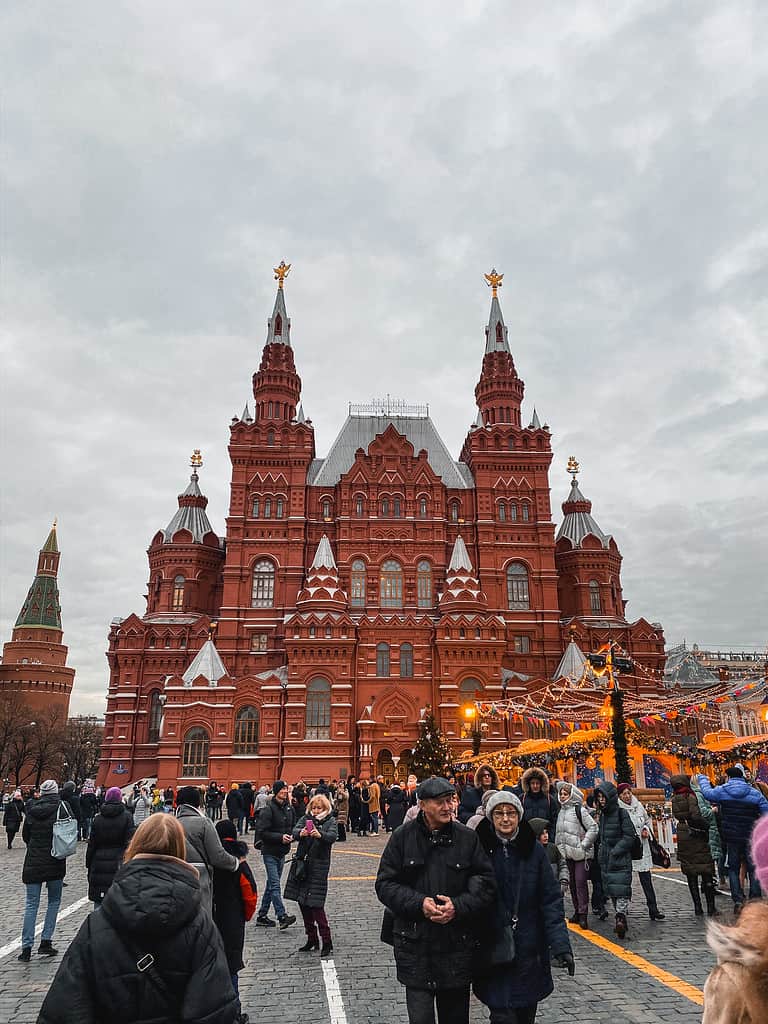

What is Star Ratings?

What do the Star Ratings mean?

Star Ratings stand for independently reviewed quality standards and are easily defined and identified:

In addition to receiving increased credibility, competitiveness and reputation, internationally recognised Star Ratings accredited properties enjoy a range of valuable benefits.

- License to use the registered Star Ratings trademarked symbols, which properties can use on their own marketing channels.

- Receive free access to a personalised ReviewPro online dashboard, valued at $1,000 AUD. The dashboard allows properties to manage their reputation and guest reviews across all major online review systems and social media platforms in one online location.

- Recognition for points in Tourism and Events Queensland’s Best of Queensland Experiences Program .

- Recognition of a property’s Star Ratings accreditation through the Australian Tourism Data Warehouse .

- Inclusion of a property within the Australian Tourism Industry Council’s Star Rated properties nationwide advertising campaigns.

- Receive a free property listing on starratings.com.au and on trustthetick.com.au – both listings support direct guest bookings.

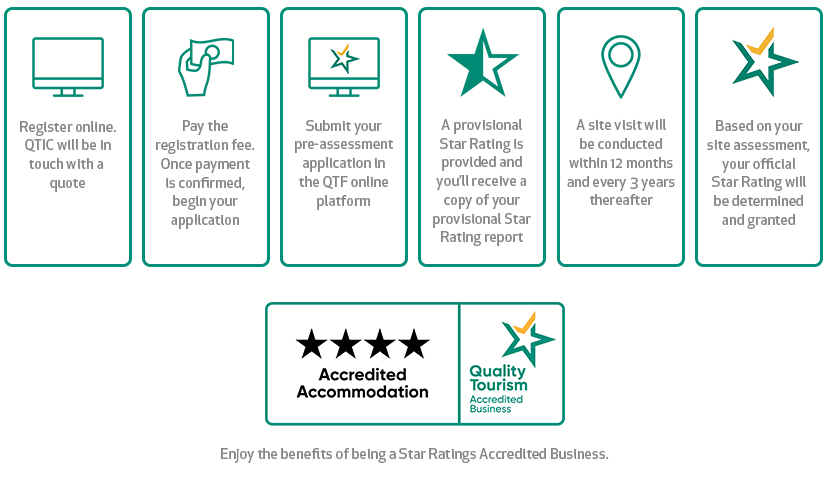

What does the process involve?

Want more information?

Star Ratings – Are they still relevant?

26 February 2024

When motel leases were first introduced in the 90’s, the star rating was a very relevant consideration. The AAA scheme was originally owned by the Australian Motoring Clubs and had been in operation since the 1950’s. It was recognised as Australia’s only independent, accredited accommodation scheme, and was seen as an independent assessment of how the property was being maintained. Many landlords were satisfied with the maintenance of their property, where a certain star rating was being achieved.

Times started to change with the increase in the digital world and the rise of various online review platforms, and subsequently the AAA rating system ceased to operate. In 2017, the Australian Tourism Council took over the star rating scheme and continues to operate as Star Ratings Australia.

Why is this relevant?

Most motel leases will still have an obligation to:

- maintain a certain star rating;

- arrange an inspection every 12 months;

- comply with the AAA inspection report; and

- provide a copy of that report to the landlord.

Usually the definition of AAA star rating will include any successors of the AAA, and Star Ratings Australia is generally accepted to be the successor of AAA.

Under Star Ratings Australia, the system was changed significantly and moteliers need to be a member of Star Ratings Australia to be part of the program. When first joining Star Ratings Australia there will be an initial inspection and then a site visit every 3 years thereafter. This is much less frequent than the reports prepared historically by AAA.

It may simply not be possible to comply with these lease obligations due to the change in the system, or it may be that the star rating system is not as relevant as it used to be for your motel.

It is also important to understand that the actual ‘star’ symbols are a licensed trademark and can only be used by properties that have been licensed to use them by the Australian Tourism Industry Council (ATIC).

Whilst many landlords are understanding of the changes, any incoming purchaser (and their financier) will want to see the lease amended and updated to ensure that they are not walking into a situation where they could technically be in breach of the lease from day one.

Maintenance and Redecoration

Historically, the star rating system was a guide of maintenance and redecoration for both landlords and tenants to ensure that the property was kept well maintained and refurbished. With the less frequent inspections, it is important that both landlords and tenants consider if their maintenance and redecorate clauses in their lease are still achieving what they are intended to achieve.

Often, older motel leases will provide that where the star rating ceases to exist and there is no alternative rating classification scheme, then the tenant must:

- at reasonable times, redecorate the motel;

- paint, repaint, re-cover, clean etc the interior and exterior of the building; and

- maintain the gardens and landscaping (which could include restoring and replacing).

New leases will require these tasks to be attended to at reasonable times throughout the term of the lease.

Often these types of works are done by tenants on an ad hoc basis or a rolling schedule, rather than in one big job. It is worthwhile checking to ensure that if you have any such “redecoration” obligations, you know what needs to be done and by when.

Key takeaways

If you haven’t read your lease lately then we strongly suggest that you do. If there is anything at all that you don’t understand then please ask us. A small investment of time now could save many hours – and potentially a lot of money – in the future.

