Your browser is not supported for this experience. We recommend using Chrome, Firefox, Edge, or Safari.

Find Your Favorite Beach

Atlantic Coast

Beach Camping

Family-Friendly

Places to stay.

Campgrounds

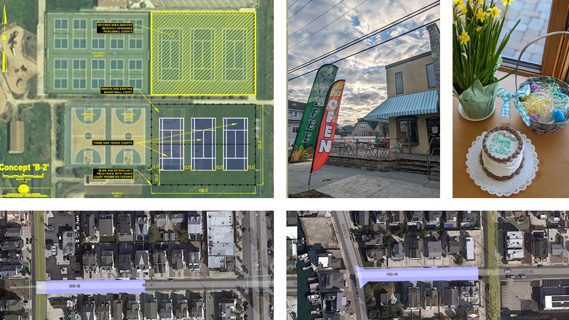

Travel Ideas

Accessible Travel

Eco-Friendly Travel

African American Heritage Travel

More Travel Ideas

Popular links.

Florida Webcams

Toll Roads Info

Travel Guides

The florida keys: seven mile bridge.

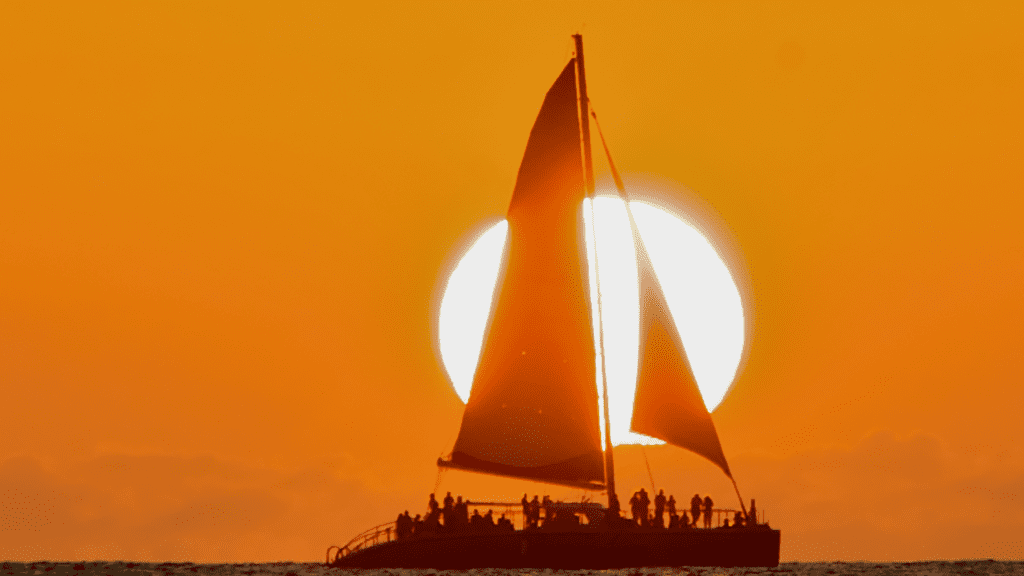

Seven Mile Bridge in the Florida Keys.

- - Peter W. Cross for VISIT FLORIDA

Jeff Klinkenberg

No need to be scared. Go ahead and drive over the Seven Mile Bridge. It’s modern now.

Finished in 1982, the longest bridge in the Florida Keys is wide enough to give a motorist room to pull over to change a flat tire and steal many glances at the perfectly green water.

The original bridge I grew up crossing was less friendly, narrow and harrowing, requiring concentration and a good grip on the steering wheel as you left Marathon Key on your way to Key West and suddenly found yourself driving over the ocean. Smart drivers kept eyes on the oncoming traffic instead of nature. The bridge seemed too constricted for two passing cars.

Completed in 1912, the old structure, initially a railroad bridge, was known as the “Eighth Wonder of the World’’ because even attempting to build something so ambitious over miles of open water and a soft bottom in a harsh tropical climate seemed a bit nutty.

Seven Mile Bridge in the Florida Keys

- Peter W. Cross for VISIT FLORIDA

As you drive over the modern bridge now you can see the old bridge nearby. Only the pelicans and great blue herons use it as a perch. But for some of us, the old bridge reminds us that the Keys have always been a place for dreamers and schemers who didn’t like to be told “You can never do that.” Henry Morrison Flagler, a craggy, white-haired business genius who made his fortune in the oil business, hadn’t gotten rich by being cautious. In the 19th century he came to Florida, built a hotel in St. Augustine and founded the Florida East Coast Railway. By 1896, his train was going all the way to Miami. That wasn’t good enough. He wanted his railroad to go another 100 miles or so south – to Key West.

“Flagler’s Folly.’’ That’s what a lot of folks called it. “Just watch me,’’ was Flagler’s credo.

Starting in 1905, he spent $30 million of his own money to lay track and build dozens of bridges, hiring 4,000 workers for the small fortune of $1.50 a day. They had to wade through swamps where boots sank into the mud as crocodiles slipped off the banks. Some workers died of heatstroke and snakebite. Everybody was bitten by mosquitoes. Folks were chronically hungry and thirsty.

In 1908, the workers reached Marathon Key where about seven miles of open water lay ahead. Flagler’s civil engineers had to invent new technology as they went along. At their disposal were two steamships, tugboats, paddle wheelers, dredges, launches and a catamaran. Flagler sent away to England for a kind of cement capable of drying underwater. Divers wearing helmets positioned underwater structures. Barges swung in the current as workers tried to keep their balance.

They slept in tents and in bunkhouses Flagler built on Pigeon Key, about two miles from shore. The bunkhouses are still there. A ferry will take you to the island and a guide will show you around. Do it. You’ll learn that on Jan. 28, 1916, the train rumbled to a stop in Key West. Flagler, 82, stepped out of his private car with his young wife. “Now I can die happy,” Flagler whispered to a friend. “My dream is fulfilled.’’ Dreams die hard in the Keys.

The death of Flagler’s railroad happened on Labor Day in 1935. It began when the barometer started dropping. Nobody knew that the most powerful hurricane to ever hit the United States was on its way.

It swept across Matecumbe Key, in the Central Keys, that evening. Officials from the railroad had dispatched a train to evacuate residents and 800 World War I veterans who were living in tents and working on a new road near the railroad tracks.

The train arrived too late.

Years ago, I spent a day with Bernie Russell, whose family – 53 brothers, sisters, aunts, uncles and cousins – lived on Matecumbe as commercial fishermen and Key lime growers. He told me what happened as the eye of the hurricane got closer.

The wind rose and the tide creeped into buildings. Russell, two siblings and his parents, abandoned a crumbling fruit packing house and made a run for the railroad tracks at the high point of the island.

In the 200-mph winds, Bernie watched his mother blow away. He never saw her again. Other relatives disappeared in the howl of wind-driven rain. Somehow he and his dad survived. In the morning, they saw that virtually every palm tree on the island was snapped in half. The railroad cars were blown off the track. Only the locomotive, which weighed 320,000 pounds, stood up to the storm.

More than 400 bodies were recovered. Most had drowned though others were killed by flying debris.

Bernie Russell lost more than 40 relatives.

The Flagler railroad was lost too.

Not every bit, but enough that the Florida East Coast Railway decided to end service to the Keys. It sold the railroad line to the U.S. Government. A roadway was placed over the surviving railroad bed and broken track became the guardrails on the new motorist bridges.

The Overseas Highway, as it still is called, opened in 1938.

I lived in Key West during the summer of 1954. I grew up in Miami, but the Keys remained my playground, a place to camp and fish and study nature and history.

When I was a kid, my dad would park the car at the end of Marathon and we’d carry our fishing poles and bait bucket out on the Seven Mile Bridge.

I don’t remember catching much. Just a few grunt and snapper. But it was a great adventure, standing on the long bridge, looking down into water clear enough to see passing sea turtles, hammerhead sharks, endangered sawfish.

The bridge was a good place for dreamers. It left its mark on me.

When I drive across the New Seven Mile Bridge now I crane my neck to look at the Old Seven Mile Bridge.

I see ghosts.

Florida Keys

RELATED CONTENT

Panama City

Panama City is a four-season paradise for water sports enthusiasts. Kayaking, paddleboarding, sailing and kiteboarding are popular activities on...

A richly personable neighborhood of Tampa, Ybor City retains the Cuban, Italian and Spanish influences that remain from its heyday as the hub of...

Panama City Beach

Panama City Beach, featuring 27 miles of white sand beaches along the turquoise waters of the Gulf of Mexico, is home to two state parks (St. Andrews...

Located between Tampa and Lakeland, Plant City was named after railroad developer Henry B. Plant. The town of Plant City is known as the Winter...

