- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

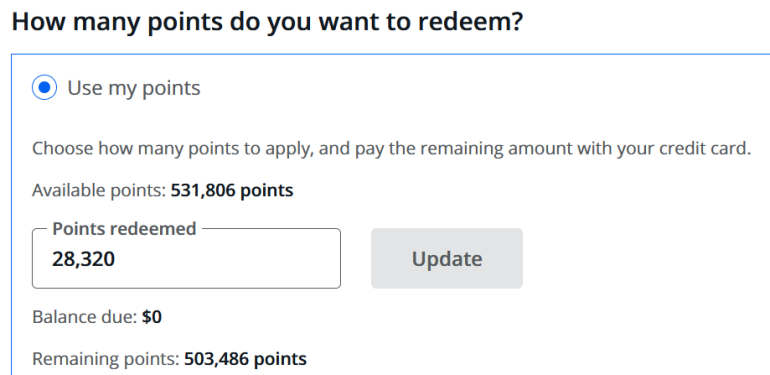

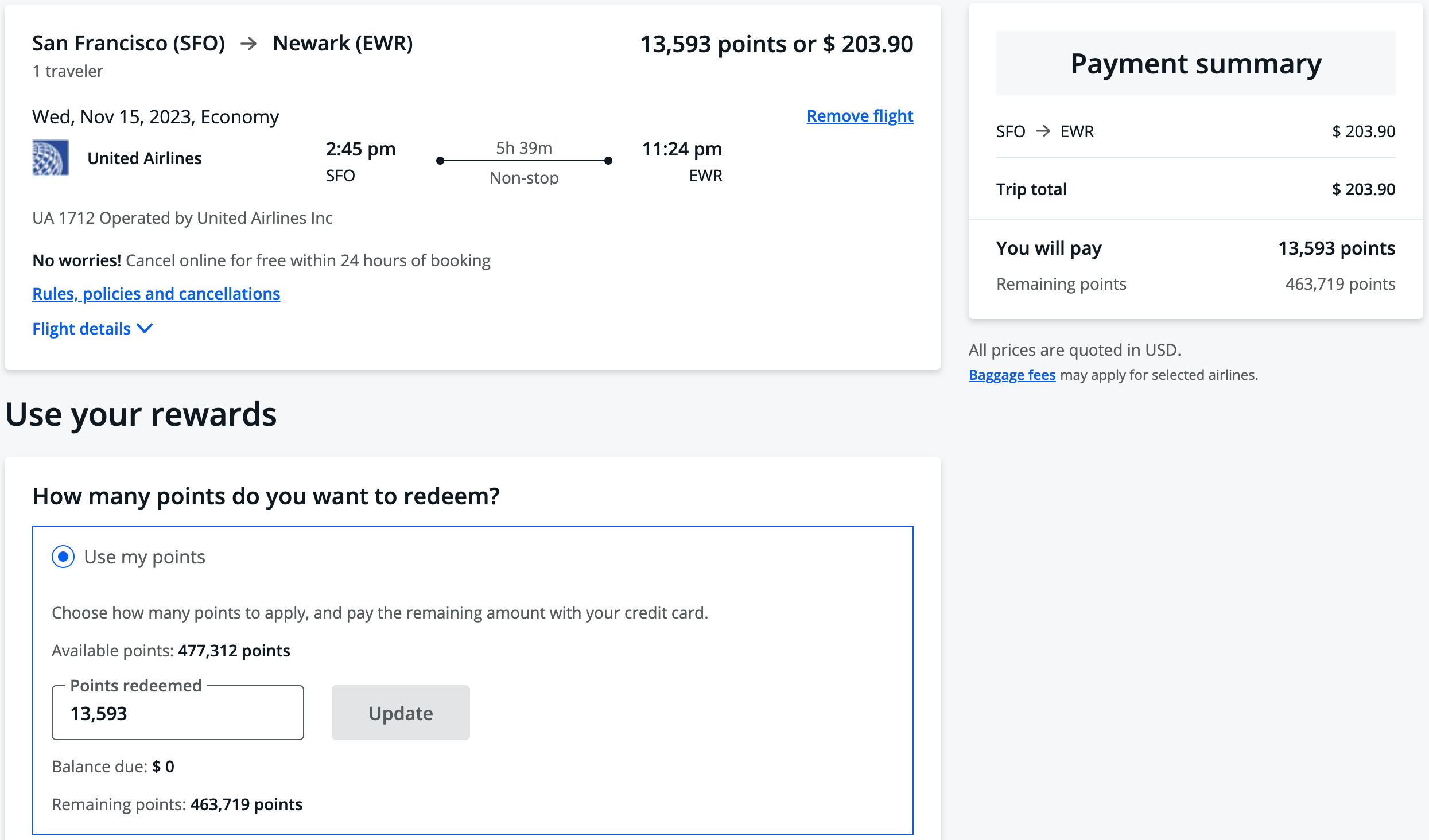

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex℠ .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card. c

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

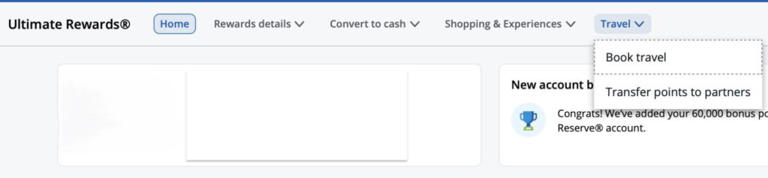

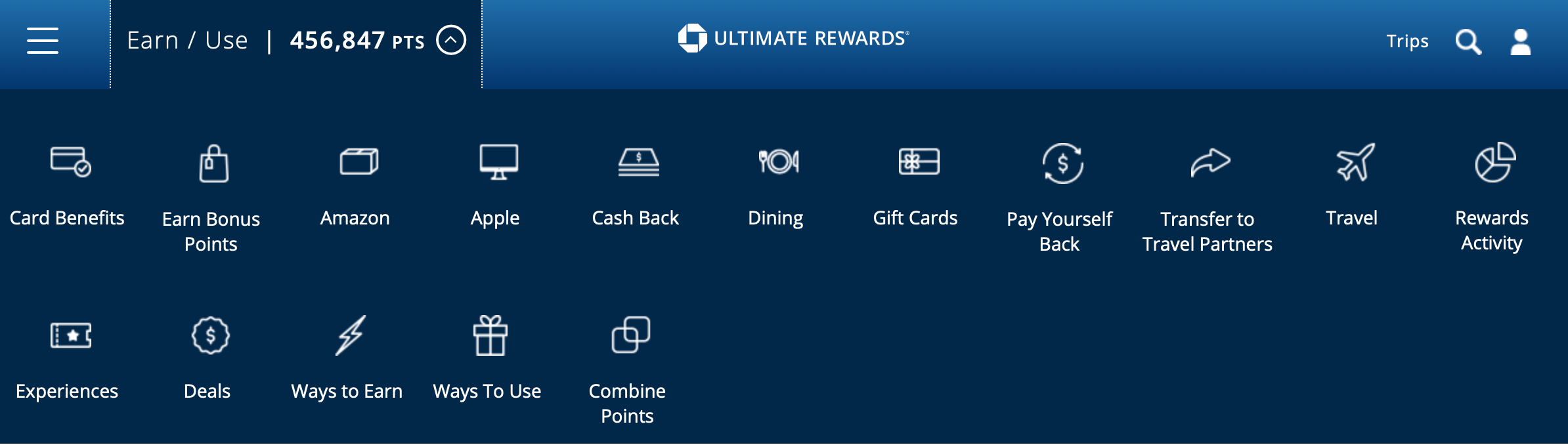

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

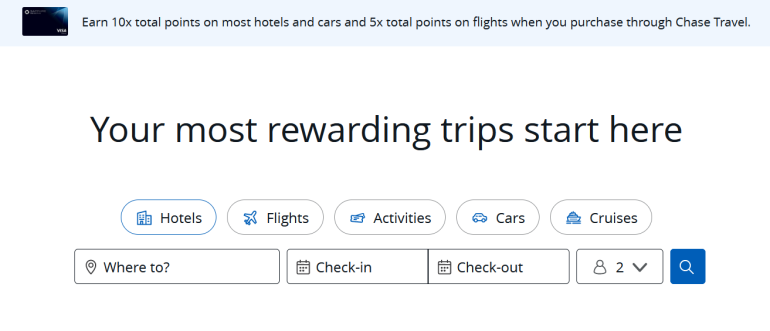

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

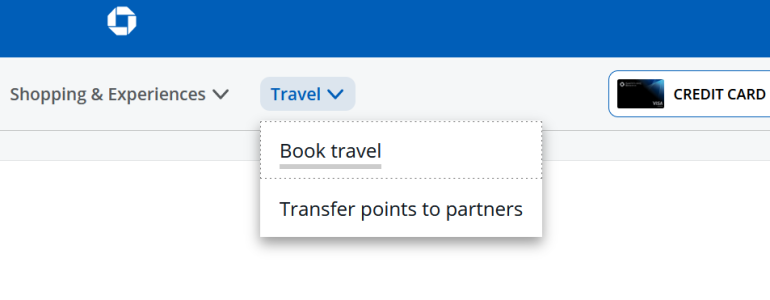

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

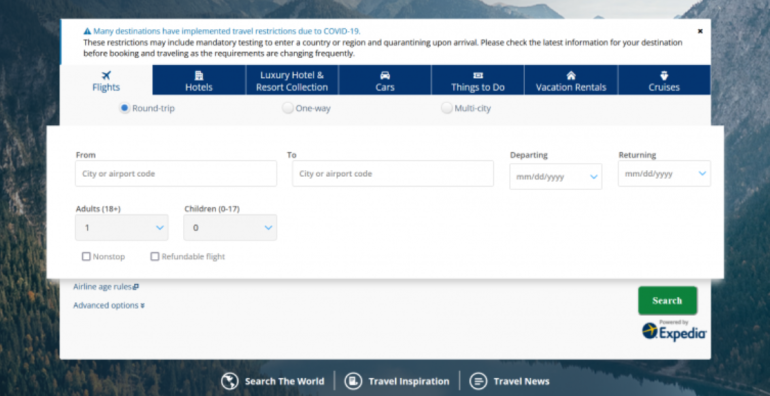

This is one of the more popular features of using points, but keep in mind that Expedia operates Chase's portal on the back end. It doesn't feature all airlines, which can frustrate travelers searching for a flight. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

