How Much Does a Doctor Visit Cost With and Without Insurance?

Without insurance, medical care can get pricy fast. Where you live, what doctor you’re going to, and what tests you need will all figure into your doctor’s visit bill. In this article, we’ll break down those costs and give you some tips for saving money.

What Goes into the Cost of a Doctor’s Visit?

Geography is one of the biggest factors in the price of a doctor’s visit. Most medical facilities pass some of their overhead expenses onto their patients. If you live somewhere with a higher cost of living, like California or New York City, you’ll likely pay more for doctors’ visits. The practice has to pay more for utilities and rent, and those costs show up in your bill. For example, Mayo Clinic’s Patient Estimates tool quotes $846 for a 60-minute office visit in Jacksonville, Florida, but $605 for the same visit in Wisconsin.

Like the cost of living, supplies and equipment will also end up on your tab. Say you need a strep test, blood draw, or Pap smear. The supplies needed for the test plus the cost of the lab fees will all figure into the price.

Bills for the same exams and procedures can also vary depending on what kind of facility you’re going to. Smaller practices and public health centers are often a lot cheaper than university or private hospital systems. This is due in part to their buildings being smaller and their overhead fees being lower.

Price of Out-of-Pocket Doctors’ Visits

The cost of a doctor’s office visit also depends on what kind of doctor and the procedure you need to have done. For example, an in-office general wellness checkup will be cheaper than a specialist procedure. If you have an emergency, an urgent care center will be much more affordable than the emergency room.

Primary Care Physician — Physical Exam

Physicals usually include blood pressure readings, cholesterol measurements, and vaccines. Prostate exams for men and Pap smears and breast exams for women are also often included. Pediatric physicals focus on the growth milestones for your child’s age. Doctors check height, weight, sleep patterns, diet, and the vaccines required by public schools.

The range for a yearly physical can be anywhere from $100 to $250 or more without insurance. A CVS Minutecare Clinic may charge just $59 for a sports physical, but not all organizations will accept this as proof of physical health.

Primary Care Physician — Procedures

On top of the base cost for physical exams, you may have extra charges for any specific tests or procedures you need. According to the Cardiometabolic Health blog, the most common procedures in primary care medicine include bloodwork, electrocardiograms, and vaccines/injections.

Bloodwork is one of the biggest cost wild cards. Certain tests can run you from as little as $10 to as much as $10,000 . Large national labs like Labcorp offer pricing on their website, so you know what to expect going in. For example, Labcorp’s General Health Blood Test , which includes a metabolic panel, complete blood count (CBC), and urinalysis, costs $78.

Electrocardiograms or EKGs check your heart health and can find cardi ac issues. This quick procedure involves monitoring your heartbeat through electrodes placed on your skin. While it’s a painless and accurate way to detect heart conditions, the costs can add up without insurance. Expect to pay as little as $410 or as much as $1700 for this procedure, depending on local prices.

Vaccines are often required before sending your kids to school. The CDC publishes a vaccination price list annually to give you an idea of what to expect. For example, they quote $19-$132 for DTaP, $21 for Hepatitis A, and $13-$65 for Hepatitis B. The COVID-19 vaccine, however, is free of cost, regardless of insurance status.

Urgent Care Visit

If you have an emergency but are stable, urgent care is much cheaper than the emergency room. According to Scripps , most urgent care centers and walk-in clinics can at least treat dehydration, cuts or simple fractures, fever, flu, strep, and UTIs. Note that if you have chest pain, a serious injury, seizures, a stroke, or pregnancy complications, you should go straight to the ER .

For a base exam at an urgent care facility, expect to pay between $100-$150 . That price will go up depending on what else you need. For example, Advanced Urgent Care in Denver quotes $80 for an X-Ray, $50 for an EKG, $135 for stitches, and $5 for a urinalysis. In comparison, expect to pay $1,000-$1,300 for the same procedures in the emergency room.

How to Lower Your Out-of-Pocket Medical Costs

Healthcare expenses may seem overwhelming without insurance. Luckily, there are many resources available to help you cover the costs.

Free & Low-Cost Immunization and Wellness Clinics

For standard vaccines and checkups, look for local free or low-cost clinics. Check out The National Association of Free and Charitable Clinics’ search tool to find a location near you. Your city’s public health department should also offer free or low-cost vaccines and basic medical care services.

Certain large vaccine manufacturers also offer vaccine programs. For example, Merck’s patient assistance program offers 37 vaccines and medicines free to eligible patients. The program includes albuterol inhalers and vaccines for Hepatitis A, Hepatitis B, MMR, and HPV.

Cash Negotiations

Most health systems offer lower rates for patients paying cash. Some even have free programs for low-income families. For example, Heritage UPC in North Carolina has a yearly membership for low-cost preventative care. In Northern California, the Sutter Health medical system offers full coverage for patients earning 400% or less of the Federal Poverty Income Guideline .

As of January 1, 2021, all hospitals in the United States now have to follow the Hospital Price Transparency Rule . That means they have to list procedure prices clearly on their website. You can also call medical billing before your appointment to discuss cash pay options.

Federal Medical Payment Support

If all else fails, there are federal programs to help you cover the cost of medical bills.

Organizations like The United Way and United for Alice offer grants for ALICE (asset-limited, income-constrained, employed) patients. These are people living above the poverty level, making them ineligible for other government programs but below the basic cost-of-living threshold.

Medicaid is available for children, pregnant women, and adults under a certain income threshold. If your income is too high to qualify for Medicaid but you can’t afford private insurance for your children, you may be eligible for the Children’s Health Insurance Program (CHIP) to cover your children’s medical care.

Use Compare.com for the Best Doctors’ Visit Prices

Navigating bills for a doctor’s visit can feel overwhelming, but Compare.com is here to help. With our price comparison tool, you can search all clinic and doctors’ office prices in your area. Compare makes sure you’re prepared for the cost of your checkup long before you schedule your appointment.

Nick Versaw leads Compare.com's editorial department, where he and his team specialize in crafting helpful, easy-to-understand content about car insurance and other related topics. With nearly a decade of experience writing and editing insurance and personal finance articles, his work has helped readers discover substantial savings on necessary expenses, including insurance, transportation, health care, and more.

As an award-winning writer, Nick has seen his work published in countless renowned publications, such as the Washington Post, Los Angeles Times, and U.S. News & World Report. He graduated with Latin honors from Virginia Commonwealth University, where he earned his Bachelor's Degree in Digital Journalism.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

- The Best Car Insurance Mobile Apps in 2024

How much does a doctor's visit cost without insurance?

$100 – $300 average cost (primary care office visit), $150 – $600 average cost (specialist office visit), $50 – $200 cost for a virtual doctor visit.

Cost of doctor visit without insurance

A doctor's visit without insurance costs $100 to $600 on average for the office visit fee alone, depending on the location, physician type, and whether it's an initial or follow-up visit. Diagnostic tests, medical treatments, and other services often increase the cost. Many doctors now offer virtual appointments for $50 to $200 .

Over 25 million people in the United States were living without health insurance in 2023. This guide breaks down the wide range of potential costs and the many factors that influence the cost of a doctor's visit without insurance.

*Office visit fee only; testing, treatments, prescriptions, and other medical services increase the cost.

As of January 2022, federal law requires medical providers to give you a "good faith estimate" if you schedule at least 3 business days in advance, or if you ask for it. This applies to both uninsured patients and patients who have insurance and are choosing not to use it.

Factors that affect the cost of a doctor's visit

Several elements influence the cost to see a doctor without insurance:

New vs. existing patient: New patient appointments are often significantly more costly due to the additional time required for initial assessments and paperwork. Established patients may only need a shorter follow-up visit or may be seen by a Nurse Practitioner or Physician's Assistant, which costs less.

Virtual vs. in-person: Telehealth appointments are usually more affordable than in-person visits, offering a cost-effective alternative for non-emergencies.

Appointment length: Many doctors charge in 10-minute or 15-minute increments. So, a short follow-up appointment will cost much less than one involving a full examination, medical history review, or multiple diagnostic tests.

Level of care: Complex medical issues that require significant time and expertise to diagnose and treat cost more than short appointments for simpler, more straightforward problems.

Tests & treatments needed: The more services you need, the higher the cost. Each diagnostic test, medical treatment, or procedure has a separate billing code and a separate charge.

Payment method: Some doctors charge a lower rate when you use cash and pay in full at the time of service.

Geographic location: The cost of living in different areas can significantly impact medical fees.

Facility type

Where you seek medical care significantly affects the cost:

Charitable clinic or Community Health Center: The cheapest way to see a doctor without insurance is typically at a charitable clinic or government-funded Community Health Center that charges based on your income.

Telemedicine / online medical service: Many online medical provider platforms start at $20 to $50 for an initial consultation and offer discounts on a wide range of medical services that don’t require in-person care.

Retail walk-in clinic: Many retailers like Walgreens and CVS now offer several basic healthcare services, with visit fees ranging from $60 to $90 .

Urgent care: An urgent care visit without insurance costs $150 to $250 on average, though the cost may be higher if you need several tests or treatments. Urgent care centers provide services for non-life-threatening conditions at a lower price than emergency rooms.

Doctor's office: A standard visit to a doctor's office without insurance ranges from $100 to $600+ . However, many doctors' offices now offer virtual appointments averaging $50 to $200.

Emergency room: An ER visit without insurance costs $1,500 to $3,000 for non-life-threatening conditions, with costs escalating quickly based on the level of care and resources utilized.

Appointment type

Doctor visit charges vary depending on the reason for your visit. A preventative care visit, also called a physical, wellness exam, or well-person exam, often costs more than a problem-focused office visit. However, the complexity of a health problem significantly impacts the potential costs associated with diagnosis and treatment.

