Would you like to view this website in another language?

Travel allowance: A Comprehensive Guide for Employees

- Written by: Rinaily Bonifacio

- Last updated: 11 March 2024

This article will explain travel allowance, when and how you can use it, and tips for getting the most out of your expenses.

Table of contents

What is travel allowance?

How does business travel allowance usually cover, what is a flat travel allowance, what is the daily allowance, easy ways on how companies manage their procedures for business travel allowances, effective communication, how to manage business travel allowances.

Travel allowance is a type of compensation employers provide to cover employee travel expenses incurred when traveling for business purposes. It helps with employee travel costs, such as transportation, lodging, meals, and other incidentals while on the job. Depending on the company policy, travel allowance may be given in cash or as reimbursed expenses.

For example, some companies provide a fixed daily amount for meals and lodging that employees can use during their travels. Other companies cover expenses incurred by employees when they submit receipts after their trip has ended. This is known as per diem allowance or transport allowance.

Business travel allowance typically covers the cost of airfare, hotel accommodations, and meals. It may also include per diem allowances such as ground transportation, parking, and incidentals. The exact coverage will vary depending on the company's policies and the type of business trip.

A flat travel allowance is a set amount of money an employee provides for travel costs. The employee is responsible for managing the funds and ensuring they are used for the intended purpose. This allowance is typically used for short trips or employees who travel infrequently.

.png?width=323&height=124&name=img-16%20(1).png)

Employee scheduling and Time-tracking software!

- Easy Employee scheduling

- Clear time-tracking

- Simple absence management

A daily allowance, also known as a per diem, is a set amount of money provided to employees for money incurred daily while traveling for business purposes. It typically covers things such as

- Transportation

- And incidentals.

The allowance amount is usually based on the location and duration of the business trip and is intended to cover living costs for that specific location.

Daily allowances are provided in addition to other travel compensation types, such as lodging or airfare reimbursement. The amount and coverage of a daily budget will vary depending on the company's policies and the nature of the business travel.

Companies can manage their procedures for business travel allowances by establishing clear guidelines and policies. This should include information on who is eligible for the assistance, what travel costs are covered, and how to submit expense reports. Additionally, companies can use travel management software to track and approve payments and ensure company policy compliance.

It is also essential for companies to communicate effectively with employees about travel allowance policies so that they are aware of their rights and obligations. This can include providing training and support and regular updates on any policy changes.

By managing their procedures for business travel allowances in a clear and organized manner, companies can ensure that their employees have the resources they need to complete their business trips while also managing the company's expenses.

Another critical aspect of managing business travel allowances is to keep an eye on the per diem rates and lodging expenses. It is essential to ensure that these expenses are within the budget and are in line with the rates established by the General Services Administration (GSA). Companies should also consider implementing a system for meal allowance and car hire reimbursement, as well as for laundry services, parking fees, and other miscellaneous expenses.

To manage business travel allowances effectively, companies should establish clear guidelines for employees traveling within the continental United States and those traveling to foreign countries. This includes setting a budget for each travel and providing employees with the necessary forms for expense reporting and reimbursement.

In addition, companies can use data analysis to identify trends and patterns in travel expenses. This can help them make more informed decisions about travel policies and budgeting and potentially save money on future trips.

It's also important to consider the needs of business travelers and their families and to establish policies that support them. For example, companies may offer additional allowances for family members traveling with a business traveler or for international travel.

Overall, an efficient reimbursement system and clear travel policies can help ensure that employees are promptly reimbursed for their expenses and that the company's expenses are tracked and managed effectively. This can be a great way to manage business travel allowances and keep costs under control.

Written by:

Rinaily Bonifacio

Rinaily is a renowned expert in the field of human resources with years of industry experience. With a passion for writing high-quality HR content, Rinaily brings a unique perspective to the challenges and opportunities of the modern workplace. As an experienced HR professional and content writer, She has contributed to leading publications in the field of HR.

Please note that the information on our website is intended for general informational purposes and not as binding advice. The information on our website cannot be considered a substitute for legal and binding advice for any specific situation. While we strive to provide up-to-date and accurate information, we do not guarantee the accuracy, completeness and timeliness of the information on our website for any purpose. We are not liable for any damage or loss arising from the use of the information on our website.

Ready to try Shiftbase for free?

- Whistleblowing Policy

- First Aid in the Workplace

- Cell Phone Policy at Work

- Inclement Weather Policy

- Employee Non-disclosure Agreement

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Understanding business travel deductions

More in news.

- Topics in the News

- News Releases

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IRS Tax Tip 2023-15, February 7, 2023

Whether someone travels for work once a year or once a month, figuring out travel expense tax write-offs might seem confusing. The IRS has information to help all business travelers properly claim these valuable deductions.

Here are some tax details all business travelers should know

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away.

Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

Employers can deduct travel expenses paid or incurred during a temporary work assignment if the assignment length does not exceed one year.

Travel expenses for conventions are deductible if attendance benefits the business. There are special rules for conventions held outside North America .

Deductible travel expenses include:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business.

- Lodging and meals .

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel.

Self-employed individuals or farmers with travel deductions

- Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) .

- Farmers can use Schedule F (Form 1040), Profit or Loss From Farming .

Travel deductions for the National Guard or military reserves

National Guard or military reserve servicemembers can claim a deduction for unreimbursed travel expenses paid during the performance of their duty .

Recordkeeping

Well-organized records make it easier to prepare a tax return. Keep records such as receipts, canceled checks and other documents that support a deduction.

Subscribe to IRS Tax Tips

Travel and Expense

What is a travel allowance definitions and insights.

A travel allowance can be an effective way to manage employee travel expenses and manage costs for the employee.

When employees travel for business, there are myriad expenses, from hotels to taxis or ride-sharing services. Using a travel allowance can help give travelers flexibility and control while increasing compliance with tax regulations.

What Is a Travel Allowance?

A travel allowance is compensation paid by an employer to employees to cover expenses incurred when traveling for business. In addition to lodging and transportation, travel allowances are typically used for airfare, meals, and other expenses related to business travel. It is business travel compensation, provided either before or after travel is completed.

Managing business travel compensation can be complex and hard to manage. The way businesses handle travel compensation is changing, as leaders look to implement tools that aid travelers and companies alike.

Technology is transforming how companies manage all aspects of employee travel , including the creation and coordination of travel allowances.

Types of Travel Allowance

There are many types of travel allowances, which can be given upfront or based on a reimbursement schedule. Here is a look at some of the most common.

Fixed Travel Allowance

A fixed travel allowance is a flat rate that is offered to an employee, irrespective of the level of expenses incurred. Employees are responsible for managing their travel expenses and determining how to use the money best to accommodate their needs. It is commonly used with employees for short trips or who travel infrequently.

Typically, with a fixed allowance, if the employee spends less than the allocated amount, the employee can keep the difference. If the employee spends more, they are responsible for making up the difference. Businesses using fixed travel allowance should work with their tax professional to understand the implications of this practice.

Daily Travel Allowance

Also called a per diem, a daily travel allowance is an amount used for each day of travel and can be used for lodging, transportation, meals, and other travel expenses. Typically, a traveler will reconcile the per diem by submitting an expense report and receipts. The traveler will be reimbursed for any expenses they spent in excess and will return money that was unspent.

Travel Reimbursement

This travel allowance requires the traveler to submit receipts for actual expenses incurred, which are then reimbursed. This process can be cumbersome and time-consuming for the traveler. If reimbursement is not done in a timely manner, it can be burdensome for the employee, who is essentially lending money to the company. Fortunately, there are technologies available today to simplify this work.

