- 永安旅遊 & BicCamera及高島屋百貨

- Travel Guru會員計劃

- 最紅簽賬獎賞 - 中國內地及澳門

- 滙豐白金Visa卡 - 賺大獎賞生活圈

- 最紅醫療保健優惠 – 卓健醫療

- 最紅購物優惠 - 衛訊

- 2024夏季香港餐廳周 - 贏家版

- 低至6折超值回饋宴及紅酒宴

- 低至6折金牌獅頭鵝•龍躉斑盛宴

- 滙豐EveryMile信用卡專享海外簽賬優惠

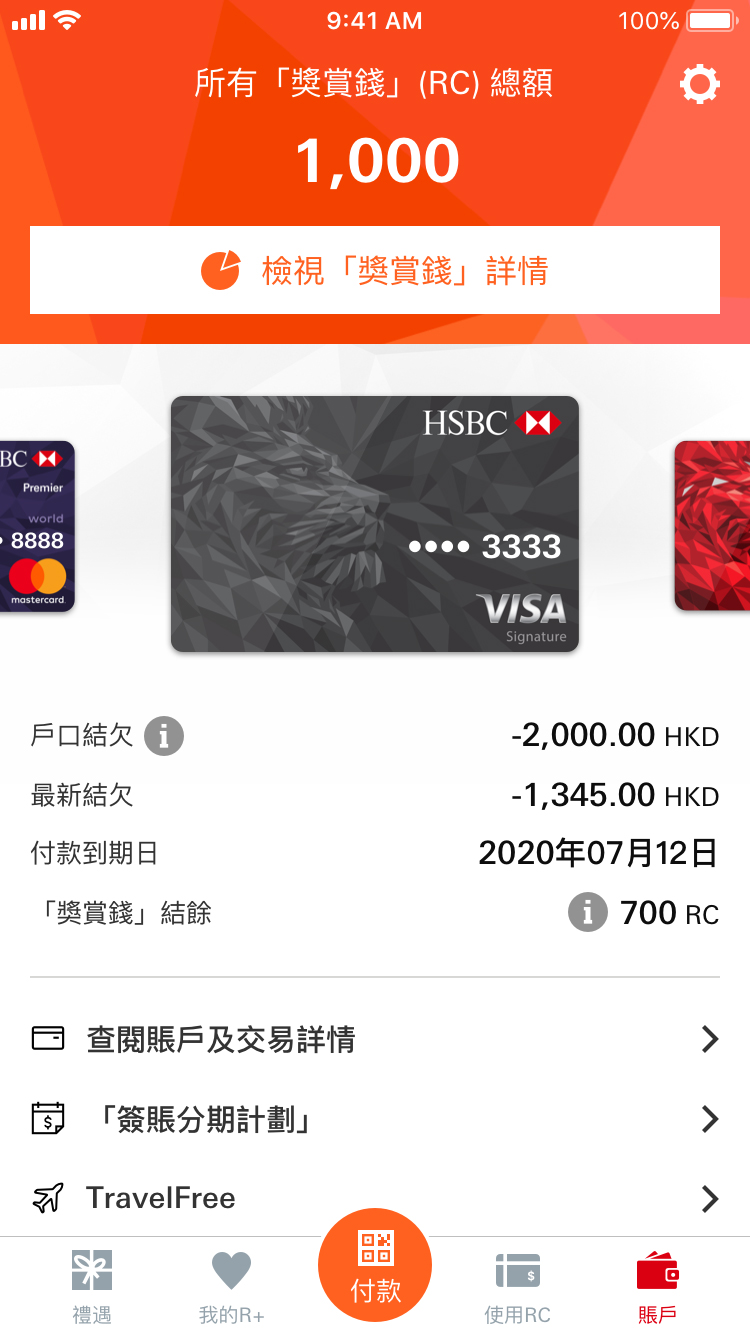

- 滙豐Reward+應用程式

- 滙豐EveryMile信用卡

- 滙豐 Visa Signature 卡

- 滙豐白金 Visa 卡

- 滙豐Pulse銀聯雙幣鑽石信用卡

- 滙豐滙財金卡 – 學生卡

滙豐Reward+應用程式TravelFree旅遊功能,讓您輕鬆掌握海外簽賬,從此便可安心去旅行。

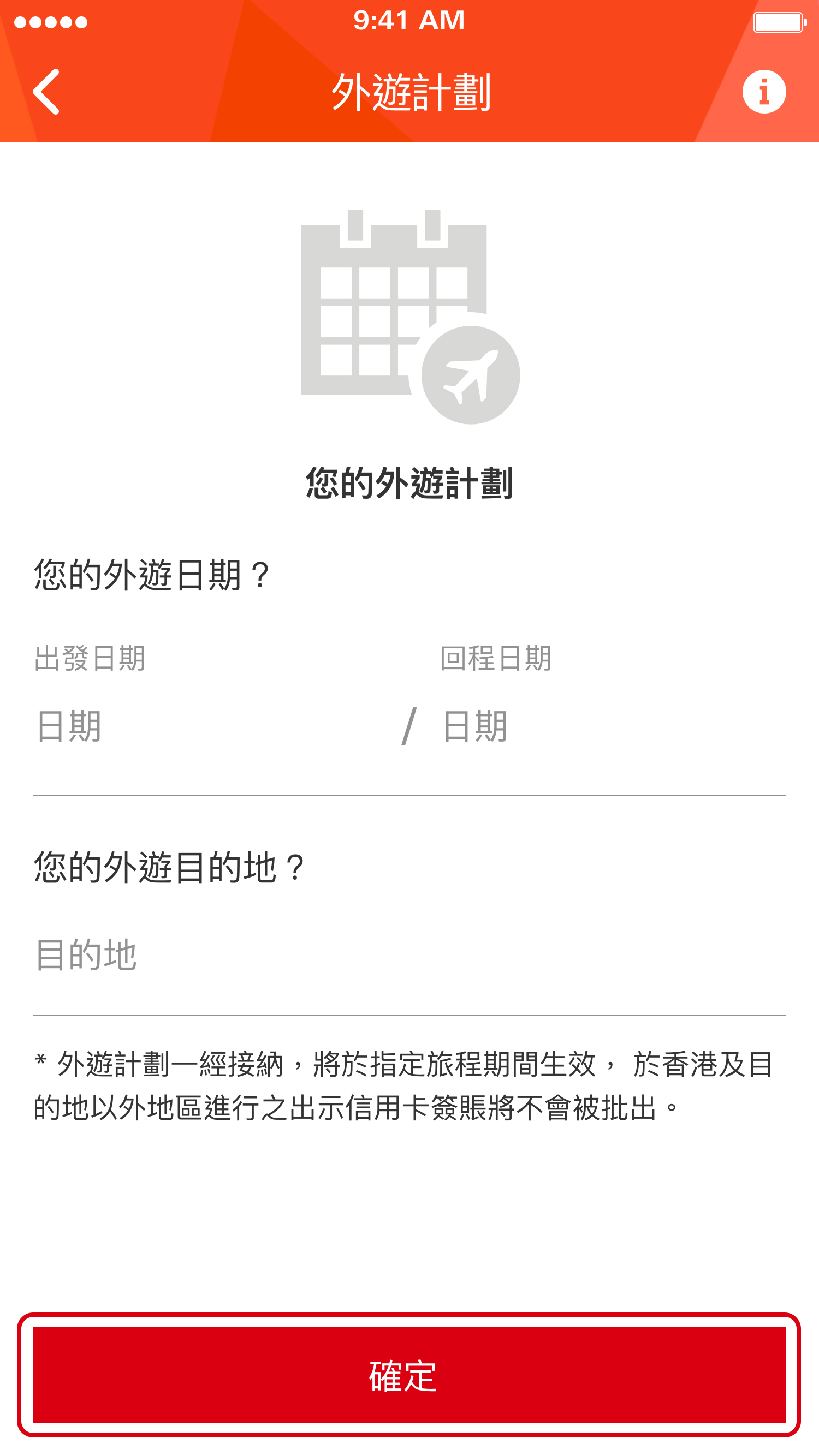

- 外遊計劃: 出發前,只需設定您的外旅遊日期及目的地,並包括任何中轉地點,於旅程期間,香港及指定目的地以外地區之出示信用卡簽賬將不會被批出,讓您享有更佳更安全的海外簽賬體驗。

- 海外簽賬限額: 一經設定,您可輕鬆掌握每月外遊消費狀況。累積的海外簽賬一旦超過您預設上限,其後的海外簽賬將不獲接納。預設上限可隨時更改。

• 外遊計劃: 出發前,只需輸入您的旅遊日期及地點,外遊計劃一經設定,將於指定旅程期間生效,香港及目的地以外地區所出示的信用卡簽賬將不獲接納,令您可於旅途上享有更佳更安全的簽賬體驗。

• 海外簽賬限額: 一經設定,您可輕鬆掌握每月外遊消費狀況。累積的海外簽賬一旦超過您預設上限,其後的海外簽賬將不獲接納。預設上限可隨時更改。

由2018年7月23日至9月30日於滙豐網上理財或滙豐流動理財兌換外幣,累積每滿港幣20,000元可享$50「奬賞錢」,最高可享$500「獎賞錢」。詳情請參 按此 。

