- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How American Express Cruise Benefits Work

Lee is a freelance travel writer and podcast host based in Nashville, Tennessee. He loves to travel with his wife and two children using miles and points. Lee has held the Southwest Companion Pass since 2007 and enjoys being spoiled thanks to his Kimpton Inner Circle status.

Giselle M. Cancio is an editor for the travel rewards team at NerdWallet. She has traveled to over 30 states and 20 countries, redeeming points and miles for almost a decade. She has over eight years of experience in journalism and content development across many topics.

She has juggled many roles in her career: writer, editor, social media manager, producer, on-camera host, videographer and photographer. She has been published in several media outlets and was selected to report from the 2016 Summer Olympics in Rio de Janeiro.

She frequents national parks and is on her way to checking all 30 Major League Baseball parks off her list. When she's not on a plane or planning her next trip, she's crafting, reading, playing board games, watching sports or trying new recipes.

She is based in Miami.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

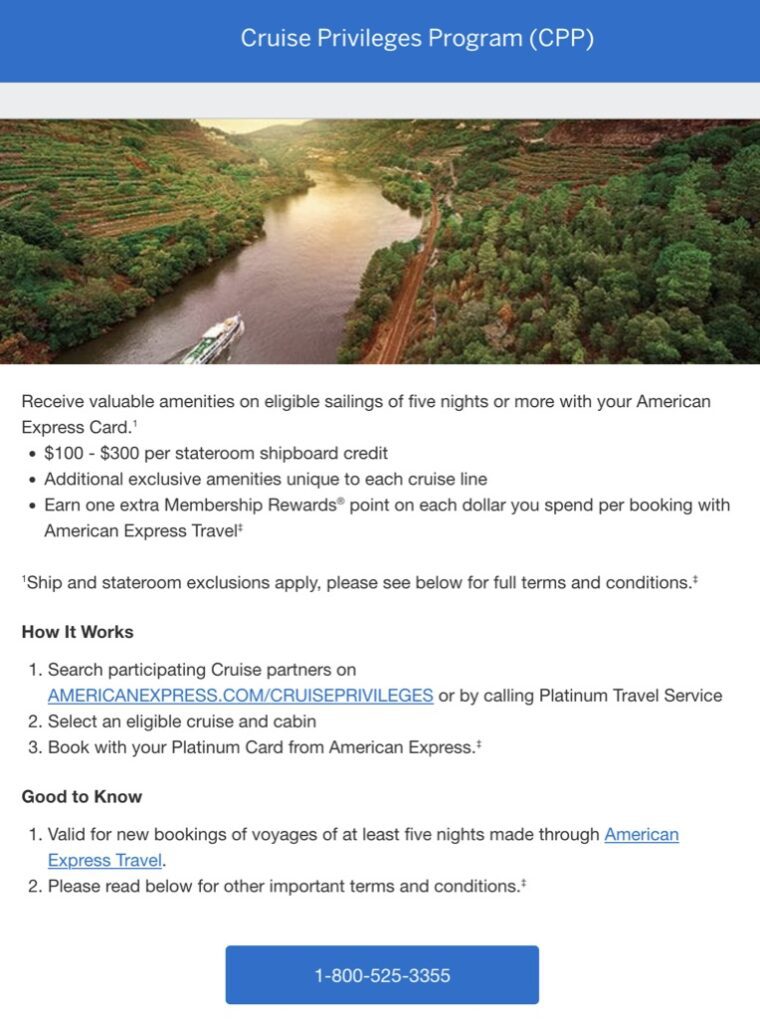

American Express offers exclusive benefits when you book a cruise through its AmEx Cruise Privileges program.

As a cardholder of The Platinum Card® from American Express or The Business Platinum Card® from American Express , you'll receive credits and amenities to enjoy during your trip. Terms apply.

Learn more about these benefits, how to use them and how to maximize rewards on your next cruise vacation.

American Express Cruise Privileges program

American Express cardholders earn rewards and benefits when booking travel through the AmEx Travel portal . The Amex Cruise Privileges program offers exclusive benefits for American Express Platinum members with participating cruise lines.

Offers include complimentary land packages and onboard credits. Additionally, all eligible American Express cards that earn Membership Rewards receive 2x points when booking cruises through AmEx Travel.

Terms apply.

» Learn more: The best ways to book a cruise

AmEx Platinum cruise benefits

AmEx Platinum cruise benefits vary based on which cruise line you book and the details of your cruise. AmEx cardholders can book online or call AmEx Travel at 866-669-4423 to receive these exclusive benefits.

At the moment, American Express partners with 18 different cruise lines. Each cruise line offers different benefits across a variety of price points, travel dates and selected cabins.

Shipboard credit

As part of the American Express Cruise Privileges program, eligible cardholders receive $100 to $300 of onboard credits per stateroom. These credits are redeemable for dining, spa services and more. They cannot be used for casino charges, gratuities or similar expenses.

The shipboard credits are applied to your final bill at the end of your cruise.

They may be paid in local currency and are subject to foreign currency fluctuations. Any unused portion of your credits is nonrefundable, so travelers should use them fully.

Exclusive amenities that vary by cruise line

In addition to an onboard credit, reservations include exclusive amenities unique to each cruise line. Examples include premium wine, assorted canapés, spa vouchers and behind-the-scenes ship tours.

American Express Royal Caribbean benefits include one bottle of champagne per stateroom, while Regent Seven Seas passengers receive a private gallery tour.

Visit the American Express Platinum cruise deals page to view each program partner's offers.

» Learn more: The best cruise lines

How to receive American Express cruise benefits

To receive your cruise benefits, follow these steps and ensure your reservation meets the requirements.

Call or book online with AmEx Travel

Your reservations must be booked through AmEx Travel online or over the phone. These benefits are unavailable if you book directly with the cruise line or through a third party, like a travel agent or online travel agency.

Cruise must be at least five days and have double-occupancy

The cruise must be at least five days long, and you must be traveling with at least double occupancy in your room.

Onboard credits and other amenities are available for up to three staterooms per eligible card member, per cruise. So, you can share benefits with fellow travelers if you book all of the staterooms together using your eligible credit card.

Cardholder must travel on the cruise

While you can book additional rooms for travel companions, the cardholder paying for the cruise must be on the trip. Otherwise, those on the cruise will not receive the benefits.

Book an eligible room type

Not all staterooms are eligible for Cruise Privileges program benefits. Requirements vary by cruise line, so double-check eligibility before booking your room to avoid disappointment during your trip.

Use an eligible card to pay

To receive benefits AmEx Cruise Privileges program benefits, you must use an eligible American Express card to pay for your trip. Eligible cards from the U.S. include:

The Platinum Card® from American Express .

The Business Platinum Card® from American Express .

The Centurion® Card.

The Business Centurion® Card.

Other cards that offer similar benefits, like the American Express® Gold Card or the Delta SkyMiles® Platinum American Express Card , are not eligible for these benefits.

» Learn more: The best travel credit cards right now

How to maximize rewards and benefits when booking cruises through AmEx Travel

You'll maximize the rewards and benefits available for your cruise vacation by booking your reservation through AmEx Travel.

Earning vs. redeeming points

American Express Platinum travel cruises earn 2x points on cash reservations. Eligible cardholders can also book American Express rewards cruises using points. Cardholders can redeem points for a portion or all of the cruise cost.

The redemption value of 0.7 cents per point is substantially lower than our average valuation of 2.8 cents each . Due to this low valuation, we recommend saving your points for another redemption and paying cash for your cruise.

Compare credits and amenities among cruise lines

With so many participating cruise lines, travelers have many options available. In some cases, the prices are similar among different lines.

Compare onboard credits and amenities offered to find the best value, even if it means paying a little more upfront.

Waived cancellation fees

AmEx Travel does not charge cancellation or change fees if you need to adjust your reservations. However, the cruise line may charge penalties depending on when you booked, where you're traveling, how long the cruise is and other factors.

Generally, these fees increase as you get closer to your departure date. Before booking your cruise, review the cruise line’s change and cancellation policies to understand what fees may apply.

» Learn more: Tips for collecting AmEx Membership Rewards

American Express cruise benefits, recapped

Eligible American Express cardholders receive exclusive perks on participating cruise lines when booking through AmEx Travel. The AmEx Platinum cruise benefits include onboard credits, exclusive amenities and 2x points on the cash portion of your reservation.

American Express partners with 18 different cruise lines, so there's a strong chance that one of them has a special offer for your desired destination.

Before booking, ensure your trip meets the cruise's requirements to qualify for your AmEx Cruise Privileges program benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

on Bank of America's website

1.5x-2x Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases.

60,000 Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

Review: American Express Platinum Cruise Privileges Program (CPP) On An Alaskan Cruise

Holders of American Express Platinum cards have access to a little known, but potentially valuable benefit – the Cruise Privileges Program (CPP).

Review: American Express Platinum Cruise Privileges Program On An Alaskan Cruise

We recently had the opportunity to try out American Express Platinum’s Cruise Privileges Program On an Alaskan Cruise.

