AI Summary to Minimize your effort

GST on Tours and Travels: HSN Code and GST Rate on Travel Agents Services

Updated on : Jun 16th, 2023

Depending on whether input tax credits (ITC) are available, there are now two separate rates of GST on tours and travels. Without the option of an ITC, a 5% GST is applied to the gross tour price, while an 18% GST rate is applied with ITC. These various rates have an impact on the total pricing for both travellers and tour operators.

Continue reading to learn more about tours and travels HSN code, and GST on travel agents.

Scope of taxation on tours and travels

The Goods and Services Tax (GST) regulations provide tour operators with three different ways to operate and claim input credits. Input tax credit (ITC) in GST refers to the tax amount that businesses can subtract from the tax owed on the purchase of goods and services.

Here is a detailed explanation:

- Acts as a tour operator with no ITC: A tour operator charges 5% GST to the customer on the total package but does not claim any ITC.

- Acts as a tour operator and claim ITC: The tour operator charges 18% GST to the customer on the total package and claims ITC. Although, it is important to consider the place of supply rule when claiming ITC.

- Acts as a pure agent: The tour operator acts as an intermediary and raises an invoice to the customer charging 18% GST. However, the entity's role is that of a facilitator, and the actual expenses incurred for services like travel, hotel, and boarding are separately mentioned on the invoice and taken as reimbursements from the customer. The tour operator must maintain proper records of these expenses.

Value of supply for GST on tours and travels

If a tour operator works as a pure agent, then they can exclude the expenses incurred by the service provider from the value of their supply . This allows for a more accurate determination of the tax liability and ensures that the tax is levied only on the actual service provided by the pure agent.

Time of supply for GST on tours and travels

The time of supply for GST depends on whether the tour operator is acting as a pure agent or not.

If they are not acting as a pure agent, the GST should be charged and paid at the time of payment or issuance of the invoice, whichever occurs earlier. In such cases, the tour operator should recognise its revenue on a payment basis for GST purposes.

However, if the tour operator opts to act as a pure agent, the GST should be charged at the time when the final invoice is raised or when the commission is received, whichever happens, earlier.

Place of supply for GST on tours and travels

When making a hotel reservation, the place of supply is the city in which the hotel is located, and the hotel will include GST in its invoice. However, the company cannot claim ITC on that specific invoice if it is not registered for GST in the place of supply.

The same applies to flight tickets, where the place of supply is the place of flight departure. If the tour operator is not registered under GST in the state from which the flight departs, ITC cannot be claimed for that invoice.

GST on tours and travels with HSN code

Under Heading 9985 of the GST Tariff Act, the applicable GST rate for tours and travel services is 5% if the following conditions are met.

- The tour operator providing the services will not be eligible for ITC on services like hotels, air tickets, etc. However, ITC can be claimed on tour operator services obtained from another tour operator.

- The tour operator must indicate in its invoice that the charged amount is the gross amount and includes charges for accommodation and transportation.

Here is a tabular representation of tours and travels SAC code and GST on travel agents’ services:

Availability of ITC claims on tours and travels GST rate

In case the tour operator chooses to charge GST at the rate of 18% on the total amount, it will be eligible to claim ITC on various services such as rent, professional fees, lease lines, telephone, etc.

Here is a more detailed explanation of ITC availability on tours and travels GST rate:

- Air travel agents can claim ITC on the GST paid for commission or service charges.

- Inbound tour fees charged on a commission basis are subject to 18% GST with ITC.

- ITC can be claimed if the service is outsourced from another agent.

- Hotels charging a commission will have 18% GST applicable, and ITC can be claimed.

- All other renting services are charged at 18% GST, with ITC

Frequently Asked Questions

- Can air travel agents avail for ITC?

Yes, air travel agencies are eligible for an ITC on the GST they paid on the commission they got from passengers or travellers.

- Is GST applicable to the cab service providers like Ola, Uber, etc.?

Yes. According to section 9(5) of the CGST Act, all cab-service companies are required to pay GST.

- Is a tour operator taxable?

Tour operators are considered ‘people’, but the brokerage charged by them is taxable.

- How much GST is on a flight ticket?

The GST on economy flight tickets is 5%, whereas that for business and premium economy is 12%.

About the Author

I preach the words, “Learning never exhausts the mind.” An aspiring CA and a passionate content writer having 4+ years of hands-on experience in deciphering jargon in Indian GST, Income Tax, off late also into the much larger Indian finance ecosystem, I love curating content in various forms to the interest of tax professionals, and enterprises, both big and small. While not writing, you can catch me singing Shāstriya Sangeetha and tuning my violin ;). Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Real Estate

Home » Invoice Templates » 7+ Free Travel Agency Invoice Templates & Samples (Excel / Word / PDF)

Invoice Templates

7+ free travel agency invoice templates & samples (excel / word / pdf).

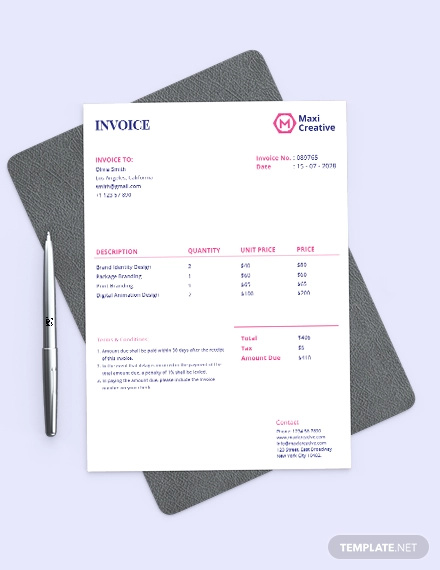

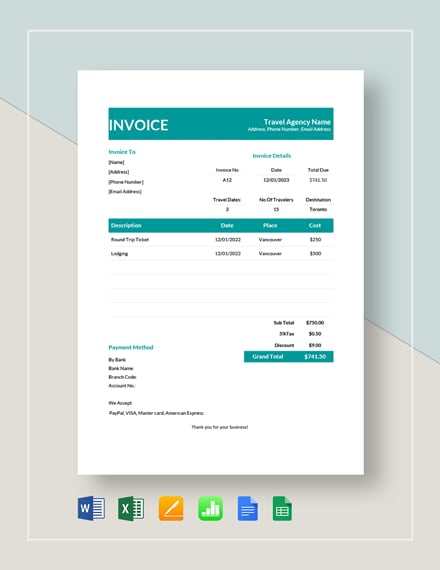

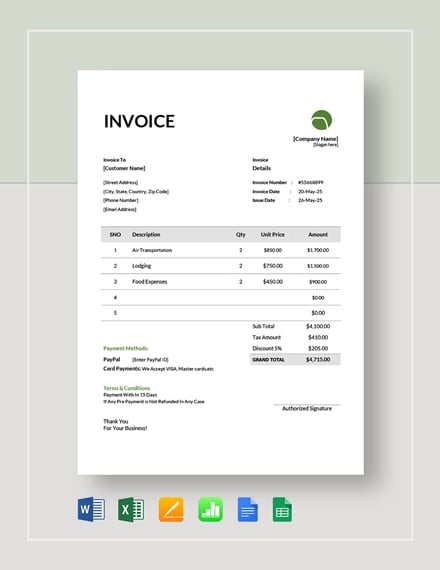

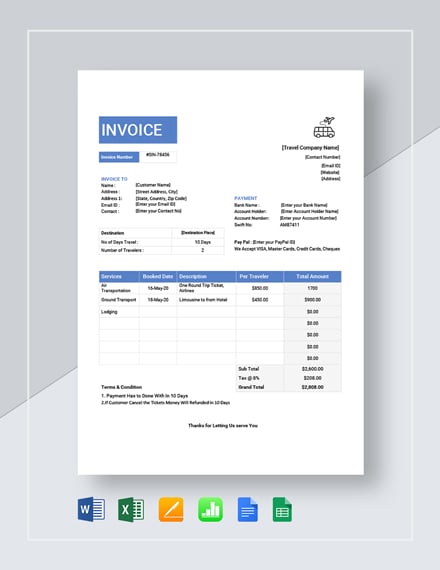

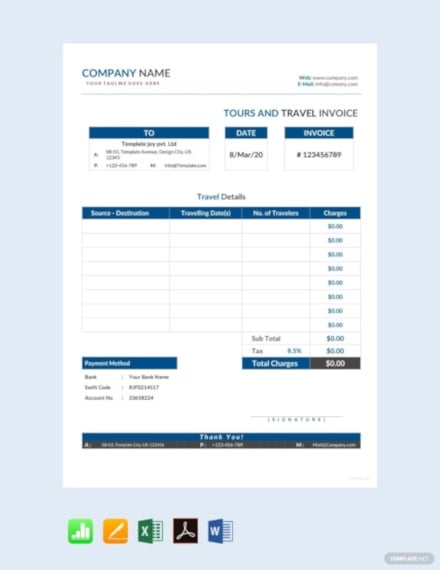

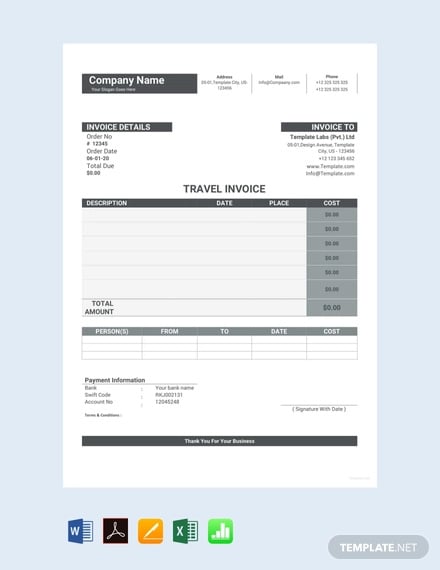

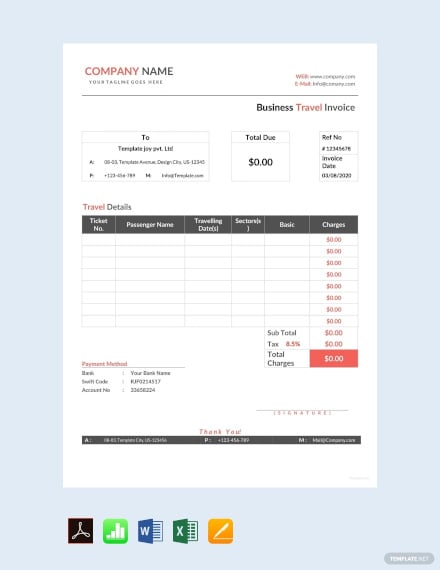

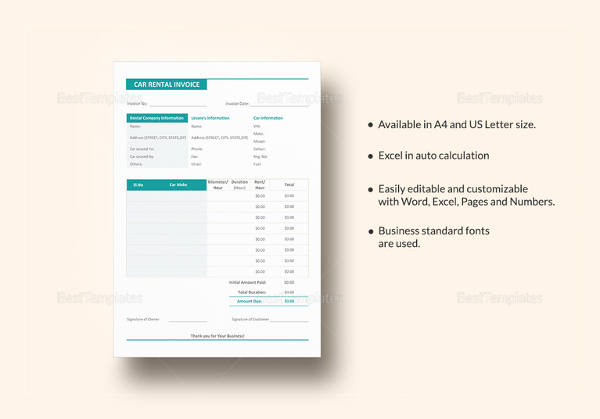

If you’re running a travel agency, you must use a travel agency invoice template to create professionally-looking invoices for your clients. This tool streamlines the invoicing process and makes timely payments from clients.