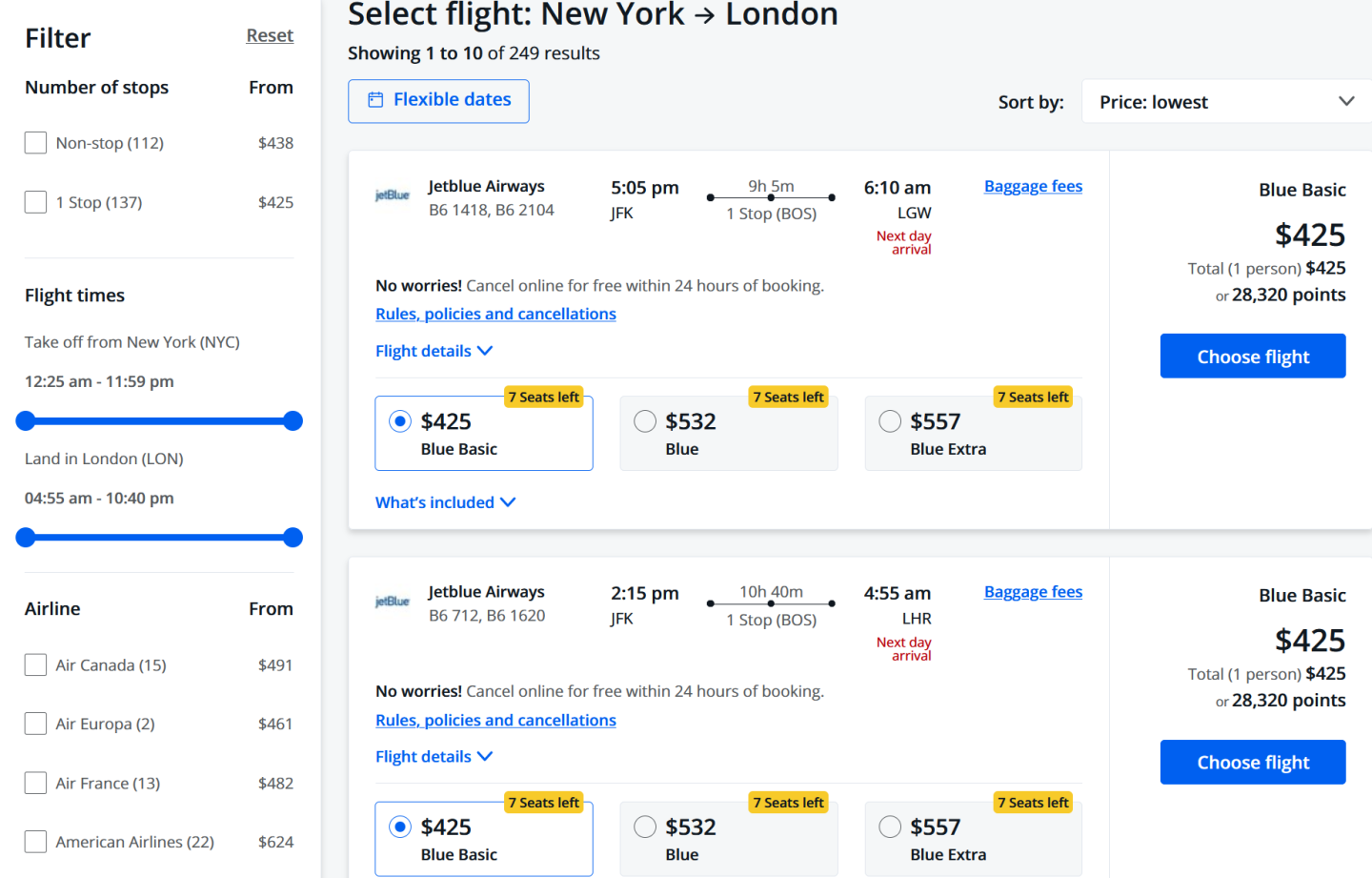

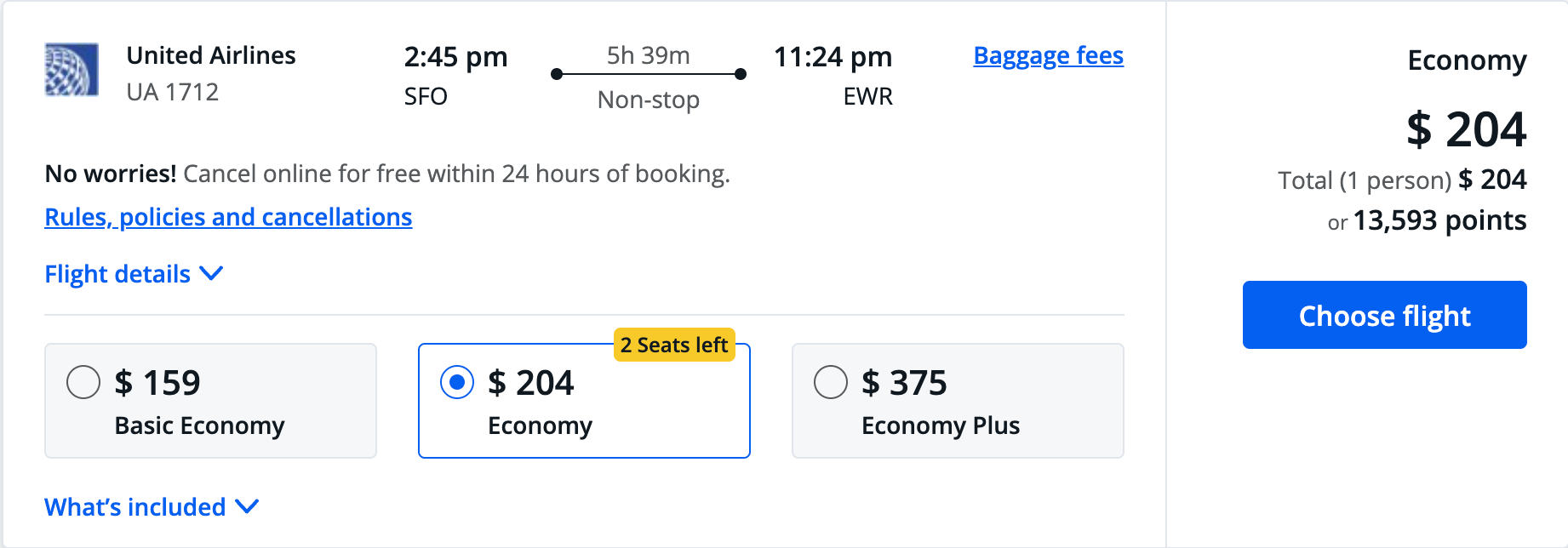

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

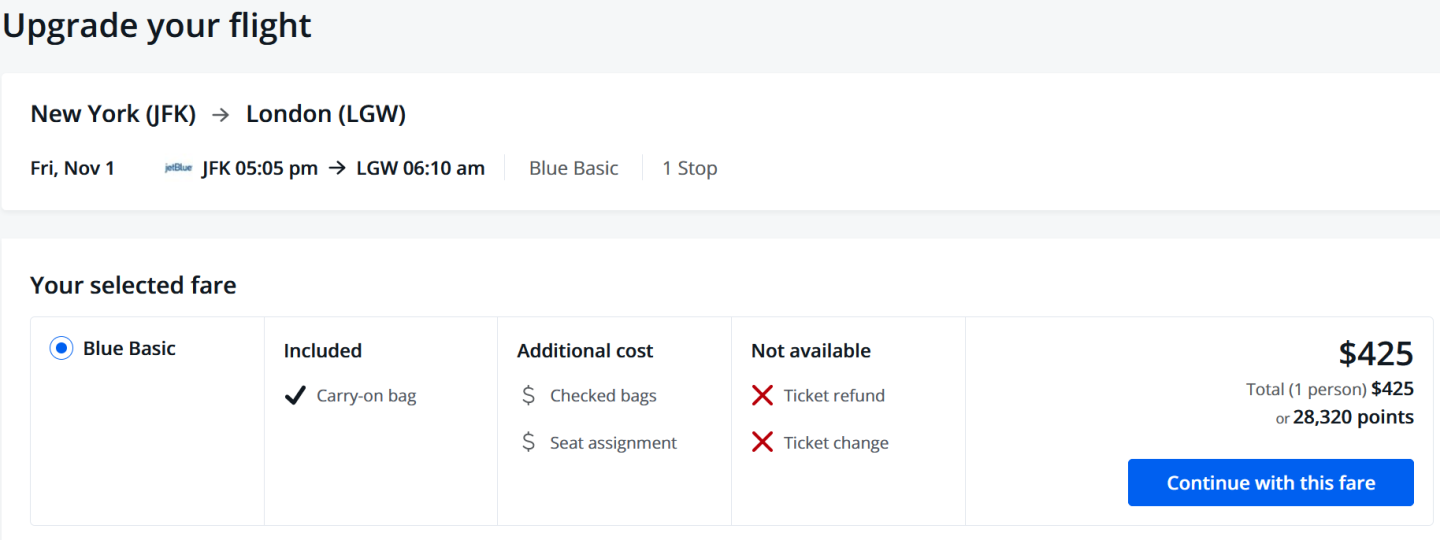

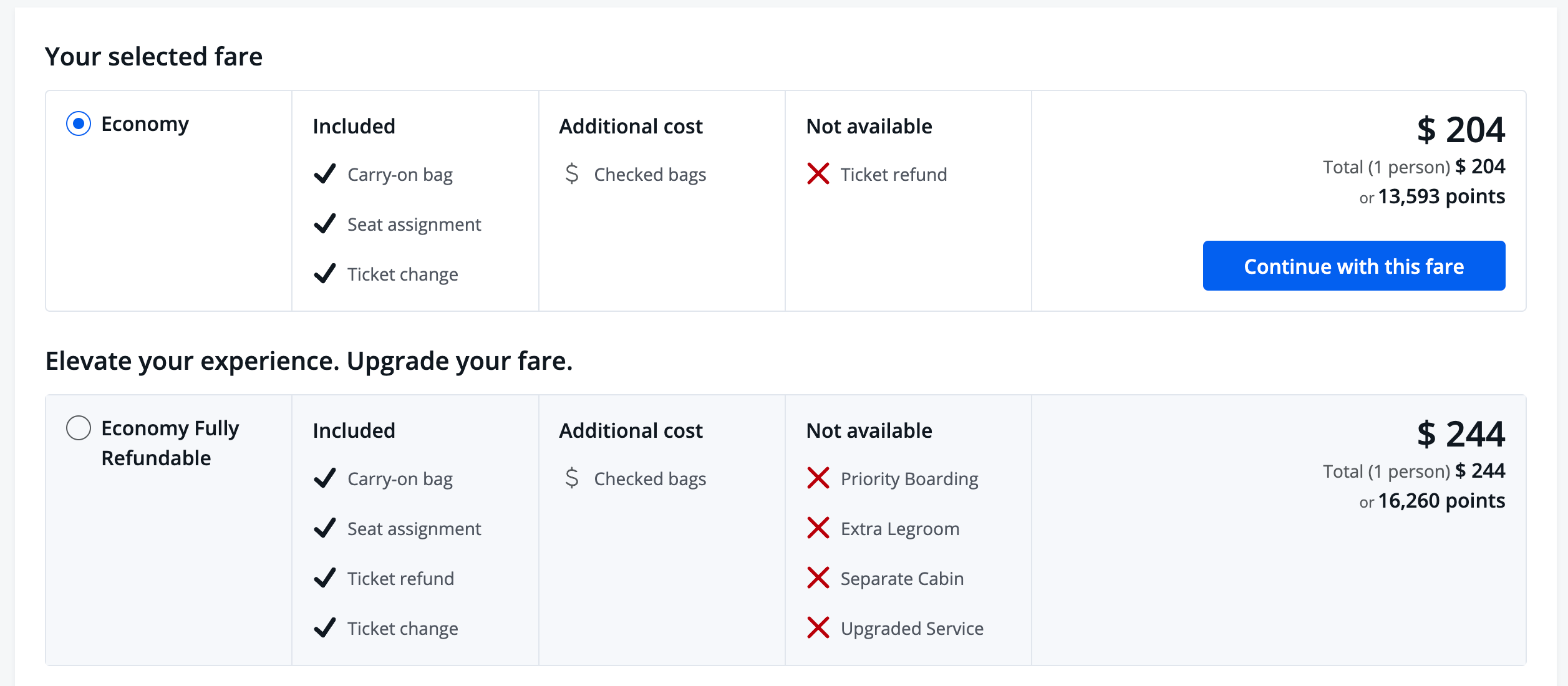

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

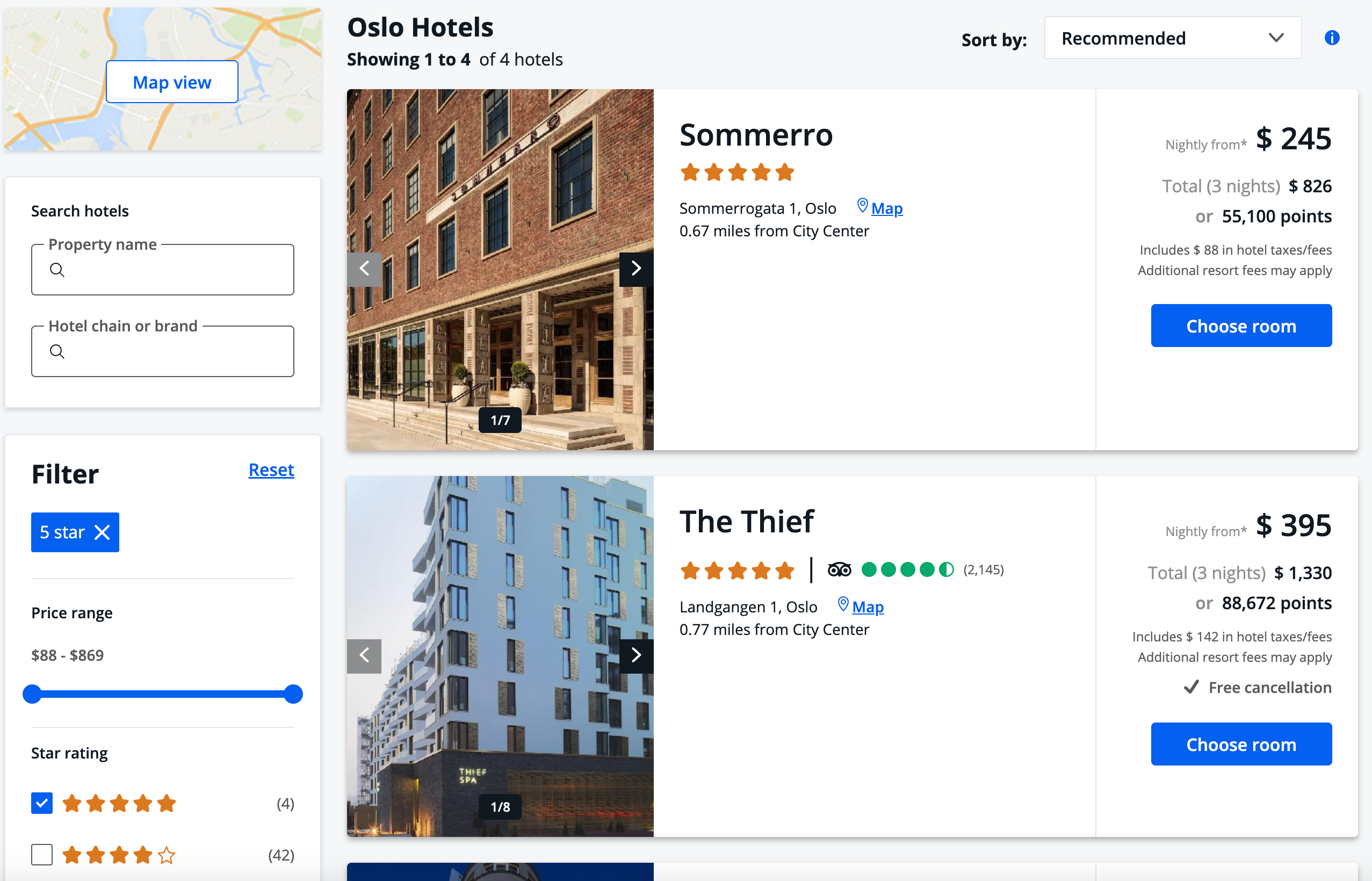

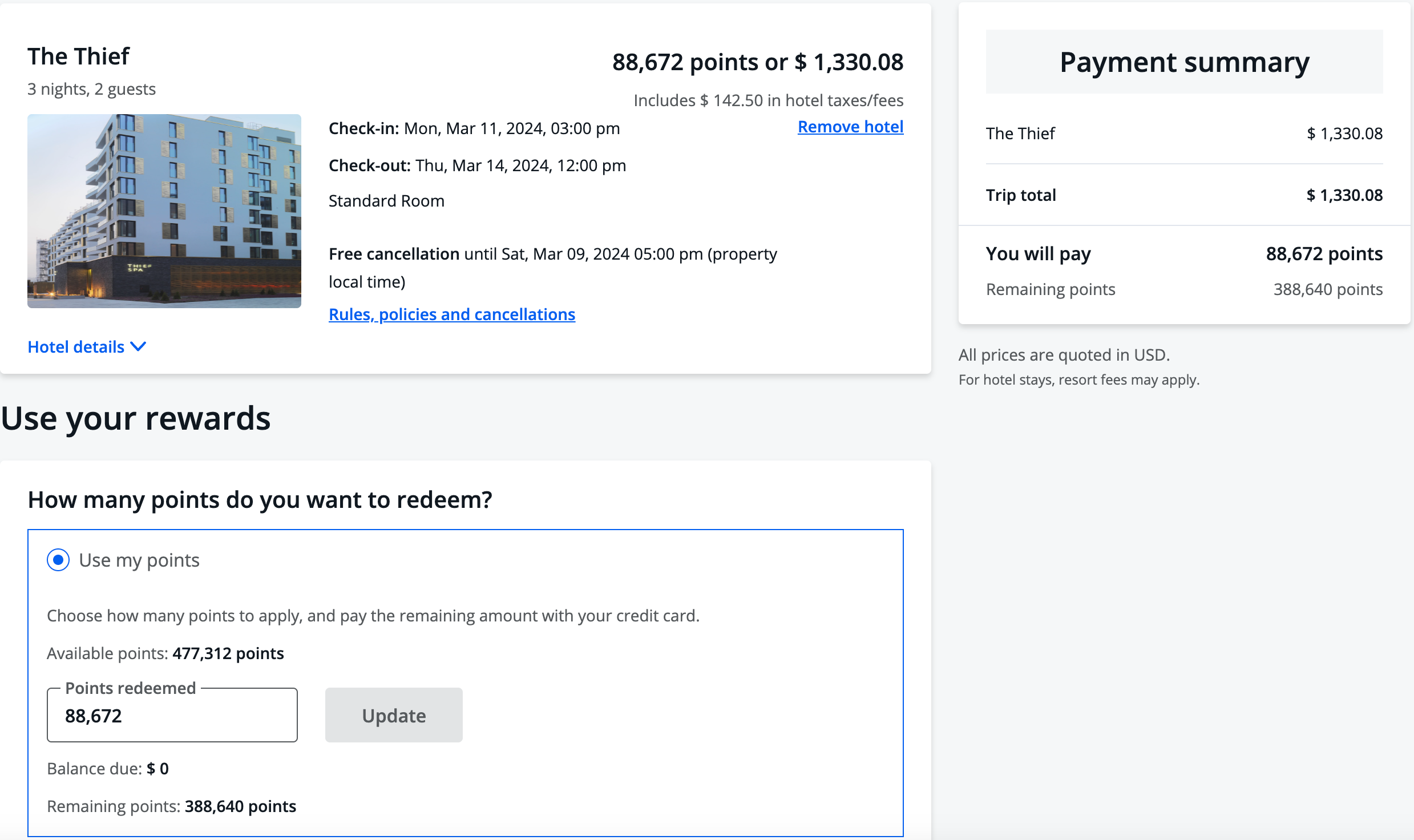

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