Physician type & specialty

Specialist visits, such as those with a cardiologist or orthopedic doctor, are typically more expensive than appointments with a primary care physician. The following table outlines the average cost of seeing various specialists without insurance:

*Visit cost only; not including labs, imaging, treatments, or other service fees.

Hidden costs & additional expenses

In addition to the upfront visit cost, hidden costs and additional expenses can add up quickly, especially for those with chronic conditions or ongoing health concerns. Added expenses may include diagnostic tests, medical treatments, follow-up visits, prescription medications, and missed work or lost wages due to the appointment.

The following table details several common tests and medical procedures and their associated costs.

FAQs about seeing a doctor without insurance

Can i visit a doctor without insurance.

You have several options for visiting a doctor without insurance. Community Health Centers are non-profit clinics that offer low-cost or free care. You can also visit urgent care or walk-in clinics, which handle non-life-threatening issues and usually cost less than emergency room visits. Telemedicine services allow virtual medical consultations.

While you can visit most doctors without insurance, you still have to pay for the services you receive. Some doctor's offices require payment upfront at the time of service, while others send you a bill.

Can I go to the hospital without health insurance?

Federal law requires hospitals to provide treatment regardless of insurance status or ability to pay. An ER doctor visit is typically more expensive than seeing a doctor at any other medical facility. However, do not hesitate to go to an emergency room if your life is in danger.

How can I calculate the cost of an upcoming doctor's visit?

Many doctors now post their prices online for full transparency. If the pricing is not available on their website, contact the doctor's office directly and ask for a good faith estimate based on the type of appointment. Ask them what the estimate includes and if there are any other potential fees for the visit.

Strategies to reduce your medical costs without insurance

There are several strategies patients can use to help lower medical bills:

Shop around for the best prices. Mention your uninsured status and ask about cash payments or pay-in-advance discounts.

Look for charitable clinics and Community Health Centers that use a sliding scale fee system and may offer some services for free.

Negotiate costs with healthcare providers when possible and ask about lower-cost alternatives to recommended treatments.

Use online medical services when in-person care isn't necessary, as virtual appointments are typically cheaper.

Ask about payment plans to spread out the cost over time.

Prioritize preventative care, such as regular check-ups, vaccinations, and screenings to reduce your risk of developing more costly chronic health conditions later.

Check to see if you qualify for Medicaid. Eligibility is based on age, household income, family size, and disability.

Using our proprietary cost database, in-depth research, and collaboration with industry experts, we deliver accurate, up-to-date pricing and insights you can trust, every time.

Cost of doctor visit by state

The following estimated costs are based on cash prices that providers have historically charged on average for doctor visit and will vary depending on where the service is done. The prices do not include the anesthesia, imaging, and other doctor visit fees that normally accompany doctor visit.

What happens at a doctor's visit?

People go to the doctor for routine physical exams as well as acute care when they get sick or injured. Visits to the doctor are important for preventing disease and managing any health problems. During your doctor’s visit, the physician checks your blood pressure, temperature, and heart rate.

Your doctor may listen to your heart, check your ears, nose, and mouth, and perform a physical exam. They may also ask you about your medical history and the medications you take. Your doctor may want you to have blood drawn for laboratory testing during your doctor’s visit.

How long should a doctor’s visit last?

It’s common for your entire visit to the doctor to take a long time. From start to finish, your appointment may take well over an hour . Many patients sit in the waiting room before being called back for examination.

How long you’ll wait depends on your specific doctor’s office and how busy they are. Once you’re in the exam room, the visit with your doctor will go quickly. On average, patients spend about 20 minutes in the exam room with their doctor.

Why are doctor visits so expensive?

Doctor's visits are expensive for several reasons, including their offices’ administrative responsibilities and the cost of medical services. Your doctor’s office has to work with different insurance companies and pay administrative staff trained in medical billing. Your doctor charges for their services, lab work, or imaging they run and may charge facility fees as well.

How much does a doctor visit cost without insurance?

Without insurance, your doctor’s visit can cost hundreds of dollars. On average, people in the U.S. pay just under $400 for their annual physical exam at a doctor’s office if they don’t have insurance. These costs include the provider fee for seeing the doctor and costs for any blood work or imaging that’s needed.

What are the signs of a bad doctor?

Know the warning signs of a bad doctor so you can avoid problems and get better medical care. One sign is if your doctor doesn’t listen to you or take your concerns into account during your visit. Another is if your doctor rushes through your appointment, not giving you the time needed to deal with your concerns.

A third warning sign is if your doctor doesn’t explain why certain tests or treatments are needed in a way you can understand.

What should you not tell your doctor?

Your doctor doesn’t need to know every detail about your life to provide proper care. But they do need you to be truthful about your health. You should never lie about the symptoms you’re experiencing or the medications you’re taking. If you aren’t taking medications as prescribed, your doctor needs to know. You don’t need to tell them health details they already know or give them any of your financial information.

Costs vary by specialty

The cost of a doctor visit could vary depending on the specialty. To see the cash prices for a specialist visit, type is a specialty.

* Savings estimate based on a study of more than 1 billion claims comparing self-pay (or cash pay) prices of a frequency-weighted market basket of procedures to insurer-negotiated rates for the same. Claims were collected between July 2017 and July 2019. R.Lawrence Van Horn, Arthur Laffer, Robert L.Metcalf. 2019. The Transformative Potential for Price Transparency in Healthcare: Benefits for Consumers and Providers. Health Management Policy and Innovation, Volume 4, Issue 3.

Sidecar Health offers and administers a variety of plans including ACA compliant and excepted benefit plans. Coverage and plan options may vary or may not be available in all states.

Your actual costs may be higher or lower than these cost estimates. Check with your provider and health plan details to confirm the costs that you may be charged for a service or procedure.You are responsible for costs that are not covered and for getting any pre-authorizations or referrals required by your health plan. Neither payments nor benefits are guaranteed. Provider data, including price data, provided in part by Turquoise Health.

The site is not a substitute for medical or healthcare advice and does not serve as a recommendation for a particular provider or type of medical or healthcare.

No Insurance? How to See a Doctor Without Insurance

Shop around, ask about cash discounts and consider community health centers and free clinics.

This article is based on reporting that features expert sources.

8 Tips for Getting Medical Care Without Insurance

Millions of people in the U.S. live without health insurance, a circumstance that can cause people to weigh the need to see a doctor against the cost. Unfortunately, many people will put off or do without medical care because they can't afford it, a decision that could jeopardize their health.

Getty Images

While the Affordable Care Act has boosted the number of Americans with insurance, millions remain uninsured. In 2018, 27.5 million people – more than 8% of the U.S. population – were uninsured, according to the U.S. Census Bureau. Private health insurance covered 67% of Americans. Those without health coverage face the dilemma: Where can I go for medical care without insurance?

The Coverage Gap

In addition to the people who are uninsured, millions are underinsured, according to a survey by the Commonwealth Fund. Among people with health insurance, 29% were underinsured in 2018, compared to 23% in 2014, according to the fund's Biennial Health Insurance Survey: "People who are 'underinsured' have high health plan deductibles and out-of-pocket medical expenses relative to their income and are more likely to struggle paying medical bills or to skip care because of cost."

The survey found that 41% of underinsured adults reported they delayed needed medical care because of cost. By contrast, 23% of people with adequate insurance coverage said they delayed such treatment. Also, 47% of underinsured adults reported medical bill and debt problems.

Tips for Finding Affordable Medical Care

If you're uninsured or underinsured, here are eight strategies for finding affordable medical care:

- Research your eligibility for insurance.

- Shop around.

- Agree to a price in writing.

- Ask about a cash discount.

- Keep good records.

- Be prepared.

- Consider community health clinics.

- Think about urgent care centers.

1. Research your eligibility for insurance.

Depending on your situation, you might be eligible to buy individual health insurance coverage from the ACA marketplace or in the individual market, or you might qualify for Medicaid, Medicare or the Children's Health Insurance Program for your kids, says Kim Buckey, vice president of client services at DirectPath, a company that provides personalized health benefits education and enrollment services to large employers.

2. Shop around.

Prices for health care appointments and procedures vary dramatically, with differences of up to 2,000%, says Bill Kampine, co-founder and senior vice president, analytics and innovation, for Healthcare Bluebook. The company's client base includes municipal and large self-insured employers. It also offers a free online tool that individuals can use to comparison shop for health care services by region.

3. Agree to a price in writing.

4. Ask about a cash discount.

5. Keep good records.

6. Be prepared.

7. Consider community health centers and free clinics.

There are a number of health care providers that provide services at little or no cost to those who are eligible, says April Temple, an associate professor of health sciences at James Madison University in Harrisonburg, Virginia.

8. Also, think about urgent care centers.

Nationwide, there's been a meteoric rise in the use of urgent care centers in recent years. These facilities provide a higher level of care than what's available at some pharmacy retail clinics, but aren't equipped to provide emergent care for things like heart attacks and strokes. Urgent care centers can treat a wide array of maladies, including upper respiratory infections, bronchitis, diverticulitis; high blood pressure, food poisoning, sprains, minor fractures and lacerations. An urgent care visit typically costs around $150, according to Debt.org.

12 Common Medical Emergencies

The U.S. News Health team delivers accurate information about health, nutrition and fitness, as well as in-depth medical condition guides. All of our stories rely on multiple, independent sources and experts in the field, such as medical doctors and licensed nutritionists. To learn more about how we keep our content accurate and trustworthy, read our editorial guidelines .

Buckey is vice president of client services at DirectPath, a company that provides personalized health benefits education and enrollment services to large employers.

Kampine is co-founder and senior vice president, analytics and innovation, for Healthcare Bluebook. The company’s client base includes municipal and large self-insured employers. It also offers a free online tool that individuals can use to comparison shop for health care services by region.

