Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Compensation: Should You Accept Cash or Miles From an Airline?

Carissa Rawson

Senior Content Contributor

250 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3112 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

What Will Airlines Give You?

Questions to consider, maximizing your value, be wary of bad redemptions, which option is best for you, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

It’s happened to us all, hasn’t it? You’ve booked your flight, packed your bags, showed up to the airport — and something goes wrong. Whether it’s an overbooked flight, a mechanical failure, or an involuntary downgrade, these instances are more than a little frustrating. After all, we did our part. Shouldn’t the airline?

What airlines owe you in these cases will depend on a variety of factors, especially when the failure isn’t something they were able to control. Still, oftentimes, airlines will attempt to make things right. This can be done in a variety of ways, but common offerings include a cash refund, a voucher valid for future travel, or a lump sum of bonus miles. While these won’t make the pain disappear, they can go a long way towards easing an otherwise upsetting situation.

But when presented with these options, which one should you pick? After all, these choices are not inherently equal — and some may be much more valuable than others. Let’s take a look.

The type of compensation you’ll receive will really depend on the type of inconvenience you experience, but generally, you can expect 1 of 3 different options:

- Cash Refund : As it sounds, the airline will give you a refund, in cash, of the amount you paid for your flight (or some portion of it).

- Voucher : Far more limited than a refund, these are generally valid for future travel. They may have an expiration date and may be non-transferable.

- Miles : Usually awarded to frequent flyers, these can be redeemed for award flights on airlines. They’re more restrictive than cash but can provide greater value.

If the type of trouble you’re receiving also extends overnight, you’ll commonly see things such as hotel stay vouchers and meal credits , which are separate from the options above.

The compensation that’s right for you will be fairly dependent on your travel situation. Here are a few things you’ll want to consider when deciding on an option:

- How often do you travel ?

- Do you have upcoming travel plans ?

- Are you familiar with frequent flyer miles ?

- How flexible are you when you travel?

- Do you need the cash cost of the flight on hand?

- Do you fly with this airline often, or is this a one-off?

As you can see, there are quite a few questions to ponder when choosing your compensation. Don’t skimp on these — they’re important. After all, if you only fly once per year and you have no future travel plans, how useful will a travel voucher be? To a lesser extent, this also includes frequent flyer miles. If you’re not familiar with how to maximize them (or you’re not willing to become familiar) it can be easy to mistakenly use them for far less than they’re worth — and far less than you’d have received in cash.

Hot Tip: Fighting with an airline? Check out our handy guide for how to get compensation when your flight is delayed or canceled .

There are plenty of people who will tell you cash is king, and that’s certainly true, to an extent. But there is a reason that the world of points and miles exists and so many people prefer credit cards that earn travel rewards rather than flat cash-back cards .

This is because it’s possible to get greater value for travel rewards than from cash-back . Think of it like this: every time you get 1 cent in cash, it’s worth 1 cent. However, certain points and miles are worth more than 1 cent apiece. Take, for example, American Airlines’ AAdvantage miles. We value AAdvantage miles at 1.4 cents per point, thanks to their ease of use and the value with which they can be redeemed.

This means that if you were given the choice between $400 in cash and 40,000 AAdvantage miles, you’ll want to consider it carefully. $400 in cash is worth $400, but we value 40,000 AAdvantage miles worth $560 towards travel — and they can be worth a lot more, given the right circumstances.

Here’s a look at a round-trip flight from Dallas (DFW) to Paris (CDG) over Thanksgiving:

As you can see, the flight is 45,000 miles — so a few thousand miles more than our hypothetical offering. You’ll also need to pay $81.07 in taxes and fees. However, take a look at the cash cost of this flight:

In this case, you’d be redeeming your American Airlines miles for a flight that would cost you $1,225 , thereby giving them a value of 2.7 cents each . This is well above our own valuation. However, more importantly, you’re redeeming those miles for far more than the $400 in cash (or voucher) you’d otherwise receive.

We mentioned above that it’s possible to make mistakes with frequent flyer miles, especially if you’re not a super savvy traveler. And while it’s all well and good to redeem miles for outsized value, you need to be equally wary about bad redemptions.

Here’s a look at a round-trip flight from Los Angeles (LAX) to Miami (MIA) over Thanksgiving:

Right away, we can see that this flight costs more miles than a trip to France. But it gets even worse when we look at the cash rate of this flight:

In this case, you’re redeeming 47,500 miles for a flight that’s otherwise worth just $402 ! This means you’ll be redeeming those AAdvantage miles at a rate of just 0.8 cents each — or less than what you’d get if you’d just opted for cash.

We’ve laid out a pretty compelling case for choosing reward miles, but the answer to this question will really be based on your personal needs. Are you the type of person who will be willing to wait for an award seat to open up ? Do you care about “maxing” out value? Or are you someone who prefers the simplicity of money in your pocket?

Note that we’ve described 3 different options in this piece, but haven’t really discussed travel vouchers. That’s because — given the choice between a voucher, money, or miles, the voucher will always be last place . This is due to their inherent limitations, which frequently include an expiration date and may not be transferable to other passengers.

Instead, the breakdown really comes down to your tolerance for inconvenience. Cash will always be more convenient, but you can extract some pretty extraordinary value out of miles given the chance. In the end, it’s really up to you .

There’s always room for error when traveling, and often there’s nothing more frustrating than trying to deal with an airline when you’re angry. However, airlines will hand out varying types of compensation for your troubles — just be sure to pick the right one for you.

Be prepared for the unexpected by purchasing your travel with one of our recommendations for the best credit cards with travel insurance coverage and protection.

Frequently Asked Questions

How much should an airline mile be worth.

The average value of an airline mile will depend on the airline itself. Some miles are more valuable than others, and we generally determine their worth by how easy they are to redeem, the number of miles it will cost for a flight, and the partners with which you can redeem miles.

How do you get compensation from airlines?

Getting compensation from airlines can be a complicated process. If you’re still at the airport, you’ll want to start with the airline desk agents. These people will help get the ball rolling. Otherwise, you can call in to your airline’s customer service number to get some help.

Do airlines compensate for delayed flights?

Airlines are not required to give you compensation for delayed flights in the U.S, though this rule varies depending on your country of travel.

What are your rights if your flight is cancelled?

If your flight is cancelled, the airline must accommodate you on another flight, or, if you choose not to travel, you are entitled to a full refund for your ticket.

Was this page helpful?

About Carissa Rawson

Carissa served in the U.S. Air Force where she developed her love for travel and new cultures. She started her own blog and eventually joined The Points Guy. Since then, she’s contributed to Business Insider, Forbes, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Why an Airline Voucher Is Sometimes Better Than a Cash Refund

By Megan Spurrell

All products featured on Condé Nast Traveler are independently selected by our editors. However, when you buy something through our retail links, we may earn an affiliate commission.

Over the past couple of months, many of us have learned about the ins and out of canceling flights . Phrases like cancel-for-any-reason insurance and airline voucher are now part of every traveler's vernacular, and we've all found inventive ways to reach airline customer service representatives.

It's also become second nature to demand that cash refund when canceling flights —and to firmly say no to the travel vouchers most airlines are offering. But should you ever consider taking that airline voucher over cash? Some experts say yes, but warn there are things to keep in mind when you do. Below, we walk you through the nuances of vouchers—the good, the bad, and the potentially negotiable—so you can make the best move next time you cancel a flight.

The case for getting your refund in cash

There are some obvious reasons to take cash over a voucher. Most of us like our money where we can see it, and it's hard to justify letting an airline hang onto your money—especially when it looks like we won't be flying any time soon . "From a high level, cash is better than a voucher because you can't pay for groceries with an American Airlines gift card," says Scott Keyes of Scott's Cheap Flights . "If you had a $500 ticket, and they’re offering a $500 cash or voucher, cash is way superior because it’s fluid, and it doesn’t have an expiration date."