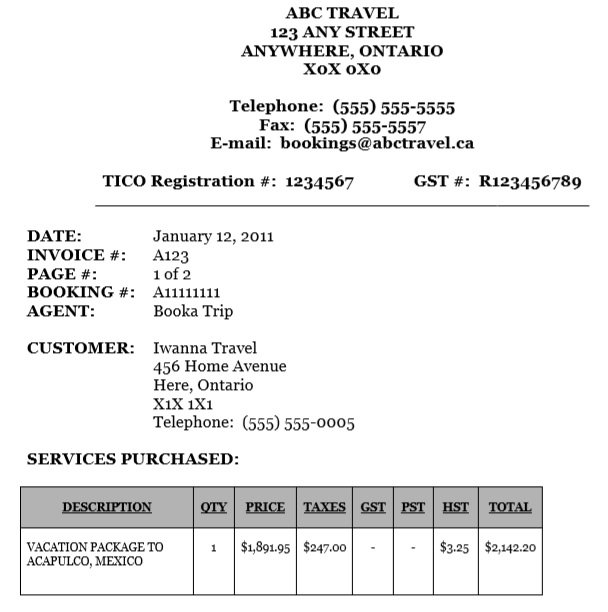

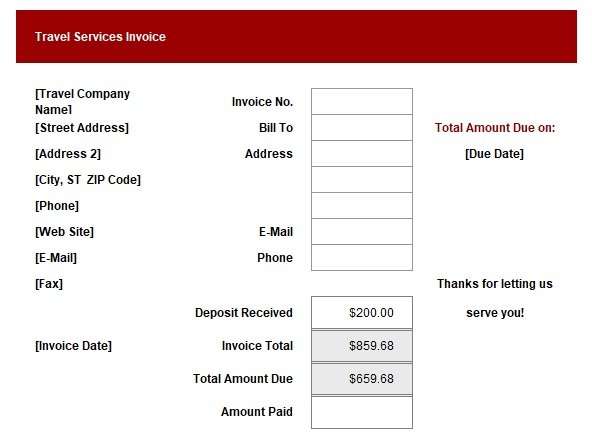

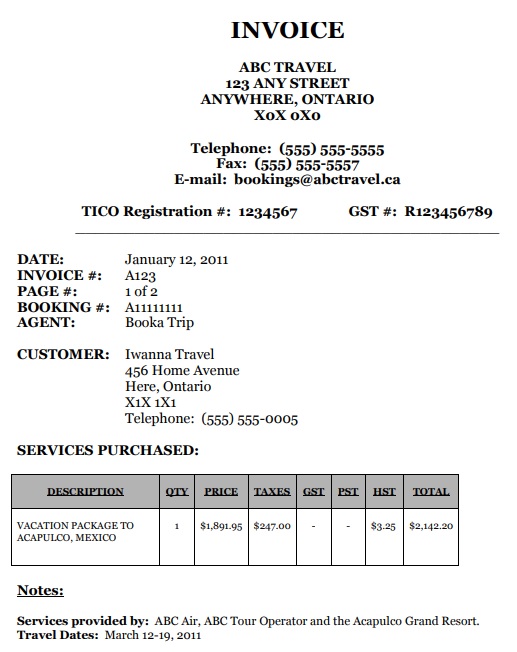

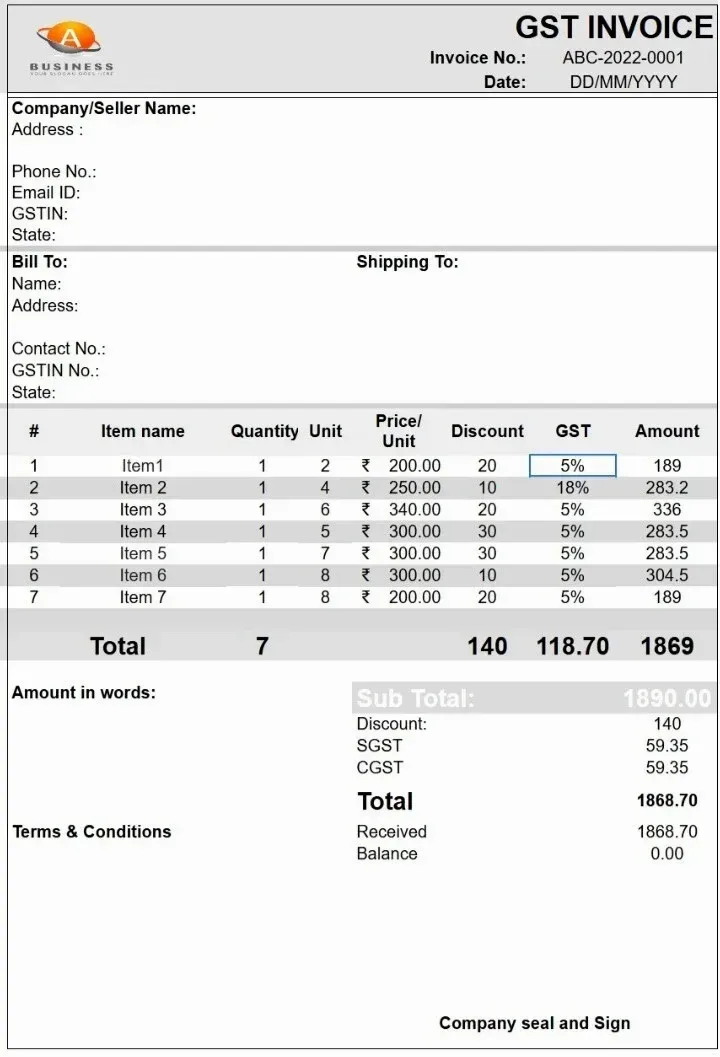

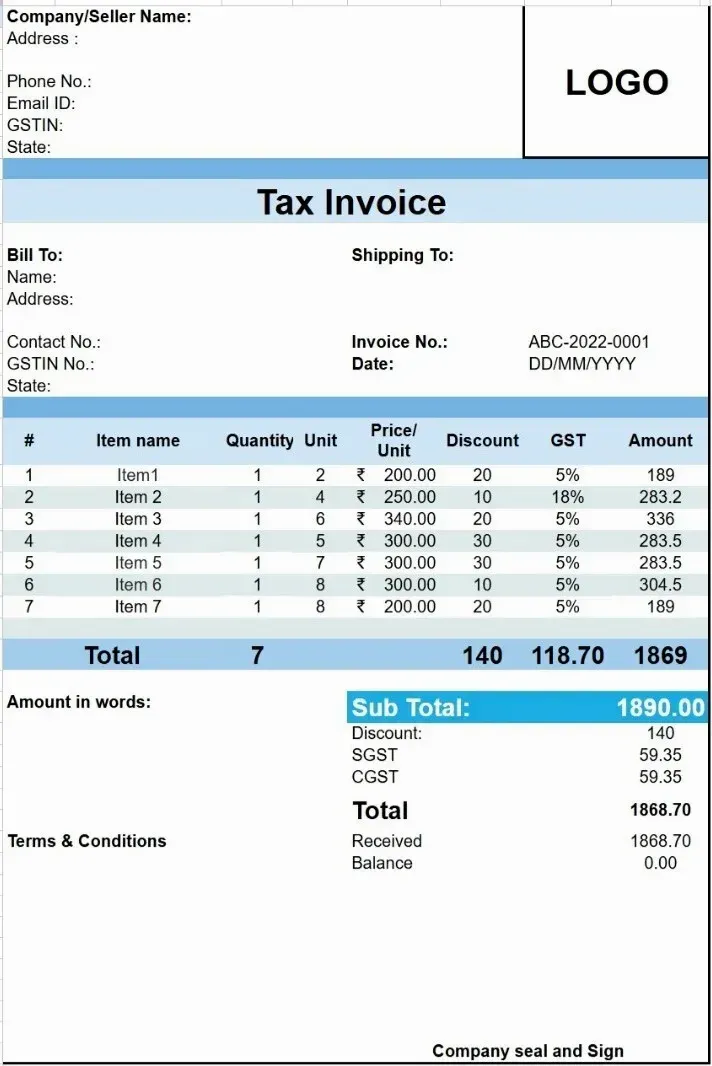

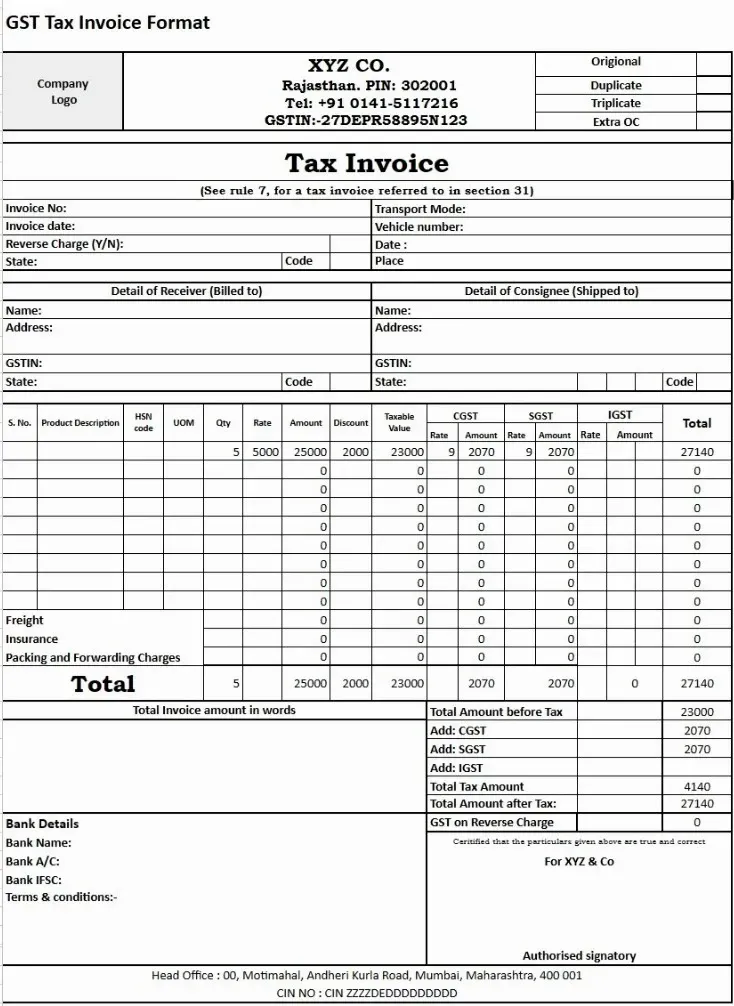

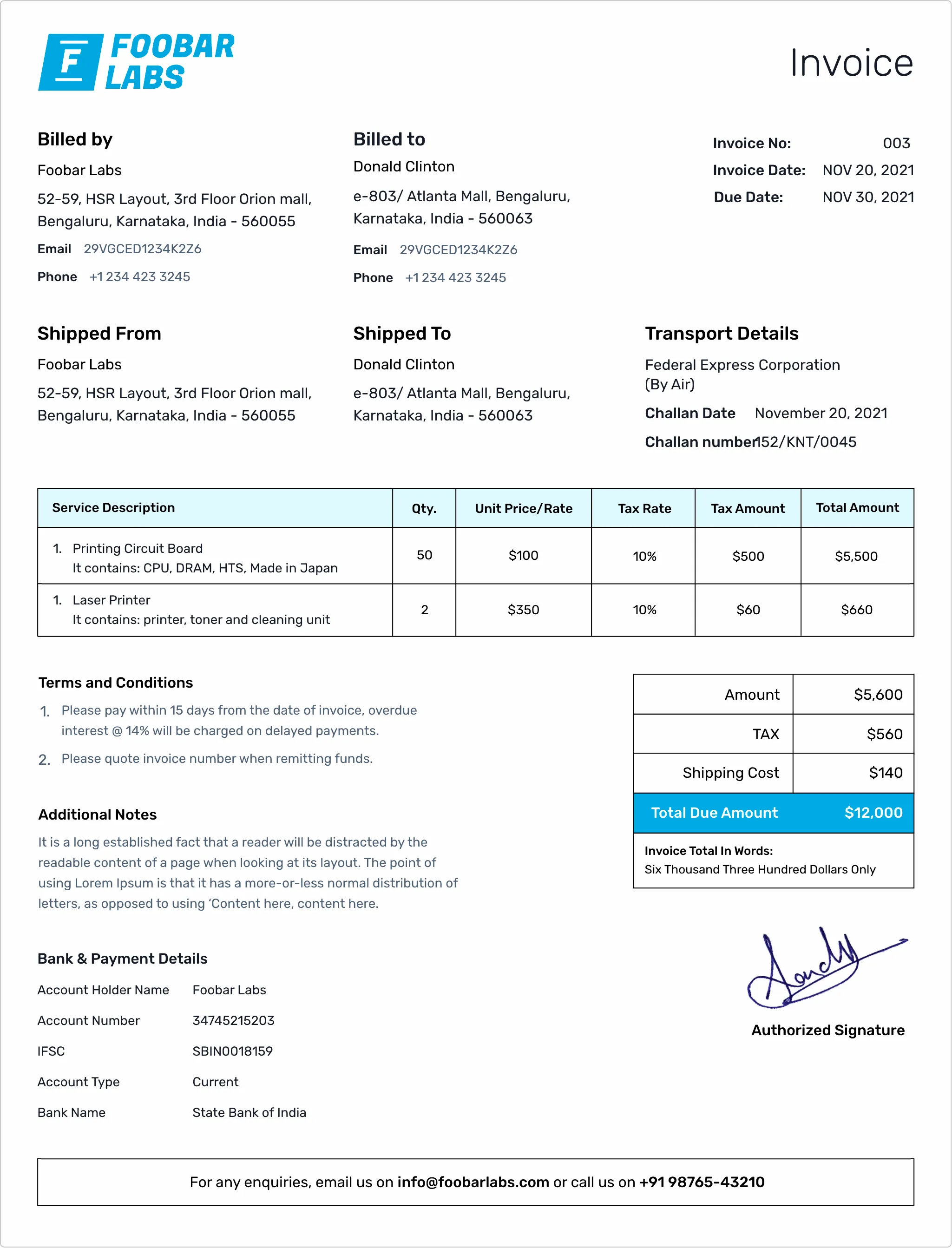

Once you have downloaded the template, you just need to customize it with your travel agency’s branding and logo. For accurate invoices, it calculates totals, taxes, and discounts automatically.

