- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

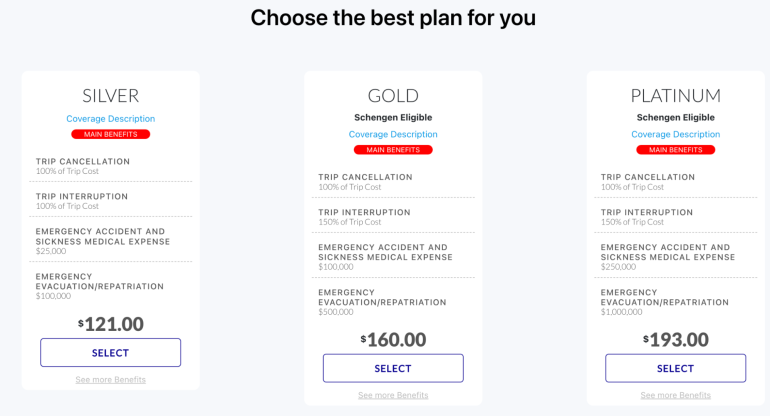

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

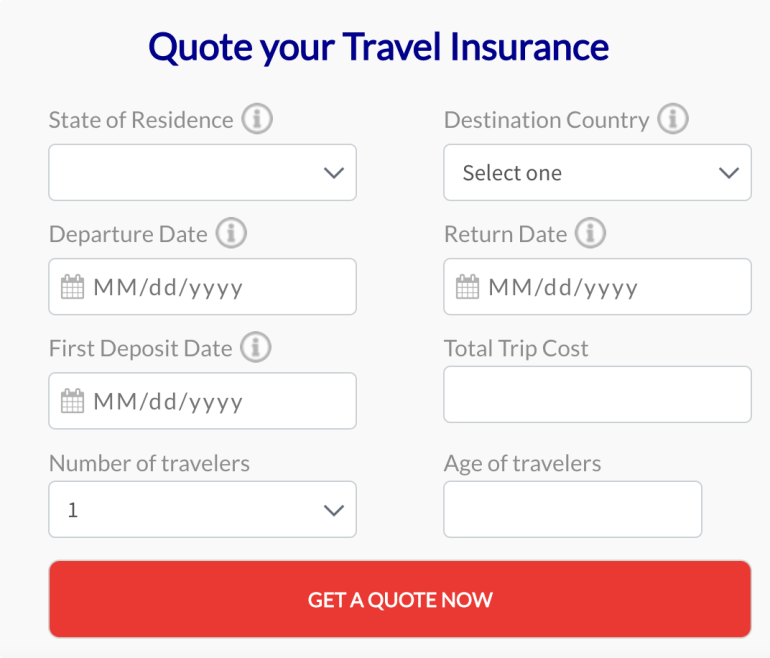

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Username or Email Address

Remember Me

AXA Smart Traveller: Your Key to worry-free Travel

Welcome to AXA Smart Traveller , your trusted provider of comprehensive travel insurance . We understand that when you embark on a journey, whether it’s for business or pleasure, you want peace of mind knowing that you’re protected against unforeseen events. That’s where AXA Smart Traveller comes in.

At AXA Smart Traveller , we offer a range of travel insurance plans designed to cater to the needs of both domestic and international travelers. Our goal is to ensure that you can explore the world with confidence, knowing that you have the right coverage in place.

With AXA Smart Traveller , you can enjoy your travels to the fullest without worrying about the unexpected. Our comprehensive plans cover a wide range of situations, including trip cancellation , medical expenses, lost or stolen luggage, and much more. Wherever you go, whatever you do, AXA has you covered.

As an AXA insurance customer, you’ll have access to our expert customer support team, available 24/7 to answer your questions and assist you throughout your journey. We pride ourselves on delivering exceptional service and personalized guidance, ensuring that you have a hassle-free experience from start to finish.

So, whether you’re a frequent traveler or planning a once-in-a-lifetime trip, trust AXA Smart Traveller to protect you every step of the way. With our comprehensive coverage and unwavering commitment to customer satisfaction, you can travel with confidence, knowing that you’re in safe hands.

Key Takeaways:

AXA Smart Traveller offers comprehensive travel insurance plans for both domestic and international travel.

- Their plans provide coverage for trip cancellation , medical expenses, lost or stolen luggage, and more.

- AXA Smart Traveller offers a range of coverage options to meet your travel needs, from basic to comprehensive protection.

- They provide 24/7 travel assistance , emergency medical coverage , and trip cancellation reimbursement.

- AXA Smart Traveller has received awards and recognition for their exceptional travel insurance products and services.

AXA Smart Traveller Coverage Options

When it comes to travel, having the right insurance coverage is essential for peace of mind. AXA Smart Traveller offers a range of coverage options to meet your travel needs and protect you every step of the way. Whether you’re embarking on a weekend getaway or a long-awaited international adventure , AXA has a plan that will suit your requirements.

With AXA Smart Traveller, you can choose from a variety of coverage options, including:

- Trip Cancellation: Protects you in case you have to cancel your trip due to unforeseen circumstances.

- Emergency Accident and Sickness Medical Expenses: Covers medical expenses in case of accidents or illness during your trip.

- Baggage and Personal Effects: Provides coverage for lost, stolen, or damaged baggage and personal belongings.

- Emergency Evacuation: Ensures you receive prompt medical evacuation in case of a medical emergency.

These are just a few of the coverage options available with AXA Smart Traveller. Each plan is designed to provide comprehensive protection, giving you peace of mind and financial security throughout your journey. Whether you’re looking for basic coverage or extensive travel protection , AXA has you covered.

“Travel with confidence knowing that AXA Smart Traveller has your back, offering coverage options that prioritize your safety and well-being.”

Benefits of AXA Smart Traveller

AXA Smart Traveller offers a wide range of benefits to ensure that you have a worry-free travel experience. With comprehensive coverage options, you can have peace of mind knowing that you’re protected in case of unexpected events. Here are some key benefits of AXA Smart Traveller:

24/7 Travel Assistance

With AXA Smart Traveller, you have access to 24/7 travel assistance . Their dedicated team is always ready to assist you, whether you need help rebooking flights or finding alternative transportation options. Travel assistance is just a phone call away, ensuring that you’re never alone during your journey.

Emergency Medical Coverage

Medical emergencies can happen anywhere, and AXA Smart Traveller has you covered. Their plans include emergency accident and sickness medical coverage , providing financial protection for unexpected medical expenses during your trip. Whether it’s a minor illness or a major medical emergency, AXA will be there to support you.

Trip Cancellation Reimbursement

Unforeseen circumstances can force you to cancel or interrupt your trip. AXA Smart Traveller offers trip cancellation reimbursement, allowing you to recoup your non-refundable expenses in the event of covered reasons such as illness, injury, or natural disasters.

Baggage Loss Coverage

Losing your baggage can be a major inconvenience, but with AXA Smart Traveller, you don’t have to worry. Their plans provide coverage for lost or stolen baggage, ensuring that you can replace essential items and continue your journey without disruption.

With AXA Smart Traveller, you can travel with confidence knowing that you have the support and protection you need. Whether it’s travel assistance, emergency medical coverage , trip cancellation reimbursement, or baggage loss coverage, AXA Smart Traveller has got you covered.

AXA Smart Traveller Plan Comparison

When it comes to travel insurance , AXA Smart Traveller understands that every traveler has unique needs and budgets. That’s why they offer a variety of plan options to cater to different requirements. From basic coverage for peace of mind to comprehensive protection for those seeking extensive benefits, AXA has you covered.

Travel insurance plans are designed to provide financial protection against unexpected events during your trip, such as medical emergencies, trip cancellations, or lost baggage. The right plan will depend on factors like your age, the length of your trip, your destination, and the level of coverage you require.

AXA Smart Traveller offers transparent pricing and detailed plan comparisons, making it easier for you to choose the insurance plan that suits your needs and budget. Whether you’re a frequent traveler seeking international travel insurance or planning a domestic getaway, AXA has the right plan for you.

Here’s a glimpse of the plan options available with AXA Smart Traveller:

Please note that the prices mentioned above are indicative and may vary based on your specific travel details. AXA Smart Traveller ensures that you have all the information necessary to make an informed decision. Compare the coverage and prices of each plan to find the one that best fits your travel needs.

AXA Smart Traveller COVID Coverage

In response to the COVID-19 pandemic, AXA Smart Traveller has introduced COVID coverage in many of their policies. This special coverage is designed to protect travelers from COVID-related risks and offers peace of mind during these uncertain times.

With AXA’s COVID travel insurance , you can be confident knowing that you have coverage for:

- COVID-related medical expenses

- Trip cancellation due to COVID-related issues

This means that if you were to contract COVID-19 during your trip and require medical attention, AXA Smart Traveller insurance would cover your medical expenses. Additionally, if you need to cancel your trip due to unforeseen circumstances related to the pandemic, such as a positive COVID-19 test or travel restrictions, AXA will provide trip cancellation reimbursement.

AXA understands the challenges faced by travelers during these unprecedented times and is committed to offering relevant and useful coverage. By including COVID coverage in their policies, they prioritize the well-being and safety of their policyholders.

“During these uncertain times, having COVID travel insurance is essential. AXA Smart Traveller’s COVID coverage provides an added layer of protection and peace of mind, allowing you to focus on enjoying your trip while staying safe and secure.”

Don’t let the fear of unexpected COVID-related issues ruin your travel plans. With AXA Smart Traveller’s COVID coverage, you can explore the world with confidence, knowing that you have the necessary protection in case of any pandemic-related challenges.

Why Choose AXA Smart Traveller?

When it comes to travel insurance , AXA Smart Traveller stands out as a reliable choice. As part of the AXA Group, a global leader in insurance and financial protection, AXA Smart Traveller brings over 50 years of experience in assistance services to the table. With their commitment to providing travelers with the support and protection they need, AXA Smart Traveller ensures peace of mind during your travels.

AXA Smart Traveller offers comprehensive travel insurance plans designed to offer protection from unexpected events that can disrupt your trip. Whether it’s a medical emergency, a trip cancellation, or lost or stolen luggage, AXA Smart Traveller has you covered. With their reliable coverage options, you can embark on your journey knowing that you’re protected.

What sets AXA Smart Traveller apart is their dedication to customer satisfaction. They prioritize providing personalized solutions that suit your specific needs. Their team of knowledgeable and multilingual insurance advisors is available 24/7 to assist you with any concerns or inquiries you may have. Travelers can rely on AXA Smart Traveller for professional customer support every step of the way.

Choosing AXA Smart Traveller means choosing peace of mind. With their extensive experience, comprehensive coverage options, and commitment to customer support, AXA Smart Traveller is the ideal choice for travelers seeking reliable travel insurance . Don’t leave your trip to chance – trust AXA Smart Traveller to protect your journey.

AXA Smart Traveller Awards and Recognition

AXA Smart Traveller has been recognized for its outstanding travel insurance products and services, receiving several prestigious awards in the industry. These accolades reflect the quality and reliability of AXA’s insurance offerings, making it a trusted choice for travelers worldwide.

Best Cruise Insurance

AXA Smart Traveller has been honored with the title of Best Cruise Insurance . This award highlights the comprehensive coverage and specialized benefits that AXA provides for travelers embarking on cruise vacations. From trip cancellation and medical emergencies to lost baggage and travel assistance, AXA’s cruise insurance ensures a worry-free experience on the high seas.

Best Senior Insurance

AXA Smart Traveller has also been recognized for its outstanding senior insurance coverage. With tailored plans designed specifically for older travelers , AXA offers comprehensive protection and peace of mind. Whether you’re planning a relaxing getaway or an adventurous journey, AXA’s senior insurance plans cater to the unique needs and concerns of mature travelers.

Best Travel Company

Additionally, AXA Smart Traveller has been acclaimed as the Best Travel Company . This award acknowledges AXA’s commitment to customer satisfaction, innovative insurance solutions, and exceptional service. With over 50 years of experience in the industry, AXA has earned its reputation as a leading travel company, providing travelers with reliable coverage and support throughout their journeys.

AXA Smart Traveller Customer Support

At AXA Smart Traveller, we prioritize excellent customer support to ensure that our policyholders have a smooth and worry-free experience. We have assembled a team of licensed representatives and multilingual insurance advisors who are available 24/7 to assist travelers with their insurance needs.

With over 50 years of experience in assistance services, we are dedicated to helping travelers choose the right coverage and providing them with the support they need throughout their journey. Whether you have questions about our travel insurance plans, need assistance with a claim, or require guidance during an emergency, our knowledgeable team is just a call away.

How We Help

- Expert Guidance: Our team of licensed representatives can provide comprehensive information about our travel insurance products and services, helping you choose the coverage that best suits your needs.

- 24/7 Availability: We understand that unexpected situations can arise at any time. That’s why our customer support team is available round the clock to assist you, no matter where in the world you may be.

- Multilingual Assistance: We take pride in our diverse team of insurance advisors who can communicate with you in multiple languages , ensuring that you fully understand and are comfortable with the information provided.

- Claims Support: If you need to file a claim, our team will guide you through the process, ensuring that you have all the necessary documentation and assisting you in making the process as smooth as possible.

We strive to provide the highest level of customer care and support throughout your journey. Your satisfaction is our priority, and we are committed to going above and beyond to meet your expectations.

“AXA Smart Traveller’s customer support team provided me with exceptional service. They were always available to answer my questions and guided me through the claims process with ease. I highly recommend their travel insurance and the support they offer.” – Sarah Johnson, AXA Smart Traveller policyholder

For any inquiries or assistance, please don’t hesitate to get in touch with our customer support team:

Our team is here to help you make the most of your travel insurance coverage and ensure that you have a worry-free journey.

Travel can be unpredictable, but with AXA Smart Traveller, you can embark on your journeys with confidence and peace of mind. Their comprehensive travel insurance plans offer coverage for various aspects of your trip, including trip cancellation, medical expenses, and baggage loss . With AXA by your side, you’ll have the necessary support to navigate unexpected events and enjoy worry-free travel .

Whether you’re planning a short getaway or a long adventure , AXA Smart Traveller has you covered. Their range of coverage options allows you to customize your plan based on your specific needs and budget. From basic coverage to more comprehensive protection, you can find the plan that suits you best.

AXA Smart Traveller is backed by the expertise and reputation of the AXA Group, a global leader in insurance and financial protection. With over 50 years of experience in assistance services, AXA understands the unique challenges travelers may face and is dedicated to providing exceptional customer support.

Choose AXA Smart Traveller for worry-free travel. Protect yourself and your trip with AXA travel insurance , and embark on your adventures with confidence, knowing that you’re backed by a trusted insurance provider.

What does AXA Smart Traveller offer?

What does axa smart traveller coverage include.

AXA Smart Traveller coverage includes trip cancellation, medical expenses, lost or stolen luggage, and more.

What benefits does AXA Smart Traveller provide?

AXA Smart Traveller provides 24/7 travel assistance, emergency accident and sickness medical coverage , trip cancellation reimbursement, and coverage for lost or stolen baggage.

What are the coverage options offered by AXA Smart Traveller?

AXA Smart Traveller offers a range of coverage options including trip cancellation, emergency accident and sickness medical expenses, baggage and personal effects, emergency evacuation, and more.

How much does travel insurance with AXA Smart Traveller cost?

The cost of travel insurance with AXA Smart Traveller varies depending on factors such as age, trip length, destination, and the level of coverage required.

Does AXA Smart Traveller provide COVID coverage?

Yes, AXA Smart Traveller has included COVID coverage in many of their policies, providing protection for COVID-related medical expenses and trip cancellation due to COVID-related issues.

Why should I choose AXA Smart Traveller?

AXA Smart Traveller is part of the AXA Group, a global leader in insurance and financial protection. They offer comprehensive travel insurance plans, excellent customer support, and have received several awards and recognition for their exceptional products and services.

Does AXA Smart Traveller offer customer support?

Yes, AXA Smart Traveller provides excellent customer support with a team of licensed representatives and multilingual insurance advisors available 24/7 to assist travelers with their insurance needs.

How can AXA Smart Traveller provide peace of mind during my trips ?

AXA Smart Traveller offers comprehensive travel insurance plans that provide coverage for unexpected events such as medical emergencies, trip cancellations, and lost or stolen luggage, ensuring peace of mind during your travels.

Source Links

- https://www.axatravelinsurance.com/

- https://www.axatravelinsurance.com/our-plans/compare-plans

- https://axa-com-my.cdn.axa-contento-118412.eu/axa-com-my/e5e702b5-2753-401f-a687-8cb242dcb556_smarttraveller enhanced single trip brochure.pdf

Hello! I'm Wise, a Filipina with a deep love for my country and a passion for sharing its beauty with the world. As a writer, blogger, and videographer, I capture the essence of the Philippines through my eyes, hoping to give foreign visitors a true taste of what makes these islands so special.

From the vibrant streets of Manila to the tranquil beaches of Palawan, my journey is about uncovering the hidden gems and everyday wonders that define the Filipino spirit. My articles and blogs are not just travel guides; they are invitations to explore, to feel, and to fall in love with the Philippines, just as I have.

Through my videos, I strive to bring the sights, sounds, and stories of my homeland to life. Whether it's the local cuisine, the colorful festivals, or the warm smiles of the people, I aim to prepare visitors for an authentic experience.

For those seeking more than just a vacation, the Philippines can be a place of discovery and, perhaps, even love. My goal is to be your guide, not just to the places you'll visit, but to the experiences and connections that await in this beautiful corner of the world. Welcome to the Philippines, through my eyes. Let's explore together!

You may also like

The Farm at San Benito: A Serene Wellness Retreat in the Philippines

Jpark Island Resort and Waterpark: A Luxurious Family Vacation Destination

One Pacific Place Serviced Residences: Your Luxury Accommodation Option in Makati

Add comment, cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Want Flight, Hotel, and Restaurant Discounts for Your Philippines Trip? Join Below!

Email address:

Buy Me a Coffee

Trip Delay Benefits

What is trip delay.

Whether you are on your way to or from your destination, AXA Travel Protection can reimburse you for covered trip delay expenses based on one of our offered plans. This coverage is applicable if you experience a delay due to inclement weather, traffic accidents, stolen identification documents, strikes, and many other reasons.

Do I Need Trip Delay Coverage?

Whether you need trip delay coverage or not depends on your circumstances. Trip Delay is a wise decision because it offers coverage if a delay occurs during your travels.

Understanding Covered Trip Delay Expenses

Our plans encompass various expenses you might incur due to a trip delay:

Unused Accommodations : We can cover the costs if you have prepaid for accommodations you cannot use due to the delay.

Reasonable Expenses : We understand that delays can lead to unexpected costs. We may cover any reasonable expenses you incur due to the delay, such as meals, local transportation, lodging, and essential phone calls.

Getting Back on Track : We will help you catch up with your trip by covering the cost of an Economy Fare from the point where your trip was interrupted to a destination where you can rejoin your planned journey.

Return Journey : If your delay results in you needing to return to your originally scheduled return destination, we can cover the cost of a one-way Economy Fare.

Special Provision for Pets - (Exclusive to Platinum Protection Plan)

We care about your furry companions, too. If you have entrusted your pet to a kennel during your trip and your delay prevents you from picking them up on the previously agreed day, we will step in.

AXA Travel Protection will cover additional kennel fees up to the maximum benefit shown on your schedule of benefits section in your AXA Travel Protection plan.

What warrants a Trip Delay?

If you are en route to or from the trip and it becomes delayed for twelve (12) or more hours due to: • Common carrier delay • Severe weather • Traffic delay due to an accident in which you are not involved • Lost or stolen passports, travel documents, money • Quarantine • Hijacking • Unannounced strike • Natural disaster • Civil commotion or riot • Road closure by state police, state officials, or other government authority

Is Trip Delay coverage necessary?

Are you worried about unexpected trip delays ruining your travel plans? With our Trip Delay coverage, you can rest easy knowing you're protected against delays caused by unforeseeable events like inclement weather, stolen travel documents, or strikes. This coverage can reimburse you for additional expenses like accommodations, meals, and transportation so you can focus on enjoying your trip instead of worrying about the unexpected.

Why choose AXA Travel Protection?

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include: • Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency • 24/7 global team of travel experts that offers assistance and assurance while traveling We understand that the needs of every traveler are unique, which is why our travel plans allow customers to choose their coverage based on their specific needs. Having your travel insured by an industry leader like AXA means having greater peace of mind.

How to get a Travel Protection Quote

Disclaimer: It is important to note that the specifics of trip delay will depend on the date of purchase and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have .

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

AXA upgrade ‘SmartTraveller Plus’: Virtual consults cruise coverage & discounts

Wednesday, March 20, 2024 Favorite

AXA Hong Kong and Macau (AXA) has unveiled the upgraded version of “SmartTraveller Plus,” featuring enhanced benefits including virtual medical consultations, medicine delivery, and optional cruise coverage. These improvements are designed to offer advanced travel insurance protection, ensuring customers can embark on their journeys with peace of mind. As part of our ongoing commitment to serving as lifelong partners to our customers, AXA continually enhances and refines our products to meet their evolving needs.

Key highlights of the updated “SmartTraveller Plus” include:

- Cutting-edge virtual medical consultations and medicine delivery through MyDoc Health Passport

Recognizing the importance of medical assistance while traveling abroad, “SmartTraveller Plus” now provides access to teleconsultations and medicine delivery via MyDoc Health Passport as part of the annual coverage across all levels. These services are available in select cities in Japan, Thailand, Vietnam, Singapore, and the Philippines. Customers can benefit from up to two free teleconsultations per insurance period, connecting them with both local and overseas doctors to address any medical concerns without language barriers. Additionally, prescribed medication can be conveniently delivered to the customer’s location, with upfront payment required, followed by reimbursement through the policy by submitting a claim.

- Specialized add-on protections and comprehensive support for cruise benefits

Our new cruise add-on protections are tailored to meet the specific needs of cruise enthusiasts. Coverage includes protection against cruise journey cancellations, curtailments, and cancellations for shore excursions, as well as coverage for accidents related to cruise hijackings.

Kenneth Lai, Chief General Insurance Officer, AXA Hong Kong and Macau , said, “In today’s dynamic travel landscape, we understand the importance of offering comprehensive support to travellers, especially as they navigate uncertainties abroad. Through our latest enhancements to ‘ SmartTraveller Plus’ , we reaffirm our unwavering dedication to ensuring worry-free travel experiences for all our customers, empowering them to explore the world with confidence, knowing that they have a trusted partner by their side every step of the way.”

Annual Cover is accessible across all plan tiers, accommodating the diverse requirements of regular travelers. This includes individuals opting for brief excursions to destinations in the Greater Bay Area, necessitating fundamental coverage for medical expenses and personal accidents, as well as those desiring extensive coverage for their global explorations.

Easter Flash Sale

Starting today until March 28 (6pm, HKT), customers purchasing “SmartTraveller Plus” can avail themselves of a 40% discount for single journey coverage or a 30% discount for annual cover and subsequent renewals.

Tags: AXA SmartTraveller Plus , Cruise Coverage , Medicine Delivery , travel insurance , Virtual Medical Consultations

Subscribe to our Newsletters

Related Posts

Select Your Language

I want to receive travel news and trade event update from Travel And Tour World. I have read Travel And Tour World's Privacy Notice .

REGIONAL NEWS

Milan Bergamo Airport Unveils Expanded Apron and New Taxiway to Enhance Operatio

Wednesday, June 12, 2024

Bumper Half-Term Holiday Propels London Stansted to New Heights in May Record wi

Melaleuca Freedom Celebration Honors Heroes with Spectacular Fireworks Show West

New Grain & Berry Location Launches in Dallas, Texas

Middle east.

Dubai Airport Prepares for 2.6 Million Emirates Travelers This Summer

Jollibee recognized as top 10 brands for customer satisfaction in Kuwait

Here is how Indonesia preserving its cultural heritage ?

Thailand Extends Visa Free Policy for Indian’s: Boon to Gen Z

Upcoming shows.

Jun 10 LE MIAMI 2024 June 10 - June 13 Jun 11 FTE Ancillary & Retailing June 11 - June 13 Jun 11 HOTEL & HOSPITALITY EXPO AFRICA June 11 - June 13 Jun 11 AdventureELEVATE – North America 2024 June 11 - June 13

Privacy Overview

Retail Internet Banking

I'm looking for

Popular tag

You are now leaving AffinAlways.com

Please be informed that upon entering a third party website, AFFIN BANK’s privacy policy ceases to apply and you are advised to read the privacy policies of the third party website. AFFIN BANK gives no warranty as to the entirety, accuracy or security of the linked third party website or any of its content.

As such, AFFIN BANK shall not be responsible or liable in connection with the content of or the consequences of accessing the third party website.

SmartTraveller Enhanced (Annual Plan)

Travel smart, all year long.

Loss of Use of Entertainment Tickets

Reimburse for unused and irrecoverable deposits or payment made for entertainment (tourist attraction centres/concerts) ticket charges due to death, hospitalisation or due to adverse weather condition or natural disaster at planned destination.

Medical, Hospital and Treatment Expenses

Reimburse expenses (including cost of emergency dental treatment) incurred during accident or sickness.

Accidental Death and Permanent Disablement

pay up to RM600,000 for Accidental Death and Permanent Disablement of Insured Person.

Baggage and Personal Effects

Pay for loss of or damage to your baggage and personal effects due to theft or negligence of the common carrier. Maximum limit for any one item or pair or set of articles is up to RM500. Maximum limit per baggage is up to RM300.

Cancellation and Postponement

Reimburse for irrecoverable travel and accommodation expenses paid in advance due to death, serious injury or illness to you or your immediate family or a natural disaster at your destination, provided that the insurance is purchased not less than 14 days prior to the commencement of the scheduled trip.

Pandemic Cover for Overseas Trip only

Option to extend cover for Pandemic events. This covers for Trip Cancellation, Trip Curtailment, Medical, Hospital and Treatment Expenses, Hospital Allowances, Emergency Medical Evacuation, Emergency Medical Repatriation and Repatriation of Mortal Remains if you are diagnosed with a pandemic illness (Medical Expenses Top Up does not apply).

Eligibility

- Customers of Affin Bank

- The available plans are Individual (age <65) plan 1 and plan 2, Senior (age ≥65) plan 1 and plan 2 and Family plan.

- Family plan includes You, Your spouse and all Your children. For Family plan, family limit applies for the total sum of coverage. * Not applicable for persons aged 65 and above.

- Duration of coverage is for 1 year. There is no limit on the number of trips during the period of insurance but subject to the maximum of 95 days for each trip. You need to renew Your coverage annually.

Important Information

- Product Disclosure Sheet

- Proposal Form

You may also like...

Provides comprehensive 24 hours worldwide protection to the Insured for bodily injury caused by accidental Get increasing coverage with Renewal Bonus feature and No Claims Discount benefit plus many other benefits for a comprehensive protection.

.jpg)

For overland domestic travel in Malaysia. Mainly provide coverage for Personal Accidents and Permanent Disablement, Medical Expenses due to Accidents, Repatriations of Mortal Remains, credit card/e-wallet protection and journey disruptions due to vehicle breakdown.

Safeguard you and your loved ones from unexpected events with affordable premium. Simple online application with no medical check-up required.

- The available plans are Individual (age <65) plan 1 and plan 2, Senior (age ≥65) plan 1 and plan 2 and Family plan

- Family plan includes You, Your spouse and all Your children. For Family plan, family limit applies for the total sum of coverage.

- * Not applicable for persons aged 65 and above.

How to reach us?

There are more ways to reach us

Back to top

Copyright 2018 Affin Bank Berhad (25046-T).

AXA SmartTraveller Plus Privilege Plan

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.hk’s Terms of Use and Privacy Policy

Already have an account? Login

【2024 "Let's Chill" Lucky draw】Over HK$50,000 gifts are Waiting For You! Included HK$15,000 valued Club Med Travel Vouchers, HK$10,898 Samsung Galaxy S24 Ultro 512GB, etc. Click HERE for more details. 【MoneySmart Exclusive Offer】 1. 15% discount on AXA Travel Insurance 2. HK$20 AIRSIM Prepaid Card 3. Enjoy One Complimentary HK$50 Park-N-Shop e-Coupon when apply for an AXA Travel Insurance with premium HK$250 or above

Are you eligible?

MoneySmart Member only

What you need to know

Applicants must be 18 or above. Each applicant might fill out one claim form only and each applicant is only allowed one gift item.

All Details

Key features.

For single journey, no upper age limit provided the insured person is at least 30 days old

For single journey, SmartTraveller Plus provides free cover for children insured under the same policy with their parent(s), regardless of the number of children

For insured person not returning to Hong Kong, the cover will terminate within 7 days from the scheduled arrival of the country of final destination, or the last day of the original declared period of insurance, whichever is earlier

SmartTraveller Plus cover travel inconvenience such as travel delay, extra or irrecoverable prepaid overseas accommodation expenses or irrecoverable missed events expenses as a result of airport closure

We cover accidental loss or damage to your baggage and personal belongings, such as your mobile phone, tablet computer, laptop computer and suitcase

Virtual medical consultation and medicine delivery (NEW)

Travel Inconvenience

Medical coverage, personal protection, also covered, plan materials.

Disclaimer: At MoneySmart.hk, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. For any discrepancy in product information, please refer to the financial institution’s website for the most updated version. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

Current time by city

For example, New York

Current time by country

For example, Japan

Time difference

For example, London

For example, Dubai

Coordinates

For example, Hong Kong

For example, Delhi

For example, Sydney

Geographic coordinates of Elektrostal, Moscow Oblast, Russia

City coordinates

Coordinates of Elektrostal in decimal degrees

Coordinates of elektrostal in degrees and decimal minutes, utm coordinates of elektrostal, geographic coordinate systems.

WGS 84 coordinate reference system is the latest revision of the World Geodetic System, which is used in mapping and navigation, including GPS satellite navigation system (the Global Positioning System).

Geographic coordinates (latitude and longitude) define a position on the Earth’s surface. Coordinates are angular units. The canonical form of latitude and longitude representation uses degrees (°), minutes (′), and seconds (″). GPS systems widely use coordinates in degrees and decimal minutes, or in decimal degrees.

Latitude varies from −90° to 90°. The latitude of the Equator is 0°; the latitude of the South Pole is −90°; the latitude of the North Pole is 90°. Positive latitude values correspond to the geographic locations north of the Equator (abbrev. N). Negative latitude values correspond to the geographic locations south of the Equator (abbrev. S).

Longitude is counted from the prime meridian ( IERS Reference Meridian for WGS 84) and varies from −180° to 180°. Positive longitude values correspond to the geographic locations east of the prime meridian (abbrev. E). Negative longitude values correspond to the geographic locations west of the prime meridian (abbrev. W).

UTM or Universal Transverse Mercator coordinate system divides the Earth’s surface into 60 longitudinal zones. The coordinates of a location within each zone are defined as a planar coordinate pair related to the intersection of the equator and the zone’s central meridian, and measured in meters.

Elevation above sea level is a measure of a geographic location’s height. We are using the global digital elevation model GTOPO30 .

Elektrostal , Moscow Oblast, Russia

Apart Hotel Yantar

View prices for your travel dates

- Excellent 0

- Very Good 0

- English ( 0 )

Own or manage this property? Claim your listing for free to respond to reviews, update your profile and much more.

Apart Hotel Yantar - Reviews & Photos

COMMENTS

Buy AXA's Smart Traveller to enjoy a worry-free family trip in the country or abroad. With this online travel insurance, you can enjoy top-tier medical coverage and other benefits. Enjoy comprehensive benefits like top-tier medical coverage with AXA's travel insurance, Smart Traveller. It is available to buy online for your convenience, so your ...

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

With our travel insurance we can take great care of you too. GET A QUOTE. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace ...

Download Smart Traveller App and unlock a world of convenience, personalised offers, and seamless services! 1. Dismiss Discover More. In order to enable certain services/features and improve your website experience, our website uses tools such as cookies, which collect data on how you interact with our website. By continuing to use our website ...

With AXA's international Travel Protection Plans, you can travel with confidence, knowing that you're covered for a variety of situations. Whether you're exploring new cultures, embarking on an adventure tour, or simply relaxing on a beach, international travel insurance is a smart investment for anyone traveling outside of their home country.

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

Compare AXA Travel Insurance Plans which includes benefits like trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay to help give you peace of mind before and during your trip. Optional benefits are also available to enhance our travel insurance plans and offer additional protection for your trip.

With AXA's travel insurance, we meet all needs of travellers like you. Enjoy your trip with trusted insurance that covers not only your life, but also your properties and travel plan. Experience a new dimension of the travel insurance with us! *AXA Smart Traveller is the commercial name of Smart Traveller Plus Insurance. AXA companies around ...

From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. GET A QUOTE 855-327-1441. If you become ill with COVID while on your trip you may be covered for Medical Expense, Emergency Evacuation, Trip Interruption, and/or Trip Delay benefits with a confirmed diagnosis, including ...

Travelers in need of assistance worldwide can tap into AXA's extensive international network of assistance services. AXA Assistance USA's Platinum plan (above) is its highest-rated plan ...

SmartTraveller Plus is underwritten by AXA General Insurance Hong Kong Limited (the Company), which is authorised and regulated by the Insurance Authority of the Hong Kong SAR. AXA General Insurance Hong Kong Limited (i.e. the merchant) is located in Hong Kong. Email: [email protected] Customer Service Hotline: (852) 2523 3061.

AXA SmartTraveller With a wide-ranging cover of 41 benefits, you'll be covered for most unforeseen situations. ... 32 Personal Money and Travel Documents $2,500 $5,000 33 Fraudulent Use of Lost Credit Card $1,500 $3,000 ... AXA SmartTraveller Summary of Benefits G2.2 / 25 May 2019 D.A. Author: Dinie Azfar Bin Mohamed Daud

AXA Smart Traveller offers a range of coverage options to meet your travel needs, from basic to comprehensive protection. They provide 24/7 travel assistance, emergency medical coverage, and trip cancellation reimbursement. AXA Smart Traveller has received awards and recognition for their exceptional travel insurance products and services.

Receive a free quote within minutes. Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8 AM-7 PM Central Time. Disclaimer: It is important to note that the specifics of trip delay will depend on the date of purchase and state of residency. Customers are advised to carefully review the terms and ...

AXA Hong Kong and Macau (AXA) has unveiled the upgraded version of "SmartTraveller Plus," featuring enhanced benefits including virtual medical consultations, medicine delivery, ... These improvements are designed to offer advanced travel insurance protection, ensuring customers can embark on their journeys with peace of mind. As part of our ...

The available plans are Individual (age <65) plan 1 and plan 2, Senior (age ≥65) plan 1 and plan 2 and Family plan. Family plan includes You, Your spouse and all Your children. For Family plan, family limit applies for the total sum of coverage. * Not applicable for persons aged 65 and above. Duration of coverage is for 1 year.

Included HK$15,000 valued Club Med Travel Vouchers, HK$10,898 Samsung Galaxy S24 Ultro 512GB, etc. Click HERE for more details. 【MoneySmart Exclusive Offer】 1. 15% discount on AXA Travel Insurance 2. HK$20 AIRSIM Prepaid Card 3. Enjoy One Complimentary HK$50 Park-N-Shop e-Coupon when apply for an AXA Travel Insurance with premium HK$250 or ...

In 1938, it was granted town status. [citation needed]Administrative and municipal status. Within the framework of administrative divisions, it is incorporated as Elektrostal City Under Oblast Jurisdiction—an administrative unit with the status equal to that of the districts. As a municipal division, Elektrostal City Under Oblast Jurisdiction is incorporated as Elektrostal Urban Okrug.

View prices for your travel dates. Check In. Mon, Jun 10. Check Out. Tue, Jun 11. Guests. 1 room, 2 adults, 0 children. Contact accommodation for availability. There are similar hotels available. View all. About. 3.5. Very good. 6 reviews #3 of 4 hotels in Elektrostal. Location. Cleanliness Service. Value. Suggest edits to improve what we show. ...

Geographic coordinates of Elektrostal, Moscow Oblast, Russia in WGS 84 coordinate system which is a standard in cartography, geodesy, and navigation, including Global Positioning System (GPS). Latitude of Elektrostal, longitude of Elektrostal, elevation above sea level of Elektrostal.

4.0. Very good. 2 reviews. #2 of 4 hotels in Elektrostal. Cleanliness. Service. Value. The Apart-Hotel offers its guests free parking of the Yantar complex, 24-hour security and video surveillance, free WI-FI in rooms, a cozy Reception zone on the ground floor, two high-speed elevators making it pleasant and quick to go up to the 5th floor ...