Jesse Neugarten of Dollar Flight Club is team voucher, but he agrees there are certain situations in which to push for your money back. "If you’re low on cash and don’t plan to travel anytime in 2020 or 2021, more cash on hand may be the best bet for you," says Neugarten. "Plus, some airlines, like Virgin Australia and smaller carriers, are shutting down, and they may not be able to honor vouchers in the future." If you bought a ticket from an online travel agent like Expedia, Travelocity, or Orbitz, then you absolutely want your cash back as well, Neugarten says, and not a gift card or voucher you have no reason to use.

If you end up needing to cancel and rebook a second time, travel vouchers can cause issues with insurance , too. "If you’re buying travel insurance, we’ve been telling people not to take the voucher and to get a refund," says Megan Moncrief, the chief marketing officer at insurance comparison website Squaremouth . "Historically, travel insurance providers widely grouped travel vouchers with points and miles , as award-based travel, which is typically uninsurable as there is no direct dollar amount associated with [the vouchers]." In laymen's terms: If you book a flight with a voucher and have to cancel, your flight cost in an insurance claim would technically be zero, meaning you wouldn't get any of that money back. Moncrief says that some providers are now changing their stance given the current situation, but it's important to keep this in mind when purchasing travel insurance—something most of us are doing these days—and make sure to understand the coverage offered on award-based trips.

The case for taking the travel voucher

All that being said, there are times when it makes more sense to take a voucher—namely, when the airline is willing to offer you a credit of a higher value. "What the smart airlines are doing is offering an incentive to take the voucher," says Keyes. "They might say you can take a $500 cash refund or a $600 travel credit [for your $500 flight], and that's when it starts getting interesting."

Neugarten says his Dollar Flight Club customers have reported the same. " American Airlines and Delta have been offering 10 to 20 percent bonus vouchers to those who elect to keep a credit with the airline, rather than take a refund," says Neugarten. "These airlines are not advertising that yet, but they are offering this over the phone to select customers on a case-by-case basis, or to those who ask for it." Few airlines, like Qatar Airways and Finnair, have formalized such offers, telling customers that all vouchers will receive 10 percent increases from the original flight prices.

"I think this poses a great opportunity for travelers to get additional value from their ticket by simply and persistently asking airline agents for these bonus vouchers," adds Neugarten. "Though these bonus vouchers have been offered at random, some people have simply asked for them." And if you're wondering how to do the dance? Neugarten says they've found a script that has worked. They make sure to thank the agent, mention they've heard of other people taking these vouchers, and use these golden words: "I would prefer to keep my ticket if you would be willing to give me a bonus voucher. Does [insert airline name] have the ability to offer this? If not, I’d happily take the refund." Given that airlines are legally required to offer cash refunds for canceled flights, it's well-worth asking—you'll either walk away with the cash you're owed, or a higher value voucher.

Alex Erdekian

Jessica Puckett

"Passengers are in much more of a position of strength than they normally are," says Keyes. "I haven’t heard of a passenger successfully negotiating a higher voucher, but it wouldn’t shock me if some airlines are in a position to do that. They need cash: They have so few incoming bookings and so many cancellations, so anytime they can hang on to a passenger's money because that passenger agreed to take a credit instead of a refund, it's worth trying."

Whenever you take a voucher, read the fine print

If we've learned anything during our coronavirus cancellations , it's to always, always read the fine print. And even when the voucher pot is, as Keyes says, being sweetened, make sure you understand the restrictions of a voucher before pouncing on it. "I’d look at two things," says Keyes. "The deadline or expiration date can be problematic for a lot of them." If a voucher expires, say, at the end of the year, it leads to a bigger question: Do you anticipate traveling by then? Is it even possible for you to use this credit?

"Secondly, who can use the voucher?" says Keyes. "Usually you can use [a voucher] to buy a ticket for anyone—a kid, a spouse, whomever—but sometimes the voucher is only eligible for the person who received it. That's another instance when a voucher becomes level valuable than cash." Keyes also suggests considering the airline offering the voucher, how frequently you fly it, and if the voucher works on partner airlines.

Vouchers are always better than miles

Last but not least, Keyes cautions that you should understand what type of travel credit you're getting—and be wary of accepting miles or points instead of a typical voucher. "There's a difference between a voucher and frequent flier miles," says Keyes. Some airlines, he warns, have been sending customers tempting deals to accept miles as refunds, or to convert vouchers into miles. But miles are even less tangible than vouchers and harder to use to your advantage. "When you purchase a flight with a voucher, it’s like purchasing with cash: You get the same status, and importantly, you earn miles," says Keyes. The same can't be said for flights purchased with miles. The only real benefit to miles as a form of refund, for the average traveler, is that they sometimes have a further out expiration date, but at that point, you're probably safest asking for your money back.

We're reporting on how COVID-19 impacts travel on a daily basis. Find all of our coronavirus coverage and travel resources here.

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Delta ‘Pay With Miles’ vs. ‘Miles + Cash’

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The behemoth Delta SkyMiles program contains many twists, turns and odd alleyways, none more confusing than the difference between the "Pay With Miles" and "Miles + Cash" programs.

Although they sound nearly identical, they work very differently. And to make matters worse, neither are the same as booking "award flights" using miles.

Here you'll find the basic differences between these options, how each one works and how you can determine which (if any) you should use to book your next flight with Delta.

In a nutshell, here are the differences between these different booking options:

"Pay With Miles"

Only available to those with a Delta co-branded credit card .

Lets you pay for some or all of your cash fare with SkyMiles.

Each SkyMile is valued at a set rate of 1 cent per mile.

You get to choose how many miles you use.

These tickets earn both Medallion Qualification Dollars and redeemable miles.

"Miles + Cash"

Available to anyone with a SkyMiles account.

Lets you pay for some of your cash fare using SkyMiles.

The value per SkyMile varies from ticket to ticket.

Delta determines the split between cash and SkyMiles.

These tickets don't earn Medallion Qualification Dollars.

Award flights are the normal way to use miles to book flights with Delta and its partners. Read our guide to booking Delta award flights for more details.

Generally, we recommend using the "Pay With Miles" feature if you loathe searching for award availability. We generally don't recommend using the "Miles + Cash" option unless you are trying to burn a very specific number of SkyMiles and have no other good options.

» Learn more: Delta Air Lines SkyMiles program: The complete guide

Pay With Miles: How it works

Again, this option is available only if you have a Delta co-branded credit card attached to your SkyMiles account. Specifically, you must hold the Delta SkyMiles® Blue American Express Card .

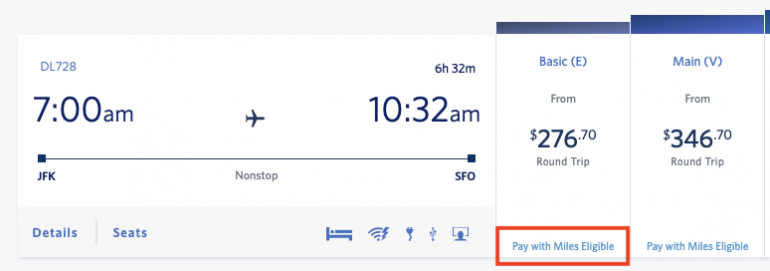

To use Pay With Miles, search for a flight as you would normally. Don’t select "shop with miles" just yet. You should see a "Pay with Miles Eligible" tag at the bottom of each cash fare.