Temple is an associate professor of health sciences at James Madison University in Harrisonburg, Virginia.

Tags: health insurance , Affordable Care Act , Medicaid , patient advice

Most Popular

Patient Advice

Pregnancy Resource Center

health disclaimer »

Disclaimer and a note about your health ».

Sign Up for Our 3-Day Guide to Medicare

Confused about Medicare? We can help you understand the different Medicare coverage options available to help you choose the best Medicare coverage for you or a loved one.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

Signs of a sports betting addiction.

Vanessa Caceres Sept. 13, 2024

Anemia: Signs, Treatment and Prevention

Claire Wolters Sept. 10, 2024

How to Find a Psychiatrist

Elaine K. Howley Sept. 6, 2024

Viral Respiratory Infections

Vanessa Caceres Sept. 6, 2024

Plans for Best Children’s Hospitals

Ben Harder Sept. 3, 2024

Menopause Guide

Christine Comizio Aug. 30, 2024

Cancer Treatment

Paul Wynn Aug. 29, 2024

Unsafe Hospital Discharge

Lisa Esposito and Payton Sy Aug. 28, 2024

In North Carolina, Exemplary Maternal Care Benefits Black Patients

Sabrina McCrear Aug. 28, 2024

Nerve Pain Management

Payton Sy and Claire Wolters Aug. 27, 2024

Find Urgent Care today

Find and book appointments for:.

- Urgent Care

- Pediatric Urgent Care

- COVID Testing

- COVID Vaccine

Price Transparency

How much does a doctor’s visit cost without insurance.

According to the Agency for Healthcare Research and Quality, the average cost of a visit to the doctor’s office in 2016 was $265, with expenses ranging from $159 to $419 depending on the specialty.

- At an urgent care center you can expect to pay between $100-200 to see a provider, plus the cost of any treatments or testing you may need.

- Always ask for pricing information before you agree to any testing or treatment. You are entitled to this information.

Going to the doctor for any reason can be expensive. Without insurance, you can expect to pay approximately anywhere from $50–$350 just for a routine medical exam, which doesn’t include additional expenses such as x-rays , blood tests, or other lab work.

The cost of a doctor's visit

According to Solv’s Chief Medical Officer, Dr. Rob Rohatsch, the cost of a doctor’s visit can vary widely depending on factors such as:

- The type of doctor you are seeing

- The reason for your visit

- Where you see the doctor, for example, if you go to an urgent care facility or a doctor’s office

- Whether you are a new or established patient

- Any necessary tests or treatments

- Whether you need lab work

Visits to specialists such as primary care providers, pediatricians, and psychiatrists were lower than the average cost, while the most expensive doctor’s visits were for orthopedists and cardiologists.

Data from the Agency for Healthcare Research and Quality indicates that if you are visiting a doctor and don’t have insurance, you can expect to pay roughly the following amounts. The cost could vary depending on the factors listed above.

- Psychiatry: $159

- Pediatrics: $169

- Primary care: $186

- Dermatology: $268

- OB/GYN: $280

- Ophthalmology: $307

- Cardiology: $335

- All other: $365

- Orthopedics: $419

Additionally, if you are a new patient, there may be an additional charge associated with your new patient exam.

Where to see a doctor without insurance

If you don’t have insurance, the cost of your doctor’s visit can also be affected by where you go to see the doctor. There are many places you can seek medical care, some of which are more affordable than others, notes the Agency for Healthcare Research and Quality:

- Community health clinics often provide free medical care or low-cost care, including preventive care, health screenings, and vaccinations .

- Urgent care centers offer many health services. Many don’t require appointments, although your wait time may be less if you schedule an appointment in advance. You can expect to pay around $100 - $200 to see an urgent care provider, plus the cost of any treatments or testing you may need.

- Many health care facilities now offer telehealth services, which are often more convenient and more affordable. For some conditions, however, you may need to be seen in person for proper diagnosis and treatment.

- If your medical need is not urgent, and you know the type of doctor you need to see, you can schedule an appointment with a primary care physician or a specialist at their office. Be sure to ask about their payment policy in advance. If you don’t have insurance, you may be required to pay the entire bill at the time of service.

- If you have a medical emergency, you can visit the nearest emergency room. Even if you don’t have insurance, you will be able to receive treatment. However, this is typically the most expensive option. If you have a non-emergency medical condition that can wait until you can be seen at one of the other options, you will likely save money.

Paying self-pay prices for doctor’s visits

Even if you have insurance, you may be able to save money by paying cash for certain medical services. While preventive care may be covered at 100% by your insurance company, other tests and treatments may be applied to your deductible. If you have a high deductible and don’t expect to meet it – especially if it’s late in the calendar year – paying cash for your medical care may be a cheaper option.

Most doctor’s offices and health care providers charge a higher price when they bill the insurance company. For example, they may charge the insurance company $70 for a treatment or service, but if the patient is paying cash, they may only charge $60. This is known as the self-pay price . If you pay cash, the claim won’t be submitted to your insurance company, but you could end up saving money.

Always ask for pricing information before you agree to any testing or treatment. You are entitled to this information. As of 2021, hospitals are required to disclose self-pay prices, even when the patient has insurance. If the doctor’s office won’t provide you with this information, be persistent, or seek care somewhere else. If you plan on paying self-care prices, you aren’t limited to the providers in your insurance network. You’ll have a wider range of options to choose from, and you can choose a provider who is willing to provide fair, clear prices.

Let your doctor’s office know that you are paying out of pocket, and ask if they offer a discount for self-pay patients. Many doctor’s offices will offer special rates for patients who are paying cash or who do not have insurance; however, they may not advertise these rates, so it’s always a good idea to ask.

Know what you’ll pay ahead of time with Solv ClearPrice TM

According to Healthcare Finance News, more than half of Americans avoid going to the doctor when they’re sick due to high medical costs or unclear costs. Solv is committed to eliminating surprise medical bills with Solv ClearPrice™ . We partner with thousands of providers across the country who have agreed to display self-pay prices for their services. When you book an appointment on Solv, you will be able to see the self-pay price for many common services.

To schedule an appointment, search our directory for a provider in your area. Begin typing the service you are looking for, and choose from the list of options that appear. If you aren’t sure which type of doctor you need to see, you may want to try an urgent care clinic or a walk-in clinic . In many cases, you can schedule an appointment quickly and conveniently online, and many of our providers have same-day or next-day appointments available.

Frequently asked questions

What factors affect the cost of a doctor's visit, what is the average cost of a visit to the doctor’s office, are there any additional charges for new patients, where can i seek medical care if i don't have insurance, what is the self-pay price, are hospitals required to disclose self-pay prices, can i get a discount if i'm paying out of pocket, what is solv clearprice™.

Michael is an experienced healthcare marketer, husband and father of three. He has worked alongside healthcare leaders at Johns Hopkins, Cleveland Clinic, St. Luke's, Baylor Scott and White, HCA, and many more, and currently leads strategic growth at Solv.

Dr. Rob Rohatsch leverages his vast experience in ambulatory medicine, on-demand healthcare, and consumerism to spearhead strategic initiatives. With expertise in operations, revenue cycle management, and clinical practices, he also contributes his knowledge to the academic world, having served in the US Air Force and earned an MD from Jefferson Medical College. Presently, he is part of the faculty at the University of Tennessee's Haslam School of Business, teaching in the Executive MBA Program, and holds positions on various boards, including chairing The TJ Lobraico Foundation.

- Agency for Healthcare Research and Quality: Expenses for Office-Based Physician Visits by Specialty and Insurance Type, 2016 https://meps.ahrq.gov/data_files/publications/st517/stat517.shtml

- Hospital Price Transparency, Centers for Medicare and Medicaid (2022) https://www.cms.gov/hospital-price-transparency

- More than half of Americans have avoided medical care due to cost (2019) https://www.healthcarefinancenews.com/news/more-half-americans-have-avoided-medical-care-due-cost

- primary care

- telemedicine

- healthcare costs

- health insurance

- urgent care

Quality healthcare is just a click away with the Solv App

Book same-day care for you and your family

Find top providers near you

Choose in-person or video visits, manage visits on-the-go, related articles.

How Much Does Urgent Care Cost Without Insurance?

When you have a pressing medical issue, your first priority is getting to see a doctor, quickly. Getting an...

The 2022 Solv Guide to Health Insurance

The final months of the year can be some of the most stressful for a variety of reasons: gift shopping, family...

Cost of Blood Test Without Insurance in 2024

When you’re uninsured, you’re likely to keep a closer eye on all of your medical costs. However, staying...

How to Save Money on Healthcare Through Self-Pay

Americans hold a few core beliefs about how health insurance is supposed to work. They know that it’s meant to...

Sick kids? Solv has your back with pediatric care

Your child is under the weather, so you call your pediatrician. They say, “Our next available appointment is in...

9 Things to Consider When Choosing Your 2020 Health Insurance

Open Enrollment began on the first of November–but what does this mean for you? Health insurance can be...

How Much Do Annual Physicals Cost Without Insurance?

If you are in need of an annual physical, you may be wondering how much annual physicals cost without...

How Much Do Stitches Cost Without Insurance?

You fell and got a nasty gash that’s going to require stitches. You can easily get it stitched at an urgent care...

What You Need to Know About Surprise Bills

This year, more than 50% of Americans will struggle to pay for medical bills, according to data from Debt.com....

Changing Consumer Behavior in Healthcare is Possible. Give Them an ...

Consumers continue to prove that they’re hungry for more information about their healthcare and want increased...

Related Health Concerns

Abdominal Pain

COVID-19 Vaccine

Cataract Surgery

Cold Medicine

Daycare Physical

Pinched Nerve

Sexually Transmitted Diseases

Urinary Tract Infection (UTI)

Urine Culture

This site uses cookies to provide you with a great user experience. By using Solv, you accept our use of cookies.