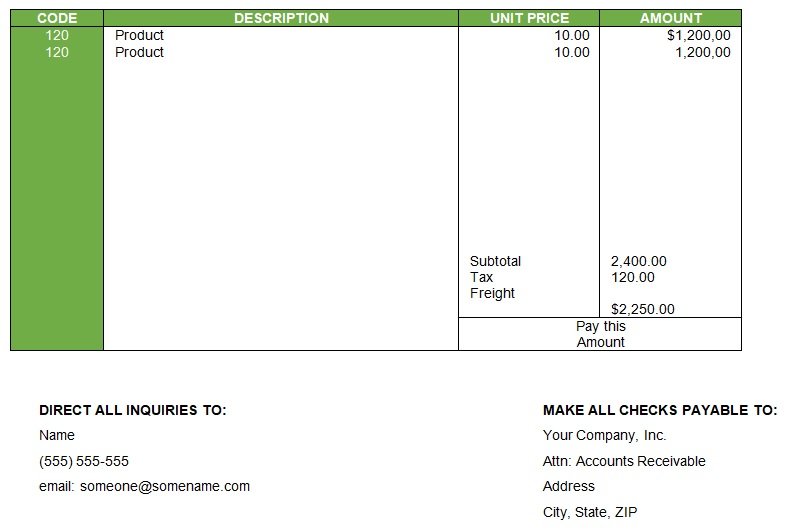

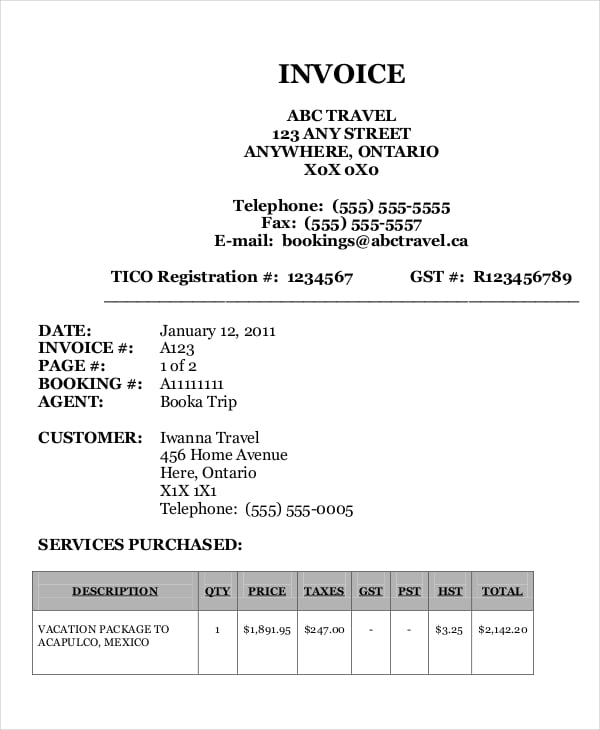

Furthermore, travel agencies are now giving up the old manual ways to enter data and save the records. The travel agency invoice template helps tourist travelers and travel agencies uphold records and automatically generate receipts for the travelers. Travel agencies efficiently invoice their customers individually and maintain their records. These have included all the relevant details for the travel like the name of the traveler and travel agencies, the details of the endpoints, expenses, hoteling, food expenses, hostel expenses, etc. The General sales tax GST is also a part of the invoice that makes it easier for customers and agencies to do calculations.

Table of Contents

The benefits of a travel agency invoice template:

The travel agency invoice template provides various benefits to travel agencies;

- It provides a pre-designed template that contains all pertinent information like booking fees, transportation costs, and more. Thus, it streamlines the invoicing process and saves you time.

- The template enables you to create well-structured and visually appealing invoices that enhance professionalism and credibility.

- This document contains a detailed breakdown of charges for easy reference which makes sure accuracy and transparency.

- The travel agency invoice template specifies payment terms and methods which facilitates timely payments.

- It provides clear and organized documentation of travel expenses which help to improve customer satisfaction.

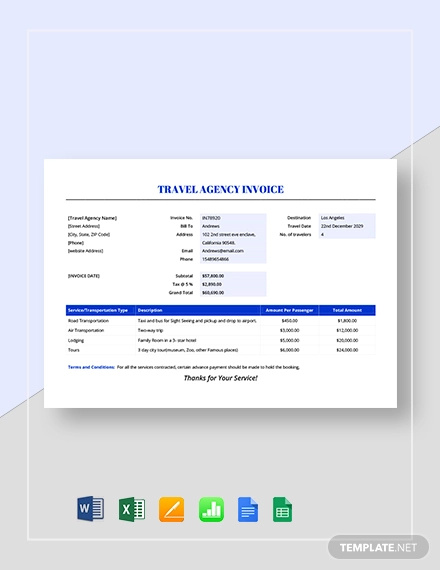

Sample of Travel Agency Form Template PDF

Travel Agency GST Invoice Format in Excel

Travel Agency Bill Format

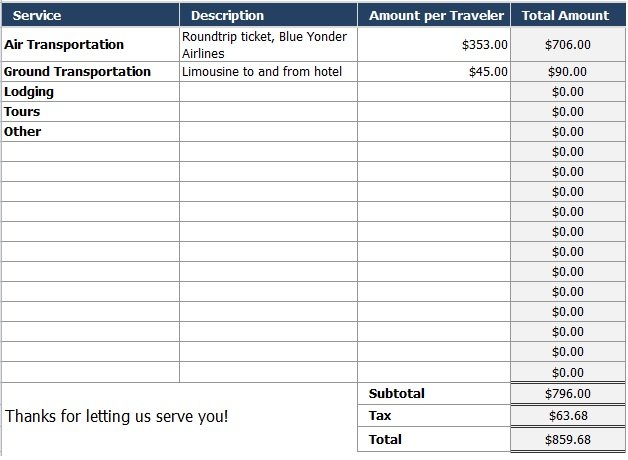

Tours and Travels Bill Format in MS excel

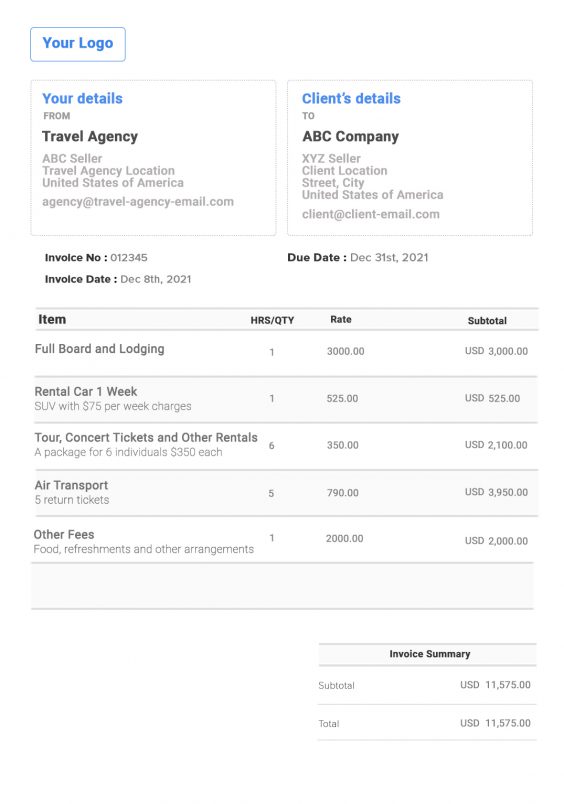

Travel Service Invoice Template

Travel Agent Commission Invoice Template

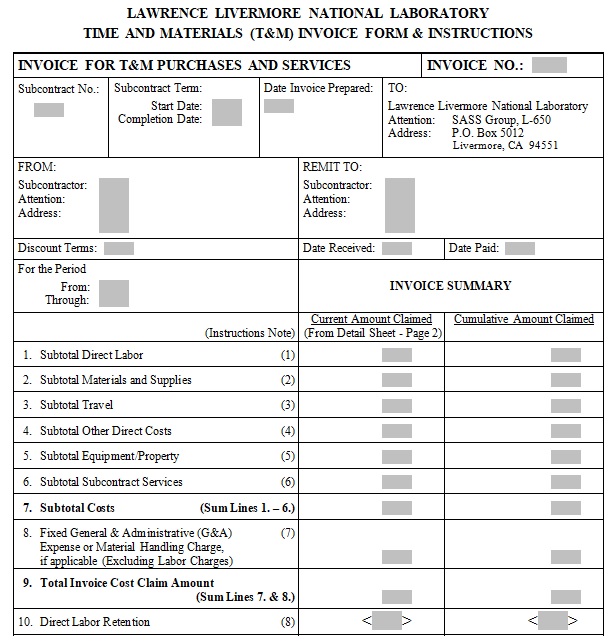

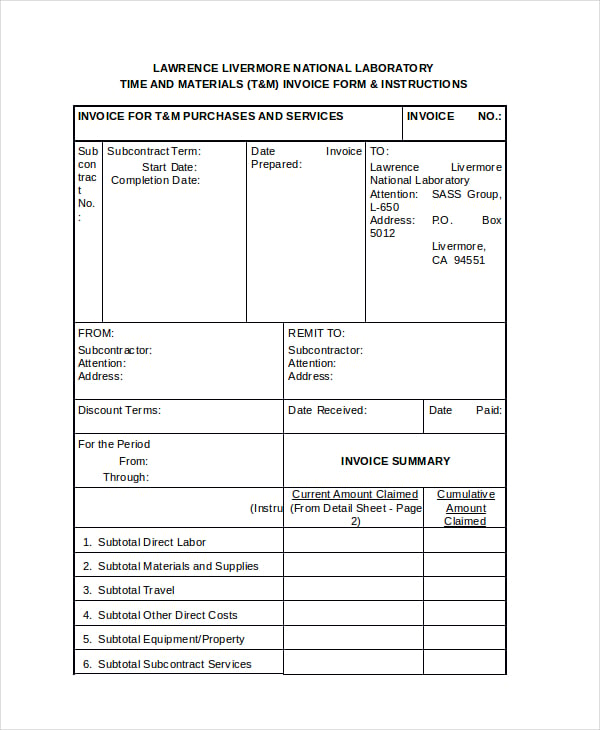

Time and Material Invoice Form

Air Travel Agency Invoice Template

How to fill out a travel agency invoice template?

Let us discuss step-by-step how to fill out a travel agency invoice;

Input your travel agency information

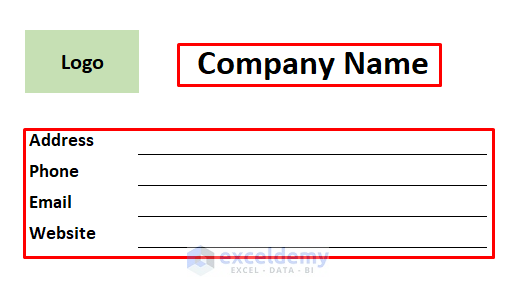

First, you need to enter the name, address, contact information, and logo of your travel agency into the invoice template. This will give your travel agency invoice a professional look.

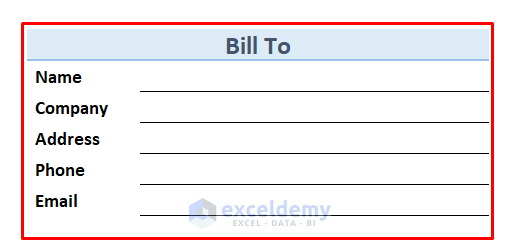

Enter client details

In the next step, enter the name, address, and contact details of the client. You should always ensure that your invoice is addressed to the right client so that they can easily identify their invoice.