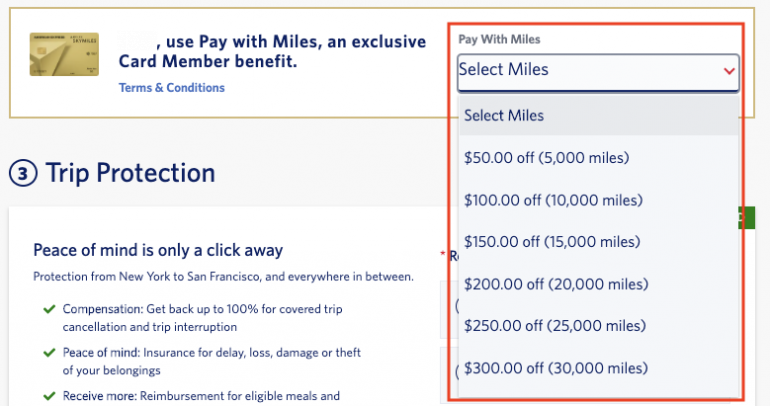

Select the fare as you usually would. On the next screen, you'll get a widget with a dropdown like this:

As you can see, you can offset the cost of the cash fare using SkyMiles in 5,000-mile increments.

SkyMiles are always worth 1 cent each when used in this way, which, while not spectacular, isn't far from our estimated value for SkyMiles of 1.2 cents each.

Given how much simpler this option is compared with normal award booking, those with little patience for blackout dates and other award calendar headaches might be willing to forego potentially higher value from their SkyMiles. However, it’s probably worth spending a few minutes comparing the value of the fares you find with "Pay With Miles" and normal award bookings (see the calculator below for help figuring this out).

» Learn more: Which Delta Air Lines credit card should you get?

Miles + Cash: How it works

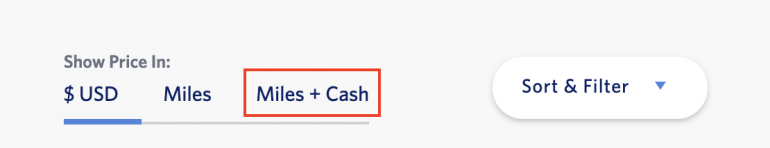

Let’s say you want to use your SkyMiles to book a ticket, but you don’t have enough miles to cover the full cost. You can use the "Miles + Cash" option on most Delta-operated flights to do just that. Make a search in the Delta booking tool like normal, then look for the "Miles + Cash" option under "Show Price In."

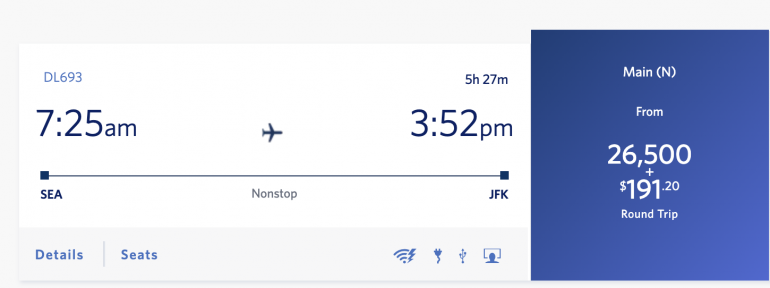

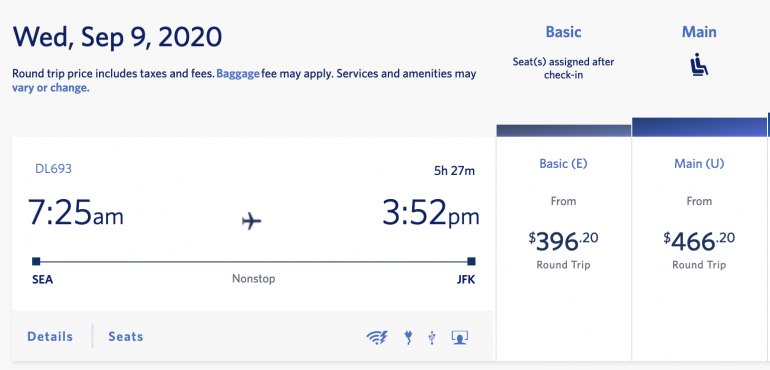

Selecting this will switch the prices over to a combination of, well, SkyMiles and cash, like this:

Since Delta is setting both the split between the amount of SkyMiles and cash, as well as the value of the SkyMiles, determining the value of this option requires a little work. For example, the same ticket paying only cash costs $466.20 in this case (note that the Miles + Cash price above is for a “Main” fare):

Subtracting the cash portion of the Cash + Miles price ($191.20) from the full cash price ($466.20) determines how much cash is being offset by miles ($466.20 - $191.20 = $275). So $275 is being offset by the 26,500 SkyMiles.

You can use this calculator to determine whether this is a good deal or not:

If the value of 26,500 SkyMiles is more than $275, this is not a good deal. If they are roughly the same, it’s a wash.

Indeed, for the most part, these Miles + Cash bookings should be considered only as a last-ditch option for burning some extra miles if you don’t have enough for a full ticket.

The bottom line

They may sound similar, but Delta’s "Pay with Miles" and "Miles + Cash" options offer fundamentally different value propositions. Neither offers particularly good bang for your SkyMiles in terms of value, but the "Pay with Miles" benefit for Delta cardholders can make sense in some cases, where the "Miles + Cash" offset rarely does.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Yes, you can still redeem your travel vouchers. Here's how to do it.

The travel credit you got after the pandemic is probably about to expire. Actually, it may have already run out.

A recent American Express survey says one in three travelers plan to burn their travel credits or points to pay for all or part of a trip. Why? They have a lot of travel credits to use. After the pandemic started, airlines, cruise lines and hotels doled out points and vouchers in such generous quantities that it put the CARES Act to shame.

"The airlines are sitting on more than $10 billion in unused travel credits, most of which expire in two years or less," says Lauren LaBar, a manager at Upaway , a travel concierge app.

But you don't have to lose your travel credit. Here are a few expert tips that will help you keep your credits and travel in the future. And there are ways of ensuring this never becomes a problem again.

Read your voucher now

If you've received a voucher, flight credit or travel certificate, find it and read it now. Cruise lines are particularly strict about their vouchers, called future cruise credits.

Learn more: Best travel insurance

“You have to know the value of your credit," says Annie Scrivanich , senior vice president at Cruise Specialists . "Also, know the terms and conditions like the expiration date and book-by date."

She warns that cruise lines aren't flexible in changing the terms, so she recommends rebooking sooner rather than later.

Track your credit

Many travel companies won't tell you if your credit is about to expire. Of course not. They want to keep your money. Don't let that happen to you, says Jeremy Ellis, head of customer care operations at Priceline .

"Keep track of your credit – and its expiration date – by flagging it in your email as soon as it hits your inbox and setting a reminder on your calendar to rebook before the deadline," he advises.

The date by which you must use your ticket should be on the cancellation confirmation of the original ticket. Also, note that there's sometimes a difference between when you have to book by and when you have to travel by.

Go back to the place you booked

If you bought your tickets or hotel room through a third party, like an online travel agency, you'll want to check with them. An agency can help, but they also add a layer of complexity – and sometimes, more restrictions. You'll want to check with the place you booked to see about your options for redeeming the voucher or credit.

If you're lucky, you bought your trip through a reputable travel advisor who can help you make the most of your credit (and possibly even extend it). If not, then you might have to deal with an automated system that is programmed to tell you "no" at every turn.

Either way, you have to start here, say experts.

How to make sense of credits

It can be confusing. Consider what happened to Tom Harriman, an attorney based in Clarksville, Maryland. He had $750 in American Airlines flight credits that were about to expire. But he couldn't redeem the scrip online because of a technical glitch.

Harriman phoned American and asked for help. A representative came up with a creative solution: She used part of his flight credits to book two new tickets, and she modified the remaining balance into travel credits, which he could use for a future trip up to a year after the date of the re-issue. It turns out American has travel credits and flight credits, each with its own rules.

"This is all crazy," he added.