Mileage Allowance

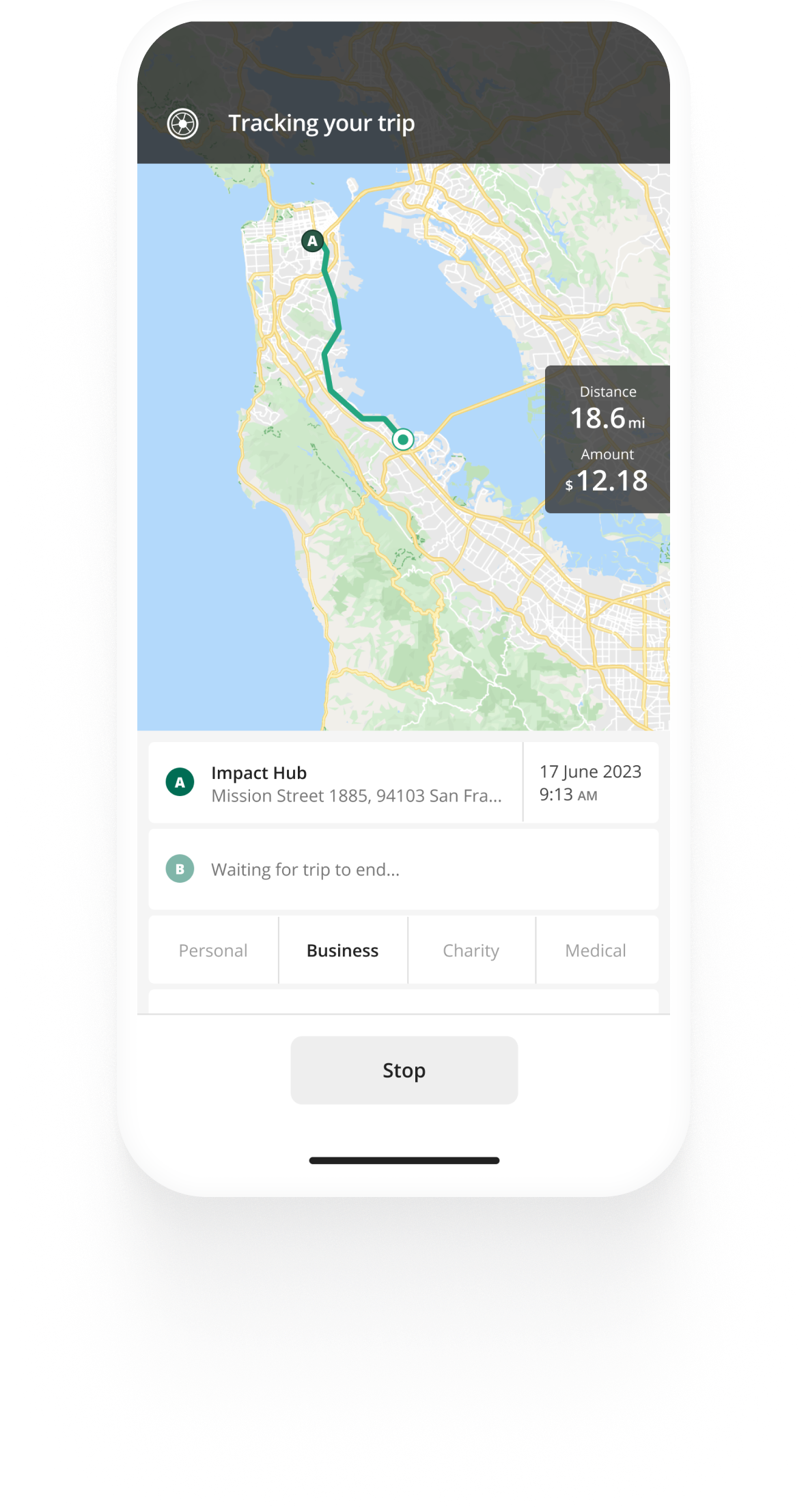

This type of allowance pays the employee for miles traveled on business. It is typically used when employees use their own car for business-related travel. Technologies can tracking and reimbursing for mileage simpler and more accurate.

Methods for Calculating Travel Allowances

When using travel allowances as part of a corporate travel program, one key consideration is how the travel allowances are calculated.

The process often has to consider the distance traveled and the time spent traveling. Here is one way to calculate a travel allowance.

Location and Days of Travel

Start by determining the location of the traveler at midnight on each day of travel. A day of travel is defined as a 24-hour period an employee is conducting business while traveling.

The day of travel ends when the next day starts or they return home from a business trip to their home or office. For example, if an employee leaves for a trip at 4 p.m., the first day of travel is from 4 p.m. that day until 4 p.m. the next.

Lodging allowances are provided based on whether an employee spends the night in accommodations other than their own home. Typically, lodging allowances are based on the location and the current price rates for various hotel categories, based on company preferences for the level of hotels allowed.

Unlike with other categories, usually lodging is an either/or determination. Employees are either allowed the lodging allowance or not based on the circumstances of the trip.

Like with lodging, meal allowances are usually based on the prevailing costs of meals in each location. It assumes that a traveler will have three meals a day.

Typically, a meal allowance covers both meals and incidentals, such as snacks. Often it is prorated based on the time in any given day a traveler is on the road.

The meal allowance may also be reduced if there are meals provided as part of the work travel, such as part of a conference registration fee or transportation ticket.

Managing Travel Allowances

Managing travel allowances is a complex task. Here are some tips on how to effectively implement and manage a program:

- Develop a Clear Policy. Travelers need to understand the specifics in your travel program and how allowances are used. The policy needs to spell out, for example, what expenses are allowed and not allowed and the ways in which allowances are calculated. Transparency is essential to ensure all employees understand how travel expenses are covered

- Consider Incidentals. Business travelers face many complexities and challenges. You want a policy that makes it easy for travelers to navigate while on the road. Be sure your policy covers costs that may arise, including parking, fuel, tips, laundry services, printing, internet fees, and luggage check fees

- Analyze Data. You need a system in place that collects and reports on travel data to allow you to better understand trends, shifts and challenges. With visibility into your travel program, you can make timely, well-informed decisions

Developing Travel Allowance Policies and Guidelines

If your company wants to develop a travel allowance policy, where should you begin?

The policy should be rooted in a broader travel policy which should consider the following:

- Scope. What aspects of business travel will your policy cover?

- Coverage. Determine which elements of travel the policy will cover, such as air travel, lodging, meals, incidentals, and ground transportation

- Reimbursement Types. Will your company use travel allowances and, if so, which types?

- Participation. How will policies be determined? Be sure to include staff from human resources, finance, and departments that frequently travel, in determining the policy

- Safety. Be sure your policy provides protection for employees while they are traveling

- Expense Reporting. Develop tools or adopt that will be used for the reporting of travel expenses, with an emphasis on scalability, technology integration, and ease of use

Technological Advancements in Travel Allowance Management

Technology is changing the way companies manage business travel . There are powerful platforms available today that integrate travel policies, allow for the booking of travel and itinerary management and provide robust data collection and travel.

Employees need access to easy-to-use tools that allow for the recording of receipts and other transactions, let them reconcile expenses and generate expense reports, and simplify approvals and routing.

SAP Concur solutions can provide companies with integrated business travel, expense, and invoice solutions. With SAP Concur solutions, companies can book travel, manage expenses, integrate with business systems, manage invoices, and more.

Learn more about how SAP Concur solutions can simplify your travel management .

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

What is a business travel allowance?

Are business travel allowances a legal requirement, what does a business travel allowance usually cover.

- Transportation expenses for additional travel outside employees' regular commute. This can encompass airfares, taxi or local transportation costs, car hire, motorway tolls, parking fees, and standard mileage rates when staff use their personal vehicles.

- A meal allowance for food and drink consumed on the business trip. Usually, this will cover breakfast and dinner only when there has been an overnight travel.

- Accommodation provisions.

- Cover for incidental expenses such as tips and gratuities.

- Entertainment expenses for cases where travelers need to step outside their food and beverage stipend for business meals or drinks with clients.

- Travel insurance policies purchased for the business trip.

- Costs for medical considerations such as vaccinations for international travel.

- Provisions for dry cleaning or other laundry services when employees are required to stay away from their usual work location for extended periods.

What is a per diem allowance?

How can companies standardize their procedures for business travel allowances, how to improve travel policy compliance with travelperk, where can you define your business travel expense policy, what is a realistic business travel allowance.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

Everything you need to know about civil service rates for mileage allowance in Ireland

?)

ATO Cents Per KM: 2024 Car allowance guide

?)

Measure these 9 top KPIs for travel management success

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

LTA (Leave Travel Allowance): Meaning, Rules, Tax Exemptions and Conditions to claim

Hiral Vakil

Travelling offers a wide range of benefits. Taking time away from daily routine can reduce stress and improve mental and emotional well-being. However, vacations can be expensive. Income Tax provides various exemptions on such expenses to salaried individuals. One such exemption available is LTA i.e. Leave Travel Allowance. LTA is an allowance employers give to their staff for vacations in India.

LTA: Meaning

Conditions to claim lta exemption, leave travel exemption: eligibility, how to claim exemption on leave travel allowance.

Leave Travel Allowance is an allowance employers give to their employees as a part of CTC for travelling alone or with family to any place in India :

- either on leave or

- after retirement from service or

- after termination of service.

Income tax has laid down rules for claiming exemption of LTA.

Section 10(5) of the Income Tax Act along with Rule 2B has prescribed the conditions and limit of exempt leave travel allowance.

- Leave travel allowance should be a part of the employee’s salary structure.

- An exemption is available for actual expenses incurred by the employee including their family for domestic travel only.

- Spouse and children

- Parents, brothers, and sisters who are wholly or mostly dependent on the employee.

- Further, this exemption can be claimed for a maximum of two children born after 01/10/1998. For children born prior to this date, there is no restriction.

- It covers only the cost of travel for the trip (travel by rail, air or any other public transport). It does not cover the cost of hotel accommodation, food, etc.

- An exemption is available only for two trips in a block of four calendar years . The current block for leave travel is from 2022 to 2025.

- If an exemption is not availed during the block period, it can be carried over to the next block and used in the first year of the next block.

Let’s understand with an example:

Let’s say, an employee does not avail Leave Travel allowance for the block of 2018-2021. He is allowed to carry forward a maximum of one unavailed LTA to be used in the succeeding block of 2022-2025. Accordingly, if he avails LTA in April 2022, the same will be considered for the block of 2018-2021. Therefore, he will be eligible for exemption in respect of that journey and two more journeys can be further availed in respect of the block 2022-2025.

The LTA exemption is available only on the actual travel costs. Expenses such as sightseeing, hotel accommodation, food, etc are not eligible for this exemption. It is also limited to the LTA provided by the employer. For example: If the actual expense incurred is INR 50,000 but LTA as part of Salary is INR 35,000 then the maximum exemption available would be INR 35,000 only.

