- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Travel allowances

Explains the PAYG withholding implications on travel allowances.

Last updated 24 August 2021

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties.

Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies.

You include the amount of the travel allowance in the allowance box on your employee's payment summary.

The exception applies if:

- you expect your employee to spend all of the travel allowance you pay them on accommodation, food, drink or incidental expenses

- you show the amount and nature of the travel allowance separately in your accounting records

- the travel allowance is not for overseas accommodation

- the amount of travel allowance you pay your employee is less than, or equal to the reasonable travel allowance rate.

If the exception applies, you:

- don't withhold tax from the travel allowance you pay your employee

- don't include the amount of the travel allowance in the allowance box on your employee's payment summary

- only include the allowance on their payslip.

If the first two exception conditions are met but you pay your employee a travel allowance over the reasonable travel allowance rate, you're required to withhold tax from the amount that exceeds the reasonable travel allowance rate. You also need to include the total amount of the travel allowance in the allowance box on your employee's payment summary.

You are always required to withhold tax from a travel allowance for overseas accommodation and include the amount of the travel allowance in the allowance box on your employee's payment summary.

Check the relevant Single Touch Payroll (STP) employer reporting guidelines to see how to report these payments through STP:

- STP Phase 1 employer reporting guidelines – allowances

- STP Phase 2 employer reporting guidelines – allowances

Reasonable travel allowance rate

Each year we publish the amounts we consider reasonable for claims for domestic and overseas travel allowance expenses.

- TD 2021/6 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2021–22 income year?

- TD 2020/5 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2020–21 income year?

- TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses

- Keeping travel expense records

- Tax return – allowances

- Tax return – work-related travel expenses

ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

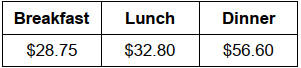

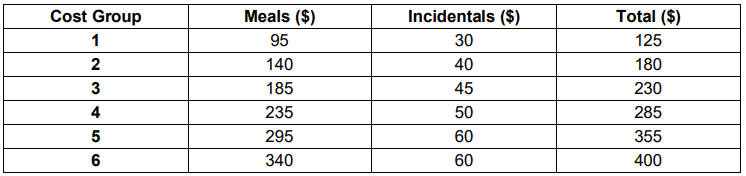

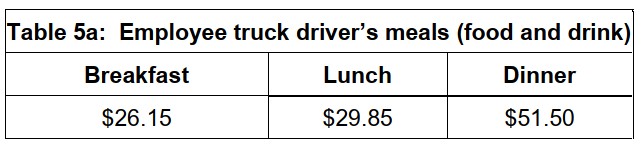

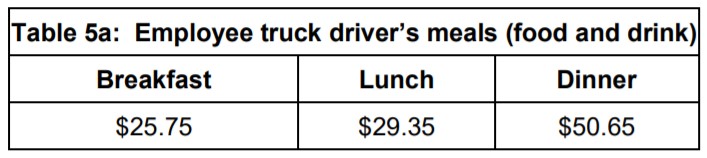

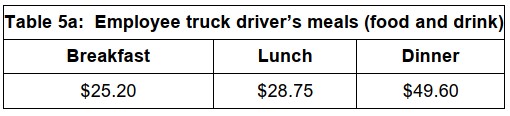

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

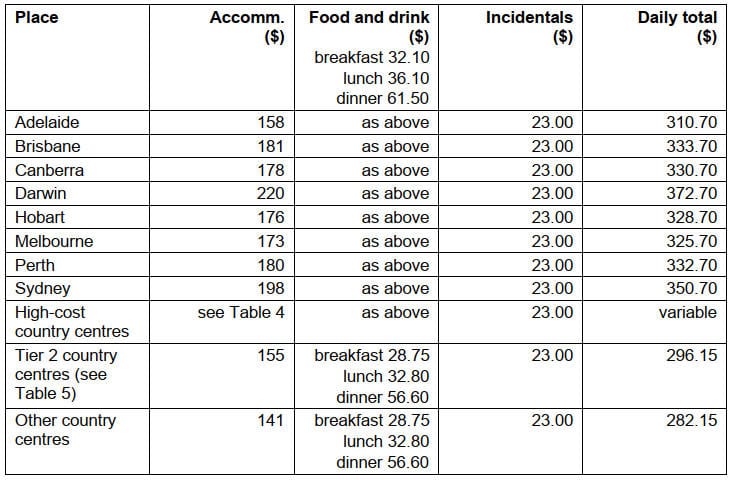

2023-24 Domestic Travel

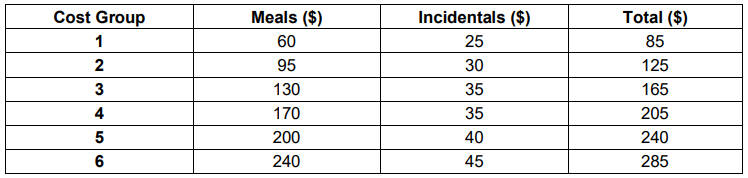

Table 1:Salary $138,790 or less

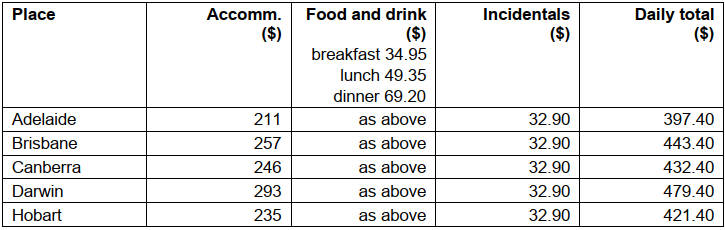

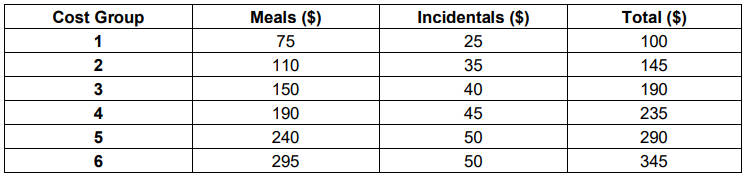

Table 2: Salary $138,791 to $247,020

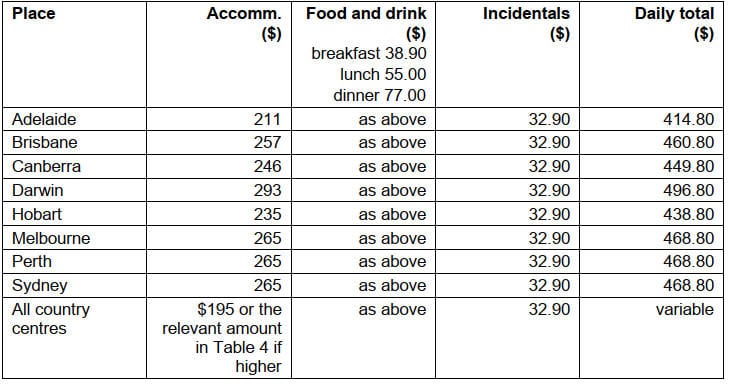

Table 3: Salary $247,021 or more