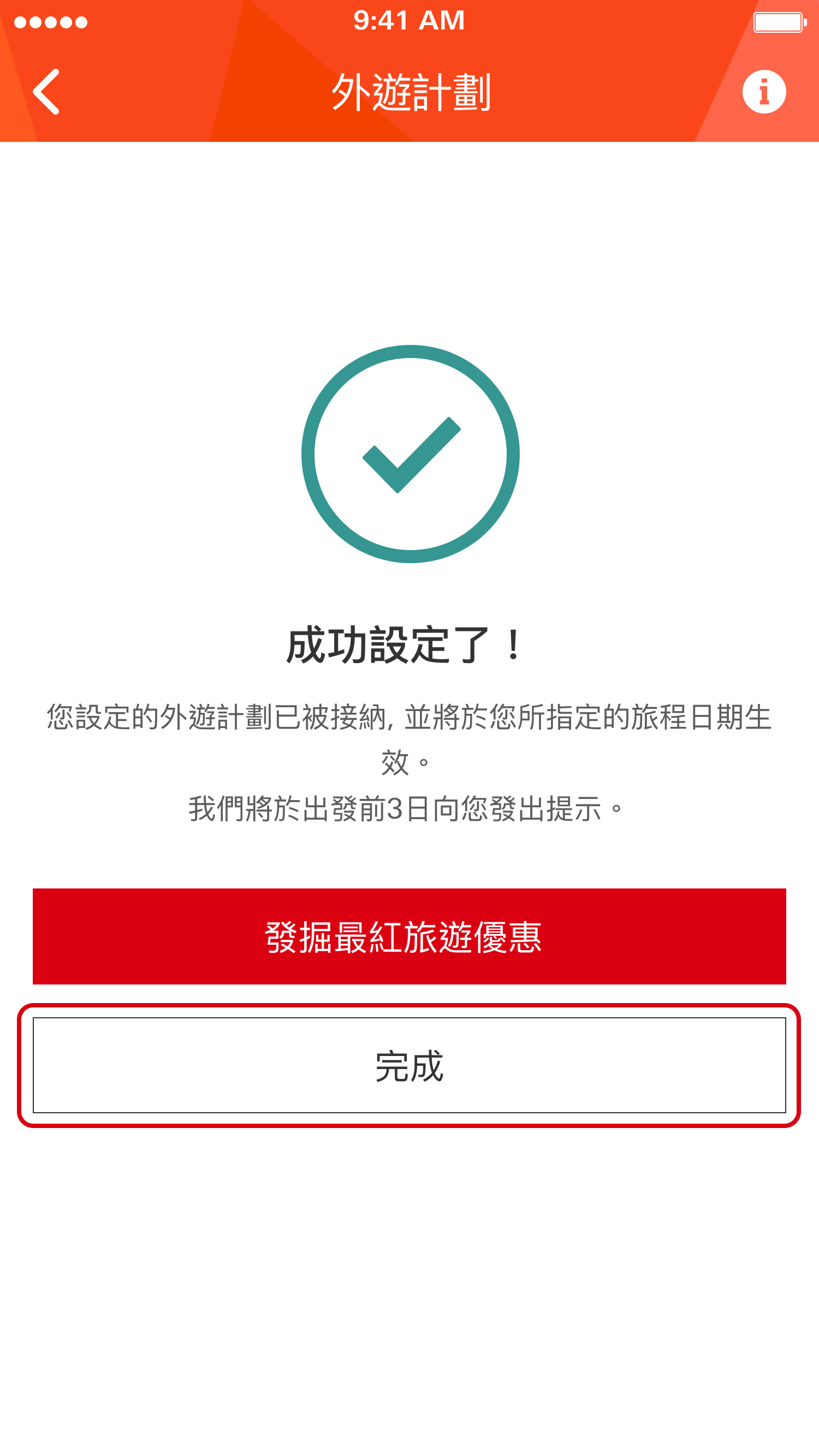

立即觀看Mc Jin介紹滙豐Reward+ 應用程式 全新TravelFree 旅遊功能

此外,由2018年7月23日至9月30日於滙豐網上理財或滙豐流動理財兌換外幣,累積每滿港幣20,000元可享$50「奬賞錢」,最高可享$500「獎賞錢」。詳情請 按此 。

仲未有滙豐Reward+應用程式?立即下載!

按此 了解更多滙豐Reward+功能

「獎賞錢」易賺易使,想點都可以,想點更Easy,立即下載,全方位體驗!

全城最好的滙豐信用卡*,一卡百應!

1. 登入滙豐Reward+。選擇信用卡並於TravelFree頁面內按「新增外遊計劃」。

2. 設定外遊計劃,只需輸入您的外遊日期與目的地。

3. 當外遊計劃一經接納,將於指定旅程日期生效。 為增加外遊簽賬的安全度,於香港及指定目的地以外地區之出示信用卡簽賬將不獲接納。

4. 所有將生效或生效中的外遊計劃將會顯示在外遊計劃頁面。

* 根據2019年10月至2019年12月期間於香港進行的Kantar Pulse Study的調查報告(樣本抽樣具人口代表性),訪問了440名信用卡持有人對該描述的認同。

風險披露 貨幣兌換風險 —外幣和人民幣存款的價值須承受因匯率波動而產生的風險。倘若您選擇將外幣和人民幣存款兌換為其他貨幣時的匯率較當初兌換外幣和人民幣時的匯率為差,則可能會因而蒙受本金損失。 向您提供的有關產品或服務的任何廣告、市場推廣或宣傳物料、市場資料或其他資料,其本身不會構成任何產品或服務的招攬銷售或建議。 本文所載資料並不構成招攬或建議任何人作存款,或購買或出售或投資任何產品的要約。

Apple為Apple Inc.商標,已於美國及其他國家╱地區註冊。App Store為Apple Inc.之服務商標。 Google Play™為Google LLC之商標。

致電 2748 8033 瀏覽 www.hsbc.com.hk/creditcard

借定唔借?還得到先好借!

參考編號: Y8-U8-CAMH0105-TravelFree

© 版權所有。The Hongkong and Shanghai Banking Corporation Limited 香港上海 滙 豐銀行有限公司 2002-2024。 不得轉載。

本網站為於香港使用而設計。 跨境披露聲明 跨境披露聲明 內容將於新視窗顯示

為保障您的個人資料,建議使用Chrome開啟此網站。 請點擊右上角「分享」然後點選「於Chrome中開啟」。

您是否滙豐網上理財現有客戶?

是,登入已預載個人資料之版面 不是,直接進行申請(只需數個步驟)

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

How to notify HSBC that you’re traveling

Great news! Due to enhancements in our security measures:

- You no longer need to schedule a notification for your HSBC debit or credit card when traveling

- We may still send you a fraud alert if we see unusual activity on your account

For more information on how we protect your account, see Credit Cards Fraud Alert & Detection

I still need help

Fastest way

- Chat with us for assistance.

Other ways to get help

By telephone

- Contact Customer Service .

- Manage HSBC Credit Card

Connect with us

Qormi branch ATMs unavailable from 2 to 8 September

Due to new machine installations, ATMs and deposit machines at our Qormi branch will be unavailable from Monday 2 to Sunday 8 September. The nearest ATMs can be found in Qormi (Operations centre), Birkirkara (HSBC branch) and Hamrun (St Joseph High Street), with the nearest deposit machines in Qormi (Triq San Bastjan), Birkirkara and Balzan. We’re sorry for any inconvenience caused.

Our website doesn't support your browser so please upgrade .

Travel insurance

Important reminder about travel insurance Please remember that your free travel insurance benefit only applies if you make part or full payment for your transportation and/or accommodation costs with your HSBC card. Remember to carefully check the limits and exclusions of your policy immediately before your date of travel to determine if the cover offered is adequate for you or your family’s purposes. More information about applicable benefits can be found in the insurer's documentation .

Free travel insurance for you and your loved ones

Travelling away from home without travel insurance puts you at risk of a number of situations. Needing medical treatment for illness, cancelled trips and other financial emergencies can turn your dream holiday into an overseas nightmare.

If you're a Premier or Advance customer, HSBC offers you free travel insurance. All you need to do is settle full or part payment of your flight, marine transport service and/or accommodation with a valid HSBC Premier/Advance debit or credit card.

Eligible accounts

What’s included.

Cover applies to you (the HSBC Premier or Advance customer) and your eligible family members* provided you are under 76 years of age for a maximum period of 90 days (HSBC Premier customer) or 60 days (HSBC Advance customer) per trip.

- free multi-trip worldwide cover

- personal accidents cover for unexpected injuries or fatal accidents

- medical expenses cover for medical treatment including hospital stays

- 24-hour emergency assistance for help when you need it most

- personal belongings cover for accidental loss, damage or theft of possessions

- travel cancellation and delay cover for when your holiday plans are disrupted

- personal liability cover for injury to someone else or damage to their property

- hire vehicle excess cover for Premier customers

A printable summary of the table of benefits highlighting your limits and excess can be found in our Important Documents page .

As with all insurance policies, terms and conditions, exclusions and limitations apply, so before each trip we recommend that you check carefully the policy documentation.

If you require additional cover, you are requested to contact Mediterranean Insurance Brokers (Malta) Ltd.

*Eligible members include partners living at the same address, as well as children living with you, under the age of 18 or under 25 if in full-time education.

Any questions

Policy queries.

Mediterranean Insurance Brokers

+356 2343 3234

Monday to Friday 08:30 - 17:00

Email Mediterranean Insurance Brokers

Premier customers

Premier Direct

+356 2148 9100

24 hours a day, 7 days a week

Advance customers

Advance dedicated line

+356 2148 9101

Monday to Saturday 08:00 - 18:00

In case of a medical emergency

In the event of a medical emergency during your trip, you must contact Global Response as soon as possible. Global Response is a world-wide organisation specialising in emergency assistance services. The service operates 24/7, 365 days a year for advice and assistance when making arrangements for hospital admission, repatriation and authorisation of medical expenses.

Over the phone: +44 (0) 292 066 2438

By email: [email protected]

Premier customers should quote Atlas Policy Certificate number - Travel: 167064 299 002

Advance customers should quote Atlas Policy Certificate number - Travel: 167064 299 001

How to make a claim

By phone.

+ 356 2343 3234

Monday to Friday from 08:30 to 17:00

Zentrum Business Centre

Level 2, Triq l-Imdina

Ħal Qormi, QRM 9010

This insurance is provided by Atlas Insurance PCC Limited and administered by Mediterranean Insurance Brokers (Malta) Ltd. A list of necessary information and documents required when making a claim can be found in our Important Documents page .

Important documents

You can download all the documents relating to our travel insurance, including terms and conditions, as well as information about what's covered and how to claim from our Important Documents page .

Frequently Asked Questions

Can i buy extra cover for a trip .

Yes, you can arrange additional cover for a trip at your own cost.

These optional extensions are available:

- Increased limit for rental vehicle excess (free up to €500 for Premier customers and can be bought separately by Advance customers)

- Winter sports extension

- Specified items extension

- Increase in baggage limit for cruises

- Cancellation of trip (extreme weather conditions)

- Maximum duration of trip extension

- Covid-19 extension

- Optional extension providing coverage for specific sailing trips

To discuss your needs and obtain a quotation, contact Mediterranean Insurance Brokers on +356 2343 3234 or email [email protected]

How long will I be covered for?

If you're a Premier customer you'll be covered for a single trip of up to 90 days; it's 60 days for Advance customers.

Am I covered for business trips?

Yes, the insurance covers both holidays and business travel.

Are eligible members travelling without being accompanied by the main cardholder still covered?

They are covered irrespective of whether travelling with the cardholder or not.

Eligible members include partners living at the same address, as well as children living with you, under the age of 18 or under 25 if in full-time education.

What information do I need when making a claim?

When making a claim it is important that you provide the necessary information and documents required, to enable Mediterranean Insurance Brokers to proceed with the handling of your claim. These may differ from one benefit to the other, however as a minimum the following documentation will be required:

- Completed claim form

- Passport Copy

- Copy of ID card of Main Card Holder

- Flight Tickets or e-tickets (departure and arrival)

- Luggage Tags

Depending on the claim being made, additional documentation may be required such as:

- Damage report by Airline/Cruise Line (Property Irregularity Report) if claiming for damaged luggage

- Police report for lost or stolen items, within 24 hours of discovery

- Medical Report/s (if claiming any medical expenses or cancellation of travel)

- Hotel Accommodation Vouchers

- Flight & Accommodation invoices & Receipts;

- Documentation to confirm reason/s for cancellation or curtailment;

- Cancellation confirmation from Airline / Agent indicating any refund due (if any);

- Evidence of money taken abroad – this may take the form of foreign exchange receipts or cash withdrawals in case of Euros.

For further guidance contact Mediterranean Insurance Brokers on +356 2343 3234 or email [email protected]

You might be interested in

Premier purchase protection.

Protect your purchases by using your Premier card.

HSBC Premier

Discover exclusive services and support for every aspect of your finances and lifestyle.

HSBC Advance

Enjoy rewards and preferential rates with the account that rewards you.

Connect with us

Anti-fraud measures

Please make sure your web browser is up to date for uninterrupted access to HSBC Malaysia Online Banking. To protect yourself, don't visit unknown links or download apps from unknown sources. Don't share your credentials, account details or authentication codes with unknown websites or apps either. Learn more

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

HSBC Premier Travel Mastercard Credit Card

Earn 1.1 Air Miles for every RM1 overseas spend

By Invitation only

Ideal for frequent flyers

HSBC Premier Travel Credit Card, the best companion for your overseas travel with air miles rewards.

eWelcome pack (PDF)

By invitation only

Eligibility:

Exclusively for HSBC Premier Elite account holders. A primary cardholder must be at least 21 years old with a minimum RM3,000,000 in total relationship balance with HSBC.

At a glance

- 1.1X Air Miles on all overseas spend 1

- 1X Air Miles for every RM4.00 local spend

- Complimentary access to Plaza Premium Lounges worldwide 2 Get away from the hustle and bustle of a busy airport and relax whilst you enjoy a range of refreshments, newspapers, television and business facilities.

- Enjoy Global Data Roaming by Flexiroam in over 150+ countries 3 Including redemption of one free 3GB 10-day Global Data Roaming pass per eligible card, per calendar year, and a 15% discount on future data plans. Learn more .

- Get free unlimited access to Digital Health services 4 Experience free consultation via Video Teleconsultations by Doctor Anywhere and Digital Health Assistant by Medi24 24/7. Register here .

- This HSBC Credit Card is now made from 100% recycled plastic

- Enjoy added peace of mind when you shop online with an HSBC Premier Travel Mastercard now 5 The e-Commerce Protection insurance by Mastercard provides you with worldwide coverage and reimbursements of up to USD200. Find out more on the Mastercard website .

- Enjoy savings with Expedia and Agoda 6 Enjoy 10% 6 discount on Expedia hotel bookings and 7% 6 discount on Agoda hotel bookings other than Air Miles rewards.

Enjoy 50% off green fees at 42 golf clubs and golf lessons at 1 participating golf academy in Singapore – Book now . Terms & Conditions apply.

Valid until: 15 January 2025

Card Privileges

Premier Junior Savers Account 7

Convert Air Miles to cashback into Premier Junior Savers Account

Premier SmartPrivileges 8

Indulge in exclusive deals and special VIP treatments from us while enjoying great savings at more than 2,000 shopping outlets nationwide with your HSBC Premier Travel Mastercard. With new and exciting offers every month, you'll be spoilt for choices.

Reward Redemption 9

Explore the extensive Premier Travel Rewards Catalogue, with wide selection of items at great value. You can redeem gifts, vouchers or frequent flyer miles with selected airlines.

Document Required

Things you should know.

Important notes

1 Amended Terms & Conditions For HSBC Premier Travel Mastercard Credit Card apply. Air Miles awarded are capped at 20,000 Air Miles for overseas spend and 30,000 Air Miles for local spend per calendar month. Earn 1 Air Mile for every RM4 local spend.

2 Terms and Conditions for HSBC Plaza Premium Lounge Programme . This programme is only applicable to Primary cardholder. Each Eligible Cardholder is entitled to a maximum number of 12 complimentary visits a year. Lounge access for the 13th and subsequent visit and accompanying guests (including Supplementary Cardholders) will be charged the lounge prevailing rates. Any subsequent visit on the same day and any visit exceeding the 3-hour limit will be subject to the applicable charges listed at the respective lounge. List of eligible Plaza Premium Lounges.

- List of eligible Plaza Premium Lounges (PDF) List of eligible Plaza Premium Lounges (PDF) Download

3 Subject to Global Data Roaming by Flexiroam Terms and Conditions apply.

4 Subject to Digital Health by Allianz Terms and Conditions apply.

5 Subject to Mastercard Terms and Conditions apply.

6 10% discount on Expedia is applicable for 1 hotel room booking. Both Agoda and Expedia's discounts are subject to their respective Terms and Conditions.

7 Protected by PIDM up to RM250,000 for each depositor.

8 Terms & Conditions for HSBC SmartPrivileges .

9 Terms and Conditions for HSBC Premier Travel Rewards Programme 2023 . Effective January 2023.

- Product Disclosure Sheet (PDF) ENG Product Disclosure Sheet (PDF) ENG Download

- Product Disclosure Sheet (PDF) BM Product Disclosure Sheet (PDF) BM Download

Everyday Global Account

The all-in-one savings account for your everyday needs, here in Malaysia and overseas.

Open an account online today in 3 simple steps.

Card features & services

Cash instalment plan.

Convert your available credit limit into instant cash.

Balance Transfer Instalment (BTI)

Consolidate all of the outstanding balances from your other credit cards to your HSBC credit card.

Cash Advance

Use cash advance for instant cash relief.

Mastercard Automatic Biller Update (Effective 12 June 2020)

HSBC Mastercard credit cardholders will automatically enjoy Mastercard Automatic Billing Updater (ABU) service. Mastercard ABU allows us to securely communicate cardholder’s account changes (credit card number updates) for card-on-file and recurring payments to participating merchants. This will help maintain existing recurring payment arrangements and reduce transaction declines that can occur due to such changes. Not all merchants participate in the ABU service. Complete the form to opt out of Mastercard Automatic Billing Updater (ABU) service.

More on credit card

Check out more credit card features.

Connect with us

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

TravelSurance

Travel confidently with comprehensive coverage

TravelSurance protects you, your family, friends and relatives from the moment you book a trip all the way until you return home. This all-in-one policy provides you with a hassle-free protection for a specific trip, including accidental injuries, medical and hospital expenses, personal liabilities, lost baggage and cash, delayed flights, stolen belongings, etc.

