Notes for Multiple Passengers in one transaction

Terms and conditions.

Payment Refund Policy for OTTSS Payment

The TIEZA Travel Tax Department may be reached through the following:

Tel. No.: (02) 8249-5987 Email Address: [email protected]

PHILIPPINE TRAVEL TAX: How to Pay + How to Apply for Exemption & Refund

One of the things that we, Filipinos, need to take care of before any international trip is the travel tax. But did you know that not all travelers have to pay this? Certain types of travelers are eligible for exemption or reduced rate. In this article, we’ll tackle all these, so read on!

WHAT'S COVERED IN THIS GUIDE?

What is travel tax?

The Philippine travel tax (or simply “travel tax”) is a levy collected from travelers leaving the Philippines. Sometimes, it is already included in your flight booking . Most of the time, you need to settle this on your own at the airport.

But this amount doesn’t go to the airline. It goes to the Philippine government:

- 50% of the proceeds to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA)

- 40% to the Commission on Higher Education (CHED)

- 10% to the National Commission for Culture and the Arts (NCCA)

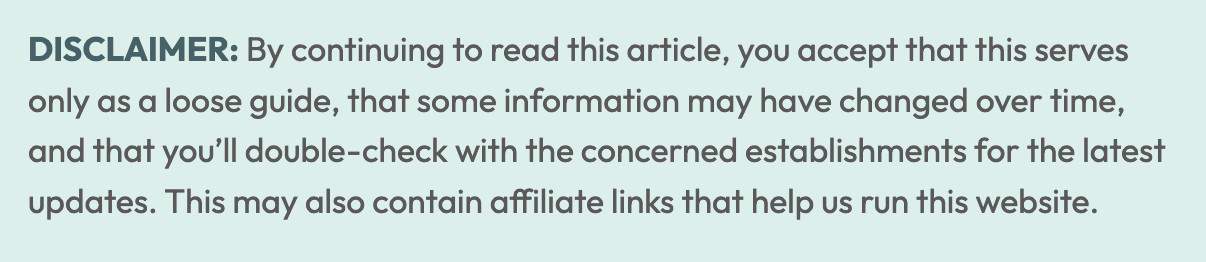

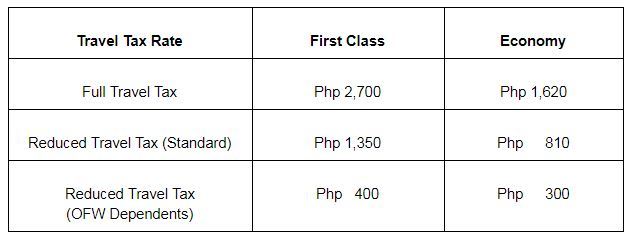

How much is the travel tax?

In most cases, the travel tax costs PHP 1,620 for economy class passengers or PHP 2700 for first class passengers.

I say “most cases” because some types of travelers are eligible for lower or reduced rates.

Here’s the price matrix:

So who can avail of the reduced travel tax?

REDUCED Travel Tax Eligibility & Requirements

Travelers falling under eligible classes can pay reduced or discounted travel tax instead of the full amount. There are two main categories: STANDARD reduced travel tax and PRIVILEGED reduced travel tax .

To avail of the reduced rates, you may apply online or on site:

- If you don’t have a flight ticket yet, accomplish this TIEZA form online .

- If you’ve already booked your flight, you may file at any TIEZA travel tax office including the travel tax counter at the counter.

Here are the eligible types of passengers and the corresponding documents you need to present to avail of the reduced rates.

STANDARD Reduced Travel Tax

CHILDREN: 2 years and 1 day to 12 years old

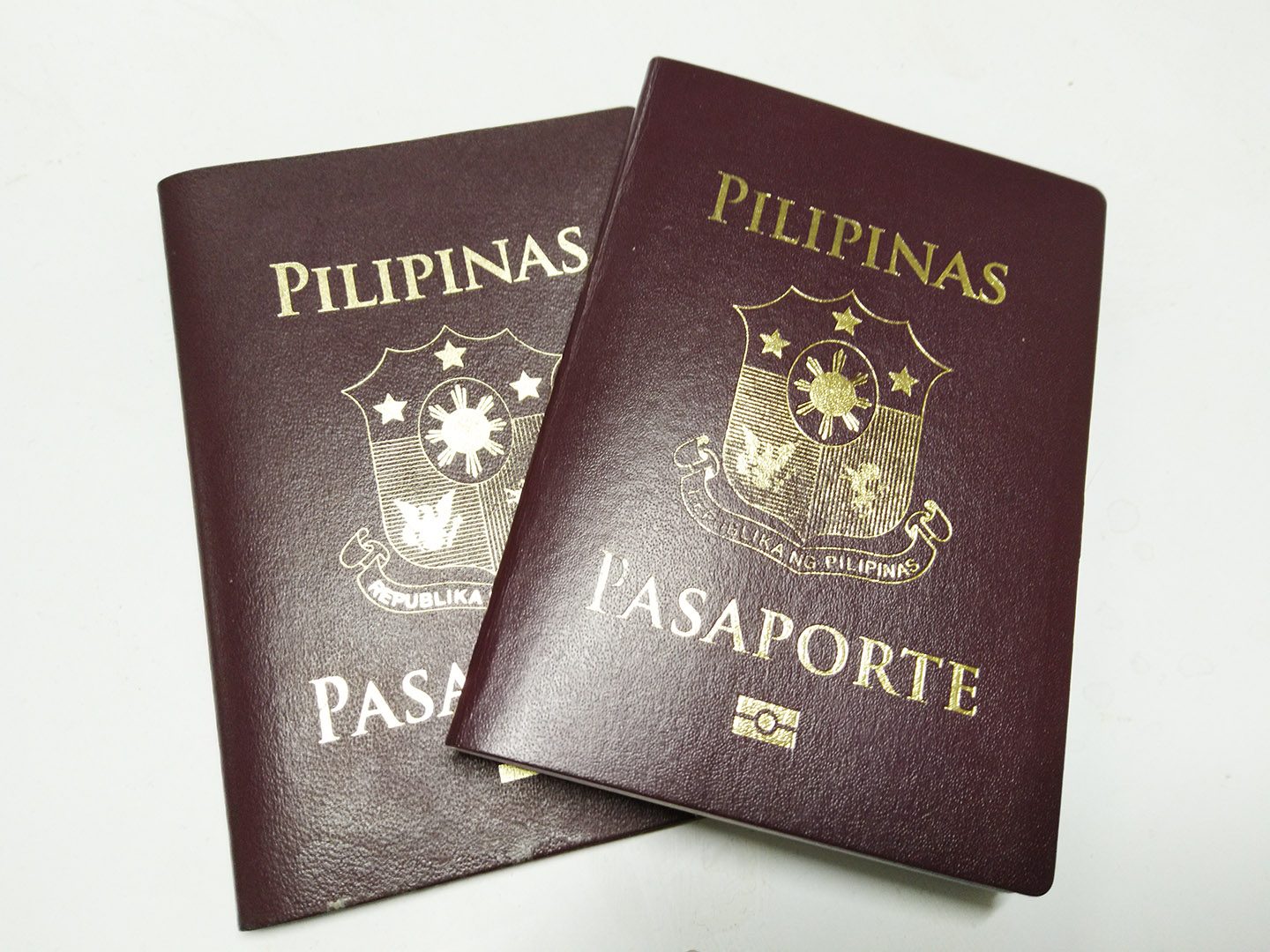

- Original Passport

- Flight booking confirmation, if issued

- If the original passport can’t be presented, submit original birth certificate and photocopy of identification page of passport

Accredited Filipino journalists on assignment

- Certification from the Office of the Press Secretary

- Certification from the station manager or editor

Individuals with authorization from the President

- Written authorization from the Office of the President

PRIVILEGED Reduced Travel Tax

Some family members of Overseas Filipino Workers (OFWs) may avail of the reduced rates if they’re traveling to the country where the OFW is based and able to provide the following documents:

OFW’s Legitimate Spouse

- OEC – Overseas Employment Certificate (original copy) or Balik-Manggagawa Form (certified true copy)

- Marriage contract, original or authenticated

- Certification that the seaman’s dependent is joining the vessel, issued by the manning agency

OFW’s children who are unmarried and below 21 years old (legitimate or illegitimate)

- Birth certificate, original or authenticated

OFW’s children with disabilities (regardless of age)

- PWD ID card, original copy issued by a National Council of Disability Affairs (NCDA) office

EXEMPTION Eligibility & Requirements

Some travelers are also exempted from paying the travel tax altogether. TIEZA has identified 19 types of passengers who are eligible for exemption including international flight crew members, diplomats, and Philippine officials on official business.