It is. Airline credits are particularly confusing. For example, Delta Air Lines offered eCredits, which operate a lot like American's vouchers. United has electronic travel certificates. Each one comes with a set of restrictions that you'll need to review.

Don't assume your airline will warn you before they expire. I've received lots of complaints on my nonprofit consumer advocacy site where passengers discovered only too late that time had run out on their vouchers.

Call to redeem your credits

If you want to redeem your travel vouchers, get a real person on the phone. That's the advice of veteran financial advisor Michael Foguth .

"The best thing to do is call and communicate with a live person in the company’s customer service department," he says. "A live representative can typically give you tips and ideas on how to utilize all of your available credits. If your rewards are expired or close to it, the representative can often extend the expiration dates."

Note that some companies may charge you to talk to a human, so ask before you do anything.

With dangerous COVID variants still out there, and travel plans still in flux, it's more important than ever to track your travel vouchers. The ones you have could expire soon. And if you don't act now, they probably will.

Don't let vouchers become a problem again

Travel companies love to hand out expiring vouchers. They know only a small percentage of customers will redeem them, meaning that they get to keep your hard-earned money. Here's how to ensure that doesn't become a problem for you.

If they cancel, you deserve a full refund. In virtually every sector of the travel industry that's the rule. For airlines, it's a federal rule . In other cases, state law protects you from purchases made but not delivered.

You get what you negotiate. Experts say there's still lots of room for negotiation if you have to cancel or postpone your next trip. So if a company offers you a credit, be sure to request a refund. Phone reps often have some flexibility in granting a refund as a one-time exception. Always ask for your money back first.

There ought to be a law. Ideally, travel credit – like the money used to purchase it – should never expire. Consumer advocates such as Travelers United are pushing to ensure future airline vouchers don't expire. There's talk that the airlines might be on board with the idea.

- Share full article

Advertisement

Supported by

Frugal Traveler

To Protect Your Miles, Be Careful How You Book

American Airlines recently announced new restrictions on point allocation based on how you book a flight. What does that mean for loyalty members?

By Elaine Glusac

Elaine Glusac is the Frugal Traveler columnist, focusing on budget-friendly tips and journeys.

Earlier this month, American Airlines announced that beginning May 1, it will require travelers to book directly with the airline, partner airlines or “preferred travel agencies” in order to receive points in its loyalty program.

The unprecedented move confused many travelers eager to protect their mileage currency, prompting posts like this one on X: “@AmericanAir your news about earning miles/loyalty points is a bit concerning — we’re loyal to you no matter who we book through!”

In an email, a representative of the airline said that the approved list of travel agencies would not be published until April.

While there is much to be determined about the new policy, a battle for customers between the airline and third-party ticket sellers, which includes online travel agencies like Orbitz, has emerged. Here’s what travelers should know before booking their next flight.

What are the new points rules at American?

Currently, the biggest domestic carriers — including Delta Air Lines , United Airlines , Southwest Airlines and American — award points and miles to members of their loyalty programs on most tickets regardless of where they are sold.

American’s new rules state that in order to receive miles and points, travelers must book through its website, a Oneworld partner airline or approved travel agencies (with exceptions for those enrolled in its business program, which targets small companies, or with a corporate contract).

Also beginning May 1, fliers booking basic economy fares, the airline’s cheapest fares, may only earn points by booking through American’s website or its airline partners.

What’s behind the switch?

According to analysts, this is largely a behind-the-scenes fight over technology.

Travel agencies have long used distribution systems like Sabre and Amadeus to sell airline tickets. But many airlines are interested in using an emerging channel developed by the International Air Transport Association called New Distribution Capability . It offers airlines a more direct means of communicating with passengers, whom they can target with personalized fares or bundled offers not available in the traditional systems, providing opportunities to sell more services.

The “preferred” agencies that American said it will announce in April will be those making a substantial number of bookings on the new platform.

“American is dead set on being a more efficient airline and reducing its cost of sales, so they have issued this new edict and travel agents who choose not to follow along will find themselves on the losing end of the battle,” said Henry Harteveldt, a travel industry analyst and the founder of the Atmosphere Research Group.

Many travel agents object to the speed of adopting a technology they say still has bugs. In a recent letter to the 18,000 member agencies of the American Society of Travel Advisors , the president and chief executive of the trade organization Zane Kerby called it “an underdeveloped technology,” with “basic servicing” issues that include problems with cancellations, booking multiple people on the same itinerary and rebooking.

Mr. Kerby cited a heightened risk to most business travelers using external agencies to make their bookings. “It feels like American Airlines is disenfranchising or willing to disenfranchise its most profitable and lucrative segment, which is the frequent business traveler,” he said.

In American’s new requirement that basic economy fliers book directly with the airline to earn miles, Brian Sumers, who writes the Airline Observer newsletter, sees a play for greater loyalty from thrifty travelers at a time when many airlines have abandoned them. Delta , for instance, no longer awards points to its basic economy passengers. United restricts basic economy fliers to one personal item carried aboard when flying domestically.

American wants those basic economy passengers, Mr. Sumers said. “The end goal is to get people so excited about having AAdvantage points and using them all the time, because that’s where they’re making money.”

How should I book to ensure I’m awarded miles for American flights?

If you are accustomed to booking online with the airline directly, earning miles is not endangered.

If you use a travel agency, including online sites like Expedia or Orbitz, check the list of approved agencies when it is published in April.

But even for travelers who are accustomed to D.I.Y. bookings, the new American policy poses some threat to earning miles. If you use a travel agent to plan a more complicated trip — say, an African safari or a trek to Machu Picchu in Peru — make sure the agent is approved by American or be prepared to make the booking yourself to earn miles.

“American is counting on the fact that travelers engaged with AAdvantage will want to remain engaged, so that if their travel agent is not onboard, the customer will find a different travel agent or opt to book directly,” Mr. Harteveldt said.

Will other airlines follow suit?

Experts say commercial aviation is a copycat industry; if a policy is successful, others are likely to follow. But it may not happen quickly in this case.

“There are some very expensive tickets that go through using the older system,” Mr. Sumers said, describing other airlines as “taking a watch-and-wait approach” to see if any defections from former American customers boost their business.

“By no means has this play reached its conclusions,” Mr. Harteveldt said. “We are in the first part of the first act.”

Follow New York Times Travel on Instagram and sign up for our weekly Travel Dispatch newsletter to get expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places to Go in 2024 .

Open Up Your World

Considering a trip, or just some armchair traveling here are some ideas..

52 Places: Why do we travel? For food, culture, adventure, natural beauty? Our 2024 list has all those elements, and more .

Mumbai: Spend 36 hours in this fast-changing Indian city by exploring ancient caves, catching a concert in a former textile mill and feasting on mangoes.

Kyoto: The Japanese city’s dry gardens offer spots for quiet contemplation in an increasingly overtouristed destination.

Iceland: The country markets itself as a destination to see the northern lights. But they can be elusive, as one writer recently found .

Texas: Canoeing the Rio Grande near Big Bend National Park can be magical. But as the river dries, it’s getting harder to find where a boat will actually float .

Your ultimate guide to the Delta Choice Benefits program

Editor's Note

Many travelers believe the Delta Air Lines SkyMiles program has decreased in value over the years. In 2023, Delta announced SkyMiles changes that were so unpopular that it walked back some of the changes about one month later.

But Delta Medallion status is still extremely valuable. One particularly valuable perk available to Platinum Medallion members and higher is the Choice Benefits program. Whether you're a newly minted elite member or a longtime Delta loyalist, here's what you need to know about Delta Choice Benefits, including how to earn them, when to select them and which benefits are best.

How to earn Delta Choice Benefits

You earn Delta Choice Benefits each calendar year you qualify for Platinum or Diamond Medallion status. Specifically, you earn one Choice Benefit when you qualify for Platinum Medallion status and three additional Choice Benefits when you qualify for Diamond Medallion status.

