Wealthy Nickel

Amex Platinum Travel Phone Number

American Express has been voted one of the best financial institutions for satisfactory customer service. The Platinum Card from American Express is the best card offering amazing benefits towards travel purchases annually. Some of the best rewards and benefits include exclusive perks such as complimentary travel insurance and airport lounge access.

The more cardholders pay for eligible purchases, the more Membership Rewards points they receive. Therefore, the cardholder of the Amex Platinum Card or Amex Business Platinum Card will enjoy premium benefits towards travel.

Aside from receiving the best benefits, all card members will access 24/7 customer service from American Express during travel. The American Express Travel website facilitates online flight booking and assists cardholders to secure reservations in partnering hotels such as Hilton Hotels. Cardholders will also use the concierge services to help book travel destinations and tickets to sold-out events in-person or online. The concierge service also covers emergencies faced by the cardholder during travel, ensuring the cardholder’s safety.

Thus, the Platinum Card from American Express offers cardholders maximum benefits and the best customer service options.

Table of Contents

Key Takeaways

· The Platinum Card from American Express offers the best customer care service for cardholders during travel

· Cardholders of the Amex Platinum Card will receive help for different services through different numbers offered by American Express

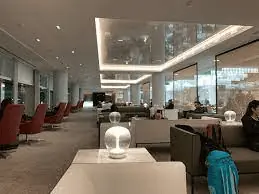

Priority Pass Number

The Priority Pass Lounges are a partnering lounge that offers cardholders complimentary access to the lounge as they wait for their flight. The cardholder must show their eligible Platinum Card, same-day boarding pass, and Priority Pass Card to receive an entry. Cardholders will receive the complimentary membership upon card account opening since they must show the Priority Pass Card as a requirement for access.

Also, cardholders will receive complimentary guest access for one guest in participating lounges across the world. Additional guests will be charged at a cost per the charge rate charged through the Platinum Card after the visit is reported.

There are over 1000 Priority Pass Lounges worldwide which Platinum cardholders have access to as they travel. In case of any issue concerning Priority Pass, Amex Platinum cardholders can contact American Express when they are in or outside the US. The official number given by American Express on matters relating to Priority Pass is 1-800-801-6564 for those within the US.

If you are traveling outside the US and need to make a call, you can use the call collect at 1-954-503-8868 across the world.

Platinum Card Concierge Service Contact Number

The Platinum Card Concierge services offer any form of assistance, especially in a hotel, but it can extend to other companies. The Platinum Card concierge services offer various services to its cardholders, assisting them in their trip. The Platinum Concierge service is only available to premium cards such as the Platinum Card, Business Platinum Card, or its other versions.

Cardholders can make dining and tickets reservations, in-store and online purchases, and ask a concierge to book restaurants on their behalf. Thus, concierge services help the cardholder, including in emergencies such as retrieving missing baggage during travel.

The cardholder is responsible for fees and taxes charged when a concierge is purchasing items on their behalf. The cardholder picks the tab covered by the Amex Platinum Card, but the purchases remain protected under American Express policies. Cardholders will request concierge services by calling 800-525-3355 while in the US, the same as the number on the Amex Travel website.

International calls can be made through a call collect at 617-622-6756 for cardholders outside the US. Alternatively, call the number on the back of your card, which allows you to choose the concierge service you need.

How do I contact Amex Travel International?

American Express customer services extend all over the world, especially for cardholders making a trip outside the US. American Express has offered numbers that ensure cardholders speak directly to customer service attendants for further help. The international phone numbers are available 24/7, although some have specific times that the lines are open. They include the following:

Amex Number

Availability

United Kingdom

+44 1273696933

+88 6227190707

+34 902375637

+66 22735544

New Zealand

+61 292718666

+81 332206100

+52 5553262929

+39 0672282

+1 9054740870 or +1 8006682639

+54 1143103002

+55 34 21026266

+33 147777000

+91 1242801800

+43 810910940

+49 6997971000

+85 222771010

+65 68801900

Netherlands

+31 205048000

M-F 8:00-20:00

+45 70 20 44 99

M-F 8:30-16:30

+47 24 05 52 63

M-F 8:00-18:00

+46 771295600

M – F: 8:00-18:00

+35 8961320400

M-F: 9:00-18:00

No matter the location, cardholders will receive quality services with ready-to-serve attendants to assist in any way possible. That way, the cardholder will feel secure and protected as they book their flight, even through American Airlines or flying a different airline. Cardholders will receive other services, including help to cancel or book restaurant reservations, book a hotel stay, and submit membership for partnering airport lounges.

Travel has never been easier using a travel card like the American Express Platinum Card. Aside from offering travel rewards and offers, the Platinum Card offers other benefits through their travel phone number. Cardholders can access Platinum Card concierge services, Priority Pass membership, and other forms of assistance through a phone number. Whether in the US or international countries, cardholders will still receive assistance from American Express.

Alternatively, cardholders may call the number on the back of their cards if they need help remembering the numbers to call.

How do I contact Amex Travel?

The Amex Travel contact can be found on the amextravel.com website, mainly used by cardholders to book a flight directly through the airlines. The number is 1-800-525-3355 for cardholders within the US or a collect call at 617-622-6756 for those outside the US. Alternatively, cardholders may contact the number on the back of their card for help directing them to the right channels.

Most countries have 24/7 open customer service numbers, which cardholders use to reach American Express for assistance.

What is Amex Global Travel phone number?

American Express cardholders can access customer care in over twenty different countries worldwide. However, each country has a unique phone number cardholders use to access American Express services. If you lack the option of using the numbers, try calling the number on the back of your Platinum Card for further assistance.

Does Amex have 24-hour customer service?

Yes, Amex has a 24-hour customer service number readily available to all cardholders, regardless of location. However, some areas limit the hours the Amex customer care service is running and accessible to cardholders. The number found on the back of your Platinum Card will always work, especially if you need immediate assistance.

- William Westerlund https://wealthynickel.com/author/william/ How Much Does McDonald’s Make a Day?

- William Westerlund https://wealthynickel.com/author/william/ Best Virtual Credit Card for OnlyFans 2023

- William Westerlund https://wealthynickel.com/author/william/ Can You Downgrade Amex Platinum?

- William Westerlund https://wealthynickel.com/author/william/ Does Amex Platinum Have Foreign Transaction Fees?

Leave a Comment Cancel reply

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

How can we help you?

