Cruise Industry News Annual Report and Industry Growth Forecast

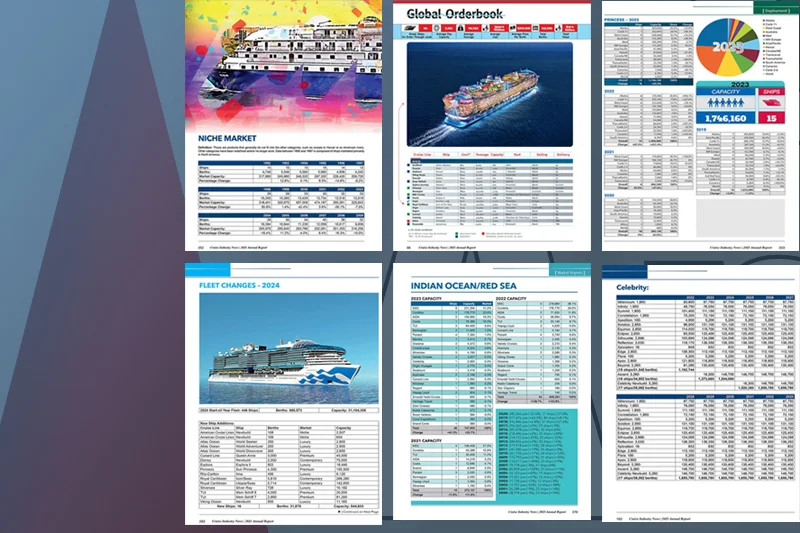

The Cruise Industry News Annual Report is the only information resource of its kind — presenting the entire worldwide cruise industry in 400 pages with cruise industry analytics and statistics , in print and PDF formats.

The 2024 Annual Report is available for order in both print and PDF formats.

About the Annual Report:

The 400-page report covers everything from new ships on order to supply-and-demand scenarios from the early 1990s through 2033.

Plus there is a future outlook through 2033 , completely independent cruise industry statistics , growth projections for each cruise line, cruise industry market reports , and detailed ship deployment by region and market, covering all the cruise lines.

Projections for capacity growth going forward take into account pandemic effects, ship delivery timeline adjustments and more.

Bought by suppliers, ports banks, financial analysts, cruise lines, and more. Useful in planning budgets and for key industry stakeholders for future forecasting.

If you are looking for a complete past, present and future global briefing on the cruise industry, look no further.

All this and more stating at $1195.

The Annual Report has been published since 1988.

Preview Pages of the Annual Report | 2024 Table of Contents

• If you are a cruise line executive: CINA gives you a total and objective overview of the industry, including profiles and growth forecasts for all the cruise lines through at least 2033.

• If you are a financial analyst : CINA gives you independent company and market growth forecasts, including supply/demand scenarios through 2033.

• If you are a port executive : CINA tells you about each line’s ship deployments in your region, and tracks the growth of each port and each sailing region.

• If you are a supplier : CINA gives you the information you need to make informed decisions about your involvement in the cruise industry.

• If you are a new supplier: CINA gives you the market intelligence and sales leads you need to target the industry.

Click here to order.

Who buys this report? Cruise lines, ports, suppliers, accounting firms, consulting companies, investment banks, think-tanks, universities and many more!

Macro Level: Big picture data and cruise industry analytics for the major and minor players, showing their footprints in 2024 and projected out through 2033.

Micro Level: Additional data includes just about everything pertaining to deployment, berth breakdown, capacity projections, historical trends and much more. 400 pages of detailed information at your fingertips.

Brand Level Data : CINA goes ship by ship, brand by brand, with data reflecting market capacity, berths, market share and more.

Ship by Ship: Every ship in the global cruise fleet is accounted for in our research, from the latest mega ships to niche expedition vessels.

Region Analysis: Each major cruise region is broken down by brand, with number of ships, projected market capacity and market shares, with past data showing trends.

Get the latest breaking cruise news . Sign up.

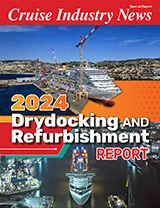

54 Ships | 122,002 Berths | $36 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Pre-Order Offer

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

CIN PDF Portal

Cruise Industry News Resource PDFs

*Note: These PDFs, as well as the content, data and graphics they are composed of, are intended for personal use only. They may not be re-published or reused in any way, shape or form without written permission from Cruise Industry News

Cruise Industry News has the following PDFs available for download:

2024 Cruise Ship Orderbook (April 2024)

2024 Cruise Ship Orderbook (March 2024)

2024 Cruise Ship Orderbook (Jan 2024)

2023 Cruise Ship Orderbook (Sept. 2023)

2023 Cruise Ship Orderbook (August 2023)

Queen Anne Cutaway

2023 Cruise Ship Orderbook (June 2023)

2023 Cruise Ship Orderbook (May 2023)

Luxury Cruise Infographic

2023 Cruise Ship Orderbook (April 2023)

2024 Guide to World Cruises

2023 Cruise Ship Orderbook (Feb. 2023)

2023 Cruise Ship Orderbook (Jan. 2023)

2022 Cruise Ship Orderbook (Nov 2022)

Cruise Ships in Service (Nov 2022)

2022 Cruise Ship Orderbook (Oct 2022)

Cruise Ships in Service (Oct 2022)

Cruise Ships in Service (Sept 2022)

Cruise Ships in Service (August 2022)

2022 Cruise Ship Orderbook (July 2022)

Cruise Ships in Service (July 2022)

Cruise Ships in Service (June 2022)

Cruise Ships in Service (May 2022)

2022 Cruise Ship Orderbook (April 2022)

Cruise Ships in Service (April 2022)

Cruise Ships in Service (March 2022)

2022 Cruise Ship Orderbook (March 2022)

Cruise Ships in Service (Feb 2022)

2022 Cruise Ship Orderbook (Feb 2022)

2022 Cruise Ship Orderbook (Jan 2022)

Cruise Ships in Service (Jan 2022)

Dec. 21 Cruise Restart Infographic

Cruise Ships in Service (Dec 2021)

2021 Cruise Ship Orderbook (Nov 2021)

Cruise Ships in Service (Nov 2021)

Cruise Ships in Service (Oct 2021)

Sustainable Sailing Special Report

Cruise Ships in Service (Sept 2021)

Cruise Ships in Service (August 2021)

Cruise Ships in Service (July 2021)

Pandemic Cruising Special Report

HVAC Solutions Special Report

Alternative Fuels Special Report

Current Cruise Ship Orderbook (Nov 2020)

Cruise Industry News Return to Service

MHA 35th Special Magazine

2020 Cruise Industry 101

2019 Cruise Lines Q4 Breakdown

Expedition Market Infographic

Riverboat Orderbook

Drydocking Infographic

Caribbean Cruise Trends

2019 Zero Emissions Target

2019 China Port Map

2019 Design Trends Report

2019 Australia Cruise Trends

2018 Cruise Industry Infographic

European Cruise Lines Infographic

Working at Sea

2018 Cruise Lines Q1 Breakdown

Seabourn - 30 Years

2017 Cruise Lines Financial Breakdown

2018 China Port Map

2018 Design Trends Report

2017 Cruise Industry News Infographic

Norwegian Cruise Line - 50 Years

2017 Cuba Deployment Guide

Legends + Leaders

Download the PDF

Please enter your name and email address; we'll send you a link immediately.

Cruise Industry 2022 Outlook Report Quantifies Value of Cruise Tourism, Underscores Leadership in Health and Safety, Environmental Sustainability and Destination Stewardship

WASHINGTON , Jan. 27, 2022 /PRNewswire/ -- Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report.

The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of cruise tourism to local communities and national economies around the world, and charts the industry's continued progress towards achieving carbon neutrality.

"The 2022 State of the Cruise Industry Outlook report provides an opportunity to reflect on how far our industry has come as CLIA ocean-going cruise lines have welcomed more than six million guests onboard since resuming operations in July 2020 . While our focus on health and safety remains absolute, our industry is also leading the way in environmental sustainability and destination stewardship," said Kelly Craighead , president and CEO of CLIA.

"Coastal and maritime tourism is an important economic driver, and we continue to work in partnership with cruise destinations so that communities thrive from responsible tourism. Our members are also investing in new technologies and new ships and pursuing the goal of net carbon neutral cruising by 2050."

The 2022 outlook report also features reflections from cruise industry partners and community members around the world, including from Robert Courts MP , United Kingdom Maritime Minister; Mato Franković Mayor of Dubrovnik; Laura McDonnell , shop owner in Juneau, Alaska ; Alex Fraile , tour guide in Palma de Mallorca , Spain ; Danny Genung , CEO, Harr Travel ; and Mandy Goddard , M.Ed., CLIA Elite Cruise Counselor (ECC).

Highlights from the report include:

- Fleet of the Future . By 2027, the CLIA ocean-going cruise line member fleet will reflect significant advancements in the cruise industry's pursuit of a cleaner, more efficient future.

- 26 LNG-powered cruise ships

- 81% of global capacity fitted with Advanced Wastewater Treatment Systems

- 174 cruise ships with shoreside power connectivity

- 2020 Global Economic Impact . When compared to 2019, the 2020 economic data illustrates the pandemic's far-reaching effects on the wider cruise community and underscores the importance of cruise tourism to economies around the world.

- 5.8M passenger embarkations ( -81% )

- 576K cruise-supported jobs ( -51% )

- $63.4B total economic contribution ( -59% )

- Resumption Progress . Industry-leading protocols are facilitating the resumption of cruise tourism around the world, which is putting people back to work and reinvigorating local and national economies.

- More than 75% of ocean-going member capacity has returned to service

- Nearly 100% projected to be in operation by August 2022

- Value of Cruise Tourists . Cruise tourists, and the money they spend, create jobs and opportunities for local communities around the world.

- Every 24 cruisers creates one full-time equivalent job

- Cruisers spend an average of $750 USD per passenger in port cities over the course of a typical seven-day cruise

- 6 in 10 people who have taken a cruise say that they have returned to a destination that they first visited via cruise ship

- Destination Stewardship. Continued collaboration with local communities in the destinations cruise ships visit remains a critical focus for the cruise industry, including in Dubrovnik, Croatia , the Greek destinations of Corfu and Heraklion, and the City of Palma in the Balearic Islands.

- Class of 2022. CLIA ocean-going member cruise lines are projected to debut 16 new cruise ships in 2022, including five LNG-powered vessels and nine expedition ships. The class of 2022 will be 100% equipped with Advanced Wastewater Treatment Systems.

To view the full 2022 State of the Cruise Industry Outlook report, please click here . For more information, please contact [email protected].

About Cruise Lines International Association (CLIA) CLIA is the world's largest cruise industry trade association and the leading authority of the global cruise community. On behalf of its members, affiliates and partners, the organization supports policies and practices that foster a secure, healthy, and sustainable cruise ship environment, promoting positive travel experiences for the more than 30 million passengers who have cruised annually. The CLIA community includes the world's most prestigious ocean, river, and specialty cruise lines; a highly trained and certified travel agent community; and a widespread network of stakeholders, including ports & destinations, ship development, suppliers, and business services. CLIA represents more than 90% of the world's ocean-going cruise capacity, as well as nearly 60,000 travel agents and agencies from around the world. The travel agent and agency members represent the largest network of travel professionals specializing in cruise travel. The organization's global headquarters are in Washington, DC , with regional offices located in North and South America , Europe , Asia , and Australasia. For more information, please visit cruising.org or follow us on Facebook , Instagram , Twitter , and YouTube with our handle @CLIAGlobal—or on LinkedIn .

SOURCE Cruise Lines International Association

Cruise industry releases 2022 Outlook Report

Friday, January 28, 2022 Favorite

Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report.

The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of cruise tourism to local communities and national economies around the world, and charts the industry’s continued progress towards achieving carbon neutrality.

The 2022 State of the Cruise Industry Outlook report provides an opportunity to reflect on how far our industry has come as CLIA ocean-going cruise lines have welcomed more than six million guests onboard since resuming operations in July 2020. Kelly Craighead, president and CEO of CLIA said while their focus on health and safety remains absolute, the industry is also leading the way in environmental sustainability and destination stewardship.

Coastal and maritime tourism is an important economic driver. They continue to work in partnership with cruise destinations so that communities thrive from responsible tourism. Our members are also investing in new technologies and new ships and pursuing the goal of net carbon neutral cruising by 2050. The 2022 outlook report also features reflections from cruise industry partners and community members around the world.

Subscribe to our Newsletters

« Back to Page

Related Posts

- Lisbon to impose €2 tourist tax on cruise ship operators from January 2024

- Cruise vacations will be at record levels next year

- YC Travel sets sail into excellence: earns the 2023 best of Florida award

- Southern Cone countries foster regional cruise cooperation

- Icon of the Seas to set sail as industry rebounds

Tags: Cruise Lines International Association (CLIA)

Select Your Language

I want to receive travel news and trade event update from Travel And Tour World. I have read Travel And Tour World's Privacy Notice .

REGIONAL NEWS

Explore Austria’s Shopping Scene: From Designer Outlets to Urban Boutique

Saturday, April 6, 2024

German Railways Faces Criticism for Excluding New Night Train Operator from Tick

Plane Collide at Heathrow, British Airways and Virgin Atlantic Escape Major Disr

One Big Itch by Sara Williams Captivates at Los Angeles Times Book Festival 2024

Middle east.

Travel to Istanbul Made Easier and More Affordable by Air Arabia Egypt from Cair

Sunday, April 7, 2024

Flydubai to launch biweekly route to the Red Sea destination from Dubai internat

Peach Aviation Limited-Time Sale on Flights to Shanghai, Hong Kong, and Bangkok

Goa Tourism and Mastercard Team Up to Revolutionize Travel with Priceless Experi

Upcoming shows.

Apr 06 April 6 - April 7 The Travel and Vacation Show 2024 Find out more » Apr 07 April 7 - April 9 ILTM AFRICA 2024 Find out more » Apr 07 April 7 - April 10 GLOBAL MEETING & INCENTIVE Find out more » Apr 07 April 7 - April 9 International Ski Travel Market (ISTM) 2024 Find out more »

Privacy Overview

- Cruise News

2022 State of the Cruise Industry Outlook Report Released

Sarah Bretz, Contributor

- January 28, 2022

Industry trade association Cruise Lines International Association has released its 2022 State of the Cruise Industry Outlook report, which charts a number of areas in which the industry has evolved over the past few years.

Highlights of the report include:

2020 Global Economic Impact

When compared to 2019, the 2020 economic data illustrates the impact of the pandemic on the wider cruise community, and underscores the importance of cruise tourism to economies around the world.

In 2020, 5.8 million people took a cruise, which was 81 percent fewer than the 29.7 million in 2019. There were 576,000 cruise-supported jobs, down 51 percent from 2019.

Resumption Progress

Health and safety protocols are aiding with the resumption of cruising around the world, and over 75 percent of CLIA’s oceangoing member cruise lines’ capacity has returned to service. Nearly 100 percent is projected to be in operation by August 2022.

MORE: 18 New Cruise Ships Debuting in 2022

Cruise Tourist Value

Every 24 cruisers create one full-time equivalent job. Cruisers spend an average of $750 per person in port cities over the course of a typical seven-night cruise, and 6 in 10 people say they’ve returned to a destination that they first experienced via cruise ship.

A Cleaner Future

By 2027, the CLIA oceangoing cruise line member fleet will reflect significant advancements in the industry’s pursuit of a cleaner, more efficient future. There will be 26 liquefied natural gas-powered cruise ships, and 174 vessels with shoreside power connectivity. 81 percent of the global capacity will be fitted with Advanced Wastewater Treatment Systems.

Class of 2022

This year, CLIA oceangoing member lines are scheduled to debut 16 new cruise ships, including five liquefied natural gas-powered vessels and nine expedition ships. All 16 will be 100 percent equipped with Advanced Wastewater Treatment Systems.

Kelly Craighead, President and CEO of CLIA, said “The 2022 State of the Cruise Industry Outlook report provides an opportunity to reflect on how far our industry has come as CLIA ocean-going cruise lines have welcomed more than six million guests onboard since resuming operations in July 2020. While our focus on health and safety remains absolute, our industry is also leading the way in environmental sustainability and destination stewardship.”

You can read the full report here.

READ NEXT: 7 Cruise Trends You’ll See in 2022

Recent Posts

Help needed after cruise passenger with dementia goes missing in cozumel, alaska cruise port will enforce passenger limits starting in 2026, passenger reportedly jumps from cruise ship in front of family, carnival vista review 2024 + cruise news [podcast], share this post, related posts.

Port Clears Cruise Ship to Leave After Identifying 69 Fake Visas

Hydration Economics: Carnival Hikes Bottled Water Prices by 25%

Bringing you 15 years of cruise industry experience. Cruise Radio prioritizes well-balanced cruise news coverage and accurate reporting, paired with ship reviews and tips.

Quick links

Cruise Radio, LLC © Copyright 2009-2024 | Website Designed By Insider Perks, Inc

- Latest News

CLIA 2022 cruise report: Industry on course for ‘almost 100%’ resumption by August

Cruise association CLIA has released its latest outlook report, highlighting that by August 2022 almost 100 per cent of its ocean cruise line members will be back in operation.

The 2022 State of the Cruise Industry Outlook report demonstrates “how the industry has continued to resume responsibly with proven protocols [and] underscores the value of cruise tourism to local communities and national economies around the world”.

Nearly 80 per cent of travellers who have cruised before say they will cruise again – the same percentage as before the pandemic, the report added.

There is also a strong focus on sustainability , with the association stating that by 2027, its ocean-going cruise line member fleet “will reflect significant advancements in the cruise industry’s pursuit of a cleaner, more efficient future”.

Included in this are 26 new LNG-powered ships; 81 per cent of global capacity fitted with advanced wastewater treatment systems, and 174 cruise ships with shoreside power connectivity.

A total of 16 new ocean cruise ships are scheduled to launch in 2022, including five LNG-powered vessels and nine expedition ships.

Economic impact on cruise

While there are positives, the report highlights the economic impact of the pandemic.

In 2020, there were 5.8 million passenger embarkations (down 81 per cent on 2019 levels); 576,000 cruise-supported jobs, a reduction of 51 per cent, and $63.4 billion in total economic contribution, down 59 per cent against 2019.

CLIA CEO Kelly Craighead said: “The 2022 State of the Cruise Industry Outlook report provides an opportunity to reflect on how far our industry has come as CLIA ocean-going cruise lines have welcomed more than six million guests on board since resuming operations in July 2020.

“While our focus on health and safety remains absolute, our industry is also leading the way in environmental sustainability and destination stewardship.

“Coastal and maritime tourism is an important economic driver, and we continue to work in partnership with cruise destinations so that communities thrive from responsible tourism.

“Our members are also investing in new technologies and new ships and pursuing the goal of net carbon neutral cruising by 2050.”

The full report is available on the official CLIA website .

Subscribe to our newsletter

Keep up to date with all the latest news and incentives in the Cruise Trade News Newsletter.

- cruise report

arrow_outward Related Articles

CTN Investigates: can port cities cope with the...

The cruise industry is often praised for its ability to transport thousands of people in...

CLIA urges governments to expedite sustainable fuel production

CLIA has called on international governments to increase the production of sustainable marine fuels to...

“Luxury river will benefit from ocean’s capacity constraints”,...

Ellen Bettridge, CEO of Uniworld Boutique River Cruises, believes the river sector is in a...

Cruise Summit returns to examine the future of...

The Cruise Summit, presented by Cruise Trade News, will return this summer to the News...

Cruise Trade News is the only dedicated trade title for the UK cruise sector. It is published by Real Response Media.

- Digital Issues

- Knowledge Hub

- Agent Incentives

- Meet the team

TERMS PRIVACY

- Tour Operators

- Destinations

- Hotels & Resorts

- Digital Edition Fall 2023

- Travel Webcast

- Suppliers Kit

- Canadian Travel Press

- Travel Courier

- Offshore Travel Magazine

What’s The Outlook For Cruising In 2022

October 20, 2022

CLIA has released its 2022 State of the Cruise Industry Outlook. The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of cruise tourism to local communities and national economies around the world, and charts the industry’s continued progress towards achieving carbon neutrality.

Kelly Craighead, president and CEO of CLIA, said that: “The 2022 State of the Cruise Industry Outlook report provides an opportunity to reflect on how far our industry has come as CLIA ocean-going cruise lines have welcomed more than six million guests onboard since resuming operations in July 2020. While our focus on health and safety remains absolute, our industry is also leading the way in environmental sustainability and destination stewardship.”

Craighead continued: “Coastal and maritime tourism is an important economic driver, and we continue to work in partnership with cruise destinations so that communities thrive from responsible tourism. Our members are also investing in new technologies and new ships and pursuing the goal of net carbon neutral cruising by 2050.”

The 2022 outlook report also features reflections from cruise industry partners and community members around the world, including from Robert Courts MP, United Kingdom Maritime Minister; Mato Frankovi? Mayor of Dubrovnik; Laura McDonnell, shop owner in Juneau, Alaska; Alex Fraile, tour guide in Palma de Mallorca, Spain; Danny Genung, CEO, Harr Travel; and Mandy Goddard, M.Ed., CLIA Elite Cruise Counselor (ECC).

Highlights from the report include:

Fleet of the Future — By 2027, the CLIA ocean-going cruise line member fleet will reflect significant advancements in the cruise industry’s pursuit of a cleaner, more efficient future.

- 26 LNG-powered cruise ships

- 81% of global capacity fitted with Advanced Wastewater Treatment Systems

- 174 cruise ships with shoreside power connectivity

2020 Global Economic Impact — When compared to 2019, the 2020 economic data illustrates the pandemic’s far-reaching effects on the wider cruise community and underscores the importance of cruise tourism to economies around the world.

- 5.8M passenger embarkations (-81%)

- 576K cruise-supported jobs (-51%)

- $63.4B total economic contribution (-59%)

Resumption Progress — Industry-leading protocols are facilitating the resumption of cruise tourism around the world, which is putting people back to work and reinvigorating local and national economies.

- More than 75% of ocean-going member capacity has returned to service

- Nearly 100% projected to be in operation by August 2022

Value of Cruise Tourists — Cruise tourists, and the money they spend, create jobs and opportunities for local communities around the world.

- Every 24 cruisers creates one full-time equivalent job

- Cruisers spend an average of $750 USD per passenger in port cities over the course of a typical seven-day cruise

- 6 in 10 people who have taken a cruise say that they have returned to a destination that they first visited via cruise ship

Destination Stewardship — Continued collaboration with local communities in the destinations cruise ships visit remains a critical focus for the cruise industry, including in Dubrovnik, Croatia, the Greek destinations of Corfu and Heraklion, and the City of Palma in the Balearic Islands.

Class of 2022 — CLIA ocean-going member cruise lines are projected to debut 16 new cruise ships in 2022, including five LNG-powered vessels and nine expedition ships. The class of 2022 will be 100% equipped with Advanced Wastewater Treatment Systems.

Go to www.cruising.org for more.

One Caribbean Canada launches new Caribbean tourism group

Sunwing & Iberostar partner to offer savings down South

- Travel, Tourism & Hospitality ›

- Leisure Travel

Cruise industry in the United States - statistics & facts

Has the u.s. cruise industry recovered from the impact of covid-19, what are the leading u.s. cruise companies, key insights.

Detailed statistics

Revenue of the cruises industry in the U.S. 2019-2028

Revenue growth of cruises in the U.S. 2019-2028

Employment in the cruise line operator industry in the U.S. 2012-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Number of global ocean cruise passengers 2019-2022, by source market

Number of cruise passengers from the U.S. 2016-2022

Related topics

Cruise market.

- Cruise industry worldwide

- Cruise industry in Europe

- Cruise industry in the United Kingdom (UK)

- Cruise industry in the Caribbean

Travel and tourism in the United States

- Travel and tourism in the U.S.

- Hotel industry in the U.S.

- City trips in the U.S.

Recommended statistics

- Premium Statistic Number of global ocean cruise passengers 2009-2027

- Premium Statistic Number of global ocean cruise passengers 2019-2022, by source market

- Premium Statistic Main global cruise destinations 2019-2022, by number of passengers

- Premium Statistic Revenue of the cruises industry in the U.S. 2019-2028

- Premium Statistic Revenue growth of cruises in the U.S. 2019-2028

- Premium Statistic Direct economic impact of the cruise industry in the U.S. 2021, by spending type

- Premium Statistic Cruise line operator industry's market size in the U.S. 2012-2022

- Premium Statistic Businesses in the cruise line operator industry in the U.S. 2012-2022

- Premium Statistic Employment in the cruise line operator industry in the U.S. 2012-2022

Number of global ocean cruise passengers 2009-2027

Number of ocean cruise passengers worldwide from 2009 to 2022, with a forecast until 2027 (in millions)

Number of ocean cruise passengers worldwide from 2019 to 2022, by source region (in 1,000s)

Main global cruise destinations 2019-2022, by number of passengers

Leading ocean cruise destinations worldwide from 2019 to 2022, by number of passengers (in 1,000s)

Revenue of the cruises market in the United States from 2019 to 2028 (in billion U.S. dollars)

Revenue growth of the cruises market in the United States from 2019 to 2028

Direct economic impact of the cruise industry in the U.S. 2021, by spending type

Direct economic impact of the cruise industry in the United States in 2021, by type of spending (in billion U.S. dollars)

Cruise line operator industry's market size in the U.S. 2012-2022

Market size of the cruise line operator industry in the United States from 2012 to 2021, with a forecast for 2022 ( in million U.S. dollars)

Businesses in the cruise line operator industry in the U.S. 2012-2022

Number of businesses in the cruise line operator industry in the United States from 2012 to 2021, with a forecast for 2022

Number of employees in the cruise line operator industry in the United States from 2012 to 2021, with a forecast for 2022

Cruise passengers

- Premium Statistic Number of cruise passengers from North America 2016-2022

- Premium Statistic Number of cruise passengers from the U.S. 2016-2022

- Premium Statistic Growth rate of the cruise passenger volume from the U.S. 2017-2022

- Premium Statistic Busiest cruise ports worldwide 2019-2022, by passenger movements

- Premium Statistic Share of U.S. travelers planning a cruise trip October 2021-June 2023

Number of cruise passengers from North America 2016-2022

Number of cruise passengers sourced from North America from 2016 to 2022 (in 1,000s)

Number of cruise passengers sourced from the United States from 2016 to 2022 (in 1,000s)

Growth rate of the cruise passenger volume from the U.S. 2017-2022

Year-over-year percentage change in the number of cruise passengers sourced from the United States from 2017 to 2022

Busiest cruise ports worldwide 2019-2022, by passenger movements

Busiest cruise ports worldwide in 2019 and 2022, by number of passenger movements (in 1,000s)

Share of U.S. travelers planning a cruise trip October 2021-June 2023

Share of travelers intending to take a cruise trip in the next 12 months in the United States from October 2021 to June 2023

Cruise companies

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023

- Premium Statistic Net income of Carnival Corporation & plc 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Premium Statistic Net income of Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic Net income of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic Percentage change in revenue of leading cruise companies worldwide 2020-2023

Revenue of Carnival Corporation & plc worldwide 2008-2023

Revenue of Carnival Corporation & plc worldwide from 2008 to 2023 (in billion U.S. dollars)

Net income of Carnival Corporation & plc 2008-2023

Net income of Carnival Corporation & plc worldwide from 2008 to 2023 (in billion U.S. dollars)

Revenue of Royal Caribbean Cruises worldwide 1988-2023

Revenue of Royal Caribbean Cruises Ltd. worldwide from 1988 to 2023 (in billion U.S. dollars)

Net income of Royal Caribbean Cruises worldwide 2007-2023

Net income of Royal Caribbean Cruises Ltd. worldwide from 2007 to 2023 (in million U.S. dollars)

Revenue of Norwegian Cruise Line worldwide 2011-2023

Revenue of Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in billion U.S. dollars)

Net income of Norwegian Cruise Line worldwide 2011-2023

Net Income of Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in million U.S. dollars)

Percentage change in revenue of leading cruise companies worldwide 2020-2023

Percentage change in revenue of leading cruise companies worldwide from 2020 to 2023 (compared to 2019)

Consumer opinions

- Basic Statistic Best-rated mega-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated large-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated midsize-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated small-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated river cruise lines by travelers worldwide 2023

Best-rated mega-ship cruise lines by travelers worldwide 2023

Best-rated mega-ship cruise lines by travelers worldwide as of June 2023

Best-rated large-ship cruise lines by travelers worldwide 2023

Best-rated large-ship cruise lines by travelers worldwide as of June 2023

Best-rated midsize-ship cruise lines by travelers worldwide 2023

Best-rated midsize-ship cruise lines by travelers worldwide as of June 2023

Best-rated small-ship cruise lines by travelers worldwide 2023

Best-rated small-ship cruise lines by travelers worldwide as of June 2023

Best-rated river cruise lines by travelers worldwide 2023

Best-rated river cruise lines by travelers worldwide as of June 2023

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

An official website of the United States government

Gross Domestic Product, Fourth Quarter and Year 2023 (Third Estimate), GDP by Industry, and Corporate Profits

- News Release

- Related Materials

- Additional Information

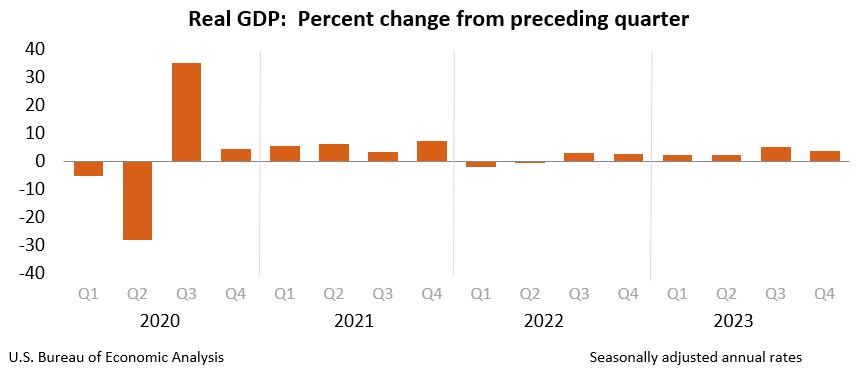

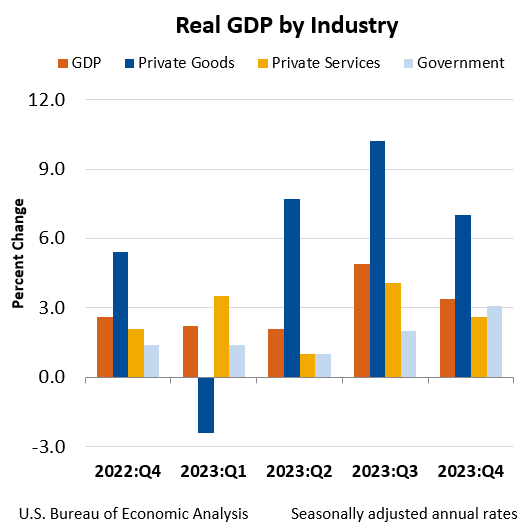

Real gross domestic product (GDP) increased at an annual rate of 3.4 percent in the fourth quarter of 2023 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 4.9 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.2 percent. The update primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment (refer to "Updates to GDP").

The increase in real GDP primarily reflected increases in consumer spending, state and local government spending, exports, nonresidential fixed investment, federal government spending, and residential fixed investment that were partly offset by a decrease in private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

Compared to the third quarter of 2023, the deceleration in real GDP in the fourth quarter primarily reflected a downturn in private inventory investment and slowdowns in federal government spending and residential fixed investment. Imports decelerated.

Current‑dollar GDP increased 5.1 percent at an annual rate, or $346.9 billion, in the fourth quarter to a level of $27.96 trillion, an upward revision of $12.4 billion from the previous estimate (tables 1 and 3). More information on the source data that underlie the estimates is available in the " Key Source Data and Assumptions " file on BEA's website.

The price index for gross domestic purchases increased 1.9 percent in the fourth quarter, the same as in the previous estimate (table 4). The personal consumption expenditures (PCE) price index increased 1.8 percent, the same as the previous estimate, and the PCE index excluding food and energy prices increased 2.0 percent, a downward revision of 0.1 percentage point.

Personal Income

Current-dollar personal income increased $230.2 billion in the fourth quarter, an upward revision of $10.7 billion from the previous estimate. The increase primarily reflected increases in compensation, personal income receipts on assets, and proprietors' income (table 8).

Disposable personal income increased $190.4 billion, or 3.8 percent, in the fourth quarter, a downward revision of $12.1 billion from the previous estimate. Real disposable personal income increased 2.0 percent, a downward revision of 0.2 percentage point.

Personal saving was $815.5 billion in the fourth quarter, an upward revision of $6.3 billion from the previous estimate. The personal saving rate —personal saving as a percentage of disposable personal income—was 4.0 percent in the fourth quarter, an upward revision of 0.1 percentage point.

Gross Domestic Income and Corporate Profits

Real gross domestic income (GDI) increased 4.8 percent in the fourth quarter, compared with an increase of 1.9 percent in the third quarter. The average of real GDP and real GDI , a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 4.1 percent in the fourth quarter, compared with an increase of 3.4 percent (table 1).

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $133.5 billion in the fourth quarter, compared with an increase of $108.7 billion in the third quarter (table 10).

Profits of domestic financial corporations increased $5.9 billion in the fourth quarter, compared with an increase of $9.0 billion in the third quarter. Profits of domestic nonfinancial corporations increased $136.5 billion, compared with an increase of $90.8 billion. Rest-of-the-world profits decreased $8.9 billion, in contrast to an increase of $8.8 billion. In the fourth quarter, receipts decreased $20.1 billion, and payments decreased $11.2 billion.

Updates to GDP

With the third estimate, upward revisions to consumer spending, nonresidential fixed investment, and state and local government spending were partly offset by downward revisions to private inventory investment and exports. Imports were revised down. For more information, refer to the Technical Note . For information on updates to GDP, refer to the "Additional Information" section that follows.

Real GDP by Industry

Today's release includes estimates of GDP by industry , or value added—a measure of an industry's contribution to GDP. Private goods-producing industries increased 7.0 percent, private services-producing industries increased 2.6 percent, and government increased 3.1 percent (table 12). Overall, 18 of 22 industry groups contributed to the fourth-quarter increase in real GDP.

- Within private goods-producing industries, the leading contributors to the increase were nondurable goods manufacturing (led by petroleum and coal products and chemical products), durable goods manufacturing (led by machinery), and construction (table 13).

- Within private services-producing industries, the leading contributors to the increase were retail trade (led by motor vehicle and parts dealers), health care and social assistance (led by ambulatory health care services), utilities, and professional, scientific, and technical services (led by computer systems design and related services).

- The increase in government reflected increases in state and local government as well as federal government.

Gross Output by Industry

Real gross output —principally a measure of an industry's sales or receipts, which includes sales to final users in the economy (GDP) and sales to other industries (intermediate inputs)—increased 2.4 percent in the fourth quarter. This reflected an increase of 3.7 percent for private goods-producing industries, an increase of 2.0 percent for private services-producing industries, and an increase of 1.8 percent for government (table 16). Overall, 13 of 22 industry groups contributed to the increase in real gross output.

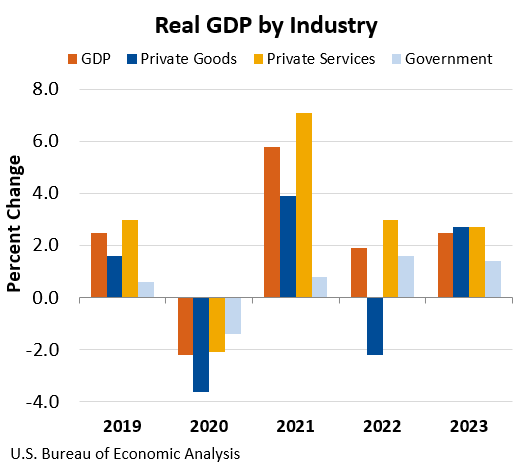

GDP for 2023

Real GDP increased 2.5 percent in 2023 (from the 2022 annual level to the 2023 annual level), compared with an increase of 1.9 percent in 2022 (table 1). The increase in real GDP in 2023 primarily reflected increases in consumer spending, nonresidential fixed investment, state and local government spending, exports, and federal government spending that were partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased (table 2).

Gross Domestic Income and Corporate Profits for 2023

Real GDI increased 0.5 percent in 2023, compared with an increase of 2.1 percent in 2022 (table 1). The average of real GDP and real GDI increased 1.5 percent in 2023, compared with an increase of 2.0 percent in 2022.

In 2023, profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $49.3 billion, compared with an increase of $285.9 billion in 2022 (table 10). Profits of domestic financial corporations decreased $55.2 billion, compared with a decrease of $0.9 billion in 2022. Profits of domestic nonfinancial corporations increased $66.6 billion, compared with an increase of $247.6 billion. Rest-of-the-world profits increased $37.9 billion, compared with an increase of $39.2 billion.

Real GDP by Industry for 2023

In 2023, private goods-producing industries increased 2.7 percent, private services-producing industries increased 2.7 percent, and government increased 1.4 percent. Overall, 17 of 22 industry groups contributed to the increase in real GDP (table 13).

- Within private goods-producing industries, the leading contributor to the increase was mining.

- The increase in private services-producing industries was led by retail trade; professional, scientific, and technical services; health care and social assistance; and information. These increases were partly offset by decreases in finance and insurance as well as wholesale trade.

Real gross output increased 2.1 percent in 2023. Private goods-producing industries increased 2.0 percent, private services-producing industries increased 2.1 percent, and government increased 2.2 percent (table 16). Overall, 17 of 22 industry groups contributed to the increase in real gross output.

* * *

Next release, April 25, 2024, at 8:30 a.m. EDT Gross Domestic Product, First Quarter 2024 (Advance Estimate)

Full Release & Tables (PDF)

Technical note (pdf), tables only (excel), release highlights (pdf), historical comparisons (pdf), key source data and assumptions (excel), revision information.

- GDP Lisa Mataloni 301-278-9083 [email protected]

- Corporate Profits Kate Pinard 301-278-9417 [email protected]

- Media Connie O’Connell 301-278-9003 [email protected]

Additional resources available at www.bea.gov :

- Stay informed about BEA developments by reading the BEA blog , signing up for BEA's email subscription service , or following BEA on X, formerly known as Twitter @BEA_News .

- Historical time series for these estimates can be accessed in BEA's interactive data application .

- Access BEA data by registering for BEA's data Application Programming Interface (API).

- For more on BEA's statistics, refer to our online journal, the Survey of Current Business .

- BEA's news release schedule

- NIPA Handbook : Concepts and Methods of the U.S. National Income and Product Accounts

Definitions

Gross domestic product (GDP), or value added , is the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production. GDP is also equal to the sum of personal consumption expenditures, gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment.

Gross domestic income (GDI) is the sum of incomes earned and costs incurred in the production of GDP. In national economic accounting, GDP and GDI are conceptually equal. In practice, GDP and GDI differ because they are constructed using largely independent source data.

Gross output is the value of the goods and services produced by the nation's economy. It is principally measured using industry sales or receipts, including sales to final users (GDP) and sales to other industries (intermediate inputs).

Current-dollar estimates are valued in the prices of the period when the transactions occurred—that is, at "market value." Also referred to as "nominal estimates" or as "current-price estimates."

Real values are inflation-adjusted estimates—that is, estimates that exclude the effects of price changes.

The gross domestic purchases price index measures the prices of final goods and services purchased by U.S. residents.

The personal consumption expenditure price index measures the prices paid for the goods and services purchased by, or on the behalf of, "persons."

Personal income is the income received by, or on behalf of, all persons from all sources: from participation as laborers in production, from owning a home or business, from the ownership of financial assets, and from government and business in the form of transfers. It includes income from domestic sources as well as the rest of world. It does not include realized or unrealized capital gains or losses.

Disposable personal income is the income available to persons for spending or saving. It is equal to personal income less personal current taxes.

Personal outlays is the sum of personal consumption expenditures, personal interest payments, and personal current transfer payments.

Personal saving is personal income less personal outlays and personal current taxes.

The personal saving rate is personal saving as a percentage of disposable personal income.

Profits from current production , referred to as corporate profits with inventory valuation adjustment (IVA) and capital consumption (CCAdj) adjustment in the National Income and Product Accounts (NIPAs), is a measure of the net income of corporations before deducting income taxes that is consistent with the value of goods and services measured in GDP. The IVA and CCAdj are adjustments that convert inventory withdrawals and depreciation of fixed assets reported on a tax-return, historical-cost basis to the current-cost economic measures used in the national income and product accounts. Profits for domestic industries reflect profits for all corporations located within the geographic borders of the United States. The rest-of-the-world (ROW) component of profits is measured as the difference between profits received from ROW and profits paid to ROW.

For more definitions, refer to the Glossary: National Income and Product Accounts .

Statistical conventions

Annual-vs-quarterly rates . Quarterly seasonally adjusted values are expressed at annual rates, unless otherwise specified. This convention is used for BEA's featured, seasonally adjusted measures to facilitate comparisons with related and historical data. For details, refer to the FAQ " Why does BEA publish estimates at annual rates? "

Quarterly not seasonally adjusted values are expressed only at quarterly rates.

Percent changes . Percent changes in quarterly seasonally adjusted series are displayed at annual rates, unless otherwise specified. For details, refer to the FAQ " How is average annual growth calculated? " and " Why does BEA publish percent changes in quarterly series at annual rates? " Percent changes in quarterly not seasonally adjusted values are calculated from the same quarter one year ago. All published percent changes are calculated from unrounded data.

Calendar years and quarters . Unless noted otherwise, annual and quarterly data are presented on a calendar basis.

Quantities and prices . Quantities, or "real" volume measures, and prices are expressed as index numbers with a specified reference year equal to 100 (currently 2017). Quantity and price indexes are calculated using a Fisher-chained weighted formula that incorporates weights from two adjacent periods (quarters for quarterly data and annuals for annual data). For details on the calculation of quantity and price indexes, refer to Chapter 4: Estimating Methods in the NIPA Handbook .

Chained-dollar values are calculated by multiplying the quantity index by the current dollar value in the reference year (2017) and then dividing by 100. Percent changes calculated from real quantity indexes and chained-dollar levels are conceptually the same; any differences are due to rounding. Chained-dollar values are not additive because the relative weights for a given period differ from those of the reference year. In tables that display chained-dollar values, a "residual" line shows the difference between the sum of detailed chained-dollar series and its corresponding aggregate.

BEA releases three vintages of the current quarterly estimate for GDP. "Advance" estimates are released near the end of the first month following the end of the quarter and are based on source data that are incomplete or subject to further revision by the source agency. "Second" and "third" estimates are released near the end of the second and third months, respectively, and are based on more detailed and more comprehensive data as they become available.

The table below shows the average revisions to the quarterly percent changes in real GDP between different estimate vintages, without regard to sign.

Annual and comprehensive updates are released in late September. Annual updates generally cover at least the five most recent calendar years (and their associated quarters) and incorporate newly available major annual source data as well as some changes in methods and definitions to improve the accounts. Comprehensive (or benchmark) updates are carried out at about 5-year intervals and incorporate major periodic source data, as well as major conceptual improvements.

Unlike GDP, advance current quarterly estimates of GDI and corporate profits are not released because data on domestic profits and net interest of domestic industries are not available. For fourth quarter estimates, these data are not available until the third estimate.

GDP by industry and gross output estimates are released with the third estimate of GDP.

IMAGES

VIDEO

COMMENTS

Description. The 2022 Cruise Industry News Annual Report is now available to order in print and digital formats.. The 35th edition of the Annual Report is the only information resource of its kind — presenting the entire worldwide cruise industry in 400 pages.. Preview Pages of the Report | Table of Contents. Research is fully independent and covers every single cruise line and ship.

2022 Cruise Industry News Annual Report. 2022 Cruise Industry News Annual Report. 2022 Cruise Industry News Annual Report. Click to view in fullscreen. Search. Backward. First. Previous Page. Next Page. Last. Forward. Zoom In. Thumbnails. Bookmarks. Auto Flip. Sound On. Fullscreen. Select Text. Search. Bookmark. add to page 1. Page Title Edit ...

The 2024 Annual Report is available for order in both print and PDF formats. About the Annual Report: The 400-page report covers everything from new ships on order to supply-and-demand scenarios from the early 1990s through 2033. Plus there is a future outlook through 2033, completely independent cruise industry statistics, growth projections ...

They may not be re-published or reused in any way, shape or form without written permission from Cruise Industry News Cruise Industry News has the following PDFs available for download: 2024 Cruise Ship Orderbook (April 2024)

WASHINGTON, DC (27 January 2022) - Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report. The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of ...

© 2024 CLIA - 1201 F Street NW, Suite 250, Washington DC 20004 | (202) 759-9370

WASHINGTON, Jan. 27, 2022 /PRNewswire/ -- Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report.

As the global leader in the cruise industry, we will lead the way in innovative and sustainable cruising to deliver memorable vacations and build borderless connections. 2022 Executive Overview During 2022, we completed a monumental 18-month journey marking our full return to guest cruise operations. Over the past 18 months we have:

Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report. The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of cruise tourism to local communities and national economies […]

Friday, January 28, 2022. Favorite. Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report. The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of ...

1share. Industry trade association Cruise Lines International Association has released its 2022 State of the Cruise Industry Outlook report, which charts a number of areas in which the industry ...

The reality of 2020 sits in stark contrast to the year that immediately preceded it. In 2019, the global cruise industry welcomed nearly 30 million passengers, creating jobs for 1.8 million people around the world and contributing over $154 billion to the global economy. With this growth came increased recognition of cruising as one of the best ...

Gary Peters, 27 January 2022. Cruise association CLIA has released its latest outlook report, highlighting that by August 2022 almost 100 per cent of its ocean cruise line members will be back in operation. The 2022 State of the Cruise Industry Outlook report demonstrates "how the industry has continued to resume responsibly with proven ...

Surplus Food: Achieving per-passenger food waste reduction of more than 30% in 2022 (vs. 2019) and establishing a new goal to reduce food waste by 40% per person by 2025. Biodigesters: Leading the industry with over 600 food biodigesters installed on ships to break down and liquify uneaten food and sustainably return it to nature.

An annual survey revealed that global cruise tourism was forecasted to surpass pre-pandemic totals this year, with the industry growing by almost 20 percent by 2028. According to the Cruise Lines International Association's (CLIA) 2023 State of the Cruise Industry Report, cruise tourism is expected to reach 106 percent of 2019 levels this year ...

CLIA has released its 2022 State of the Cruise Industry Outlook. The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of cruise tourism to local communities and national economies around the world, and charts the industry's continued progress towards achieving carbon…more ›

Premium Statistic Employment in the cruise line operator industry in the U.S. 2012-2022 Overview Premium Statistic Number of global ocean cruise passengers 2009-2027

Cruising Home | CLIA

2022 was a year of many significant milestones and accomplishments for Norwegian Cruise Line Holdings Ltd. Our entire fleet successfully returned to service, capping our nearly yearlong Great Cruise Comeback. We christened the highly anticipated Norwegian Prima, the first of six Prima Class ships to be delivered through 2028.

Overall, 13 of 22 industry groups contributed to the increase in real gross output. GDP for 2023. Real GDP increased 2.5 percent in 2023 (from the 2022 annual level to the 2023 annual level), compared with an increase of 1.9 percent in 2022 (table 1). The increase in real GDP in 2023 primarily reflected increases in consumer spending ...