Delta now only uses one metric — Medallion Qualification Dollars — for elite qualification. Here are the current calendar year requirements for the two tiers of Delta Medallion status that offer Choice Benefits as a perk:

- Platinum Medallion status : 15,000 MQDs

- Diamond Medallion status : 28,000 MQDs

You can earn MQDs on flights and other transactions with Delta and its partners, including vacation packages and spending on cobranded credit cards. Plus, starting Feb. 1, 2024, cardholders of the following premium cobranded Delta credit cards get a boost of 2,500 MQDs per card toward status qualification each year:

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

If you want to earn Delta Medallion status, having one or more of these premium Delta cards in your wallet could be extremely helpful.

Related: Which credit card should you use for Delta Air Lines flights?

When to select Delta Choice Benefits

You can select Delta Choice Benefits after you earn Platinum or Diamond Medallion status based on activity within a calendar year. And you must select your Choice Benefits by the day your status would expire if you didn't requalify. Here's an overview of when you should select your Choice Benefits based on the calendar year during which you earned Platinum or Diamond Medallion status:

- 2022 : Select between when you qualified in 2022 and when your status expires Jan. 31, 2024

- 2023 : Select between when you qualified in 2023 and when your status expires Jan. 31, 2025

- 2024 : Select between when you qualify in 2024 and when your status expires Jan. 31, 2026.

Some Choice Benefits expire on a set date regardless of when you select the benefit. So, you'll get the most value from some Choice Benefits by selecting the benefit as soon as you're eligible.

2023 Medallion year Delta Choice Benefits

If you qualified for Delta Platinum or Diamond Medallion status during the 2022 calendar year, you earned status for the 2023 Medallion year and should select your Choice Benefits by Jan. 31, 2024.

You can select one Choice Benefit when you qualify for Platinum Medallion status and three additional Choice Benefits when you qualify for Diamond Medallion status. Here's a look at your Choice Benefits options if you earned Platinum or Diamond status for the 2023 Medallion year (based on your 2022 activity):

Now, let's take a closer look at each option and the value it might provide if you qualified for Delta Platinum or Diamond Medallion status during the 2022 calendar year.

Upgrade certificates

You could use your one Choice Benefits selection after earning Platinum Medallion status for four regional upgrade certificates. Or if you reached Diamond Medallion, each of your choices could get you four global, eight regional, or two global and four regional upgrade certificates .

These one-way upgrade certificates give higher priority than Medallion complimentary upgrade requests. You can apply these upgrade certificates to most fares except Delta basic economy for a one-class, space-available upgrade.

However, you'd need to book and fly using these certificates by the end of Jan. 31, 2024, since they would be associated with your 2023 Medallion year. As such, they may not be the best option if you are selecting your 2023 Medallion year Choice Benefit(s) now.

Bonus miles

With your Choice Benefits, you can select bonus miles for yourself, another SkyMiles member or a SkyWish charity. Platinum Medallion members can select 20,000 bonus miles, while Diamond Medallion members can select 25,000 miles per choice.

TPG's valuations peg the value of Delta SkyMiles at 1.2 cents each. So, 20,000 bonus miles are worth about $240, while 25,000 bonus miles are worth about $300. Bonus miles are a good option if you are selecting your 2023 Medallion year Choice Benefit(s) now.

Related: How to redeem Delta SkyMiles for maximum value

Delta Sky Club benefits

Once you earn Diamond Medallion status, you could use one or more of your Choice Benefits selections for the following Delta Sky Club access benefits:

- Individual membership : Get complimentary access to Delta Sky Club locations around the globe for yourself through Jan. 31, 2024.

- Guest pass : Upgrade complimentary Delta Sky Club access from an eligible credit card to include complimentary access for up to two guests (or your spouse or domestic partner and children under 21) traveling with you through Jan. 31, 2024.

- Executive membership (requires two Choice Benefits unless you already have a Delta Sky Club individual membership valid through Jan. 31, 2024): Get complimentary access to Delta Sky Club locations around the globe for yourself and up to two guests (or your spouse or domestic partner and children under 21) through Jan. 31, 2024.

You'll only get these benefits through Jan. 31, 2024. As such, we don't recommend this option if you are selecting your 2023 Medallion year Choice Benefit(s) now.

Delta travel voucher

You can select a Delta travel voucher worth $200 per choice. You're the only one who can use the voucher, but you can use it toward the Delta airfare portion of a Delta Vacations package.

Vouchers are valid 12 months from issuance, which should occur within 48 hours of selection. As such, this is a decent option if you are selecting your 2023 Medallion year Choice Benefit(s) now.

Gift Delta Medallion status

Finally, you can opt to gift Delta Medallion status to someone else. Platinum Medallion members can gift Silver Medallion status, while Diamond Medallion members can gift Gold Medallion status.

Your gift recipient must have no Medallion status or a lower tier of Medallion status. However, this status will only last through Jan. 31, 2024, so we don't recommend this option if you are selecting your 2023 Medallion year Choice Benefit(s) now.

Related: Airline and hotel loyalty programs that let you give the gift of elite status

Which Delta Choice Benefit is best for the 2023 Medallion year?

As noted previously, you must select 2023 Medallion year Choice Benefits by Jan. 31, 2024. However, many of the perks expire Jan. 31, 2024.

So, you'll want to choose your benefits carefully. The best option for most members selecting one or more 2023 Medallion year Choice Benefits now will be bonus miles. The bonus miles should provide more value than the travel voucher, plus Delta SkyMiles don't expire.

2024 Medallion year Delta Choice Benefits

If you qualified for Delta Platinum or Diamond Medallion status during the 2023 calendar year, you earned status for the 2024 Medallion year and should select your Choice Benefits by Jan. 31, 2025.

You can select one Choice Benefit when you qualify for Platinum Medallion status and three additional Choice Benefits when you qualify for Diamond Medallion status. Here's a look at your options if you earned Platinum or Diamond status for the 2024 Medallion year:

While some Choice Benefits are identical to previous years, others are new. So, let's look at each option and the value they might provide if you qualified for Delta Platinum or Diamond Medallion status during the 2023 calendar year.

After earning Platinum Medallion status based on 2023 activity, you could use your one Choice Benefits selection for four regional upgrade certificates . And if you earned Diamond Medallion status, each additional choice could give you one of the following:

- Four global upgrade certificates

- Eight regional upgrade certificates

- Two global and four regional upgrade certificates

These upgrade certificates give higher priority than Medallion complimentary upgrade requests and can get you a one-class, space-available upgrade on most fares except Delta basic economy .

However, you must book and fly using these certificates by the end of Jan. 31, 2025, since they would be associated with your 2024 Medallion year.

Related: The ultimate guide to getting upgraded on Delta flights

With your Choice Benefits, you can select bonus miles for yourself, another SkyMiles member or a SkyWish charity. At the Platinum Medallion tier, you could choose 20,000 bonus miles (worth $240 based on TPG's valuations ). And at the Diamond Medallion tier, you could choose 25,000 bonus miles (worth $300) per choice.

At the Delta Diamond Medallion tier, you could trade all three Choice Benefits choices for a Delta Sky Club executive membership. This membership — typically costing $1,495 or 149,500 miles — gives you and up to two guests (or your spouse or domestic partner and children under 21) unlimited complimentary Delta Sky Club access through Jan. 31, 2025.

MQDs toward the 2025 Medallion year

You can use Choice Benefits selections for MQDs for the 2025 Medallion year. You'd get 500 MQDs for your choice at the Platinum Medallion tier and 1,000 MQDs per choice at the Diamond Medallion tier.

As these Medallion Qualification Dollars will count toward your qualification in the 2024 calendar year for the 2025 Medallion year, you'll see them in your account in January 2024.

