Compare rates and fees for your money transfers.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Helpful tools to ensure you get the best rates on money transfers.

A Guide to Travellers Cheques

Once a foreign currency staple, this form of prepaid funds has existed for hundreds of years, designed as a way to allow payment from one person to another across currencies. As the financial services sector continues to shift to online solutions , we look at how, where and why travellers cheques are used, as we discuss the relevance of this form of currency.

What are travellers cheques?

The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day.

A safe and convenient method of payment for anyone travelling to foreign territories, these pre-printed cheques hold a fixed amount which can be used worldwide across a range of currencies. Designed to facilitate payments from one person to another, using different currencies, travellers cheques were initially seen as a more practical way for individuals to carry their spending money.

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two decades.

How do you use travellers cheques?

When you first receive your travellers cheques, you will be required to sign each one before use, as a way of verifying your signature. Each cheque will have a fixed value (usually $20, $50, $100, $500 etc.) as well as a unique serial number which can typically be found in the top right corner.

It is important to take note of these serial numbers as they will be referenced in any case of lost or stolen cheques. Unlike cash, if anything happens to your travellers cheques, the original vendor will be able to issue a refund for the exact same value. This added level of security is why this payment method was seen as revolutionary when first introduced.

As well as signing upon receipt, you will also need to sign each travellers cheque when used by a retailer or exchanged for cash. The act of signing your name as a form of security is somewhat outdated, given the modern technologies in place nowadays.

When accepted by retailers, a travellers cheque will be treated like local currency, which means you should receive any change in the standard, local currency.

Where can I get travellers cheques?

Due to dwindling demand, travellers cheques are not as readily available as they once were. However, they can still be acquired from some banks and financial institutions, post offices and currency exchange offices, like Travelex.

One thing to note is you may be required to settle the handling, commission or cash-in fees that often accompany travellers cheques, and these can be expensive, amounting to 2 - 3% in some cases. This cost is another reason they are no longer as frequently used.

Where can I use travellers cheques?

Generally, travellers cheques are still accepted all over the world, albeit harder to find vendors selling them and retailers accepting them as legal tender. Consider your destination before deciding on this form of travel money: if you are travelling to major cities there is more chance of you finding somewhere to cash your cheques or use them for in-store purchases. However, more remote destinations may not be equipped or able to accept this type of funds.

How safe are travellers cheques?

The original blueprint for travellers cheques was a paper payment method which could be used as foreign currency but was more secure than handling cash. At the height of its popularity, travellers cheques were generally considered much safer than cash due to the added security of their unique serial numbers, meaning customers could cancel and replace cheques if need be. These numerical codes were a money-back guarantee for anyone whose cheques were misplaced, destroyed or stolen. Another added benefit, if your travellers cheques are intercepted, you will not be vulnerable to bank fraud, as they are in no way connected to your bank account, unlike credit or debit cards.

Financial security measures have evolved greatly since the inception of travellers cheques, however, with the introduction of PIN codes, two-factor authentication, fingerprint touch ID and facial recognition, to name a few forms of fintech security commonly available now. With this in mind, the concept of a travellers cheque no longer measures up in terms of fraud protection and data encryption.

Travellers cheque vs. Cashiers cheque: What is the difference?

In terms of appearance, a travellers cheque looks nearly identical to a standard issue cashier's cheque: but are they similar in any other ways?

A cashiers cheque is issued by a bank or financial institution and is designed to be processed quickly, by the individual whose name is printed on the cheque. Conversely, a travellers cheque is for use overseas, is loaded with prepaid foreign currency - usually USD or GBP - and does not have a name or account number printed on it, although it does require a signature. Because travellers cheques do not have any bank details printed on them, they are deemed safer than cashiers cheques in terms of potential for fraudulent use. In addition to this, they are paid for when printed, meaning it is not possible for a travellers cheque to bounce.

What are the alternatives?

Credit or debit cards.

If you are worried about travellers cheques not being widely accepted where you are going, then this form of travel money will offer more flexibility. Using your regular bank cards overseas provides a record of spending and offers maximum convenience, but there are also some frequently flagged concerns. Primarily these concerns focus on the sky-high fees and below-average exchange rates related to using your debit or credit card abroad. This isn’t always the case, however, as many banks and financial institutions offer travel credit cards, tailored to suit the needs of frequent flyers.

Travel money cards

Prepaid travel money cards are the modern equivalent to travellers cheques and have become very popular. This is largely due to the fact that they are totally separate from your regular bank account, allowing users to spend their balance freely without the worry of potential fraud or overspending. Preloaded with funds, travel money cards often help limit additional currency exchange charges. In addition to this, in spite of fluctuating currency rates, these cards let customers lock-in a favourable exchange rate ahead of time.

International bank accounts

If you are headed overseas for a sustained period of time, it could be more convenient and cost-effective to open a bank account in your destination country. You would be subject to the relevant security and eligibility checks but this decision pays off if you are making regular international money transfers or being paid in a different currency by foreign clients . Find out more about this option by reading our guide: How to Open a Bank Account Overseas.

Due to the growing alternative digital payment methods available nowadays, it seems this age-old travel money no longer measures up in terms of accessibility, cost and convenience. When travellers cheques were originally launched, ATM withdrawals were not commonplace for travellers, and digital point of sale systems had not been invented. Nowadays, it is easy to access local currency using an assortment of different payment methods such as debit or credit cards, travel money cards or money transfer apps .

The best option for anyone who is reluctant to use their debit or credit card overseas, would be to use a prepaid travel money card. Prepaid travel money cards are a safer and more widely used alternative to travellers cheques, and customers do not need to seek out a bank to use them, are not required to sign for each transaction and security measures in place are far more advanced. This method enables customers to secure multiple foreign currencies, locking in the optimum exchange rate for your currency pairing ahead of your trip abroad. Use our comparison tool to ensure you receive the most competitive exchange rates for your international money needs.

Related content

Related content.

- A Guide to Travel Money Cards Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals. January 16th, 2024

- UK Passports Offer Better Travel Freedom Since Brexit The Henley Passport Index is an annual research project that evaluates the relative power of passports from 199 countries. It determines how many locations each passport allows its holders to access visa-free or with visa-on-arrival, creating a global ranking. June 5th, 2023

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. June 5th, 2023

- Cheapest European city breaks on the British government’s exemption list The study incorporated numerous factors across a variety of areas including: February 15th, 2023

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! February 19th, 2024

Contributors

April Summers

- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Beginning in the late 1980s, traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions such as American Express.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe. In 1891, a company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include American Express , Visa , and AAA . They often come with a 1% to 2% purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account. The redemption application online should take less than 15 minutes to complete.

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from American Express, Visa, and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Many hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/_How-does-a-prepaid-card-work-960201_Final2-a914cdbc7901430d80de45153461af0a.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Using travellers cheques abroad: the pros and cons

In this article

What are travellers cheques?

Why do people choose travellers cheques, are there any disadvantages to using travellers cheques, getting a good deal on travellers cheques.

Travellers cheques are preprinted cheques for fixed amounts. They can be used when you’re on holiday in place of cash, or can be exchanged for cash while you’re away.

Travellers cheques can be issued in sterling or in foreign currencies and, depending on the country you are visiting, you may be able to spend them at your hotel, or in shops and restaurants. Alternatively, you’ll be able to swap your travellers cheques for local money at banks and bureaux de change.

When you purchase travellers cheques, you’ll need to sign each one (usually in the top left-hand corner) and take a note of the serial number of every cheque you are issued. This is in case your travellers cheques need to be replaced at a later date.

When you spend or cash in your travellers cheques, you’ll be required to countersign each one a second time in the presence of the person accepting it. This is so the two signatures on the travellers cheque can be compared and your identity verified.

Although many people have now moved to using foreign currency prepaid cards and credit cards for overseas spending, travellers cheques still remain popular.

The key advantage of travellers cheques is that they are safer to carry around than cash. Provided you have noted down the serial number of each cheque you were originally issued, you will be able to get them replaced should they be stolen or lost.

Remember to keep your note of the serial numbers separate from the cheques themselves. If you lose this along with your wallet, for example, you are likely to have difficulty claiming replacement cheques.

Another thing some holidaymakers like about travellers cheques is that they do not carry expiry dates. In other words, should you fail to spend all your travellers cheques on one holiday to a particular destination, there is no reason why you can’t simply use them the next time you visit.

Some people see travellers cheques as an outdated way to spend money abroad, especially now prepaid cards , which work in a similar way to travellers cheques, are so readily available.

The only notable disadvantage to using travellers cheques, however, is the potential for them to be an inconvenient – and in some cases unexpectedly costly – payment method.

While in some countries, such as the United States, you may find it easy to spend your travellers cheques, in others you may have to queue up at a local bank or bureau de change to have them exchanged.

It’s also important to be aware that if you are planning to exchange travellers cheques in one currency for cash in a different local currency – for example by swapping a US dollars travellers cheque for money in a South American destination – you may be charged a foreign-exchange rate and commission on these transactions.

Travellers cheques are offered at slightly different exchange rates to cash, and it’s worth shopping around to compare a variety of deals before you buy.

When you buy travellers cheques in a foreign currency, such as euros or US dollars, you’re unlikely to be charged commission.

However, if you buy sterling travellers cheques for use abroad it’s likely you’ll have to pay commission of around 1%. You should take this into consideration if you’re flying to a destination that might accept travellers cheques in a currency other than sterling.

Finally, if you know you’ll need to exchange your travellers cheques for local cash upon arrival at your holiday destination, think about the impact that paying the necessary money-exchange rates and commission might have on your budget overall.

If it looks as though this could be significant, you may want to consider other options such as using a debit or credit card for overseas spending.

- Best debit and credit cards for spending abroad

- Using prepaid cards for spending abroad

- Buying travel money on the high street

- Buying travel money online

Related articles

- Best and worst airlines

- How to save money at the airport

- Airport fast track: is it worth paying more?

- Share on Facebook

- Share by email

Latest News In Which? Travel

Train and Border Force strikes in April and May

29 Apr 2024

Spain's passport requirements and the £97 per day rule

25 Apr 2024

Which is really better – easyJet or Ryanair?

22 Apr 2024

When British Airways is cheaper than Ryanair

Is it safe to travel to Dubai for a holiday?

19 Apr 2024

This summer’s cheapest package holiday destinations

The best European cities for food and drink

12 Apr 2024

Camping checklist: Your ultimate camping essentials checklist – with a few added luxuries

10 Apr 2024

Best places to visit in May

04 Apr 2024

Rules for British passports in the EU

28 Mar 2024

Best small ship cruise lines

27 Mar 2024

Holiday destinations in April

25 Mar 2024

Cheapest destinations for a holiday cottage this Easter

22 Mar 2024

Beyond Eurostar: New sleeper train routes across Europe

Which? Get Answers podcast: a beginners guide to camping

18 Mar 2024

Whatever happened to cheap holidays?

15 Mar 2024

Bank holidays in 2024: How to maximise your annual leave

14 Mar 2024

Which holiday companies have we recommended the longest?

Which? Travel at 50 – the story of the UK's longest running travel magazine

13 Mar 2024

How travel has changed in 50 years

What are traveller’s cheques, and when should you use them?

When travelling abroad you will have to make use of the local currency when purchasing goods and services. However, it’s not always feasible or safe to carry cash in a foreign country.

13 May 2021 · Isabelle Coetzee

We have a look at how traveller’s cheques attempt to solve this problem, and we consider their place in the current marketplace.

Tip: Have a look at our currency converter to find out which exchange rate to aim towards.

What are traveller’s cheques?

According to Sebastien Alexanderson, CEO of National Debt Advisors, traveller’s cheques are a way of transporting currency between countries when the carrying of cash is not recommended. While still functional in some situations, they are now considered dated.

Formerly accepted from foreigners by many businesses, traveller’s cheques were considered reliable because they would not “bounce” – unless the person using them went bankrupt. They could also be replaced by their linked financial institution if they were stolen or lost.

Traveller’s cheques were basically interest-free loans, which were taken out by travellers from financial institutions. Rather than attracting interest, travellers were charged a fee to purchase these cheques.

Are they still used today?

Alexanderson says that advances in technology have made traveller’s cheques almost obsolete and a nuisance to convert. Alternatives started surfacing in earnest during the 1990s.

“ATMs and chip-and-pin devices are available in every corner of the world. As long as you have a debit card, it’s cheaper and safer to use your card,” says Alexanderson.

“If, for whatever reason, you don't have a bank account and feel that cash is too risky to carry, you could attempt to source and use traveller’s cheques,” he notes.

Traveller’s cheques are mostly safe. However, they have attracted fraudsters in the past. For example, people have bought them, sold them at a 50% discount, and then reported them as “stolen”. This led to financial institutions reimbursing them as well, so the user would gain a large profit.

Nowadays it makes more sense to simply use your debit or credit card when paying abroad. It’s easier to navigate, and you don’t have to keep track of numerous documents.

Get rid of your debt quicker by getting a consolidation loan today.

[email protected] 5th Floor, 11 Adderley Street, Cape Town, 8001

© Copyright 2009 - 2024 Terms & Conditions · Privacy Policy

Quick links

Your credit score is ready.

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.

- Cambridge Dictionary +Plus

Meaning of traveller's cheque – Learner’s Dictionary

Your browser doesn't support HTML5 audio

(Definition of traveller's cheque from the Cambridge Learner's Dictionary © Cambridge University Press)

Translations of traveller's cheque

Get a quick, free translation!

Word of the Day

not a living soul

Hidden in plain sight: words and phrases connected with hiding

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- Learner’s Dictionary Noun

- Translations

- All translations

To add traveller's cheque to a word list please sign up or log in.

Add traveller's cheque to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

- Dictionaries home

- American English

- Collocations

- German-English

- Grammar home

- Practical English Usage

- Learn & Practise Grammar (Beta)

- Word Lists home

- My Word Lists

- Recent additions

- Resources home

- Text Checker

Definition of traveller’s cheque noun from the Oxford Advanced Learner's Dictionary

traveller’s cheque

Want to learn more?

Find out which words work together and produce more natural-sounding English with the Oxford Collocations Dictionary app. Try it for free as part of the Oxford Advanced Learner’s Dictionary app.

travellers cheques ne demek?

- Seyahat çekleri

- Bk. yolculuk

- Yolculuk, gezi.

travellers cheque

- Seyahat çeki

travellers check

Türetilmiş kelimeler (bis).

- How it Works

- Why choose us

- Snowbirds Real Estate

- Personal Expenses

- Importing Businesses

- Exporting Businesses

- Property Buyers

- International Students

Get started

What Are Traveller’s Cheques and How Do They Work?

You’ve probably heard of traveller’s cheques but may not have used them. A traveller’s cheque is among the many cashless methods of paying for services or goods. However, traveller’s cheques have been losing their popularity since the onset of credit and debit cards.

The good news is that traveller’s cheques are still functional and can save you from the stress and risk of carrying a huge chunk of money while travelling.

Here, we will answer the following questions:

- What are traveller’s cheques?

- How do they work?

- What are the benefits of traveller’s cheques?

- Can traveller’s cheques be a hassle?

- What are alternatives to traveller’s cheques?

Let’s get started.

Don't Waste Money With Banks. Get Exchange Rates Up to 2% Better With KnightsbridgeFX

What are Traveller’s Cheques?

A traveller’s cheque is a printed cheque that allows payment from one person to another and across currencies. So, travellers get the cheque before they travel to exchange it with the local currency after getting to their destination.

You can easily get traveller’s cheques in Canada from financial institutions like American Express or Visa. Also, some local banks offer traveller’s cheques, but most of them scrapped it a long time ago.

How Do Traveller’s Cheques Work?

Traveller’s cheques do not bounce since you pay upfront for a specific amount that you wish to spend. The cheque will have a fixed value and a unique serial number.

Once you receive your traveller’s cheque, you should be conversant with how to use it. So, you should follow the issuer’s instructions and sign the traveller’s cheque upon receipt.

When making purchases, countersign the cheque in the presence of the receiver; the recipient should compare the signatures and confirm that they match. Any change is returned in the local currency since the traveller’s cheque is accepted at the same exchange rate as a cash payment.

However, you must enquire from the recipient if they accept traveller’s cheques as a means of payment before making any purchases. While the traveller’s cheques still work, some institutions and persons refer to them as outdated and do not accept them. You can still make the purchases in such cases, but you need to deposit the traveller’s cheque and receive cash in the local currency. Also, do your research ahead of your trip. Ensure that you can easily access services via your traveller’s cheque before purchasing them.

Most importantly, keep the details of your traveller’s cheque safe. If you lose your traveller’s cheque, you need to provide proof of purchase and the unique serial number to get a refund. Also, contact your cheque issuer immediately after losing your traveller’s cheque.

The traveller’s cheques do not expire. Therefore, you can keep them safe and use them in the future. Alternatively, you can deposit them in your bank account once you get home.

Benefits of Traveller’s Cheques

Here are the various advantages of traveller’s cheques.

- Safety: Traveller’s cheques are safe and can allow you to carry a large amount of money while travelling.

- Refunds are possible: With traveller’s cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank once you get home.

- Does not expire: Your traveller’s cheque does not expire and can be kept and used again in the future.

- Branded Cheques: The American Express and Visa offer branded traveller’s cheques that come in various denominations and are readily acceptable globally.

- Good exchange rates: In some cases, traveller’s cheques can access a better conversion rate.

Can Traveller’s Cheques Be A Hassle?

Traveller’s cheques have several advantages, but today, you can experience many struggles while using them.

For starters, the cheques have become outdated. Therefore, most hotels, banks, and individuals will decline them.

As a result, you will likely be forced to hunt down banks and hotels that will accept the traveller’s cheques prior to travelling. If you travel without doing your research, you can be frustrated finding that the cheques are not accepted at your destination.

Also, most banks no longer offer traveller’s cheques. The few banks that offer the cheques might charge you traveller’s cheque fees for the service.

Other Payment Methods That You Might Consider

Purchasing a traveller’s cheque may save you from the stress of carrying a large amount of money that can get lost or stolen. However, it has several limitations.

So, while travelling, you may need to consider the following alternatives:

Debit Cards

The popularity of debit cards is increasing every day. The size of the card and its acceptability rate make it among the most convenient methods of payment. So, many foreign banks, hotels, and ATMs accept foreign debit cards.

Credit Cards

Like a debit card, a credit card is small and secure to travel to various places. Besides, credit cards like MasterCard, Visa, and American Express are accepted as a method of payment in most countries globally.

Although carrying a huge amount of money while travelling is risky, it’s ideal to have a certain amount of money in cash for emergency purposes. For that reason, ensure you bring with you a given amount in the form of cash.

Prepaid Card

Prepaid cards work like debit cards and credit cards since you load them with your bank account money. Therefore, you can use your prepaid card as a debit card on the ATMs and credit card when making purchases and in hotels.

Traveller’s cheques are a safer, cashless method to use when travelling.

However, with the growing popularity of debit cards and credit cards, traveller’s cheques are quickly losing their place in the payment method.

Also, they are unacceptable in most places, making them more unreliable when travelling to destinations that limit their use. So, alongside your traveller’s cheque, carry your debit card, credit card, and some little cash to enjoy your travels .

Stop overpaying with your bank on foreign exchange

We are built to beat bank exchange rates and save you money

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788. Like most financial institutions, we are required to validate the identity of all clients. We have strict measures in place to protect your privacy.

You're 0% there.

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788 .

130,000+ Satisfied customers

There is no obligation to transact and no hidden fees.

We guarantee to beat your bank's rate 100% of the time.

Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Month January February March April May June July August September October November December

Year 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Are you or any close relative a Politically Exposed Foreign Person?

(Head of State, Member of Senate, House of Commons, or Legistrature, etc)*

I confirm I am not transacting on behalf of a third party and I have read and I agree to the Terms and Conditions*

- Daily Update (2,677)

- Editorials (40)

- Finance Tips (23)

- Guides (285)

- Holiday Hours (1)

- In the News (34)

- International Money Transfer (10)

- Monthly Canadian Dollar Outlook/Forecast (108)

- Real Estate (11)

- Trading Tips (15)

- Travel Tips (34)

- Uncategorized (6)

Recent Posts

- Canadian Dollar Update – Canadian Dollar awaiting GDP

- Canadian Dollar Update – Canadian Dollar opens nearly unchanged from Friday

- Canadian Dollar Update – Canadian Dollar rising

- Canadian Dollar Update – Canadian Dollar firming ahead of US GDP

- Canadian Dollar Update – Canadian Dollar gains on shaky ground

- Canadian Dollar Update – Canadian Dollar rises as Middle East tensions fall

- Canadian Dollar Update – Canadian Dollar caught in a geopolitical vortex

- Canadian Dollar Update – Canadian Dollar Ignores Federal Budget

- Canadian Dollar Update – Canadian Dollar Awaits CPI

- Canadian Dollar Update – Canadian Dollar recoups some losses

- Canadian Dollar Update – Canadian Dollar remains under pressure

- Canadian Dollar Update – Canadian Dollar gets hammered

- Canadian Dollar Update – Canadian Dollar facing dual risks

- Canadian Dollar Update – Canadian Dollar becalmed before BoC

- Canadian Dollar Update – Canadian Dollar Eclipsed

Foreign/Currency Exchange Resources

- Currency converter Canada

- Currency Conversion

- Foreign Exchange

- $100 USD in CAD

- RBC currency converter

- RBC foreign exchange rate

- BMO exchange rate

- CIBC exchange rate

- BMO currency exchange

- Tire Bank Exchange Rate

- Scotiabank exchange rate

- HSBC exchange rate

- PayPal conversion rate

- Knightsbridge FX Reviews

- Canadian Dollar History

Useful Links

- Why Choose Us

- Get Started

- Send Money to US

- Currency Exchange Canada

- Currency Converter

- USD to CAD Exchange

Our Offices

Main office (Appointment only)

First Canadian Place

100 King Street West Suite 5700 Toronto, ON, M5X 1C7

(416) 479-0834 Toll-Free: 1-877-355-5239 Fax: 1-877-355-5239

Local offices

Toronto : (416) 479-0834 Montreal : (514) 613-0393 Calgary : (403) 800-3025 Ottawa : (613) 704-1798 Vancouver : (604) 229-1065 Victoria : (877) 355-5239 Winnipeg : (204) 318-1150 Halifax : (902) 800-2063

Get up to 5% better than the bank

Choose your currency pair and get rate alerts

All rights reserved. Knightsbridge Foreign Exchange

Currency Exchange Canada.

Travellers Cheques

Everything you need to know about travellers cheques and their alternatives., they’re easy to use, they’re safe, they’re accepted worldwide, they don’t expire, so why aren’t people using travellers cheques as much anymore, travel money card, travel insurance, travelex info, join the conversation, customer support.

Travellers Cheques FAQ

Travellers cheques frequently asked questions, passport and credit/debit card replacement assistance, quick links, about travelex, useful information, customer support, travelex foreign coin services limited.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Redemption of American Express ® Travelers Cheques

Travelers Cheques have been a timeless addition to the world traveler’s carry-on for over 130 years. While new Travelers Cheques are no longer issued, your Cheques remain backed by American Express and have no expiration date.

REDEEM WITH AMEX ANYTIME

NO EXPIRATION DATE

24/7 CUSTOMER SERVICE

BACKED BY AMERICAN EXPRESS

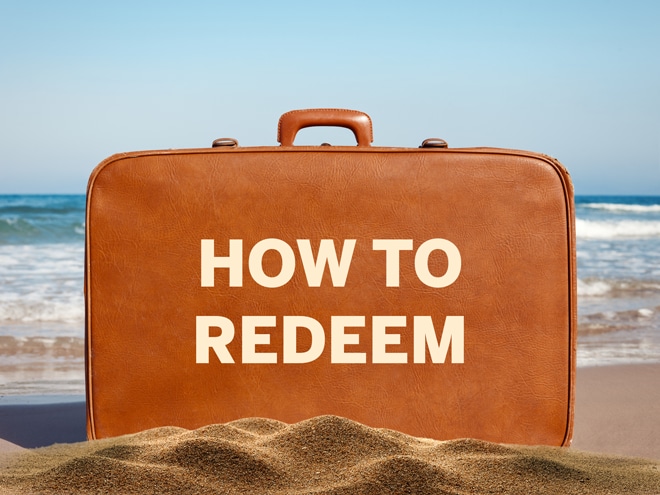

HOW TO REDEEM

Travelers Cheques can no longer be purchased but can be redeemed in several convenient ways. Here’s how:

REDEEM WITH AMERICAN EXPRESS TRAVEL RELATED SERVICES COMPANY, INC.

REDEEM ONLINE

Quickly and securely redeem your Travelers Cheques online .

Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to redeem over the phone.

DEPOSIT WITH YOUR BANK

Confirm whether your bank allows account holders to deposit Travelers Cheques. Fees may apply.

EXCHANGE FOR LOCAL CURRENCY

Travelers Cheques can be exchanged worldwide. Find exchange locations . Fees may apply.

TRAVELERS CHEQUES EXCHANGE LOCATOR

Find the nearest exchange location.

Service Center

Have more questions?

Here are some common scenarios and what to do.

UNDERSTANDING TRAVELERS CHEQUES

Keep your Cheques secure until you’re ready to redeem.

Protect yourself in case of loss or theft by signing on the upper signature line.

Record the serial numbers and keep them in a safe place when you travel.

Keep your Cheques tucked away and hidden like you would cash.

When the time comes, sign your Cheque on the lower signature line in sight of the person accepting it.

Find documents you may need in case of claiming inherited Cheques, lost or stolen Cheques, and more.

DOCUMENTATION

Additional documents may be required based on the claim type. Typical documents include:

- Valid Photo ID (Passport, Driver's License or Government Issued ID)

- Copy of the Voided Travelers Cheque(s)

- Refund Details

UPLOAD DOCUMENTS

Once you have gathered the required documents and filled out any required documents and forms, upload here. Clear images will help expedite processing.

UNABLE TO UPLOAD?

If you’re unable to upload your completed documents, you can send hard copies directly to American Express .

INHERITED CHEQUES

How to redeem your inherited Travelers Cheques if the original owner is deceased or incapacitated.

1. OPEN A CLAIM

Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to begin a claim over the phone.

2. IDENTIFY & LOCATE REQUIRED DOCUMENTS

List of required documents and forms can be found here . You’ll need these to submit your claim.

3. UPLOAD REQUIRED DOCUMENTS

Be sure to upload clear images for faster processing.

4. IF YOU’RE UNABLE TO UPLOAD

As an alternative to submitting online, you can also mail hard copies of your documents to American Express .

*Travelers Cheque Encashment service is provided by American Express Travel Related Services Company, Inc.

Can I buy Travelers Cheques?

Travelers Cheques are no longer issued and so cannot be purchased.

Where can I redeem my Travelers Cheques?

There are thousands of foreign exchange partners in countries around the world where you can exchange your American Express Travelers Cheques for local currency. You can find places to redeem your Travelers Cheques using " Find Exchange Locations ". It may also be possible to redeem your Travelers Cheques directly for goods and services. Check first, though, with the merchant. American Express does not approve the use of its products, or any services related to its products, in the following territories: Crimea, Donetsk, and Luhansk Regions of Ukraine, Cuba, Iran, North Korea, Syria, Russia and Belarus.

Can I redeem my Travelers Cheques directly with American Express?

Yes, you can redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. online . Alternatively, you can call American Express Customer Service at 1-800-221-7282 to register a redemption claim. You can find additional contact numbers based on your location. We may have to contact you with questions regarding your claim or to request additional information.

How do I redeem my Travelers Cheques?

You can redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. Please refer the “How to Redeem” section above. Alternatively, simply present the Cheque at an eligible foreign exchange partner or merchant location. Make sure the acceptor watches while you countersign the Cheque on the lower signature line. Photo identification may be required. We strongly recommend you retain and carry your original Cheque purchase receipt with you when you travel. Commission charges may apply and can vary by country or exchange partner. Exchange limits may apply due to local regulations and exchange policies.

What happens if I sign my Travelers Cheques in the wrong place, or if my signatures don't match?

Acceptance of Travelers Cheques is based on the acceptor watching the customer sign the Cheque on the lower signature line, and then comparing that signature with the original signature on the upper signature line. The acceptor must observe the customer signing the Cheque. If the signatures are a reasonable match, the Cheque should be accepted. Photo identification may be required at the discretion of the acceptor. As always, if the acceptor is unsure, they should call an American Express Travelers Cheque Customer Service Center .

Is there a fee to cash Travelers Cheques?

Commission charges may apply and can vary by country and/or exchange partner. Before you travel, we recommend that you find the most convenient Travelers Cheque exchange locations using the Find Exchange Locations .

What happens if my Cheques are lost or stolen?

Lost or stolen Travelers Cheques may be refunded.* Please call Customer Service at 1-800-221-7282 or find the additional contact numbers for your current location. Have your recorder serial numbers on hand when you call.

* Terms & Conditions and restrictions apply. Identification and proof of purchase required.

How are Gift Cheques cashed?

When cashing a Gift Cheque, the recipient should fill out the "pay to the order of" line and countersign the Gift Cheque in the lower corner with the acceptor watching. If you encounter diffiulties in cashing a Gift Cheque in the United States, please encourage the merchant to call American Express for instructions at 1-800-221-7282 . If you are located outside of the U.S., you can find additional contact numbers to provide the merchant based on your location.

Can I redeem my Gift Cheques directly with American Express?

Yes, you can redeem your Gift Cheques directly with American Express Travel Related Services Company, Inc. online . Alternatively, you can call American Express Customer Service at 1-800-221-7282 to register a redemption claim. You can find additional contact numbers based on your location. We may have to contact you with questions regarding your claim or to request additional information. You can also find places to redeem your Gift Cheques using Find Exchange Locations . There also may be restrictions on the currency and method of redemption and the value of Gift Cheques that can be redeemed.

Still Need Help?

Call American Express Customer Service 24/7 at 1-800-221-7282 or find additional contact numbers based on your location.

American Express stopped issuing Travelers Cheques, so they’re no longer available for purchase. Support is available by phone and the American Express website for customers to redeem valid Travelers Cheques. Travelers Cheques remain backed by American Express and have no expiration date.

- Classifieds

- Greece Guide

Cards & Traveller's cheques

How to use them.

The first bank you’ll love

Greece - money.

An instant method of obtaining cash in Greece is to use a debit, credit or charge card from an automatic teller machine (ATM).

Traveller’s Cheques

By Just Landed

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Further reading

- Banks: Where to manage your finances

- Accounts: How to open a bank account in Greece

- Cost of Living: What is the cost of living in Greece?

- Importing & Transferring Money: How to receive and transfer money

- Offshore Banking: Putting your money in a tax haven

- Income tax: An introduction to Greece's income tax

- Income Tax Liability: Who is liable to pay income tax?

- Taxable Income & Allowances: What part of my income is taxable?

- Income Tax Rates: Calculating your income tax

- Income Tax Returns: Filing and payment

Does this article help?

Do you have any comments, updates or questions on this topic? Ask them here:

Royal Mail strikes are expected in November.

We advise all our customers to order their travel money this month to reduce any inconvenience caused from any upcoming delays or backlogs next month.

Compare Exchange Rates

- Currency Converter

- Convert British Pounds To Australian Dollars

- Convert British Pounds To Euro

- Convert British Pounds to Japanese Yen

- Convert British Pounds To Turkish Lira

- Convert British Pounds To US Dollars

- Convert Australian Dollars To British Pounds

- Convert Euro To British Pounds

- Convert Japanese Yen To British Pounds

- Convert Turkish Lira To British Pounds

- Convert US Dollars To British Pounds

Found yourself stuck with travellers cheques? Here's how you can exchange your travellers cheques to cash.

JANUARY 2021

Before we start talking about exchanging your travellers cheques into cash, let's start at the beginning.

What exactly is a travellers cheque? According to the Oxford dictionary, it is defined as "a cheque for a fixed amount that may be cashed or used for payments abroad after endorsement by the holder's signature". Traveller's cheques used to be available in several currencies such as US dollars, Canadian dollars, pounds sterling, Japanese yen, Chinese yuan and Euros.

Travel Money

I have British Pounds

1 GBP = Your exchange rate

1 GBP = Real exchange rate

- Transfer Type

- Low cost transfer - 369.39 GBP fee Send money from your bank account

- Advanced transfer - 369.39 GBP fee Send from your GBP account outside the UK

The more you order the lower the fee

I want to buy

These rates are available only when you pay online - rates in branch will differ

Last updated on

Source: compareholidaymoney.com

*We capture the exchange rates being offered by airports and high street providers once a month and calculate what spread they are taking off the live interbank rate. We then compare that to what rates we are offering to calculate the savings you can make if you use us.

*Your potential saving has been calculated using our exchange rate and the most expensive provider's rate in the market at a given point in time.

They were seen as a safer alternative to carrying physical cash around and at one point in time, very popular amongst tourists. Restaurants, bars, shops and most businesses would happily accept them as a travellers cheque could never "bounce". The issuer will unconditionally guarantee payment of the face amount. For reference only, the organization that produces a traveller's cheque is known as the issuer. The bank or financial institution that sells the travellers cheques is the agent of the issuer and the traveller who buys the cheque is the purchaser. The shop or restaurant you go into and use the cheque is known as the merchant.

The most well known issuers of travellers cheques were Thomas Cook, Bank of America and American Express. However, since the 1990s there has been a great decline in their use as cash, pre paid cards, ATMs, multi currency cards and credit cards have taken over when spending money abroad.

Now it is very difficult to use travellers cheques abroad. In fact most businesses will not accept them and they have indeed become an obsolete.

How can I exchange my travellers cheques?

Even though these cheques can no longer be used in shops when you go on your next holiday, they have no expiry date and there are still some ways that you can cash them in but just expect a poor exchange rate when you do exchange them for cash.

1) Your local Post Office

Luckily, you can still walk down your high street and into your local Post office to exchange your travellers cheques into cash. The exchange rate you do this at will probably be poor and there may even be associated fees but this is at least a quick and simple solution. Remember to take your proof of ID with you, this could be your photographic driver's licence or passport.

2) Visit your local bank

A few banks still allow account holders to deposit Travellers Cheques to their personal bank account and so it may be worth checking with your bank first to see if you can exchange your travellers cheques with them directly and they deposit the GBP equivalent directly into your current account. Once again, if you go in person to your local bank branch will be asked to present photographic ID that includes your signature for sign off of these cheques.

3) Go online

It is also worth visiting the issuer's website directly to get guidance on redeeming your travellers cheques.

For example, if your travellers cheque has American Express logo on them, you can click on this link American Express Travelers Cheques. The page provides you with your nearest location to exchange your Travellers cheques in person and also provides an option to redeem them online.

Alternatively, if your travellers cheques are issued by Travelex, Thomas Cook, Mastercard or Interpayment Visa you can use their encashment form found here encashment-form-newv5.pdf (travelex.co.uk)

Generally speaking, exchanging your travellers cheques into cash requires you to print out and complete a form from the issuer. You will be asked to complete the details of the currency denominations of your travellers cheques and also to keep a record of their respective serial numbers. Additionally, since this process is done online and not over the counter in front of a clerk, they will request a copy of your proof of identification which also includes your signature. This can be a photograph drivers license or a passport. For larger amounts they may even request a proof of address - so a recent utility bill or bank statement.

Make sure you have the above at hand when filling these forms out to make things quicker for you

What are the alternatives to taking travellers cheques?

Travel money is a very easy and cheap way to spend money abroad. To find the best exchange rate, simply go online and compare exchange rates and any associated fees that foreign exchange providers are offering.

Some foreign exchange companies may say no commission and no fees on top but may in fact hide their fees within the exchange rate. So, instead of purchasing your travel money at the real exchange rate, you may be offered something away from that rate and this is the spread which incorporates their fees.

Other companies are easier to buy travel money online from as they are transparent. The Currency Club for example, offers their best exchange rates on any currency and additionally gives you access to review the live interbank exchange rate before you confirm your transaction giving you complete transparency. You can then easily compare how much you can save. The company will deliver the travel money directly to your home, fully insured by 1pm using with you selecting the day that suits you best.

Credit cards (pre paid and others)

There has been a significant increase in travellers using their cards abroad. Of course a pre paid currency card helps travellers to budget, as you top up only the amount you wish to spend. Additionally, like travellers cheques they can be a safer option in the event that your card is stolen.

However, the problem arises when you visit a place that does not accept cards. In which case you are at the mercy of taking cash out of ATMs when abroad and this can work out to be very expensive.

Not only may you get charged withdrawal fees each time, but the exchange rate may also be very poor since ATMs are also charging you for the convenience of having cash on tap!

The safest and most sensible solution is to always have some travel money and perhaps one other alternative. This way, it's easier to stick to a budget and it means you will not need to waste your time or money visiting ATMs when abroad.

Buy Traveller Cheques

As an alternative to cash, we offer the best currency exchange rates on travellers cheques. They are safest ways to carry money around. In the event that the travellers cheques are lost or stolen you can report this and receive a replacement immediately.

Make sure you sign each travellers cheque when you receive them from us and keep the serial numbers in a safe place before you travel so you are protected in the event that your cheques are lost or stolen. When you want to make a purchase or exchange them for cash, just sign the travellers cheque in the designated area in the presence of the acceptor, along with your passport (you may be required to show your passport when you decide to use them).

Then you're good to go!

We can buy back your leftover euros so you can always transact at the best GBP to EUR exchange rate with no hidden fees.

Send money abroad in Euro (EUR) at low cost with our best exchange rates

Get your rate on the move.

Download our app to place travel money orders, send funds abroad and get alerts on the go.

- Daily Crossword

- Word Puzzle

- Word Finder

- Word of the Day

- Synonym of the Day

- Word of the Year

- Language stories

- All featured

- Gender and sexuality

- All pop culture

- Grammar Coach ™

- Writing hub

- Grammar essentials

- Commonly confused

- All writing tips

- Pop culture

- Writing tips

Advertisement

traveller's cheque

- a cheque in any of various denominations sold for use abroad by a bank, etc, to the bearer, who signs it on purchase and can cash it by signing it again

- Moscow Tourism

- Moscow Hotels

- Moscow Bed and Breakfast

- Moscow Vacation Rentals

- Flights to Moscow

- Moscow Restaurants

- Things to Do in Moscow

- Moscow Travel Forum

- Moscow Photos

- All Moscow Hotels

- Moscow Hotel Deals

- Things to Do

- Restaurants

- Vacation Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

changing currency/travellers cheques - Moscow Forum

- Europe

- Russia

- Central Russia

- Moscow

changing currency/travellers cheques

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Central Russia forums

- Moscow forum

How easy is it to exchange US dollars for local currency.

Are there readily available ATMs for cash withdrawal on credit cards?

Since you've you used the word cheque can I assume your English? Yes you can take US dollars or euros and exchange them for roubles, but unless they're your local currency I wouldn't bother. If you arrive at Domodedovo airport as you clear customs there's 2 ATM machines about 15 metres on your left one of which is a Barclay's bank machine. A little further on the right there's an exchange bureau, but rates aren't as good as you'd get in the city.

Plz read Top Questions at the top right of this page re: money...forget money exchange, go with ATMs...but read the background first...it will answer ALL of your questions...in fact, check this reference stuff out overall, as well as all the excellent links on the left of this page...

No need for the trvl checks. Exchange stations at all airports I have been in. All Russian ATM machines I have seen will have a screen that pops up with an english button on it. As easy to use as any other, in any country. Some of the old ones even had a actual English button on the side? Wow. AIM.

Note - I might avoid using ATM to get cash on a credit card...from what I know, you really can get whacked doing this. If possible, use a debit card...all of this is covered in Top Questions...top right of this page.,..

Atm's are the way to go.

IF you bring cash to exchange, they MUST be NEW, FRESH-lokking bills otherwise they won't except them. THis will frustrate you to no end.

So- ATM forst choice

2nd- bring US dollars -keep them NEW, do NOT bend/fold the bills or no one will take them.

Have fun. ;-)

lots of places to change cash into rubles. the airport having the worst rate i saw. some of my bills were used and/or folded but in excellent shape and were taken with no issues several places.

travelers checks have become problematic just about anywhere i go. i no longer use them.

i also used my credit card a few places without problems. looked at my statement today and the charge amount was reasonable. be sure your card does not charge extra fees or treat these exchanges as a cash advance and inform them where you will be traveling.

This topic has been closed to new posts due to inactivity.

- travel to moscow yesterday

- Planning trip to Russia Apr 28, 2024

- Train Booking Moscow to St. Peter Apr 24, 2024

- SIM card. Russian SIM cards, do they still work in the UK? Apr 09, 2024

- Union Pay debit card Mar 27, 2024

- Russian trying to book a hotel in Jerusalem Mar 14, 2024

- Dual Citizen Arrested in Russia Mar 12, 2024

- about clothes Feb 27, 2024

- NOTE - border crossing from Finland into Russia closed Feb 09, 2024

- Snow boots in Red Square Feb 04, 2024

- Travelling to Moscow & Murmansk with toddle in winter Feb 02, 2024

- Anyone traveling from London to Moscow this week ? Jan 27, 2024

- Booking accommodation Jan 11, 2024

- Traveling friends (Designers preferred) :) Jan 05, 2024

- Moscow to St Petersburg train or air?? 32 replies

- New Sapsan Express Train from Moscow to St Petersburg 18 replies

- New year's in moscow 8 replies

- Hop on Hop Off Bus Tour 5 replies

- How do you purchase Bolshoi Ballet tickets at a great price? 2 replies

- Select-a-room.com Are they legitimate? 3 replies

- Weather Moscow and St. petersburg in May 8 replies

- Night train to St Petersburg 3 replies

- ATM Access 12 replies

- Visa needed if on layover at Moscow Airport??????? 15 replies

- Where can I get initial answers to ANY question?

The text on this page has been made available under the Creative Commons Attribution-ShareAlike License and Creative Commons Licenses

Notable Places in the Area

Elektrostal Satellite Map

Trains Moscow to Elektrostal: Times, Prices and Tickets

- Train Times

- Seasonality

- Accommodations

Moscow to Elektrostal by train

The journey from Moscow to Elektrostal by train is 32.44 mi and takes 2 hr 7 min. There are 71 connections per day, with the first departure at 12:15 AM and the last at 11:46 PM. It is possible to travel from Moscow to Elektrostal by train for as little as or as much as . The best price for this journey is .

Get from Moscow to Elektrostal with Virail

Virail's search tool will provide you with the options you need when you want to go from Moscow to Elektrostal. All you need to do is enter the dates of your planned journey, and let us take care of everything else. Our engine does the hard work, searching through thousands of routes offered by our trusted travel partners to show you options for traveling by train, bus, plane, or carpool. You can filter the results to suit your needs. There are a number of filtering options, including price, one-way or round trip, departure or arrival time, duration of journey, or number of connections. Soon you'll find the best choice for your journey. When you're ready, Virail will transfer you to the provider's website to complete the booking. No matter where you're going, get there with Virail.

How can I find the cheapest train tickets to get from Moscow to Elektrostal?

Prices will vary when you travel from Moscow to Elektrostal. On average, though, you'll pay about for a train ticket. You can find train tickets for prices as low as , but it may require some flexibility with your travel plans. If you're looking for a low price, you may need to prepare to spend more time in transit. You can also often find cheaper train tickets at particular times of day, or on certain days of the week. Of course, ticket prices often change during the year, too; expect to pay more in peak season. For the lowest prices, it's usually best to make your reservation in advance. Be careful, though, as many providers do not offer refunds or exchanges on their cheapest train tickets. Unfortunately, no price was found for your trip from Moscow to Elektrostal. Selecting a new departure or arrival city, without dramatically changing your itinerary could help you find price results. Prices will vary when you travel from Moscow to Elektrostal. On average, though, you'll pay about for a train ticket. If you're looking for a low price, you may need to prepare to spend more time in transit. You can also often find cheaper train tickets at particular times of day, or on certain days of the week. Of course, ticket prices often change during the year, too; expect to pay more in peak season. For the lowest prices, it's usually best to make your reservation in advance. Be careful, though, as many providers do not offer refunds or exchanges on their cheapest train tickets.

How long does it take to get from Moscow to Elektrostal by train?

The journey between Moscow and Elektrostal by train is approximately 32.44 mi. It will take you more or less 2 hr 7 min to complete this journey. This average figure does not take into account any delays that might arise on your route in exceptional circumstances. If you are planning to make a connection or operating on a tight schedule, give yourself plenty of time. The distance between Moscow and Elektrostal is around 32.44 mi. Depending on the exact route and provider you travel with, your journey time can vary. On average, this journey will take approximately 2 hr 7 min. However, the fastest routes between Moscow and Elektrostal take 1 hr 3 min. If a fast journey is a priority for you when traveling, look out for express services that may get you there faster. Some flexibility may be necessary when booking. Often, these services only leave at particular times of day - or even on certain days of the week. You may also find a faster journey by taking an indirect route and connecting in another station along the way.

How many journeys from Moscow to Elektrostal are there every day?

On average, there are 71 daily departures from Moscow to Elektrostal. However, there may be more or less on different days. Providers' timetables can change on certain days of the week or public holidays, and many also vary at particular times of year. Some providers change their schedules during the summer season, for example. At very busy times, there may be up to departures each day. The providers that travel along this route include , and each operates according to their own specific schedules. As a traveler, you may prefer a direct journey, or you may not mind making changes and connections. If you have heavy suitcases, a direct journey could be best; otherwise, you might be able to save money and enjoy more flexibility by making a change along the way. Every day, there are an average of 18 departures from Moscow which travel directly to Elektrostal. There are 53 journeys with one change or more. Unfortunately, no connection was found for your trip from Moscow to Elektrostal. Selecting a new departure or arrival city, without dramatically changing your itinerary could help you find connections.

Book in advance and save

If you're looking for the best deal for your trip from Moscow to Elektrostal, booking train tickets in advance is a great way to save money, but keep in mind that advance tickets are usually not available until 3 months before your travel date.

Stay flexible with your travel time and explore off-peak journeys

Planning your trips around off-peak travel times not only means that you'll be able to avoid the crowds, but can also end up saving you money. Being flexible with your schedule and considering alternative routes or times will significantly impact the amount of money you spend on getting from Moscow to Elektrostal.

Always check special offers

Checking on the latest deals can help save a lot of money, making it worth taking the time to browse and compare prices. So make sure you get the best deal on your ticket and take advantage of special fares for children, youth and seniors as well as discounts for groups.

Unlock the potential of slower trains or connecting trains

If you're planning a trip with some flexible time, why not opt for the scenic route? Taking slower trains or connecting trains that make more stops may save you money on your ticket – definitely worth considering if it fits in your schedule.

Best time to book cheap train tickets from Moscow to Elektrostal

The cheapest Moscow - Elektrostal train tickets can be found for as low as $36.35 if you’re lucky, or $56.07 on average. The most expensive ticket can cost as much as $80.45.

Find the best day to travel to Elektrostal by train

When travelling to Elektrostal by train, if you want to avoid crowds you can check how frequently our customers are travelling in the next 30-days using the graph below. On average, the peak hours to travel are between 6:30am and 9am in the morning, or between 4pm and 7pm in the evening. Please keep this in mind when travelling to your point of departure as you may need some extra time to arrive, particularly in big cities!

Moscow to Elektrostal CO2 Emissions by Train

Anything we can improve?

Frequently Asked Questions

Go local from moscow, trending routes, weekend getaways from moscow, international routes from moscow and nearby areas, other destinations from moscow, other popular routes.

IMAGES

VIDEO

COMMENTS

Obverse and reverse side of traveller's cheque of National Bank of Poland (nominal value: 1000 Polish złoty); sold in April 1989 in Budapest (), for use during travel to Poland only, never used. Security hologram against counterfeit on cheques with the denomination of 50 US-Dollars from American Express, c. 2012.. A traveller's cheque is a medium of exchange that can be used in place of hard ...

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two ...

Traveler's Check: A traveler's check is a medium of exchange utilized as an alternative to hard currency . Travelers often used traveler's checks on vacation to foreign countries. In 1891 ...

The key advantage of travellers cheques is that they are safer to carry around than cash. Provided you have noted down the serial number of each cheque you were originally issued, you will be able to get them replaced should they be stolen or lost. Remember to keep your note of the serial numbers separate from the cheques themselves.

Discover the ultimate travel hack: Travellers cheques! 🌍💰 Learn all about this prepaid instrument that will revolutionize your payment experience while glo...

Rather than attracting interest, travellers were charged a fee to purchase these cheques. Are they still used today? Alexanderson says that advances in technology have made traveller's cheques almost obsolete and a nuisance to convert. Alternatives started surfacing in earnest during the 1990s.

TRAVELLER'S CHEQUE definition: 1. a piece of paper that you buy from a bank or a travel company and that you can use as money or…. Learn more.

traveller's cheque definition: a special piece of paper that you buy at a bank and exchange for local money when you are in…. Learn more.

Definition of traveller's cheque noun from the Oxford Advanced Learner's Dictionary. ... (US English traveler's check) jump to other results a cheque for a fixed amount, sold by a bank or travel agent, that can be exchanged for cash in foreign countries (more common in the past than now) Topics Shopping c1, Holidays c1, Money c1. Take your ...

travellers cheques nedir ve travellers cheques ne demek sorularına hızlı cevap veren sözlük sayfası. (travellers cheques anlamı, travellers cheques Türkçesi, travellers cheques nnd)

Here are the various advantages of traveller's cheques. Safety: Traveller's cheques are safe and can allow you to carry a large amount of money while travelling. Refunds are possible: With traveller's cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank ...

They're accepted worldwide. You can use American Express Travellers Cheques at thousands of locations all over the world - like shops, restaurants, hotels, banks and currency exchanges - either as payment or in exchange for local currency. They're available in euros, pounds or US dollar s.

Acceptance of Travellers Cheques is based on the acceptor watching the customer sign the Cheque in the lower left-hand corner, and then comparing that signature with the original signature in the upper left-hand corner. The acceptor must observe the customer signing the Cheque. If the signatures are a reasonable match, the Cheque should be ...

Call American Express Customer Service 24/7 at 1-800-221-7282. or find additional contact numbers based on your location. American Express stopped issuing Travelers Cheques, so they're no longer available for purchase. Support is available by phone and the American Express website for customers to redeem valid. Travelers Cheques.

From Longman Dictionary of Contemporary English Related topics: Currencies traveller's cheque ˈtraveller's ˌcheque British English, traveler's check American English noun [countable] PEC MONEY a special cheque for a fixed amount that can be exchanged for the money of a foreign country From Longman Business Dictionary traveller's cheque ...

Here you can buy or sell foreign currencies, buy and cash travellers' cheques, and obtain a cash advance on credit and charge cards. Note, however, that some Greek banks refuse to cash travellers' cheques. Bear in mind that airport banks and other outlets usually offer the worst exchange rates and charge the highest fees.