- Portuguese (Brazil)

- All about taxes in Andorra

- Invest in Andorra

- Living in Andorra

- How to buy or participate in an existing company in Andorra

- Business Center Andorra

- Coworking in Andorra

- Substance requirements in Andorra

- Passive residency and residence permits without employment

- Residency Andorra + Active residence

- Digital Nomads in Andorra

- Accounting Services Andorra

- Consulting services Andorra

- Distance selling – e-commerce Andorra

- SICAV in Andorra

- Real Estate Andorra

- Banks in Andorra

- Employment Solutions and Outsourcing in Andorra

- CLIENT SOLUTIONS

New tourism tax in Andorra 2022

- July 11, 2022

- Posted by: andorrasolutions

- Category: News Andorra

As of 1 July, Andorra introduced a tourist tax for stays in tourist accommodation ranging from 1 to 3 euros per night. The aim of this new tax is to be used exclusively to boost tourism in the country, to promote it or to promote sustainability. The Andorran government estimates annual revenue of around 12 million euros.

It is possible that this type of direct tax will be familiar to tourists as it is currently applied in other European cities such as Paris, Malta, Lisbon, the Balearic Islands, etc.

The rules for the application of this tourist tax in Andorra are as follows:

- A maximum taxation limit of 7 days is established. This means that for stays of up to 7 days in the same tourist accommodation, the client will have to pay the corresponding tax for each day. From the 8th day onwards in the same accommodation, the tax is exempted.

- The tax is paid per person and per day.

- Children under 16 years of age are exempt from this tax.

- Residents of Andorra are also exempt from this tax.

The price of the fee varies according to the category of tourist accommodation and is payable per night and per person:

* espigas is the equivalent unit to hotel stars, but for rural accommodation.

In the Official Gazette of the Principality of Andorra – BOPA No. 76, published on 22 June 2022 , you can find the details of Law 19/2022 of 9 June, which explains the tax on stays in tourist accommodation. It also explains that the funds raised by this tax will be used to finance projects or actions that pursue the following objectives:

- The promotion of tourism in the Principality of Andorra.

- The promotion of sustainable, responsible, inclusive and quality tourism.

- The protection, preservation, recovery and improvement of tourist resources.

- The promotion, creation and improvement of tourism products.

- The development of infrastructures and services related to tourism.

- Actions to deseasonalise tourism.

- The promotion of training activities aimed at people in sectors directly related to tourism.

How is this tourist tax paid in Andorra?

The tourist will pay the tax corresponding to the tourist accommodation multiplied by the number of nights he/she is staying, up to a maximum of 7 nights in the same accommodation . If you change accommodation, the previous nights are not taken into account. For example, a person staying in a 5-star hotel for 10 nights will have to pay a tourist tax of 7 x 3 = 21 euros. Another person who stays the same 10 days but in different 5-star hotels, without exceeding 7 days in any of them, will pay a total of 10 x 3 = 30 euros in tourist tax, distributed between the different accommodations in which he/she has stayed.

How is this tourist tax collected in Andorra?

In general, the holders of tourist licences are responsible for the tax, unless they act via intermediaries. In the latter case, they are the ones who are responsible for the tax. They are obliged to pay it quarterly to the Ministry of Finance.

USO DE COOKIES

Privacy overview.

Andorra Gazettes Law Amending Tax on Tourist Accommodations

The Andorran Official Gazette June 22 published Law No. 19/2022, amending the tax on stays in tourist accommodations. The law includes measures: 1) exempting certain stays in accommodations from the tax; 2) requiring certain solidary managers and individuals to pay the tax; 3) determining the tax base and rates; 4) implementing invoicing, reporting, and tax payment rules; 5) establishing refund rules and penalties for noncompliance; 6) setting rules for complimentary accommodations, and camping and glamping establishments; and 7) setting registration requirements for tourist accommodations. The law enters into force June 23. [Andorra, Official Gazette, 06/22/22]

Reference: View Law No. 19/2022 ...

Learn more about Bloomberg Tax or Log In to keep reading:

Learn about bloomberg tax.

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools.

Andorra introduces tourist tax

Andorra ( Pyrenees ) has approved a bill regulating the tax on accommodation in hotel facilities . The only exceptions are the areas where camping-cars are located.

Thus, a tax of 3 euros will be applied to tourist accommodation in 5-star hotels, 2 euros – in 4-star hotels and 1.50 euros – in 2 or 3-star hotels. The tax in 1 star hotels will be 1 euro per stay.

Children under 12 are exempt from tourist tax.

See also Andorra best ski resorts

See also Andorra travel guide

See also Pyrenees travel guide

Custom limits. Andorran export limits for food, alcohol, tobacco and industrial products

Postcode finder: Andorra

Speed limit. Police radars: Andorra

Administrative structure of Andorra: cities and parishes

Aliga SG Àliga SL – best ski tracks in Grandvalira

10 amazing facts: Andorra

Traveling to Andorra: requirements and 9 tips for tourists

Are you going to travel to Andorra soon and you don't know very well how to manage this trip? In this article we will give 7 tips or advice you should keep in mind when visiting this country as a tourist so that the management is as easy and enjoyable as possible and you can enjoy the Principality without too many complications. These tips will be very helpful when planning your trip

Requirements to travel to Andorra

Andorra has agreements with its neighbors Spain and France because you can only enter the country precisely through them. According to these agreements, to enter Andorra a person only needs that documentation that is required to enter Spain or France . So, for example, the requirements to travel to Andorra from Spain are to bring the documentation that has had to be obtained to travel to Spain. Obviously, if you are going to be Andorran resident , more documentation is required but not to travel as a tourist. Thus, the list of requirements would be as follows:

- Spanish people or people from within the European Union: they only need the ID or valid passport .

- People from countries outside the European Union and within the Schengen Area: bring the valid passport .

- People from countries outside the Schengen area: provide the Valid passport and Schengen visa .

Regarding the requirements to travel to Andorra due to the covid, there are currently none . You can travel to Andorra from Spain and from France without any extra requirements. PCR is not needed to travel to Andorra and neither is TMA or other tests.

Travel to Andorra from Barcelona

To travel to Andorra from Barcelona, obviously, there are many options . You can go by taxi, but then prepare your wallet because it's not going to be cheap. You can also look for options in blablacar , since it is usual for people from Andorra to travel to Barcelona and vice versa and it is easy for someone to have a Blablacar service.

But without any doubt the most reasonable and most used option is the bus . In this sense there are two main lines; on the one hand Andorra By Bus , which also allows you to take buses from Toulouse and on the other Directbus , which only Barcelona offers. However, DirectBus offers a stop at Barcelona Sants, Barcelona's train station, while AndorraByBus only has stops at airports.

Finally, there are other bus options such as Alsa buses and also those of Flixbus . All trips are around €30 per person for a one-way ticket and €55 per person for a return ticket.

Travel to Andorra from Madrid

Similarly, to travel to Madrid we can do it with a taxi, although it is not recommended, and we can also search if there is any Blablacar . On the other hand, the company Alsa also offers Madrid-Andorra trips for €52 one way and €98 round trip. However, the best option without a doubt for those who do not want to waste time is to use the newly opened flight from Andorra to Madrid , since for €59 the trip is made from La Seu d'Urgell airport to Madrid and vice versa in one hour.

In any case, we tell you more about how to get to Andorra here .

Travel insurance and healthcare

You'll probably be interested take out travel insurance before coming to Andorra . As we told in our article on the functioning of Andorran healthcare , the European health card does NOT work in Andorra: it is not valid. the principality is not within the European Union and therefore this card is useless.

Therefore and as if that were not enough, when having any urgency tourist taxes apply that is, on Andorran non-residents. And it is necessary to say that ski slope insurance only covers you on the ski slope , not out of it.

Therefore, in addition to request scroll wheel ( E/AND.101 ) in the Spanish Social Security, for example) take out travel insurance it can be very interesting. So you will not have to worry about your health while you are here because you will have full medical insurance as a tourist.

About telephony and mobile internet

Do not enter the country with the foreign mobile internet activated, nor activate it at any time once inside. The strictest recommendation we can give regarding telephony when traveling to Andorra is turn off the phone at the border, before entering the country and turn it on again but without entering the PIN or activate the SIM card. Thus, the mobile will be completely blocked at the telephone level and they will not be able to charge you any absolutely crazy cost.

We make that recommendation because there are telephone companies that charge to receive the call in a foreign country , with which even if you turn off the data or do not answer the calls, they can charge a plus for receiving said call on a foreign network, and return from your trip to Andorra with a disgust.