You can use your Choice Benefits to gift Delta Medallion status to someone else. Each choice is worth two gifts, with Platinum Medallion members able to gift Silver Medallion status to a pair of travelers and Diamond Medallion members able to gift Gold Medallion status.

The gifted status will last through Jan. 31, 2025, regardless of when you select your 2024 Medallion year Choice Benefits.

Related: Delta baggage fees and how to avoid paying them

Delta Vacations Experience credit

You could use your one Choice Benefits selection after you earn Platinum Medallion status for a $400 credit toward a Delta Vacations package. Or you could wait until you earn Diamond Medallion status for a $500 credit. However, you can only select a Delta Vacations Experience credit as a Choice Benefit once per Medallion year.

The credit is valid for one year after it's issued, and a two-night minimum stay is required.

Delta American Express statement credit

If you are the primary cardmember of the Delta Platinum Amex , Delta Platinum Business Amex , Delta Reserve Amex or Delta Reserve Business Amex , you can choose a statement credit on your card as a Choice Benefit at each Medallion status tier.

You can choose a $200 statement credit at the Platinum Medallion tier and a $500 statement credit at the Diamond Medallion tier. However, you can't use multiple Choice Benefits to get multiple statement credits at the Diamond Medallion tier.

Related: Delta SkyMiles Reserve vs. Delta SkyMiles Reserve Business

You can select a Delta travel voucher with your Choice Benefits, worth $250 per choice. You're the only one who can use the voucher, but you can use it toward the Delta flight portion of a Delta Vacations package.

Vouchers are valid for 12 months from their issuance, which should occur within 48 hours of when you select the voucher.

Sustainable aviation fuel contribution

You can use your Choice Benefits to support Delta's use of sustainable aviation fuel. Delta will apply $250 toward the incremental cost of sustainable aviation fuel instead of traditional jet fuel for each choice.

Related: How you can donate your points and miles to charity

Starbucks Rewards stars

Finally, U.S.-based SkyMiles members who are enrolled in Starbucks Rewards and have linked their accounts may choose 4,000 Starbucks Rewards stars as a Choice Benefit once at each tier. However, stars will expire six months after the calendar month they were deposited.

Related: These are the best credit cards to use at Starbucks

Which Delta Choice Benefit is best for the 2024 Medallion year?

You must select 2024 Medallion year Choice Benefits by Jan. 31, 2025. Many of the perks expire Jan. 31, 2025, but that may still leave you plenty of time to use them.

At the Platinum Medallion tier, the best option for most travelers is four regional upgrade certificates, 20,000 bonus miles or the $400 Delta Vacations Experience credit. However, the best choice for you will depend on whether you'd be able to get good value from the regional upgrade certificates and whether you plan to book a Delta Vacations Experience soon.

At the Diamond Medallion tier, some combination of upgrade certificates, 25,000 bonus miles, the $500 Delta Vacations Experience credit and the $500 Delta Amex statement credit will appeal to most Delta loyalists. The Delta Sky Club executive membership may also appeal to Diamond Medallion members who frequently travel with family members or friends. However, giving up all three choices may be too difficult.

2025 Medallion year Delta Choice Benefits

If you qualify for Delta Platinum or Diamond Medallion status during the 2024 calendar year, you'll earn status for the 2025 Medallion year.

Delta hasn't yet updated its Choice Benefits page for the 2025 Medallion year . But I expect you'll still be able to select one Choice Benefit when you qualify for Platinum Medallion status and three additional Choice Benefits when you qualify for Diamond Medallion status. I also expect you'll need to select your Choice Benefits by Jan. 31, 2026.

Delta may continue some of the 2024 Medallion year Choice Benefit options. But based on the information provided by Delta about its changes to the Delta SkyMiles program , we know the program is offering the following new or improved options for the 2025 Medallion year:

As we don't have any additional information from Delta, we won't go into additional detail about these Choice Benefit options now. However, we'll update this post once the 2025 Medallion year Choice Benefits are fully unveiled.

Bottom line

There are many options when it comes to Delta Choice Benefits. These benefits can provide significant value, so making an informed choice is important — especially since some perks may expire quickly if you choose them near the end of your Medallion year.

Ultimate guide to canceling a flight and getting a refund with major US airlines

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This post was updated with new information.

Most airlines now have favorable policies if you need to cancel your flight, especially if you booked using points or miles. If you book the right fare with an airline that has friendly cancellation policies, you may not be out hundreds of dollars — or be on the hook for astronomical fees — should your travel plans change.

However, with many different airlines and varying policies, it can be overwhelming to figure out each carrier’s rules. To make it easier, we put together this guide about the cancellation and refund policies for the major U.S. airlines.

Can I cancel a flight and get a refund?

These days, all airlines allow you to cancel a flight, and most make it extremely easy to do so. You can usually cancel a flight online, and many carriers let you get a refund in some capacity.

For the most part, if you book a nonrefundable fare — the most common fare type — you’ll receive a credit or voucher for a future flight. However, you’ll find that some airlines charge a fee to cancel, and they might base the fee on how far in advance you cancel.

For example, Southwest Airlines has one of the most generous cancellation policies, regardless of the fare type. As long as you cancel at least 10 minutes before your flight’s scheduled departure time, there is no fee to cancel your reservation, whether it is a paid fare or one booked on points. While you’ll end up with a travel credit for the amount paid if you cancel a paid fare, Southwest won’t deduct any fees from that voucher. Also, if you booked using Southwest points, the airline will immediately return them to your account with no fees.

Delta Air Lines, American Airlines and JetBlue Airways also have favorable cancellation policies — as long as you didn’t book their least expensive basic-economy fare .

On the other hand, Frontier Airlines will charge you a $75 fee when canceling a reservation booked on miles. However, as long as you cancel at least 60 days before your flight, there’s no fee for canceling paid reservations.

Perhaps the least favorable airline is Allegiant , which requires you to cancel seven or more days in advance and charges a cancellation fee per segment (not round-trip).

So, when you wonder if you can cancel a flight and get a refund, the answer depends on many factors, including the airline, the fare type and how far in advance you cancel.

How to cancel a flight with major airlines

Many airlines allow you to cancel a flight without hefty fees. Since every airline operates slightly differently, we’ve compiled the policies for each major airline and the associated fees so you can figure out how to cancel a flight. This information is for a regular passenger (not one with status) on a standard reservation.

If you booked under special circumstances, we’ve linked to our full guide for each respective airline which goes into more detail about each one’s policy. These guides also include the policies for changing a flight instead of fully canceling.

Alaska Airlines’ cancellation policy

Canceling a paid alaska airlines reservation.

Alaska allows you to cancel reservations — including its cheapest Saver fares — within 24 hours of booking. While Alaska’s other fare types are eligible for refunds within 24 hours of booking, Saver fares are not refundable.

The 24-hour cancellation policy only applies to flights that depart more than 24 hours from the time of purchase. If you change flights, you may have to pay the difference if your new itinerary has higher fares.

When you cancel a Saver fare, you’ll instead receive a credit deposit or credit certificate, and Alaska may also charge change fees at the time the credit is deposited.

Canceling an Alaska reservation booked with miles

Passengers can cancel an award reservation by calling Alaska’s reservation center. The airline will deposit the miles back into your account once you cancel your award flight, and you’ll receive a refund for any taxes paid.

Allegiant Airlines’ cancellation policy

Canceling a paid allegiant reservation.

Allegiant has one of the more strict policies when canceling a flight: You must cancel seven days before departure and will still have to pay a fee. Typically, the fee is $75 per segment (not for the entire reservation), but for now, Allegiant has reduced the fee to $25 per segment. When canceling, you’ll receive a voucher for the amount paid (minus the total cancellation fee), valid for up to one year from the original booking date.

When canceling a flight within seven days, the airline won’t issue a credit, and you’ll lose the entire ticket value.