If you are a frequent traveller, you can be protected under our MultiTrip TravelSurance. It provides covers for all the trips you may take during the year so you don’t have to re-apply every time you travel. In addition to Worldwide coverage, if your destination is within the Greater Bay Area, then our MultiTrip TravelSurance - Greater Bay Area Plan is tailored for you, ensuring you have the right protection while exploring this exciting area all year round, at an even more affordable price.

Should you have any queries about TravelSurance cover under Coronavirus Disease 2019 , please see our FAQs

Key benefits

Covered for emergencies

Comprehensive cover, including personal accidents up to HKD2 million, and medical expenses up to HKD5 million

Designated loss coverage

Cover designated loss such as adverse weather conditions, strike, terrorism or natural disasters

Covers all ages with full benefits

All insured persons, including any children, will enjoy the full benefits

Coverage for your mobile

Get up to HKD6,000 coverage for your mobile phone

Limited time offer

Apply for TravelSurance between 01 January and 31 December 2024 (both days inclusive) to get:

- Enjoy 30% off on first-year’s premium for MultiTrip Worldwide plan; plus 30% off on first-year’s premium and 20% renewal discount for Greater Bay Area plan;

- 15% off for Single Trip TravelSurance

T&Cs apply .

Compare HSBC TravelSurance Plans

Check out the full coverage details . Enjoy extra benefits if you choose the Annual MultiTrip TravelSurance Worldwide Plan:

- Year-round protection with one-off premium payment for unlimited number of trips per year, up to 100 days per trip.

- Experience the convenience with e-Policy servicing which provides you with 24-hour online access to your insurance policy details and allows you to submit policy service requests without hassle.

- If you travel to mainland China frequently, enjoy hospital admission deposit guarantee at designated hospitals in mainland China with a China Medical Card option under your Annual MultiTrip policy.

- MyDoc Health Passport provides you 6 free-of-charge virtual medical consultations per Period of Insurance. Additionally, enjoy prescribed medication and door-to-door medicine delivery service, where the expense could be reimbursed under the Medical Expenses benefit of your policy, when you are travelling to select cities in Japan, Singapore, Thailand and Vietnam.

The Annual Greater Bay Area Plan has the following features:

- Year-round protection with one-off premium payment for unlimited number of trips per year, up to 15 days per trip.

- Free China Medical Card offers you hospital admission deposit guarantee at designated hospitals in mainland China.

The coverage shown above is applicable to TravelSurance policies applied on or after 23 June 2024. For coverage of policies applied before 23 June 2024, please call our insurance service hotline (852) 2867 8678 .

What's included?

Our plans generally cover:

We'll reimburse the necessary medical expenses incurred during a trip and follow up medical expenses within 3 months after return to the Hong Kong SAR up to HKD5 million. For the Greater Bay Area Plan, medical expense benefit is applicable for in-patient only.

We'll also cover additional travel and accommodation costs for your children if they have to travel back to Hong Kong SAR while you stay in hospital (not applicable for Greater Bay Area Plan).

Sports and Activities [@sportsactivitiestravelsurance]

We provide cover for various sports and activities, including dune driving, sand boarding, safari adventures, whale tours, hot springs, horse riding, cable cars, iceberg climbing, watching auto racing, water sports, skiing, ice-skating, biking, thrill rides at amusement parks etc.

TravelSurance even covers certain hazardous sports activities such as hot air ballooning, bungee jumping, hang-gliding, parachuting, ziplining, rafting, speed-boating, jet-skiing, trekking, water skiing, wakeboarding, wake-surfing, sea kayaking, scuba diving (that is diving to a depth not greater than 40 metres), mountaineering, rock-climbing etc.

You'll receive cover for baggage loss or damage up to HKD20,000. We'll reimburse emergency purchases of essential items or clothing up to HKD2,000 if baggage is delayed for more than 6 hours after you've arrived at your destination abroad (not applicable for Greater Bay Area Plan).

Expand

Travel delays and cost of catch-up tickets.

We'll pay up to HKD2,500 if your scheduled transportation is delayed for 6 hours or more. For the Greater Bay Area Plan, we’ll pay up to HKD950 if your scheduled high-speed rail is delayed for more than 3 hours or more.

If you choose to buy Standard Plan, you have the option of buying another one-way travel ticket to catch up with the planned itinerary and may get reimbursed up to HKD4,000.

HSBC credit card protection

In the event of death of the insured person caused by an accident outside the Hong Kong SAR, any outstanding balance payable under the insured person’s HSBC credit cards up to HKD50,000 for items charged while outside the Hong Kong SAR during the trip will be covered.

Funeral expenses

In the unlikely event that a fatal incident occurs while you are travelling, we will pay the reasonable funeral expenses (other than the burial or cremation charges) outside Hong Kong SAR up to HKD100,000 (not applicable for Greater Bay Area Plan).

What's NOT included?

Our plans generally do not cover:

- riot, civil commotion, war, invasion, civil war and related perils

- suicide, self-inflicted injury, illegal acts, insanity, drugs-taking, alcoholism, venereal disease, AIDs

- any pre-existing conditions, including congenital conditions

- childbirth, pregnancy, miscarriage

- engaging in:

- any sports or activities which are played in professional capacity or in competition involving prize money or reward of any kind

- deep water diving (that is diving to a depth of greater than 40 metres)

- motor rallies

- aviation other than as a fare-paying passenger

- manual work or hazardous work (eg involving the use of mechanical and/or electrical equipment or handling of explosive or hazardous substances, etc.)

- property more specifically insured

- claims where no written notification is given to AXA General Insurance Hong Kong Limited within 31 days after end of the trip

For a full list of exclusions and terms and conditions, please refer to our policy wordings .

How to apply

Eligibility.

To be able to apply you must:

- be an HSBC bank account or credit card holder

- be an HKSAR resident and applying for this insurance policy in the HKSAR

- depart from and return to the HKSAR from your insured destination

- hold an HKID card for online applications

- for child under 18 years old, the parent or legal guardian[@legalguardiantravelsurance] information of the child must be provided during the application

- children aged under 12 years old must be accompanied by an adult during the trip

- provide information of any spouse/partner[@partnerdefinition], children, relatives and friends if you wish to insure them under the same policy

Important Information

- TravelSurance Declaration, Terms and Conditions TravelSurance Declaration, Terms and Conditions Modal

- Fees & Charges Fees & Charges Modal

- Forms and documents Forms and documents Modal

- Important Information Important Information Modal

- TravelSurance Product Factsheet TravelSurance Product Factsheet Download

- TravelSurance policy document TravelSurance policy document Download

- Frequently asked questions (FAQs) Frequently asked questions (FAQs) Modal

- Find a branch Find a branch Modal

HSBC customers can apply for a TravelSurance policy online

Or visit a branch

You can visit one of our branches to find out more

Find out more

Can non-hkid holders apply for travelsurance .

Yes, non-HKID holders can apply for TravelSurance via HSBC branches, as long as the trip starts from, and returns to, the Hong Kong SAR.

Can a child aged under 18 apply for TravelSurance if they are not travelling with adult?

If cover is required for children under 18 years old, parent’s or legal guardian’s[@legalguardiantravelsurance] information must be provided during the application process. For children aged under 12 years old, they must be accompanied by an adult during the trip.

Can I buy the TravelSurance for my friends or my friends' child(ren)?

Yes, you can buy TravelSurance for your friends and your friends’ child(ren) who is/are under 18 years old by providing your friend’s full name, HKID number and date of birth.

If cover is required for children under 18 years old, parent’s or legal guardian’s[@legalguardiantravelsurance] information must be provided during the application process. For children under 12 years old, they must be accompanied by an adult during the trip.

In case of emergency, how can I contact AXA for assistance?

You can call the Emergency Assistance Hotline on (852) 2528 9333 at any time for emergency medical and evacuation assistance, travel information, baggage assistance, medical referrals, legal referrals and emergency ticketing. The hotline operates in English, Cantonese and Mandarin.

How can I manage my policy in case I want to extend the covered period during my travel?

Should you have any queries about your policy, including request to extend the covered period, you can call our insurance service hotline at (852) 2867 8678 (during office hours) or manage your policy at ease by e-Policy servicing after logging on to HSBC Online Banking if you are an HSBC Online Banking customer. This online service provides you with 24-hour access to your policy details and allows you to submit policy service requests without hassle. Please note the covered period can be extended during travelling if you give us the notice of change before the start date of the extension while the policy is still in force. However, please note any extension is subject to AXA’s approval.

What if I’m being confined in an overseas hospital but not able to speak the local language, is the interpretation service fee covered under the policy?

In case you are confined in overseas hospital for over 24 hours due to accidental bodily injury or sickness during the trip and appoint a local translator referred by Emergency Assistance Service, a maximum of HKD500 per day subject to a HKD5,000 per trip is payable for the interpretation service.

What is the catch-up ticket benefit under in case of travel delay?

If you are insured under Asia or Worldwide Standard Plan, in the event the common carrier in your original travel itinerary is delayed during the trip for more than 6 hours due to covered conditions and you decide to buy another one-way travel ticket to catch up with the planned itinerary, the additional and reasonable cost of the ticket replacement will be reimbursed, up to HKD2,000 for Asia Standard Plan and HKD4,000 for Worldwide Standard Plan.

