International tourism, receipts (current US$) - China

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

- Asia Briefing

- China Briefing

- ASEAN Briefing

- India Briefing

- Vietnam Briefing

- Silk Road Briefing

- Russia Briefing

- Middle East Briefing

China’s Tourism Sector Prospects in 2023-24

Amid the post-pandemic recovery, China’s tourism sector is rebounding with vigor in 2023. We discuss the resurgence of outbound and domestic travel, evolving traveler behavior, and tech-enabled trends in this article. From cultural exploration to wellness escapes and digital integration, the stage is set for foreign businesses and investors to seize opportunities in this transformed landscape.

After enduring the significant impacts of the COVID-19 pandemic, China’s tourism sector is gearing up for a strong resurgence in 2023. Projections indicate that the total revenue from domestic tourism is expected to exceed RMB 4 trillion (approximately US$580.96 billion), marking an impressive 96 percent growth. Several driving forces contribute to this revival in China’s tourism landscape, including:

- Easing of travel restrictions;

- Increase in disposable income among Chinese consumers; and

- Growing popularity of domestic tourism.

In particular, the government’s support in revitalizing the tourism sector is evident through subsidies and tax exemptions provided to tourism enterprises. The robust resurgence of China’s tourism industry also serves as a positive indicator for the nation’s economy, with tourism being a significant driver of economic growth and expected to contribute notably to the country’s GDP. Overall, 2023 has seen a continuous stream of new policies, products, technologies, concepts, trends, and opportunities impacting the tourism industry.

China’s evolving tourism landscape

Insights from outbound tourism in h1 of 2023.

Both outbound and inbound tourism markets in the first half of 2023 have shown impressive vitality, surpassing the levels observed in the same period of 2019. Average expenditures for outbound travelers have exhibited a notable increase, with Hong Kong and Macao leading the resurgence of outbound tourism. The total number of inbound and outbound individuals has surged by approximately 170 percent.

Data from the World Tourism Alliance’s reports, reveal that the outbound tourism sentiment index reached 28 percent in the first half of 2023, marking a 21-point increase from the same period in 2019. The outbound tourism market has displayed a gradual “U-shaped” recovery, emphasizing a steady resurgence rather than an abrupt rebound.

According to recent data from Alipay’s Overseas Spending Platform, the average expenditure per user for outbound travel in the first half of 2023 grew by 24 percent compared to 2019. Among popular destinations, the top 10 outbound travel destinations in terms of transaction volume for the first half of 2023 were:

- South Korea;

- United Kingdom; and

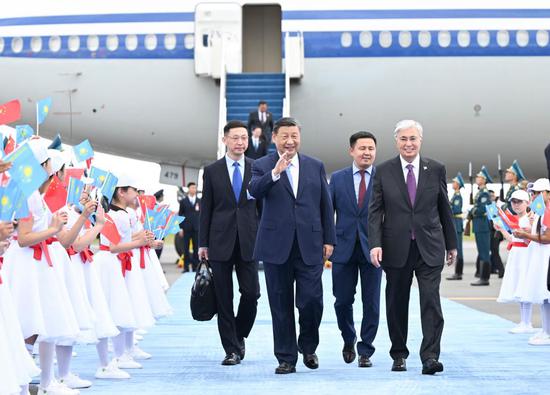

This data is supported by several favorable policies. Since the beginning of the year, the National Immigration Administration has continuously optimized and adjusted inbound and outbound management policies.

Starting from February 20, 2023, mainland cities within the Greater Bay Area initiated a pilot implementation of visa endorsements for cross-border talent to and from Hong Kong and Macao. On May 15, 2023, policies such as the nationwide implementation of group travel endorsements for mainland residents traveling to Hong Kong and Macao were fully restored.

The streamlined and optimized policies for travel to Hong Kong and Macao prompted provinces across the mainland to organize multiple tour groups, leading to a consistent rise in mainland visitors to these regions. According to data released by the Hong Kong Tourism Board, nearly 13 million visitors arrived in Hong Kong in the first half of 2023, of which approximately 10 million were mainland visitors, accounting for around 77 percent of the total.

Furthermore, based on recent data released by the National Immigration Administration, the first half of 2023 witnessed a total of 168 million inbound and outbound individuals passing through China’s immigration, marking a year-on-year increase of 169.6 percent.

At the same time, approximately 42.798 million entry and exit permits for travel to and from Hong Kong, Macao, and Taiwan were issued, indicating a significant 1509 percent increase compared to the same period in 2022.

These figures further underline China’s promising revival in outbound tourism. Indeed, Chinese tourists have once again become a significant force driving global tourism and offline consumption.

In terms of outbound travel numbers, the top 10 departure cities were: Shenzhen, Shanghai, Guangzhou, Beijing, Hangzhou, Foshan, Dongguan, Zhuhai, Chengdu, and Wuhan. This highlights that outbound travel is mainly concentrated in first-tier and new first-tier cities, with the “Guangzhou-Shenzhen-Foshan-Dongguan-Zhuhai” Greater Bay Area cities also playing a pivotal role in outbound tourism.

The primary reason driving Chinese tourists to travel abroad is leisure, with business and visiting friends and relatives (VFR) as the subsequent motivations. The rapid expansion of outbound tourism from China can be attributed to the rising incomes of the middle class , the growing desire among Chinese travelers to explore diverse countries and cultures, and the ease of obtaining visas and fulfilling entry criteria for various destinations.

Moreover, the retail sector captures the largest portion of Chinese tourists’ spending when traveling abroad and is anticipated to retain its dominant position in terms of outbound tourism expenditure over the projected timeframe.

The steady recovery of outbound tourism

Initial expectations for a robust rebound in outbound tourism this year have encountered a more precarious reality. Notable evidence of this transformation is seen in the changing preferences of Chinese leisure travelers. As reported by CNBC, the desire to travel abroad has surged from 28 percent to 52 percent among Chinese leisure travelers since last year, nearly doubling.

Business travel intentions have tripled, and interest in education, family visits, and medical tourism abroad is also on the rise. Other findings align, revealing that 50 percent of Chinese travelers plan to journey internationally within the next year.

A significant shift has also occurred in travel fears, particularly concerning Covid contraction. While it topped travelers’ concerns in 2022, it has diminished to the least worrisome aspect this year, as per Morning Consult’s survey. This shift reflects growing traveler confidence. Factors influencing this gradual recovery go beyond preferences. A recent report from the Mastercard Economics Institute reveals a shift in Chinese residents’ spending patterns.

Known for their shopping inclination, there’s a rising trend toward investing in experiences over possessions, particularly in a zero-Covid environment. Despite global economic uncertainties, Asia-Pacific’s, including China’s, travel recovery remains steady. As travel capacity grows, costs are anticipated to decrease, fueling a more dynamic travel landscape.

Contrary to an instant “boom,” China’s international travel revival is unfolding steadily. Though not as swift as initially projected, the evolving interests, changing attitudes, and gradual shift toward experiential spending all point to a growing and adaptive outbound tourism sector, offering a promising glimpse into the future.

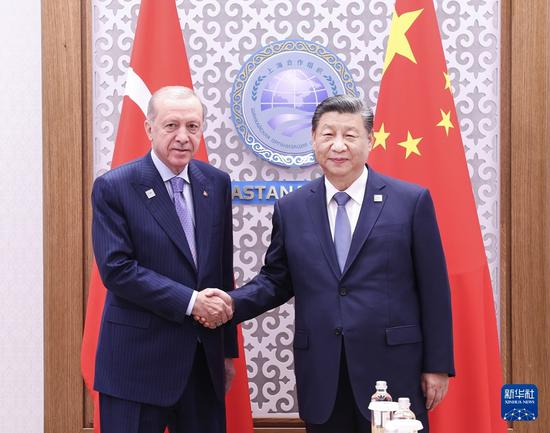

The Chinese government’s recent efforts to revive outbound group travel

China’s Ministry of Culture and Tourism recently expanded outbound group tour destinations, including popular places like Japan and the US. A recent analysis provided by the EIU indicates that this move will aid global tourism recovery, benefiting countries with simplified visa procedures.

While the relaxed restrictions will moderately boost outbound tourism, obstacles and cautious spending persist. Nonetheless, domestic travel agencies are expected to see increased revenue, leading to employment and income growth in the sector.

However, challenges such as limited flights and labor shortages could hinder outbound tourism’s full recovery. A complete relaxation of restrictions is predicted in late 2023, but pre-pandemic outbound levels might not return until 2025.

Domestic tourism is thriving

In the first half of 2023, domestic tourism revenue (total tourist spending) reached RMB 2.3 trillion (approx. US$318 billion), marking a substantial increase of RMB 1.12 trillion (approx. US$155 billion) compared to the previous year. Notably, urban residents’ expenditures on travel accounted for a year-on-year surge of 108.9 percent, while rural residents’ travel spending grew by 41.5 percent.

The remarkable rebound of China’s domestic tourism sector can be attributed to a set of factors that differentiate it from the relatively slower recovery of outbound tourism. For one, the domestic tourism industry appears to be less affected by uncertainties surrounding employment and income growth compared to other service and retail sectors.

This is primarily due to the strong yearning of Chinese consumers to explore after years of mobility limitations imposed by the pandemic.

On the other hand, the prolonged revival of outbound flights has further bolstered the domestic tourism scene. Many individuals redirected their travel plans within China as international travel remained limited.