STRATEGIC ALLIANCE PARTNERS

This Iconic Florida Bridge Is Somehow Even More Terrifying Than It Is Beautiful

T he United States has an abundance of engineering marvels. Over the centuries, visionaries have reversed the flow of rivers, blasted the faces of presidents into mountains with dynamite, transformed the skyline of cities with towering steel buildings, connected vast bodies of water with canals, and worked out the hair-raising logistics of putting humans on the surface of the moon. Projects like these require a ton of money, a huge labor force, and an unerring desire to bend history to your will. 82-year-old magnate Henry Flagler had employed all three when he stepped off his private carriage at Key West in 1912 to celebrate his "eighth wonder of the world," a 156-mile stretch of railway connecting the Florida Keys with Miami. The showpiece was, and still is, the Seven Mile Bridge, a route of incredible scenic beauty matched by a reputation as one of the most terrifying bridges in the world .

A motorist approaching the bridge is faced with a daunting prospect. Leaving dry land at Knights Key in Marathon, the roadway soars across open water on 265 piers until it touches down again at Little Duck Key. For almost 7 miles (6.79 Mile Bridge doesn't have the same ring), you are stuck in one narrow lane with nowhere to go in an emergency other than the sparkling turquoise sea below. Not only that, the parallel Old Seven Mile Bridge serves as a reminder of the hundreds who died in a devastating disaster almost a century ago.

Read more: Amazing Bridges Around The World

Is There Any Reason To Fear Seven Mile Bridge?

Opened in 1982, the new Seven Mile Bridge strikes out with no land on either side, creating an illusion of jeopardy that concerns some motorists who fret that there is no room for error if a crisis occurs. There are also some contentious articles online claiming that hundreds of people have lost their lives and that it is one of the most lethal bridges in the country. There is little evidence to support this, and Seven Mile Bridge regularly fails to make the roster in articles about the most dangerous bridges in America.

Like any stretch of highway, however, fatal accidents have taken place on Seven Mile Bridge. In July 2022, an 85-year-old woman died after a collision with a drunk driver. In the previous year, a man was charged after he stole a pickup truck and caused a head-on crash with an ambulance. Thankfully, nobody lost their lives that day.

A more unusual fatal accident occurred in 2022 when a boat captain cut his parasailing customers loose in stormy weather, causing them to strike the Old Seven Mile Bridge. A woman died, and her son and nephew were seriously injured in the incident. The captain was later charged with manslaughter. These are all tragic examples, but you shouldn't fear Seven Mile Bridge. Just buckle up, drive safely, and enjoy the magnificent sea views from one of the most amazing bridges around the world .

When Disaster Struck The Seven Mile Bridge

Henry Flagler died a happy man a year after seeing his vision completed, bringing the world to the far-flung islets of the Florida Keys. There is a statue of him sitting on a bench outside the Sails to Rails Museum in Key West, reclining with the air of a man who knows he has cemented his place in history. Yet, while the railway line and bridge was an extraordinary achievement, it wasn't quite as successful as its creator had hoped.

His detractors nicknamed it "Flagler's Folly," and it became associated with death and destruction during the darkest chapter of the bridge's history. In 1935, a mammoth 200-mph Category 5 hurricane hit the Keys, killing around 600 laborers working on the rails, toppling a rescue train, and stripping the tracks from the bridge. The railway sold the bridge in the wake of the disaster, and it was converted in 1938 to carry automobiles instead.

Today, the new Seven Mile Bridge is a real showstopper that makes for an unforgettable Florida road trip , and Flagler's original is open to the public for walking, cycling, and fishing. Both bridges have an undoubted cinematic quality, making them a spectacular location for movies like "License to Kill," "Mission Impossible III," and "2 Fast 2 Furious." Perhaps their most famous screen appearance came in James Cameron's "True Lies," with hair-raising stunts and a runaway limo scene that evoked the fears of nervous drivers who venture out across the water.

Read the original article on Explore .

Cruise FAQs

How to get to seven mile beach from cruise port.

Key Takeaways

- Taxi is a convenient and hassle-free option to get to Seven Mile Beach from the cruise port.

- Public bus is a more affordable option with scenic views along the way.

- Hotel shuttle services are included in many accommodations and provide a convenient and hassle-free way to reach the beach.

- Renting a car or bike offers flexibility and independence to explore Seven Mile Beach and its surroundings.

Taxi: A convenient and quick option for getting to Seven Mile Beach from the cruise port is taking a taxi. Taxis are readily available at the port and can take you directly to the beach.

Public Bus: For a more budget-friendly option, you can take a public bus to Seven Mile Beach. The bus stop is located near the cruise port, and buses run regularly throughout the day.

Shuttle service: many hotels and resorts in the area offer shuttle services to seven mile beach. if you’re staying at one of these accommodations, this can be a convenient and hassle-free option., rental car: if you prefer to have more flexibility and independence, you can rent a car and drive to seven mile beach. there are several car rental companies located near the cruise port., bike rental: for a fun and eco-friendly way to get to seven mile beach, consider renting a bike. there are bike rental shops near the cruise port, and biking along the scenic coastline can be a memorable experience..

- Stay hydrated: Bring a water bottle to stay refreshed during your ride.

- Dress appropriately: Wear comfortable clothes and shoes suitable for biking.

- Follow safety rules: Observe traffic rules and wear a helmet for your safety.

- Take breaks: Make sure to take breaks along the way to rest and enjoy the beautiful scenery.

Walking: If you’re up for a leisurely stroll, you can also walk to Seven Mile Beach from the cruise port. The beach is located within walking distance, and you can enjoy the beautiful surroundings as you make your way there

Frequently asked questions, are there any other transportation options besides taxis, buses, shuttles, rental cars, bikes, and walking to get to seven mile beach from the cruise port, how much does it typically cost to take a taxi from the cruise port to seven mile beach, how often do the public buses run from the cruise port to seven mile beach, do all hotels and resorts in the area offer shuttle services to seven mile beach, are there any bike rental shops that offer guided tours or suggested routes to take when biking to seven mile beach.

Meet Asra, a talented and adventurous writer who infuses her passion for exploration into every word she writes. Asra’s love for storytelling and her insatiable curiosity about the world make her an invaluable asset to the Voyager Info team.

From a young age, Asra was drawn to the power of words and their ability to transport readers to far-off lands and magical realms. Her fascination with travel and cultures from around the globe fueled her desire to become a travel writer, and she set out on a journey to turn her dreams into reality.

How To Bid On Celebrity Cruise Upgrades

How Tall Is Suri Cruise 2022

Meet Asra, a talented and adventurous writer who infuses her passion for exploration into every word she writes. Asra’s love for storytelling and her insatiable curiosity about the world make her an invaluable asset to the Voyager Info team. From a young age, Asra was drawn to the power of words and their ability to transport readers to far-off lands and magical realms. Her fascination with travel and cultures from around the globe fueled her desire to become a travel writer, and she set out on a journey to turn her dreams into reality.

You may like

What can you not eat on a cruise.

- Restricted foods on cruises include raw or undercooked meats, homemade or perishable foods, and open food containers.

- Common allergens to avoid on a cruise are gluten, shellfish, and peanuts.

- Proper handling and storage of food is important to prevent contamination.

- Cruise lines strive to accommodate dietary restrictions and preferences.

Common Allergens to Avoid

Restricted Foods for Safety Reasons

Dietary restrictions and preferences.

Specialty Dining Experiences

Food and beverage packages.

Food Safety and Hygiene Practices

Proper handling and storage of food, sanitization of utensils and surfaces, monitoring and regulation by health authorities, room service and in-room dining, food options at ports of call, tips for managing dietary restrictions, enjoying the dining experience on a cruise, are there any specific food options available for vegetarians and vegans on a cruise, can i bring my own food or snacks on board a cruise ship, are there any restrictions on consuming alcohol while on a cruise, are there any options for people with gluten intolerance or celiac disease, can i request specific dietary accommodations, such as low sodium or sugar-free options, while on a cruise, how many security guards on a cruise ship.

- Cruise ships implement access control systems and security measures to control and restrict access to sensitive areas and prevent theft and unauthorized access.

- Trained security guards are present on the cruise ship to patrol and maintain a secure environment, respond to emergencies, and manage disruptive passengers.

- Cruise ships prioritize the safety and well-being of passengers by having trained staff equipped with necessary medical supplies and expertise to respond to medical emergencies promptly and effectively.

- Continuous improvement and adaptation of security systems are carried out to stay ahead of evolving threats, incorporating the latest technology, industry best practices, and collaboration with relevant authorities.

The Importance of Security on Cruise Ships

Roles and responsibilities of cruise ship security guards, industry standards for security staffing on cruise ships.

Training and Qualifications for Cruise Ship Security Guards

Collaborative efforts with law enforcement and maritime authorities.