Please note that cash allowance and trip re-routing benefits will not be payable if catch-up ticket benefit is paid, and vice versa.

What kind of sports and activities are covered by TravelSurance?

TravelSurance covers various kinds of sports and activities provided that they are not played in professional capacity or in competition involving prize money or reward of any kind. For example, you are covered for dune driving, sand boarding, safari adventures, whale tours, hot springs, horse riding, cable cars, iceberg climbing, watching auto racing, water sports, skiing, ice-skating, biking, thrill rides at amusement parks etc.

TravelSurance also covers hazardous sports activities such as hot air ballooning, bungee jumping, hang-gliding, parachuting, zipline, rafting, speed-boating, jet-skiing, trekking, water skiing, wakeboarding, wakesurfing, sea kayaking, scuba-diving (that is diving to a depth not greater than 40 metres), mountaineering, rock-climbing etc.

To see what you’ll be covered for under TravelSurance, check the full list .

What extra protection can I receive if a Travel Alert is issued for the planned destination?

Except Greater Bay Area plan, you will be protected against the issuance of the Travel Alert in the following ways, provided that no claim has been paid. Before the trip, you may:

- upon any Travel Alert, cancel your Single Trip policy and receive a full premium and levy[@insurance-travelsurance-levyrefund] refund;

- upon Red Travel Alert (except for the reason of a pandemic), be reimbursed up to 50% of the irrecoverable deposits or charges paid in advance upon cancellation of trip up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

- upon Black Travel Alert (except for the reason of a pandemic), be reimbursed up to 100% of the irrecoverable deposits or charges paid in advance upon cancellation of trip up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

During the trip, you may:

- upon any Travel Alert, have your insurance automatically extended for 10 days free if your trip is unavoidably delayed;

- upon Red Travel Alert, be reimbursed up to 50% of the unused irrecoverable prepaid costs or additional travel-related costs upon curtailment of trip for up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

- upon Black Travel Alert, be reimbursed up to 100% of the unused irrecoverable prepaid or additional travel-related costs upon curtailment of trip for up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

- upon Black Travel Alert, obtain an additional HKD1,000 allowance to subsidise any unexpected cost due to curtailment of trip or unavoidable delay of the scheduled trip.

Can I claim for medical expenses incurred during my trip for any sickness or disease?

The policy covers medical expenses incurred provided that such sickness or disease is not in existence prior to the trip, and not caused by:

- an event of same nature mentioned in the black or red travel alert (except for the reason of COVID-19), unless the journey has been started before the issuance of such travel alerts.

- claims relating to the vaccine-preventable diseases if prior to the trip: (i) the insured person fails to obtain the related vaccine; and (ii) the vaccine is mandatorily required by the government(s) of Hong Kong SAR and/or the destination where the insured person has planned to travel.

For Greater Bay Area Plan, this benefit is only applicable for medical treatment requiring hospitalisation.

What is the virtual medical consultation service about and how can I use this?

If you have taken out the MultiTrip Worldwide Plan, you are entitled to 6 free virtual medical consultations per period of insurance by using MyDoc Health Passport. The consultations are usually available during local doctors’ office hours. Following a virtual medical consultation, you may choose to obtain the prescribed medication and have it delivered to your doorstep as needed during specific hours; however, this will incur charges which you will need to pay first and may then claim in accordance with your policy if eligible.

The virtual medical consultation is currently available in Tokyo, Osaka, Hokkaido and Fukuoka for Japan, and countrywide for Singapore, Thailand and Vietnam.

You will receive a confirmation email with a step-by-step guide on how to use the virtual medical consultation service.

Please note the above details are subject to change without prior notice.

Is an epidemic/ pandemic considered as a natural disaster?

Natural Disaster does not include epidemic or pandemic.

You may also be interested in

Home Contents Insurance

Our home contents insurance (ResidenceSurance) can meet your needs, leaving you free to enjoy your life without worrying about your most treasured possessions.

Personal Accident Insurance

A comprehensive insurance that protects you and your dependents against the financial strain that a personal accident can bring.

Medical and critical illness insurance

Safeguard yourself against unexpected medical expenses and critical illnesses.

Disclaimer

General Insurance products are applicable to HSBC Account holders and HSBC credit card holders only.

The above information is intended as a general summary. Please refer to the policy wording for exact terms and conditions and details of the exclusions.

The above policy is underwritten by AXA General Insurance Hong Kong Limited ("AXA"), which is authorised and regulated by the Insurance Authority of the Hong Kong SAR. AXA will be responsible for providing your insurance coverage and handling claims under your policy. The Hongkong and Shanghai Banking Corporation Limited is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an insurance agent of AXA for distribution of general insurance products in the Hong Kong SAR. General insurance plans are products of AXA but not HSBC.

For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction by HSBC, HSBC will enter into a Financial Dispute Resolution Scheme process with you. On the other hand, for any disputes over the terms and conditions of your policy, AXA will resolve with you directly.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

Start your trip right with TravelSure

Things may not always go according to plan when you travel. But TravelSure can help protect you against the unforeseen. It offers more than 50 benefits including Cancel For Any Reason (CFAR) and COVID-19 coverage. So no matter if you're travelling for work or leisure, you can do so with more assurance.

Special offers for greater peace of mind

From now till 30 September 2024, enjoy 50% premium discount for Single-Trip plans and 20% premium discount for Annual plans.

Key benefits

Cancel for Any Reason (CFAR)

Overseas medical expenses

COVID-19 coverage

Delayed departure

Choose your plan, compare the key benefit limits between the plans.

The limits shown above are based on individual sum insured. Please note that the new Cancel For Any Reason (CFAR) benefit is available for Plus and Advanced plans only.

For full details, please see the TravelSure full benefits summary (PDF) .

What you need to know

Forms and documents .

- TravelSure policy document (issued on / after 7 Aug 2024) TravelSure policy document (issued on / after 7 Aug 2024) This link will open in a new window

- TravelSure policy document (issued before 7 Aug 2024) TravelSure policy document (issued before 7 Aug 2024) This link will open in a new window

File a TravelSure claim online

You can submit claims under your TravelSure insurance plan online, at any time, on the MSIG website.

Buy TravelSure now

Complete an online application form to get a quote and buy a TravelSure plan.

If you have any questions or need some assistance, please contact MSIG Singapore .

Frequently asked questions

What does 'cancel for any reason' (cfar) cover .

It covers up to 75% of the cost of bookings made for the trip. These include bookings for tours, public transport, accommodations, and entertainment tickets. It only applies to the bookings you made before you bought the travel insurance policy for the trip. CFAR covers:

- Travel cancellation

- Travel postponement

- Replacement of traveller

- Unused entertainment ticket

The coverage is capped at the amount shown in the benefits summary document.

How do I qualify for 'Cancel For Any Reason' (CFAR) cover, and how much will I be reimbursed under it?

You'll need to purchase a TravelSure Plus or TravelSure Advanced policy within 14 days from the date you first booked your trip. You must include the details of the payment you made to the relevant provider when you made the booking.

Claims won't be paid for events that fall under the general exclusions. For a complete list of these exclusions and more, please see the policy wording.

When does my TravelSure cover start and end for each trip?

Your TravelSure cover starts from the time you leave your home or workplace in Singapore to begin your trip abroad.

It ends 3 hours after your return to Singapore or upon the expiry of your TravelSure plan, whichever is sooner.

What's the difference between family cover and group cover?

Family cover is for the insured person, their legal spouse and any number of their legal children. It covers a family of up to 7 persons.

On the other hand, group cover is for two or more individuals such as friends, students or relatives.

Can I extend the period of cover if I extend my trip while overseas?

You're allowed to extend your travel insurance period of cover during the period of your insured travel. This is subject to a minimum premium of SGD10, and provided that there are no known circumstances or events likely to lead to a claim.

To request an extension, please call the MSIG Assist hotline at any time.

- See more frequently asked questions See more frequently asked questions This link will open in a new window

You may also be interested in

Overseas study insurance , homesure , car insurance , product disclosure .

This product is underwritten by MSIG Insurance (Singapore) Private Limited ("MSIG") and distributed by HSBC Bank (Singapore) Limited ("HSBC"). It's not an obligation of, a deposit in or guaranteed by HSBC. The full details of the terms, conditions and exclusions of this insurance are provided in the policy and will be sent to you upon MSIG accepting your application. This is not a contract of insurance and MSIG is not agent nor representative of HSBC. It does not constitute an offer to buy an insurance product or service. It's also not intended to provide any insurance or financial advice.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact MSIG or visit the General Insurance Association www.gia.org.sg or SDIC www.sdic.org.sg website.

The information and contents contained in this website are for information only, have been obtained from sources believed to be reliable, but HSBC makes no representation or warranty as to their adequacy, completeness, accuracy or timeliness for any particular purpose, are subject to change without notice, are restricted for use in Singapore only and are not intended for distribution to, or use by, any person or entity outside Singapore or in any jurisdiction or country where such distribution or use would be contrary to law, regulation or rule. HSBC does not undertake an obligation to update the information or contents or to correct any inaccuracy that may become apparent at a later time.