The Margerie Glacier In Glacier National Park, Alaska

About The American Express Platinum Cruise Privileges Program

The American Express Platinum’s Cruise Privileges Program offers exclusive benefits to cardholders who book their cruises through American Express Travel. The program provides onboard credit and additional exclusive amenities unique to each cruise line for eligible sailings of five nights or more.

The program is available only to U.S.-based Platinum or Centurion cardholders residing in one of the 50 states. The program is offered by some cruise lines, and Princess Cruises is one of them.

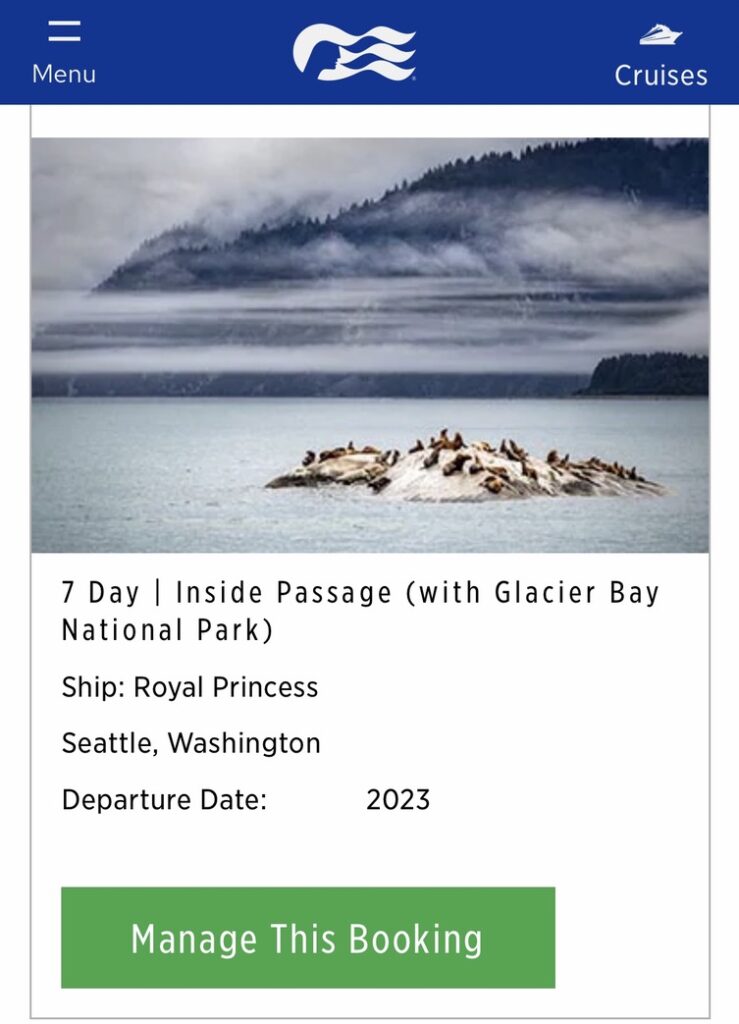

The Cruise We Selected

We utilized the Cruise Privileges Program on a 7 Day, Inside Passage (with Glacier Bay National Park) cruise on Princess Cruises, about Royal Princess ship (roundtrip from Seattle Washington).

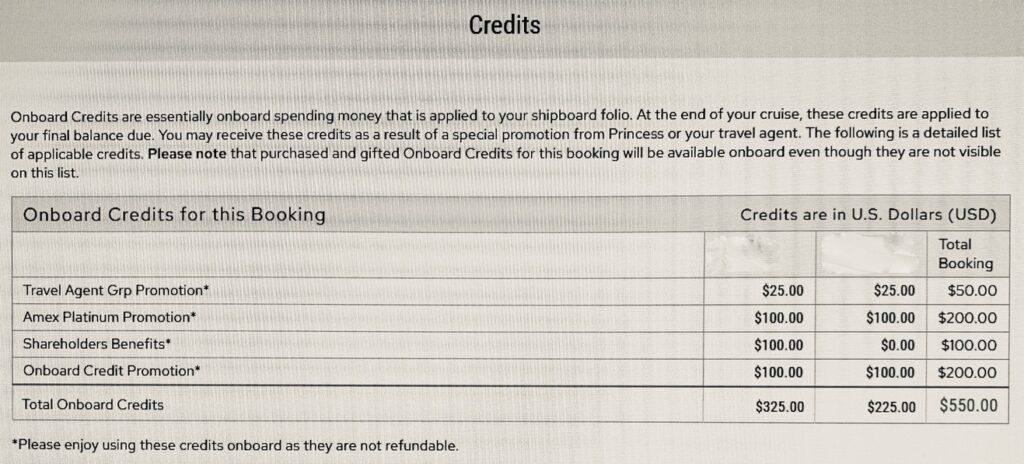

The Cruise Privileges Program Credits

Because there were two of us, we received an Amex Platinum Promotion onboard credit of $100 each (this was in addition to the other credits we received from other promotions and benefits (which totaled US $550)).

The Cruise Privileges Program Welcome Gift

When we arrived in our stateroom, there was a welcome gift of assorted canapes waiting in the refrigerator.

The Stateroom Upgrade

We were upgraded from a Royal Princess Balcony Stateroom to a Royal Princess Deluxe Balcony Stateroom, although it wasn’t clear if this was an “unofficial perk of the Cruise Privileges Program” or due to my Princess Ruby status (or just a random upgrade).

Princess does offer a bid-based system that allows guests residing in the U.S. to bid on a coveted upgrade to oceanview, balcony, deluxe balcony, mini-suite, and even a full suite (we did not participate in this program and still got an upgrade).

Video: The Royal Princess Deluxe Balcony Stateroom Walkthrough Tour

The Royal Princess Deluxe Balcony Stateroom

Official Image: princess.com

Actual Stateroom Photos: Royal Princess Deluxe Balcony Stateroom

The Bottom-Line Review: American Express Platinum Cruise Privileges Program On An Alaskan Cruise

We had a great experience with the American Express Platinum’s Cruise Privileges Program on our Princess Cruise to Alaska.

We found the American Express Platinum’s CPP was a great way to get additional benefits when booking cruises through American Express Travel. In our case, we got a $200 Amex onboard credit (that stacked with other Princess promotions), we earned 2x American Express Membership points on the cruise and onboard spending, and we got an additional exclusive welcome gift.

I suspect we were upgraded from a Royal Princess Balcony Stateroom to a Royal Princess Deluxe Balcony Stateroom due to Amex Travel’s CPP as an unofficial “hidden benefit”, but I don’t know that for sure. Guess that means we’ll have to try out American Express Platinum’s Cruise Privileges Program on our next cruise – and why wouldn’t we?

Flying High On Points

Spending offer alert: earn 15,000 bonus points with your marriott bonvoy business american express card, review: hyatt place moab (utah), you may also like, review: intercontinental the clement monterey (california), review: pier south, autograph collection (san diego, california), review: virgin hotels las vegas, curio collection by..., walkthrough tour of a 2 queen bedroom at..., review: fine hotels & resorts (fhr) – (2nd..., walkthrough tour of a 2 queens room at..., walkthrough tour of a 2 queen beds suite..., review: courtyard las vegas henderson/green valley (nevada), review: hotel republic, autograph collection (san diego, california), review: hilton resorts world las vegas (nevada).

[…] This was published by Flying High On Points, to read the complete post please visit https://www.flyinghighonpoints.com/review-american-express-platinum-cruise-privilege-program-on-an-a… ;. […]

Comments are closed.

Get onboard credit and more when you book through the American Express Cruise Privileges Program

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Suppose you want to book a cruise and have The Platinum Card® from American Express or The Business Platinum Card® from American Express in your wallet. In that case, you should consider booking through the American Express Cruise Privileges Program.

Cardholders of the Amex Platinum and Amex Business Platinum can get onboard credit and an extra onboard amenity through the Amex Cruise Privileges Program on eligible sailings of five nights or more when they book their cruise through American Express Travel . Here’s what you need to know.

What is the Amex Cruise Privileges Program?

The Cruise Privileges Program offers extra perks on eligible cruises of five nights or more when booking through American Express Travel.

Your booking must be for double occupancy to benefit from the Cruise Privileges Program. You must pay with an American Express card in the eligible Platinum or Centurion cardmember’s name, and the cardmember must travel on the itinerary booked.

However, cardmembers can book up to two other rooms on the same sailing that would also get perks through the Cruise Privileges Program.

Related: 21 tips and tricks that will make your first cruise go smoothly

Amex Platinum cruise benefits

Only some cruise lines participate in the Cruise Privileges Program. Also, you must be a U.S.-based Platinum or Centurion cardholder residing in one of the 50 states to benefit from the Cruise Privileges Program. If you book an eligible cruise through American Express Travel, you’ll usually get an onboard credit per room and additional exclusive amenities unique to each cruise line.