How Much Does a Doctor Visit Cost?

A doctor visit will be necessary whether you have a medical condition or you simply want to show up for a routine physical.

There are so many factors involved when visiting a doctor’s office and paying the bill, so it can be hard to offer an “exact” estimate.

How much does a doctor visit cost?

In general, a regular routine appointment with a primary care doctor, without any other tests involved, can cost anywhere from $150 to $300 without insurance . If the visit is through the hospital at an emergency room, then the fees can soar to $375 to more than $700+ without insurance. Doctor visits at home can range anywhere from $200 to $550, depending on how far the doctor has to travel and what needs to be diagnosed.

A doctor’s visit at a pharmacy, such as CVS or Walgreens , could cost anywhere from $89 to $129 without insurance. These visits, most of the time, will be performed by a nurse practitioner.

Ultimately, the cost of a doctor’s visit will depend on the severity of your condition, where you were cared for and the additional tests that were required.

If you have health insurance, you will more than likely be responsible for your deductible and co-pays, and this doctor’s visit should always be covered by insurance, and routine annual exams, according to Affordable Health Care Act, will be covered 100 percent. To find out more, contact your insurance company to know what you’re responsible for. Those who have a co-pay often find themselves paying anywhere from $5 to more than $50; again, depending on the policy. If you do not have insurance or you are looking for a new policy, consider browsing through hundreds of policies at eHealthInsurance.com .

Refer to our table below to see what you may have to pay for a doctor’s office visit without any insurance:

NOTE: If you’re an established patient, these costs can drop by more than 50 percent, depending on your doctor’s office billing policy.

In 2015, 79 percent of uninsured callers who called a doctor’s office were offered an appointment, whereas six percent were denied due to their insurance status. According to this John Hopkins study , the average price for a new uninsured patient was quoted for $160, with some states such as Oregon being as high as $188. The prices were much lower than a federally qualified health center.

What are the extra costs?

Aside from the doctors’ office visit, there could be a good chance that a doctor will want to order more tests, which will add to the total estimates as noted above. Refer to our table below to see what routine diagnostic tests and routine lab services can cost without any insurance being involved.

How can I save money?

Many doctor’s offices will offer a cash discount to those who don’t have health insurance. Talk with the doctor’s office ahead of time to see if they have any discounts available.

Consider a virtual doctor’s visit if your symptoms are mild. These visits can be less than $75 if you have no insurance. For instance, Doctor on Demand charges $75 for those without insurance, and another company — Amwell — charges $59 for those who have no insurance. With these services, you can either use your computer or phone and video chat with a doctor, just like you would in a waiting room, but unlike a regular doctor’s office, you won’t have to drive there or sit in a waiting room with sick people.

As mentioned, schedule your annual physical ahead of time. As long as you have a health insurance policy, it will be 100 percent covered.

If your doctor does prescribe a prescription, ask for a generic equivalent if they have one and ask if there are any other ways to save.

Advertising Disclosure: This content may include referral links. Please read our disclosure policy for more info.

Average Reported Cost: $203

How much did you spend?

Select State Alaska Alabama Arkansas Arizona California Colorado Connecticut District of Columbia Delaware Florida Georgia Hawaii Iowa Idaho Illinois Indiana Kansas Kentucky Louisiana Massachusetts Maryland Maine Michigan Minnesota Missouri Mississippi Montana North Carolina North Dakota Nebraska New Hampshire New Jersey New Mexico Nevada New York Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah Virginia Vermont Washington Wisconsin West Virginia Wyoming

insuranance never has paid for 6ix monthso

Blue Cross Blue Shield so I had to pay at beginning of hospital request I ended up paying 102.33 dollars after medicare now the insurance co. said I still should be reimbursed.

About Us | Contact Us | Privacy Policy | Amazon Affiliate Disclosure Copyright © 2022 | Proudly affiliated with the T2 Web Network, LLC The information contained on this website is intended as an educational aid only and is not intended as medical and/or legal advice.

- Skip to main content

- Skip to secondary menu

- Skip to primary sidebar

- Skip to footer

Health Share 101

The #1 Website about Health Shares

How much does a Doctor’s Visit cost without Insurance?

Updated June 2, 2024 by Holly Patiño Leave a Comment

This post may contain affiliate links, which means if you enroll through my link, I’ll receive a small commission at no extra cost to you.

Many people visit a doctor regularly or have yearly health checks. However, a doctor’s visit can be prohibitively expensive without a policy.

But how much does a doctor’s visit cost without health insurance, exactly?

Without insurance, a doctor’s visit costs between $300 to $600, depending on the type of doctor, appointment, treatment administered, and location of the doctor’s office or clinic. The cost of a specialty doctor visit is higher than the cost of a primary care doctor visit.

Keep reading to learn more about the cost of uninsured doctor’s visits.

How Much Does a Doctor’s Appointment Cost Without Insurance?

The following table has the average cost of a doctor’s visit without insurance.

Exactly how much it will cost to go to the doctor varies on the following factors.

- Type of doctor you are seeing

- Reason for your visit

- Where you see the doctor (urgent care facility, doctor’s office)

- New or frequent patient

- Tests and treatments

- Lab work done

The cost of a specialty doctor is often higher than the cost of a primary care specialist. Orthopedists and cardiologists are the most expensive doctors to visit.

“The average cost of a doctor’s visit in 2016 was $265, with expenses ranging from $159 to $419 depending on the specialty.” Agency for Healthcare Research and Quality

How Much Does a Doctor’s Appointment Cost With Insurance

Now that we’ve answered the question, “How much does a doctor appointment cost without insurance,” let’s compare the relevant costs to the same appointments with insurance.

Where to See a Doctor If You Don’t Have Health Insurance

If you don’t have health insurance, these are a few affordable options for medical care.

Community Health Clinics

Community health clinics provide free or low-cost services to their patients. These services include preventative care, vaccinations, and health screenings.

Average Cost: Free

Urgent Care

Urgent Care facilities offer many different services to their patients, including doctor’s appointments. Some urgent care facilities take walk-in appointments, while others require you to book in advance (usually on their website).

Average Cost: $100-200 + service-related fees

Many healthcare providers offer telehealth services to make care more accessible. After consultations, the doctor may prescribe medication or give you medical advice. Sometimes, they’ll advise you to see a doctor in person.

Average Cost: $65-260 ( Teladoc , MDLive , and Doctor on Demand ); $5 for Mira Members

Doctor’s Office

You can still see a doctor at most doctor’s offices if you don’t have health insurance. Ask the office in advance about their policies and pricing for uninsured patients. If you tell your doctor that you don’t have health insurance ahead of time, you may be able to negotiate the cost of your doctor’s visit.

Average Cost: Around $315 (varies significantly by specialty and specific offices)

Mira is a great option if you do not have access to health insurance. Mira members can have virtual visits for $25 and in-person visits to urgent care for $99. Mira also offers affordable lab testing, prescriptions, and behavioral services.

However, Mira is meant to be used by women to track their fertility health. It’s not the best option for men or women who aren’t looking for fertility help.

Average Cost: $25-99

How Much Is a Doctor’s Visit Without Insurance: Factors Affecting Cost

Multiple factors affect how much a doctor’s visit costs. The exact cost ultimately depends on the appointment needed and the type of provider you see.

Type of Appointment

The type of patient you are affects the cost of a doctor’s visit.

Your first visit to a new doctor’s office is typically longer than a regularly scheduled check-up because your medical provider needs information about your medical history. As a result, new patients might need to pay an additional fee in addition to the original cost of the appointment.

Healthcare Provider

The type of healthcare provider you choose also affects the costs. Seeing a primary care provider will cost you less than seeing a specialist or cardiologist.

For example, primary care office visits cost around $265, while seeing an orthopedic doctor costs about $416 without health insurance.

Some primary care offices have physician assistants who see patients. Generally, those visits cost much less than seeing an actual physician or doctor.

The type of service performed also affects the cost of the visit. For visits requiring only a minor examination, the appointment may cost less than a normal visit. However, if the visit requires additional examinations and procedures, such as injections or lab draws, it will cost more than a normal doctor’s visit.

The cost of a doctor’s visit varies depending on where your appointment is being held. Seeing a physician in an emergency room will cost significantly more than seeing one at a walk-in clinic. Visiting a medical provider in a larger city will likely cost more than a doctor’s visit in a smaller city.

Check the prices of the other medical offices before scheduling an appointment to ensure you know how much you are paying. Remember that in-office appointments typically cost more than visits conducted over the phone.

How to Save Money at the Doctor Without Health Insurance

Here are a few ways to save money on doctor’s visits without health insurance.

Ask for Self-Pay Discounts

When calling to make an appointment, tell the receptionist at the desk that you are a self-paying patient. Then ask if the office has any special prices for patients paying for themselves. In some circumstances, this method can be cheaper than insured rates.

Negotiate Cost

Some doctor’s offices allow patients without health insurance to negotiate the cost of a visit. When you make a doctor’s appointment, ask if you can negotiate the appointment cost and tell the receptionist that you don’t have health insurance.

Call in Other Providers

Call multiple offices around town and compare prices with each location. You might see that there are huge price differences if you shop around! Make a list of the cost of each provider or location so you can find the most affordable one.

Community health clinics are great at providing cheap healthcare, so go to a local community health clinic rather than a traditional doctor’s office. Some may offer services for free, while others may charge you based on your family’s income.

Avoid Unnecessary Tests

Tests can cost a lot of money, especially if you don’t have health insurance. If you want to save money, ask your doctor if the tests they are conducting are really necessary. If they aren’t, don’t allow them to do the test.

Use Telehealth Services

To save money on a doctor’s visit, use telehealth services and don’t physically go to the doctor’s office. Telehealth doctor’s visits typically cost between $30 and $100 without health insurance. Plus, you never have to leave your home, and you won’t have to wait for the doctor to be ready!

Find out if your primary care provider offers telehealth services. If they don’t, there are many affordable telehealth services that you can use.

However, remember that a telehealth doctor’s visit involves many questions about your health, which takes time. Telehealth doctors also can’t conduct tests, so they may refer you to a physical doctor or specialist if you have health issues that they can’t diagnose remotely.

Visit University Clinic

If you live near a medical school or the local university has a clinic that people who aren’t students can visit, make a doctor’s appointment at the clinic. The visit will likely be cheaper than a doctor’s visit at a non-university clinic, as most employees will be students.

Possible Questions to Ask Before a Doctor’s Visit

To help you determine the cost of a doctor’s visit, ask the receptionist at the doctor’s office you are calling the following questions.

- How much is a doctor’s visit without insurance?

- How much will a new patient appointment cost?

- How much will a follow-up visit cost?

- How much will a check-up cost?

- How much do lab tests typically cost?

Places that Offer Free Doctor Consultations

There is a wide variety of online doctors to speak with free of charge. Below are some ideal options that can work for a wide spectrum of diverse patients with unique needs!

Your Doctor’s Online

Your Doctor’s Online is a free online doctor chat service that provides connections with certified physicians. If you download their free app, you can book appointments promptly. All of these appointments will be online. As a member, you can receive free urgent care anywhere in the area.

ICliniq is a useful service that offers 24/7 doctor consultations at reduced costs. With this program, you can receive answers from doctors and consultants for all kinds of medical questions. To participate in this program, you need to write a detailed health inquiry, choose a chat plan that fits your needs, and chat with a doctor whenever you need advice based on your plan.

Health Resources Services Administration

Consult the Health Resources Services Administration (HRSA). These health centers can provide low-cost health care. Their programs have supported people with low incomes, people who have come in contact with HIV, pregnant women, parents and families with children, people in or from rural communities, patients who require transplants, and people in the health workforce.

Smart DocMD

SmartDocMD gives customers access to an online doctor for free if they need to discuss existing health problems or issues with a healthcare professional. You can get started by contacting an online doctor. You can easily get in touch with experts and learn more about their various services.

If you are looking for cheap or free doctor’s visits, many of the resources listed above can help you with these existing issues. These resources can provide cheap healthcare that generally takes place within your home. Don’t pass up these opportunities, especially if you are eligible for these services!

Overall, while doctor’s visits can be expensive if you do not have health insurance, there are things that you can do to save money. While you may not think it is important to go to the doctor regularly, especially if you are a relatively healthy person, it is important because it lets you track your health and notice potential issues before they negatively affect you.

Finding a place that offers affordable doctor’s visits may take work, but the effort will be worth it in the end. Before you make an appointment at a free or low-cost medical clinic, keep in mind that the number of appointments available may be limited. Many people need affordable health care, and only so many doctors can work at free or low-cost clinics.

No Insurance?

When it comes to healthcare, most people think that their only options are to pay for expensive Health Insurance or try their luck being uninsured.

The great news is that you have a third option: join an affordable Health Share plan that meets your needs! Health Sharing programs are one of the most effective and affordable alternatives to Health Insurance.

If you don’t know what a Health Share is, you can start here to learn how it works and why it’s a great alternative to health insurance. If you are looking for affordable healthcare, I highly recommend checking out my article about the Best Health Share Plans .

Related Posts:

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Hello! My name is Holly, and I am so happy you have found my website! My mission is to help more people, like you, access affordable healthcare. I have found that one of the best ways to do this is by joining a reputable Health Share.

Privacy Policy

Terms and Conditions

Disclosures

Ready to get started?

Get a Quote

Health Share Plans Guide

Best Health Share Plans

What are my care options and their costs?

When you or a family member needs care, there may be more options than you realize. Some options may save you time — others may save you money, particularly if you get health insurance through work. So, before you spend time waiting in the emergency room (ER) or maybe end up with an unexpected bill, consider these alternatives that could save you up to $2,500. 1

Compare your care options

Primary care provider, average cost.

$170 1 for in-person visits, $99 or less for virtual primary care visits

Hours open:

Weekday office hours, generally

Usually little wait with scheduled appointments

Your primary care provider may know your history best, they can quickly access your records and may offer in-person and virtual care .

- Urinary tract infection

Sign in to find care

24/7 virtual visits.

Less than $49 2

Available all day, every day

Usually no wait

Connect with a care provider by phone 3 or video for diagnosis of common medical conditions and, if needed, Rx prescriptions.

- Cold and Flu

- Sinus problems

- Yeast infections

Convenience care clinic

Nights and weekends, generally

30 minutes or less on average

Get care for common symptoms from nurse practitioners and physician assistants — without an appointment — at retail pharmacy clinics.

- Minor injuries

Urgent care center

Get walk-in care for serious illnesses and severe injuries from physicians and care teams.

- Muscle sprains or strains

- Skin infections

- Broken bones

Emergency Room

Available 24 hours a day, generally

Up to 2 hours on average

Get immediate care for life-threatening injuries or illnesses from physicians and care teams at hospital emergency departments.

- Shortness of breath

- Major burns

- Severe injuries

- Heavy bleeding

Choose network care providers to help avoid cost surprises

Freestanding emergency rooms, also called urgency centers, are facilities typically unattached or unaffiliated with a hospital. Although these facilities treat many of the same conditions as a traditional ER, they may come with higher costs because they're out of network.

Get a closer look at your care options

Watch a video presentation to get details about:

- Care options

- Costs for care

- How to choose care

800.970.1964 | Contact Us | Client Portal

- Search for: Search Button

- Beginner’s Guide to Medicare

3 Common Medicare Mistakes

- How to Sign Up For Medicare

- Parts of Medicare (A, B, C, D)

- When to Enroll in Medicare

- Medicare Costs [Updated 2024]

- Sign up for Medicare Easy Pay

- Medicare IRMAA Explained

- Medicare Supplements Explained

- Medigap Eligibility

- Medigap Enrollment Periods

- Medigap Plan F

- Medigap Plan G

- Medigap Plan N

- Best Medicare Supplement Plan

- Medicare Advantage Explained

- 3 Types of Advantage Plans

- Advantage Enrollment Periods

- Part D Drug Plans Explained

- Part D Enrollment Periods

- Part D Donut Hole

- Part D Extra Help (LIS)

- Medicare & Employer Coverage

- Medicare with Medicaid

- Medicare for Veterans

- Medicare for the Disabled

- Medicare with FEHB

- Medicare for Expats

- Insurance Companies

Supplements vs. Advantage

Social Security

Dental Insurance

- Cheat Sheet

Calculators

Cancer Insurance

Hospital Insurance

Health Insurance

Meet the Team

Our Reviews

Medicare Mama

- Schedule Appointment

How Much Does It Cost to See a Doctor With Medicare?

Sylvia Gordon

- November 29, 2023

The average American sees a doctor roughly four times per year, whether it’s their primary care physician or a specialist. That number is higher the older we get, as our health needs become more complicated.

You can make the most of each visit by coming prepared with your concerns or choosing virtual appointments. However, each doctor’s visit has a cost, known as copays or coinsurances.

Copays and coinsurance are your shares of the cost of medical treatment. Usually, you pay this amount at each visit to the doctor. This may be what you think of when trying to figure out your cost to see a doctor with Medicare.

In this article, we will cover four scenarios:

- Cost to see a Doctor with Part B only

- Cost to see a Doctor with Medicare advantage

- Cost to see a Doctor with Medicare Supplement Plan G

- Cost to see a Doctor with Medicare Supplement Plan N

We will cover each scenario in detail, and then you can compare the costs for yourself.

Who is covered?

When we talk about a doctor’s visit, this can refer to your primary care physician and a specialist. Medicare defines a doctor as a Doctor of Medicine (MD) and a Doctor of Osteopathic Medicine (DO). You can also be covered for services from other healthcare providers, such as nurse practitioners, clinical social workers and physical therapists.

A dentist, podiatrist, optometrist, or chiropractor can be covered in some specific cases.

Seeing the Doctor: With Part B

Medicare Part B will cover 80% of your doctor’s fee for your visit and any required diagnostic tests. This fee would apply after the annual deductible has been paid. This means that you will only be responsible for paying 20% of the bill.

Make sure your provider accepts Medicare payment, called accepting assignment , for the lowest cost to see a doctor with Medicare. If your doctor will accept Medicare’s fee for the visit and doesn’t charge anything else, they are said to “accept assignment.” But if your doctor charges more than Medicare pays, you are responsible for the difference.

If your doctor does not accept assignment, they may still accept Medicare on a case-by-case basis. In these situations, you may be responsible for the whole amount up front, and you or the provider will need to submit the claim to Medicare.

There are also two annual appointments that have no out-of-pocket costs.

“Welcome to a Medicare” preventive care visit.

During your first year in Medicare Part B, Medicare provides complete coverage for a preventive care doctor visit, which includes:

- a review of your medical history

- a simple vision test

- certain screenings

- a measurement of your vital signs (such as weight and blood pressure), and

- a plan of any other screenings or preventative services you may need.

Annual wellness visit.

After your first year of coverage, you are covered for one annual wellness visit. Your doctor will review your medical history, update your list of medications, measure and update your vital signs and discuss your health.

Seeing the Doctor: With Medicare Advantage

Medicare Advantage plans are managed care plans that cover all the benefits you receive under Original Medicare (Part A and Part B). However, some plans may have additional benefits and may charge a premium.