For personalized service, please tell us about your request:

Did you know?

Still need help.

You can call us at +1 (312) 279-7761 .

Expensivity

Exploring the world of money and finance

How can I contact American Express Customer Service?

It’s easy to connect with an American Express Representative by phone. Personal credit card users can access 24/7 support by calling 1-800-528-4800. You can also correspond online with American Express Customer Service representatives 24/7 by logging into your existing account dashboard or through your mobile app and clicking on the “Chat” icon in the bottom corner of your home screen.

American Express’s customer service is noted for its general excellence. Account holders typically report high levels of satisfaction with their customer service experiences. One reason is because American Express offers its customers a variety of ways to get in touch. Customers may connect with representatives by:

- Online Chat

- Social Media

In order to access many of these channels, you must be an American Express account holder. Not yet an American Express account holder? Find out how likely you are to qualify .

Otherwise, read on to learn more about connecting with American Express Customer Service.

How can I get the fastest customer service?

The fastest way to get customer service is to call the phone number connected to your specific account type. American Express customer service makes it easy to connect with live human help by channeling accounting holders to specific customer services departments. So for the most efficient help, your best bet is to check out the American Express directory of numbers.

You’ll find contact numbers for every type of credit card that American Express offers along with hours of availability, options for hearing impaired customers, and alternative automated calling systems if you just wish to make payments over the phone.

American Express offers unique phone numbers for Personal Cards, Corporate Business Accounts (1-800-528-2122), Traveler Rewards Cards (1-800-297-2977) and Membership Rewards Cards (1-800-297-3276). But really, that’s just the tip of the iceberg.

The phone numbers listed in the American Express customer services directory include specific departments for small businesses, merchants, and those who use AmEx for their accounts payable solutions. You can also find specific phone numbers for booking cruises, managing personal loans, and much more.

Still shopping around for the right American Express Card? Check out this list of 30 questions you should ask before settling on the right credit card offer for you.

How can I contact American Express customer service online?

You may contact American Express Customer Service online using the “Chat” feature on your American Express website account dashboard. In order to use the Chat feature, you must be an account holder with access to your online account portal. If you already have an American Express card, but you have not yet created an online account, you can register here .

Once you have created an account, you will not only be able to manage payments, request higher credit limits, redeem rewards and and replace lost or stolen cards through your online dashboard, but you will also be able to use the online “Chat” feature to contact 24/7 customer service. Simply locate the “Chat” icon on the bottom of your homepage to initiate a conversation.

How can I connect with American Express Customer Service using my mobile app?

Once you have an American Express account, you’ll want to grab the AmEx mobile app for your smartphone or tablet. The mobile app gives you the power to manage your account, make payments, request credit limit increases, and replace lost or stolen cards all while on the go. And the mobile app also offers direct access to a 24/7 Chat feature. Find the “Chat” icon on the top right corner of your mobile app, click it, and connect with American Express customer service.

How can I connect with American Express on Social Media?

American Express also invites its customers to reach out directly through a number of leading social media channels in order to engage on a variety of topics. Customers may use these channels to engage directly with public facing company representatives.

For instance, American Express has a publicly accessible Facebook page on which customers are free to share their views–both positive and negative–on the company, their experiences as customers, and their views on the company’s policies writ large. A quick scan of comments on the page shows that American Express representatives are highly responsive to customer feedback of all shapes and sizes.

At one time, American Express also operated a Twitter page called Ask AmEx. This page is no longer active, instead directing visitors, “For Amex service, please contact us directly by phone, app or at http://amex.co/contactus .”

And in general, American Express strongly advises its customers to reach on through more private channels to address personal customer service matters. According to its own community service guidelines, “For customer care inquiries specific to your account, please call the number on the back of your Card, chat with us on americanexpress.com or within our mobile app . If you have a Card issue from an American Express Network Partner, please contact your issuer by calling the number on the back of your Card.”

How can I contact American Express Customer Service by mail?

You may contact American Express Customer Service by mail. If this is your preferred form of correspondence, you may send communications, forms, and documents to the following address:

American Express P.O. Box 981535 El Paso, TX 79998-1535

Protect Your Privacy

Before corresponding and transmitting personal information through any of these channels, be sure that you’ve taken all the appropriate steps to protect your privacy, your identity, and your account information. American Express stresses the importance of protecting your privacy, especially when corresponding through its social media channels.

In its Community Guidelines statement , American Express advises account holders to “protect your privacy and don’t share personal information about you, your family, or others on the American Express Facebook page. For example, you should never post your Card number, Social Security Number, phone number, or other non-public personal information about yourself or anyone else.”

While it may seem obvious that you shouldn’t share your Social Security Number on Facebook, there are plenty of far less obvious ways that identity thieves, hackers, and credit card scammers can steal your information. To learn more, and keep yourself safe, check out our list of ten ways you can protect yourself against credit card fraud.

Guide to American Express Platinum Concierge

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

- Connect with Holly D. Johnson on Twitter Twitter

- Connect with Holly D. Johnson on LinkedIn LinkedIn

- • Travel rewards credit cards

- • Loyalty programs

- Connect with Tracy Stewart on LinkedIn LinkedIn

- Get in contact with Tracy Stewart via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- If you’re paying a hefty annual fee, make sure you’re taking full advantage of everything your card offers, including its concierge service. While card concierge services are typically considered a secondary benefit, they can save you a lot of time and money.

- Amex Platinum cardholders have access to complimentary concierge service, available 24/7. You can access this service by dialing the number on the back of your card.

- Amex Platinum Concierge service can assist cardholders with gift recommendations, dinner reservations, travel arrangements, flower delivery, purchasing tickets to concerts or sporting events, and many other tasks. If you’re unsure if your request falls under the concierge’s services, you can always call and ask. You may be surprised.

The Platinum Card® from American Express is one of the most popular travel cards on the market today. And it’s easy to see why when you consider its luxe travel perks and opportunities, including one standout benefit that takes it to the next level: the card’s luxury concierge service.

Once you are approved for this American Express credit card , you can qualify for up to a $200 annual airline fee credit, one of the most generous airport lounge memberships available today, up to $200 in Uber credits annually and much more. The points you earn with the Platinum Card are extremely flexible, too. You can redeem them for travel, gift cards and merchandise, or for valuable transfers to Amex airline and hotel partners .

In addition to all of that, the American Express Platinum offers a dedicated concierge with a variety of services, whether you need help securing dinner reservations or finding the perfect gift.