After your own review of the lease, you may find that it is an opportune time to check in with your landlord and have a discussion about some possible updates. This can only be done with the agreement of both parties, however in our experience, it is much easier to reach an amicable agreement when the goal is to update the lease so that it serves the interests of both parties. This is certainly easier to do in times of peace than in the heat of a battle arguing about who needs to do what, or with the pressure of a sale.

As each lease and business situation will be different, please take our comments as general guidance and contact Mahoneys to obtain timely and practical legal advice on the actual issues you are facing.

Written by Amy ODonnell

Previous Article

Next Article

Level 18, 167 Eagle Street Brisbane QLD 4000 GPO Box 3311 Brisbane QLD 4001

P: 07 3007 3777 F: 07 3007 3778 Contact Us

Level 2, 235 Varsity Parade Varsity Lakes QLD 4227 PO Box 482 Varsity Lakes QLD 4227

P: 07 5562 2959 F: 07 5575 7803 Contact Us

- News & Insights

- Newsletters

"Liability limited by a scheme approved under Professional Standards Legislation"

© 2024 Mahoneys | Privacy Policy | Sitemap

Hotel Management

AAA Tourism to close, Star Ratings stays

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

It remains ‘business as usual’ for Star Ratings in Australia, despite the dissolution of Club Tourism, a joint-venture between AA Tourism in New Zealand and AAA Tourism in Australia.

A result of the dissolution, AAA Tourism will cease operations on December 31, 2013, with the Australian assets transferring to Australian Motoring Services (AMS) on behalf of the Australian Auto Clubs, including Star Ratings.

“AMS will assume management of the Star Ratings scheme in Australia on behalf of the Australian Auto Clubs,” Club Tourism CEO, Moira Penman, said in a letter to the industry.

“From January 1, 2014, Star Ratings will operate as a stand-alone accreditation business with a focus on producing independent and reliable accommodation ratings,” she said.

When contacted by HM , AAA Tourism was unable to comment on the changes, however, it was conveyed that it remains “business as usual” for the Star Ratings scheme going forward.

Penman said the dissolution to dissolve the joint venture was “the result of a number of factors, such as the rapid expansion of digital media channels in the travel and tourism sector and declining print advertising revenues for accommodation guide books”.

“The decision to wind-up CTP Australian publishing operations and the AAA Tourism business has not been taken lightly and is the result of considered analysis by the CTP board, partners and management,” she said.

HM understands around 30 jobs will go as a result of the closure of AAA Tourism, a figured not confirmed by the organisation.

James Wilkinson

Editor-In-Chief, Hotel Management More by James Wilkinson

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Conventus Law

More results...

Australia – A Legal Guide On The Hotels, Leisure & Gaming Industry.

August 9, 2017 by Conventus Law

9 August, 2017

Australia’s tourism industry is one of the largest in the world. Tourism is Australia’s largest services export and it contributes approximately A$35 billion to the country’s Gross Domestic Product. The Australian tourism industry spans across a range of sectors including luxury resorts, casinos, nature retreats, theme parks, short-term accommodation, travel agents, transport companies, retail, and education providers. This publication provides an overview of the business, legal and policy issues relating to foreign investment in tourism assets as well as particular legal issues associated with investments into the hospitality industry and the gaming industry.

Overview of the tourism investment market

Investment Market

Australia’s proximity to expanding Asian markets has enabled it to capitalise on the increasing demand for unique tourism destinations from consumers in the AsiaPacific region.

In the past five years, offshore investment into the Australian tourism industry has been on a steady increase. During 2013, Asian investors’ interests in Australian tourism assets grew rapidly as evidenced by the completion of a number of large hotel transactions involving Asian investors.

Strong investment conditions comprising of stable and consistent consumer demand, a stable economy, a transparent legal system and a secure political environment have made and will continue to make Australian tourism assets appealing investment options for offshore investors.

Government Policy

National Strategy – Tourism 2020

The Australian Government’s publication Tourism 2020 sets out its national strategy to enhance the growth and competitiveness of the tourism industry. The policy aims to accelerate the growth of tourism and tourism investment in Australia by focusing on the following six strategic areas:

- growing demand from Asia;

- building competitive digital capability;

- encouraging investment and implementing a regulatory reform agenda;

- ensuring the tourism transport environment supports growth;

- increasing supply of labour, skills and Indigenous participation; and

- building industry resilience, productivity and quality.

As part of the Tourism 2020 initiative, some of the more specific commitments the Australian Government is working towards include:

- reducing barriers to investment in the tourism industry;

- improving levels of investment facilitation by State and Territory governments;

- facilitating the increase of international and domestic airline seats on a sustainable basis; and

- increasing the supply of labour in the tourism industry.

Government Objectives

The Australian Government has announced that it aims to achieve more than $115-$140 billion in overnight visitor expenditure by 2020 (up from $70 billion in 2009) by:

- undertaking high impact, effective and coordinated international tourism marketing campaigns;

- facilitating the existing development pipeline to deliver quality rooms to meet the target of 6,000 to 20,000 new rooms by 2020;

- increasing international and domestic aviation capacity to create an additional 1.9 million inbound seats (as at March 2016) by 2020; and

- employing an additional 152,000 persons by 2020 to meet increasing demand.

Tourism Australia shares this goal with the Australian tourism industry and federal, state and territory governments in an effort to maximise tourism’s economic contribution to Australia.

Hotels

According to JLL, over the past five years, capital inflows from foreign investors account for more than 50% of the capital invested in the hotel investment market. These capital contributions were primarily sourced from Asia, in particular Singapore, Hong Kong and Malaysia, with growing investor interest from China. Offshore investment interest has mainly been concerned with hotel acquisitions and hotel developments.

The attractiveness of hotel investment in Australia is illustrated by the diagram below. More specifically, the diagram shows the relative performance of the hotel industry, as compared with other property investments in Australia.

Please click on the graph to enlarge.

Development of new hotels has generally proceeded proportionally to the existing distribution. The graph below shows the supply forecast for the hotel industry, with high rates of development currently in Sydney, Melbourne, Brisbane and Hobart.

Please click on the image to enlarge.

Hotels are a distinct class of accommodation asset which can be broadly categorised into three types:

- traditional hotels and motels;

- resorts; and

- serviced apartments.

Rating systems which can be used by Australian hotels are governed by the AAA Tourism STAR Rating Scheme.

Under the STAR Rating Scheme, hotels are rated between 1 to 5 stars based upon a hotel’s compliance with the hotel standards established by AAA Tourism.

The hotel sector is one of the most highly regulated areas compared to other business sectors. Each State and Territory has different legislation and different policies governing liquor licensing, gambling, food hygiene, safety/security and planning in relation to hotels. The following sections provide guidance on a number of legal issues a foreign investor should be aware of when considering hotel investments in Australia.

Hotel Transaction Process

While a hotel transaction involves the acquisition of property in most cases, it is far more complex than a typical property sale. The diagram below shows the typical transaction process for a hotel sale from a buyer’s perspective and the legal issues and steps to be taken at each stage of the transaction process (these are further discussed below). It should be noted that a hotel sale transaction can be by way of an asset sale or a share sale. An asset sale involves only the transfer of the physical hotel and the business assets to a purchaser. A hotel acquisition by way of a share sale, on the other hand, involves buying the shares in the entity holding the relevant hotel asset.

Depending on which method of sale is proposed, different legal issues will arise (for example, only a share sale will require the purchaser to take on any liabilities, including tax liabilities, of the entity in which it seeks to acquire shares, which were accrued prior to the purchase of the hotel).

To be assisted through each stage of the transaction process, an investor should engage consultants with adequate experience and specialised knowledge of the hotel and tourism industry. This step should be undertaken at the beginning of the transaction process before any action is undertaken as a strong team of consultants is essential to ensuring a successful transaction. The diagram below shows a typical team of consultants that an investor may appoint at the beginning of a transaction.

Hotel Development

Not all hotel investments in Australia have been in the form of a purchase of an existing hotel. Over the years there has been a steady interest in hotel development where investors either acquire vacant sites for development into hotels or mixed-use developments, or acquire existing commercial or office buildings for conversion into hotels.