Notably, the return of international air traffic to approximately 80 percent of pre-pandemic levels is not expected until the fourth quarter of 2023, which creates a favorable environment for the vigorous resurgence of domestic tourism in the meantime.

Changing Chinese travelers’ preferences in 2023

In the wake of the COVID-19 pandemic and the subsequent travel restrictions, Chinese travelers underwent a transformation in their preferences and behaviors. Over the past three years, while international travel remained limited, domestic exploration thrived.

Around 8.7 billion domestic trips were taken, indicating an annual rate of around 50 percent of pre-pandemic levels. This period allowed the domestic market to mature, and travelers became more sophisticated in their pursuits, engaging in various new leisure experiences such as beach resorts, skiing trips, and city “staycations.”

As a result, the post-COVID-19 Chinese traveler exhibits distinct traits: heightened digital savvy, elevated expectations, and an appetite for novel experiences. These characteristics paint the profile of a typical Chinese traveler in 2023:

- Experiences matter: Survey data reveals that the rejuvenated Chinese tourist is driven by experiential travel. While outdoor and scenic trips remain popular, the preferences have evolved. Sightseeing and culinary experiences, highly valued in the initial survey series, are now joined by a growing interest in culture and history, beaches, and resorts, as well as health and wellness. This shift solidifies the trend towards experience-driven travel. Additionally, activities like skiing and snowboarding have gained popularity, possibly influenced by the 2022 Beijing Olympic Winter Games .

- Digital expert: Chinese travelers are among the world’s most digitally adept consumers, easily integrating mobile technologies and social media into their daily lives. The pandemic further propelled their online engagement. Short-form videos and livestreaming have emerged as dominant online entertainment options.

- Curious: The desire to explore novel experiences in unfamiliar destinations remains strong among Chinese travelers. Despite travel radius limitations imposed by policies, survey respondents express eagerness to visit new attractions. Instead of revisiting familiar places, 45 percent of participants prioritize short trips to new sites, while long trips to new destinations are the second most favored option.

Emerging trends and destinations

Cultural and heritage tourism.

A significant shift in China’s tourism landscape is the increasing emphasis on cultural tourism, where traditional heritage seamlessly intertwines with contemporary travel. As the nation preserves and celebrates its abundant historical and cultural treasures, a surge in cultural tourism activities like immersive experiences and interactive exchanges has taken center stage.

This trend is particularly pronounced in the realm of domestic tourism, where travelers are flocking to heritage sites and cultural landmarks to gain a deeper understanding of China’s rich heritage.

Moreover, the development of cultural and tourism industries constitutes a crucial component of China’s cultural confidence-building efforts. This sector has received significant attention from the government, evidenced by policies like the “14th Five-Year Plan for Cultural Development” and the “14th Five-Year Plan for Tourism Industry Development.” Such policies drive the integration of culture and tourism, increase the supply of cultural tourism products, and enhance the quality of such offerings.

Wellness tourism

In 2023, a remarkable shift in travel preferences among Chinese tourists has propelled wellness and health tourism to the forefront. As observed by Rung Kanjanaviroj, Director of the Tourism Authority of Thailand’s Chengdu office, Chinese travelers are displaying a distinct preference for destinations that offer a blend of sunny beaches and holistic well-being experiences.

This evolving trend has prompted destinations like Thailand to proactively adapt by refining their offerings. Through the enhancement of health tourism services and a focus on engaging student and youth travelers, Thailand has positioned itself as a prime destination for those seeking rejuvenation and self-care during their journeys.

The rise in wellness and health tourism reflects a broader shift in Chinese travelers’ priorities, as they seek destinations that not only provide scenic beauty but also nurture their physical and mental well-being.

Tech-enabled tourism in China’s innovative travel landscape

China’s tourism industry has evolved dramatically through the fusion of technology and changing consumer demands. In 2023, the landscape is marked by a growing emphasis on tech-enhanced experiences that cater to modern travelers’ evolving preferences that foreign businesses and investors in the sector can learn from.

- Smart appliances and IoT integration: China’s tech-driven tourism trend showcases the integration of smart appliances and the Internet of Things (IoT) into the travel journey. Travelers now wield the power to personalize their environment and encounters via smartphone apps. Innovations range from smart hotel rooms adjusting lighting, temperature, and ambiance to IoT-enabled transportation providing real-time updates, enhancing comfort and efficiency.

- Virtual and augmented reality immersion: Tech-savvy Chinese travelers are increasingly seeking immersive encounters. Virtual and augmented reality (VR/AR) have taken center stage, enabling tourists to explore historical sites, cultural landmarks, and natural marvels through virtual tours that breathe life into destinations. This not only enhances engagement but also serves as a potent tool for destination marketing.

- Seamless contactless services and digital payments : Contactless services and digital payments have become integral to China’s tech-enhanced tourism scene. Travelers can navigate touchpoints like check-in, security, dining, and shopping with minimal physical interaction. QR codes have revolutionized payment methods, enabling transactions through smartphones, and eliminating the need for physical currency or cards, in alignment with the country’s cashless society drive.

The city of Hangzhou offers a glimpse into the future of tech-enabled tourism. Hangzhou’s West Lake, a UNESCO World Heritage site, now features interactive kiosks that provide historical context, virtual guides, and navigation assistance to visitors. These digital enhancements blend seamlessly with the serene natural landscape, enriching the cultural experience.

Similarly, the China National Tourist Office uses VR to transport potential travelers to iconic destinations. Through immersive VR experiences, individuals can virtually explore the Great Wall, the Terracotta Army, and other renowned sites, sparking wanderlust and encouraging travel planning.

Preparing for the return of Chinese tourists to the international scene

The gradual easing of travel restrictions in China still presents a promising avenue for the recovery of the international travel and tourism sector. Amid this positive outlook, attracting Chinese tourists is becoming a priority for global businesses.

Chinese travelers, known for their enthusiasm to explore beyond their borders, are now seeking immersive experiences, quality accommodation, and exceptional service. Here are some strategies that foreign businesses can employ to entice and captivate the adventurous Chinese traveler.

Crafting authentic and familiar experiences

After a three-year hiatus from overseas travel, Chinese tourists are now yearning for high-quality experiences in familiar destinations.

They are looking beyond traditional shopping and sightseeing, expressing a keen interest in entertainment and experiential offerings. Theme parks, cultural activities, water sports, snow sports, and shows are among the sought-after activities.

The key is to offer authentic experiences that resonate with Chinese travelers’ desires for immersion, while still maintaining a touch of familiarity.

Businesses should leverage deep customer insights to design offerings that strike a balance between accessibility and authenticity, ensuring a comfortable yet exciting experience.

Harnessing the power of social media

Social media, particularly short videos, has emerged as a pivotal source of travel inspiration for all age groups. Tourist destinations have capitalized on this trend by launching engaging short video campaigns, maximizing exposure and engagement.

The burgeoning trend of city-walking , for example, where urban exploration is undertaken solely on foot, has not only captured the attention of locals but has also made significant waves across various social media platforms. Chinese netizens are embracing this form of experiential travel, and businesses can leverage social media to align with their preferences.

Platforms like Douyin, China’s counterpart to TikTok, have witnessed the rise of “city-walk content”. A recent video showcasing city-walk routes in Guangzhou amassed over 171,000 likes and found its way into the favorites of 72,000 viewers.

Furthermore, Xiaohongshu, a prominent lifestyle-sharing platform in China, reported a remarkable 30-fold increase in searches related to city walk during the first half of 2023 compared to the previous year.

Businesses can leverage social media platforms to connect with potential Chinese tourists, employing captivating content and innovative campaigns to pique their interest. Creating a strong presence on platforms like TikTok and engaging with influential figures can significantly boost visibility.

Collaboration with Internet giants

China’s tech-savvy travelers are deeply intertwined with the digital world, and internet giants like WeChat and Alipay play a pivotal role in their daily lives. Foreign businesses can tap into these existing digital ecosystems rather than starting from scratch.

For instance, Amsterdam’s Schiphol Airport offers a WeChat Mini Program providing information about the airport, including duty-free shopping and travel planning. Alibaba’s Alipay, renowned for its mobile payment capabilities, has partnered with tax refund agencies to streamline the tax refund process for Chinese travelers.

Such digital innovations enhance convenience and are fast becoming an expected norm.

Prioritize direct-to-consumer (D2C) channels

Navigating China’s intricate travel distribution landscape can be complex, as it encompasses diverse channels, such as online travel agencies (OTAs), online travel portals (OTPs), and traditional travel agencies. To make the most of this landscape, businesses can consider embracing D2C channels.

By leveraging social media platforms and official brand platforms, businesses can create a compelling value proposition that resonates with Chinese travelers. Investing in D2C channels not only enhances branding but also facilitates direct engagement with potential tourists, allowing for a personalized and enticing approach.

Key takeaways: Navigating China’s tourism resurgence

All in all, in 2023, China’s tourism is making a strong comeback, driven by key trends that reveal changing traveler preferences.

Domestically, easier travel rules and higher incomes are fueling local exploration. Internationally, outbound tourism is gradually recovering with a focus on immersive experiences, wellness, and cultural discovery.

Chinese travelers are becoming more tech-savvy, seeking out tech-enhanced experiences like virtual reality tours. This shift is boosting cultural, heritage, and wellness tourism.