But let’s highlight these four (4) categories as these are the most inclusive:

Overseas Filipino Workers (OFWs)

- Original passport

- Copy of passport bio page

- 2×2 ID photo, taken within the past six months (JPG only)

- Airline ticket or flight booking

- If hired through POEA, Overseas Employment Certificate (OEC)

- If directly hired abroad, Employment Contract authenticated by the Philippine Embassy or Consulate OR Certificate of Employment issued by the Philippine Embassy or Consulate

Balikbayans whose stay in the Philippines is shorter than one year

- Copy of stamp of last departure from the Philippines and stamp of arrival in the Philippines, which should show duration of at least one (1) year

- Flight ticket/booking used to travel to the Philippines

Filipino permanent residents abroad whose stay in the Philippines is shorter than one year

- Copies of the stamp of last arrival in the Philippines

- Proof of permanent residence abroad (US Green card, Canadian Form 1000, or similar)

- Certification of Residence, issued by the Philippine Embassy or Consulate (if the country of residence does not grant permanent resident status or appropriate entries in the passport)

Infants (2 years old and below)

- If the original passport cannot be presented, birth certificate (original copy)

How to Pay Travel Tax

There are several ways to settle the travel tax.

Option A: Upon booking your flight

Some legacy airlines automatically include the Philippine travel tax in each booking. Most low-cost carriers don’t, but give you an option to do so.

When booking with Cebu Pacific and AirAsia, the system will ask you if you want to include the travel tax in your payment. It comes with a PHP 50 processing fee.

Option B: At the Airport Travel Tax Counter

This is the most common and my preferred way of paying.

TIEZA has travel tax counters at all terminals of all international airports in the Philippines. At Manila’s Ninoy Aquino International Airport (NAIA) Terminal 3 , you’ll find a counter at every aisle. Just approach one and present the following:

- flight booking confirmation

Once paid, you will be handed two copies of the official TIEZA receipt. You can keep the original copy to yourself, but the duplicate copy must be submitted to the check-in agent in order to receive your boarding pass.

If you’re not sure if it’s already included in your flight ticket, check the payment breakdown in your booking confirmation. It should show you the various taxes and fees that you paid for, but look specifically for PH TAX that costs P1620 (P2700 for first class) or equivalent amount in foreign currency.

If you find it, no need to pay at the airport. Otherwise, don’t pay just yet because you might be double charged. Instead, skip the travel tax counter and line up to the check-in counter directly. As you check in, the agent will tell you whether or not the travel tax has been settled. If not, they will instruct you to pay first and return to them with the receipt before they could give you a boarding pass.

Don’t worry, you won’t have to queue up again. Just walk straight to the agent when you come back.