Onboard credit

The amount of onboard credit you’ll receive for new Cruise Privileges Program bookings through American Express Travel varies depending on your cruise line and room type. On Celebrity Cruises , Norwegian Cruise Line , Holland America Line , Princess Cruises and Royal Caribbean International , you’ll get an onboard credit per room as follows:

- $100 for inside and outside cabins

- $200 for balcony, verandah and mini-suite cabins

- $300 for suites

On Ama Waterways , Oceania , Regent Seven Seas Cruises , Azamara , Seabourn , Silversea , Uniworld and Windstar , you’ll get a $300 onboard credit per room. And on Cunard , you’ll receive an onboard credit of $300 per room if you book a Qu een Mary ocean-view cabin of category EF (or higher) or a Queen Victoria or Queen Elizabeth ocean-view cabin of category FA (or higher).

Centurion cardmembers get an additional $200 onboard credit on Regent Seven Seas Cruises, Seabourn and Silversea.

Onboard credits will be applied to your cabin folio at checkout upon completion of your cruise, but they can’t be used for casino charges, gratuities or other similar charges. Celebrity Cruises Galapagos sailings aren’t eligible for onboard credit even when you make a new Cruise Privileges Program booking through American Express Travel.

Related: 15 ways that cruising newbies waste money on their first cruise

Additional onboard amenity

You’ll get an additional onboard amenity per cabin for eligible Cruise Privileges Program bookings through American Express Travel. Onboard amenities vary by participating cruise line, but here’s what you can expect for each cruise line based on Amex’s cruise partners page :

- Ama Waterways : $100 spa voucher

- Azamara : Behind-the-scenes ship tour and a bottle of premium Champagne

- Celebrity Cruises : Bottle of Champagne or wine

- Cunard : Bottle of wine

- Holland America Line : Plate of chocolate-covered strawberries

- Norwegian Cruise Line : Complimentary dinner for two at Le Bistro Restaurant

- Oceania : Premium wine-tasting event, plus a complimentary bottle of wine from the event

- Princess Cruises : Plate of canapes

- Regent Seven Seas Cruises : Exclusive private gallery tour

- Royal Caribbean International : Bottle of Champagne

- Seabourn : “Suite Dreams” turndown service (once per cruise) and a bottle of premium wine

- Silversea (except Silversea Expeditions): Bottle of premium Champagne and tour of the vessel’s galley

- Uniworld : Bottle of wine and fresh flowers

- Windstar : “Romance Under Sail” amenities package including a bottle of premium Champagne, chocolate-covered strawberries and canapes

Unfortunately, you won’t get an onboard amenity on Silver Explorer, Silver Galapagos, Silver Discoverer and Celebrity Cruises Galapagos sailings even when you make a Cruise Privileges Program booking through American Express Travel.

Related: The 8 best luxury cruise lines for elegance and exclusivity

Booking American Express cruises

Any American Express cardmember can book cruises through Amex Travel. However, only Amex Platinum and Centurion cardmembers get Cruise Privileges Program perks on eligible cruises when they book through American Express Travel; this includes the Platinum Travel Service, Centurion Travel Service, any American Express Travel office, eligible Travel Associate Platform agencies and the Agency Services Desk.

For Cruise Privileges Program bookings, you must pay with an American Express card in the Platinum or Centurion cardmember’s name. You’ll earn 2 Membership Rewards points per dollar when you book your cruise through American Express Travel using The Platinum Card from American Express or The Business Platinum Card from American Express. If you also have the American Express® Green Card, you might want to use it to pay for your cruise to earn 3 points per dollar on the travel purchase.

To see the cruises available through American Express Travel, head to Amex’s cruise website and pare down your results by destination, month and cruise line.

Next, you can filter the cruises by duration, departure port and ship. Remember, your cruise must be five nights or longer to get Cruise Privileges Program perks.

Once you select a sailing, decide which room you’d like. Cruise Privileges Program onboard credits for many cruise lines are based on the room type you book, so choose carefully if the onboard credits are important to you.

Once you reach the checkout page, you can redeem American Express Membership Rewards points to book. Since Amex Pay with Points only gives you 0.7 cents per point on cruises and TPG’s valuations peg the value of Amex points at 2 cents each, we don’t usually recommend redeeming points for your cruise.

Related: Use these credit cards to maximize your next cruise vacation

Bottom line

If you make a new Cruise Privileges Program booking through American Express Travel for an eligible cruise, you’ll get an onboard credit and amenity. This means booking through Amex Travel may be better than booking directly with the cruise line.

But there are many ways to save on a cruise . For example, you could get a deal on a cruise by booking your travel through Costco . Be sure to shop around before booking your cruise.

SPONSORED: With states reopening, enjoying a meal from a restaurant no longer just means curbside pickup.

And when you do spend on dining, you should use a credit card that will maximize your rewards and potentially even score special discounts. Thanks to temporary card bonuses and changes due to coronavirus, you may even be able to score a meal at your favorite restaurant for free.

These are the best credit cards for dining out, taking out, and ordering in to maximize every meal purchase.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

- Royal Caribbean International

Amex platinum cruise privileges run around

By cusematt4 , October 18, 2022 in Royal Caribbean International

Recommended Posts

Link to comment

Share on other sites.

As an AMEX Platinum cardmember, I think you may be referring to this benefit:

"Cruise Privileges Program" which is one of the many benefits available to Platinum Card members.

But just like the many, many other benefits that come with the card, there's a lot of fine print that separates your understanding of the benefit from the reality of qualification from the benefit. I have pasted all the hoops to jump through that are listed on their website. (Log-in to our account, then making sure your Platinum Card is selected if you have multiple cards, navigate to benefits and drill down to Travel, to find this particular benefit and Learn More.)

The most important part of this benefit --like many of their other travel related benefits-- is the requirement that the travel (in this case a cruise) is booked and paid for through American Express Travel with your AMEX card.

I looked this up because common sense and my 40 + years as an Amex Card member told me that AMEX was simply NOT going to dole out $200 credits for simply paying for a cruise using their card. I've always looked at these benefits as AMEX sharing a part of their profit earned from my purchase and from their travel volume contracts they have with cruise lines and upscale hotel chains (Fine Hotels and Resorts which includes ONE ANNUALLY $200 statement credit, breakfast for two every morning of stay, noon check-in based upon availability, guaranteed 4pm check-out, and usually a use it or lose it property credit that generally cannot be used towards the hotel's daily resort fee or valet parking.)

Cruise Privileges Program ("CPP") benefits are valid only for new CPP bookings made with participating cruise lines through American Express Travel. CPP benefits are valid only for eligible U.S. Consumer and Business Platinum and Centurion ® Card Members (Delta SkyMiles ® Platinum Card Members are not eligible). CPP bookings must be made using the eligible Card. CPP benefits are non-transferable. Participating cruise lines and program benefits are subject to change. The benefits of an onboard credit and amenity are valid for new CPP bookings of at least five nights and require double occupancy; the eligible Card Member must be traveling on the itinerary booked; the total cost of the CPP booking must be paid using an American Express ® Card in the eligible Card Member's name. Onboard credits and amenities cannot be combined with other offers unless indicated; blackout dates, category and fare restrictions may apply. Onboard credits and amenities may not be available to residents outside of the 50 United States. Onboard credits and amenities apply per stateroom, with a three-stateroom limit per eligible Card Member, per cruise. For new CPP bookings with Celebrity Cruises, Norwegian Cruise Line, Holland America Line, Princess Cruises, and Royal Caribbean International, eligible Card Members receive an onboard credit (in USD) of: $100 for inside and outside staterooms, $200 for balcony, verandah, and mini-suite staterooms, and/or $300 for suites. For new CPP bookings with Cunard, eligible Card Members receive an onboard credit (in USD) of: $300 for all Queen Mary ocean-view staterooms category EF or higher, and/or Queen Victoria or Queen Elizabeth ocean-view staterooms category FA or higher. For new CPP bookings with Ama Waterways, Oceania, Regent, Azamara, Seabourn, Silversea, Uniworld, and Windstar, eligible Card Members receive an onboard credit of US$300 for all stateroom categories. For new CPP bookings, Centurion Members receive an additional US$200 onboard credit on Regent Seven Seas Cruises, Seabourn, and Silversea. Onboard credits will be applied at checkout upon completion of the cruise; credit amounts in local currency may vary due to foreign exchange rates; credits are subject to cruise line terms and policies; credits cannot be used for casino charges, gratuities or other similar charges. Any unused portion of a credit is non-refundable and is not redeemable for cash. Other restrictions may apply. Onboard amenities vary by participating cruise line and are not available on Silver Explorer, Silver Galapagos and Silver Discoverer. Onboard credits and amenities are not available on Celebrity Cruises Galapagos sailings. Extra Membership Rewards ® points: CPP-eligible Card Members that are Membership Rewards program-enrolled will receive one (1) extra Membership Reward ® point per eligible dollar spent on new CPP bookings made with participating cruise lines through American Express Travel; separate airfare and other charges associated with such bookings are not eligible. CPP bookings must be made using the eligible Card (described above). The extra points will be credited to the Card Member's Membership Rewards account 8-12 weeks after completion of the CPP cruise. For more information visit membershiprewards.com/terms .