Exemption when various modes of transport are used for travel

Employees can claim Leave Travel Allowance exemption by submitting details in Form 12BB . They should submit the proof in support of their claim. Further employees can submit boarding passes, air tickets, train tickets, invoices from travel agents, etc, as documentary proof to their employers.

No, LTA can be claimed only for domestic travel. You can only claim LTA if the Employer provides it as part of your salary.

If an employee travels to different locations on a single vacation then the exemption available will be for the travel cost eligible from the place of origin to the farthest location by the shortest route possible.

It depends on the organisation’s policies as many companies allow LTA exemption only if employees take specific leave for vacation and not on official holidays or weekends.

No, You can claim LTA exemption only twice in a block of 4 calendar years. The current block of four years is 2022-2025.

Employees are advised to maintain proof such as flight tickets, invoices from travel agents, passes, etc. as they have to be submitted to the employer.

Employees can know the exempt Leave Travel Allowance amount from Form 16 issued by the employer at the end of the financial year. It is exempt u/s 10(5) of the Income Tax Act.

Since Leave Travel Allowance is a part of salary income, an employee can file ITR-1 while claiming exempt LTA. However, salaried need to file ITR-2 if their income is more than Rs. 50,00,000.

Got Questions? Ask Away!

Hey @sushil_verma

There are a wide range of deductions that you can claim. Apart from Section 80C tax deductions, you could claim deductions up to INR 25,000 (INR 50,000 for Senior Citizens ) buying Mediclaim u/s 80D. You can claim a deduction of INR 50,000 on home loan interest under Section 80EE.

Hey @Dia_malhotra , there are many deductions that you can avail of. Your salary package may include different allowances like House Rent Allowance (HRA) , conveyance , transport allowance, medical reimbursement , etc. Additionally, some of these allowances are exempt up to a certain limit under section 10 of the Income Tax Act.

- Medical allowance is exempt up to INR 15,000 on a reimbursement basis.

- Children education allowance is exempt up to Rs. 200 per child per month up to a maximum of two children.

- Conveyance allowance is exempt up to a maximum of Rs. 1600 per month.

Tax on employment and entertainment allowance will also be allowed as a deduction from the salary income. Employment tax is deducted from your salary by your employer and then it is deposited to the state government.

The benefit Section 80EEB can be claimed by individuals only. An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 1.5 lacs u/s 80EEB. However, if the electric vehicle is used for the purpose of business, the vehicle should be reported as an asset, loan should be reported as a liability and the interest on loan can be claimed as a business expense irrespective of the amount. (We have updated the article with the changes).

Thus, if you have a proprietorship business, you should claim interest amount as a business expense only if the vehicle is used for business purpose. However, if it is used for personal purpose, you can claim deduction of interest u/s 80EEB in your ITR since you would be reporting both personal and business income in the ITR (under your PAN).

As per the Income Tax Act, the deduction under Section 80EEB is applicable from 1st April 2020 i.e. FY 2020-21.

No issues. You’re welcome!

Hey @shindeonkar95

In case of capital gain income (LTCG/STCG), transfer expenses are allowed as deduction, except STT.

However, in case of business income (F&O, intraday), all expenses incurred for the business (including STT) are eligible to claim deduction in ITR.

Hope, it helps!

Is it possible to claim deductions under S. 80CCF for Infra bonds bought in the secondary market and held to maturity?

There were a number of 10 year infra bonds issued in the 2010- 2013 period, which will start maturing soon. These are all listed on the exchanges (although hardly any liquidity or transactions in them). If I were to buy some of these bonds in the open markets and hold them in my demat to maturity (<3 years), is it possible to claim tax deductions (upto 20k per year) under 80CCF for buying?

I couldn’t find anything on this. Any help is appreciated.

Hello @Veejayy ,

Yes you can claim deduction under 80CCF for investment made in specified infrastructure and other tax saving bonds bought in the secondary market and held to maturity.

Deduction under Section 80CCF can be availed only through investment in certain tax saving bonds, issued by banks or corporations after gaining permission from the government which shall be restricted upto 10,000 per year.

These bonds are generally long term bonds, having tenure of more than 5 years with a lock in period of 5 years in most of the cases. These bonds can be sold after the lock in period!

Also, interest earned on these bonds will be taxable.

Hope this helps!

Hi, I need to file my income tax for FY21, I am using Quicko platform for filing, I wanted to confirm if the ELSS investment amount for the FY21 is to be added in the section 80C, since I already the amount of Rs30,072 , should I add my ELSS amount to this existing amount and submit the total

Hey @Sheirsh_Saxena , yes, the investment amount needs to be added under 80C.

