- Trip Reports

- Flight Reviews

- Lounge Reviews

- Hotel Reviews

- AIR VANUATU: Cancels flights, enters voluntary administration

QANTAS: AU$120 million fine and compensation for selling 'ghost' flights.

MARRIOTT: Plans for three Adelaide hotels - Westin, Marriott and ?

QANTAS: Customers can access other passengers' information on app

- BONZA: Goes into administration. Officially!

TRIP REPORT: Flight Review - Sydney to Christchurch on Qantas in Business - same, same but different

LOUNGE REVIEW: Revisiting the Sydney Qantas First Lounge

TRIP REPORT: Introduction – my trip to Christchurch, New Zealand flying Emirates First Class on an A380

QANTAS: A runway, brakes, fire trucks and a cancelled flight

TRIP REPORT: I just booked a 7+ hour trip in Business in a Boeing 737 MAX on Oman Air. Am I mad?

TRIP REPORT: Pointless New Zealand double status credit run to requalify as Qantas Platinum 2023

QANTAS: What I ate in Business Class on planes and lounges in 2023 so far, compared to one meal in 2019

QANTAS: Singapore First Lounge - WOW! First impressions

EMIRATES: Pyjamas in Business, Brisbane flights & Lounge reopens

QANTAS: New safety video featuring destinations it doesn't fly to

REX: To partner with Turkish Airlines in Australia?

QANTAS: Green shoots of improved service already showing? Premium frequent flyers recognised.

QANTAS: Extra legroom costs more from 18 April

QANTAS: Changes to frequent flyer scheme from April 2024

QANTAS: International WiFi, App improvements and automatic COVID refunds. About time.

QANTAS: Aircraft update including A220s interiors

LOUNGE REVIEW: Qantas Melbourne International First Lounge. My first time - I was treated gently.

FLIGHT REVIEW: Sydney to Melbourne in Qantas Economy - call that a meal?

EMIRATES: Does Easter hot, cross, buns

QANTAS: promises catering will be bigger & better on international and domestic flights and lounges

Select Page

VIRGIN AUSTRALIA: Extends expiry date of travel bank credits for booking and flights to 30 June 2025

Posted by 2paxfly | Sep 22, 2023 | News , Airlines , Loyalty

‘COVID credits’ are Standard Credits issued on or before 31 July 2022, for bookings made from 21 April 2020 through 31 July 2022.

I just received an email from Virgin Australia. According to their records (and mine), I have a travel credit in a Travel Bank account that meets the criteria.

Virgin Australia usually distinguishes between Standard Credits and what it calls ‘COVID credits’, but if they meet the dates above, they are being treated the same. And this is not the first time Virgin Australia has extended them. In fact, it’s the third.

Content of this Post:

More time to fly, more time to book

COVID credits can be used to book travel on all Virgin Australia flights, including long-haul international codeshare flights with other airlines, in both Business and Economy. You can also use them with no minimum spend and for any passenger, so they are not limited to the passengers named on the original booking.

This applies to fares that were booked directly with Virgin Australia. Other conditions may apply to fares booked on Virgin Australia but via other sources, like travel agents. Check with the organisation that you booked through.

Virgin Australia v Qantas

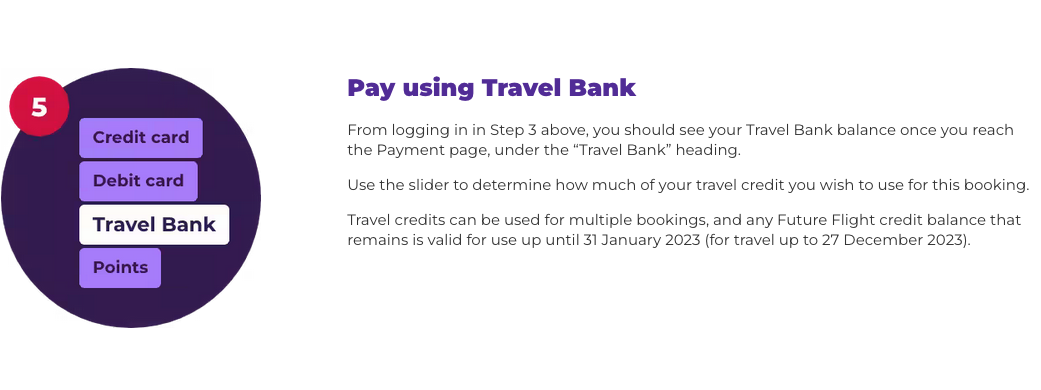

Virgin Australia has, on the whole, had a simpler system for travel credits than Qantas . But that is not to say it’s not unproblematic. For a start, the information on cut-off dates for travel credits is inconsistent across their website. A simple example is on their Travel Bank page. They have contradictory information about when your credits run out at the top of the page; compared to under ‘5’, it says your credits run out on 31 January 2023 for travel to 27 December 2023.

Logging in to Travel Bank

When your Travel Bank was first created, a username would have been sent to you, so first search through your emails. If that fails, then …

Log in to the www.virginaustralia.com website, select ‘ BOOK ‘ in the menu bar, then choose ‘ Manage booking ‘ and under that ‘ Retrieve your Travel Bank details ‘. Fill in the requested information, and Bob’s your auntie.

Alternatively, if you are a Velocity Frequent Flyer member, you can access your Travel Bank using your username and password.

If all that fails, then call the Contact Centre on 13 67 89

Using Travel Bank

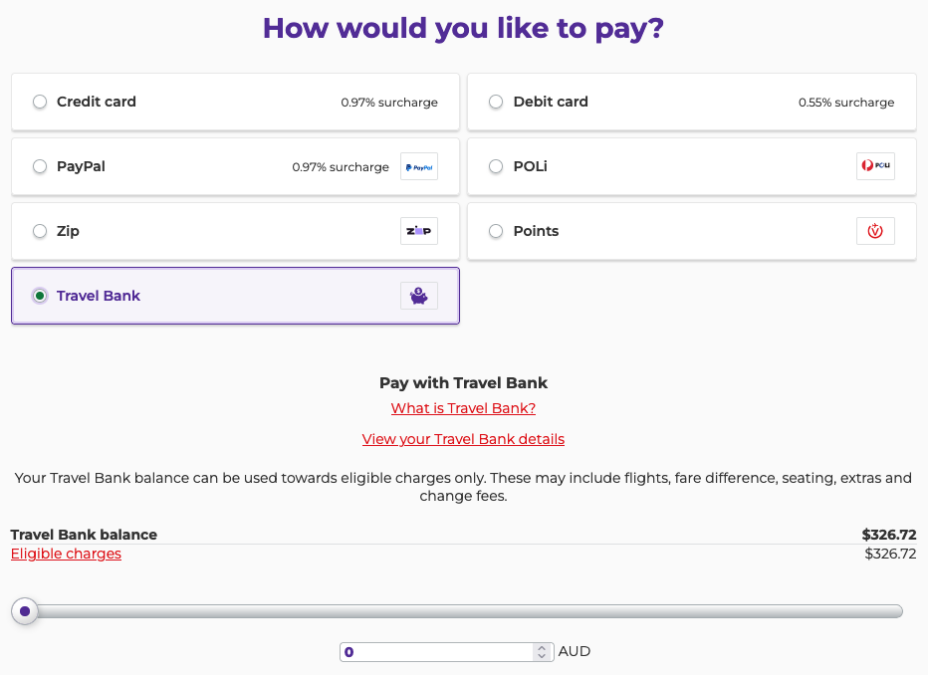

Go ahead and book your flight in the normal way on the Virgin Australia website . When you get to the payment page, you should see your Travel Bank balance under ‘Travel Bank’. you can use the slider to determine how much of the travel credit you wish to use.

2PAXfly Takeout

Virgin Australia has increased the period you can book and take flights using a ‘COVID’ travel credits to June 30, 2025.

This extension should get them out of the Australian Competition and Consumer Commission’s sights.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

You might also like to read:

Related posts.

I have to escape Sydney Winter – Hello Bali!

August 4, 2016

Virgin Australia new 777 interiors – Remove 22 seats and 2 toilets – more comfort?

May 16, 2016

Is Alaska Airlines paying too much for Virgin America?

April 5, 2016

Virgin – Profit up, Frequent Flyer benefits down – or are they?

March 1, 2016

Leave a reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Search this site

Subscribe To Our Newsletter

Receive the latest updates on 2PAX fly

Newsletter Regularity Weekly Daily

You have Successfully Subscribed!

Go on - you know you want to.

Latest Reviews

- HOTEL REVIEW: Hotel Debrett – friendly, quirky gem of a hotel in the centre of Auckland, New Zealand Score: 80%

- HOTEL REVIEW: New Le Méridien, Melbourne. Where I used to dance my sox off! Score: 82%

- HOTEL REVIEW: Hotel Realm, Canberra Score: 60%

- HOTEL REVIEW: Pullman Sydney Airport – emergency one night stay Score: 75%

- Review Hotel: The Westin Melbourne, Victoria Score: 85%

What did you say?

- 2paxfly on QANTAS: Customers can access other passengers’ information on app

- AlohaDaveKennedy on QANTAS: Customers can access other passengers’ information on app

- 2paxfly on AIR NEW ZEALAND: Complicates fare structure for short haul flights

Previously . . .

2paxfly rss feed.

- HOTEL FIRST LOOK: Westin Brisbane, nice but not a patch on Melbourne sister

- QANTAS: AU$120 million fine and compensation for selling ‘ghost’ flights.

- MARRIOTT: Plans for three Adelaide hotels – Westin, Marriott and ?

- QANTAS: Customers can access other passengers’ information on app

- BONZA: Flights cancelled. Operations suspended. Planes repossessed

- VIRGIN AUSTRALIA: Adelaide to Bali flights suspended due to aircraft shortage

- SOUTH AFRICAN AIRWAYS: Flying direct, Perth/Johannesburg from 28 April 2024

- AIRLINES: Best statistics for domestic airlines ‘on-time arrival’

Subscribe to the Newsletter

Join our mailing list to receive regular updates about 2PAX fly .

Reviews, deals, offers, and most of all opinion will be in your inbox.

We won't spam you, and we won't share your details with others.

Use it or lose it: The Virgin Australia credits expiring in December

I'm about to lose $296 in Virgin Australia flight credit – are you at risk too?

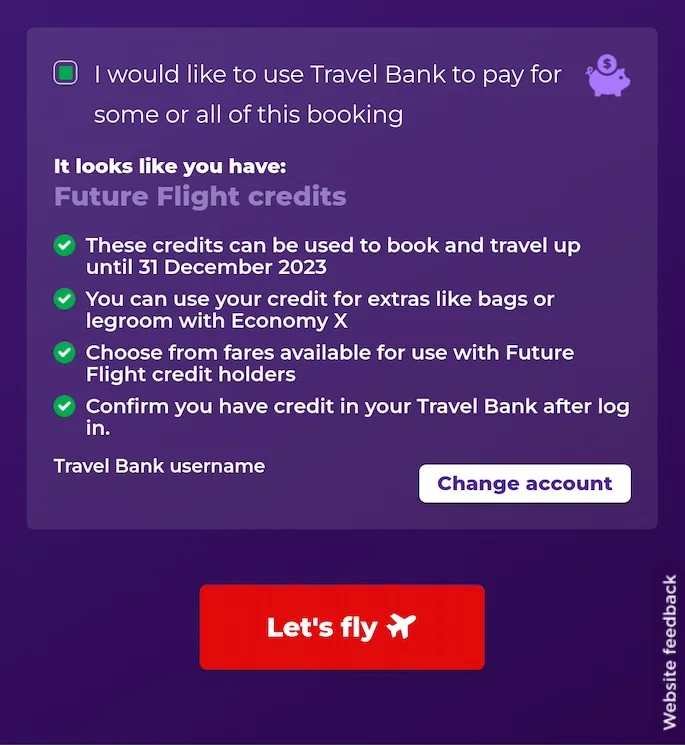

Virgin Australia Future Flight credits expire on 31 December 2023.

This type of credit was issued for bookings made on or before 20 April 2020 and then cancelled.

What's important about this date is that it was just before Virgin Australia went into voluntary administration.

That process means the funds are treated differently to flight credits issued after 20 April 2020.

And because of that, anyone with Future Flight credits now has around 2 weeks to use them.

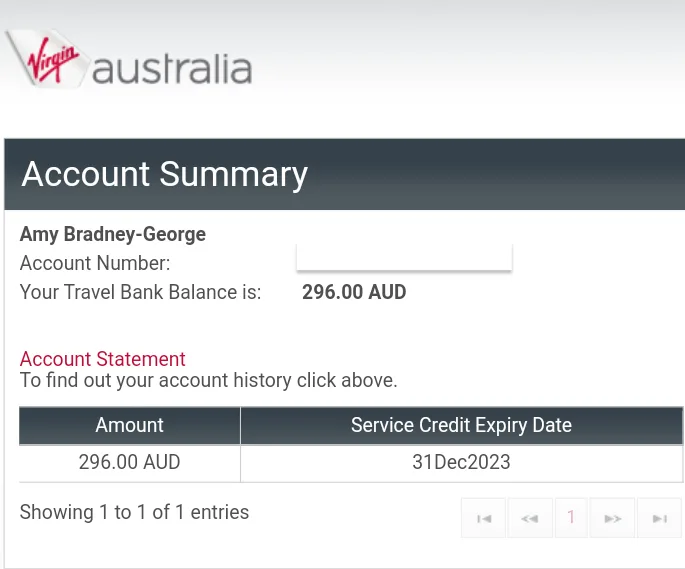

My Virgin Australia Travel Bank account summary, with $296 of Future Flight Credit due to expire at the end of the year. Image: Finder (Amy Bradney-George)

How I tried (and failed) to use this travel credit

I had 2 Virgin Australia Travel Bank accounts set up, and managed to successfully use the funds in one of them.

But then Virgin Australia stopped flying to my nearest airport (Coffs Harbour).

It also extended the expiry date for Future Flight credits, so using them became a problem I planned to deal with "in the future".

When I got an email reminding me about the definite expiry on 31 December, I considered a few ways to use them, including:

- Asking for a refund (I also tried this in 2020)

- Asking friends and family if they could use them for upcoming trips

- Booking a flight from a different airport

- Booking a flight and then cancelling it

The last two options seemed to be my best bet – and I got close to booking flights from Sydney to Perth to visit friends next year.

Then I realised the 31 December 2023 deadline was for both the booking and the actual flight.

So I started looking at flexible flights that I could book and then cancel.

I was hoping to get a credit with a later expiry date.

But when I checked the Future Flight credit terms and conditions, I discovered cancelling would only get me a new "Future Flight credit".

And this particular type of credit would still expire on 31 December 2023.

So now I'm resigned to that fact that the $296 in credit is going to expire.

Getting myself to Sydney or another airport to make use of them would cost more than they're worth.

How to check when your Virgin Australia flight credit expired

Virgin Australia has 2 types of flight credit:

- Future Flight credit: For bookings made on or before 20 April 2020. These expire at the end of this year.

- Standard credit: For bookings made on or after 21 April 2020. These credits expire on 30 June 2025.

You can view details about your flight credit by logging in to your Virgin Australia Travel Bank account.

These accounts are set up when credit is issued, with login information sent by email.

You can also enter your Travel Bank username on Virgin Australia's booking page to check the type of credit and (hopefully) use it.

You can view and redeem your travel credit by entering your Travel Bank username on the Virgin Australia booking page. Image: Finder (Amy Bradney-George)

In October, the ABC reported that Virgin Australia had $270 million in Future Flight Credits.

So if you have any credits, make sure you check the expiry to avoid losing them at the end of the year.

Planning your next trip? Check out our frequent flyer tips for ways to earn points and use them for flights instead of cash.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Latest headlines

- The Uber rip-off you don’t know about

- Budget 2024: Everything we know (so far) and how it could save you money

- Save up to $377 a month by switching your home loan | Dollar Saver tip #81

- 2024 BMW iX1 Review (xDrive30)

- Finder’s RBA Survey: $171K is the minimum income needed to afford average Aussie house

Get exclusive money-saving offers and guides

Straight to your inbox

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Fly in Style: A Guide to Logging In to Your Virgin Travel Bank Account

Virgin Travel Bank is a convenient and secure way to manage your travel credits and book your next trip with Virgin. Here’s how to log in to your account.

First, go to the Virgin Travel Bank website ( https://www.virgin.com/travelbank/ ). This is the official website for the Virgin Travel Bank program.

Next, click on the “Sign In” button in the top right corner of the page. This will take you to the login page.

Enter your Virgin account email address and password in the appropriate fields. If you don’t have a Virgin account, you can create one by clicking on the “Create an Account” link.

Finally, click on the “Sign In” button to log in to your account.

Once you’re logged in, you can view your travel credits, book a flight, and more. You can also access your account through the Virgin app, which is available for download on the App Store and Google Play.

By logging in to your Virgin Travel Bank account, you can book your next trip in style. Whether you’re traveling for work or pleasure, Virgin Travel Bank makes it easy to manage your travel credits and book your flights on the go. Happy travels!

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Virgin Voyages Help & Support for Payments

- Help & Support

- / Before You Sail

Other topics related to "Payments"

- Pre-Voyage Policies

- Voyage Protection

Need help getting the As to your Qs?

Hit the big, red button below and reach out to our sailor services crew..

Our Travel Support is available 24/7

Our Travel Concierge is available 24 hours a day, 7 days a week to serve you with your travel needs including changes and cancellations to travel booked through TravelBank. You can get in touch with our team via email, in-app chat, or via telephone at 866-682-8785.

They can also assist you with travel discounts and exclusive travel inventory. Get in contact with our Customer Success team to learn more.

American Express and Virgin Atlantic transfer bonus: Get 30% more Virgin points when transferring Membership Rewards points

Looking to travel to Europe? Is an island vacation on your bucket list? Want to take that dream trip for fewer points than you thought you could?

If so, there's good news — for a limited time, American Express Membership Rewards® card members that earn Membership Rewards points can receive a 30% bonus when transferring Membership Rewards points to Virgin Atlantic Flying Club . Terms apply.

Usually, card members can transfer Membership Rewards points to Virgin Atlantic Flying Club at a 1:1 ratio, but the 30% bonus available through May 31 means you'll receive 1,300 Virgin points for every 1,000 Membership Rewards points you transfer.

Here's how this transfer bonus works and ways you can use it to travel more for less.

Transfer Amex Membership Rewards points to Virgin Atlantic Flying Club for a 30% bonus

With access to the most point transfer partners of any major U.S. credit card loyalty program, American Express is the go-to issuer for many travelers. Here are several popular American Express cards that earn transferable Membership Rewards points:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- American Express® Gold Card

- American Express® Business Gold Card

If you have one of these cards or another eligible card that earns American Express Membership Rewards points, you can utilize this transfer bonus to Virgin Atlantic. If you aren't yet familiar with how to transfer Membership Rewards points to participating hotel and airline partners, such as Virgin Atlantic, here's a guide to that process .

Virgin Atlantic is a member of the SkyTeam alliance , meaning you can earn and redeem points flying with Virgin Atlantic and even use them to fly the carrier's partner airlines, including Delta Air Lines, Air France and KLM. This gives you a vast array of flight options when using points.

Fly to London for just 8,000 transferred points

Unlike many other airlines that make it hard to know what the award price will be ahead of time since redemption rates vary, Virgin Atlantic still uses an award chart separated by route, cabin class and peak or standard (off-peak) season.

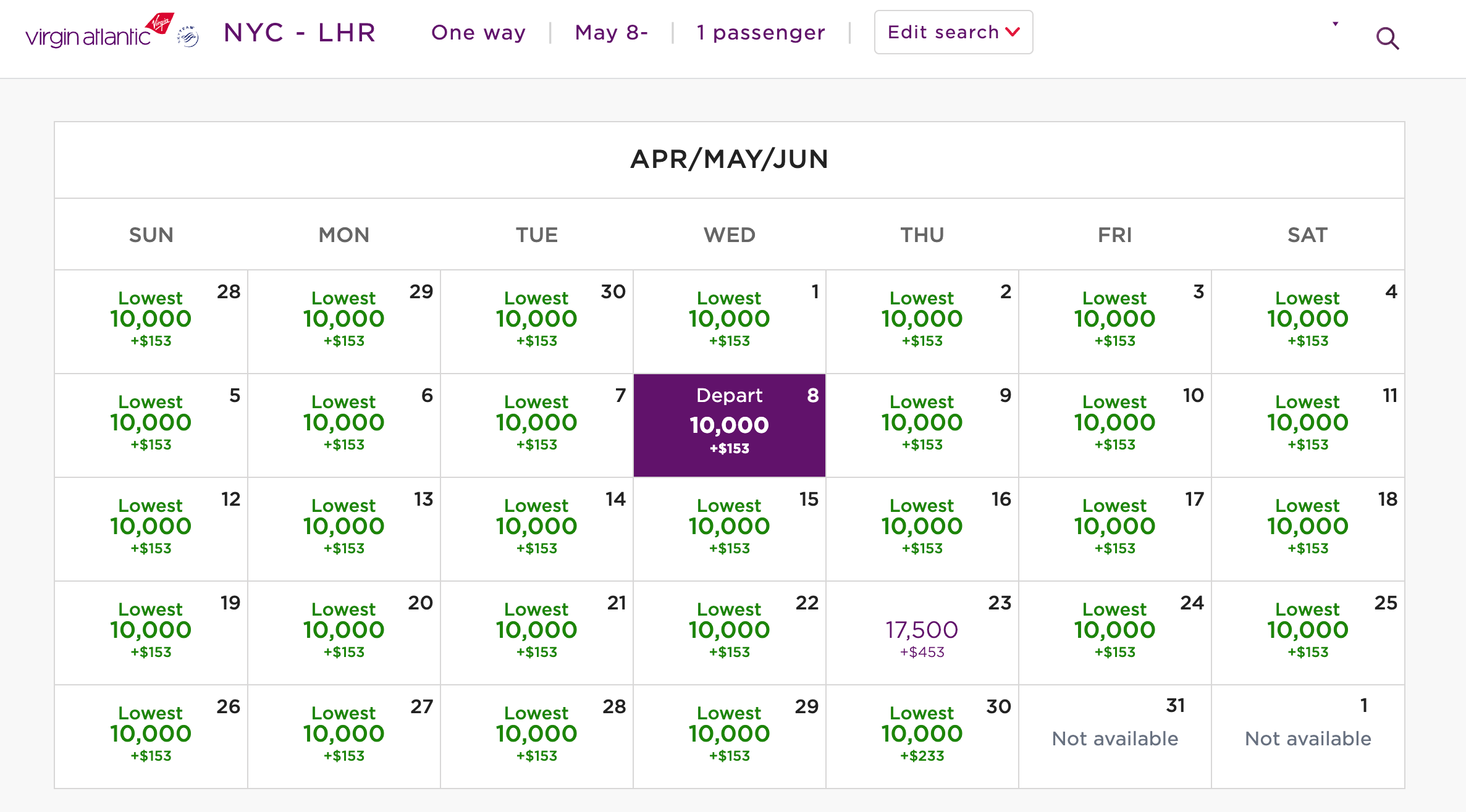

Flights to London from the eastern U.S. during the standard season start at 10,000 Virgin points — excluding taxes, fees and carrier-imposed surcharges of around $150 — each way for Economy Classic seats.

This rate applies for flights departing New York's John F. Kennedy International Airport (JFK), Boston Logan International Airport (BOS) and Washington, D.C.'s Dulles International Airport (IAD) and arriving at Virgin Atlantic's home at London's Heathrow Airport (LHR). It includes checked baggage, a full-size carry-on and onboard food and beverages. In other words, it's a full-service ticket rather than one that just barely gets you on the plane.

During Amex's 30% transfer bonus offer, you only need to transfer as few as 8,000 American Express Membership Rewards points to Virgin Atlantic to book this 10,000-point Virgin reward flight to London.

Virgin also offers a cabin they call Premium (which may compare to what you might think of as premium economy). Virgin Atlantic Premium is available on all flights to and from North America for guests wanting additional cabin space, a welcome glass of bubbly, elevated meals served on real china, a premium check-in experience and priority boarding.

Flights from the eastern U.S. to London in Virgin Atlantic's Premium cabin start at 17,500 Virgin points (excluding taxes and fees) one-way on standard dates, while flights from Los Angeles International Airport (LAX) and San Francisco International Airport (SFO) to LHR in the same cabin cost as little as 27,500 points (plus taxes and fees) each way on standard dates.

At the 17,500-point level, you would only need to transfer 14,000 Membership Rewards points to Virgin Atlantic during the 30% bonus.

Related: Is Virgin Atlantic premium economy worth it on the A330-900neo?

For the ultimate indulgence, there's Virgin Atlantic's Upper Class cabin, which has lie-flat beds, direct aisle access for all passengers, multicourse gourmet dining with Champagne and fine wines, luxurious bedding, and onboard social spaces to unwind and relax.

As you might've guessed, these are the seats we really love.

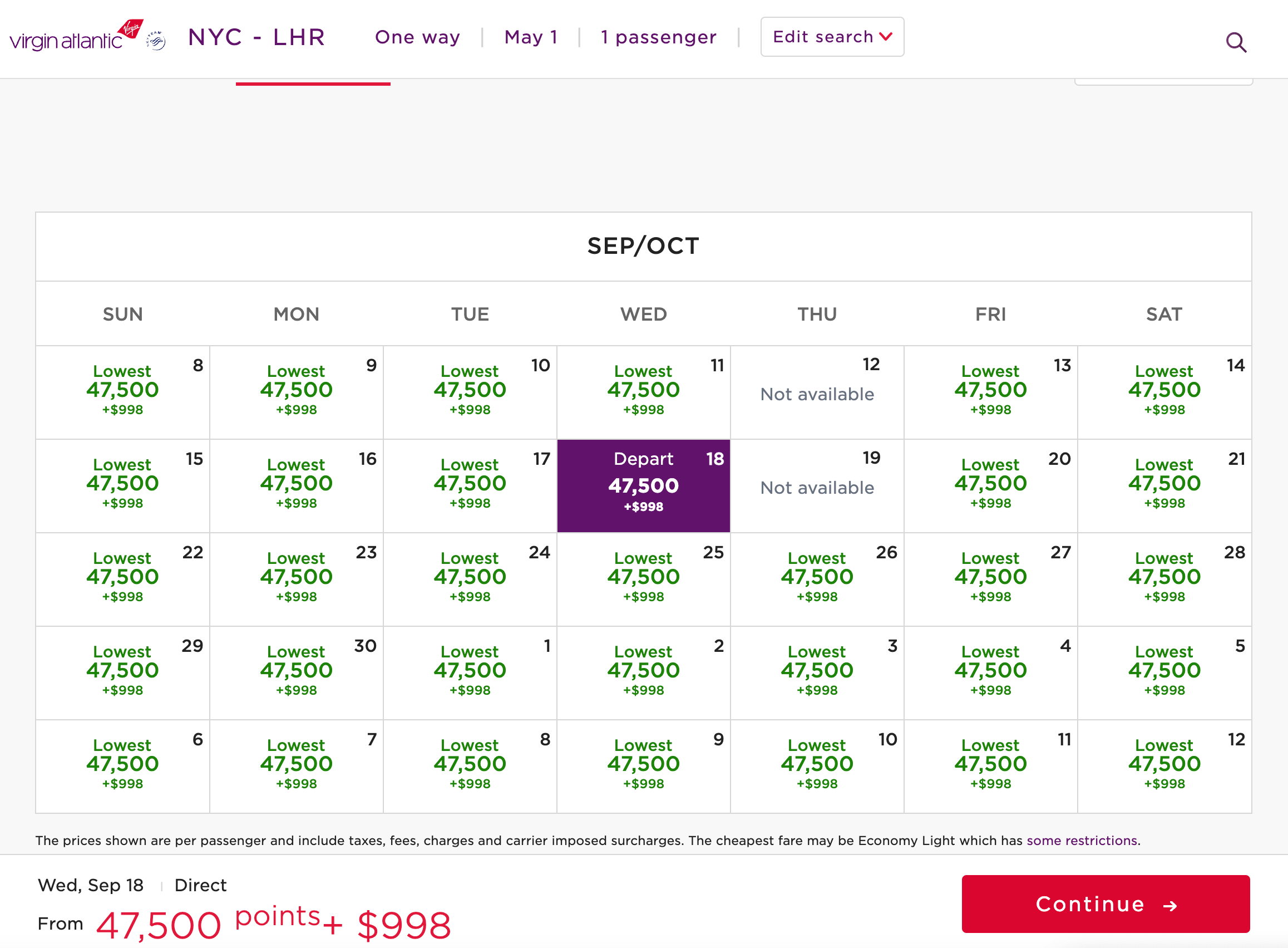

Upper Class redemptions to London from the eastern U.S. start at 47,500 Virgin points or just 37,000 Membership Rewards points transferred during this promotion, which is a pretty outstanding price for a lie-flat seat across the Atlantic.

Do note that the fees, taxes and surcharges for these tickets come to about $998, so factor that into your decision-making process.

Also, keep in mind that Membership Rewards points can only be transferred in increments of 1,000; therefore, you would need to transfer 37,000 Membership Rewards points to book this 47,500-point award.

How to maximize Membership Rewards points for Virgin flights

Though Virgin Atlantic is based in London, it flies to 32 destinations across five continents. You can connect to destinations in South Africa, the United Arab Emirates, India, Nigeria, Israel and even the Maldives, among other locales.

There are plenty of other ways to redeem Virgin points, including:

- A seat on a short-haul Delta-operated flight within North America for as little as 7,500 Virgin points.

- A round-trip first-class seat to Japan in one of All Nippon Airways' fancy suites for just 170,000 points — if paying with cash, this seat typically costs upward of $20,000.

- A Virgin Atlantic reward seat sale for up to 50% off the number of points required for certain award flight routes, such as this flight to Europe that I booked for only 5,000 Virgin points .

Related: How 5,000 credit card points saved me over $650 on a flight to London

Use the Membership Rewards transfer bonus to book an upgrade

Virgin Atlantic has a new plane: the A330-900neo. On it, there are two exclusive Retreat Suites that I've found to be an incredibly luxurious way to cross the Atlantic.

There are sliding doors for maximum privacy, ottomans so you have the option to dine with a friend, high-definition flat-screen TVs and more noteworthy extras you won't find in many business-class cabins.

While you can't book these seats outright with points right now, you can use your Virgin points to book Upper Class seats and then upgrade from there to the Retreat Suites for a surcharge of about $250 per seat if there's availability within 14 days of travel.

The A330-900neo is now flying on select routes from Boston, New York and Tampa to London.

Bottom line

Until May 31, eligible American Express card members can receive a 30% bonus when transferring Membership Rewards points to Virgin Atlantic's Flying Club program.

Before transferring Membership Rewards points, here are a few things to keep in mind:

- You must be enrolled in Virgin Atlantic's Flying Club to participate in this offer.

- Airline tickets are subject to availability, so check this before transferring Membership Rewards points.

- Transfers are usually immediate, but allow up to 48 hours for the transfer to be completed, as you cannot book flights using transferred Membership Rewards points until the transfer is complete.

- Transfers are not reversible and are subject to the terms and conditions of the Virgin Atlantic Flying Club program.

With this Virgin Atlantic points transfer bonus, your travel dreams might be closer than you think.

Terms and conditions:

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

You must be an eligible Membership Rewards® Card Member enrolled in Virgin Atlantic Flying Club in order to participate in this offer, visit https://flywith.virginatlantic.com/gb/en/flying-club.html to enroll. If INVEST for Amex by Vanguard, American Express® Rewards Checking, and/or American Express® Business Checking are your only Membership Rewards® Products, you are not eligible for this offer at this time. American Express is not responsible for availability of flight, accommodations or any other rewards in the Virgin Atlantic Flying Club. Once you have transferred Membership Rewards points, they become subject to the Terms and Conditions of the Virgin Atlantic Flying Club and cannot be transferred back to your Membership Rewards program account. Taxes, fees, charges and surcharges, including airline surcharges, apply on Virgin Atlantic redemption flights and upgrades. See Virgin Atlantic Flying Club Terms and Conditions for details. Individual air carrier restrictions may apply.

Minimum transfer is 1,000 Membership Rewards points. Redeem for this exclusive offer from 12:00 a.m. MT on 4/21/2024 to 11:59 p.m. MT on 5/31/2024 to receive 30% additional Virgin Points. Additional Virgin Points will be awarded at the time of transfer. Generally, transfers are immediate but please allow up to 72 hours for the transfer to be completed. POID: GHVO:0002 ©2024 American Express Travel Related Services Company, Inc. All rights reserved.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- • Rewards credit cards

- • Travel credit cards

Claire Dickey is a product editor for Bankrate, CreditCards.com and To Her Credit. Before joining Bankrate, Claire worked as a copywriter for brands within the telecommunications industry as well as a hybrid marketing and content writer.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Virgin Atlantic World Elite Mastercard®

*The information about the Virgin Atlantic World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

30,000 bonus Virgin Points after spending $1,000 or more on purchases within the first 90 days of account opening. Earn up to 15,000 bonus Virgin Points every anniversary after qualifying purchases. Earn up to 5,000 bonus Virgin Points when you add additional cardholders to your account

Offer valuation

Offer valuation is not available for this credit card.

Rewards rate

3 miles per dollar spent directly on Virgin Atlantic purchases 1.5 miles per dollar spent on all other purchases

Regular APR

On This Page

- Pros and cons

- Current offer details

- Value of rewards

- Key cardholder perks

- Understanding the fees

- Virgin Atlantic World Elite vs. other hotel cards

- Frequently asked questions

Editor’s note: Some of the offers on this page may be expired. Check out our Best Credit Cards page for the most up-to-date offers for our favorite credit cards.

Virgin Atlantic World Elite Mastercard Overview

For frequent flyers of Virgin Airlines who prefer rewards for future trips, the Virgin Atlantic World Elite Mastercard could be worth adding to your wallet. Earn 3X points on Virgin Atlantic purchases including flights, holiday packages, and in-flight extras plus 2.5X points on all other purchases. That makes the $90 annual fee is easy to recoup. Also, for those who don’t travel as much, this can act as a good flat-rate card for everyday buys.

That being said, this card is geared towards Virgin Atlantic customers only. While you can earn points on any eligible purchase, all rewards are only redeemable on Virgin Atlantic travel. For most this may be too narrow but for brand loyalists, this card can go a long way.

What are the advantages and disadvantages?

30,000 Flying Club bonus miles when you spend $1,000 or more within the first 90 days of account opening

No foreign transaction fees

Opportunity to earn a Premium upgrade or a companion ticket (after qualifying purchases)

Popular airline partners like Delta Air Lines, Air France and Air China

3% balance transfer fee ($10 minimum)

Blackout dates may apply

No introductory APR period (18.24% – 26.24% variable APR on purchases and balance transfers)

A deeper look into the current card offer

Quick highlights.

- Rewards rate : 3X points per dollar spent directly on Virgin Atlantic purchases. 1.5X points per dollar spent on all other purchases

- Welcome offer : Earn 30,000 bonus Virgin Points after spending $1,000 or more on purchases in the first 90 days of account opening

- Annual fee : $90

- Purchase intro APR : N/A

- Balance transfer intro APR : N/A

- Regular APR : 18.24 percent to 26.24 percent, variable

Current Welcome Offer

New cardholders can earn 30,000 bonus points when they spend $1,000 on purchases within the first 90 days of opening an account. This is halved from the previous 60,000-mile bonus after spending $2,000 within 90 days of owning the card. While the value is a clear downgrade, it is easier to obtain with cardholders only having to spend $334 per month versus $668.

According to the Points Guy valuation , Virgin Atlantic Flying Club points are worth 1.5 cents per dollar, which is an average rewards rate for travel cards. In total, this bonus is worth $450, much higher than the $90 annual fee.

Rewards Rate

With a rate of up to 3X points on every purchase, Virgin Atlantic Flying Club points accumulate quicker than you think. Redemption may be limited, as points can only be used on Virgin Atlantic travel options but can be applied on a variety of travel bookings such as flights, seat upgrades, and more. You can also use a combination of points and miles to cut costs. Keep in mind that blackout dates can apply depending on dates and locations.

How you earn

Built for Virgin Atlantic loyalists who travel often, the Virgin Atlantic World Elite Mastercard gives you multiple opportunities to earn bonus miles.

Virgin Atlantic offers three membership tiers (Red, Silver and Gold) through which you can gain benefits like premium check-in, lounge access and rewards flights. Every $2,500 you spend on net purchases with the Virgin Atlantic World Elite Mastercard, you’ll earn 25 Tier Points (a maximum of 50 Tier Points can be earned each month and 600 Tier Points each year).

Super-spenders can earn either a premium upgrade or same-class companion ticket after spending $25,000 annually. Other bonus mile-earning opportunities include 15,000+ Flying Club bonus miles each anniversary (after qualifying purchases) and up to 5,000 Flying Club bonus miles when you add an authorized user to your card. Miles don’t expire as long as your account is active once every three years.

If you value a solid list of transfer airline partners, the card boasts quite a few, including:

- Delta Air Lines

- KLM Royal Dutch Airlines

- Hawaiian Airlines

- All Nippon Airways

- South African Airways

- Virgin Australia

- Singapore Airlines

- Scandinavian Airlines

- Air New Zealand

You can also earn and spend miles with Virgin Atlantic’s list of 13 hotel partners.

How to redeem

There’s no limit to the number of miles that you can earn, and miles can be redeemed for either Virgin Atlantic flights, partner flights or upgrades. Whether booking a Virgin Atlantic Holiday, getting a rental car, or reserving a room with one of the hotel partners, your Virgin points go far. Say you spend $1,500 each quarter on Virgin Atlantic purchases and an additional $200 a month on all other purchases. You’ll have earned 21,600 miles by the end of your first year. Based on your spending, you’ll qualify for the 30,000-mile welcome bonus (achieved after spending $1,000 within your first 90 days of account opening), for a total of 81,600 miles.

However, you can only spend points on travel bookings and extras, which can be a big drawback for those who prefer to spend points on purchases or redeem for statement credits.

How much are the Virgin Atlantic World Elite Mastercard rewards worth?

You earn 1.5 cents per dollar spent with your Virgin Atlantic World Elite Mastercard. As you can only redeem points through Virgin Atlantic offers, this point value stays consistent versus other cards that can vary depending on the redemption method like the Chase Sapphire Reserve. This rate is higher than some popular airline miles, such as Delta SkyMiles and United MileagePlus.

Other Cardholder perks

Because of its partnership with Mastercard, this card has more than enough perks to make it worth its yearly price tag. Not only does it come with protections such extended warranty protection as well as a few Bank of America benefits ($0 liability guarantee for fraudulent transactions, FICO® Score for free access and account alert reminders), but it also offers benefits for special events and shopping.

Travel protections

This card offers travel benefits like emergency roadside assistance, travel assistance, extended warranty and concierge services,

You can also expect purchase assurance, meaning stolen or damaged items purchased with the card may be eligible for up to $1,000 in protection within 90 days from the date of purchase, common carrier travel accident insurance and identity theft recovery assistance.

Concierge service

Every cardholder has access to Mastercard’s concierge service, which helps you get VIP access to top-tier restaurants, hotels, and hard-to-find tickets. You will also get exclusive access to special events and discounts. The service is available 24/7 so you can get assistance any time you need. You can contact them through the Mastercard Concierge app, using an online request form or by calling the number on the back of your card.

Shopping bonuses

The Virgin Atlantic makes shopping even more rewarding with Shop Away, an online shopping site that lets you earn bonus points, up to 12 points per dollar spent on popular brands. Earn points on clothing, toys, beauty products and more. This becomes even more valuable when combined with the complimentary ShopRunner membership, giving cardmembers free 2-day shipping and returns at over 140+ stores.

Rates and fees

There’s a $90 annual fee for the Virgin Atlantic World Elite card, a great price for frequent Virgin Atlantic flyers. This can easily be offset by taking a Virgin Airlines flight of $170 or more. You can also recoup it through $350 in other purchases.

While there are no foreign transaction fees, making it a great go-to card overseas, there are other fees to consider. Currently, there are no intro APR offers on purchases and balance transfers so the ongoing, variable 18.24 percent to 26.24 percent when you leave a balance on your card. For balance transfers and cash advances, a 3 percent or $10 fee, whichever is greater. There’s also a penalty. For late penalties, the APR is 29.99 percent and a late fee up to $40 is applied.

How does Virgin Atlantic World Elite Mastercard compare to other travel cards

The Virgin Atlantic World Elite credit card is a great addition for Virgin Atlantic loyalists, but what about the travelers who want more from their travel credit cards? For frequent travelers, a more general travel card or rewarding co-brand card may be a better fit.

Recommended Credit Score

Bank of America® Premium Rewards® credit card

Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

Earn unlimited 2 points for every $1 spent on travel and dining purchases. Earn unlimited 1.5 points for every $1 spent on all other purchases.

Marriott Bonvoy Brilliant® American Express® Card

Earn 95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy® 3X points at restaurants worldwide and on flights booked directly with airlines 2X points on all other eligible purchases

Virgin Atlantic World Elite Mastercard vs. Bank of America Premium Rewards credit card

For those who want a general rewards card on par with the Virgin Atlantic card, the Bank of America® Premium Rewards® credit card is a good choice. Both cards have similar annual fees (the Bank of America Premium Rewards card being $95 per year). The welcome bonus of 60,000 bonus points (after spending $4,000 on purchases in the first 90 days) is worth more than the Virgin Atlantic card bonus but it costs more upfront to receive.

However, if you don’t have a brand preference when traveling, the perks of the Bank of America Premium will definitely go much farther. This card gives cardholders access to the Visa Signature Luxury Hotel collection, which comes with room upgrades, complimentary breakfast, and a $25 food and beverage credit. You can also receive up to $100 flight credit, cutting down costs on flights.

Virgin Atlantic World Elite Mastercard vs. Marriott Bonvoy Brilliant American Express

If you prefer a co-brand card, the Marriott Bonvoy Brilliant ® American Express ® Card is very rewarding. While the annual fee is much higher at $650, the rewards rates are as well. You earn 6X points of eligible purchases when you stay at hotels participating in Marriott Bonvoy program as well as 3X points at restaurants worldwide and on flights booked directly with airlines and 2X points on all other eligible purchases. That’s twice as much as Virgin Atlantic rates and applies to more categories.

You also get airport perks that Virgin Atlantic World Elite card doesn’t like access to Priority Pass Select lounges and up to $100 for Global Entry or TSA PreCheck along with standard travel protections.

The biggest downside is the point value with Marriott Bonvoy points being only 0.84 cents per point versus Virgin Atlantic 1.5 cents. However, because of the varying categories and higher rates, it’s easier to earn more points with the Marriott Bonvoy Brilliant card.

Best paired with Virgin Atlantic World Elite Mastercard

Because of its specificity, the Virgin Atlantic World Elite Mastercard isn’t the best travel card by itself. This card would pair well with a general travel card that has no annual fee such as the Capital One VentureOne credit card . Not only do you earn 5X points on hotels and rentals cards, but you have a solid rate on all other general purchases at 1.25X points.

It can also be a good idea to have another co-branded card for hotels if you have a brand you love to stay at. For example, the Hilton Honors American Express has great rates on Hilton hotel and resort bookings at 7X points per dollar and 3X points on general purchases. It also earns 5X points at supermarkets, gas stations and restaurants in the U.S., all without charging an annual fee. Either option gives you a no-cost way to earn points towards your next trip.

Frequently Asked Questions

Is the virgin atlantic world elite mastercard hard to get, who issues the virgin atlantic card, can i downgrade the virgin atlantic.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Capital One Platinum Credit Card Review

Capital One QuicksilverOne Cash Rewards Credit Card Review

SuperCash™ Card Review

Credit One Bank® Platinum Rewards Visa® with No Annual Fee Review

Credit One Bank® Platinum X5 Visa® Review

Credit One Bank Wander® Card Review

Credit One Bank American Express® Card Review

Credit One Bank® Platinum Visa® Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

- Fly with Virgin Atlantic

Flying Club

Soar towards more rewards with Flying Club and Virgin Red.

Join Flying Club for free to unlock even more rewards and benefits than ever before

Earn and spend points

on flights and holidays with Flying Club

Unlock 100s of rewards

with Virgin Red, Virgin's reward club

Virgin Points never expire

so you can save as long as you need for your next adventure

Reward your adventures with Flying Club

Earn Virgin Points every time you travel

Earn whenever you fly with us or any of our airline partners, and watch your points balance grow

Exclusive tier benefits

Enjoy exclusive benefits as you move up tiers, such as Premium check-in or lounge access

Spend on the travel you love

From little treats to Upper Class suites - use your points for flights, upgrades and more!

Earn and spend more with Virgin Red

Boost your balance every day

Earn Virgin Points when you spend with hundreds of your favourite brands so you can book your next flight faster

All your points in one place

Every Virgin Point you earn through Flying Club and Virgin Red combines into a single balance

More ways to spend your points

Starting at just 200 Virgin Points choose from little treats, Virgin exclusives and VIP concerts.

Show me more about Virgin Red

Start saving in three simple steps

Join Flying Club

It's free! And you can start earning from your very first flight with us or any of our airline partners.

Activate Virgin Red

You're auto-enrolled so check your emails to activate your Virgin Red account

Watch your points soar

Earn and spend across both programmes and you'll be on your dream adventure in no time!

Earn with Virgin Atlantic

Earn Virgin Points every time your fly

Points never expire

%20(1).jpg)

Earn 2 Virgin Points per £1

for the lead passenger when you book a package holiday with Virgin Atlantic Holidays

Earn Virgin Points

When you spend on your Virgin Atlantic Credit Card. Representative 26.9% APR (variable) . Terms and limits apply. Credit subject to status. UK residents, 18+ Credit Card provided by Virgin Money, a trading name of Clydesdale Bank Plc.

Spend with Virgin Atlantic

Reward seats on every flight

We save at least 12 seats on every flight just for Flying Club members

Take a trip

Explore Antigua's 365 beaches from 20,000 points^

Upgrade to Upper Class

You're a VIP and deserve the best. Why not upgrade?

Boost your points with Virgin Red

Virgin Trains Ticketing

Book train tickets and earn points on any train, on any route, across the whole of Great Britain when you book with Virgin Trains Ticketing

From make-up and toiletries to medicine, earn points whenever you shop on Boots.com

Ticketmaster

Whether you're into music, sports, comedy... earn points when you book events online at Ticketmaster

A card that really takes you places

When you spend on your Virgin Atlantic Credit Card, you’ll earn Virgin Points to put towards your next adventure.

Representative 26.9% APR (variable) Terms and limits apply. Credit subject to status. UK residents, 18+. Credit Card provided by Virgin Money, a trading name of Clydesdale Bank Plc.

Already in Flying Club?

Membership tiers

The big picture on our tiers and the benefits you'll get in each one. Start seeing the world in Red, Silver and Gold.

Reward flight deals

The dream. Select your destination to find out the number of points you'll need.

Flying Club News

Keep up to date with everything going on in the Flying Club world right now.

Flying Club help

We've got all the answers to your frequently asked Flying Club questions.

- Help centre

- Travel news

- Travel alerts

Avoidance of Russian airspace

We’re continually monitoring the situation in Ukraine and Russia, operating in full compliance with all relevant safety regulators, authorities and governments.

On Thursday 24 th February 2022, Virgin Atlantic took the decision to avoid Russian airspace for our India routes which typically overfly Russia. On Friday 25 th February, the Russian authorities announced a restriction on all UK carriers. Virgin Atlantic has not overflown Ukraine since 2014, and until further notice, will not operate any flights in Russian airspace either.

We have adjusted the flight paths of our passenger services to and from India when operating in either direction.

The adjusted flight routing means that our flight times will be slightly longer than scheduled and the final journey time to your destination can vary between 30 – 75 minutes. We apologise for any inconvenience caused.

If you are scheduled to travel before 14 th March and have an onward connecting flight in your booking that will be impacted by the longer flight time, our teams will rebook you onto the next available service to your final destination. As our teams on the ground and in the air will do our very best to minimise the arrival delay caused by this longer routing, we will rebook your connecting flight on your day of departure to ensure that only connecting flights impacted by the actual arrival delay are rescheduled.

Flights scheduled to operate between 15 th March & 26 th March will be re-timed to reflect the extended flight times and customers due to travel on an affected route will be notified of their adjusted itinerary this coming Saturday 5 th March. Customers with a connecting flight that will be impacted by the schedule change will be rebooked on the next available connecting flight to their final destination.

The safety and security of our customers and people always comes first, and we thank you for your understanding.

Trans-Atlantic travel restart means the world to Virgin Atlantic, says boss

- Medium Text

Sign up here.

Reporting by Sarah Young; Editing by Nick Macfie

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Sarah reports on UK breaking news, with a focus on British companies. She has been a part of the UK bureau for 12 years covering everything from airlines to energy to the royals, politics and sport. She is a keen open water swimmer.

Business Chevron

Lufthansa boss vents frustration about Boeing problems

Aircraft delivery delays from Boeing are "extremely annoying" and cost Lufthansa lots of money, but the U.S. planemaker should be able to resolve its problems, the German airline's CEO said in a newspaper interview.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Here are the best corporate credit cards of 2024, these cards offer rewards and additional features designed to help corporations manage the financials..

Corporate credit cards are similar to business credit cards but have a few key differences. Small business cards are typically designed for smaller businesses or sole proprietorships and usually require a personal guarantee and personal credit check . However, corporate cards typically don't require a personal guarantee and instead often have other requirements such as revenue minimums or are only available to U.S. registered business entities (LLCs, corporations, etc.).

Corporate cards are designed to help business managers seamlessly manage spending for a large number of employees and some offer rewards as well. Below, CNBC Select details the best corporate cards with a range of benefits. (See our methodology for information on how we chose the best corporate credit cards).

Best corporate credit cards

- Best for travel spending: Brex Card

- Best for cash back: Ramp Visa® Corporate Card

- Best for travel perks: The American Express Corporate Platinum Card ®

- Best for mid-sized corporations: U.S. Bank Commercial Rewards Card

Best for travel spending

Earn rewards and cash back on everything you spend, like 7x on rideshare, 2x on recurring software, and access exclusive events and over $400K in software discounts.

Welcome bonus

10,000 points when you spend $3,000 on your Brex card within three months of your Brex business account being opened.

- No annual fee

Brex does not charge interest

Regular APR

Balance transfer fee, foreign transaction fee.

No foreign transaction fees, free ACH and wires worldwide, global acceptance on the Mastercard network

Credit needed

No personal guarantee or credit check. Only companies organized and registered in the United States may apply for a Brex account. See Platform Agreement for business criteria.

- No foreign transaction fee

- You'll have to pay off the balance daily or monthly

* Offer available to new Brex Card customers only.

Brex Mastercard® issued by Emigrant Bank, Member FDIC. Brex Cash provided by Brex Treasury LLC, member FINRA and SIPC. Brex Treasury is not a bank; Brex Cash is not a bank account. Testimonials may not represent experiences of all clients. Terms apply, visit brex.com. Information about the Brex Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Who's this for? Brex is a fintech company that offers financial services to corporations, including the Brex Card , which offers an exceptional return for many different bonus spending categories.

Standout benefits : The Brex Card is available to Brex business account members (a cash management account). Eligible businesses can earn generous rewards in useful bonus categories like rideshare , Brex travel, restaurants, eligible Apple purchases through the Brex rewards portal, recurring software and additional categories depending on your primary industry. The Brex Card is a charge card that must be paid off monthly or daily. If you opt for daily payments, your company may earn additional rewards in certain categories.

[ Jump to more details ]

Best for cash back

Ramp visa corporate card.

Earn an unlimited 1.5% cash back on all purchases

Receive $250 after you apply and are approved with no minimum spending requirement.

No personal guarantee or credit check.

- Strong cash-back rate

- Need at least $75,000 in a U.S. business bank account to qualify

Who's this for? The Ramp Visa® Corporate Card is worth considering if your company wants to earn straightforward, yet valuable cash-back rewards.

Standout benefits : The Ramp Visa Corporate Card can boost your company's bottom line with an uncapped 1.5% cash back on all purchases. This card has no annual fee and a long list of partner deals which can save you even more money. Ramp members enjoy discounts with UPS, OpenAI, Stripe, Amazon Web Services, QuickBooks , Indeed and more. You can even transfer Ramp rewards to various airline and hotel loyalty programs.

Best for travel perks

The american express corporate platinum card®.

Earn 1X Membership Rewards® points on all purchases; 5% Uber Cash on Uber rides and U.S. Uber Eats orders

Good/Excellent

Terms apply.

- Amazing airport lounge access benefits

- Annual statement credit when you have a personal Amex Platinum Card

- Hotel and rental car perks

- Low reward earning rate

- Corporate Membership Rewards program doesn't allow point transfers

Information about the The American Express Corporate Platinum Card® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Who's this for? The American Express Corporate Platinum Card ® offers some of the same valuable benefits as other versions of The Platinum Card® from American Express but with some key differences.

Standout benefits : Corporate employees on the go will appreciate this card's travel benefits, and the crown jewel of what this card offers is its airport lounge access . Cardholders can access over 1,400 airport lounges through the American Express Global Lounge Collection, including Amex Centurion lounges , Delta Sky Clubs , Priority Pass lounges (enrollment required), Plaza Premium lounges, Escape lounges and Lufthansa lounges.

Best for mid-sized corporations

U.s. bank commercial rewards card.

Companies can choose rebates or rewards as follows: Qualify for 1% cash back after spending $150,000 per quarter or earn 5X points on car rentals, 4X points on lodging, 3X points on airlines and 1X points on all other purchases

Revenue requirements

$10 to $150 million annually

- Flexibility in what type of rewards you earn

- No annual fees or interest

- Quarterly spending requirement to qualify for rebates

Who's this for? The U.S. Bank Commercial Rewards Card provides mid-sized corporations flexibility in how they earn rewards.

Standout benefits: With a U.S. Bank Commercial Rewards Card account, companies can choose what type of rewards they earn. If your company opts for earning a rebate, it will earn a 1% cash rebate after hitting $150,000 in quarterly spending. With the rewards option, the company earns 5X points on car rentals, 4X points on lodging, 3X points on airlines and 1X points on all other purchases.

More on our best corporate credit cards

The Brex Card has extremely generous spending categories, which are even more valuable than they appear because you can transfer Brex points to partner travel programs.

Brex Exclusive rewards (monthly payments):

- 7X points on rideshare

- 4X points on Brex travel rewards

- 3X points at restaurants

- 3X points on eligible Apple purchases through the Brex rewards portal

- 2X points on recurring software

- 1X points on all other purchases

By opting for daily payments (instead of monthly) you can earn an additional 1X points in select categories. Life sciences companies don't earn bonus rewards on software, rideshare or restaurant purchases. Instead, they earn additional points on lab supplies and life sciences conference tickets.

Brex also has a custom rewards program that's available to companies with 50 or more Brex users who also will meet minimum spending requirements. You'll have to speak with Brex to see if your company qualifies.

Learn more about all reward multipliers and options here .

Earn 30,000 points after spending $3,500, or 50,000 points after spending $9,000 in the first 30 days.

$0 (paid plans available)

Notable perks

The Brex Card is a World Elite Mastercard® and includes Mastercard ID Theft Protection ( activation required ), MasterRental Insurance (rental car damage and theft coverage) and Mastercard Luxury Hotel Program (free daily breakfast for two guests, room upgrades when available, etc.).

The card also unlocks discounts for a long list of software services and business products such as TurboTax , Microsoft 365, QuickBooks® and Salesforce Essentials. Brex account holders also receive 5% back on Microsoft advertising purchases on up to $10,000 in annual spending per card.

You can use Brex rewards for a long list of redemptions including, gift cards, travel, cryptocurrency, cash back and more. One of the best ways to use Brex points is to transfer points to one of its partner airline loyalty programs, including:

- Air France/KLM (Flying Blue)

- Singapore Airlines KrisFlyer

- Emirates Skywards

- Avianca LifeMiles

- Aeromexico Club Premier

- Qantas Frequent Flyer

- Cathay Pacific Asia Miles

You are allowed to transfer points to any cardholder associated with the Brex account.

[ Return to card summary ]

Ramp Visa® Corporate Card

Ramp is a financial technology company that issues the Ramp Visa® Corporate Card and provides expense management and other services to U.S.-based corporations.

- 1.5% cash back on all purchases

Earn a $250 bonus after account approval.

$0 (paid subscriptions available)

Ramp is a fintech company that offers businesses a variety of tools to manage and automate their finances, including bill payments, expense reimbursement and corporate cards. To qualify for Ramp your company will need at least $75,000 in a U.S. business bank account , be a business registered in the U.S. and the majority of your operations and spending should be in the U.S.

The Ramp card's Visa Signature Business benefits include:

- Rental car collision insurance (primary coverage)

- Purchase security

- Extended warranty protection

- Travel and emergency assistance services

Ramp users have access to a massive amount of deals and discounts on business-related products, services and software. Some of these deals include (at the time of writing):

- QuickBooks discounts

- Up to $5,000 in Amazon Web Services credits

- Up to $2,500 in OpenAI credits

- UPS discounts

- 50% off Amazon Business Prime

- And many more

In addition to straight cash back or gift cards, you can transfer Ramp rewards to airline and hotel partners at a 1.5:1 ratio, including:

- AeroMexico Rewards

- Air France/KLM Flying Blue

- British Airways Executive Club

- Etihad Guest

- Marriott Bonvoy

- Qatar Airways Privilege Club

- TAP Air Portugal Miles&Go

- Wyndham Rewards

While Ramp's transfer ratio isn't great, having the option to convert your cash back to hotel and airline points can help you increase the value of your rewards. For example, you can often book one-way Star Alliance business-class awards from the U.S. to Europe through Avianca for 63,000 miles (94,500 Ramp points).

The American Express Corporate Platinum Card ® provides cardholders with a robust list of travel perks such as lounge access and elite-status benefits.

- 1X points on all purchases

- 5% Uber Cash on Uber rides and Uber Eats orders (enrollment required)

$550 (see rates and fees)

Employees with a personal Amex card , in addition to an Amex corporate card, can qualify for a Personal Card Annual Credit . To be eligible for the credit you must have the same type of personal and corporate card (i.e. Gold, Platinum, etc.). Cardholders with both a personal and corporate Platinum card receive an annual statement credit of $150.

Other perks include:

- Up to $189 in CLEAR Plus credit

- Up to $200 in airline fee credit per calendar year (airline selection required)

- Cell phone protection

- Global Entry or TSA PreCheck application fee credit

- Hilton Honors Gold status (enrollment required)

- Marriott Bonvoy Gold status (enrollment required)

- Roadside assistance

- Trip delay insurance

- Trip cancellation and interruption insurance

- Baggage insurance

- Global Assist Hotline

- The American Express Global Lounge Collection (enrollment required)

- Fine Hotels and Resorts program

- Rental car status perks

Corporate Amex Platinum cards can be linked to either an individual or a corporate rewards program, each card can be enrolled in one program at a time. With the corporate rewards program, designated account administrators can manage and redeem rewards. American Express' corporate rewards program allows redemptions for gift cards , statement credits, travel and merchandise. As an employee, you may be able to link your corporate card to an existing individual Membership Rewards account and redeem the rewards as you like. However, not all Amex corporate cards are eligible for enrollment in an individual rewards account , so you'll need to contact your program administrator to find out your options.

The U.S. Bank Commercial Rewards Card is available to corporations with an annual revenue between $10 million and $150 million.

A company can choose how it earns rewards:

- 1% rebate after spending at least $150,000 in quarterly spending

- 5X points on car rentals

- 4X points on lodging

- 3X points on airlines

With a U.S. Bank Commercial Card account, your company will have access to more than just the ability to earn rewards. This card also has several tools and features designed to simplify expense management and corporate travel. It offers integration with popular accounting software, including QuickBooks online, NetSuite, Xero and more. When employees book through the travel platform it automatically tracks the receipts. You can also set card limits or merchant category restrictions to align with company policies.

How do corporate cards differ from small business cards?

The key differences between corporate and small business cards are how you qualify and what type of business the card is designed for. Small business cards usually require a personal guarantee and personal credit check, whereas corporate cards do not. Corporate cards typically require the business to have a specific legal structure, minimum revenue or cash holdings or a certain minimum number of employees.

Is it hard to get a corporate credit card?

Corporate credit cards aren't necessarily hard to get, but your business typically needs to be larger than a small business with just a couple of employees. To qualify for a corporate card, you could need 15+ employees, a minimum of six figures in annual expenses or a large sum of money in the bank.

Does a corporate credit card hurt your credit score?

If your employer issues you a corporate credit card it won't have an impact on your personal credit score. Corporate card activity isn't tied to your personal credit report.

Bottom line

Corporate credit cards are designed for larger businesses and often offer additional services beyond just credit card rewards. If your company is at the point where managing small business credit cards is becoming tedious, the features offered by the best corporate credit cards may be able to save you time and money.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best corporate credit cards.