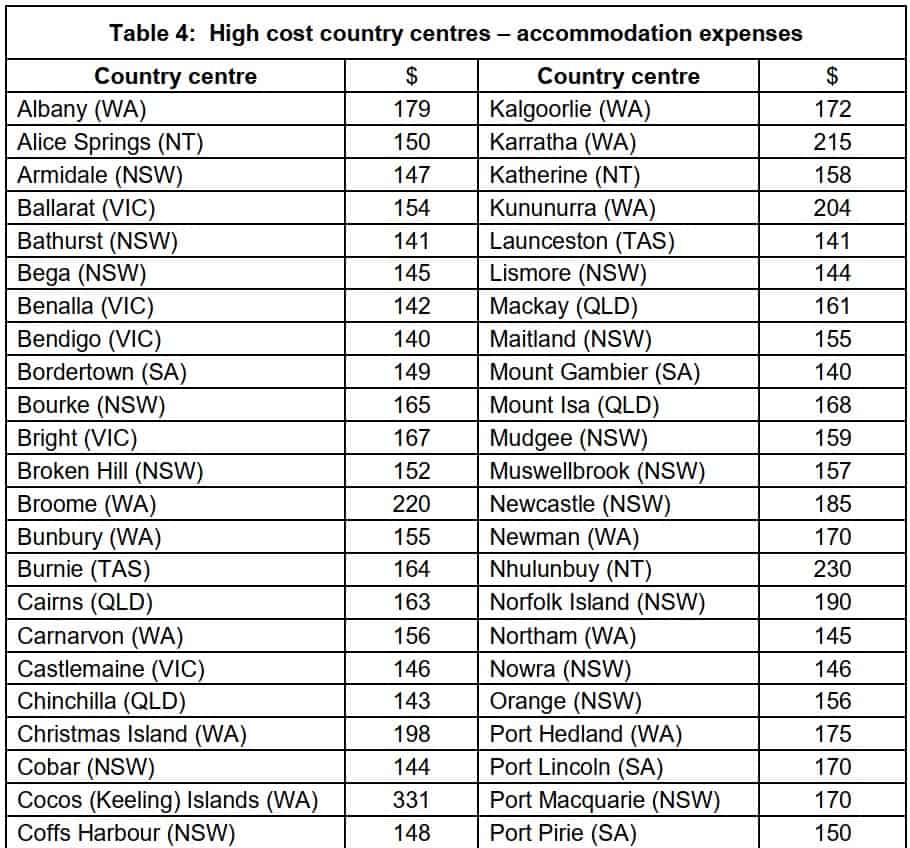

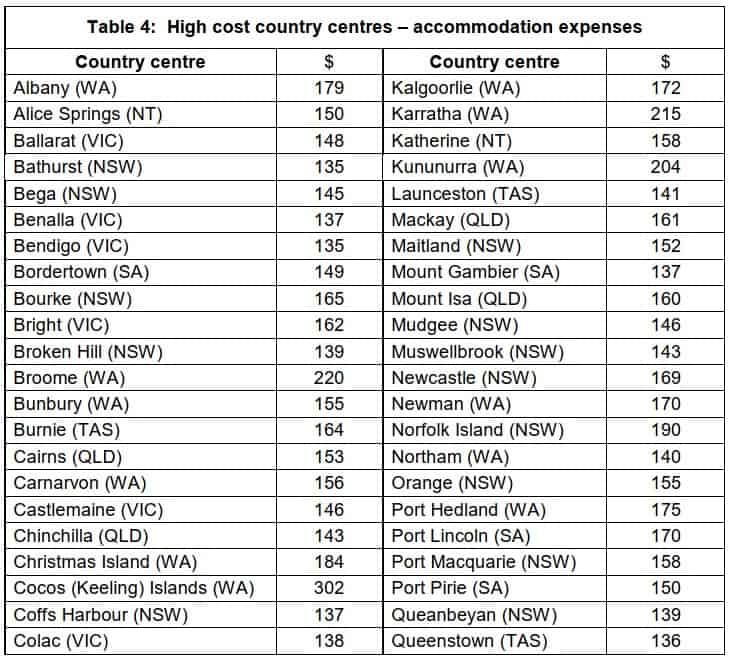

Table 4: High cost country centres accommodation expenses

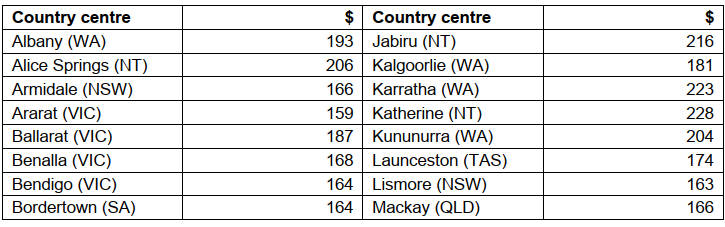

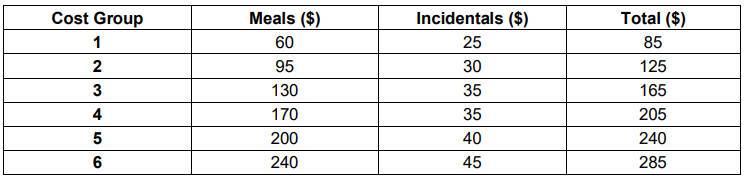

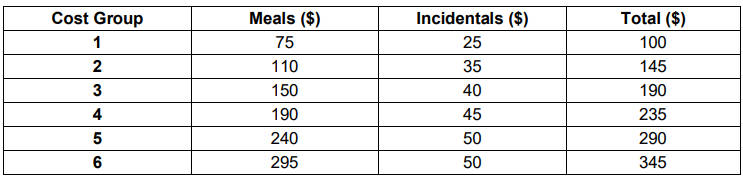

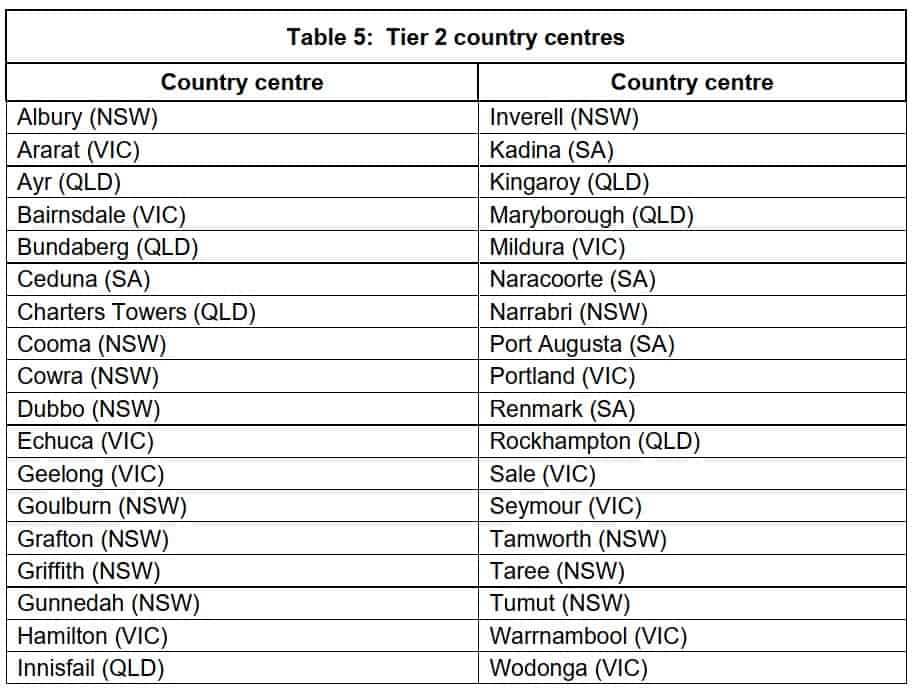

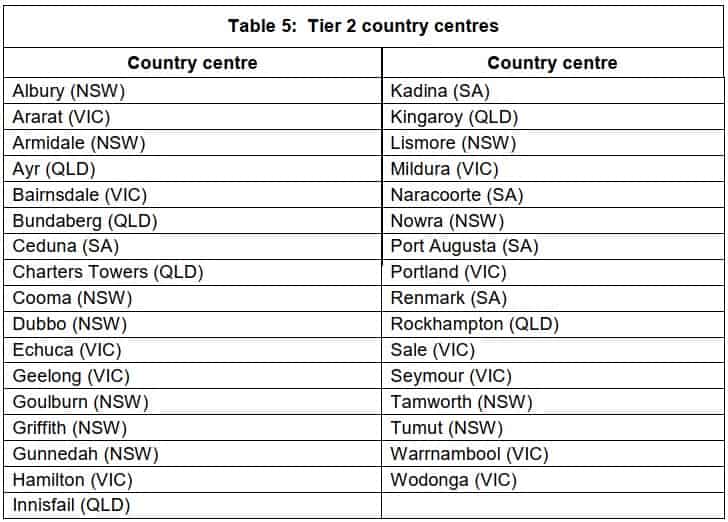

Table 5: Tier 2 country centres

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

Table 7: Salary $138,791 to $247,020

Table 8: Salary $247,021 or more

Table 9: Table of countries

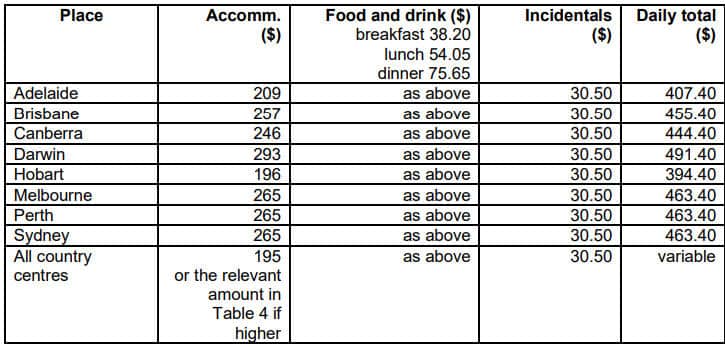

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

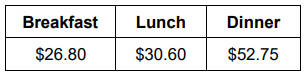

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

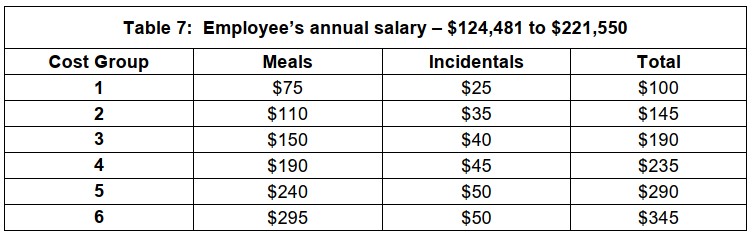

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

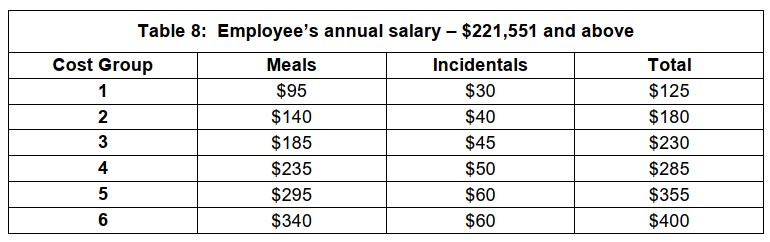