Your Medicare Advantage plan will typically cover most of your doctor’s visits, although you must pay a copay. That copay will vary depending on your plan. Instead of a percentage, it would be a set amount (such as $20 per visit).

Seeing the Doctor: With Medicare Supplement Plan G

Medicare Supplement Plan G is gaining popularity with many seniors as it covers the gaps that Original Medicare does not. With Plan G, you will be responsible for paying the annual Part B deductible. After that, Plan G will pay 100% of your doctor’s visit costs.

Seeing the Doctor: With Medicare Supplement Plan N

Medicare Supplement Plan N is similar to Plan G in that it covers the gaps not covered by Original Medicare. However, there are some differences. With Plan N, you will be responsible for paying the annual Part B deductible and a copay of up to $20 for some doctor’s visits and up to $50 for an emergency room visit that does not result in your admission.

Medicare provides a summary of the differences between their Medicare Supplement Plans .

Comparing Your Costs

By way of example, say a doctor charges $100 for each visit. Under each plan, how much would you owe?

Under Medicare Part B, you would owe $20 after you had paid your deductible. With Medicare Advantage, it would depend on your co-pay. Once your deductible has been paid, you would have no costs under Supplement Plan G. Depending on the type of doctor’s visit, you would owe between $0 and $50 under Medicare Supplement Plan N.

Making the Right Choice With The Medicare Family

Navigating how to choose your Medicare plan can be overwhelming. There are many choices, and each has advantages and disadvantages. Of course, you must also consider your health needs and concerns. Health care is already expensive, don’t add to your costs by making mistakes with your Medicare coverage. Schedule an appointment with The Medicare Family today, and let us help you get the coverage you need.

Recent Posts

How to avoid the medicare part d donut hole, does medicare cover compression stockings, does medicare cover portable oxygen concentrator, unlocking savings: how to get eliquis cheaper on medicare.

“This was the best experience I’ve ever had dealing with Medicare information.” – Darrell P.

Read Our Reviews (2,500+)

For 40 years, our family has been helping seniors understand their Medicare benefits and find the best plan for their unique situation – the best part? Our service is always 100% free to you!

Wouldn’t this be

Easier on video ?

Reading about Medicare can be confusing…Thats why we took all the important parts and put them into an easy, free video.

Get Our FREE Medicare & Social Security Cheat Sheet

Download this FREE printable cheat sheet to get the information you need in one place. You’ll never worry about forgetting a number, date, or deadline again. UPDATED FOR 2024!

Popular Articles

Beginner's Guide to Medicare

Learn how Medicare works, when and how to sign up, and a breakdown of all the coverage options in this easy guide.

There are several severe penalties to make sure you avoid when dealing with Medicare. If you get them, they can stay with you for life.

Medicare Costs for 2024

The costs for Medicare change each year. In this article we break down the costs for Medicare premiums and co-pays.

Learn Medicare

© 2023 The Medicare Family. All Rights Reserved.

Owned by: ESG Insurance LLC. This website is not connected with the federal government or the federal Medicare program. The purpose of this website is the solicitation of insurance. We do not offer every plan available in your area. Currently we represent 31 organizations which offer 3,740 products. Please contact Medicare.gov or 1-800 MEDICARE or your local State Health Insurance Program to get information on all of your options.

Privacy Policy ∙ Terms of Use ∙ Accessibility

Helpful tips each week in your inbox.

© 2024 The Medicare Family. All Rights Reserved.

Beginner’s Guide to Medicare

Applying For Medicare

Medicare Supplements

Medicare Advantage

Prescription Drug Plans

Download Cheat Sheet

Watch Workshop

Join FaceBook Group

Life Insurance

Where should we send your cheat sheet?

By entering your email address, you agree to receive emails from The Medicare Family. We respect your privacy and you can unsubscribe anytime.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Health Insurance

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- The Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

How Much Does Healthcare Cost in the U.S.?

The United States is notorious for having the highest healthcare costs in the world. You've likely heard stories of Americans going bankrupt due to medical bills, often because they don't have enough insurance or any at all. Unfortunately, these stories are not uncommon and highlight a serious issue with the affordability of healthcare across the country.

Whether you're considering visiting the United States, preparing for a possible move, or simply curious about the country's healthcare system, it's important to understand the potential financial burden you might face.

So, what is the actual cost of healthcare in the U.S. ? To give you a clearer picture, we've gathered the latest 2024 average prices for various common procedures and treatments without health coverage, so can make informed decisions before coming to the country and avoid any unpleasant surprises.

High-Quality Care Comes with a Price

Despite its mixed reputation, the U.S. healthcare system excels in many areas. It leads the world in medical research and innovation and drives the development of new treatments, technologies, and medicines. The country is also known for its excellent emergency care and high survival rates for serious conditions like heart attacks and strokes.

In addition, American doctors and healthcare professionals receive extensive training from some of the best medical schools and programs in the country. The U.S. healthcare system also offers patients many choices and access to the latest treatments, with a focus on personalized care.

However, high-quality care comes with a price, and healthcare costs in the U.S. are incredibly expensive. As a result, traveling to or living in the country can become extremely costly without sufficient coverage to manage the costs.

Find the Best International Medical Insurance

- Compare multiple quotes and coverage options

- Work with an insurance expert at no additional cost

- Find the best plan for your needs and budget

Why Is U.S. Healthcare So Expensive Compared to Other Countries?

Whether you are a resident, expat, or visitor to the U.S., you can't deny that the average cost of healthcare is much higher compared to other countries. This is not the result of one particular factor but rather a combination of issues that all contribute to increasing prices.

The lack of a universal healthcare system , high administrative costs, expensive medical technology, and higher prices for services all play a role. Other factors such as wasteful spending, high legal costs, and unregulated drug prices also drive up the cost of care.

Additionally, medical professionals in the United States earn higher salaries than their counterparts in other countries, which contributes to higher healthcare costs. Some hospitals operate as for-profit businesses, which further drives up costs as they aim to maximize profits by charging higher prices for services and treatments. Moreover, doctors often run a lot of tests out of fear of malpractice lawsuits.

All these factors combine to make healthcare unaffordable for many, especially those without health coverage to manage the costs.

Read More: US Health Insurance for Non-Citizens

How Much Does Healthcare Cost Without Insurance?

The infographics below show the average costs of common procedures in the United States, as well as unexpected medical treatments without coverage. While these are estimates and actual prices may vary depending on where you are and how complex the care is, they offer a good idea of what you might face as an expat or visitor without travel or international health insurance .

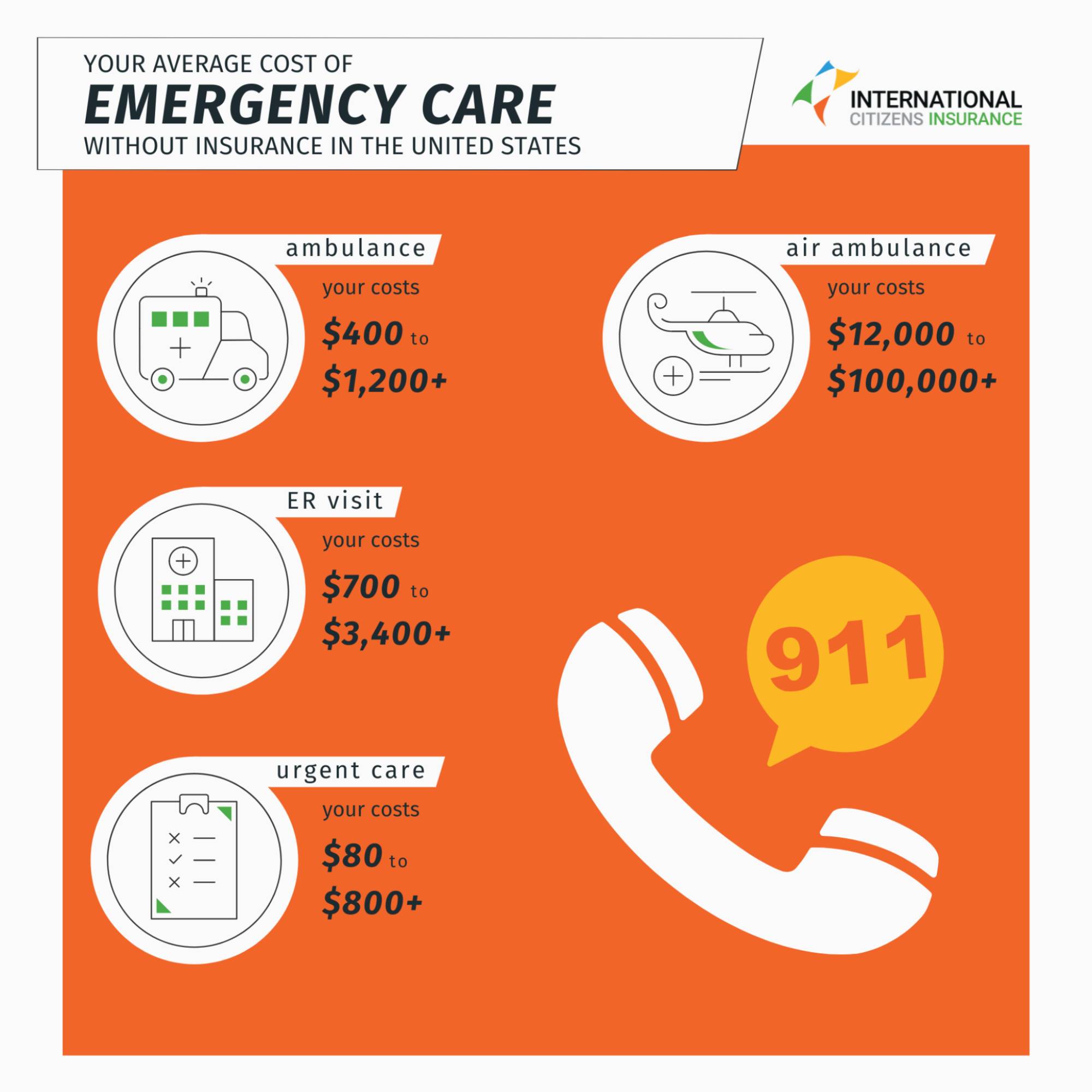

How Much Is Emergency Transport and Care?

If you become ill and need emergency care, your bills will begin adding up right away. An ambulance ride to the hospital starts at $400 and can reach up to $1,200 or more. And that’s just for the pickup – if you need any procedures in the ambulance, the costs can add up before you even reach the hospital. If you need air transport, the expenses are even higher, with emergency evacuation starting at around $12,000 and exceeding $100,000 in extreme cases.

An ER visit can cost between $700 and $3,400, depending on the type and complexity of care you need. If you have to stay overnight, an extra $5,000 might be added to your bill. These costs vary based on where in the U.S. you are treated and the nature of your emergency, but without coverage, it can be very expensive.

One way to save money if you need immediate attention is to go to an urgent care clinic instead of the ER. While you might still face additional costs for treatment, tests, and medications, the visit itself usually ranges from $80 to $800 or more.

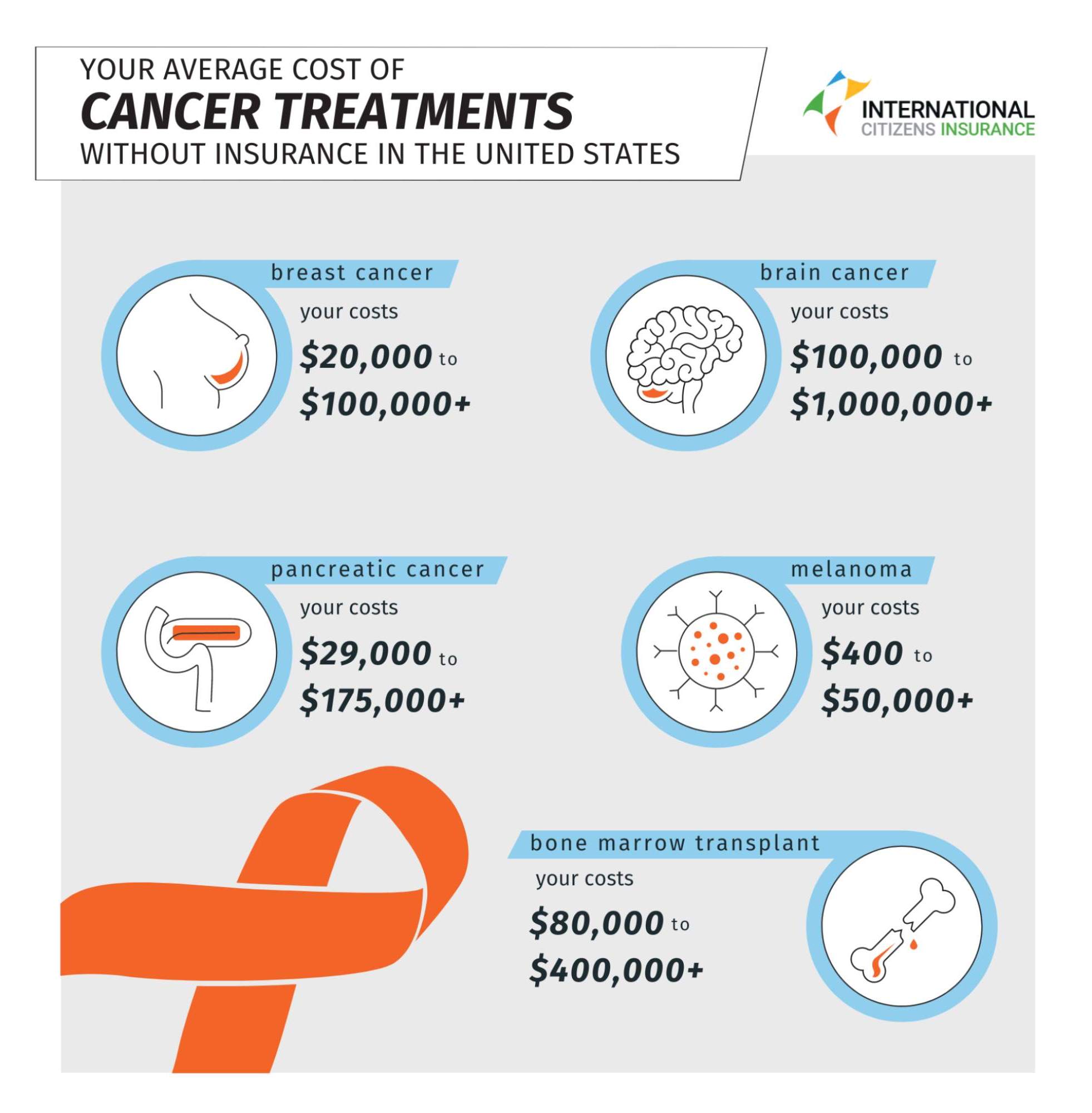

What Is the Average Cost of Cancer Treatment Without Health Insurance?

Cancer is something no one wants to think about, but it's important to understand the potential costs if it does become a reality.

Unfortunately, cancer care in the U.S. is very expensive. For example, early-stage melanoma might cost as little as $400, but without coverage, the cost can rise to $50,000 or more. Breast cancer costs can vary widely depending on the stage at which it is detected, but tend to start around $20,000 and can exceed $100,000.

Pancreatic cancer treatment can range from $29,000 to $175,000, while a bone marrow transplant can cost as much as $400,000 or more. Meanwhile, the price of treating brain cancer can exceed $1 million.

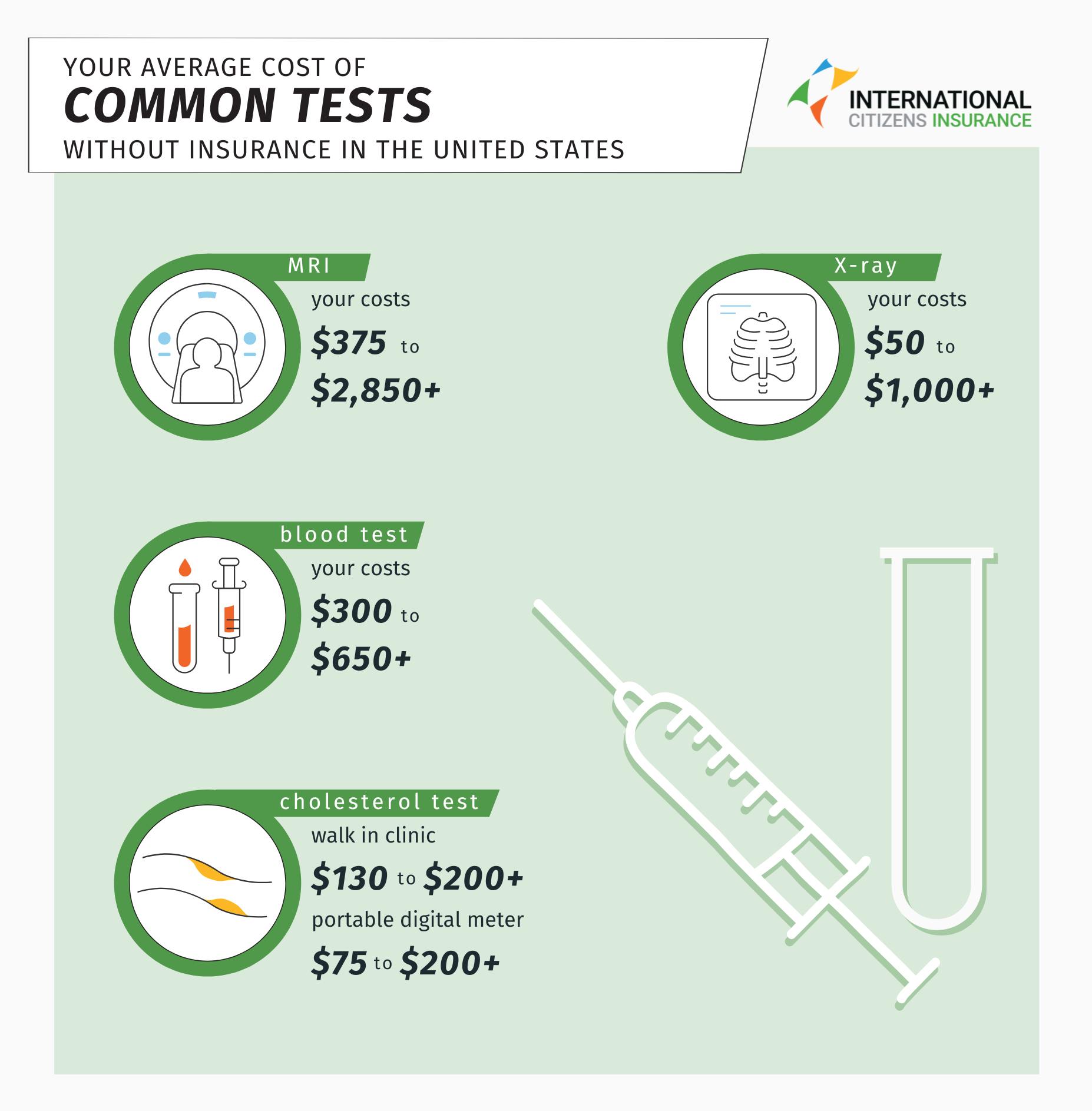

How Much Do Lab Tests Cost Without Insurance?

Lab tests are often essential when a doctor is trying to diagnose your medical issues. However, this is another area where the cost of U.S. healthcare can be high.

Without coverage, routine blood work can cost anywhere from $300 to $650 or more. If you just want to check your cholesterol levels, a lipid panel can range from $130 to $200 at the lab, or $75 to $200 for a portable digital meter to use at home.

An MRI scan can range from $375 for the simplest imaging, to $2,850 or more for a full body scan. While X-rays are generally more affordable, sometimes costing as little as $50, they can exceed $1,000 depending on the circumstances.

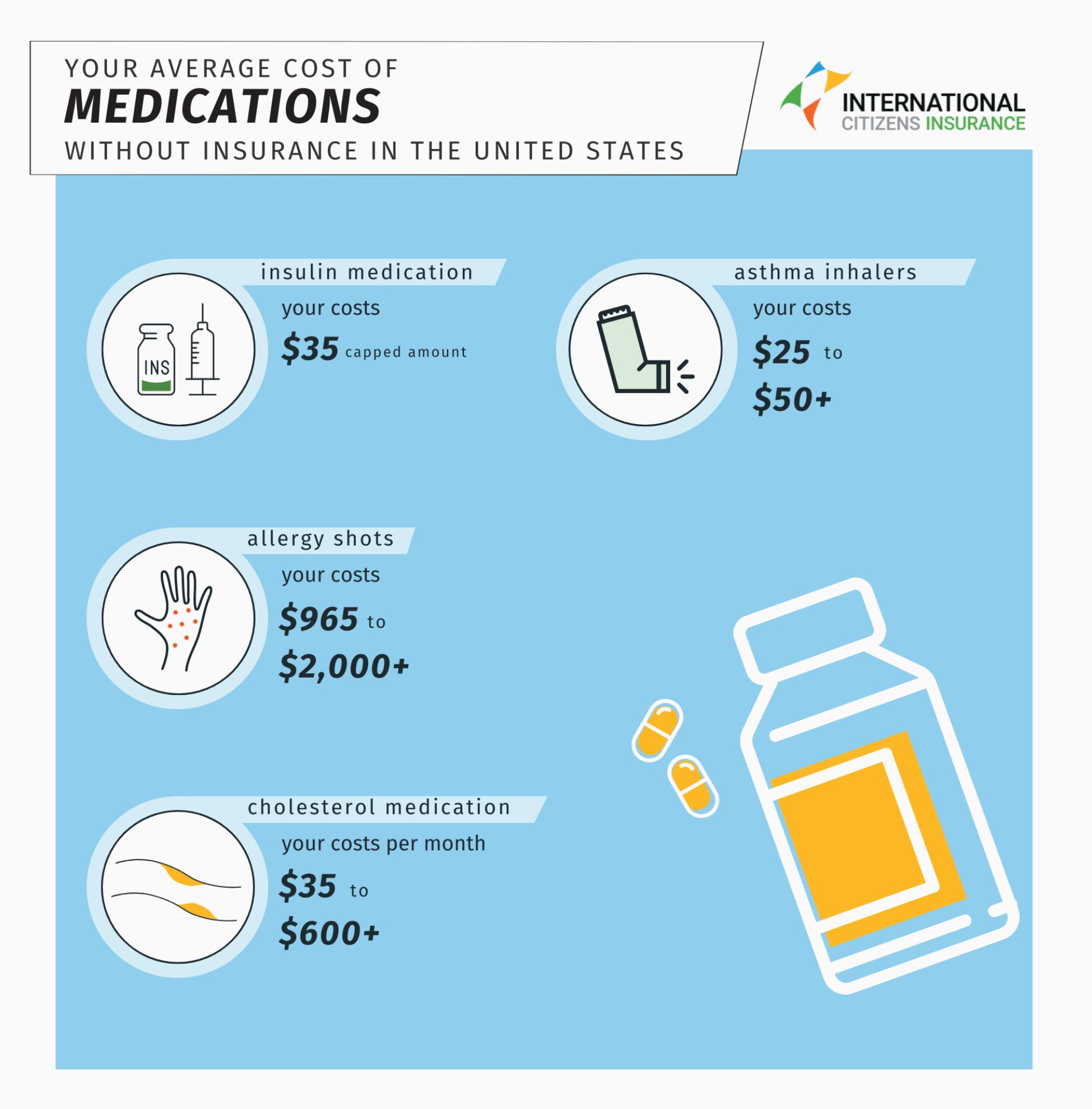

What Is the Cost of Prescription Drugs Without Insurance?

American healthcare prices are also high when it comes to prescription medication, though there have been some recent improvements. For example, insulin for diabetes is now capped at $35 per month, even without coverage. Following a price hike crisis, the cost of asthma inhalers is also more controlled, with prices ranging from $25 to $50.

However, prices for other medications can still vary widely depending on several factors. For instance, cholesterol medication may cost between $35 and $600 per month, while a year’s worth of allergy shots can range from $965 to over $2,000.

Prescription drugs can take up a large part of a patient's budget, which is why many insurance plans include coverage for these costs.

How Much Does It Cost to Have a Baby in America?

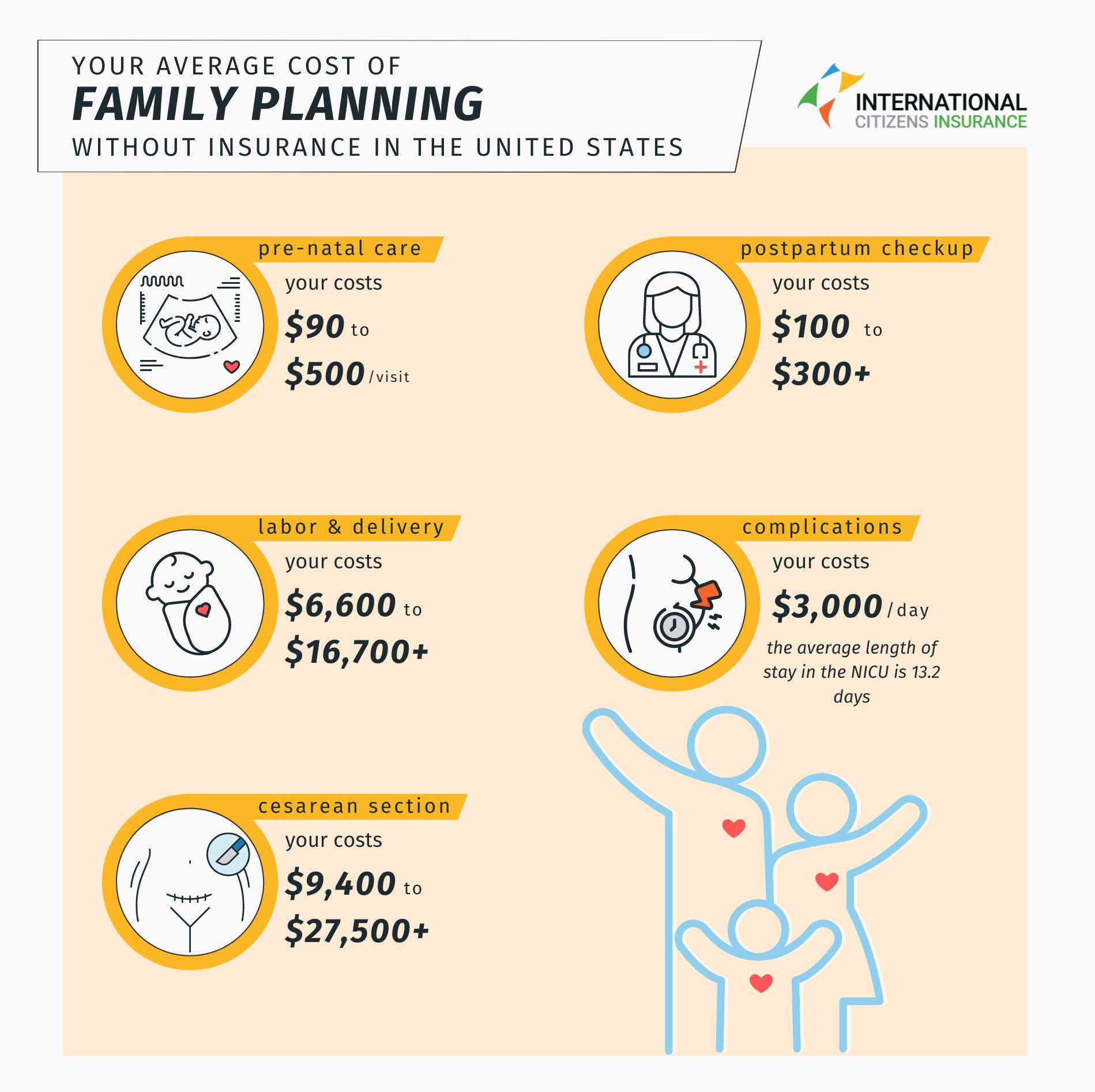

The United States is a notoriously expensive place to have a baby, and if you decide to start a family or add to it while living in the country, your healthcare costs will quickly add up.

Prenatal doctor visits generally cost between $90 and $500 each time, and you will need several of them throughout your pregnancy. Labor and delivery alone can cost anywhere from $6,600 to $16,700 – and that’s for a vaginal delivery. A cesarean section, whether planned or emergency, is more expensive, ranging from $9,400 to $27,500 or more.

If there are complications and your baby needs a stay in the NICU, you can expect to pay around $3,000 per day without coverage. Given that the average NICU stay in the U.S. is 13.2 days, this could result in a staggering total bill of $39,600.

Postpartum checkups have similar costs to prenatal ones, ranging from around $100 to $300 per visit. Overall, pregnancy and childbirth in the U.S. are very costly, so having health coverage is crucial.

How Much Does Surgery Cost Without Insurance?