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit www.americanexpress.com/travelterms . California CST#1022318; Washington UBI#600-469-694

I'm a no longer practicing, Independent "VERY SMALL" Travel Agent who "signed up" with AMEX many moons ago to offer clients CPP benefits. I've procured the $200/$300 benefit on several occasions BUT NOT the " Extra Membership Rewards ® points" ( I think you need your own "Merchant account" for that.

It wasn't difficult, didn't cost me anything, & I didn't have to prove anything to AMEX other than signing up to offer it. It was though VERY HARD to find out how/where to do so. My perseverance paid-off as I'm getting the OBC these days :-)

I suggest asking point-blank if the agency/agent is geared up to offer CPP. There must be others like me, out there, somewhere.

Chiming in, but it was my understanding that you have to actually book the cruise through the AMEX travel site in order to receive the OBC. Also, when I've done "mock bookings" before the fare on the AMEX site didn't reflect the deals on the RCCL site, so it always ended up costing more to book through AMEX anyway.

1 hour ago, GetToLivin said: Chiming in, but it was my understanding that you have to actually book the cruise through the AMEX travel site in order to receive the OBC. Also, when I've done "mock bookings" before the fare on the AMEX site didn't reflect the deals on the RCCL site, so it always ended up costing more to book through AMEX anyway.

Nope, not necessary (I know first hand)... you just need to find an agency that's taken the time to sign up with AMEX to offer CPP benefits.

7 hours ago, GetToLivin said: Chiming in, but it was my understanding that you have to actually book the cruise through the AMEX travel site in order to receive the OBC. Also, when I've done "mock bookings" before the fare on the AMEX site didn't reflect the deals on the RCCL site, so it always ended up costing more to book through AMEX anyway.

Your understanding aligns with what I cut/pasted here from the AMEX website.

Adolfo2's exact words were "many moons ago." I will guess that any travel agency that still has the contract to offer CPP is grandfathered in.

I became a Platinum Cardmember back when it was a "by invitation only" card. Back then, which was prior to the internet, they offered PTS: "Plantinum Travel Service," an exclusive team to help with cardmember travel needs. Only the first time I called to book a Royal Caribbean Cruise that my aunt and uncle asked me to purchase as their gift for my parent's anniversary, the AMEX agent scoffed at the idea that she would have to waste her time to book a simple 7 day cruise. Read: not enough commission. Today, things have changed: do it yourself on their website or wait way too long to speak with someone. What hasn't changed is their focus on generating profit for shareholders. Given their current "relationship" with Expedia, it's all about funneling business through American Express travel. And as GetToLivin points out, their prices aren't always the best.

Sunshine3601

6 hours ago, adolfo2 said: Nope, not necessary (I know first hand)... you just need to find an agency that's taken the time to sign up with AMEX to offer CPP benefits.

Have you done this recently?

13 hours ago, Sunshine3601 said: Have you done this recently?

No, I haven't signed up to participate/offer the CPP program recently (Must be ~ 10-years ago) BUT I did get a $200.00 CPP benefit applied to a RoyalC, non-suite stateroom on 5/16/22 😲

5 minutes ago, adolfo2 said: No, I haven't signed up to participate/offer the CPP program recently (Must be ~ 10-years ago) BUT I did get a $200.00 CPP benefit applied to a RoyalC, non-suite stateroom on 5/16/22 😲

Luxury "High-End" agencies belonging to the Ensemble or Virtuoso travel consortia are your best bet to be participating w/CPP

Jkaczanowski

14 hours ago, Sunshine3601 said: Have you done this recently?

My travel agent is also signed up with American Express Platinum and had my $300 OBC applied to my January 7th sailing when I made my final payment in late September. It required her to contact someone at American Express to verify the booking was eligible (all payments made with Amex platinum) and then either she or they applied a “code” to the booking.

Joseph2017China

Sounds like the issue is simply a misunderstanding on how the program works.

Cruise Gopher

You do NOT need to book through AMEX Travel. I just applied this to three reservations in the last week.

The agent logs into a special AMEX portal, then types in the customer’s Amex card number to have the system validate that it’s a Platinum card. Then you input the cruise reservation details into a from, like the sail date, ship, res # and total cost and then submit and it generates a confirmation number. Then you call a special number at the cruise line and they ask you for the confirmation code and then they add the OBC (and sometimes other perks like bottle of wine) to the reservation.

That’s it. It’s super easy for agencies to do but they do have to have their agency registered with the special AMEX website.

11 minutes ago, Jkaczanowski said: My travel agent is also signed up with American Express Platinum and had my $300 OBC applied to my January 7th sailing when I made my final payment in late September. It required her to contact someone at American Express to verify the booking was eligible (all payments made with Amex platinum) and then either she or they applied a “code” to the booking.

BINGO, same here, other than my obtaining/applying CPP benefits "up-front" @ deposit stage.

1 hour ago, Cruise Gopher said: You do NOT need to book through AMEX Travel. I just applied this to three reservations in the last week.

I always book directly with a RCCL agent, anyone know if they can or will do this? Or does it have to be an independent agency?

1 hour ago, adolfo2 said: Luxury "High-End" agencies belonging to the Ensemble or Virtuoso travel consortia are your best bet to be participating w/CPP

My agent is an independent franchise owner with a large travel agency that is not high end. That being said, most / much of her business is star class and suites so she may be participating because of that.

1 hour ago, GetToLivin said: I always book directly with a RCCL agent, anyone know if they can or will do this? Or does it have to be an independent agency?

Not sure BUT would surprise me if they did. You can always call & ask...

3 hours ago, GetToLivin said: I always book directly with a RCCL agent, anyone know if they can or will do this? Or does it have to be an independent agency?

Highly doubt Royal will do this directly.

On 10/3/2022 at 3:41 AM, Biker19 said: Venue operating hours should be listed in the app.

On 10/18/2022 at 5:55 PM, Sunshine3601 said: Have you done this recently?

I am booked on cruise now that I bought maybe month ago through a ta.

My Amex benefits apply for destination family, free meal at johnny rockets plus any kids get free soda.

The $200 benefit could be used but was not combinable with offer for cruise. Ta had negotiated rate with refundable deposit that was better than 200 obc.

On 10/18/2022 at 5:44 PM, PWP-001 said: Your understanding aligns with what I cut/pasted here from the AMEX website. Adolfo2's exact words were "many moons ago." I will guess that any travel agency that still has the contract to offer CPP is grandfathered in.

It can be any travel agent that is willing to jump though the hoops. I believe the procedure mentioned by several people here, including Cruise Gopher, is known as the "Agency Services Desk".

Terms and Conditions:

1. Valid for new bookings of voyages of at least five nights made with a participating supplier through Platinum Travel Service, Centurion Travel Service, any American Express Travel office, eligible Travel Associate Platform agencies, or the Agency Services Desk .

I've sort of given up on this for my Royal cruises, as it seems like my fare is never combinable, and I used to get better travel insurance benefits/more credit card points by using a different credit card. However, I have had success with it for my Cunard sailings, and Amex Plat travel insurance has improved recently. Maybe I should try again soon.

Booked my NCL cruise using the Platinum AMEX benefits ($200 OBC + dinner at the French Specialty Restaurant + bottle of wine) that I’m sailing end of this month. I have used the perk probably 6-8 times over the last 4 years, or so. The perk goes as high as $300OBC + dinner + wine).

I’ve used it on Royal, NCL and Celebrity and combined it with whatever perks/discounts were offered by the cruise line. For example, on my Celebrity Cruises, Celebrity offered $600 OBC. I was sailing in the Retreat. AMEX Platinum offered $300 OBC. Combined, that was $900 OBC I used.

My TA participates in the AMEX program. I believe the TA pays a fee to AMEX to do so. Not all do.

It’s not necessary to book the trip through AMEX Travel. Also, I note that the cruise lines don’t offer the perk if you book directly with them.

Icesk8rReedy

My TA is an AmEx travel agent and she told me to get it, you have to book deposit with the card and pay the fare in full with it too.

9 hours ago, Icesk8rReedy said: My TA is an AmEx travel agent and she told me to get it, you have to book deposit with the card and pay the fare in full with it too.

Yes that is correct.

On 10/19/2022 at 8:07 AM, Cruise Gopher said: You do NOT need to book through AMEX Travel. I just applied this to three reservations in the last week. That’s it. It’s super easy for agencies to do but they do have to have their agency registered with the special AMEX website.

Do you ever have issues when AMEX says it's not combinable? Or has RCL eased upon this (similar to how the shareholder benefit is almost always combinable now, but wasn't for a period of time). For example, can this be applied if booked into agency "group space"? Are there any sales that have caused issues? Or does this work pretty seamlessly these days?

15 minutes ago, karl_nj said: Do you ever have issues when AMEX says it's not combinable? Or has RCL eased upon this (similar to how the shareholder benefit is almost always combinable now, but wasn't for a period of time). For example, can this be applied if booked into agency "group space"? Are there any sales that have caused issues? Or does this work pretty seamlessly these days?

I've never encountered Non-combinable but it wasn't available on Anthem ot Seas during the first season.

I’m not certain the AMEX Plat perk is even available when booking directly with Royal. I know it’s not when booking directly with NCL. And, I booked my last Royal Cruise through my TA, and that was the way I got the perk.