Some key issues and trends in relation to hotel developments are addressed in the following sections.

Environmental and planning laws in Australia have many complexities. There is no uniform national planning system in Australia. Each State and Territory has its own legislation and administrative departments for regulating the use and development of land within its jurisdiction. Within each State and Territory, there are regulatory frameworks and policies at both the state level as well as the local government level. For example, in NSW the legislation permits local governments and the state government to each create environmental planning instruments (EPIs) to regulate the development of land in matters within their control.

In addition to the development control framework in each State and Territory, the federal government also imposes obligations on developers in relation to issues of national significance (for example, approval is required where a development will have or likely have a significant impact on World Heritage areas or threatened or migratory species). Similar to the regimes in each State and Territory, there are also defined processes for obtaining development approvals from the federal government.

Land use is controlled at the broadest level by the division of land into “zones”. Depending on the zoning of land, a particular development may be permitted without regulatory approval, only permitted with regulatory approval, or prohibited. For example, land in an urban area may be zoned “residential” and only certain kinds of dwellings and associated infrastructure may be permissible with development consent from the applicable local government.

While there are similarities between development control processes in each State and Territory, there will also be significant procedural differences. It is recommended that a foreign investor be aware of all the development approvals and processes (at the State level and federal level) required before committing to a development proposal.

Office Conversion

In recent times, investors faced with limited hotel investment opportunities have turned to the option of converting well located office buildings to hotel accommodation. Investors interested in exploring office conversion options should obtain advice in relation to real estate law and environmental and planning law in the relevant jurisdiction.

Mixed Use Developments

Given the significant emphasis placed by foreign investors on investment return and growth potential, many investors have ventured outside the traditional hotel development and instead have turned to mixed use developments. Mixed use developments are developments which involve any combination of residential, commercial (including hotel) or retail land uses. For investors, mixed use projects are generally considered to bring higher returns, spread risk and generate synergies between uses.

Strata-Titled Developments

Strata-titled hotel developments emerged in response to investors’ needs for flexible funding options, and have become particularly popular in many tourism destinations around Australia. Strata-titled developments involve the division of land or property into multiple parcels to permit independent ownership of the divided parcels. Generally the individual strata units in a hotel are sold to individual investors and then leased back to the developer/ operator to be managed and operated as a hotel. This form of development is particularly relevant for serviced apartment development (which is a form of mixed use development involving commercial accommodation use and residential use). As an alternative to the traditional debt and equity financing structure, strata-titled developments permit a developer or investor to attract capital from small, medium and large investors.

The legal frameworks relating to strata-titled properties differ across Australia. This factor can be an inhibiting issue in the pursuit of large Australia-wide operations by developers, body corporate service providers and other key players in the industry.

Hotel Structures

There are a number of ownership structures that can be adopted by a hotel owner to deal with the management and operation of a hotel. The following sections will briefly explain the features and key issues affecting a hotel operated under a management agreement, franchise agreement and a management lease.

Hotel Management Agreement

A hotel management agreement is the most common form of hotel operating structure. A management agreement is an agreement between the hotel owner and the hotel management company, under which the hotel owner appoints the hotel management company to manage and operate the hotel for and on behalf of the hotel owner. Under a management agreement arrangement in Australia, the operator is responsible for managing the day to day running of the hotel while the hotel owner is responsible for providing capital and employing the employees.

The operator is usually paid a management fee which is calculated by reference to the gross revenue and/or profit of the hotel.

Hotel Franchise Agreement

A hotel franchise agreement has many of the essential features of a hotel management agreement. However a key difference with a franchise arrangement is that the hotel owner, as a franchisee, also acts as the operator of the hotel and the franchisor has very little day to day management of the hotel business. Under a franchise arrangement, the hotel owner pays a fee to the franchisor in return for the franchisor’s business system and branding. These arrangements are generally more appropriate where the hotel owner is interested in adopting a working business model but not willing to give up control of the operation of the hotel business.

Hotel Management Lease

A management lease is a hybrid arrangement combining many of the terms usually contained within a lease and a management agreement. However, unlike a management agreement or a franchise arrangement, the hotel owner does not have an interest in the hotel business other than through the payment of rent. Under the arrangement, the hotel owner owns the land and the improvements of the hotel building. The hotel owner leases the land to the operator who manages the hotel business on its own behalf. While, subject to the rent structure, the hotel owner is less exposed to the risk of the business, a management lease is not a typical arrangement for managing a hotel in Australia.

The table below identifies some of the key features and responsibilities of parties in each of the hotel ownership structures outlined above.

Please click on the table to enlarge.

Key Terms of Operating Agreements

A summary of some of the key terms for each hotel ownership arrangement is set out in the table below.

The gambling industry is a heavily regulated sector in Australia. Each State and Territory implements a number of distinct laws, and establishes regulatory authorities and policies for governing this area. Despite this, investment in the sector has grown and in recent years this sector has received increased attention from investors.

Forms of Legal Gambling

Legal gambling in Australia can be categorised as follows:

- Gaming – which comprises all legal forms of gambling (other than wagering), including:

- electronic gaming machines (EGMs);

- keno; and table games;

- sports betting; and

- race betting.

In Australia, gambling revenue is primarily dominated by gaming. In the past five years, revenue from EGMs in clubs and hotels has accounted for around 50% of gross profits from gambling operators in the industry. Revenue from casinos account for around 20% and wagering for around 15% of gross profits of gambling operators. The following sections will provide a brief overview of the electronic gaming machines market, casino market and wagering market.

Electronic Gaming Machines

In each of the States and Territories legislation and authorities regulate almost every aspect of business activity relating to EGMs. There are stringent licensing processes which apply to businesses wishing to operate in the industry with different licences needed in order to manufacture, supply, transfer, service, own or hold, and operate gaming machines in each jurisdiction. Additionally, for some States and Territories, there are caps and limits on the number of EGMs which may be operated within the State or Territory.

As at June 2017, the Australian casino industry comprises 13 casinos (noting that the development of the Queens Wharf Casino in Brisbane and Crown Restricted Gaming Facility in Sydney is under way). In addition to the existing casinos, there are also a number of proposals which relate to the development of new integrated resorts with casino features.

The operation of casinos involves a complex regime of policies, regulations and fees and there are in some jurisdictions restrictions on foreign ownership of casinos. For example, in Western Australia legislation limits foreign ownership of a casino licensee to 40%.

The profitable nature of a casino business has underpinned growing interest in integrated resort developments. Foreign investors considering investment into casinos should note that a casino’s revenue source include EGMs, table games and international VIP programs.

Australia has a number of wagering and betting service providers, some of which have been recently purchased by foreign investors. These betting agencies generally act as sports and racing bookmakers, and providers of online wagering. While the legislative framework for wagering is statebased, the provision of online wagering services has changed the dynamics of the industry significantly. In particular, many betting agencies are now able to provide services to individuals in another jurisdiction without obtaining separate licences in that second jurisdiction.

Taxes related to gaming and wagering are regulated separately by each jurisdiction and are dependent upon the type of gaming and wagering conducted. It is important for investors to be aware of the tax obligations associated with the operation of gambling services.

Given the recent developments and growth in foreign investment in Australian tourism assets and the Australian Government’s commitment to supporting the growth of tourism investment in Australia, the Australian tourism industry will continue to be an area of international focus. For Chinese investors and institutions proposing to invest in the industry, it is recommended that steps be undertaken to understand the unique and complex commercial, legal and policy issues affecting relevant investment. Advice should be sought from professionals and consultants with specialised knowledge in this industry

Interactive Gaming

Interactive and internet gaming is regulated under State and Territory legislation as well as federal legislation, which regulates interactive and internet gaming occurring both within Australia and extraterritorially.

The diagram below provides a useful summary of what types of gaming are considered to be “interactive gambling services” under the federal legislative framework.

Liquor licensing

One of the complex issues that can arise in a hotel transaction is in relation to a hotel’s liquor licence. While the operation of a hotel’s accommodation business does not require a licence, a liquor licence is required if a hotel’s business will involve the sale and supply of alcohol for consumption.

The sale and supply of liquor is regulated by each State and Territory, through its own legislation, regulatory authority and licensing framework. While there are similarities between the regulatory framework in each State and Territory, the framework in each operates independently. Generally the decision to grant a liquor licence is based on an assessment of the overall social impact of the hotel.

In some States, for example NSW, a hotel licence may also enable gaming machines to be operated where separate approval has been granted.

One of the most important questions an investor should ask when entering into a transaction to purchase a hotel is: who holds the beneficial interest in the hotel’s liquor licence and how can this be effectively transferred to the hotel purchaser? There may be different answers to this question depending on the licensing framework and hotel structure that has been adopted by the hotel owner and operator (see information on hotel structures).

Furthermore, the approval process of the relevant licensing authority may also complicate, if not cause delay to, a hotel transaction. In some jurisdictions, there are disclosure requirements imposed by the licensing authority which require personal and confidential details of the incoming hotel owner and directors. In order to ensure that the hotel business as a whole is successfully transferred to the buyer, due diligence must be conducted in the early stages of a transaction so that appropriate measures can be taken to transfer the hotel’s liquor licence to the buyer.

Key transactional issues

There are various key issues introduced into transactions which involve properties that are the subject of a liquor licence. Some of these critical issues include:

- key due diligence issues

- achieving provisional approval as a condition precedent

- extent of probity and disclosure obligations state to state

- approval of management agreements in applicable jurisdictions

- approved manager or nominee requirements

- other compliance issues.

Foreign investment

The general policies and regulatory requirements which apply to foreign investment in Australia under the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA) also regulate foreign investment in Australian tourism assets. Generally for foreign investment in Australia, an application must be made to the Foreign Investment Review Board (FIRB) prior to a foreign person obtaining an interest in Australian land (unless a relevant exemption applies).

From 1 December 2015, changes to FATA and the Foreign Acquisitions and Takeovers Regulation 2015 (Cth)(Regulations) commenced. On the same day, the Foreign Acquisitions and Takeovers Imposition Fees Act 2015 (Cth)and the Register of Foreign Ownership of Agricultural Land Act 2015 (Cth) also came into effect (collectively, the Framework).

The Framework introduced new thresholds for notifiable actions based on both the type of acquisition and the nature of the foreign person seeking to invest. The Framework also introduced record keeping and reporting obligations, applications fees and penalties for non-compliance.

Relevant actions under the Framework are classified as either significant actions or notifiable actions. Actions that are notifiable must be notified and significant actions may be, but are not required to be notified to FIRB. Significant actions and notifiable actions include acquisitions of the types of interests set out in the table below, where the relevant threshold test is met.

Interests in Australian land may be significant or notifiable. An interest in Australian land includes:

- a legal or equitable interest in Australian land;

- an interest in a security in an entity that owns Australian land, being a security that entitles the holder to a right to occupy a flat or home unit situated on the land;

- an interest as lessee or licensee in a lease or licence giving rights to occupy Australian land if the term (including extension or renewal) is reasonably likely to exceed 5 years;

- an interest in an agreement involving the sharing of profits or income from the use of, or dealings in, Australian land if the term of the agreement (including extension or renewal) is reasonably likely to exceed 5 years;

- an interest in a share in an Australian land corporation or agricultural land corporation;

- an interest in a unit in an Australian land trust or agricultural land trust; and

- if the trustee of an Australian land trust or agricultural land trust is a corporation – an interest in a share in

- that corporation.

Categories of the Australian Land

In respect of interests in Australian land, the table below sets out the categories of Australian land:

Examples of Notifiable Actions

In addition to the previous table, the table below sets out the types of acquisitions and arrangements in the tourism industry which are subject to the FATA.

Monetary Thresholds

Monetary screening thresholds are indexed annually on 1 January using the GDP implicit price deflator (except for the $15 million agricultural land threshold and the $50 million land threshold for Singapore and Thailand investors, which are not indexed). The below table is current as at June 2017.

* All such actions are notifiable where the person taking the action is a foreign government investor.

** To obtain the benefit of this increased threshold, the investor cannot be a wholly owned Australian subsidiary.

Contacts or Binding Documentation

Contracts or binding documentation entered into by foreign investors in relation to any of the above transactions must be made conditional upon the Treasurer’s approval (unless approval has already been granted or a no objection letter has been obtained). Contracts should provide for a minimum 40 days from the date of lodgement for a decision from the Treasurer.

Decision to Approve or Object

In deciding whether to approve or object to a foreign investor’s proposed transaction, the Treasurer assesses whether the proposed transaction is contrary to the national interest. FIRB has previously reported that the following factors are normally assessed in respect of each proposed transaction, on a case by case basis:

- national security;

- competition;

- impact on other Government policies (including taxation); and

- impact on the economy and the community and the character of the investor.

The Treasurer is entitled under the FATA to impose conditions when approving a proposed transaction (for example, time periods for the commencement and completion of construction or development works in relation to a proposal to acquire vacant land for development into a hotel). More recently, conditions are increasingly being imposed on foreign government related investors.

Exemption Certificate

Section 58 of the (Cth) allows a foreign person to apply for an exemption certificate in relation to acquisitions of one or more interests in Australian land. Applications are considered on a case-by-case basis to ensure that they are not contrary to the national interest.

An exemption certificate will typically specify the maximum value of interests that can be acquired and the period during which acquisitions can be made.

Application Fees

Fees (which are indexed each financial year) apply to applications and must be paid before an application will be considered by FIRB. The fee payable by an applicant depends on the type and value of the proposed investment and are non-refundable if an application is rejected.

More information about fees can be found on the FIRB website: https://firb.gov.au/applications/fees-2016-17/

Tax Conditions

In February 2016, the Treasurer announced that “standard conditions” would be imposed on foreign investment approvals to ensure multinational companies investing in Australia pay tax in Australian on their Australian earnings. The conditions are very broad (a breach may arise from even minor acts) and potentially burdensome. In essence, the conditions will require compliance with Australian taxation law and with Australian Taxation Office (ATO) directions to provide information in relation to the investment.

On 4 May 2016, FIRB released revised “taxation conditions of certain no objection decisions”. The original announcement and tax conditions appeared to indicate that standard tax conditions would be applied universally to all no objection approvals.

The Government announcement that accompanied the release of the revised tax conditions stated that the conditions effectively target those foreign investors that pose a risk to Australia’s revenue – which may suggest that the tax conditions will not be applied in all cases. This is consistent with a Guidance note that was released by FIRB on the revised tax conditions, on 24 November 2016, which also provides additional information on the conditions.

A copy of revised tax conditions can be found online on FIRB’s website at: https://firb.gov.au/files/2016/05/Tax_conditions.pdf

Property Law

While hotels are businesses, they are also a subclass of commercial property. The land and building on which a hotel is situated is governed by property law. An investor wishing to acquire an interest in a hotel must undertake title due diligence to examine the quality of the interest they are proposing to acquire.

Overview of Australian Property Law

Under the Torrens system, title or ownership right to land or property is created by the act of registration in a central register or record. In most cases, the person who is recorded as the owner of a parcel of land cannot have their title challenged or overturned. Priority between interests in property is determined by order of registration and not order of execution. Generally, upon registration of an interest, a person’s registered interest is only subject to prior registered interests and free from all interests which are not registered. This rule is subject to a number of exceptions such as fraud, some short-term leases and misdescription of boundaries.

Each State and Territory has its own property legislation and title registration system. Whether an interest can be registered or not varies between States and Territories. A buyer undertaking title due diligence of a hotel should be aware of the types of interests, including property interests and contractual interests, which may arise in a hotel transaction.

Property Interest

Property interests, unlike contractual interests, can be enforced against all other persons. The table below sets out a number of property interests, some of which may be registered under the Torrens system.

Contractual Rights

Contractual interests and rights are only enforceable against particular persons who may be party to the contract giving rise to the contractual interest. The following rights are purely contractual:

- Licence – a grant of non-exclusive use or access to land;

- Options – a call option or put option to acquire land; and

- Right of first refusal to acquire land – where the land owner agrees with a person not to sell the land without first offering it to that person

Australia’s three levels of government – Federal, State and local – all impose taxes on real estate related transactions and investment. In order to facilitate cross border investment the Australian government has also established taxation agreements with numerous foreign governments to simplify the taxation of foreign investors and avoid double taxation.

The main taxes that apply to real estate investment and transactions for both local and foreign investors in Australian real estate include:

- income tax – which encompasses capital gains tax (CGT) and withholding tax for foreign investors;

- goods and services tax (GST);

- stamp duty; and

Income tax is imposed by the Australian federal government and is levied on individuals, companies, superannuation funds and, in some circumstances, trustees. The income of partnerships (other than limited partnerships) and trusts (other than certain public unit trusts) is generally taxed in the hands of partners or beneficiaries.

Income tax is levied on taxable income, being assessable income less allowable deductions. Assessable income includes net capital gains under the CGT rules. Taxable income is generally calculated for an income year, which is the year ending 30 June, unless the taxpayer has been given leave by the Commissioner to adopt a substituted accounting period. Leave will usually be granted for an entity with a foreign parent to adopt an accounting period that ends at the same time as that of its parent.

A tax loss may arise for an income year if the allowable deductions exceed the total assessable and certain exempt income for the year. Such losses may be carried forward and deducted in future years, subject to satisfying certain loss utilisation tests in the case of companies and trusts.

Foreign Investors

A foreign investor’s Australian assessable income in a given year of income can include Australian sourced income and any capital gains from an investment in “taxable Australian property”.

Taxable Australian property includes direct holdings in Australian real estate. It also includes any property that the foreign resident has used at any time in carrying on a business through a permanent establishment, as defined in the Tax Acts, in Australia.

Indirect interests in real property are taxable Australian property if it is shares or other interests in companies or entities such as trusts that are Australian land-rich where the holding of the investor, together with holdings of associates, constitutes at least a 10% interest in that entity (determined at the time of the disposal or the CGT event, or throughout any 12 month period that began no earlier than 24 months prior to the time of disposal or the CGT event). A company or trust is considered land rich if more than 50% (measured by market value) of its assets consist of Australian real property. Such indirect interests are called “indirect Australian real property interests”.

From 1 July 2016, a non-final withholding tax applies in respect of disposals by foreign residents of the following types of taxable Australian property (unless the disposal is an excluded transaction):

- indirect Australian real property interests;

- direct holdings of Australian real estate; and

- options and rights to acquire the above mentioned assets.

Examples of disposals which are excluded transactions include where the disposal occurs on an approved stock exchange, and in the case of a disposal of a direct holding of Australian real estate, the market value of the Australian real estate immediately after the disposal occurs is less than A$2 million (to be decreased to A$750,000 for acquisitions occurring on or after 1 July 2017).

If the regime applies to a disposal, the entity which acquires the asset (whether the entity is an Australian resident or foreign resident) may be required to withhold an amount of up to 10% (to be increased to 12.5% for acquisitions occurring on or after 1 July 2017) of the consideration paid to acquire the asset and remit that amount to the Australian Taxation Office (ATO) on completion of the disposal. This is a non-final withholding tax that is calculated on the purchase price rather than the capital gain. Consequently, to the extent that the amount withheld exceeds the tax liability on any capital gain on the disposal of the asset, the foreign resident vendor can obtain a tax credit or refund by lodging an Australian income tax return with the ATO for the income year in which the disposal occurs.

Australia also has a non-final withholding tax regime which applies to a limited range of payments made to foreign residents (such as payments for certain construction and installation activities).

Australia has a final withholding tax regime for the following types of income:

- interest is subject to withholding tax at the rate of 10% (certain exemptions can apply);

- “unfranked” dividends (ie dividends paid out of profits on which no company tax has been paid) is subject to withholding tax at the rate of 30% – no withholding tax is payable on “franked” dividends (ie dividends paid out of taxed profits); and

- royalties are subject to withholding tax at the rate of 30%.

Australia’s double tax agreements generally reduce the tax on unfranked dividends to 15% (and under some agreements to 5% or nil) and on royalties to 10% (5% under some agreements). The tax on interest is generally not reduced below 10% (unless specific exemptions are available under certain agreements to reduce it to nil).

As explained further below, Australia also has a “Managed Investment Trust” (MIT) regime for qualifying Australian Real Estate Investment Trusts (REITs). Under this regime, foreign resident investors who are resident in “exchange of information” countries are generally taxed at 15% on their income from the REIT (10% if the MIT holds only newly constructed energy efficient commercial buildings (or equivalent standard in retail and residential buildings)).

Taxation on Real Estate Transactions

Gains on the disposal of real estate can be taxed as ordinary income or as capital gains.

The company tax rate on income is 30% (or 27.5% for companies with an associate-inclusive annual turnover of less than A$25 million). The Government has proposed legislation to gradually decrease the company tax rate for all companies to 25% by 2026/27. The top marginal tax rate for individuals is currently 45% plus 2% Medicare levy for Australian residents (with this Medicare levy proposed to be increased to 2.5% from 1 July 2019 as announced in the 2017/18 Federal Budget). From an income tax perspective, both an Australian resident taxpayer and a foreign resident taxpayer can be subject to capital gains tax on interests in Australian real estate holding companies or entities.

Where the seller is an Australian resident individual, trust or Australian complying superannuation fund and has held the real estate for at least 12 months, a discount (CGT concession) may apply so that only 50% (or 66.6% in the case of a superannuation fund) of any capital gain will be subject to tax. There is no discount for companies.

The CGT discount no longer applies to foreign residents in respect of assets acquired after 8 May 2012. For assets held by foreign residents prior to 8 May 2012, the CGT discount rules may be partially applicable depending on the circumstances.

The following sections outline taxation rules for different entities.

Income Tax Rates – Resident Individuals

Taxpayers who are residents of Australia are liable to tax on income derived from all sources, whether inside or outside of Australia.

The marginal rate of tax applicable to an Australian resident individual is scaled according to his or her annual taxable income. The resident individual tax rates for the 2017-18 tax year are, generally, as follows:

Income Tax Rates – Foreign Resident Individuals

Foreign residents are liable to tax only on income derived from Australian sources. The foreign resident individual tax rates for the 2017-18 tax year are as follows:

Foreign resident individuals are taxed on their Australian source income (apart from dividends, interest and royalties and certain payments from managed investment trusts, which are subject to withholding tax) at the above rates. In some situations a foreign resident individual may be relieved from Australian tax under an applicable double tax agreement (see information on foreign purchaser duty subcharges).

Companies

Taxation of Australian Resident Companies

An Australian resident company is liable for tax at the rate of 30% on its worldwide taxable income (or at the rate of 27.5% if the company’s associate-inclusive annual turnover is less than A$25 million). The Government has proposed legislation to gradually decrease the company tax rate for all companies to 25% by 2026/27.

A company is defined for tax purposes as including all bodies corporate and unincorporated but excluding partnerships (other than limited partnerships, which are generally taxed like companies). Certain public unit trusts are also taxed like companies.

Australia has a tax consolidation regime where Australian companies and other entities treated as companies for tax purposes can generally choose to consolidate for income tax purposes with all its wholly-owned Australian entities.

Taxation of Foreign Resident Companies

A foreign resident company is taxed on its Australian source income (apart from dividends, interest and royalties and certain payments from managed investment trusts, which are subject to withholding tax) at the same rate as resident companies. A foreign resident company may be relieved from Australian tax under a relevant double tax agreement.

Certain foreign hybrid entities may be treated as companies or partnerships for tax purposes at the election of the Australian shareholder or partner.

Investors in a resident trust are generally taxed on the share of the net taxable income equal to the share of trust income they are presently entitled to receive. If no beneficiaries are presently entitled to receive income of the trust estate the trustee must pay income tax (potentially at the top marginal rate for individuals plus Medicare levy).

The net income of a trust estate is generally the difference between its assessable income (including net capital gains) and all allowable deductions, calculated as if the trust was a resident taxpayer. A net loss of a trust is not deductible to beneficiaries. Resident beneficiaries, whether individuals or companies, are required to include in their assessable income the share of the net income of a resident or foreign resident trust estate equal to the share of the trust income to which they are presently entitled, and are subject to tax on their share of the net income at the rates generally applicable to them.

Foreign resident beneficiaries who are presently entitled to a share of the trust income are subject to tax on their share of the net income of the trust estate that is attributable to sources in Australia, at the rates applicable to foreign residents.

Special rules apply to the taxation of distributions to foreign investors from trusts that qualify as a MIT (see below).

Australian Real Estate Investment Trusts (REITS)

Australian REITs are a specific application of the general law of trusts in Australia. The tax structure of REITs requires the real estate holding vehicle to be a passive fund and allows the fund to distribute 100% of the cash it derives from its assets. This allows REITs to maximise their yields but it is in turn dependent on their ability to raise equity in the market for refurbishment and other management requirements. The regulatory structure supports this raising of equity through rigorous disclosure, licensing and registration requirements, all designed to promote transparency and investor confidence.

Australian investors in Australian REITs are taxed as ordinary beneficiaries of a trust. To the extent that the distributions exceed the investor’s share of the net taxable income of the trust (eg cash distributions that are sheltered by building or plant depreciation) are considered “tax deferred”, as that excess reduces the investor’s cost base of its interest in the trust. If the cost base is reduced to nil, a capital gain is realised for the remaining excess.

Foreign investors in Australian REITs are subject to the following:

Australian tax on their share of the REIT’s net income attributable to Australian sources (including capital gains) at their personal tax rates or at 15% in the case of a qualifying investor in a REIT that is a MIT;

withholding tax of 10% on interest and 30% on unfranked dividends included in the income of REIT to which they are presently entitled, and distributed by the REIT. This may be reduced by double tax treaties (if applicable); and capital gains tax on the investor’s interest in the Australian REIT whether held directly or indirectly through an interposed entity. Individuals may qualify for part of the 50% CGT discount concession if assets are disposed of that were held prior to 2012. The 50% CGT discount is not available to foreign resident individuals in respect of assets acquired after 8 May 2012. Similar to Australian residents, tax deferred distributions reduce foreign investors’ cost base of their interest in the REIT. When the cost base is reduced to nil, a capital gain is then realised on any subsequent tax deferred distributions received by the investor.

Australian REITs that qualify as MITs are provided with additional tax concessions in Australia, including the ability to treat assets such as real property as assets held on capital account (which allows its eligible beneficiaries to access the CGT discount concession) and to apply a reduced 15% withholding tax on distributions made to its foreign resident beneficiaries that are tax resident in countries that are on an “exchange of information” list.

From 1 July 2016 (or from 1 July 2015 at the election of the MIT), an attribution regime applies to MITs that are qualifying “Attribution MITs” (AMITs). One of the key features of this regime is that investors in the AMIT are taxed based on the amounts attributed to them, rather than on their share of the income of the AMIT to which they are presently entitled.

Double Tax Agreements

Australia has entered into agreements with a large number of countries for the purposes of eliminating double taxation of income. The general effect of a double tax agreement is to limit Australia’s taxing rights in respect of certain classes of income derived by a resident of the other country and vice versa.

Although similar, the double tax agreements are not all identical and similar payments may lead to different Australian tax consequences, depending on the country of residence of the taxpayer.

For residents of countries with which Australia does not have a double tax agreement, Australia will generally tax Australian source income derived by such a person determined in accordance with Australia’s domestic source rules. Dividends, interest and royalties, are subject to withholding tax as described above.

Thin Capitalisation

Thin capitalisation rules operate to deny debt deductions (including interest and borrowing costs) where an entity’s debt levels exceed certain prescribed thresholds.

The main thresholds in relation to general foreign investment in Australia are:

- broadly, the average value of total debt used to fund the investment must not exceed 60% of the average value of the total assets (subject to some adjustments for nondebt liabilities and associate entity equity); or

- if the debt exceeds the threshold (referred to above), the debt must not exceed an “arm’s length” amount or a “worldwide gearing debt” amount.

The characterisation of debt and equity for the purposes of applying the thin capitalisation rules is based on the debt/equity rules in the Australian tax law. These rules, broadly speaking, seek to characterise instruments as debt or equity for tax purposes based on economic substance rather than legal form.

There is a de minimis rule which provides that where the total debt deductions of the entity and its associate entities do not exceed A$2 million for the income year, the thin capitalisation rules will not apply to deny the entity’s debt deductions regardless of the entity’s gearing ratio.

Transfer Pricing

International transfer pricing rules are contained in both Australian domestic law and double tax agreements. These rules allow the Commissioner to determine and substitute an arm’s length price for Australian tax purposes if the Commissioner is satisfied that the parties are not dealing at arm’s length. Parties will broadly be dealing at arm’s length if they deal with each other as if they were independent persons entering into transactions at market value.

In order to satisfy the Commissioner that an acceptable arm’s length pricing methodology has been adopted in relation to such a transaction (in accordance with Organisation for Economic Cooperation and Development (OECD) guidelines), sufficiently detailed documentation must be maintained.

Foreign Exchange

There are comprehensive rules for translating foreign currency amounts into Australian currency for income tax purposes, and for taxing foreign exchange gains and losses.

Anti-Avoidance Rules

There are numerous specific anti-avoidance rules and general anti-avoidance provisions in the Australian tax law.

In almost every significant transaction, consideration of the general and specific anti-avoidance provisions is necessary.

The general anti-avoidance rule (Part IVA) enables the Commissioner to make determinations to cancel tax benefits obtained by a taxpayer (and include an amount of assessable income, disallow a deduction or a foreign income tax offset or impose a withholding tax liability) if, having regard to various matters, it would be concluded that a “scheme” was entered into for the sole or dominant purpose of obtaining the tax benefit. The promoter of a scheme to which the general anti- avoidance provision applies may also be subject to substantial civil penalties.

Australia also has a multinational anti-avoidance rule (MAAL) which applies to tax benefits obtained by large foreign multi-national taxpayers (with global turnover of A$1 billion or more) on or after 1 January 2016 under both new and existing schemes. In general terms, the MAAL may be applied where the principal purpose of the scheme is to obtain an Australian or Australian and foreign tax benefit and where certain supplies were made to an Australian customer with the assistance of associated or dependent Australian entities such that the income derived is not attributed to a taxable Australian permanent establishment. If applied by the Commissioner, the MAAL could result in the imposition of Australian tax on that income and significant penalties and interest.

Australia also has a recently enacted "diverted profits tax" (DPT) which applies from 1 July 2017 to schemes which are entered into before or after that date.

Broadly, the measure is designed to target arrangements entered into by large multinational taxpayers which are Australian residents or Australian permanent establishments of foreign residents, where:

the taxpayer "diverts" profits offshore to a low-tax related party which results in an overall tax reduction on the profit by more than 20%; and

it would be concluded that the arrangement has insufficient economic substance as it was designed to secure the

tax reduction.

The Commissioner is empowered to impose a significant "diverted profits charge" on the taxpayer at a rate of 40% of the diverted profit, and if invoked, there will be prescribed periods in which the taxpayer may request a review and/or challenge the assessment.

Goods and Services Tax

Transfer of Real Estate

Transfers of real estate are subject to Australian Goods and Services Tax (GST) if the requirements for a taxable supply are satisfied. As a supply is defined very broadly to include the supply of goods, services or real estate and the creation, grant, transfer, assignment or surrender of any right or obligation, GST can also potentially apply to incidental supplies, such as covenants to repair, releases and payments under indemnities.

GST, generally calculated as 10% of the purchase price for the real estate, is imposed on the seller, but in the case of non-residential real estate the cost is normally passed on to the buyer under the contract (who can usually claim an input tax credit for the GST incurred). The Government has announced a proposal to require purchasers of new residential premises and subdivided land to withhold and remit GST on such sales from 1 July 2018.

Land or commercial premises transferred as part of a sale of an enterprise (which can include an enterprise of leasing the land/premises) can be GST-free under an exemption for the supply of a going concern if this treatment is agreed in writing by the seller and the buyer. The parties to the transfer of leased commercial premises will generally agree to treat the supply as a supply of a going concern as this removes the cash flow cost of GST being passed on to the buyer, and also reduces the stamp duty cost (as stamp duty is calculated on the GST inclusive price). The Government has announced a proposal to require purchasers of new residential premises and subdivided land to withhold and remit GST on such sales from 1 July 2018.

The concessional margin scheme can also apply to reduce GST on the transfer of real estate, subject to agreement between the seller and buyer. Under this scheme, GST is generally paid on the difference between the price the seller paid to acquire the real estate and the purchase price received by the seller when selling. Where the seller acquired the real estate after 1 July 2000 (when GST was introduced), this price difference, or “margin”, is generally calculated by using the actual price paid by the seller when it acquired the real estate. Where the seller acquired the real estate prior to 1 July 2000, the margin is generally calculated by reference to the value of the real estate as at 1 July 2000. Generally, the margin scheme can only be applied on a sale where the margin scheme was applied to the seller’s acquisition of the real estate.

While the margin scheme can reduce the GST payable, the buyer cannot claim input tax credits for GST paid if the margin scheme applies. Because of this, in practice, the margin scheme is generally only applied where the real estate will (or may) be ultimately redeveloped and sold as new residential premises (as buyers of new residential premises will generally not be entitled to claim input tax credits and so GST will need to be absorbed into the end sale price).

Hotels, motels, boarding houses, inns and hostels are generally treated as commercial residential premises which attract GST on transfer unless the going concern exemption is available.

Transfers of residential premises, other than new residential premises or commercial residential premises, are input taxed and so do not attract GST (but input tax credits are generally denied for GST paid on acquisitions which relate to such input taxed supplies).

A transfer of shares or units is also input taxed and so does not attract GST.

Supply of Accommodation

The supply of accommodation in hotels, motels etc is a taxable supply for GST purposes and thus subject to GST.

Stamp Duty on Land Transfers

Stamp duty on purchase of land

Stamp duty is a State based transaction tax. All Australian States and Territories impose stamp duty (at varying rates) on transfers of land and certain other property transferred with the land. This may include goods and certain business assets sold with land. The grant of a lease for a premium also attracts duty.

Often, the rate of stamp duty is charged on an increasing scale. As an example, the rates in New South Wales start at 1.25% and gradually increase to a top rate of 5.5% for land with a dutiable value in excess of A$1million (with a premium rate of 7% applying to the transfer of residential land with a dutiable value exceeding $3m).

Stamp duty is usually payable by the buyer, although in some States (eg Queensland) both parties to the transaction are jointly and severally liable. It is normal commercial practice for the buyer to bear the duty cost on transfers of real estate.

Stamp duty is payable from one to three months after the contract for sale (or in the case of Victoria and Tasmania, after the transfer) is signed, depending on the State or Territory. Penalties can apply for late payment. The land transfer cannot be registered until duty has been paid.

Foreigner purchaser surcharges

In addition, the States of New South Wales, Victoria, Queensland and (from 1 January 2018) South Australia each impose an additional surcharge on foreign purchasers acquiring residential property. While these measures are aimed at residential land, there has been considerable uncertainty as to their application to serviced apartments, hotels, student accommodation, retirement villages and the like. The table on the following page summarises the current surcharge provisions.

Landholder Stamp Duty

Marketable securities stamp duty on transfers of shares or units has been abolished in all States and Territories (with the exception of South Australia which still imposes duty on transfers of units in a unit trust scheme until 1 July 2018).

To prevent stamp duty on the transfer of land being avoided by interposing an entity, all jurisdictions apply landholder duty to certain acquisitions of shares in a private company, or units in a private trust which directly or indirectly owns land. Except for ACT all jurisdictions also apply landholder duty to the acquisition of a significant interest in listed companies and trusts. The acquisition of an interest in a landholding entity, whether by way of direct transfer or, for example, by means of the issue or the redemption of units or buy-back of shares, can result in a liability for landholder duty, which is calculated by reference to the gross market value of the proportionate interest in the underlying land at the transfer duty rates. Foreign surcharges can also apply to the acquisition by foreigners of interests in entities which hold residential land (in the same way as for an acquisition of the land – see above for details).

The landholder duty provisions vary considerably from State to State. However, in general, the provisions only apply to changes in “significant” interests in companies and trusts (generally 50% for private companies or trusts and 90% for listed companies or trusts) where the company or trust holds land with a value above a stated threshold. For example, the provisions in New South Wales apply to changes of interests of 50% or more in an unlisted company or unit trust where land held by it, or entities linked to it, has an unencumbered value of A$2,000,000 or more.

The table below summarises the current landholder duty thresholds.

In all States and the ACT, land tax is payable on an annual basis on the unimproved value of land, subject to certain exemptions (eg for a principal place of residence or land used for primary production). Except in the ACT, tax free thresholds apply. These thresholds and land tax rates vary. In New South Wales the top rate is 2%, while in Victoria the top rate is 2.25% with a surcharge of up to 0.375% for landholdings held by certain trusts with an unimproved land value of between A$25,000 and A$1.8million.

Some States impose an additional land tax surcharge on foreign or absentee owners of residential property. For example, in New South Wales, an additional surcharge of 0.75% is imposed on residential land owned by foreign persons from 1 January 2017. This rate will increase to 2% from the 2018 tax year. Foreign persons are defined as an individual, corporation or trust who are not ordinarily resident in Australia (ie individuals or two or more persons or trustees who have not been in Australia for 200 days or more in a 12 month period).

In Victoria, the surcharge on absentee owners is 1.5%, and includes all land which is subject to land tax (not only residential land). Absentee owners include corporations incorporated outside of Australia or in which a non-resident person has a controlling interest (eg holds more that 50% of the shares in the landholding corporation). In addition, a new vacant residential land tax of 1% of the capital improved value applies to vacant residential properties in the inner and middle suburbs of Melbourne. A Commonwealth vacant land tax surcharge of an amount equal to the FIRB application fee is also proposed for residential property acquired from 9 May 2017 by foreign owners where the property is not occupied or genuinely available on the residential market for at least six months per year.

There is also a foreign owner land tax surcharge of 1.5% in relation to Queensland land with a taxable value of $350,000 or more. However, as currently proposed, it appears to only apply to land which is owned by one or more individuals.

If the seller is liable to pay land tax on the real estate, the general practice is for the land tax to be adjusted between the seller and the buyer on completion or closing even if the real estate will not be liable to land tax in the buyer’s ownership.

Australia’s three levels of government – Federal, State and local – all impose taxes on real estate transactions and investment.

A foreign investor’s Australian assessable income in a given year of income can include any net capital gains from an investment in taxable Australian real estate.

A non-final withholding tax regime applies for disposals of taxable Australian real estate by foreign residents, which may require the purchaser to withhold up to 12.5% of the consideration for the disposal.

Foreign investors are generally not liable to pay income tax on dividends, interest and royalties derived in Australia. Rather, they are liable for a final withholding tax.

Australia has double tax agreements with other countries which will vary the amount of tax paid by foreign investors.

Australia has a concessional Managed Investment Trust regime that can provide a reduced 15% withholding tax on Australian sourced income and gains.

A broad based goods and services tax applies to the supply of real estate at the rate of 10% subject to exemptions for sales of going concerns, and the margin scheme concession.

State based stamp duties often represent a significant transaction cost and need to be carefully considered.

Foreign purchasers may be liable to a surcharge on the purchase of residential land in some States. Annual land tax charges apply to most land. Land tax foreign owner surcharges and absentee owner surcharges can also apply.

Other Issues

Intellectual Property

Intellectual property may be relevant to a hotel transaction in two scenarios. The first scenario relates to the intellectual property of the outgoing hotel owner. Where the seller owns intellectual property (including business name, trade mark and domain name) in relation to the hotel business, these interests may not necessarily be transferred with the hotel business if they are not specifically dealt with in the transaction documentation.

Accordingly, due diligence and diligent contract preparation will be crucial for ensuring all intellectual property necessary for the operation of the hotel business are transferred to the incoming hotel owner.

The second scenario is in relation to intellectual property of third parties, including where intellectual property is owned by a franchisor or operator under a management or franchise agreement. Generally the buyer is responsible for managing the use of any intellectual property owned by third parties. However in relation to a management or franchise agreement, consent will be required from the operator or franchisor if the buyer intends to operate the hotel on an as is basis. Due diligence will enable the buyer to understand the obligations of the hotel owner under the relevant arrangement.

One of the key features which distinguish a hotel sale transaction from a traditional property sale transaction relates to a hotel’s employees. In Australia, the employees of a hotel business are usually employed by the hotel owner and not by the hotel operator. Therefore where there is a sale of the hotel business, the incoming hotel owner will generally assume all the rights and responsibilities of the outgoing owner and employ the existing hotel staff. Accordingly, it is important for a hotel investor to undertake due diligence on key employment contracts of a hotel business in order to understand the scope of its rights, obligations and liabilities in respect of the hotel’s employees. Failure to do so may expose an incoming hotel owner to potential liability under employment laws.

Tourism is Australia’s largest services export and it contributes approximately A$35 billion to the country’s Gross Domestic Product.

Please click here to download the PDF of the report (451MB).

For further information, please contact:

Pauline Tan , Partner, Ashurst [email protected]

Register for your monthly Asia legal updates from Conventus Law

Error: Contact form not found.

Regulating The Promotion Or Use Of Cryptoassets In Indonesia.

- winnie yamashita rolindrawan - ssek,.

Corporate Governance In Indonesia: Management Of A Company.

- indonesia - ira andamara eddymurthy, partner, ssek,.

Indonesia Legal Update: New OJK Regulation On Insurance Products And Marketing.

- fitriana mahiddin - partner, ssek.

CONVENTUS LAW

CONVENTUS DOCS CONVENTUS PEOPLE

3/f, Chinachem Tower 34-37 Connaught Road Central, Central, Hong Kong

- Hospitality Products

- Hospitality Suppliers

- Hospitality News

- AHD Digital Edition

- Barter Exchange

- Hospitality Equipment Leasing

- ATM Machines

- Australian Business Loans

- Bookkeeping & Accountants

- Business Finance Solutions

- Clocks & Time Systems

- Fast Business Loans

- Hospitality Loans

- Hospitality Super Funds

- Merchant Facilities

- Online Business Loans

- Payroll Services & Software

- Unsecured Business Loans

- AV Systems : Sales & Hire

- Baked Goods Suppliers

- Bakery Equipment

- Baking Ingredients Foodservice

- Cakes & Cake Mix Suppliers

- Pizza Bases

- Automatic Hand Dryers

- Bathroom Cleaners & Dispensers

- Bathroom Fixtures & Fittings

- Commercial Hot Water Systems

- Guest Toiletries

- Paper Towels & Toilet Paper

- Towels & Towel Hire

- Alcohol & Liquor Suppliers

- Barware Suppliers

- Beer Suppliers

- Beverage Suppliers

- Coffee & Commercial Machines

- Commercial Bar Equipment

- Commercial Beverage Systems

- Commercial Juicers & Blenders

- Frozen Beverage Equipment

- Fruit Juice Suppliers

- Soft Drink & Cordial Suppliers

- Soft Drink & Mixer Suppliers

- Tea Bag & Leaf Tea Suppliers

- Wine & Champagne Suppliers

- Wine Importers & Merchants

- BBQs & Char Grills

- Butchers Equipment

- Cake Decorating Equipment

- Catering & Kitchen Equipment

- Catering Equipment Hire

- Chef's Knives & Accessories

- Chef's Thermometers & Probes

- Commercial Kitchen Products

- Commercial Kitchenware

- Cooking Utensils

- Cutlery Polisher Machines

- Deep Frying Equipment

- Dishwashing Machines & Supplies

- Dough Mixers & Pressers

- Equipment Service & Repair

- Food Display Cabinets & Counters

- Fryer Filter Oil Equipment

- Glass Washing Machines

- Hospitality Equipment Finance

- Ice Making Machines

- Juicers & Blenders

- Kitchen Appliances

- Kitchen Bins

- Kitchen Cleaning

- Kitchen Mixers

- Kitchen Trolleys

- Oil & Water Filters

- Oven & Cooktops

- Pancake Making Machines

- Pizza & Pasta Making Equipment

- Professional Kitchen Scales

- Rotisseries

- Slicing Machines

- Used Commercial Equipment

- Chef & Hospitality Aprons

- Hospitality & Chef's Shoes

- Hospitality Uniforms & Clothing

- Hotel Bed Linen & Pilllows

- Hotel Manchester

- Light Commercial Vehicles

- Refrigeration Vehicles

- Asian Food Foodservice Suppliers

- Biscuit Suppliers

- Breakfast Food Suppliers

- Bulk Catering Foodservice Supplies

- Canned Food Suppliers

- Cheese Suppliers

- Chocolate Suppliers

- Condiment Suppliers

- Confectionery Suppliers

- Dairy Product Suppliers

- Delicatessen Product Suppliers

- Dessert Product Suppliers

- Disposable Packaging Products

- Disposable Packaging Suppliers

- Distribution Foodservice

- Dressing Marinade Sauce Supply

- Egg Suppliers

- Finger Food Suppliers

- Food Suppliers

- Foodservice Suppliers

- Frozen Food Suppliers

- Fruit Suppliers

- Gelato & Ice Cream Suppliers

- Gluten Free Food Suppliers

- Halal Food Suppliers

- Health Foods Foodservice Suppliers

- Herb & Spice Foodservice Suppliers

- Jam & Dip Suppliers

- Kosher Food Suppliers

- Meat Foodservice Suppliers

- Native Food Suppliers

- Nut Suppliers

- Oils & Fat Suppliers

- Organic Food Suppliers

- Pasta & Pasta Sauce Suppliers

- Pastry Product Suppliers

- Portion Control Suppliers

- Poultry Suppliers

- Processed Food Suppliers

- Rice Suppliers

- Seafood Suppliers

- Snack Food Suppliers

- Sugar & Sweeteners

- Vegetable Foodservice Suppliers

- Bar & Restaurant Lighting

- Bar Furniture & Fitouts

- Beds & Bedroom Furniture

- Cafe & Restaurant Design & Fitouts

- Cafe & Restaurant Furniture

- Commercial Kitchen Fittings

- Conference Rooms

- Fast Food & Food Counter Design

- Furniture Repairs & Restoration

- Hospitality & Restaurant Furniture

- Hospitality Floor Mats

- Hospitality Furniture Hire

- Hospitality Storage & Shelves

- Office & Reception Furniture

- Outdoor Restaurant & Bar Furniture

- Plants & Plant Hire

- Restaurant & Hospitality Flooring

- Staging Systems

- Tables, Chairs & Cushions

- Hotel Guest Transport