Please note (a) the information and contents are intended for general circulation; (b) the information and contents do not take into account the specific objectives, financial situation or particular needs of any particular person; (c) advice should be sought regarding the suitability of the products, taking into account the specific objectives, financial situation or particular needs of any person, before the person makes a commitment to purchase the products; should the person choose not to do so, he should consider carefully whether the product is suitable for that person; in particular, all relevant documentations pertaining to the product should be read to make an independent assessment of the appropriateness of the transaction; and (d) this advertisement has not been reviewed by the Monetary Authority of Singapore, or any regulatory authority elsewhere.

HSBC, its related companies, their directors and/ or employees may have positions or other interests in, and may effect transactions in, the product(s) mentioned here. HSBC may have alliances or other contractual agreements with the provider(s) of the product(s) to market or sell its product(s). In addition, HSBC, their directors and/or employees may also perform or seek to perform broking, investment banking and other banking or financial services for these product providers.

To the extent permitted by law, HSBC accepts no liability whatsoever for any direct indirect or consequential losses, claims or damages arising from or in connection with the use of or reliance on the information, opinions or contents herein.

Connect with us

Our website doesn't support your browser so please upgrade.

Using your card abroad

Access your money worldwide, including local currency withdrawals and payments

Discover easier worldwide spending and payments when you open an Expat Bank Account.

Use your card worldwide

Enjoy the convenience of using your card wherever you see your card's logo. Fees apply.

- Use in any outlet that displays the Visa or Mastercard logo on your card

- ATM locator to help you find where you're able to use your visa debit or credit card abroad

- Fees apply and non-HSBC cash machines may also charge a fee[@cashwithdrawals]

Security while travelling

If you let us know you're away, we can manage your transactions more effectively while you're on holiday.

- We automatically monitor accounts for unusual foreign transactions

- We look out for possible fraud and declined transactions

- If you have a joint account you both need to notify us. For credit cards, only the primary cardholders needs to give us travel notifications

How to use your card abroad

Overseas usage fees .

Any non sterling transactions (including cash withdrawals) are converted to sterling by using the relevant payment scheme exchange rate applying on the day the conversion is made. We will deduct the payment and related transaction fees from your account once we receive details of the payment from the card scheme, at the latest the next working day.

Cost illustration (Visa)

Cost illustration of making a transaction abroad of EUR 100.00 using the Visa exchange rate on 6 June 2017 of 0.876855 = GBP 87.69 to which will be added the fees appropriate to your card and transaction.

See more information on the rate of exchange Visa used when converting your transaction.

Cost illustration (Mastercard)

Cost illustration of making a non-sterling transaction of EUR 100.00 using the Mastercard exchange rate on 5 June 2017 of 0.875944 = GBP 87.59 to which will be added the fees appropriate to your card and transaction.

See more information on the rate of exchange Mastercard used when converting your transaction.

You receive up to 56 days interest-free credit on credit card purchases if you pay your whole balance in full and on time. Please be aware that interest is charged from the date transactions are applied to your account until payment is received. There is no interest-free period on cash advances. Some cash machine operators may apply a direct charge for withdrawals from their cash machines and this will be advised on-screen at the time of withdrawal. ATM withdrawal limits are applicable.

You can use your card to make non-sterling cash withdrawals from self service machines operated by a third party and agree that the third party will perform the currency conversion for you. The applicable exchange rate, the amount of cash you will receive and the amount in sterling will be shown on the screen. The amount in sterling will be deducted from your account balance when we receive details of the payment from the self service machine operator, at the latest the next working day.

Travelling in the EEA

If you're travelling in the EEA[@eea], see how paying in local currency on your HSBC credit or debit card compares to the European Central Bank (ECB)'s latest foreign exchange rates .

Let us know when you're travelling

Tell us when you're away so we can manage your transactions more effectively.

- Tell us online using our online Live Chat service

- HSBC Premier customers call: +44 1534 616 313

- HSBC Advance customers call: +44 1534 616 212

Just so you know, we may monitor and record your communications with us. This is in the interest of security and to help us continually improve our service.

Start using your card abroad

Already with expat.

If you're already with HSBC Expat, simply activate your card to get started.

New to Expat?

You'll need to apply for an Expat Bank Account.

You might be interested in

Staying safe abroad.

Crisis24 security services offers international risk management for all Expat customers, covering everything from travel safety to identity theft.

Card support

Get help with all your card questions.

Guide to moving abroad

Read our 10-step guide to moving abroad to make sure you've got everything covered.

Additional information

Connect with us.

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Extended: HSBC TravelOne Card 30,000 miles welcome bonus with just S$500 spend

From now till 30 September 2024, spend S$500 and get 30,000 bonus miles with a new HSBC TravelOne Card, with fee-free instant conversions and lounge access.

Back in June 2024, the HSBC Travel One Card enhanced its welcome offer by bumping it up to 30,000 bonus miles (previously: 20,000), which given the minimum spend of just S$500, represents one of the best sign-up offers in Singapore on a spend-to-miles ratio.

This offer was originally set to lapse on 31 August 2024, but has now been extended for applications submitted by 30 September 2024.

While I have concerns about the longevity of the TravelOne Card, there’s nothing objectionable at all about the first year’s value proposition: 30,000 miles, eight lounge visits, fee-free conversions with small enough blocks to avoid orphan miles, and the widest range of transfer partners in Singapore.

There should be more than enough in there to recover the first year’s annual fee, and then some.

HSBC TravelOne Card 30,000 miles welcome offer

HSBC TravelOne Cardholders who apply between 21 June to 30 September 2024 will receive 30,000 bonus miles (in the form of 75,000 HSBC points) when they:

- Pay the annual fee of S$196.20

- Spend at least S$500 by the end of the month following approval

- Provide marketing consent during application (an important step that people sometimes forget!)

There used to be a first year fee waiver option, without the bonus miles, but that has been discontinued.

This offer is open to all applicants, regardless of whether or not they currently hold a HSBC credit card . However, if they have cancelled a HSBC TravelOne Card in the past 12 months, they will not be eligible to receive the welcome offer again.

Bonus miles are on top of the base miles that TravelOne Cardholders normally earn, namely:

- 1.2 mpd for local currency spend

- 2.4 mpd for foreign currency spend

For example, if you spend the full S$500 in local currency, you’ll receive a total of 30,600 miles (30,000 bonus, 600 base).

Since the S$196.20 annual fee must be paid, you’re basically paying 0.65 cents per mile, which is an extremely compelling price.

What counts as qualifying spend?

Cardholders must make a minimum qualifying spend of S$500 by the end of the month following card approval.

You basically have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. Try to get approved early in the month so you have more time to make the minimum spend.

Qualifying spend includes all online and offline retail transactions, excluding the following:

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

When will bonus miles be credited?

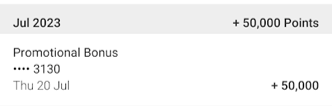

The 30,000 bonus miles will be credited (in the form of 75,000 HSBC points) within 90 days from the card opening date, provided the eligibility criteria is met.

In my personal experience, I applied in early May and received the bonus points on 20 July 2023.

Terms & Conditions

The terms & conditions of this welcome offer can be found here.

What can you do with HSBC points?

HSBC points earned on the TravelOne Card can be transferred to 21 airline and hotel partners, as shown below.

Do remember that not all partners share the same ratio, so your effective mpd and size of the welcome offer depends on which partner you choose.

The quoted figures of 1.2/2.4 mpd and 30,000 miles only apply if you choose a partner with a 25,000 points = 10,000 miles transfer ratio. Otherwise, it can go as low as 0.6/1.2 mpd and 15,000 miles on the other end of the spectrum if you pick a partner with a 50,000 points = 10,000 miles transfer ratio.

Conversions must be done via the HSBC Singapore app ( Android | iOS ) and are processed instantly, with the exception of the following:

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 10 business days

Transfers are free of charge till 31 January 2025.

While the minimum transfer block is 10,000 miles/points (Accor: 5,000 points), the subsequent block is just 2 miles (Accor: 1 point). In other words, you could choose to transfer 10,002 miles or 20,958 miles, which helps you avoid orphan points.

HSBC points are now pooled across all cards, ever since May 2024.

Other card benefits

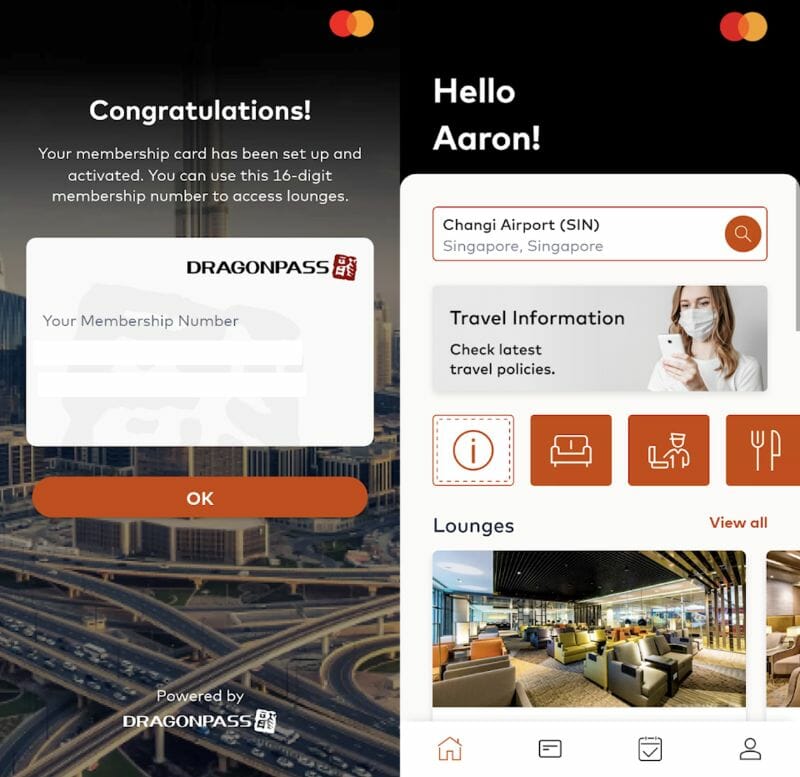

Four complimentary lounge visits.