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- ANNOUNCEMENT: Set Sail on Sun Princess®

- Hurricane Zone 2024

- Cruise Insurance Q&A w/ Steve Dasseos of Tripinsurancestore.com June 2024

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started Friday at 04:47 PM

LauraS · Started Wednesday at 05:58 PM

LauraS · Started Wednesday at 04:15 PM

LauraS · Started Tuesday at 08:03 PM

LauraS · Started Tuesday at 05:30 PM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

How Do I Activate and Use the Amex Platinum Card Benefits? [2024]

Christine Krzyszton

Senior Finance Contributor

314 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Editor & Content Contributor

160 Published Articles 785 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Keri Stooksbury

Editor-in-Chief

36 Published Articles 3293 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![cruise program amex How Do I Activate and Use the Amex Platinum Card Benefits? [2024]](https://upgradedpoints.com/wp-content/uploads/2023/11/flydubai-737-800-economy-IST-IGA-lounge-seating.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Getting started, accessing the enrollment center, how to enroll and use benefits, activity tracker, additional benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The number of features and benefits on The Platinum Card ® from American Express can be overwhelming. It’s easy to miss an opportunity to take advantage of a travel benefit, receive a statement credit for a purchase, or earn additional rewards.

The precise number of perks offered by the Amex Platinum card changes, but currently, there are around 4 dozen features and benefits. To help avoid the almost inevitable event of missing out on any of them, today’s article focuses on activating and using each of the top Amex Platinum card features and benefits .

We’ll also include links to more detailed articles about each perk.

Here’s how to activate and use the Amex Platinum card’s top features and benefits.

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Before accessing any benefits, the first step when receiving your card is to activate it. You can do this by calling the number on the back of the card or visiting americanexpress.com/confirmcard .

Once completed, the card is immediately ready for use. It’s important to note the card approval date to ensure you meet the minimum spending requirements within the required period to qualify for the generous welcome offer .

Now we’re ready to browse the exciting card offerings, enroll in or register for them, and learn more about how each benefit works.

Some features and benefits of the Amex Platinum card require enrollment before they are activated. Others are activated by simply making a required purchase.

Starting with the perks that require enrollment can be the most efficient plan of attack. You don’t want to miss out on any perk for failure to enroll or opt-in.

The easiest — and fastest — way to be sure you’re enrolled for all the features and benefits is to access the Enrollment section of your online card account.

Log in to your card account and under Rewards & Benefits , select Benefits . Scrolling down, click on the dropdown box of the Enroll section.

Here you can conveniently find the perks requiring enrollment all in the same place.

Once in the Enroll section, you can sign up for all the key benefits and spend a moment reading the details for each one.

Here’s a breakdown of the items requiring enrollment and how they might be utilized.

Enrolling in Amex Platinum card benefits is easy. Once you’re in the Enroll section, you’ll always start by clicking on the Learn More icon. Next, read about the benefit and complete the required action.

Here’s how to activate each offer and some information about each one.

American Express Global Lounge Collection

The Amex Platinum card lounge access benefit is superior to any other credit card. Once enrolled, you’ll have access to over 1,400 properties worldwide . To access most lounges, you can use your Amex Platinum card and a same-day boarding pass.

You’ll need a Priority Pass membership card to access Priority Pass and affiliated lounges. In the Enroll section, click on the Learn More icon, then Enroll Now . Once enrolled, you’ll receive a Priority Pass Select membership number. You can then download the Priority Pass app ( iOS , Android ) and use a digital version of the card for lounge access. A physical card will also be mailed to you within approximately 10 days.

Here is a list of the lounge networks you can access with the Amex Platinum card and your Priority Pass Select membership card.

- Amex Centurion Lounges (worldwide access)

- Delta Sky Clubs (when flying Delta same-day)

- Priority Pass Select

- Escape Lounges – The Centurion Studio Partner

- Plaza Premium Lounges

- Lufthansa Lounges (when flying Lufthansa same-day)

- Additional Global Lounge Collection Partner Lounges

- Select Virgin Atlantic Clubhouses

Access to many lounges also includes 2 guests. Guest access to the Centurion Lounges and Delta Sky Club requires spending $75,000 on your card within a calendar year . Fortunately, there’s a tracker in your online card account.

Digital Entertainment Credit

You can receive up to $240 in statement credits for select digital entertainment purchases. These included Hulu , Disney+, The Disney Bundle , ESPN, The New York Times, Peacock TV , and The Wall Street Journal.

A maximum monthly statement credit of $20 will be applied to qualifying digital entertainment purchases made with your card.

Enroll in the benefit after clicking on Learn More , then add your Amex Platinum card as the payment method in your qualifying digital entertainment account.

One important element of the enrollment section is that the provided tracker shows how much credit has been used each month:

For example, you can see that my monthly ad-free Hulu subscription of $17.99 resulted in a statement credit of $18.

Airline Fee Credit

Before receiving airline fee statement credits, you must select a qualifying airline. Once again, click on the Learn More icon and complete the selection. After choosing your airline, wait a day or 2 before purchasing to ensure the selection is active.

While the credit is meant to reimburse you for airline incidental fees such as checked bags and inflight refreshments, other purchases are known to trigger the credit.

An example would be the United Travel Bank, one reason I selected United Airlines as my qualifying airline.

For more tips on utilizing the Amex Platinum card’s airline fee credit , our article on the topic can help.

You won’t want to miss the $15 in Uber Cash added to your account each month and VIP recognition. Plus, in December, you’ll receive a bonus of $20, for a total of $35. That’s $200 in Uber Cash each year.

Once clicking on the Learn More icon, then Enroll , you’ll want to add the Amex Platinum card as the payment option in your Uber account.

You can then make the required purchase using the Uber Cash in your account. Any amount charged more than your Uber Cash balance will be charged to your card.

Uber Cash can be used for Uber rides and Uber Eats in the U.S.

Here’s more information on maximizing the Uber Cash credit on the Amex Platinum card .

Hilton Honors and Marriott Bonvoy Gold Elite Status

While the Amex Platinum card comes with Hilton Honors and Marriott Bonvoy Gold elite status, it doesn’t happen automatically. To receive these benefits, you must enroll in the benefit with your hotel loyalty program membership number.

Click on the Learn More icon and type in your loyalty program number for Hilton Honors (for example), then repeat the process for Marriott Bonvoy.

Learn more about Hilton Honors and Marriott Bonvoy Gold elite status and the related benefits in our informative article.

$200 Prepaid Hotel Credit

While enrollment is not required, booking via AmexTravel.com is a prerequisite to receiving the $200 prepaid hotel stay credit.

When you book at least a 1-night stay with Fine Hotels + Resorts , or a 2-night stay with The Hotel Collection , you’ll receive $200 in statement credits shortly after charging the prepaid stay to your card.

The benefits beyond the $200 are many and include on-site perks valued at more than $600. You’ll also be earning 5x Membership Rewards points .

Enroll in the ShopRunner benefit to receive free 2-day shipping, complimentary returns, plus deals from over 100 select retailers .

Enroll in ShopRunner by clicking on the link and registering with your card.

Saks Fifth Avenue Credit

Shopping at Saks is more fun when you receive up to $50 in statement credits for your purchase. The credit is available once from January through June, and again from July through December. That’s up to $100 in statement credits each calendar year .

To enroll, click on the Enroll Now icon under the Shop Saks with Platinum section, then use your Amex Platinum card for your purchase.

Here are some great ideas for using your credit at Saks .

CLEAR Plus Membership Credit

CLEAR Plus membership can speed up your airport security experience. While you do not need to enroll your card specifically, to receive the statement credit, you can enroll in CLEAR and pay your application fee (or renewal fee) with your Amex Platinum card. A link is provided in the Enroll section to sign up for a CLEAR Plus membership .

If you belong to any airline frequent flyer programs, check for discounted CLEAR Plus membership offers. Enroll in CLEAR Plus via your frequent flyer account, use your Amex Platinum card to pay the fee, and receive a statement credit of up to $189.

Once you’ve used your credit, it will show on the tracker in your card account.

Monthly Walmart+ Membership Credit

The Amex Platinum card comes with a monthly Walmart+ membership credit of $12.95 plus the applicable taxes .

To receive the Walmart+ membership credit, you must first enroll in a Walmart+ membership . You’ll then add your Amex Platinum card as payment to that account. Click the Get Started button to be taken to the Walmart+ enrollment page.

The key benefits of Walmart+ membership are free delivery with a minimum purchase of $35, free shipping (no minimum order), 10 cents per gallon fuel savings, and a complimentary Paramount+ subscription.

Equinox and SoulCycle Credit

Use your Amex Platinum card to purchase an Equinox+ digital subscription or Equinox Club membership and receive up to $300 in statement credits each calendar year. Or, buy a SoulCycle At-home bike with your card and receive a credit of up to $300.

Here’s more information on how to maximize the Equinox credit .

Under the Benefits tab in your online card account, you’ll find the activity tracker for all the benefits that have requirements or provide a statement credit. You’ll be able to view the status of all the credits and your progress toward any spending requirements.

