What are you looking for?

Wise vs revolut: which is better in 2024 [detailed & unbiased].

One of the top tips I can give you while travelling is to invest in a great travel card - trust me you won’t regret it!

There are plenty to choose from, but this guide is going to dive into the similarities and key differences between Wise and Revolut .

We started using Revolut back in 2016 on our backpacking trip around South America , and we’ve used Wise since early 2019 so we’ve got a few years of experience with both...

To give you a good idea of which travel card is most suited to you, I’m going to go through the pros and cons of each for both personal and business accounts.

So, let’s get stuck in…

Travellerspoint

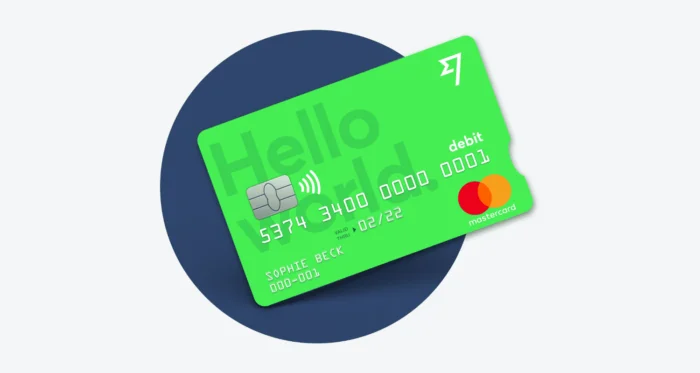

Great features of Wise for travel

First of all, let’s take a look at Wise and the features that benefit us travellers so much…

- Although not travel-specific, Wise is FREE to sign up for and there are no monthly fees

- You can hold money in 50+ currencies and convert between them for the real exchange rate

- With Wise, you can withdraw up to 200 GBP per month from international ATMs for FREE

- You can use the Wise debit card abroad like you would any other debit card

- You can freeze your card if it gets lost or stolen

- Low transfer fees

- Better exchange rate than many other platforms out there

- Wise is great for receiving payments in foreign currencies and then offering great exchange rates and low fees to convert to pounds

- Available in over 60 countries, and your card will be shipped out for you (for a fee)

- Wise offers virtual cards as well as plastic ones

Wise Business

Now, let’s take a look at the benefits of opening a Wise Business account !

Of course, this is tailored specifically towards individuals who are self-employed but if you’re a keen traveller and a digital nomad then it’s likely that you may fall under this bracket.

With a Wise Business account, you’ll have many benefits of business banking but without any hidden charges, monthly fees, or high rates.

So, what are these benefits?

Key Features of a Wise Business account

- International invoices can be paid in one click with a real (and live) exchange rate

- Charges regarding payments can be up to 19x cheaper than the likes of Paypal

- Quick payments - 50% of payments are instant or arrive within the hour

- You can easily make batch payments in just one click (up to 1,000 people)

- Money can be moved between currencies in seconds, avoiding high conversion fees

- Your Wise Business account can be connected with other platforms like Xero

The best part about having a Wise Business account is that they’re very affordable.

For those who are in the EEA or UK, there's one-off set-up fee of £45 (50 euros).

The price of this one-off fee will differ depending on where you're from (and where the business is registered), but typically you'll be paying between £16-£42. With some countries, it does cost more to verify your account so you may be charged a higher fee.

After that, you don't need to worry about any hidden or monthly fees which is a huge bonus, and you'll benefit from low transfer fees and high exchange rates.

Many business owners or freelancers tend to use the likes of PayPal, but as I’ve just mentioned transfers with Wise can save you a lot of money! Trust me, if you’re using PayPal the charges add up over the year…

However, Revolut has some fantastic features too so let’s take a look at them next...

Great features of Revolut for travel

Here’s a quick overview of the features that may convince you to choose Revolut as your next travel card…

- Revolut offers the best exchange rate possible

- Travel insurance is included with the paid plans (Premium, Metal, and Ultra plans)

- A clear account overview of all expenses

- Compatible with Google Pay and Apple Pay

- Offers an easy sharing bills feature

- You’ll be able to receive international payments

- Quick currency conversions

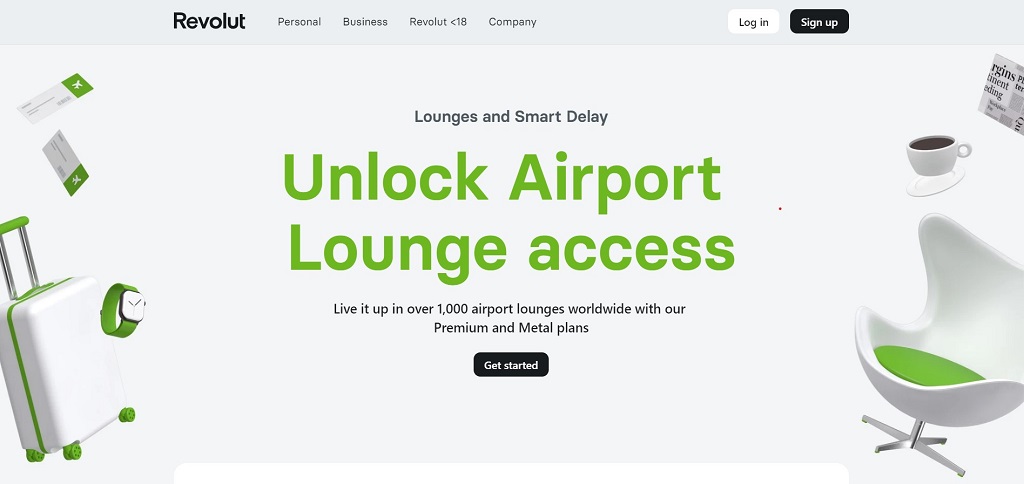

- Some of the paid plans offer FREE airport lounges and a concierge service

- No-fee ATM withdrawals

Additional Revolut features

- The opportunity to get involved with cryptocurrency trading

- A stock trading market

- You can make charitable donations

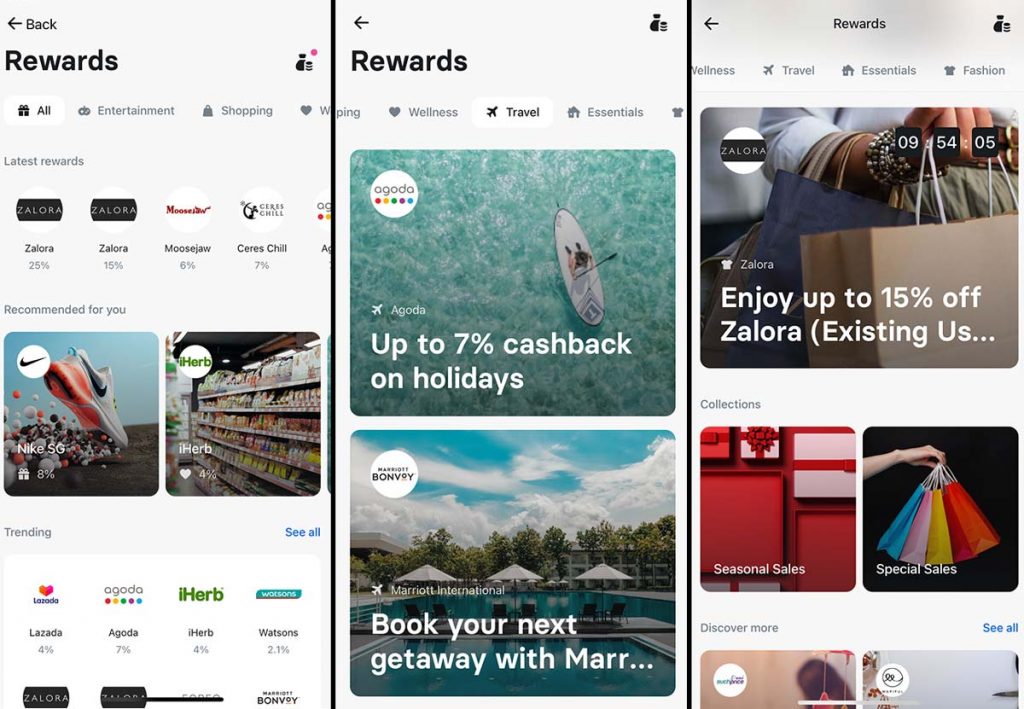

- With Revolut, you can receive cashback on specific purchases

Revolut Paid features

It’s important to note that Revolut has a wide variety of personal plans , and some of these aren’t free. Therefore, there will be several paid features that won’t be accessible on a free account.