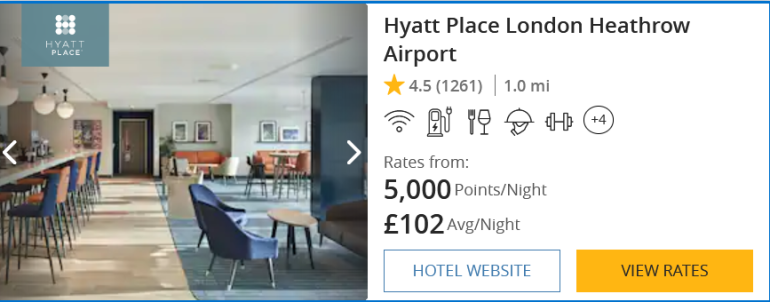

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

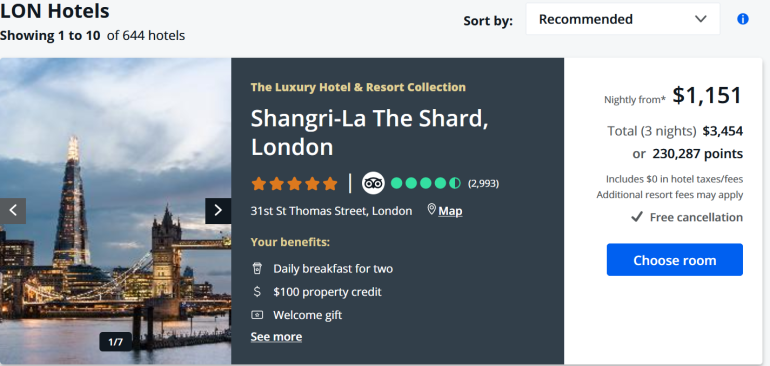

One of the booking tabs also leads to the Chase Luxury Hotel & Resort Collection . This subset of high-end hotels delivers bonus perks like free breakfast, a $100 hotel credit and room upgrades, depending on the property and other things.

You can book directly through Chase or redeem points and be eligible. It’s nice to have elite status-style perks at a hotel where you may not have status or that doesn't have a loyalty program.

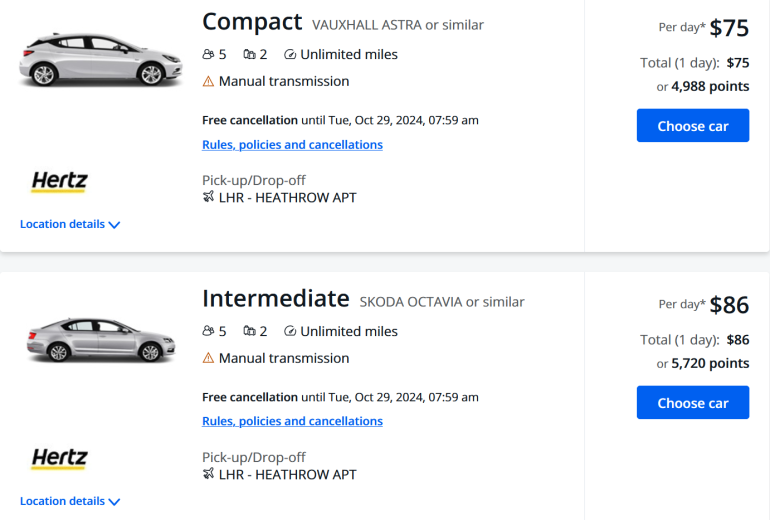

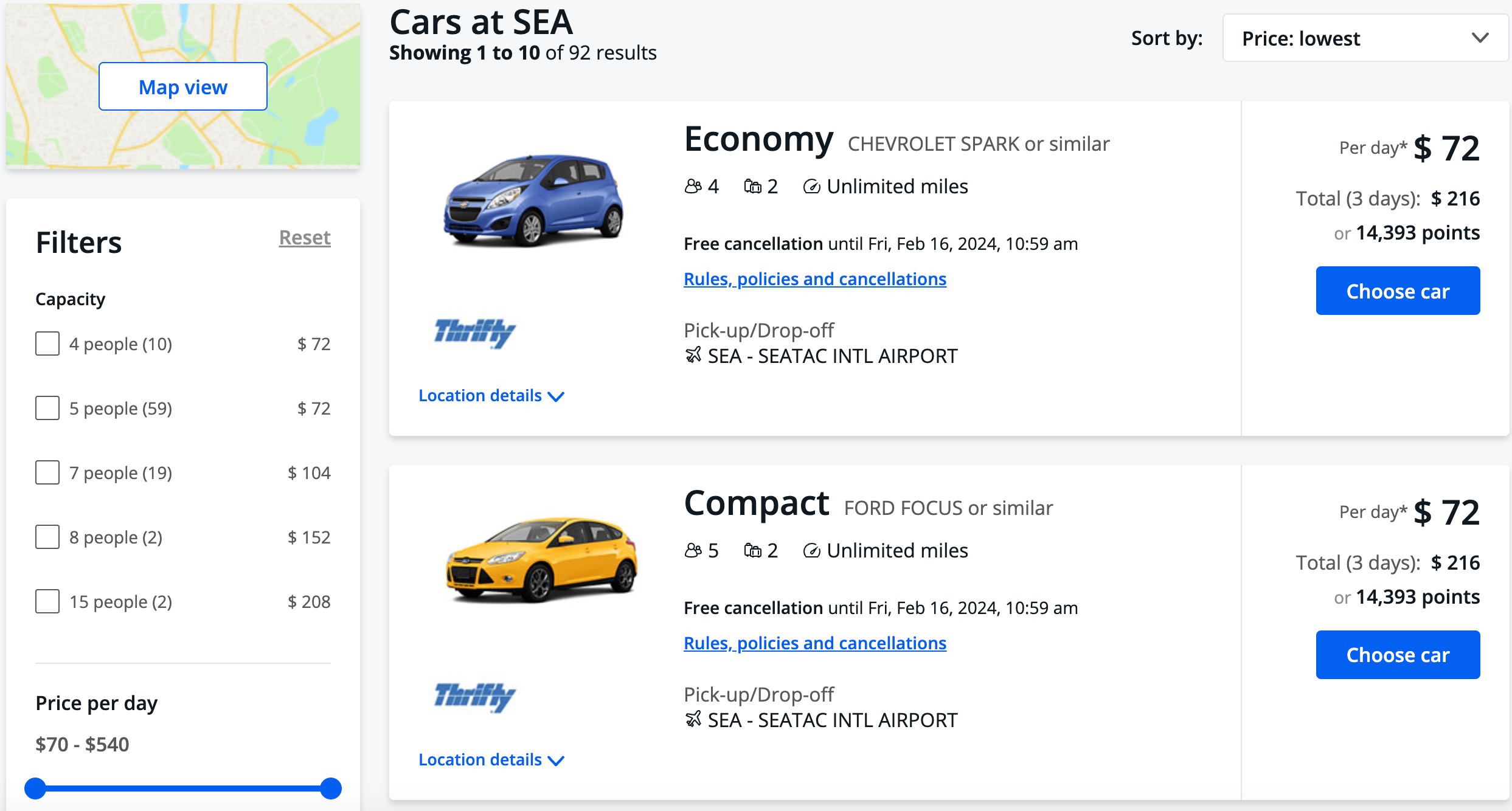

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

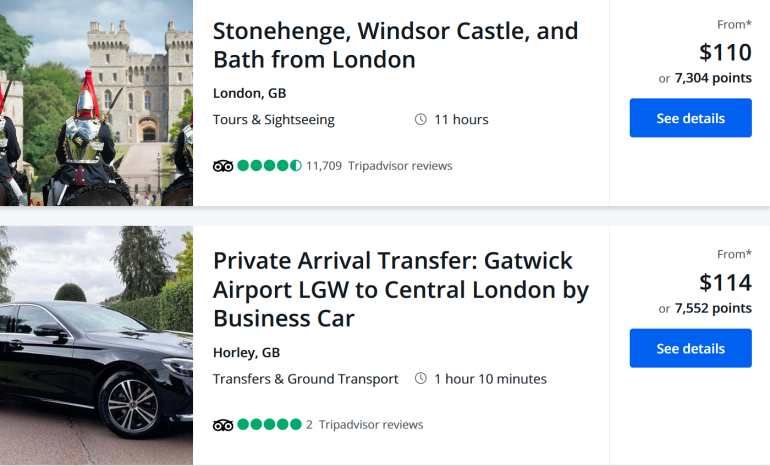

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site, whether flight, hotel, car rental or activity, you've got one option: a good, old-fashioned telephone call.

For support on flights, hotels, car rentals and activities — especially changes or cancellations — Chase lists one number: 866-331-0773.

Chase also lists different contact numbers based on the card you hold, so you may want to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- Sapphire Reserve offers

- Sapphire Reserve benefits

- Not a cardmember? Learn more

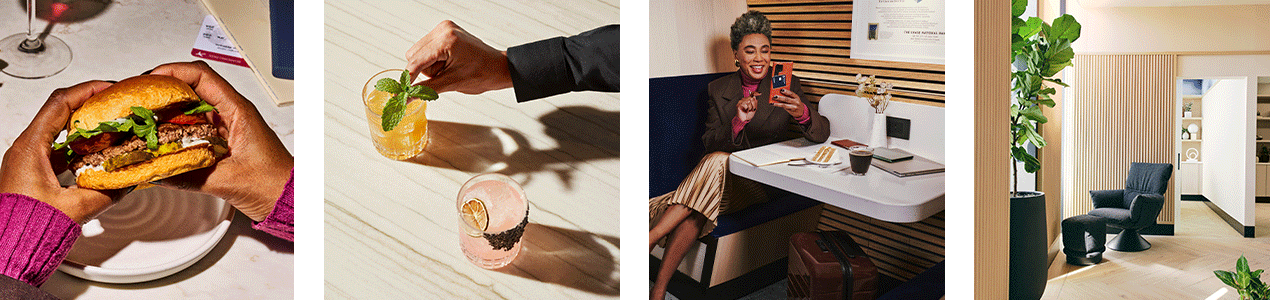

Welcome to Chase Sapphire Lounge by The Club

Local flavor with a side of city-inspired design

At Sapphire Lounge by The Club, you're treated to locally inspired menus, a curated selection of beverages and an atmosphere to remember.

Sapphire Reserve cardmembers may access the Sapphire Lounge with up to two guests. To enter, show your activated, complimentary Priority Pass TM membership that comes with your Reserve card and a valid boarding pass, up to three hours before your departing flight.

To activate your complimentary Priority Pass membership, go to chase.com/MyCardBenefits .

Amenities may vary by location

Find a Sapphire airport lounge in these cities

Each lounge features thoughtfully crafted spaces and amenities designed to reflect the character and energy of its host city.