Principal HSBC TravelOne Cardholders enjoy four complimentary lounge visits per year, provided via DragonPass.

Allowances are awarded by calendar year , which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in June 2024, you will be awarded:

- On date of approval: 4x visits (expires 31 December 2024)

- On 1 January 2025: 4x visits (expires 31 December 2025)

Allowances cannot be rolled over to the following year, so be sure to fully utilise your visits by the end of the calendar year. For avoidance of doubt, using the second calendar year’s allotment does not preclude you from cancelling the card at the end of the first membership year, if that’s what you wish to do.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app ( Android | iOS )

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

The main catch is that these visits cannot be shared with a guest.

Entertainer with HSBC

Principal HSBC TravelOne Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

Complimentary travel insurance

HSBC TravelOne Cardholders receive complimentary travel insurance when they:

- Use their TravelOne Card to purchase air tickets, or

- Use their TravelOne Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This provides coverage of S$75,000 for accidental death, S$150,000 for overseas medical expenses, S$1 million for emergency medical evacuation, as well as coverage for travel inconveniences like flight delays and lost luggage.

Do note that there is no coverage for personal liability or rental vehicle excess, so you may need to purchase supplementary coverage if this is important to you.

The HSBC TravelOne Card has extended its 30,000 miles welcome offer to 30 September 2024, while keeping the minimum spend and all other eligibility criteria the same. Even though the first year’s S$196.20 annual fee must be paid, I feel there’s enough here to make it worthwhile.

What’s more, you can apply for both a TravelOne Card and a Live+ / Advance Card and enjoy new-to-bank gifts for both, since HSBC sees the two as separate types of products.

For a detailed review of the HSBC TravelOne Card, refer to the post below.

Review: HSBC TravelOne Card

- credit cards

Similar Articles

Extended: uob prvi miles card uncapped 45,200 miles sign-up bonus, uob x amaze nerf: implications and workarounds, 20 comments.

Hi Aaron, can I apply for both a TravelOne Card and the HSBC Visa Infinite Credit Card to enjoy new-to-bank gifts?

yes, though there isn’t actually a new to bank gift for hsbc vi card (unless you’re referring to the 35k welcome miles which everyone gets anyway)

Ah thank you! So it’s not a new to bank gift! Thank you very much

Thinking of getting this and then cancel revolution card. Will the points be transferred over since points can pool?

no, points earned from revolution will be lost once u cancel. pooling only affects redemption in that you redeem from a common pool,with expiring points redeemed first.. but backend, points earned from each card follows that card.

Ohhh!… So can apply this card to get the bonus miles, then redeem all the points, then cancel the revolution card then?

no it doesn’t transfer over. points pool only for redemption purpose.

Out of curiosity: Is there anything DragonPass unlocks which Priority Pass doesn’t?

Railway stations in China

anyone realised that the card application via singsaver is not working? had my details filled using singpass and nothing happens after clicking continue.. and manual filling in keeps kicking me back to select card page

Does this promo stack with any singsaver sign up promo?

I would like to know too

Is the 1st bullet exclusion is spending in foreign currency not counted for a minimum of $500 spent?

Hi Aaron, can I check when do they charge the first year annual fee?

I just called in because I don’t see the annual fee in the transaction history. CS told me 90 days after card approval date. And then in the next cycle after fee is paid then the miles (as points) will be credited.

What do you mean by next cycle? So the following month?

Hi Aaron, I check with HSBC agent and they told me the annual fees cannot be waived even if I don’t want the welcome gift. So which is correct? Thanks

hmmm it looks like they’ve removed the first year free option from the website. will update, thanks!

Hi Aaron, do Amaze transactions count towards fulfilling the sign up spend requirement?

Hi guys, just to share that I had applied for this HSBC T1 credit card in May 2204 and received the 50k points (=20k miles) in Aug 2024. I wanted to accumulate more and redeem by 31 Jan 2025 to avoid charges. The curious thing is that 2 weeks later after the welcome bonus points were credited, my card got hit with fraudulent charges so I had to cancel the card & all the points earned disappeared. I was told that the missing points will be transferred to the new card which I’m waiting for a week now. The frustrating … Read more »

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Security Alert May 17, 2024

Worldwide caution.

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents.

Get a Passport

Renew or Replace a Passport

Get My Passport Fast

Prepare to Apply

Passport Help

Legal Matters

Renew or Replace a Passport Homepage

Share this page:

Renew by Mail

Renew Online

Change or Correct a Passport

Report my Passport Lost or Stolen

Replace a Limited Validity Passport

Get Copies of Passport Records

Eligible U.S. citizens can now renew their passports online. We're conducting a beta release of an online passport renewal system.

If you are unable to start your application because we have reached the daily limit, try again another day. If you do not want to wait or do not qualify to renew online, you may also renew by mail .

This beta release during which we are limiting the daily applications is an important and standard part of the software development process. We appreciate your patience while we test our system and prepare for a full launch of the updated online passport renewal system.

Follow these steps to renew your passport online and track your status:

Confirm you meet the requirements

- Create your account

Start your application

- Enter your most recent passport info

Enter travel plans

- Upload digital photo

Sign and pay

Enroll in email updates.

You can renew online if you meet all these requirements:

- The passport you are renewing is or was valid for 10 years, and you are age 25 or older.

- We issued the passport you are renewing between 2009 and 2015, or over 9 years but less than 15 years from the date you plan to submit your application.

- You are not changing your name, gender, date of birth, or place of birth.

- You are not traveling for at least 8 weeks from the date you will submit your application. We will only offer routine service during this beta release, and the time it takes to get a passport will be the same as renewing by mail.

- You are applying for a regular (tourist) passport. You cannot renew a special issuance (diplomatic, official, service) passport online.

- You live in the United States (either state or territory). You do not qualify to renew online if you live in a foreign country or have an Army Post Office (APO) or Fleet Post Office (FPO) address.

- You have your passport with you, and it is not damaged or mutilated, and you have not reported it as lost or stolen. Keep your most recent passport and do not mail it to us.

- You can pay for your passport using a credit or debit card.

- You can upload a digital passport photo.

- You are aware that we will cancel the passport you are renewing after you submit your application. You cannot use it for international travel.

If you do not qualify to renew online, you may be able to renew by mail or in person at a passport agency or center .

Create your account

Click the Sign In button on the MyTravelGov homepage. Clicking the button will take you to Login.gov where you can sign in as an existing customer or create a new account.

Watch a video explaining how to create an account.

Find answers to frequently asked questions about the process of creating an account.

After creating your account, click on the "Renew Your Passport" button on the home page to start your application.

You can save your application and finish it at a later date. You have 30 days to complete your application after you start it. If you do not complete your application in 30 days, you will need to start over.

Enter info about your most recent passport

At this stage, we check the passport(s) you are renewing against our records to see if you can renew online.

- Enter your information as we printed it on the passport you are renewing.

- Try again if you believe you should be eligible to renew online. We may be experiencing temporary, technical issues with our system.

- If you are not eligible to renew online, the application will give you a list of reasons. Double check your information before re-entering it.

Validity of Most Recent Passport : Make sure your most recent passport is or was valid for 10 years. The passport must be expiring within one year or have been expired less than five years.

Your Name : Check the spelling, capitalization, hyphens, and spacing between letters in your name and compare them to your most recent passport.

- If your last name is spelled "McDonald" but printed as "Mc Donald," (with a space), make sure you enter your name as "Mc Donald"(with the space included) on the application.

- If your last name is spelled “Smith-Jenkins“ (with a hyphen) and printed in your most recent passport with the hyphen, try entering your name as “Smith Jenkins” (without a hyphen) or "SmithJenkins" (with no space). We will add the hyphen to your name when we review your application.

Passport Book, Passport Card, or Both Documents : You can renew passport books and passport cards online. If you want to renew a passport book but not a passport card, leave the card section blank on the application. If you want to renew a passport card but not a passport book, leave the book section blank.

The following chart explains what documents you can renew online:

Watch this video to learn how to enter info about your passport

If you are traveling in less than 8 weeks, you cannot renew online. We are only offering routine service .

- Routine times do not include mailing times.

- Routine times are the same for customers who renew online and by mail.

Need your passport in 3-8 weeks? Get expedited service and renew by mail .

Need your passport in less than 3 weeks? Make an appointment to renew in person at a passport agency or center.

Upload a digital photo

You will need to upload an original, digital photo in .JPEG file format.

- Go to our Uploading a Digital Photo page to see photo examples and requirements.

- Have someone else take your photo. No selfies.

- Do not scan a photo, or take a photo of an already printed photo.