Canceling an Allegiant reservation booked with miles

Allegiant offers a unique policy regarding canceling an award booked with miles. You’ll be charged the same fee per segment, and the flight must be canceled at least seven days in advance. The points redeemed will not be redeposited back into your account; you’ll instead receive a voucher for the value of the ticket.

Related: How to change or cancel an Allegiant Air flight

American Airlines’ cancellation policy

Canceling a paid american reservation.

You can cancel all American reservations, except American’s basic-economy fares, without a fee. However, some flights that originate outside North and South America have slightly different policies.

Basic economy is only eligible for a refund if canceled within 24 hours of booking. Otherwise, basic economy fares do not allow any cancellations — even for a fee — so you’ll lose the entire ticket value if you can’t make the flight.

When canceling a reservation (besides basic-economy fares), you’ll receive a travel credit that expires one year from the date of issue of the original ticket.

Canceling an American reservation booked with miles

American allows you to cancel award flights for free. There are no redeposit fees, and your miles will immediately go back into your account. Since you can’t book a basic-economy fare with miles, there’s no need to worry about this more restrictive fare type.

Related: How to change or cancel an American Airlines flight

Delta Air Lines’ cancellation policy

Canceling a paid delta reservation.

Most Delta fare types for flights originating in North America (except Delta basic-economy tickets) will allow you to cancel your flight without a fee.

When canceling a basic-economy fare for travel within the U.S. or to Mexico, the Caribbean or Central America, the fee is $99. For all other routes, the cancellation fee is twice the amount, at $199. Additionally, Delta will charge up to $500 in fees for flights that originate outside of North America.

Canceling a nonrefundable fare will result in an eCredit for the full amount paid (minus any cancellation fees, depending on fare type and route). However, if you cancel a refundable ticket, you’ll get the amount paid refunded back to your original form of payment. ECredits typically expire a year after receiving them, but as of right now, Delta has extended the expiration date of all eCredits to at least Dec. 31, 2023.

Canceling a Delta reservation booked with miles

Similar to a paid reservation, as long as you book a fare type other than basic economy, you can cancel your flight, and Delta will re-deposit the miles back into your account with no fee. Additionally, Delta will refund any taxes and fees to the original form of payment.

For reservations booked as basic economy, you can still cancel your flight. However, Delta will deduct between 9,900 and 19,900 miles from the amount it redeposits into your account when you cancel.

Related: How to change or cancel a Delta Air Lines flight

Frontier Airlines’ cancellation policy

Canceling a paid frontier reservation.

There’s no fee if you cancel a Frontier reservation 60 days or more before your flight. However, within the 60-day window, you’ll be charged a fee.

It costs $49 for flights canceled between 59 and seven days before departure and $79 for flights canceled six days or less before departure. You’ll receive a credit for the price paid minus the cancellation fee, and you’ll need to use this credit within 90 days of receiving it.

Canceling a Frontier reservation booked with miles

Unlike many other airlines, Frontier charges a cancellation fee even if you booked with miles. Regardless of how far in advance you cancel, you’ll need to pay a $75 redeposit fee if you cancel.

Related: How to change or cancel a Frontier Airlines flight

Hawaiian Airlines’ cancellation policy

Canceling a paid hawaiian reservation.

You can cancel main cabin, first-class and business-class fares on Hawaiian without a fee — but there’s a catch. While you’ll receive a flight credit for the amount paid, you’ll lose any remaining value associated with your credit when you book a new flight if the new flight is less expensive than the previous flight.

Canceling a Hawaiian reservation booked with miles

For tickets purchased with HawaiianMiles, there’s no fee to cancel and redeposit your miles.

Related: How to change or cancel a Hawaiian Airlines flight

JetBlue Airways’ cancellation policy

Canceling a paid jetblue reservation.

For all fare types, except for Blue Basic fares, there’s no fee to cancel your reservation before departure.

For all nonrefundable fares, you’ll receive the entire amount paid back as a JetBlue Travel Bank credit, which expires 12 months after receiving the credit. These credits are nontransferable, but you can use a credit to book for another passenger from within your JetBlue account.

For Blue Basic fares, the cancellation fee is either $100 or $200, depending on the route. For routes in the U.S., Mexico, Canada and Central America, the fee is $100 per person. For all other routes, the fee is $200 per person. You’ll still receive a travel credit (minus the fee) for these reservations.

Canceling a JetBlue reservation booked with miles

You can cancel any JetBlue flight booked with points without a fee. When canceling, the points redeemed will go back into your account. However, the taxes and fees paid will go into your JetBlue Travel Bank credit — not back to your original form of payment (which is the policy for most other airlines).

Related: How to change or cancel a JetBlue flight

Southwest Airlines’ cancellation policy

Canceling a paid southwest reservation.

Southwest is one of the best airlines if you need to cancel your flight. You can cancel a Southwest flight for free if you do so at least 10 minutes before departure.

For Wanna Get Away and Wanna Get Away Plus fares — the two least expensive fare types — you’ll receive a credit for the amount paid. For Wanna Get Away fares, the credit isn’t transferable, and only the original passenger can use the credit. If you booked a Wanna Get Away Plus fare, any individual can use the credit.

Anytime and Business Select fares, however, are fully refundable. If you need to cancel one of these fares, you’ll receive a full refund for the amount paid back to your original form of payment.

Canceling a Southwest reservation booked with miles

Similar to a paid reservation, when you cancel a flight booked with miles at least 10 minutes before departure, Southwest will return the points to the account used to book the award without charging any fees. The taxes and fees paid for the award will return to the original payment form.

Related: How to change or cancel a Southwest Airlines flight

Spirit Airlines’ cancellation policy

Canceling a paid spirit reservation.

Spirit allows you to cancel a flight but charges a fee based on when you cancel the flight. If you cancel, you’ll receive a credit for the amount paid minus the fee. However, the credit isn’t transferable and expires 60 days from when you receive it.

Here’s what you can expect to pay in fees when you cancel a paid Spirit reservation:

Canceling a Spirit reservation booked with miles

When canceling a Spirit flight you reserved with miles, the same cancellation policy applies as if it were a paid reservation. Spirit will charge you a $49-$99 fee to redeposit your miles if you cancel within 59 days of your flight. It won’t charge a fee if you cancel 60 days or more before your flight.

Related: How to change or cancel a Spirit Airlines flight

United Airlines’ cancellation policy

Canceling a paid united reservation.

For almost all United flights, except those booked in basic economy, you can cancel for free if you are traveling within the U.S. (including Alaska and Hawaii), Canada, Mexico or on an international flight that originates in the U.S. For United basic-economy tickets, if your plans change, you’ll ultimately lose the value of the ticket entirely.

Unless you book a refundable fare (or a basic economy fare), you’ll receive a travel certificate for the value of the price paid when you cancel. These certificates expire one year from the original ticketing date.

Canceling a United reservation booked with miles

United no longer charges fees for canceling award flights; your miles will be re-deposited after you cancel your flights. However, United charges a $125 fee, regardless of status, for re-depositing miles if you’re a no-show to your award flight.

Related: How to change or cancel a United Airlines flight

Can you cancel plane tickets?

Many people book flights a year in advance and hope their vacation plans stay intact. However, plans can change. Fortunately, many airlines now offer more friendly cancellation policies, so you don’t have to wonder whether you can cancel a plane ticket.

Whether you book with miles or as a paid reservation, you can always cancel a plane ticket, but the refund policy varies from one airline to the next. You must be comfortable with how you’ll receive your money or miles back. For the most part, you’ll receive the money back as a credit and the miles back into your account. For lower-cost airlines, though, there’s typically an associated fee.

Related: Complete guide to changing and canceling award tickets

Can you refund plane tickets?

Whether you can refund plane tickets depends on the fare type purchased and what you are looking for in terms of a refund. No airline offers full refunds back to the form of payment for every ticket purchased. Instead, you must purchase a more flexible fare type or a refundable ticket if you want this privilege.