Boston (BOS)

Boston Logan International Airport near gate B40

5 a . m . –11 p . m . daily (Hours may change)

Expand for more + Close -

Complimentary amenities

Local food and beverages

- Taproom with local draft beers *

- Fresh, seasonal and chef-inspired dining options from Douglass Williams

- Craft cocktails and curated wine list *

- Local coffee from Atomic Coffee Roasters and a selection of teas

* Only non-alcoholic beverages are available before 8:00 a.m. Monday through Saturday and before 10:00 a.m. Sunday.

- Spaces for working or relaxing

- Wellness area with bookable private rest pods and anti-gravity massage chairs, plus meditations from Devi Brown

- Private bathrooms with showers

- Nursing room

- Family room

- High-speed wi-fi

- Curated artwork, including local talent

- Digital experience to enhance your stay with a la carte ordering and access to magazines and newspapers

Sample locally inspired bites from Chef Douglass Williams

Play the video to hear Chef Williams' inspiration for the lounge menu >

A local’s guide to Boston

Hong Kong (HKG)

Hong Kong International Airport Terminal 1

6 a . m . –12 a . m . daily (Hours may change)

- Fresh, seasonal dining options

- Artisanal cocktails, local beer and curated wine list

- Local coffee and a selection of teas

- Private bathrooms

- Nursing room

New York City (LGA)

LaGuardia Airport, Terminal B

4 : 30 a . m . –9 : 30 p . m . (Hours may change)

LaGuardia Airport, Terminal B

- Fresh and seasonal menus, including select chef-created items from NYC restaurant Joseph Leonard

- Craft cocktails by Apotheke and curated wine list from Parcelle *

- Self-serve and barista-made offerings from NYC-based Joe Coffee and a selection of teas

* Only non-alcoholic beverages are available before 6:00 a . m . Monday through Saturday and before 10:00 a . m . Sunday.

- Spaces for working or relaxing on two levels

- Wellness area featuring facial treatments from Face Haus, meditations from Devi Brown and private rest pods

- Private and accessible bathrooms

- Artworks curated by the JPMorgan Chase Art Collection

Indulge in elevated travel at LGA

The Reserve Suites by Chase

Reserve cardmembers, treat yourself to The Reserve Suites at the Sapphire Lounge at LaGuardia Airport in Terminal B. Each of the three suites features:

- A dedicated host

- Signature caviar service on arrival

- Exclusive menus from Jeffrey's Grocery

- Special selection of wine from Parcelle

- In-suite entertainment, including TV and speaker

- Private bathrooms with spa showers

Sapphire Reserve Cardmembers can book a suite for a fee up to 72 hours prior to flight departure. Find details on the Chase Mobile ® app in Benefits & Travel. The Reserve Suites are limited and subject to availability.

Explore local tastemakers

Joseph Leonard

Jeffrey's Grocery

Discover other partners in the lounge

Artist Eugenia Mello, based in NYC

Get inspired by nyc.

The Infatuation's favorite NYC food and drink spots are landing at LaGuardia

A local's guide to New York City

New York City (JFK)

John F. Kennedy International Airport, Terminal 4

5 a . m . –11 p . m . (Hours may change)

Sapphire Lounge by The Club with Etihad Airways

John F. Kennedy International Airport, Terminal 4 post- security in the mezzanine on Level 4 located above gate A2

- Fresh, seasonal dining options, including halal food offerings

- Local coffee from Joe Coffee and a selection of teas

- Reflection rooms

Las Vegas (LAS)

Coming soon

Philadelphia (PHL)

Phoenix (PHX)

San Diego (SAN)

Access even more airport experiences.

Sapphire Terrace at Austin (AUS)

Enjoy convenient grab-and-go bites, local beverages, games, and indoor and outdoor seating on the Sapphire Terrace at Austin-Bergstrom International Airport (AUS). Sapphire Reserve cardmembers are invited to show their card to enter with up to two guests.

1,300+ Priority Pass lounges

Enroll in your complimentary Priority Pass TM Select membership to visit over 1,300 Priority Pass airport lounges, plus every Sapphire Lounge by The Club. Once enrolled, find your Priority Pass Digital Membership Card in the Chase Mobile ® app: Go to Benefits > Travel > Explore Lounges. Then save your card to your mobile wallet and show for entry.

The Etihad Lounge at Dulles Airport (IAD)

Sapphire Reserve cardmembers can now access The Etihad Lounge at Washington Dulles International Airport in Washington, D.C. To enter, show your activated Priority Pass membership and valid boarding pass. Make sure you've activated your complimentary Priority Pass Select membership before you visit.

Frequently Asked Questions

Access policy, which chase customers have complimentary access to sapphire lounge by the club.

Chase Sapphire Reserve, J.P. Morgan Reserve and The Ritz-Carlton TM Credit Card primary cardmembers and authorized users have lounge access with their complimentary Priority Pass TM membership.

Sapphire Reserve and J.P. Morgan Reserve cardmembers may bring up to two guests, per visit, for free, and additional guests for $27. There's no additional charge for children under two. Ritz-Carlton cardmembers may bring unlimited guests at no charge.

How can I access Sapphire Lounge by The Club if I don't have a Sapphire Reserve, J.P. Morgan Reserve or The Ritz-Carlton Credit Card?

If you don't have one of these Chase-issued credit cards but you have a Priority Pass membership, you receive one complimentary visit to a Sapphire Lounge by The Club per calendar year. (At the Sapphire Lounge at Hong Kong International Airport, Priority Pass members have unlimited access.) To enter a Sapphire Lounge, show your Priority Pass membership card and valid boarding pass within three hours of your departing flight.

For additional information, see the lounge location listings or FAQs on the Priority Pass website.

I'm a Sapphire Preferred cardmember. Can I access Sapphire Lounge by The Club?

No, complimentary lounge access is not a benefit for Chase Sapphire Preferred. If you would like to upgrade to Sapphire Reserve, call the number on the back of your card. Learn more about the Sapphire Reserve card here .

For additional questions regarding your Priority Pass membership, please visit the Priority Pass website for more information.

Requirements to enter

How do chase sapphire reserve, j.p. morgan reserve and the ritz-carlton credit card cardmembers access sapphire lounge by the club.

Cardmembers can access the Sapphire Lounge by showing the physical or digital membership card that comes with their complimentary Priority Pass Select membership with their Chase card and a valid boarding pass within three hours of their departing flight.

Chase Sapphire Reserve cardmembers must activate their Priority Pass membership before visiting the lounge by signing in to their Sapphire Reserve account at chase.com/MyCardBenefits or by calling the number on the back of their card. J.P. Morgan Reserve and Ritz-Carlton cardmembers are automatically enrolled in their Priority Pass membership.

Your Priority Pass Digital Membership Card can be found in the Chase Mobile ® app in Benefits > Travel > Explore Lounges. You can save your card to your mobile wallet for easier access.

Please visit Priority Pass for full details on Sapphire Lounge location listings and FAQs .

Locations and amenities

Where can i find a sapphire lounge by the club.

To see the locations of Sapphire Lounge by The Club, return to this page. Sapphire Reserve, J.P. Morgan Reserve and Ritz-Carlton cardmembers can also search for lounges in the Chase Mobile ® app in Benefits > Travel > Explore Lounges. Priority Pass members who are non-Chase cardmembers can search on the Priority Pass app or website for lounges and details .

What amenities and features can I find in Sapphire Lounge by The Club?

At Sapphire Lounge by The Club, you'll find thoughtfully crafted spaces and amenities designed to reflect the character and energy of its host city. In every lounge you'll be able to enjoy self-serve and made-to-order food options, signature cocktails and local beverage options, comfortable seating designed for working or relaxing, as well as a digital platform for ordering food and beverage, digital media and booking amenities if available. Select lounges may also include wellness offerings.

All amenities and features of the lounge are included with entry. There are no additional fees once you're in the lounge. The Reserve Suites are bookable for a fee.

What do The Reserve Suites by Chase at LGA include?

The Reserve Suites by Chase are located in the Sapphire Lounge by The Club at LGA and can be reserved for a fee by Sapphire Reserve and J.P. Morgan Reserve cardmembers at least 72 hours prior to your flight departure. Find details on the Chase Mobile ® app in Benefits & Travel. Your Reserve Suite reservation includes a dedicated host, signature caviar service on arrival, exclusive menus from Jeffrey's Grocery, special selection of wine from Parcelle, in-suite entertainment, including TV and speaker, private bathrooms with spa showers, as well as everything included in the Sapphire Lounge at LGA. The Reserve Suites are limited and subject to availability.

What is the Chase Sapphire Terrace at AUS? How do I get in and what is included?

The Chase Sapphire Terrace at Austin-Bergstrom International Airport is an indoor and outdoor experience located on the mezzanine level of the Barbara Jordan Terminal. Sapphire Reserve and J.P. Morgan Reserve cardmembers can enter with up to two guests by showing their Reserve credit card, government issued ID and eligible boarding pass within three hours of their departing flight. Visitors can enjoy grab-and-go bites, local beverages, games and indoor and outdoor seating on the terrace, included with entry. To learn more, visit chase.com/sapphireterraceaus .

There’s so much more for you

Sapphire Reserve Offers

See a summary of benefits, offers and experiences for Sapphire Reserve cardmembers.

Reserved by Sapphire SM

Your Sapphire Reserve card opens new doors to more flavors, sights and sounds. Explore the extraordinary lineup of experiences—including culinary, sports, music and entertainment.

Refer-A-Friend

Earn up to 50,000 Bonus Points per year by referring friends to the Sapphire Reserve card.

Are you ready for your next trip?

Find inspiration for new destinations and book your next getaway through Chase Travel.

Not a Sapphire Reserve cardmember yet?

We’re glad you’re here. Learn more about getting a Sapphire Reserve card.

Es posible que esta comunicación contenga información acerca de usted o su cuenta. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

© 2024 JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. Member FDIC

Washington Dulles International Airport, Concourse A, adjacent to Gate A14

6 a . m . –10 p . m . daily (Hours may change)

- Craft cocktails with curated wine list

- Local coffee from Commonwealth Joe Coffee Roasters and a selection of teas

- Private bathrooms and spa shower

- Reflection room

- Digital experience to enhance your stay

How to Transfer Chase Ultimate Rewards Points – Maximize Value with the Right Transfer Partner

Vault’s viewpoint.

- Transferring Chase points and redeeming them for luxury travel is one of the best ways to maximize their value.

- Newsweek values Chase points between 1-1.62 cents each, though transferring them can unlock additional value.

- Chase points transfer to most programs instantly, though a few exceptions can take longer.

Value of Chase Points

Chase points are worth 1-1.62 cents each, depending on how you use them and which credit card you have. If you have a Chase Sapphire Reserve® , your points are worth 1.5 cents each when used for bookings redeemed through Chase Travel. If you have a Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card , your points are worth 1.25 cents each.

Chase points are worth 1 cent each redeemed for cash back, gift cards or merchandise. However, the best way to get more value from your points is by transferring them to one of Chase’s 14 airline and hotel loyalty partners . Regardless of which Ultimate Rewards-earning card you have, all transfers are 1:1. By transferring points to some of these programs and redeeming them for premium travel, you can get 1.62 cents or more in value per point according to our Newsweek valuation.

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- IHG One Rewards

- JetBlue TrueBlue

- Marriott Bonvoy

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

How to Transfer Chase Ultimate Rewards Points: Step-by-Step

Transferring your Chase points to an airline or hotel loyalty program is pretty straightforward. You’ll need to have your loyalty program membership number handy. If you don’t have one yet, you’ll need to create one. Keep in mind that transfers to newly created accounts can take a little longer than usual. I learned this fact the hard way when my sister tried transferring Chase points to a newly created United MileagePlus account. It took days for the points to land, delaying our trip plans and creating extra hassle. Be mindful of this possibility and plan accordingly.

Without further ado, here’s a step-by-step look at how the Chase transfer points process works:

Step 1: Log into your Chase Ultimate Rewards account . Under the “Travel” tab, select “Transfer points to partners.”

Step 2: Select the program you want to transfer points to. Review the (then current) terms, scroll down to the bottom of the page and select “Transfer points.”

Step 3: Provide your loyalty account number, then hit “next.”

Step 4: Enter the number of Ultimate Rewards points you want to transfer, then hit “next.” Points must be transferred in 1,000-point increments.

Step 5: Confirm transfer details and submit your request.

After following these steps, you should log in to your loyalty program account and confirm that the points have indeed been transferred. Transfers can take longer to some programs, especially if you’re transferring them for the first time or it’s a new account. Transfers to Marriott Bonvoy can take up to 39 hours, so you’ll want to have a backup plan and avoid booking those awards too close to departure.

Should You Transfer Your Chase Points?

Transferring your Chase points can be an excellent way to redeem them for maximum value. Chase has 14 transfer partners, consisting of eleven airlines and three hotel loyalty programs. Points transfer 1:1 and sometimes Chase even offers bonus points when you transfer to specific programs. Offers like these can help you stretch your Chase points even further.

One of the best ways to redeem Chase points is by transferring them to airlines and hotels for luxury travel experiences. You can get well over 2 cents in value out of each point, making transfers an exceptional way to use these rewards. However, before transferring your Chase points, you should consider the following:

Compare Loyalty Program Rates Against Chase Travel

The Chase Travel portal allows you to redeem points towards the cost of flights, hotels, activities and even cruises. If you have a Chase Sapphire Reserve, your points are worth 1.5 cents each, while the Chase Sapphire Preferred gets 1.25 cents per point. Before transferring your points to one of Chase’s 14 loyalty partners, it’s worth comparing rates on the Chase Travel portal. You might end up redeeming fewer points through Chase Travel, especially during off-peak periods.

For example, hotel rates in New York City are notoriously low in January. Looking at point rates for the first week of January 2025, I found the Dream Midtown for 21,000 Hyatt points per night. Meanwhile, the same room costs $174 on the Chase Travel portal. Since I have a Sapphire Reserve card, I can book this hotel through Chase for just 11,585 points. This example shows how booking through Chase will save almost 10,000 points over transferring points to Hyatt. So, it’s important to compare rates against Chase Travel before transferring them.

Evaluate the Best Transfer Partners

Chase has numerous airline transfer partners, some of whom are in the same alliance. Sometimes, booking with Singapore Airlines Krisflyer miles requires fewer points than using United MileagePlus for the same flight. Whether you’re looking for alliance-specific flights or not, it’s essential to compare award redemption rates among Chase airline partners before transferring your points to any one program. Doing so ensures you’re getting the best deal possible.

Consider Transfer Bonuses

This idea is on par with choosing the best transfer partners: Sometimes, Chase offers bonus points when you transfer Ultimate Rewards points to a specific loyalty program. This option can significantly reduce the cost of your award ticket, saving you both points and cash. You can check current transfer bonuses by navigating to the transfer partner page in your Ultimate Rewards account. You’ll see the transfer bonus amount and the promotion end date if a promotion is ongoing.

For example, Chase offers a 25% bonus when you transfer points to Air France and KLM’s joint Flying Blue program. This promotion ends on April 30, 2024. If you have upcoming travel plans involving Flying Blue, this transfer promotion can be a great way to redeem your Chase Ultimate Rewards points.

Be Mindful of Transfer Times

While Chase points transfer instantly to most programs, Chase provides a disclaimer stating it can take up to seven days. Some exceptions can also impact your travel plans. For example, point transfers to Marriott Bonvoy can take up to 39 hours, which can impede your ability to secure award space if the hotel and dates are popular. While points transfer almost instantly to most airlines, first-time transfers can take longer.

The first time I transferred Chase points to United , it took almost two days to clear. The award I wanted to book was gone by the time the points landed in my account, making me wish I’d just redeemed points at 1.5 cents each towards a flight booked on Chase Travel. One workaround is to put award tickets on hold whenever possible. But if you’re booking travel close to departure, it’s best to have a backup plan and perhaps reconsider transferring points in case processing takes longer than expected.

Related Articles

- How To Choose a Credit Card

- How Many Credit Cards Should I Have?

- Best Credit Cards

Frequently Asked Questions

How do i combine chase points from different cards.

You can combine Chase points from different cards by logging into your Chase Ultimate Rewards account and selecting “combine points” under the “Rewards Details” tab. From there, you can choose the cards you want to transfer points between.

Is It Better To Transfer Chase Points to Airlines?

It’s better to transfer Chase points to airlines if you want to save money on flights, especially for business and first-class tickets. However, you can also get good value by transferring Chase points to hotel loyalty programs like World of Hyatt, IHG One and Marriott Bonvoy.

How Do I Transfer Chase Points to Another Family Member?

You can transfer Chase points to another family member if they’re a member of your household and an authorized user . You can transfer points to qualifying accounts by logging into your Ultimate Rewards account and navigating to the “Rewards Details” tab and selecting “combine points.”

The post How to Transfer Chase Ultimate Rewards Points – Maximize Value with the Right Transfer Partner first appeared on Newsweek Vault .

Chase Sapphire Reserve ® Credit Card

New cardmember offer, 60,000 bonus points, at a glance, exceptional travel rewards and benefits.

Travel Credit Card Rewards & Benefits

after you spend $4,000 on purchases in the first 3 months from account opening. * Opens offer details overlay That's $900 toward travel when you redeem through Chase Travel SM .

This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.

$1,000 in additional partnership benefit value

Take advantage of over $1,000 in partner value Opens overlay. with Sapphire Reserve. * Opens offer details overlay

$300 Annual Travel Credit

Take advantage of the most flexible travel credit available Opens overlay. by receiving up to $300 in statement credit reimbursements each anniversary year for more of your travel purchases than any other card. * Opens offer details overlay

More ways to earn

Earn 5x total points on flights when you purchase travel through Chase Travel after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Earn 10x total points on hotels (excluding The Edit SM ) and car rentals when you purchase travel through Chase after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Earn 3x points on dining at restaurants, including eligible delivery services, takeout, and dining out. Plus earn 3x points on other travel worldwide after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Earn 10x total points on Chase Dining purchases with Ultimate Rewards ® . * Opens offer details overlay

Get 50% more value when you redeem for travel through Chase. For example, 60,000 points are worth $900 toward travel. * Opens offer details overlay Plus, ultimate rewards points do not expire as long as the account is open. * Opens offer details overlay

Complimentary Airport Lounge Access

Complimentary access to 1,300+ airport lounges worldwide with up to two guests, plus every Chase Sapphire Lounge by The Club location, after an easy one-time enrollment in Priority Pass ™ Select. * Opens offer details overlay

Global Entry or TSA PreCheck ® or NEXUS Fee Credit

Receive one statement credit of up to $100 every four years as reimbursement for the application fee charged to your card. * Opens offer details overlay

Explore Additional Benefits

Refer Friends

if you already have either Chase Sapphire ® Credit Card!

Earn up to 75K bonus points per year

Click the button below to start referring.

Cardmember Reviews

This card has been fantastic. The sign up bonus was amazing. Great value added.

Amazing Travel Card

I am obsessed with this card. The points are so easy to earn and so easy to redeem. I love how easy it is to transfer to travel partners, and so many of them! As a military family, we have used the travel protection when we get surprise orders after booking a trip. Keep up the great work, Chase!

Awesome Travel Credit Card

I travel every week for business and several times a year for family vacation. No card has the benefits or service or reward points that the Chase Sapphire Reserve card offers. If you travel, you must have this card in your wallet. It's a must have. Thank you to the Chase Team for offering such an amazing travel card...

Browse credit cards by category

Your points get you more, turn points into travel experiences and so much more, 50% more in travel redemption.

Get 50% more value when you redeem for travel through Chase Travel. For example, 60,000 points are worth $900 toward travel. * Opens offer details overlay

No Blackout Dates or Travel Restrictions

As long as there's a seat on the flight or room at the hotel, you can book it through Chase Travel.

1:1 Point Transfer

Transfer your points to leading airline and hotel loyalty programs at 1 to 1 value. That means 1,000 Chase Ultimate Rewards points equal 1,000 partner miles/points.

Ultimate Rewards Points Do Not Expire

Ultimate Rewards points do not expire as long as the account is open.

No foreign transaction fees

You will pay no foreign transaction fees when you use your card for purchases made outside the United States. † Opens pricing and terms in new window For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Elevate your travels from door to door

Automatically receive up to $300 in statement credits as reimbursement for travel purchases charged to your card each account anniversary year. * Opens offer details overlay

The Edit SM

Book through The Edit SM and discover a curated collection of inspired stays with cardmember benefits including daily breakfast for two, a $100 property credit, room upgrades (upon availability) and more. * Opens offer details overlay

Reserved by Sapphire

Explore the extraordinary lineup of experiences * Opens offer details overlay —including culinary, sports, music and entertainment.

Your Sapphire Reserve Visa Infinite card unlocks special car rental benefits

Enjoy VIP amenities, complimentary status upgrades, and discounts with Avis ® , Hertz ® , National ® and Audi On Demand when you book with your Sapphire Reserve Visa Infinite card. * Opens offer details overlay

Travel protection

The most comprehensive suite of travel benefits, auto rental collision damage waiver.

Decline the rental company's collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad. ^ Same page link to disclaimer

Trip Cancellation / Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and 20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels. ^ Same page link to disclaimer

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket. ^ Same page link to disclaimer

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000. ^ Same page link to disclaimer

Travel and Emergency Assistance Services

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel emergency assistance. (You will be responsible for the cost of any goods or services obtained.) ^ Same page link to disclaimer

Lost Luggage Reimbursement

If you or an immediate family member check or carry-on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger. ^ Same page link to disclaimer

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days. ^ Same page link to disclaimer

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000. ^ Same page link to disclaimer

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year. ^ Same page link to disclaimer

Emergency Medical and Dental Benefit

If you're 100 miles or more from home on a trip, you can be reimbursed up to $2,500 for medical expenses if you or your immediate family member become sick or injured. ^ Same page link to disclaimer

^ Same page link to disclaimer reference These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

Partner benefits

Earn more points.

Earn 10x total points on Lyft rides. * Opens offer details overlay Plus, get a complimentary 2 year Lyft Pink All Access membership including member-exclusive pricing and benefits – activate by Dec 31, 2024. Membership auto renews annually. * Opens offer details overlay

Earn 10x total points on Peloton equipment and accessory purchases over $150 with a max earn of 50,000 total points now through March 31, 2025. * Opens offer details overlay

DashPass subscription

Get complimentary access to DashPass – a membership for both DoorDash and Caviar – which unlocks $0 delivery fees and lower service fees on eligible orders for a minimum of one year when you activate by December 31, 2024. * Opens offer details overlay With DashPass you also get $5 in DoorDash credits each month, redeemed at checkout. * Opens offer details overlay

Instacart benefit * Opens offer details overlay

Skip the trip and have your groceries delivered to your doorstep with 1 year of complimentary Instacart+. * Opens offer details overlay Plus, Instacart+ members earn up to $15 in statement credits each month through July 2024. Membership auto-renews. * Opens offer details overlay

Purchase coverage

Purchase protection.

Your new purchases will be covered for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. ^ Same page link to disclaimer

Return Protection

You can be reimbursed for eligible items that the store won't take back within 90 days of purchase, up to $500 per item, $1,000 per year. ^ Same page link to disclaimer

Chip-enabled for enhanced security

You’ll carry a credit card with an embedded chip that provides enhanced security and wider acceptance when you make purchases at chip-enabled card readers in the U.S. and abroad.

24/7 Fraud Monitoring

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. * Opens offer details overlay

Zero liability protection

You won’t be held responsible for unauthorized charges made with your card for account information. If you see an unauthorized charge, simply call the number on the back of your card. * Opens offer details overlay

Extended warranty protection

Extends the time period of U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less. ^ Same page link to disclaimer

Chase Pay Over Time SM

Chase Pay Over Time * Opens offer details overlay lets eligible Chase customers break up credit card purchases into budget friendly payments. There are two potential ways to pay over time:

After purchase: Pay off an eligible purchase you've already made of $100 or more * Opens offer details overlay in smaller, equal monthly payments. No interest - just a fixed monthly fee † Opens pricing and terms in new window with plan durations that range from 3-24 months. Start a plan by selecting an eligible purchase with the "Pay Over Time" option next to the transaction amount in your credit card account activity.

At checkout: Chase credit card members may have the option to create a payment plan at checkout on Amazon.com. Orders totaling $50 or more * Opens offer details overlay using your eligible Chase credit card at Amazon.com could be eligible for Chase Pay Over Time. You will be able to view Chase Pay Over Time plan options (including the fixed APR and durations) at checkout.

Keep in mind: Even though you may have an eligible card, access to Chase Pay Over Time is not guaranteed. Your ability to create a Chase Pay Over Time plan is based on a variety of factors, such as your creditworthiness, credit limit and account behavior, and may change from time to time.

For more information on Chase Pay Over Time features, please visit chase.com/chasepayovertime Opens in a new window .

Apply for a card, use it the same day

Receive instant access to your card by adding it to a digital wallet, like Apple Pay ® , Google Pay ™ or Samsung Pay. Find out how at chase.com/digital/spend-instantly Opens in a new window .

$300 Travel Credit

Merchants in this category include airlines, hotels, motels, timeshares, car rentals agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages. Some merchants that provide transportation and travel-related services are not included in this category; for example, real estate agents, educational merchants arranging travel, in-flight goods and services, on-board cruise line goods and services, sightseeing activities, excursions, tourist attractions, RV and boat rentals, merchants within hotels and airports, public campgrounds and merchants that rent vehicles for the purpose of hauling. Purchases from gift card merchants or merchants that sell points or miles will not qualify in the travel category. * Opens offer details overlay

Reserve Partner Value Modal

Lyft Pink Membership

Get 2 complimentary years of Lyft Pink All Access when activated by Dec. 31, 2024 —a value of $199 /year. This includes 10% off Lux rides, free Priority Pickup upgrades discounts on bikeshare and more. Membership auto-renews. * Opens offer details overlay You'll also earn 10x total points on Lyft rides through March 2025. * Opens offer details overlay

DoorDash DashPass Subscription

Get a complimentary access to DashPass - a membership for both DoorDash and Caviar —a value of $120 for 12 months - which unlocks $0 delivery fees and lower service fees on eligible orders for a minimum of 12 months when you activate by Dec 31, 2024. * Opens offer details overlay

Monthly DoorDash Credit

Get $5 in DoorDash credits each month through Dec 31, 2024, redeemed at checkout. * Opens offer details overlay

Instacart Membership

Skip the trip and have your groceries delivered to your doorstep with 1 year of complimentary Instacart+ —a value of $99 /year. Activate by July 31, 2024. Membership auto-renews. * Opens offer details overlay

Monthly Instacart Credit

Instacart+ members earn up to $15 in statement credits each month through July 2024. * Opens offer details overlay

Priority Pass Select Membership

Enjoy a complimentary Priority Pass Select membership at 1,300+ VIP airport lounges worldwide —a value of $469 /year. * Opens offer details overlay

10x on Peloton Purchases

Earn 10x total points on Peloton equipment and accessory purchases over $150 through March 31, 2025. * Opens offer details overlay That's $150 when you purchase a Peloton Bike and redeem for cash.

DoorDash Dashpass Subscription

Get complimentary access to DashPass – a membership for both DoorDash and Caviar —a value of $96/year - which unlocks $0 delivery fees and lower service fees on eligible orders for a minimum of one year when you activate by Dec 31, 2024. * Opens offer details overlay

Skip the trip and have your groceries delivered to your doorstep with 6 months of complimentary Instacart+ —a value of $60 value . Activate by July 31, 2024. Membership auto-renews. * Opens offer details overlay

Quarterly Instacart Credit

Sapphire Preferred Instacart+ members earn up to $15 in statement credits each quarter through July 2024. * Opens offer details overlay

5x on Peloton Purchases

Earn 5x total points on Peloton equipment and accessory purchases over $150 through March 31, 2025. That's $75 when you purchase a Peloton Bike and redeem for cash. * Opens offer details overlay

5x total points on Lyft

Earn 5x total points on Lyft rides through March 31, 2025. That's 3x points in addition to the 2x points you already earn on travel. * Opens offer details overlay

Offer Details

Offers may vary depending on where you apply, for example online or in a branch, and can change over time. to take advantage of this particular offer now, apply through the method provided in this advertisement. review offer details before you apply..

60,000 Bonus Points After You Spend $4,000 On Purchases In The First 3 Months From Account Opening: The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months. If you are an existing Sapphire customer and would like this product, please call the number on the back of your card to see if you are eligible for a product change. You will not receive the new cardmember bonus if you change products. To qualify and receive your bonus, you must make Purchases totaling $4,000 or more during the first 3 months from account opening. ("Purchases" do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

$300 Annual Travel Credit: A statement credit will automatically be applied to your account when your card is used for purchases in the travel category, up to an annual maximum accumulation of $300. Annual means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. (For applications submitted before May 21, 2017, annual means the year beginning with your account open date through the first December statement date of that same year, and the 12 billing cycles starting after your December statement date through the following December statement date each year.) Call the number on the back of your card to see when you are eligible for your next $300 Annual Travel Credit. Purchases are when you, or an authorized user, use a card to make purchases of products and services. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count: balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. We do not determine whether merchants correctly identify and bill transactions as being of a certain type. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs Opens in a new window . Statement credit(s) will post to your account the same day your travel category purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. The Annual Travel Credit will be issued for the year in which the transaction posts to your account. For example, if you pay for baggage fees, but the airline does not post the transaction until after the current annual period ends, the cost of the baggage fees will be allocated towards the following year's Annual Travel Credit maximum of $300.

Earning Points: Rewards Program Agreement: For more information about the Chase Sapphire Reserve rewards program, view the latest Rewards Program Agreement (PDF) Opens in a new window . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com/ultimaterewards Opens in a new window . How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a Chase Sapphire Reserve credit card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count and won't earn points: any purchases that qualify for the $300 Annual Travel Credit, balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 3 points ("3X points") on travel purchases: You'll earn 3 points for each $1 spent on purchases made in the travel category after the $300 Annual Travel Credit is earned. 5 points ("5X points") on Chase Travel airline ticket purchases: You'll earn 5 points total for each $1 spent on airline ticket purchases made using your card through Chase Travel after the $300 Annual Travel Credit is earned in the travel category (2 additional points on top of the 3 points earned on each purchase in the travel category). 10 points ("10X points") on Chase Travel hotel accommodation and car rental purchases: You'll earn 10 points total for each $1 spent on qualifying hotel accommodation and car rental purchases made using your card through Chase Travel after the $300 Annual Travel Credit is earned in the travel category (7 additional points on top of the 3 points earned on each purchase in the travel category). Hotel accommodation purchases made using your card with The Edit (previously The Luxury Hotel & Resort Collection) will qualify to earn 3 points for each $1 spent in the travel category, but will not qualify to earn 7 additional points for each $1 spent. Any purchases that qualify for the $300 Annual Travel Credit, won't earn points. "$300 Annual Travel Credit" means the statement credit that is automatically applied to your account annually on purchases made using your card in the travel category, up to an annual maximum accumulation of $300. "Annually" means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. 10 total points ("10X points") on qualifying Lyft rides through 03/2025: You'll earn an additional 7 points for each $1 spent when your card is used for qualifying Lyft products and services purchased through the Lyft mobile application through 03/31/2025. Qualifying Lyft products and services include rides taken in Classic, Shared, Lux, or XL modes; bike and scooter rides; and subscription and membership products. Purchase of gift cards, car rentals, vehicle service centers, miscellaneous fees and other Lyft products and services are excluded from this promotion. Future Lyft products or services may not be eligible for additional points. You may see "10X" in marketing materials to refer to the 7 points in addition to the 3 points earned on travel purchases (see above). The additional 7 points will appear on your billing statement in a separate line from the 3 points. Lyft is not responsible for the provision of, or the failure to provide, Chase benefits or services. 3 points ("3X points") on dining at restaurants purchases: You'll earn 3 points for each $1 spent on purchases in the following rewards category: dining at restaurants including takeout and eligible delivery services. 10 points ("10X points") on Ultimate Rewards Chase Dining purchases: You'll earn 10 points for each $1 spent on Chase Dining purchases made using your card through the Ultimate Rewards program. 1 point ("1X points"): You'll earn 1 point for each $1 spent on all other purchases. How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third parties. Redemption values for reward options vary. Points expiration/losing points: Your points don't expire as long as your account remains open, however, you will immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs Opens in a new window .

The Edit: The Edit program benefits are available exclusively on select Chase credit cards. To receive benefits, reservations must be made for "The Edit" properties through Chase Travel. Benefits are per room and based on double occupancy. Benefits may be subject to availability at check-in and are not redeemable for cash. Benefits may not be combined with other offers, including tour operator or wholesaler rates and packages. Complimentary Wi-Fi benefit provided, with the exception of locations where Wi-Fi is already complimentary or not available. Program benefits and participating properties may change without notice. Visit www.theeditbychase.com to learn more, other terms may apply.

Priority Pass ™ Select Membership: One time activation required. Priority Pass Select membership includes access to airport lounges and select airport experiences participating in the Priority Pass Select network. There is no additional cost to activate your membership and certain terms, conditions and exclusions apply. Primary Cardmembers and Authorized Users are granted complimentary access to the Priority Pass lounges and are allowed a maximum of two accompanying guests each. For any additional guests, your card will be charged $27 per guest, per visit. Your card will be charged after you have signed for the additional guest visits in the participating lounge and the visits have been reported to Priority Pass. Access may be denied if the lounge is at capacity. Participating lounges are owned and operated by independent third parties and their participation and/or facilities may change. To access a lounge, member must show his/her valid Priority Pass Select membership card. Priority Pass Select membership is subject to the Priority Pass Select Terms and Conditions. Your Chase Sapphire Reserve account must be open and not in default to maintain membership. For complete Priority Pass Select Terms and Conditions and a listing of participating lounges and select airport experiences, please visit www.prioritypass.com/select .

Global Entry or TSA PreCheck ® or NEXUS Application Fee Statement Credit You will receive one statement credit (up to $100) every four years after the first program (either Global Entry or TSA PreCheck ® or NEXUS) application fee is charged to your Chase Sapphire Reserve card, by you or an authorized user. This benefit applies only to the Global Entry, TSA PreCheck ® or NEXUS programs, other Trusted Traveler programs are not eligible. The statement credit will appear on your credit card billing statement within 1-2 billing cycles. You are responsible for payment of all charges until the statement credit posts to the account. Chase has no control or liability regarding these programs including, but not limited to, applications, approval process or enrollment, or fees charged by CBP or TSA or DHS. For more information about the Global Entry, TSA PreCheck ® and NEXUS programs, including application details and full terms and conditions, go to https://ttp.cbp.dhs.gov/ . Websites and other information provided by government agencies are not within Chase's control and may not be available in Spanish. To receive statement credits, your account must be open and not in default at the time of fulfillment. TSA PreCheck ® is a registered trademark and is used with the permission of the U.S. Department of Homeland Security.

2-year complimentary Lyft Pink All Access membership: Your Chase Sapphire Reserve account will receive one complimentary Lyft Pink All Access membership for 2 consecutive years, a value of $199/year, when the membership is activated with a Chase Sapphire Reserve card by 11:59 PM Eastern Standard Time on 12/31/2024. After your complimentary 2-year period ends, you'll be automatically enrolled in an annual membership at 50% off the then current annual Lyft Pink All Access rate for one year. After the discounted year, you will continue to be enrolled and charged the then current annual Lyft Pink All Access rate, every year unless canceled. You can cancel auto-renewal anytime on the Lyft mobile application and continue to enjoy the benefits of your Lyft Pink All Access membership through the end of your complimentary or discounted membership term. Cardmembers who do not utilize any services associated with their membership during the last six (6) months of their complimentary membership term, will not be auto-renewed and will not be eligible for the Lyft Pink All Access discounted membership. Lyft Pink All Access will be registered in the name of the primary cardmember or an authorized user, whoever activates the benefit first. PayPal or digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Mobile applications, websites, and other information provided by Lyft are not within Chase's control and may or may not be available in Spanish. All Lyft products and services are subject to the Lyft Terms of Service and Lyft Pink Terms & Conditions. Chase is not responsible for the provision of, or the failure to provide, Lyft benefits and services. Your Chase Sapphire Reserve account must be open and not in default, and your Chase Sapphire Reserve card must be included as a payment method within the Lyft App to maintain complimentary two-year membership benefits and purchase the discounted membership in your third year.

Complimentary DashPass: You and your authorized user(s) will receive at least 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date, when the membership is activated with a Chase Sapphire Reserve card by 12/31/2024. Membership period for all users on this Chase Sapphire account will begin and end based on when the first user activates the membership on DoorDash or Caviar. The same login credentials must be used on DoorDash and Caviar in order for the DashPass benefit to be used on both applications. To receive the membership benefits, the primary cardmember and authorized user(s) must first add their Chase Sapphire card as a default payment method on DoorDash or Caviar, and then click the activation button. Once enrolled in DashPass, you must use your Chase Sapphire card for payment at checkout for DashPass-eligible orders to receive DashPass benefits. Benefits of DashPass include no delivery fee on orders above the minimum subtotal (as stated in the DoorDash and Caviar apps and sites) from DashPass eligible merchants (amounts subject to change). However, other fees (including service fee), taxes, and gratuity on orders may still apply. Current value of the DashPass membership is as of 04/01/2022. DashPass orders are subject to delivery driver and geographic availability. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Mobile applications, websites and other information provided by DoorDash or Caviar are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, DoorDash or Caviar benefits and services. If you product change to another Chase credit card eligible for a DashPass membership during the promotional period, your DashPass benefits may change. You may experience a delay in updating your applicable DashPass benefits on DoorDash or Caviar; please note, once you product trade, the benefits from your previous credit card are no longer available for your use. You can only access the benefits available with your current credit card. Your Chase Sapphire account must be open and not in default to maintain membership benefits. See full DoorDash terms and conditions at: https://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US .

Earn $5 monthly DoorDash/Caviar Credits through 12/31/2024: Get $5 in DoorDash/Caviar credits each calendar month while enrolled in DashPass through 12/31/2024. When applied to an order, the $5 credit will apply only to the subtotal of your DoorDash or Caviar order at checkout. The credit does not apply to fees, taxes, or tip and gift card purchases are excluded. You or up to 7 authorized users must be enrolled in DashPass and use your Chase Sapphire Reserve or J.P. Morgan Reserve card for payment at checkout to receive the credit. Once you spend the issued credits on one platform (e.g., DoorDash), it will be automatically deducted from your balance on the other (e.g., Caviar). Any monthly credit issued before you create an account on the other platform will only be available on the original platform for that month. Once you have accounts opened on both platforms, any credits issued will be available for onetime use on either DoorDash or Caviar. Your credit balance may be different on each platform, but your credit usage will still be linked from that point on. If a credit is not used within the calendar month, it will be carried over for a maximum of 2 months. Up to $15 in credit can be accrued before a $5 credit expires. DoorDash credits have no cash value and are non-transferable. Chase is not responsible for the provision of, or the failure to provide, DoorDash benefits and services. Credit card product changes during the promotional period will forfeit this offer. Additional DoorDash promotional terms and conditions available at: https://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US . All deliveries subject to availability. Must have or create a valid DoorDash account. Qualifying orders containing alcohol will be charged a $0.01 Delivery Fee. No cash value. Non-transferable. See full terms and conditions at: help.doordash.com/consumers/s/article/offer-terms-conditions .

Complimentary Instacart+ Membership: You will receive one complimentary Instacart+ membership per eligible card account for 12 months (for Chase Sapphire Reserve and J.P. Morgan Reserve cardmembers) when the membership is activated on http://www.instacart.com/chase with an eligible card between 6/15/2022 and 7/31/2024. ("You" and "your" mean you as the primary cardmember or any authorized user, depending on which user activates first). This offer is non-transferrable. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Benefits of Instacart's membership include no delivery fee on orders that total over $35 (amount subject to change – see Instacart.com for current minimum); however, other fees, taxes, and/or tips may apply. Delivery subject to availability. If you do not currently have a paid or trial Instacart+ membership, by activating your Instacart+ membership, you agree to the Instacart+ Terms and you agree that after the complimentary Instacart+ membership period ends, you will be automatically enrolled in an annual Instacart+ membership and billed at $99/year or the then current annual Instacart+ membership rate for each membership activated, unless you have not placed any orders or you cancel during your complimentary Instacart+ membership period. If you currently have a paid or trial Instacart+ membership, you agree that your existing membership will be paused for the duration of this benefit and resume upon expiration. Your existing membership will automatically renew based on the Instacart+ Terms previously agreed upon unless you cancel. Your membership fees will be billed to any active payment method on file until you cancel. You can cancel your Instacart+ membership prior to the end of your complimentary Instacart+ membership period or at any time thereafter by selecting "Cancel Membership" in your Account Settings. Cancellation goes into effect during the next billing cycle. You may cancel within the first 15 calendar days of your paid Instacart+ membership and receive a refund of the Instacart+ membership fee you paid, but only if you have not placed any orders using your Instacart+ membership. If you change to another Chase credit card during the promotional period, your benefits may change. Mobile applications, websites and other information provided by Instacart are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Your complimentary membership benefits may be removed if your eligible credit card account is closed or in default.