Mention the services provided

Specify the services you provided to the client including a description, quantity, and price for each service. The type of services may include flight bookings, hotel reservations , tour packages, etc.

Calculate the total amount due

Add up the prices of all the services provided to calculate the total amount due. This way, your clients clearly understand the total cost of their travel arrangements.

Include payment terms

To ensure a smooth payment process, mention the payment terms as well as the due date and accepted payment methods.

Review and send the invoice

Review the invoice and double-check all the details to ensure accuracy and professionalism. This may include the client’s details, services provided, and the total amount due. Send the invoice to the client after your satisfaction.

Track payment and follow up

For each invoice, keep track of the payment status and follow up with clients as required. This will help the travel agency maintain a healthy cash flow . In addition, it also ensures that you will receive payments in a specified time.

A travel agency invoice is a document that serves as proof of financial transactions between a travel agent and their clients. It contains all the details about the travel services provided.

The important elements to include in a travel agency invoice are; 1- The travel agency details 2- Client’s information 3- Travel itinerary 4- Booking dates 5- Costs and payment terms

You May also Like

Sharing is caring!

I am Ryan Duffy and legal writer. I received a bachelor of business administration (BBA) degree from London Business School. I have 8+ years of writing experience in the different template fields and working with ExcelTMP.com for 7 years. I work with a team of writers and business and legal professionals to provide you with the best templates.

Travel Agency Invoice

Create professional invoices online with free travel agency invoice template

Faster & Simpler Invoicing for Travel Agencies

Spend more time creating travel itineraries and less time on billing. Use our free invoice template to get paid faster and free up your time to focus on what you really love: making travel easy & enjoyable for your clients. You are a travel agent because you enjoy advising & planning memorable trips, making perfect travel arrangements and booking suitable accommodations. Not because you want to process invoices. U se our free, precise & simple invoice templates to send invoices to your clients that have all the details of the unique work that you’ve done for them. .

Travel Agency Invoice Requirements

How to invoice for travel & vacation services.

Being a travel & tourism agent means carrying out different tasks, from transportation & ticketing to consultation & accommodation. Your clients might not realize how much goes into your work, so make sure to break down your services so clients understand what exactly they are paying for.

As an example, you are responsible to manage a family trip for 10 people. The type of task would be “Travel and Trip Management,” and the tasks would be “making reservations”, “accommodations”, “rentals” & “ticketing”.

It’s a good idea to use a travel & tourism invoice generator and create a list of your most provided services, so you can copy and paste them into your invoice.

Which Travel & Vacation Services Need an Invoice?

Why do you need a travel & vacation agency invoice.

As a travel agency/agent or a virtual assistant making travel arrangements & flight bookings, an invoice can get you paid for all the unique services you provide. Other benefits include:

✔ Find income information when it’s time to file taxes. ✔ Keep track of the different services that you offer. ✔ Stay in control of your client accounts. ✔ Always know when payments are due or overdue. ✔ Make it simple to follow up on late payments. ✔ Monitor your travel & tourism business’ growth. ✔ Keep book-keeping in-house for longer. ✔ Show tax authorities that you are organized and reliable.

When is the Right Time to send an Invoice?

If you’re a travel & tourism agent or agency, your contract should include details about when the client needs to pay for your work. The best time to invoice depends on the project.

Some companies have a fixed day of the month when they make their international payments , so send in your invoice a few days in advance.

Travel Agency Invoicing Best Practices

Making travel arrangements comes easy, but invoicing for travel & tourism services leaves you stumped. Here’s a list of travel agency invoicing best practices to make things easier:

✔Accept as many payment methods as possible, especially electronic transactions. ✔Include multiple ways for your client to contact you, in case they have a question. ✔Review your contract to check that you’ve fulfilled all the terms and that your invoice details match what you agreed with the client. ✔Use a free travel agency invoice template to make your invoice look professional and easy to read. ✔List special costs like late fees, and taxes like sales tax, separately. ✔Keep a copy of every invoice for your own records, so that you can track when payment is due. ✔Follow up on client payment. Make sure to send reminders promptly if anyone misses a payment.

What Types of Invoices are there?

There’s more than one kind of invoice for travel & tourism services, so choose the right kind for your situation.

Professional Templates

Choose a profession to generate an invoice with relevant sample items.

Tax Templates

Choose a tax region to generate a template with the taxes from that region already set.

Commercial, Business, or Ecommerce Templates

Choose a commercial or business document to generate a template with relevant sample items.

- GST Billing Software

- Billing & Inventory Pricing

- Digital Store/Dukaan Pricing

- Create Account

- [XLS, Word, PDF] Download Bill Book Formats for Travel Agency for Free

![tours and travels bill format with gst [XLS, Word, PDF] Download Bill Book Formats for Travel Agency for Free](https://www.billclap.com/_next/image?url=https%3A%2F%2Fstatic.billclap.com%2Fstorage%2Fblog_images%2Fcover-img-1702277739099.png&w=1920&q=75)

Why These Bill Book Formats Are a Game-Changer for Travel Agencies?

What's packed inside the bill book, how to rock these formats:, want to create gst bill or invoices for your travel agency business.

Have you tried our mobile app?

Download our mobile app from playstore now

Create GST bill

All-in-one cloud-based business management software. Sell Smart, Sell Online with 0% Commission. Manage billing, bahikhata, inventory & expenses

- Privacy Policy

- +91-8929003309

- [email protected]

- www.billclap.com

- C-4, Rayos Business Park, Block C, Sector 63, Noida, UP-201301

Upload Logo

Send invoice to client, travel and tourism invoice template, free online invoice generator.

- Template 1 (Left Logo)

- Template 2 (Centered Logo)

- Template 3 (Right Logo)

- Show all formats

- United States Dollar

- Pound Sterling (United Kingdom Pound)

- Australian Dollar

- Canadian Dollar

- Egyptian Pound

- United Arab Emirates (AED)

- Indian Rupee

- New Zealand Dollar

- Show all Currencies

Select Currency

- Netherlands Antilles Guilder

- Argentinian Nuevo Peso

- Aruban Guilder

- Convertible Mark

- Barbados Dollar

- Bahraini Dinar

- Burundi Franc

- Bermudian Dollar

- Brunei Dollar

- Bahamian Dollar

- Belarussian Rouble

- Belize Dollar

- Swiss Franc

- Chilean Peso

- Yuan Renminbi

- Colombian Peso

- Costa Rican Colón

- Escudo Caboverdiano

- Czech Koruna

- Djibouti Franc

- Danish Krone

- Dominican Republic Peso

- Algerian Dinar

- Eritrean Nakfa

- Ethiopian Birr

- Fiji Dollar

- Falkland Pound

- Gibraltar Pound

- Guyana Dollar

- Hong Kong Dollar

- Croatian Kuna

- Iraqi Dinar

- Iranian Rial

- Icelandic Króna

- Jamaican Dollar

- Jordanian Dinar

- Kenyan Shilling

- Kyrgyzstani Som

- Comorian Franc

- Democratic People's Republic of Korean Won

- Republic of Korean Won

- Kuwaiti Dinar

- Cayman Islands Dollar

- Lebanese Pound

- Sri Lankan Rupee

- Liberian Dollar

- Libyan Dinar

- Moroccan Dirham

- Moldavian Leu

- Macedonian Dinar

- Mauritius Rupee

- Malawian Kwacha

- Mexican New Peso ( Mexican Peso)

- Ringgit (also known as Malaysian Dollar)

- Namibia Dollar

- Norwegian Krone

- Nepalese Rupee

- Philippines Peso

- Pakistani Rupee

- Qatari Riyal

- Rwandan Franc

- Saudi Riyal

- Solomon Islands Dollar

- Seychelles Rupee

- Sudanese Pound

- Swedish Krona

- Singapore Dollar

- St Helena Pound

- Somali Shilling

- Syrian Pound

- Tunisian Dinar

- Turkish Lira

- Trinidad and Tobago Dollar

- Taiwan Dollar

- Tanzanian Shilling

- Uruguayan Peso

- Uzbekistani Som

- Bolivar Fuerte

- Viet Nam Dông

- Franc de la Communauté financière africaine

- East Caribbean Dollar

- West African Franc

- Franc des Comptoirs français du Pacifique

- Yemeni Riyal

- Zambian Kwacha

- Egyptian Pound (جنيه )

- United Arab Emirates (درهم)

- Online Invoice Generator

- All Features call_made

- Estimates and Invoices

- Invoice Management

- Saved Invoices

- Secure Access

- Mobile Invoices

- Business Expense Tracker

- Industry Templates

- Word Invoice

- Excel Invoice

- Invoice PDF

- Google Sheets & Google Docs Invoice

- Printable Invoice

- Pro Forma Invoice

- Itemized Bill

- Online Invoice Generator call_made

- Rent Receipt

- Cash Receipt

- Donation Receipt

- Receipt Maker call_made

- Quote Template

- Estimate Maker call_made

- Profit Margin Calculator

- TRY IT FREE NOW call_made

- Support call_made

- Login call_made

Travel Agency Invoice Templates

Here’s our collection of travel agency invoice templates. Feel free to download, modify, and use any you like.

CREATE A CUSTOMIZED TEMPLATE

Downloadable Free Travel Agency Invoice Templates

free travel agency invoice template

travel agency word and excel invoice template

printable travel agency invoice template

sample travel agency invoice template

These templates all have separate labor and materials sections and print well. for more templates, refer to our invoice template collection . you can also check out our online invoice generator for an easy way to create an invoice for your projects that will look fantastic..

When should I use a travel agency invoice template?

As a travel agent or agency, you can benefit in several ways from using a travel agency invoice template:

- Accuracy and Consistency: Using a travel agency invoice template ensures that all essential details are consistently and accurately documented. This will reduce the likelihood of errors.

- Professionalism: A well-designed travel agency invoice template conveys professionalism to clients. This enhances your reputation and reinforces trust in your services.

- Time-Saving: Travel agency invoice templates streamline the billing process by providing pre-formatted fields. This eliminates the need to create invoices from scratch for each client.

By leveraging a template, you can improve efficiency, accuracy, and professionalism in your billing processes while maintaining organized financial records.

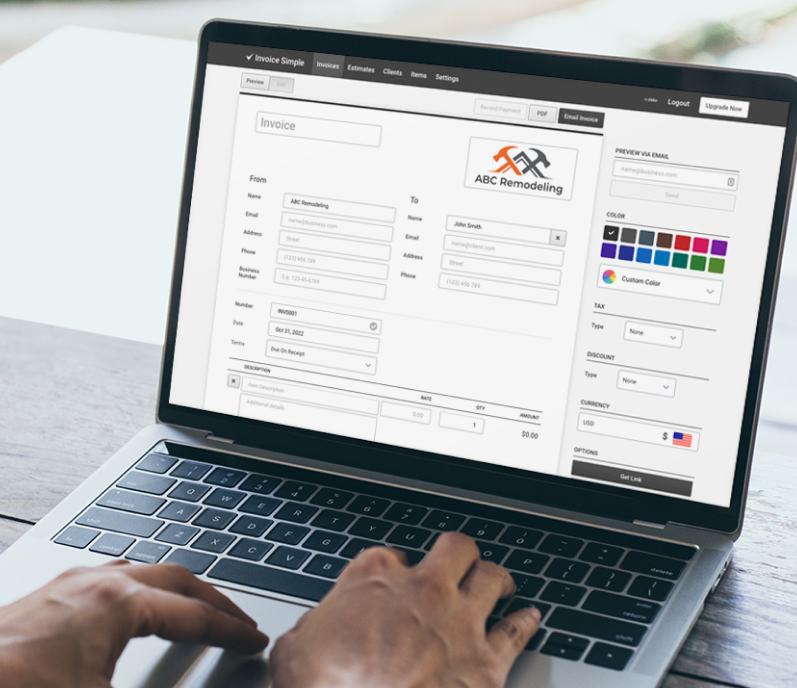

How do I create a travel agency invoice template?

Not sure how to create your own travel agency invoice? We’ve got you covered!

Try our online invoice generator.

With it, you can create a printer-friendly and fully customizable travel agency invoice template that includes the essential invoicing elements. The invoice generator even calculates subtotals and the total amount due, minimizing accounting errors.

After ensuring that your travel agency invoice is accurate and complete, send it to your client via email as a PDF attachment to maintain the format and ensure it cannot be altered. This method also provides both parties with a digital record of the transaction. If the client prefers a different method, you can also send the invoice through postal mail or use a client portal if your agency utilizes one, which might include invoicing capabilities for easy tracking and management.