How does the American Express Platinum Concierge work?

Concierge service is complimentary once you apply and are approved for the Amex Platinum, and you can use this service as often as you want.

To request help from the Amex Platinum concierge, all you need to do is reach out via the concierge desk (open 24 hours a day, 7 days a week). You can reach the concierge by calling the phone number on the back of your card.

The concierge can then help answer questions or find resources to accommodate any requests you have.

What services does the American Express Platinum Concierge offer?

Having access to the Amex Platinum Concierge is a lot like having your own personal assistant. You can call them to ask about almost anything, whether you need help finding the cheapest gas on your road trip or you want to see if you can get tickets to a sold-out show.

Some of the most popular services Amex customers reach out to their concierge for include:

- Gift recommendations

- Flower delivery

- Dinner reservations

- Scheduling spa and salon appointments

- Accessing translation services

- Travel planning

- Advice on cultural experiences

- Tickets to concerts and sporting events

When you use the Amex Platinum Concierge for any of these services, the assistance you receive is offered on a complimentary basis. You only pay for the actual goods and services they help connect you with, such as concert tickets or travel booking.

How do I maximize the Amex Platinum Concierge?

If you want to make the most of Amex Platinum Concierge services, use this benefit to save yourself time. This means delegating tasks to the concierge that would otherwise require you to sit on the phone or spend hours researching online.

Here are a few options to consider:

- Dinner reservations: Ask your concierge to help you find a restaurant reservation based on the type of cuisine you’re looking for, location or dining times that work with your schedule. The concierge may even help you snag a hard-to-get reservation at a popular spot. Your concierge can make dinner reservations on your behalf, and all you have to do is show up.

- Event tickets: If a concert or sporting event seems sold out, your concierge may be able to get special access to seats you may not even know about. Or if you know an event will go on sale soon, you can use the concierge to help you secure tickets before they sell out. Ask them to help with getting you the best seats in the house.

- Flowers and other gifts: Whether you need to send flowers for Mother’s Day or want to surprise your spouse, the Amex Platinum concierge can provide you with suggestions and ideas. Better yet, they can order the gift and set up delivery for you based on your preferences and spending limit, then charge the purchase to your card.

- Help at home: Maybe you need a chef to whip up a meal for a last-minute dinner party, or a plumber to come and install a new kitchen faucet. Your concierge can help research providers and set up an appointment at a time convenient for you.

- Travel: If you need to book airfare or research hotel options in any destination, the Amex Platinum Concierge will do the research and provide recommendations for you. They can even book your travel plans on your behalf, saving you time and stress.

These are just a few examples of how you can maximize this service, but there are plenty more ways to use this perk to save yourself both time and stress. To get the most out of concierge service, call the help desk any time you’re short on time and need help with a task. If you’re unsure if your request falls under the concierge’s services, you can always call and ask. You may be surprised at how helpful concierge services can be, but you won’t know until you try.

How do I contact the American Express Platinum Concierge?

American Express offers a specific concierge hotline you can call for personalized help with almost anything you need. Once you’re a cardholder, you can call the number on the back of your card.

From there, you’ll be connected with a dedicated expert who can help you plan a trip, make reservations, send a surprise gift and more.

The bottom line

While card concierge services are typically considered a secondary benefit, they can save you a lot of time and even money. The concierge service you get with the Platinum Card from American Express is complimentary, and it can make your life easier. If you’re already paying the card’s hefty $695 annual fee, make sure you’re taking full advantage of all it has to offer, including concierge service.

If you don’t have this card yet, consider whether might be a good fit, especially if you already have an Amex card and want to maximize your spending with a card strategy like the Amex trifecta . And check out our American Express Membership Rewards guide to learn all the ways you can use the points you earn with this card.

Learn more: Check out Bankrate’s travel toolkit for tips and tricks on how to maximize travel with a credit card.

Related Articles

Guide to Bank of America Preferred Rewards

Best American Express Business Credit Cards - September 2024's Top Offers

Hilton Honors American Express Card benefits guide

American Express Platinum offers bonus up to 150,000 points via CardMatch

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Platinum Travel Insurance

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When does the AmEx Platinum travel insurance kick in?

Amex platinum travel insurance benefits and limits, how to make an amex travel insurance claim, what if the card’s insurance benefits are insufficient, the platinum card® from american express travel insurance, recapped.

Travel insurance can provide peace of mind when you’re away from home, especially when you’ve spent significant money on your vacation. Although you can choose to buy a separate travel insurance policy, not everyone wants or needs to do so.

Many travel credit cards offer complimentary insurance for a variety of occurrences. The Platinum Card® from American Express offers travel insurance with a suite of benefits for eligible travelers, including coverage for trip interruption, rental car damage and lost luggage.

Let’s take a look at travel insurance on The Platinum Card® from American Express , its limits and the benefits it provides.

» Learn more: What is travel insurance?

So, does The Platinum Card® from American Express have travel insurance? The short answer to this is yes, but you’ll need to meet specific requirements for it to apply.

To get coverage from your card, you’ll need to use it to pay for your trip in its entirety. This is true whether you’re looking to utilize the trip insurance or the rental car insurance — you must pay for the full cost with The Platinum Card® from American Express .

Be aware of coverage limitations if you’re traveling using points or miles. While it’s possible to receive benefits when using your card to pay the taxes and fees on a reward redemption, coverage may not always apply.

You may still be covered for trip interruption, delay, and cancellation insurance when using points or frequent flyer miles.

However, rental car and baggage insurance only apply when you’ve used your card to pay for the full cost of whatever you’re buying — no points allowed. The exception is if you redeem American Express Membership Rewards to pay for some or all of the booking.

» Learn more: How does credit card travel insurance work?

We’ve included a breakdown of all the insurance benefits and other travel protections provided by The Platinum Card® from American Express .

Trip cancellation protection

The trip cancellation insurance you’ll receive will pay for any nonrefundable losses you incur due to a covered event.

Given the current climate, you may also be wondering: does The Platinum Card® from American Express travel insurance cover COVID? It can, depending on the reason you need to cancel. Covered events include quarantine imposed by a physician or illness for you, your family members or a traveling companion.

Other eligible events include a change in military orders, inclement weather or jury duty.

If you need to cancel your trip, AmEx will provide up to $10,000 per trip and a maximum of $20,000 every 12 months. Terms apply.

