- Book Travel

- Credit Cards

New HSBC World Elite Mastercard Features & Premium Card Are Here

HSBC has rolled out changes to many of their credit cards, including the popular HSBC World Elite Mastercard . These changes are in effect as of February 1, 2023.

In This Post

New features: hsbc world elite mastercard, new product: hsbc metal world elite mastercard, annual fee rebates.

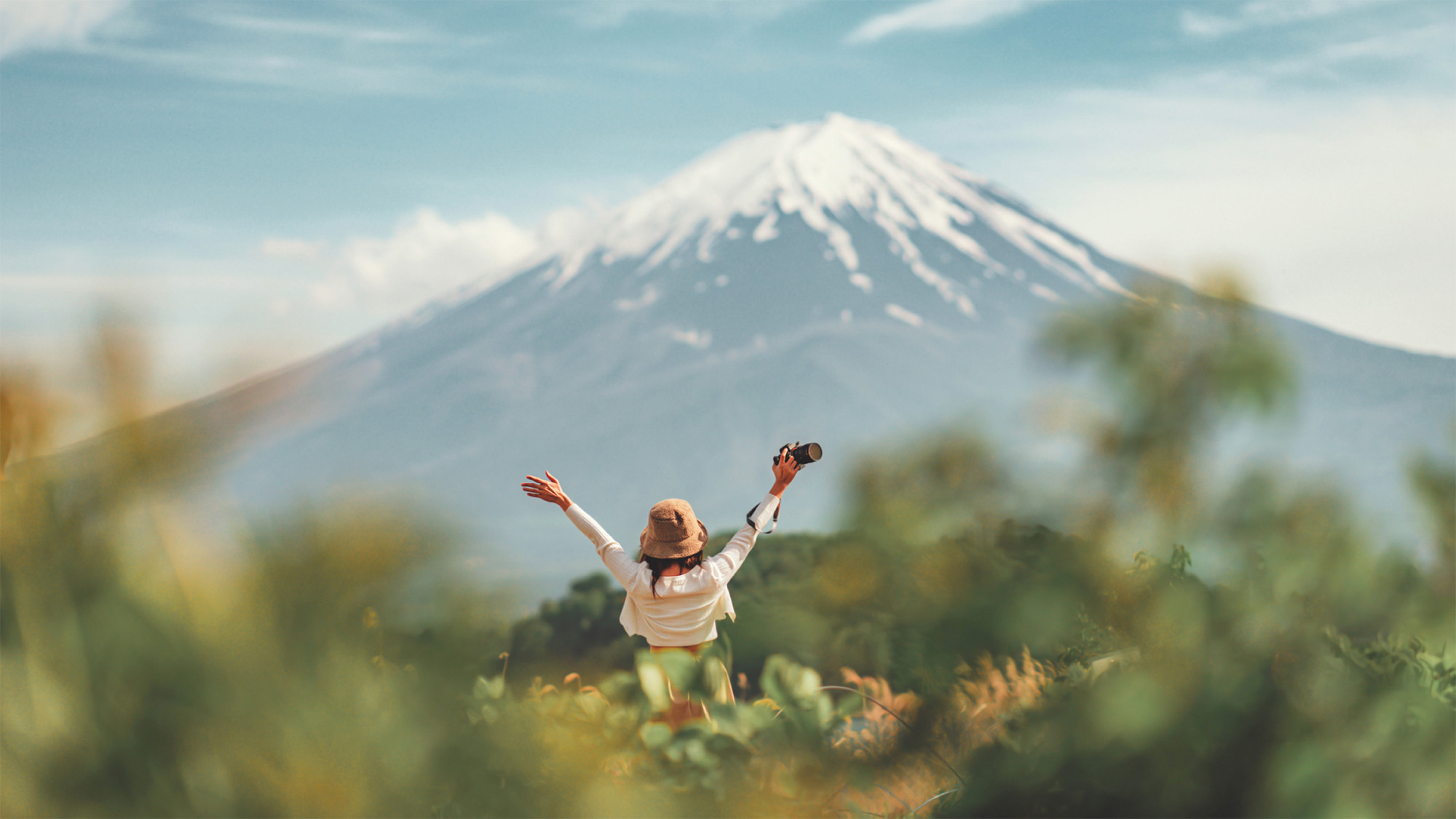

One of our longtime favourite Mastercards for travel , the HSBC World Elite Mastercard is getting a modest but comprehensive makeover.

Some of our favourite features are staying the same, such as no foreign transaction fees , Boingo airport Wi-Fi, and the ability to transfer HSBC Rewards to frequent flyer programs.

Many areas are getting a slight adjustment, including earning rates, insurance, and ways to save on annual fees. Here are they key changes to be aware of as a traveller and points collector.

Category Earning Rates

The card has introduced new category bonuses. Here’s what you’ll earn on everyday spending:

- 6 points per dollar spent on travel

- 4 points per dollar spent on groceries, gas, and drugstores

- 2 points per dollar spent on all other purchases

With HSBC Rewards valued at 0.5 cents per point for statement credit, or more via airline transfer partners , the card earns a minimum of 1% back on every purchase.

Before, the card earned 6 points per dollar spent on travel, and 3 points per dollar spent on all other purchases.

While the move to category bonuses will be disappointing for anyone who highly valued the card’s uniquely strong base rate, it’ll benefit anyone who uses the HSBC World Elite Mastercard as their daily driver. Plus, it aligns HSBC more closely with its competitors, as almost all other Canadian credit cards use a category structure.

Improved Insurance

HSBC has also added new and improved insurance benefits for cardholders .

Emergency medical insurance is getting a significant boost. Now, you’ll now be covered for up to $2 million in claims for trips up to 31 days, or 21 days for cardholders 65 years or older.

Previously, cardholders were only covered for up to $1 million, and only those under the age of 65. This is a hugely generous protection for a vulnerable demographic, one that is often underserved by credit card insurance for that very reason.

Baggage delay insurance is also getting a boost. Instead of claiming up to $750 for delays of 12 hours or longer, you can claim up to $1,000 for delays of six hours or longer.

Rounding out the travel coverage, there’s new insurance coverage for flight delays over 6 hours, and hotel burglary up to $1,000.

As for everyday purchases, cardholders will also enjoy mobile device insurance up to $1,000. Previously a niche perk, this coverage is now slowly making its way throughout the credit card industry.

Finally, HSBC has added price protection, a very exciting and rare feature on Canadian credit cards. You’ll be able to claim the difference between the price you paid and a lower advertised price, if the price drops within 60 days of your purchase, up to $500 per transaction and $1,000 per calendar year.

Needless to say, these insurance additions are sweeping, and HSBC has really stepped up here.

No More Supplementary Card Fee

The HSBC World Elite Mastercard has eliminated the $50 fee to add a supplementary card to your account. Plain and simple, this is a win for anyone who adds multiple users to the same spending account.

As before, you can add up to four supplementary cards to your account. Note that insurance benefits may vary for supplementary cardholders.

Finally, it’s worth noticing that HSBC has redesigned the art of their legacy credit cards, aligning them with their newer entry-level products .

I’ll miss the signature triangle lion, but I can’t begrudge HSBC for a cosmetic tweak in line with design trends across the financial services industry.

HSBC has launched the new HSBC Metal World Elite Mastercard, replacing the HSBC Jade World Elite Mastercard.

(Yes, the name of the product is the Metal card, and it is indeed metal!)

The card’s page on the HSBC website provides confusing information: the card is only available to HSBC Private (formerly Jade) banking clients; however, the $499 annual fee is waived for Private banking clients. It seems to me that you must be a Private client to apply for the card, but you can continue holding it (for a $499 annual fee) if you later decide to downgrade your HSBC relationship.

On top of the features of the mass-market HSBC World Elite Mastercard, the Metal card offers some truly premium benefits.

Most notably, the card offers a supercharged DragonPass membership with unlimited visits for the cardholder and one guest.

That’s a big step up from Visa Infinite Privilege cards, which only offer six complimentary visits per year. It also blows other Mastercards out of the water, many of which, including HSBC’s own World Elite Mastercard, offer a membership but no complimentary visits.

Unlimited lounge access puts the card on par with the Amex Platinum cards for accessing Plaza Premium lounges which are abundant in airports across Canada, not to mention over a thousand lounges worldwide.

As an interesting wrinkle, there’s no fee to add a supplementary cardholder. While the terms don’t specify, it seems to me that supplementary cards could also be eligible for a DragonPass membership of their own.

In that case, this card begins to resemble the Capital One Venture X Card in the United States, a premium credit card with annual rebates offsetting the high fee, and with which you can essentially gift unlimited lounge access to your family.