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

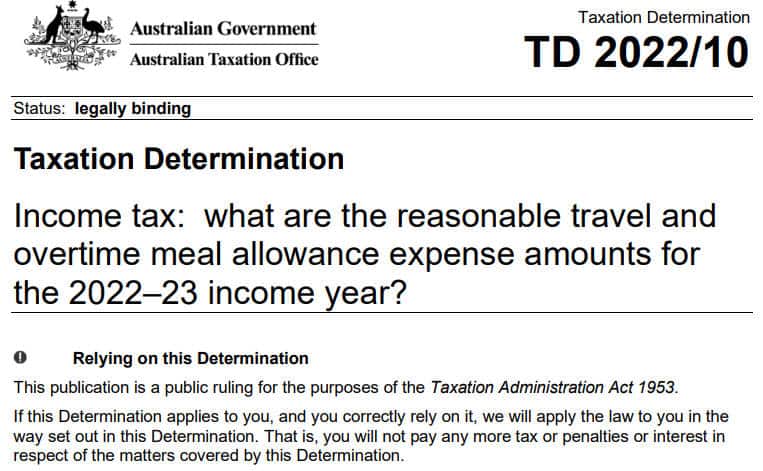

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

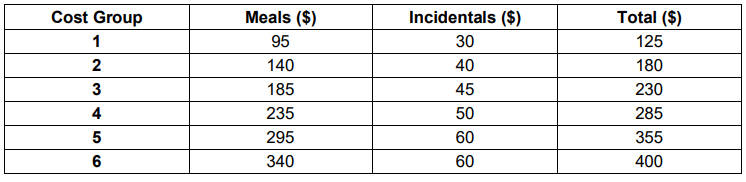

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

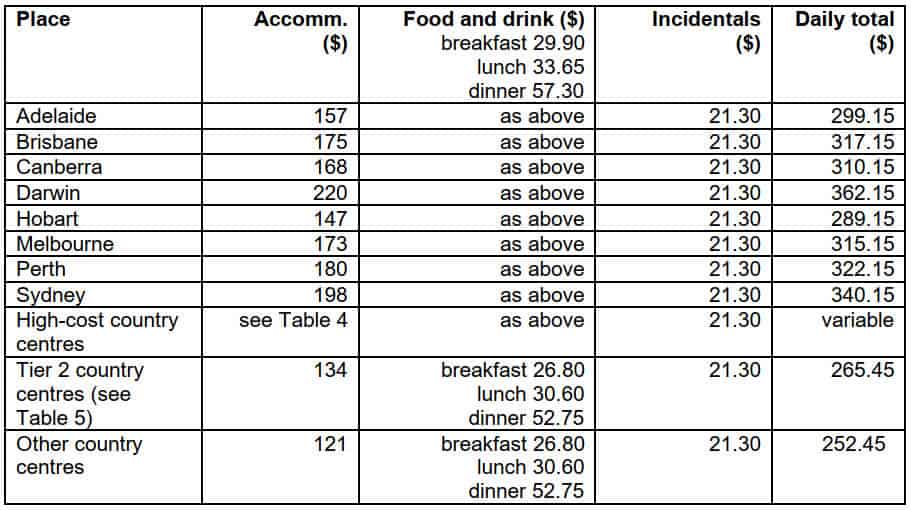

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

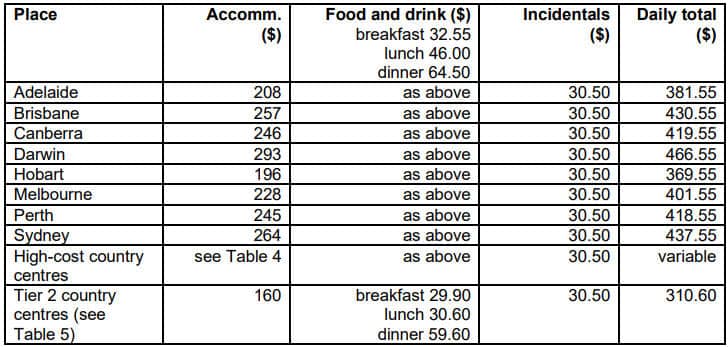

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

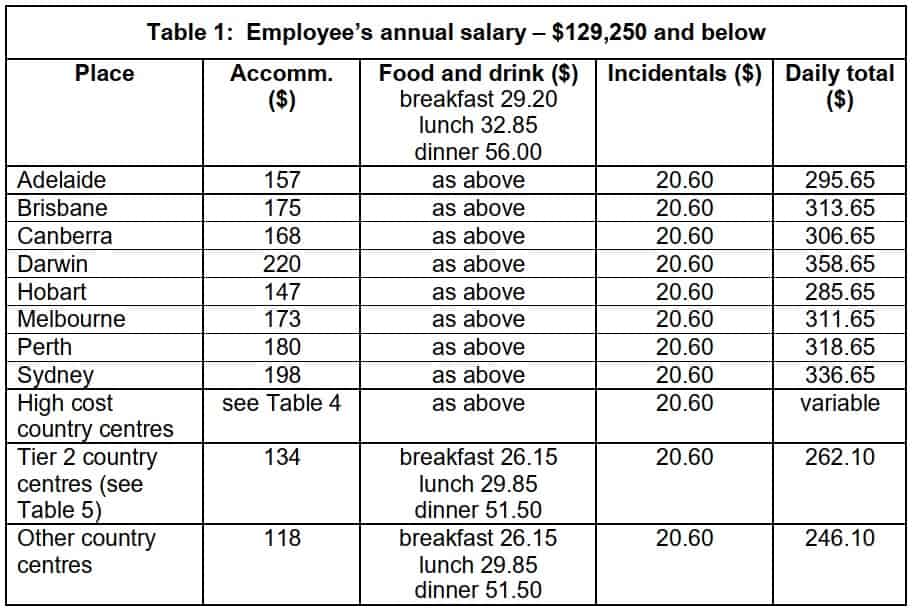

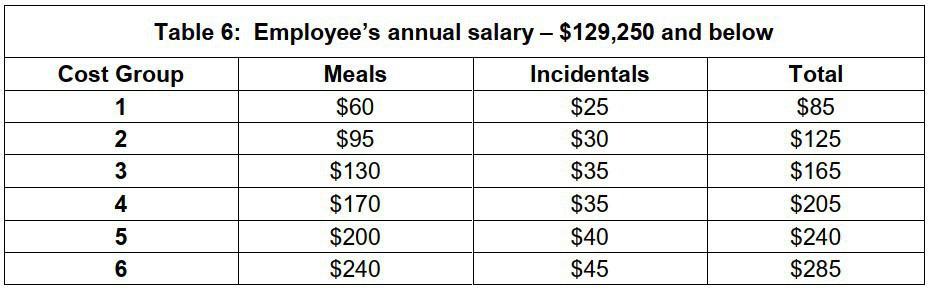

Table 1: Salary $129,250 and below

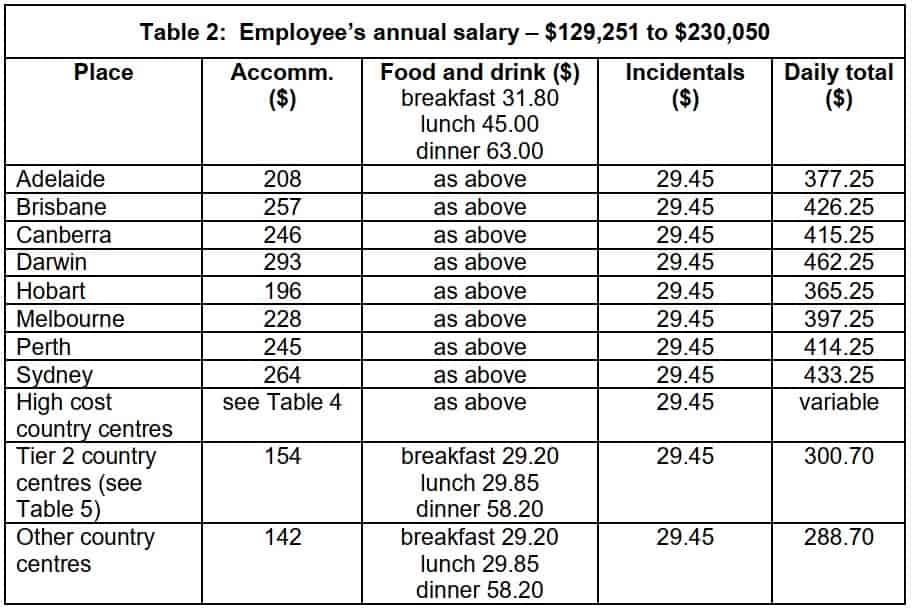

Table 2: Salary $129,251 to $230,050

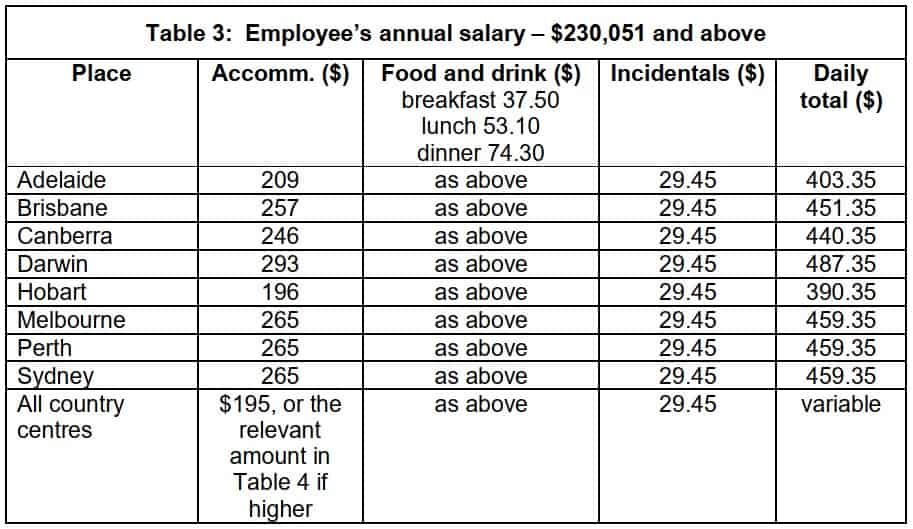

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

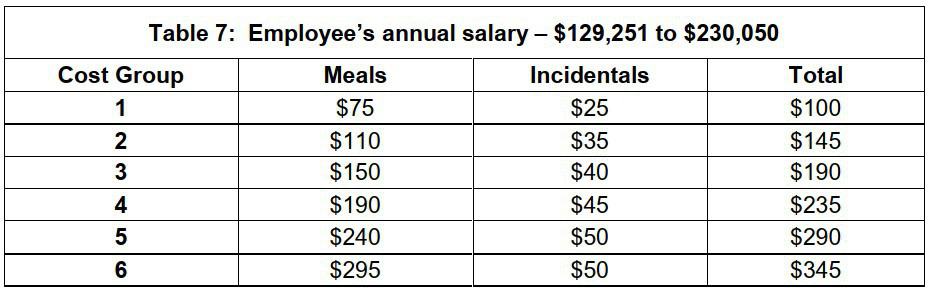

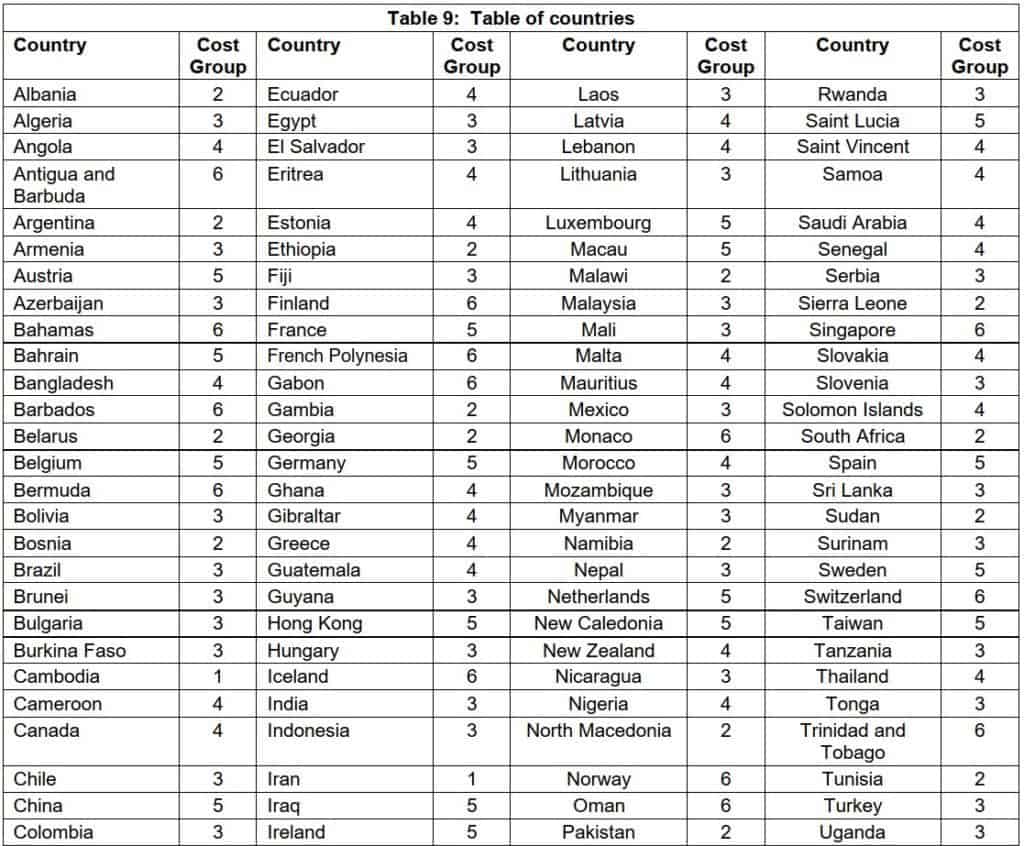