Watch this video to learn how to upload a digital photo

Paying for your Passport

To complete your application, you must pay all passport fees . Click the “Sign and Pay” button which will take you to pay.gov where you will pay your passport fees.

Use your credit or debit card so we can process your payment fast. You can also use an ACH, or Automated Clearing House payment, to transfer funds from your bank account. Processing an ACH payment may take longer than a credit or debit card.

Confirming Payment

We will send you emails about the status of your payment.

The first email will notify you that your payment is pending. The second email will confirm we processed your payment, which may take up to 3 days. If we are unable to process your payment, you will receive an email asking you to login to your account and pay again.

Check your spam or junk folder if you do not see the emails in your inbox.

Keep Your Most Recent Passport

When you complete your application, you will need the passport you are renewing on hand. Keep your most recent passport. Do not mail it to us, or try to use it to travel since we will cancel it.

Watch this video to learn how to pay online

One week after you apply, go to our Online Passport Status System to enroll in more emails about the status of your application. We will notify you when your application is in process, approved, and when we send your passport. We will also notify you if we need more information to process your application.

Our Application Status page includes details about what each status message means.

Watch this video to learn what to do after you apply

How to get support

Request faster service or change your mailing address.

If your travel plans change, you may request expedite service for an extra $60, or 1-2 delivery of your completed passport book for an extra $21.36. One-to-two day delivery is not available for passport cards. We only send cards via First Class Mail.

If you are changing your mailing address, please note your new address must be in the United States (either state or territory). You cannot use an Army Post Office (APO) or Fleet Post Office (FPO) address.

Call the National Passport Information Center at 1-877-487-2778 . Provide your application number, or your last name and date of birth.

After you contact us, you won’t see any changes to your application in your MyTravelGov account.

Respond to a request for more information

Follow the instructions in the letter or email. You must respond within 90 days of the date on the letter or email. Our Respond to a Letter or Email webpage has tips and reminders on how to respond.

Contacting us if you need help

There are two different paths for support:

Technical Support for your Account : Contact the Login.gov team if you need help changing your password, verifying your account, or changing your account information.

Customer Support for your Passport Application : Contact us at 1-877-487-2778 if you have an issue completing your passport application, or you want to upgrade to expedited service, 1-2 day delivery, or change your mailing address.

Processing Times for Renewing Online

Routine: 6-8 weeks*

Expedited: We do not offer this service if you are renewing online. Mail us your application and supporting documents.

Urgent Travel: We do not offer this service if you are renewing online. Make an appointment at a passport agency or center.

*Mailing times are not included in processing times . Processing times only include the time your application is at one of our passport agencies or centers. The total time to get your passport includes both processing and mailing times.

External Link

You are about to leave travel.state.gov for an external website that is not maintained by the U.S. Department of State.

Links to external websites are provided as a convenience and should not be construed as an endorsement by the U.S. Department of State of the views or products contained therein. If you wish to remain on travel.state.gov, click the "cancel" message.

You are about to visit:

10 Visa and Passport Tips for Hassle-Free Travel 2024

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Southwest Airlines' battle with activist investor heats up: Are free bags on the chopping block?

The luggage policy at southwest is known for allowing customers to have two free checked bags.

Southwest Airlines has been experiencing some ‘turbulence’: Jack Otter

Jack Otter and the panel discuss the downfall of Southwest Airlines’ popularity and how they could turn it around on ‘Barron’s Roundtable.’

Activist investor Elliott Investment Management has continued pushing for a "comprehensive" review of Southwest Airlines' business while building its stake in the carrier.

Elliott now holds 10% of the airline’s common stock, a Tuesday filing with the Securities and Exchange Commission (SEC) showed, allowing it to call a special meeting with Southwest.

The investment firm has also advocated for numerous changes at Southwest that it has argued will improve the carrier’s financial performance. As part of Elliott's push for a business review, it said the airline has "written off key commercial innovations and revenue opportunities across the airline industry" in the past, like checked bag fees.

The luggage policy at Southwest allows customers two free checked bags, regardless of the type of ticket fare.

"There’s no work currently underway to change our industry-leading two bags fly free policy, but it’s important for us to know what our Customers value most," Southwest said in a statement to FOX Business. "We’ll continue our efforts to track stakeholder sentiment on many aspects of our business model to ensure we remain competitive and current on Customer preferences."

A Southwest Airlines Boeing 737 Max 8 aircraft departs from Los Angeles International Airport in Los Angeles on May 5. (Kevin Carter/Getty Images / Getty Images)

SOUTHWEST AIRLINES CEO SAYS NO PLANS TO STEP DOWN DESPITE PRESSURE FROM ACTIVIST ELLIOTT

The airline has been facing an activist investor challenge from Elliott since June. Representatives from both the airline and the investment firm are meeting early next week.

"We remain prepared to meet with Elliott next week and look forward to sharing details on our continued transformation at our Investor Day on Sept. 26," Southwest told FOX Business.

Travelers use a Southwest check-in kiosk at Logan International Airport in Boston on July 19, 2019. (Scott Eisen/Bloomberg via Getty Images / Getty Images)

SOUTHWEST SHARES JUMP AFTER ACTIVIST ELLIOTT BUYS $2B STAKE

The company has previously said it plans to "provide more details on its comprehensive plan to deliver transformational commercial initiatives, improved operational efficiency and capital allocation discipline during its Investor Day in late September."

A Southwest Airlines Boeing 737 Max 8 prepares for takeoff at Los Angeles International Airport in Los Angeles on Dec. 29, 2023. (AaronP/Bauer-Griffin/GC Images / Getty Images)

There have been some new policies announced for Southwest customers in recent months.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In late July, Southwest said it would start assigning seats and offering premium seating options on all flights in the future, a departure from its open seating and all-economy-class cabin, as FOX Business previously reported .

FOX Business' Daniella Genovese contributed to this report.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Attractions

- Festivals + Events

This NYC Festival Is About More Than Just Music — It's About Doing Good

This NYC festival is about more than just music.

:max_bytes(150000):strip_icc():format(webp)/Stacey-Leasca-2000-631fabdcfe624115bea0ce8e25fdec96.jpg)

Global Citizen Festival History

- How to Get Free Tickets

What to Expect While Attending

Where to stay near the festival.

- Who's Headlining in 2024

Why the Festival Is Such a Big Deal

ANGELA WEISS/Getty Images

Going to a music festival is almost always a guaranteed good time. After all, it means spending an afternoon (or an entire weekend) seeing your favorite acts perform and dancing the day away with friends. But there's an added bonus to attending the Global Citizen Festival in New York City: You get to do good just by showing up.

For more than a decade, the Global Citizen Festival has brought together thousands of music fans to demand action against climate change, poverty, and inequity, raising billions of dollars along the way. On Sept. 28, 2024, the festival will return to Central Park's Great Lawn, promising a great time and to deliver financial assistance where it's needed most.

Ready to see it for yourself? Here's what you need to know about the Global Citizen Festival, including how you can earn free tickets.

The festival began in 2012, with 60,000 people attending the very first event on the Great Lawn in Central Park. The inaugural festival included appearances by Neil Young, The Black Keys, and Band of Horses. Since then, everyone from Rihanna to Coldplay has taken the stage.

The timing of the festival is no coincidence, either. The website noted it's "timed to coincide with the UN General Assembly to leverage opportunities to get policy and financial commitments from government, corporate, and philanthropic leaders to defeat poverty, demand equity, and defend the planet."

How to Get Free Tickets

You're welcome and able to simply purchase tickets to the festival. You can buy in one of three categories: general admission; global VIP, which comes with a special entrance and restrooms; and ultimate VIP, which includes backstage access, catering, and private entry. Tickets begin at $99 for general admission and go up to $3,000 for ultimate VIP.

However, there's a better way to get in, and that's by earning free tickets through acts of service. To snag them, you simply need to download the Global Citizen app, sign up to become a Global Citizen, and choose the issues that matter to you. From there, the app will ask you to take action, which includes picking from a list like signing petitions, sharing social posts, or reading stories. Once you earn enough "actions," you can enter a raffle to win a pair of tickets to the event.

There's more to do beyond listening to music. Throughout the event, attendees can expect to hear speeches from activists and educators on equality, climate change, and ending poverty around the globe. Guests can also check out various booths set up by nonprofits, along with plenty of delicious food. (In 2023, the festival went completely meat-free , so get ready for lots of tasty vegetables this year, too.)

Luckily for those coming from out of town, there are lots of options for where to stay in New York City . But if you're hoping to be near the park — and spend a few days in the lap of luxury — the iconic Plaza Hotel is just a few steps away. There's also 1 Hotel Central Park , a fantastic choice for eco-conscious travelers. The property's nature-inspired design includes reclaimed wood accents and living green walls, making it an ideal oasis for your festival stay.

For even more arts and culture, consider the nearby Hilton Club The Quin New York . The contemporary hotel is just a quick walk from the festival grounds and home to several artist salons and a 15-foot-tall video wall that will leave you mesmerized.

Who's Headlining in 2024

The 2024 Global Citizen Festival has an incredible lineup of musical acts. This year, headliners include Post Malone, Doja Cat, Lisa, Jelly Roll, Benson Boone, Raye, and Rauw Alejandro. The event will also feature appearances by Global Citizen ambassador Hugh Jackman, Dr. Jane Goodall, and Chris Martin for an added touch of star power.