Some of these ‘paid features’ include:

- Personalised Cards

- FREE card delivery

- 24/7 priority customer support

- Daily interest on USD savings

- Higher monthly withdrawal limits

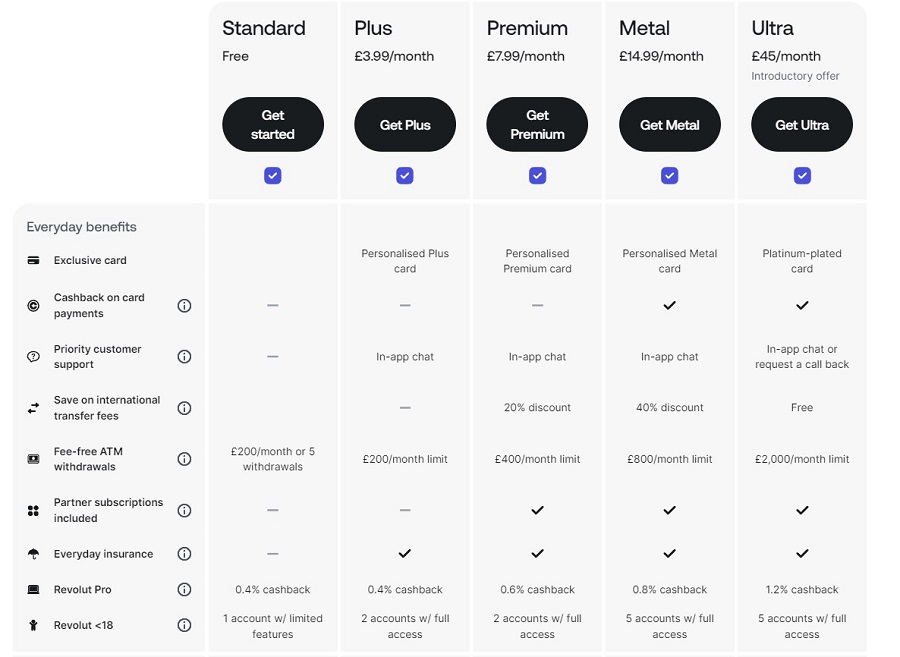

Comparing Revolut personal plans

As you can see there are a variety of personal plans to choose from, so to make things easier I’ve dropped a screenshot of the differences below…

For a more in-depth comparison, I’m going to dive into the Plus, Premium, Metal, and Ultra plans.

The Plus Plan - £3.99 per month

- Personalised Plus Card

- In-app priority customer support

- Two accounts for under 18s with full access

- Up to £1,000 purchase protection for a year on eligible items

- Refund protection that covers you for a full 90 days after purchases

- Ticketed events can be reimbursed up to £1000 if you can't make it due to a reason that's beyond your control (Insurance T&Cs apply)

- Earn up to 2.39% AER/Gross (variable) paid daily on your savings

- International transfers - money can be sent in 29+ currencies

The Premium Plan - £7.99 per month

- Unlimited foreign exchange Monday-Friday

- Up to £400 free international ATM withdrawals per month, and a 2% fee afterwards

- Full purchase protection

- Travel Insurance is included with your monthly fee

- 20% off fees on every international transfer

- Earn up to 3% AER/Gross (variable) paid daily on your savings

- 5 commission-free stock trades every month

- Perks Plus - discounts off top brands

- Benefit from an additional virtual card to help against fraud

- Up to 5% cashback on accommodation

- Access to airport lounges at discounted rates

The Metal Plan - £14.99 per month

All the standard benefits plus…

- Up to £800 free international ATM withdrawals per month, and a 2% fee afterwards

- Earn up to 4% AER/Gross (variable) paid daily on your savings

- 10 commission-free stock trades every month

- 40% off fees on every international transfer

- Up to 10% cashback on accommodation

- Cashback on card payments (up to 0.1% on transactions in Europe and UK, and 1% elsewhere)

- Personal Liability Insurance up to £1 million

- Five accounts for under 18s with full access

The Ultra Plan - £45 per month (the plan I am on!)

With Ultra you get some extra benefits...

- Up to £2000 free international ATM withdrawals per month, and a 2% fee afterwards

- Free International Transfers

- Earn up to 4.75% AER/Gross (variable) paid daily on your savings

- Trip and event cancellation insurance

- Perks worth £4,000+ in annual benefits

- Unlimited lounge access

- Platinum-plated card

- Subscriptions for Sleep Cycle, Headspace, NordVPN, and Picsart

- Can request a call back when it comes to priority customer support

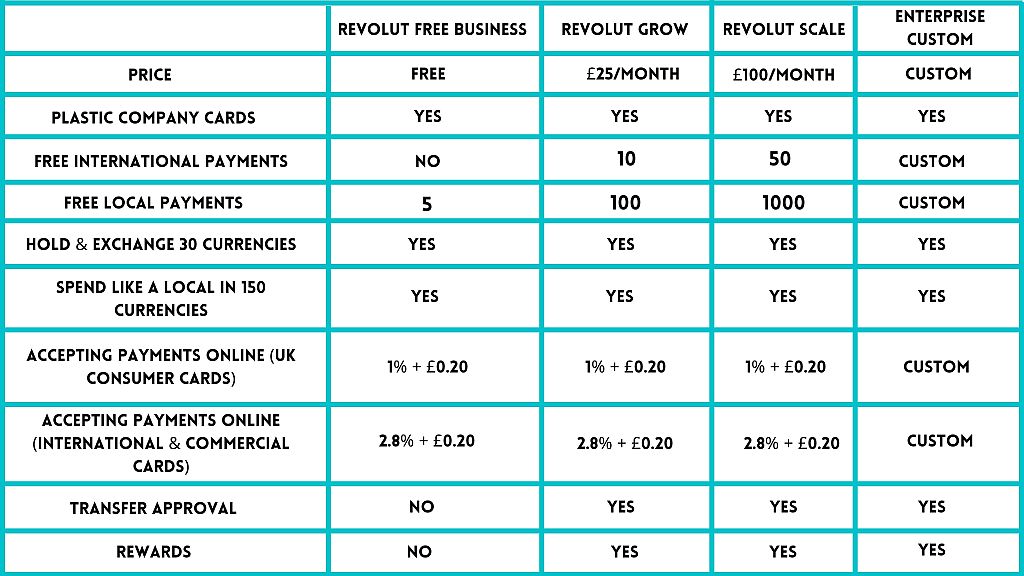

Revolut Business Accounts

Likewise, Revolut also offers business accounts if you’re self-employed or you’re a business owner.

We’ve used Revolut Business since 2021, as we wanted to make sure that we were losing as little as possible on fees once our business started to scale more!

Unlike Wise, Revolut has a variety of business accounts available and some of them are paid accounts.

Comparing Revolut Business Accounts

As well as the benefits included with personal plans, you’ll also get extra if you’ve got a business and opt for a business plan.

There are four types of Revolut business plans and honestly, which one you should choose will all depend on how big your business is, how much money you’re making, and how many international payments you’ll need to make.

Here’s a quick breakdown of the differences between each business plan…

You can find out some of the other differences between Revolut business accounts through their account pricing plans .

What’s great about purchasing a Revolut Business plan is that they’ve evolved their accounts so that you can now receive domestic USD and EURO payments.

Before this, businesses would pay into my Wise account if the payment was in dollars or euros and then I’d have to exchange the currency over to my GBP account in Revolut Business.

Luckily, the process is now much smoother. Now, I can get paid directly from business to the domestic USD & EURO accounts in Revolut Business. This helps you avoid any intermediary fees, although there is a limit on how much you can exchange for free.

You’ll find a couple of other fantastic reasons to upgrade your Revolut Business plan, but this is generally the key reason to do so and the main differentiator in their pricing structure!

If you need to exchange more than, say £10K a month, you can then upgrade your business plan further but just make sure that it makes financial sense to do so first.

Revolut Pro

This platform have also introduced Revolut Pro, an account which is tailored towards freelancers and those with a side hustle. Although relatively new, it's already a great option as there are some brilliant benefits. These include:

- The ability to create, track, and send invoices in seconds

- You can accept in-person payments with Revoluts card reader (transaction fees are 1.5%).

- You can create a QR code or payment link for customers to pay you (transactions fees are 2.5%)

- This account also allows you to receive payments via Apple Pay and digital wallets

- You'll earn cashback on payments used with the Revolut Pro card

- You can make and receive payments in 36 different currencies at an excellent exchange rate

- It's free to open, as you can sign up for standard Revolut account and then set up Revolut Pro through there

What are the key differences between Wise and Revolut?

Now, this is what you’ve all been waiting for…

There are several key differences between Wise and Revolut , so to make this section easier I’m going to split it up into personal accounts and business accounts.

Then later, I’ll dive into the important differences between the companies in more depth…

Comparing Wise personal accounts Vs Revolut personal account

As you can see there are plenty of differences between Wise and Revolut, especially when it comes to personal accounts.

Although Wise and Revolut both offer free plans, Revolut’s paid personal plans offer a lot more flexibility in terms of monthly withdrawals and other features.

However, Wise operates in more countries and you can hold and exchange up to 50 currencies, which is a much higher amount than Revolut.

We’ll dive into a more in-depth comparison of the key differences between the two later on…

Comparing Wise business accounts Vs Revolut business accounts

Although you may not have thought about using Wise or Revolut for a business bank account, both have a lot to offer.

Overall, from a business standpoint, we currently still have both, as there is some nice cohesion there between the two!

However, I’ve definitely started to cut Wise out more and more since the introduction of those domestic USD & EURO accounts with Revolut.

Although that’s the case for me, Wise still stands out greatly in its sheer quantity of different currencies in order to receive payments, which makes its (relatively modest) fees definitely worth the convenience!

Especially as this allows us to cut out PayPal 99% of the time, which is a nightmare when it comes to fees…

Revolut Vs Wise: A breakdown of the key differences…

Both Wise and Revolut have fantastic features, but it’s always important to compare them to see which one comes out on top!

So, let’s take a look at some of the most important features when it comes to travel cards…

1. Withdrawing money from ATMs whilst abroad

Now, this is arguably one of the most important features that a travel card needs to have!

If you’re not careful then withdrawing money from ATMs abroad can cost you a lot in fees, especially in Asian countries such as Thailand.

Both Wise and the Revolut Free accounts allow you to withdraw up to £200 per month at ATMs without fees. However, the paid personal plans with Revolut allow you to withdraw up to £2,000 a month which is a much larger amount (you can withdraw this amount with the Ultra Plan which is what we have).

If you don’t want to pay for this luxury, then you can have a card with both Revolut and Wise, and then this will allow you to withdraw up to £400 without fees.

Due to the monthly limits, Revolut wins this hands down…

2. Foreign currency fees

If you’re planning to receive large foreign payments, then it’s always best to invest in a travel card that will help you save on fees! At the start, we used PayPal and I think we lost around 8-10% of the actual GBP value of our payments which is CRAZY.

After we signed up for Wise in early 2019, we saved so much money due to the great exchange rates and low fees when converting to GBP.

However, after TransferWise was rebranded to Wise in 2022, I’ve found that their fees have increased and they’re not as cheap as they once were!

In fact, we now save more money through Revolut which is the clear winner in this regard !

3. Number of currencies the accounts can hold

Wise is the clear winner when it comes to the number of currencies available!

This is another important factor to think about, especially if you’re a digital nomad or long-term traveller who likes to move around a lot.

Wise allows you to receive and send money abroad from over 50 currencies in total, although some of these transfers can only occur via local transfer.

There’s a full list of currencies on Wise’s website if you’re looking for more information…

Whereas, Revolut allows you to send and receive money from 25+ currencies, which is much lower.

So, if you pick Wise you can hold and exchange over 50 currencies, whilst this is restricted to around 25 with Revolut.

4. Replacing lost cards

One of the best things about using Wise and Revolut is that they both allow you to ‘freeze’ your card if you misplace it or it’s been stolen.

It’s an easy process with both companies as you simply have to head into your account and then go to your ‘manage card’ section.

Both companies will charge you a fee to replace the card of £5. However, if you’re located outside the UK expect to pay a lot more!

Depending on where you live, international delivery can cost upwards of £17.99.

Both Wise and Revolut come out on top for this one so there are no winners…

5. Transfer Fees

Both Wise and Revolut are known for having low transfer fees , especially compared to traditional banks and other platforms such as Paypal.

However, it’s Revolut that takes first place when it comes to fees!

If you’re transferring money to other countries in Europe you won’t encounter any fees, although for international transfers there will be a fee on every transfer - unless you opt for a paid business account.

It’s often a fixed fee which makes it better than Wise’s variable transfer fees , as they are always changing based on market fluctuations.

Wise do have some fixed transfer fees, but even then Revolut offers more bang for your buck. This makes them the best option if you're sending money abroad!

6. Locations where you can open an account

Another key thing to think about when deciding on a travel card is, of course, your location.

Although a company may offer great rates on international money transfers and market exchange rates, it’s useless if it’s not available in your country of origin.

Revolut is only suitable for citizens of the European Economic Area (EEA), the UK, Australia, New Zealand, Singapore, Japan, Brazil, Switzerland, and the United States.

Whereas Wise is available in over 60 countries at the minute. Due to its widespread availability, Wise is the clear winner here, but just make sure your country is included before downloading the app.

These are just a couple of the key differences between Wise and Revolut, so let’s take a look at some of the differences (and similarities) that aren’t travel related…

Other differences between Wise and Revolut that aren’t travel-related

1. User-friendliness

Here’s another key factor to consider when choosing between Wise and Revolut. Whilst abroad, you’re going to want a travel card that’s easy to use!

We’ve been using our standard personal Revolut account since we began travelling in 2016, and throughout the years we’ve watched the app evolve for a better customer experience.

Even though the app has been easy to use from the get-go, today, it’s much more functional. However, Wise is also very easy to use although its app isn’t as popular as the desktop version.

Both of these companies offer a user-friendly experience, although it’s Revolut that has to take the top spot due to the popularity of its app!

2. Customer Support

Customer support is one of the most important factors to consider when choosing a travel card!

Wise is known to offer fantastic customer service with an online help centre and a support team that can be contacted via email, Facebook messenger, phone, Twitter, and Whatsapp.

The one thing to be aware of with the Revolut personal plans is that although you’ll have access to customer support, only the paid plans will have access to 24/7 priority customer support.

The Revolut app offers 24-hour customer service anyway so there will always be someone available if you’re encountering any problems, but the response time will often differ depending on your plan - hence ‘priority support’.

Even with this, Revolut is the winner because they have several live chat options and you can easily talk to the customer service team.

3. Reputation

With a rating of 4.4 on the Google Play Store and 4.9 on the Apple Store, the Revolut app has plenty of excellent reviews. The Revolut Business app also has a rating of 4.6 and 4.8 respectively.

In terms of positive reviews, people have commented on the convenience of virtual cards, being able to split bills, and the wide variety of features.

However, people have left negative reviews regarding problems with customer support, and higher rates on weekends.

Wise has a rating of 4.7 on the Google Play Store and 4.5 on the Apple Store. These ratings are similar to Revolut, and there are plenty of positive reviews regarding smooth transfers and an easy-to-use design.

However, negative reviews have been left regarding the increased transaction fees, app malfunctions, and lack of customer support.

There seems to be pros and cons to both, although Revolut has the higher ratings!

4. Additional Features

In terms of additional features, this is another win that goes to Revolut.

Although Wise has plenty to offer in terms of transfers, banking, and helping to avoid fees, you won't find many other features on this platform.

Revolut, however, has plenty of awesome additional features including stocks, shares, and cryptocurrency. I’ve actually had a play around with these, and they’ve got much better since they’ve been rolled out.

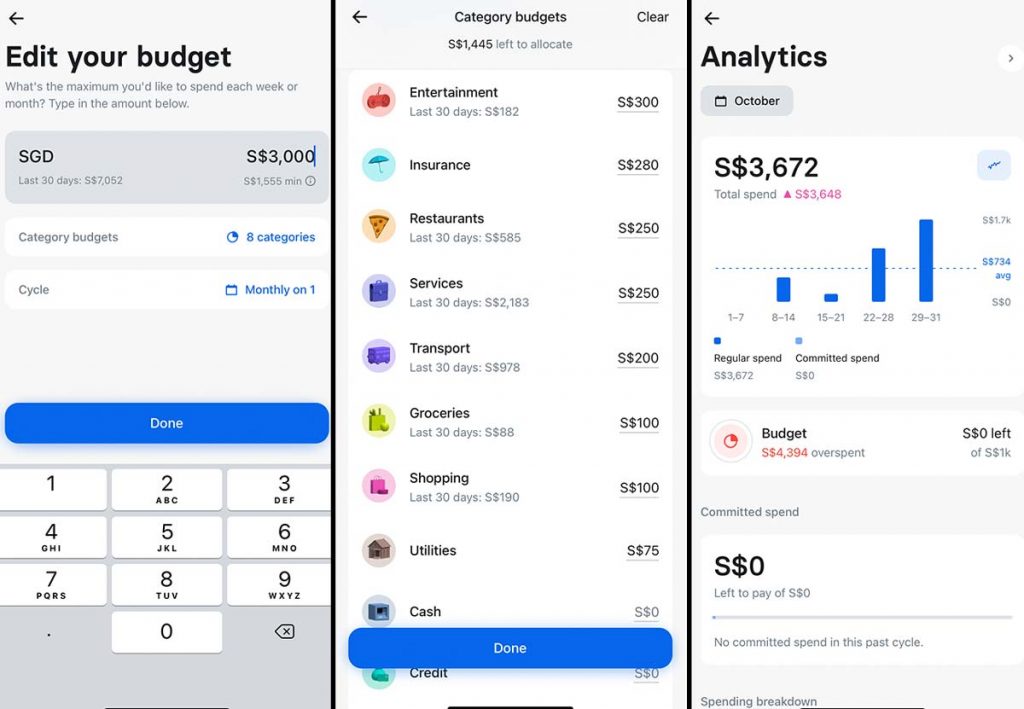

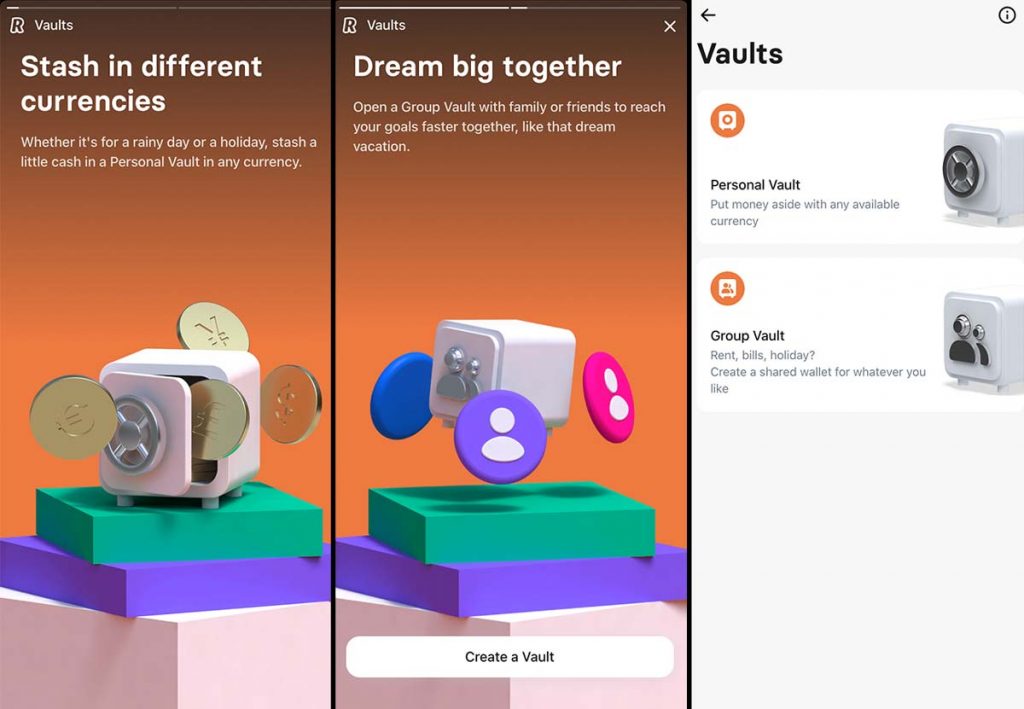

Not only that, but Revolut allows you the ability to set budgets, receive cashback when purchasing certain products, and use ‘saving vaults’.

That’s just a few of the additional features that they offer, and more can be found on their website!

Overall verdict: Wise Vs Revolut - which one is better for travel?

As you can see, Revolut seems to take first place in terms of both travel features and other differences such as user-friendliness and customer support.

Although Wise has plenty to offer regarding availability and currencies, it’s Revolut that stands out to me!

If you’re looking to pay for a personal plan, then Revolut has a lot more to offer than Wise in terms of both banking and travel advantages.

Not only will you benefit from better exchange rates, cheaper transfer fees, and a user-friendly app, but some of their plans offer a free concierge service, airport lounge passes, and travel insurance perks.

You won’t find many other travel cards that offer these kinds of perks, and Wise definitely doesn’t offer anything of the sort either.

Revolut also offers a variety of business accounts, and you can choose your plan accordingly based on the features and what's on offer. Whereas Wise just has the free business account so you won’t have access to as many great benefits.

Another fantastic thing about Revolut is that they offer the ‘pay feature’ which we’ve used a few times to receive payments from brands that don’t want to (or know how to) do an international bank transfer.

This is incredibly handy for brands or companies who’d rather pay for something from us using a traditional credit card payment.

We now have the Ultra Plan and although it's the most expensive paid personal plan, it's certainly worth the price in our opinion as it comes with a ton of awesome perks!

However, Wise has proved very useful on a personal level when it comes to direct debits! For example, during our travels in Canada and America, we were able to set up direct debits for gym memberships and other things.

It is also still a key part of our business when it comes to receiving foreign payments. That being said, now that we have a paid Revolut business account, the markup fees they charge are actually less than Wise's newer, slightly higher commission structure.

As you can see, both these companies have a lot to offer but for me, Revolut easily takes first place! They offer a better user experience, and even with the free personal and business accounts, you’ll benefit from a lot more features.

Not only that, but the Revolut exchange rate is just typically better!

For more information, you can check out our in-depth Revolut guide ...

Advice for new users

If you’re planning a trip and you’re not sure which app to download , then I’d recommend going with Revolut .

Whether you stick with their FREE account or you upgrade is totally up to you, but either way, you’ll get access to a ton of awesome features.

However, for the best experience, it may be a good idea to download both Wise and Revolut so you can have a card from each one.

This will allow you to withdraw two lots of money from an ATM so you can avoid fees! Not only that, but you won’t truly know which one will work better for you without trying it yourself…

The future of Wise and Revolut

Although Revolut tips the scale for us, it’s important to state that both of these providers are fantastic in allowing you to handle your finances.

Everyone’s preference is different when it comes to travel cards, and you must make the decision based on what’s best for you rather than just going off our opinion!

At the time of writing, we believe Revolut has more to offer in terms of additional features but this may change in the future…

Companies are always keeping an eye on their competitors, and you might find that to even the playing field, Wise may introduce some more features in the next couple of years.

How to sign up for Wise and Revolut

Signing up for Wise or Revolut is extremely easy! The first step is downloading the app for each one…

- Find Wise here

- Find Revolut here

From there, you’ll need to enter some basic details like your name, birthday, email address, and home address.

After you’ve signed up you can then request for your card to be sent out to you. Although this will only take a few working days in the UK, you’ll need to allow 2-3 weeks if you live abroad.

Other travel cards to try

This guide is focused on highlighting the differences and similarities between Wise and Revolut, however, there are a couple of other fantastic travel cards out there.

Here are two of the other companies that we’ve tried…

Monzo is one of the stand-out travel cards on the market with fantastic exchange rates, the ability to apply for an overdraft, and the fact that the cards are compatible with Apple and Google Pay.

We always keep both Monzo and Revolut cards on us, and to be honest there’s no real difference between the two if your sole purpose is to spend abroad and draw out money.

Both have £200 limits on ATM withdrawals (although Monzo has a 3% surcharge fee beyond that), so having one of each allows us to withdraw money with both and avoid charges.

If you want to find out more then you can check out our Monzo Vs Revolut review …

2. Starling Bank

With Starling Bank , you'll have access to 24/7 customer support, be covered by the FSCS, and you can sign up digitally in minutes.

That being said, in all honesty, we’ve never been a big fan of Starling Bank compared to our favourites; Monzo and Revolut.

They don’t offer a ton of additional features, and we found the exchange rate to be slightly worse than some of the other travel cards we’ve used.

We got a card with them because they didn't have a cap on free monthly withdrawals, which is a huge bonus but this bank just didn't work for us.

However, some people really love Starling Bank so it's all about preference I guess!

Wise Vs Revolut? Which one takes the top spot for you…

Choosing the perfect travel card isn’t an easy task when you’ve got to consider their money transfer services, currency exchange rates, and other fees.

I hope this guide has given you a detailed comparison of Revolut and Wise (or TransferWise as it was previously known), and what each one has to offer.

Companies are constantly upgrading their features too, so I’d recommend checking the websites yourself to see which travel card is most suited to you!

Here are some other guides that you may find helpful if you’re planning a trip:

- The Best Vacation Rental Sites

- In-depth SafetyWing Review

- Ultimate Travel Packing List

Leave a comment

Let us know what you think.

5 million people can't be wrong

- Destinations

- Travel Tips

- Travel With Us

- Paid Travel Internship

- TTIFridays (Community Events)

- SG Travel Insider (Telegram Grp)

Revolut Review —Travelling For 10 Months with Only One Multi-currency Card For Money

This Revolut Review took many months to test. Download Revolut here — Apple Store or Google Play .

It’s been a while since we travelled, so when we were selected by Airbnb to Live Anywhere around the world for 10 months, we immediately got down to planning for a long trip.

Read also : Guide to Singapore’s Vaccinated Travel Lanes

One of the challenges we faced was figuring our cash situation. Do we bring 10 months’ worth of cash? Or just suck it up and pay hefty surcharges at ATMs overseas — not to mention unfavourable rates 🙁

Setting up local bank accounts in different destinations would also be too much of a hassle.

So when Revolut reached out and asked us to review their product, we thought it was the perfect opportunity to put its different functions to the test.

For our 10 month trip, it was the only financial card we brought along.

We’re not financial experts, but we tried our best to test the card in every situation common to a traveller — both long and short term travel. Hope you find this Revolut review useful!

Note: This Revolut Review is for Singapore Residents only. There are different product features for different markets around the world.

Disclosure : While the writer was provided with a spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

But first, what is Revolut?

Revolut is a financial super-app that is best known for its multi-currency wallet and remittance services amongst frequent travellers and expats.

Credit cards typically charge too much for currency exchange so multi-currency wallets/cards like Revolut makes it a lot more affordable and convenient to pay overseas. In fact, their exchange rates are usually very close to that of Google and often better than a physical money changer in Singapore!

Revolut also allows you to hold multiple currencies in your account, letting you lock in favourable exchange rates ahead of time.

Revolut Review: How Revolut works

Revolut works like a supercharged multi-currency pre-paid debit card, with plenty of security and lifestyle features that make it attractive to use overseas.

Picking a Revolut plan to suit your needs

Revolut is free to use, but you can get more features and benefits with their paid subscriptions. There are three Revolut cards with monthly subscription plans . Here’s a quick summary:

We’re on the Metal Plan and the card looks and feels gorgeous. It also gives us a higher limit for ATM withdrawals, lower currency exchange fees, priority customer support, insurance, and LoungeKey Pass access. The Metal Card also offers 1% cashback on overseas spending .

While a free card will be suitable for most of our travels, the metal plan is super useful for long-term travelling or overseas living.

Using Revolut for cashless transactions

Revolut works like a debit card, and can be used anywhere that accepts Visa or Mastercard . The difference with traditional debit/credit cards is that it uses real exchange rate without any markup.

Read also : Multi-currency Cards vs Miles Credit Cards

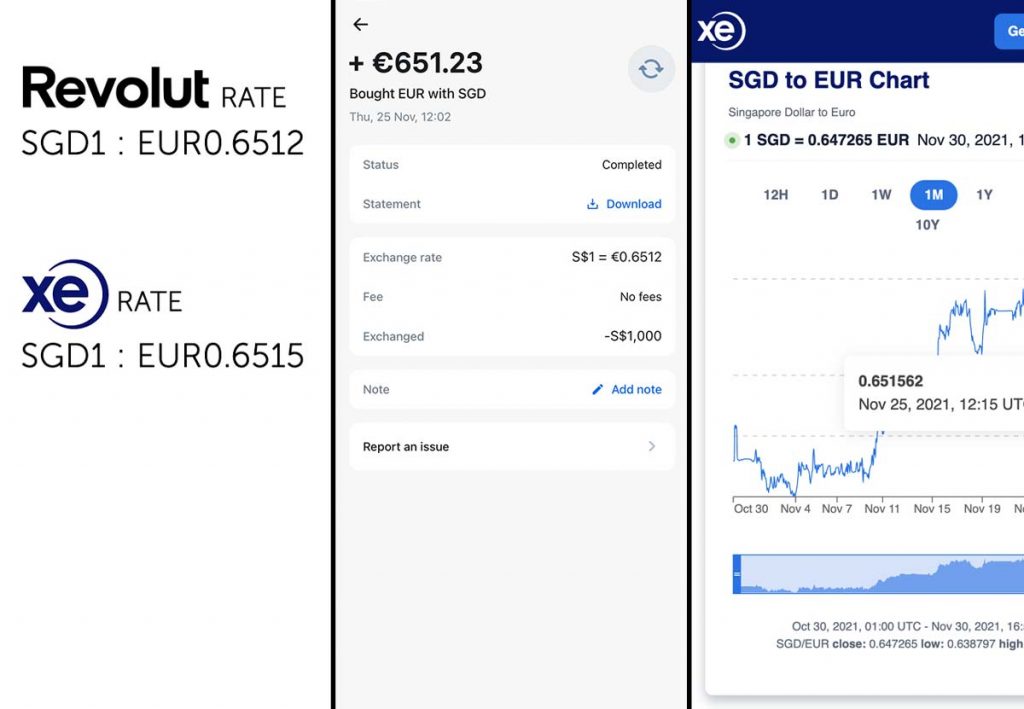

According to Revolut, the ‘real’ exchange rates (or interbank rates ) are “based on the foreign exchange market data feeds that we get from a range of different independent sources.” While it sounds a little iffy, the rates we regularly got were usually the same as the internet rate or sometimes even better.

Other than using the physical card for payment, Revolut can also be linked to your smart devices (smartphones, smartwatches etc) for more convenience.

All you need is to make sure the card has a sufficient balance for your transaction.

Top-up is available via bank transfer, debit cards, credit cards, and even Apple Pay.

Once you’ve topped up the card, you can either exchange it to the local currency, or leave it in your home currency and it will use the real exchange rate at the time of transaction.

It also serves as a multi-currency wallet so you can store up to 28 different currencies at once.

Currency Exchange Fees : 0-2% depending on membership and market hours

Currency exchange fees are charged after a certain amount is spent on the card, but don’t worry, this resets each month. The amount depends on your membership plan:

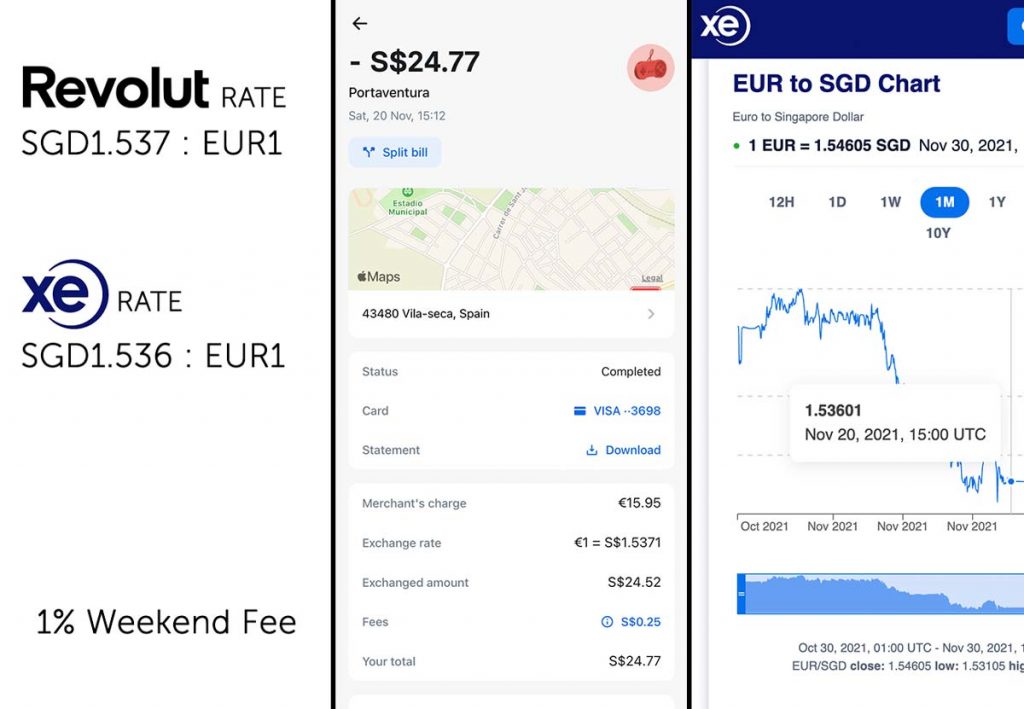

Weekend fee: 1–2% depending on the currency

Revolut also charges a fee for exchanges over the weekend to protect against market fluctuations when it’s closed.

We were charged an additional 1% for transactions over the weekend when converting from SGD to EUR.

* Pro-tip: Exchange money before the weekend to avoid additional fees

The good thing is that the process is transparent and the foreign exchange rate can be viewed on the Revolut app before any transactions involving foreign exchange.

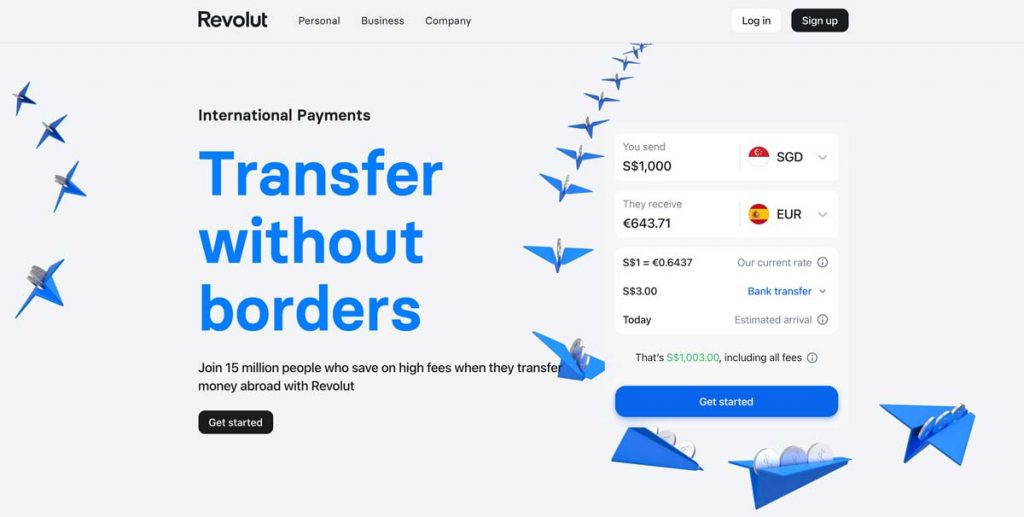

Using Revolut as a remittance service

Revolut supports over 28 currencies (including SGD), which means you can transfer money to foreign bank accounts at a much lower fee. The fees are stated upfront and uses the more favourable interbank transfer exchange rate. Perfect for those studying or working overseas who need to remit cash.

You can use their in-app or website calculator to get an estimate.

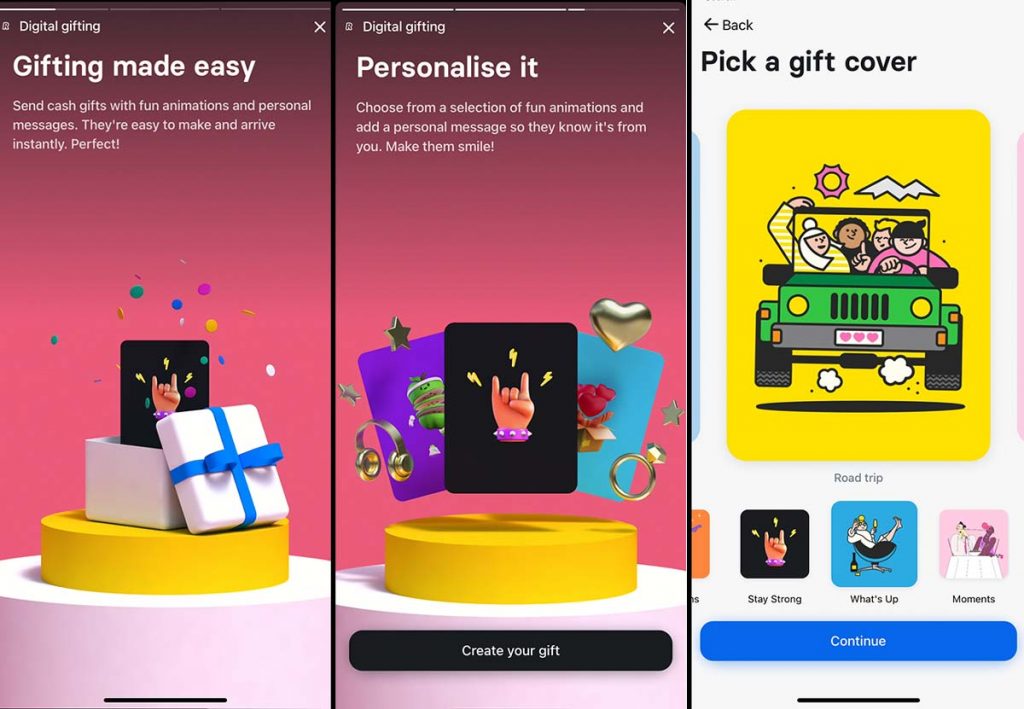

Revolut also allows you to transfer money to other Revolut users for free. As all members of our team have a Revolut account, it was easy to transfer money in the local currency to each other without having to convert to SGD first. There’s also the option of sending money in the form of gifts, which includes adorable animated cards that make it a little more fun.

You can even set up Group Bills, allowing you to split bills easily with every member of the party. Compared to other budgeting apps, you can “settle up” directly into your Revolut account.

Using Revolut to withdraw cash at local ATMs

This is generally fuss-free and ATM withdrawal on Revolut is free up to a monthly cap based on your membership level: Standard: S$350/month Premium: S$700/month Metal Card: S$1050/month

A 2% usage fee is charged only after you’ve exceeded your limit. Some foreign banks may still charge a transaction fee even though Revolut doesn’t.

Here’s a 2019 community-created list of transaction fees for different banks (if any) by country .

We withdrew money at OTP Banka in Croatia for free.

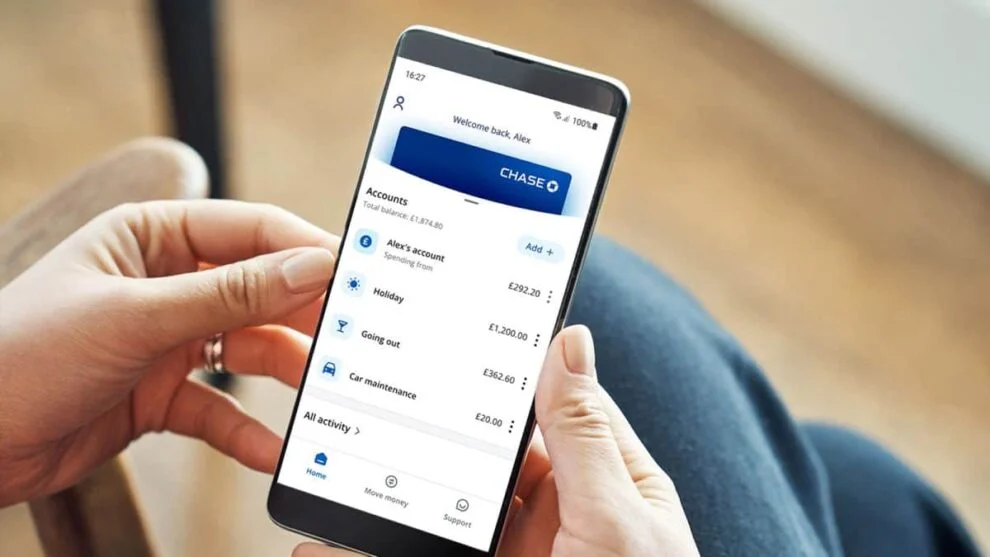

Revolut App Budgeting & Lifestyle Features

Beyond using Revolut to pay for stuff, there are also a few budgeting and analytics tools on the app to help keep your spending in check. Set monthly budgets by categories, receive notifications when you are overspending, and get insights into your spending habits.

You can also set up Personal & Group Vaults to work towards your saving goals. Revolut tries to make this effortless by automatically rounding up your purchases to the nearest dollar and saving it in your account.

For online shoppers, the Rewards feature allows you to get additional cashback when you pay with Revolut.

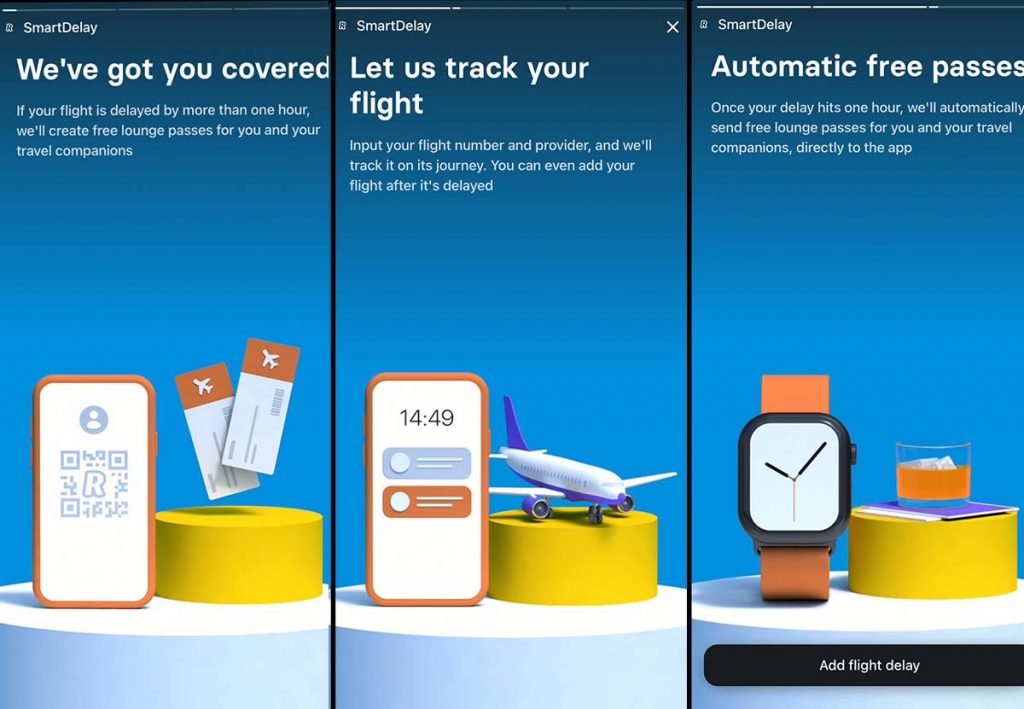

If your flights are delayed for more than one hour, Premium and Metal Plan users also get complimentary lounge passes for their companions and themselves under Smart Delay .

Even if there’s no flight delay, Premium and Metal Plan users can purchase Lounge Passes on the App if you simply want to take a break.

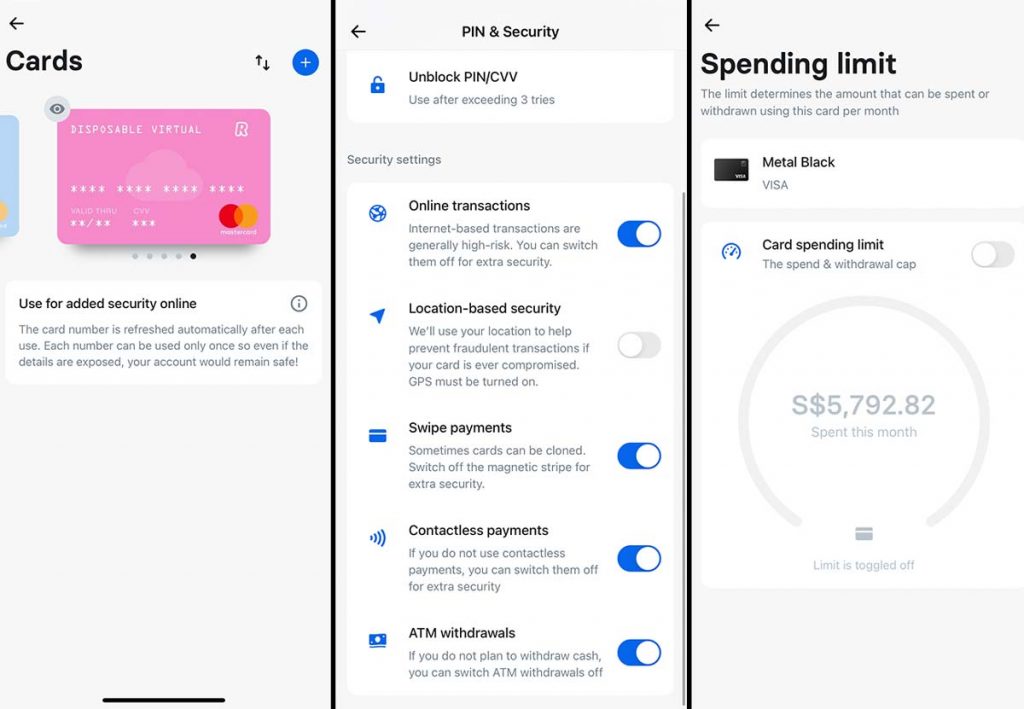

Revolut Security Features Review

Convenient access and control of security features For long-term travel, these security features were extra useful. For example, we may want to disable magnetic stripe use in certain countries with a reputation for copying credit cards. In other instances, we may want to increase spending limits if we know we’ll be shopping more.

Revolut allows you to easily toggle security features like location-based security, use of contactless payments, ATM withdrawals, online payments, magnetic stripe usage, and spending limits via the app. This means even if you lose it without realising, the card cannot be misused since the features only work when you activate them.

You can easily change your PIN number, or unblock your own PIN if it has been accidentally blocked.

My favourite is the ‘Freeze card’ feature, which allows you to temporarily deactivate your card through the Revolut app . I’m sure many of us have been in situations where we think we’ve lost our credit card, only to find them a few days later after going through the trouble of calling the bank and having it deactivated permanently.

All these features make it super convenient as you can easily change them on the app instead of calling the bank.

Disposable Virtual Cards

You can also create Disposable Virtual Cards — perfect for times when you need to make online payments via foreign websites that might have questionable security protocols.

Disposable Virtual Cards are automatically refreshed after every use and can only be used once. So even if your details are exposed, your account will remain safe!

Revolut Review — thoughts after using Revolut for a few months

Over the last couple of months, our Revolut account generally worked really well. We used it for our everyday expenses and simply didn’t leave home without it.

The currency exchange rates were very favourable and the security controls were robust and useful. I personally loved the UI, which is intuitive and easy to navigate.

The biggest drawback would probably be the need for data connection. You need a data connection to top-up, so it’s important to make sure that you always have extra money in the account for unexpected purchases or emergencies. You don’t want to get stuck without money in a small town or rural area!

We also occasionally experienced situations where Revolut flags a suspicious transaction and blocks the card. While it’s easily resolved by logging into the app to unblock the card and mark it as a legit transaction, I can imagine how this might be a problem if you happen to be without data connection.

That said, I hardly carry my wallet around anymore and simply leave home with some emergency cash and the Revolut app on my smartphone. As the world becomes more connected and cashless, I can only imagine how using a multi-currency wallet and super-app like Revolut will become the main form of payment.

If you’d like to give Revolut a try, apply for an account and download the app here: – Apple App Store – Google Play

Revolut is also giving usersa 3% cash back on travel expenses till 23 December. More information here !

Hope you found this Revolut Review useful. Do let us know if you have any questions or suggestions to improve this review.

Disclosure : While the writer was provided with spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

This post was brought to you by Revolut .

For more travel inspiration, follow us on Facebook , Instagram , and YouTube .

View this post on Instagram A post shared by thetravelintern.com 🇸🇬 (@thetravelintern)

RELATED ARTICLES MORE FROM AUTHOR

How to Pay in China Without WeChat or Alipay — New Cashless Solution For Singaporeans

JR Pass Budget Alternatives — Is the JR Pass, Single Shinkansen Tickets or Regional Passes More Worth It?

11 Travel Hacks and Pro-tips from Frequent Travellers

Changi is Giving Away 4 Business Class Tickets/Month Until End Oct 2024 — Here’s How to Get Yours

Mobile Payment in China: Step-by-step Guide to Using Alipay and WeChat Pay without a Chinese Bank Account

9 Must-Have Remote Working Travel Essentials That Make Life Easier While on The Road

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

A first-timer’s guide to Belgium — why this should be your...

Top 11 Hotels Near Tokyo Disney Resort — Quirky Themes, Dino...

32 New Deals and Attractions in Singapore this May 2024

Tulipmania is Back at Gardens by the Bay from 29 April...

11 Unique Things to Do in South Australia — Quirky Wineries,...

- Terms Of Use

- Privacy Policy

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

14 Best Travel Credit Cards of May 2024

ALSO CONSIDER: Best credit cards of 2024 || Best rewards credit cards || Best airline credit cards || Best hotel credit cards

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

250+ credit cards reviewed and rated by our team of experts

80+ years of combined experience covering credit cards and personal finance

100+ categories of best credit card selections ( See our top picks )

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of May 2024

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Citi Premier® Card : Best for Triple points on multiple categories

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, triple points on multiple categories, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Bank of America® Travel Rewards credit card

Our pick for: Flat-rate rewards + no annual fee

One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. Bank of America® has an expansive definition of "travel," too, giving you additional flexibility in how you use your rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Premier® Card

Our pick for: Triple points in multiple categories

The Citi Premier® Card earns bonus points on airfare, hotels, supermarkets, dining and gas stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

Are you in Canada?

See NerdWallet's best travel cards for Canada.

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.

Seize every opportunity to pick up the tab, especially if your travel credit card pays bonus rewards on dining; your friends can pay you back while you collect rewards.

Redeem rewards for travel instead of gift cards, merchandise or (in most cases) cash back to get the best value.

Join the loyalty program associated with a co-branded card — a frequent-flyer or frequent-guest program.

Shop for essentials in your card’s online bonus mall or through its exclusive offers, if available, to get extra rewards.

OTHER CARDS TO CONSIDER

It’s worth considering whether a travel credit card is even right for you in the first place. A NerdWallet study found that cash-back credit cards often earn more money — even for many travelers.

If you carry a balance from month to month, the higher interest rates typically charged by rewards cards can cancel out any rewards earned. If you have a good credit score, you're better off with a low-interest credit card that can save you money on interest.

A good travel credit card shouldn't charge foreign transaction fees, but there are good non-travel cards that also don't charge them. See our best cards with no foreign transaction fee .

If you value transparency and flexibility in your rewards, you can't go wrong with a cash-back card — and you can still use the rewards for travel, if you want.

Finally, if you're still not sure what's right for you, take a look at our best rewards credit cards for options beyond travel and cash back.

NerdWallet's Sam Kemmis contributed to this article.

To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of The Platinum Card® from American Express , see this page .

Last updated on May 7 , 2024

Methodology

NerdWallet's Credit Cards team selects the best travel rewards credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of travelers. Factors in our evaluation include each card's annual fee, foreign transaction fees, rewards earnings rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, and cardholder perks such as automatic statement credits and airport lounge access. Learn how NerdWallet rates credit cards.

Frequently asked questions