Continue the conversation on TaxQ&A

87 more replies

Participants

Last Updated on 5 months by Shreya Sharma

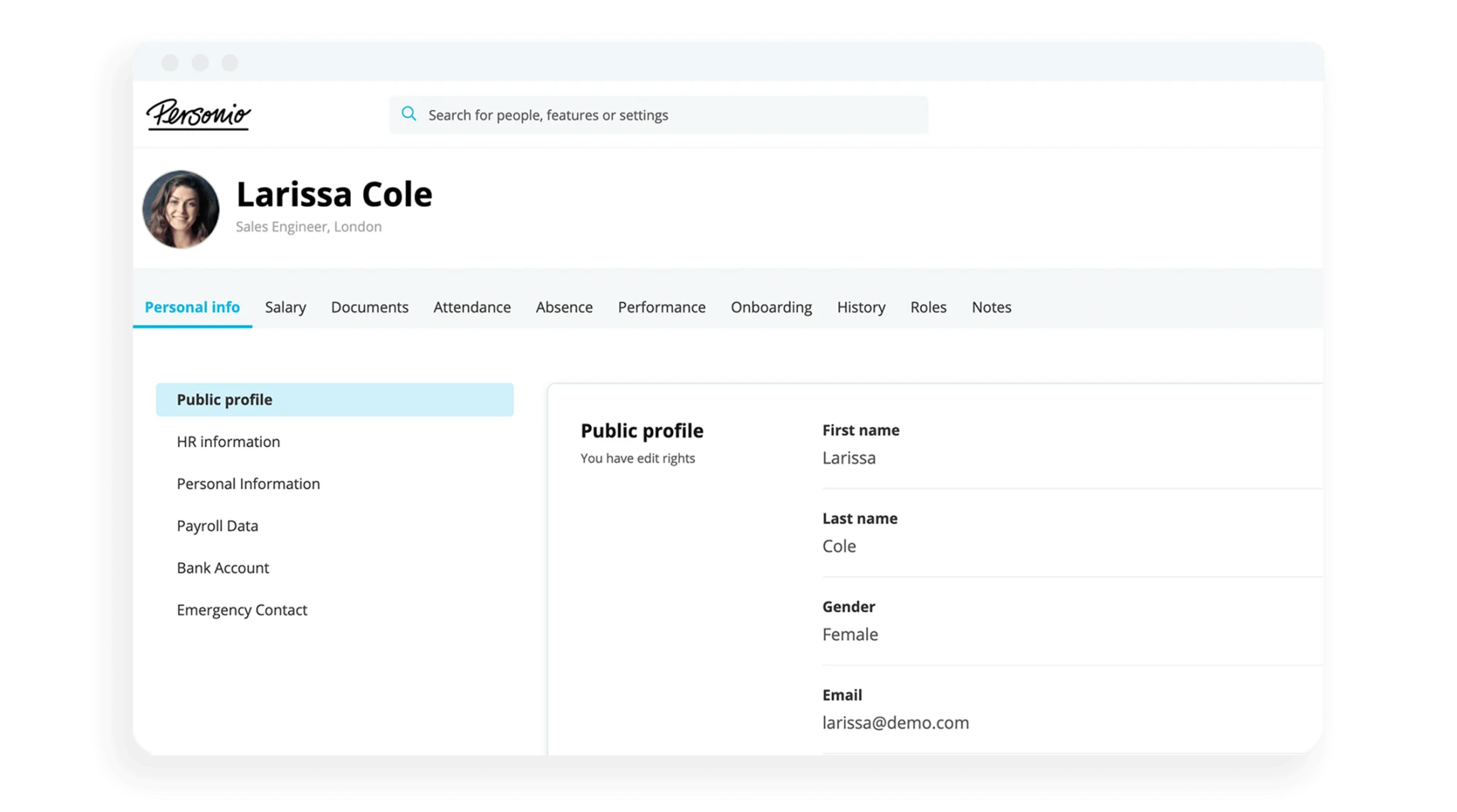

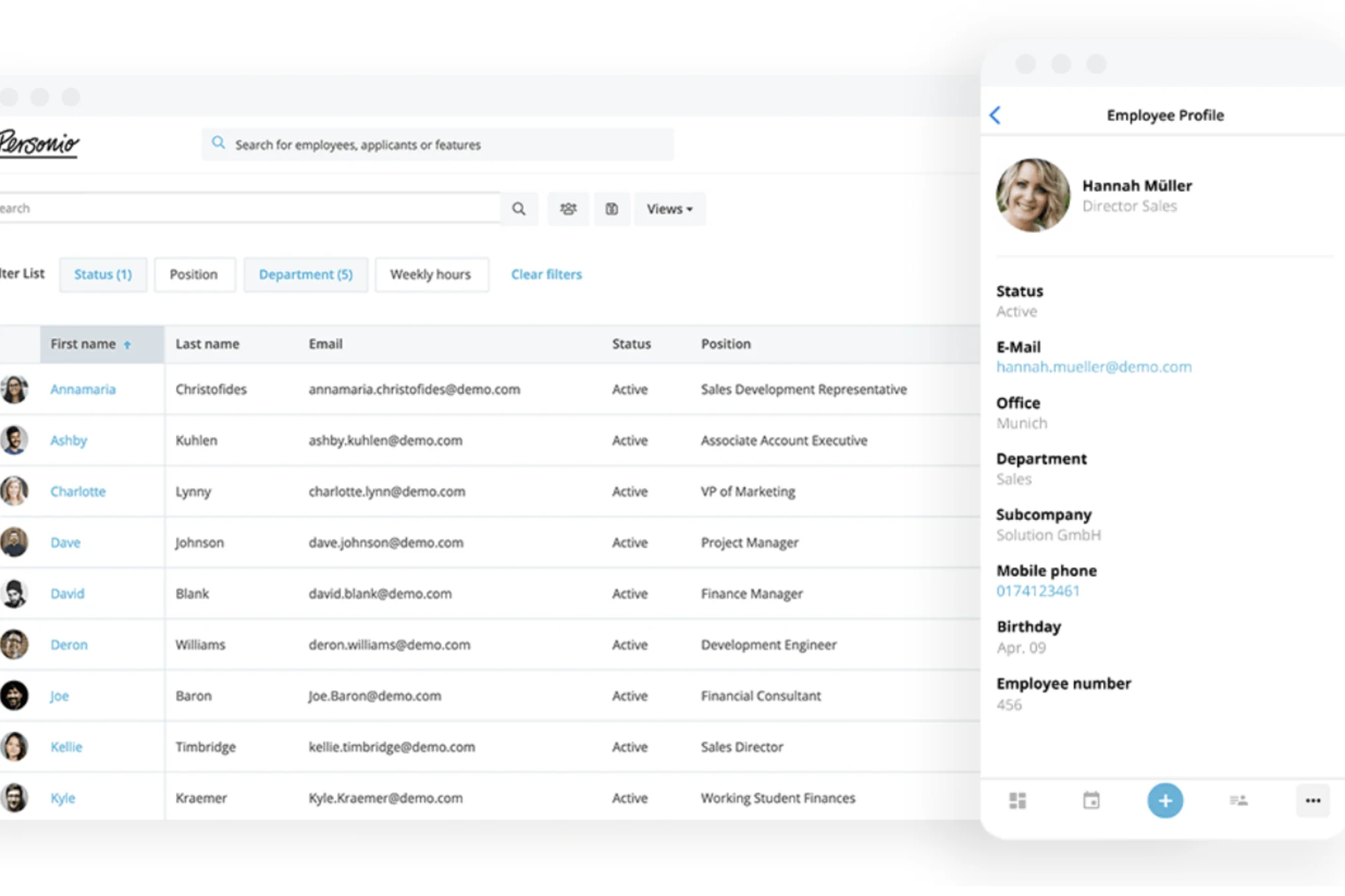

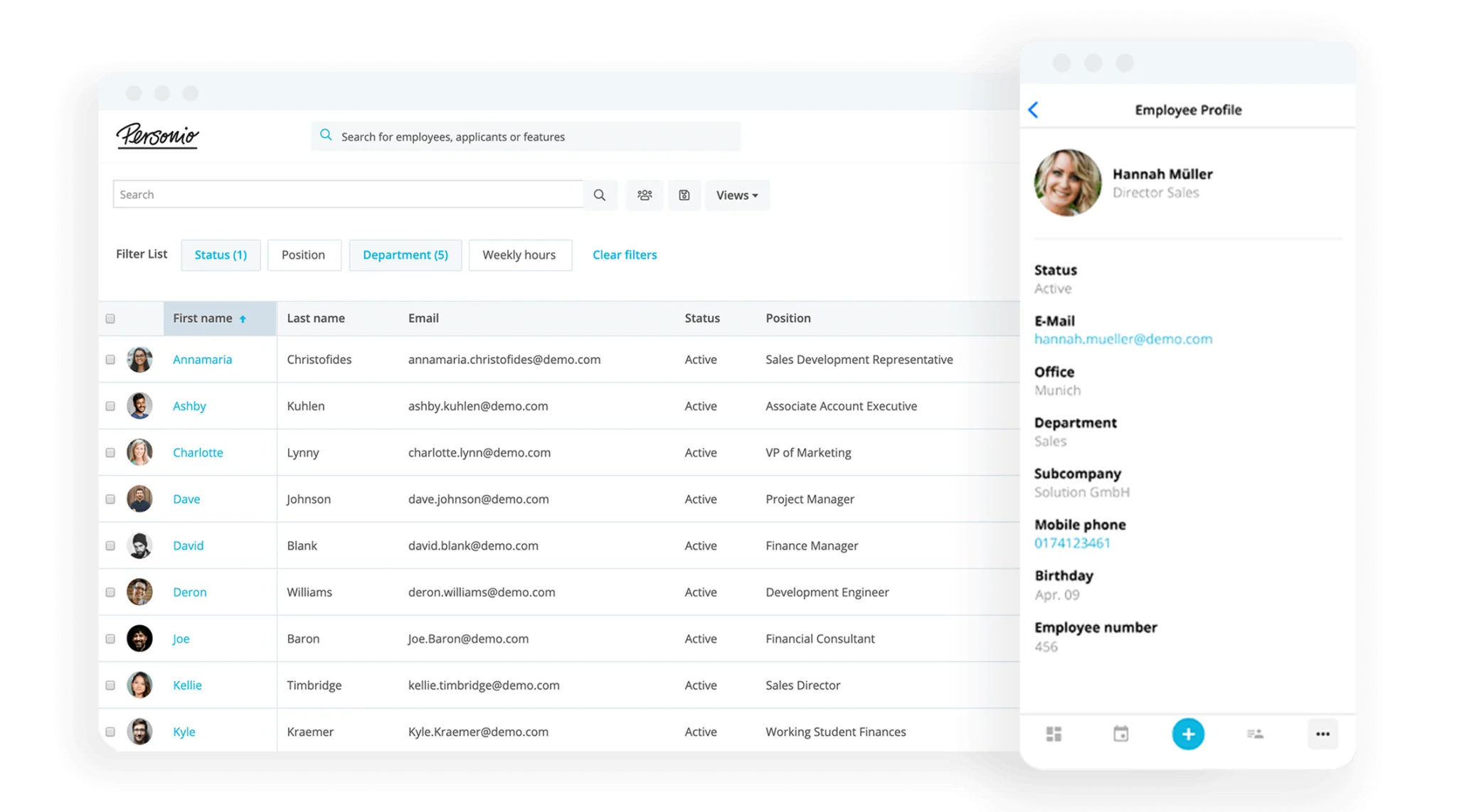

NEW : Run fairer and faster compensation reviews - learn how here

Say Hello To The Future of Filing

Organise your employee data.

Latest blog posts, travel allowance: how it works for employers.

A travel allowance is an optional perk offered by the employer and is discussed on a case-by-case basis between the employer and the employee. The goal of the travel allowance is to help commuters financially. This article will give you all the information you need about the travel allowance, covering the benefits and rules that come with it.

- 1 What is a travel allowance?

- 2 Using travel allowance to retain employees

- 3 Travel allowance: employer's tax responsibility

- 4 How to calculate travel allowance

What is a travel allowance?

In the UK, a travel allowance is a form of financial assistance provided by employers to employees to cover their commuting costs. This allowance helps employees offset the expenses incurred while traveling between their residence and their workplace.

Here's how a travel allowance typically works in the UK:

Employer decision: The provision of a travel allowance is at the discretion of the employer. It's not a mandatory benefit and is usually offered as an incentive to attract and retain employees.

Negotiation and agreement : If an employer offers a travel allowance, the terms are usually negotiated and agreed upon between the employer and the employee. This can include the amount of the allowance, the frequency of payment and any specific conditions.

Commute distance: The travel allowance may be influenced by the distance the employee has to travel to reach their workplace. Longer distances often result in higher allowance amounts.

Taxation : In the UK, travel allowances are subject to taxation. The amount of tax varies depending on various factors, including whether the allowance is considered a taxable benefit or not. Generally, travel allowances are subject to income tax and National Insurance contributions.

Claiming expenses: Alternatively, some employers may provide a travel expense reimbursement system instead of a fixed allowance. In this case, employees can claim expenses for their actual travel costs, such as public transport fares or mileage if they use their own vehicle for commuting.

Reporting and documentation : Employers and employees need to keep accurate records of travel expenses, such as receipts for public transport tickets or mileage logs. These records are important for tax purposes and may be requested by tax authorities.

Tax relief: Some employees may be eligible for tax relief on their travel expenses. This is typically applicable if an employee's travel is necessary for their job and the employer doesn't reimburse the full amount of expenses. The employee can claim tax relief through HM Revenue and Customs (HMRC).

Cycle to work scheme: In the UK, there's a specific scheme called the "Cycle to Work" scheme, which allows employees to obtain bicycles and cycling equipment through salary sacrifice, thereby saving on tax and National Insurance contributions.