Social media, especially platforms like TikTok and WeChat, are vital for engaging with Chinese travelers effectively.

In essence, China’s tourism resurgence is multifaceted, with travelers seeking enriched experiences, digital engagement, and authenticity.

Businesses that align with these preferences and capitalize on domestic and international opportunities are likely to thrive in the evolving travel landscape.

China Briefing is written and produced by Dezan Shira & Associates . The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at [email protected] .

Dezan Shira & Associates has offices in Vietnam , Indonesia , Singapore , United States , Germany , Italy , India , Dubai (UAE) , and Russia , in addition to our trade research facilities along the Belt & Road Initiative . We also have partner firms assisting foreign investors in The Philippines , Malaysia , Thailand , Bangladesh .

- Previous Article Exporting Food Products to China: A Step by Step Guide

- Next Article China Issues 24 New Measures in Clear Directive to Boost Foreign Investment

Our free webinars are packed full of useful information for doing business in China.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Want the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

Get free access to our subscriptions and publications

Subscribe to receive weekly China Briefing news updates, our latest doing business publications, and access to our Asia archives.

Your trusted source for China business, regulatory and economy news, since 1999.

Subscribe now to receive our weekly China Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week's issue.

Search our guides, media and news archives

Type keyword to begin searching...

This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

China Domestic Tourist

View china's china domestic tourist from 1990 to 2023 in the chart:.

What was China's China Domestic Tourist in 2023?

Related indicators for china domestic tourist, accurate macro & micro economic data you can trust.

Explore the most complete set of 6.6 million time series covering more than 200 economies, 20 industries and 18 macroeconomic sectors.

China Key Series

Buy selected data, more indicators for china, request a demo of ceic.

CEIC’s economic databases cover over 200 global markets. Our Platform offers the most reliable macroeconomic data and advanced analytical tools.

Explore our Data

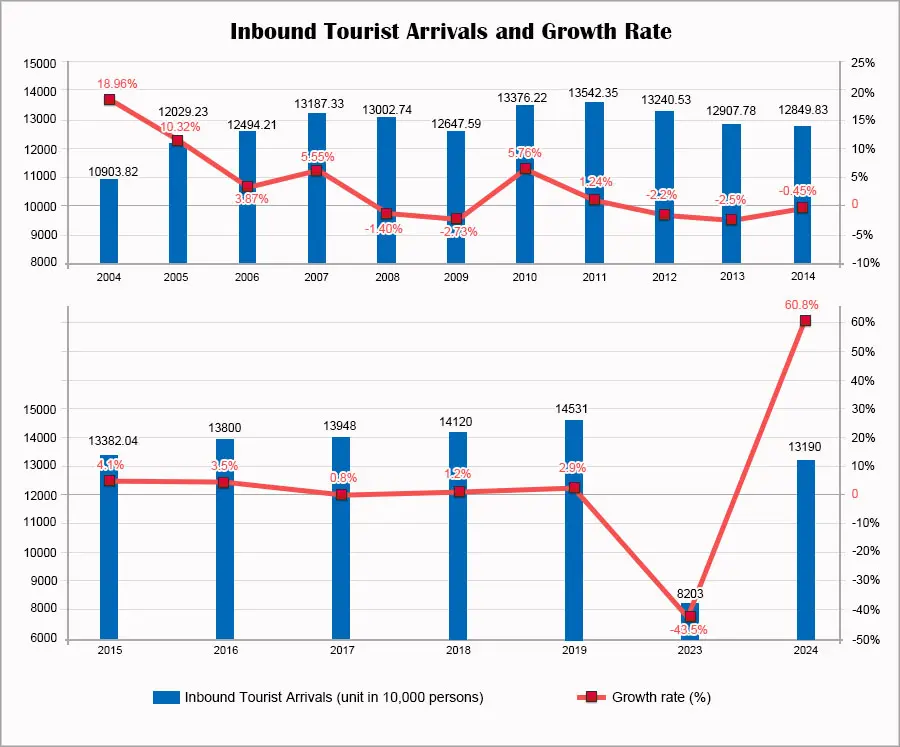

China Tourism

China tourism industry has seen unprecedented development in recent years due to the sustainable economic growth, the further implementation of the Reform and Opening-up Policy, as well as the substantial increase in people's personal income. The enormous outbound market has drawn the attention of the world. The domestic market keeps expanding steadily. However, the inbound market is in a downturn.

Inbound Tourism:

In fact, China has carried out various measures to cope with the inbound tourism downturn. At present, the 72-hour visa-free transit policy has been adopted in more and more cities to welcome more overseas guests. The convenient flight network and the operation of many high speed trains in recent years make traveling in China faster and smoother. Besides, extensive campaigns are held to fight against environmental problems and ensure food safety. It's believed that more advantageous steps will be taken in the near future.

Outbound Tourism:

Domestic tourism:.

List of China Tour Operators

- Heilongjiang

- Inner Mongolia

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 05 July 2024

Assessing the reactions of tourist markets to reinstated travel restrictions in the destination during the post-COVID-19 phase

- Xuankai Ma 1 , 2 , 4 , 5 ,

- Rongxi Ma 2 , 4 ,

- Zijing Ma 5 ,

- Jingzhe Wang 6 ,

- Zhaoping Yang 3 , 4 ,

- Cuirong Wang 2 , 4 &

- Fang Han 2 , 4

Scientific Reports volume 14 , Article number: 15495 ( 2024 ) Cite this article

191 Accesses

Metrics details

- Socioeconomic scenarios

- Sustainability

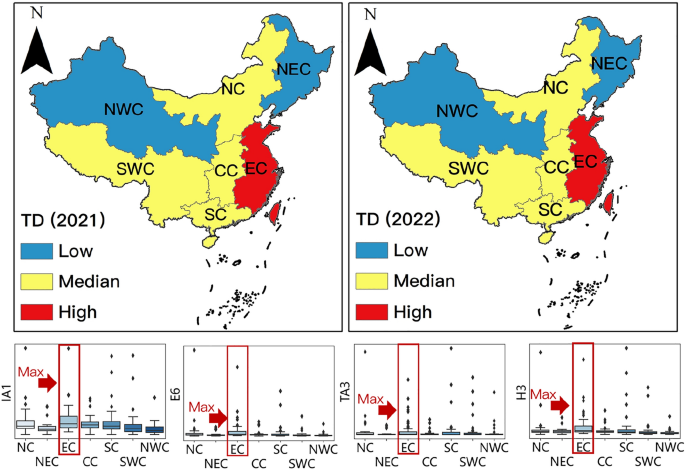

This study, leveraging search engine data, investigates the dynamics of China's domestic tourism markets in response to the August 2022 epidemic outbreak in Xinjiang. It focuses on understanding the reaction mechanisms of tourist-origin markets during destination crises in the post-pandemic phase. Notably, the research identifies a continuous rise in the potential tourism demand from tourist origin cities, despite the challenges posed by the epidemic. Further analysis uncovers a regional disparity in the growth of tourism demand, primarily influenced by the economic stratification of origin markets. Additionally, the study examines key tourism attractions such as Duku Road, highlighting its resilient competitive system, which consists of distinctive tourism experiences, economically robust tourist origins, diverse tourist markets, and spatial pattern stability driven by economic factors in source cities, illustrating an adaptive response to external challenges such as crises. The findings provide new insights into the dynamics of tourism demand, offering a foundation for developing strategies to bolster destination resilience and competitiveness in times of health crises.

Similar content being viewed by others

Analysis of spatial patterns and driving factors of provincial tourism demand in China

Tourism in pandemic: the role of digital travel vouchers in China

A ten-year review analysis of the impact of digitization on tourism development (2012–2022)

Introduction.

The COVID-19 pandemic has had an enormous and long-lasting social and economic impact on the tourism industry 1 . International tourist arrivals (overnight visitors) plummeted by 73% in 2020 due to a global embargo, widespread travel restrictions, and a massive drop in demand. Compared to 2019, there were approximately 1 billion fewer international visitors that year 2 . The year 2021 is considered by scholars as the Year of Recovery for tourism, with tourism indicators signaling recovery 3 , 4 . The climate crisis and the European return to war are expected to restrict international travel 5 , and the domestic market will be an appropriate approach to drive tourism recovery 6 . The expansion of domestic tourism is propelled by a considerable accumulation of suppressed demand, a rising preference for domestic locales, and stringent border entry and exit controls.

Nevertheless, the mutation of the Omicron virus resulting in greater contagiousness will lead to localized areas being re-closed to counter the diffusion of the Virus 7 . It is an additional shock to the recovering tourist destinations. The investigation of the response of origin markets to the reclosure of destinations during the tourism recovery period is of significant relevance for regional authorities to assess the impact of the outbreak and the maintenance of tourist origins.

This paper aims to investigate what changes occur in origin market demand for destinations affected by reclosure during the tourism recovery period, what spatial differences such changes show, and how the differences in response exhibited by origin markets arise. The response in tourism demand is quantified through the analysis of annual growth rates in the domestic market during periods of reclosure. Based on tourism demand theory, demographic, economic, and environmental conditions, COVID-19 epidemic status, healthcare conditions, Internet access coverage, and traffic activation will be potential influential factors to account for the variation in origins market response. We add new insights to the COVID-19 study of short-term effects and spatial differences in tourism demand by examining the pattern of origins market response in the face of destination reclosure from the tourist origins' perspective (cities).

