- Prepaid Cards >

- Travel Prepaid Cards

Compare our best prepaid travel cards

Simplify your spending abroad with a prepaid travel card, find a prepaid travel card, what is a prepaid travel card.

A prepaid travel card , also known as a 'travel money card', is a debit card that you preload with money and take on holiday. It's a good way to stick to your holiday budget and avoid carrying a lot of cash.

Prepaid travel cards can be used at cashpoints, in shops and restaurants , or anywhere that accepts Mastercard or Visa debit or credit cards.

However, a prepaid travel card is not the same as a credit card for two key reasons:

You can only spend the amount you have put on the card; the pre-loaded limit prevents you overspending and getting into debt

You can choose which currency to preload your travel money card with depending on where you're going, which often means you can secure a better exchange rate

Pick a card with fees that suit how you plan to use it, e.g. choose one with no withdrawal fees if you'll be withdrawing cash often while travelling.”

What are the different types of prepaid travel cards?

Multi-currency prepaid cards.

These can be loaded with several different currencies , making them ideal for both frequent travellers and those taking trips to multiple destinations. For example, you holiday in Europe but often visit the US on business, you could use a prepaid travel card to cover your everyday spending wherever you are by topping it up with say £600 then exchanging £200 into euros and £200 into US dollars. The different currencies will then be stored in separate “wallets” , allowing you to switch currencies when you like.

Sterling prepaid cards

These can be used at home and abroad , making them even more flexible than the best travel cards offering multiple currencies. You don’t need to worry about setting up a wallet for the currency you want to use; the card provider simply converts your pounds to the required currency each time you make a purchase . However, this can make holiday budgeting harder and may increase your costs, depending on the charging structure.

Euro prepaid cards

As well as multi-currency cards, you can take out prepaid cards designed to hold a specific currency . This can work out excellently if you're trying to lock in a good rate now by loading your euro prepaid card, but if you then use the card to buy things in a country that isn't in the eurozone. That's because if you spend in a country that does not use the euro, it converts to the local currency each time you make a purchase, which can work out more expensive.

Prepaid US dollar cards

These keep your balance in dollars . If you spend in countries that use a different currency, the card will exchange your dollars to the local currency, and you might well be charged a fee. The currency exchange takes place as soon as you load your card . If the pound strengthens afterwards, you won’t be getting the best value for money, but it if weakens you'll do well.

How to get a prepaid travel card

Compare cards.

Use our table below to find prepaid travel card that offers the features you need with the lowest fees

Check your eligibility

Make sure you fit the eligibility criteria for your chosen travel money card and can provide the required proof of ID

Apply for the card

Click 'view deal' below and fill out the application form on the provider's website with your personal details

What are the eligibility requirements?

Anyone can get a prepaid travel card. There's no need to have a bank account, and no credit checks are required . Some providers have a minimum age of 18, but many will let you have a prepaid card from the age of 13 with parental consent.

Sometimes parents like to use travel money cards to give their children a set amount of holiday money , and to help teach them about budgeting and financial responsibility.

Pros and Cons

What exchange rate do you get.

Exchange rates vary over time depending on what is happening in the wider economy. That means the exchange rate you get on a US dollar travel card today, for example, might not be the same as you get tomorrow or next week.

What prepaid cards offer is the ability to lock in today's rate to use later on. That could see you better off if the pound weakens, but might also mean you get a poor deal if the pound strengthens.

That offers is certainty - you'll know exactly how many dollars, euros, lira or whichever currency you load onto the card you have to spend on holiday.

Today’s best exchange rates

At what point is the currency exchanged with prepaid travel cards.

Some prepaid travel cards hold the balance in pounds sterling. These convert the required amount to the local currency every time you spend on them .

The exchange rate isn’t fixed, so you’ll only know how many pounds you have on the card - not what it will buy you while overseas.

But the cards in our comparison table convert your money when you add it onto the card. This means you know the exchange rate used and your card's exact balance before you go away.

Compare the rates before you choose a prepaid card. Although rates can change several times a day, some travel cards will be more competitive than others.

Using a card with competitive exchange rates will mean you get more local currency for your pound.

You also need to watch out for fees as well as withdrawal limits when choosing a card, as these can vary between providers.

What are the alternatives to prepaid travel cards?

Travel credit card.

A travel credit card works just like a regular credit card, with which you can make purchases by borrowing money. The main difference is that travel credit cards don't charge foreign transaction fees for spending abroad.

Travel money

For many people, cash is the most comfortable form of payment when travelling. It's hassle-free and universally accepted. But it’s riskier, as you'll lose out if it’s lost or stolen and you’ll need to budget carefully to ensure your foreign currency lasts the length of your trip.

Travel debit card

These days, there are plenty of specialist banks and providers that offer bank accounts that don't charge foreign transaction fees when used abroad. This offers you a chance to take advantage of the best exchange rates. And if it's your main current account, you won't have to worry about topping up your account before you go.

What other costs or fees are there with prepaid travel cards?

As well as the exchange rate, you might have to pay several other charges on your prepaid travel card.

These could include:

A fee to buy the card

A monthly or annual fee for keeping the account open

Cash withdrawal fees

Transaction fees when you pay for anything on the card

Inactivity fees

Loading fees when you add money onto the card

Some cards also charge fees for withdrawing cash or making purchases inside the UK .

But some of the cards in this comparison do not charge fees in countries that use currencies loaded on the card - just make sure the right one is selected before spending on them.

Check carefully for fees before you pick one.

Read our full guide on how much it costs to use a travel prepaid card and how to choose one .

"With multi-currency cards, check you've selected the right currency before you arrive."

How long does it take to get a prepaid travel card?

You can apply online and get a decision immediately. However, it can take up to two weeks before your card arrives in the post.

Can I use any prepaid card abroad?

Yes, you can use prepaid Visa or Mastercard cards in most destinations worldwide. Travel prepaid cards are usually cheaper to use overseas than a standard credit or debit card.

Can I withdraw cash abroad?

Yes, you can use a travel money card in a cash machine outside the UK. Some cards charge fees for this, so always check if you want to use your prepaid travel card to make cash withdrawals.

What currencies can my card hold?

All the travel money cards in our comparison can hold a balance in popular currencies such as euros or dollars, while some support more than 50 different currencies.

Can I make international payments?

Yes, some providers let you send or receive money from abroad by logging into your online account, which works in the same way as standard internet banking.

Who sets the exchange rate?

This depends on the company that processes the transactions. Typically, it’s down to Visa or Mastercard , as well as your card provider, which may take an additional cut.

Can I use my prepaid card in the UK?

You can use prepaid cards to withdraw cash or buy things in the UK or online. However, you may pay fees or even an exchange rate if your card is loaded with a foreign currency.

Explore our prepaid card guides

About the author

Didn't find what you were looking for?

Our most popular prepaid card deals

Other products that you might need for your trip

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

A safe-to-use, prepaid, reloadable, multi-currency card that’s not linked to your bank account

No charges when you spend abroad*

Make contactless, Apple Pay and Google Pay™ payments

Manage your account and top up or freeze your card easily with our Travel app

*No charges when you spend abroad using an available balance of a local currency supported by the card.

Win £5000 with Post Office Travel Money Card

A chance to win £5000 when you top up a new or existing Travel Money Card*. Offer ends 12 May

*Exclusive to travel money cards. Promotion runs 4 March to 12 May 2024. 1 x £5,000 prize available to be won each week. Minimum equivalent spend of £50 applies.

Why get a Travel Money Card?

Carry up to 22 currencies safely.

Take one secure, prepaid Mastercard® away with you that holds multiple currencies (see ‘common questions’ for which).

Accepted in over 36 million locations worldwide

Use it wherever you see the Mastercard Acceptance Mark – millions of shops, restaurants and bars in more than 200 countries.

Manage your card with our travel app

Top up, manage or freeze your card, transfer funds between currencies, view your PIN and more all in our free Travel app .

It’s simple to get started

No need to carry lots of cash abroad. Order a Travel Money Card today for smart, secure holiday spending.

Order your card

Order online, via the app or pick one up in branch and load it with any of the 22 currencies it holds.

Activate it

Cards ordered online and in-app should arrive within 2-3 working days. Activate it by following the instructions in your welcome letter.

It’s ready to use

Spend in 36 million locations worldwide, and top up and manage your card in the app or online.

Stay in control

Manage your holiday essentials together in one place on the move, from your Travel Money Card and travel insurance to extras like airport parking.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Order a Travel Money Card

Order your card online – or through the Post Office travel app – and we'll deliver it within 2-3 days. Just activate it and go.

Need it quick? Visit a branch

Pick up a Travel Money Card instantly at your local Post Office. Bring a valid passport, UK driving licence or valid EEA card as ID.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Common questions

How can i order my card.

There are three ways that you able to obtain a Travel Money Card, each very simple.

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

- Via our travel app: you can order and store up to three Travel Money Cards in our free travel app . Delivery will take 2-3 working days.

- Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered. Once it arrives you can link it to our Travel app to manage on the go.

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card in order to obtain your card, and you can take it away the same day.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How do I use my card?

Travel Money Card is enabled with both chip & PIN and contactless, so you can make larger and lower-value value payments with it respectively. For convenience, you can also add it to Apple Pay and Google Wallet.

You can load it with between £50 and £5,000 (see more on load limits below). You can use it to pay wherever the Mastercard Acceptance Mark is displayed. And you can withdraw cash with it at over 2 million ATMs worldwide (charges and fees apply, see 'Are there top-up limits?' below).

Your Travel Money Card is completely separate from your bank account so it’s a safe and secure way to pay while you’re abroad.

How can I manage my card?

After you've activated your card, you can manage it using our travel app or via a web browser. You can check your recent transactions, view your PIN, transfer funds between different currency ‘wallets’, top up your card, freeze your card and more.

Our travel app brings together travel essentials including holiday money, travel insurance and more together in one place. As well as managing your Travel Money Card you can buy cover for your trip, access your policy documents on the move, book extras such as airport parking and hotels, and find your nearest ATM while overseas or Post Office branches here in the UK.

Which currencies can I use?

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. You can top up funds on the card and transfer currencies between different ‘wallets’ for these currencies easily in our travel app or online.

Currencies available:

- EUR – euro

- USD – US dollar

- AUD – Australian dollar

- AED - UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish krone

- GBP – pound sterling

- HKD – Hong Kong dollar

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish Krona

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

What are the charges and fees?

Full details of our charges and fees can be found in our Travel Money Card terms and conditions .

The Post Office Travel Money Card is intended for use in the countries where the national currency is the same as the currencies on your card. If the currency falls outside of any of the 22 we offer on your card, you’ll be charged a cross-border fee. For example, using your card in Brazil will incur a cross-border fee because we do not offer the Brazilian real as a currency.

Cross border fees are set at 3% and are only applicable when you use your currency in a country other than the ones we offer.

For more information on cross border fees, please visit our cross border payment page.

There are no charges when using your card in retailers in the country of the currency on the card. This means that a €20 purchase in Spain would cost you €20 and will be deducted from your euro balance.

To avoid unnecessary charges to your card, wherever asked, you should always choose to pay for goods or withdraw cash in the currencies of your card. For example, if you are using the card in Spain you should always choose to pay in euro if offered a choice; choosing to pay in sterling (GBP) in this example would allow the merchant to exchange your transaction from euro to sterling. This would mean your transaction has gone through two exchange rate conversions, which will increase the total cost of your transaction.

For loads in Great British pounds, a load commission fee of 1.5% will apply (min £3, max £50). A monthly maintenance fee of £2 will be deducted from your balance 12 months after your card expires. Expiration dates can be found on your TMC; all cards are valid for up to 3 years.

A cash withdrawal fee will be charged when withdrawing cash from a UK Post Office branch or from any ATM globally that accepts Mastercard.

We have listed all available currencies and their associated withdrawal limits and charges below:

EUR – euro Max daily cash withdrawal: 450 EUR Withdrawal charge: 2 EUR

USD – US dollar Max daily cash withdrawal: 500 USD Withdrawal charge: 2.5 USD

AED – UAE dirham Max daily cash withdrawal: 1,700 AED Withdrawal charge: 8.5 AED

AUD – Australian dollar Max daily cash withdrawal: 700 AUD Withdrawal charge: 3 AUD

CAD – Canadian dollar Max daily cash withdrawal: 600 CAD Withdrawal charge: 3 CAD

CHF – Swiss franc Max daily cash withdrawal: 500 CHF Withdrawal charge: 2.5 CHF

CNY – Chinese yuan Max daily cash withdrawal: 2,500 CNY Withdrawal charge: 15 CNY

CZK – Czech koruna Max daily cash withdrawal: 9,000 CZK Withdrawal charge: 50 CZK

DKK – Danish krone Max daily cash withdrawal: 2,500 DKK Withdrawal charge: 12.50 DKK

GBP – Great British pound Max daily cash withdrawal: 300 GBP Withdrawal charge: 1.5 GBP

HKD – Hong Kong dollar Max daily cash withdrawal: 3,000 HKD Withdrawal charge: 15 HKD

HUF – Hungarian forint Max daily cash withdrawal: 110,000 HUF Withdrawal charge: 600 HUF

JPY – Japanese yen Max daily cash withdrawal: 40,000 JPY Withdrawal charge: 200 JPY

NOK – Norwegian krone Max daily cash withdrawal: 3,250 NOK Withdrawal charge: 20 NOK

NZD – New Zealand dollar Max daily cash withdrawal: 750 NZD Withdrawal charge: 3.5 NZD

PLN – Polish zloty Max daily cash withdrawal: 1,700 PLN Withdrawal charge: 8.5 PLN

SAR – Saudi riyal Max daily cash withdrawal: 1,500 SAR Withdrawal charge: 7.50 SAR

SEK – Swedish Krona Max daily cash withdrawal: 3,500 SEK Withdrawal charge: 20 SEK

SGD – Singapore dollar Max daily cash withdrawal: 500 SGD Withdrawal charge: 3 SGD

THB – Thai baht Max daily cash withdrawal: 17,000 THB Withdrawal charge: 80 THB

TRY – Turkish lira Max daily cash withdrawal: 1,500 TRY Withdrawal charge: 7 TRY

ZAR – South African rand Max daily cash withdrawal: 6,500 ZAR Withdrawal charge: 30 ZAR

Are there top-up limits?

Yes, all currencies have top-up limits and balances. See full information below, which is applicable to all currencies available on the Travel Money Card.

- Top-up limit: minimum £50 – maximum £5,000

- Maximum balance: £10,000 at any time, with a maximum annual balance of £30,000

- Read more Travel Money Card FAQs

Other related services

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

For the first time in 16 years of our reports, Lisbon is not only the cheapest ...

The nation needs a holiday. And, with the summer season already underway, new ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Our annual survey of European ski resorts compares local prices for adults and ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Find out more information by reading the Post Office Travel Money Card's terms and conditions .

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

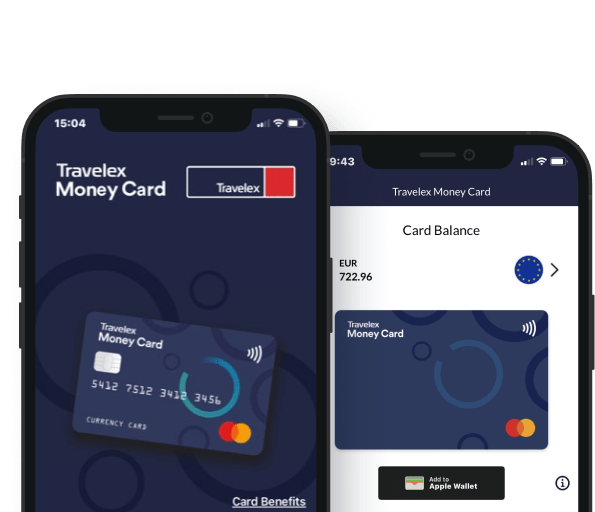

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Travel money card

Planning a trip overseas? Our prepaid travel money card lets you load your chosen currency and lock in a top rate before you go. Spend safely abroad with a Sainsbury’s Bank Travel Money Card.

Wherever you go, we’ve got your back

With a Sainsbury's Bank Travel Money Card, spending money abroad has never been easier – or safer. Once you’ve experienced the benefits of a travel money card, it’ll be your first choice every time. Our prepaid money travel card allows you to:

Load up to 15 currencies at any one time. No more worrying if your currency will be in stock at the bureau de change

Make secure, contactless payments. Just look for the contactless symbol when eating out or shopping abroad. Contactless payment is subject to merchant acceptance, and there may be a maximum limit when paying this way

Manage your account on the go. Use the Sainsbury’s Bank travel money card app to manage your currency card wherever you are

Put security first. Travel with confidence knowing your card is chip and PIN protected and there’s no direct link to your bank account

Live like a local. Use your travel money card to withdraw local currencies at ATMs worldwide for free. Remember to check whether the ATMs charge their own fee

Enjoy rates you can rely on. Fix the exchange rate any time you load or move money between currencies

Enter a world of convenience. Whenever you use your travel card, it automatically knows where you are and which currency to use

It’s free to get. And it won’t cost you a penny – or a cent – to load with foreign currency

Your adventure awaits. To get your travel money card next day from your local instore bureau click 'order for collection'. Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days).

What is a travel money card?

Travel cards are a hassle-free alternative to taking cash on holiday. And a handy way of taking multiple currencies if you’re travelling to a few different destinations.

Use it like a debit card – without worrying about overseas bank fees when you spend in a currency loaded on the travel card. Pay contactless, pay with your PIN or withdraw at a local ATM. You can even use it to make online purchases.

Since it’s a prepaid travel money card, it’s also a great way to keep an eye on your holiday spending – just load your money before you jet off. And if you need a little extra you can even easily top up your card from the beach. Download the Sainsbury’s Bank travel money card app or find out more .

Which currencies can I load?

The world’s your oyster when you get a Sainsbury’s Bank Travel Money Card. Pick up to 15 currencies at any one time. Along with the Great British Pound, you can choose from:

- Euros

- US Dollars

- Australian Dollars

- NZ Dollars

- Canadian Dollars

- South African Rand

- Turkish Lira

- Swiss Francs

- UAE Dirham

- Mexican Peso

- Polish Zloty

- Czech Koruna

- Swedish Krona

- Japanese Yen

When you use your travel money card abroad, it will automatically pick up where you are and know which currency to use.

And as soon as you load money onto your prepaid travel money card, you’ll get a fixed exchange rate for the currency, or currencies loaded. So you know exactly how much you’ll have to spend even if rates change while you’re away.

Ready to get your travel money card?

It's easy. To get your travel money card next day from your local instore bureau click 'order for collection'.

Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days). When it arrives, remember to sign the back of the card.

To start using your card, simply load it with a minimum of £50. All that's left to do is decide where you’re going.

Fees, limits and terms and conditions

Get to know our Sainsbury’s Bank travel money card fees and limits. It’ll help you understand whether it’s the right option for you.

For a full description of fees, limits and terms and conditions, please click here .

± If the currency of your transaction does not match any of the currencies on your card, or there are insufficient funds on your card in a currency to cover the whole transaction, the (remainder of the) transaction amount will be exchanged to another currency (-ies) on the card in the order of priority, at an exchange rate determined by Mastercard® on the day the transaction is processed, increased by 5.75% (the foreign exchange fee).

‡ A foreign exchange rate will apply if transferring funds to another currency. The currency exchange rate is selected from the range of rates available in wholesale currency markets (which vary each day), together with a margin.

+ If, following the debit of any monthly inactivity fee, the card fund balance is less than the fee, we will waive the difference.

^^ The amount that can be loaded/reloaded will vary depending on which channel you choose, i.e. online, in store, telephone or internet banking.

^^^ If you’ve forgotten your travel money card PIN, you can contact us for a replacement.

Already got a card?

If you’ve already got a travel money card with us, login online or use the app to top up and manage your account.

Prefer to take foreign currency?

We can help with that too. With travel money bureaux all over the UK, it’s easy to find one near you . You can also order online for home delivery. There’s 0% commission, plus, if you’re a Nectar member, you’ll get better rates. ±

Travel tools and guides

Going on holiday.

Read our holiday checklist to help you create the perfect travel plan

Keeping your valuables safe abroad

Helpful tips on how to protect your valuables while you’re on holiday

Currency converter

Use our calculator to find out how much foreign currency you could get

Frequently Asked Questions

How does a sainsbury's bank travel money card work.

Sainsbury’s Bank Travel Money Card is a chip and PIN protected prepaid Mastercard® currency card.

You can load multiple currencies onto it before you travel and then use it in millions of ATMs around the world displaying the Mastercard Acceptance Mark, to access your money quickly and safely. You can also pay for goods and services online and in-store.

Where can I use a Sainsbury's Bank Travel Money Card?

Your Sainsbury’s Bank Travel Money Card can be used to withdraw money from ATMs worldwide~ displaying the Mastercard® Acceptance Mark. All you need to do is to find your nearest ATM.

Alternatively, you can use the card to pay online and in stores around the world~.

You can use your Sainsbury’s Bank Travel Money Card in countries or areas with a different currency to those on your Card. The system will automatically convert your stored currency (-ies) to the local one. Please note that for any transactions in a currency different from the Currencies loaded on your Card, the funds available on the Card will be used in the following order of priority: GBP, EUR, USD, AUD, CAD, NZD, ZAR, TRY, CHF, AED, MXN, PLN, CZK, SEK and JPY at an exchange rate determined by Mastercard on the day the transaction is processed, increased by a percentage determined by us (see the Fees and Limits section for more details).

How do I download the Sainsbury’s Bank Travel Money Card app?

Search Sainsbury’s Bank Travel Money Card app in the Apple App Store or on Google Play.

How do I top up my Sainsbury's Bank Travel Money Card?

Even with a zero balance, your card is still valid (up to the expiry date printed on the front of the card), and you can reload it any time before your next trip##.

For information on how to reload your Sainsbury’s Bank Travel Money Card, please see the 'top up' section.

## Until card expiry and subject to reload limits (see Fees and Limits section).

What if an ATM asks for a six-digit PIN?

In some countries, you may be asked for a six-digit PIN when using an ATM.

Sainsbury’s Travel Money Card uses a standard four-digit PIN, which will still be accepted as normal if the ATM has been set up correctly in compliance with Mastercard regulations.

If you need assistance with any PIN issues, please call Card Services.

Can I get cash back with my Sainsbury's Bank Travel Money Card?

No, cash back is not available on a Sainsbury’s Bank Travel Money Card.

Terms and conditions

Sainsbury’s Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

* Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy in store or online. You need to tell us your Nectar card number at the time of your transaction. We reserve the right to change or cancel this offer without notice.

Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

- Currency Card

- Travel Money

Compare Best Prepaid Travel Money Card

Compare travel money card and travel like a pro.

- Travel Budgeting

- Security of your holiday cash abroad

- Easy reloading of cash

Who offers the best travel money card?

Compare Prepaid Euro Travel Money Cards

Compared Prepaid US Dollar Travel Money Cards

Compare Prepaid Travel Money Cards

Other popular currencies.

- Australian Dollar Card

- Canadian Dollar Card

- New Zealand Dollar Card

- South Africa Rand Card

- Swiss Franc Card

What is a travel money card?

For most people that go overseas, using your normal debit or credit card frequently on holiday comes as second nature. Perhaps you leisurely whip out the card to buy a round of drinks, buy lunch for the family or use your plastic at a favourite local restaurant. Unfortunately, you are more than likely being ripped off on a daily basis with the high costs associated with using your debit and credit card abroad!

Fortunately, your new best friend abroad maybe a specialist travel money card.

This type of plastic is a free to obtain prepaid currency card that is pre-loaded with foreign currency prior to your departure. Most offer free ATM cash withdrawals overseas and specialist travel money cards alleviate the need for any currency conversion to take place. It works in a very similar way to your standard UK Visa or Mastercard debit card. Without the hefty overseas card charges!

Effectively, the travel money card eliminates the totally unnecessary complex series of fees and charges you may encounter when taking cash out or paying for goods with your everyday debit or credit card.

In a nutshell, we have found the best prepaid currency cards as an excellent way to budget your trip, so you know exactly how much you have to spend abroad. The best card issuers listed on our travel money card comparison tables charge no overseas ATM withdrawal fees for using the card.

Budget like a pro

We all know that spending money abroad feels like play money.

One of the best benefits of a prepaid travel money cards is that they help you stick to a holiday budget. However, if you need cash fast when your abroad and running low on funds, be sure to carry some cash too. Otherwise, you will need to reload the currency card.

PrePaid cards are a secure and safe way of carrying cash abroad

One of the best advantages of prepaid currency cards versus foreign cash is that if you lose your card, you can have it replaced for a small fee. On the other hand, if you lose foreign cash in the back of a Spanish taxi, you can say 'Arivaderchi.'

How much cheaper is it to get a travel money card

Research shows the cheapest travel currency cards can save you up to 10% on buying holiday money at the airport & 5% on the cost of using UK debit and credit cards abroad.

The cheapest currency cards on the market will let you take advantage of better currency exchange rates than you would likely obtain from the high street or (heaven forbid!) airport bureaus. Airports are the world’s worst place to convert currency.

As previously mentioned, you also alleviate the complex set of fees and charges your bank will take for the convenience of using your everyday card abroad. If you use your normal credit card when taking cash out of the wall, you will have to pay interest immediately, which accentuates the costs. In most cases, when using a travel currency card there are no ATM fees for drawing money out the wall and are often the safest option when travelling.

In short, for the benefits listed below, we recommend using a pre-paid travel currency card when holidaying abroad or making a business trip.

What are the benefits of a pre paid travel money card?

Explain to me in simple terms: how travel money cards work.

- Check website for any additional in-destination fees (good housekeeping)

- Compare providers & apply for the card

- You need to make an initial first load on your new prepaid currency card

- Lock in exchange rates as soon as you load your card

- Travel money card can then be used anywhere you see a Mastercard OR Visa sign

- Use in shops or ATM’s abroad fee free to withdraw cash as you would your regular UK debit card.

- Check your balance either online, SMS or via telephone

Add more currency to your card via SMS, Online OR Telephone. Be aware of the cost of overseas calls if you top up over the phone

What prepaid travel money card is right for me?

Below, we compare travel money cards and highlight some top picks that include no spending or load fees.

It's important to remember that depending on the destination you are travelling to, you can take advantage of currency specific cards that will help you save on overseas charges.

For a more extensive comparison, check out our specialist comparison tables for: Euro Currency Cards , Dollar Currency Cards , Worldwide Currency Cards

Our Recommendation

Prepaid card comparison: best load rates or free cost of card.

You can dynamically compare rates using our prepaid travel card calculator here. We screen scrape the live exchange rates offered for all major euro and dollar currency card providers.

This is a question we are asked most often. The cheapest travel money card is not necessarily the provider who offers the currency card free of charge OR even the card that offers the best initial load rate. Consider both the purchase cost of the card together with the ‘in destination’ costs when comparing travel cards. Trying to compare prepaid currency cards on an ‘apples by apples’ basis can be difficult.

Loading your travel money card operates in a similar way to buying foreign cash online. The travel currency card exchange rates on both the Euro and Dollar specific cards will be determined on the initial load. Once you have loaded your card with foreign currency, try not to worry too much about whether the pound strengthens or weakens. Even the best traders are not able to forecast future currency fluctuations!

Who typically uses a prepaid currency card?

Holiday With Family or Friends

Whether your travelling to Spain, France or Australia you can save a fortune with superior exchange rates. Youll get more bang for your buck with a prepaid card versus using your standard UK debit or credit card abroad.

Business Travel

Business usage of currency cards is perfect to track both your and your team’s expenses abroad. You get all the benefits of your standard plastic without the unnecessary transaction costs of your standard Visa & Mastercard. This is a particular favourite of Finance Directors from small start-ups to large corporates who can manage controlled usage of spending money overseas. With most currency card programs, you don’t need to log expenses as these are detailed online in your usage reports.

Regular Travellers

The best currency cards are valid for three years so once you have applied, you can simply top up before you go abroad. This makes prepaid currency cards perfect for overseas property buyers, expats and worldwide travellers. With millions of Visa & Mastercard ATM’s worldwide, it alleviates the need to store cash every time you travel in your hotel or apartment.

Students & Backpackers

We’ve covered the budgeting benefits & boy do backpackers need to stick to a budget! This makes prepaid currency cards perfect for those 3, 6 or 12 month stints abroad. And what’s more, once your money has maxed out on the card, you can always call the bank of mum and dad to help out with a small top up to keep you going.

Pre Paid Travel Cards are issued by Visa and Mastercard

The prepaid currency card you end up choosing will either be a Visa travel money card or Mastercard issued. You can use your prepaid travel card to withdraw cash worldwide from any ATM that displays either Visa or Mastercard.

Are there more Visa or Mastercard ATM’s worldwide?

Mastercard have over one million ATM’s in over 210 countries. You can check on their website using the Mastercard Global ATM locator tool. Likewise, Visa offer a Visa Global ATM locator service for their 1.8 million ATM’s worldwide and it is recommended to use both to ensure you are never too far away from an ATM when using your prepaid visa card or prepaid mastercard abroad.

- Press centre

- Testimonials

- Privacy Policy

- Terms & Conditions

- Travel Money Widgets

- Travel Blogger University

- MyCurrencyTransfer.com

Popular Currencies

- Order Euros online

- Order US Dollars online

- Order Canadian Dollars online

- Order Australian Dollars online

- Order Thai Baht online

- Order Turkish Lira online

- Order Swiss Francs online

- Order Japanese Yen online

- Order New Zealand Dollars online

Popular Pages

- Travel Money Reviews

- Euro Currency Card

- Travel Money Survey 2012

- Buy Euros Online

- Travel Blog Awards 2012

- Travel Money Affiliates

- MyTravelMoney News

About MyTravelMoney

MyTravelMoney.co.uk is the UK’s leading travel money comparison website, with featured reviews, guides and information to bring you best deals.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for the UK - 2024

If you’re visiting the UK, a specialised travel money card can make it cheaper and more convenient to access British pounds for spending and withdrawals. There are various options available, such as travel debit cards, prepaid travel cards, and travel credit cards, which cater to different types of customers. The right one for you will depend on your personal preference and how you like to manage your money.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - our pick for travel debit card for the UK

Before we get into details about different travel money card options, let's begin with the Wise card as a versatile travel money debit card that can hold and spend GBP , as well as a diverse range of other currencies.

Hold and exchange over 50 currencies alongside GBP

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing costs and no interest to pay

ATM fees apply once you exceed your plan limits

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Just like your normal bank card, a travel money card can be used for online and in-store purchases, as well as for cash withdrawals. However, with a travel money card, the features and fees are tailored for global usage. This may mean you get a better exchange rate, or fewer charges, in comparison to using your regular card abroad. Some travel cards - particularly travel credit cards- also offer opportunities to earn cashback and rewards for using your card internationally.

6 travel money cards for the UK compared

Before we get into each card option in more depth, here’s a summary of how six of the best travel money cards for the UK compare to each other.

The features of various travel money cards can differ significantly. Generally, travel debit cards can be convenient and relatively inexpensive to use, while travel credit cards may offer extra benefits such as cashback or rewards. However, they also come with the risk of incurring interest and late payment fees, if you don’t pay off your bill in full every time.

Travel debit cards usually allow you to easily add funds online or via a mobile app, which helps you stick to your budget and avoid overspending. Conversely, travel credit cards enable you to spend up to your credit limit, and you can pay off the balance over several months. Which is best for you will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Broadly speaking, Canadian customers can pick a travel money card from either a traditional bank or a specialist provider, from a selection including travel debit cards, travel prepaid cards or travel credit cards. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Specialist providers typically offer travel debit cards, which are accompanied by digital accounts that allow you to top up, hold, and exchange currency balances. While these cards may have different features, they usually provide a user-friendly online platform and mobile app for effortless balance top-ups. With the convenience of viewing your balance and receiving transaction notifications on your phone, it’s easier to manage your finances no matter where you are in the world.

Travel debit card Option 1: Wise

Wise is our pick for travel debit card for the UK . There’s no fee to open a Wise account, and no delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account , no minimum balance requirement

No fee to get your Wise card, free to spend any currency you hold

2 withdrawals, to 350 CAD value per month for free, then 1.5 CAD + 1.75%

Hold GBP and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive CAD, GBP and 7 other currencies for free

Travel debit card Option 2: Canada Post Cash Passport

You can pick up a Canada Post Cash Passport in your local Post Office, and top up your account in CAD. You can then switch your balance to any of the 7 supported major currencies - or you can just allow the card to convert to the currency you need, although there is a foreign exchange fee of 3.25% for doing so. You can use your Canada Post Cash Passport card in ATMs and wherever the network is supported. ATM fees apply which vary by currency.

Supports 7 major currencies, including GBP

No fee to spend currencies you hold in your account

Variable ATM fee, 1.7 GBP when in the the UK for example

1.5% fee for using your card in Canada - plus any applicable fee to convert funds back to CAD if you hold a foreign currency

Pros and cons of using debit travel cards in the UK

Avoid interest costs and late payment fees

Hold and exchange currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed using just your phone

Safe to use, as accounts aren’t linked to your main Canadian bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for the UK?

Choosing the best travel debit card for the UK depends on your personal preferences and financial management style. If you travel often - and not just to the UK - it's smart to consider an account that offers mid-market currency exchange rates and a wide selection of supported currencies, including GBP, like Wise. Other providers like Canada Post also support GBP alongside a handful of other major world currencies, and the Cash Passport can be conveniently collected in your local Post Office.

Is there a spending limit with a travel debit card in the UK?

Card use limits are determined by individual providers and can vary depending on the transaction type. Limits may apply on a daily, weekly or monthly basis. For instance, there may be a cap on the number or value of ATM withdrawals allowed per day or a limit on the value of contactless payments you can make. These limits are set for security reasons and can often be adjusted using the provider's app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll usually need to first order a card and then add funds in CAD from your bank account or card. Once you have a balance you can then pay merchants and make cash withdrawals at home and abroad. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - you may find you pay a foreign transaction fee when overseas, depending on the specific card you select.

Prepaid travel card option 1: BMO Reloadable Mastercard

The BMO Reloadable Mastercard can be topped up in CAD and used when you travel in the UK. You’ll pay a 2.5% foreign transaction fee when overseas, but you’ll still have the advantage that - as with other prepaid and travel cards - this card is not linked to your primary bank account, so it can increase security when spending abroad. There’s a 6.95 CAD annual fee, but as this is a purchase card rather than a credit card, there’s no interest to worry about. You just top up and you can spend up to your account balance freely.

6.95 CAD annual fee, 2.5% foreign transaction fee

5 CAD ATM fee

No interest to worry about

Manage your card online or using your phone, to top up and view balance

Add funds from BMO or other Canadian banks directly

Prepaid travel card option 2: Koho Premium Mastercard

You can get up to 2% cash back with the Koho Premium Mastercard, and there’s no foreign transaction fee to worry about. Instead, you pay a monthly card fee of 9 CAD. The basic card is free to get, or you can upgrade to a Koho metal card for 159 CAD if you want a fancier way to pay when you’re at home and abroad.

9 CAD/month premium fee

No foreign transaction fee

Earn cash back on your spending

Pros and cons of using prepaid travel cards in the UK

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Issued on globally popular networks for good coverage

ATM withdrawals supported globally

Some accounts have extras like options to earn cash back or reward points

Typically only CAD supported - watch out for foreign transaction charges

Transaction fees apply to most accounts

How to choose the best travel prepaid card for the UK?

There’s no single best travel prepaid card for the UK - it’ll come down to your personal preference. If you don’t mind paying a monthly fee you might like the Koho Premium card which waives foreign transaction fees, and other charges like ATM withdrawal fees. Otherwise, if you just want a simple prepaid card and don’t mind the foreign transaction fee when you’re in the UK, the BMO prepaid card might suit you.

Is there a spending limit with a prepaid card in the UK?

Prepaid travel cards usually have different spending and withdrawal limits that can vary depending on the currency. To find the right card for you, you’ll want to carefully review the terms and conditions of each card provider you’re considering. This way, you’ll be confident you’ve picked a provider that meets your specific needs and requirements.

3. Travel Credit Cards

Travel credit cards often come with additional benefits not found in regular credit cards. These benefits can include lower or no fees for foreign transactions and the chance to earn extra rewards when using the card abroad. While travel credit cards offer safety and convenience, it's worth noting that they may be more expensive than using a debit card.

Before choosing a travel credit card, it's essential to consider factors such as fees, rates, eligibility criteria, and interest rates. Take the time to compare different options and select the one that suits you best.

Travel credit card option 1: HSBC World Elite Mastercard

The HSBC World Elite Mastercard has been optimised for overseas use, with extra rewards on international spending and travel, plus no foreign transaction fees to pay. There are lots of ways to earn rewards, including variable new customer bonus offers - the downside is that there’s an annual fee of 149 CAD, so you’ll need to check if the benefits outweigh the costs. As with any other credit card, you’ll also need to pay off your bill in full every month to avoid interest charges.

149 CAD annual fee, 5 CAD ATM withdrawal fee

Variable interest rate

Options to earn rewards, including enhanced benefits for travel spending

Travel credit card option 2: Home Trust Preferred Visa Card

The Home Trust Preferred Visa Card is a credit card with a variable interest rate, no foreign exchange fees and 1% cash back on all eligible purchases. There’s no annual fee to pay, although the ATM withdrawal fees can run pretty high - 1% or 1.5% depending on the ATM type, and the maximum cap is 15 CAD for some withdrawals.

No annual fee, no foreign transaction fee

1% cash back on all eligible purchases

ATM fees apply, which are set as a percentage, and can run pretty high

Pros and cons of using credit cards in the UK

Enjoy peace of mind with zero liability policies offered by some cards

Spread the cost of your travel expenses over several months

Some cards have no foreign transaction fees, saving you money on international purchases

Exchange rates typically offered by card networks are usually fair

Earn cash back and rewards on your spending with select cards, making your travel even more rewarding.