Public transport schemes: Some employers may offer discounted or subsidised public transport schemes to their employees as part of their travel allowance benefits.

It's important to note that the specifics of how a travel allowance works can vary from one employer to another. Additionally, tax laws and regulations may change over time, so it's essential to stay informed about the latest guidelines.

Using travel allowance to retain employees

The rising rents in major cities will likely lead more employees to relocate to rural areas in the future. The scarcity of skilled professionals makes finding capable employees even tougher due to sometimes lengthy commutes.

Despite the high number of commuters, many employees prefer workplaces close to home to minimise travel time and expenses. Employers can use travel allowances as an extra tool for retaining employees, alongside other measures.

Centralise Your Employee Data

Stop relying on lists and spreadsheets. Organise and edit personnel files and documents with ease, all in one secure, legally compliant place.

Travel allowance: employer's tax responsibility

An employer's tax responsibility for a travel allowance in the UK involves ensuring proper taxation and reporting of the allowance according to the guidelines set by HM Revenue and Customs (HMRC). The tax treatment of a travel allowance depends on various factors, including the nature of the allowance and the method of payment.

Here's an overview of an employer's tax responsibilities for a travel allowance:

Classifying the allowance: Employers need to determine whether the travel allowance is a taxable benefit or an expense reimbursement. This classification affects how the allowance is treated for tax purposes.

Taxable benefit: If the travel allowance is considered a taxable benefit, it will be subject to income tax and National Insurance contributions. Employers are responsible for deducting the appropriate tax and National Insurance from the allowance before paying it to the employee. The value of the taxable benefit is usually calculated based on the amount of the allowance provided.

Expense reimbursement: If the travel allowance is purely a reimbursement of actual expenses incurred by the employee, it may not be subject to income tax and National Insurance. However, the reimbursement must be supported by valid receipts or documentation, and the expenses must be directly related to the employee's business travel.

Flat Rate Scheme: In some cases, employers may choose to use a flat rate scheme for travel allowances. This involves applying a fixed amount for tax purposes, regardless of the actual expenses incurred. The use of a flat rate scheme is subject to HMRC's rules and limitations.

Record keeping: Employers are responsible for maintaining accurate records of the travel allowances provided to each employee. Proper documentation should include details of the allowance, dates, amounts, and the purpose of the travel.

Reporting to HMRC : Employers are required to report taxable benefits and expenses provided to employees on the annual P11D form. This form outlines the value of benefits and expenses provided during the tax year. Employers must submit the P11D form to HMRC and provide a copy to the employee.

PAYE Settlement Agreement (PSA): In certain cases, employers may choose to include travel allowances within a PAYE Settlement Agreement (PSA). A PSA allows employers to settle the tax liability on behalf of the employee, simplifying the reporting process.

Compliance: Employers must ensure compliance with all relevant tax laws, regulations, and guidelines when providing travel allowances to employees. Failure to accurately report and deduct the appropriate taxes can lead to penalties.

It's important for employers to stay informed about any changes in tax laws and regulations related to travel allowances. Consulting with tax professionals or seeking guidance from HMRC can help ensure that an employer's tax responsibilities are met accurately and in line with the current regulations.

How to calculate travel allowance

Calculating a travel allowance in the UK involves considering various factors, including the distance of the commute, the method of transportation and whether the allowance is a flat rate or based on actual expenses.

Here's a general overview of how travel allowances can be calculated:

1. Determine the method of calculation: Some employers use a flat rate for travel allowances. In this case, a fixed amount is provided for each qualifying journey. Alternatively, employers may reimburse employees for the actual expenses incurred during their commute. This requires employees to provide valid receipts or documentation.

2. Calculate the commute distance: For a flat rate allowance, the commute distance may not be a direct factor in the calculation. For reimbursement based on actual expenses, calculate the distance between the employee's home and workplace. This can be done using tools like Google Maps or GPS devices.

3. Calculate the allowance amount: If using a flat rate, the employer decides on a fixed amount to be paid per qualifying journey. This amount could be based on typical travel costs, distance, or other relevant factors.

If reimbursing actual expenses, the allowance amount would be based on the expenses submitted by the employee. These expenses may include public transport fares, mileage for using a personal vehicle, parking fees, and tolls.

4. Take into account tax considerations: Determine whether the travel allowance is taxable or not. Taxable allowances are subject to income tax and National Insurance contributions, while non-taxable reimbursements are not.

5. Report and document everything: Keep accurate records of the allowance calculations, receipts and documentation for each employee. This is important for tax reporting and compliance.

6. Decide on frequency of payment: - Decide how frequently the travel allowance will be paid (e.g. weekly or monthly).

7. Notify employees: Communicate the details of the travel allowance calculation method, amount and payment schedule to employees.

8. Apply tax and national insurance deductions: If the travel allowance is taxable, deduct the appropriate income tax and National Insurance contributions before paying the allowance to the employee. The amount deducted depends on the employee's tax code and earnings.

It's important to note that travel allowance calculations can be complex, and employers should ensure compliance with HMRC guidelines and regulations. Employers may also consider consulting with tax professionals or payroll experts to ensure accurate calculations and reporting. Additionally, employees should be aware of the tax implications and any reporting requirements related to the travel allowance they receive.

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.

Keep Vital Data At Your Fingertips

Sign In to Digit

- Car Insurance

- Two Wheeler/Bike Insurance

- Commercial Vehicle Insurance

- Taxi/Cab Insurance

- Auto Rickshaw Insurance

- Truck Insurance

- Health Insurance

- Super Top-up Health Insurance

- Arogya Sanjeevani Policy

- Corporate Health Insurance

- Health Insurance Portability

- International Travel Insurance

- Shop Insurance

- Home Insurance

- Digit Life Insurance (clicking here will take you to Digit Life Website)

File a Claim

File health claim, file motor claim for garages, check health claim status, digit cashless garages, digit cashless hospitals, anywhere cashless hospitals, become digit posp, check pending challans, free credit score check, download digit policy, download digit app, marine open certificate issuance, grievance redressal procedure, irdai's call centre feedback survey.

- हिंदी English

Our WhatsApp number cannot be used for calls. This is a chat only number.

More Products

Trusted by 3 Crore+ Indians

Third-party premium has changed from 1st June. Renew now

Try again later

I agree to the Terms & Conditions

Terms and conditions

{{bikeCtrl.lastVisitedData.vehicle.makeModel | toTitleCase}} {{bikeCtrl.lastVisitedData.vehicle.variant? (bikeCtrl.lastVisitedData.vehicle.variant|toTitleCase): (bikeCtrl.lastVisitedData.vehicleCharacteristics.vehicleType | toTitleCase)}}

5"> {{bikeCtrl.lastVisitedData.vehicle.licensePlateNumber}}

{{bikeCtrl.selectedPlanDisplay[bikeCtrl.lastVisitedData.dropOffSelectedPlan? bikeCtrl.lastVisitedData.dropOffSelectedPlan: bikeCtrl.lastVisitedData.selectedPlan]}}

₹{{((bikeCtrl.lastVisitedData.dropOffSelectedPlan ? bikeCtrl.lastVisitedData.dropOffGrossPremium:bikeCtrl.lastVisitedData.chosePlan.grossPremium) .replace('INR ','')).split('.')[0] | rupeeFormatWithComma}} (Incl 18% GST)

Most Popular (You can select more than one)

{{geography.description}}

Popular Countries (You can select more than one)

As mandated by Spanish Authorities your travel insurance needs to extend 15 days after your trip ends. We will extend your coverage period accordingly.

In case, you wish to buy a plan for your siblings, aunts, uncles or any other relatives, you can buy a separate plan for them.

Try agian later

Port my existing Policy

Please accept the T&C

(Incl 18% GST) -->

You can select more than one member

- - healthCtrl.maxChildCount-1}"> + healthCtrl.maxChildCount-1 && healthCtrl.lastAdded===familyMember.name">Max kids (s)

Which countries are you visiting?

{{travelCtrl.countriesList}} Edit

- {{country}}

Leaving date

{{travelCtrl.startDate}} Edit

Return date

{{travelCtrl.endDate}} Edit

Travel Allowance: Exemptions Allowed Under Various Tax Regime

Salaried individuals receive various kinds of allowances, which helps them efficiently handle expenditures related to work, house etc. One such allowance is travel allowance. This piece will discuss travel allowance and its tax provisions thoroughly.

What Is Travel Allowance?

Travel allowance, in general, refers to the allowances provided to employees to meet expenses related to travel or for the purpose of transport.

However, travel allowance as mentioned under Section 10(14) of the Income Tax Act, 1961 and rule 2BB can refer to either of the following as travel allowance -

- Allowance offered to employees to cover expenses for commuting between place of residence and place of duty.

- Allowance offered to employees involved in transport business to cover their personal expenses during duty hours for running such transport from one place to another. Here, travel allowance is available only if employees do not receive a daily allowance.

Once the meaning of travel allowance is clear to individuals, let’s find out the exemption limit and other details.

What Is the Exemption Limit on Travel Allowance?

As per Section 10(14) and rule 2BB of the Income Tax Act, 1961, individuals can get an exemption on travel allowance. Take a quick glance at the following table to learn about the exemption limit of travel allowance specified under the Income Tax Act.