Literature review

The covid-19 and the tourism industry.

The dramatic impact of COVID-19 on the tourism industry has intensified the involvement of scholars in studies on the issue. In the initial phase of the pandemic (2020), UNWTO reported international tourist arrivals to decline by 70–75% for 2020. Academics have addressed the effects of the pandemic on national tourism markets 8 , 9 , the response of the tourism industry to the crisis 10 , 11 , and the framework for sustainable development 12 , 13 , 14 . Greece, with its developed tourism industry, the loss of tourism revenue due to the pandemic has directly contributed to the overall economic decline of the country 15 . The pandemic has declined tourist arrivals and affected employment and productivity in the Balearic Islands, revealing the region’s decline 1 . Hotel revenues in Italy fell by 66% relative to Turkey due to the embargo policies 16 . The U.S. hotel industry lost about $30 billion in revenue in the spring of 2020 17 , while the restaurant industry also faced a notable crackdown 18 . The multidimensional assessments of the influence of the pandemic on tourism demand were performed by comparing this crisis with the normal state of affairs before the crisis, which pointed to a significant negative consequence of tourism with its sibling sectors along the entire tourism industrial chain 19 . Restoring tourist arrivals to pre-crisis standards will probably confront prolonged pain 20 .

Some improvement in the epidemic accompanies the crisis response and recovery period (after 2021). Regardless, the pace of recovery continues to be sluggish and uneven in all regions of the world due to varying degrees of mobility restrictions, vaccination rates, and traveler confidence. Dynamic adjustment of travel restrictions within the country during the post-pandemic period could stimulate a recovery to a limited extent and allow domestic tourism to dominate 21 , 22 . Empirical studies show that regions with monoculture industries have no buffers to adapt to the crisis in the face of shocks that significantly reduce tourism demand 23 , 24 . In contrast, regions with prosperous industries and strong tourism specialization will be highly resilient to disruptions in the context of less restrictive movement of people, presenting a competitive advantage with a slight decline in demand 25 , 26 . Scholars believe this is the best time to promote equitable and sustainable tourism development, and the disconnect between tourist demand and destination development (growth expansion) needs to be repaired 27 , 28 . The construction of tourism sustainability will focus more on the changing needs of tourists themselves and their demand preferences. In the future, regulating the balanced development of regional tourism by changing tourists’ needs is the focus of tourism sustainability in the post-epidemic era 29 , 30 .

Measures of tourism recovery

In the tourism literature, scholars have proposed and implemented the concept of tourism resilience to quantify post-crisis tourism outcomes, particularly the ability and magnitude of regional tourism to recover from the COVID-19 disruptions 31 . Metrics such as employment rates, tourist arrival rates, and tourism revenues are measures to assess regions’ tourism resilience within geographically large areas 32 , 33 , 34 . It is noteworthy that the recoverability of tourism in different regions varies by geographic area and thus shows distinct patterns of recovery. Thus, the spatial heterogeneity of tourism recovery must be considered 35 . Scholars have argued that location quotients 36 , the share of an industry in the local total divided by the share of the industry in the national total, can better account for the speed of tourism recovery from that region’s crisis 37 .

Tourism demand change observation

In the era of Big Data, the utilization of search engines by tourists to acquire travel-related information ahead of their trips has become the initial step in travel planning 38 . The significance of search engine data in characterizing and predicting tourism demand has been gradually acknowledged by tourism researchers since 2010 and has been incorporated into various models for analytical work 39 , 40 , 41 , 42 . Due to the search behavior of tourists based on their destinations of interest, these electronic behavior records are normalized into search engine indexes to indicate tourism demand, preferences, travel intentions, and the location of the tourists’ origin 43 . Researchers have conducted studies on tourism demand response to pandemics and tourism recovery rates with search engine data, confirming the significant advantages of search engine data in fitting economic indicators during the COVID-19 pandemic 22 , 44 , 45 . Therefore, we attempted to characterize the rate of change in tourism demand in the origins market by investigating search engine data for a specific period (destination reclosure) as search engine data gives high-frequency information on the travel intentions of Internet users in different regions for a defined destination.

Overview summary

In the post-epidemic era of tourism recovery, a sub-black swan event of local reclosure is inevitable. We are interested in how origin markets will respond to destination reclosure, the characteristics of the spatial response patterns, and the reasons for this heterogeneity that need to be urgently explored. While the literature has usefully explored the recovery of tourism with mature domestic markets, it is crucial to focus on the changes in tourism demand for destinations at the national level, where the origin markets are the roots of tourism demand. To address the limitations of previous research, this paper contributes to the tourism literature by using a search engine to quantify short-term tourism changes during tourism crises and constructing models of tourism demand changes in different regions to explore the drivers of different response patterns.

Materials and methodologies

Tourism demand data.

Search engine data is identified as an efficacious data source for measuring high-frequency tourism demand. Google Trends has extensive applications worldwide, whereas Baidu has a more indicative role in China. The Baidu search engine has two data products: Keyword Search Index and Brand Index ( https://index.baidu.com ). The Keyword Search Index contains data from 2011 till now, and the Brand Index is a more professional industry-based index that will be available from August 2021. This paper utilizes daily keyword indices from 2011 to 2022 to investigate the background of tourism demand for the Duku Road and brand indexes from August 10 to October 31 in 2021 and 2022 to measure changes in tourism demand for the Duku Road from different origins regions during the destination closure period under the impact of the pandemic.

where i is a tourist origin city; j is a date from August 10 to October 31; BBI is the Baidu Brand Index of a city search for Duku Road on a date. s is a spatial series of origin cities or an individual city; t is a temporal series of dates; T.D. is the sum of demand from s during t .

The Chinese domestic tourism market was chosen as the study case due to the robust intervention policies adopted by China during the first pandemic, dramatically impacting international and domestic tourism in China. In the post-epidemic era, a multitude of countries have eased international travel restrictions. The massive mobility of individuals within China and the mutation of the Virus made travel policies contingent on the consequences of the containment of the pandemic. In this context, domestic tourism demand has emerged a robust recovery. This phenomenon is also prevalent in other countries, and scholars are confident that domestic tourism will be the recovery engine in the short term. It is a matter of significant concern that tourist arrivals may abruptly decline to zero in instances where destinations are compelled to shut down anew amidst a pandemic resurgence. Notwithstanding, it is pertinent to note that latent tourism demand persists. In response, this study meticulously tracks variations in demand at these destinations and corresponding responses from origin markets, employing high-frequency search engine data as a quantitative metric of demand. Distinct from conventional statistical methods, the monitoring of such rapid changes necessitates the utilization of big data analytics.

Xinjiang was one of the most popular destinations for domestic tourism in 2022, with millions of tourists entering Xinjiang by self-drive, high-speed rail, and air. The Duku Road (high-rank landscape driveway) is the most attractive destination for tourists, with 28.35% of tourism demand in Xinjiang. It serves as a tourist hub, radiating tourists to other attractions 46 . Tourism prosperity has made Xinjiang an unignorable destination during domestic tourism recovery. Nevertheless, the massive tourist flows have planted the potential for the spread of the epidemic. The entire territory of Xinjiang entered a region-wide silent management to control the epidemic on August 10 and will remain in effect through the winter. During this period, all travel activities had to be ceased, and the government organized the transfer of healthy travelers back to their origins. This unexpected outbreak has had a fatal impact on Xinjiang’s thriving tourism industry. The study case has typical implications. This paper investigates the origins market’s response to the destination’s reclosure, considering the Duku Road as the destination and cities outside Xinjiang as the domestic origin markets.

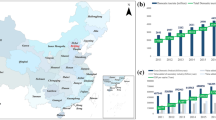

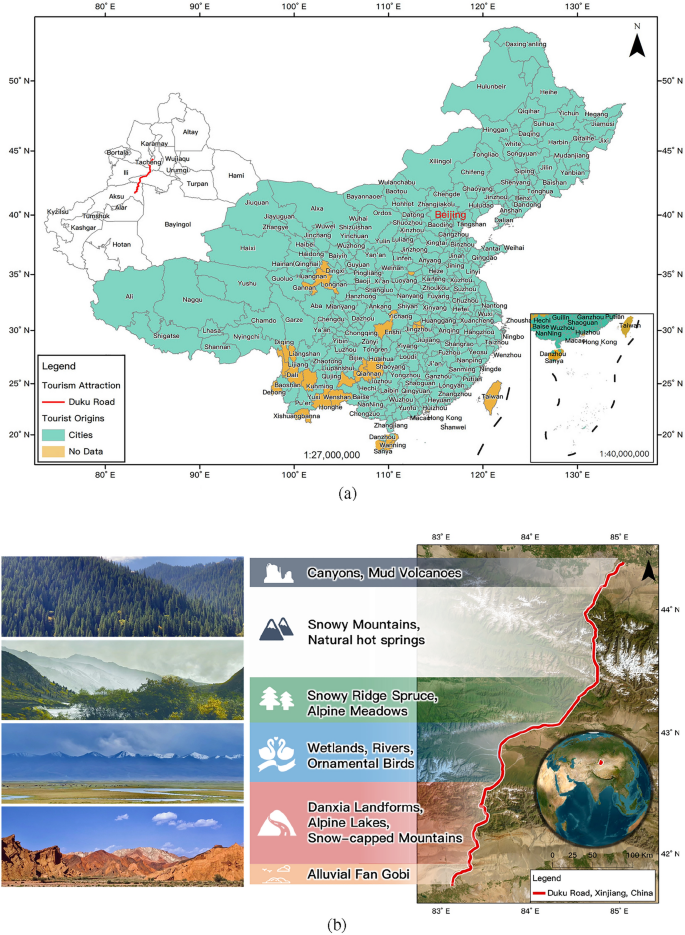

Three hundred and seven cities of China’s domestic tourism market were adopted as the tourist origins for the case study. The Duku Road, located in Xinjiang, served as the destination (Fig. 1 a). The Duku Road is a mysterious and fascinating landscaped driveway that stretches through the north and south of the Tianshan Mountains, a World Natural Heritage Site, which is also known as the Tianshan Road. The Duku Road runs with a unique topography, with numerous sharp curves and steep slopes, more than 280 km of road sections above 2000 m above sea level, 1/3 of the whole course is a cliff, 1/5 of the lot is in the high mountain permafrost, crossing nearly ten major rivers in the Tianshan Mountains, and over four ice-pass of mountains that accumulate snow all year round (Fig. 1 b). Driving on Duku Road, travelers experience the seasonal transformations in a single day, which shows the magnificent scenery of “four seasons in one day, ten miles in different skies” to off-road enthusiasts and self-driving tourists.