Table 7: Salary – $129,251 to $230,050

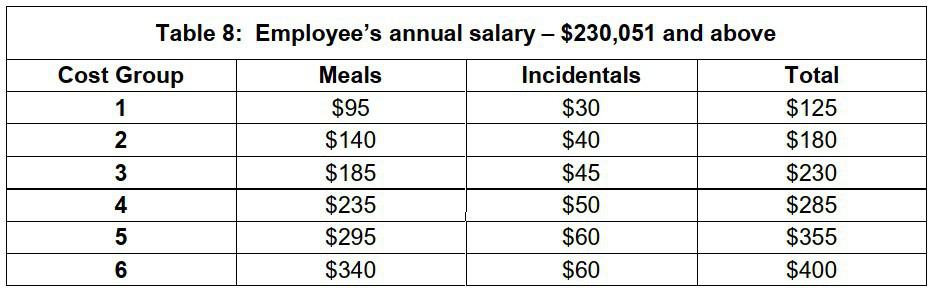

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

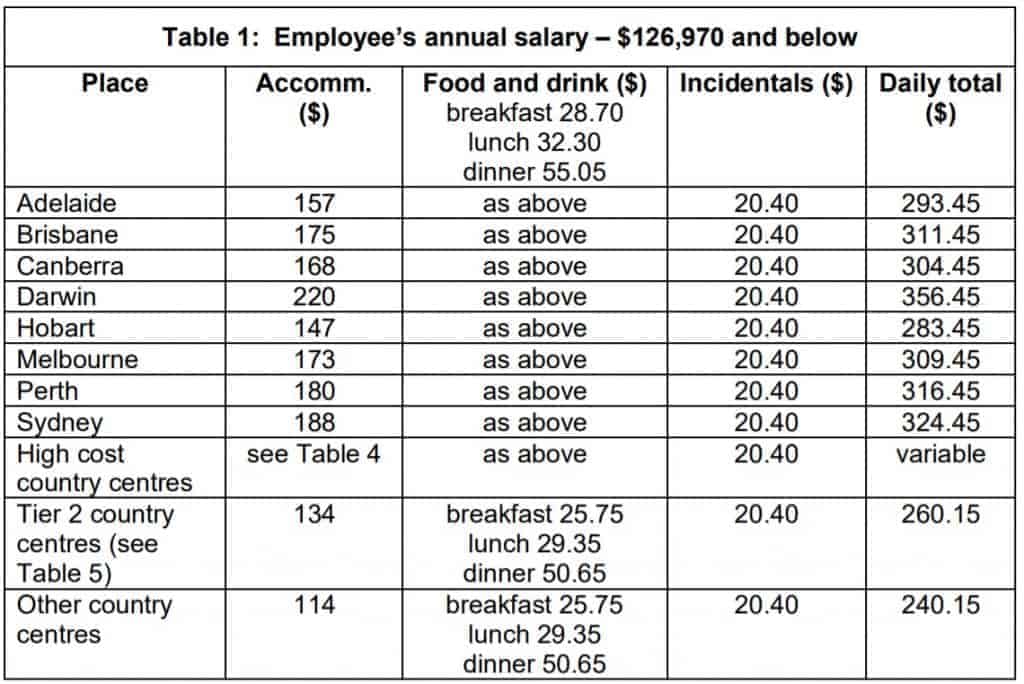

Table 1: Salary $126,970 and below

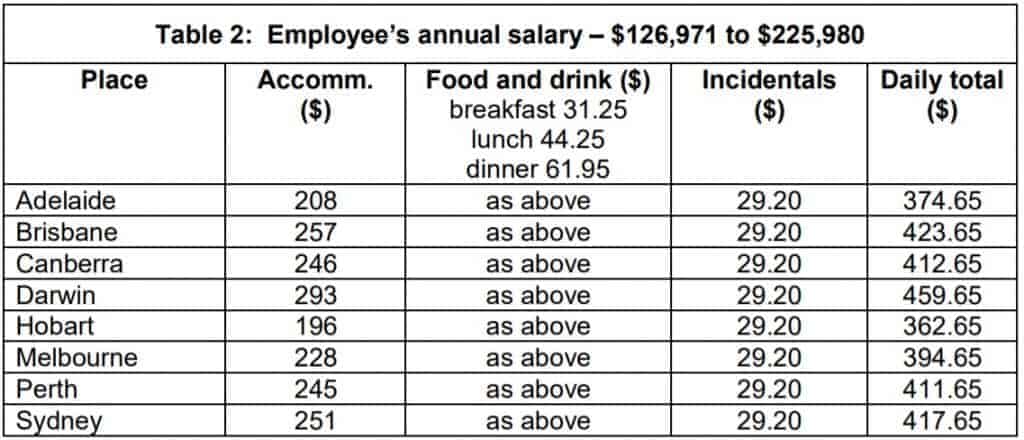

Table 2: Salary $126,971 to $225,980

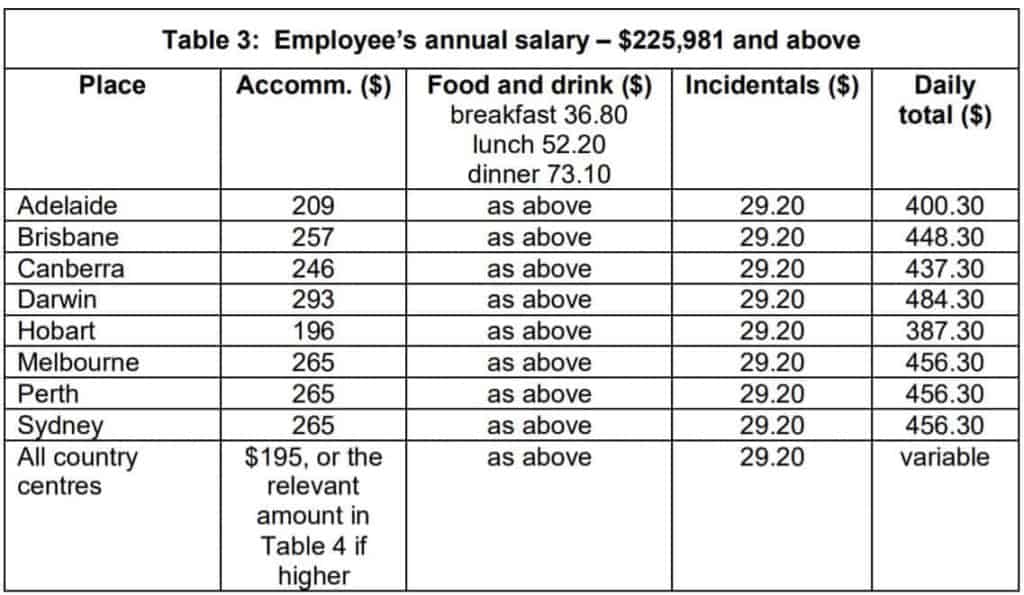

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

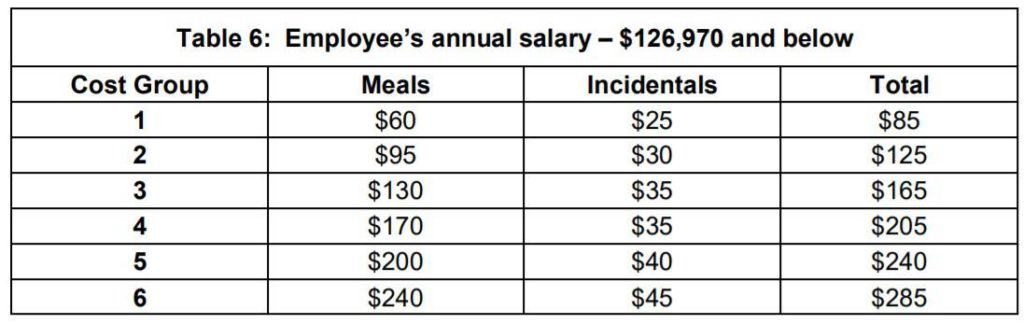

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

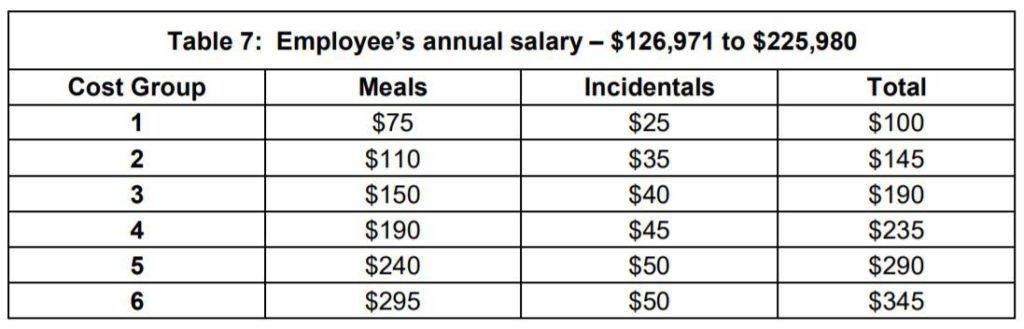

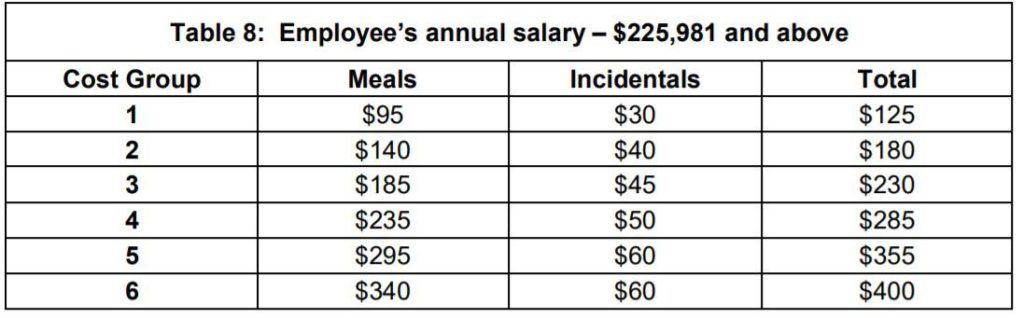

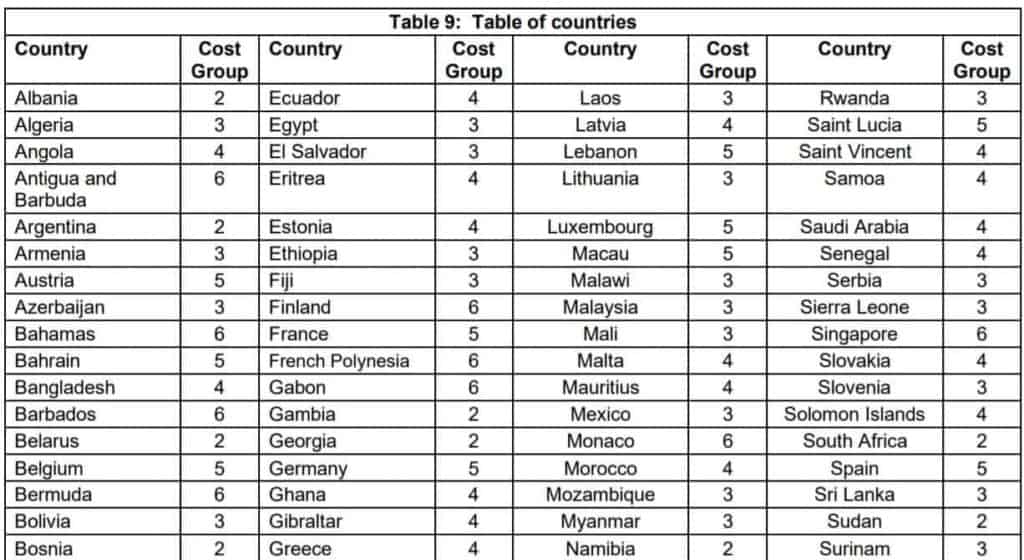

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

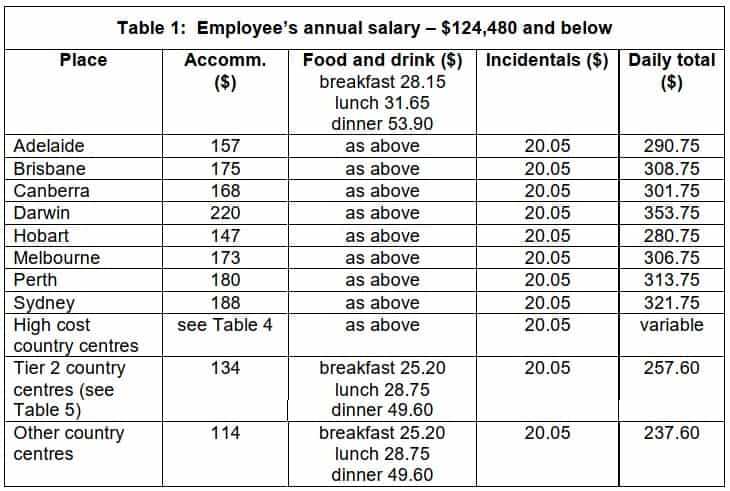

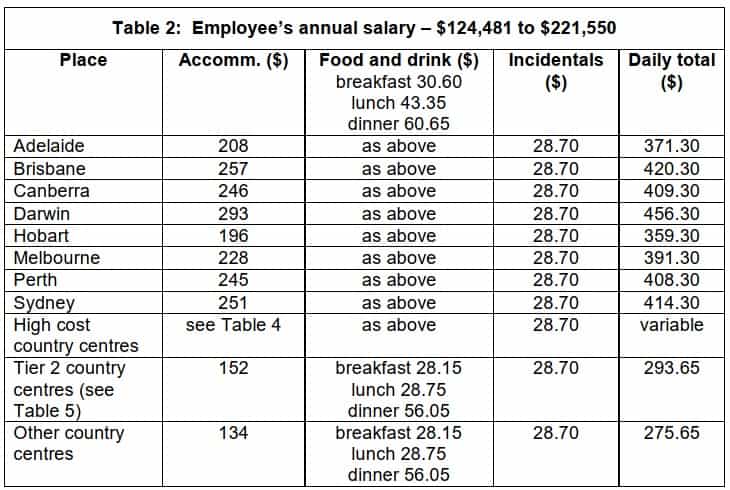

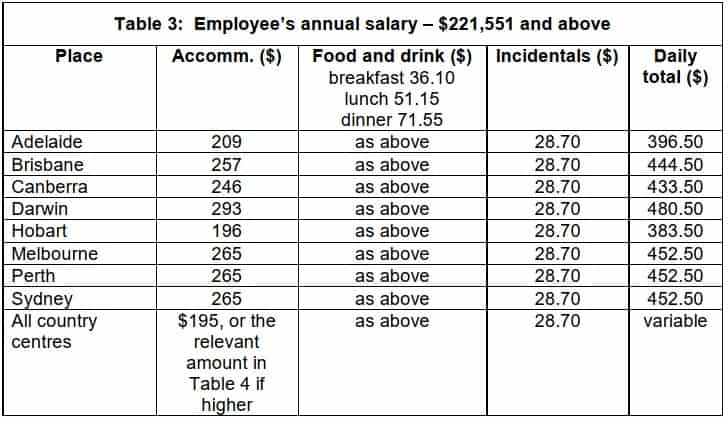

Allowances for 2019-20

The determination in sections:

Domestic Travel

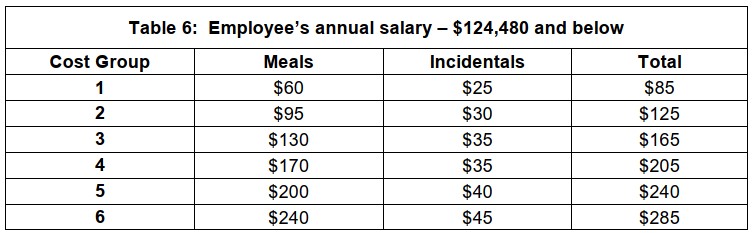

Table 1: Employee’s annual salary – $124,480 and below

Table 2: Employee’s annual salary – $124,481 to $221,550

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

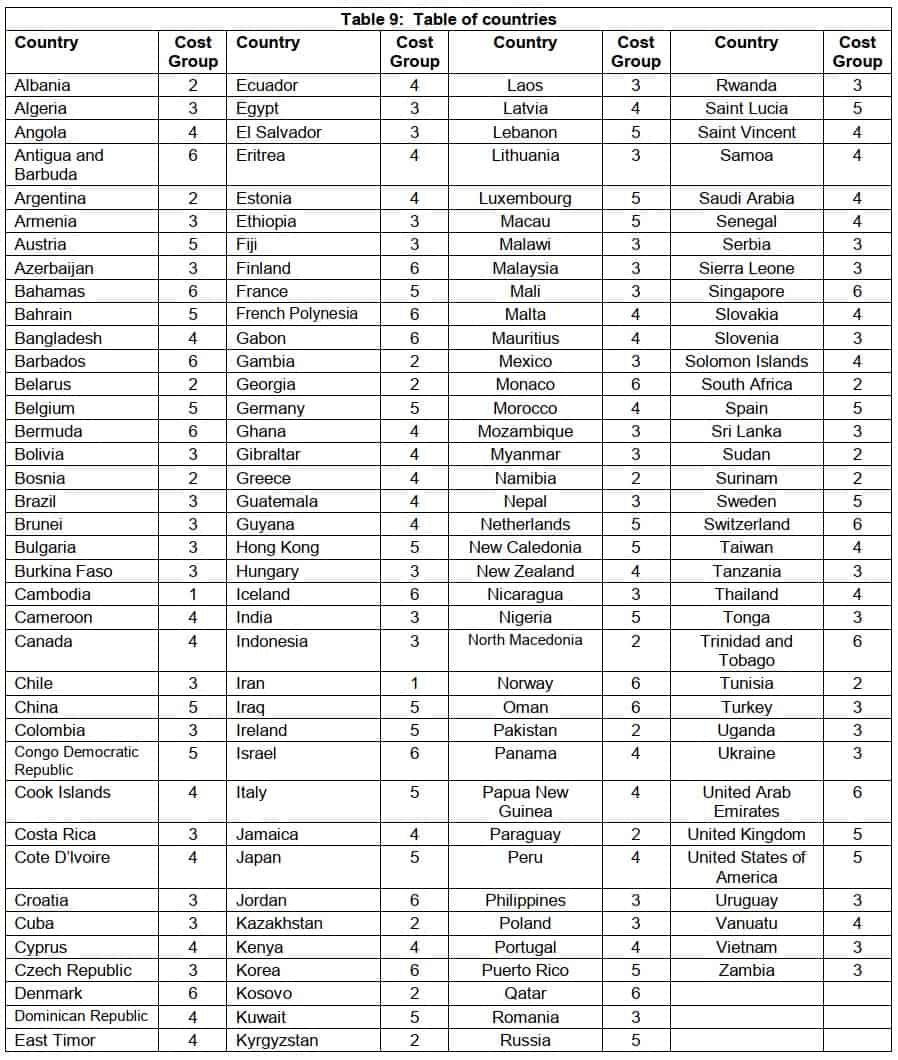

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

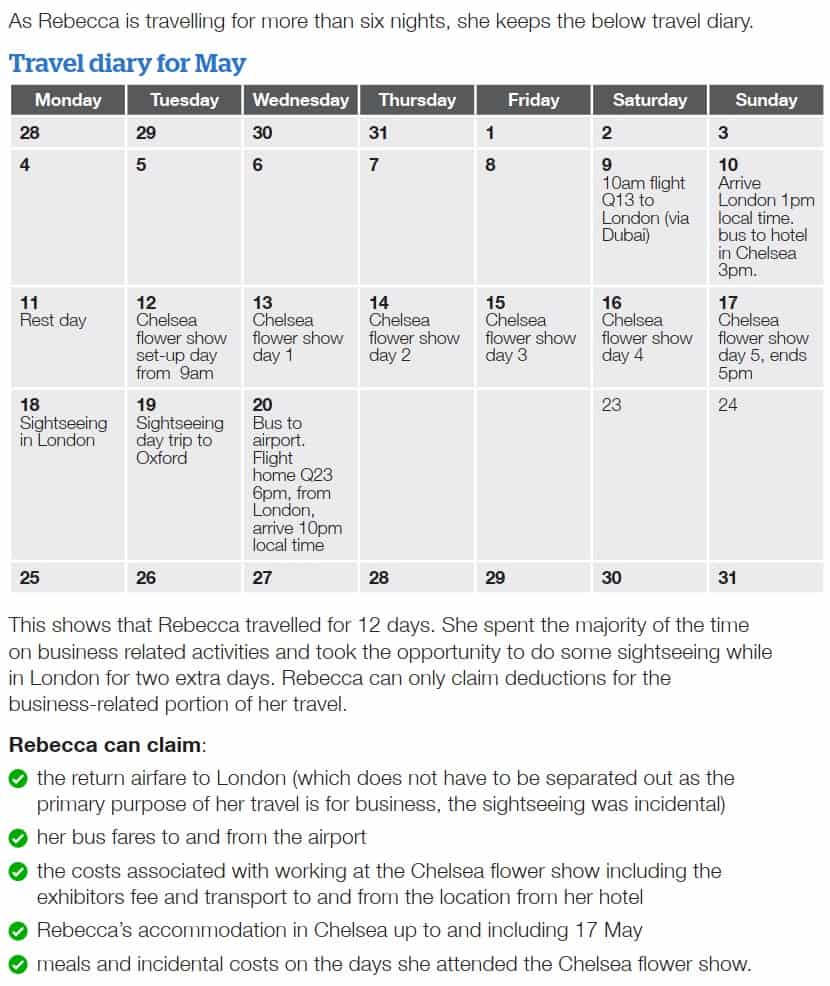

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

KPMG Personalization

- Home ›

- Insights ›

AU – Travel for Work Can Have Tax Implications

Australia – if planning to travel for work, consider tax implications.

This GMS Flash Alert provides an overview of three separate documents released by the Australia Taxation Office in relation to employee travel. One draft ruling was simultaneously withdrawn. The current draft guidance suggests that for some globally-mobile employees, depending on the duration of their assignments, some of the benefits they are provided (e.g., accommodation) may be subject to Fringe Benefits Tax.

ATO Documents

Is there a “bright line” test to establish travelling for work or living away from home.

Hayley Lock

KPMG Australia

Daniel Hodgson

Mardi Heinrich

While personal travel might not be on the cards for all yet, some recent releases from the Australian Taxation Office (ATO) mean that tax costs in Australia need to be front of mind when movement resumes. 1

The ATO recently released three separate documents in relation to employee travel and, simultaneously, withdrew one draft ruling.

These latest releases are a continuation of a process that started in 2017 with the ATO seeking to clarify its position in relation to the tax treatment of employer-provided transport, accommodation, and meals.

WHY THIS MATTERS

An employee’s categorisation as travelling for work, living away from home, or indefinitely relocating, will determine the Australian tax treatment of transport, accommodation, and meal benefits (including allowances).

It is important for employers of internationally-mobile employees travelling into or out of Australia to have a clear view on this categorisation and the resultant impacts to avoid any unnecessary or unexpected tax costs. This is particularly relevant for Fringe Benefits Tax (FBT) in Australia, where the liability rests with the employer and is currently 47 percent on the grossed-up value of the benefit (for example, if accommodation were subject to full FBT, then for every $100 spent on accommodation there would be roughly a corresponding $100 of FBT payable).

From a global-mobility perspective, the ATO had previously provided some guidance whereby international employees on short-term assignments to Australia for up to three months were travelling for work and, as such, not subject to FBT. 2 The current draft guidance suggests that for what are similar circumstances but a longer assignment period (expressed as 90 to 120 days), some of the benefits provided (e.g., accommodation) may be subject to FBT.

Recent Releases

- Final Taxation Ruling, TR 2021/1 Income tax: when are deductions allowed for employees’ transport expenses?

- accommodation and food and drink expenses;

- travel allowances; and

- living-away-from-home allowances.

- Draft Practical Compliance Guideline, PCG 2021/D1 : Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach.

Draft Ruling Withdrawn

- TR 2017/D6 Income tax and fringe benefits tax: when are deductions allowed for employees’ travel expenses?

Given the significant impact the categorisation of an employee’s circumstances can have on the employer’s tax position, whether there exists a “bright line” test that can be used to establish if an employee is travelling for work or living away from home is a valid question and one that is asked often in practice.

The ATO’s prevailing view is that every scenario must be considered on its own merits considering the relevant “facts and circumstances.” However, the ATO has also released some Practical Compliance Guidance (PCG) (currently in draft) specifically providing a “safe harbor” test. 3

PCG 2021/D1 highlights the ATO’s compliance approach when determining if allowances or benefits provided to an employee relate to travelling for work or living at a location. The PCG incorporates a “day count” test, allowing employers a numerical basis for categorisation. It is important to note, this also increases the possibility of automation of this aspect of the FBT process (among other things).

The compliance approach sets a “safe harbour” of an aggregate period of fewer than 90 days in an FBT year for presence at a temporary work location to be treated as travelling for work. Provided that this requirement is met, PCG 2021/D1 allows an employee to have numerous short stints of travel of up to, and including, 21 continuous days.

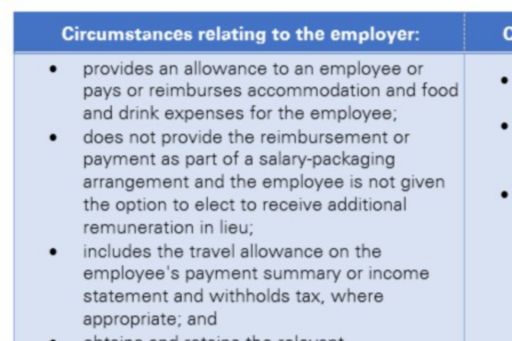

The following table summarises the requirements for the PCG to apply:

The PCG as a Guideline

It should be noted that the PCG only provides a guideline as to what will be accepted by the ATO as reasonable. If a scenario does not meet the criteria, the PCG does not render the relevant expenses automatically taxable, rather, it will require the employer to collate more evidence to support a “travelling for work” position. In an audit situation, the ATO will want to see evidence of how the employer has come to this conclusion, despite the PCG, and why.

Concluding Thoughts

The introduction of the PCG and the safe harbour it offers will provide a set of rules that can be applied to data and help an organisation assess retrospectively which trips might not require further consideration to classify.

Similarly, the PCG provides an opportunity for employers to plan employee travel within these limits if it wishes to do so and other practical business realities allow it to do so.

Organisations may need support in navigating the relevant legislation, cases, and ATO guidance in considering all relevant facts and circumstances and helping employers classify their travelling employees correctly.

1 For related coverage, see GMS Flash Alert 2020-487 , 9 December 2020.

2 For prior coverage, see GMS Flash Alert 2020-113 , 25 March 2020.

3 Draft Practical Compliance Guideline, PCG 2021/D1 .

PEOPLE SERVICES IN AUSTRALIA

Dan Hodgson

Perth, Western Australia

Partner – People Services

Tel. +61 8 9278 2053

Direct Tel. +61 8 9278 2053

Mobile: +61 416 017 131

Melbourne, Victoria

Partner – Deals, Tax & Legal People Services

Tel. +61 3 9838 4348

Direct Tel. +61 3 9838 4348

Mobile: +61 410 602 993

Ablean Saoud

Sydney, New South Wales

Tel. +61 2 9335 8550

Direct Tel. +61 2 9335 8550

Mobile: +61 421 052 596

Brisbane, Queensland

Tel. +61 7 3434 9176

Direct Tel. +61 7 3434 9176

Mobile: +61 477 764 638

Jackie Shelton

Partner – Deals, Tax & Legal

Tel. +61 2 9335 8511

Direct Tel. +61 2 9335 8511

The information contained in this newsletter was submitted by the KPMG International member firm in Australia.

FLASH ALERT - ALL

TAX FLASH ALERTS

AUSTRALIA FLASH ALERTS

FLASH ALERTS BY COUNTRY

FLASH ALERTS BY TOPIC

FLASH ALERT HOME

To subscribe to GMS Flash Alert, fill out the subscription form .

KPMG Australia acknowledges the Traditional Custodians of the land on which we operate, live and gather as employees, and recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

©2024 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organisation.

Liability limited by a scheme approved under Professional Standards Legislation.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance .

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Connect with us

- Find office locations kpmg.findOfficeLocations

- Email us kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

- Request for proposal

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Browse articles, set up your interests , or View your library .

You've been a member since

How to get the biggest tax deductions for your overseas travel

Did you know that if you're on an overseas holiday and you attend a work-related conference, that some of your expenses for the day and a portion (possibly 100%) of your flights will be tax deductible? In light of overseas travel ramping back up, this article details what is deductible and how to make sure that you’re keeping the appropriate records.

How can I claim a tax deduction for overseas travel?

To claim a tax deduction the primary purpose of the travel should be directly connected to you developing your professional and business capability and experience (e.g., attending seminars, work tours, or conferences). Since it’s common to combine business and pleasure, follow this rule of thumb: overseas costs are deductible to the extent they are incurred for the purpose of producing income. This purpose determines the deductibility of the expenses. When it is unreasonable to link the travel and the expense to a commercial reason, the ATO deems this as a private holiday and therefore non-deductible.

What records do I need to keep?

Special substantiation rules apply to both overseas and domestic travel. These types of expenses may not be deductible unless you do the following:

- Keep written evidence of the travel expenses and the reason why you are incurring them (regardless of the length of absence from your home). In the instance of a business travel expense this only needs to be kept if the travel was for at least one night away from home; and

- Travel records such as diaries must be kept in the instance where the travel was for six or more consecutive days away from home. Diaries should refer to the nature of the activity, the day and time the activity began, how long it took, and the location of where it took place.

What are some examples of tax deductions?

Typical expenses associated with overseas travel include airfares, accommodation, and daily costs like meals and local travel. So what is actually deductible?

- Airfares – when the main purpose of the travel is for business/professional development, in most cases 100% of the airfare will be deductible, otherwise, a % of the total cost will be.

- Accommodation – this needs to be apportioned between the time you spent doing business and the time you spent for private leisure.

- Travel, meals, and other ancillary costs – car hire, public transport, Uber, and taxis, used on the days you attended business-related activities, including the meals you eat (although there are some interesting rules about food/drink), are claimable.

Can I claim a tax deduction for the costs of an accompanying person?

Travel expenses linked to your partner or spouse are generally not deductible, however special rules may apply in certain circumstances.

If you have been accompanied by your partner or spouse, the ATO accepts the following methods as ways to identify non-deductible costs:

- 50/50 apportionment; or

- Marginal cost (i.e. the difference in single v double room rates); or

- A mixture of these two approaches.

For example, a full deduction for hotel room accommodation would usually be allowable where your partner stays with you, on the basis that the same cost would have been incurred for the accommodation irrespective of whether your partner joined you or not.

Airfares are an interesting one as they are most likely not deductible unless they too are incurred in the derivation of income.

To summarise the article, there are many expenses that may be deductible when you are on an overseas holiday, however, there does need to be an income-producing/professional development component of the trip. If you’d like to get some guidance on this, contact Link Advisors and we can provide our thoughts.

You may also enjoy.

How to finalise single touch payroll in xero for the financial year, the purpose behind tax optimisation, the pitfalls of borrowing from your business.

19th July, 2021

Work travel expenses: What you can (and can’t) claim

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time.

The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel.

The new ruling, Income tax: When are deductions allowed for employees’ transport expenses? was released this week, bringing together and clarifying the rules for business advisors and their clients alike.

Key takeaways:

- The ATO’s new ruling sheds light on what travel expenses employees can and cannot claim

- Travel between work locations (neither of which are your home), is typically tax deductible

- Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can’t be claimed on tax

Travel from home to a regular place of work generally isn’t deductible. The ruling states that even if you travel to work by plane, receive a travel allowance or make incidental business-related stops on the way to work, you still cannot claim your travel expenses.

But moving between two separate work locations – like driving from your office to a construction site, or from your business to a meeting at a client’s office – can be claimed.

Tax specialist and accountant, Leo Hollestelle said the ruling is well timed ahead of the busy End of Financial Year period.

“It’s timely that these views are brought together and codified into a single ruling,” said Hollestelle. “Tax advisors will be able to more easily familiarise themselves with the rules and in turn advise their clients on it.”

What are work-related expenses?

Work-related expenses are expenses that you incur in the course of gaining or producing your assessable income.

What work-related travel expenses can I claim?

Transport expenses you incur while travelling between work locations are usually deductible. The travel must occur while gaining or producing your assessable income.

While you can’t usually deduct expenses for travelling between your home and work, you might also be able to deduct the cost of travel from your home to somewhere other than your regular place of work. This might be, for example, to attend a client’s premises or one of your employer’s other offices.

To work out if travel expenses are work-related, things like these are taken into consideration:

- Does the travel fit within your duties of employment?

- Do the travel expenses arise out of your employment and not your personal circumstances?

- Is the travel relevant to the practical demands of carrying out your work duties?

- Has your employer asked you to travel?

- Has the travel occurred during normal work time?

What work-related travel expenses can’t I claim?

Transport expenses that you incur for travel between your home and a regular place of work are not deductible.

If there is a close connection between travel and your private or domestic life, this will usually not be considered deductible. For example, if you travel to your regular place of work from another location in which you undertake private activities, for example a library or a holiday house, the cost of the travel is not deductible.

If you happen to live a significant distance from your regular place of work, your travel expenses are usually considered private and not deductible.

You may also not deduct expenses that are capital, private or domestic in nature. Transport expenses that may be considered capital in nature include, for example, the cost of purchasing a car. Ask your advisor whether such expenses may be recognised under another tax provision.

How much can you claim for work-related expenses?

You can only claim the actual cost of the expenses themselves. These will need to be proven with receipts and/or other written documentation. Your advisor will be able to help you with this.

READ: How to save tax in Australia – 15 tax minimisation strategies

How to calculate work-related travel expenses

You can claim deductions for work-related travel expenses in your tax return , but how you do this depends on the expenses themselves. (See also Claiming overseas-travel expenses , below.)

If your expenses relate to a car you own, lease or hire, you may be able to use the logbook method or the kilometres method .

READ: How long does it take to get a tax return?

Working-away-from-home tax deductions

If your employment requires you to travel away from home overnight, because of your employment (and not because of private circumstances like where you choose to live, for example), the transport expenses incurred in travelling to your alternative work location will usually be considered deductible.

Claiming overseas-travel expenses

If you travel overseas for work, you might be able to deduct expenses relating to flights, accommodation, meals, transport or other minor things (like taxis or using hotel wifi). You’ll need to keep records such as receipts and you may also need to keep a travel diary.

Where’s your regular place of work?

Interestingly, there are several exceptions that – if claimed correctly – can give you an edge come tax time. This is especially true when it comes to defining what a “regular work location” actually is.

For example, imagine you currently work for a business with an office 15-minutes from your home.

But you’re asked to cover a long-service vacancy for six months at another of your business’s offices one hour away. Because this new office becomes your regular place of work for a sustained period of time, travel to and from it cannot be claimed on tax.

But, if your period of work was only for three months, then it could be argued that the second office never became a regular place of work.

Therefore, travel could potentially be claimed on tax.

This is a call to take care in making any assumptions about what you can actually claim. As the ATO ruling states, ‘the full facts and circumstances of the specific working arrangement in place must always be considered in determining the nature and deductibility of the transport expenses incurred’.

And that’s something to keep in mind when it comes to all travel-related tax claims this tax time, as it could be this ruling also indicates an increase in scrutiny for travel-related claims.

“While the ruling is very much in line with the Commissioner’s existing views on travel expenses, the timing is worth noting,” said Hollestelle.

“After a year where many employees have been working from home, it may be the ATO is concerned there will be both workers and employers seeking to make dubious claims in the tax period ahead.”

What else do I need to know?

Find more guidance on transport and travel expenses on the ATO website.

Always seek advice on your individual situation from an accredited business advisor or tax specialist to find out exactly how tax changes and updates might impact your business.

Need an advisor? Find one today with MYOB’s Find an Advisor directory .

You might also like

Car allowances and logbooks: what you can claim, 7th may, 2024 by kellie byrnes, working from home tax deductions for business owners, tradies, tax and tricky deductions at eofy, 3rd may, 2024 by myob team, subscribe to be updated on all things myob.

What you need to know about work-related travel expenses in Australia

I f you are required to travel as part of your job, then you likely incur various costs. Whether making a short trip to attend a meeting or taking an overseas trip for an extended period, you can deduct your travel expenses. However, the laws surrounding travel expenses are complicated, and the Australia Taxation Office (ATO) keeps close tabs on travel expenses . So, it's vital to pay close attention to what you claim to avoid mistakes.

What is work-related travel expenses

Work-related travel expenses are expenses incurred while travelling for work. If you incur any expenses related to work-related travel, such as accommodation or meals, you may be able to claim them as travel expenses on your tax return.

Using your car for work

If your job requires you to use a personal vehicle, you are entitled to deduct the motoring costs you incur while completing your job. This does not generally include the commute you make from your home to your place of work.

Eligibility

However, there are limited circumstances that may allow it. For example,

- An employee travelling between work sites throughout the day can claim their commute.

- If you travel directly from one job to a second job, as long as you do not return home in between.

- If you are travelling to a course or meeting for work, you can deduct expenses.

Methods to calculate work-related travel expenses

There are two options when it comes to vehicle travel for work tax deductions.

- As of April 2023, there is a flat rate of 78 cents per kilometre, and you can claim up to 5,000 km . You will need to keep a log of your travel to determine how far you travel for work purposes.

- Use a logbook if you travel and detail your running expenses, from mileage to fuel, servicing, repairs, insurance, and depreciation. If you use the logbook method, your logbook needs to show your work-related trips for a minimum continuous period of 12 weeks

Alternatively, you can use a r eputable tax software that will provide you with mileage auto-tracking and a simple snap and store for all of the receipts related to your business expenses.