**Physically challenged employees –employees who are deaf or dumb or blind or orthopedically handicapped with disability of lower extremities

Individuals can get a fair idea about the exemption limit from the table mentioned above. Now, let’s learn about travel allowance under the new tax regime (FY 2020-21 onwards).

What Is Travel Allowance Under the New Tax Regime (FY 2020-21 Onwards)?

The Government has introduced an optional new tax regime for individuals and HUF from FY 2020-21. As per the new tax regime, there are flat tax rates and deductions and exemptions are no longer available.

For instance, individuals availing of the new tax regime cannot claim exemption on HRA allowance and others.

Further, individuals availing of the new tax regime cannot get a deduction on any kind of tax-savings investment.

Under the new tax regime, individuals can claim the exemptions mentioned below -

- Allowance to cover conveyance expenses spent while performing office duties or duties related to the employment of profit. Here, employers must not offer free conveyance to their employees. In short, this allowance is inclusive of travelling expenses of employees that might have incurred while on official duty.

- Allowance provided by an employer for managing the cost of travelling expenses incurred during tour or transfer. Here, allowance usually involves costs such as rail fare and other transportation expenses.

- Allowance provided by an employer to employees for covering daily expenditures while being absent from their usual place of work. The allowance is available while on a tour and for a certain time of transfer-related journey. This type of allowance includes expenses related to food and other daily expenses.

For salaried individuals who are blind or deaf or dumb or orthopedically handicapped with disability of lower extremities can avail travel allowance exemptions of up to ₹ 3,200 per month. This allowance is available for covering commuting expenditure from home to the workplace.

The details of travel allowance might confuse those who have little knowledge about Conveyance Allowance. Let’s clear the fog of confusion.

How Is Travel Allowance Different from Conveyance Allowance?

Travel allowance refers to those allowances that employers offer to employees to cover travelling expenses from the place of residence to the place of work or covering personal expenses of employees of transport business.

On the other hand, Conveyance Allowance refers to those allowances that employers offer to employees to cover expenses occurring due to official duties.

On the other hand, the actual expenditure incurred on conveyance is allowed for an exemption.

From the above discussion, individuals can gain a thorough understanding of travel allowance, exemption limits and the difference between Travel and Conveyance Allowance. Further, the discussion on the new tax regime (FY 2020-21 onwards) will help salaried individuals claim tax deductions judiciously.

Frequently Asked Questions

How much travel allowance can a handicapped person claim as an exemption annually.

Handicapped personas can claim exemption on travel allowance ₹38,400 per annum. [Source]

Handicapped personas can claim exemption on travel allowance ₹38,400 per annum.

How to calculate travel allowance?

To calculate travel allowance, subtract the employer-provided allowance amount from the offered exemption limit. For instance, if a handicapped person receives ₹6200 per month as TA, he/she can claim an exemption of up to ₹3200, which means the remaining taxable balance is ₹4000 per month. [Source]

To calculate travel allowance, subtract the employer-provided allowance amount from the offered exemption limit. For instance, if a handicapped person receives ₹6200 per month as TA, he/she can claim an exemption of up to ₹3200, which means the remaining taxable balance is ₹4000 per month.

Please try one more time!

Other Important articles

Standard Deduction on Salary

What Is Gratuity in Salary?

What is Gratuity Act?

7th Pay Commission

What Are the 7th Pay Commission Leave Rules in India?

- What is Basic Salary

What is Gross Salary

What is Discretionary Bonus

Difference Between Gross Salary and Net Salary

What is Double Taxation Avoidance Agreement (DTAA)?

City Compensatory Allowance

Dearness Allowance

Per Diem Allowance

- Travel Allowance

Leave Travel Allowance

Difference Between Real Income and Nominal Income

What is Net Salary

What is Medical Allowance in Salary?

What is Variable Pay?

What is Real Income?

Important Articles related to Finance

Employee Provident Fund

EPF Registration Process

How to Withdraw EPF Online

- Atal Pension Yojana Calculator

How to Change Details in Atal Pension Yojana Scheme

How to get Atal Pension Yojana Statement

How to Close Atal Pension Yojana Account

Sukanya Samriddhi Yojana

How to Open Sukanya Samriddhi Yojana Account

- Sukanya Samriddhi Yojana Calculator

What is Public Provident Fund?

How to Open PPF Account?

How to Check PPF Account Balance?

Eligibility Criteria to Open PPF Account

Types of PPF Forms

How to Withdraw PPF Online?

How to Invest in PPF?

- Financial Planning for Salaried Employees

Importance of Financial Planning

Financial Planning Tips for Women

How to Apply for Atal Pension Yojana?

What is UAN Number?

How to check EPF Balance

KVP Calculator

Voluntary Provident Fund

Difference between EPF and EPS

How to Check Sukanya Samriddhi Account Balance?

Investment Planning Guides

Professional Tax in India

Disclaimer: This information is added only for informative purposes and collected from different sources across the Internet. Digit Insurance is not promoting or recommending anything here. Please verify the information before making any decisions.

- Digit Insurance

- Salary Structure & Other Information

Last updated: 2024-03-14

Get our app

- Motor Insurance

- Bus Insurance

- Tractor Insurance

- Commercial Van Insurance

- Passenger Carrying Vehicle Insurance

- Heavy Vehicle Insurance

- Goods Carrying Vehicle Insurance

- Commercial Vehicle Third Party Insurance

- E-Rickshaw Insurance

- Electric Car Insurance

- Pay As You Drive

- Electric Bike Insurance

- Types of Motor Insurance

- Comprehensive vs Zero Depreciation

- Comprehensive Health Insurance

- Wellness Benefits

- Diabetes Health Insurance

- Family Floater VS Individual Health Insurance

- Health Insurance for Parents

- Health Insurance Plans for Family

- How to Lower Your Health Insurance Premium

- Indemnity Health Insurance

- Individual Health Insurance

- Health Insurance Premium Calculator

- Health Insurance Tax Benefits

- Health Insurance for Senior Citizen

- Health Insurance in Bangalore

- Corona Health Insurance

- Health Insurance covering Critical Illness

- Family Floater Health Insurance

- Third Party Bike Insurance

- Comprehensive Bike Insurance

- Zero Depreciation Bike Insurance

- NCB in Two Wheeler Insurance

- IDV Value Calculator for Bike

- Cashless Bike Insurance

- Add-on Cover in Bike Insurance

- Bike Insurance Calculator

- Own Damage Bike Insurance

- Comprehensive vs Third Party Bike Insurance

- Compare Bike Insurance

- Royal Enfield Classic Insurance

- Best Scooty in India

- How to Transport a Bike by Train

- Difference between Torque & BHP in Bikes

- Car Insurance Calculator

- Third Party Car Insurance

- Comprehensive Car Insurance

- Zero Depreciation Car Insurance

- NCB in Car Insurance

- IDV Calculator for Car

- Bumper to Bumper Car Insurance

- Own Damage Car Insurance

- Comprehensive vs Third Party Insurance

- Compare Car Insurance

- Find Vehicle Registration Details Online

- CNG Car Insurance

- Own Damage Insurance

- Popular Car Insurance

- Car Segment Guide

- What is RPM in Cars

- Property Insurance

- Fire Insurance

- Burglary Insurance

- Building Insurance

- Office Insurance

- Bharat Griha Raksha Policy

- Bharat Laghu Udyam Suraksha Policy

- Bharat Sookshma Udyam Suraksha Policy

- Home Insurance for Home Loan

- Pet Insurance

- Mobile Insurance

- Home Insurance Premium Calculator

- Top Low-Investment Franchise Businesses in India

- Assessing Officer of Income Tax Department

- Identity Theft & Frauds

- What is Financial Planning

- Management Liability Insurance

- General Liability Insurance

- Fidelity Insurance

- Professional Liability Insurance

- Workmen Compensation Insurance

- Money Insurance Policy

- Sign Board Insurance

- Plate Glass Insurance

- Erection All Risk Insurance

- Contractors' All Risks Insurance

- Directors' and Officers' Liability Insurance

- Marine Cargo Insurance

- Contractors' Plant and Machinery Insurance

- What is Micro-enterprise

- Difference Between Trademark and Patent

- Different Types of Industries

- Machinery Breakdown Insurance

- Non-Creamy Layer Certificate

- Income Tax Calculator

- HRA Exemption Calculator

- BMI Calculator

- Bike Loan EMI Calculator

- EPF Calculator

- Personal Loan EMI Calculator

- ULIP Calculator

- Vehicle Road Tax Calculator

- Online GST Calculator

- SIP Calculator

- 80D Deduction Calculator

- Human Life Value Calculator

- Ovulation Calculator

- Invoice Generator

- PDF to JPEG Converter

- Rent Receipt Generator

- What is Credit Score

- What is Public Provident Fund

- What is Sukanya Samriddhi Yojana

- Property Tax Guides

- Road Tax Guides

- How to Apply for Reissue of Passport

- Income Tax Slabs in India

- What is Atal Pension Yojana Scheme

- Everything about EPF

- Financial Planning for Women

- Everything about NPS

- ULIP vs Mutual Funds

- What is Professional Tax

- Everything about Annuity

- What is UPI Reference Number

- QR Code Guides

- Investment Guides

- Aadhaar Card Guides

- Is KYC Mandatory for Buying Insurance

- Everything about GST

- GST Registration in India

- Types of Insurance

- Types of General Insurance

- Government Holidays in India

- Indian Passport Rank

- Visa Free Countries for Indians

- Visa on Arrival for Indians

- PAN Card Guides

- Business Insurance Guides

- Best Business Ideas

- What is Custom Duty

- What is Debenture

- What is Nominal Account

- How to Drive a Car

- PUC Certificate

- Vehicle Registration Certificate

- New Traffic Fines

- Fine for Driving without Helmet

- Types of Driving Licence in India

- Driving Licence in Delhi

- Driving Licence in Bangalore

- Driving Licence in Jaipur

- Bangalore Traffic Fines

- Pune RTO Fine

- RTO Ahmedabad

- RTO Bangalore

- RTO Lucknow

- RTO Chennai

- Reasons for Visa Rejection

- Check UK Visa Application Status

- Schengen Travel Insurance

- Thailand Travel Insurance

- USA Travel Insurance

- Dubai Travel Insurance

- What Is Bangkok Famous For?

- Best Countries to Visit in August

- Best Beaches in the Maldives

- How to Get PR in Australia

- Countries with Easy Work Visa Process

- Foriegn Embassies in India

- Indian Embassies in Foriegn Countries

- Travel Insurance covering Adventure Activities

- Lost Your Passport When Travelling

- Apply for Schengen Visa from India

- Minimise the Cost of Travel Insurance

- How to Get International Driving License

- India Travel Guides

- Student Travel Insurance

- Family Travel Insurance

- Digit Insurance Reviews

- Car Insurance Reviews

- Bike Insurance Reviews

- Commercial Vehicle Insurance Reviews

- Travel Insurance Reviews

- Health Insurance Reviews

- Mobile Insurance Reviews

- General Insurance Agent

- Health Insurance Agent

- Motor Insurance Agent

- Everything about DigiLocker

- Bank Branch Locator

- IFSC Code Finder

- Excise Duty on Fuel in India

- Which Fuel is Used in Aeroplane

- Deductions & Exemptions Under the New Tax Regime

- Cooling System in Automobiles

- Importance of Motorcycle Helmets

CIN: U66010PN2016PLC167410, IRDAI Reg. No. 158.

Go Digit General Insurance Limited (formerly known as Oben General Insurance Ltd.) - Registered Office Address - 1 to 6 floors, Ananta One (AR One), Pride Hotel Lane, Narveer Tanaji Wadi, City Survey No.1579, Shivaji Nagar, Pune-411005, Maharashtra | Corporate Office Address - Atlantis, 95, 4th B Cross Road, Koramangala Industrial Layout, 5th Block, Bengaluru-560095, Karnataka | Trade logo of Go Digit General Insurance Ltd. displayed above belongs to Go Digit lnfoworks Services Private Limited and is provided and used by Go Digit General Insurance Ltd. under license.

What Is Covered Under LTA

LTA basically covers the expenses incurred by the employee for his own and family member’s travel. Spouse, parents, siblings and children are considered to be family members as far as the provisions relating to LTA are concerned. Travel cost incurred by the employee to book tickets for any other relatives will not qualify for exemption under LTA provisions.

It is also important to note that the costs incurred during the entire trip, which includes food, shopping and other expenses are not covered under tax exemption. The exemption is also not available for more than two children of an individual born post October 1, 1998.

If an employee books air tickets for the travel then his/her ticket cost should be equal to or lower than the limit allotted for LTA.

What Type Of Travel Is Considered Under LTA

LTA is only for domestic travels and does not cover international trips. LTA can be claimed by both the husband and wife in case both of them are working and the employer offers Leave Travel Concession. However, both of them cannot claim LTA for the same trip. Similarly, LTA cannot be claimed for the travel of only family members if the claimant is not travelling along.

Claiming LTA

You should check your pay structure before you plan to claim LTA as it is not a common part of the salary structure. It varies for one employee to the other. In case you are eligible for an LTA, you will be required to produce proof for your travel according to the criteria. You would be given a form to be filled along with travel documents like tickets, boarding passes and submitted to the relevant department once a date is announced for the same. This needs to be done before the final calculation for tax liability is done by the employer.

How To Claim LTA For A Multi-destination Journey

You need not worry if you are planning a multi-destination journey with your family. To claim LTA, travel need not be from one destination to the other. If you visit multiple places one after the other, LTA can be claimed for the journey from the place of origin to the farthest point you travel to by the shortest route. Just make sure to keep all travel proofs handy.

Making Journeys In A Block

LTA is provided for two travels made in one block. If you claim only one LTA in a block then the remaining LTA can be carried forward. However, it has to be claimed in the first year of the next block. Hence, in one block an employee can claim a maximum of three LTAs.

LTA forms an integral part of our salary structure as the concession is provided by the government to encourage employees to travel. So plan your travel well and spend some quality time with your family and enjoy your vacation well.

BankBazaar.com is a leading online marketplace in India that helps consumers compare and apply for Credit Card , Personal Loan , Home Loan , Car Loan , and insurance.

The post Confused About How To Claim LTA? Here’s Everything You Need To Know appeared first on BankBazaar - The Definitive Word on Personal Finance .

Track mileage automatically

Travel allowance, in this article, what is a travel allowance, how travel allowances work, providing travel allowances in the usa.

A travel allowance is provided to individuals embarking on business trips, work-related travel, or programs across the United States. In this article, learn all about:

- what a travel allowance is

- how it works, and

- how to make sure you follow the regulations around receiving it.

A travel allowance is an amount of money provided to individuals to cover the costs associated with traveling for business, work-related purposes, or as part of a government program. It is designed to reimburse travelers for their expenses while away from home, including meals, lodging, transportation, and incidentals.

Using your personal vehicle to travel for work? Automate business mileage logging with the Driversnote mileage tracker app .

Mileage tracking made easy

Trusted by millions of drivers

When you receive a travel allowance, it is typically provided as a daily or weekly amount, depending on the duration of your trip. The specific allowance may vary depending on factors such as the purpose of travel, destination, and the organization or company you are affiliated with. Travel allowances are governed by specific guidelines and regulations set by the IRS to ensure fairness and transparency.

Travel allowances cover transportation costs, including flights, train tickets, rental cars, taxi fares, or public transportation expenses. Some companies may have their own specific policies regarding the mode of transportation or reimbursement limits.

Besides transportation, travel allowances also include meals, lodging, business calls, dry cleaning and other relevant incidental expenses.

Find out more about receiving employee reimbursement for your meal and lodging expenses and travel-related expenses .

Travel allowances are commonly provided by employers, government agencies, educational institutions, and other organizations. The specific rules and regulations around the allowance can vary depending on your organization and the purpose of travel, but the IRS sets the base for travel allowance payouts and deductions.

Firstly, business travel allowances are available when employees travel away from their tax home or main place of work for business reasons. Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

To receive a travel allowance, you will typically need to submit an expense report or a detailed record of your expenses, supported by receipts or other relevant documentation. Adhering to the guidelines and providing accurate information is crucial to ensure a smooth reimbursement process.

How to automate your mileage logbook

Automate your logbook

Related posts, per diem allowance.

Wondering what a per diem allowance is? Learn everything there is to know about these allowances, how they work and if you could receive one.

IRS Mileage Guide

Mileage reimbursement in the US — rates and rules for employees, self-employed and employers in the US.

IRS Mileage Rates 2024

The standard mileage rate for business will be 67 cents per mile, effective Jan. 1st, 2024 - up 1.5 cents from the 2023 rate of 65.5 cents.

Choose your Country or region

Precision in Payroll - Acing Taxes and Compliance

Webinar HR Metrics Magic: Transforming Insights into Actions Register Now

Leave Travel Allowance (LTA)

What is lta.

LTA or Leave Travel Allowance, is a tax exemption for an allowance paid to the employee by the employer for travel expenses, while he or she is traveling on a leave.

Leave travel allowance can act as a tool for employees to save on taxes while taking leaves for traveling across India. Section 10(5) of the Income Tax Act, 1961, along with Rule 2B, provides tax exemptions and outlines the conditions for such exemptions. However, individuals opting for the New tax slab are not eligible for leave travel allowance.

An employee needs to plan their travel according to the purpose of claiming LTA exemption successfully. The income tax department of India has listed some rules and regulations regarding claiming exemptions under LTA.

Eligibility Criteria for Claiming LTA

The eligibility criteria for claiming LTA or leave travel allowance are as follows.

1. Legitimate evidence: Employees have to provide real pieces of evidence of their travel expenses to claim the LTA. It allows all modes of travel including land, train, and air. Only legitimate cost of travel is permitted for reimbursement. 2. Only travel costs: Other costs during traveling such as food, lodging, activities, etc are not covered under LTA. 3. Only domestic travel: Leave travel allowance only covers domestic travel across India. Employees cannot claim LTA for overseas (foreign trips) travel. 4. Twice in 4 years: The Government of India allows employees to claim LTA only twice in a block of 4 years. They cannot apply for LTA every fiscal year.

How to Claim Leave Travel Allowance (LTA)?

The process for claiming leave travel allowance differs according to the company. Employers commonly announce a due date for employees to claim for LTA. It is important to go through the LTA policy of the organization for a detailed claiming process.

In general, it contains these 3 basic steps:

- Filling out the LTA form provided by the employer.

- Submitting proof of travel details (documents).

- Waiting for approval and reimbursement.

Documents Required for Claiming LTA

Employees might have to submit proof of travel records such as

- Boarding passes

- Receipts from travel agencies, etc.

Although in many cases, employers do not ask for the above-mentioned proof of records, it is advisable for employees to retain these documents.

LTA Rules for Exemption

1. employees can travel to any place in india..

Traveling to any destination across India is allowed under LTA. If the destination is not directly connected by recognized public transport, it will be assumed that the journey is made using the Indian railway using the shortest route. The exempted travel costs will be based on the fare of AC first-class rail tickets from the origin city to the destination city.

2. No international trips are considered.

In a case where the employee is taking an international or foreign trip, he/she/they is not eligible for an exemption.

3. There should be an actual journey to be eligible for claiming the exemption.

An employee cannot claim an exemption without traveling. The employer may ask for proof of travel records such as tickets, boarding passes, or receipts from the travel agent.

4. Food or stay or any other expenses are not considered.

Only the travel cost is exempted under LTA. Other expenses such as food, lodging, vacation activities, and sightseeing are not covered under LTA.

5. LTA can be claimed only for two journeys in a block of four years.

A block year is predetermined by the Government of India for employees to claim LTA. The first block year began in 1986 and is for a period of 4 years. The latest block year for claiming LTA is 2018-2021. Employees can claim exemption on travel expenses twice in one block of 4 years.

6. The family of the employee can also claim an exemption.

Employees can claim for exemption of travel expenses if any family member such as a spouse, children, dependent parents, brother, or sister takes a journey with or without them.

Unclaimed LTA – Carry Forward

In a case where an employee does not claim the leave travel allowance within the 4 years block, one of the 2 unused LTA is applicable to be carried forward to the next 4-year block. The employee can then use 3 LTAs in that block of 4 years.

To be eligible for the unutilized Leave Travel Allowance (LTA), the employee must undertake a trip during the first calendar year of the subsequent block. If the unclaimed LTA is not utilized within the initial year of the following block, it will expire and cannot be claimed at a later time.

What expenses can be included under LTA?

Leave Travel Allowance can be claimed only on the travel expenses incurred by an employee during a trip. It cannot be claimed for other expenses during the trip such as food, lodging, vacation activities, sightseeing, local conveyance, etc.

Calculation of Leave Travel Allowance

Calculating leave travel allowance includes evaluating the income from the salaries of employees. The LTA is exempted to a certain limit, beyond that, the rest of the amount is taxable under the general income tax slab.

For example, imagine an employee receiving an LTA of ₹10,000. If the travel expense incurred by him is ₹8,000, he is only allowed to claim an exemption for ₹8,000. The balance amount of ₹2,000 will be included in his taxable salary income.

5 Benefits of Leave Travel Allowance

1. Tax Saving: LTA allows employees in India to save on income tax by claiming exemption on travel fares or benefits for journeys taken within the country. 2. Family Coverage: LTA extends to the travel expenses of immediate family members, including spouses, siblings, parents, and children, provided they travel together with the employee. 3. Customization by Employers: Employers have the flexibility to determine the LTA amount. It is based on factors like pay scale, job responsibilities, and job title, allowing for customization in an employee’s salary structure. 4. Employee Motivation: Including LTA as part of the salary package can serve as an additional incentive for employees, boosting their overall job satisfaction and motivation. 5 . Domestic Tourism Promotion: LTA encourages employees to explore various destinations within India. This promotes domestic tourism and contributes to the growth of the country’s tourism industry.

Frequently Asked Questions (FAQs)

Q. who is eligible for lta.

Any salaried employee in India working under a registered company is eligible for LTA. The LTA can be claimed only on travel costs incurred by the employee. The travel expense claimed under LTA is only allowed on domestic travel. The LTA can only be requested if the employee has taken time off from work specifically for traveling.

Q. Can I claim LTA without traveling?

No, Leave Travel Allowance cannot be claimed without traveling. LTA is a benefit provided to employees to cover their travel expenses when they take leave for the purpose of travel. To claim LTA, you must have undertaken the travel and provide relevant proof such as tickets or travel receipts.

Q. What happens if LTA is not claimed?

Under the carry-over concession rules, if an employee has not claimed LTA in the previous block or has claimed it only once, they can still claim an additional LTA in the next block of calendar years. This allows the employee to avail of LTA tax breaks for up to three journeys in the current block of years.

Q. How many leaves are required to claim LTA?

The minimum number of leaves required to avail of the Leave Travel Allowance (LTA) exemption is not specified in the Income-tax Act. However, it is advisable to inquire with your employer as they may have their own requirement regarding the number of leaves needed to claim the exemption.

Q. Can I claim LTA in ITR?

Yes, you can claim LTA in your ITR. LTA is a tax benefit for travel expenses within India provided by employers. Keep necessary documentation and receipts for support. Ensure you meet the specific conditions and limitations set by your employer. Consult a tax professional or refer to the latest guidelines for accurate filing.

Q. Is Leave Travel Allowance only for Domestic Travel?

Yes, Leave Travel Allowance can be exempted only for domestic travel across India. It does not allow tax exemptions for foreign trips or overseas travel. It can be claimed for travel to any destination within India by means of road, rail, or air. The purpose of LTA is to encourage employees to take vacations and explore different parts of the country.

Q. How much is LTA in salary?

LTA deductions are applicable only for the shortest tour journey, including the place of departure and return. For instance, if a salaried employee receives ₹50,000, they can claim only ₹30,000. The remaining ₹20,000 will be treated as taxable income based on the applicable tax slab rates.

Q. What is the maximum limit in LTA?

The maximum limit for LTA (Leave Travel Allowance) is determined by the employer and may vary. However, there is a caveat that the exemption is limited to the lowest of the following three amounts:

- The actual travel expenses incurred by the employee for the trip.

- The amount specified by the employer in the LTA policy.

- The amount is equivalent to the economy-class airfare of the national carrier (in case of air travel) or the first-class AC train fare (in case of rail travel) for the shortest route to the destination.

People also look for

By clicking “Accept", you consent to our website's use of cookies to give you the most relevant experience by remembering your preferences and repeat visits. You may visit "cookie policy” to know more about cookies we use.

Travel Allowance: Meaning, Rules & More

What is travel allowance.

An employee may receive a travel allowance from their employer to help cover the costs associated with work travel. This kind of allowance is usually given on top of an employee's base pay or salary and is intended to cover the costs of business travel. The amount of travel reimbursement may differ based on the employer's policies, the nature and length of the journey, and the destination.

What are the Types of Travel Allowances?

Depending on the nature of the job, travel frequency, budget constraints of the company, and more such factors, different types of travel allowances can be offered to an employee.

1. Fixed Travel Allowance

A fixed travel allowance in salary implies that this is a fixed amount offered to the employee irrespective of the actual expenses incurred.

2. Daily Travel Allowance

As the name suggests, a daily travel allowance is offered to employees on a per-day basis, which covers their travel, meals, accommodation, and other such expenses.

3. Mileage Allowance

Employers can also provide a miles-based travel allowance to their employees, which depends on the number of miles they travel for business.

4. Travel Reimbursement

A travel reimbursement depends on the actual expense proofs submitted by an employee, which can include travel by air, rail or road.

The type of travel allowance offered by an employer may depend on various factors such as the nature of the job, frequency of travel, and budget constraints.

What are the Rules Applicable for Travel Allowance?

In India, there are specific tax rules governing travel allowances. Some of the basic travel allowance rules applicable to employees are as follows:

Exemption Limit

The exemption limit for travel allowances is determined by the Indian government and is subject to change. The exemption limit for travel allowance in India is ₹1,600 per month or ₹19,200 per year, as per FY 2022-2023. Read about taxation related to business travel in this blog .

Proof of Travel

The employer needs to provide proof of travel to claim the travel allowance, such as travel tickets, boarding passes, etc.

Actual Expenses

According to the travel allowance rules, if the amount of travel allowance exceeds the actual expenses incurred by the employee during travel, the excess amount is liable for a tax deduction.

Tax Deducted at Source (TDS)

If the amount of travel allowance in salary exceeds the exemption limit, the excess amount is subject to TDS, at a rate of 5%.

Clubbing with Salary

The travel allowance is considered a part of the employee's salary and is subject to taxation accordingly.

Both employers and employees need to understand tax-related travel allowance rules. Employees must keep proper records of travel expenses and provide valid proof to claim the exemption. Employers should also ensure that they deduct TDS at the correct rate and report the travel allowance as a part of the employee's salary in their tax returns.

In conclusion

In conclusion, travel allowances are provided by employers to cover the expenses associated with work travel. Different types of travel allowances, such as fixed allowances, daily allowances, mileage allowances, and travel reimbursements, may be offered based on various factors. It is important for both employers and employees to understand the tax rules and regulations governing travel allowances, including exemption limits, proof of travel, taxation on excess amounts, TDS deductions, and the inclusion of travel allowances in the employee's salary. Compliance with these rules ensures proper documentation and accurate reporting of travel allowances for taxation purposes.

Frequently Asked Questions

1. is travel allowance fully exempted.