The study case. ( a ) The domestic tourist markets of Duku Road. ( b ) The location of Duku Road, Xinjiang, China. Notes: The map in ( a ) was produced using ESRI ArcMap 10.2, and the standard map service was provided by the Ministry of Natural Resources of China, accessible at http://bzdt.ch.mnr.gov.cn/ with Grant No. GS (2021) 5448. The photographs in ( b ) were taken by the first author for tourism resources investigation in September 2021.

Dependent variables

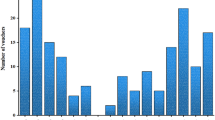

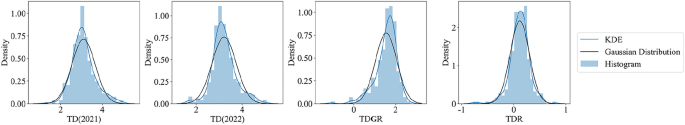

The literature has proposed numerous valid measures of change in tourism demand, and scholars have characterized tourism resilience based on micro-level expenditure elasticities and annual percentage changes between the pre-and post-pandemic periods 6 , 25 . This paper pays attention to measuring the instantaneous response of origin markets to the public health crisis in a destination that caused the closure period (August 10–October 31), where typically, growth rates are employed to capture the difference in performance relative to a benchmark 26 , 47 . Thus, tourism demand in 2021 is considered the initial period of the post-pandemic recovery period, and the growth rate for the corresponding period in 2022 versus the benchmark period is adopted as a measure of Tourism Demand Growth Rates (TDGR). The demand ratio is chosen indicator of short-term resilience 48 , and we generate the Tourism Demand Ratio (TDR) as the alternative dependent variable to test the robustness of conclusions. To illustrate the distribution of these dependent variables, Fig. 2 presents a histogram, kernel function density estimation plot, and maximum likelihood Gaussian distribution fit, providing a comprehensive view of the underlying data structure and the variability in Tourism Demand Growth Rates (TDGR) and Tourism Demand Ratio (TDR).

where i is a tourist origin city; t' is the current year (2022), and t is the control year (2021); TDGR i is the tourism demand variation of the city i; \({TD}_{i}^{t}\) is the sum of demand from city i in year t .

Statistical distribution analysis of TD, TDGR, and TDR variables. Notes: TD. is the Baidu brand index during the closure period, metric tourism demand, and the number in parentheses is the year; TDGR is the growth rates of tourism demand, and TDR is 2022 vs. 2021 ratio of tourism demand. The values of the above variables are processed by f = ln(x).

Determinants and proxy variables

The willingness of tourists to explore a destination depends on the determinants of the origin’s financial capacity, physical constraints, and psychological tendencies, in addition to the destination’s attractiveness. Furthermore, challenged by pandemic restrictions on mobility, we considered the origin markets’ epidemic circumstances and medical availability. We have selected the population, economics, environmental conditions, COVID-19, medical healthcare, Internet accessibility, and traffic activeness of the origin cities as potential determinants of tourism demand to analyze their impact on tourism demand changes, as detailed in Table 1 43 , 49 , 50 , 51 , 52 , 53 .

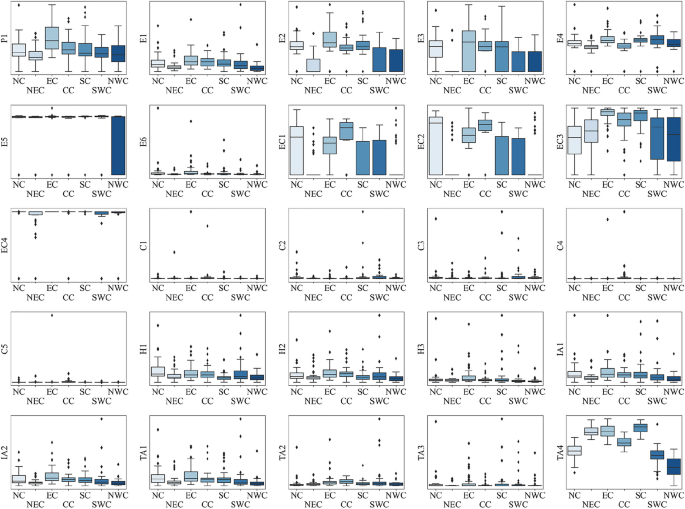

China has a substantial tourism market with spatially non-stationary development levels of cities in each region, and origins cities have significant spatial stratification heterogeneity. Accordingly, following large administrative geographical regions, we disaggregate the origin markets into East China, South China, Southwest China, North China, Northeast China, and Northwest China. The statistical data of each city are obtained from the National Bureau of Statistics ( http://www.stats.gov.cn/ ), and the epidemic data sources of COVID-19 are informed by the National Health and Health Commission and the provincial health and health commissions ( https://2019ncov.chinacdc.cn/2019-nCoV/ ). The advantages of this paper’s dataset are that it measures the seven explanatory variables mentioned above through twenty-five proxy variables, which captures the diversity of factors driving the tourism demand changes. Additionally, all the proxy variables will be standardized within large administrative geographical regions (Fig. 3 ), which helps to reveal significant differences in the explanatory variables performing distinct roles in different local regions.

Proxy variable box plots group by regions. Notes: The labels of the X-axis, East China, South China, Southwest China, North China, Central China, Northeast China, and Northwest China are abbreviated as N.C., NEC, E.C., CC, SC, and NWC, respectively. The Y-axis labels are abbreviations for the proxy variables in Table 1 .

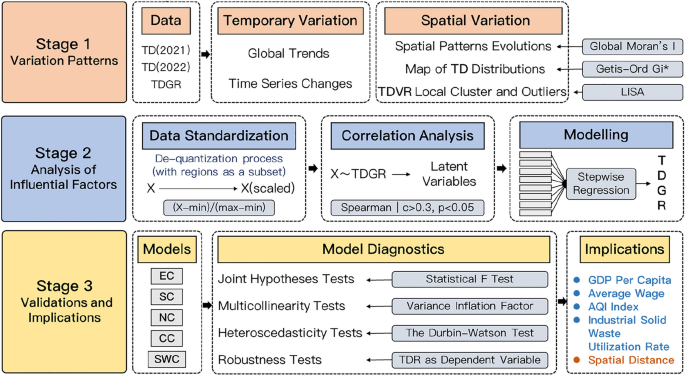

Research framework

The research framework, as illustrated in Fig. 4 , consists of three stages: temporal and spatial change analysis of tourism demand, exploratory regression analysis, and model evaluation.

The research framework. Notes: TD-Tourism Demand; TDGR-Tourism Demand Growth Rates; LISA- Local Indicators of Spatial Association; EC, SC, NC, CC, SWC are the models in different regions (East China, South China, North China, Central China, and Southwest China) respectively.

The first stage involves depicting the spatial pattern of the Duku Road tourist origin markets and its changing process in the temporal dimension. The Global Spatial Autocorrelation method is applied to assess the spatial patterns of the origin markets, the Getis-Ord Gi* Hotspot Analysis method 54 detects the dominant origin market clusters, and the Local Spatial Autocorrelation Analysis method 55 is assigned to reveal clusters and outliers areas of tourism demand variation. The spatial distribution characteristics will map out the origin markets and pinpoint the dominant origin regions.

In the second stage, this paper uses an exploratory knowledge discovery strategy, i.e., finding the most significant drivers of each region among the many proxy variables that may impact tourism demand changes. Candidate proxies that are significantly correlated are initially filtered out from the Correlation Analysis between the proxies and explanatory variables. Then the candidate proxies are imported into a multi-round Linear Regression Analysis for iterative modeling and comparisons, thereby investigating the factors influencing the tourism demand variation in each region. Since the proxy variables in this paper are not entirely customarily distributed, Spearman’s Correlation Analysis 56 has the advantage of handling mixed data. The proxy variables with correlation coefficients greater than 0.3 and a significance over 95% will be considered candidate proxy variables. The Stepwise Regression Analysis 57 can perform multiple turns of regression analysis on candidate proxy variables and automatically remove the insignificant variables, resulting in the exploration of the model with the optimal performance with significance.

The third stage is the diagnostic evaluation and robustness testing of the model. Multiple linear regression, autocorrelation, normality of residuals, and eteroscedasticity are used to diagnose the model’s performances 57 . We compare the conclusions obtained from Stepwise Regression Analysis with the results obtained by substituting the dependent variable to evaluate the validity of the conclusions. The above experiments will be replicated with the ratio of tourism demand during the destination closure in 2022 to the corresponding period in 2021 as the dependent variable, and the conclusions will be considered dependable and robust in case of substantial consistency.

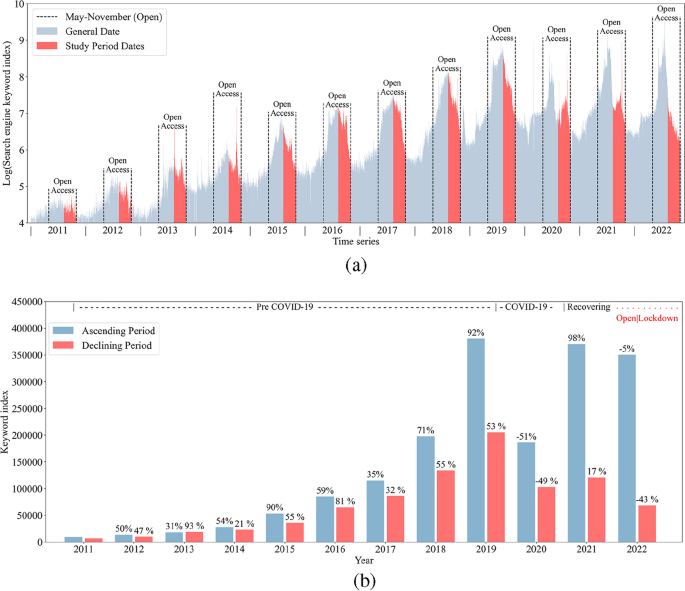

Spatial and temporal changes in origin markets demand

The paper utilizes the Baidu search engine to garner search records of the Duku Road in China over the past decade (Fig. 5 a). Results indicate a rapid surge in the attraction of the Duku Road since 2015, peaking in 2019. Despite the impact of COVID-19 in 2020, the demand for tourism quickly rebounded, hitting a new high in 2022. It is imperative to note that due to safety risks associated with the Duku Road, it is only accessible to tourists from May to October every year. During this period, the tourism demand for Duku Road exhibits a primary and secondary peak, with a critical point at the main peak, dividing this phase into a rising and a declining period. Specifically, the rising period commences in early May, peaking towards the end of July, followed by a continual decline. However, a second surge forms during the National Day Golden Tourism Week, which subsequently dwindles gradually.

Variation of Baidu index for Duku Road (2011–2022). ( a ) The daily Baidu Index trend for Duku Road (2011–2022). ( b ) The Baidu Index during the years of unrestricted access for The Duku Road (2011–2022).

Considering a sudden outbreak of COVID-19 across Xinjiang, local authorities initiated a silent management policy, imposing traffic restrictions from August 10 to October 31. According to historical time series characteristics of the Duku Road, this time point coincides closely with the critical date when the tourism demand transitions from a peak to a decline. A comparison of the keyword index during the rising and declining periods of each year reveals that the tourism demand maintained a high level before the travel restrictions, while the destination closure significantly impacted the tourism demand, causing a sharp decline (Fig. 5 b).

Although post August 10, 2022, marked the declining phase of tourism demand for the Duku Road, the Baidu index for the keyword “Duku Road” remained high (only a 5% decrease compared to the same period in 2021) before August 10, 2022. This suggests a stable tourism demand for the Duku Road prior to the pandemic closure. However, post August 10, the Baidu index plummeted by 43% compared to the same period in 2021, inferring a direct impact on the tourism demand for the Duku Road due to the outbreak of COVID-19 in Xinjiang and the traffic control measures. Noteworthy is that despite the inability to conduct any tourism activities in Xinjiang post August 10, the source market maintained a robust potential tourism demand for the Duku Road from August 10 to October 31. During the COVID-19 outbreak and lockdown in Xinjiang, the tourism demand from seven administrative regions in China for the Duku Road grew by an average of 31.49% compared to 2021, indicating a strong resilience in the tourism demand for the Duku Road. This reflects that despite the restrictions imposed by the pandemic and traffic control policies, the restrained tourism demand will gradually be released once the situation is under control, highlighting a significant potential for recovery.

Based on the spatial autocorrelation analysis results (Table 2 ), the tourism demand from the source market demonstrates a significant spatial clustering pattern, with the spatial pattern of the Duku Road’s source market transitioning from a low level to a moderate level of spatial clustering. The spatial distribution of tourism demand from source cities to the Duku Road has been impacted by the pandemic crisis, exhibiting a trend of contraction and clustering towards core source cities.

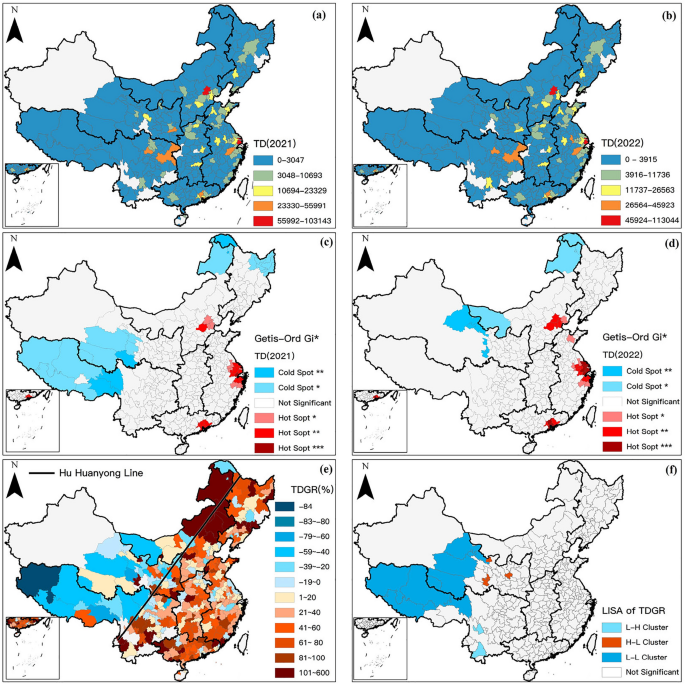

Viewed from the perspective of source cities, this section utilizes the Jenks Natural Breaks method to categorize source cities into five groups based on the intensity of tourism demand towards Duku Road and constructs a spatial distribution map of tourism demand from the source market. The map employs a color gradient from blue to red to represent the intensity of tourism demand from source cities to the Duku Road, where red and orange cities signify core and secondary source cities, respectively. The domestic source market is primarily distributed in the developed cities in eastern China. In Fig. 6 a,b, cities like Beijing and Shanghai are identified as core source cities, while Chengdu, Chongqing, Hangzhou, and Guangzhou are recognized as secondary source cities. A comparison between Fig. 6 a,b reveals that cities like Lanzhou, Xi’an, and Nanjing no longer serve as secondary source locations, indicating that some secondary source cities are more sensitive to the tourism demand for Duku Road under Xinjiang pandemic crisis than others, which exhibiting a variability within the secondary source market.

The spatial patterns of tourism demand and its' variation. Notes: Hu Huanyong Line in ( e ) is a comparison divider proposed by Chinese geographer Hu Huanyong (1901–1998) in 1935 to delineate the population density of China, which has significant heterogeneity in the population, society, and economy between the east and west of the line.

Upon further hotspot analysis of the source market, the results exhibit significant statistical clustering in the spatial domain for the Duku Road’s source market. As depicted in Fig. 6 c,d, the red zones represent the hotspots of tourism demand, encompassing the Jing-Jin-Ji region, Yangtze River Delta, and the Pearl River Delta, which emerge as the most crucial source markets with lesser impact from the pandemic crisis on Duku Road. On the other side, the blue zones signify the cold spots of tourism demand, where cities within these regions exhibit an exceedingly low tourism demand towards the Duku Road. A comparative inspection of Fig. 6 c,d unveils a shift in some cold spot areas (for instance, the disappearance of the cold spot on the Qinghai-Tibet Plateau, and the emergence of a new cold spot area north of the Hexi Corridor), while the stability of cold spot regions in Northeast China remains high (such as Hulunbuir and Daxing’anling area).

This section analyzes the growth rate of tourism demand, designating cities with growth rates below zero with a gradient of cool colors (blue), and those with growth rates above zero with a gradient of warm colors (red), with intervals of (±) 20%. As shown in Fig. 6 e, cities with a growth rate exceeding 100% are rendered in deep red. There is a significant positive correlation in the spatial distribution of tourism demand growth rates, indicating neighboring cities share a consistent response pattern to the pandemic. A distinct contrast is formed on either side of the Hu Huanyong Line; source markets to the east primarily exhibit positive growth rates, while those in the western regions display negative growth rates. Analysis of local clustering and outliers reveals the formation of three distinct local clusters in the spatial distribution of tourism demand growth rates (Fig. 6 f). Cities near the Qinghai-Tibet Plateau and Hexi Corridor in Northwestern China respond strongly to the pandemic crisis, with rapid declines in tourism demand towards Duku Road in this area (L–L). A sporadic distribution of outlier cities (H–L) emerges on the eastern side of Northwestern China, exhibiting superior risk resilience and higher tourism demand compared to other local areas. In Southwest China, Yunnan province has higher demand growth, with Pu’er and Lijiang being typical tourist cities. The fluctuations in their demand are impacted by their respective tourism industries, exhibiting a phenomenon where they are encircled by proximate cities experiencing high demand growth rates (L–H).

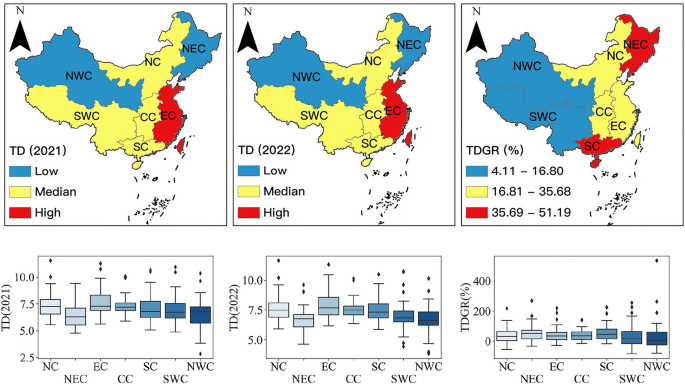

By dividing the source market according to administrative regions, summing up the tourism demand from cities within each administrative region to Duku Road, and averaging the growth rate of tourism demand, regional differences are identified. As shown in Fig. 7 , a comparison of tourism demand scale and growth between 2021 and 2022 across administrative regions is made. Using the Jenks Natural Breaks method, they are categorized into high, medium, and low levels. This corresponds to East China being the primary source market for Duku Road, while North, Central, South, Southwest China are secondary source markets, and Northeast and Northwest China are potential source markets. Northeast and South China have the highest growth rates in tourism demand, followed by North, Central, and East China, with Southwest and Northwest China having the lowest. There is minimal variation in the scale of tourism demand from cities within each region to Duku Road, but a larger difference in the growth rates of tourism demand.

The maps with box plots of the tourism demand and growth rates.

Correlation analysis for TDGR

The correlation between explanatory variables and the growth rate of tourism demand significantly varies across different regions, suggesting that a more nuanced analysis could be obtained by partitioning the source market for modeling. In the South China region, 64% of the explanatory variables are negatively correlated with the growth rate of tourism demand, while in the Northwest region, no explanatory variables exhibit significant correlation. In the Northeast region, only two explanatory variables are negatively correlated with the tourism demand growth rate. In East China, Southwest, North China, and Central China, about one-third of the explanatory variables show a correlation with tourism demand growth rate at a significance level better than 0.05.

The correlation results indicate that under the “dynamic zeroing” policy control, new cases in source areas do not correlate with the potential tourism demand growth rate of residents. For instance, the numbers of newly confirmed and asymptomatic cases only show a negative correlation with the tourism demand growth rate in the South and Southwest regions of China. The relationship between the number of COVID-19 recovered patients and the tourism demand growth rate differs between the southern and northern regions, showing a weak positive correlation in the Southwest region and a weak negative correlation in the North China region. Notably, a significant moderate negative correlation exists between public medical resources of local source cities and the tourism demand growth rate. In the post-pandemic era, factors related to tourism demand growth rate are constantly changing, and the relationship between influential factors and tourism demand growth rate shows spatial non-stationarity across different regions.

Significant explanatory variables in the East China region include per capita disposable income, average wages, consumer price index, savings deposits, the number of people covered by basic medical insurance, and highway passenger traffic. In South China, the variables include the resident population, per capita GDP, per capita disposable income, per capita consumer spending, savings deposits, PM2.5 concentration, AQI index, newly confirmed cases, newly confirmed asymptomatic cases, the number of hospitals, hospital bed count, basic medical insurance coverage, mobile phone user count, broadband access user count, private car ownership, and civil aviation passenger traffic. In Southwest, the variables include per capita GDP, infection count, newly confirmed cases, newly confirmed asymptomatic cases, recoveries, private car ownership, highway passenger traffic, and spatial distance. In North China, significant variables include savings deposits, industrial solid waste utilization rate, recoveries, mobile phone user count, broadband access user count, and private car ownership. In Central China, the variables include per capita GDP, savings deposits, AQI index, hospital bed count, basic medical insurance coverage, mobile phone user count, broadband access user count, private car ownership, and spatial distance. In Northeast, the significant variables are average wages and savings deposits. In Northwest, no significant explanatory variables have statistically meaningful correlation with tourism demand growth rate.

Stepwise regressions

Diverging from studies that directly engage in regression analysis with correlation tests 6 , this chapter adopts a stepwise regression modeling approach. It sequentially incorporates significant explanatory variables from Table 3 (highlighted in bold) for each region into the model to explore influential factors under optimal fitting circumstances. However, the results of stepwise regression analysis reveal that in the Northeast and Northwest regions (Table 4 ), due to a limited number of significant explanatory variables and a lack of significant linear relationships between these variables and the dependent variable, no effective models are obtained. In other regions, there is a noticeable disparity between influential factors and model fit.

In East China, average wages are the sole factor affecting the growth rate of tourism demand, albeit with weak explanatory power (R 2 = 0.08). In South China, the AQI index exerts a negative impact on the tourism demand growth rate, contributing to 17.9% of the variance explanation. In North China, the growth rate of tourism demand is negatively affected by the industrial solid waste utilization rate, with an explanatory power of 17.8%. In Central China, per capita GDP is a significant factor negatively impacting the tourism demand growth rate. In the Southwest region, the tourism demand growth rate is influenced by multiple factors, where spatial distance has a positive impact, and per capita GDP has a significant negative impact. Combined, they account for 42% of the explanatory power concerning the growth rate of tourism demand.

In summation, the growth rate of tourism demand in source markets chiefly hinges on local economic, environmental, and transportation factors. Although there is a significant weak correlation between the local pandemic situation and the tourism demand growth rate in certain areas, it fails to exert a statistically significant impact on the local tourism demand towards the Duku Road.

The efficacy of the models has been corroborated by the diagnostic items and parameters delineated in Table 5 . The results indicate that the models passed the F-test (p < 0.05), implying that the independent variables in each model significantly affect the dependent variable TDGR, denoting the models are meaningful. With a limited number of dependent variables in the models, the VIF (Variance Inflation Factor) values are well below 5, suggesting that there is no multicollinearity issue, and the models are well-constructed.

In the autocorrelation test of the models, the D-W (Durbin-Watson) value of the model for the South China region deviates significantly from 2 (1.508 < 1.7), indicating that the significance testing and goodness of fit for this model would be unreliable; hence, this model failed the validation, while the other models are deemed credible. Moreover, this section re-models using TDR from Sect. 7.2.2 as an alternative dependent variable following the framework procedure. The results of the new model are consistent with the conclusions previously obtained, eventually leading to linear regression models for the tourism demand growth rate in four regions.

Factors affecting TDGR

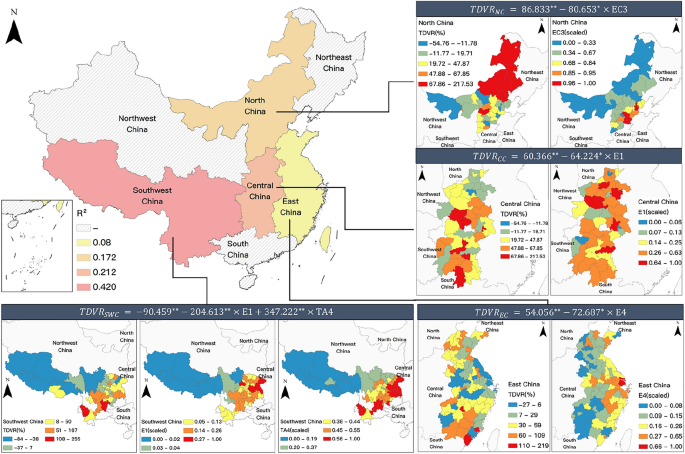

The response to the changes in tourism demand for the Duku Road during the pandemic period is manifested through the tourism demand growth rate of the source cities. The results of the regional model construction discussed earlier (see section " Stepwise regressions ") indicate that the factors affecting the growth of tourism demand for the Duku Road vary significantly across different regions. As shown in Fig. 8 , on a national scale, the models for the North China, Central China, East China, and Southwest regions have all passed the significance test and robustness test. Each model corresponds to a subplot, with the title of the subplot being the model formula for the respective region, and the content of the subplot displaying the spatial distribution of the tourism demand growth rate and explanatory variables. All indicators are divided into five intervals using the Jenks Natural Breaks classification method, with colors from blue to red representing intervals from low to high.

The influential factors models of response heterogeneity of tourist origin markets to Duku Road.

Upon comparing the similarities and differences across regional models, it is found that during the pandemic period in Xinjiang, the primary factors influencing the response differences to destination lockdowns in the domestic source markets for the Duku Road include Per Capita GDP, average wages, industrial solid waste utilization rate, and spatial distance. Economic factors have a counteractive effect on the tourism demand growth of the source cities, an impact widely present in East China, Central China, and Southwest regions, exhibiting robust spatial consistency. Notably, environmental factors indicate that the growth of tourism demand is constrained by the industrial solid waste utilization rate, a significant relationship found only in North China. This section observes that in industrially prosperous areas within this region (Hebei-Tianjin), the growth of tourism demand is limited, or even decreased, whereas in remote areas with lower industrial levels (Inner Mongolia), the tourism demand is not high, but generally has a high rate of growth. The significant positive impact produced by the distance factor in the Southwest region can be attributed to the distinct differences between the Qinghai-Tibet Plateau and the Sichuan-Chongqing-Yunnan-Guizhou Plateau; the former has low levels of tourism demand and growth rate, while the latter has relatively higher tourism demand and growth rate, thereby leading to a higher tourism demand growth response in source cities farther from the Duku Road.

Factors influencing tourism demand towards Duku road

Understanding the factors influencing the tourism demand from source cities to Duku Road is crucial for grasping the heterogeneity in tourism demand growth rates. This section employs a loop iteration approach to individually examine the linear fit between twenty-five explanatory variables of source cities within seven administrative regions, and the tourism demand scale of these cities towards Duku Road, to investigate the factors affecting the tourism demand scale of source cities to Duku Road. From a total of 175 linear models, eight models were identified as statistically significant and demonstrating a superior degree of fit ultimately. These models, with a significance level exceeding 0.01 and an R 2 value greater than 0.8, effectively explain the scale of tourism demand across more than four administrative regions.

As illustrated in Table 6 , different variables significantly positively impact the demand for tourism to the Duku Road across various regions. The rise in the number of broadband and mobile phone users suggests more individuals have mobile communication capabilities, enhancing the accessibility to information regarding Duku Road. This improved digital outreach fosters the online visibility and awareness of the destination, consequently boosting the local residents’ desire to travel there. Savings deposits reflect the economic capacity of individuals or families in the source cities, laying the foundation for affording travel to Duku Road. A higher per capita Gross Domestic Product indicates a relatively higher income level and consumer spending capacity, enabling more discretionary income for long-distance travel expenditures. The economic stature of the source cities implies a higher preference for tourism and a more open cultural backdrop, collectively fostering an increased interest and demand for traveling to Duku Road. An augmentation in the number of individuals covered by basic medical insurance and the quantity of hospital beds signifies enhanced medical security for more residents. Better medical services and emergency response capabilities help mitigate the impact of local epidemics on residents’ travel activities. Simultaneously, it alleviates tourists’ concerns about the travel risks and uncertainties associated with the epidemic situation in Xinjiang, bolstering their confidence in traveling to Duku Road. Higher air passenger traffic denotes more flight connections between the residents and the destination, supporting the accessibility for inland tourists to Duku Road. Elevated private car ownership in source cities inclines residents towards choosing self-driving tours to Duku Road, offering greater flexibility, freedom, comfort, and convenience. This mode of travel satisfies tourists’ desire to explore the scenic routes of Duku Road and indulge in personalized experiences.

In summary, determinants such as the extent of internet coverage, economic conditions, medical security, and transportation facilities in the source markets influence the residents’ demand for tourism to the Duku Road in various aspects. The extent of internet coverage lays the foundation for environmental awareness of the Duku Road among residents of the source cities; whereas economic conditions are essential for residents to travel to the Duku Road. Amid an ongoing pandemic, medical security in the source cities can mitigate the adverse effects of the local epidemic on residents’ travel behaviors; transportation conditions provide diversified accessibility for the residents of the source cities. In the source markets of the Duku Road, areas with a large scale of mobile phone users, high residents’ savings, comprehensive medical insurance coverage, and developed passenger aviation contribute the most to the tourism demand to the Duku Road. This conclusion aligns with the spatial pattern of tourism demand discussed in section " Spatial and temporal changes in origin markets demand ". As illustrated in Fig. 9 , box plots of the number of mobile phone users (IA1), savings deposits (E6), the number of individuals covered by basic medical insurance (H3), and the volume of civil aviation passengers (TA3) demonstrate that the Eastern China region ranks highest in these four indicators nationwide, and concurrently, it has the highest demand for tourism to the Duku Road. Furthermore, summarizing the determinants in Table 6 and arranging them in descending order based on the average R 2 reveals that the economic conditions > transportation accessibility > medical conditions > extent of internet coverage, indicating that economic conditions are the most crucial determinant affecting the scale and spatial pattern of tourism demand in the source markets.

Tourism origins market maps corresponding with boxplots of variables in regions.

The competitive resilience of core tourist attractions

The study unveils a nuanced understanding of tourism demand dynamics, particularly illuminating the interplay between spatial structures of source markets and economic factors amidst unprecedented health crises such as COVID-19. Even during the crisis, the potential demand from tourist origin markets for a leading tourist attraction continues to be remarkably high and will have considerable potential to counteract the crisis in the post-pandemic era 11 . By delving into the spatial patterns and demand determinants for Duku Road in Xinjiang during the epidemic silent management period, the study extrapolates the driving forces behind the resilience and demand sustenance of core tourism attractions.

Firstly, the notable positive spatial autocorrelation within Duku Road’s source markets elucidates a significant conceptual insight: geographically proximate source cities harbor similar tourism demands. The absence of a Matthew Effect, and the ensuing market dispersion and diversity, underscores Duku Road’s ability to allure visitors from a broad geographic spectrum, thereby diluting over-reliance on singular markets. This diversification not only embodies adaptive capacity to navigate tourism adversities but also buffers the blow from crises by enabling a continuum of demand from unaffected markets. The relative unscathed potential tourism demand during the epidemic crisis manifests the merits of such market diversification.

Secondly, the decisive role of economic factors extends beyond merely shaping the tourism demand from tourist markets towards Duku Road; it critically impacts the spatial configuration of its source markets 58 . The stratified heterogeneity in crisis response, with economically robust core source cities demonstrating stability versus the sensitivity of secondary source cities with moderate economic levels, unveils an inherent inertia in the spatial structure steered by economic dynamics. This is a salient contribution to understanding the spatial-economic nexus in tourism demand studies.

Lastly, the regional variance captured through sectional models divulges that core source cities with high economic indicators face a saturation effect in tourism demand scale for Duku Road, contrasting with potential source cities that possess a larger scope for escalating tourism demand growth rates. It also identifies regional differences in the factors influencing tourism demand variations 19 , 59 , 60 . This saturation effect, negatively impacting tourism demand growth rates, accentuates the regional disparities in factors influencing tourism demand variations. The knowledge will help to provide insights into the influential factors driving tourism demand variations in distinct regions 59 .

In synthesis, the resilience of core tourism attractions within a region is constructed on a quadrate foundation: the uniqueness of tourism experience, market dispersion, heterogeneity in crisis response, and spatial structural stability induced by economic factors in source cities. Post-crisis, core attractions sustain a substantial scale of potential tourism demand, with economic factors significantly steering the tourism demand scale, leading to a spatial structural inertia towards core cities. The marked discrepancies in response patterns among source cities, tied to the saturation effects on local economic factors, spotlight the imperative of diversifying source market risks to accrue potential tourism demand, thereby accelerating recovery and sustaining competitive edge post-crisis.

These insights are seminal for policymakers and industry stakeholders to craft efficacious strategies for mitigating crises impacts, fostering tourism recovery, and bolstering resilience. The discourse propels a deeper comprehension of the factors instigating regional variances in tourism demand, furnishing a robust theoretical scaffold for future empirical explorations in the realm of tourism demand studies amidst crises. This narrative, therefore, extends a substantial theoretical contribution towards understanding the ramifications of COVID-19 on tourism demand, while amplifying the criticality of domestic demand in substituting the downturn in international tourism, thereby laying a robust groundwork for successful post-crisis recovery and long-term resilience in regional tourism sectors.

Limitations and prospects

The limitation in dataset is that the dependent variable does not measure the actual visits, revenues, or employment in tourism in the destination area. Instead, it measures Internet searches for a particular attraction. As Internet interest is indeed correlated with actual trips, the possibility of inferring short-term variations in demand on the search alone is limited. Regarding our emphasis on core tourist attractions within a regional destination has inadvertently disregarded the vulnerabilities of a broader array of regional attractions. Forthcoming studies will encompass an evaluation of the comprehensive repercussions that tourism crises exert on the destination system, alongside an analysis of the source market’s reactions. Additionally, studies will classify tourist attractions by their level or type and will subsequently discuss the risk resilience and the mitigating strategies employed for each group of tourist attractions. An integrated and differentiated methodology such as this promises to yield a more systematic understanding, benefiting the strategic planning and operational decisions of tourism management entities.

In contemplating future research directions, several potential areas warrant further investigation. Initially, a novel comprehensive indicator should be generated for monitoring tourism demand by integrating search data, user-generated content on social media platforms, and statistical data. This integration would avoid the original error in sample coverage of the source market due to internet access disparities. Furthermore, expanding the research framework to encompass additional destinations and broader dimensional factors, and employing mixed-effect models to study the overall impact of these factors on tourism demand, would yield a more holistic understanding of tourism demand dynamics during crisis situations. Additionally, examining the economic downturn in the post-epidemic era, with a particular focus on the influence of decreased travel intentions following the lifting of travel restrictions and the subsequent general reopening, could offer crucial insights into the resilience of various destinations and origin markets. Lastly, an in-depth analysis of the long-term consequences of crisis events on tourism demand, as well as the recovery trajectories of destination and origin markets, would be instrumental in providing essential guidance for policymakers and industry planners aiming to mitigate the adverse effects of crises on the tourism sector.

Conclusions