Use a travel agency invoice when you have completed arranging travel services for a client or at the end of a booking process. It is essential when you need to formalize the request for payment for bookings made, including flights, accommodations, tours, and other travel services. This helps ensure that all charges are agreed upon and paid in a timely manner, maintaining clear and professional financial transactions with your clients.

To write a travel agency invoice, start with your travel agency’s contact information at the top, followed by the client’s details. List each service provided, such as airline tickets, hotel bookings, and other travel services, along with descriptions, dates, and prices for each. Include any taxes, fees, and additional charges. Clearly state the total amount due, payment terms (due date and accepted payment methods), and include a unique invoice number for tracking and record-keeping purposes. Ensure the invoice is clear and all charges are accurately described to avoid any confusion.

A travel agency invoice template should include the agency’s name and contact information, client’s name and contact details, and a detailed list of travel services provided with corresponding dates and charges. It should outline the costs for each element of the trip, including any taxes and additional fees. The template should also include total costs, payment terms, and a unique invoice number. Optionally, you can add fields for special instructions or additional notes related to the travel arrangements.

Customize a travel agency invoice by adding your agency’s branding, such as a logo and color scheme. Tailor the invoice template to include fields specifically useful for travel services, such as destination, travel dates, types of accommodations, and transportation options. Consider adding sections for advance deposits or cancellation policies. This customization not only enhances the professional appearance of your invoices but also makes them more informative and useful for both your agency and your clients.

Not finding what you're looking for? Head over to Support

Featured In

Build a Custom Invoice

Create the perfect invoice for your business with our Online Invoice Generator.

Travel Agent and Tour Operator Services: GST

April 13, 2023.

If you are a travel enthusiast who enjoys traveling but does not want to deal with the time-consuming process of searching for and booking hotels, transportation, and so on, you may be a travel-agent type of traveler, but you should be aware that your travel budget is not only exceeded by travel commission but GST is also paid for all such services. So you also pay the government. Determine how much of your budget is going to the government in the form of GST.

Definition:

Types of income sources for travel agents and tour operators:, 1. air ticket booking:, 2. hotel booking:, 3. services like visa/passport:, 4. rail ticket booking:, 1. inbound tour: india tour for foreign travelers, 2. outbound tour: foreign tour for an indian/foreigner, conclusion:, frequently asked questions:.

A “Travel Agent” is a person or entity who acts as an intermediary and sells holiday packages and tours. Their services include accommodation, rail/air ticket booking, sightseeing, cab pickup drop, etc. The services they provide are commission based, on which they receive a certain amount of commission which is taxable and falls under the GST regime.

“The Tour operator” is a person or organization responsible for organizing, planning, and scheduling trips and holiday packages. They are brokers who provide such services and charge brokerage or fees for the same. The amount of brokerage is taxable, and GST is applicable to it.

A travel agency has two significant sources of income from which they can charge commission/service fees by raising an invoice to below mentioned:

1. The airline/hotels – actual service providers

2. Customer/Client

Let us check how much and what % of GST is applicable in either of the above ways.

Chargeable Services of Travel Agents

The chargeable services of Travel Agents are as follows:

1. Air Ticket Booking

2. Hotel Booking

3. Services like Visa, Passport

4. Rail Ticket Booking

Now, let us understand what percentage of GST applies to the services mentioned above:

18% GST will be applicable on the commission received by an agent through the airline as well as the service charges collected from the customer. Now let us understand the bifurcation of GST to be paid on the commission received from Airlines and Air travelers.

- GST on Commission received from Airlines:

- In the case of Domestic Air Ticket – 18% on 5% of the Basic fare.

- In the case of International Air Ticket – 18% on 10% of the Basic fare.

- GST on processing fees received from Air Traveller:

- GST @ 18% on the invoice value from Air Traveller.

GST will be applicable on bookings done through agents or intermediaries. Again, two ways GST will be charged, so let us understand in detail so we can get know which type of GST will be applicable, i.e. ( IGST or CGST + SGST )

- When the Agent receives a commission from the Hotel:

- If the Hotel is located in India, i.e., domestic, then the place of supply will be the location of the Hotel.

- If the Hotel is located outside of India, the place of supply will be the Agent’s location.

Let us comprehend all of this using an example:

• When the Agent receives a commission from Traveller:

- If a traveler is registered, then the place of supply will be the traveler’s location.

- If the traveler has not registered, the location of the supply will be the Hotel.

Visa and Passport services can be provided in two ways:

• Visa Statutory Authorities:

- If a customer directly approaches Visa Statutory Authorities, then the charges charged by the Statutory Authorities are exempted from GST.

• Visa Facilitation Centres:

- If a visa/passport is obtained from facilitation centers or through a travel agent, then the same shall be taxable. When an air travel agent provides these services by adding his commission, the same will be taxable at 18% GST, and he can take ITC of the tax paid to Visa Facilitation Centres.

A traveler has two ways to book a train ticket. He can book it through a rail travel agent or directly through railways. If he books a ticket through a rail travel agent, then GST will be applicable at 18% on the commission charged by the Agent to the traveler. At the same time, no commission is paid by the railways to the Agent for the booking.

These were the GST on several services provided by the Agent. Now, what about the GST on the Tour operator services or company? They sell entire tour packages and let’s check whether they will be liable to pay GST.

A. If Service provider and Recipient, both are in India:

1. Recipient is Registered – Place of supply will be the location of the recipient.

2. Recipient is Unregistered – Place of Supply will be the location of the recipient, if the address on records exists.

B. If Either the Service Provider or Recipient is outside India:

GST on the Sale of Tour Packages

➢ If the customer is charged on a principal basis for the inbound tour, 5% GST will be charged without benefit to claim ITC.

➢ If the customer is charged on a commission basis for the inbound tour, then 18% GST will be charged with the benefit of claiming ITC.

- If the customer/traveler is made to pay on a principal basis and also registered, the place of supply will be the location of the customer.

- If the customer/traveler is charged on a principal basis, but is not registered, then the place of supply will be the customer’s location per the service provider’s records.

According to the detailed explanation above, all services provided by travel agents or tour service providers to customers are subject to taxation under the GST tax regime. So, make sure you understand the GST that your travel agent charges you for the services he provides, so you can plan your next trip budget with confidence.

1. What is the full form of ITC?

Ans: ITC means Input Tax Credit.

2. What is the meaning of Input Tax Credit?

Ans: Input Tax Credit is the tax a business can claim to reduce their tax liability to the limit of GST paid on purchases.

3. Can air travel agents avail for ITC?

Ans: Yes, the air travel agents can avail of ITC on GST paid on the commission received from the passenger/traveler.

4. Is GST applicable to the cab service providers like Ola, Uber, etc.?

Ans: Yes, Cab service providers like Ola and Uber are liable to pay GST to the government as per section 9(5) of the CGST Act.

5. Are Cab drivers liable to get registered and pay GST?

Ans: No, it is not mandatory for cab drivers to register, and they are also not liable to pay any tax.

6. What if I want to avoid claiming ITC? How much GST do I have to pay?

Ans: You are liable to pay 5% GST on the total amount if you want to avoid claiming ITC for CAB rental services

7. What is SAC? And what is the meaning of it?

Ans: SAC code means Services Accounting Code. SAC is applied to all the services provided within India.

8. Why is the SAC code used?

Ans: SAC code is used to bifurcate, identify and determine the type of services provided and the rate of tax to be charged.

9. Why is it necessary to know the place of supply of the Agent?

Ans: Place of Supply will help us to determine the type of supply, i.e. Intra- State or Interstate.

10. What is the complete form of the HSN Code?

Ans: HSN Code means Harmonized System of Nomenclature Codes.

11. What is the difference between the HSN and SAC codes?

Ans: SAC codes are used for the provision of services, whereas HSN codes are used for the Sale of Goods.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- +91 97394 32668

- [email protected]

- GST Software

- E-Way Bill Software

- E-Invoicing Software

- Intelligence Insight

- GST Compliance & Reconciliation

Quick Links

- Plans & Pricing

- Partner Program

- Privacy Policy

Make Professional Life Easier!

17 Free Travel Agency Invoice Templates & Forms (Excel / Word / PDF)

Home / Business Templates / 17 Free Travel Agency Invoice Templates & Forms (Excel / Word / PDF)

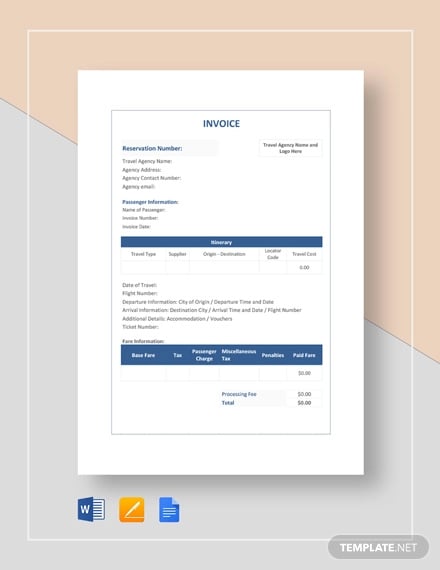

Travel agencies use a travel agency invoice template to generate invoices to collect payment for travel-related services. They use this tool to make their billing process convenient as they provide their clients with a wide range of services. The travel agency invoice should contain all the essential information to look professional.

Table of Contents

- 1 What is a travel invoice?

- 2 What is a travel agency invoice template?

- 3.1 Company information

- 3.3 Date and invoice number

- 3.4 List of goods and services

- 3.6 Itemized fees

- 3.7 Total amount due

- 4.1 Standard Invoice

- 4.2 Commercial invoice

- 4.3 Progress Invoice

- 4.4 Timesheet

- 5 Best Collections of Travel Agency Invoice Templates

- 6 How do you create a travel invoice?

- 7.1 For Travelers:

- 7.2 For Travel Agencies:

- 8 How to submit a travel invoice?

- 9 Which travel services require an invoice?

- 10 What benefits a travel agency invoice template provide?

- 11 FAQ (Frequently Asked Questions)

What is a travel invoice?

Generally, a travel invoice is a business invoice document that includes all the travel services and their due payments. This document is usually provided and organized by the travel service provider or a company. It also informs about the due payments. The travel invoice includes the following information;

- The date of buying the service

- Travel agency information

- Invoice number

- Information about the destination of travel

- The number of travelers taking advantage of the service.

- Inventory of travel services bought.

For travelers and the travel agency, this document is crucial. It helps them to keep track of bookings.

What is a travel agency invoice template?

A travel agency invoice template is a formal document that is given to the customers by the travel agents while asking for payment. This template allows the travel agents to write down the type of travel service, service rate, and taxes. For the notes, the template contains a separate section that is sent to the customer.

The components of a travel invoice:

Let us discuss below the important components of a travel invoice;

Company information

Both the payer and the payee have to provide their company’s legal name, business address, contact number, and fax number. Include these details near the top and bottom of the invoice. It is important to make sure which company is the payer and which one is the payee.

In the header, label your document as an invoice. This removes the confusion about what the document is.

Date and invoice number

Specify the date on which the invoice is issued, an invoice number, and another unique identifier. Make your ID on the basis of any system or stylistic preference.

List of goods and services

In this section, you have to provide the following details about the good or service;

- The quantity

It is incredibly important to specify the terms of payment on an invoice. The standard terms of payment may vary on the basis of your industry, your company’s preference, and your relationship with the client.

Itemized fees

Indicate any taxes, handling fees, or other charges that have to be imposed. Make sure to list each of these as a separate line item.

Total amount due

The total amount due should be properly displayed on the invoice.

Different types of invoices:

Let us discuss below the different types of invoices;

Standard Invoice

The format of a standard invoice is similar to different business transactions. This type of invoice includes the following information;

- The unique invoice number

- Name of the seller

- The company’s name

- Contact details

- The name of the buyer

- Items purchased

- Total costs

Multiple industries use this type of invoice like the retail industry, agriculture industry, etc.

Commercial invoice

As its name implies, it is specifically created for the documentation of any foreign trade. When the product is crossing the international border then it is used for customs declaration. It consists of the following details;

- The names of the seller and the buyer and their addresses

- Items being sold

- The cost of items

- Amount of tax payable

Progress Invoice

Progress invoice is very expensive and most commonly used in the construction industry. Contractors send this type of invoice from time to time in order to indicate the progress of the work. They also use it to specify the amount required to be paid to them as they have to pay the employees who are working under them.

Professionals whose services are assessed on the basis of the time use this kind of invoice. Their services are more intellectual than technical. It is most commonly used by consultants, psychotherapists, lawyers, and tuition teachers.

Best Collections of Travel Agency Invoice Templates

How do you create a travel invoice?

If you want to create your own travel invoice then follow the below steps;

- At first, you have to include your travel agency name, contact details, and address at the top of the document.

- Secondly, insert your company logo and also mention your company name.

- Next, write down the details of the customer. Also, mention the payment method.

- After that, enter the invoice number and invoice thorough information.

- Then, create a table for listing the services provided and their relevant prices.

- In the end, provide a complete total of all the prices.

Why does a travel agency need a travel invoice?

The main purpose of this invoice is that it provides a travel agency and its customers a record of travel. However, it performs the following basic functions;

For Travelers:

- It gives out all the travel expenses.

- It acts as evidence of completed payments.

- If there is a discrepancy in travel expenses, then it acts as documentary proof.

For Travel Agencies:

- It gives out the customer’s payment.

- It keeps a track of bookings.

- It identifies if clients have already paid or not.

How to submit a travel invoice?

Consider the following tips while submitting a travel invoice;

- First, make sure that your invoice is following a proper format. You can also download simple invoices and printable invoice templates for reference.

- You must check the content of your travel invoice before sending it. This is to ensure that you are not asking your clients to pay for items they didn’t buy.

- You can consider the following options after checking its content; 1- Email your travel invoice 2- Send it via mail 3- In some cases, you may give the invoice to clients when they would agree to pay in advance.

Which travel services require an invoice?

Here are the services that need a travel agency invoice;

- Transportation

- Board & Lodging

- Tours & Tickets

- Car Hire or Rentals

- Planning Travel Itineraries

- Accommodation

- Sports Tours & Conferencing

- Travel Insurance

- Leisure Travel

- Travel Consultation

- Flight Reservations

- Hotel Reservations

What benefits a travel agency invoice template provide?

If you are running a travel agency, it’s crucial for you to keep a travel agency invoice template because you are asking about payment from your travelers. Most importantly, it makes sure a perfect organization of your billing by providing it a formal structure.

You should use an organized layout because it looks more professional. Here you can mention all the services besides the prices and you can get all these things through a travel agency invoice. All these templates are designed completely you don’t have to create an entire invoice.

FAQ (Frequently Asked Questions)

An itemized invoice is a type of invoice given to you before paying for goods or services. It specifies the cost of each item purchased instead of just the total cost.

The buyer generates a purchase order to authorize a purchase transaction. The purchase order is uniquely identified by a PO number. In the invoice, the buyer will tally the PO number to the purchase order.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.

As you found this post useful...

Follow us on social media!

You Might Also Like

Free Letter of Transmittal Templates (27+ Examples & Samples)

Free Printable Certificate of Origin Templates (Word, Excel)

20+ Free Software Test Plan Templates [Examples]

Free Referral Agreement Templates & Forms (MS Word)

20 Free Project Status Report Template (Word / Excel)

Customizable Product Sell Sheet Templates [100% Free]

Printable Tap Drill Chart PDF [100% Free]

Free Printable Packing List Template (Excel, Word, PDF)

Ready-To-Use Project Budget Templates (Excel, Word)

33+ Free Sales Receipt Templates (Excel / Word / PDF)

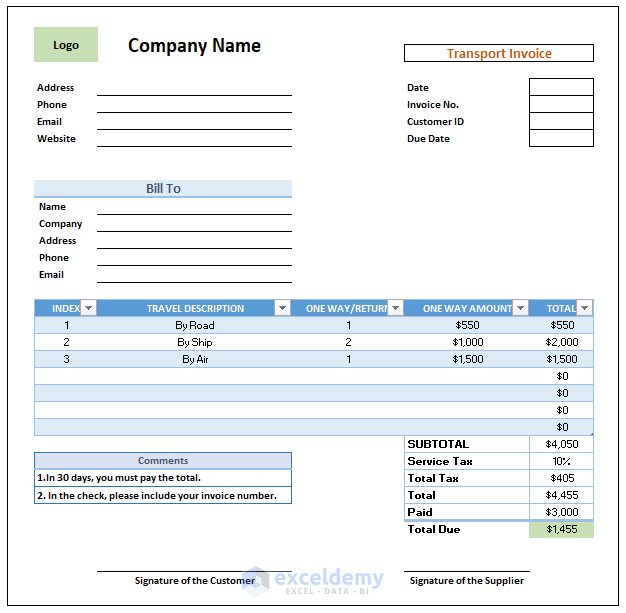

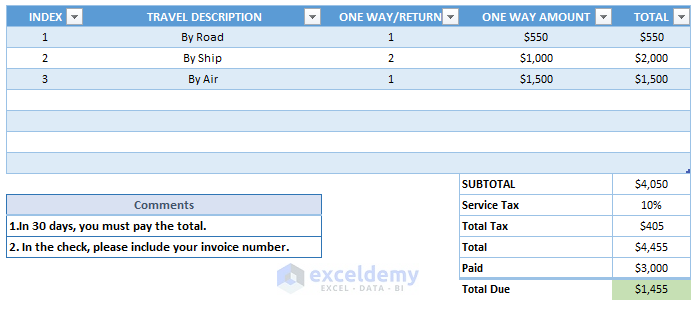

Transport Bill Format in Excel (Create in 4 Simple Steps)

What Is an Excel Transport Bill Format?

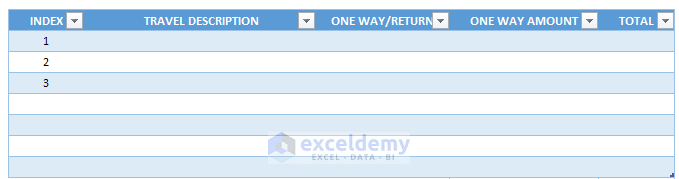

A transport bill is a type of receipt provided by a transport service. The overview of a bill template is in the image below.

Main Details of Transport Bill Format in Excel

- Company Name

- Customer’s Information

- Transport Invoice

- Description of Services

- SUBTOTAL Calculation

4 Steps of Creating a Transport Bill Format in Excel

Step 1 – input the details of a company.

- Create the segment for Company Name . This section will consist of the Address, Phone, Email, and Website of the company.

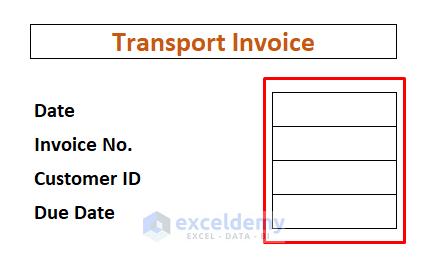

Step 2 – Customer Details in the Transport Bill Format

- Add the Transport Invoice section. This section contains bookkeeping information.

Step 3 – Describe the Services Provided

- We can add different transportation methods in the TRAVEL DESCRIPTION section.

- We have added a numerical value for determining whether the journey is one way or two-way, which correlates to the number of times the cost will be added to the total.

- ONE WAY AMOUNT and the TOTAL transportation cost will be prices.

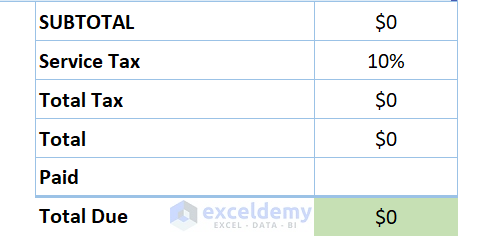

Step 4 – Calculate the SUBTOTAL

- This section contains the Service Tax, Total, and Paid amount .

- We get the information for the Total Due amount from this section.

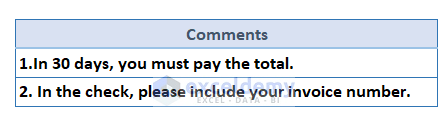

Additional Segments

- Add the Comments section.

- Insert the section to input signatures for suppliers and customers. When the sheet is printed or saved as a PDF, the signatures can be filled in.

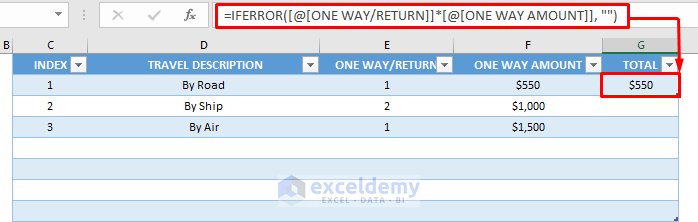

Demo Calculations of the Transport Bill Format in Excel

- Insert some values for the transportation details.

- For ONE WAY/RETURN, insert 1 for one way trip and 2 for a return trip.

- Insert the following formula in the first cell of the TOTAL column for calculating the total transportation cost By Road .

- Add the corresponding formula for the other cells in the Total column.

- We get the total transportation cost in the SUBTOTAL section.

- Add the Service Tax to the SUBTOTAL amount to get the actual transportation cost.

- Subtract the paid amount from TOTAL to get the amount of Total Due .

How Does the Formula Work?

- [@[ONE WAY/RETURN]]: This part takes the value 1 under the column ONE WAY/RETURN .

- [@[ONE WAY AMOUNT]]: This part takes the value $550 under the column ONE WAY AMOUNT .

- IFERROR([@[ONE WAY/RETURN]]*[@[ONE WAY AMOUNT]], ” “): Returns the product of ONE WAY/RETURN and ONE WAY AMOUNT . It will return blank if any we any invalid value.

Download the Template

Related Articles

- Tax Invoice Format in Excel

- Create GST Invoice Format in Excel

- Excel Invoice Tracker

What is ExcelDemy?

Tags: Excel Invoice

Mukesh Dipto is an excellent marine engineer who loves working with Excel and diving into VBA programming. For him, programming is like a superhero tool that saves time when dealing with data, files, and the internet. His skills go beyond the basics, including Rhino3D, Maxsurf C++, AutoCAD, HTML, CSS, JavaScript, and WordPress. He got his B.Sc in Naval Architecture & Marine Engineering from BUET, and now he's switched gears, working as a content developer. In this role, he... Read Full Bio

Leave a reply Cancel reply

ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems.

Contact | Privacy Policy | TOS

- User Reviews

- List of Services

- Service Pricing

- Create Basic Excel Pivot Tables

- Excel Formulas and Functions

- Excel Charts and SmartArt Graphics

- Advanced Excel Training

- Data Analysis Excel for Beginners

Advanced Excel Exercises with Solutions PDF

- Accounting Software

- GST Billing Software

- Invoicing Software

- Quotation Software

- e-Invoicing Software

- eWay Bill Software

- Invoicing API

- Lead Management Software

- Consultants

- Export/Import Business

- Professional Services

- Freelancers/Self-Employed

- Invoice Generator

- GST Invoice Maker

- Quotation Generator

- Create Proforma Invoice

- Create Purchase Order

- Quotation Templates

- Commercial Invoice

- Consulting Invoice

- Android App

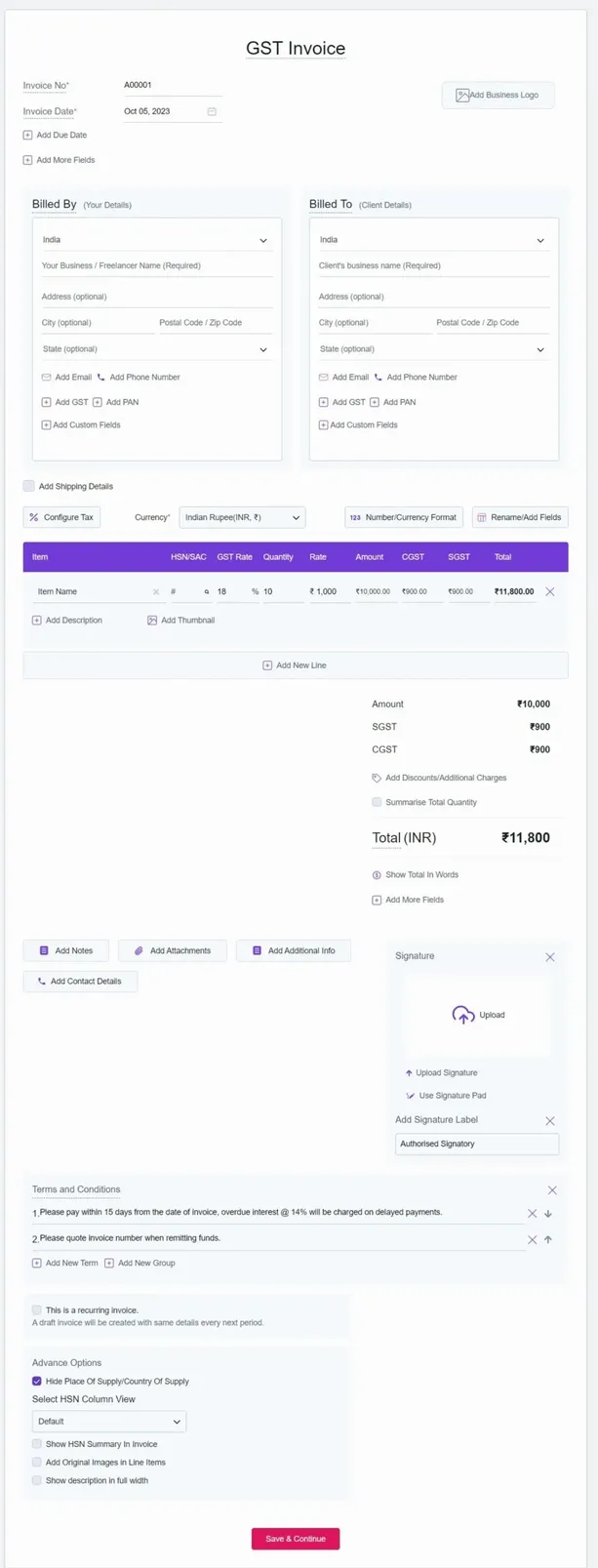

GST Bill Format & GST Invoice Maker

Create, manage, share and track gst invoices and gst bills for free., refrens gst bill format to create cgst, sgst/utgst or igst invoices., gst invoice generator, loved & trusted by more than 2 lakh+ smes in india..

