What is outbound tourism and why is it important?

Outbound tourism is an important type of tourism . Many countries rely heavily on travellers leaving their home country in search of an international tourism experience.

But what does it actually mean to be an outbound tourist? In this article I will explain what is meant by the term outbound tourism, provide definitions of outbound tourism and I will discuss the advantages and disadvantages of outbound tourism. Lastly, I will provide examples of destinations which have significantly sized outbound tourism markets.

What is outbound tourism?

Outbound tourism definitions, the advent of low cost travel, increased disposable income and leisure time, globalisation, the importance of outbound tourism, the growth of the chinese outbound tourism industry, positive impacts of outbound tourism, negative impacts of outbound tourism, the value of outbound tourism to the uk, outbound tourism: conclusion, further reading.

Outbound tourism is the act of travelling ‘out’ of your home country for the purposes of tourism.

Outbound tourism does not include the purchasing of good or services before or after the trip within the tourism generating country.

To learn more about what a ‘tourism generating country’ is, read my post about Leiper’s Tourism System .

The terms outbound tourism and inbound tourism are often used interchangeably.

This is because a tourist who is travelling internationally is both an outbound tourist (because they travel OUT of their home country) and an inbound tourist (because they travel IN to another country).

The only exception to this would be if a person was travelling on a multi-centre trip, for example a backpacker. This is because they are not necessarily travelling from their home country.

The most widely utilised definition of tourism , proposed by the World Trade Organisation (WTO) and United States (UN) Nations Statistics Division (1994), prescribes that in order to qualify as a tourist one must travel and remain in a place outside of their usual residential environment for not more than one consecutive year for leisure, business or other purposes.

When considering outbound tourism, it therefore makes sense to simply add in the prerequisite of leaving your home country country…

Based on this commonly accepted definition (although this is not without its limits- see this post for more details ), therefore, outbound tourism can be defined as:

‘The act of leaving your home country to travel internationally for not more than one consecutive year for leisure, business or other purposes.’

Some other organisations have also offered definitions for the term outbound tourism.

The European Union define outbound tourism as:

‘Visits by residents of a country outside that country’.

Similarly, Visit Britain state that outbound tourism is:

‘The activities of a resident visitor outside of their country of residence’.

The growth of outbound tourism

The outbound tourism market has grown considerably throughout the years.

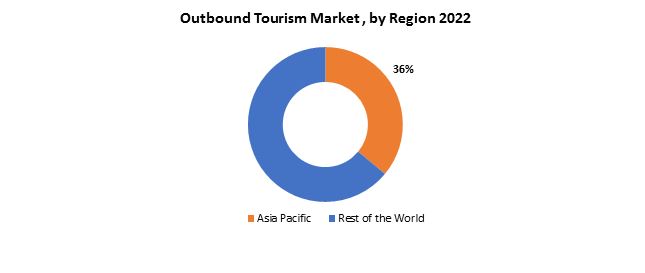

Of course, the outbound tourist market has grown at different rates in different parts of the world, but the reasons for this growth are largely the same.

Three of the biggest factors contributing to the growth of outbound tourism are: the advent of low cost travel, increases in disposable income and leisure time and globalisation.

The past two decades have seen significant developments in the history of tourism .

Increased competition within the marketplace and the introduction of low cost airlines has meant that more of us are able to travel more often.

In recent years the amount of disposable income that the average person has each year has increased. This means that people have more money to spend on international tourism .

People also have more leisure time than they used to. Paid holidays and increased flexibility as a result of flexi-time practices at work, means that people have more opportunities for international tourism than they did in the past.

Other posts that you might be interested in: – What is tourism? A definition of tourism – The history of tourism – The structure of the tourism industry – Stakeholders in tourism – Inbound tourism explained: What, why and where – What is ABTA and how does it work? – The economic impacts of tourism

More people want to experience outbound tourism nowadays than ever before. Globalisation has opened up many opportunities for us around the world.

Many destinations that were not previously accessible have opened up and subsequently developed their tourism industries.

Click here to learn more about globalisation and its impact on the tourism industry!

Outbound tourism is hugely important to many countries around the world. The OECD have a handy tool on their website which demonstrates the value of this tourism in different parts of the world.

Outbound tourism has many positive economic impacts that reaches further than just the tourism industry. Outbound tourism can help to enhance the economies of many countries by providing economic boosts in a range of sectors such as retail, healthcare and education.

Many countries, however, rely too much on outbound tourism. Should there be a reason that tourism declines, for example during the 2020 Coronavirus pandemic, a country’s economy could face dire consequences if they do not diversify their income.

A major recent development in the tourism industry is the growth of Chinese outbound tourism.

Today, China is the largest outbound tourism market in the world.

Chinese tourists spent more than $288billion on international travel in 2018, which equates to a whooping 25% of global tourism spend . It is predicted that Chinese tourists will take 160 million overseas trips by 2020.

This growth is largely attributed to rising incomes amongst Chinese workers and new freedoms allowed to the population . Many countries around the world now offer simpler and easy to obtain visas for Chinese citizens than they did in previous years.

This has resulted in a boom in Chinese outbound tourism. Whilst Chinese tourists travel all over the world, markets in Asian countries such as Thailand and Bali have seen particular increases in overall tourism numbers as a result.

Chinese tourists typically spend significantly more money when they travel than tourists from other countries. This means that the Chinese outbound tourism market is particularly welcomes in many destinations around the world.

Outbound tourism can be beneficial for both the traveller generating region and the tourist destination region .

In the tourist’s home country, outbound tourism can help to boost the economy. If tourists use a local operator to organise their travel arrangements, such as the national airline or a domestic travel agent, then some of the profits made will be retained in the home country.

When the tourist reaches their holiday destination there are many economic advantages to the host destination. The graph below by the Office of National Statistics (ONS) outlines the areas that profit the most from outbound tourism.

Foreign exchange income can be particularly beneficial in destinations where the currency is weak. Many destinations focus their marketing efforts in countries that have strong currencies, such as the UK, USA or Europe.

Another positive impact of outbound tourism is that income from tourism can be used to help boost the wider economy. Money can be reinvested in areas such as healthcare and education.

There are two major economic impacts that can have a negative effect on the destination.

The first is economic leakage in tourism . Outbound tourists often seek the familiar and may choose to spend their money in large chain organisations such as a Hilton Hotel or a McDonalds fast food restaurant. This causes money to be taken out of the tourist destination region, thus limiting the positive impacts from tourism.

The second is over dependence. If a destination relies too heavily on their outbound tourism industry, they could come into trouble should this be disrupted.

Disruptions to the tourism industry occur frequently around the world. Reasons include natural disasters, political unrest, economic instability and pandemics.

You can read about the economic impacts of tourism in more detail here.

According to the ONS, outbound tourism is a significant market in the UK, accounting for 1.8% of GDP.

The outbound tourism sector accounts for more than 221,000 jobs in the United Kingdom.

The economic contribution of UK outbound tourism equates to £37.1 billion.

The graph below indicates which destinations UK outbound tourists are choosing to travel to, with Spain being the most popular.

Outbound tourism is an important part of the structure of the tourism industry . Many countries rely heavily on outbound tourist markets and outbound tourism is a significant economic contributor. The outbound tourism market has grown and developed throughout the years, with the most significant and rapidly emerging market being the Chinese.

- An Introduction to Tourism : a comprehensive and authoritative introduction to all facets of tourism including: the history of tourism; factors influencing the tourism industry; tourism in developing countries; sustainable tourism; forecasting future trends.

- The Business of Tourism Management : an introduction to key aspects of tourism, and to the practice of managing a tourism business.

- Tourism Management: An Introduction : gives its reader a strong understanding of the dimensions of tourism, the industries of which it is comprised, the issues that affect its success, and the management of its impact on destination economies, environments and communities.

By: Bastian Herre , Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

Trends, Growth, and Opportunity Analysis of Outbound Tourism in the United States

In-depth Look at Demand Forecast for Outbound Tourism in the United States by Leisure Travel and Business Travel through 2034

Growing Desire Among the American Population to Indulge in Diverse Cultural Traditions Leading to Increase in Outbound Tourists from the United States

- Report Preview

- Request Methodology

United States Outbound Tourism Industry Snapshot

The demand for outbound tourism in the United States is expected to be valued at US$ 108.81 billion in 2024 and reach US$ 412.26 billion by 2034. Outbound tourism is expected to progress at an impressive CAGR of 14.2% through 2034.

Industry Outlook

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

United States Outbound Tourism Growth Analysis

- Tourists from the United States are increasingly flocking outbound not only to roam destinations but also to immerse themselves in the culture of the region. Thus, outbound tourism’s function is increasing in consumers’ eyes in the United States.

- The United States is recognized to be a melting pot of cultures and an increasing number of tourists in the country are traveling internationally to connect to their roots.

- Rising disposable income in the United States is enabling the population of the country to spend more money on outbound tourism activities.

- The United States passport is in the top 10 when it comes to passport rankings, allowing American tourists to travel to nearly every recognized country in the world. Thus, the ease factor is propelling the outbound tourism industry in the country.

- By highlighting previously little-explored locales around the world or showcasing popular destinations in a new light, social media is playing a key role in inducing wanderlust among the population of the United States and leading to growth in outbound tourism in the country.

United States Outbound Travel Trends

- Mexico remains the region that Americans travel to the most, with a survey by the National Travel and Tourism Office of the United States pegging the number at 33.5 million in 2022. The vibrant culture of the nation, along with party hotspots like Acapulco and Tijuana, is inducing more outbound tourism from the United States to the country.

- Increasing number of American patients are taking the plunge and traveling abroad for medical tourism . This trend is particularly evident in Americans traveling to Asian countries for local remedies not widely available in the United States, like Ayurveda treatments in India.

- Rise in pollution levels in the United States is seeing an increasing number of tourists in the country traveling abroad for escapism. Beaches in the Caribbean and jungle safaris in Africa are winning over tourists from the United States.

- Continuing expansion of American companies in the United States is seeing more international travel from the country for business purposes.

- Passionate sports culture in the United States is helping the outbound tourism industry in the country. A survey commissioned by Visit Anaheim that about 45% of American sports fans have traveled abroad to watch sports and 35% have planned international trips around the location of a sporting event.

- With remote work becoming more prominent among the American population, an increasing number of Americans are taking workcations, thus increasing the scope of outbound tourism from the United States.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Overview of Restrictive Factors for Outbound Tourism in the United States

Worsening geopolitical conditions and rising flight prices are factors restraining the growth of outbound tourism in the United States. Safety concern while traveling abroad is another factor impeding the growth of the industry.

Comparative View of Adjacent Industries

In addition to the United States outbound tourism industry, analysis has been done on two other related industries. The industries by name are the India outbound tourism industry and the Japan outbound tourism industry.

Government initiatives to facilitate more international travel are helping the growth of outbound tourism in India. Social media influence is also fueling the desire for international travel among Indians.

Rising disposable income in Japan is enabling more Japanese people to engage in outbound tourism. Japanese people’s propensity to make frequent trips to nearby nations like the Philippines and South Korea is also benefitting the outbound tourism industry in Japan.

United States Outbound Tourism Industry:

India Outbound Tourism Industry:

Japan Outbound Tourism Industry:

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Category-wise Insights

Leisure travel is the overwhelming reason for outbound travel among american consumers.

Leisure travel is anticipated to account for 45.0% of the industry share in 2024. Some of the reasons it is the top reason for outbound tourism are:

- Rising disposable income among the American youth is seeing the young generation of the country more inclined towards taking luxurious holidays. Thus, leisure-based abroad trips are getting more extensive among American tourists.

- Tourists are traveling abroad in the United States to immerse themselves entirely in the traditions of the locale they are visiting. Thus, the scope of leisure travel is increasing in the United States outbound tourism.

Families are the Predominant Configuration of Outbound Tourists from the United States

In 2024, families are expected to account for 44.3% of the industry share by tourist type. Some of the reasons families remain the predominant type of tourists are:

- Tourist companies in the United States advertising attractive packages for group travel are seeing tourist units comprised of families travel abroad more.

- Rising concerns with safety and comfort show that American consumers prefer taking trips with families over solo travel.

Competitive Landscape

Framing attractive packages and introducing discounts, offers, and more, is a common policy among players in the United States. Extensive trips spanning multiple countries are also being increasingly offered by these tour providers.

Butterfield & Robinson is one of the prominent players in the American outbound tourism landscape. The company is attracting consumers through its luxury tours. Other players are focused on partnerships and mergers to strengthen their position in the landscape.

Recent Developments

- In July 2023, Brand USA hosted its first sales mission in Japan.

- In 2019, LoungeBuddy, a platform that aims to ease access to lounges in airports, was acquired by American Express.

Key Coverage in the United States Outbound Tourism Industry Report

- USA Overseas Tourism Industry Analysis

- Growth Forecast of Traveling Abroad from the United States

- USA Tourist Spending Overseas Assessment

- USA Outbound Tourism Growth Report

- Demand in the USA Outbound Tourism Industry

- Industry Value of the USA Outbound Tourism

Scope of the Report

The united states outbound tourism industry by category, by purpose:.

- VFR & Others

By Booking Channel:

- Phone Booking

- Online Booking

- In Person Booking

By Tourism Type:

- Cultural & Heritage Tourism

- Medical Tourism

- Eco/Sustainable Tourism

- Sports Tourism

- Wellness Tourism & Others

By Tourist Type:

- Independent Traveller

- Package Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

Frequently Asked Questions

What is the estimated industry value for outbound tourism in the united states in 2024.

The United States outbound tourism demand value is estimated to be US$ 108.81 billion in 2024.

What is the Demand Forecast for Outbound Tourism Through 2034 in the United States?

Outbound tourism demand is expected to reach US$ 412.26 billion by the end of 2034 in the United States.

What is the United States Outlook for Outbound Tourism?

The United States is expected to register a CAGR of 14.2% over the forecast period.

What are the Key Trends for Outbound Tourism in the United States?

Undertaking tourist expeditions to escape worsening environmental conditions and the rising popularity of medical tourism are two of the trends related to outbound tourism in the United States.

What are the Prominent Companies for Outbound Tourism in the United States?

Butterfield & Robinson, Expedia Inc., Priceline Group, and America Express Global Business Travel are some of the prominent companies offering outbound tourism in The United States.

Table of Content

Recommendations

Travel and Tourism

India Outbound Tourism Market

October 2022

REP-GB-15747

Trends, Growth, and Opportunity Analysis of Outbound Tourism in Japan

November 2022

REP-GB-15775

October 2023

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Request Methodology -

- customize now -.

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Outbound tourism

- Living reference work entry

- First Online: 01 January 2015

- Cite this living reference work entry

- Peiyi Ding 3 &

- Shan Jiang 4

151 Accesses

1 Citations

Outbound tourism describes the phenomenon of residents traveling from one country to another (World Tourism Organization 1994 ). It does not comprise of goods and services acquired for or after the trip within the generating country. It may be contrasted with inbound, domestic, and border tourism . For example, from an Australian perspective, visitors from the United States are inbound tourists, while from the US standpoint, they are outbound tourists.

With rising levels of disposable income, however, many emerging economies have shown fast growth. In 2012, the world’s top five destinations were the United States, Spain , France , China , and Macao (China). Source markets are largely concentrated in the industrialized countries of Europe , the Americas , and Asia and the Pacific (UNWTO 2013 ). With regard to expenditure on outbound tourism, China has shown by far the fastest growth. With the 2012 surge, China leaped to first place (US$102 billion), overtaking both the longtime top spender Germany...

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Institutional subscriptions

Gholipour, F., and R. Tajaddini 2014 Cultural Dimensions and Outbound Tourism. Annals of Tourism Research 49:203-205.

Article Google Scholar

Pearce, D., and R. Butler 2010 Tourism Research: A 20-20 Vision. Oxford: Goodfellow.

Google Scholar

World Tourism Organization 1994 Recommendations on Tourism Statistics. New York: United Nations.

UNWTO 2013 UNWTO Tourism Highlights. Madrid: World Tourism Organization.

Download references

Author information

Authors and affiliations.

Tourism Confucius Institute, Gold Coast Campus, Griffith University, Parkland Dr., 4215, Southport, Australia

Capital Normal University, Beijing, China

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Peiyi Ding .

Editor information

Editors and affiliations.

School of Hospitality Leadership, University of Wisconsin-Stout, Menomonie, Wisconsin, USA

Jafar Jafari

School of Hotel and Tourism Management, The Hong Kong Polytechnic University, Hong Kong, Hong Kong SAR

Honggen Xiao

Rights and permissions

Reprints and permissions

Copyright information

© 2015 © Crown

About this entry

Cite this entry.

Ding, P., Jiang, S. (2015). Outbound tourism. In: Jafari, J., Xiao, H. (eds) Encyclopedia of Tourism. Springer, Cham. https://doi.org/10.1007/978-3-319-01669-6_139-1

Download citation

DOI : https://doi.org/10.1007/978-3-319-01669-6_139-1

Received : 20 April 2015

Accepted : 20 April 2015

Published : 29 September 2015

Publisher Name : Springer, Cham

Online ISBN : 978-3-319-01669-6

eBook Packages : Springer Reference Business and Management Reference Module Humanities and Social Sciences Reference Module Business, Economics and Social Sciences

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Market information

- What is the demand?

- Share this on:

What is the demand for outbound tourism on the European market?

Global outbound tourism continues to recover well, reaching 84% of pre-pandemic levels by the end of July 2023. Germany and the UK are the largest European markets, and demand for outbound travel from these markets is high. Africa and Asia are the most visited regions by Europeans, and Turkey is the most popular destination by some margin. Europeans want to enjoy a wide variety of travel experiences. These include culture, wellness, food tourism, nature tourism and ecotourism, walking and hiking, and community-based tourism (CBT). In developing destinations, Europeans often look for adventure tourism.

Contents of this page

- What makes Europe an interesting market to target?

- Which European markets offer the most opportunities for tourism suppliers in developing countries?

- Which tourism products from developing countries are most in demand in European markets?

1. What makes Europe an interesting market to target?

Europe is an interesting market to target because it is the largest outbound travel market. As the tourism sector continues its recovery, Europe and the Middle East are bouncing back most quickly. The industry expectation is that tourism will recover to 2019 levels by the end of 2024 or 2025, although this will vary from region to region. Challenges to the sector’s recovery include the state of the global economy and the impact of economic developments on personal travel budgets, as well as the ongoing war in Ukraine, which continues to create uncertainty. Longer term, sustainability remains a challenge as the sector strives to meet global net-zero commitments by 2050.

Current status of worldwide tourism after the pandemic

Tourism is proving to be a highly resilient global industry. The sector is on track for a full recovery, with arrivals reaching 84% of pre-pandemic levels between January and July 2023 and 90% in July 2023. Around 700 million tourists travelled internationally between January and July 2023. This is roughly 43% more than in the same months in 2022.

Table 1: Worldwide tourism arrivals in 2022 and Q1-Q2 2023 compared to 2019

Source: UNWTO

- The Middle East witnessed the strongest performance between January and July 2023. Arrivals were 20.3% higher than those reported for the same period in 2019. In Q1 2023, the region already saw a 15% increase in arrivals compared to the same quarter in 2019, making it the first to achieve pre-pandemic numbers in a full quarter.

- Arrivals to Europe reached 91% of pre-pandemic levels by the end of July 2023. Recovery was mostly driven by strong intra-regional demand: Europeans preferred to visit neighbouring European countries over long-haul destinations. The Southern Mediterranean region exceeded pre-pandemic levels by 1%.

- Africa also performed strongly, witnessing a return to 92% of pre-pandemic levels. The North Africa subregion in particular exceeded pre-pandemic levels in the first half of 2023 (+8%).

- The Central America subregion also performed strongly in the first seven months of 2023, exceeding pre-pandemic levels by 1.7%. The region was quicker to open up to international tourism following the pandemic, which stimulated faster growth.

- South America recovered to 89% of pre-pandemic levels, led by strong performers such as Colombia, where arrivals are already exceeding 2019 levels.

- Asia was the slowest growing region, recovering to 61% of pre-pandemic levels. Many countries in this region opened up more slowly – China did not reopen its borders to international tourism until March 2023. South Asia, however, enjoyed a stronger recovery (93%) than other Asian subregions.

By destination, several countries exceeded arrivals recorded between January and July 2019, with some even enjoying double-digit growth. Many of these high performers were European countries, including Albania (56%), Andorra (31%), Armenia (31%), Liechtenstein (19%), Serbia (17%), Montenegro (14%) and Iceland (13%). Outside Europe, many developing destinations also saw unprecedented growth in the first quarter of 2023. Arrivals in these countries were much higher than in 2019, as can be seen in the table below.

Figures from the International Air Transport Association also show a strong recovery post-pandemic. By the end of May 2023, global air traffic revenues had recovered to 96% of pre-pandemic levels . Passenger numbers were back at 88%.

Future projections and challenges

The state of global tourism mid-2023 is cause for optimism, and current projections indicate that recovery will continue. International tourism is expected to remain on track to recover to between 80% and 95% of pre-pandemic levels, depending on the region. There is also growing confidence that international tourism will fully recover – to pre-pandemic levels – by the end of 2024. However, this will also vary from region to region.

In October 2023, the International Monetary Fund (IMF) predicted that the global economy would grow by 3% in 2023, an increase of 0.2%. Growth is expected to be driven partly by increased travel after the pandemic, as well as by a strong jobs market and services sector. Still, challenges to this growth remain.

Downturns or slow growth in some of the world’s largest economies, including the US, Europe and China, may have a negative impact on tourism performance at a macro level. At a more local level, there are high consumer prices, high inflation and high interest rates, which continue to dent consumer confidence.

Driven by the war in Ukraine, which has pushed up prices, the cost-of-living crisis has affected many countries, including developed nations. The soaring costs of food and energy, along with high inflation rates, are negatively affecting consumer budgets. Other factors that are limiting growth are travel disruptions caused by staff shortages and industry disputes in the travel and transportation sector. These continue to play a role in several destinations.

Besides the war in Ukraine, there are other geopolitical tensions as well. The relationship between NATO and Russia is strained, for instance, as is the one between the US and China. These tensions could also threaten the recovery of the tourism industry. Safety and security are becoming more and more important as tourists actively assess any potential threats to their own personal safety while travelling.

- Stay up to date on global, regional and national issues that might have an impact on your local tourism sector. Having a good understanding of these issues will help you reassure your buyers if they have concerns. Be sure to take appropriate action to address issues if necessary.

- Use the CBI study How to manage risks in tourism to keep your risk management policy up to date. Although the pandemic is officially over, other risks remain.

Sustainability requirements

At a macro level, switching to sustainable business practices to fight climate change has never been more important. Net-zero targets have been adopted by 97 countries , including the EU’s 27 member states and the UK. At a micro level, tourists are increasingly concerned about their negative impact on the planet, people and places. Europeans are becoming more eco-conscious and expect tourism businesses to be sustainable. They also want to see evidence that their actions are not damaging the places they visit.

The EU Green Deal was launched in 2019 and involves a series of sustainability measures. The goal of these measures is to help Europe become the first climate-neutral continent by 2050. This will have an impact on European tour operators, who will have to meet certain sustainability standards. These standards will also apply to their partners, including local tour operators.

- To find out how to make your business sustainable, read the CBI study How to be a sustainable tourism business .

Analysis of outbound tourism volumes from Europe

Europe is the largest source market for outbound tourism, making it an interesting region to target. In 2019, there were 743.9 million international tourist arrivals from Europe (UNWTO). These accounted for just over one half (51%) of global outbound tourism (1.465 billion international arrivals).

By 2022, the share of international arrivals from Europe had risen to 62% of global outbound tourism, reaching 595 million (80% of the 2019 level). This share may decrease again as tourism returns to normal levels. Still, it remains a good indicator of the strength of the European market. Air passenger traffic also shows that Europe is recovering well from the pandemic. By Q3 2022, it had already recovered to 86% of the 2019 level.

Source: Eurostat

An analysis of travel data reveals that Europeans predominantly visit European destinations. Of 1.1 billion trips taken by European nationals in 2019, 96.3% were to European countries, according to Eurostat. This means that 33.8 million trips were taken to destinations outside Europe. These figures are not surprising. Most Europeans prefer short-haul destinations, and there are many neighbouring countries with excellent tourist attractions that are easily accessible and familiar to European nationals.

But many Europeans also like to explore the rest of the world. Before the pandemic, demand for travel to developing destinations was increasing, and exciting experiences, transformative travel and nature-based travel were becoming more and more popular. This means that there are lots of opportunities for local tour operators to reach this large outbound tourism market.

Asia and Africa are the most popular destinations for trips outside Europe, accounting for 44.3% and 35.1% of trips in 2019 respectively. Central and South America accounted for 16.2% of trips.

The most popular destinations for Europeans have remained the same for many years. Turkey, Egypt, Thailand and Morocco are the countries with the highest number of visitors from the key source markets. Turkey, Egypt and Morocco are medium-haul destinations. They are relatively easily accessible by Europeans from all over the continent and are well served by air, including by low cost carriers (LCCs). These destinations appeal to all kinds of visitors, from budget to luxury tourists.

Thailand is a long-haul destination, but it has drawn European nationals for many years. It offers world-class attractions and extraordinary natural environments, and has a reputation as a good value destination. Like Turkey, Egypt and Morocco, it also has a favourable, warm climate that appeals to Europeans.

In 2019, 33.5 million Europeans travelled to Turkey, making it the top destination by a wide margin. Egypt was the second most visited destination (8.4 million), followed by Thailand (7 million). Turkey was also quicker to recover after the pandemic, welcoming a significant number of visitors in both 2020 and 2021.

Further analysis of arrivals to top developing destinations from key source markets shows that tourists from different European countries prefer different destinations. For instance, the table below shows that in 2019:

- The top destinations for German holidaymakers were Turkey (5 million arrivals) and Egypt (1.7 million).

- British tourists preferred Turkey (2.5 million) and Thailand (1 million).

- French tourists mostly travelled to Morocco (2 million) and Turkey (0.9 million).

- Spanish tourists also preferred Morocco (0.9 million), as well as Mexico (0.4 million).

Language is clearly a factor when it comes to these preferences. Morocco has a high proportion of French speakers, while the national language of Mexico is Spanish. These factors are more fully explored in the section below, Which European markets offer the most opportunities for tourism suppliers in developing countries ?

Analysis of global and European value of tourism

International tourism expenditure was €1,335 billion in 2019 . After collapsing to roughly a third of the 2019 level in 2020, by 2022 expenditure had recovered to €979 billion, 69% of the pre-pandemic level. Europe accounted for the largest share of global spending in 2022, at 53%.

European countries are big spenders when it comes to outbound tourism. There are six major European markets in the top 15 countries by outbound expenditure, and Germany, the UK and France are the top spending markets after the US and China. Moreover, tourists from Germany, the UK and France spent almost as much in 2022 as they did in 2019, which shows that these markets are on track to make a full recovery.

Table 2: International tourism expenditure by top source markets, 2019 and 2022

Source: UNWTO; *ONS

Outside the top 15, Switzerland, Belgium and Norway are the biggest European outbound tourism spenders, making them interesting markets to target.

- Continue to monitor tourism recovery trends and patterns in your target markets. Google Trends and Looker Studio (previously Data Studio) have a range of free online tools for this. Google Trends shows the popularity of top Google search queries, while Looker Studio creates graphs, charts and tables to help visualise this data. CBI has created several Data Studio Dashboards to help you understand demand and recovery in the biggest outbound markets.

- Read the study How to forecast tourism demand with Google Trends & Data Studio? for more information, and watch the video on how to use the dashboard .

2. Which European markets offer the most opportunities for tourism suppliers in developing countries?

The European markets that offer the most opportunities for tourism suppliers in developing countries are Germany, the UK, Italy, France, the Netherlands and Spain. These are the largest outbound overnight tourism markets from Europe. Please note that the UK figures in the chart below also include day visitors.

Sources: UNWTO; OECD (Germany, 2021); ONS (UK)

Research conducted by CBI in 2022 indicates that these source markets have a high preference for travel to developing countries. It is also interesting to note that there was a greater intention to travel to developing countries in the next 12 months, particularly amongst British, Spanish, Italian and French nationals.

Table 3: Europeans’ travel plans in the next 12 months, 2022

Source: CBI

Germany has a population of 83 million, the largest of any European country. It also has the largest economy in Europe and the fourth largest in the world. Germans enjoy a high standard of living. Like most of Europe at the beginning of 2023, Germany was affected by high energy costs as a result of the war in Ukraine, and by rising inflation. These factors led to low consumer confidence, which affected consumer spending.

The German economy is strong, but there are still uncertainties about economic growth, consumer confidence and the longer-term outlook. (It should be noted that these uncertainties are not unique to Germany, but also exist in other European countries.) In September 2023, it was reported that the German economy had stagnated in Q2 2023 and was forecast to shrink by 0.4% for the year. Inflation is expected to fall to 6.4% in 2023 and to 2.8% in 2024. Looking ahead, the German economy is forecast to grow by 1.1% in 2024.

German outbound travel market

Germany is Europe’s largest outbound travel market. In 2019, German nationals made 99.5 million overnight trips. The market is also predicted to grow over the next 10 years. In 2022, Germany’s outbound tourism market was valued at US$95.3 billion , and it is projected to grow to US$241.4 billion by 2032. This represents a compound annual growth rate (CAGR) of 9.7% during the forecast period. Germans are keen travellers and Germany is likely to be one of the first European outbound tourism markets to recover fully from the pandemic.

In 2022, Reise Analyse reported that German nationals took 67.1 million holiday trips of 5+ nights . Of these trips, 73% were to international destinations (49.0 million), only slightly less than in 2019. 2022 was a record year for holiday travel expenditure, with German tourists spending €80.1 billion, €7 billion more than in 2019.

Figure 7: Volume of German holiday travel in 2022

Source: Reise Analyse

Germans like to travel to a variety of destinations, both domestically (27% of all trips) and internationally (73%). Europe is the top destination for German tourists (57%); long-haul destinations account for just 6%. Turkey is the most popular developing destination for German tourists, representing 7.9% of all outbound trips in 2022, a 1.6% increase on 2021. Turkey is conveniently located and well served by a range of scheduled, charter and LCC flights.

Egypt, Thailand, Morocco and South Africa are also popular with German tourists, although German arrivals to these destinations have not fully recovered yet. Before and (to some extent) after the pandemic, other popular destinations for German tourists have included Vietnam, Sri Lanka and Namibia. German is still spoken in in certain areas of Namibia, which adds to its appeal.

German travel behaviour

According to Reise Analyse, the average length of stay in 2022 was 12.6 days, slightly longer than in 2019 (12.4 days). Average spending per trip also increased, from €1,032 in 2019 to €1,194 in 2022. Additional research found that German tourists spent more than one third of their budget on accommodation (35.6%), more than any of the other source markets. This was followed by flights and other transport (23.9%). Activities accounted for 12.8% of German budgets, more than any other source market except France.

Germans like to book package holidays, more than other European tourists. In the past, they preferred to book directly with travel agents. However, they are increasingly booking their holidays online (49.6%, an increase of 5.6% percentage points). At the same time, face-to-face bookings are falling (36.1%, a decrease of 2.9% percentage points).

German characteristics and travel motivations

Germans are particularly motivated by a desire to experience nature. They enjoy beautiful scenery and wildlife, and going to the beach is a popular activity. They also like to stay active – walking/hiking and cycling are important pastimes. Culture is important to them as well, and visiting cities, shopping and enjoying local food and wine are key activities that appeal to German tourists.

Like many Europeans, German tourists care about sustainability, and they are increasingly looking to minimise their travel impact. Research conducted by the EU in 2021 found that amongst German tourists:

- 54% would choose to consume locally sourced products while on holiday.

- 47% would be prepared to pay to protect the natural environment.

- 45% planned to reduce waste while on holiday.

- 43% would travel to less visited destinations.

United Kingdom

The UK has a large population of 67.3 million, as well as the second largest European economy. Because the British economy is largely service-driven, it contracted more sharply during the pandemic. Although GDP grew by 4% in 2022, it has fallen since then, and the economy is expected to be weak in 2023 and 2024 . Inflation and interest rates remain higher than in many other European countries. This directly contributes to the current cost-of-living crisis, which in turn has a negative impact on consumer confidence.

British outbound travel market

The UK is the second largest outbound tourism market in Europe, and British tourists made more than 93 million outbound trips in 2019. Since the end of the pandemic, demand for travel has been very high. In 2022, British nationals took 71 million trips, 76% of the 2019 level. It is most likely that outbound tourism from the UK will recover in 2024 or later, depending on the state of the economy and the spending power of British tourists. An optimistic projection from 2022 suggested that outbound tourism would reach 86.9 million trips by 2024 .

The future outlook for outbound tourism from the UK is positive, despite economic difficulties. The UK’s outbound travel market was estimated to be worth US$76.7 billion in 2022 and is projected to reach US$175.2 billion by 2032, growing at a CAGR of 8.6% during the forecast period. However, continued economic uncertainties may affect tourism’s recovery. Affordability is now a major criterion for British tourists in deciding where to go on holiday. British tourists spent £62.3 billion abroad in 2019, and £58.5 billion in 2022 (94% of the 2019 level).

Britons are very keen tourists, and they travel to a diverse range of countries. Compared to the other key source markets, British tourists are most likely to visit developing destinations. Turkey has consistently been the most popular long-haul destination for British tourists for many years, followed by India. India and many African countries like Kenya and Tanzania are traditionally popular destinations for UK nationals, owing to historical ties.

The table below clearly shows that UK arrivals to developing destinations are beginning to recover. In 2022, arrivals to Turkey, Mexico, Nigeria and Egypt surpassed those in 2019, showing robust demand for overseas tourism from the UK.

Source: ONS

British travel behaviour

In 2022, British tourists stayed for an average of 8.7 nights while on holiday, 6.9 nights when travelling for business and 17.1 nights when visiting friends or relatives. In 2019, the average spend per holiday trip was £739, compared to £697 per business trip. By 2022, average expenditure had risen to £887 for a holiday trip and £1,070 for a business trip – an increase of 20% and 46% respectively.

Britons spend almost a third of their travel budget on flights and transport, over a quarter (28.3%) on accommodation and almost a fifth (19.8%) on food and drink. Tourists from the UK spend the least on accommodation compared to other source markets.

A 2022 study found that online travel agencies (OTAs) were the preferred booking method for British tourists (39%), followed by booking accommodation and flights separately (26%). Tour operator bookings accounted for 16%.

British characteristics and travel motivations

Travel is important to UK nationals and they are experienced overseas tourists. Visiting other countries allows them to escape their daily routine, recharge and have new experiences. While they like immersive experiences, hygiene, accessibility, convenience and safety are still important to them. British tourists also like to take part in activities, which is one of the top factors influencing their final decision. Common activities include visiting natural attractions and wildlife watching.

In 2023, Mintel conducted a study on British holiday intentions in the next 12 months. It found that:

- A summer beach holiday was the most popular planned holiday (47%).

- City breaks were the second most popular (45%).

- 35% were planning a family holiday.

- 23% intended to go on a cultural and historical sightseeing holiday.

British tourists are very sustainability minded. In a recent survey, 86% of British respondents stated that sustainability was important to them . Amongst the 18-24 age group, this figure rises to 95%; in the 65+ age group, it is 75%. Other research revealed that 32% of British travellers avoid flying altogether on account of environmental concerns, and 62% would use more sustainable forms of transport (such as trains) if they were cheaper. Busy destinations are avoided by 59%, who are more interested in travelling to lesser-known places.

All in all, sustainable destinations are more likely to attract British tourists.

Italy has a population of 60.2 million, the fifth largest in Europe. Its economy – the eighth largest in the world – grew by 3.9% in 2022, driven by domestic demand. This growth is expected to slow down in 2023, however, as a result of high inflation. Most Italians are well educated and enjoy a high standard of living. They tend to speak English to a good level, but appreciate information being made available in Italian.

Italian outbound travel market

Italian tourists made 34.7 million outbound trips in 2019. In 2021, they made 12.4 million outbound trips; this figure rose to 25.1 million in 2022, reaching around 72% of the 2019 level. By the end of May 2023, outbound travel was at 88% compared to 2022, suggesting that recovery in Italy may be slower than in other European countries. Some forecasters estimate that Italian tourism will not fully recover from the pandemic until 2025 , and business travel until 2027.

According to the Banco d’Italia, outbound tourists spent €26.0 billion in 2022 , just short of the €27.1 billion spent in 2019 (96%).

Domestic travel is very popular in Italy; outbound travel accounts for just 24% of tourism departures. Egypt, Turkey and Morocco are the most popular outbound developing destinations for Italian tourists. There was notable growth in departures to Turkey and Mexico in 2021.

Destinations popular with Italian tourists before the pandemic included Madagascar, Indonesia, Jordan, Vietnam and South Africa.

Italian travel behaviour

The average length of stay of Italian tourists has been increasing. In 2019, the average length of stay while on holiday was 8.3 days; by 2021, this had risen to 12.9 days. It is likely that Italians were keen to make the most of their travel time after the pandemic and opted for longer stays. The average spend per trip in 2022 was €909.63, a 16% increase from 2019 (€780.97). This could be the result of the increased length of stay.

Italians spend the largest share of their travel budget on accommodation and flights (30.6% and 27.1% respectively). Around 12.8% is spent on activities, the highest amongst the source markets along with France and Germany.

Italian tourists like to book trips well in advance, sometimes up to 11 months. They value recommendations from friends and family very highly (52%) and often use review sites (41%). In general, they like to do a lot of online research before making a decision. Italians are more likely to book their own travel arrangements using online platforms compared to other European countries and tend not to book package holidays.

Italians are tech savvy and spend a lot of time on social media.

Italian characteristics and travel motivations

Italians look for active, cultural holidays and prefer exploration to relaxation. They enjoy nature and like to spend time in the great outdoors, visiting natural attractions and experiencing wildlife. They are also very outgoing and like to eat out and socialise.

Italian tourists have the following characteristics:

- Older, wealthier Italians will travel at any time of the year.

- Italians like guided tours with Italian-speaking guides.

- Security, high-quality accommodation and good food are important to them.

- More than a quarter of Italians like to travel off-season.

While keen on sustainability, Italians are less sustainably minded than other European nations when they travel. However, as a nation of ‘foodies’, they do like to consume locally sourced produce while on holiday (42%). They also prefer to travel outside the main tourist season (27%), offering good opportunities to attract Italians in the low and shoulder seasons.

France has a population of 67.6 million people, the third largest in Europe. The French enjoy a high standard of living and above average wages within the European region. France’s economy is the third largest in Europe, after Germany and the UK. Despite the cost-of-living crisis and high inflation, which are affecting most countries in Europe, the French economy is expected to grow by 1% in 2023 and 1.2% in 2024 .

French outbound travel market

The French like to travel, making 30.4 million outbound trips in 2019 and 13.1 million in 2021. France’s outbound tourism expenditure is the third highest in Europe, after Germany and the UK, and in 2019 French tourists spent €56.7 billion overseas. The domestic leisure market proved resilient during the pandemic, and outbound travel is expected to recover in 2024 .

The outbound travel market is estimated at US$33.9 billion and projected to reach US$51.6 billion by 2032. This represents a CAGR of 4.3%.

Outside Europe, Africa is the most popular continent for French nationals to travel to. In 2019, Morocco was the most popular destination for French tourists, followed by Tunisia and Turkey. The table below shows that French tourism to most developing destinations still has some way to go before it reaches 2019 levels again. Before the pandemic, Malaysia, Sri Lanka, Chile, Colombia and Costa Rica were popular choices for French long-haul tourists. Countries with historical ties to France, like Senegal and Madagascar, are also favoured.

S ource: UNWTO

French travel behaviour

The average length of an outbound trip was 8.45 days in 2019; in 2021, this had fallen to 8.11 days. French tourists spend most of their travel budget on flights and transport (30.2%) and accommodation (29.5%). They also spend a comparatively large amount on food and drink (19.4%). Meanwhile, activities represent 13.1% of their expenditure, more than any other source market.

French tourists tend to start planning their trips around six months in advance, depending on the destination. They particularly value recommendations from friends and relatives (54%) and use websites to look at reviews and ratings from other tourists (29%). They are also keen users of traditional guidebooks alongside social media platforms. Generally, French tourists prefer to book directly with airlines and hotels (28%), and through online platforms (22%). If possible, they will use personal connections to book through a trusted source (26%).

French characteristics and travel motivations

French tourists are especially interested in the natural environment of a destination, and off-the-beaten-track destinations are becoming more popular. Local cultural offerings are also very important to them.

French people are known for their independent nature. Many French tourists like to make their own decisions and prefer to travel individually rather than as part of a group. The French can be very direct and straightforward in their communication, and they tend to speak less English than tourists from other European countries – if you can speak French to them, it will be appreciated. Reassurance about health and safety precautions are important for French holidaymakers.

French tourists are particularly interested in food, nature and scenery, and experiencing local culture. They like authenticity and immersive experiences. As an ageing country, the 55+ age group is set to be an important consumer group.

As a nation, France is especially concerned with sustainability, and French tourists are more likely to pay more for sustainable travel and accommodation than other Europeans. According to EU research, almost half of French people (48%) feel that sustainably certified accommodations are important . Individually, French tourists are increasingly choosing to travel less and stay longer. They may also look for alternative travel options, for instance taking the train instead of flying. French tourists have a number of strong preferences:

- Eat locally sourced products while on holiday (52%).

- Reduce waste while on holiday (45%).

- Know that more of their money directly benefits local communities (39%).

- Go on holiday outside the main tourist season (39%).

Netherlands

The Netherlands is a small but densely populated country of 17.5 million people. It is a wealthy, highly developed nation with a well-educated population. The Dutch economy is set for moderate growth in 2023 . The Netherlands is one of the most environmentally aware and sustainability-minded countries in Europe.

Dutch outbound travel market

Travel is extremely important to the Dutch – 85% of the population travel for personal reasons. In 2019, there were 22.0 million outbound trips from the Netherlands, which is an average of 1.3 trips per person and higher than the European average. The value of outbound tourism was €17.6 billion in 2019 and €7.5 billion in 2021, 60.4% below the level of 2019.

Recent outbound expenditure shows that Dutch people are increasingly keen to travel overseas again. In Q3 2022, outbound Dutch tourists spent more than €8.4 billion overseas , of which €1.4 billion was spent outside Europe. This represents an increase of 9% over the same period in 2019.

Turkey was the most popular destination for Dutch tourists in 2019, and demand for Turkish holidays showed strong growth in 2021. Morocco and Mexico were also popular destinations for Dutch tourists. Other notable destinations for Dutch tourists both before and after the pandemic include Malaysia, Vietnam, India and Colombia.

Dutch travel behaviour

According to Eurostat, the average length of stay of Dutch tourists abroad was 10.2 nights, and they spent €790 per trip. Dutch tourists are price conscious and look for good value. Like tourists from other European markets, the Dutch spend the majority of their travel budget on accommodation (30.2%) and flights and transport (28.2%). They also spend a relatively high proportion of their budget on food and drink (22.2%).

When planning a trip, the Dutch rely heavily on word of mouth from friends, colleagues and relatives (53%), and they use their own personal experiences to help shape their decisions (40%). As tech-savvy consumers, Dutch tourists also use websites like Tripadvisor to compare customer reviews and ratings, and to gather information.

Dutch characteristics and travel motivations

Nature and culture are important to Dutch tourists. They are also adventurous, seeking less crowded destinations with good sustainable credentials. Authentic experiences are important to them as well. They look for relaxation and the opportunity to get away from the stresses of everyday life by enjoying nature and outdoor activities.

Many Dutch people speak multiple languages to a good level, particularly English. They are interested in other cultures and are careful with their money, looking for good value. They are well organised when it comes to planning their holidays, often researching trips up to six months in advance. They are very comfortable using the internet to book their trips; few Dutch tourists use traditional travel agents to book their trips these days.

In general, the Dutch are very concerned about the environment, preferring to travel sustainably. The younger age groups show the strongest intention to change their travel behaviour. These changes include choosing alternative forms of transport to avoid flying and minimising their use of plastics to protect the environment. More and more Dutch people are becoming vegetarians (11% of the population) , particularly the younger generation aged 18-24. Destinations with good vegetarian cuisines will be popular choices for conscious consumers.

Figure 18: Importance of sustainability to Dutch tourists

Source: Visit Britain

Additional EU research found that Dutch tourists like to take practical action to travel sustainably, and that they aim to:

- Take holidays outside the main tourist season (45%).

- Eat locally sourced products while on holiday (44%).

- Reduce waste while on holiday (44%).

- Travel to less visited destinations (43%).

Spain has a large population of 47.2 million people and a well-diversified and resilient economy. It has the 14th largest economy in the world and the fourth largest in the EU. Although the Spanish economy grew by 5.5% in 2022, driven by public spending, it has yet to return to 2019 levels. Moreover, growth is expected to slow in 2023. This means that, like other European tourists, Spanish holidaymakers will be looking for good value experiences as the cost of living continues to influence spending behaviour.

Spanish outbound travel market

In 2019, Spain was the fifth largest outbound tourism market in the EU, with 19.8 million outbound trips. Most of these trips were to European destinations, the most popular being France, Portugal and Italy. Spanish outbound tourists spent a total of €27.7 billion in 2019.

Before the pandemic, Morocco was the most popular developing country for Spanish tourists by some margin, followed by Mexico. In 2021, there was a notable increase in departures to Mexico and Costa Rica from Spain. Both of these countries are Spanish speaking, and Latin America opened up more quickly to tourism than Asia.

Other destinations that appeal to Spanish tourists include Vietnam, Indonesia and India. South Africa is also a trending destination for Spanish holidaymakers, with arrivals in 2022 exceeding expectations by 60.2%.

Spanish travel behaviour

In 2019, Spanish tourists’ average length of stay was 7.2 days; by 2021, this had risen to 9.4 days. This most likely reflects a desire to travel again after the pandemic. It is also possible that Spanish tourists saved their holiday leave to go on longer trips. However, expenditure per day fell from US$123.9 in 2019 to US$92.4 per day in 2021. Spanish tourists spend more than half of their travel budget on accommodation (30.3%) and flights and transport (27.5%), in line with other European nations. However, they also spend more than one fifth of their budget on food and drink (20.5%), more than any other source market.

EU research shows that Spanish tourists value recommendations from friends and relatives, and that they use a variety of online websites to book their trips, including OTAs. Cultural offerings are the most important factor for them, closely followed by nature and price.

Many Spanish tourists book their holidays online, and they typically plan their trips abroad one to six months in advance, depending on the destination.

Spanish travel motivations

Beach destinations are the most popular amongst Spanish outbound tourists (37%), followed by rural/nature destinations (17%). They are also keen on taking part in religious activities, most likely because many Spanish people are Catholic and actively take part in religious festivals and ceremonies – more so than many other European nations. Food and drink experiences, CBT and ecotourism are also increasing in popularity amongst Spanish tourists. Other post-pandemic trends include taking big, once-in-a-life trips, and nomadic travel.

Value for money and authentic experiences with opportunities to interact with local people and cultures are also important factors for Spanish holidaymakers in choosing a destination. However, local cultural offerings (44%) and the natural environment (43%) are the most important factors.

Spanish tourists are amongst the most sustainably minded and proactively look to minimise their impact on destinations when they travel. They like to:

- Consume locally sourced products while on holiday (71%).

- Reduce waste while on holiday (68%).

- Take holidays outside the main tourist season (53%).

- Travel to less visited destinations (52%).

- Reduce water usage while on holiday (52%).

- Contribute to carbon-offsetting activities (52%).

- To find out more about European markets, do your own internet research. Many countries’ tourism organisations publish market profiles and consumer insights, including the UK , South Africa , and Australia . Although these organisations focus on inbound markets, they can still offer valuable information about tourists’ characteristics and motivations.

- Look for tourism research published by the EU. The Eurobarometer studies survey public opinion in the EU. The Flash Eurobarometer 499 – Attitudes of Europeans towards tourism was published in 2021.

- To keep up with relevant statistics, consult UNWTO and Eurostat’s tourism database . UNWTO has a tourism dashboard for statistics, but for more detailed data you will have to pay to get access to the e-library . Eurostat publishes many statistics that can be accessed for free.

3. Which tourism products from developing countries are most in demand in European markets?

The tourism products from developing countries that are most in demand in European markets are closely aligned with the adventure tourism segment. Adventure tourism is defined as tourism that includes at least two of the following three elements: a physical activity, the natural environment and cultural immersion. Developing countries offer some of the world’s most exciting and interesting adventure tourism opportunities, which Europeans are especially keen to take part in.

The most popular tourism products amongst European tourists are culture, wellness, food tourism, nature tourism and ecotourism, walking and hiking, and community-based tourism (CBT). All of these segments, which are profiled below, overlap or have links with adventure tourism, which is the primary segment for most developing countries.

Cultural tourism

Cultural tourism involves travel to experience and learn about the culture of a country or region. It includes both the tangible features (built heritage) and intangible features (such as music, local lifestyles, homestays and so on) of a destination’s history and heritage, culture, art, architecture and religion that have shaped its way of life.

Cultural tourism is perhaps the largest tourism niche in the world today, valued at up to US$1.1 trillion. It overlaps with many other niches, including CBT, visiting cities, religious tourism and food tourism. According to UNWTO, at least 40% of all tourists worldwide are cultural tourists. Cultural tourism is also set to grow, as tourists seek meaningful, immersive experiences and transformative and experiential tourism have become major trends.

The market for European cultural tourists is large as well, accounting for an estimated 40% of all European tourism. Tourists from Italy, France and the Netherlands are most interested in cultural tourism, while Germany has the largest European cultural tourism market. Cultural tourists have specific characteristics. They are typically well educated, tech savvy and affluent, and they are active and frequent travellers. They also tend to stay longer in a destination, spend more per day and enjoy interacting with local communities.

Figure 21: Enjoying cultural tourism in Machu Picchu, Peru

Source: Unsplash

The quality of a cultural tourism product depends to a large extent on the quality of local guides. They must be able to offer interesting and stimulating information, as well as an authentic and unique experience. Like all tourism products, cultural tourism must be developed based on sustainable, responsible and ethical principles. It must directly benefit local communities, while any negative impact on those communities, and on the environment and local culture, must be minimal.

The market for European buyers is very large. Most European tour operators, including Window to Travel and Nomade Aventure , offer cultural tourism – usually as part of a trip that also involves other forms of tourism. Culture is also a popular theme in tour operators’ advertising. There are specialist cultural tour operators as well, such as Martin Randall and Envoy Tours . Online travel agents (OTAs) such as Withlocals and Viator sell huge numbers of cultural products, ranging from short tours to full-day sightseeing excursions. Private guides, cooking classes, guided tours and skip-the-line tickets to major attractions are also popular.

- To find out how to attract European tourists, read the CBI study What are the opportunities on the European cultural tourism market ?

Wellness tourism

Wellness tourism is another significant niche that has shown particular resilience since the pandemic. Globally, people have been more interested in their own health and wellness, actively seeking ways to stay fit, both physically and mentally. Wellness encompasses many traditional activities, including yoga, meditation, spa treatments, hot springs tourism and eating healthy. However, ‘feel good’ activities like CBT, walking, cycling and swimming also contribute to wellness, so this is a broad category.

Besides North America, Europe is the largest market for wellness worldwide. European wellness tourists took almost 300 million wellness trips the year before the pandemic, and this market is expected to expand. It was valued at US$814.6 billion in 2023 , and over the next seven year it is predicted to grow at a CAGR of 12.4%.

There are two types of European wellness tourists: primary wellness tourists and secondary wellness tourists. Primary wellness tourists usually stay in all-inclusive wellness resorts that are typically luxurious and offer a full wellness package. Secondary wellness tourists are a much larger group, accounting for almost nine in 10 wellness trips, and 86% of total wellness expenditure. They engage in wellness activities as part of a bigger trip and are more interested in the cultural link between a destination and its unique local wellness remedies. This is the group that offers the best opportunities for local tour operators.

Germany, the UK and France are the most important source markets for wellness tourism. The Netherlands, Spain and Italy are other important markets. Germans are particularly experienced wellness travellers who value spending time in nature. British tourists focus on mental wellness and often choose yoga and meditation retreats for their wellness trips. French holidaymakers spend more than their counterparts from other European countries and will often travel further (if they can), favouring French-speaking countries like Madagascar.

There are many specialist wellness tourism providers in the European market, such as Healing Holidays and Wellnessurlaub . OTA platforms like Viator , GetYourGuide and Musement offer an enormous range of wellness trips, tours and experiences. Wellness products sold to European consumers must meet strict regulations around health, safety, cleanliness and qualified practitioners. These are key to ensuring the safety of wellness tourists and confidence in the skills and professionalism of local operators.

- To discover more about the European wellness tourism market, read the CBI study What are the opportunities on the European wellness tourism market ?

Food tourism

Food tourism is a very large and important tourism niche that has become more and more popular amongst outbound tourists. Estimates of its value vary from US$500 billion to US$1 trillion. It is a very diverse niche spanning many different things, such as food festivals, food museums, cooking classes, wine tastings and artisan producer visits. Through food, tourists can get a true sense of a destination’s culture, heritage and traditions. Local cuisines are often the main factor in choosing a destination.

Europeans who want to have immersive and authentic experiences often choose food experiences. This means that there are lots of opportunities for local operators to develop unique food tourism products and showcase their local cuisine. Food tourism also reaches many more people than just dedicated food tourists. It can also help stimulate year-round tourism by attracting tourists travelling out of season.

The European market is estimated to account for 35% of the food tourism niche. Holidaymakers from Spain are most likely to be food tourists (31%), followed by Italy (22%), France (20%) and Germany (18%). Food tourists spend roughly the same as other tourists during a trip (€1,547).

The European buyer market is a mix of tour operators for longer trips and OTAs for short food experiences. Tour operators like Original Travel and Essential Escapes usually include food experiences as part of a longer trip. There are also a small number of specialist food tour operators, such as Gourmet on Tour . OTAs are the most common platforms for short experiences. This group includes specialist platforms like Traveling Spoon and Eatwith , as well as larger activity-based OTAs like Viator .

- To find out more about the food tourism niche market, read the CBI study What are the opportunities on the European food tourism market ?.

Nature tourism and ecotourism

Nature tourism and ecotourism are closely related. Nature tourism involves travel for the purpose of enjoying natural areas and their biodiversity. Ecotourism involves environment-based experiences that are sustainable, low impact and help to protect or preserve local communities or natural environments. Demand for authentic and immersive experiences in natural surroundings is very high in the European market. This has been driven by the pandemic, which caused tourists to actively seek out less crowded destinations and natural environments.

The nature tourism niche is a significant segment. In 2018, global tourism to protected areas was valued at US$600 billion, while wildlife tourism was valued at US$343.6 billion. In line with sustainability trends, demand from Europeans for authentic, responsible nature trips is high. Germany has the largest market for nature tourists, followed by France and the Netherlands. Ecotourists are often prepared to pay more for experiences if they are meaningful and immersive.

Figure 22: Nature tourism and ecotourism in Costa Rica’s rainforests

Sustainability is an essential component in nature tourism and ecotourism. Taking a ‘ nature positive ’ approach to tourism development has been identified as crucial in the global effort to halt and reverse biodiversity loss by 2030 and build a better world. EU research from 2021 shows that Europeans want to behave sustainably when they travel, for instance by consuming locally sourced produce and reducing waste.

European tour operators usually offer a range of different experiences as part of nature packages, including trekking, cycling, wildlife safaris and birdwatching. Ecotourism experiences are often included in nature packages, but they can also be sourced directly (such as an ecolodge in the rainforest). Examples of European tour operators that specialise in nature tourism and ecotourism include Better Places , Far and Wild Travel and ASI Reisen .

- Do your own research on the nature tourism and ecotourism markets. The CBI studies What are the opportunities in the European market for nature tourism ? and What are the opportunities on the European ecotourism market ? are a good place to start.

Walking and hiking

Walking and hiking are popular all over the world, and they are directly linked to nature tourism and ecotourism. There are all kinds of walking and hiking opportunities, ranging from easy trails over gentle terrain to more challenging routes in more difficult conditions. Trips can last from a few hours to days or weeks, or longer. Walking and hiking tourism encompasses several specialist niche markets, including trekking, Nordic walking, hill and mountain walking, rock climbing and long-distance walking. Many hikers wants to discover remote destinations, immerse themselves in local cultures, and enjoy local cuisines en route.

Walking and hiking are amongst the most popular pastimes across Europe, attracting people of all ages. France has the largest hiking community in Europe – 54% of the population, or 38 million people, identify as hikers. In the UK, social media platforms are driving an increase in walking groups of people in their 20s and 30s. Research in 2018 found that 81% of UK millennials (born between 1980 and 1995, aged 27 to 42 today) would consider taking up hiking as a hobby. In Germany, Spain, Italy and the Netherlands, more and more people are taking to the trails every year.

Additional CBI research has shown that walking tourists usually stay longer at a destination, for an average of 12.6 nights. They also spend more, at €1,657 per trip. Walkers prefer to book their accommodation online, either on specialist platforms like Booking.com, or on platforms that combine services.

Almost half of all European tour operators are active in the walking and hiking niche (49.8%). Many operators specialise in walking holidays, such as Walks Worldwide (UK) and SNP Natuurreizen (Netherlands). Others include walking and hiking as themes within their portfolios. It is relatively easy to develop sustainable walking products that have minimal impact on the local environment and benefit local communities. They can also be less costly to implement.

- To find out more about the walking tourism niche, read the CBI study What are the opportunities for walking tourism from Europe ?

Community-based tourism

Community-based tourism (CBT) involves community-led tourism experiences where communities own, host and manage their own tourism programmes. Local communities benefit from this through economic empowerment and skills development. This form of tourism also inspires tourists and promotes cross-cultural understanding. CBT is a very popular tourism activity today, particularly amongst Europeans seeking authentic and immersive experiences. CBT is directly aligned with the growing demand for indigenous-led tourism experiences.

Sustainability is an essential component of CBT. This means that local CBT tour operators must offer sustainable products. As a result of the EU Green Deal, more and more European tour operators will only work with suppliers that are certified as sustainable. Travelife for Tour Operators , the Good Travel Seal and TourCert are the most widely recognised certification schemes by European buyers.