Ensure you maintain your logbook for a minimum of 12 weeks before relying on it for your income tax return. The log should include odometer readings to determine the proportion of time you use it for work purposes. Store all receipts and invoices noting your spending on your vehicle so that you can claim the correct percentage of vehicle expenses.

Travel to and from work is considered a private expenditure unless your employer requires you to transport bulky equipment and vehicles. That being said, the ATO pays close attention to these types of claims and may disallow them.

Other work-related transport expenses in Australia

There are other expenses that can also be claimed for work-related travel if they are for:

- Heavy vehicles and utes if they have a carrying capacity of more than one tonne

- Vans with a carrying capacity of 9 or more passengers

- Fees for hiring or renting a car

- Costs incurred while driving someone else's vehicle for work purposes, such as fuel expenses

- Public transportation fares, including air, bus, train, tram, ferry, taxi, ride-share or ride-sourcing fares

- Expenses associated with work-related transport expenses such as bridge tolls, road tolls, and car parking fees

Other travel expenses

You can claim additional work-related travel expenses for costs you incur that your employer doesn't reimburse. These travel expenses must be work-related rather than your daily commute to and from work.

- Airfare and taxi fares

- Tunnel or bridge tolls

- Car parking

- The cost of public transport

If you are fined for a motoring offence, whether it is for parking, speeding or otherwise, you cannot claim these.

Overnight meals & accommodation

If you are travelling away from home, you can claim accommodation, meals and entertainment. You cannot claim meal expenses if your employer reimburses you or provides you with a full allowance for these expenses. A number of businesses will provide an allowance, expenses included, so the employee doesn't need to cover the costs. You may be taxed for those allowances, in which case a deduction is possible for costs incurred.

The ATO provides a lengthy list of what is viewed as a reasonable spend on accommodation, meals, and incidental expenses. You won't need to produce detailed records with receipts or invoices if you claim below the specified ATO allowance. If you exceed the reasonable amounts as laid out by the ATO, or you don't receive an allowance, then you need to keep detailed records to show your spending wasn't extravagant.

The ATO established a reasonable amount to highlight when detailed records must be kept. Many people would assume that they can claim this maximum amount, but we don't recommend you do this. You must only claim the amount of money you spent.

Even if you claim below the reasonable amount, you should be able to prove the expenses you incurred. A bank or credit card statement is viewed as sufficient evidence should the need arise. It will help support your claim that you were in the particular area at the time you claimed.

As long as your travel includes an overnight stay, you can claim business meals, food and beverages. You can't claim meals when you work from home. You could claim tax travel expenses if you always work from home and need to travel to an office.

What you can’t claim

Travel for personal reasons or between your home and your workplace can’t be claimed Examples include:

- Travel between your home and regular place of work or vice versa

- Travel for personal reasons, like running errands on the way to or from work

- Travel for overtime or out-of-hours work

- Travel from your home (which is also your place of work for one job) to another location where you work for someone else

Read our guide to tax deductions to learn about other tax deductions.

Other situations that allow you to claim travel deductions

You may be able to claim work-related travel expenses tax if you attend a work conference or course. If it is local, you can claim transport or mileage. If it's interstate or overseas, you can claim accommodation, airfares and meals.

In all cases, your best bet is to visit a tax agent to ensure your travel deductions are above board.

This article originally appeared on QuickBooks and was syndicated by MediaFeed.org .

43 incredible facts about Australia you may not believe are true

What are SuperEntitlementTypeCodes L, O and R used in STP2 reporting

Need explanation of the three SuperEntitlementTypeCodes L, O and R used in STP2 reporting please.

My provider of STP software GOVREPORTS has outlined them as;

L = Super Liablility

O = Ordinary Time Earnings

R = Reportable Employer Super Contribution RESC

Not sure if that is correct as I have seen elsewhere them classified as;

L (Income Stream Collection) : This code is used when reporting income streams. If you’re providing an Income Stream Collection, you’ll need to use this code.

O (Other) : The “Other” category covers various allowances and entitlements. Here are some examples:

- Allowance – Accommodation – Domestic (amount exceeds ATO reasonable amount): Reportable.

- Travel allowances (allowance type RD): Reportable.

- Allowance – Accommodation – Overseas (for business purposes): Reportable.

- Allowance – Accommodation – Overseas (for private purposes): Non-deductible (ND).

- Allowance – Car – Flat rate: Non-deductible (ND).

- Allowance – Cents per km (for business-related travel): Reportable.

- Allowance – Cents per km (for private travel): Non-deductible (ND).

- Allowance – Cents per km (other vehicles like motorbikes or vans): Non-deductible (ND).

- And many more!

R (Reportable Fringe Benefits) : Use this code for reporting fringe benefits that are reportable.

- Report as inappropriate

Most helpful reply

Hiya @johnlink 👋

Wow, you're going deep!

The information from GOVREPORTS is 💯 correct, as defined in the ATO STP2 technical documents for DSPs to build their solutions.

The other information has been taken out of context. For example:

- L - it is for the employer super guarantee contribution, but the other "explanation" provided is true, because if you have income, you MUST report super liability, even if it is zero, as per the ATO STP2 Employer Guidance (you may have to manually scroll down to "Reporting Super" as the new website links are 🥴)

- O - in the context of the Super Entitlement Type Code is OTE. However, Allowance Type Code also has a value for "O" that refers to Other Allowance Types, just as Paid Leave Type Code also has a value for "O" that refers to Other Paid Leave.

- R - this is RESC, as it's in the Super Entitlement Type Code field, as per the ATO STP2 Employer Guidance . RFBA is reported via the RFB Exemption Status Code field and the only values permitted are T (taxable) and X (exempt).

Context is king 👑 Please trust your DSP: they've passed the ATO testing to be whitelisted, they know the technical requirements of STP2 😇

Related articles

- Stapled super funds – what’s it all about?

- Employer's guide to STP, PAYG, paying Super and FBT

- Super guarantee set to rise on 1 July

- Strengthen your small business with our new online learning platform

Related keywords

- Managing Employees / Contractors Managing Employees / Contractors

- Single touch payroll (STP) Single touch payroll (STP)

Top Liked Authors

Peter_Clyne

Top Contributors

733 contributions

588 contributions

320 contributions

251 contributions

148 contributions

IMAGES

VIDEO

COMMENTS

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies. You ...

On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax: employees ...

A travel allowance is a predetermined amount of money provided by an employer to an employee to cover the expenses associated with travelling for work-related purposes. The ATO considers a travel allowance to be tax-free if it meets the following conditions: The travel is required as part of the employee's job duties.

Draft Practical Compliance Guideline (PCG) 2021/D1 - Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location - ATO compliance approach. These newly published products replace previous ATO draft guidance TR 2017/D6 which has been withdrawn. The subject matter of TR 2021/1 is ...

For overseas travel where a travel allowance is received - No written evidence is required for a deduction claimed up to the ATO reasonable travel allowance amount for meals and incidentals (otherwise written evidence is required for all expenses). Written evidence is required for accommodation expenses as it is not included in the allowance.

'Reasonable' allowances received in accordance with ATO's reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements. ... overseas travel expenses - for food and drink, and incidentals when travelling overseas for work; On this page: 2023-24. 2022-23 ...

However, the ATO has also released some Practical Compliance Guidance (PCG) (currently in draft) specifically providing a "safe harbor" test. 3. PCG 2021/D1 highlights the ATO's compliance approach when determining if allowances or benefits provided to an employee relate to travelling for work or living at a location.

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 2021/22) financial year. Tax Determination TD2021/6 sets out the rates for employee taxpayers who travel within Australia or overseas for work-related purposes and receive travel allowances. Substantiation requirements do not apply if accommodation, food ...

In August 2021, the Australian Taxation Office (ATO) finalised Taxation Ruling TR 2021/4 and PCG 2021/3, which provide guidance on the income tax deductibility of accommodation, food and drink expenses incurred in connection with travel.To the extent that an employer provides these types of benefits to employees, these rulings will be relevant in determining the extent that these expenses may ...

You can claim travel expenses you incur as an employee, however the amount you can claim depends on whether you received a travel allowance from your employer. I recommend having a look at the following: Other travel expenses. If you receive a travel allowance. Apportioning travel expenses. Accommodation allowances and expenses. Hope this helps.

If you want to apply for a private ruling about the deductions you can claim for overseas travel, you need to: complete and submit the relevant private ruling application form (for tax professionals or not for tax professionals) provide the supporting information listed below. If you want to lodge an objection about the rental property ...

To claim a tax deduction the primary purpose of the travel should be directly connected to you developing your professional and business capability and experience (e.g., attending seminars, work tours, or conferences). Since it's common to combine business and pleasure, follow this rule of thumb: overseas costs are deductible to the extent ...

The ATO's new ruling sheds light on what travel expenses employees can and cannot claim. Travel between work locations (neither of which are your home), is typically tax deductible. Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can't be claimed on tax.

For example if you travel overseas for 9 months as part of your job on the set of a film crew, are you living away from home during that time or just traveling for work. The line on the ATO website in relation to claiming accomodation expenses is " are only working away from home for relatively short periods of time (you aren't living away from ...

However, the laws surrounding travel expenses are complicated, and the Australia Taxation Office (ATO) keeps close tabs on travel expenses. So, it's vital to pay close attention to what you claim ...

Travel expenses include: Transport expenses are deductible when you travel in the course of performing your duties. This includes the cost of driving your car, flying, catching a train, taxi or bus. Accommodation, meals and incidental expenses are deductible when you travel in the course of performing your duties AND are required to be away ...

Travel allowances (allowance type RD): Reportable. Allowance - Accommodation - Overseas (for business purposes): Reportable. Allowance - Accommodation - Overseas (for private purposes): Non-deductible (ND). ... Context is king 👑 Please trust your DSP: they've passed the ATO testing to be whitelisted, they know the technical ...

An international travel equipment allowance of $430 (as at 1 January 2018) is provided to offset expenses that an employee may incur as a result of preparing to travel overseas, e.g. sturdy luggage and travel accessories including seasonal weather clothing. 26. The equipment allowance is not payable to a person more than once in any 36 month