Only if you are totally sure that this is not your case, it may be advisable not to do the restart, although it is the safest. If this is the case for you and you decide not to restart your phone, the advice is that you must remember not to take any incoming calls and turn off the data of the device before entering the country and not turn them back on that SIM card until you return to the country of origin.

But then how do I connect?

Andorra is a pioneer country in technology and internet connection . The first solution is that you wait to go to your hotel or lodging place, restaurant, etc. where you can access the internet via local WIFI and you can connect, using the local wife of that site.

The second option, but only if it is an emergency is to connect to one of multiple free wife networks that are spread through all the country. For example, the Andorra wifi offered by the Andorran select company, Andorra Telecom, is a free Wi-Fi network that connects the most important points of the country. Also, the libraries and (common) municipalities of Andorra have free Wi-Fi and even some shopping centers such as the River Shopping Center , located in Sant Julia de Lòria, or the same Ill Carlemany .

Use this second option only if it is an emergency and never enter personal or important information such as credit cards, passwords or ID. These networks are not secure.

And finally, if you want to have 4g mobile internet and not rely on WiFis to access the network, one of the tips is to buy a prepaid card for your visit , especially if you are going to travel to Andorra for several days. One option is the famous card Holly or similar with which you can get mobile connection in many countries. Another alternative is to buy a andorra Telecom prepaid internet card with which you will be able to navigate, call and send SMS, although it is better to see the communication rates of the card before carrying out any action.

Andorra and the snow

Don't leave Andorra without having enjoyed the snow , unless your trip is in summer. If you are going to travel to Andorra in non-snow seasons, you should also visit the wonderful Andorran mountainous landscape to discover the whole country. Having three natural parks, one of which is a World Heritage Site, unique lakes and peaks, not making trips to the Andorran mountains is a sin, excuse me.

Andorra in winter is splendid. Going up to a ski resort should be in your travel plans, even if its not for skiing . The Principality is one of the best sites in the Pyrenees for the experience of the mountains and the good snow. You can not only ski, but do all kinds of activities . For this we offer you to go to 3 ski resorts where you can not only ski, so you do not leave here without enjoying the snow.

Grandvalira

Grandvalira is the largest ski resort in Andorra, and one of the largest in the world. It has 7 different sectors from which to access its tracks and peaks (Encamp, Canillo, Solder, Gray Rig, Ex Tarter, Patrol, Pas de la Casey). With more than 120 slopes and more than 200 km of skiing, this is undoubtedly the great Andorran ski resort. The Grandvalira ski pass is one of the most expensive (although not so much) but it works for all these sectors. It is the definitive option for a great weekend.

Grandvalira is the most common stop for anyone who is going to travel to Andorra. Regarding activities without skiing, in the Grau Roig sector you can do activities such as snowmobiles (€120 for 2 seats) or make an igloo, and in the Palau de Gel de Canillo you can ice skate with a rink that is all the year open, and other activities such as karting, quads etc. This track, in addition, is free for those of the Super 3 Club.

Andorra Vallnord

Although Vallnord it has fewer sectors (Pal, Arousal, Ordino Arcades), it is more affordable than Grandvalira. The price of the ski pass for an adult is €41 and for beginner skiers there is a ski pass for €19.50 that allows you to take the chairlift and conveyor belt for beginners, with the access cable car included. The ski pass for children under 6 years old is free and from 6 to 15 years old it costs €35.

In Pal if you do not like skiing, you can sled on a good track for 5 euros the person with a conveyor belt.

Naturlandia

In Naturlanda – La Rabassa There is not only a great cross-country ski station and snowshoe routes, but also a park for adventure activities (snowmobiles, zip lines, etc…) with an animal park. If you don't like skiing, this beautiful place is probably the best for you if you are wondering what to see or do on your trip to Andorra.

It is divided into two levels: at the 1600 level is the amusement and adventure park and at the 2000 level is the animal park and the Nordic ski slopes and snowshoes. Cross-country skiing or snowshoeing while watching the animals fully integrated into their habitat in a large forest, a beautiful spectacle! The price of the Nordic ski pass is €12 and that of the animal park €14 for adults.

Be careful with shopping

You can buy a lot of reduced price products , but pay special attention to the amount (in monetary value) of what you buy . Shopping in Andorra can be very affordable, not only because VAT or consumption tax there (IGI) is 4.5% or less , but for the special taxes on tobacco, gasoline, alcohol, etc. But the purchases are not unlimited. One of the tips is nothing to buy perfumes, electronics, tobacco and alcohol for the whole neighborhood.

You have to know that there are limits on private importation of these products. Smuggling is a very typical activity when traveling to Andorra, but it is very controlled. If you exceed any of these limits, you will have to declare them at customs and pay a fee or fine that will make your product more expensive than if it were foreign, even being more profitable if they requisition it in some cases.

First, note that the maximum limit of the value of what you import per person over 16 must be less than €900 . And for each product there is also a different limit:

- The limit for alcohol below 22 degrees is 3 liters

- For beer is 16 liters

- At most you can import 300 units of cigarettes

- In sugar or candy you must carry less than 5 kilos

- Milk less than 6 liters

- Coffee you can only 1 kg

- And some more limits

In addition, you must also know that the total value of what you wear both when entering and leaving (cash and valuables) must be less than €10,000.

Travel to Andorra with children and pets

The first tip to remember is that you must have all the documentation in hand. If you come from countries with which Andorra has an agreement, such as Spain, France or Portugal with the DNI of all people you can enter the Principality . If not, you must have your passport and/or other documentation in order and in force. So if you are traveling with children on board, do not forget that they must have a valid DNI.

Best travel plans to do in Andorra with children

Well, the truth is that when traveling to Andorra you can do almost anything with children: from mountain walks, hiking in nature and routes to lakes to snow sports such as skiing, snowshoeing, or snowmobiling. You can also go to Naturlandia, the Caldea spa... almost all plans can be done with children in Andorra . Even so, we recommend a few that are key:

- The Chaldea Lipids , in the spa of Chaldea , to spend 3 hours in the SPA with your partner alone while the children have fun in an exclusive children spa with monitors and have a great time.

- The second plan is to got ice-skate in the ice skating rink of the Paley de Gel in Canillo . A plan that we also remember is free if you have the Super 3 Club cards.

- Go to ; the two dimensions of Naturlandia and enjoy its adventure activities, animals and the small snowshoe circuit, charming for everyone. The Naturlandia Animal Park is also a very interesting place to visit, since animals from the area such as deer, wolves, bears or boreal lynxes coexist in semi-freedom. In addition, they have a spectacular Tobotronc through which launching will be the illusion of children in Andorra.

- Walking among animals and dinosaurs through the Jerri contemporary gardens located in Sant Julia de Lòria. In these private gardens but whose visit is free of charge, you can find a collection of contemporary art sculptures taken care of by their owner, as well as dinosaurs and many other animals.

- Climb the Naturlandia Airtrekk, which is the largest adventure activity facility in Europe. It is a wooden structure full of nets, platforms, ropes, zip lines, walkways, etc.

- You can also do easy hiking trails such as the Ruth Del ferry , on foot or with snowshoes on a small route where your children will discover everything about the exploitation of the old iron mines or the green ring path .

- Finally, the museums could not be missing. The Miniature Museum, the Carmen Thyssen Museum, the National Automobile Museum, or the ARTALROC exhibition hall

Travel to Andorra with dogs

If you bring a dog when traveling to Andorra, you must complete certain documentation before visiting the country of the Pyrenees. The requirements to enter animals in Andorra is that they have to be over 3 months old, they have to have the animal passport that your veterinarian will make for you, the rabies vaccine up to date and next to it there must be a serology that is negative for animal rabies made by your veterinary. As for activities, if your dog lives in the mountains, obviously almost any plan will delight him.

The chains or contact tires

If you visit the country in winter, make sure that you carry chains or winter contact wheels in your vehicle .

No excuses that if it is a good day, if it is only a moment or that you will not climb much, The Pyrenees climate is very treacherous and can change in a short time and start to snow. On the other hand, on a cold day, nobody assures you of not finding an ice or snow plate on the road. Therefore, never forget the chains , and being able to be 4 , one for each wheel if you go to Andorra by motor home or 2 minimum if you go by car.

In addition, in 2015 a modification of the Andorra Traffic Code entered into force, in which it forces to bring adequate equipment (chains or tires adapted) to all vehicles that circulate on the roads and streets of the small country of the Pyrenees. The obligation begins each season on November 1st , and finish the May 15th of the following year

Normally the andorra police fine only when in case of snowfall or ice on the road (although you can do it at any time within that mandatory period), a vehicle gets stuck hindering the movement.