Implementing Security Measures to Ensure Passenger Safety

Dealing with potential threats and security risks, preventing theft and unauthorized access, responding to medical emergencies, managing disruptive passengers, security protocols during port visits and shore excursions, continuous improvement and adaptation of security systems, maintaining a safe and secure environment for everyone on board, how many security guards are typically employed on a cruise ship, what are the primary responsibilities of cruise ship security guards, what qualifications and training do cruise ship security guards undergo, how do cruise ship security guards work with law enforcement and maritime authorities, what security measures are implemented to ensure passenger safety on board a cruise ship, how far is tampa airport from cruise terminal.

- The distance between Tampa International Airport and the cruise terminal is approximately 8 miles or a 20-minute drive.

- Various transportation options are available from the airport to the cruise terminal, including shuttle services, taxis, ride-sharing services, public transportation, and car rental services.

- Shuttle services are a cost-effective and popular choice for direct transportation from the airport to the cruise terminal.

- Taxi services and ride-sharing services like Uber and Lyft are slightly more expensive but provide quick and convenient options for transportation to the cruise terminal.

Location of Tampa International Airport

Location of the Port of Tampa Bay

Distance between tampa airport and the cruise terminal.

Transportation options from the airport to the cruise terminal

Shuttle services available for cruise passengers, taxi and ride-sharing options, public transportation options, car rental services at the airport, parking options at the cruise terminal, tips for a smooth transition from the airport to the cruise terminal, what are the immigration and customs procedures at tampa international airport for cruise passengers, are there any luggage storage facilities available at the cruise terminal, can i book a shuttle service from the cruise terminal to tampa international airport, are there any hotels near tampa international airport that offer free shuttle services to the cruise terminal, are there any nearby attractions or activities that i can explore before or after my cruise from tampa.

Affiliate disclaimer

As an affiliate, we may earn a commission from qualifying purchases. We get commissions for purchases made through links on this website from Amazon and other third parties.

Where Does Carnival Cruise Dock In Nassau Bahamas

What Is A Fish Extender Disney Cruise

Finding Deals On Unsold Cruise Cabins: Tips And Strategies

How To Get From Venice To Trieste Cruise Port

Ultimate Guide To Ncl’s Onboard Wifi

Where Does Viking River Cruise Dock In Amsterdam

Azamara Onward: Origins, Renovation, and Future Plans

Anthony Bourdain: Unconventional Culinary Icon and Global Influencer

Authentic Tacos and Local Delights: A Culinary Adventure in Cabo San Lucas

Arctic Adventure: Uncharted Destinations With Le Commandant Charcot

Authentic Art, Exciting Auctions: The Ultimate Cruise Ship Experience!

What Drinks Can You Bring On Princess Cruise

What Is The Weather Like On A Transatlantic Cruise In April

How to Contact Someone on a Carnival Cruise Ship

Carnival’s Cruise Industry Recovery: Challenges, Progress, and Optimistic Outlook

What Is The Average Age Of Passengers By Cruise Line

Decoding Norwegian Cruise Line’s Gratuities and Service Charges

What Cruise Lines Depart From North Carolina

A Visitor’s Guide to Grand Cayman’s Seven Mile Beach

If you’ve ever googled ‘the best beaches in the world,’ odds are the Grand Cayman’s Seven Mile Beach has come drifting across your screen. And, while being touted among the best in the world doesn’t come lightly, you’ll quickly find it’s true. There’s no doubt about it, this stretch of cerulean seas and pearly, powder-soft sand is the picture of heaven.

But, before you can submerge your soul into paradise, AKA Seven Mile Beach, here is a visitor’s guide you’ll need to know how to get there. Start by centering yourself smack-dab in the middle of the Caribbean. It’s a precious pocket of sea pinched between the Americas, where the Cayman Islands are arguably the king of the proverbial sandcastles.

Seven Mile Beach, well, it’s the icing on the cake…er, castle. It’s THE place to be on Grand Cayman Island. The hub of utopia if there ever was one. Located on, you guessed it, seven miles (well, almost) of pristine beaches. Butted up against dreamy seaside accommodations, epic beach bars, and obviously, seafood eateries with million-dollar views.

How To Get To Seven Mile Beach From George Town

Seven Mile Beach is situated just seven miles from Owen Roberts International Airport, making it easy to reach for both arriving and departing flights. The beach is also close to George Town cruise port, making it a convenient stop for visitors on a Caribbean cruise. There are several ways to reach Seven Mile Beach from both the airport and George Town, and the cost will vary depending on the transportation method you choose.

This is the most popular option and will cost about $25-$30 from the airport and $10-$15 from George Town.

Public bus

There are buses running between Seven Mile Beach, the airport and George Town several times a day. The bus fare is just $7 per person, making it an affordable option for travelers on a budget.

Airport transfer

This service provides transfer from the Owen Roberts International Airport to a hotel, resort, or other type of accommodation in Seven Mile Beach. It’s normally $50 – $60 per person and it includes a pick-up and a return drop-off.

This is a good option for travelers who are staying in this island for an extended period and want the freedom to explore the island at their own pace. Driving in Grand Cayman offers flexibility and convenience, allowing visitors to discover hidden gems and popular attractions alike. Car rental rates will vary depending on the rental agency and the type of vehicle chosen, but rates start at around $50-$60 per day.

What To Do In Seven Mile Beach

If you’re looking for something to do besides basking beneath palm trees and bobbing in heaven’s seas, you’ll find there’s a little bit of something for everyone on and around Seven Mile Beach.

Water sports at Seven Mile Beach

Seven Mile Beach is one of the most popular destinations for water sports and activities in the world. This stunning stretch of sand is known for its warm, turquoise waters and gentle waves, making it perfect for some on the water fun. Whether you’re looking to swim, surf, jet ski, or snorkel, the options are endless. You’re promised to be kept entertained in Seven Mile Beach.

One popular activity in this area is stand-up paddleboarding. With its paddle attached to a longboard, this growing sport lets you explore the ocean up close and personal. And because of the calm waves and shallow reefs found along many parts of Seven Mile Beach, stand-up paddling is an ideal way to take in all the area has to offer. Other popular water sports here include kiteboarding, windsurfing, and kayaking.

In addition to its beautiful beaches , Seven Mile Beach is also known as an ideal spot for swimming, sunbathing, and soaking up some rays. With shallow water that stretches out into the sea and no strong currents, it’s easy to splash around or go for a relaxing dip any time of day. The shallow waters make it great for families with young children who want to learn how to swim.

Land activities in Seven Mile Beach

Feel like ditching the sea legs? There’s plenty to do ashore, too! Be it a safari, a spa, a golf course, or an art gallery, they have thought of it all on this stretch of Grand Cayman. You can even go shopping and head to the theater, or spend the day stretching for drop shots on a tennis court. How about stretching your muscles at a yoga studio?

Other popular land activities include hiking, biking, and picnicking. You can also find several playgrounds located along the beach, making it a great spot for families with young children.

There is also plenty to see if you enjoy bird watching in this area. With a diverse range of local species flocking to the beach throughout the year it’s a great spot for avid bird watchers looking to spot some incredible species.

Dining options in Seven Mile Beach

Seven Mile Beach is a culinary paradise for all kinds of tastes! With options that range from beachfront casual to exquisite fine dining, this Caribbean oasis has something for everyone. Sample local cuisine at some of the inland restaurants or enjoy the international fare at any number of spots with spectacular beach views.

Here, you can have a romantic dinner for two, an intimate night out with friends, or a family-friendly experience – whatever your taste and budget there’s something here to please even the pickiest eater.

Aerial Tours on Grand Cayman

Traveling to Seven Mile Beach from the skies is an experience unlike any other! Aerial Tours take you on a breathtaking journey across the island with incredible views of turquoise waters, white sand beaches and lush green jungles. Get a unique perspective of the picturesque island that you might not be able to get anywhere else – explore untouched areas of Seven Mile Beach and enjoy the beauty of it all from an aerial view!

Which part of Seven Mile Beach is the best?

There is no easy answer to this question, as the entire stretch of Grand Cayman’s Seven Mile Beach is stunning. From the crystal-clear water, powdery white sand to the serene, balmy weather and vibrant marine life, it’s difficult to pick a favorite section of this incredible beach. Some might prefer the quiet solitude offered by the northernmost tip of the beach, while others may gravitate towards the lively bars and dining spots closer to downtown. For those planning a honeymoon in Cayman Islands , this beach offers an ideal setting to explore and create lasting memories.

Ultimately, it all comes down to personal preference, so the best way to find your ideal spot on the beach is simply to explore and enjoy! After all, an afternoon spent soaking up the sun or kicking back in a lounge chair with a good book is sure to be time well spent on any part of this exquisite beach. Without a doubt, whatever area of the beach you find yourself on you’re bound to be impressed.

Where To Stay On Seven Mile Beach

Accommodation options on Seven Mile Beach are as varied as the fish in the sea, so long as you’re looking for condos, resorts, and villas! It is undoubtedly the best place to stay on Grand Cayman Island, particularly if you’re yearning for ocean views, sea breeze, and endless amenities.

Tip: be sure to book your stay well in advance, especially if you’re planning to visit during the high season or for special events. Here are 3 popular complexes:

Snug Harbour View

With 9 beautifully renovated one and two-bedroom condos, a large canal-front swimming pool, private storage lockers, ample parking, and a 186-foot private boat dock, Snug Harbour View is the ideal choice for beach lovers. You can rent boats and jet skis steps from your front door and explore shopping, restaurants, bars, and entertainment attractions just minutes away!

Regal Beach Club

If you want a hassle-free beach vacation, check out Regal Beach Club . You can enjoy pristine sugar-white beaches and lush palms, as well as nearby restaurants, shops and entertainment steps away. Luxury 2 and 3-bedroom condos have been remodeled with designer furnishings and high-end bedding – ideal for travelers who want to be close to the action but still have the privacy of their own vacation rental.

Seven Mile View

Experience luxury and relaxation like never before at Seven Mile View Condos ! Enjoy beautiful oceanfront views from each of the five units, making it the perfect destination for couples or families seeking an unforgettable, VIP getaway. Watch the sunrise over the Caribbean Sea from your very own private balcony , take part in world-class activities, or simply relax and enjoy the warm sunshine.

The Best Time To Visit Seven Mile Beach

Saying there isn’t a good time to visit Seven Mile Beach is like saying there isn’t a good time to eat chocolate, not true! After all, air and sea temps have little variation throughout the year. It’s always summer in the Caribbean! However, if you are looking for special distinctions like on or off-season, it may indeed matter.

High season on the Cayman Islands

The high season for the Cayman Islands is from mid-December through mid-March. This is when lodging, tours, and activities have both the highest booking rates and least availability. So it’s the crucial season to plan and book ahead.

Hurricane season in the Caribbean

You might also be wondering about hurricanes, which is a natural concern in the Caribbean. The greatest chance of hurricanes affecting the Cayman Islands is from September through November. Although, that certainly doesn’t mean the islands are closed up. You can still visit, and likely enjoy a less expensive trip. Fortunately, there hasn’t been a major disturbance from hurricanes on Grand Cayman in nearly 20 years.

The best season to visit Seven Mile Beach

Arguably, the best time to visit Seven Mile Beach and Grand Cayman is during the shoulder season. This is the time of year when the crowds are less, costs are down, and the threat of storms is minimal. The shoulder season on Grand Cayman is during summer in the Northern Hemisphere. This means the perfect time to book an island getaway is during the months of May through August.

With so many amazing vacation properties to choose from, you’ll have no shortage of options when it comes to finding the perfect place for your island escape. Start planning your dream Cayman Islands getaway today!

For more information on visiting the Grand Cayman Islands, please visit our national tourism board website .

Commonly Asked Questions About Grand Cayman’s Seven Mile Beach

Seven Mile Beach is actually approximately 6.3 miles long, but it is referred to as Seven Mile Beach due to its reputation as one of the longest and most beautiful beaches in the Caribbean.

You can enjoy different activities at Seven Mile Beach including swimming, sunbathing, snorkeling, parasailing, kayaking, and more. There are also a few beachfront bars, restaurants, and shops that offer refreshments and souvenirs.

Yes, there are a few restrictions for visitors, including that nudity is prohibited and you are not allowed to bring glass containers onto the beach.

No, there is no entrance fee for Seven Mile Beach. However, some of the beachfront facilities and activities may require a fee, such as beach chairs and umbrellas, water sports, and equipment rentals.

Yes, Seven Mile Beach in Grand Cayman is a great place for families with children. The beach has gentle waves, calm waters, and different activities to keep everyone entertained.

The best way to get to Seven Mile Beach in Grand Cayman is by car, with several large parking areas available for visitors. Taxis and shuttle buses are also available from George Town and other parts of the island, and the beach is easily accessible by foot from many nearby hotels and resorts.

Seven Mile Beach in Grand Cayman is home to a variety of wildlife, including sea turtles, iguanas, and a number of bird species. Visitors can also see schools of colorful fish while snorkeling and may even spot dolphins or rays from the shore. It’s important to respect wildlife by not disturbing or feeding them.

Related Posts

Preparing For Your Grand Cayman Vacation!

Setting off on a Grand Cayman journey in 2024 and beyond is the gateway to an extraordinary experience where the beauty of azure waters meets…

Continue to Read »

New Cayman Airport Opened

New Cayman Airport Opened The highly anticipated announcement of the newly expanded Owen Roberts International Airport on Grand Cayman took place yesterday afternoon, with the…

The Annual Cayman Cookout 2018!

The Annual Cayman Cookout 2018! The tenth annual Cayman Cookout will take place on January 10-14, 2018, when The Ritz-Carlton, Grand Cayman becomes the culinary…

Pirates Week 2019 Dates Announced!

Pirates Week 2019 Dates Announced! Perhaps no other Caribbean nation celebrates its pirate legends and cultural heritage quite like the Cayman Islands, which erupts into…

An elite retail experience.

7 mile travel.

7 Mile Travel is a full service year round Travel Agency with over 16 years in the Travel business. We are committed to offering travel services of the highest quality. Our experience and commitment to customer satisfaction has earned us a solid reputation in the travel industry. We offer all types of customized vacations to suit your needs and budget. Stop in or call us for an appointment to plan your trip of a lifetime.

1943 North Route 9 Clermont, NJ 08210 Office: 609-465-7306 [email protected] www.7miletravels.com

Your Name (required)

Your Email (required)

Your Message

SEVEN MILE BEACH

Award winning seven mile beach, grand cayman.

Named the 4th Best Beach in the Caribbean by Tripadvisor, and the 12th of the best beaches in the world by MSN, Seven Mile Beach is among the many reasons why Cayman is considered the ultimate Caribbean destination. Situated on the western side of Grand Cayman, the area attracts travellers from all over the world. With sparkling waters and coral sands, this shoreline is home to many of the Caribbean's most luxurious properties. The expansive waterfront here is open to the public, making it possible to walk the full length of the shore regardless of where you’re staying. Taking a stroll, you’ll stumble on restaurants at the resorts and several beach bars. Seven Mile Beach encompasses so many different activities, too. Whether you want to work on your tan and watch the waves roll in, or partake in some parasailing or take an exciting ride on a jet ski , Seven Mile Beach gives you every chance to enjoy what Cayman is all about.

Seven Mile Beach is also in close proximity to several popular areas including Cayman’s capital, George Town, as well as Camana Bay.

Seven Mile Beach (Grand Cayman)

Price & Hours

- Facilities 4.5

- Atmosphere 5.0

U.S. News Insider Tip: No matter where you land on Seven Mile Beach, be sure to stop in at woto, a restaurant in the Westin Grand Cayman, for the island's best sushi and some seriously good cocktails. – Taryn White

For several years now, Seven Mile Beach has been lauded as one of the Caribbean's best beaches . Take one glance at this crescent-shaped shore and let your toes sink in the soft, coral sand and you'll easily understand why. Many of Grand Cayman's best resorts are situated on Seven Mile, and there are a number of casual beach bars and restaurants, a playground, restrooms and showers to boot. What's more, it's also a great spot to try snorkeling for the first time – the clear water allows snorkelers to see the vibrant fish and beautiful coral.

Seven Mile Beach Hotels

When visiting Grand Cayman, you'll definitely want to stay in accommodations on or near Seven Mile Beach. Here are top places to stay.

The Ritz-Carlton, Grand Cayman : This five-star resort features six restaurants (including the Caribbean's only AAA Five Diamond restaurant) and a myriad of resort activities and events, including hosting the annual Cayman Cookout.

The Westin Grand Cayman Seven Mile Beach Resort & Spa : The 343-room resort has the largest freshwater pool on the island, complete with cushioned loungers, cabanas and a swim-up bar, and also incorporates the Westin brand's signature wellness programs.

Kimpton Seafire Resort + Spa : In addition to standard guest rooms and suites, this Kimpton property offers a trio of private bungalows perfect for groups, and complimentary dining for children 4 and younger.

Palm Heights : The islands' first all-suite hotel features 52 ocean facing suites, a luxury spa, and services and programming focused on active wellness and regenerative wellbeing.

Botanica Luxury Cottages : Located across the street from Seven Mile Beach, this locally-owned boutique hotel provides an intimate setting with 14 spacious cottages that are equipped with full kitchens, washer/dryer combos, private gardens and outdoor showers.

Recent visitors enjoyed the calm waves and soft sand even though there were heavy crowds. Reviewers say Seven Mile Beach is one of the most beautiful places in the world, affording ample opportunities to snorkel and stand-up paddleboard, as well as build sand castles and take long walks. If you're visiting during the summer, heed the advice of past visitors and pack bug repellent.

This public beach sits just north of George Town on the western coast of Grand Cayman. It's free to enjoy, though services and amenities cost extra. To reach the beach, you can hop on the bus (route Nos. 1 and 2 service the beach) or take a taxi.

Popular Tours

Grand Cayman Cruise: Starfish Point, Stingray City, Coral Garden

(830 reviews)

from $ 80.00

Stingray City Sandbar, Coral Gardens Snorkeling & Starfish Point

(87 reviews)

from $ 69.00

Starfish and Stingray City Fun Tour with Reef Snorkeling- 3 stops

(760 reviews)

More Best Things To Do in Cayman Islands

#2 Stingray City (Grand Cayman)

U.S. News Insider Tip: For the best experience, bring a snorkel mask and towel, and aim to visit on a day with low tide and calm seas. – Taryn White

Located in the North Sound area of Grand Cayman about 25 miles from the shore, Stingray City is the most popular attraction on any of the three Cayman Islands. The "city" is actually a shallow (three to five feet) sandbar where you can interact with and feed the wild Atlantic stingrays that live freely in those waters (there are no penned enclosures). The area has been a popular gathering spot for these creatures for decades; the stingrays were initially attracted to the sandbars by fishermen, who would clean and discard the scraps from their daily catches in the calm waters. Today, the stingrays associate the sound of boat engines with food, making them comfortable with human contact.

Explore More of Cayman Islands

Things To Do

Best Hotels

You might also like

Puerto Plata

# 6 in Best Cheap Destination Wedding Locations

St. Kitts & Nevis

# 4 in Best Places to Visit in January 2024

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

Recommended

The 28 Best Water Parks in the U.S. for 2024

Holly Johnson|Timothy J. Forster May 8, 2024

The 18 Best Napa Valley Wineries to Visit in 2024

Lyn Mettler|Sharael Kolberg April 23, 2024

The 25 Best Beaches on the East Coast for 2024

Timothy J. Forster|Sharael Kolberg April 19, 2024

The 50 Best Hotels in the USA 2024

Christina Maggitas February 6, 2024

The 32 Most Famous Landmarks in the World

Gwen Pratesi|Timothy J. Forster February 1, 2024

9 Top All-Inclusive Resorts in Florida for 2024

Gwen Pratesi|Amanda Norcross January 5, 2024

24 Top All-Inclusive Resorts in the U.S. for 2024

Erin Evans January 4, 2024

26 Top Adults-Only All-Inclusive Resorts for 2024

Zach Watson December 28, 2023

Solo Vacations: The 36 Best Places to Travel Alone in 2024

Lyn Mettler|Erin Vasta December 22, 2023

26 Cheap Beach Vacations for Travelers on a Budget

Kyle McCarthy|Sharael Kolberg December 4, 2023

- Today’s Availability

- Special Offers

- From Rum Point

- Stingray City

- Evening Excursions

- Seven Mile Beach

- Private Charters

- Dive Courses in Grand Caym

- Beach Activities

- Our Reviews

- Stingray City Sandbar & Snorkeling Excursions

- Seven Mile Beach Snorkeling Excursions

- Excursions from Rum Point

- Scuba Diving at Seven Mile Beach

- East End Scuba Diving

- Get Certified

- Further Training

- PADI Specialities

- Refresh Your Diving Skills

- Try Freediving

- Scuba Diving Policy

- Shopping Destinations

- Order a Gift Certificate

A Visitor’s Guide to Grand Cayman’s Seven Mile Beach

If you’ve ever daydreamed about relaxing on a beautiful beach in a Caribbean paradise, you likely imagined something very close to Seven Mile Beach on the island of Grand Cayman. With warm, clear, azure ocean waters, soft, pearly white sand, and swaying palm trees, this beach is known as one of the best in the world.

And that’s not just our opinion! Caribbean Travel and Life named it ‘Best Beach in the Caribbean’, while MSN rated it the 12th best beach worldwide.

At Red Sail Sports, we are leaders in boat excursions in Grand Cayman , as well as beach activities and watersports , so we know Seven Mile Beach inside out. As such, we’re perfectly placed to provide this Visitor’s Guide to Grand Cayman’s Seven Mile Beach.

Keep scrolling down to read through our advice and recommendations. And if you have any questions about adventures on the island, please feel free to get in touch !

Where is Seven Mile Beach?

Seven Mile Beach is a huge, crescent-shaped beach running along a vast stretch of our island’s western coastline and is undoubtedly one of the best beaches in Grand Cayman . Owen Roberts International Airport is conveniently located only seven miles away. As such, Seven Mile Beach is easily accessible for new arrivals to Grand Cayman and those who have a flight to catch or a cruise ship to return to.

What are the Sand and Water Like at Seven Mile Beach?

The three Cayman Islands are the peaks of coral mountains beneath the water. As such, Seven Mile Beach has soft, powdery coral sand. The beach is also well-kept and clean, so it always looks inviting and pristine.

In addition to being a flat coral island, Grand Cayman doesn’t have any rivers. This means there’s essentially no natural runoff that adds silt to the water. These factors combined result in Grand Cayman’s famously clear ocean water. It’s so clear, in fact, that visibility typically varies between 60ft and 100ft.

And if that didn’t sound amazing enough, the water’s year-round temperature varies from 73°F to 85°F.

Even National Geographic said there’s no better introduction to Grand Cayman than Seven Mile Beach.

What Can You Do at Seven Mile Beach?

There’s something for everyone at Seven Mile Beach, from reading a book in the shade to feeling the thrill of watersports, and everything in between.

Here are a few of our favourite recommendations for Seven Mile Beach activities…

Watersports

Seven Mile Beach is renowned for its gentle waves and warm waters, so it’s ideal for an array of watersports, including:

- Windsurfing

- Kiteboarding

- Snorkelling

- Stand-up paddleboarding

At Red Sail Sports, we provide the complete experience for anyone looking to go snorkelling at Seven Mile Beach . This includes sailing on a luxury catamaran, exploring teeming coral reefs, and viewing the wreck of the Kittiwake, a 251ft sunken submarine vessel.

For an even deeper experience, consider scuba diving at Seven Mile Beach . Our Ultimate Guide to Diving in the Cayman Islands is a must-read if you’re planning a dive holiday here in paradise.

Beach Activities on Seven Mile Beach

When you want to get out of the water and try something different, there’s plenty to do on the beach itself and in the surrounding area. If you’re visiting Grand Cayman and Seven Mile Beach for the first time, you might be surprised by what you can find on this stunning stretch of coastline.

There is a golf course and an art gallery, as well as tennis courts, yoga studios, and multiple playgrounds for children to enjoy. There are also plenty of opportunities for a spot of shopping too!

Some other popular activities on and around the beach include picnicking (no glass allowed on the beach itself), birdwatching, hiking, and long strolls. Of course, you can always take it easy and top-up your tan while sunbathing.

Whether you’re hitting the water or staying ashore, Red Sail Sports has got all your Seven Mile Beach activities covered.

What are the Dining Options at Seven Mile Beach?

From family-friendly meals to romantic dinners for two, you can find the full spectrum of dining options around Seven Mile Beach. If you want to try some local cuisine while you’re here, there are plenty of great restaurants to choose from slightly inland from the beach.

You can find incredible international fare with spectacular views along the beachfront. What could be better than enjoying mouthwatering food while watching a beautiful Grand Cayman sunset?

Here are some of our personal favourite dining options along Seven Mile Beach…

- Local Cuisine: Peppers, Heritage Kitchen

- Fun and Family-Friendly: Casa43, Lloyds, Tukka, Macabuca

- On the Water and Romantic: Casanova, Pappagallo, Morgans, Bacaro

- Our Favourites: Agua, Grand Old House, Abacus, Cracked Conch

We know how important food is to any holiday, so we’ve written plenty on the topic! If you’re hungry for more, check out our Grand Cayman Culinary Guide . You can also read our picks for the best local Caribbean restaurants in Grand Cayman and the best food to try when visiting the Cayman Islands .

What Kind of Wildlife is at Seven Mile Beach?

You can find a diverse range of wildlife here, including iguanas, sea turtles, exotic bird species, and schools of colourful fish. There’s also a chance of seeing stingrays! For the ultimate stingray experience, check out our Stingray City tours .

When at Seven Mile Beach, it’s important to respect any wildlife you encounter. Please do not feed or disturb any animals.

What is the Best Way to Get to Seven Mile Beach?

The answer to this question will depend on where you are staying while in Grand Cayman. There are multiple large parking lots at Seven Mile Beach, so travelling by car is easy. Plus, all parking in Cayman is free!

Taxis and shuttle buses also operate from George Town and other areas of the island. Of course, if you’re staying in a hotel or resort by the beach, it’s easily accessible on foot.

Read our blog on how to get around in the Cayman Islands for more useful information about the best and most convenient ways of travelling around Grand Cayman.

Is Seven Mile Beach Seven Miles Long?

It’s actually not! But it measures 6.3 miles long, so it’s close enough! Regardless, on a beach this size, you can find the perfect spot to enjoy the kind of vacation you have in mind.

As we are reaching the end of this blog, we’d like to point you in the direction of our Ultimate Guide to Seven Mile Beach, Grand Cayman . Whereas this blog is more of an introduction, our Ultimate Guide offers a much deeper dive and is packed with essential information you need to plan a memorable stay at Seven Mile Beach.

Discover Seven Mile Beach and Grand Cayman with Red Sail Sports!

We hope this Visitor’s Guide to Grand Cayman’s Seven Mile Beach has inspired and informed in equal measure. And remember, this is only an introduction — there’s so much more to see and do here!

Browsing our range of boat excursions in Grand Cayman is the perfect place to start planning your adventure! For more information about any of our activities or tours, please don’t hesitate to contact us .

Leave a Reply Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

Popular Tours

Grand Cayman PADI Freediving Course

Stingray City Sail from Rum Point, Grand Cayman

Rum Point & Stingray City Sail in Grand Cayman

Popular searches

Best beaches, seven mile beach, stingray city, tours & excursions, welcome to seven mile beach.

With crystal clear water and beautiful fine white sand, Seven Mile Beach is truly gorgeous.

The world famous Seven Mile Beach in Grand Cayman is the jewel of the Cayman Islands. Voted one of “The Caribbean’s Best Beaches”, white powdery sand and sparkling turquoise water come together for miles, providing locals and holiday goers with endless opportunities for activities, restaurants, cocktails, sunset strolls and more!

Despite the moniker, Seven Mile Beach is actually only 5.5 miles however that's still miles of glorious white sandy beach and clear blue water to enjoy. There’s no shortage of water-based activities to try, with snorkelling, diving and jet-skiing among some of the most popular.

Not surprisingly, most of Grand Cayman's high end hotels and condos are located on Seven Mile Beach, while some of the Caribbean’s best cuisine can also be found here.

Explore Seven Mile Beach

Seven mile beach restaurants, shopping in seven mile beach, things to do in seven mile beach, seven mile beach accommodations, plan a trip to seven mile beach, anchor & den, divers supply, the falls steakhouse, balaclava jewellers, caribbean club, carlos v garcia – fine and contemporary art gallery, engel & völkers cayman, funky monkey, hibiscus spa, the westin grand cayman, kennedy gallery cayman fine art, framing & printing, ms piper's, national gallery of the cayman islands, off the peg, paradise pontoons, parasailing professionals, re/max agent - kass coleman, discover the other districts, george town, bodden town.

Please let us know if you have any comments, corrections or ideas to improve!

Explore Cayman Magazine

The 2024 edition of the Explore Cayman magazine is a 160 page full colour magazine and is available on Island for free!

Explore Cayman App

The Explore Cayman app is the #1 app for the Cayman Islands and can be downloaded for free from the Apple app store.

Guide To Seven Mile Bridge (& What You Can See On The Way)

Your changes have been saved

Email Is sent

Please verify your email address.

You’ve reached your account maximum for followed topics.

7 East Coast Places Where You Would Theoretically Be Safe From Hurricanes

7 rv summer destinations in canada perfect for retirees, 7 towns in colorado with aspen vibes, but better.

The Florida Keys are a famous sunshine state destination —chock full of both laidback towns and world-renowned vacation getaways, there’s truly something for everyone on a classic Keys vacay to the Sunshine State.

And one of the main things that make the keys such a fun destination is the area’s variety; travelers can settle down in a spot like Key West for a week-long getaway, or spend a trip traveling throughout the keys to experience a bit of distinctive flavor in the many stops along the way. For example, planning a trip from the Lower Keys to the Middle Keys (or vice versa) is a snap—all due to the famous Seven Mile Bridge.

RELATED: If You’re In The Keys, Visit Florida’s Dolphin Research Center

About The Seven Mile Bridge

The longest bridge connecting the Florida Keys, the original Seven Mile Bridge was also the longest bridge in existence at the time of its construction in the year 1900. Once known as the Knights Key Bridge, the ‘old’ Seven Mile Bridge is no longer used for vehicular traffic but is instead a pier and pedestrian/cyclist route that just reopened as of January 2022 after extensive renovations. The ‘new’ bridge was completed in the early 1980s and runs parallel to the old bridge. Running from the west end of Marathon FL to the Lower Keys, Seven Mile Bridge has even been added to the National Register of Historic Places due to its massive span and ubiquitous presence connecting the Florida Keys.

Road Trip: Seven Mile Bridge

A trip across the iconic Seven Mile Bridge may only take a matter of minutes, but there’s plenty to see along the way. While there is no stopping on the bridge, there are areas where visitors can visit and access whether by ferry, on foot, or by bicycle. The following itinerary is a sample of fun things to see and do in the areas surrounding the Seven Mile Bridge and can be customized depending on available time.

Note: The following itinerary is designed as a one to a two-day getaway that begins in Marathon, Florida, and ends in Key West. However, the trip could be easily customized, depending on the time. It can also be traveled vice versa from Key West to Marathon--after all, the Seven Mile Bridge runs both ways!

RELATED: Miami To Key Largo: The Ultimate Florida Day Trip

See The Sights In Marathon

The city of Marathon is set on a total of 13 islands in the Middle Keys—and its location makes it an ideal spot for some of the best water sports around , including fishing, boating, kayaking, and paddleboarding. It’s also a great introduction to any road trip on the Seven Mile Bridge.

- Start at the Marathon Visitors Center to pick up some maps and some tips for exploring the area, visitors say that the staff is especially helpful with advice and recommendations for dining, lodging, and attractions

- Grab a bite at one of Marathon’s delicious waterfront restaurants such as Burdine’s Waterfront Marina Bar & Grill or the famous local food truck Irie Island Eats

- Those who want to stretch their legs before hitting the road will want to stop at the Crane Point Nature Area , a great spot for scenic views, local wildlife viewing, and hiking trails. Don’t forget to visit the nearby museum and take a trolley tour around the botanical gardens

- Visit lovely Sombrero Beach a lovely place to have a picnic and scope some stellar views

- Rent a bike and explore the area on two wheels

Things To Look For: The Seven Mile Bridge

Just the act of driving across the Seven Mile Bridge is impressive—its span, its views, the Old Bridge lingering in the background. And while there is nowhere to stop on the new bridge, there are things to look for while crossing.

- Fred The Tree is an Australian pine tee growing out of the historic Seven Mile Bridge. Beloved of both locals and tourists alike, Fred is a sturdy symbol of survival for an area plagued by destructive hurricanes—in fact, the tree even survived Hurricane Irma in 2017

- Park in Marathon and take the ferry and guided island tour to lovely Pigeon Key , now only accessible via boat—though there is a 60-passenger tram connecting Marathon and Pigeon Key opening in Spring 2022, making the area even more accessible. Ferry $15 for adults; $12 for children

- Access the newly reopened section of the Old Seven Mile Bridge and rollerblade, bike, or stroll across the historic span 65-feet above the Atlantic

- After arriving in Key West, check out another hidden FL gem before heading back to Marathon—the beautifully eerie Geiger Key Beach . Accessible via US 1 from Key West, the sandy beach is private, with an almost ghostly, abandoned feel only heightened by its mysterious driftwood structures and abandoned canoes. A great place for a photo op, or to just spend a quiet moment before heading back across the Seven Mile

The iconic Seven Mile Bridge has long been an epic span connecting the Middle and Lower Keys—essentially two bridges in one, the newer portion is exclusively for vehicles, while the older one has recently been reopened as a pedestrian’s paradise ( and a great place to snap some Insta-worthy shots! ) And while the drive across this historic bridge is relatively uneventful, there are plenty of things to see and do in the surrounding areas—from hidden gems to quirky, offbeat attractions. Whether by bike, foot, or car, crossing the Seven Mile Bridge is still an epic way to travel through the Keys, and remains an important part of local lore and history to this day.

NEXT: What To Know About Visiting The Longest Suspended Walking Bridge In The World

Florida's iconic 100-year-old Seven Mile Bridge reopens to cyclists and walkers

Mar 23, 2022 • 4 min read

Fresh off a multimillion-dollar facelift, a Florida landmark is welcoming back cyclists and pedestrians for sunrises, sunsets and one of best photo ops in the state Andy Newman / Florida Keys News Bureau / HO

After a years-long $44 million restoration, Florida 's landmark Old Seven Mile Bridge is welcoming runners, cyclists and pedestrians once again, for sunrises, sunsets, and one of best photo ops in the state.

Running parallel to the Florida Overseas Highway in the Middle Keys and linking the city of Marathon with Pigeon Key, a tiny island below the bridge, Old Seven – as it's known locally – was originally built in the early 1900s as part of Henry Flagler’s Florida Keys Over-Sea Railroad, which connected the islands to the mainland for the first time. In 1938, the bridge was converted for automobile use, and in the 1980s it evolved once again, becoming a hub for outdoor pursuits of all kinds.

More recently, however, the century-old 2.2-mile span began showing its age, and by 2016 there were reports of crumbled decking and rusted and broken railings, per the Miami Herald . Renovations began the following year, kicking off phase one of a 30-year, $77 million plan to restore and maintain the iconic structure.

To that end, changes were implemented to make Old Seven safer for recreational use, with improvements including structural steel and bridge joint system repairs, as well as new decking and handrails for pedestrians and cyclists.

“What made the project challenging was that it is a historic bridge, and that we had to restore the bridge to the same aesthetic fabric as the original,” project manager Tony Sabbag, a Florida Department of Transportation contractor, said in a press release.

The bridge reopened in mid-January, several months ahead of schedule, and the crowds are already returning. “It really is more of a linear park, where people can come out and recreate and go biking, walking, cycling, running, take a look at all the marine resources whether it be spotting turtles, sharks, rays, tarpon,” Kelly McKinnon, executive director of the Pigeon Key Foundation, said in the press release. “It's just an unbelievable experience for individuals and families to come out and take advantage of."

In addition to the recreational opportunities provided by the bridge, Pigeon Key is an attraction in its own right. Once home to 400 workers on Flagler’s railroad, it now offers snorkeling, bird-watching, fishing off the pier and a small museum with artifacts detailing the island’s history – and by spring, a new 60-passenger tram is slated to be up and running for easy access.

“As you come onto Pigeon Key, you really do step back in time,” McKinnon said. “It's fantastic to walk around, see these original structures, be on the same ground that these men 100-plus years ago were on.”

Both Pigeon Key and the bridge itself are listed on the National Register of Historic Places, and their significance has been well established, thanks to the involvement of Henry Flagler. One of the main architects of modern Florida, Flagler recognized the state’s potential as a tourism destination early on, and he was responsible for some of its trailblazing accommodations, including the Hotel Ponce de León in St Augustine and the Breakers in what’s now Palm Beach.

According to the Henry Morrison Flagler Museum , the Standard Oil tycoon began acquiring Florida railroads the 1880s with an eye toward further development, so when the US announced plans for the Panama Canal in 1905, he quickly clocked that extending his Florida East Coast (FEC) Railway from Miami to Key West could prove valuable for trade with Cuba, Latin America and even California to the west.

Still, the engineering challenges involved in that extension were not insignificant – steel and concrete bridges were required to lift almost half of the 156 miles of track over water and marshland, for one – and the project was dubbed “Flagler’s Folly” by the doubters.

But seven years, five hurricanes and a reported $50 million later, the first train on the Over-Sea Railroad rolled into the depot at Key West. The line would operate from January 22, 1912, until Labor Day 1935, when a massive category 5 hurricane demolished the Keys, killing more than 400 people and the railway along with it.

“I was a school teacher then and myself and another teacher were coming back to Key West from Tulane University in New Orleans where we’d taken a course,” Wilhelmina Harvey, a Keys native and then Monroe County Commissioner, reminisced to the Miami Herald in 1982, when the new Seven Mile Bridge was dedicated and the old one retired. “When we got into the FEC depot in Miami, I asked ‘what time is the next train to Key West?’ The man said, ‘Young lady, the last train that has ever gone to Key West left a few days ago. Haven’t you heard, there’s been a hurricane.’”

“I’ll always remember being a passenger on that train traveling north,” Harvey continued. “I can still hear the porter call out in a high voice, ‘Seven Mile Bridge coming up.’ And everybody would leave their seats and we would hang our heads out the windows as much as we could so we could get a look at the beautiful view. It still is beautiful.”

You might also like: First-time Florida Keys: island hopping along the Overseas Highway Which Florida Keys island is best for you? Land the perfect outdoor adventure in the Florida Keys

Explore related stories

Jun 20, 2024 • 7 min read

This city in the Sunshine State has pristine beaches, great food and top-notch shopping. Here's all you need to know before your first trip to Naples.

Apr 19, 2024 • 10 min read

Apr 14, 2024 • 6 min read

Apr 10, 2024 • 6 min read

Apr 6, 2024 • 6 min read

Apr 5, 2024 • 6 min read

Apr 3, 2024 • 5 min read

Apr 3, 2024 • 10 min read

Apr 3, 2024 • 6 min read

Mar 26, 2024 • 5 min read

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Destinations

- The Caribbean

How to Plan the Perfect Trip to Grand Cayman

This stunning Caribbean island combines an incredible food scene with white-sand beaches — and it's easy to get to.

:max_bytes(150000):strip_icc():format(webp)/carley-rojas-avila1-CarleyRojasAvila1-2d1f25addb774f8d95109e36b51069c4.png)

- Best Hotels & Resorts

Best Things To Do

Best restaurants, best time to visit, how to get there, neighborhoods to visit, how to get around.

mikolajn/Getty Images

The legendary white sands of Seven Mile Beach put the Cayman Islands firmly on the map as a beach destination, chosen by Travel + Leisure editors as one of the best places to travel in 2023 . However, beaches are just the start in Grand Cayman, an island increasingly known for everything from its budding art scene to its foodie bona fides that extend beyond the Caribbean.

Home to the annual Cayman Cookout at The Ritz-Carlton, Grand Cayman , the island is considered the culinary capital of the Caribbean. "It earns the title. Grand Cayman is small enough that all the chefs know each other and can collaborate. It makes for great synergy," says Sandy Tuason, the executive chef at The Westin Grand Cayman Seven Mile Beach Resort & Spa .

Innovation from Grand Cayman's tastemakers continues beyond the food. Several new, elevated cocktail bars, with Kimpton Seafire Resort + Spa's Library by the Sea at the helm, are transforming the island into a full-blown mixology destination.

Refurbished beachside accommodations and new, stylish boutique properties like Palm Heights add a healthy dose of style to the island. With one of the most extensive flight lifts in the Caribbean, Grand Cayman looks more accessible and appealing than ever.

Courtesy of Palm Heights

Best Hotels & Resorts

The westin grand cayman seven mile beach resort & spa.

The largest pool in Grand Cayman and the longest stretch of white sand on Seven Mile Beach make The Westin Grand Cayman Seven Mile Beach Resort & Spa one of the most impressive resorts on the island. Extensive health, wellness, and activities offerings, plus a kids club, the Hibiscus Spa, and innovative dining options like Woto are highlights.

Kimpton Seafire Resort + Spa

Voted one of our reader's favorite resort hotels in the Caribbean in 2020 by T+L readers, the Kimpton Seafire Resort + Spa sits on the heart of Seven Mile Beach. This 264-room property also boasts the impressive Library by the Sea cocktail bar and Mexican street food-inspired beach eatery Coccoloba, which warrant a visit even among travelers staying elsewhere.

The Ritz-Carlton, Grand Cayman

Home to the largest luxury suite in the Caribbean, The Ritz-Carlton, Grand Cayman shines after an extensive refurbishment in 2021. "It sits along the Seven Mile Beach so the stunning beach is conveniently accessible," says Susmita Baral, T+L's travel editor. "While guests should leave the property and explore the island, you could stay on-site the entire time and have a great time."

The resort's Cayman Cookout festivities every January are a must for foodies, though the tasting menus at Blue by Eric Ripert make the resort a culinary destination year round. "Guests at the Cayman Cookout can experience great food and famous chefs, but it's really about making memories," Marc Langevin, general manager of The Ritz-Carlton, Grand Cayman tells T+L at the 2024 Cayman Cookout. "We hope to create a myriad of experiences — a moment and memories — that they'll remember when they go home."

Palm Heights

Opened in October 2019, Palm Heights is a stylish boutique property and one of the newest resorts in Grand Cayman. As Sarah Greaves-Gabbadon recently reported for T+L , Palm Heights is "a haven for creative types — and those who want to be near them — who crave a bit of visual stimulation with their relaxing resort vibes." With just 52 rooms and suites, it offers a refreshing boutique experience amidst nearby mega-resorts.

Related: Top All-inclusive Cayman Islands Resorts

Stephen Frink/Getty Images

Stingray City

A short cruise takes visitors to a sand bar surrounded by crystal-clear waters to swim with giant yet gentle stingrays at Stingray City . One of the most popular experiences in Grand Cayman, these excursions also offer optional snorkeling at colorful Coral Gardens.

Kittiwake Shipwreck

"Throw on a snorkel anywhere in Grand Cayman, and it's like National Geographic out there," says Kimpton Seafire Resort + Spa's Jim Wrigley. However, one of the island's most unique dive sites is the shipwreck of the USS Kittiwake , sunk in 2011. Turtles and tropical fish now populate the wreck, known for being easily accessible even for less-experienced divers.

National Gallery of the Cayman Islands

The National Gallery of the Cayman Islands is "the best place to discover Caymanian art and to understand its evolution," says Sarah Greaves-Gabbadon for T+L . It's just the start of numerous galleries and art exhibits for travelers looking to discover a burgeoning art scene on the island.

Queen Elizabeth II Botanic Park

Visit Grand Cayman's impressive botanical gardens to see all the richness of the island's flora, including species of orchids you won't find anywhere else on the planet. The park also welcomes visitors to its conservation facility for the island's endemic blue iguanas.

eric laudonien/Getty Images

Library by the Sea

Kimpton Seafire Resort + Spa's Library by the Sea serves a curated collection of literary-inspired cocktails that offer "a slice of time and history with each sip," says the resort's beverage manager Jim Wrigley. Highlights include a glowing blue Dune -inspired drink and a Hemingway daiquiri made using 1932 Bacardí rum, just like the author would have had at El Floridita in Havana. Drinks are "served" with first-edition and vintage copies of the tomes that inspired their creation.

Located in the shopping and entertainment hub of Camana Bay, Next Door is a new cocktail bar offering some of the most innovative drink creations on the island. A commitment to using sustainable ingredients and frequent live music events have made it one of the island's best happy hour spots.

Blue by Eric Ripert

The Caribbean's only AAA Five-Diamond restaurant, Blue by Eric Ripert at the Ritz-Carlton offers tasting menus highlighting local seafood, making it the undisputed fine dining star of Grand Cayman. "Blue by Eric Ripert created the dining scene in the Cayman Islands, Langevin tells T+L. "It's the flagship restaurant at the Ritz-Carlton and elevates the dining experience on the island."

Ms. Piper's Kitchen + Garden

Patterned after a bohemian backyard oasis, Ms. Piper's Kitchen + Garden might just be the coolest place to eat in Grand Cayman. The retro 70's vibe woven into every detail and international-inspired menu are refreshing and unique.

As Grand Cayman's first dedicated poke, sushi, and ceviche restaurant, The Westin's Woto has quickly become a favorite dining destination. Chefs trained in Japan make dishes authentic, while locally-sourced ingredients root them in Caribbean flavors.

Peppers Bar & Grill

Tastemakers, foodies, and chefs across the island all recommend beachfront Peppers Bar & Grill as one of the best local restaurants in Grand Cayman. "The jerk chicken, rice, and peas are the best on the island," says Wrigley.

Coccoloba at Kimpton Seafire Resort + Spa is Seven Mile Beach's elevated beach bar experience. The Mexican street food-inspired menu offers everything from fresh-catch tostadas to churros and an incredible piña colada.

lightphoto/Getty Images

Grand Cayman enjoys warm, tropical weather year round, with temperatures hovering around the 80s. Wet weather and tropical storms are possible during the Atlantic hurricane season between June and November.

Travel high season falls from December through April. While prices are the highest and beaches the busiest, consistently mild weather and sunny skies make these months one of the best times to visit the island. For a sweet spot combining lower prices, fewer tourists, and nice weather, the late spring months of April, May, and June are another great time to visit Grand Cayman.

Cayman Cookout is held annually in mid-January and is worth planning your trip around. The event brings celebrity chefs to the forefront with cooking demos, wine tastings, curated dinners, and an array of exclusive activities. (In 2024, guests could go deep sea fishing with chef Emeril Lagasse and take a private jet to Jamaica's GoldenEye resort with chef Eric Ripert and the CEO of New Zealand-based winery Craggy Range.)

Visit in early May for Cayman Carnival Batabano . Batabano isn't as over-the-top as the carnival celebrations of some Caribbean neighbors, but it’s a fantastic time to experience Caymanian food, music, and dance traditions.

Grand Cayman is one of the most accessible Caribbean islands for North American travelers. Numerous airlines offer frequent direct flights to Grand Cayman's Owen Roberts International Airport from cities such as New York, Los Angeles, Atlanta, and others. Miami, just under two hours away, is a gateway city to the Cayman Islands, with up to four daily direct flights to Grand Cayman during the high travel season.

Cayman Airways offers small daily inter-island flights between Grand Cayman, Cayman Brac, and Little Cayman. While there is no public ferry service between the islands like you might find in other Caribbean destinations, travelers can also choose private boat charters, which are relatively affordable.

Many visitors also arrive in Grand Cayman by cruise ship at the port in the capital city of George Town. The cruise port allows for up to four ships to anchor at once; any additional ships remain in harbor. Passengers are tendered to shore and arrive at one of three terminals.

Seven Mile Beach

Nestled along the white sands of one of the most beautiful beaches in the world is the indisputable center of the action in Grand Cayman. The Seven Mile Beach area is home to Grand Cayman's buzziest resorts, bars, and restaurants, all within short walking distance of each other.

Just a stone's throw from Seven Mile Beach is the Camana Bay area. Jump on a catamaran cruise from the harbor or explore the bustling Town Centre, which features frequent events and a Wednesday farmers and artisan market from 12:00 - 7:00 p.m. This modern neighborhood has lots of shopping and some of the island's best eateries and bars, including Next Door and chef-favorite Agua .

Kick back and relax on the breezy white-sand beach at Rum Point for a quintessentially Caribbean escape from the island's built-up resort area. Rum Point's Wreck Bar holds the distinction for creating the iconic Caymanian cocktail known as the mudslide. While the recipe differs from many classically Caribbean beverages - think vodka, Kahlua, Bailey's, and cinnamon — it's an island classic.

Head east for the antithesis of the built-up Seven Mile Beach area. Weekend farmers' markets and more remote beaches are favorites. "East End is more of a trek, but the local food here is worth it. You'll find food shacks where you just walk up and receive a plate of delicious food from grandma in the back who has been doing this for ages," says Wrigley.

Marc Guitard/Getty Images

With so many of the best resorts, bars, and restaurants in Grand Cayman clustered along Seven Mile Beach, booking a rental car is only a necessity for travelers looking to explore Rum Point or the island's East End. The airport is the best place to rent a car, with a number of large companies here. Remember that cars drive on the left side of the road in the Cayman Islands, though you can find cars with the steering wheel on either side of the vehicle.

Taxis tend to be the best transportation option for most travelers in Grand Cayman, though they can be comparatively expensive. Download CI:GO , an app the Cayman Islands government created to calculate taxi fares between locations, which will estimate your fare in USD and Cayman Islands Dollars (KYD).

Grand Cayman doesn't have the ridesharing companies most visitors will recognize from home. The local app Island Ride is an alternative, though many travelers tend to stick with taxis, as ridesharing can be even more expensive than a standard taxi.

Local Buses

Mini-buses run on predetermined routes around the island and cost just a few dollars per trip, though they tend to get crowded and won't stop if they're already full. Catch a bus at a stop along the route or by flagging one down as it passes. More information on routes and schedules is available on the Public Transportation Unit website .

Related Articles

Welcome Home

To avalon + stone harbor.

Once referred to as the “Jewel of the Jersey Coast,” 7 Mile Island continues to attract visitors and locals to its soft, sandy beaches and sparkling surf. Each resort town on this island offers something unique, while sharing a history and culture that connects.

Discover all there is to see and do on 7 Mile Island.

Now Happening Around Town

Memorial Day Weekend Guide to Avalon & Stone Harbor

Designated Beaches, Activities and Beach Rules in Avalon

Bicycling Safety & Rules When Visiting Avalon and Stone Harbor

Advertisements

Events in Avalon + Stone Harbor

Find more events nearby ⟶, browse more guides.

Designated Beaches, Activities and Beach Rules in Stone Harbor

Everything You Need to Know About the Jitney Service on 7 Mile Island

Parking, Accessibility and Access to Stone Harbor Beaches

Who’s Moved, Who’s Gone & What’s New: Avalon 2024

Churches of 7 Mile Island: For Summer and Year-Round Worship

Want to see more guides, early, get vip access, start planning your trip.

Find Services While You're Here

In our community, civic + charity, town halls, fire, police, like to know what's happening in town.

Get upcoming events, local news, insider offers and more – delivered to your inbox!

Navigate to...

Join Mary and 9.1+ million other Small Business Owners

7 Mile Travel

Our ideal customer is anyone who is interested in travel to anywhere around the world.

7 Mile Travel is a full service Travel Agency with over 16 years in the Travel business. We are committed to offering travel services of the highest quality. Our experience and commitment to customer satisfaction has earned us a solid reputation in the travel industry