GST Invoice Template in PDF (Add invoice details and download it in PDF format.)

Download GST Bill Format for FREE

Featured In

Features of GST Bill Format

Pricing of GST Invoice Generator

Happy customers.

Frequently Asked Questions (FAQ)

- Add invoice date and due date.

- Add your company details.

- Add your client details.

- Enable GST and add the product name.

- Add rate, quantity and GST rate.

- Fill in your terms and conditions with your signature.

Yes, this GST invoice generator is free. You can create 20 invoices for free.

We provide GSTR-1 report which is helpful for filing the taxes. If you need any report that is not currently there, you can request us on chat support, we will get it included in our system.

Yes. All the bills created by you are saved online. You can access all the bills and invoices anytime just by logging to your account.

Yes, you can save and manage all the details of your client under the client management tab. This feature helps you to avoid retying of customer details every time on the invoice.

Refrens provides invoice generator , GST invoice format , proforma invoice templates , purchase order templates , quotation generator , freelance invoice templates , invoice templates , quotation templates .

Yes, you can add extra details like shipping details, discount, custom fields for both client and line item. Apart from that, you can also upload your logo, signature and attachments.

Yes. Refrens support multiple invoice formats which also include letterhead. You can also change the colour and font headings of the invoice.

The place of supply includes the location of the buyer or recipient who is receiving the product or service.

Absolutely. Only you can decide who you want to share the invoices, quotations with. The documents you create are accessible only through special URLs that you share or PDFs that you download. We do not share your data with anyone for any purpose.

You can receive payments via regular banking system like IMPS, NEFT, RTGS and UPI, directly into your account from the client. Such methods of payments have no involvement from our end and we do not charge anything. Refrens has a dedicated payment gateway to receive payments online via Debit card, Credit card, Net Banking, Wallets and International cards. You can also receive international payments in India through our payment gateway. Please see the pricing page for more details on pricing for payment gateway charges for card-based payments.

We initiate the process of verifying your bank account after we have received a payment for any of your invoices. Once your account is verified, we initiate the payouts automatically, subject to clearance from bank.

If you are not receiving payments through us, we do not verify the bank account.

Yes, Refrens account is necessary to use this GST bill format. While creating an account, you can access all the GST invoices bills in one place and also makes the invoice creation procedure easy.

Explore More Tools

Sample gst bill format.

GST Bill Format for Service Business

GST Bill Format in Excel

GST Tax Invoice Format for Goods Sold Business

GST Invoice Template & GST Bill Format

What is a gst invoice or gst bill.

A GST invoice, often referred to as a GST bill, is a crucial document in the realm of Goods and Services Tax (GST). It serves as more than just a payment request; it is a comprehensive record of a transaction between a GST-registered vendor and their customer. This document plays a pivotal role in providing transparency and clarity throughout the purchasing process. Let's delve into the key aspects and significance of a GST invoice:

Transaction Record:

- A GST invoice acts as a detailed record of a commercial transaction. It outlines the particulars of the goods or services provided, the agreed-upon prices, and relevant tax details. This level of transparency is essential for both the vendor and the customer.

Mandatory for GST-Registered Vendors:

- GST-registered vendors are required to issue a GST invoice for all taxable supplies of goods and services. This practice is mandated by tax regulations to ensure proper documentation and compliance with GST laws.

Components of a GST Invoice:

- Vendor details (name, address, GSTIN)

- Customer details (name, address, GSTIN, if registered)

- Invoice number and date

- Description of goods or services

- Quantity and unit of measurement

- Value of the supply

- Taxable value and applicable GST rates (CGST, SGST/UTGST, IGST)

- Place of supply

- Payment terms and other relevant terms and conditions

GST Bill vs. Bill of Supply:

- While a GST invoice is issued for taxable supplies, a Bill of Supply is issued in situations where the vendor is selling exempted goods or services or has opted for the GST composition scheme. The Bill of Supply contains necessary details but excludes the tax component.

Importance for Input Tax Credit (ITC):

- The GST invoice is crucial for both the vendor and the customer to claim Input Tax Credit (ITC). It serves as documentary evidence for the tax paid on inputs, enabling the recipient to offset their tax liability.

Legal Compliance:

- Issuing a GST invoice is not just a good business practice; it is a legal requirement. Non-compliance with GST invoicing regulations can lead to penalties and other legal consequences.

Smooth Audits and Assessments:

- Properly maintained GST invoices facilitate smooth audits and assessments by tax authorities. A well-documented transaction trail ensures transparency and reduces the likelihood of discrepancies.

What is an online GST bill?

An online GST bill refers to the digital representation of a Goods and Services Tax (GST) invoice generated and managed using online invoicing platforms such as Refrens. In the contemporary business landscape, there is a growing shift towards digitization, and online tools are becoming increasingly popular for managing various business processes, including billing.

Using online invoice software like Refrens simplifies the process of creating, managing, and sending GST bills. This approach eliminates the need for dealing with physical files and documents, providing a centralized platform to generate and store all billing information. The convenience of online billing becomes evident in its accessibility, allowing users to retrieve billing details swiftly and efficiently.

Refrens offers a comprehensive solution for handling GST bills online. Whether users need to send, print, or download their GST bills, Refrens provides a user-friendly and efficient platform. This transition from traditional, manual billing methods to the streamlined and automated approach of online invoicing enhances convenience, reduces hassles, and boosts overall efficiency for businesses.

Who can issue a GST invoice?

In the business realm, the issuance of a Goods and Services Tax (GST) invoice is authorized for any registered business. This includes businesses that are providing goods or services and are registered under the GST framework. The process involves issuing GST-compliant invoices for the services rendered or products supplied, and, conversely, receiving GST-compliant purchase bills from registered vendors.

Proper documentation of these transactions is paramount for businesses to remain compliant with tax regulations, ensuring accuracy and transparency. By adhering to GST regulations and maintaining thorough documentation, businesses not only avoid potential errors but also foster trustful relationships with clients and vendors. This commitment to compliance is a fundamental aspect of running a successful and reputable business in today's competitive and regulated business environment.

What are the essential elements of a GST bill format?

When it comes to creating GST invoices , attention to detail is critical. Failing to include all of the necessary elements in your invoice format can lead to costly mistakes down the road. To avoid these issues and ensure compliance with GST regulations, make sure your invoice format includes the following essential elements:

Invoice Title - Clearly state that the document is an invoice. Example: " Tax Invoice " or " GST Invoice ".

Invoice Number - Assign a unique identification number to the invoice for tracking and reference purposes.

Issue Date and Due Date - Include the date when the invoice was issued and specify the due date by which payment should be made.

Supplier Details - Include complete details of the supplier, including name, address, GSTIN (Goods and Services Tax Identification Number), and contact information.

Recipient Details - Provide accurate and comprehensive information about the recipient, including name, address, GSTIN (if registered), and contact details.

Place of Supply - Clearly indicate the place where the goods or services are supplied. This is crucial for determining the applicable GST rate.

Goods/Services Details - Provide a detailed list of goods or services supplied, including names, descriptions, quantities, unit prices, total prices, and relevant HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) codes.

GST Details -

- Include GSTIN of both the supplier and the recipient.

- Specify the applicable GST rate for each item (e.g., 12%, 18%, 5%).

- Break down the GST amount into CGST (Central GST) and SGST/UTGST (State/Union Territory GST) or IGST (Integrated GST) based on the transaction type.

Shipping Details (If Applicable) - Include the shipping address and other relevant details if the goods are being shipped.

Total Amount Due - Sum up the total amount payable after considering the item rates, quantities, and applicable taxes.

Discounts or Adjustments (If Applicable) - Clearly state any discounts or adjustments applied to the invoice total.

Terms and Conditions - Include any relevant terms and conditions governing the transaction, such as payment terms, delivery terms, or return policies.

Supplier's Signature - The invoice should be signed by the supplier, adding authenticity and credibility to the document.

By including all of these elements in your GST invoice format , you can minimize the risk of errors, ensure compliance with regulations, and maintain a professional and trustworthy image with your clients and partners.

What is HSN code under GST invoice?

In today's global marketplace, the ability to classify and identify goods and services accurately is critical for businesses of all sizes. To help streamline this process, the World Customs Organization (WCO) developed a regulated system called the Harmonized System of Nomenclature (HSN) , which assigns unique 8-digit codes to products and services traded domestically and internationally.

In India, more than 5000 products are classified under HSN codes , making it an essential tool for businesses looking to operate efficiently and stay compliant with GST regulations.

Under GST regulations in India, HSN codes are required on invoices for businesses with an annual turnover exceeding 1.5 crores.

- Businesses exceeding 5 crores are required to provide HSN codes up to 4 digits,

- Businesses exceeding 1.5 to 5 crores are required to provide codes up to 2 digits.

- Businesses exporting products are required to provide 8-digit HSN codes on invoices.

To ensure compliance with GST regulations and streamline the billing process, it's essential to create a quotation for the client before creating a GST invoice.

This allows you to obtain approval from the client and create a proforma invoice, which can be used to accept advance payments and simplify the process of creating a GST-compliant invoice. With tools like Refrens' free quotation generator and proforma invoice generator , businesses can create accurate and professional invoices that meet all necessary GST requirements.

GST Bill Format to Create Invoices

When it comes to creating a GST invoice, businesses have the flexibility to design their own invoice format. However, the government has mandated specific fields that must be included on every GST invoice. By following these guidelines, businesses can ensure compliance with GST regulations and avoid any potential errors or issues.

How to create a GST invoice?

Create GST Invoice

- GST Invoice Header

When it comes to creating a GST invoice, the first step is to start with a clear and informative header. Begin by including the title of the invoice as “GST invoice”.

While it's not mandatory, it's a good practice to follow as it helps to provide clarity to the recipient. Additionally, include the invoice number, date, and due date.

The due date can help automate reminders to clients and ensure timely payment. Don't forget to add a purchase order or quotation number if applicable. Finally, consider uploading your business logo to personalize your invoice.

- Suppliers Information

Your supplier information is an essential component of your GST invoice. It should include your business name, address, and contact details, as well as your GST registered number . If you're issuing a GST invoice, having a GSTIN number is compulsory. When you add your GSTIN, your PAN number will automatically be fetched from the GSTIN and added to the bill.

- Recipient Information

When adding recipient information, be sure to include their name, address, and GST details. If the recipient isn't registered under GST, and the taxable amount is 50,000 or more, it's compulsory to include the name of the state and its code. Having these details saved will save you time and effort when creating future invoices.

- Shipping Details

If you're selling tangible goods, shipping details must be included. This includes the delivery address, state, challan number, transport, and date of delivery. However, if you're selling intangible goods or services, shipping details aren't required.

- Goods/Services Description

When describing goods or services, select the invoice currency from the dropdown box. Then, add a line, item, or service with a detailed description, quantity, rate, and amount. Customize and hide any columns of the lien item description as per the requirements of the GST invoice .

Adding GST is an important component of the invoice. Enable GST and add rates like 18%, 12%, or 5% and the HSN/SAC code. If you're using software like Refrens GST bill format , the taxable amount will be auto-calculated and divided equally as per the state selected in the address field.

Finally, it's compulsory to have the place of supply and country of supply when creating a GST invoice format .

- Additional Notes & Signature

The additional notes section is an excellent place to include anything else that doesn't fit into the mandatory fields. Consider uploading your signature image or signing by using your mouse to make your invoice look professional .

How to personalize GST invoices using a GST Bill Generator?

To personalize GST invoices effectively, utilizing a GST Bill Generator can be a game-changer. One of the key aspects of customization is incorporating your business's logo into the invoices, as it adds a professional touch. This small but impactful detail can contribute to creating a strong brand identity.

Moreover, customization goes beyond just adding a logo. With GST invoice templates, you have the flexibility to tailor the invoices according to your specific business needs. This includes adding extra fields and columns to accommodate unique requirements and provide a comprehensive overview of the transactions.

The beauty of customization lies in the ability to make the invoice reflect your brand's style. Whether you want to infuse a pop of color, include specific details, or follow a particular layout, there's a template available that can align with your preferences. By leveraging the customization options offered by a GST invoice generator, you can go beyond generic invoices and create a distinct, branded invoice that stands out professionally.

Invoice Format with GST

Refrens provides a variety of free invoice templates to cater to the diverse needs of different users. These templates cover a wide range of professionals, freelancers invoice templates , import-export traders invoice templates , GST-registered vendors, IT professionals invoice templates , consultants invoice templates , and more. Here's a brief overview of the types of invoice templates Refrens offers:

GST Invoice Templates - Designed specifically for vendors registered under GST, these templates ensure compliance with GST regulations.

Professional GST Invoice Templates - Suitable for a broad spectrum of professionals across various industries, these templates offer a professional and standardized format.

Letterhead GST Invoice Templates - Tailored for small to mid-sized business owners, these templates include a letterhead design for a more formal and branded look.

Print-friendly GST Bill Format - These templates are optimized for printing, offering a black & white and compact format that allows for more line items on a single page.

Modern GST Bill Format - Specifically crafted for freelancers, self-employed individuals, and businesses, these templates feature a modern design suited for contemporary needs.

Business GST Bill Format - Ideal for digital and software agencies, as well as IT developers, these templates cater to the unique requirements of businesses in the technology sector.

With Refrens, users can choose the template that best fits their invoicing needs, ensuring a professional and efficient invoicing process.

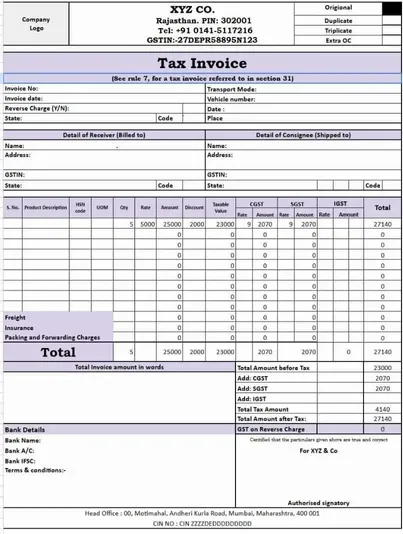

How many copies of an invoice are required for the supply of goods?

When supplying goods and creating a GST invoice using a free invoice maker , it is typically required to generate three copies of the invoice. These copies serve different purposes in the supply chain:

Original Copy - This copy is intended for the recipient of the goods. It provides them with a record of the transaction and details the products or services supplied along with their corresponding prices.

Duplicate Copy - The duplicate copy is meant for the person responsible for transporting the goods from the supplier to the recipient. This copy serves as a reference during the transportation process.

Triplicate Copy - The triplicate copy is retained by the supplier for their records. It helps the supplier maintain a comprehensive record of transactions and serves as a reference for accounting and compliance purposes.

By creating and distributing these three copies, all parties involved in the supply chain have access to the necessary documentation, promoting transparency and ensuring compliance with GST regulations.

How many copies of an invoice are required for the supply of services?

When supplying services and creating a GST invoice using a free invoice maker, two copies of the invoice are typically required. These copies serve different purposes in documenting the transaction:

Original Copy: This copy is intended for the recipient of the services. It provides them with a record of the transaction and details the services provided along with their corresponding charges.

Duplicate Copy: The duplicate copy is retained by the supplier (service provider). This copy serves as a record for the supplier's documentation, accounting, and compliance purposes.

Unlike the supply of goods, where a triplicate copy is also created for the transportation process, the supply of services involves only the creation of an original and a duplicate copy. These copies help ensure that both the service provider and the recipient have comprehensive records of the transaction.

GST Invoice Generator to Share Invoices

Effortless Invoicing with GST Compliance

Refrens GST bill generator streamlines the entire invoicing process. Easily create, manage, and track invoices and bills while adhering to GST rules. Our platform ensures that your invoices are compliant with GST regulations, saving you time and effort in managing tax-related complexities.

Seamless Communication with Clients

In addition to its invoicing capabilities, Refrens also facilitates seamless communication with clients. The platform enables you to send invoices directly to clients through its mailing system. You can stay informed about the status of your invoices, knowing when they are delivered and opened by clients. If a client hasn't opened the email, the platform provides a "Send Reminder" feature to prompt them, ensuring timely attention to your invoices. This feature enhances communication efficiency and helps you maintain a smooth invoicing process with your clients.

Multiple Options for Sharing GST Invoices

Refrens offers a range of options for sharing your GST invoices, providing flexibility and convenience in your invoicing process:

Download as PDF: Easily download your invoices as PDF files and manually send them to your clients. This option allows you to have duplicate and triplicate copies for your records without incurring additional costs.

Print Option: Print your invoices directly from the platform, facilitating physical documentation as needed.

WhatsApp Sharing: Seamlessly share invoices through WhatsApp, leveraging the widespread usage of this messaging platform for efficient communication with clients.

Unique Public URL: Generate a unique public URL that you can share directly with clients, providing them with instant access to their invoices. This option enhances accessibility and convenience for both you and your clients during the invoicing process.

Secure Online Payments for Faster Transactions

Refrens provides a secure and efficient solution for online payments, ensuring a faster and smoother transaction experience for both you and your clients. Here's how Refrens facilitates secure online payments through its platform:

Bank Details on Invoices: Easily add your bank details to the invoice, streamlining the payment process and providing clients with the necessary information to make payments.

Diverse Payment Options: Enable various online payment options, including debit cards, credit cards, NetBanking, and digital wallets. This diverse range of choices ensures that clients can conveniently use their preferred payment method.

International Transactions: Refrens' payment gateway supports international transactions, allowing you to collect payments from clients globally. This feature is especially beneficial for businesses with an international clientele.

Partial and Advance Payments: Accept partial payments and advance payments seamlessly. This flexibility in payment options caters to the varying needs of both you and your clients.

Why Use Refrens GST Bill Format?

Refrens provide simple, easy-to-understand, and fastest billing software for small businesses and freelancers. Refrens GST invoices are specially designed for Indian Markets . Our online bill generator does all the work for the business which includes creating and managing invoices, recurring invoices, collecting payments, and many more.

Just fill in the required information and create invoices within seconds. Make professional GST invoices with one click without prior knowledge of GST with an online GST invoice generator . Build your brand by adding a personal logo, digital signature, terms, and attachments like files, images, and many more. The simple-to-use interface helps you to manage all your invoices in one place without any cumbersome.

Not just GST invoices, Refrens online GST bill generator also supports more than 200+ countries and multiple currencies which includes the rarest of the rare. You can change the currency on the invoices with one click if your business has global clients. On Refrens, it is easy to create e-invoices under GST and generate your e-invoice IRN within seconds.

Receive online payments faster with Refrens GST bill generator . You can receive online payments through UPI, Net Banking, Debit/Credit cards, and many other ways. Currently, Refrens is one of the most trusted platforms in India to receive international payments . All the payouts are made within 2 transaction days.

Online bill generator gives options to Email the invoices to your client, Download them as PDFs, and print invoices. Not only this, but you can also share through WhatsApp and also by sharing the link(after copying the link).

The best part is Refrens GST Invoice Maker is FREE . No registration or signup fee. No Hidden Charges. No Conditions.

Insight Reports Using GST Invoice Generator

Refrens GST invoice generator provides various reports which ease the process of the invoicing cycle in many ways. As you create GST invoices or bills for the client, reports are created for you. You get different reports such as client reports, payment reports, TDS reports, and GST reports .

Not just reports, you can also manage all your clients under a client management system where you can add, edit and create invoices against each client individually. Alongside you can add those clients to the portfolio as well. Under the client report, you get all the invoices created against each client and also the average paying date of each one.

The payment report helps you to keep track of all the invoices paid by your clients. You can also track the payment mode and status of the invoice (approved, timeout, success). Refrens also provides a GSTR-1 report which is helpful for filing taxes. If you need any report that is not currently there, you can request us on chat support, we will get it included in our system.

Benefits of Using a GST Invoice Maker

There are many benefits of using a GST invoice maker . Some major ones are quoted below:

No Cost Invoicing

Creating GST bills or invoices on Refrens is completely free. Create, manage, track and send GST invoices for a lifetime without spending a single penny. Not only invoices, but different reports, and invoice templates are also free.

Time-Saving

Save your time by creating an invoice within seconds. Helps you to organize your invoices in one place. Know business growth by quickly viewing through the overview section, client report, and payment report.

GST Invoice Templates

Access all our invoice templates for free. Use templates that fit your business. Fully customizable templates in 250+ colors . You can also change the font style of the invoice heading.

Business Reports

It is always better to look at your business reports. It gives you a way to grow your business at a rapid pace. Refrens provides all the essential reports like invoice report , client report, payment report, GST report, and TDS report . In the GST report , we provide GSTR-1 which is useful for filling the GST.

Get Paid Faster

Adding a payment link to the GST invoice increases the chances of getting paid faster. Accept payment through Refrens payment gateway which supports debit and credit cards, net banking, wallets, and UPI. We are one of the trusted payment gateways to receive international payments.

If you are specifically looking for a bill generator that helps you create invoices for reimbursement expenses you can check out our utility bill generator for free.

Who Can Use Refrens GST Bill Format?

Refrens GST bill format is designed for a wide range of professionals who need efficient and reliable invoicing solutions. Here’s how it can benefit various professions:

1. Small Business Owners

Small business owners in India can benefit from our GST billing format. It simplifies the billing process, helps you manage multiple clients, and ensures all your invoices are GST compliant. From retail shops to small service providers, our GST invoice software is the perfect tool for your business needs.

2. Consultants

Consultants often deal with multiple clients and projects. Our GST billing format helps you generate detailed invoices for your consulting services, track payments, and manage your financial records efficiently. It’s ideal for business consultants, IT consultants, and more.

3. E-commerce Businesses

E-commerce businesses require precise billing and inventory management. Our GST billing format is tailored to meet these needs, providing a seamless way to create invoices for your online sales, manage stock, and comply with GST regulations. It’s a must-have for online retailers.

4. Service Providers

From electricians and plumbers to digital marketers and tutors, service providers can use our billing format with GST to create professional invoices, track their income, and manage their client database. It’s an essential tool for anyone providing services and needing to invoice clients regularly.

5. Accountants

Accountants can leverage our GST billing format to manage multiple clients’ invoices, ensure accurate tax calculations, and streamline their billing processes. It’s perfect for accounting firms and independent accountants who need reliable billing software.

6. Agencies

Marketing agencies, design firms, and other types of agencies can use our GST billing format in India to handle client invoicing, manage multiple projects, and ensure timely payments. It helps agencies maintain a professional image and streamline their billing operations.

7. NGOs and Non-Profits

Non-governmental organizations and non-profits can use our GST bill format to manage their funding, create transparent financial records, and comply with GST requirements. It simplifies the financial management process for organizations working for social causes.

Using Refrens GST bill format, professionals across various fields can enhance their invoicing process, ensure GST compliance, and manage their finances more effectively. Try our GST bill format today and experience the ease of professional billing.

- We are Hiring

- Become Refrens Partner

- Terms of Service

- Privacy Policy

- Refrens Android App

- Refrens iOS App

- Hire Chartered Accountant

- Chartered Accountant in Mumbai

- Hire Freelancers

- e-Way Bill Software

- Lead to Quote Software

- Expense Management Software

- Online Invoice Generator

- Quote and Invoice Software

- Pipeline Management Software

- Invoicing Software for Freelancers

- Indiamart CRM Integration

- Billing Software for Professional Services

- Invoicing Software for Consultants

- Invoice Templates

- GST Invoice Format

- Proforma Invoice Templates