The amount of the penalty goes from 180 euros at 500 euros in the case of vehicles of more than 3.5 tons. And to avoid it, the vehicle must be equipped with winter tires or with metal or cloth chains, which are suitable for the dimensions of the wheels. At a minimum they must be carried on the tractor wheels. The measure affects both Andorran residents vehicles and no residents ones .

One last point

Finally we remember and recommend contact us if they want to settle in Andorra, move to this country, open your company in Andorra o reside and live in Andorra . You can make it pressing here . They can also see the all general advantages offered by the Principality of the Pyrenees .

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Current ye @ r *

Leave this field empty

ABAST Technology and Systems Specialist

Andorra Insiders is an information platform about Andorra managed by ABAST, an Andorran professional consultancy firm for legal, tax and accounting services specialized in establishing people and businesses in the Principality of Andorra. More information here.

Most recent posts

ESLAND Awards in Andorra in 2024: all the details

Andorra in winter: 5 plans with snow that you will love

Abast (Andorra Insiders) Launches New Offices in La Torre

Is there unemployment in Andorra? All about employment and unemployment

Find us on the networks.

- Living in Andorra

- Open a business

- Taxes, taxation

- Types of residence

- Health and wellness

- Content creator

- Trader, broker or agent

- Cryptocurrencies and blockchain

- Retired or retired

- digital entrepreneurs

- Privacy Policy

Copyright © 2024 ABAST ~ All rights reserved

- Create a new plan

Enter your email

Enter your password

Enter the email you use for your Andorraworld Fan account and we’ll help you create a new password.

The system has detected a problem while processing this form. Please try again later.

We have sent you an email to: [email protected] so you can create a new password for your Andorraworld Fan account.

- Andorra Selected

- Health and wellness tourism

- Inclusive tourism

- As a family

- With friends

- As a couple

- Your Atypical winter

- Ski on never-ending slopes

- Family experiences

- Cross-country skiing

- Freeride routes

- Your Atypical summer

- Routes bursting with life

- Enjoy cycle tourism

- Activities at the resorts

- Andorra, World Heritage

- Exhibitions

- Theatre, music & dance

- Festivities and traditions

- Aparthotels

- Tourist Apartments

- Tourist accommodation

- Rural accommodation

- Campsites and motorhomes

- Other accommodation

A premium experience without leaving the capital.

4 and 5 stars at the foot of the Madriu-Perafita-Claror valley.

High quality in the country’s lowest parish.

Feel like a VIP among alpine landscapes.

The best services in the heart of the Pyrenees.

Exclusivity surrounded by the tallest peaks in Andorra.

The maximum category of comfort and natural beauty.

- Sleeping and totally relaxing

- Sleeping in the centre

- Sleeping surrounded by nature

- Sleeping among the stars

- Sleeping with your bicycle

- Basic information

- Some of our history...

- Surprising facts about Andorra

- Business tourism

- Sports stages

- How to get to Andorra

- Passport, visas & customs

- Things to do… more info

- Travel guides

- Contact us!

Enter at least 3 characters to display results

Andorra tourism guides: plan your holidays

Download the Andorra Tourism guides and find out what the country offers in nature, culture, cuisine, wellness and much more. A thousand and one ways to enjoy your mountain holidays.

The map of Andorra shows all the services, tourist attractions, monuments, peaks and lakes, nature parks, roads of Andorra, and more. You'll find everything you need to travel around our country at your own pace with the map of Andorra.

Whenever you visit Andorra, this guide will tell you at a glance all you want to know about the activities on offer. Enjoy our fine cuisine, discover the country's natural wonders and our GR hiking path network, get to know our extensive culture and relax in Andorra's grand well-being centres. A wide range of activities that will ensure your holidays in Andorra are unforgettable.

Feel right at home during your stay in Andorra The Andorra accommodation guide includes over 200 hotels as your base to discovering the country in all its facets. Relax and rest in the hotel of your choice after a day's tourism in Andorra.

Enjoy local Andorran cuisine, which over time has assimilated both French and Catalan culinary influences. Andorran cuisine has always been closely associated with our local products.

Discover all the adventure and outdoor activities on offer in Andorra with this outdoor guide. All the information you need to enjoy your favourite outdoor sports. See the map of Andorra for mountain routes and hiking paths through our magnificent countryside.

If you enjoy hiking, then be sure to check out the hiking paths in the Principality. There are over 66 fact sheets with all the information you need to enjoy the mountains to the full. You'll find isolated routes that can't be reached by the roads of Andorra.

For many years, Andorra has been a point of reference in prestigious professional cycling events such as the Tour de France or Spain's Vuelta a España, thanks to the demanding nature of its mountain roads. Discover cycle touring in Andorra.

Andorra is a unique destination for outdoor sports, with cycling being one of the most attractive and special ways to discover the natural environment and the beauty of the Principality's mountains. Enjoy our mountain bike and e-bike routes.

With the mountain shelter and GR map you can plan your hiking route through Andorra's most stunning landscapes. Discover the beauty of our lakes and Andorra's unique flora and fauna. Over 26 mountain shelters and long-distance GR routes await you in Andorra.

In the fishing map of Andorra you'll find out how to reach some of the rivers and lakes accessible by the roads of Andorra. These fishing reserves will provide all the information you need on prices and fishing licences, among other things. Everything you need for mountain fishing in Andorra.

Romanesque art, museums and monuments, cultural routes and festivals are just a small sample of what's on offer on a cultural trip to Andorra. Unusual spots to visit when on holiday in Andorra.

Discover the Principality's must-see sights by travelling the roads of Andorra on the Tour Bus. In summer, there are seven guided tours for you to experience the Principality's culture and nature first-hand, with explanations of ancient traditions and visits to monuments and the most emblematic sculptures.

The mountains are high and the snow thick all winter long. We are one of the sunniest skiing destinations and have over 300 km of the best, most modern ski slopes. Consult access to slopes, services and facilities and the map of the slopes of Andorra.

Shopping in Andorra is one of our country's great activities thanks to its more than 2,000 modern shops and the new trends featured each season. Learn about customs exemptions and get information on how many products you can take back over the border without declaring them, and therefore saving on taxes.

DOWNLOAD ACTIVE TOURISM

PREPARE YOUR GETAWAY… AND PACK YOUR BAGS!

Check the suggestions and services that most interest you and plan the perfect getaway.

Hotels, mountain refuges, apartments… A wide range of accommodation options are available to you.

Find out the best way to get here, whether by car, train or plane…

Find out all the key information you need to prepare your trip. Travel with absolute peace of mind!

The Andorra Tax System

Hidden in the Pyrenees mountains is the low-tax Principality of Andorra.

Andorra offers endless opportunities for both residents and tourists alike. However many of these people would have never found Andorra on the map without its low, but fair tax system.

In this article we’ll review Andorra’s tax rates, the different types of tax and the laws associated with the Andorran tax system for both individuals and companies.

Table of Contents

Resident Personal Income Tax

Andorra’s income tax for resident individuals is known as IRPF , or “Impost sobre la renda de les persones físiques”.

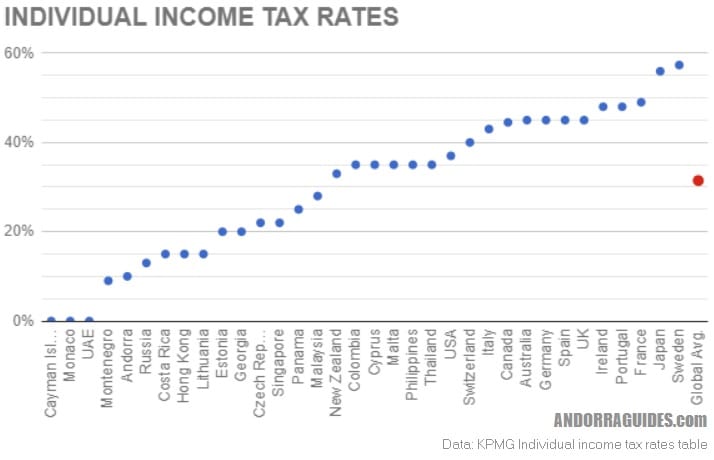

What Is the Personal Income Tax Rate in Andorra?

The nominal personal income tax rate in Andorra is 10% . That is, the maximum an individual will pay is 10%.

Similar to many countries however, Andorra uses a bracket approach to its personal income tax system.

Income Tax Brackets for Individuals

- €0 – €24,000: 0%

- €24,001 – €40,000: 5%

- €40,001+: 10%

Income Tax Brackets for Married Couples

- €0 – €40,000: 0%

Who Is Liable for IRPF?

IRPF applies to any individuals with Andorran tax residency, that is;

- someone who resides in Andorra for more than 183 days in a year, or

- someone who keeps the majority of their business, economic and life activities in Andorra, commonly referred to as a “permanent place of abode” by some countries.

What Type of Income Is Taxable?

Andorran income tax applies to all forms of income, capital gains and losses. Unlike many countries with a territorial taxation system , Andorra taxes its residents on their worldwide income.

Taxable income includes:

- salary from an overseas employer,

- dividends or coupons from investments held abroad,

- pension, superannuation, savings or insurance plans from abroad.

Are Any Types of Income Exempt?

Though limited, some forms of income are exempt from tax. In most of these cases, the investments need to be made within Andorra.

Exempt types of income include:

- income from Andorran government bonds,

- dividends and other income from holdings in entities registered in Andorra,

- dividends and other income from holdings in entities resident in Andorra,

- capital gains and losses,

- income from funds deposited with an Andorran bank, up to €3,000,

- public grants and scholarships,

- literary, artistic or scientific prizes.

For more information, see Article 5 – “Exempt Income” of Law 5/2014 .

Non-Resident Income Tax

Tax on income for non-resident individuals and entities is known as IRNR , or “Impost sobre la renda dels no-residents fiscals”.

IRNR is payable when an non-resident individual or entity earns income from economic activities in Andorra.

IRNR, the Andorran income tax on non-resident individuals and entities is 10% .

Corporate Tax in Andorra

Any company incorporated in Andorra, or resident in Andorra (due to a registered office or having effective management in the country) is considered a tax resident in Andorra.

Entities resident in Andorra are taxed under IS , or “Impost de societats”.

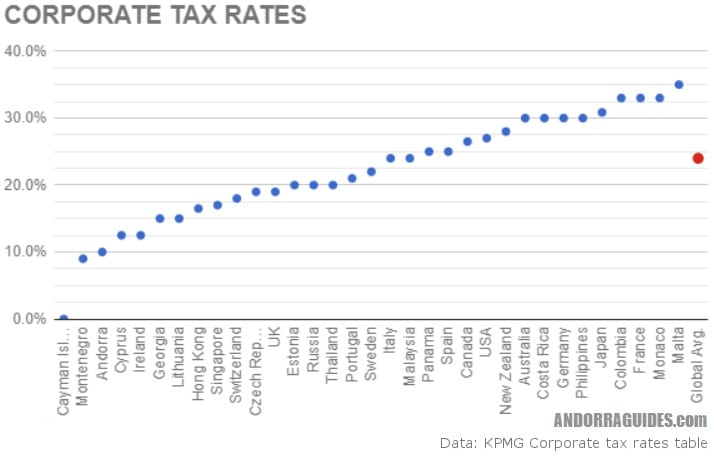

The nominal corporate tax rate on profits in Andorra is 10% . Though a special effective tax rate of 2% exists for certain types of companies such as holding companies investing in foreign companies (such as those owning property and intellectual property), this system is expected to see significant changes.

Corporate Withholding Taxes

The corporate withholding tax rate in Andorra , also known as a dividend withholding tax is 0% .

Royalties are taxed at a rate of 5% .

VAT; Indirect Tax

Andorra is known for its tax free shopping, but in reality most sales made within the country’s borders attract a 4.5% “ I.G.I. “, or value-added tax.

This rate can be reduced to 0%, mostly for non-profits, education and medical care. 1% on foodstuffs (outside of alcohol), books, newspapers and magazines, and 2.5% on tourism operators and art.

An increased rate of 9.5% is applied to banking and financial services.

Capital Gains Tax

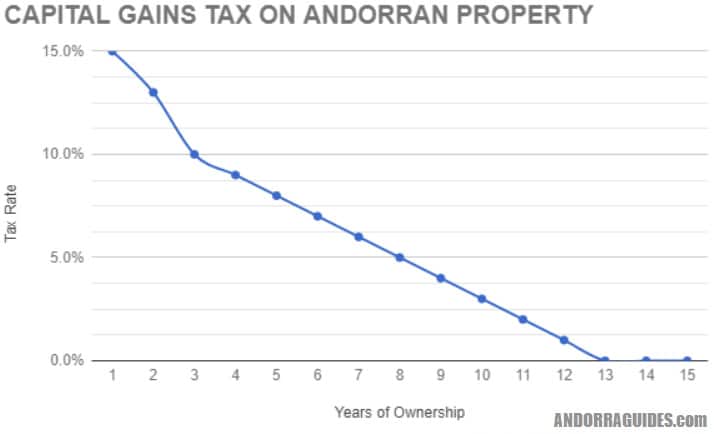

The nominal rate of capital gains tax in Andorra is 10% . There are however, some exceptions:

- This is especially interesting for traders of publicly listed companies (please note: options, commodities and other investments are not covered by this exemption).

- Any asset held for more than 10 years is exempt from capital gains tax.

Capital gains tax in Andorra applies to investments worldwide. Where tax at or above the Andorran rate of 10% has already been paid on this investment abroad, it is not chargeable locally under double-taxation law.

Please note capital gains tax on real estate in Andorra is different again, which we cover below.

Tax on Real Estate

Real estate in Andorra is not subject to inheritance or transfer taxes, however owners are liable for both purchase taxes and capital gains tax on sales before 13 years of ownership.

Tax on the Purchase of Andorran Property

When buying property in Andorra , you should expect to pay two different types of tax:

- Fixed tax: 1.5% of the sale price paid to the comu (local government)

- Impost de Transmissions Patrimonials: 2.5% of the sale price paid to the Andorran Government

Tax on the Sale of Andorran Property (Capital Gains Tax)

Selling taxes are much more variable.

Andorran property has a capital gains tax between 0% and 15% , how much you pay depends on how long the property was held:

- 1 year: 15%

- 2 years: 13%

- 3 years: 10%

- 4 years: 9%

- 5 years: 8%

- 6 years: 7%

- 7 years: 6%

- 8 years: 5%

- 9 years: 4%

- 10 years: 3%

- 11 years: 2%

- 12 years: 1%

- 13 years or more: 0%

Double Taxation Agreements

Since the radical change in Andorra’s tax laws to meet international obligations and avoid being blacklisted as a tax haven , the government has been negotiating on double taxation agreements with countries around the world.

To date, the following countries have double taxation agreements with Andorra currently or will do shortly:

- France: Effective from July 1, 2015.

- Liechtenstein: Effective from November 21, 2016.

- Luxembourg: Effective from March 7, 2016.

- Malta: Signed September 20, 2016.

- Portugal: Effective from April 23, 2017.

- Spain: Effective August 1, 2017.

- United Arab Emirates: Effective August 1, 2017.

Andorra has been in negotiations with Belgium, Czech Republic and The Netherlands, and has expressed intentions to negotiate with Estonia, Latvia and Lithuania.

Andorra’s Tax System

While Andorra’s tax laws continue to evolve, the system remains straightforward enough to negotiate without too much headache.

Whether your plan is to incorporate or live in Andorra, you will be treated to some of the lowest tax rates in the developed, compliant world.

For more tax information in Andorra, please review the other articles available on this topic, in our Andorra Tax section.

- Category: Tax

BOOKING Bloc Doblemente OA - General

- Grandvalira Resorts

- How to get here

- Schedule and contact

- Technical data

- Weather forecast

- Discover Andorra

- Merchandising

- Season ski pass

- Daily ski passes

- Ski Pass Plus+

- Mountain Pass

- Extracurricular ski pass

- Private Classes

- Group Classes

- Mountaineering Skiing

- Children's school

- Club Màgic Ski

- Freeride Academy

- Cafeteria Fast Food L'Hortell

- Cafeteria Fast Food Els Planells

- La Coma Restaurants

- Refuge Les Portelles

- Ski Mountaineering

- Kids Forest Circuit

- Adapted Skiing

- Equipment Rentals

- Ski lockers

- App Ordino Arcalís

- Epic Andorra by Grandvalira

- Sorteny Natural Park

- Borrufa 2024

- FWT 2024 By Peak Performance

- Calendar of events

- Client area

Money in Andorra: Currencies, roaming, taxes and customs

Going on a ski holiday in Andorra is an exciting experience, not just because of the beautiful Pyrenean ski slopes but also because this is a very unique country. However, being a unique country means that a lot of everyday services and rules might be different from what you’re used to.

So, here we have a guide to how money works in Andorra and the best money tips for Andorra tax, roaming, customs and currency queries .

Currency in Andorra: What is the official type of money in Andorra?

Even though Andorra is not a member of the European Union, the currency in Andorra is the Euro . Previously, the currency in Andorra was a mix of the French franc and the Spanish peseta. But, Andorra has long used the Euro and the currency in Andorra has been officially recognised as the Euro since 2011 , after the principality established a monetary agreement with the European Union and signed the Euro into Andorra laws.

Andorra tax haven: Is Andorra really a tax haven?

The answer to the question of ‘Is Andorra expensive?’ is no, because the prices in Andorra are relatively low compared to many other European countries , and this is largely down to the Andorra laws on tax. There are several Andorra tax advantages, although it is important to point out that both the European Union and the Organization for Economic Cooperation and Development reject the Andorra tax haven label . In their view, Andorra is not a tax haven despite there being a few Andorra tax advantages and a low Andorra tax rate.

Andorra tax rate: What is the current Andorra income tax rate?

Looking at the 2023 Andorra tax rate for income tax , it is 0% for annual personal income between €0 and €24,000, it is 5% for annual personal income between €24,000 and €40,000 and then any amount over €40,000 brings an obligation to pay 10%. That’s according to ABAST, who point out that: “With a maximum rate of 10%, the Andorran personal income tax is one of the lowest in Europe.”

As for the Andorra tax rate for the country’s equivalent to VAT, this general tax rate is just 4.5% , while there are also some exceptions that are even lower.

Andorra data roaming and mobile charges abroad: How much are the Andorra roaming charges?

If you’re looking to make calls or access the internet on your phone while on your skiing holiday in the Pyrenees , do be aware of the Andorra roaming charges. Even though these charges disappeared across most of Europe a few years ago, keep in mind that in Andorra data roaming still exists and can be costly if you’re not careful .

But, there are solutions to the data roaming Andorra issue . As the Andorra tourism board explains: “You can activate a pre-paid eSIM, with domestic Andorra Telecom charges, during your stay in Andorra. The eSIM is available for all visitors to Andorra who had a mobile phone compatible with this technology - which has been around for about three years now - which will allow you to download an eSIM, equivalent to the physical SIM card in your phone but in a digital format. This service allows you to keep communicating in Andorra while saving on the fees that come with roaming.”

There is also Andorra public Wi-Fi in the main shopping districts of Andorra la Vella and Escaldes-Engordany, if you can wait until you’re in those areas. Your ski resort should also have free Wi-Fi available.

Andorra border control: How do Andorra customs work?

The final Andorra money tip to keep in mind concerns the Andorra customs rules. Since the borders of Andorra are with the European Union and since the microstate is not a part of the European Union itself, there are sometimes custom checks when driving in Andorra or out Andorra . While many items are not subject to Andorra tax duties, you should keep in mind that there are limits on the amount of cigarettes, perfumes or alcohol that you can carry . These Andorra laws regularly change, so it’s worth checking the latest versions before travelling.

Taxes in Andorra

Home · · taxes in andorra.

Everyone talks about taxes in Andorra, but what do you really know about the Andorran tax system?

Taxes in Andorra compared to its neighbors

Andorra enjoys a very competitive tax system compared to its neighbors, which is one of the country's most prominent attractions. To benefit from this tax system, it is necessary to be fiscally resident in Andorra.

Taxes in Andorra, like in most countries, are divided into two main groups: Direct taxes and indirect taxes.

Therefore, in the following table, we show a comparison of the taxation that activities carried out by an entity would be subject to, both from a direct and indirect tax perspective.

Information about Taxes in Andorra

The Andorran tax system is one of the most advantageous tax systems in the world, with very few costly and complex administrative procedures, and internationally recognized legal security. This is supported by having signed more than 10 agreements on non-double taxation with the main countries in our geographical area.

The advantages of these agreements are to avoid that the incomes earned by companies, entrepreneurs, or residents in Andorra are taxed twice, both in the country where they are earned and in the country where one is a resident. Currently, Andorra has treaties to avoid this double taxation with Spain, France, Portugal, Luxembourg, Liechtenstein, the United Arab Emirates, Malta, Cyprus, San Marino, and Hungary.

These international agreements to avoid double taxation establish mechanisms to prevent the same income earned by a taxpayer from being taxed in two or more countries for the same taxable event or identical tax periods.

Direct Taxes

Currently, the general tax rate in Andorra is 10%, both for companies, non-residents, and individuals. In the corporate tax, this general tax rate of 10% can include a series of deductions to avoid international or national double taxation, deductions for job creation, or for investments or R&D. There is also a tax system that includes certain deductions or bonuses for entrepreneurs starting their activity.

Additionally, similar to many other countries in our environment, in the personal income tax (IRPF), the tax rate is progressive, with an exemption in the tax for incomes below 24,000 euros per year, or a deduction in the form of a 5% bonus for incomes obtained between the range of 24,000 euros per year to 40,000 euros per year.

These bonuses, deductions, and exemptions in Andorran taxes aim to attract talent from other parts of the world to make Andorra an innovative and entrepreneurial country that attracts foreign investment

Indirect Taxes:

Indirect taxes affect all countries, but their tax rates vary depending on each country. In this sense, Spain has a general rate in its indirect taxes (VAT) of 21%, France of 20%, Luxembourg of 17%, Portugal of 23%, or Germany of 19%, among others (see attached table).

Andorra offers a general rate of 4.5%, lower than many of the tax rates offered by countries in our European environment; mainly due to its strong commercial and historical tradition based on trade and to be able to offer a complementary offer to its extensive tourist offer.

The liquidation and operation of the tax is similar to that used in the European Union, following its same European directives; internationally approved and with a very similar but simpler operation than the countries in our environment. For example, the system of indirect taxes in Andorra does not use the "famous pro-rata rule" of some European countries, making its application and development much easier.

As the main conclusion and differential aspect of the Andorran tax system is that it is a system recognized internationally, based on regulations similar to those of countries in our environment, but with a much simpler implementation and application, due to the characteristics of Andorra as a European microstate, which makes us a country with fewer bureaucratic procedures.

Indirect Taxes in Andorra

Direct Taxes in Andorra

FREE CANCELLATION... Covid-19 update & cancellation policy: click here .

1. Select your resort

2. your first day on the slopes, 3. add extras, 1. select airport, 2. select resort, 4. passengers.

- Pas de la Casa

- Grandvalira

- Lift Passes

- Accommodation

- Airport Transfers

Andorra Resorts Blog

Welcome to our skiing blog, with updates and news for winter holidaymakers and snowsports lovers!

Tag: Andorra tourist tax

Andorra tourist tax.

If you’re coming to Andorra this winter you need to be aware of the new Andorra tourist tax, which started to apply to most tourist accommodation from July 2022. The tourist tax is payable by everyone aged 16 years and older, and is charged per person per night up to a maximum of seven nights.

- Company Formation

- Importing Cars

Tax System in Andorra

Andorra is a gorgeous principality in the Pyrenees mountain range, well known for its favorable taxation policies. The micronation didn’t have income taxes until the EU pressured it to implement basic income tax in 2015 with a maximum rate of 10%.

There are many advantages to becoming a tax resident, which is why you’ll see a steady increase in the expat community residing here.

In this guide, we’ll explore how Andorra’s taxation system works and learn more about the different kinds of taxes.

Andorran Taxes in a Nutshell

Even though Andorra is no longer recognised as a tax haven, its taxation policies are still among the most favorable you’ll find anywhere in Europe. The rules differ slightly for active and passive residents.

Passive residents can be exempt from the personal income tax (IRPF, with a maximum 10%) if they reside here for less than 183 days per year. They are also not required to make any passive declarations or declare their movements.

In practical terms, the 90-day requirement for passive residency and the 183-day requirement for active residency is a grey area.

Many of our clients voluntarily report themselves as fiscal residents and declare the tax with the authorities. Due to exemptions, their tax return can be zero. It’s possible to be a fiscal resident in the principality by residing for less than 183 days a year. This way your income is not subject to taxation.

The time spent here is not monitored and you don’t have to be physically present in the country for more than 183 days if you wish to declare taxes in Andorra and only pay a fixed rate of 10% for all income above €40,000/year.

Types of Taxes Levied in Andorra

The Andorran tax structure is designed with the intention of boosting economic activity, welcoming foreign investment, providing a solid base for expats, and creating a favourable environment for entrepreneurs. Here’s what the rates look like:

- Maximum 10% income tax (0% for passive foreign residents).

- Corporate tax rate of 10% (0-2% on foreign-sourced income).

- Lowest VAT In Europe at 4.5% (many items tax-free).

- Low property taxes (€100/year for a large house).

- Tax-free dividends (on all Andorran CIF funds for retirees).

- Non-taxable interest (on bank savings to €3,000 per year).

The IRPF, or Impost Sobre la Renda de les Persones Físiques , is a personal income tax that was introduced in 2015 after pressure from the French and Spanish governments — Andorra didn’t have an income tax prior to 2015.

Income tax varies based on the marital status of the tax resident. The government provides relief for couples with children and mortgages.

Value-Added Tax

VAT (Value-Added Tax) is the lowest in Europe. The most popular shopping items such as alcohol, cigarettes, and perfumes are duty-free and millions of shoppers from nearby countries shop in the country for cheaper prices.

Consumer goods are 20-40% cheaper than in France. The general VAT for other purchases is capped at 4.5% except for banking fees. Similar to other European countries, the VAT is determined by the product being purchased:

- 0% VAT on items such as cigarettes, alcohol, and perfumes. VAT exemptions also apply for medical services, housing rentals, and gold.

- 1% VAT for books, magazines, water, and meat products.

- 2.5% VAT for transport tickets, library membership, museum tickets, access to historical places, theatre tickets, art sales, theatre tickets, and similar.

- 9.5% VAT for banking and financial services.

For comparison, VAT is 20% in France, 20% in the UK, 21% in Spain, and 23% in Ireland. As a resident here, you will enjoy some of the cheapest consumer goods in Western Europe due to low VAT.

Corporate Tax

The principality has the lowest corporate taxes in Western Europe, with many tax exemptions. For comparison, Ireland, the biggest corporate tax haven in Europe has a tax rate of 12.5%. Here, the corporate tax is only 10%.

You don’t have to physically reside in the country to incorporate for tax purposes. It is possible to incorporate in Andorra for as little as €3,000 (not including agency fees).

The Andorran government gives tax advantages for the first 3 years:

- 50% reduction in the first year. This means the effective tax rate is only 5% for the first 12 months. If the company produces an income of €1,000,000, the corporate tax rate will only be €50,000.

Residents also have corporate tax exemptions in the first 3 years of operation. All new entrepreneurs and businesses who incorporate for the first time can enjoy the following privileges:

- 5% tax rate for income between €0-50,000 in the first 3 years.

We offer a company formation service and we can help you set up your corporation, including handling all paperwork in Catalan.

Real Estate Tax

Property tax is symbolic and tends to cost €100/year for a large 150m 2 + home. On average, you’ll be paying €0.75 per square meter in property taxes a year. The tax is determined based on the parish of residence.

The property tax only applies to property owners between the ages of 18 and 65. Property owners over the age of 65 do not have to pay property tax. There are transfer taxes for sold properties between 1.5-2.5% that are paid by the seller.

Note: Each parish imposes annual taxes for infrastructure maintenance that can amount to between €500 and €1,000 per year. This is the only real tax burden on property owners in the principality.

Tax on Rental Income

Rental income in Andorra is taxed depending on the property owner’s resident status. Local residents enjoy lower taxes on rental income while foreign residents still get relatively low taxes.

If you rent out a property on a long-term basis or a short-term rental such as Airbnb, you will pay between 0.4-4% as a local resident. As a foreign investor deriving income in the principality, the tax rate is fixed at 7.5% of the gross rental income.

Capitals Gains Tax (For Sales)

Capital gains taxes are paid by property owners who sell their Andorran property for a profit, however this rate changes depending on length of ownership.

The rate is the highest, at 15%, if the property is sold within 12 months of ownership. This decreases to 13% in the second year, 10% in the third year, and 1% each year thereafter. The capital gains tax is 0% if you’ve held the property for more than 12 years.

Capital gains taxes do not apply if the property was used as the main residence and the property owner purchases another property with the funds obtained from the sale within 6 months.

Vehicle Tax

Andorra makes it easy to import a car from the European Union and abroad. The import tax rate is only 4.5% (VAT) on the market value of the car. If a car is worth €10,000, the import tax will only be €450. The registration cost for a car is €200 as a one-time fee.

The license plate cost is €60 and is issued by the Automobile Club of Andorra. Vehicle registration is only possible for residents who possess a residencia (residence permit) in the principality and can provide proof of address.

The following vehicle importation rules apply:

- The vehicle has to be Class 5 or above energy-efficient, according to the EU emission standards.

- Older vehicles such as high-value classic cars can be imported and are exempt from the class-5 rating requirement.

- Important for UK residents: Vehicles with a right steering wheel are not permitted.

- Automotive insurance is mandatory for all vehicle registrations in the principality.

- Cars manufactured outside the European Union will be subject to a 10% income tax.

Dividends Tax

Dividends tax in Andorra only applies to foreign dividends. If the dividends are derived from Andorran entities and companies such as Andorran CIFs, they are subject to 0% personal income tax. This means that retirees who invested their money in Andorran CIFs can enjoy tax-free income for the rest of their lives.

If the dividends are derived from companies that are not resident in Andorra, they may be subject to the personal income tax at a maximum tax rate of 10%. However, these dividends can also be exempted under the double taxation rule. If the dividends have been taxed at 10% or more in it’s country of domicile, they are not likely to attract tax in Andorra.

A Fair System

So there you have it. While Andorra is no longer a country with zero tax, it’s what many would consider incredibly fair.

Similar to the tax benefits of Singapore and similar “offshore” countries like Hong Kong and the UAE, there are many opportunities to lower the amount you pay to the government each year, while staying completely compliant. That’s thanks to Andorra being compliant with OECD and other organisations.

Want to move to Andorra and become a tax resident? We can fast-track you to residency and advise you on tax-residency in the Principality of Andorra.

Main Benefits of the Tax System in Andorra

- Andorra has historically been known for its low tax policies.

- While it is not technically a tax-free country, the few rates that do apply are some of the lowest in Europe.

- There is a tiered system for the newly introduced personal income tax.

- The VAT system was introduced in 2013 and replaced the old Sales Tax regime.

Personal Finances, Investing and Macroeconomics

Taxes in Andorra [2023] – A Tax Haven in Europe

Last updated on 3 de April de 2023

Andorra is one of the most fiscally attractive countries in Europe. It also has plenty to offer. In this post, we do an in-depth analyses of taxes in Andorra.

Andorra’s economy

- Social security

Personal Income Tax

Capital income taxes, taxes on the purchase of a home, corporation tax.

Andorra is a very small country, with a population of less than 80,000 inhabitants. Its geographical location, between Spain and France in the Pyrenees, ski slopes and attractive taxes, make Andorra a unique place in the world.

The financial and tourism sectors are the most important for the Andorran economy. Financial services, skiing, and shopping lock in over 10 million visitors each and every year.

Because Andorra overhauled its tax system a few years ago, it is no longer officially considered a tax haven by the OECD. However, that designation tends to be subjective. And, as we will see below, there is no doubt that Andorra is, compared to most other countries in Europe, a tax paradise.

Taxes on earned income

Earned income in Andorra is subject to Social Security payments and personal income tax. This is what most workers in Andorra pay:

Social Security

Like most Western countries, Andorra has a social security system, managed by the Andorran Social Security Fund, known as CASS .

The CASS is responsible for a number of social benefits. These include retirement pensions, health insurance for residents of the country, as well as benefits associated with sick leave and unemployment.

Social Security contributions to the CASS are made by both the employer and the employee. And the self-employed contribute to it as well.

Companies that employ workers in Andorra must pay 15.5% of their gross salary to the social security. Of this percentage, 8.5% goes to the pension system, while the other 7% is for the rest of benefits.

As for employees, they must pay 6.5% of their gross salary to the CASS. 3.5% will go to the pension system, and 3% to other benefits.

Finally, let us look at what the self-employed pay to the social security in Andorra. In this category we would find the famous Youtubers who have decided to leave their country of origin to reduce their tax bill.

Youtubers, as well as other self-employed people, must pay 22% of the average monthly salary in Andorra to the CASS. The average monthly salary is always that of the previous year, which is around €2,100. Thus, the monthly contributions of the self-employed will be about €460.

In certain circumstances, it is possible for the self-employed to pay a lower social security contribution. This is the case only if they have recently started their economic activity or have incomes below the average salary in the country.

Employees and self-employed people in Andorra also pay personal income taxes. The personal income tax in Andorra is known as IRPF and has three applicable rates, which depend on the individual’s income level:

- 0 to €24,000: 0%

- €24,000 to €40,000: 5%

- More than €40,000: 10%

As you can see, both low and high incomes pay very little tax. This is why Andorra is such an attractive place when it comes to taxes. This is especially true for those who earn a lot of money and can choose where they want to live.

In addition, the Andorran income tax has several deductions that allow to reduce the tax bill even further. Thus, those who have children, are paying a mortgage or contributing to a private pension plan, will have to pay less taxes.

In fact, income taxes in Andorra are so low that, apparently, it is very common for workers to negotiate with their company what their net salary will be. The company will take care of any income taxes.

Capital income is also treated very favourably in Andorra. The first €3,000 per year that residents in Andorra receive are exempt from taxes. Everything that exceeds that figure will be taxed at a rate of 10%.

The tax rate applicable to capital income is not only low, but also easy to calculate. This contrasts with other countries, where taxes are much higher and their calculation is more cumbersome.

VAT in Andorra is known as IGI, which stands for General Indirect Tax, and taxes the consumption of goods and services in the country.

Although the general VAT rate in Andorra is 4.5%, reduced rates exist for certain categories. The following table lists all VAT rates, and the main products and services to which they are applied:

As you can see, the IGI rates are very attractive, especially when compared to those of other countries. In fact, Andorra is one of the European countries with the lowest VAT.

The purchase of a home in Andorra is also accompanied by the payment of taxes. In this case we would have to pay 4% of the value of the purchase, regardless of the amount.

Although this tax is not low, it is lower than what is paid in the two neighboring countries, Spain and France.

Corporation Tax in Andorra is 10%, applicable to both small and large companies. Thus, it is one of the most attractive rates in Europe.

To put it in perspective, the corporate tax in Spain is 25%, in France between 28-31%, depending on the size of the company, in Germany nearly 30% and, in Ireland, considered by many as a tax haven for companies, 12.5%.

Additionally, dividends distributed by companies domiciled in Andorra are not subject to any withholding taxes. This prevents double taxation.

Dividends are a good means for the self-employed to get paid, as there is no difference between receiving a salary, or getting paid through dividends. In both cases a tax rate of 10% will apply.

Andorra is a country with low taxes for everyone. It is for this reason that it is such an attractive place for those who can freely decide where they want to live.

Something remarkable, in addition to the low tax rates, is that the Andorran tax code is extremely simple. There are very few tax figures, making it possible for everyone to know how much they are paying.

This is in contrast with the tax codes of most European countries which are both expensive and difficult to follow.

If you would like to learn how much taxes are paid in other countries, check out this section: Taxes

I also encourage you to subscribe to my newsletter: Clear Finances

Published in Impuestos Taxes

Comments are closed.

- 2.1 History

- 2.2 Economy

- 2.3 Electricity

- 2.4 Visitor information

- 3.1 By plane

- 3.2 By helicopter

- 3.3 By train

- 3.4.1 Car rental

- 3.5.1 From France

- 3.5.2 From Spain

- 3.6.1 From Spain

- 3.6.2 From France

- 4.3 By taxi

- 7.1 Ski resorts

- 7.2 Hiking and trekking

- 8.2 Shopping

- 13 Stay safe

- 14 Stay healthy

- 16.1 Cellular service

- 16.2 Internet

- 16.3 Postal services

Andorra is a small, mountainous country in Western Europe , up in the Pyrenees between France and Spain . Full of beautiful mountains and charming old villages, the country thrives on tourism, mainly visitors from nearby countries who come for shopping, skiing, hiking, and banking.

Cities [ edit ]

- 42.5 1.5 1 Andorra la Vella — capital of Andorra

- 42.47 1.49 3 Sant Julia de Loria — south of Santa Coloma towards the border with Spain

- 42.508889 1.540833 4 Escaldes-Engordany — this is really an eastern suburb parish of Andorra La Vella

- 42.536111 1.582778 5 Encamp — parish to the NE of Andorra La Vella between Engordany and Canillo on the road to France

- 42.544167 1.516389 6 La Massana — small town and parish about 5 miles north of Andorra La Vella . You can access Arinsal - Pal ski area from it directly

- 42.555 1.533056 7 Ordino — northernmost and least populated parish but almost the largest by area

- 42.566378 1.60094 8 Canillo — northeasternmost parish on the main road and border to France

- 42.566667 1.483333 9 Arinsal — small village and ski resort in the north west

- 42.55 1.483333 10 Pal

- 42.543736 1.733736 11 Pas de la Casa — a town bordering with France

- 42.576944 1.667222 12 Soldeu

Understand [ edit ]

History [ edit ].

For 715 years, from 1278 to 1994, Andorrans lived under a unique co-principality ruled by the French head of state and the Spanish bishop of Urgell. In 1993, this feudal system was modified with the titular heads of state retained, but the Andorra government transformed into a parliamentary democracy. The French claim goes back to the Counts of Foix, whose claim passed to the Kings of Navarre, who came to be French kings in the 16th century. France abandoned the claim during the First Republic, but has continually exercised the position since the days of Napoleon, even under Republican governments. Long isolated and impoverished, mountainous Andorra achieved considerable prosperity since World War II through its tourist industry. Many migrant workers (legal and illegal) are attracted to the thriving economy with its lack of income taxes.

Economy [ edit ]

Tourism, the mainstay of Andorra's tiny, well-to-do economy, accounts for roughly 80% of GDP. An estimated 9 million tourists visit annually, attracted by Andorra's duty-free status and by its summer and winter resorts. Andorra's comparative advantage has eroded as the economies of neighbouring France and Spain have been opened up, providing broader availability of goods and lower tariffs. The banking sector, with its "tax haven" status, also contributes substantially to the economy. Agricultural production is limited—only 2% of the land is arable—and most food has to be imported. The principal livestock activity is sheep raising. Manufacturing output consists mainly of cigarettes, cigars, and furniture. Andorra is a member of the EU Customs Union and is treated as an EU member for trade in manufactured goods (no tariffs) and as a non-EU member for agricultural products.

Electricity [ edit ]

Electricity is supplied at 220 to 230 V 50 Hz. Outlets are the European standard CEE-7/7 "Schukostecker" or "Schuko" or the compatible, CEE-7/16 "Europlug" types.

Visitor information [ edit ]

- visitandorra.com (official tourism website)

Get in [ edit ]

Due mainly to the mountainous nature of Andorra, there is only one road entering Andorra from France , and only one widely-used road entering Andorra from Spain. Almost all entry into the country happens at one of these two points.

Andorra doesn't require a visa from any visitors, but because the country can only be entered from Spain or France, you'll need to enter the Schengen Area first in order to get to Andorra. See the Schengen Area entry requirements.

As Andorra is not a member of the EU, everyone entering Andorra is required to go through customs controls. See the Visit Andorra web-site for more information on your duty-free allowances.

Visitors from outside the EU should note that Andorra is not a Schengen member, and exiting France or Spain into Andorra would theoretically terminate a single-entry visa. In practice, though, immigration does not enforce this.

By plane [ edit ]

The nearest larger airports are:

Perpignan ( PGF IATA ) (France) 128 km (80 mi) to the east, no coach connections but you can take a Yellow train to La tour de Carol and further to l'Hospitalet.

Toulouse –Blagnac ( TLS IATA ) (France) 196 km (122 mi) to the north. You can pre book a coach or a taxi from Toulouse Airport to all the resorts in Andorra with Sea-Lifts .

Barcelona El Prat ( BCN IATA ) (Spain) 202 km (126 mi) to the south.

By helicopter [ edit ]

To Andorra la Vella, La Massana or Arinsal heliports, the journey from airports in Toulouse or Barcelona for a maximum of 5 passengers, takes less than an hour and costs €2500 .

See the Heliand website for more information (click "serveis particulars" when it appears).

By train [ edit ]

Andorra is the only sovereign non-island state in Europe to have never had a railway.

While there are no train lines or stations in Andorra, stations near the border can be accessed easily from Barcelona , Perpignan and Toulouse . There's also a direct sleeper from Paris .

As of 2017, the French Intercités de Nuit still serves both stations, but the network has been curtailed severely and this service could be axed in the foreseeable future, too. As with most long distance trains, early booking can net you very good deals indeed.

The French railway company, SNCF, used to operate one bus per day (TER Midi-Pyrénée, dep 09:35, 26 min, €3.20 , SNCF discounts apply) from the train station of L'Hospitalet-près-l'Andorre (also called Andorre-L'Hospitalet-SNCF or L'Hospitalet) to the first town after the Andorran border, the supposed shoppers' paradise of Pas de la Casa , from where it's possible to take frequent buses to Andorra-la-Vella ( €5.85 ) — every 30 min with Cooperativa Interurbana ( ☏ +376 806 556 , line 4) or cia Hispano-Andorrana [dead link] ( ☏ +376 807 000 ). Check!

Hispano-Andorrana [dead link] bus company runs services twice a day from the L'Hospitalet train station directly to Andorra-la-Vella, also calling at some other stops, for about €8 .

From France, getting to Andorra by train and onward bus costs around the same as the direct bus. It is very cost-effective for holders of SNCF discount cards such as Carte 12-25 or those coming with the sleeper train from Paris. Anyone under 26 years-old traveling at off-peak hours with SNCF is entitled a 25% discount (called "Découvert 12-25").

From Barcelona, the train-bus combination is much cheaper than the direct bus; however, it requires two changes: one in Latour de Carol and one in L'Hospitalet.

Caution : L'Hospitalet train station is in a deserted area, is often unmanned, and its rooms have restricted open hours, so in winter it's important to match connections well. If you need assistance, you may want to call the Toulouse train station at ☏ +33 8 91 67 76 77 .

By car [ edit ]

Roads in Andorra are generally of a good quality. Entering from the Spanish side is a relatively straightforward drive; however entering from France is a more stressful affair involving many hairpin bends. Border control officers at both sides are generally fine. Entering Andorra, you generally do not need to even stop, but you must slow down and be prepared to stop if requested. When leaving Andorra, you must stop and be prepared for delays during busy times. Fuel prices are usually lower in Andorra than France and Spain, so it's a good idea to fill up your tank before leaving the country.

Also beware of black ice and snow drifts as the temperature in Andorra can be much colder than at sea level. Be sure your car is in good condition.

The approach from the French side passes through the 2.9-km-long Tunel d'Envalira which requires a credit or debit card for payment of the fee. The amounts are: Dec–Mar (Apr–Nov)

- Cars €5.60 ( €4.80 )

- Others €16.70 ( €10.70 )

Occasionally the road through to France can be closed in winter due to heavy snowfall and avalanche risk. Weather and road conditions may be very different on the northern slope of the Pas de la Casa than to the south.

From November to April, it is necessary to have winter tyres or snow chains at hand in the car. In snowy road conditions, cars without winter tyres or snow chains fitted are not allowed to drive. This is often enforced by police checkpoints on access roads to the ski resorts and on mountain passes such as the CS-311 and the road above Pas de la Casa.

Car rental [ edit ]

The usual car hire companies operate from locations such as 'downtown'; the desks are sometimes quiet and unmanned so it may be a good idea to book in advance on-line, your rates should still be good value.

Taxi [ edit ]

Taxi Josep provides a Mercedes Benz car and speaks many languages ☏ +376 323 111 . Taxi Domènec Segura provides a van but does not speak English or French ☏ +34 636 490 685 (Spanish number) (Taxi Josep can arrange the ride). Payment must be in cash.

Andy runs private transfers from Barcelona city centre and El Prat airport. Price starts at €230 to Andorra la Vella for a 4-passenger sedan.

By bus [ edit ]

An overview of local buses can be found at bud.ad (in Catalan) international destinations are listed at busandorra.com .

Many coach routes serve Andorra, particularly from Spain , mainly Barcelona but also Girona , Madrid , Malaga , Lleida and Valencia .

Flixbus stops in the towns Andorra la Vella and Sant Julia de Loria .

From France [ edit ]

Toulouse is the main hub for accessing Andorra.

Andbus runs from Toulouse 's Matabiau bus station and Toulouse–Blagnac airport (both 3 hr, €35 ). The stop at Toulouse airport is outside Arrivals, Hall B in front of door B.

Other coach services operate via the French border towns L'Hospitalet (3 km from Andorra) and Latour-de-Carol (Spanish: La Tor de Querol, near the Spanish border, 20 km from Andorra). It is not recommended to take a train from Toulouse or Latour-de-Carol and connect to the public bus at the Gare d'Andorre-L'Hospitallet train station in the morning because the bus departs half an hour before the first SNCF train arrives at this station. The only suitable train-bus connection is the daily train from Toulouse that arrives at Gare d'Andorre-L'Hospitallet at 19:21 and the bus departs at 19:45. This bus service is catered towards Andorrans departing for France or Spain and connect to those trains towards Toulouse and Latour-de-Carol. An alternative option from the Gare d'Andorre-L'Hospitallet train station is to take a taxi to Pas de la Casa (~ €30 ).

From Spain [ edit ]

The trip from Barcelona takes 3 hr 15 min to 4 hr, depending on the number of stops.

Andbus connects Andorra to Barcelona 's airport ( €30 ); and Girona 's bus station and airport (both around 3 hr 30 min, €32 ).

Autocars Nadal also travels between Andorra and Barcelona and its airport.

Alsina Graells has eight trips a day from Barcelona ( €23 one-way and €40 round-trip).

ALSA has daily trips between Barcelona and Andorra. Bus leaves from Barcelona Nord. Tickets are ( €29 one-way and €55 round-trip).

By bicycle [ edit ]

From La Seu d'Urgell in Spain, a 10-kilometre (6.2 mi) ride with a moderate climb of some 150 m (490 ft) of elevation leads to the border of Andorra. There is no dedicated cycle path to the border. You'd ride on the wide shoulder of a somewhat busy highway with cars passing by at a respectful distance. From the border it's another 10 km (6.2 mi) and another 150 m (490 ft) climb to the capital Andorra La Vella.

While entering and leaving from Spain should be doable for most, the only connection with France goes across a true mountain pass. From the last village in France, L'Hospitalet près-l'Andorre (bikes can be brought on the train here from Toulouse) at 1,446 m (4,744 ft) elevation, you get to climb up to Port d'Envalira pass at 2,408 m (7,900 ft) before going back down to Andorra la Vella at 1,023 m (3,356 ft). While the pass seems to be open all year, it naturally can get extremely cold up there. Bicycles do not seem to be permitted on the Túnel d'Envalira which cuts through the mountain under the pass at about 2,000 m (6,600 ft) elevation.

For those who don't want to climb the mountain pass, the local L4 bus connects the capital Andorra la Vella and the border town El Pas de la Casa (2,080 m (6,820 ft) elevation) which is 15 km (9.3 mi) from L'Hospitalet près-l'Andorre. It's usually possible to lay the bikes in the luggage compartment of the bus without a requirement for further wrapping; note that this is not a specialised storage for a bicycle and the drivers naturally take no responsibility for any damages.

Get around [ edit ]

If you have a few days in Andorra, then you can easily visit most of the main villages by the local bus service operated by Cooperativa Interurbana Andorrana, S.A .

There are 7 main bus lines or 'línies', and all of these pass through Andorra La Vella. The fare is between €1.85 to €6.10 one-way depending on how far you are going. Drivers provide change. For the towns nearest to Andorra La Vella, the service is very regular, and as frequent as every 10 minutes during the day. If you are travelling to outlying rural places like Canolic, there are only 2 or 3 buses per day.

The lines are :

- L1 Sant Julia de Loria - Andorra la Vella / Escaldes-Engordany

- L2 Andorra la Vella - Encamp

- LC Circular bus route within Andorra la Vella and Escaldes-Engordany

- L4 Andorra la Vella - Encamp - Soldeu - Pas de la Casa

- L5 Andorra la Vella - La Massana - Arinsal

- L6 Andorra la Vella - La Massana - Ordino

- E (express) Sant Julia de Loria - Andorra la Vella/Escaldes-Engordany

There are also three night bus lines with sparse intervals:

- Bn1 Andorra la Vella - Sant Julia de Loria (every 60 min)

- Bn2 Canillo - Andorra la Vella - Canillo (every 120 min)

- Bn3 Ordino - Arsinal - Andorra la Vella - Ordino (every 90 min)

The roadways in Andorra are winding, congested, and small. Despite the close distances indicated on the chart, it is worthwhile to take your time. Traffic moves slowly. Many locations have narrow streets. It is crowded, particularly in and around the city. Sometimes it's challenging to locate parking.

The 43-km-long main route runs through Andorra. Although the road is generally in good condition, it can get very crowded, particularly near the borders. Although the highway is wide in some areas, driving through Andorra takes a while because of the towns and villages it travels through.

In Andorra, the top speed restriction is 90 km/h. These stretches are few and far between, and even those that do occur are not very long. Numerous roundabouts are present. Watch your mirrors because on the inside of the roundabout, locals often past sluggish tourists.

For Andorran travelers, rest or picnic places are few and far between. They are lacking even in places where there is room to construct them. Later on in this guide, a number of locations are recommended.

By taxi [ edit ]

Taxi Barras ☏ +376 323743 provides local service.

Talk [ edit ]