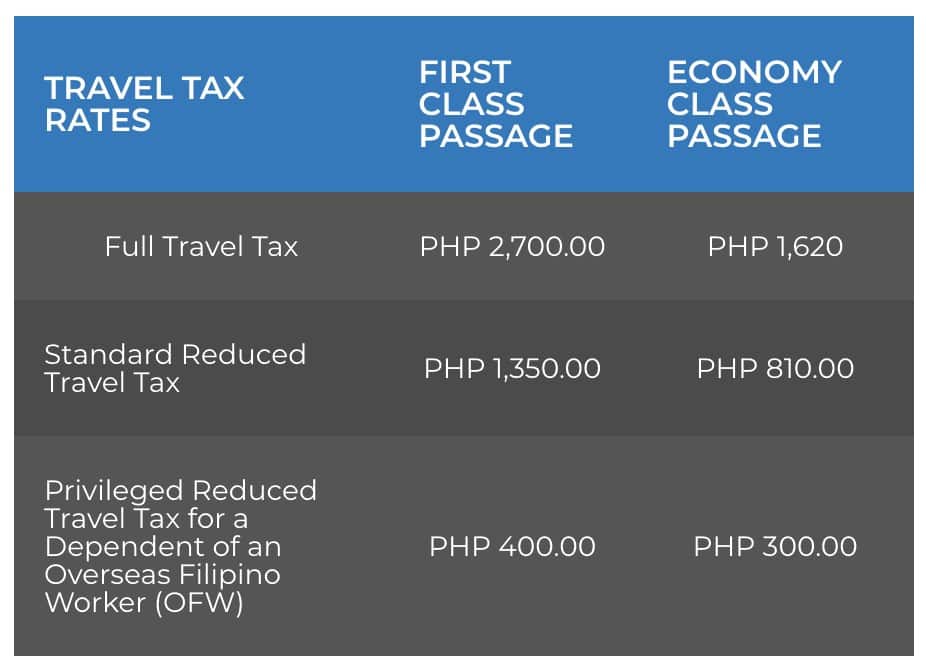

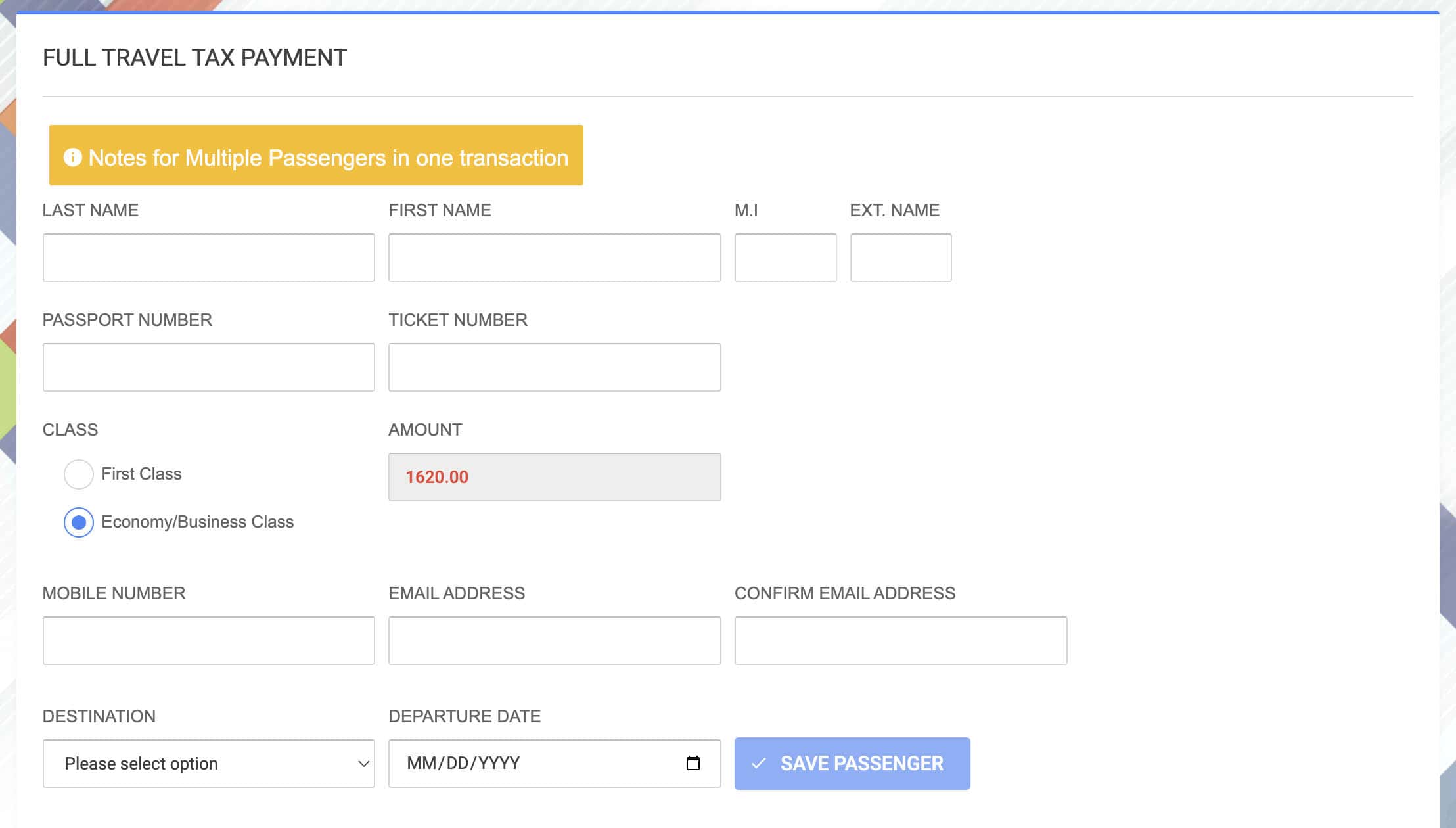

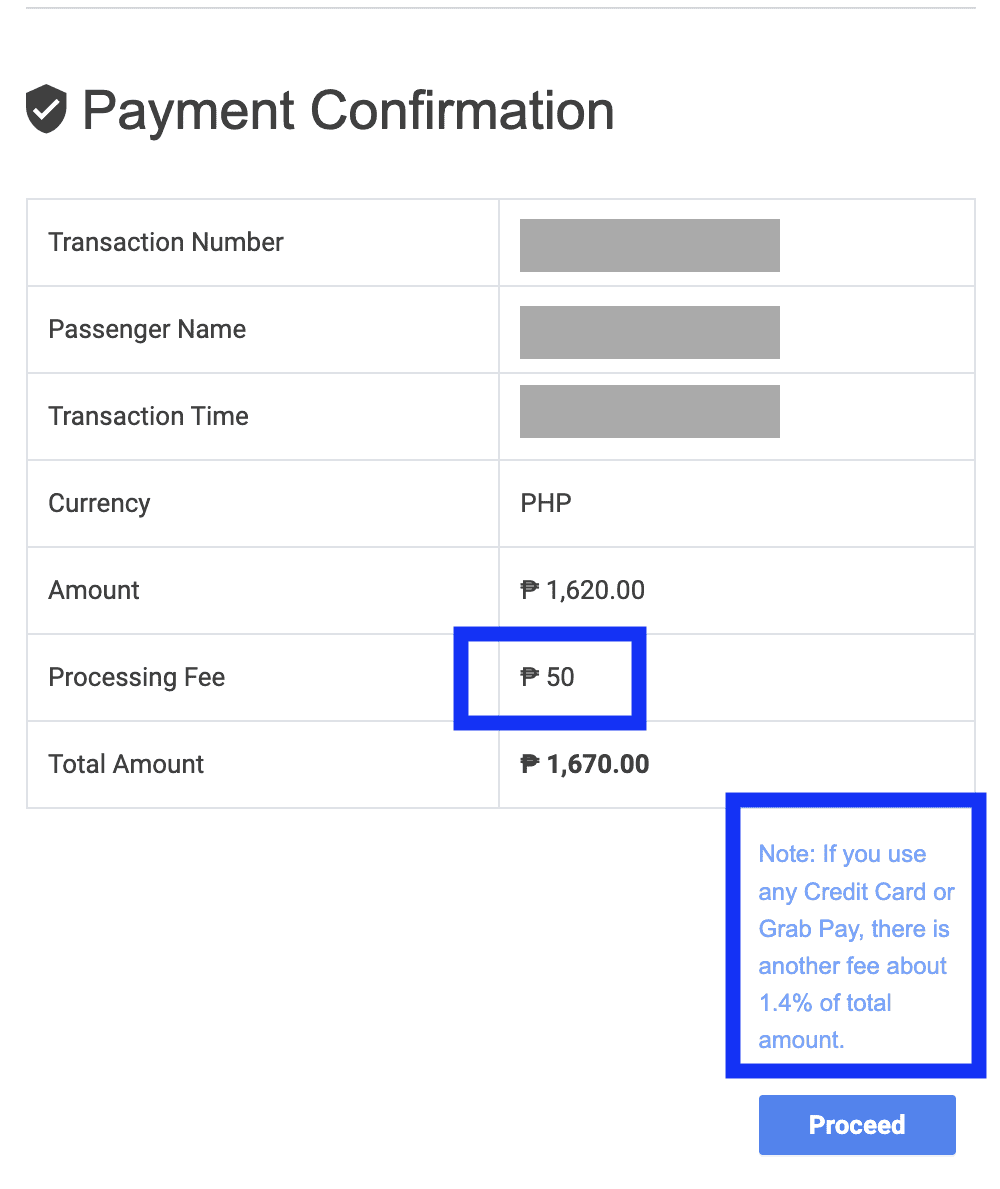

Option C: Via the TIEZA Website

You can also pay online in advance. Just visit the TIEZA Payment Page , fill out the form, and select the most convenient payment method for you.

You can pay through any of the following:

- E-wallet: GCash, GrabPay, Maya, ShopeePay

- Credit card: Visa, MasterCard

- Bank Transfer: BDO, BPI, UnionBank, Metrobank, RCBC, Maybank, Instapay

- Over the Counter: 7-Eleven, Cebuana Lhuiller, Western Union, Bayad Center, EC Pay, The SM Store, Robinsons Malls, etc.

⚠️ Note: The TIEZA website charges a processing fee of PHP 50. In addition, paying via GrabPay and credit card entails additional charge of 1.4% of total amount.

Travel Tax Refund

You can file for a refund if you paid when you’re not supposed to or you paid more than what you’re supposed to.

Here are the acceptable reasons or cases for a refund:

- You didn’t get to travel because the flight was cancelled, you were offloaded, or you just chose not to for whatever reason.

- You’re a non-immigrant foreigner who are not subject to the Philippine travel tax.

- You’re eligible for travel tax exemption.

- You’re eligible for reduced travel tax but you paid the full amount. In this case, you can get a partial refund.

- You paid for first-class passage but you were downgraded to economy class. Partial refund applies.

- You paid the travel tax TWICE for the same ticket.

If you paid the travel tax at the airport counter, you can get the refund on the same day or at the latest, within the next 24 hours. If you paid it via other channels, it might take longer to process, depending on your selected payment method.

In general, here are the requirements you need to present to claim a refund:

- original passport

- TIEZA refund form no. 353

- TIEZA travel tax receipt

- airline ticket showing you paid the travel tax (if included in the flight payment)

But depending on your reason, there may be additional documents you need to present to support your case. You can find the full list of requirements here .

You can file for a refund claim within 2 YEARS from the date of payment. If you have unflown tickets from last year or so, you can still get a refund for that now.

Updates Log

2024 • 5 • 9: Original publication

More Tips on YouTube ⬇️⬇️⬇️

Is this post helpful to you?

Related Posts:

- NAIA TERMINAL 3 GUIDE: What to Do Before an International Flight

- 8 Things You Could Buy with the P1620 Travel Tax

- MANILA AIRPORT: New NAIA Terminal Assignments will NO LONGER Proceed

- 9 THINGS I WISH I KNEW WHEN I WAS A TRAVEL NEWBIE: Airport Edition

- Requirements for Non-Essential International Travel for Filipinos

- CAGAYAN DE ORO: New Travel Requirements & Guidelines

- How to Contact the BUREAU OF IMMIGRATION in the Philippines

- NAIA ARRIVAL Protocol & Requirements for OFWs, Non-OFWs & Foreigners

- Recent Posts

- 2024 Cebu Pacific Promos & PISO SALE with Number of Seats Available - 7 September 2024

- U.S. VISA APPLICATION Requirements & Interview Questions in the Philippines - 4 August 2024

- WHERE TO SHOP IN BANGKOK • Top 8 Shopping Centers and Malls - 29 July 2024

Featured On

We heard you!

Your comment is now queued for moderation! We’ll try to get back to you soonest. While waiting, follow us on these channels.

Subscribe on Youtube! Follow us on Instagram!

Cebu Pacific Promo Tickets 2024 and Piso Fare 2025

The latest seat sale for 2024 like Cebu Pacific promos as well as piso fare 2025 offers

Philippine Travel Tax Refund: Reasons and Process

August 21, 2024 at 4:31 pm

The Philippine travel tax is a fee imposed on Filipino citizens and permanent residents traveling abroad. It helps fund the government’s tourism and infrastructure projects. The tax amount varies based on the traveler’s status and destination, and it is typically collected by airlines or travel agencies at the time of ticket purchase. Certain exemptions and discounts apply, such as for overseas Filipino workers (OFWs) and senior citizens.

Usual Tax rates for the Philippine Travel Tax is at 2,700 Pesos for First Class Tickets and 1,620 Pesos for Regular Tickets!!!

Click the link below to know more about the Philippine Travel Tax:

Things You Need to Know About the Philippine Travel Tax

But did you know that there are instances that you could ask for a REFUND on your Philippine Travel Tax?

Refunds for the Philippine travel tax can be requested for several reasons. Here are some common scenarios where a refund might be applicable:

- Overpayment : If you paid more than the required travel tax amount or were charged incorrectly, you can request a refund for the excess amount. A good example of this is that you’ve got an ECONOMY CLASS Ticket but paid for the TAX for a First Class ticket instead, or your Business Class seats got a down grade.

- Non-Travel : If you paid the travel tax but your travel plans were canceled and you did not travel, you might be eligible for a refund. Cancelled Flights, or getting offloaded are some of the most common reasons for non travel.

- Duplicate Payment : If you accidentally paid the travel tax twice for the same trip, you can request a refund for the duplicate payment.

- Refunds for Certain Categories : Certain groups, such as overseas Filipino workers (OFWs), senior citizens, and other exempt categories, may be eligible for refunds if they were incorrectly charged.

- Errors in Processing : If there was an error in the processing of your travel tax payment (e.g., incorrect passenger details or flight information), a refund might be warranted.

- Travel Tax Waiver : If you were granted a travel tax waiver or exemption but still paid the tax, you would be eligible for a refund.

Things that you need in order to apply for a Philippine Travel Tax Refund

Claiming your Philippine Travel Tax refund can be done within two years from your date of departure. You can visit TIEZA or the TOURISM INFRASTRUCTURE and Enterprise Zone Authority offices or counters for your refunds.

If you’ve paid the the travel tax during your airplane tickets at Cebu Pacific Air, Philippine Airlines, then you can ask refunds directly from these companies.

Identification Cards need for your refunds:

Depending on your reasons, here are some documents that you need to present in order to get a refund:

SAME-DAY REFUND (SDR) of Travel Tax paid directly to TIEZA at travel tax counters at various airport terminals within 24 hours from time of payment.

If you paid the Philippine Travel Fund at the airport hours before your flight and needs a refund, then you can do these:

Save this article for you or your family might have an unused international plane ticket or needs a refund in the future!!!

LIKE us on Facebook at PISO FARE Philippines for more travel news and airline promo fares and Piso Seat Sale Alerts!!!

Share this:

Check out these other promos.

- Inspiration

- Fashion & Style

PHILIPPINES TRAVEL TAX: How to pay + How to apply for exemption and refund

RELATED STORIES

UAE CULTURAL DAYS IN MOSCOW

Cafe Rio shredded chicken (copycat)

There are several ways to pay the travel tax.

Option A: When you book your flight

Some traditional airlines automatically include the Philippines travel tax in each booking. Most low-cost carriers don't do this, but they give you the option to do so.

When booking with Cebu Pacific and AirAsia, the system will ask if you want to include the travel tax in your payment. It comes with a processing fee of PHP 50.

Option B: at the airport travel tax counter

This is the most common and preferred payment method.

TIEZA has travel tax counters in all terminals of all international airports in the Philippines. At Manila Ninoy Aquino International Airport (NAIA) Terminal 3 , you will find a counter in each hallway. Simply walk up to one and present the following:

- flight reservation confirmation

Once paid, you will be given two copies of the official TIEZA receipt. You may keep the original copy, but you must send the duplicate copy to the check-in agent in order to receive your boarding pass.

If you're not sure if it's already included in your flight ticket, check the payment breakdown in your booking confirmation. It should show you the various taxes and fees you paid, but specifically look for the PH TAX which costs P1,620 (P2,700 for first class) or an equivalent amount in foreign currency.

If you find it, you won't have to pay at the airport. Otherwise, don't pay yet because you may be charged double. Instead, skip the travel tax counter and queue directly at the check-in counter. Upon check-in, the agent will inform you whether or not the travel tax has been settled. Otherwise, they will tell you to pay first and return it to them with the receipt before they can give you a boarding pass.

Don't worry, you won't have to wait in line again. Simply walk straight up to the agent when you return.

Option C: Through the TIEZA website

You can also pay online in advance. Just visit the TIEZA payment page Complete the form and select the payment method that best suits you.

You can pay through any of the following means:

- Electronic wallet: GCash, GrabPay, Maya, ShopeePay

- Credit card: Visa Mastercard

- Wire transfer: BDO, BPI, UnionBank, Metrobank, RCBC, Maybank, Instapay

- On the counter: 7-Eleven, Cebuana Lhuiller, Western Union, Bayad Center, EC Pay, The SM Store, Robinsons Malls, etc.

⚠️ Note: The TIEZA website charges a processing fee of PHP 50. Additionally, paying via GrabPay and credit card incurs an additional charge of 1.4% of the total amount.

Our Company

- About Amoize

- Online Advertisement

- Become a Contributor

- Real Weddings

- Refund and Returns Policy

© 2024 JNews - Premium WordPress news & magazine theme by Jegtheme .

- Home – Layout 1

- Home – Layout 2

- Home – Layout 3

- Landing Page

- Support Forum

- Pre-sale Question

Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds

Traveling is not cheap. Although we Filipinos, sometimes budget our way when going out of the country, there are certain expenses that we need to pay. One of those things we can’t seem to escape during our vacation is the Travel Tax and Terminal Fees in the Philippines .

According to Presidential Decree 1183, the Travel tax is imposed on individuals leaving the Philippines . But not all have to pay; certain people are exempted from the Travel Tax or have reduced payment. The proceeds are for TIEZA (Tourism Infrastructure and Enterprise Zone Authority), CHED’s tourism-related programs (Commission on Higher Education), and NCCA (National Commission for Culture and Arts).

This article will discuss Philippine Travel tax; how much is the payment, who needs to pay, and who is exempted, how to get a refund or exemption. This will also discuss the Terminal fees of the Philippine Airports.

- How to Schedule a DFA Online Appointment to Get a Philippines Passport

- One year Visa-free Balikbayan Stay in the Philippines for the Foreign Spouse/ Children of Filipino Citizens

- OFW Guide – List of Work Abroad Websites To Help You Find Jobs Overseas

- Philippines Tourist Visa – How to Get a Tourist Visa to Visit the Philippines

- How to Teach English Abroad – Get 60% OFF Your TEFL Certification Online

Travel Tax in the Philippines

How much is the travel tax in the Philippines?

Who needs to pay a travel tax?

- Filipino Citizens

- Foreign Nationals who are Permanent Residents of the Philippines

- Non-Resident Foreign Nationals who stayed for more than 1 year in the Philippines

What are the Requirements Needed for paying the Travel Tax?

- Airline Ticket

- Travel Tax Payment (maybe in Cash or Credit)

How to Pay Travel Tax?

- Included when booking an airline ticket

- At Travel Tax Centers or Counters

- Online: https://tieza.gov.ph/online-travel-tax-payment-system/

If you are in a hurry, I recommend paying ahead to avoid the long queues at the counters. However, refunds may take time but it is still possible.

Philippine Travel Tax Exemption

Who are exempted from payment of travel tax in the philippines what are the requirements needed.

Main Requirement: Passport

Overseas Filipino Workers

- If hired through POEA: Original Overseas Employment Certificate

- If directly hired: Certificate of Employment issued by the Philippine Embassy or Consulate in the country where you are working or a copy of Employment Contract authenticated by the PH Embassy or Consulate

Filipino Permanent Residents Abroad whose stay in the Philippines is less than a year

- Bio page of passport and stamp of the last arrival in the Philippines

- Permanent Residency Card or any proof that you reside permanently in a foreign country

- Certification of Residence issued by Philippine Embassy or Consulate in case the country you are staying doesn’t grant permanent residency

Balikbayan whose stay in the Philippines is less than a year

- Airline Ticket used to travel to the Philippines

Balikbayan who is a former Filipino Citizens and naturalized to another citizenship whose stay in the Philippines is less than a year (including spouse and children)

- Philippine and Foreign Passport

- For Children: certified true copy or authenticated copy of birth certificate or adoption papers

- For Spouse: certified true copy or authenticated copy of marriage certificate

Infants who are two years old and below (if two years old and one day, then standard reduced travel tax is paid)

- If no passport, PSA copy of birth certificate

Foreign Diplomatic, consular officials, and staff accredited in the Philippines. Immediate members of the family and household staff are included as long as there is an authorization from the Philippine Government.

- Certification from their respective Embassy or Consulate, from the Department of Foreign Affairs or Office of Protocol

United Nations organization and its agencies’ Officials, Consulates, Experts, and employees and those exempt under Laws, Treaties or International Agreements

- UN Passport or Certificate of Employment from UN office or agencies with international agreements with the Philippines

US military personnel and their dependents. US nationals with fares paid by the US government or on US government-owned transports. Filipinos in US military service and their dependents. Filipino employees of US government or US State department visitors traveling to the US for government business.

- Government Transport Request for airline tickets or certification from the US Embassy that the US government paid for the fare

Airline crew of international routes

- Crew’s Name

- Location of aircraft

Philippine Foreign Service personnel assigned abroad and their dependents

- Certification from the Department of Foreign Affairs

Officials and employees of Philippine Government on official business (except GOCCs)

- Certified True Copy of Travel Authority or Travel Order from Department Secretary

Grantees of foreign government-funded trip

- Proof that the foreign government funds travel

A student with an approved scholarship from a Philippine Government Agency

- Certification from the government agency

Personnel and their dependents of a multinational company with regional headquarters but not engaged in business in the Philippines

- Certificate of Board of Investments

Authorized by the President of the Philippines for national interest

- Written authorization stating that the passenger is exempt from travel tax

How to get Tax Exemption?

- Present passport and documents to the Travel Tax officer

- Get Travel Tax Exemption Certificate

Reduced Travel Tax

Certain people don’t need to pay the full amount of travel tax. There are two types; standard and privilege reduce travel tax. Here are the qualifications.

Who can avail Standard Reduced Travel Tax in the Philippines ? What are the requirements?

Minors – 2 years and one day – twelve years old (it must be exact, if twelve years old and one day, no more exemption).

- Airline Ticket, if already issued

Accredited Filipino Journalist (writers, editors, reporters, announcers) in pursuit of assignment

- Certification from an editor or station manager that passenger is an accredited journalist

- Certification from the Office of the Press Secretary

- Written authorization from Office of the Presidents stating the passenger is entitled to Reduced Travel Tax

Who can avail of Privilege Reduced Travel Tax in the Philippines ? What needs to be submitted?

If you are a dependent of an OFW traveling to the country where your spouse or parent is at, then you can avail of this.

Main Requirements: Passport and any of the following:

- Original Overseas Employment certificate

- Certified true copy of Balik-Manggagwa Form or OFW’s Travel Exit Permit

- Certification of Accreditation or Registration

- OFW’s Work Visa or Work Permit

- Valid Employment Contract or Company ID of the OFW

- Recent payslip of OFW

Legitimate spouse of an OFW

- PSA Marriage Certificate

- Certificate from the agency that the dependent is joining the seaman’s vessel

Unmarried children of an OFW who are 21 years old and below (legitimate or illegitimate)

- PSA Birth Certificate

Child of an OFW who is a Persons With Disability (any age)

- PWD ID Card issued by an office of National Council of Disability Affairs

How to get Reduced Travel Tax?

- Present passport and documents to the Travel Tax officer.

- Pay the fee.

- Get the Reduced Travel Tax Certificate (RTTC).

Philippine Travel Tax Refund

In case you have paid tax refund or are qualified for such but have paid. You can get a tax refund. You can claim if within two years from your date of payment.

Who can get a tax refund? What are the requirements?

Main Requirements: Passport and Airline Ticket with travel tax payment or If travel tax was paid at TIEZA, official receipt (passenger copy and airline copy)

Owners of an Unused ticket

- Fare refund voucher or certification from airline signatory that ticket is unused, non-rebookable and has no fare refund value

Owners of a Downgraded Ticket

- Certification from the airline that the ticket was downgraded or the airline flight manifest

Non-immigrant foreign nationals who have not stayed in the Philippines for more than a year

- If passport can’t be presented; a certification from the Bureau of Immigration indication passenger’s identity, status, and applicable date of arrival

Those Qualified for Travel Tax Exemption

- Supporting Documents (see list above)

Qualified for Reduced Travel Tax

Double payment (paid travel tax for the same ticket), undue travel tax, how to get travel tax refund.

- Fill-up TIEZA Refund application form.

- Present passport and documents to the Travel Tax officer and a SPA if the claimant is not a passenger.

- Get a check of the refund.

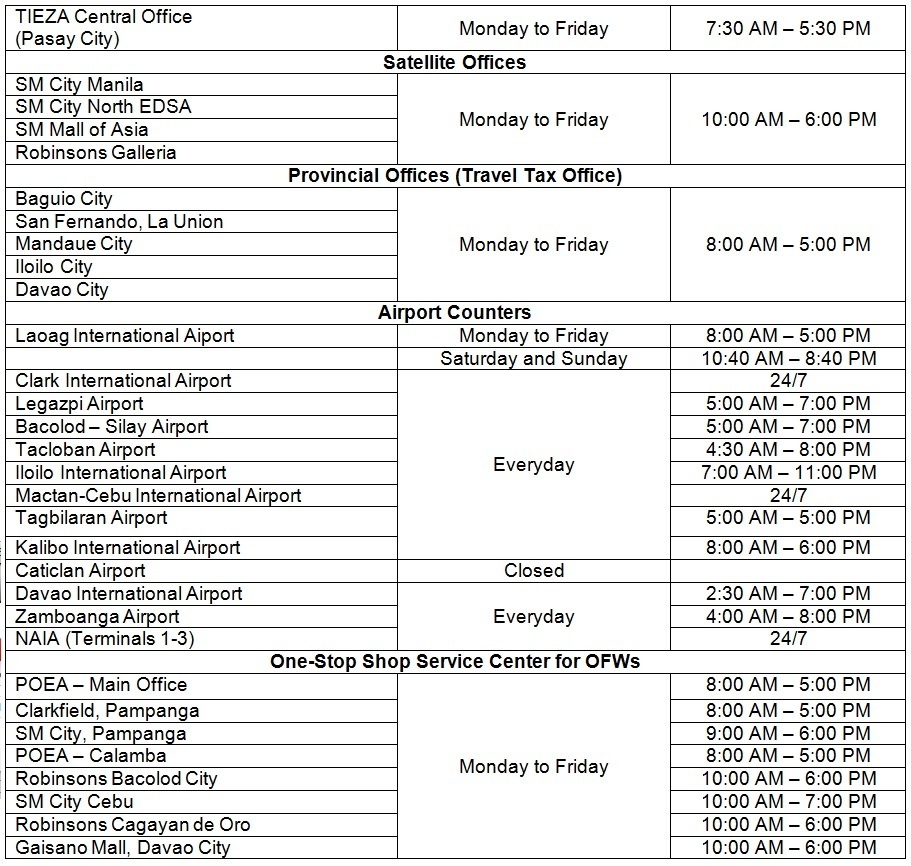

Travel Tax Centers and Schedules

Here are the places you can process or pay your travel tax, tax exemption, reduced tax, or travel tax refund. It’s better to process before your flight as it might take longer at the airport if there are long queues.

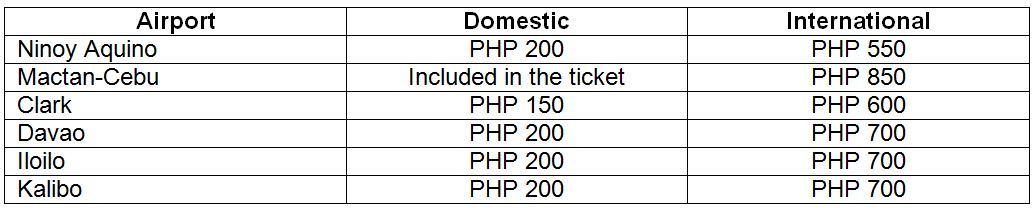

Terminal Fees

Terminal Fees are paid at the airport counters or it is included in the airline ticket. Sometimes, it is named as Passenger Service Charge. However, this is the list of terminal fees:

Who are exempted to pay terminal fees:

Note that most domestic flights cost Php 20 – 200; they are usually included in the ticket, For International flights Php 500 – 850

- Children below two years old

- Overseas Contract Workers

- Denied Passengers

- Airline Crew

- Athletes – must be endorsed from Philippine Sports Commission

- Muslim Passengers for Mecca or Hajj

- Passengers specified by law

Where to pay terminal fees?

- There are counters at the airport, you may pay there, or it is included in the airline ticket as Passenger Service Charge

I hope this guide has helped you in getting information on the Travel Tax in the Philippines or the terminal fees. So, it’s better to bring cash or pay ahead as you might get unlucky and the ATMs malfunctions. Don’t worry though; it can be refunded! Happy Travels!

Are you on Pinterest? Pin these!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

7 thoughts on “ Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds ”

How can i take my travel tax refund when im missed to passed by a counter for that?i travelled internationally and domestically.And i am an ofw.

Hello good morning. I would like to know if I am eligible to get a travel tax refund as I was denied by the BOI in Manila to board my flight to KL Malaysia last March 1 2022. I am a Filipino citizen who wanted to travel in Malaysia as a tourist. And can I get the refund if I’m eligible in Iloilo travel tax centers in my own province which is in Iloilo? Thank you.

im an ofw, where can i get my PAL and CEB terminal fee refunds?

You can have your terminal fee refunded at the terminal fee payment counters in Mactan Cebu Airport. Just make sure you have your OEC with you, and your boarding pass stamped by the airline for refund, when you approach the counter.

hello i need a government of my country to fetch me, this is lee dong rou i am a tourist licence but i have left my U.N passport because of foreign degree because i am a cabin crew different airline

Hi I’m a filipino citizen who live abroad I want to ask if I have to pay tax because my flight is only rescue flight because my son he’s a Austrian national and I have visa card from Austria thanks I hope u answer plead

If you have a permanent residency abroad then you can be exempted.

COPYRIGHT DISCLAIMER: Many of the articles on Two Monkeys Travel Group are guest posts by a number of Approved Contributors and are hosted by Two Monkeys Travel Group. Approved Contributors control their own work and post freely to our site. This includes all text and images that they use within their own work. All contributors are instructed to follow internationally recognised copyright and intellectual property guidelines. Two Monkeys Travel Group takes its own responsibilities very seriously, so if you feel that any part of this work is abusive in any way, please send us an email so that we can investigate - [email protected]

DISCLOSURE: Please note that some of the links above are affiliate links. So when you make a purchase we sometimes make a small commission, at no extra cost to you. The cost to you remains the same, sometimes even cheaper if we have negotiated a special deal for our readers.We use all of the companies we have listed here and that’s why they are in this list, but of course we need to keep Two Monkeys Travel Group running as well as it can, which is exactly what you’re helping with if you do decide to buy or book something through an affiliate link! If you have any more questions about the companies we use or any other companies you’re looking at, just email us and we’ll be happy to help. Please see our full disclaimer page for more information.

Written by Kach Umandap

Founder of Two Monkeys Travel Group. Since 2013, Kach has visited all the 7 continents (including Antarctica) and 151 countries using her Philippines Passport. In 2016, she bought a sailboat and went on sailing adventures with her two cats - Captain Ahab & Little Zissou in the Caribbean for 2 years. She now lives in Herceg Novi, Montenegro where she's enjoying her expat life and living on a gorgeous Stonehouse. She writes about her experiences traveling as a Filipina traveler with a PHL Passport. Also tips on backpacking trips, luxury hotel experiences, product reviews, sailing & adventure travel.

Theme Parks of Quintana Roo: Xcaret, Xel-Há, and Xplor

Take off in style: simple flight booking & entertainment, madrid: why this city is so worth visiting, top places to visit to see penguins in their natural habitat, unveiling the perks of flight deal aggregators: are you getting the most out of your travel budget, related posts, list of the best luxury hotels in davao, philippines, list of the best beaches in davao, philippines, how foreigners can get a 13a marriage visa in the philippines (non-quota immigrant visa by marriage), laguna camping – best camping sites in laguna [with rates available], previous post, filipinos, check these tesda online courses for free, travel guide to san pablo city, laguna: explore the city of seven lakes, subscribe to our newsletter.

Receive tips on how you can live a sustainable long-term travel lifestyle!

- First Name *

- Email This field is for validation purposes and should be left unchanged.

Traveloka PH

11 Jul 2024 - 8 min read

Travel Tax in the Philippines: Everything a Traveler Needs to Know

What is the Philippine Travel Tax?

Shutterstock.com

The Philippine travel tax is an additional fee you need to pay every time you go abroad. You can read up on it in greater detail under Presidential Decree 1183 , but all you need to know about it is that you are required to pay this fee no matter which country you are headed to.

Who is required to pay the Philippine Travel Tax?

If you fall under any of the following demographic, you are required to pay the travel tax:

- Filipino citizens

- Taxable foreign passport holders

- Non-immigrant foreign passport holders who have stayed in the Philippines for more than a year

Who is exempted from paying the travel tax?

- Filipino citizens who are permanent residents abroad

- Balikbayan visitors who have stayed in the Philippines for less than a year

- Overseas Filipino contract workers

There are also other individuals who are exempted from paying the travel tax:

- Foreign diplomatic representatives in the Philippines

- United Nations employees

- US military personnel

- Members of an international carrier crew

- Philippine foreign service personnel

- Philippine government employees who are traveling on official business

- Students on scholarships

- Personnel of multinational companies

I fall under the travel tax exemption. What do I need to avail of it?

Depending on your case, you will need:

1. Original documents required by your embassy or agency, which can include but are not limited to:

- Proof of permanent residency

- A copy of your original passport

- Certification of work

- Overseas employment certificate

- A marriage certificate

2. Travel to the nearest TIEZA Travel Tax Field Office in the Philippines, either in the airports or in the provincial field offices.

Show your original documents, as well as photocopies.

3. Pay a PHP 200 processing fee.

Wait for your Travel Tax Exemption Certificate to be released, and present this to the authorities at the airport.

How much do I have to pay?

Depending on your ticket, your travel tax will vary. See the table below:

Where do I pay the Philippine travel tax?

RaksyBH / Shutterstock.com

You can pay your travel tax in advance in several malls. Check out these mall counters that accept travel tax payments:

1. SM City Manila Travel Tax Service Counter

Government Service Center

5th Floor, SM City Manila

10 AM to 6 PM

2. SM City North EDSA Travel Tax Service Counter

Lower Ground Floor, The Annex, SM City North EDSA, Quezon City

3. SM Mall of Asia Travel Tax Service Counter

Government Service Express

Level 2, North Parking Building

East Side, SM Mall of Asia, Pasay City

4. Robinsons Galleria Travel Tax Service Counter

Lingkod Pinoy Center

Ground Floor, Robinsons Galleria

EDSA corner Ortigas Ave., Mandaluyong City

You can also pay your travel tax on the day of your flight in the airport counters. You need to show your ticket and passport.

5. NAIA Terminal 1

Departure Lobby

Ninoy Aquino International Airport Terminal 1

6. NAIA Terminal 2

Ninoy Aquino International Airport Terminal 2

7. NAIA Terminal 3

Ninoy Aquino International Airport Terminal 3

8. Laoag International Airport

Laoag International Airport

Laoag City, Ilocos Norte

8 AM to 5 PM (Monday to Friday)

10:40 AM to 8:40 PM (Saturday and Sunday)

9. Clark International Airport

Clark International Airport

Clarkfield, Clark Freeport Zone, Pampanga

10. Puerto Princesa International Airport

Departure Area

Puerto Princesa International Airport

Rizal Avenue, Barangay San Miguel

Puerto Princesa, Palawan City

6 AM to 7 PM

Flight to Manila

AirAsia Philippines

Start from ₱ 902.15

Kalibo - Boracay (KLO) to Manila (MNL)

Mon, 30 Sep 2024

Philippine Airlines

Start from ₱ 922.05

Fri, 13 Sep 2024

Cebu Pacific

Start from ₱ 1,022.15

Fri, 27 Sep 2024

11. Legazpi Airport

Legazpi Airport

Legazpi City, Albay

5 AM to 7 PM

12. New Bacolod – Silay Airport

New Bacolod-Silay Airport

Baranga Bagtic, Silay City, Negros Occidental

13. Tacloban Airport

Daniel Z. Romualdez Airport

San Jose, Tacloban City, Leyte

4:30 AM to 12:30 PM (Monday to Friday)

7 AM to 3 PM (Saturday and Sunday)

14. Iloilo International Airport

Departure Area II A

Iloilo International Airport

Cabatuan, Iloilo

7 AM to 11 PM

15. Mactan – Cebu International Airport Terminal 1

Domestic Departure Area

Mactan Cebu International Airport Terminal 1

Lapu-Lapu City, Cebu

16. Mactan – Cebu International Airport Terminal 2

International Departure Area

Mactan Cebu International Airport Terminal 2

17. Bohol-Panglao International Airport

Bohol-Panglao International Airport

Tawala, Panglao, Bohol

5 AM to 5 PM

18. Kalibo International Airport

Kalibo International Airport

Kalibo, Aklan

8 AM to 6 PM

19. Davao International Airport

Davao International Airport

Barangay Sasa, Buhangin, Davao City

3 AM to 7 PM

20. Zamboanga International Airport

Zamboanga International Airport

Moret Field, Baliwasan, Zamboanga City

4 AM – 8 PM

Meanwhile, there are also provincial offices and other government offices where you can pay the travel tax:

1. Baguio City Travel Tax Office

Department of Tourism Building

Governor Pack Road, Baguio City

8 AM to 5 PM

2. San Fernando, La Union Travel Tax Office

2nd Floor, Lupac Building, Quezon Avenue

San Fernando City, La Union

3. Mandaue City Travel Tax Office

Cebu Travel Tax Field Office

Andres Soriano Ave., cor. PJ Burgos St.

Centro, Mandaue City

4. Iloilo City Travel Tax Office

Casa Real Building, Old Iloilo Provincial Capitol

Iloilo City

5. Davao City Travel Tax Office

Door 12, Tourism Complex, Ramon Magsaysay Park

You can also pay online. Here's how:

1. Visit the website of the TIEZA Online Travel Tax Payment System .

2. Create an account if it’s your first time using the online portal. If not, log in.

3. Select your type of travel—either First Class or Business/Economy Class.

4. Enter your ticket number or booking reference number, mobile number, departure date, and country of destination.

5. A reference number will be sent to your email or mobile number. The reference number expires 24 hours after it is generated.

6. Using the reference number, pay via your credit card, debit card, the Bayad Center Mobile App, or Bayad Center Branches nationwide.

7. An email containing an acknowledgment receipt will be sent to you confirming you have successfully paid the travel tax.

8. Print two copies of the acknowledgment receipt and present these when checking-in at the airport.

Where does that money go?

As per Section 73 of the Republic Act No. 9593, the money earned from the travel tax is divided accordingly:

50% to TIEZA (or the Tourism Infrastructure and Enterprise Zone Authority)

40% to the Commission on Higher Education’s tourism-related educational programs and courses

10% to the National Commission for Culture and Arts

How do I get a refund?

You qualify for a refund if you fall under one of the following conditions:

- You have an unused ticket

- You are exempted but you already paid

- Your ticket was downgraded from first-class to economy-class

- You paid twice

- You were offloaded from your flight

- Your flight was canceled

What do you need to present to get a refund?

Depending on your case, prepare the following:

- Original passport, plus photocopies

- A filled-out TIEZA Refund Application Form 353

- Airline ticket showing travel tax collection

- Any supporting documents that prove your claim, especially if you fall under the previous travel tax exemptions

- The official receipt of your travel tax if you paid directly to TIEZA

- Proof that your ticket was not subject to tax

- Certification from an airline-authorized signatory

Subic Bay Freeport Zone

Zoobic Safari Tickets

Araneta Center

Art in Island: The Media Square

Enchanted Kingdom Laguna

El Nido Tour D - 1 Day

Frequently Asked Questions

1. Do I have to pay travel tax in the Philippines?

Yes, you may need to pay the Philippine Travel Tax if you're departing the Philippines on an international flight . The exact amount depends on your flight class (economy, business, etc). Be sure to check with your airline or travel agent to confirm the specific tax amount that will apply to your ticket. In most cases, you'll be able to pay the travel tax directly at the airport before checking in for your flight.

2. Are foreigners exempted from Philippines travel tax?

Foreign tourists visiting the Philippines for less than one year are exempt from paying travel tax. However, you may encounter a terminal fee upon departure from some airports which is often already included in your airline ticket price, especially if departing from major airports like Manila. The Philippine travel tax applies to non-immigrant foreign passport holders who have resided in the Philippines for more than a year .

3. How much is the Philippines’ travel tax in 2024?

The Philippines' travel tax in 2024 varies depending on your departing flight class and eligibility for any exemptions. Full Travel Tax applies to passengers departing in business class or economy class who don't qualify for any reductions. Full Travel Tax is PHP 2,700 for business class and PHP 1,620 for economy class.

Passengers in economy class may be eligible for a reduced rate of PHP 810 and PHP 1,350 for first-class passenger. Dependent family members of registered Overseas Filipino Workers (OFWs) departing in economy class can enjoy the lowest travel tax rate of PHP 300 and PHP 400 for first class.

4. How much is the terminal fee in the Philippines?

While the travel tax applies to all departing passengers from the Philippines, the terminal fee is a separate charge collected by individual airports to cover maintenance and improvement costs. This fee varies depending on the airport you're departing from and the type of flight (domestic or international).

Domestic terminal fees typically range from PHP 50 to PHP 300, while international terminal fees can be higher, from PHP 650 to PHP 850. Be sure to check with your airline or the specific airport website for the most up-to-date information on terminal fees applicable to your departing flight.

5. How to refund travel tax in the Philippines?

Yes, you can get a travel tax refund under certain circumstances. You may need your passport , fill out the TIEZA Refund Form , attach the payment proof , and your flight ticket . Refunds can be claimed within two years from the date of payment.

6. Who needs to pay travel tax in the Philippines?

Yes, most travellers departing the Philippines will need to pay a travel tax. This levy is imposed by the Philippine government on all individuals leaving the country, regardless of where their air ticket was purchased or how they paid for it. This regulation is based on Presidential Decree (PD) 1183, as amended

7. How do I know if I paid travel tax in the Philippines?

After successfully paying your travel tax online or at the airport counters, you'll receive an email containing an Acknowledgment Receipt (AR) . This email serves as your official confirmation. For a smooth check-in process, be sure to print two copies of your Acknowledgment Receipt. Present both copies to the airline check-in counter before boarding your flight.

8. Is travel tax the same as terminal fee in the Philippines?

No, travel tax and terminal fee in the Philippines are two distinct charges on air passengers. Travel Tax is a government-imposed on individuals departing the Philippines by air. Meanwhile Terminal Fee is the maintenance and development of airport facilities.

In short, as a tourist staying less than a year in the Philippines, you won't be subject to travel tax. However, you might still need to pay the terminal fee depending on your departing airport

9. Is there a departure tax at Manila Airport?

While there isn't a separate departure tax for domestic flights leaving Manila Airport, international travellers need to settle the Philippine Travel Tax before their flight. This travel tax is a mandatory fee collected by the Philippine government from passengers departing the Philippines for international destinations.

10. How do I claim my Philippine travel tax back?

Claiming your Philippine Travel Tax refund can be done within two years from your date of departure. You may need your passport, fill out TIEZA refund application form, and proof of payment. In some cases, the travel tax might be included in your airline ticket price. If so, your airline ticket serves as proof of payment.

Now you know the basics of your travel tax. Make sure you keep them in mind when planning and booking your trip with Traveloka ! Book your flight tickets to the Philippines, accommodation , and tourist attractions tickets just got easier.

Payment Partners

About Traveloka

- How to Book

- Help Center

Follow us on

- Airport Transfer

- Things to Do

- ProductItems.cruises-search

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

- Vulnerability Disclosure Program

Download Traveloka App

Attention, Pinoy travelers: Here's how you can pay travel tax online via TIEZA's website

By JUSTINE PUNZALAN Published Mar 02, 2023 9:02 pm Updated Mar 02, 2023 10:35 pm

Standing in snaking queues in Philippine airports may be exhausting, but there are ways to outsmart the impossible. Specifically, doing everything that you can online, including paying travel tax.

Now you can pay your travel tax sans the long queues at the airport through the Department of Tourism's Online Travel Tax Services Systems (OTTS) launched on Fab. 28.

The new online platform was developed by the agency's Tourism Infrastructure and Enterprise Zone Authority (TIEZA) in partnership with the Travel Tax Department and government payment service provider MyEG Philippines Inc.

TIEZA chief operating officer Mark Lapid said during the website's launch that its main objective is "to provide an easy and convenient way for everyone to pay their travel tax online, without the hassles of going through heavy traffic and long lines."

"In the near future, the OTTSS will become the central online hub for all travel tax services, including reduced payments, exemptions and refund," he added.

TIEZA said that the online process will. only take a minute to complete. It can also be done any time, with the website's services being available 24/7.

Here's how you can pay for your travel tax online:

1. Visit TIEZA's website at http://tieza.gov.ph .

2. Click "Menu" on the upper right corner of its homepage then select "Pay Travel Tax Online."

3. Choose your payment method from the options provided by the website. After which, you will be redirected to an online form.

Here, you would have to provide the following information:

- Passport number

- Ticket number

- Airplane seat class

- Mobile number

- E-mail address

- Destination

- Departure date

There is also a field for the amount you would have to pay, but that will be automatically filled out by the system after you have provided your destination.

4. Select your preferred payment option.

5. Send your payment.

OTTSS accepts digital payments via e-wallets such as GCash, Maya, GrabPay, and ShopeePay, as well as bank transfers from BDO, BPI, RCBC, Unionbanl, and Maybank. You can also pay using your debit card or VISA, Mastercard, and JCB credit card.

If you prefer to transact in cash, you can do so in any branch of 7-Eleven, Bayad Center, SM Malls, or Robinsons Department Store, among many others.

TAGS: Travel tax TIEZA

JUSTINE PUNZALAN

Justine is a lifestyle journalist who enjoys learning and writing about people, pop culture, and BTS.

IMAGES

VIDEO

COMMENTS

TIEZA Refund Application Form No. 353. Airline ticket showing travel tax collection. Certification from the airline that the ticket was downgraded or a certified copy of the airline flight manifest. Original TIEZA Official Receipt (passenger copy), if travel tax was paid directly to TIEZA. Double payment.

The Tourism Infrastructure and Enterprise Zone Authority (TIEZA), a Government Owned and Controlled Corporation (GOCC) attached to the Department of Tourism (DOT), was created by virtue of Republic Act No. 9593, otherwise known as the Tourism Act of 2009. It is responsible for implementing policies and programs of the DOT pertaining to the ...

TIEZA Online Travel Tax Payment System (OTTPS)

Online Travel Tax Services System

PHILIPPINE TRAVEL TAX: How to Pay + How to Apply for ...

STEP 2: Fill-up a TIEZA Refund Application Form. You can print this form ahead, too. STEP 3: Present the documents to the TIEZA Centers. STEP 4: Wait when your check is available. It's usually within three working days buy you can avail the one Same-day refund. See below who can avail. STEP 5: Get your check refund.

Original Passport TIEZA Refund Application Form No. 353 (signed by airline authorized signatory), if travel tax was collected by the airline Airline ticket showing travel tax collection Copy of fare refund voucher or certification from the airline authorized signatory that the ticket is unused, non-rebookable, and has no refund value.

TIEZA has travel tax counters in all terminals of all international airports in the Philippines. ... Simply walk straight up to the agent when you return. Option C: Through the TIEZA website. You can also pay online in advance. Just visit the TIEZA payment pageComplete the form and select the payment method that best suits you. Payment through ...

Travel Tax - Tourism Infrastructure and Enterprise Zone Authority ... Travel Tax

TIEZA Online Travel Tax Services System

The TIEZA travel tax only applies to international travellers. Filipino citizens, taxable foreign passport holders, and non-immigrant foreign passport holders who have stayed in the Philippines for more than one year and wish to travel abroad will need to pay the levy. As mentioned above, travel taxes can be settled at the airport while waiting ...

Click Travel Tax on the navigation menu, and choose Pay Travel Tax Online option. On the page, they need to click the MYEG icon. Fill-up the form. Select the preferred payment option. Pay ...

TIEZA FORM NO. 353

Welcome to the TIEZA Online Travel Tax Payment System (OTTPS). Already have an account? Login. Welcome to the TIEZA Online Travel Tax Payment System (OTTPS) The OTTPS is used to process your travel tax payments online. Full Travel Tax Rates FIRST CLASS ₱ 2,700.00. ECONOMY/BUSINESS CLASS ₱ 1,620.00 ...

How to get Travel Tax Refund? Fill-up TIEZA Refund application form. Present passport and documents to the Travel Tax officer and a SPA if the claimant is not a passenger. Get a check of the refund. Travel Tax Centers and Schedules. Here are the places you can process or pay your travel tax, tax exemption, reduced tax, or travel tax refund.

Travel Tax Exemption

Claiming your Philippine Travel Tax refund can be done within two years from your date of departure. You may need your passport, fill out TIEZA refund application form, and proof of payment. In some cases, the travel tax might be included in your airline ticket price. If so, your airline ticket serves as proof of payment.

If you paid your tax at the airport in 1 minute, you'll have a hard time getting a refund. What you should do is bring the original & photo copies of the following documents I'll be enumerating below to PTA MAIN OFFICE Kalaw St. Ermita, Manila during office hours.

Now you can pay your travel tax sans the long queues at the airport through the Department of Tourism's Online Travel Tax Services Systems (OTTS) launched on Fab. 28. The new online platform was developed by the agency's Tourism Infrastructure and Enterprise Zone Authority (TIEZA) in partnership with the Travel Tax Department and government ...

Pay Travel Tax Online

The acceptance of applications for travel tax credit is within two (2) months from the date of public announcement or not later than November 30, 2022. The travel tax credit shall have a validity of one (1) year from the date of issuance. To apply for a Travel Tax Credit Certificate, please email our Travel Tax Department at [email protected].

E-mail Address. Password. Forgot Password? Click. RESEND EMAIL. , if you didn't receive any activation email or you're having problem activating your account. Welcome to the TIEZA Online Travel Tax Payment System (OTTPS).

Reduced Travel Tax