While not all airlines offer refundable fare options, some airlines allow you to purchase an add-on to your ticket. This add-on may make your reservation fully refundable if you need to cancel.

For example, Frontier offers “The Works” package , where one of the benefits is that your fare is fully refundable.

Some airlines do not allow refunds on their most basic fare types. For instance, if you purchase a basic-economy fare on Delta , you can’t get a refund on a plane ticket. If your plans change and you must cancel, you’ll lose your entire ticket value.

Related: Why you should wait to change or cancel your flight if you want your money back

Bottom line

Before purchasing your next plane ticket, it’s smart to be well-versed in the airline’s policy. You always hope that your intended travel plans go off without a hitch. However, life happens, and there are times when you might need to cancel a flight.

If you’re not confident of your plans when booking your flight, booking with a more favorable airline or purchasing a fare class with more flexibility may be your best bet.

Additional reporting by Meghna Maharishi.

SPONSORED: With states reopening, enjoying a meal from a restaurant no longer just means curbside pickup.

And when you do spend on dining, you should use a credit card that will maximize your rewards and potentially even score special discounts. Thanks to temporary card bonuses and changes due to coronavirus, you may even be able to score a meal at your favorite restaurant for free.

These are the best credit cards for dining out, taking out, and ordering in to maximize every meal purchase.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

- Weird But True

- Sex & Relationships

- Viral Trends

- Human Interest

- Fashion & Beauty

- Food & Drink

trending now in Lifestyle

Plastic surgeons warn 'Ozempic face' has taken over Hollywood

My year of casual sex: I set out to be 'fearless' in the bedroom...

Being a top earner on OnlyFans has 'made me a better mom'

I'm a dietitian — eat this easy late night snack if you want...

NYC airport shamed over sky high beer prices — stressed flyers...

Ozempic use appears to be changing people's personalities...

The best 4/20 food deals you need to satisfy your munchies.

‘I flew over 1,500 miles to meet man I'd been talking to online...

American airlines changes passenger rules for earning miles — and travel agencies are pissed.

- View Author Archive

- Get author RSS feed

Thanks for contacting us. We've received your submission.

American Airlines has multiple travel advisors up in arms after it announced plans to restrict AAdvantage Miles earnings for certain booking agencies.

The airline behemoth announced in February that flyers hoping to earn AAdvantage miles for their flights will have to do so directly through American, their airline partners, or preferred travel agencies recognized by the company.

The change will take effect on May 1, but American has yet to reveal which agencies will be included in its “preferred agencies.”

The change comes as part of the airline’s effort to minimize costs for agencies using older technology booking systems.

The airline has tried to convince agencies using the older booking systems to upgrade to newer platforms like the one American uses on its website.

While American announced a list would be shared in “late April,” agencies unsure if they’ll make the cut are expressing their distaste for the major change.

The American Society of Travel Agents (ASTA), Association of Canadian Travel Agencies and Advisors (ACTA), Foro Latinoamericano de Turismo (FOLATUR), and World Travel Agents Associations Alliance (WTAA) emphasized that any plans to restrict their clients’ earning miles could be detrimental to their agencies.

“It’s clear from the consensus among WTAAA, ACTA and FOLATUR, representing travel professionals around the world, the detriment that American’s decision will have on the travel industry globally,” President and CEO of ASTA, Zane Kerby, told Travel and Tour World .

Kerby called out American for “operating in bad faith” and was “looking to pad its bottom line at the expense of our valued clients and the millions of consumers who rely on their trusted travel advisor.”

Henry Harteveldt, president of the travel industry market research firm Atmosphere Research Group, told Fodor’s Travel the move is a “very inward-looking” perspective on American Airlines.

“It’s not a very consumer-friendly approach, and American is being a bit of a bully here,” Harteveldt explained — adding the move will put loyalty airline members in the crossfire of the company’s dispute with agencies.

Harteveldt believes the move is also being monitored by the company’s competitors, who may adopt the change if it’s a success or whose sales teams may swoop in to poach any American flyers unpleased with the new method.

“As risky as American’s actions are, a lot of airlines are watching to see if it works out well for them, because if it does, I would not be surprised to see United and Delta copy it in certain ways,” he told the outlet.

While the airline is deadset on the change, Brett Snyder — author of the popular travel industry blog Crankyflier and CEO of the travel assistance service Cranky Concierge — said the move could cause “confusion” for the company’s flyers who already are trying to navigate their “frequent changes.”

“The biggest impact will likely be on business travelers who may not have a choice of where to book depending upon company policy,” Snyder told the outlet.

“The fact that American still hasn’t told everyone who is or is not preferred adds more to the confusion.”

As the airline industry waits to hear who American will list as their “preferred agencies,” occasional travelers may also feel the weight of the change, Snyder explained.

He worries that some agencies may not disclose that to their customers during the booking process.

Also, the move could affect cruise lines that book airfares as part of their packages, who may opt against using certain agencies not listed as one of American’s preferred agencies.

The changes will only affect travelers who collect AAdvantage Miles for their flights on American.

Flyers using corporate accounts with American will continue to earn miles for their flights no matter which booking channel they use unless they book a Basic Economy fare.

Travelers collecting miles from other Oneworld partners—the global airline alliance American is a member of with 13 other Airlines, such as British Airways, Qatar Airways, and Malaysia Airlines—will continue to earn miles for American Airlines flights regardless of booking channel.

Share this article:

Advertisement

I've traveled over 10,000 miles on the open road — after technology failed me, I'll never make these 3 mistakes again

- As a seasoned traveler, I always felt ready for road trips — but on each trip, tech failed me.

- I now print directions now and travel with extra car-key fobs.

- Planning for mishaps provides more enjoyment and saves me hours of frustration.

AI can plan travel itineraries and Apple AirTags can track luggage — but tech and travel aren't always a foolproof combination when it comes to road trips.

After driving 10,000 miles around the US over the last several years, I've learned a few critical tech lessons the hard way.

Here are the backup solutions I now put in place before leaving home — and why you might want to try them if you're traveling anytime soon.

A spare car key is now essential for all road trips

During the height of the coronavirus pandemic, I hopped in my SUV to travel to Fort Myers, Florida. I felt prepared to leave Minneapolis outfitted with the essentials — N95 masks, hand sanitizer, a flashlight, mace, and a full gas tank.

But when stopping for fuel 600 miles away from home, with 1,100 miles remaining, "Key battery low, replace soon" appeared on my car's display.

I didn't bring my spare smart key fob, let alone a flathead screwdriver or a replacement battery. Before turning to the internet to look for solutions, I called my car salesperson, who explained how to start the vehicle if the fob died.

Fortunately, I didn't have to get to that point because a nearby dealership was able to change the battery for me.

Related stories

To save myself a headache, I now travel with two extra fobs, a screwdriver, and batteries. But if you're in a pinch, many auto shops and big-box stores sell the batteries commonly used in fobs and the screwdriver needed to replace them.

I make plans for when smart locks on rentals aren't so smart

When traveling to Dallas , my youngest and I arrived at our Airbnb and discovered the smart-lock entry code didn't work.

We texted our host, who was able to get us inside the rental, but technology failed again when we had to leave for an appointment. The smart lock wouldn't let us lock the door.

We left the condo unlocked and hoped our belongings wouldn't be stolen. Later, the owner brought a physical key for us and hid it in an inconspicuous spot.

Now, before booking a vacation rental , I ask about the lock system. If it's a smart lock, I ask for a contingency plan in case the tech isn't so bright.

I print directions in case my phone dies, or I lose service

I've relied on Google Maps to set my route and add fun stops on trips, such as a dog park for my pup. However, when my phone unexpectedly died on an unfamiliar highway recently, I felt lost without as much as an old-fashioned map.