- Disney Cruise: Start Here 1️⃣

- 101 Disney Cruise Tips 💡

- What to Expect on Your First Disney Cruise 🚢

- Disney Cruise Packing List

- Castaway Cay Tips

- What’s Included Disney Cruise?

- Fish Extenders

- Disneyland Paris

- Disney Good Neighbor Hotels

- Animal Kingdom Lodge Tips

- Animal Kingdom Lodge Rooms

- Animal Kingdom Lodge Restaurants

- Aulani Tips

- All About the Aulani Spa

- Aulani Daily Iwa

- BoardWalk Inn Tips

- BoardWalk Inn Rooms

- BoardWalk Inn Dining

- 50 Magical Disney Coronado Springs Tips

- Disney Coronado Springs Dining: 2022 Guide

- Disney Coronado Springs Rooms: Full Guide & Reviews

- Polynesian Village Resort Tips

- All About Spirit of Aloha Luau

- Best Dining at Polynesian Village Resort

- 50 Magical Pop Century Resort Tips, Secrets & Hacks

- Disney Pop Century Dining: 2022 Guide

- Disney’s Pop Century Rooms: 2021 Guide

- Port Orleans Riverside Tips

- Port Orleans Riverside Rooms

- Port Orleans Riverside Dining

- Saratoga Springs Tips

- Saratoga Springs Rooms

- Saratoga Springs Dining

- Star Wars Hotel News

- Rent DVC Points

- 101 Disney Gift Ideas 🎁

- Latest Disney Deals 🔥

- Disney Black Friday Deals

- Disney World Tickets

- Disneyland Tickets

- Why Use a Disney Vacation Travel Agent

- Mickey Mouse Shirts

- Star Wars Shirts

- Moana Shirts

- Beauty and the Beast Shirts

- How to Get Two Free Audiobooks for Your Disney Vacation

- Disney Shirts

- 101 Disney Freebies

- Mickey Mouse Nails

- Minnie Mouse Nails

- Star Wars Tattoos

- Harry Potter Tattoos

- Disney Recipes

- Get Disney+ Free

- Disney Plus Gift Card

- Disney+ Bundle

- Best Movies on Disney+

- Best Shows on Disney+

- Disney+ Marvel

- Mickey Mouse Coloring Pages

- Minnie Mouse Coloring Pages

- Toy Story Coloring Pages

- Star Wars Coloring Pages

- Frozen Coloring Page

- Moana Coloring Pages

- Little Mermaid Coloring Pages

- Tangled Coloring Pages

- Avengers Coloring Pages

- Captain America Coloring Pages

- Spiderman Coloring Pages

- Coco Coloring Pages

- Frozen Font

- Star Wars Font

- Free Disney Character Pennant Banner

- Free Disney Vacation Scavenger Hunt

- What’s in the Cricut Mystery Box?

- The Cricut Maker…Everything You NEED to Know

- The Cricut EasyPress Mini – Everything You Need to Know

- 101 Disney Cricut Ideas

- Star Wars Cricut Ideas

- How to Make a Disney Shirt

- How to Make Disney Luggage Tags with Cricut

- How to Make a Disney Card

- How to Make a Disney Water Bottle

- How to Make Mickey Mouse Earrings

- How to Make a Mickey Mouse Inspired Wreath

- Best of 2022

- Travel Credit Cards

- Hotel Credit Cards

- Airline Credit Cards

- Cash Back Credit Cards

Disney Cruise Travel Insurance

Disclosure: This guide about Disney Cruise travel insurance contains affiliate links. Read full Disclosure Policy .

Disney Cruise Insurance

...do you need it?

By Alisha Molen

There's a 17% chance you'll need it*

* Source: US Travel Insurance Association Survey

You're spending $5000 or more on your Disney Cruise. Are you willing to gamble this money?

E ssentially, this is the question we're asking ourselves when deciding whether or not to purchase cruise travel insurance for a Disney Cruise . (Or Aulani vacation .)

For me , the answer is no. Disney Cruises are expensive. I'm not willing to gamble the money I'm spending on this dream vacation.

But everyone is different. Let's explore what might be right for you.

Why? What Could Go Wrong?

1 in 6 americans.

say their travel plans have been impacted by medical conditions, natural disasters including severe weather; or mechanical or carrier-caused problems.

Travel Can Bring the Unexpected

Here are some real-life examples of things that I have personally experienced or witnessed in my travels:

- Theft on beach in Hawaii

- Pickpocketers in Italy

- Stung by stingray in Mexico

- Trip to Cabo San Lucas cancelled due to hurricane

- Slept in Nashville airport thanks to severe weather forcing a flight cancellation

- Missed connection in Denver

- Lost luggage in Las Vegas, Salt Lake City & Phoenix

- Forced to stay extra day at sea on Disney Cruise thanks to Hurricane Matthew

How Your Disney Cruise Could Be Messed Up

"No one needs insurance until they need insurance."

21 REAL LIFE STORIES “Have you ever had to make a claim for Disney Cruise travel insurance?” Read 21 real life stories .

(I know I don’t.)

Unfortunately, Disney Cruises, despite all their magic , are not immune to accidents or unexpected mishaps.

What can happen on or before a Disney Cruise that could put your vacation dollars at risk?

You Miss the Boat

Your cruise ship has a schedule to keep. It will not wait for you.

You Have to Cancel

Sometimes people get sick, loved ones pass away, divorce can change plans. Depending on when "life happens", your deposit is at risk.

You Get Hurt

With a Disney Cruise brings new adventures. Unfortunately, accidents can happen.

You Lose Your Bags

Losing a bag en route to your cruise is, at best, inconvenient. You might not have time to buy replacements. And if you have to purchase anything on the ship -- that's expensive.

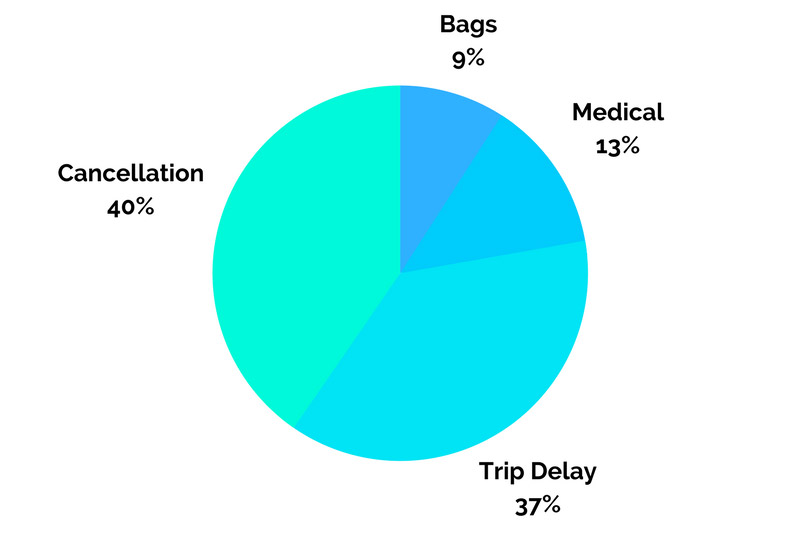

Breakdown of Claims: Why People are Using Trip Insurance

* Source: Tripinsurance.com claims data

Trip Cancellation: 40% of Claims

It happens every day. People have to cancel their Disney Cruises for many reasons. Having Disney Cruise cancellation insurance is a buffer against common reasons like these:

Bad Weather

Bad weather cancels or delays a flight en route to a connection or cruise.

Airline Delay

Airline delay or strike makes you miss a connection or cruise

Death, injury or illness

Death, injury, or illness of a family member

Car Trouble or Accident

Undriveable car or accident on the way

Home is damaged

Your home is damaged due to natural disaster, fire, or burglary

Court appearance

You are summoned by a judge to appear in court (jury duty, etc)

Divorce or Pregnancy

A divorce or unexpected pregnancy causes a change of plans

You're laid off due to no fault of your own

Trip Delays & Interruptions: 37% of Claims

Trip interruption is any situation that causes you to unexpectedly have to end your trip and return home. Trip delay is any time your trip has been delayed due to accident or a canceled flight or whatever.

What could cause a trip interruption or delay?

Natural Disaster

Floods, tornados, wildfires, whatever! Mandatory evacuations can really slow you down

Illness or injury

Getting sick or hurt is no fun. Especially on vacation!

Attack, Assault, Robbery

A vicious attack can interrupt or abruptly end a trip

Job or Money Problems

Have to work unexpectedly?

Labor Strike

When travel workers go on strike, it can really mess up your plans

Trip Provider Bankruptcy

A travel supplier (tour operator, etc) ceases operations due to financial default or bankruptcy

Medical Expense: 13% of Claims

If you get sick, hurt, or (heaven forbid) die while on your Disney Cruise, there can be a bevy of hefty costs. Here are just a few:

Hospitalization

Spending any amount of time in the hospital is expensive

If you get hurt in a remote spot, you'll need to be transported to a hospital

Return of Remains

Care for the deceased after unexpected death

Lost or Delayed Baggage: 9% of Claims

Stuck somewhere without your bathing suit, toiletries, Mickey Ears and fresh pair of undies ?

Yeah, it's a total bummer and inconvenience, but worse...last second replacements are often outrageously expensive.

VIDEO: How to Book Disney Cruise Insurance in 5 Minutes

4 reasons you might not need dcl travel insurance, cost of vacation is minimal.

Not spending much on flights or other travel? Got a screaming deal on a 3-day cruise and it just wasn't that expensive? (If yes, show me how!)

Your Domestic Health Insurance Will Cover Medical Emergencies Abroad

Check with your existing carrier to find out what they will or won't cover overseas.

You're Comfortable with Risk of Lost Luggage

You can deal with the inconvenience of lost or stolen baggage.

You're Okay with Losing Any Amount of Money

You can handle the loss of the cost of your trip plus any additional costs you incur due to medical emergencies, evacuations, or added travel expenses.

What Travel Insurance Should I Choose?

S o, are you leaning toward getting Disney Cruise travel insurance for your upcoming sailing?

Next step is to select an insurance provider.

I know, I know. Seems overwhelming, right?

Don't Stress! I'll Give You a Place to Start

Yes, there are a lot of options out there. A LOT. I definitely recommend you do comparison on your own. However... I've done a lot of research on this. I've got you.

There are two basic types of Disney Cruise travel insurance policy:

Individualized policies tend to cover specific worries you might have. If you want just one type of coverage in particular (e.g. medical) call your insurance company and ask for that.

Comprehensive

Comprehensive insurance policies cover basically everything I mentioned earlier (always read your policy to understand it) all in one package.

Here...let me make it simple

I've looked at a lot of travel insurance options.

To keep things simple, I have narrowed my comparison to two comprehensive options commonly selected by Disney Cruisers:

- Disney Cruise Line's Vacation Protection Plan

- Allianz Global Assistance

Let’s take a look at each...

Disney Cruise Vacation Protection Plan

D isney has Disney cruise insurance coverages that you can purchase through Disney (or your travel agent) that are underwritten by Transamerica Casualty Insurance Company. When Can You Buy Disney Cruise Vacation Protection Plan? You can purchase online, over the phone through DCL, or via your travel agent any time before your final payment is made. How Much Does Disney Cruise Vacation Protection Cost? 8% of the per person sailing fare. Minimum per person cost is $29; maximum per person cost is $399.

Convenience

You can book it at same time you book everything else through DCL or your travel agent.

Flights not covered

Unless you book your air travel through Disney, your flights aren't covered.

More expensive

Per person cost for DCL's insurance is higher than many other plans.

No pre-existing conditions

Pre-existing conditions are not covered

Allianz Global Assistance OneTrip Prime Plan

A llianz Global Assistance offers several plans that vary in coverages.

The most popular plan, and the one that is the best for a Disney Cruise, is called “OneTrip Prime” .

When Can You Buy Allianz Global Assistance's "Prime Plan"? You can purchase up to 11pm eastern of the night before you begin your travels. If you have a pre-existing condition, you'll want to purchase within 14 days of your first deposit, in order to meet an important condition for having pre-existing conditions covered.

How Much Does Allianz Global Assistance "Prime Plan" Cost? Around 2-6% of the total cost of your trip. My last quote was under 4% of my trip cost.

Kids are free

Kids under 18 are covered free when traveling with a parent or grandparent.

Better coverages

Overall better coverage limits.

Half the cost

Cost is about 4% of the total cost of your trip. Disney is 8%.

Pre-existing conditions

Buy policy within 14 days of making first deposit, it will also cover pre-existing conditions.

Umm...it's not Disney?

Only thing I can think of is you have to book Allianz Global Assistance outside of Disney .

What's Covered? Comparison

NOTE: Disney Cruise's own insurance (Vacation Protection Plan) has some restrictions in the fine print: - First, the trip cancellation plan only covers flights booked through Disney. If you make your own flight arrangements, you're not covered. - Second, if you must cancel for a reason that's not covered, all you get is a Disney cruise credit equal to 75 percent of the cancellation fees imposed.

* Benefits as of August 16, 2018

Why I Chose Allianz Global Assistance

Allianz Global Assistance offers quite a bit more coverage for your Disney Cruise travel insurance than the DCL protection plan.

In my personal experience and all of my research, Allianz Global Assistance has provided competitive prices, paid out claims, and given awesome customer service.

Disclosure: If you buy a DCL insurance policy through the Allianz Global Assistance links, I get a small commission. It’s not much but it helps keep the website running and doesn’t cost you any extra. You don’t have to use my links, but I’m very thankful when you do. I recommend them not because of the commission but because I use them myself.

GET A FREE (AND QUICK) QUOTE

Click the image below to get a quick quote from Allianz Global Assistance for your Disney Cruise travel insurance.

Understand Your Disney Cruise Cancellation Insurance Policy

Frequently asked questions, what if i have personal health insurance.

Check with your personal health insurance company and ask if they cover overseas personal travel. Most do not. Remember that Disney Cruise travel insurance (also known as DCL insurance) not only gives you more health coverage but also provides insurance for flight delays, travel interruptions and lost luggage.

Can I Change My Mind?

All trip insurance plans have a "Free Look" period that starts when the plan is purchased and lasts between 10 and 15 days (check your plan details).

This free look period gives you time to review your policy and return it for a refund within the time period.

How to Make an Travel Insurance Claim

Regardless of what Disney Cruise travel insurance provider you go with, here are three tips to help you if you ever have to make a claim:

Doctor Support

If you cancel a trip due to sickness or you have a medical emergency while traveling, you will need documentation from a doctor.

Keep All Documents

The more documentation you have of your expenses, the better. The insurance company will require proof of expenses, amounts you have paid, and any refunds you may receive.

Contact your Disney Cruise travel insurance company as soon as possible. Virtually every good trip insurance company offers 24/7 support. Get in touch with them early and assume nothing. Ask a lot of questions.

Pin For Later

How Much is Disney Travel Insurance?

Whether you want to finally see Cinderella’s castle or book a Disney Cruise , a Disney vacation is sure to be a memorable trip. However, it could also be one of the most costly trips of your lifetime; for many, travel insurance is crucial. After all, there are many uncertainties in travel these days.

By the Numbers

You can purchase travel insurance from a reputable company, or you may already have it available through certain credit cards. If not, you may buy it directly from Disney, which provides insurance as an add-on for various vacation packages at its United States theme parks. Disney’s travel insurance costs approximately $6 per child and $82.50 per adult for its theme park vacation packages at Walt Disney World Resort in Florida.

Fixed-fee travel insurance policies are perfect for ultra-expensive vacations but a lousy option for budget vacations. Take a five-night stay during the Easter holiday for a family of five at Four Seasons Resort Orlando at Walt Disney Resort, for instance. If you book your stay alongside four-day theme park tickets and opt for add-ons such as water park admission, you may pay approximately $15,000. Adding travel insurance may cost $183; roughly 1.22% of your overall travel cost.

But suppose you planned a trip in May when the children are at school–two adults can stay at Disney’s Wyndham Lake Buena Vista, for example, with three-day tickets for $1,200. When you include Disney travel insurance, your cost increases to $1,365—an overall price increase of approximately 14%.

Travel insurance that works out to 1.2% of your overall vacation cost is a good deal, but 14% is far from that. Most travel insurance costs between 5% and 10% of the total vacation cost, per the United States Travel Insurance Association.

A Disney Cruise, on the other hand, has a different price structure for its travel insurance. The price for a Disney Cruise travel protection plan is based on a percentage of the voyage fare (typically around 8%) rather than a fixed dollar amount; but there is also a minimum cost ($35 per person) and maximum cost ($1,600 per person) limit in place to ensure that the premium cost is never too low or high.

As an example, a 7-night European cruise for two people in summer 2023 had a trip price of $8,078 (before taxes and port fees), and travel insurance was an additional $646.24 (8% of the fare).

What Does Disney Travel Insurance Cover?

If you’re planning to visit Disneyland in California or Walt Disney World in Florida and have booked hotel and theme park tickets, you qualify for Disney’s Travel Protection Plan. This insurance plan was underwritten by Arch Insurance Company and is available for United States residents or United States residents living abroad who book via Disney’s website. (If you have questions about where to purchase Disney World tickets , take a look at our other articles on the subject).

The exact benefits and coverage availability of Disney’s Travel Insurance depend on your location, but usually include:

- Trip interruption or cancellation–this provides prepaid vacations up to your total cost for covered reasons, such as injury, illness, military service, or job loss.

- Trip delay–this reimburses expenses of up to $600 per trip or $200 per day.

- Luggage loss–this reimburses $2,000 for stolen, damaged, or lost luggage.

- Luggage delay–this reimburses essential items if your luggage is delayed for twelve or more hours.

- Emergency medical costs–this offers a maximum of $25,000 if you become ill or injured while traveling.

- Rental vehicle damage–this reimburses repair expenses of up to $25,000 in case of theft, collision, vandalism, or vehicle damage.

- Travel accident–this offers a maximum of $25,000 in case of dismemberment or accidental death.

- Emergency help–this qualifies you for 24/7 medical aid, travel assistance, and emergency services.

- Emergency repatriation and evacuation–this insurance policy covers emergency medical transportation and other costs if you’re injured while traveling.

Remember, this is the coverage for theme park based vacations; Disney Cruise Line coverage and Adventures by Disney trip coverage has different terms.

Final Thoughts

Given the uncertainty of vacations nowadays, even a quick two-day getaway requires insurance, which is where Disney’s Travel Insurance comes in handy. With this insurance plan, you can get reimbursement for trip cancellation, trip delay, luggage delay, and even rental car damage.

If you’re looking for a completely new experience, check out our recent article, Disney Difference – Adventures by Disney .

For help pricing out Disney Travel Insurance or any other part of your Disney vacation, contact the Disney experts at The Vacationeer !

Get your free, no-obligation trip quote today… their services are provided at no additional cost to you!

Related Posts:

Share This Page: Choose Your Platform!

Related posts.

Leave A Comment Cancel reply

Please review our Terms of Use , which changed on May 24, 2024.

Help Center

How can we help you.

Hotel Reservations – Frequently Asked Questions

What are the benefits of the Travel Protection Plan?

The Travel Protection Plan helps protect you and your family for unexpected covered losses from the moment that you step out of your front door until the moment you safely arrive back home. The Travel Protection Plan provides coverage if you cancel or interrupt your Walt Disney World, Disneyland or Aulani, a Disney Resort and Spa package for covered reasons described in the plan such as illness or injury. If you cancel due to a covered reason, the Travel Protection Plan will provide a refund for the prepaid, nonrefundable travel package, including the cost of airfare that is scheduled for travel within 7 days of the travel package.

The Travel Protection Plan also provides coverage for covered losses while traveling, such as trip interruption, trip and baggage delays, baggage protection and medical expense protection (including emergency medical transportation). In addition, the Travel Protection Plan contains non-insurance services for 24-hour worldwide emergency assistance (provided by LiveTravel).

To view the terms, conditions and exclusions, visit: www.affinitytravelcert.com/docs/DSP01

If you have questions, please call (844) 203-3123 to speak with a representative from Aon Affinity, the program administrator.

You can purchase a Travel Protection Plan for eligible trips any time prior to final payment. To purchase the Travel Protection Plan when making a new reservation, select “Add Travel Protection” at the time of booking. To add the plan to an existing reservation:

- Go to the bottom of any page of Disneyworld.com and select “My Plans.”

- Select “Change Reservation” next to your package reservation.

- Scroll down to see if your trip is eligible for a Travel Protection Plan—if it is, “Add” will be available; if it is not, “Add” will be unavailable.

- Select “Add” and follow the prompts.

You may also add the Travel Protection Plan to your reservation by calling Walt Disney World Resort at (407) 939-5277. However, due to a high volume of calls, you might experience delays. Guests under 18 years of age must have parent or guardian permission to call.

Aon Affinity is the brand name for the brokerage and program administration of Affinity Insurance Services, Inc. (TX 13695); (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. Aon Affinity Contact Information: 900 Stewart Ave #400, Garden City, NY 11530; 800-842-4084; [email protected]. As an MGA we are acting on behalf of our carrier partner, Arch Insurance Company (NAIC #11150). Arch Insurance Contact Information: 844-289-3443.

Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150), under Policy Form series LTP 2013 and applicable amendatory endorsements. Assistance services are provided by the designated travel assistance company listed in your Travel Protection Plan. This is a brief overview of the coverages. Subject to terms, conditions and exclusions. This is a general overview of insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

Did you find this answer helpful?

Related Questions

Will I be responsible for any cancellation or change fees or other amounts if a hurricane warning is issued within 7 days of my arrival date?

Do I need to buy travel protection?

What does it mean for my vacation plans if a hurricane warning is issued within 7 days of my arrival date?

Travel Insurance

Learn more about how to purchase a travel protection plan for your next disney world resort vacation..

- Go to the bottom of any page of Disneyworld.com and select “My Plans”.

- Select “Change Reservation” next to your package reservation.

- Scroll down to see if your trip is eligible for a Travel Protection Plan—if it is, “Add” will be available; if it is not, “Add” will be unavailable.

- Select “Add” and follow the prompts.

You may also add the Travel Protection Plan to your reservation by calling Walt Disney World Resort at (407) 939-5277. However, due to a high volume of calls, you might experience delays. Guests under 18 years of age must have parent or guardian permission to call.

The Travel Protection Plan is designed for and is available to US residents. Please view your state’s specific terms, conditions and exclusions at www.affinitytravelcert.com/docs/DSP01 .

Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150), under Policy Form series LTP 2013 and applicable amendatory endorsements. This is a brief overview of the coverages, subject to terms, conditions and exclusions. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

Additional Information - Opens Dialog

Guest Services

- Travel Services

Use CoBrowse to Share Your Screen?

Even as the Disney Cast Member guides you around our site, they will be unable to access or view any files or information on your device or anything you type.

To stop the session, click the X in the screen-sharing window at any time. You can remain on the phone with the Cast Member.

Enter the code provided by the Cast Member and Accept to get started.

Invalid code. Please reenter

Not on the Phone with a Cast Member?

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Much Does a Disney Cruise Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Where does Disney sail?

Disney's fleet of cruise ships, disney cruise costs, how to save money on a disney cruise, disney cruise costs, recapped.

If you’ve caught yourself researching Disney cruises lately, we don’t blame you — with waterslides galore and a reputation for luxury, Disney cruises can be a lot of fun. But they can also be pricey, and those costs can add up if you’re sailing with multiple people.

If you’ve been asking, “How much is a Disney cruise?,” we have the answer for you. Let’s look at the options for cruises, how much they cost and ways you can make them more affordable.

No matter where you’re looking to go, Disney likely has a cruise for you. Sure, you won’t find ships heading to Antarctica, but there are still plenty of destinations from which to choose, including:

New Zealand.

Pacific Coast.

Panama Canal.

South Pacific.

Trans-Atlantic.

Many of these destinations are oriented toward North American travelers, but you’ll find options scattered all over the world.

» Learn more: Is cruise travel insurance worth the cost?

Despite its wide variety of destinations, Disney operates only six ships. Its newest ship, the Disney Treasure, is set to launch in December 2024.

Along with the Disney Treasure, you can opt to sail with:

Disney Dream.

Disney Fantasy.

Disney Magic.

Disney Wonder.

Disney Wish.

» Learn more: The best Disney credit card might surprise you

So, how much should you save to cover Disney cruise costs? The short answer: It depends.

No, that’s probably not what you want to hear, but it’s the truth. The price of a Disney cruise is going to be influenced by a variety of factors, including:

Where you’re going.

The trip’s duration.

Which Disney ship you’re on.

How many people you’re traveling with.

The type of stateroom you book.

Any add-ons or specialty bookings you choose.

If you’re looking for an all-out experience, it’s pretty easy to rack up a big bill. Disney cruises are well known as an expensive option, but tacking on high-end touches such as a concierge room and spa visits will really drive up the price.

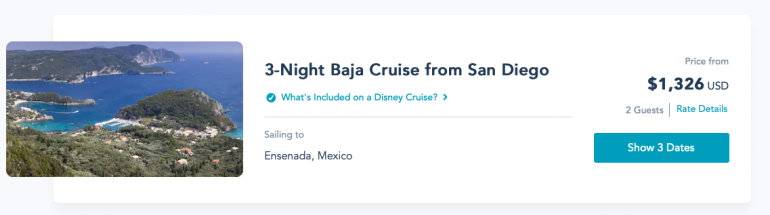

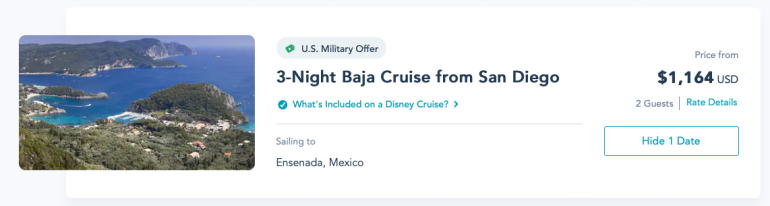

The cheapest cruises you’ll find tend to sail from San Diego, and they’re the shortest trips as well. We searched for sailings across the calendar and found the cheapest rates rang in at $1,326 for two guests in an inside room on a three-night trip from San Diego.

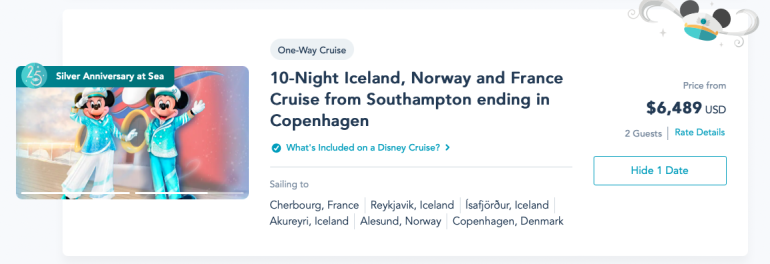

In contrast, the most expensive cruise we found was a 10-night option that travels through Iceland, Norway, France and Denmark. The price tag came in at $6,489 for two guests in an inside cabin and rose to $28,089 for a concierge-level room.

» Learn more: How I did a 5-day, $4,000 Disney trip for just $1,600

There’s no denying that Disney cruises can be expensive. However, there are ways you can save money on your booking.

Find discounted sailings

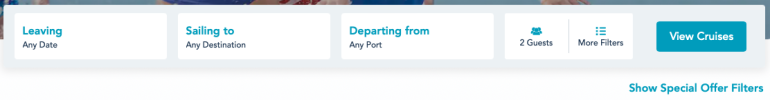

This first option seems obvious, but you’ll want to specifically search for discounted sailings. Although Disney doesn’t always offer sales, if they are available, you'll find them on the Disney cruise line page — just click “Show special offer filters” when searching.

The special offers filter will let you know what types of discounts are available, like the example above promoting up to 35% off on select sailings.

Skip the add-ons

The base fare for these trips includes almost everything, so if you’re looking to drop the cost of a Disney cruise, consider avoiding add-ons. This means skipping out on things like wine tastings and specialty drinks as well as forgoing dinner at Palo, the adults-only Italian restaurant that comes with additional costs.

Instead, enjoy the plethora of complimentary activities, such as pools, movies, shows, karaoke, dancing and more. And when it comes to food and beverage, simply sip the included soda and coffee, eat the (already amazing) free food and don’t forget to order a Mickey ice cream bar with your complimentary room service.

Disney is notable in that it also allows you to bring your own alcohol on board. Each guest older than 21 can bring up to two bottles of wine or six cans of beer when they first board and at every port of call. Considering that alcohol on the ship can be pretty expensive, this is a good way to save money.

Use a promotion

Do you live in Florida or Southern California? Or perhaps you’re a member of the U.S. military ? If any of these apply to you, you may have special access to discounted Disney cruise prices.

You’ll be able to find these deals via that special offers filter shown above. For example, that three-night San Diego sailing mentioned above dropped from $1,326 to $1,164 once we selected the U.S. military filter.

Redeem points

Last, but certainly not least, is the option to redeem your points for a Disney cruise. While there’s no good way to transfer points directly, there are still ways you can use points toward your booking.

The most convenient way is by using a credit card that’ll wipe away your travel costs. Plenty of cards have this feature, but two fairly decent ones are the Bank of America® Premium Rewards® credit card and the Capital One Venture Rewards Credit Card . Both cards will allow you to redeem your points toward purchases at a rate of 1 cent per point.

Even better, these redemptions can be stacked with other discounts, allowing you to drop your costs even more. For example, a member of the U.S. military can redeem 116,400 Capital One Miles to pay for their entire cruise, an excellent double dip that saves money and miles.

» Learn more: 7 tips for getting the best deal on your next cruise

The cost of a Disney cruise can vary dramatically based on your needs and sailing preferences. However, you should expect to spend at least $1,000 on a cruise for two passengers. The price goes up from there depending on your cabin selection, trip duration and destination choices, among other options.

If you’re looking to save money on a Disney cruise, consider waiting for a sale, checking relevant discounts or redeeming points to help keep your out-of-pocket costs low. And if you like to enjoy an alcoholic beverage every once in a while, we recommend bringing your preferred drink with you on board.

(Top photo courtesy of Disney Cruise Line)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-3x Earn 3X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Disney Travel Insurance Plans – Worth It? Top Tips

Sometimes things don’t go as planned. Things beyond our control can cause bumps in the road with our vacation plans. Luckily, Disney has travel insurance plans that are available for its Guests. Plans are available for multiple Disney Destinations and cover a wide variety of cancellations and circumstances.

Have you ever considered travel protection for your Disney vacation? It’s not a bad idea! As you know, Disney vacations are very expensive . The magic can disappear rather quickly if an issue arises and you aren’t able to do anything about it. While Disney vacation packages are very flexible overall, things can still go wrong and it’s better to be safe than sorry.

In this article, I’m going to give you an overview of the Travel Protection Plans that Disney offers to its Guests. I will discuss which destinations are protected, what it covers, and how much the plans cost. I will also provide you with information on other travel plans that you can consider! Keep reading to see how you can protect your Disney vacation from the unknown.

Discount Disney Tickets

If you need help booking your next Disney World vacation, look no further than our favorite Disney-approved re-seller, Get Away Today! Get Away Today offers the best Walt Disney World discount tickets around. In addition to great discount prices, their customer service and support is absolutely fantastic. They have an entire department dedicated to making sure every order has a wonderful experience and they are on-call to help you during your vacation if you need them.

And at no additional charge, you get FREE concierge Walt Disney World services! These services include having Get Away Today’s experts take care of all your dining reservations and more! Rather than waking up at odd hours of the night to book all your reservations, why not let their travel agents take care of it for you- for free!

Get Discount Disney World Tickets Here!

Buying tickets from Get Away Today is easy and convenient since all their tickets are sent electronically. You can take their vouchers and head straight to the gate without needing to wait in any ticket booth lines. They also offer layaway plans so you can pay off your vacation over time.

Disney Travel Insurance

Which disney destinations are covered by travel insurance.

A Disney Travel Protection Plan is available for vacations to Walt Disney World, Disneyland, and Aulani – A Disney Resort and Spa in Hawaii. You may be wondering about the other Disney Destinations since I didn’t mention them all just now. Don’t worry! Those Disney vacations have coverage options too. Disney Cruise Line, Adventures by Disney, and Disney Vacation Club all have their own separate plans that are available to Guests. No matter which Disney Destination you’re headed to, you can rest assured that travel insurance is available to you.

What Is Covered By Disney's Travel Insurance?

Since the different destinations don’t all have the same protection plan, I will go over each of the plans and what they cover.

Disney World, Disneyland, and Aulani Travel Protection Plan

- Reimburses up to total trip cost of the prepaid travel arrangements due to illness, injury and non-medical reasons such as job loss, military service and more

- Reimburses related expenses, up to $600 ($200 per day) if your trip is delayed for 6+ hours

- Reimburses up to $2,000 for lost, stolen, or damaged luggage and personal effects ($500 each item/$500 aggregate limit)

- Reimburses up to $500 for the purchase of necessary personal items if your bags are delayed 12+ hours

- Provides up to $25,000 of coverage if you get ill or injured on your trip

- Arranges and prepays for emergency medical transportation and other covered expenses, up to $100,000 max limit

- Provides up to $25,000 in the event of accidental death or dismemberment

- Reimburses repair costs up to $25,000 in the event of collision, theft, damage or vandalism to rented vehicles

Disney Cruise Line Travel Protection Plan

- Up to total trip cost ($20,000 limit) if you cancel or interrupt due to sickness, injury, death and other covered reasons

- Up to $500 if your cruise vacation is delayed for 6+ hours due to carrier-caused delays—including weather, unannounced strike and more

- Up to $20,000 to cover medical treatment, hospitalization and more if you become sick or injured on your cruise vacation

- Up to $30,000 to cover emergency medical transport

- Up to $3,000 to cover loss, theft or damage to your bags or personal possessions

- Up to $500 to cover the purchase of necessary items if your bags are delayed for 24+ hours

Adventures by Disney Travel Protection Plan

- Up to 100% trip cost ($50,000 limit per insured) if you cancel or interrupt due to sickness, injury, death and other covered reasons

- Up to $2,000 ($500 per day) for catch-up expenses if your vacation is delayed for 6+ hours due to carrier-caused delays – including weather, quarantine and more

- Up to $50,000 to cover emergency medical treatment, hospitalization and more if you become sick or injured during your vacation

- Up to $3,000 ($500 per item) if your luggage or personal items are lost, stolen or damaged

- Up to $500 to cover the purchase of necessary items if your bags are delayed for 24+ hours

- Up to $100,000 to cover emergency medical transport

- $25,000 to cover loss of life or limb

Adventures by Disney Protection Plan Plus

- Up to 100% trip cost ($30,000 limit per insured)) if you cancel or interrupt due to sickness, injury, death and other covered reasons

- 75% of non-refundable payments and deposits for trips up to $30,000

Disney Vacation Club Travel Protection Plan

- Helps protect your travel investment by reimbursing you for pre-paid, non-refundable dues and other out-of-pocket expenses if you must cancel or interrupt your trip due to a covered reason.

- Ensures you receive adequate medical care when traveling and can cover the cost of transporting you to the nearest medical facility in an emergency.

- Provides coverage if you are delayed for 5 hours or more while en route to or from your destination.

- Provides easy claims handling and less time and hassle to receive reimbursement for eligible losses with no deductibles. Funds may be recovered from your medical or other collectible insurance plans.

- Safeguards personal articles and expenses if bags are lost, stolen, damaged or delayed for 12 hours or more while traveling.

- Provides coverage for accidental and unintentional damage to your unit and its contents

How Much Does Disney's Travel Insurance Cost?

Just like the coverage, the prices of these travel protection plans vary. Some are a flat fee while others are a percentage of the trip.

Disney World, Disneyland, and Aulani Travel Protection Plan – This protection plan is a flat rate fee. However, the price does vary depending on which destination you’re traveling to. The price per adult is $95 for Walt Disney World, $85 for Disneyland, and $99 for Aulani. Children through age 17 are free.

Disney Cruise Line Travel Protection Plan – For Disney Cruise Line, I can't give you an exact amount of what your travel insurance will cost. With Disney Cruise Line, the Travel Protection Plan will be 8% of your total cruise cost.

Adventures by Disney Travel Protection Plan – Travel insurance for Adventures by Disney is also a percentage of your total trip cost. For the standard protection plan, your travel insurance will be 8.38% of your total cost. If you choose the Plus option, your travel insurance will be 13.41% of the total cost of your adventure.

Disney Vacation Club Travel Protection Plan – The price of travel insurance for Disney Vacation Club is another flat fee. For just $99, you will receive a full year of protection for your Disney Vacation Club travels.

How To Get Disney's Travel Insurance

Adding travel insurance to your Disney vacation is quick and easy! For Disney World, Disneyland, Aulani, and Disney Cruise Line, you can add travel insurance to your vacation online. You can either do this when you are making your reservation, or you can add it on later.

In order to add travel insurance to your Adventures by Disney trip, you’ll need to call in. There is not an option to add this travel protection plan online. To add this travel insurance, you can call Adventures by Disney at (800) 543-0865.

Disney Vacation Club travel insurance can be secured online or by phone. To add this travel insurance online, just click here ! If you’d prefer to call, you can call Member Services at (800) 800-9800 or (407) 566-3800.

If you’re working with a travel agent , they will also be able to add any of these travel protection plans to your reservation for you. Please note, that all of these travel protection plans MUST be added to your reservation prior to the final payment being made towards your vacation.

Get Away Today Travel Insurance

If you’re looking for both savings and protection for your vacation, then we’re going to refer you to Get Away Today again! As I discussed earlier, Get Away Today can provide you with the best priced tickets as well as assist you with your Disney vacation planning. However, their assistance doesn’t stop there. They also have travel insurance available for you to add to your magical vacation.

The travel protection plan at Get Away Today is called the Peace of Mind Plan . The Peace of Mind Plan is only $99 per vacation package. This plan provides you with both comfort and flexibility. Get Away Today’s Peace of Mind Plan allows you to change or cancel your tickets, reschedule your hotel, change your hotel, drop a night from your hotel stay, cancel your hotel stay, or even cancel your entire package at no additional cost to you! Enjoy the relief of knowing that if anything happens with the vacation package that you book with Get Away Today, you’ll be taken care of.

Protecting Your Disney Vacation

Due to the expense of Disney vacations along with the unexpected expenses that could arise without warning, it’s understandable to want to protect your trip. While Disney does offer its own Travel Protection Plans, and we recommend Get Away Today’s Peace of Mind Plan, there are other options out there!

If you decide that you want to protect your Disney vacation, take some time to shop around. Consider speaking to your travel agent or your insurance company first to hear what recommendations they have. You can also browse the web to find travel insurance that works best for you. Prices of 3rd party plans will almost always vary depending on your vacation price, the size of your party, the age of the travelers in your party, where you’re traveling to, and how you’re traveling. You’ll also want to consider how much coverage you’re looking for. No matter which travel insurance company or protection plan you decide to go with, make sure that it does provide you with relief so you can enjoy your time on your magical Disney vacation!

Frequently Asked Questions

How much does disney travel insurance cost.

The cost of Disney travel insurance varies depending on which Disney Destination you're looking to insure. Here is a list of current Disney travel insurance prices:

- Disney World – $95 per adult (Children through age 17 are free)

- Disneyland – $85 per adult (Children through age 17 are free)

- Aulani, a Disney Resort and Spa in Hawaii – $99 per adult (Children through age 17 are free)

- Disney Cruise Line – 8% of your total cruise cost

- Adventures by Disney – 8.38% of your total trip cost for the standard plan, 13.41% of your total trip cost for the Plus plan

- Disney Vacation Club – $99 per year

What insurance company does Disney World use?

The travel insurance that Disney World offers to its Guests is provided by Arch Insurance Company.

Does travel insurance cover Disney tickets?

If you are using Disney's travel insurance, your Disney tickets are eligible for reimbursement as part of your vacation package. When using Disney's Travel Protection Plan, under Trip Cancellation and Trip Interruption, you're eligible for reimbursement up to the total trip cost of the prepaid travel arrangements due to illness, injury, and non-medical reasons such as job loss, military service, and more. If you're using a third party insurance company, you would need to check with them to see if your Disney tickets are eligible for coverage. However, if you book your Disney vacation with Get Away Today, you can protect your Disney vacation package for as little as $99 with their Peace of Mind Plan. Under this insurance plan, your Disney tickets are absolutely covered!

Is Disney insurance refundable?

If you change your mind about covering your Disney vacation through Disney's Travel Protection Plan, you can rest assured that this Disney insurance is refundable. However, this travel insurance is only refundable within 14 days of its purchase date.

Plan Your Disney Vacation!

For ways to save money on your next Disney World vacation, be sure to subscribe to our FREE newsletter for the most up-to-date planning information. This also includes exclusive deals and the lowest ticket prices anywhere. Additionally, make sure to check out our other guides to help plan your next Disney World vacation:

- Everything You Need to Know About Discount Disney World Tickets for 2024

- Best Disney World Resorts for EPCOT Visits

- Best EPCOT Rides – Top Walt Disney World Rides 2024

- Every DOLE Whip You Can Get at Disney World Ranked

- Disney Gift Card Discounts 2024

Related Posts

NEW Themed Port Opens Today at Disney Park with Frozen, Peter Pan, and Tangled offerings

Disneyland Halts Magic Key Annual Pass Sales Ahead of Unprecedented Summer Ticket Offer

Pixar Fest Offering at Disneyland Ending Months Early

Disney Releases Tiana’s Bayou Adventure Full Ride-Through POV

Disney Reveals New Songs Coming to Country Bear Jamboree

Progress Moves Forward on Disney’s Animal Kingdom Major Expansion As Key Permit Is Approved

Leave a comment cancel.

Save my name, email, and website in this browser for the next time I comment.

Previous Post: Oogie Boogie Bash- Disneyland Halloween Party 2024 DETAILS Announced

Next Post: Burger King Kids Meal Toys Right Now 2024: Current Toys, Past Hits

Exclusive Discounts + BREAKING NEWS!

Join our FREE newsletter of 100,000+ readers for exclusive discounts, planning tips, and Disneyland & Walt Disney World breaking news. "Essential for planning your trip!"

- Helen from Portland, Oregon

Dreams Unlimited Travel

- Request Pricing

- Client Login

Disney Cruise Line Insurance Information

When planning a Disney Cruise Line vacation, the only thing you will want to worry about is which suntan lotion to pack. Just as Disney Cruise Line has created a vacation that anticipates your every need, they have also planned for the unexpected by arranging the Disney Cruise Vacations Protection Plan.

When including insurance with your Disney Cruise package, it can be added to your cruise up until your balance due date or when full payment is made. (It can also be removed prior to paying your balance.) Once the final payment is made, insurance cannot be added or removed.

COST: 8% of the per person voyage fare, including the non-commissionable portion of the voyage fare.

Prices are per guest and are subject to change without notice.

It's designed to give them peace of mind by protecting vacation investment, health and belongings. The Plan is a combination of travel insurance benefits and emergency hotline services created and provided by World Access Service Corporation. Below is a brief summary of what is included.

- Trip Cancellation/Interruption Protection* for any non-refundable fees if your clients must cancel or interrupt their trip due to a covered medical condition or other specified cause. Clients who have to cancel for any reason not covered will receive 100% of the non-refundable cancellation fee toward a future Disney Cruise Vacations package.

- Travel Delay Protection* for reasonable, additional traveling expenses incurred up to $500 due to a covered travel delay.

- Emergency Medical/Dental Benefits* if your clients suffer a covered accidental injury or illness while on their trip. They will be reimbursed up to $10,000 for covered emergency medical and dental expenses.

- Emergency Medical Transportation to the nearest appropriate medical facility due to a covered illness or injury incurred by them for up to $30,000.

- Baggage Coverage* and Delay Protection* for a covered loss, theft, or damage to personal effects up to $3,000. For baggage delays of more than 24 hours, the Plan provides reimbursement up to $500 for the purchase of essential items.

- Emergency Assistance with a world-wide 24-hour hotline for help with travel-related problems such as lost travel documents and emergency cash transfers.

*Insurance coverages underwritten by Transamerica Casualty Insurance Company. Only expenses booked through Disney Cruise Vacations will be covered. Maximum coverage available is $10,000 per individual.

Prices are per guest and subject to change without notice. All prices are in U.S. dollars.

Pre-Existing Condition exclusions and other exclusions, limitations and restrictions apply. For a full description, detailing the limits, terms, conditions and exclusions of the Plan, and what to do in the event of an emergency, please refer to the Description of Coverage that is included with travel documents. If you have questions you may call World Access Service Corporation directly at 877-593-4988.

The Emergency Medical Transportation and Assistance services are provided by Access America, a division of World Access Service Corporation.

Please be advised this optional coverage may duplicate coverage already provided by your personal auto insurance policy, homeowner's insurance policy, personal liability insurance policy or other source of coverage. This insurance is not required in connection with the Insured's purchase of travel tickets.

If you find that this coverage does not suit your needs, or if you prefer making your own trip insurance arrangements, you may want to visit this website: www.insuremytrip.com . You can compare the different policies that are available for travelers.

Get a Cruise Quote

Listen to the dreams show, watch the dreams show.

Disney Cruise Line Discounts & Special Offers

Exclusive - Shipboard Credit up to $1000 and a FREE Gift!

Combinable - Disney VISA Shipboard Credit Offer! This offer CAN be combined with the Dreams Unlimited Travel shipboard credit offer for up to $600 in addition!!

Learn more about Dreams' unique planning and concierge services , provided to our clients free of charge! Find out why our clients are raving about us, and how we can make your Disney World vacation , Disneyland vacation or Disney Cruise Line vacation truly magical!

How much does a Disney cruise really cost?

Editor's Note

Disney Cruise Line is known for its family-friendly cruises complete with all of your favorite Disney characters, impeccable dining, exciting entertainment and thrilling ports of call. With everything that's included on the sailings, you might be wondering how much a Disney cruise costs — and if you can afford one.

Cruises with Mickey Mouse and his pals range in price depending on many factors such as the embarkation port and destination, departure date, length of the cruise and cabin type you book. No matter which cruise you book, it will be pricey, like any Disney vacation. You'll have to determine what value you put on experiencing the "magic" of Disney.

For cruise news, reviews and tips, sign up for TPG's cruise newsletter .

To me, it's worth a lot. I've experienced all five ships in the Disney fleet and have sailed seven times to destinations around the Caribbean and the Mediterranean .

Here, I'm sharing how much a Disney cruise costs per ship and itinerary, any extras that are worth the additional fees and how to save money on a Disney cruise.

How much does it cost to go on a Disney cruise?

Let's be honest: A cruise on any Disney ship isn't cheap. Factors like cabin type and category, sail date, destination, length of cruise, traveling party size and if you're on a themed cruise can impact the overall cost. If you're trying to keep your costs lower, your best option is to pick a cruise on an older ship (Disney Wonder, Disney Magic, Disney Dream, Disney Fantasy) or pick a shorter cruise length.

The cheapest Disney cruise we found cost $1,000 for an inside cabin for two people on a two-night sailing on Disney Wonder in Australia. That's $250 per person per night.

If you're looking for a cheap Caribbean or Bahamian sailing, consider a three-night Bahamas cruise on Disney Magic starting at $1,500 for an inside cabin for two people. This also equates to $250 per person per day. Add in drinks, specialty dining, souvenirs and other expenses, and you can expect to spend around $2,500 in total.

On a recent sailing on the Disney Dream , my family of three and I spent five nights at sea in a balcony room and paid a grand total of $4,514.06. This total included everything from the cruise fare and pre-night hotel stay to parking and spa services.

Some examples of starting prices for each ship and its major itineraries for an inside cabin or a balcony cabin are listed below so you can get a sense of pricing across the fleet. Prices are based on double occupancy.

Disney Magic

One- to three-night Bahamas: inside cabins, $1,500 to $2,500; balcony cabins, $1,900 to $3,300 Four-night Caribbean and Bahamas: inside cabins, $1,800 to $3,200; balcony cabins, $2,300 to $4,000 Five- to six-night Caribbean and Bahamas: inside cabins, $2,200 to $4,400; balcony cabins, $3,000 to $6,600 Seven-night Caribbean: inside cabins, $2,700 to $3,300; balcony cabins, $3,800 to $4,900

Disney Wonder

Two- to three-night Australia: inside cabins, $1,000 to $2,100; balcony cabins, $1,200 to $2,800 Four-night Australia: inside cabins, $1,700 to $3,000; balcony cabins, $2,200 to $4,000 Seven-night Alaska: inside cabins, $3,300 to $5,000; balcony cabins, $5,900 to $10,500

Disney Dream

Three-night Bahamas: inside cabins, $1,700 to $2,300; balcony cabins, $2,000 to $2,600 Four-night Bahamas: inside cabins, $2,100 to $3,500; balcony cabins, $2,500 to $4,000 Five-night Caribbean: inside cabins, $2,800 to $4,400; balcony cabins, $3,100 to $5,000 Five-night Bahamas: inside cabins, $2,700 to $4,000; balcony cabins, $3,200 to $4,600 Seven-night Europe and Mediterranean: inside cabins $4,400 to $6,800; balcony cabins, $5,200 to $9,500

Disney Fantasy

Four-night Bahamas: inside cabins, $2,100 to $3,000; balcony cabins, $2,400 to $3,400 Five- to six-night Bahamas: inside cabins, $2,700 to $4,400; balcony cabins, $3,200 to $4,900 Seven-night Caribbean: inside cabins, $3,300 to $5,700; balcony cabins, $3,900 to $7,000

Disney Wish

Three-night Bahamas: inside cabins, $2,000 to $3,000; balcony cabins, $2,500 to $3,500 Four-night Bahamas: inside cabins, $2,600 to $4,600; balcony cabins, $3,000 to $5,600

Disney Treasure

The maiden voyage is set for Dec. 21, 2024.

Seven-night Caribbean: inside cabins, $4,200 to $5,800; balcony cabins, $5,200 to $7,000

Related: The 3 types of Disney Cruise Line ships, explained

Where do Disney cruises sail from?

Disney Cruises depart from 15 different ports around the world, but the major ones to think about from the U.S. include:

- Fort Lauderdale

- Port Canaveral, Florida

- Galveston, Texas

- New Orleans

The major international ports Disney Cruise Line sets sail from include:

- Civitavecchia (Rome), Italy

- Melbourne, Australia

- Southampton, England

- Brisbane, Australia

- Vancouver (British Columbia), Canada

Depending on the cruise you pick, getting to and from the home port can be easy or take a little longer — and that can impact the total cost of your Disney cruise.

For instance, many people drive to Fort Lauderdale or Port Canaveral if they already live in the southern U.S. Driving can save money versus flying, and you might not have to stay in a pre-cruise hotel if you can drive right to the port.

You will have to pay to park at the port or at a third-party parking lot. While the off-site parking lots are often cheaper, you will need to think about how to get to and from the ship, tipping the porter or driver, plus the added time to get from your car to the ship.

On the other hand, if you are taking a cruise from an international destination or flying to a domestic home port, your costs automatically go up because of flights for your family, a pre-cruise hotel, meals before the sailing, and transportation to the ship and back to the airport.

Related: The 5 best destinations you can visit on a Disney Cruise Line ship

What's included in the price of a Disney cruise?

You might pay a lot for a Disney cruise, but you get a lot for your money. The cost of a Disney cruise covers your onboard dining and most nonalcoholic drinks, an abundance of entertainment for kids and adults, onboard activities and transportation between cruise ports. Even most entertainment and food on Disney's private island Castaway Cay (and upcoming private island destination Lookout Cay at Lighthouse Point) is part of the fare.

Entertainment

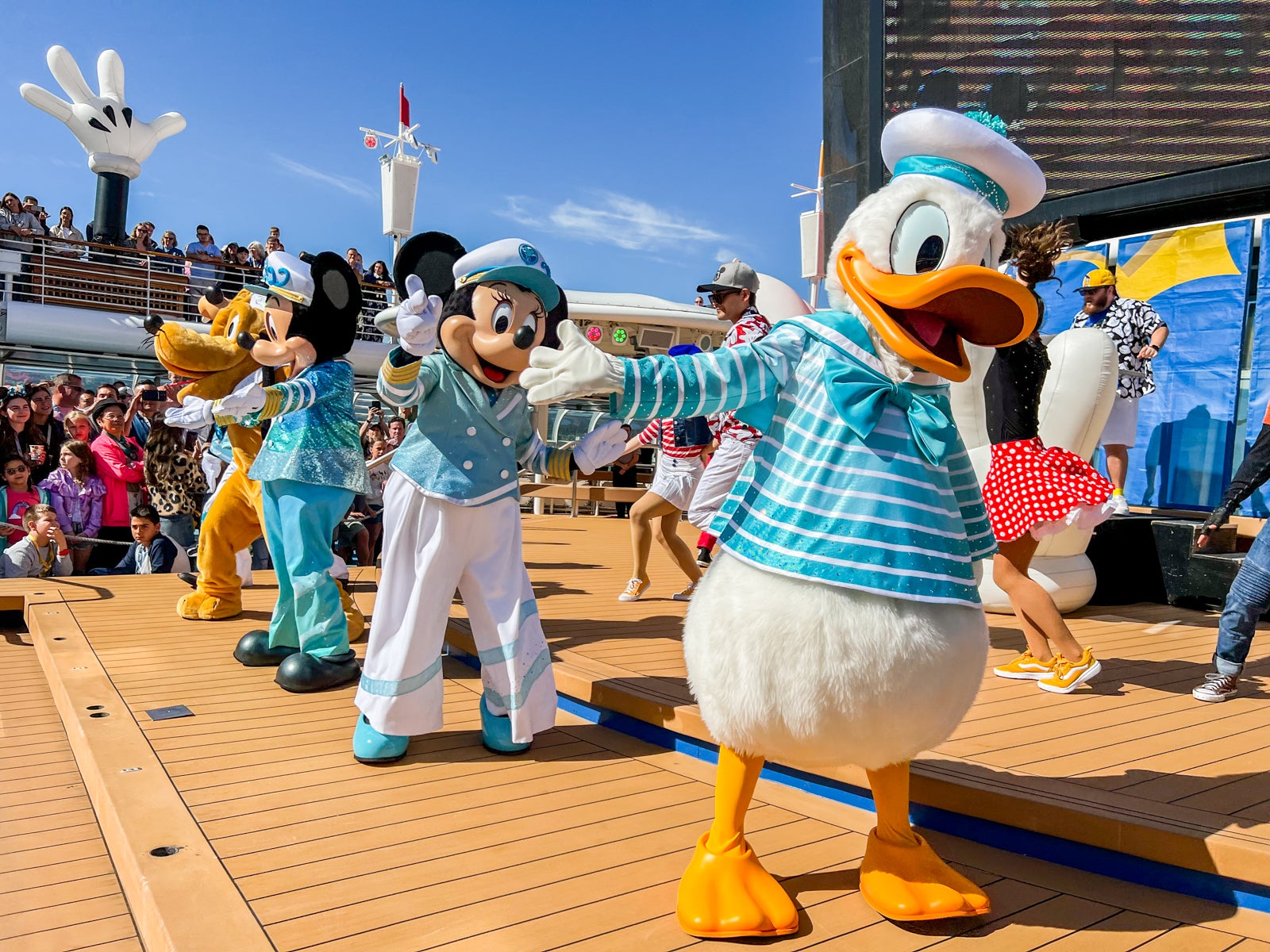

Most of the entertainment on board is included in the overall cost of your sailing. On your cruise, you can experience Broadway-quality shows inside the Walt Disney Theater, watch first-run movies from Disney's production companies (like Disney, Pixar, Marvel and Star Wars), listen to live music and participate in game shows in the adults-only lounges. Most itineraries feature a deck party with a fireworks show.

Kids can meet and play with their favorite Disney characters and participate in activities like karaoke. Family-friendly sun decks with pools, waterslides, splash zones and wading pools are also included in the cost.

Disney Cruise Line is known for its rotational dining evening dinner service. Families rotate through three onboard restaurants throughout the sailing, and your service team moves with you. Each of the rotational dining options is included in your cruise fare. One of the restaurants will be open for drop-in, sit-down meals during breakfast and lunch as well. Complimentary room service is available 24 hours a day.

On the upper decks, quick-service food stations, soft-serve ice cream and a buffet are available. Every Disney cruise also includes unlimited coffee, tea and soda.

Accommodations

Almost every cabin across the Disney fleet features Disney's distinctive split bathroom concept. One of the bathrooms has a vanity, sink and tub-shower, plus another bathroom with a vanity, sink and toilet. Each room also has a small refrigerator, safe and hair dryer.

Every child ages 3 to 17 will have access to Disney's kids clubs on board. Youngsters ages 3-10 can enjoy Disney's Oceaneer Club and Disney's Oceaneer Lab . Tweens ages 11-14 have access to Edge, and teens ages 14-17 can chill out in Vibe.

Each kids club has dedicated counselors and a host of activities every day. The best way to see the list of activities is to download the Disney Cruise Line Navigator app and scroll through the daily agenda. You can flag activities your kids want to attend, so you can get to the kids clubs before they start.

Adult-exclusive activities

Disney cruises are packed with family-friendly programming, but adults can find spaces and events geared just for them in the adult-only nightclubs and lounges on board. Live music, interactive games and shows are only some of the nightly activities.

Additionally, adults have a dedicated pool and hot tub area that includes a bar and coffee shop. (Drinks cost extra, but access is free). For those looking to stay fit while onboard, access to the fitness center is also included.

Castaway Cay

On most Bahamas and Caribbean sailings, you'll stop at Disney's private island, Castaway Cay . At the island, your family can enjoy the family beach or adult-exclusive beach (for those 18 and older).

Use of towels, beach chairs and shade umbrellas are complimentary, as are waterslides and splash zones. Live music and character appearances take place around the island. Kids and teen club activities are available on Castaway Cay — again, at no extra charge. Runners can participate in the Castaway Cay 5K and get a finisher medal.

When it's time to eat, three spots serve an included barbecue lunch, complete with soft-serve ice cream. Coffee, tea and fountain drinks are also included at Castaway Cay.

To get around the island, you can walk or use the complimentary trams.

Related: Are cruises all-inclusive? What's actually included in your cruise fare

Are there any extra Disney costs?

Even though many activities, dining options and entertainment are included in the cost of your cruise, you will find things to pay extra for on a Disney cruise. These may or may not be worth it for your family, depending on your budget and interests. Below is a list of things not included in your overall cruise fare.

Some of the cutest Disney activities are also ones that cost extra. Kids who want more time with the Disney characters might be interested in the Royal Court Royal Tea — a tea party with characters for kids ages 3 to 12. According to planDisney (Disney's online resource for vacation-planning tips) , the cost is $220 per child and $69 for anyone 13 and up. Each tea party includes a selection of tea and a two-course meal; every child gets an assortment of gifts.

Kids can also play dress-up and get a full regal or pirate (only available on Pirate Party Nights) makeover at Bibbidi Bobbidi Boutique, found on every Disney ship. Depending on the package you booked for your child, expect to pay $100 to $450 for each makeover.

Disney Dream and Disney Fantasy both have a virtual sports simulator that requires a reservation and a fee. You can play various sports, from football to golf, for either 30- or 60-minute time blocks. Cost varies based on time, sport and number of people playing.

Specialty dining and cocktails

Four specialty dining restaurants are offered across the Disney Cruise Line fleet. Exclusive to Disney Wish (and coming soon to Disney Treasure ) are Enchante and Palo Steakhouse. Expect to pay $60 to $205 plus an 18% auto-gratuity for a meal at Enchante; Palo Steakhouse is $50 for a prix-fixe meal, but an a la carte menu is also available.

On the four other Disney Cruise Line ships, Palo is also $50 for prix-fixe and offers an a la carte menu. An 18% auto-gratuity is also tacked onto your bill.

On Disney Dream and Disney Fantasy, Remy is also available, with the dessert experience starting at $65 without the 18% auto-gratuity, while brunch and dinner are $80 and $135 respectively, plus an additional 18% auto-gratuity.

On all ships, themed bars and lounges sling drinks. Because there's no drink package available through Disney Cruise Line, you will have to pay for each drink individually. The planDisney panel says the average drink can range from $6 to $20.

If you're looking for specialty coffee, tea or hot chocolate drinks, look for the Cove Cafe on all ships; there are also specialty counters off of the atrium on Disney Dream, Fantasy and Wish. These drinks cost anywhere from $5 to $8, depending on your order. You can also order alcoholic drinks from the coffee bars, which run the typical cocktail prices.

Outside the Walt Disney Theater or near the movie theaters on board each ship, you'll also smell the buttery goodness of freshly popped popcorn. You can buy the popcorn for an added fee to take into the shows with you. Additionally, there are some specialty popcorn buckets available for purchase on each ship; you can refill them for a discounted price every time you want to munch on the salty snack. (Specialty buckets purchased off the ships at a Disney resort or theme park are not eligible for a discounted popcorn refill.)

Additionally, each ship offers beverage-tasting seminars where you can learn how to make and taste a variety of cocktails in a given category. Seminars can range from $40 to $70 and last about an hour.

While crew gratuities on Disney Cruise Line are not included in the overall cost, some can be prepaid before you step onboard. These include gratuities to your dining room server, assistant server and head server, plus your cabin host. Disney recommends a gratuity of $14.50 per night per person, including infants and children in regular cabins. It's recommended that those in concierge cabins and suites pay $15.50, with the extra going to your cabin assistant host.

Gratuities that are not included can be paid on board. Such gratuities include anything extra you would like to give to your service team, tips on alcoholic beverages in the dining room, adult dining locations, room service and the spa. The concierge lounge team is also not included in prepaid gratuities for concierge guests, and Disney recommends $8 per night per guest.

Keep in mind that an 18% gratuity is automatically added to bar tabs across the ship and for spa services. To make it easy while on the ship, you can charge all your gratuities to your onboard account.

If you want to bring something home from your trip — whether from a port of call or from the onboard shops — you'll want to budget for that extra cost. Souvenirs off the ship can range from a few dollars to a few hundred dollars, depending on what you buy. Be prepared that some shops will only take local currency; purchases at Castaway Cay shops will be charged to your onboard account.

On the ship, easy-to-transport souvenirs included trading pins, magnets and apparel. These can range anywhere from $20 to $75. Other more expensive onboard souvenirs include jewelry, luxury brand purses and wallets, and art.

Related: 26 Disney cruise tips, tricks, secrets and extra magic to unlock

How do I save money on a Disney cruise?

If you're reeling from sticker shock, know you can find many ways to save money on a Disney cruise. Here are a few of my favorite money-saving tips.

Letting Disney choose your cabin can be a great way to get a deal on the cruise. These are known as guaranteed rates, and they are the cheapest fares in each category. All you have to do is pick your room type, such as inside, ocean view or balcony, and Disney picks which specific room number you get. This works best if you don't care where your room is on the ship.

If you're looking for a room upgrade , but that's not a make-it-or-break-it deal for your family, consider waiting to upgrade your room until you get to the port. If your cruise still has rooms available, you can ask at check-in about a room upgrade for a discount. The cost will be relative to the room type you originally booked and the room type you want to upgrade to. Sometimes, you can even upgrade to a concierge room or a suite, but you will need to get an early port arrival time to potentially score one of those upgrades.

Disney Cruise Line has one of the most generous alcohol policies of any big-ship cruise brand. At the start of your cruise, you can bring up to six cans of beer or two bottles of wine per person over 21 years old. Then, at each port, you can restock and bring the same alcohol allotment per person over 21 onto the ship to store in your room and enjoy. You might find that beer and wine are cheaper in port than on board — a smart way to save on your drinking expenses.

Related: Best Disney cruise ships for everyone — even Disney adults

Are Disney cruises cheaper or more expensive than other cruise lines?

Other family-friendly cruise brands include Carnival Cruise Line, Royal Caribbean, Norwegian Cruise Line and MSC Cruises. While all of the family-friendly brands have pros and cons, picking the right one for your family can come down to a matter of cost. Disney is almost always the most expensive.

For example, we priced out a three-night weekend cruise departing on the same dates for Disney Wish and Royal Caribbean 's soon-to-debut Utopia of the Seas. We found that Disney was almost $500 more expensive for the same weekend, cabin type and length of sailing. Utopia of the Seas came out to $2,850.10 for two people staying in a balcony cabin, while the Disney Wish cruise, also in a balcony room, cost $3,337.20.

What Disney does best — and why many people choose to cruise with the brand — is it provides a high level of service to families, even those in the least expensive cabins. The crew on Disney ships goes above and beyond to make your vacation easy. I've seen everything from dining staff cutting kids' food and taking children to the bathroom to room hosts ensuring parents know about the parental locks on balcony doors (so kids can't just wander outside without an adult).

The extra amenities that Disney offers — such as Broadway-quality shows, character experiences and larger standard cabins — all bring the overall cruise cost up.

Disney also has a smaller fleet than all its family-friendly competitors, meaning there is less cabin inventory to sell. Plus, its ships generally carry fewer passengers. For example, Disney Wish, Disney's biggest ship, carries 4,000 people at full capacity; Royal Caribbean's Icon of the Seas can carry 7,600 guests at capacity. The low inventory combined with the high demand for Disney cruises means that Disney can charge higher fares and still fill ships.

Bottom line

Cruise fares with Disney can change based on factors like room type, travel party size and sailing date. The minimum price you can expect to pay for a cruise to the Caribbean or Bahamas starts at $1,500 for an inside cabin for two people on Disney Magic.

Disney Cruise Line includes a variety of dining experiences (including room service), soda, character meet-and-greets and Broadway-caliber entertainment in its fares; it also allows passengers to bring alcohol on board in every port of call. For these reasons, you don't necessarily have to spend much on board to have a fantastic vacation. The cruise can be a good value depending on the extras you choose to add.

The real question is whether you want to spend more on the base cruise fare to immerse yourself in the world of Disney versus paying less for another family-friendly cruise line.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- A beginners guide to picking a cruise line

- The 8 worst cabin locations on any cruise ship

- The ultimate guide to what to pack for a cruise

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- Top ways cruisers waste money

- The ultimate guide to choosing a cruise ship cabin

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards