Top Travel Companies (0)

Don't see your company?

No company matches

Adjust filters or clear all to view companies

Work Your Passion. Live Your Purpose.

Bizvibe Blog

Global B2B Marketplace for Supplier Selection, Vendor Selection

Top 10 Travel Companies in the World by Sales in 2020, Travel Industry Factsheet

The Current State of the Travel Industry

As economic prosperity rises all over the world, the top 10 travel companies in the world are contributing to stellar growth and driving critical innovation by leveraging technology in a modern travel industry.

How big is the travel industry? As the economy for travel and tourism becomes more lucrative for a global audience, the travel industry grows as well. The global travel industry has grown from USD 6.03 trillion in 2006 to USD 8.27 trillion by 2017, growing at a CAGR of 2.9% — making the travel and tourism industry one of the world’s largest industries in the world in terms of global economic contribution (direct, indirect and induced).

- Discover who are the top 10 travel companies in the world by sales in 2020?

- A complete ranking and breakdown of 20 of the top travel companies in the global travel industry right now.

- Travel and tourism industry trends and stats you should know.

BizVibe is already helping the top travel companies in the world connect. Connect and track the latest news and insights from these companies.

Try BizVibe Free

Travel Industry Trends and Stats

- Convenient booking remains the biggest trend in the global travel industry.

- Solo Travel: Leisure travel is no longer just a family affair.

- The travel and tourism industry generated 10.4 percent of all global economic activity last year.

- The travel industry is the second-fastest-growing sector in the world, ahead of healthcare (+3.1%), information technology (+1.7%) and financial services (+1.7%), and behind only manufacturing.

- Last year, travel and tourism increased its share of leisure spending to 78.5 percent.

- Three in five travel companies say they offer customer service via chat.

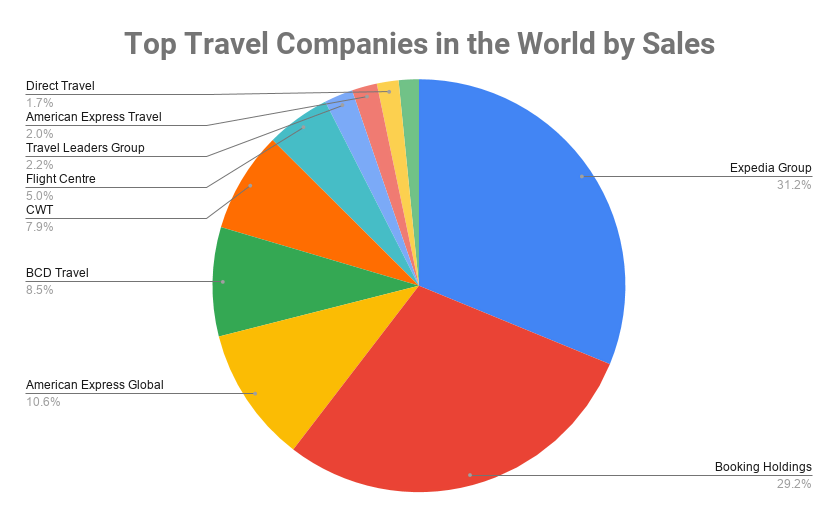

Top 10 Travel Companies in the World by Sales in 2020

Who are the top 10 travel companies in the world by sales as of 2020? The following is a list of largest adventure travel companies and top travel agencies ranked by sales generated in USD billion.

1. Expedia Group

What is the best travel agency? That’s a hard and subjective question to answer, but if you were to go by the best travel agency in the world in terms of sales, then your answer is Expedia Group. Expedia Group is an American online travel shopping company for consumer and small business travel. The company is mainly known for its travel fare aggregator websites where you can drop in and book all your travel needs from flights, car rentals, and even hotels. Expedia is also a metasearch engine to search up and plan your entire travel plans.

Expedia is a travel technology company that brought in sales of USD 99 billion last — making it the leaders in sales among the top 10 travel companies in the world on this list. In addition to the main expedia.com website, the company runs multiple websites from the best travel companies including Travelocity and trivago.

- Founded: 1996

- Expedia Group Headquarters: Bellevue, Washington, USA

- Expedia Group Sales: USD 99 billion

- Expedia Group Number of Employees: 24,000

Expedia Group Products and Services

- Classic Vacations

- Expedia CruiseShipCenters

- Expedia Local Expert

- Expedia Partner Solutions

- Hotwire Group

- Travelocity

2. Booking Holdings

Number 2 on this list of the top 10 travel companies in the world is the American company Booking Holdings Inc. The company is known for operating travel fare aggregator websites and travel and tourism search engines such as its flagship booking.com, as well as Priceline.com, Agoda.com, Kayak.com, Cheapflights, Rentalcars.com, Momondo, and OpenTable. Booking Holdings generated sales of USD 92.7 billion last year, with nearly 90% of its profits coming from booking.com and outside the USA. Book Holdings is truly a global travel company that is expected to continue generating stellar sales within the global market.

- Booking Holdings Headquarters: Norwalk, Connecticut, USA

- Booking Holdings Sales: USD 92.7 billion

- Booking Holdings Number of Employees: 24,500

Booking Holdings Products and Services

.

- Cheapflights

3. American Express Global Business Travel

American Express Global Business Travel (GBT) is 3 rd on this list of the top 10 travel companies in the world. GBT is a corporate management travel company operating under a 50% ownership stake from American Express. GBT is known as a business travel management company, major corporations use GBT’s services to manage corporate travel and meetings programs, providing services and support to business travelers.

Last year, GBT brought in sales of USD 33.7 billion — making it one of the top travel companies going by sales figures.

- Founded: 2016

- American Express Global Business Travel Headquarters: Jersey City, New Jersey, USA

- American Express Global Business Travel Sales: USD 33.7 billion

- American Express Global Business Travel Number of Employees: 17,400

4. BCD Travel

BCD Travel ranks 4 th on BizVibe’s list of the best travel companies by sales figures in 2020. BCD Travel is a provider of global corporate travel management and the largest travel company in the Netherlands. Currently, the company operates in over 109 countries and last year generated USD 27.1 billion in sales. BCD Travel’s parent company is BCD Group, a privately held Dutch company focused on travel services and corporate travel management.

- Founded: 2006

- BCD Travel Headquarters: Utrecht, Netherlands

- BCD Travel Sales: USD 27.1 billion

- BCD Travel Number of Employees: 13,800

BCD Travel Products and Services

- Travel management

- Travel consulting, meetings and events

5. CWT

Formerly known as Carlson Wagonlit Travel, CWT ranks 5 th on this list of the top 10 travel companies in the world by sales in 2020. CWT is a travel management company that manages business travel, meetings, incentives, conferencing, exhibitions, and handles event management. The company is known for running a top tier B2B travel management platform, offering business travel, technology, and meetings and events management across 145 countries.

Last year, CWT generated sales of USD 25 billion — making it one of the top travel companies in the world in terms of transactional sales.

- Founded: 1994

- CWT Headquarters: Minneapolis, Minnesota, USA

- CWT Sales: USD 25 billion

- CWT Number of Employees: 18,000

6. Flight Centre Travel Group

6 th on BizVibe’s list of the top 10 travel companies in the world is Flight Centre, the largest retail travel agency in Australia. Flight Centre is headquartered in Brisbane and was founded in 1982. Flight Centre operates over 2,800 stores and offices under various retail and corporate brands in n Australia, New Zealand, United States, Canada, United Kingdom, South Africa, Hong Kong, India, China, Singapore, United Arab Emirates, and Mexico.

Last year, Flight Centre generated USD 16 billion making it one of the top travel agencies in the world by sales numbers. 50% of the company’s sales come from leisure and 50% from business.

- Founded: 1982

- Flight Centre Headquarters: Brisbane, Queensland, Australia

- Flight Centre Sales: USD 16 billion

- Flight Centre Number of Employees: 20,600

7. Travel Leaders Group

Ranking 7 th on BizVibe’s list of the top 10 travel companies in the world is the Travel Leaders Group, a multi-unit travel industry company headquartered in New York City that has more than 7,000 company-owned, franchised and affiliated travel agency locations in the United States, Canada, the United Kingdom, and Mexico. The company has more than 52,000 travel agents worldwide and last year generated sales of USD 7.12 billion — making it one of the best travel agencies around. USD 3.73 billion in sales come from 52,000 hosted agents.

- Travel Leaders Group Headquarters: New York City, New York, USA

- Travel Leaders Group Sales: USD 12 billion

- Travel Leaders Group Number of Employees: 4,000

8. American Express Travel

American Express Travel is a full-service global travel and lifestyle network and 8 th on this list of the top 10 travel companies in the world by sales. Last year the company generated sales of USD 6.27 billion. In March 2014, American Express announced that it signed an agreement to create a joint venture for business travel and spun off its corporate travel business like American Express Global Business Travel

- Founded: 1915

- American Express Travel Headquarters: New York City, New York, USA

- American Express Travel Sales: USD 6.27 billion

- American Express Travel Number of Employees: 5,000

9. Direct Travel

Direct Travel is a leading travel management company, DT creates personalized solutions through an agile approach to corporate travel, meetings & events, and leisure. The company ranks 9 th on BizVibe’s list of the top 10 travel companies in the world due to its stellar sales figures — generating USD 5.4 billion in transactional sales last year.

DT sells directly to consumers for corporate travel, meetings and incentives, group travel, and leisure vacations., with 87% of its sales coming from its business segment; 8% from leisure, and 5% from all other avenues.

- Founded: 1980

- Direct Travel Headquarters: Centennial, Colorado, USA

- Direct Travel Sales: USD 5.4 billion

- Direct Travel Number of Employees: 2,000

10. Corporate Travel Management

Rounding out BizVibe’s list of the top 10 travel companies in the world in 2020 is Corporate Travel Management, a global provider of innovative and cost-effective travel solutions spanning corporate, events, leisure, loyalty, and wholesale travel. CTM provides local service solutions to customers around the world, through a blend of CTM owned and operated offices and a network of independent partner agencies. Last year, CTM generated USD 5 billion in sales — making it one of the top travel companies in the world by sales numbers.

- Corporate Travel Management Headquarters: Denver, Colorado, USA

- Corporate Travel Management Sales: USD 5 billion

- Corporate Travel Management Number of Employees: 725

This is BizVibe’s list of the top 10 travel companies in the world in 2020 by sales. These companies are changing the way businesses are pushing the boundaries in the global travel industry and are leveraging technology to push travel agencies and corporate travel management to new heights.

Reach out to the top travel companies on BizVibe today.

Top Travel Companies by Sales in 2020

The following is BizVibe’s complete ranking of the top travel companies in the world by sales figures in 2020. This list of travel companies are paving the way for success in the travel industry, connect with them on the BizVibe platform to track the latest news and insights from these companies.

The Future of the Global Travel Industry

What’s the future of the global travel industry? As economic prosperity rises throughout the world, the travel industry will be flooded by people from all over the world, and businesses are going to be at the forefront of this growth pushing their services to meet demand. Expect the top 10 travel companies in the world to continues pushing the industry to new heights. The main thing to keep in mind going forward as more people travel from all over the world is that the future will be about more travelers and easier to reach places

Connect on BizVibe

Related Articles

- Top 10 Largest Pharmaceutical Companies in the World by Revenue 2020

- Top 10 Largest Insurance Companies in the World by Asset Size in 2020

Related Posts

The US Diamond Market Remains the World’s Largest

The US diamond market continues to show signs of strong performance, as both market demand and diamond exports are experiencing…

Global Oil and Gas Industry Overview: Largest Oil and Gas Consuming Countries (2018)

The global oil and gas industry is one of the most critical sectors in the modern society, as it is…

How to Increase Sales: 9 Strategies for Improving Sales Numbers

How to Increase Sales in 2023? A good sales strategy is essential to any company trying to compete in the market.

Manage Settings

Get 50+ Insights for 45K Travel Companies | Risk Reports | Financials | Top Competitors | Regional Trends Try for Free>>

IMAGES