Accessing this section periodically will ensure you don’t miss out on any monthly perks or spending deadlines.

Here are additional Amex Platinum card benefits you’ll want to consider, some of which have requirements before use.

- Global Entry / TSA PreCheck Fee Reimbursement — Use your card to pay your application or renewal fee and receive reimbursement as a statement credit, up to $100.

- Cell Phone Protection — Pay your monthly wireless bill with your card and receive coverage for damage or theft, up to $800 per claim. There is a limit of 2 approved claims per 12-month period and a $50 deductible per claim. Terms apply.

- Premium Car Rental Protection — For 1 low price covering the entire rental period you’ll receive premium primary car rental protection. Enroll your card before renting to activate coverage effective whenever you use your card for a rental.

- Global Dining Access by Resy — Receive exclusive reservations, priority for open tables, and access to special experiences. Download the app and add your Amex Platinum card as the payment option.

- Amex Offers — Log into your online card account and select from up to 100 offers with merchants and service providers. Add the offer to your card and complete the required purchase to earn additional rewards or receive statement credits.

- Auto Purchasing Program — Shop with one of the certified dealers and receive upfront pricing for a new or used car. You may be able to charge up to $2,000 (or more) on your Amex Platinum card when purchasing a new vehicle.

The number of Amex Platinum card benefits may seem daunting.

However, with the Enroll section and trackers within your online card account, you can manage the perks and ensure you’re on track to receive the most value possible. Plus, maximizing these benefits can help offset the card’s annual fee of $695 ( rates & fees) .

It’s also worth the time to read the requirements and descriptions of each benefit so you don’t miss out.

This article provides further information for a comprehensive overview of Amex Platinum card benefits .

For the cell phone protection benefit of The Platinum Card ® from American Express, coverage for a stolen or damaged eligible cellular wireless telephone is subject to the terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per eligible card account. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per eligible card account per 12 month period. Eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Which benefits do i need to register for with the amex platinum card.

Several of the benefits offered on the Amex Platinum card require enrollment. In your online card account, under the Rewards and Benefits section, you will find the Enrollment section under Benefits . Here you’ll find a list of benefits that require enrollment. You’ll also want to review all the card benefits as some have requirements before using.

Can I use the Amex Platinum card for Priority Pass lounges?

You must enroll in Priority Pass and receive a Priority Pass Select membership card number before gaining lounge access at Priority Pass locations. After logging into your online Amex Platinum card account, you can enroll in Priority Pass in the Enroll section and receive a membership number. You can then use a digital version of the card via the Priority Pass app. A physical card will be sent in the mail.

How do I use the Uber Cash on my Amex Platinum card?

Once you’ve added your Amex Platinum card as the payment method on your Uber account, you will receive $15 in monthly Uber Cash. In December, you’ll receive $35. You can use Uber Cash for Uber rides and Uber Eats in the U.S. Any amounts greater than your Uber Cash will be charged to your card.

Can I use my Amex Platinum card CLEAR Plus credit for someone else?

Yes. Just charge the application or renewal fee to your Amex Platinum card and if you have the credit available, you will receive a statement credit for up to $189.

What counts for the Amex Platinum card digital entertainment credit?

You can receive up to $20 in monthly statement credits for purchases with Hulu, Disney+, the Disney Bundle, ESPN, The New York Times, Peacock TV, and The Wall Street Journal. You can make purchases with multiple services but the maximum monthly credit is $20.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!).

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

This is the announcement bar for Poornima to test the Close Button. It will expire May 31 2024.

- Pre-Cruise FAQ

- Onboard FAQ

- Post-Cruise FAQ

- Cruisetours FAQ

- Special Offers Sign Up

- Cruise Deals

You have been logged out

Your window will update in 5 secs

Double the cruise credits, double the love

For a limited time only! Purchase Princess Plus® or Princess Premier® at least two days before you sail, between August 1 through December 1, 2024, and we’ll double your cruise credits and you’ll also move up through Princess Captain’s Circle® faster.

Are you already booked? Please log in to add Princess Plus or Premier Package to your booking.

Level up – faster.

Double the love. Double the credits.

After your first cruise.

After completing 3 cruises or 30 cruise days.

After completing 5 cruises or 50 cruise days.

After completing 15 cruises or 150 cruise days.

Why Purchase Before Sailing?

Convenience – get on board and get to the fun. It’s already attached to your booking and available to be used. No need to wait in line.

Peace of Mind – enjoy your vacation without checking your folio or worrying about overspending on fees.

Know your trip cost – By bundling Princess Plus/Premier with your fare, you will know what your full trip cost is and not have to worry about things you’ll cover later like drinks, Wi-Fi and gratuities.

More Value - These packages are different than the stand-alone Plus and Premier Beverage Packages because they include MORE like Wi-Fi, gratuities, casual dining, fitness classes, premium desserts and photo packages.

Get the Princess Plus or Premier Package Today and Double Your Cruise Credits!

Frequently asked questions.

For a limited time, guests who add the Princess Plus package or Princess Premier package to their cruise booking will have that cruise count twice towards loyalty level tier achievement in the Captain’s Circle loyalty program.

Guests sailing on any Princess cruise that departs between August 1, 2024 and December 1, 2024 who add the Princess Plus package OR the Princess Premier package to their booking. The Princess Plus or Princess Premier package must be added to the booking at least 2 days prior to embarkation day. All guests, (this includes all U.S. and all non-U.S. resident guests) who meet these criteria are eligible.

ANY guest who purchases Princess Plus or Princess Premier package at least two days prior to sailing and who sails during the sailing time period (August 1 – December 1, 2024) qualifies and will have their cruise and # of days cruised count double towards their Captain’s Circle level achievement.

There is no promo code to enter. Any booking that sets sail between August 1 and December 1, 2024 which has also added either a Princess Plus or Princess Premier package to the booking at least 2 days prior to applicable embarkation date will automatically have their cruise credits doubled. Cruise credits are how each Guest’s Captain’s Circle tier level is achieved. Both cruises taken and cruise days count towards calculating a guest’s loyalty tier and both will be doubled for eligible guests. A guest’s cruise credits will appear on their “My Princess” page, on the Captain’s Circle tab within a few days of completion of their cruise.

For reference, current Captain’s Circle Tiers are:

Example: Guest is booked on a 7-night cruise that sails on August 1, 2024 and the guest adds Princess Plus to their booking. That one cruise will count as 2 cruises and 14 cruise days towards their Captain’s Circle tier qualification.

Within 2-3 days after the completion of the cruise.

Cruise credits refer to the number of cruises that a guest has sailed with Princess and/or the number of days cruised with Princess and are used to determine the guest’s Captain’s Circle loyalty level.

We value your loyalty and thank you for being a loyal Princess Guest. While you are already at the highest level of Captain’s Circle, your cruise credits continue to be tallied (and celebrated such as being recognized as the most traveled guest at the Captain’s Circle party onboard). All guests, including Elite-level guests, who meet the promotional criteria will have their cruise credits doubled.

Yes! (And smart choice! Enjoy getting the most out of your cruise!) Note that an email will be sent in mid-July to guests who already purchased Princess Plus or Princess Premier and who are sailing between August 1, 2024 and December 1, 2024 to advise that they are automatically included in this offer.

Captain’s Circle is Princess’ loyalty program which provides loyal guests with increasingly more benefits and perks the more they sail with Princess. For more details about the program, please visit: Princess.com/CaptainCircle

Princess Plus and Princess Premier are packages which include beverages, Wi-Fi, crew appreciation and many other benefits. Both packages provide significant savings. Click here for details on each .

Terms & Conditions

Loyalty Accelerator Terms: The Loyalty Accelerator “Offer” is only available to legal residents of US/DC, Australia, & Canada and allows a guest booking an eligible cruise with the Princess Plus or Princess Premier package to receive double cruise credits for such booking. To be eligible , guest must book on, or upgrade to, Princess Plus or Princess Premier package no later than 2 days prior to embarkation on a Princess Cruise departing between 8/1/2024 and 12/1/2024. Upon completing the eligible cruise, the eligible guest will receive the credits. Doubled credits shall be automatically deposited into guest’s Captain Circle account after completion of eligible cruise sailing. All Captain’s Circle™ and Princess Plus and Princess Premier terms and conditions apply (including that Captain’s Circle tier calculation and doubling only applies to cruise portion of the trip). Offers and their parts (if any) are not substitutable. Princess Cruise Lines, Ltd. (“PCL”) is not responsible or liable for any errors, including technological or other errors. PCL may change or revoke Offer at any time.

The ultimate guide to saving money with Amex Offers

Editor's Note

At TPG, we spend a lot of time focusing on redeeming points for travel, but the savviest points experts are the ones who know how to take advantage of every deal and save money — even when they're not traveling.

One of the best options for saving money and earning some bonus points on a wide variety of purchases is taking advantage of offers on American Express credit cards .

We'll walk through everything you need to know to enroll in and redeem these extra discounts so that you can reap the benefits of potentially saving hundreds — or thousands — of dollars on everyday purchases.

What are Amex Offers?

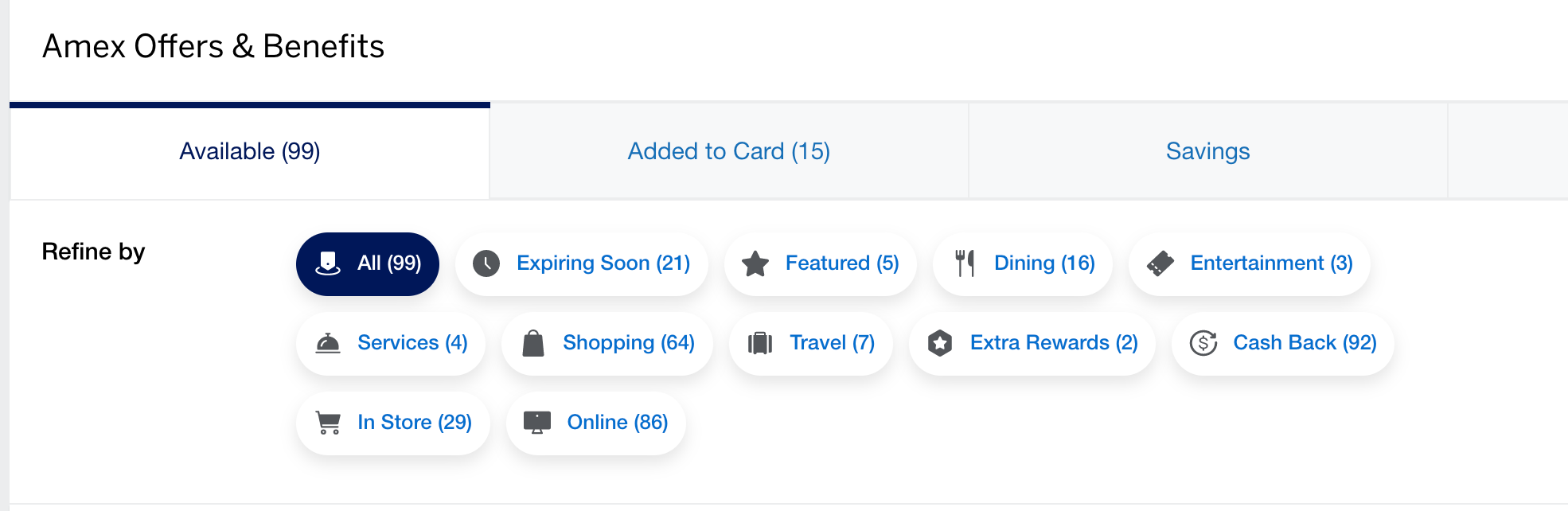

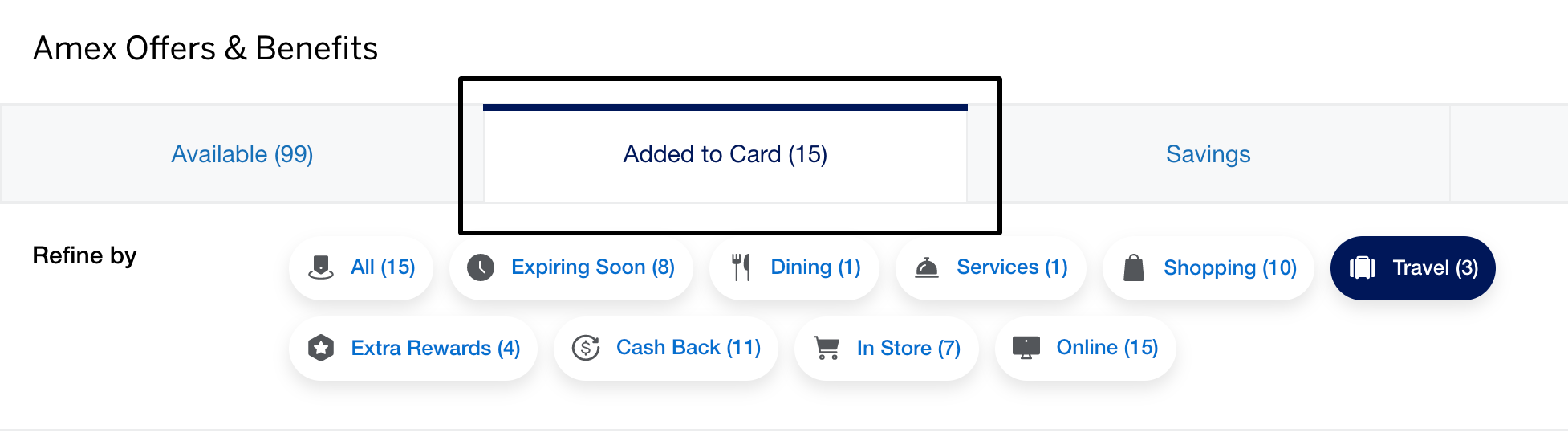

All American Express cards, including core ones such as The Platinum Card® from American Express and cobranded cards like the Delta SkyMiles® Gold American Express Card , have access to Amex Offers. You'll see all the Amex Offers available to you if you scroll down to "Amex Offers & Benefits" on your online account page or click on the "Offers" tab on the Amex app.

These offers come from a wide variety of merchants, including travel providers, restaurants, and clothing and jewelry stores. Generally speaking, Amex Offers come in one of four forms:

- Spend $X, get Y number of bonus points

- Spend $X, get $Y back

- Get additional points for each dollar you spend at a select merchant

- Get X% back by using the link provided

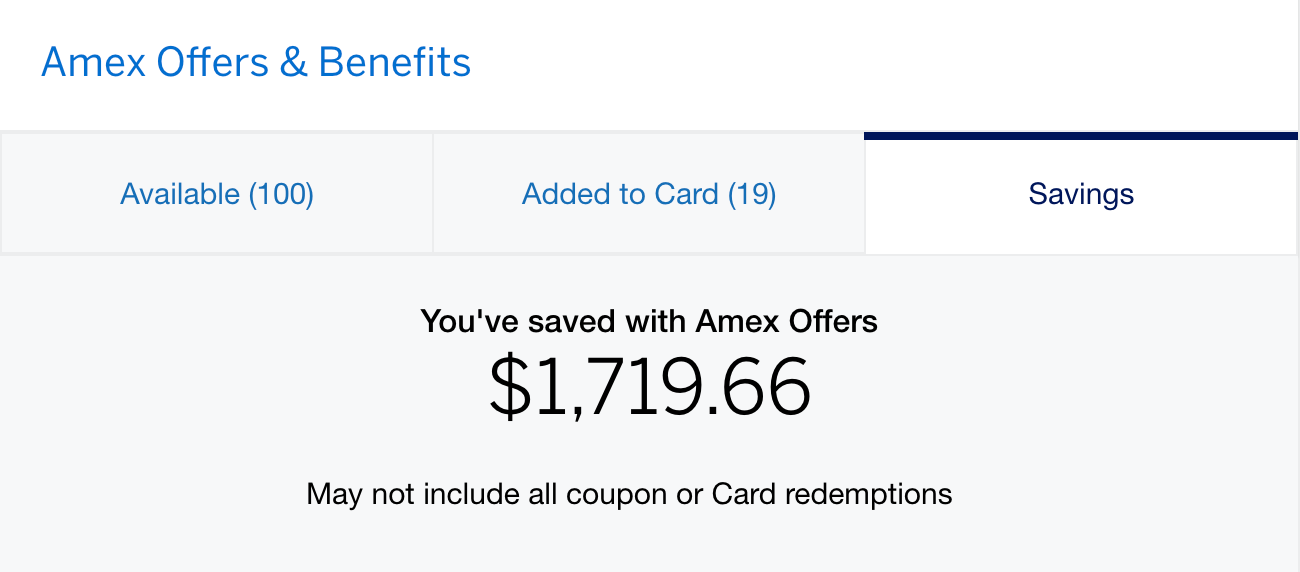

These offers are targeted, both to the individual cardholder and the specific card. You can tell this right away because each of your cards should have a different number of offers available. The maximum number of offers you'll see on any card at a given time is 100 offers. If you aren't seeing anything that interests you, adding offers to your card can free up space for new offers to appear.

Related: The secret to getting more (and sometimes better) Amex Offers on your card

How to filter your offers

You can refine your offers by specific categories, such as "expiring soon," "travel," and "dining."

Previously, there was a drop-down menu with more limited filtering options. This is a better user experience for those who want to see which offers are available and keep track of the ones already added to your card.

Based on my experience and several data points I've seen online, it appears that Amex sometimes targets the most valuable offers — that is, the most points, the largest discounts or the easiest merchants to redeem at — to its core Membership Rewards-earning cards, such as the Platinum card or the American Express® Gold Card .

Eligibility for these offers is limited. Enrollment is required in the Amex Offers section of your account before redeeming.