» Learn more: The guide to American Express travel insurance

Trip interruption coverage

As with trip cancellation protection, trip interruption insurance will reimburse you for nonrefundable losses by a covered event.

If your trip is interrupted, American Express will cover you for prepaid land, air and sea travel bookings you’ve missed. They’ll also pay for the cost of an economy-class ticket on the most direct route to rejoin your covered trip (or take you home).

The maximum benefit you’ll receive is $10,000 per trip and up to $20,000 every 12 months. Terms apply.

Trip delay insurance

As it sounds, trip delay insurance will reimburse you for expenses incurred when your trip doesn’t go as scheduled. In the case of The Platinum Card® from American Express , coverage kicks in after you’ve been delayed by at least six hours for a covered reason.

Covered purchases may include food, toiletries, lodging, medication and other personal use items. You’ll be reimbursed for up to $500 on a covered trip and can make two claims within a 12-month period. Terms apply.

Rental car insurance

The Platinum Card® from American Express provides secondary rental car insurance . This means it’ll kick in after other claims — like those made to your personal insurance — have been paid. To activate coverage, you’ll need to decline the insurance offered by the rental car company.

AmEx will provide up to $75,000 due to damage or theft of the rental vehicle, but be aware that the policy doesn’t provide liability insurance.

It’ll also give you up to $1,000 per person (max of $2,000) for personal property lost in the incident and up to $5,000 for accidental injury. Finally, you’ll receive up to $300,000 for accidental death or dismemberment, though the rates will vary depending on the severity of your injuries.

This rental car insurance is valid worldwide with a few notable exceptions, including Australia, Italy and New Zealand. Terms apply.

» Learn more: Credit cards that provide travel insurance

Baggage coverage

Cardholders and their families are eligible for baggage insurance provided they’ve paid for the fare using The Platinum Card® from American Express . This benefit is only for lost baggage; delayed luggage is not protected.

Coverage limits vary depending on whether you’ve checked your bag or carried it on:

Checked bags: Up to $2,000 per person.

Carry-on: Up to $3,000 per person.

Note also that checked baggage is only covered when you’re actually traveling with a common carrier. Meanwhile, carry-on luggage is also covered when traveling to and from or waiting at the terminal.

There are also specific limits for high-risk items such as jewelry and electronic equipment. For these items, you’ll receive a maximum of $1,000 per person per trip. Terms apply.

» Learn more: Baggage insurance explained

Premium Global Assist

What else does The Platinum Card® from American Express travel insurance cover? Although this last benefit isn’t technically a type of travel insurance, it’s worth including as it can offer help while you travel.

AmEx’s Premium Global Assist hotline is a 24/7 service that can assist you in various ways, such as helping you get a new passport, finding translation services and even arranging for emergency medical evacuation.

Although using Premium Global Assist is free, the services that you may end up using are not necessarily covered by AmEx.

There are exceptions to this — if you need repatriation of mortal remains, emergency medical evacuation or if a child under 16 is left without care, AmEx will provide aid at no additional cost. Terms apply.

To file a claim, you’ll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you’re using:

Trip cancellation, interruption or delay insurance: Within 60 days, call 844-933-0648.

Baggage insurance: Within 30 days, call 800-228-6855 or online .

Rental car insurance: Within 30 days, call 800-338-1670 or online .

» Learn more: The guide to AmEx Platinum rental car benefits

If The Platinum Card® from American Express travel insurance doesn’t seem like it’ll be enough for your trip, or if its coverage doesn’t include features that you’d like to have, consider purchasing a separate travel insurance policy before you travel.

Several companies allow you to compare various policies for any vacation and modify inclusions as you shop.

» Learn more: How much is travel insurance?

The travel insurance offered by The Platinum Card® from American Express includes some pretty generous benefits for travelers, especially since it’s complimentary (the $695 annual fee notwithstanding). Terms apply.

If you want to take advantage of this insurance, pay for your trip using your AmEx card and double-check any other stated requirements before heading out to ensure coverage.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Insurance Benefit: Car Rental Loss & Damage Insurance

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

Insurance Benefit: Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

American Express Travel: Your Guide to Booking Flights, Hotels, Car Rentals, & Cruises

Jarrod West

Senior Content Contributor

456 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

43 Published Articles 3380 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1203 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

What is amextravel.com, why should you use amextravel.com, booking flights with amextravel.com, amextravel.com hotel programs, flights+hotel packages, rental cars, amextravel.com insiders, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Key Takeaways

- American Express Travel is an online travel portal where you can book hotels, flight deals, cruises, and car rentals.

- AmexTravel.com offers incredible customer service, and certain credit cards can earn double points or more for booking through the website.

- The Fine Hotels & Resorts program provides Platinum and Centurion cardholders with amenities like daily breakfast, late checkout, and complimentary Wi-Fi.

American Express is best known as a credit card issuer, but the company also offers other products and services, including travel booking and planning using AmexTravel.com.

While AmexTravel.com is available for anyone (not just cardmembers), holding an Amex card can definitely help you get extra value when using the program.

Here’s a look at what AmexTravel.com is, what services it provides, what the cost to use, the best ways to use it, and when it’s worth using!

At its most basic, AmexTravel.com is an online travel booking portal (or “online travel agency”) just like Expedia , Kayak , and Orbitz .

You can use it to book a whole trip or just a flight, hotel (or flight + hotel packages), rental cars, or even cruises. If you’d like extra assistance from a customer service agent, you can book by phone as well.

Flights booked through the portal can be subject to small fees. However, sometimes the benefits can make these fees worth it, and they’re waived for holders of the Platinum Card ® from American Express .

There are also a few “sub-categories” that fall under the AmexTravel.com umbrella, including the Hotel Collection and Fine Hotels and Resorts .

The main reason to book with AmexTravel.com is the incredible customer service . If you run into any problems during your trip (like delays, cancellations, over-bookings, etc.), you can connect with a live travel agent by phone 24/7 who will work with you to find a solution.

Additionally, if you hold an Amex credit card that earns Membership Rewards points, you can often earn 2x points or more by using it to pay for travel services booked through AmexTravel.com.

Hot Tip: If you use your Amex Platinum card , you can earn 5x Membership Rewards points on flights booked directly with airlines or with AmexTravel.com.

Fees for Using the Portal

Anytime you book a flight through AmexTravel.com (either on its own or as part of a package), you’ll pay a fee of $6.99 for domestic flights and $10.99 for international flights .