As a cherry on top, you’ll also get a $200 annual travel credit, up from $100.

If you’re a Private client with $1 million in personal assets at HSBC, the HSBC Metal World Elite Mastercard is a no-brainer to elevate your travel lifestyle at no extra cost.

HSBC is expanding and simplifying the annual fee rebates they offer for their banking clients.

HSBC has three banking tiers, with various requirements to qualify. To summarize, you can qualify for (from low to high) Advance, Premier, or Private banking on the basis of your balances, recurring deposits, mortgage with HSBC Canada, or HSBC tier in another country.

HSBC has revamped their credit card annual fee rebates, which can be applied towards any credit card:

- Private: full annual fee rebate

- Premier: $50 annual fee rebate

- Advance: $25 annual fee rebate

It appears they’ve also consolidated the old Premier World Elite Mastercard with the standard version, which only differed by offering a $50 annual fee rebate for Premier. This ought to streamline their product catalog, reducing needless complexity.

Combined with the $100 annual travel credit, this effectively reduces the $149 annual fee to $24 for Advance clients, or a net gain of $1 for Premier clients, respectively. For a card that already had strong appeal as a long-term keeper, that proposition has only gotten stronger.

If you’re not interested in the World Elite card, the HSBC +Rewards Mastercard’s $25 annual fee will be fully waived for any Advance, Premier, or Private client.

Overall, I’d say the upcoming changes to the HSBC World Elite Mastercard are mostly positive, and on balance a net win.

In particular, comprehensive insurance on travel and everyday purchases is quite impressive. I’m also pleased to see that the costs of being a cardholder are reduced for HSBC banking clients.

I’m sad to see the card’s strong base earn rate cut in favour of higher rewards on categorized spending. Most importantly, though, no foreign transaction fees are here to stay.

The new HSBC Metal World Elite Mastercard is an exciting introduction to the market as Canada’s first truly premium Mastercard, going toe-to-toe with industry leaders for travel benefits. It may give Private banking clients pause when considering whether to add the additional expense of a top-tier Visa or Amex.

As an HSBC banking client myself, I certainly plan on using my HSBC World Elite Mastercard long-term. Even with the reduced earn rate on uncategorized transactions, there’s still more than enough appeal to make this card an everyday fixture.

If you’re interested in the World Elite card, the current signup bonus for up to 80,000 HSBC Rewards points is still available until February 28, 2023. For the Metal World Elite card, I’d recommend making an appointment with a banking advisor.

- Earn 6 HSBC Rewards points per dollar spent on travel purchases

- Plus, receive an annual $100 travel enhancement credit *

- Transfer HSBC Rewards points to Singapore Airlines KrisFlyer and other frequent flyer programs for premium flights, or redeem points for statement credit for any travel expense

- No foreign transaction fees *

- Minimum income: $80,000 personal or $150,000 household

- Annual fee: $149

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Air Canada Adds New Sports Channels to Live TV Selection

News Apr 19, 2024

Air India to Launch A350 on Delhi–Dubai Route

Amex Aeroplan Card: New Offer for Up to 50,000 Points

Deals Apr 18, 2024

Recent Discussion

Rbc changes earning rates on the rbc® british airways visa infinite†, review: rbc® avion visa infinite†, air canada announces summer 2024 schedule, how to use air canada same-day airport changes, prince of travel elites.

Points Consulting

Review: HSBC World Elite Mastercard

Reed Sutton Apr 11, 2024 / Card Review , HSBC / Leave a comment

Credit Cards

by [author_plus] | Published May 27, 2022 | Edited [modified_date]

Card Review , HSBC

[comment_number]

Difficulty:

Categorized: Credit Cards

This card has been discontinued and is unable to be applied for (11/2023).

Do you like to travel? Do you like earning and redeeming flexible rewards points? Do you hate foreign transaction fees? Then the HSBC World Elite Mastercard might be a credit card to consider.

The World Elite card from HSBC is a phenomenal card for avid travelers, with strong earning rates on travel purchases, and comprehensive travel insurance, in addition to being one of the only cards in Canada with no foreign currency transaction fees.

Let’s take a look at our HSBC World Elite Mastercard review to see if you should be adding this premium travel credit card to your wallet.

Welcome Bonus

The HSBC World Elite Mastercard offers a tiered welcome bonus of 50,000 HSBC Rewards points , which is worth an estimated $250 when redeemed for travel. The bonus is structured as:

- Welcome bonus of 20,000 HSBC Rewards points ($100 value)

- Earn 30,000 HSBC Rewards points when you spend $1,000 within 60 days of account opening ($150 value)

The HSBC World Elite Mastercard earns HSBC Rewards points and offers cardholders benefits including an annual $100 travel enhancement credit * and free Boingo Wifi membership.

For 2023, we selected this card as the Best Foreign Transaction Credit Card.

Check out our HSBC World Elite Mastercard review for more details.

The $149 annual fee is also rebated for the first year and the card offers a $100 Travel Enhancement Credit (explained below). This offer is scheduled to end on September 29, 2023 .

Earning Rates

The HSBC World Elite Mastercard earns HSBC Rewards points for all purchases made on the card at the following rates:

- 6 HSBC Rewards points for every dollar spent on eligible travel purchases (up to $50,000 per calendar year).

- 4 HSBC Rewards points for every dollar spent on gas, grocery, and drugstore purchases.

- 2 HSBC Rewards points for every dollar spent on all other eligible purchases.

HSBC Rewards points can be redeemed at a rate of 0.5 cents per point , or 200 points for every $1 CAD . This means on travel purchases, the HSBC World Elite earns effectively 3% return, 2% on gas, grocery, and drugstore purchases, and 1% on all other purchases.

The HSBC World Elite Mastercard has an annual fee of $149. However, it is often rebated as part of the welcome offer, so ensure you always read the terms of the current offer carefully.

$100 Travel Enhancement Credit

The HSBC World Elite Mastercard comes with a $100 Travel Enhancement credit, which can be used towards eligible airline baggage fees, airline seat upgrades, or airport lounge pass purchases.

The credit will be automatically available when your credit card is first issued and will be renewed annually on the anniversary of your account opening date. The credit must be used within one year.

You must charge the eligible travel purchases to your HSBC credit card. Then you can redeem the credit against them by submitting a redemption request. To do so, log in to your HSBC online account and click “Redeem Your Points Here”. Then select the “Redeem Now” dropdown, and click on “Travel Enhancement Credit”. On the next screen, eligible charges that you can apply the credit towards will appear.

The definition of ‘eligible travel purchases’ is quite lax for the annual Travel Enhancement credit. People on RedFlagDeals report no issue using the refundable hotel trick to book a refundable hotel on Expedia, apply the credit towards the booking, and then cancel the hotel booking to liquidate the $100 into a statement credit.

Zero Foreign Transaction Fees

Credit cards with no foreign transaction fees are a rarity in Canada. With the HSBC World Elite Mastercard, you will pay no foreign transaction fees, only the exchange rate set by Mastercard for the currencies being converted.

This means that you will save 2.5% on all foreign currency conversion charges whether they occur when traveling outside of Canada or for online shopping purchases. This also makes the HSBC World Elite Mastercard one of the best no foreign transaction fee credit cards in Canada.

Free Boingo WiFi Access

As with all World Elite credit cards, the HSBC World Elite Mastercard comes with unlimited access to WiFii at Boingo hotspots around the world. Importantly, Boingo membership can be used to access free WiFi on WestJet flights , as well as other select airlines. You can sign up for Boingo through the World Elite-specific link .

LoungeKey Lounge Program Membership

The HSBC World Elite Mastercard grants a complimentary membership in the Mastercard LoungeKey program for the primary cardholder. Authorized users of your HSBC World Elite will also get complimentary LoungeKey membership.

Unfortunately, you still have to pay for each individual airport lounge visit as this card does not include airport lounge passes. Each visit will cost $32 USD per person. If you are interested in lounge access, it would be worth looking at other credit cards which offer complimentary airport lounge access not only for the primary cardholder but for their guests as well.

Insurance Coverage

The HSBC World Elite Mastercard offers a plethora of strong insurance benefits.

This includes worldwide emergency medical insurance for up to 31 days per trip for yourself, your spouse, and any dependent children traveling with you, up to $1,000,000 per insured person. This coverage is not extended to those over the age of 65 or for trips to Cuba.

The card offers insurance on baggage delay/loss, including loss or damage, theft, burglary, and fire or transportation hazards during the trip, as well as trip cancellation, interruption, and delay. For the latter, you must charge at least 75% of eligible expenses to your card. Covered events include death, injury, or illness of yourself or your immediate family.

Car rental insurance covered by the card includes Car Rental Collision/Loss Damage, as well as Personal Effects and Car Rental Accidental Death and Dismemberment. To be eligible, you must charge at least 75% of the cost of the rental vehicle to your HSBC World Elite Mastercard and decline the rental agency’s collision or loss damage waiver.

Finally, purchase protection provides coverage in the event of loss, damage, or theft for 90 days from the purchase date and extended warranty coverage doubles the manufacturer’s warranty for a maximum of one additional year. The FULL cost of the item must be charged to the HSBC World Elite Mastercard.

Refer to the HSBC World Elite certificate of insurance for complete details and conditions.

Redeeming HSBC Reward Points

The HSBC Rewards program allows members to redeem points for travel rewards, a statement credit, gift cards, and merchandise. However, the value of redeeming for anything aside from travel is quite poor and not recommended.

Alternatively, HSBC Rewards points can be transferred out to other points programs for potentially very good value.

When doing an HSBC Rewards redemption, there is a minimum quantity you must redeem, as follows:

- A minimum of 25,000 HSBC Rewards points must be redeemed

- On top of the 25,000 minimum, HSBC Rewards points may be redeemed in increments of 10,000 points

So you can redeem 25,000 points, 35,000 points, 45,000 points, and so on. This makes redeeming a bit awkward but this is how the program is set up.

Redeeming HSBC Rewards Directly Towards Travel Purchases

As mentioned, HSBC Rewards points can be redeemed for credit towards travel purchases at a rate of 0.5 cents per point (ie. each point is worth $0.005, or 10,000 points is worth $50).

Redeeming points this way is very flexible and works similarly to redeeming TD points and CIBC Aventura points for self-directed travel. You can book with any travel provider such as airlines, hotels, Airbnbs, car rental companies, and so on – then redeem your HSBC Rewards points against the purchase through the HSBC Rewards Portal.

Note that when redeeming points this way you must redeem within 60 days of the purchase posting to your account.

Transfer HSBC Rewards to Other Airline Loyalty Programs

What makes HSBC Rewards points even more flexible is their ability to be transferred to other partner loyalty programs, including British Airways Avios , Singapore Airlines KrisFlyer, and Cathay Pacific Asia Miles.

Transfer HSBC points to these programs at the following rates:

- 25,000 HSBC Rewards points = 10,000 British Airways Executive Club Avios

- 25,000 HSBC Rewards points = 9,000 Singapore Airlines KrisFlyer miles

- 25,000 HSBC Rewards points = 8,000 Cathay Pacific Asia Miles

HSBC Rewards can only be transferred to other programs in chunks of 25,000 points, unfortunately.

Comparable Cards to the HSBC World Elite Mastercard

One of the rare benefits of the HSBC World Elite Mastercard card is that it has no foreign currency or foreign transaction fees. When making purchases internationally, this benefit will save you 2.5% per transaction, so it can definitely add up. Credit cards that offer this benefit in Canada are few and far between, but there are a couple of cards that you might want to consider if the HSBC World Elite Mastercard doesn’t fit your lifestyle.

Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite card is a good choice if you only want a single credit card for travel abroad as it has no foreign transaction fees and Visa typically has higher merchant acceptance internationally. The Scotiabank Passport Visa Infinite also comes with 6 complimentary lounge passes.

The Scotiabank Passport Visa Infinite card earns Scene+ Rewards points and offers cardholders benefits such as no foreign transaction fees and six complimentary airport lounge access passes annually.

Check out our Scotiabank Passport Visa Infinite card review for more details.

In 2024, we awarded this card as the Best Foreign Transaction Credit Card.

Scotiabank Gold American Express Card

Alternatively, the Scotiabank Gold American Express credit card has no FX fees and is a great card for grocery purchases. However, if you are using this card while traveling, American Express typically does have lower merchant acceptance internationally so ensure you have another Visa or Mastercard on hand, just in case.

The Scotiabank Gold American Express card earns Scene+ Rewards points and gives cardholders the opportunity to earn 5x Scene+ points on grocery, restaurant, and entertainment purchases. This card charges no foreign exchange fees .

Check out our Scotiabank Gold American Express card review for more details.

American Express Platinum Card

As far as lounge access is concerned, there are many better options than the HSBC World Elite credit card for getting into airport lounges for free as I personally wouldn’t pay US$32 to access an airport lounge. The American Express Platinum card is one of those cards, as it offers full access to the American Express Global Lounge Collection , including American Express Centurion Lounges .

The American Express Platinum card earns Membership Rewards and offers cardholders a variety of benefits including an annual $200 travel credit , complimentary airport lounge access, an annual $200 dining credit , and instant elite status with many hotel loyalty programs.

In 2024, we awarded this card as the Best Credit Card for Airport Lounge Access.

The HSBC World Elite Mastercard is a solid credit card for travel and in general as it offers no foreign transaction fees coupled with a flexible points program (redeem for travel credit or transfer to airline loyalty program partners). As a Mastercard, it will be accepted nearly anywhere (including Costco in Canada). The rate at which the card earns HSBC Rewards points for travel is great (6 points per dollar or 3%) and good for all other eligible purchases (3 points per dollar or 1.5%).

The $100 annual travel enhancement credit offsets most of the annual fee, so this card can be a great addition to your portfolio as a long-term keeper card.

My main gripe with the card is the redemption increment restrictions. With the 25,000 HSBC Rewards minimum redemption, you can end up stuck in a spot where you have thousands of points or up to $100+ of value tied up until you earn more points. This can be a bit of an inconvenience but can be resolved with careful redemption planning.

Frequently Asked Questions

World Elite Mastercards are a premium credit card product and have strict requirements, including a personal income requirement of at least $80,000 or a household income of at least $150,000.

In general, World Elite cards are harder to get due to income requirements. With HSBC in particular, you will want to have at minimum a good credit score (700+), and ideally an excellent one (750+).

HSBC states on their website that they obtain credit reports from Equifax and TransUnion. While this means they likely have the ability to pull from either, in practice, it has been observed that HSBC usually pulls from Equifax only.

HSBC Rewards points can be redeemed for travel, a statement credit, gift cards, products, and experiences, through the HSBC Rewards online dashboard. Travel purchases generally grant the best redemption value where 10,000 points are worth $50 (0.5 ‘cents per point’). Travel purchases are purchases made from merchants that are classified as airlines, hotels, car rental agencies, and so on. You can also transfer HSBC Rewards in chunks of 25,000 to three other airline programs: British Airways Executive Club (25,000 HSBC Rewards points = 10,000 Avios), Singapore Airlines KrisFlyer (25,000 HSBC Rewards points = 9,000 miles), and Cathay Pacific Asia Miles (25,000 HSBC Rewards points = 8,000 miles).

HSBC Reward points do not expire as long as your account is in good standing. HSBC reserves the right to close your account at any time. If you close your account without redeeming your points then they will be forfeited.

Yes, you can buy additional points as a top-up. This option is available at checkout from the rewards portal if you don’t have enough points for a selected item. However, this option is not available for any cash equivalent redemption options.

Yes HSBC Rewards points can be redeemed for a statement credit at a value of 0.3 CPP or 333 points = $1. However, a better way to convert HSBC Rewards to cash is using the refundable hotel method . You can convert at the travel rate of 0.5 CPP by booking a refundable hotel, redeeming HSBC Rewards towards it, and then canceling the hotel for a full refund.

The HSBC World Elite Mastercard is a good credit card for travel purchases, earning effectively a 3% return on spend (assuming earned HSBC Rewards points are redeemed for travel). The HSBC World Elite also has no foreign transaction fees, a strong insurance offering, free Boingo WiFi membership, and an annual $100 travel enhancement credit. It is definitely a credit card worth considering!

- Latest Posts

Reed Sutton

Latest posts by reed sutton ( see all ).

- The Best Luxury Lodges for Wildlife and Wilderness Lovers - Mar 4, 2024

- Welcome to the Frugal Flyer Team, Andy - Feb 20, 2024

- Update on IRS Processing of Certified True Copies of Canadian Passports - Jan 20, 2024

- Best Balance Transfer Credit Card Offers in Canada - Jan 15, 2024

- Review: The Saint Hotel New Orleans French Quarter, Autograph Collection - Jan 4, 2024

5 Best Things to Do in Rome, Italy

Definitive guide: nexus membership in canada, leave a comment cancel reply.

All comments are moderated according to our comment policy. Your email address will NOT be published.

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. For complete and current information, please consult the entity's website.

By Hannah Logan

Updated: August 09, 2023

Play article

( mins)

( )

The Best HSBC credit cards in Canada

HSBC / HSBC

From cards offering travel rewards to paying no annual fee, our expert advises on how to select an HSBC Canada credit card that works best for your lifestyle.

Considering an HSBC credit card? Given that HSBC is the seventh-largest bank in Canada, it’s well worth adding one of their credit cards to your wallet. Although not as well-known as other credit cards on the market, they offer some excellent benefits. In this article, we’re breaking down our top picks for the best HSBC credit cards in Canada to help you decide which card is best for you.

The best HSBC Canada credit cards

Best for travel: hsbc world elite® mastercard®.

Get up to $649 in total value* for the first year! Must apply by August 31, 2023. Conditions apply.

If you are looking for a travel rewards credit card , the HSBC World Elite® Mastercard® is a good pick. Earn 3% in travel rewards on all eligible travel purchases* (6 points per $1); 2% in travel rewards on all eligible gas, grocery, and drugstore purchases* (4 points per $1); and 1% in travel rewards on all other eligible purchases* (2 points per $1). In addition, the card is currently extending an impressive welcome offer to new cardmembers.

Special offer: Earn up to 80,000 points* ($400 travel value) PLUS a full annual fee rebate for the primary cardholder for the first year* ($149 value) and receive a $100 annual travel enhancement credit*. Must apply by August 31, 2023. Conditions apply.

- Welcome bonus of 20,000 points* ($100 travel value)

- Earn 10,000 points* each month when you spend at least $1,000 each month for the first 6 months of account opening (up to $300 travel value)

- First year annual fee rebate for the primary cardholder* ($149)

- Receive a $100 annual travel enhancement credit*

An HSBC Rewards point is worth $0.005 when redeemed for travel, so that adds up to $649 in total value* in the first year. Conditions apply.

For reference, 200 points are equal to $1 to redeem towards travel as well as merchandise, HSBC financial products, gift cards, and more. Cashing in your rewards is easy: you just apply your points to a purchase you have made on your credit card within the last 60 days. You can do this yourself online, or call customer service and have someone do it for you.

Other cardholder benefits include no foreign transaction fees (only the exchange rate applies), a $100 annual travel enhancement credit* (which can be used towards upgrading your airline seats, covering baggage fees, or towards airport lounge passes), and a complimentary membership to Mastercard Travel Pass provided by DragonPass, offering you access to over 1,300 airport lounges worldwide.

The card also comes with Worldwide Emergency Travel Medical insurance with coverage for 31 days – which is one of the longest included policies among the travel credit cards in Canada. Additional “nice to have” perks include 10% savings on select hotel bookings made through the HSBC Expedia and Agoda websites and unlimited Wi-Fi at Boingo hotspots worldwide.

Despite the current global pandemic, many Canadians still need to travel domestically for business. While you may not have any use for the perks and benefits at this time, you can take advantage of the opportunity to earn extra travel rewards to use in the future when it is safe to travel abroad again as your points will remain valid for up to 3 years from the earn date.

The overall value of the card in terms of perks, earn rates, and the fact that it has no foreign transaction fees makes up for the annual fee. The HSBC World Elite® Mastercard® does have a lot of benefits, making it one of the best travel credit cards in Canada.

The details:

- Annual fee: $149

- Minimum income eligibility: Annual individual income of $80,000 or $150,000 household income, or minimum of $400,000 in assets under management (based on liquid, investable assets with a financial institutions in Canada)

- Credit score required: N/A

- Welcome bonus: Get up to $649 in total value* for the first year! Must apply by August 31, 2023. Conditions apply.

- Purchase APR: 20.99% | Cash advance APR: 22.99% | Balance transfer APR: 22.99%

This offer is only available to residents of Canada other than the province of Quebec (Quebec residents eligible for separate offer).

*Terms and Conditions apply.

®/TM Mastercard and World Elite are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated. Used pursuant to license.

Best for low interest: HSBC +Rewards™ Mastercard®

Special offer: Earn up to 35,000 points* ($175 travel value) PLUS a full annual fee rebate for the primary cardholder for the first year* ($25 value). Must apply by August 31, 2023. Conditions apply.

Earn 35,000 points* when you spend $2,000 within 180 days of account opening ($175 travel value)

First year annual fee rebate for the primary cardholder* ($25 value)

An HSBC Rewards point is worth $0.005 when redeemed for travel, so that adds up to $200 in total value* in the first year. Conditions apply.

Thanks to the pandemic throwing the economy into a spiral, many Canadians are currently struggling to pay credit card debt. In this case, consider a low-interest credit card like the HSBC +Rewards™ Mastercard® . It offers an interest rate of 11.9% — an incredible rate given that most credit cards have interest rates of 19.9% and higher. By switching to a low-interest credit card, you can avoid astronomical interest charges and pay off credit card debt faster .

As a low-interest credit card, the HSBC +Rewards™ Mastercard® doesn’t come with a ton of perks and benefits but offers a low annual fee, and unlike other no-frills cards, you can still earn rewards. Earn 2 Points for every $1 on eligible dining or entertainment purchases*. Earn 1 Point for every $1 on all other everyday purchases*. Cardholders will also benefit from purchase assurance for 90 days, price protection service (find a lower price within 60 days of your purchase and the difference will be refunded), and extended warranty insurance that doubles the manufacturer’s warranty for up to 1 additional year.

- Annual fee: $25

- Minimum income eligibility: N/A

- Welcome offer: Get up to $200 in total value* for the first year! Must apply by August 31, 2023. Conditions apply.

- Additional perks: Redeem points for travel, financial rewards, gift cards, merchandise, and more; extended warranty and purchase protection; optional travel insurance

- Purchase APR: 11.9% | Cash advance APR: 11.9% | Balance transfer APR: 11.9%

Comparing HSBC credit card in Canada

The verdict: which hsbc credit card is best.

Each HSBC credit card has excellent features, but it will depend on your personal needs. Take the time to examine your spending habits, decide whether the perks are worth paying for, and know your bottom line. For a broader range of brands and options, you can also check out the best credit cards in Canada.

About our author

Hannah Logan is a freelance writer, blogger, and content creator from Ottawa. She spends half the year in Canada and half the year travelling around the world. A self-described wannabe Indiana Jones, Hannah first developed an interest in personal finance in an effort to prolong her travel lifestyle. Today, she shares her stories from her travels as well as finance tips, tricks, and knowledge to help others fulfil their savings and travel goals as well. You can keep up with Hannah’s adventures on her personal travel blog, EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

Latest Articles

Canadian business: 5 things to watch for this week

Cap on plastic production remains contentious as Ottawa set to host treaty talks

What Australia and the U.K.'s grocery codes can teach us about Canada's food fight

Ottawa puts up $50M in federal budget to hedge against job-stealing AI

Tim Hortons says proposed Roll Up the Rim class action suit has no merit

What's a Barnacle? It's yellow, sticks and screams if you try to pry it off your car

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

HSBC World Elite ® Mastercard ®

This offer is only available to residents of Canada other than the province of Québec (Québec residents eligible for separate offer ).

Summary of Flytrippers' review

Why get this card.

- Welcome bonus of ≈ $71

- Points that are very flexible

- No foreign transaction fees (FX fees)

- Excellent earn rates

- Excellent insurance coverage

WHO SHOULD GET THIS CARD

- Those who aren’t eligible for the Scotiabank Passport Visa Infinite Card ‘s welcome bonus

How to learn more

Detailed card review (VIDEO and TEXT)

- Go to our editorial card review page

- Keep scrolling here for all the details

- Apply now via HSBC secure link

- See all the best credit cards in Canada

Card details

Welcome bonus structure

20,000 points Bonus after making 1 purchase (no minimum spending)

Earn on the minimum spending requirement

0 points No earn on the minimum spending requirement (there is no minimum spending requirement)

Total rewards by unlocking the welcome bonus

20,000 points Welcome bonus

‣Apply for the HSBC World Elite ® Mastercard ®

Flytrippers Valuation of the welcome bonus

≈ $120 Bonus after 1 purchase (20,000 pts at ≈ 0.6¢/pt) $100 Annual travel credit (can be cashed out) –$149 Card fee (deducted from Flytrippers Valuation)

≈ $71 Total net value by unlocking the welcome bonus alone

( ≈ 7100 % back on the minimum spending requirement of $1 )

‣ Learn more our Flytrippers Valuation of welcome bonuses

Minimum fixed value of the welcome bonus

$100 Bonus after 1 purchase (20,000 pts at 0.5¢/pt) $100 Annual travel credit (can be cashed out) –$149 Card fee (deducted from Flytrippers Valuation)

$51 Total net value by unlocking the welcome bonus alone

( 5100% back on the minimum spending requirement of $1 )

‣Learn more about the minimum fixed value of HSBC points (coming soon)

Rewards from welcome bonus

You will have 20,000 HSBC points after unlocking the Welcome Bonus AND a travel credit ( $100 ).

That gives you either:

- ≈ $120 in rewards at the Flytrippers Valuation + $100

- $100 in rewards at the simpler minimum fixed value + $100

‣ Learn more about the best uses of HSBC points

Earn rate (at Flytrippers Valuation)

6 points per $ (≈ 3.6% ):

4 points per $ (≈ 2.4% ):

- Groceries (and indirectly at all retailers offering gift cards in grocery stores )

- Drugstores and pharmacies

2 points per $ (≈ 1.2% ):

- Everywhere else

‣Learn more about credit card earn rates (coming soon)

Earn rate (at minimum fixed value)

6 points per $ ( 3% ):

4 points per $ ( 2% ):

2 points per $ ( 1% ):

Earning with additional cards

Fee for additional cards: $0 Quantity allowed: 4 Minimum age: N/A

‣Learn more about additional cards (coming soon)

No foreign transaction fees One of the few cards in Canada that does not charge a 2.5% fee for all foreign currency transactions.

‣ Learn more on foreign currency transaction fees

$100 Annual Travel Credit A travel credit applicable to any travel expense (and that can even be cashed out with our tip).

‣ Learn more about the HSBC annual travel credit

Free global access to Boingo Wi-Fi Access over 1 million Wi-Fi hotspots worldwide through the Boingo program.

‣Learn about the Boingo Wi-Fi program (coming soon)

10% discount on hotels Via Expedia for HSBC and Agoda for HSBC . But always compare on other sites to see if the price is really lower.

‣Learn more about discounts from booking sites (coming soon)

Membership in the Mastercard Travel Pass by DragonPass Warning: Many cards offer membership AND free lounge access passes; this one just gives membership and no free passes.

‣Learn more about airport lounge access (coming soon)

Insurance included

Medical travel insurance for 31 days (64 years and under) Medical travel insurance for 21 days (65 years and above) Trip cancellation insurance Trip interruption insurance Flight delay insurance Baggage delay insurance Rental car insurance Lost or stolen luggage insurance Hotel burglary insurance Travel accident insurance Purchase insurance Extended warranty Mobile device insurance Price protection

‣Learn more about HSBC World Elite ® Mastercard ® insurance coverage (coming soon)

Insurance not included

‣Learn more about the different types of insurance coverage (coming soon)

Redemptions HSBC Rewards points can be used for specific flights to maximize their value (via transfers to partner programs). But they can also be used as a simple travel credit (which can be applied to any travel expense).

‣ Learn more about the HSBC Rewards program

Value HSBC points are hybrid rewards: they can be used as fixed-value rewards (fixed value of 0.5¢) or variable-value rewards (value depending on how you use them; our Flytrippers Valuation is ≈ 0.6¢, which is ≈ 20% more).

‣ Learn more about the value of HSBC points (coming soon)

Expiry HSBC points never expire as long as you have the card. And even if you no longer have the card, it’s possible to extend the expiration indefinitely easily.

‣ Learn more about HSBC points expiration

Pooling If you have travel companions, it’s possible to combine HSBC points via transfer partners.

‣ Learn more about pooling HSBC points

Transfers HSBC points can be transferred to multiple partner programs and this often provides the best value.

‣ Learn more about HSBC point transfers

Other redemption options HSBC points can be used for rewards other than travel but this should be avoided.

‣ Learn more about why you should always use your rewards for travel (coming soon)

Logistics of redemptions You can use your points directly on the HSBC website.

‣ Learn more about how to get started with HSBC Rewards (coming soon)

Program summary Rewards: HSBC Points Type: Hybrid rewards Subtype (fixed value): “Eraser” or “Standard” rewards Subtype (variable value): “Standard” rewards Variety: Bank rewards Flytrippers Valuation: ≈ 0.6¢ per point Minimum value: 0.5¢ per point Maximum value: Unlimited Transferable: Yes (3 partners)

‣ Learn more about rewards programs basics (coming soon)

Card eligibility Minimum income: $80,000 (personal) OR $150,000 (household) Age: Majority in your province Estimated credit score: Good or Excellent Credit bureau: Equifax

‣ Learn more about credit card eligibility requirements (coming soon)

Welcome bonus eligibility Within the 12 months prior to application, you must not have had the HSBC World Elite ® Mastercard ® , HSBC Premier World Elite Mastercard, or HSBC Metal World Elite Mastercard.

‣ Learn more about credit card welcome bonus eligibility rules (coming soon)

Offer end date Offer may be changed at any time

‣ Subscribe to Flytrippers’ free travel rewards newsletter to get all card updates

Card details Issuer: HSBC Network: Mastercard Card Type: Credit card Product Type: Personal card

‣Learn more about credit card types (coming soon)

Fees and rates Card fee: $149 Card fee (net): $49 after $100 annual credit Fee for additional card: $0 FX fee: 0% Purchase annual interest rate: 20.99% Cash advance annual interest rate: 22.99% Balance transfer fee: 22.99% Cash advance fee: $5

‣ Learn more about why Flytrippers recommends ignoring fees and rates (coming soon)

Special offer: Earn 20,000 points ($100 travel value) and receive a $100 annual travel enhancement credit. Conditions apply.

o Welcome Bonus – 20,000 points ($100 travel value)

o Receive a $100 annual travel enhancement credit

- Primary Cardholder Annual Fee: $149

- Annual Interest on Purchases: 20.99% (19.9% for Quebec residents)

- Annual Interest on Cash Advances and Balance Transfers: 22.99% (21.99% for Quebec residents)

- Supplementary card annual fee: $0 per card

Rates and fees

Enjoy an annual fee rebate if you’re an HSBC Private, Premier, or Advance client

*Terms and Conditions apply

®/TM Mastercard and World Elite are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated. Used pursuant to licence.

Start earning rewards today

And make sure to download our free checklist for when you get a new card—it includes very important mistakes to avoid (it will open in a separate tab, or you can click here ).

via HSBC secure application

*Beta version of card page. Sign up to get updated guide soon.*

This content is not sponsored. However, this page may contain some affiliate links that allow Flytrippers to earn a commission at absolutely no cost to you. Thank you for using our links and helping us keep all our content free for everyone. This helps us fulfill our mission of helping Canadians travel more for less.

The views and opinions expressed on this page are purely our own. They have not been provided, approved, endorsed, or ratified by any third party mentioned on the site.

Financial institutions are not responsible for updating or ensuring the accuracy of the information on Flytrippers’ website. All the information was independently collected by Flytrippers and not provided by financial institutions.

All offers described on the Flytrippers website are subject to the financial institutions’ latest terms and conditions, which can be found on their official website. No efforts are spared to ensure this page is up to date but offers from financial institutions change quickly. It is your responsibility to ensure the accuracy of these offers on their website. Flytrippers will not accept any responsibility for the accuracy of the offers or the result of your actions.

Flytrippers’ website does not contain all available credit card offers or all available credit card products on the market. In addition, Flytrippers never shares an offer if it is not considered advantageous for some travelers, at its sole discretion.

No author on Flytrippers’ website is a financial advisor, a financial planner, a legal professional, or a tax professional. No author on Flytrippers’ website can in any way be considered as such.

All articles, pages, and content on Flytrippers’ website are merely personal opinions of a general nature and are for informational purposes only and should not be considered advice for specific situations. It is your responsibility to perform your own personal research to ensure that travel rewards are appropriate for your own situation.

You can learn more about our terms of use here .

Terms & conditions — Travel rewards

† Terms and conditions apply.

You can learn more about our terms of use here .

Share this post to help us help more people travel more for less:

Apply now for the HSBC World Elite ® Mastercard ® and get a welcome bonus worth ≈ $ -49 !

HSBC: How do I use the $100 HSBC Annual Travel Credit?

Following the acquisition of HSBC Bank by RBC , the HSBC World Elite ® Mastercard ® has now been discontinued since October 2023. For another great card with no conversion fees , consider the Scotiabank Passport™ Visa Infinite* Card.

$100 Annual Travel Enhancement Credit

With the HSBC World Elite MD Mastercard MD , you benefit from an annual $100 Travel Privilege credit . You must wait until the eligible travel expense has been charged to your account before you can use it, 60 days after the date of purchase.

You can use this travel credit for any purchase related to an airline ticket upgrade, baggage fees, seat selection or airport lounge admission. Some travel agencies may also qualify (such as Expedia ).

This credit must be used between the card purchase date and the annual renewal date (this credit is based on the anniversary date of your card account, not on the calendar year). If it is not used, it is lost.

You get this Travel-Privilege credit when subscribing to the HSBC World Elite ® Mastercard ® . This is in addition to the card’s other benefits, including the welcome bonus .

Access the HSBC Rewards portal

To use the Travel Privilège credit on your HSBC World Elite ® Mastercard ® , you must log in to your HSBC online account.

Then click on the link for your HSBC credit card. Another way is to go directly to the HSBC Rewards portal at this address .

Then click on ” View more details “.

When the details drop-down menu opens, click on ” Reward Points “. A page will open and you will be directed to the HSBC Rewards portal. Please make sure that your browser does not block this new window.

Choose the expense to apply the travel credit

Once on the HSBC Rewards portal, select “Travel Enhancement Credit ” from the” Travel ” menu. Alternatively, you can click on this link to go to this page.

Then all you have to do is check off the eligible expense( s) such as this Easyjet ticket upgrade. Then indicate the amount you would like to use.

This can be useful if you have several small fees (such as baggage fees, seat selection or airport lounge admissions).

Then click on “Add to shopping cart.”

Then, once in your cart, you will have to confirm once by clicking on “Proceed to checkout” .

Then a second time by entering your email address and clicking on “Redeem” .

The travel credit will then appear directly on your credit card account within 48 hours.

Note that travel expenses, such as with Expedia can also be accepted. Convenient for 100% cancelable hotel reservations .

Bottom Line

The HSBC World Elite ® Mastercard ® had an annual fee of $149. Using this $100 Annual Travel Privilège credit each year, you virtually lower your annual fee to $49 . What’s unique about a credit card :

- Mastercard World Elite (with insurance and accepted everywhere)

- No foreign currency conversion fees

- Earning 6 points per dollar on all travel purchases

- Earning 4 points per dollar for grocery, gas and drugstore purchases

- Earning 2 points per dollar on all purchases (including Costco)

And with reward points you can use on any travel purchase .

The HSBC World Elite MD Mastercard MD will be converted to an RBC credit card by the end of March 2024. Use your travel credit as soon as you can!

All posts by Audrey

Suggested Reading

WealthRocket is reader-supported. When you buy through links on the website, we may earn an affiliate commission.

HSBC Travel Rewards Mastercard® Review 2023

Victor Irungu

Why you can trust us

The team at WealthRocket only recommends products and services that we would use ourselves and that we believe will provide value to our readers. However, we advocate for you to continue to do your own research and make educated decisions.

HSBC Travel Rewards Mastercard®

Rated 1.8/5 stars.

- 3 pts Earn 3 points per $1 spent on eligible travel-related purchases.

- 2 pts Earn 2 points per $1 spent on gas and transportation.

- 1 pt Earn 1 point per $1 spent on all other eligible everyday purchases.

- Welcome Bonus None

- Annual Rewards $142 Learn how we calculate this.

- Annual Fee $0

- Minimum Income Required None

- No annual fee

- $0 supplementary card fee

Travel insurance

- Extensive list of partners for rewards

- 2.5% foreign transaction fee

- Capped travel rewards amount of $6,000

- Low rewards for non-travel-related purchases

The HSBC Travel Rewards Mastercard is designed for the frequent traveller. This travel rewards credit card allows you to earn points on every purchase. You can use your points in one of three ways: for travel, for a statement or loan credit, convert into cash and save, or redeem for gift cards and merchandise at select partners.

In This Article

Hsbc travel rewards mastercard: an overview, hsbc travel rewards mastercard rewards, hsbc travel rewards eligibility, hsbc travel rewards interest rates and fees, hsbc travel rewards mastercard perks, compare hsbc travel rewards mastercard alternatives, our final thoughts.

The Royal Bank of Canada (RBC) will be purchasing HSBC Canada. As a result, HSBC products will be discontinued shortly. Please refer to the best credit cards in Canada for alternatives.

Are you looking for a credit card that rewards you for travelling? With generous discounts on travel bookings, valuable travel insurance, and a variety of rewards points, the HSBC Travel Rewards Mastercard ® is an all-in-one travel card that can help you save on your next trip.

This HSBC Travel Rewards Mastercard review discusses the features and benefits of this card. It outlines the rewards you can earn, explains how to redeem your points, and provides an overview of any additional perks or discounts associated with the card. Read on to learn more about this travel rewards credit card and if it’s right for you.

The HSBC Travel Rewards Mastercard is an excellent choice for travel junkies who want to maximize travel rewards. This card offers points on every purchase, additional points for travel-related purchases, and no annual fee. To redeem points for the best value, cardholders can apply their points to travel related purchases. This includes purchases made from airlines, hotels, campgrounds cottages, cruise lines, and more.

The HSBC Travel Rewards Mastercard offers points on almost all purchases made.

Eligible travel: 3 points per dollar spent with a cap amount of $6,000 per calendar year (after you reach the cap amount, you’ll earn 1 point per dollar)

Eligible gasoline and daily transit: 2 points per dollar spent

All other eligible purchases: 1 point per dollar spent

Redeeming rewards with the HSBC Travel Rewards Mastercard is simple. Your earned points will appear on your account, and you can redeem them either online or over the phone.

For travel-related purchases, your online account will have a tab titled “Redeem Now.” From there you can select “Travel” to find travel purchases or to book directly using your HSBC credit card. For a statement credit, cardholders can find all travel-related transactions made in the last 60 days to apply points directly to their purchase. This is useful because cardholders are not restricted to specific companies for travel expenses. All purchases of goods and services from airlines, car rental agencies, hotels, cottages, campgrounds, and more will show up as a travel-related purchase that users can apply points to.

Cardholders can use their points in three different ways:

- Travel: HSBC points can be used for all things travel related. Book transportation, hotels, cruises, rail tickets, and more directly on the rewards site. You can also redeem points for a statement credit toward travel purchases made online or through travel agents and charged to the card.

- Financial: Use your points to achieve your financial goals. Convert your points for a credit toward your HSBC Bank Canada residential mortgage, credit card balance, or add the points to your HSBC personal savings account in the form of cash.

- Gift cards and merchandise: With an extensive list of exclusive partners, HSBC points can be used for Apple products, other electronics, accessories, home and beauty essentials, and hundreds of other items. Don’t see an item you like? HSBC has more than 50 gift card options and 3 charities to put points toward.

To apply for the HSBC Travel Rewards Mastercard, you must be of legal age and have a good credit score of around 670 to 739. There is no minimum income requirement to qualify for the card or annual fee.

- Annual fee: $0

- Foreign transaction fee: 2.5%

- Extra card fe e: $0

- Cash advance fee: $5 (doesn’t apply to Quebec)

Interest rates

- Purchases: 20.99%

- Cash advances: 22.99%

- Cash advances (Quebec): 21.99%

- Balance transfers: 22.99%

- Balance transfers (Quebec): 21.99%

- Penalty APR: 25.99%

In addition to its rewards, this card offers a few extra benefits for travellers.

The HSBC Travel Rewards Mastercard comes with baggage delay, trip interruption, and hotel/motel burglary travel insurance. For a low annual premium of $69, you can tack on emergency medical coverage, too.

Extended warranty coverage

Extended warranty coverage, and purchase assurance offers extra security when making purchases with your card.

- Annual Rewards $142

TD First Class Travel® Visa Infinite* Card

- Welcome Offer Up to $800 value, including up to 100,000 Aeroplan points.

- Annual Fee $139

- Interest Rates Purchases: 20.99%, Cash Advances: 22.99%

- Recommended Credit Score 760 - 900

American Express Cobalt Credit Card

- Welcome Offer Up to 30,000 Membership Points

- Annual Rewards $1029

- Annual Fee $155.88

The HSBC Travel Rewards Mastercard is a good choice for those looking for an easy way to earn rewards points on travel-related purchases. The capped rewards amount may be an issue for some. However, the card provides a lot of value that can outweigh this factor. All in all, it’s a great option if you’re looking for an easy way to maximize your rewards while travelling.

Victor is a freelance content/SEO writer based in Kenya. He has 10 years’ experience covering financial topics such as cryptocurrency, forex trading, insurance, mortgages, and investing.

Related Articles

Cibc aeroplan® visa* card for students review 2023.

Barry Choi November 23, 2023

EQ Bank Card Review 2024

Sandra MacGregor January 25, 2024

CIBC Dividend® Visa Infinite* Card Review 2024

Steven Brennan March 15, 2024

BMO Air Miles Mastercard Review 2023

Sandra MacGregor November 1, 2023

SimplyCash® Preferred Card from American Express Review 2023

H.G. Watson October 23, 2023

Neo Secured Credit Card Review 2023

Rachel Morgan Cautero October 25, 2023

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

HSBC Premier Credit Card

Unlimited rewards points with no expiration.

35k Introductory Offer

Earn 35,000 Rewards Bonus Points worth at least $400 in air travel – after spending $3,000 in the first 3 months from Account opening 2

2× Travel Points

You’ll earn 2× Rewards Points on new travel purchases – including airline, hotels, and car rentals

1× on all other purchases You’ll earn 1× Points per $1 spent

No Annual Fee 5

- No Foreign Transaction Fees

- Competitive Variable APR 5 of 21.24% to 25.24% on Purchases and Balance Transfers

Redeem your points for rewards

- Redeem Points for flights, hotel reservations and car rentals using our online travel site

- Book your own airline travel, and receive a statement credit to reimburse the cost

- Transfer your Points to air miles with participating airline partner 3

Cash Rewards

- Reward yourself with cash back

- Direct deposit to your HSBC bank account

- Statement credits can be applied to your HSBC card account

- More than 100 brands in variable denominations 3

- Find the perfect fit across dining, travel, shopping, and entertainment 3

- Macy's, Starbucks, Home Depot®, Amazon.com, and Best Buy® are a few of the most popular in this vast collection 3

Merchandise

- A collection of over 3,000 items with new ones added every week 3

- Shop categories from luggage to electronics, kitchenware to fashion, and everything in-between 3

- Find top brands including Bose, Apple, Tumi, Dyson, Kate Spade New York, and many more 3

Explore this card

Travel benefits, everyday values and experiences, peace of mind.

Up to $85 TSA Precheck(R) Credit Receive one Statement Credit every 54 months, to cover up to $85 towards your TSA Precheck Application fee 6 .

(Not applicable towards the Global Entry Fee)

Mastercard Travel Rewards

Get exclusive offers from top brands in over 15 countries outside the U.S. including France, Hong Kong, U.K. and more when you use your HSBC Elite or Premier Credit Card. 3

Rewards For Miles

Transfer your Points into any of the Rewards for Miles partners’ loyalty programs. We have expanded the program to now include 11 airlines and 2 hotel partners.

- Learn More Learn More Modal link

View more travel benefits

No Foreign Transaction Fees There are no added costs when using your card to make purchases in a foreign country.

MasterRental TM Coverage Provides protection for physical damage and theft to most rental vehicles 4 .

Mastercard Travel & Lifestyle Services TM Connects you with access to luxury travel benefits, amenities and upgrades at some of the most sought-after travel destinations either by phone, email or a personalized online platform 4 .

Travel Accident Insurance Receive accidental death or dismemberment coverage of up to $1,000,000 when traveling 4 .

Trip Cancelation Insurance Reimburses you for your prepaid, non-refundable expenses in case you have to cancel your trip for a covered reason 4 .

Hotel and Motel Burglary Insurance Get reimbursed up to $1,500 per claim for personal property stolen or damaged from your hotel or motel room as a result of burglary by forcible entry 4 .

Lost Luggage Insurance Get reimbursed up to $1,500 per claim for checked or carry-on luggage that is lost or damaged while traveling on a common carrier 4 .

Baggage Delay Insurance Get reimbursed up to $250 per claim for the cost of essential items such as clothing and toiletries if your luggage is delayed in getting to your scheduled destination 4 .

Mastercard ® Airport Concierge Enjoy a 15% savings on Airport Meet and Greet services. Arrange for a personal, dedicated Meet and Greet agent to escort you through the airport on departure, arrival or any connecting flights at over 450 destinations worldwide 4 .

Priceless Experiences

Get exclusive, once in a lifetime experiences in the cities where you live, shop and travel.

Complimentary ShopRunner membership for unlimited, free 2-day shipping and free return shipping at over 140 online stores.

Take 3 rides, get a $5 Lyft App credit every month with your HSBC Credit Card. 4

Priceless Golf®

Discounted access to select golf courses, complimentary grounds passes for PGA Tournaments, Priceless Lessons with PGA Tour professional and much more.

Mastercard ID Theft Protection TM

If your identity is compromised, you’ll receive one-on-one support until your claim is resolved 4 .

Identity Fraud Expense Reimbursement

Provides expense reimbursement in the event your identity is compromised through identity fraud 4 .

Cellular Wireless Telephone Protection

Provides reimbursements up to $600 per claim if your cellphone is stolen or damaged 4 .

Tap & Go® with any HSBC Credit Card

Tap & Go® contactless payments are faster than swiping or inserting your card for payment.

- Place – Simply place your HSBC Credit Card close to a contactless payment terminal

- Hold – Briefly hold your card close to the terminal until it confirms the payment with a green light or beep,

- Done – Follow the prompts, and you're done!

Thousands of merchants accept contactless payments – use your card wherever you see the contactless symbol.

† Summary of Terms can be accessed here

HSBC Premier World Mastercard® credit card Rewards & Benefits and Mastercard Guide to Benefits brochure can be accessed here .

How to apply

To apply for an HSBC Premier World Mastercard® credit card, you must have an existing U.S. HSBC Premier checking 1 account relationship.

I have an HSBC Premier checking account relationship

New to HSBC

To apply for an HSBC Premier World Mastercard® credit card 1 , you must have an existing U.S. HSBC Premier checking account relationship. Explore the benefits today.

Existing HSBC Customer

Log on to Personal Internet Banking to apply for an HSBC Premier World Mastercard® credit card.

Contact our 24/7 Premier Customer Relationship Center.

888.662.4722 (HSBC)

If you’re calling from outside the US or Canada, call

716.841.6866

Find the Wealth Center closest to you to apply in person.

- Wealth Center locator

I do not have an HSBC Premier checking account relationship.

Applying to become an HSBC Premier client 1 has many benefits beyond access to the HSBC Premier World Mastercard® credit card.

- Learn more about HSBC Premier

- Fraud Protection

As an HSBC customer, you’re automatically enrolled in our fraud alert program.

- FICO®

See your FICO® score for free, along with key score factors, on your monthly statement.

- Mobile Payments

All HSBC credit cards are compatible with Apple Pay®, Google Pay TM , Fitbit Pay TM , Garmin Pay TM and Samsung Pay TM .

1 HSBC Premier World Mastercard® requires a U.S. HSBC Premier relationship. For a complete list of HSBC Premier Relationship eligibility requirements please visit https://www.us.hsbc.com/premier/ or speak with your Relationship Manager.

2 The 35,000 Rewards Bonus Points offer applies when you open a new HSBC Premier World Mastercard® credit card and charge the qualifying amount or more in new purchases (minus returns, credits and adjustments) within the first three (3) months from Account opening (“Promotional Period”). The Bonus Points offer does not apply to account upgrades, account transfers, balance transfers, credit card checks, cash advances or overdrafts. Your HSBC Premier World Mastercard® credit card must be open and in good standing at the time of Bonus Points fulfillment. Allow 4-6 weeks after the Promotional Period has ended for the Bonus Points to post to your Account. Customers who have opened the same credit card product within the last 36 months are not eligible to receive the Rewards Program Bonus Points offer.

3 As an HSBC Elite or HSBC Premier credit cardholder, you do not need to enroll or register for the Mastercard Travel Rewards program. This program is available to you automatically, at no additional cost. Merchants may provide to eligible HSBC Elite and HSBC Premier Mastercard credit cardholders (“cardholder”) certain discounts, rebates or other benefits on the purchases of goods and services ("Offers") that will be available on the Mastercard Site. Merchants may also have different payment acceptance criteria for online purchases (e.g., debit or prepaid cards may not be accepted). Such Offers are subject to certain Terms & Conditions and may change at any time without notice to you. Payment acceptance criteria is determined by the merchant in its discretion and may be visible on the Merchant website. HSBC or Mastercard will not be liable for any loss or damage incurred as a result of any interaction between you and a merchant with respect to such Offers. Except as set forth herein, all matters, including but not limited to delivery of goods and services, returns, and warranties are solely and strictly between you and the applicable merchants. You acknowledge that HSBC or Mastercard does not endorse or warrant the merchants that are accessible through the Mastercard Site nor the Offers that they provide. If applicable, all offer redemption is dependent on merchant shipping policies and availability to cardholder's shipping address. For all offers that are specified as “unlock additional online offers” cashback is not earned on shipping, handling, tax or the purchase and/or use of gift vouchers, which for avoidance of doubt, includes gift cards, gift certificates, or any other similar cash equivalents. Terms and conditions apply, see https://www.us.hsbc.com/credit-card-resource-center/premier/#rewards for additional information. All third party-trademarks are the property of the respective owners.

4 Certain restrictions, limits and exclusions apply. Visit https://www.lyft.com/mastercard for a full list of current merchant offers and applicable terms & conditions.

5 The information about the costs and benefits of the card described is accurate as of {{currentDate}}. The information may have changed after that date. To find out what may have changed, call 888.662.4722 (HSBC). A variable Purchase APR applies to credit card purchases and will be 21.24% to 25.24%, depending on your credit worthiness, for the HSBC Premier World Mastercard® credit card . A variable Balance Transfer APR applies to balance transfers and will be 21.24% to 25.24%, depending on your credit worthiness. The variable Cash APR applies to cash advances and is 30.24%. These APRs will vary with the market based on the Prime Rate. For each billing cycle, variable APRs are calculated by adding a specified amount (“Spread”) to the U.S. Prime Rate published in the Money Rates table of The Wall Street Journal that is in effect on the last day of the month (“Prime Rate”). If the Prime Rate changes, the new APRs will take effect on the first day of your billing cycle beginning in the next month. The Minimum Interest Charge is $1.00. A Balance Transfer Fee of either $10 or 4%, whichever is greater, will apply on each balance transfer. A check fee of either $10 or 4%, whichever is greater, will apply on each check written for purposes other than Balance Transfer. A Cash Advance Fee of either $10 or 5%, whichever is greater, will apply on each cash advance transaction. There is no Annual Fee and no Foreign Transaction Fee. See Summary of Terms for details .

6 Certain restrictions, limits and exclusions apply. Benefits may not be offered in every state. Coverage may be underwritten and managed by companies that are not affiliated with Mastercard® or HSBC Bank USA, N.A. Please refer to the HSBC Premier World Mastercard® credit card Rewards and Benefits brochure and Mastercard® Guide to Benefits brochure, for full details.

How you earn Rewards Program Points or Cash Rewards : You earn Points or Cash Rewards when you use your card to make new purchases (minus returns, credits and adjustments).

HSBC credit cards are issued by HSBC Bank USA, N.A., subject to credit approval and requires a U.S. HSBC checking account relationship. To learn more, speak with an HSBC representative.

Deposit products offered in the U.S. by HSBC Bank USA, N.A. Member FDIC.

Mastercard®, Tap & Go and the circles design are registered trademarks of Mastercard International Incorporated.

Mastercard® and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC.

Apple Pay works with iPhone 6 and later in stores, apps, and websites in Safari; with Apple Watch in stores and apps; with iPad Pro, iPad Air 2, and iPad mini 3 and later in apps and websites; and with Mac in Safari with an Apple Pay enabled iPhone 6 or later or Apple Watch. For a list of compatible Apple Pay devices, see https://support.apple.com/km207105 .

Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, Mac, Safari, and Touch ID are trademarks of Apple, Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

Samsung, Samsung Pay, Galaxy S7 and Samsung Knox are trademarks or registered trademarks of Samsung Electronics Co., Ltd. Other company and product names mentioned may be trademarks of their respective owners. Screen images are simulated; actual appearance may vary. Samsung Pay is available on select Samsung devices.

Fitbit, Fitbit Pay and the Fitbit Logo are trademarks, service marks and/or registered trademarks of Fitbit, Inc. in the Unites States and in other countries.

Garmin and Garmin logo are trademarks of Garmin, Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Connect with us

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

TravelSurance

Travel confidently with comprehensive coverage

TravelSurance protects you, your family, friends and relatives from the moment you book a trip all the way until you return home.

This all-in-one policy provides you with a hassle-free protection for a specific trip, including accidental injuries, medical and hospital expenses, personal liabilities, lost baggage and cash, delayed flights, stolen belongings, etc.

Should you have any queries about TravelSurance cover under Coronavirus Disease 2019 , please see our FAQs .

Key benefits

Covered for emergencies

Comprehensive cover, including personal accidents up to HKD2 million, and medical expenses up to HKD5 million

Designated loss coverage

Cover designated loss such as adverse weather conditions, strike, terrorism or natural disasters

Covers all ages with full benefits

All insured persons, including any children, will enjoy the full benefits under this plan

Coverage for your phone

Get up to HKD6,000 coverage for your phone

Limited time offer

Apply for TravelSurance between 18 Mar 2024 and 17 May 2024 (both days inclusive) to get:

- 30% off your first year’s premium and HKD100 Wellcome supermarket cash vouchers for annual MultiTrip TravelSurance

- 15% off for Single Trip TravelSurance

T&Cs apply

Compare HSBC TravelSurance Plans

Check out the full coverage details . Enjoy extra benefits if you choose our Annual MultiTrip TravelSurance:

- Year-round protection with one-off premium payment for unlimited number of trips per year, up to 100 days per trip

- Experience the convenience with E-Policy servicing which provides you with 24-hour online access to your insurance policy details and allows you to submit policy service requests without hassle.

- If you travel to mainland China frequently, enjoy hospital admission deposit guarantee to designated hospitals in mainland China with a China Medical Card option under your annual MultiTrip policy

What's included?

Our plans generally cover:

We'll reimburse the necessary medical expenses incurred during a trip and follow up medical expense within 3 months after return to the Hong Kong SAR up to HKD5 million. We'll also cover additional travel and accommodation costs for your children if they have to travel back to Hong Kong SAR while you stay in hospital.

Sports and Activities [@sportsactivitiestravelsurance]

We provide cover for various sports and activities, including dune driving, sand boarding, safari adventures, whale tours, hot springs, horse riding, cable cars, iceberg climbing, watching auto racing, water sports, skiing, ice-skating, biking, thrill rides at amusement parks etc.

Travelsurance even covers certain hazardous sports activities such as hot air ballooning, bungee jumping, hang-gliding,parachuting, zipline, rafting, speed-boating, jet-skiing, trekking, water skiing, wakeboarding, wakesurf, sea kayaking,scuba-diving (that is diving to a depth not greater than 40 metres), mountaineering, rock-climbing etc.

You'll receive cover for baggage loss or damage up to HKD20,000 . We'll reimburse emergency purchases of essential items or clothing up to HKD2,000 if baggage is delayed for more than 6 hours after you've arrived at your destination abroad.

Expand

Travel delays and loss of documents.

We’ll pay up to HKD2,500 if your scheduled transportation is delayed for more than 6 hours.

If you choose to buy the standard plan, you can have an alternative option of buying another one-way travel ticket to catch up with the planned itinerary and may reimburse up to HKD4,000. If you lose important documents such as your passport, we’ll cover replacement costs up to HKD5,000.

- China Medical Card (PDF)

Simply present your China Medical Card with your personal identification to designated hospital in mainland China, you won’t need to pay any deposit in advance. The card only costs HKD300 per annum.

Credit card protection

In the event of death of the insured caused by an accident outside the Hong Kong SAR, any outstanding balance payable under the insured’s credit cards up to HKD5,000 for items charged while outside the Hong Kong SAR during the trip will be covered.

- Find out more about credit card protection (PDF)

Funeral expenses

For more details, refer to the policy provisions (PDF)

What's NOT included?

Our plans generally do not cover:

- riot, civil commotion, war, invasion, civil war and related perils

- suicide, self- inflicted injury, illegal acts, insanity, drugs-taking, alcohol abuse, venereal disease, AIDs.

- any pre-existing conditions

- childbirth, pregnancy, miscarriage, travelling for the purpose of obtaining medical treatment

- any sports or activities which are played in professional capacity or in competition involving prize money or reward of any kind

- Deep water diving (that is diving to a depth of greater than 40 metres)

- motor rallies

- aviation other than as a fare-paying passenger of travelling by a recognised airline or air charter company

- manual work (e.g. involving the use of mechanical and/or electrical equipment or handling of explosive or hazardous substances, etc.)

- property more specifically insured

- claims where not notified in writing to AXA General Insurance Hong Kong Limited within 31 days after end of the trip

For a full list of exclusions, refer to the policy provisions (PDF) .

How to apply

Eligibility.

To be able to apply you must:

- be an HSBC bank account or credit card holder

- be an HKSAR resident and applying for this insurance policy in the HKSAR

- depart from and return to the HKSAR from your insured destination

- hold an HKID card for online applications

- take note of the below for child cover:

- for child under 18 years old, the parent or legal guardian[@legalguardiantravelsurance] information of the child must be provided during the application

- children aged under 12 years old must be accompanied by an adult during the trip

- provide information of any spouse/partner[@partnerdefinition], children, relatives and friends if you wish to insure them under the same policy