How to enroll and redeem Amex Offers

Although each offer is slightly different depending on the merchant, all Amex Offers start with some version of the following terms and conditions:

Must first add offer to Card and then use same Card to redeem. Only U.S.-issued American Express® Cards are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Valid online only. Valid only on U.S. website. Valid only on purchases made in U.S. dollars. Excludes authorized retailers. Excludes wholesale purchases. See the merchant website for the shipping policy. Some merchants may not ship to all areas. Offer is non-transferable. Limit of 1 statement credit per Card Member.

Credit cards come with a lot of fine print that most of us don't bother reading, but this is one time when it's really worth bringing out your glasses, putting on a pot of coffee and sitting down to study the terms.

There are a few important things to know:

Enrollment is limited

Even though the offer might be showing on your account, Amex may have a quota for how many people can enroll in this offer. Once that limit is reached, you may not be able to register. If you think there's any chance you'll use this offer, go ahead and add it to your card. Nothing happens if you end up not using the offer, but you lock in the ability to do so later.

If you've added an offer but it isn't showing up in your account on a web browser, try checking your Amex app. We've heard reports of people thinking their offers were lost, only to find them neatly listed in their app.

Related: These Amex Offers will help you save money and make life easier right now

Amex agents can move Amex Offers from one card to another

If you have multiple Amex cards, keep track of which card each offer was added to. because it may be possible to move Amex Offers from one card to another Amex card. If you have an Amex Offer on one account, it can be moved to another Amex card, which could result in a better earning rate on your purchase. This requires speaking with an Amex customer service representative, and the best way to contact them is via the chat function on the mobile app or on the website.

This is very much a hang-up and call again (HUCA) situation, where some agents may not be able to or know how to move offers, whereas other agents are able to. Reach out to a representative via chat to request the offer to be moved, and if there's no success, end the chat and try again later.

One offer per cardmember across all American Express offer channels

Even though the terms have always been read this way, it used to be possible to add an Amex Offer to multiple cards and receive the credit as many times as you were targeted. Amex has been cracking down on this practice, so even if you are able to add the offer to multiple cards, the system will likely only give you credit the first time you use it.

You won't have any luck calling in and asking Amex to manually credit the second card, either, so it's best not to get greedy. Stick to a single card.

You should carefully pick the card to which you add an offer. I always try to load my offers onto my Blue Business® Plus Credit Card from American Express to earn 2 Membership Rewards points on my first $50,000 of purchases per calendar year (then 1 point per dollar thereafter).

However, if an offer is related to Marriott , I'll add it to my Marriott Bonvoy Business® American Express® Card . The same applies to offers related to restaurants and U.S. supermarkets — I add these to my Amex Gold card as this card earns bonus points in these categories.

You can also leverage Amex Offers to help meet your minimum spending requirement on a new credit card.

The rest of the terms and conditions repeat this point several times until you have it clear: One Amex Offer per account, period.

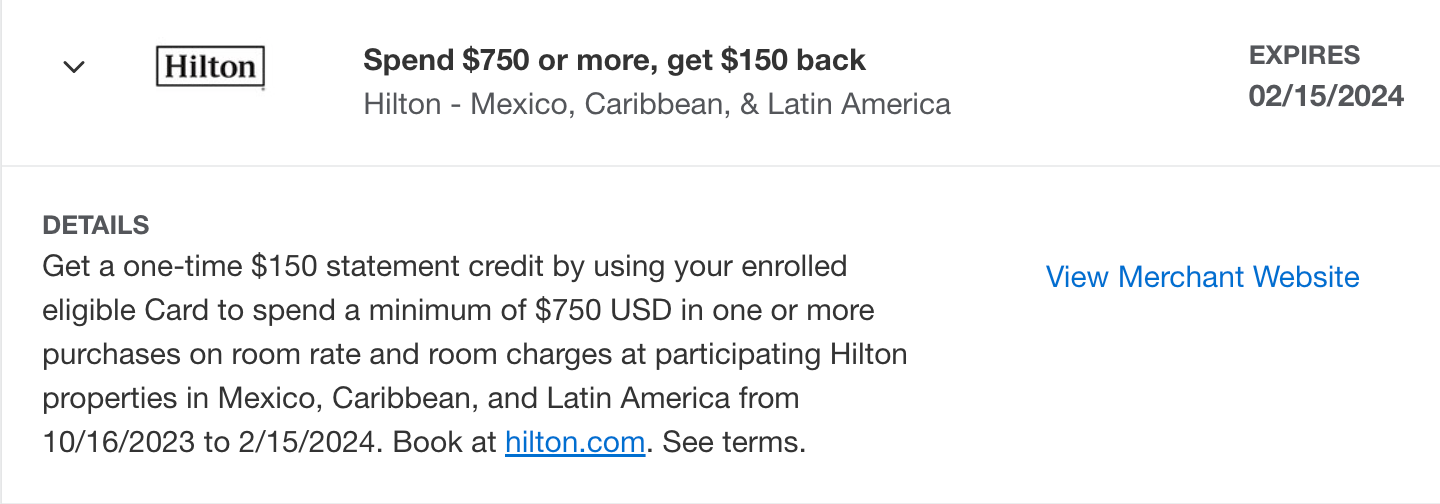

On top of these general terms, a specific offer will have a few terms worth noting. Each offer has an expiration date, and many travel offers have geographical restrictions, such as only valid for transactions in U.S. dollars or only valid at properties in North America.

You must usually purchase directly from the merchant to receive the offer. In the case above, making a Marriott hotel booking through hotels.com or Expedia won't earn you the discount.

Some offers even require you to purchase through a unique American Express link, so it really pays to do your homework before you make a purchase.

Many merchants exclude certain items, such as gift cards or promotional items, from the offer. You also have to be careful about how your transaction is processed, as Amex will only give you the cash rebate or bonus points if it receives information that appropriately identifies your transaction.

Affiliate links, such as online shopping portals , and promo codes at checkout may sometimes disqualify an Amex Offer. Here's what an Amex Offer for The Shade Store specifies:

You may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer. For example, you may not receive the statement credit if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

It will usually take up to 90 days for your bonus points or a statement credit to be posted to your account. But you should get an email almost instantly after the transaction posts, confirming that you've triggered the offer.

How to maximize and stack Amex Offers

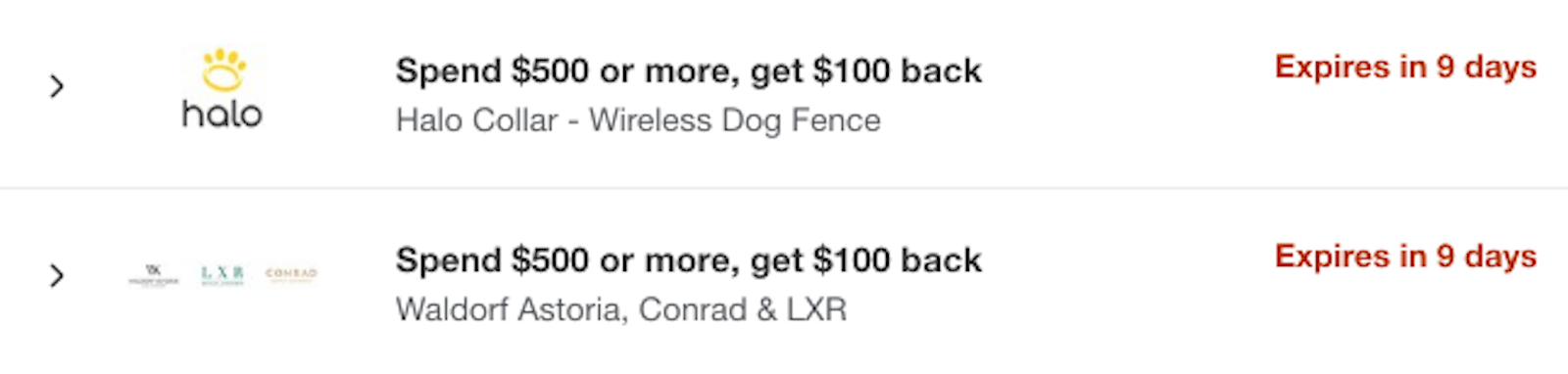

Amex Offers can be a great way to save money on purchases you were already planning to make, but just because something is on sale doesn't automatically make it a good deal. For instance, I would love to get 20% back on a stay at a fancy Waldorf Astoria hotel. On the flip side, I live in an apartment, so an offer for a wireless dog fence doesn't help me.

Amex Offers can be a great deal on their own, but you can double- or even triple-dip to get a much better return. You can use Amex Offers in addition to online shopping portals to earn extra cash back or bonus miles on your purchase.

You can also leverage credit card bonus categories to earn bonus points in addition to cash back.

However, as noted previously, the offer terms may state that additional stacking — such as through online portals and promo codes — could disqualify you from triggering the Amex Offer. So, read the terms carefully.

You can even stack Amex Offers with other Amex perks, such as the annual statement credits at Saks Fifth Avenue on the Platinum Card and Dell (for U.S. purchases) that come with the Platinum Card and The Business Platinum Card® from American Express , respectively.

Enrollment required for select benefits.

Related: 10 items you can buy with the Amex Business Platinum's $200 Dell credit for the new year

Bottom line