These fees are waived if you have the Amex Platinum card and are logged into your account.

If you choose to book a flight by phone rather than online, there’s an added $39 phone service fee .

If you make changes to your flight, there’s a $39 reissue fee in addition to whatever fee the airline charges. This only applies to advance changes, not changes due to problems like canceled flights .

Below, we’ll take a look at how to use AmexTravel.com to book flights, hotels, vacation packages, rental cars, and cruises.

Searching for Flights

Searching for flights with AmexTravel.com is similar to other online travel agencies. You can search by city or by specific airport, select your departure and return dates, and click whether you want to search for lower fares within 3 days of your chosen dates.

On the results page, American Express lists the most relevant Delta result at the top highlighted as a “featured airline.” The featured airline is followed by the lowest available fares.

When you scroll down, you can use the controls on the left sidebar to filter the results by the number of stops, departure/arrival times, airline, or even specific flight number.

By default, flights are displayed in price order starting with the lowest, except for a featured Delta flight at the top (when available). At the top of the search window above the results, all available airlines are shown, as well as the lowest available price with each airline.

Insider Fares

Depending on your search, you may see a blue tab labeled “Insider Fares Available��” above some of the airlines listed at the top of the search window.

These are discounted fares, and they only apply if you pay for the entire flight with Membership Rewards rather than cash. Note that cash prices are rounded to the nearest dollar.

If you’re logged in and have enough Membership Rewards points to cover the entire flight, you will be able to see these discounted fares.

For example, in the below search, you’ll see an example of an Insider Fare available for purchase. The Insider Fare offered a slight discount rather than just matching the cash price in points with each point worth 1 cent (more on that below).

The difference can be fairly minimal. In the JFK-ATL example above, the discount was from 25,259 Membership Rewards points to 24,120 — changing the value from 1 cent per point to about 1.05 cents per point .

Amextravel.com charges a fee to book, but they bundle this into the displayed price. The fee is $6.99 per domestic ticket or $10.99 per international ticket. These fees are waived as a benefit of the Amex Platinum card , just make sure you’re logged into your Amex account when booking.

Hot Tip: AmexTravel.com now offers Trip Cancel Guard coverage that you can add when purchasing flights via AmexTravel.com whether paying with an American Express card, with Membership Rewards points using the Pay With Points option, or a combination of both. It provides for reimbursement of up to 75% of the cost of the non-refundable prepaid flight expense, penalty and change fees caused by the cancellation, or the amount of any expired vouchers/flight credits received for the canceled flight. Coverage is applicable when your flight is canceled for any reason and is valid until 2 full calendar days prior to your trip’s originally scheduled departure date.

When searching several different flights across different online travel agents, we found similar results to the below example each time.

To compare prices, we searched multiple online travel agents and portals using the same search parameters: departing John F. Kennedy-New York (JFK), arriving at London-Heathrow International (LHR), round-trip, 1 traveler, economy, and nonstop on specific dates.

We selected the lowest-priced nonstop flight available through AmexTravel.com: a Finnair flight operated by Oneworld partner , American Airlines.

When searching on AmexTravel.com, the flight was $595.86. This breaks down to $133 in base fare and $462.86 of government, airline, and American Express-imposed fees.

We received the same search results when we replicated this search on Finnair’s U.S. website, Kayak, and Orbitz.

In a second search, we looked for a domestic round-trip from Phoenix Sky Harbor (PHX) to Los Angeles International (LAX) on the same dates. This flight was priced at $199.40. Keep in mind, you would usually see this rate plus the $6.99 Amex booking fee, but again, this is waived for Amex Platinum cardholders.

When cross-referencing this itinerary on Delta’s website, we found the same price listed for a regular economy fare of $199.40. However, there was a basic economy option that was a bit cheaper, which was not available through AmexTravel.com.

Other online travel portals, including Orbitz and Kayak , listed the same price.

This means, if you’re already set on the specific itinerary you want to fly, booking through AmexTravel.com can often cost the same as booking directly with the airline, or through a third party . This assumes you receive waived booking fees for being an Amex Platinum cardholder.

However, what if you’re just looking for the cheapest flight on a particular day? If you do a general search for a route on set dates, will AmexTravel.com find the same rates as other portals? In our experience, the answer is no.

In our example search, here are the lowest available regular economy non-stop flights we could find between New York (any airport) and London (any airport) when searching the same set of dates on a few different websites (sorted by price ascending):

*Including a $10.99 AmexTravel.com booking fee.

The reason for these results is likely due to the fact that the Amex portal doesn’t include some low-cost carriers like Norwegian, so travel portals that do will often win on price.

Even excluding the low-cost carriers, though, other portals like Expedia and Orbitz were able to offer lower fares by about $15.

That said, AmexTravel.com was able to find about the same fares you would find when booking directly with an airline.

Hot Tip: If you hold The Business Platinum Card ® from American Express you can get a 35% rebate on select flights when you pay with points through AmexTravel.com.

There are actually 3 programs offered for booking hotels:

The Hotel Collection

- Fine Hotels and Resorts

- AmexTravel.com booking (standard)

What Is The Hotel Collection?

The Hotel Collection is a program through AmexTravel.com only available to holders of certain cards:

- The American Express ® Gold Card and the American Express ® Business Gold Card

The Amex Platinum card and the Business Platinum Card ® from American Express

The Centurion card

Perks of The Hotel Collection

When you book a hotel through The Hotel Collection, you get certain perks including:

- Room upgrade at check-in (if available)

- Up to a $100 hotel credit for on-site amenities like the restaurant, bar, room service, or spa

- Ability to use Pay With Points on prepaid reservations

- 3x Membership Rewards points for Amex Gold cardholders on prepaid bookings

- 5x Membership Rewards points for Amex Platinum cardholders on prepaid reservations

- Up to $200 credit each year towards prepaid hotel reservations with either The Hotel Collection (2-night stay) or Fine Hotels and Resorts with select credit cards

Usually, American Express guarantees that any hotel booked through AmexTravel.com will have the lowest publicly-available rates (prepaid rates only), but this rule does not apply to bookings through The Hotel Collection per the terms & conditions . Be certain to check multiple booking options to ensure you’re getting the best deal.

Rooms have to be booked through AmexTravel.com. That means that if you book directly through the hotel or another service, you won’t get the perks, even if the hotel is a part of The Hotel Collection and you pay for the stay with your American Express card.

Further, you must stay a minimum of 2 nights , and you cannot book consecutive stays within 24 hours of each other.

The good news is that these benefits are available for up to 3 rooms per stay . So if you book 3 rooms for family members, you’ll get a total hotel service credit of up to $300.

Hotel Points and Elite Benefits

Typically, you won’t earn points through a hotel loyalty program if you book through a third party, and this includes the AmexTravel.com portal.

Further, you won’t get any elite benefits that you might otherwise be entitled to if you have status with that hotel chain.

Bottom Line: The Hotel Collection is potentially useful if you’re planning to pay with your eligible Membership Rewards-earning card. This comes at the expense of hotel-specific elite benefits, including points and elite credits in any hotel loyalty program.

American Express Fine Hotels and Resorts

What is the fine hotels and resorts program.

AmexTravel.com runs a second hotel program called Fine Hotels and Resorts (FHR). It can be a little bit confusing since it sounds like it would overlap with the Hotel Collection, but that’s not the case.

The Fine Hotels and Resorts program is exclusive to Amex Platinum cardholders (personal or business) , as well as those with the invitation-only Centurion Card .

FHR includes different hotels and resorts than The Hotel Collection, with minimal overlap. The FHR collection tends to be more geared toward leisure travelers who wish to book stays at higher-end properties.

Perks of Fine Hotels and Resorts

Booking hotels through the Fine Hotels and Resorts collection entitles you to a handful of potentially valuable perks, including:

- Early noon check-in (when available)

- Room upgrade on arrival (when available)

- Daily breakfast for 2 people

- Guaranteed 4 p.m. late checkout

- Complimentary Wi-Fi

- A unique amenity valued at $100 or more; examples include a property credit, dining credit, spa credit, or similar amenity

Unlike The Hotel Collection, rooms booked through Fine Hotels and Resorts are not all prepaid. In fact, most are standard rates that you’ll pay for at the end of your stay when you check out. In comparing several properties, including the Park Hyatt in Chicago, we found rates identical to the non-prepaid rates when booking directly through the hotel.

However, keep in mind that the hotel may directly offer prepaid and early-purchase options which may be much cheaper, though you won’t benefit from the Fine Hotels and Resorts perks.

There are fewer terms with Fine Hotels and Resorts than with The Hotel Collection. You must book through AmexTravel.com/FHR to receive the benefits .

As with The Hotel Collection, if you book directly with the hotel or through a different travel agency or portal, you won’t be able to claim FHR benefits even if it’s a participating hotel. Other terms vary by property.

Good news here! Unlike stays booked through The Hotel Collection, stays through American Express Fine Hotels and Resorts count as “qualifying rates” for hotel loyalty programs. That means if you’re staying at a hotel that’s part of a loyalty program, you’ll be able to earn points and receive the relevant benefits if you hold elite status.

Hot Tip: Want to know about the differences between these programs? Dig into our dedicated guide on the differences between the Hotel Collection and Fine Hotels & Resorts .

Standard Hotel Booking

Searching hotels.

Searching for hotels at AmexTravel.com works more or less the same as with flights. You enter your city, dates, number of rooms, and guests. You can check a box to have properties from The Hotel Collection and Fine Hotels and Resorts displayed at the top.

Of course, if you’re interested in booking through either of those programs, you could also just book on their dedicated pages.

By default, search results are ranked by “recommended,” which seems to be decided by an algorithm factoring in price, location, and reviews.

Terms vary by the specific hotel and rate you book, so make sure to read the fine print.

The site can be a bit confusing when trying to compare prices since American Express doesn’t include all taxes and fees in the price displayed (while some hotel websites do).

For example, we searched for a 4-night stay at the Hyatt Regency London – The Churchill. American Express quoted an average of $337/night, which should make the total stay around $1,348. When you go to book, though, the total with fees is $1,625.

While it initially looks more expensive to book directly with Hyatt (where the cost is quoted at $404/night), that price includes all taxes and fees , so you’ll actually pay $1,611, or $14 less.

Our search for the Marriott Regent Park yielded similar results. It’s listed at $233/night in the search function, which implies the total to be $932.

In reality, once you click through, the total is $1,120. Booking directly with Marriott, rates are listed at $261/night, but that includes taxes and fees — for a total prepaid rate of $1,080.

For the 2 hotels in question, here’s how total prices compared through different portals (sorted by price ascending):

In both tickets, AmexTravel.com was within a few dollars of the other online travel agencies, which were all more expensive than booking directly through the hotel’s website.

Similar to The Hotel Collection, rates booked through AmexTravel.com aren’t eligible for elite benefits or hotel loyalty points.

Bottom Line: Like most other online travel portals and agencies, prices can vary between AmexTravel.com and the hotel’s direct booking channel. You won’t get elite benefits or hotel points, so it might be worth booking directly if those are valuable to you.

Like with many online travel portals and even airline websites, you can book packages that include flights and hotels through AmexTravel.com. Usually, the point of booking these packages is to get a discount, special perks, or promotions.

Searching for Packages

The search window for Flights+Hotels is simple: input airports (or cities), dates, number of travelers, and rooms. Results are listed in a recommended order by default just like when searching for a standard hotel.

Terms vary by the specific package you book, so make sure to read the fine print !

As with standalone flight reservations, AmexTravel.com charges a fee to book Flights+Hotel packages: $6.99 per domestic ticket or $10.99 per international ticket .

Again, these fees are waived for holders of the Amex Platinum card or the Centurion card.

In the results field, a total starting price per person is listed, including all taxes and fees with the cheapest flight option. American Express also lists how much you’re saving with the package, although this is missing for some hotels.

Once you select the hotel, you can customize your flight. The total price changes based on which flight you select.

In a sample search, we chose the Hyatt Regency London – The Churchill, and picked the cheapest nonstop flight: British Airways flight, which was Newark Liberty International (EWR) to LHR and London-Gatwick (LGW) to JFK. The package came to $1,446 per person, or $2,892 total.

Compare Flights+Hotel to Booking Separately

Annoyingly, AmexTravel.com doesn’t show a breakdown of hotel and airfare costs and fees; instead, it just displays a total per person.

For comparison, you can search the flight and hotels separately. We tried searching for the flight first on the same day.

We found Finnair flights operated by American Airlines for $660 per person — an option that wasn’t offered as part of the package (although with the booking fee, the flights should have been $671). When we filtered the search to British Airways only, it showed a ton of options for $671.

Searching hotels next, we again chose the Hyatt Regency London – The Churchill’s lowest prepaid rate. It was listed as $337 per night for 1 room (plus taxes and fees), for a total of $2,031. For the 2 flights and the hotel, that comes to a total of $3,351, or $1,675.50 per person.

In this case, booking the trip as a package saves almost $460, even though the search results page didn’t highlight any savings specifically.

The main downside to booking a package is that you have less flexibility. Say you want to change hotels for part of the trip or maybe stay with a friend for the last few days. This isn’t an option because you must book a single hotel for the entire time between your flights. It can also make solutions harder to find if there are any problems — although the AmexTravel.com customer support should make up for that.

Bottom Line: If you’re using AmexTravel.com and your plans allow for the lack of flexibility, you might be able to save a lot of money with a package. Just make sure to compare the listed price to booking everything separately. Note that you can’t book a package retroactively: you have to book the flights and hotel at the same time.

AmexTravel.com also offers a rental car booking service. You can make reservations from rental stations at airports and elsewhere.

To search for rental cars, simply enter an airport or city . You can also click a button to search near a specific address.

Results are shown in a handy grid format, with each column showing a different rental company, and each row displaying the pricing for a different category of car (economy, compact, midsize, and so on).

Bookings of up to 4 days are charged a daily rate, while bookings 5-7 days are charged on a weekly basis. There are specific rates for weekends and weekdays, as well as monthly options, with specific details varying by the rental agency.

In several sample searches, prices were generally consistent with other online travel agencies — though sometimes lower by $1-$2/day. Prices were identical to booking with the rental company directly.

Bottom Line: Renting a car through AmexTravel.com doesn’t get you any benefits above what you’d receive for paying with your credit card, such as the collision damage waiver for paying with your Amex Platinum card. However, the convenient search page makes it a great option for comparing multiple prices at once.

AmexTravel.com also offers tools to book cruises . In addition to letting you search for cruises all over the world, AmexTravel.com periodically highlights special offers on cruises, usually in the form of credits to use onboard.

Searching for Cruises

To search for cruises, you need to enter the region you want to travel in, the cruise line(s) you want to travel with (or search all available lines), the month you’re planning the trip for, and the approximate length of the cruise you want.

Results are shown in order, from the lowest-priced option to the highest . Note that this is based on the lowest available rate; hovering over any result will show all available cabin types and the corresponding prices.

Under each result, the information shown includes the port of departure/return, date of departure, and ports visited.

Hot Tip: Wondering what to pack for your time at sea? Check out our ultimate cruise-based packing list — it’s printable and complete with tons of tips and advice!

Cruise rates booked through AmexTravel.com were within $1-2 of rates found on other online travel agents and websites . We found identical prices on the various cruise company websites — though each online travel portal and cruise line offers different promotions, so it might be worth comparing them.

For example, during a sample search for a weeklong Caribbean cruise in December, we found that Royal Caribbean was offering a $50 onboard credit if you booked directly.

Special Offers

On the search results page, you might notice a tab labeled “Special Offers.” Those offers are generally onboard credits, but can also include discounts or other special features. If you aren’t committed to a specific cruise line, these are often worth exploring.

Cruise Privileges Program

Those with the Amex Platinum card have special access to the Cruise Privileges Program . Like the Fine Hotels and Resorts program, this is only available on specific cruises, although it’s more limited than FHR.

It includes onboard credit (often higher than otherwise offered) and a special onboard amenity, like complimentary dinner for 2 or a bottle of premium champagne.

Bottom Line: It can be worth booking a cruise through AmexTravel.com, especially if there are special offers. Make sure to compare different booking sites , though, as some may have better or exclusive promotions.

AmexTravel.com offers a feature called Travel Insiders. When you use the program, American Express connects you with a travel expert who can help you plan an itinerary based around your desired destination. Fees vary based on location, length of the trip, and details of the itinerary.

AmexTravel.com can be a very useful tool when booking flights, hotels, vacation packages, cruises, or rental cars. In many cases, it may not offer the best rate options , but it’s worth comparing to other booking sites and airlines or hotels directly.

If you have an American Express card that offers access to the Hotel Collection or Fine Hotels and Resorts, the perks can be very worthwhile.

Additionally, the extra Membership Rewards points you earn by booking through AmexTravel.com can be valuable, as long as the price is right.

Aside from the Hotel Collection and Fine Hotels and Resorts, the real value of AmexTravel.com is in the customer service provided. Booking a trip on your own is easy — dealing with problems when they arise can be less so!

If you book through AmexTravel.com, you’ll have easy access to someone who can help you get on a new flight, find a new hotel, or manage whatever other issues come up day or night. So if you’re looking to have that extra support, then AmexTravel.com might be a great choice for you!

The information regarding the Centurion ® Card from American Express was independently collected by Upgraded Points and was not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the American Express ® Business Gold Card, click here .

Related Posts

![american express travel platinum card phone number American Express Cash Magnet Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/07/American-Express-Cash-Magnet-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

What are points and miles worth? TPG’s September 2024 monthly valuations

Editor's Note

One of the questions people often ask us is, "How much is a point or mile worth?"

The true answer varies from point to point and person to person. It also depends on your travel goals and how much you maximize a particular loyalty currency. Still, some rewards credit cards are worth more than others, and our goal is to give you a sense of how they stack up.

Historically, TPG has valued points and miles based on a combination of factors: the price at which we would purchase the miles, award costs in the program (factoring in availability and fees) and our expertise in the program's inner workings. However, we now use extensive data for the top six U.S. airline loyalty programs to better estimate the value you should aim to get from your rewards. Read our explainer post on our data-driven valuations for a full methodology breakdown.

Note: These valuations are not provided by card issuers.

What are credit card points and miles worth?

What are airline points and miles worth.

*Calculated using TPG's data-backed valuations methodology launched in September 2023.

What are hotel points worth?

News highlight of the month.

One of the best ways to fly first class to Europe has become much more expensive. Last month, the Avianca LifeMiles program increased award rates on most partner flights between the U.S. and Europe .

While one-way economy-class award prices rose only 17% to 35,000 miles and business-class rates increased by 11% to 70,000 miles (which still represents good value), the first-class increase was brutal. Previously, you could book one-way first-class award flights between North America and Europe for 87,000 LifeMiles. Now, without notice, the rate is a whopping 130,000 miles each way, an increase of approximately 50%.

Of the handful of Star Alliance airlines that operate international first class across the Atlantic, Swiss and Singapore Airlines do not offer first-class seats to partner programs like LifeMiles. However, German carrier Lufthansa has consistently offered last-minute unsold first-class seats to LifeMiles in the days leading up to departure. So, if you were happy to book at the last minute, it was a terrific way to redeem your points and miles.

If you want to book Lufthansa's first class to experience the famous first-class terminal in Frankfurt , your best option now is to book through Air Canada's Aeroplan program . Aeroplan charges 90,000 to 100,000 points each way, depending on where in the U.S. you originate or terminate.

This LifeMiles devaluation is the latest in a series of no-notice price increases. Devaluations are an unfortunate reality in the points and miles world and reinforce the value of collecting transferable credit card points . You can protect yourself from devaluations by only transferring credit card rewards to a partner program when you are ready to book and are certain the price won't rise.

Related: Why points and miles are a bad long-term investment

Travel credit card offers

Here are some of the best options if you're looking for a new travel rewards card that earns transferable points.

Chase Sapphire Preferred Card

The Chase Sapphire Preferred® Card is one of our favorite travel rewards cards, especially if you're just getting started with points and miles. The Chase Sapphire Preferred currently offers a welcome bonus of 60,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening. Per our valuations, this welcome bonus is worth $1,230 if you leverage the Ultimate Rewards transfer partners or $750 if you redeem through Chase Travel℠ at 1.25 cents per point.

The card comes with a $95 annual fee but offers many perks, including a $50 annual hotel credit for reservations made through Chase Travel and a 10% anniversary points bonus based on your previous year's spending. For more details, check out our Chase Sapphire Preferred Card review .

Official application link: Chase Sapphire Preferred Card

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is a compelling option due to its great earning rates and included perks. The card currently offers a welcome bonus of 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening. Due to the value you can get when redeeming with the Capital One transfer partners , our valuations peg the value of this welcome bonus at $1,388.

You'll earn at least 2 miles per dollar spent on purchases and get access to a variety of useful benefits, including a $300 annual credit for bookings through Capital One Travel , 10,000 bonus miles each account anniversary and unlimited complimentary access to Capital One airport lounges for you and up to two guests per visit. Check out our Capital One Venture X card review for more details.

Learn more: Capital One Venture X Rewards Credit Card

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card has a welcome offer of 75,000 bonus miles after you spend $4,000 on purchases within the first three months of account opening, plus a $250 Capital One Travel credit to use in your first cardholder year. However, this offer ends Sept. 9 .

If you plan to transfer your miles to Capital One's hotel or airline partners, this welcome offer is worth around $1,638 (combining the value of the miles and the $250 Capital One Travel credit). The annual fee for the Capital One Venture card is $95, a reasonable fee for a card with such a generous welcome offer. See our Capital One Venture card review for more details.

Learn more: Capital One Venture Rewards Credit Card

The Platinum Card from American Express

With the current welcome offer on The Platinum Card® from American Express , you'll earn 80,000 Membership Rewards points after you spend $8,000 on purchases in the first six months of card membership. However, you may be targeted for a higher offer through the CardMatch tool . (This offer is subject to change at any time.)

Our valuations peg 80,000 Membership Rewards points at $1,600 based on the value you can get when leveraging the Membership Rewards transfer partners . The Amex Platinum Card is packed with benefits (enrollment is required for select benefits), so read our Amex Platinum review for all the details. The Amex Platinum Card has a $695 annual fee (see rates and fees ).

Official application link: The Platinum Card from American Express

American Express Gold Card

One of the most popular cards with TPG staffers, the American Express® Gold Card offers 60,000 bonus points after you spend $6,000 on purchases in the first six months of card membership. Plus, receive 20% back in statement credits on eligible restaurant purchases (up to $100 back) within the first six months of card membership. Based on our valuations, this welcome offer is worth $1,300. But check the CardMatch tool to see if you're targeted for an even higher offer. (This offer is subject to change at any time.)

The Amex Gold Card is great for many everyday purchases. You'll earn 4 points per dollar spent on groceries at U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1 point per dollar) and 4 points per dollar spent at restaurants (on up to $50,000 in purchases per calendar year, then 1 point per dollar). The card has a $325 annual fee (see rates and fees ) but offers dining credits and Uber Cash each month on U.S. purchases. To receive this benefit, you must add your Amex Gold to the Uber app. For more details, check out our Amex Gold review .

Official application link: American Express Gold Card

The Business Platinum Card from American Express

The Business Platinum Card® from American Express offers 150,000 Membership Rewards points after you spend $20,000 on eligible purchases with your card in the first three months of card membership. Per our valuations, this welcome offer is worth $3,000.

You'll find many lesser-known Amex Business Platinum perks similar to (but slightly different from) those of the personal version. For more details, check out our Amex Business Platinum review . Then, check out our comparison of the Amex Platinum and the Business Platinum to see which card better fits your wallet.

Official application link: The Business Platinum Card from American Express

Capital One Venture X Business

The Capital One Venture X Business card offers a welcome bonus of 150,000 miles after you spend $30,000 in the first three months from account opening. While that's a large spending requirement, those rewards can go a long way toward your next trip. Our valuations peg the value of this welcome bonus at $2,775.

The Venture X Business features perks that are nearly identical to those on the personal version of the card — including a $300 annual credit for bookings through Capital One Travel, extensive airport lounge access and 10,000 bonus miles each year after your cardholder anniversary. For more details, check out our Capital One Venture X Business review .

Learn more: Capital One Venture X Business

Ink Business Preferred Credit Card

The Ink Business Preferred® Credit Card offers a welcome bonus of 90,000 bonus points after you spend $8,000 on purchases in the first three months from card opening. Based on our current valuation of Chase Ultimate Rewards points, this welcome bonus is worth $1,845.

The Ink Business Preferred can be a great option for business owners who want to benefit from a generous welcome bonus but might not meet the higher spending requirements of the Capital One Venture X Business welcome offer . Business owners may also appreciate that the Ink Business Preferred offers 3 points per dollar on the first $150,000 in combined purchases each account anniversary year on travel; shipping purchases; advertising purchases with social media sites and search engines; and internet, cable and phone services. For more details, check out our Ink Business Preferred Credit Card review .

Official application link: Ink Business Preferred Credit Card

For rates and fees of the Amex Platinum Card, click here . For rates and fees of the Amex Gold Card, click here .

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans