Bankwest credit card complimentary travel insurance

Eligible bankwest platinum and world mastercard credit cards offer overseas travel insurance, cover for eligible trips in australia and other types of insurance. here's what you can get..

- Credit cards

- Frequent flyer

- Credit score

- Money management

- Sustainability

In this guide

Which Bankwest credit cards have complimentary travel insurance?

How to get cover with bankwest credit card international travel insurance, what's covered by bankwest credit card overseas travel insurance, what's not covered, existing medical conditions, how to make a claim through your bankwest credit card complimentary international travel insurance policy, other types of bankwest complimentary credit card travel insurance, bankwest credit card complimentary insurance for shopping, frequently asked questions, what you need to know:.

- Bankwest credit cards offer comprehensive international travel insurance for trips of up to 31 days with an eligible Platinum card and up to 6 months with a World Mastercard.

- You don't need to activate this insurance or apply to get cover for an overseas trip - coverage is automatic once you meet eligibility and the terms and conditions.

- You can pay a premium to extend your cover and/or get more cover for issues including cancellation, rental vehicle excess insurance and existing medical conditions.

- Your spouse and dependants travelling with you can also get cover, but there are some requirements and exclusions .

Have a question or need to make a claim right now? Call insurance provider Cover-More on 1300 468 340 (from Australia) or +61 2 8907 5061 (from overseas).

- Have an active, eligible Bankwest credit card in your name at the time of the incident (e.g. when you're overseas and need to make a claim).

- Make sure you'll be under 80 years of age when you start your overseas trip and/or when you get a Certificate of Insurance.

- Travel overseas from Australia.

- Bankwest Platinum Cards: Up to 31 days in a row for included cover and up to 3 months for upgraded cover.

- Bankwest More World Mastercard credit cards: Up to 6 months in a row for included cover and up to 12 months for upgraded cover.

- Optional: Request and pay the premium if you want to extend the length of the cover or if you have a platinum card and want access to upgraded cover benefits including cancellations, car rental excess cover and baggage delays.

The cover is automatically available to you and eligible family members when you meet these requirements. If you need further details or want confirmation of cover, go to the insurance section of the Bankwest app or call Cover-More on 1300 468 340.

Here, we've broken down the key options for different types of claims and situations. But remember: you should always read the insurance policy booklet for complete details of the cover.

Included complimentary overseas travel insurance for eligible Platinum and World Mastercard credit cards

More cover and upgraded benefits for overseas travel insurance.

If you have an eligible Bankwest Platinum credit card, you can pay a premium to upgrade your cover and get the benefits in this table.

Bankwest World Mastercard credit cards automatically include most of these benefits, so you would only need to pay a premium for an additional period of cover or to cover an existing medical condition.

Want to upgrade your policy? Call Cover-More on 1300 468 340 or request upgraded cover through the Bankwest app or website.

Some of the key things you won't be covered for with Bankwest credit card complimentary international travel insurance include:

- Epidemics and pandemics (except for claims related to COVID-19 in specific situations)

- If you don't follow the advice of a government or another official source (e.g. Do Not Travel warnings)

- If the issue is the result of substance abuse or non-prescription drugs

- Claims relating to elective medical, dental or cosmetic procedures you have when you're overseas (includes getting new tattoos and piercings)

- Dangerous activities including rock climbing (with equipment), white water rafting, bungy jumping, off-piste snowboarding or skiing and quad or motorbike riding on a vehicle that has an engine capacity of 200cc or more

Does Bankwest complimentary credit card travel insurance have coronavirus cover?

Yes, this policy offers cover for overseas emergency medical and hospital expenses if you are positively diagnosed with COVID-19 during your trip. But you won't get cover if you were diagnosed while on a multi-night cruise, or for other claims (such as cancellation costs)..

⚠️ Remember: Check the Bankwest credit card insurance booklet or call Cover-More on 1300 468 340 for more details about exclusions or COVID-19 cover.

If you need cover for a skiing trip, bungy jumping or other overseas adventures, check out adventure sport travel insurance costs and conditions.

This complimentary overseas travel insurance automatically covers a limited number of existing medical conditions when you meet the requirements. For any existing medical condition to be covered, you must:

- Be under 79 years of age

- Have not been hospitalised in the past 12 months for that condition

- Have not had surgery involving joints, your back, spine, brain or abdomen if it required at least an overnight stay in hospital for the condition

Some existing medical conditions also have more specific requirements, including:

⚠️ Keep in mind: Every travel insurance policy has its own definition and requirements for existing medical conditions (also referred to as pre-existing conditions). For Bankwest credit cards, check the insurance booklet or call Cover-More on 1300 468 340.

What if I don't meet the requirements or have another existing medical condition?

You can apply for existing medical condition cover through the Bankwest app or by calling Cover-More on 1300 468 340.

If your request for cover is approved, you'll need to pay a premium. The cost will be advised at the time you apply, and you'll then be issued with a certificate of cover.

Otherwise, you won't get cover for any pre-existing conditions that cause issues.

Got a pre-existing health condition that's not covered? Check out travel insurance policies that offer cover for conditions including allergies, epilepsy and physical disabilities.

If it's an emergency, call Cover-More on +61 2 8907 5061 from overseas or 1300 468 340 in Australia. Then, submit a claim as soon as possible by following these steps:

- Go to https://claims.covermore.com.au/BW/TravelClaims

- Select "Create a new claim".

- Fill in the details on the claim form and upload your supporting documents.

- Use the "Save" button if you need to come back to the claim later.

You can also start the claim process by logging in to your Bankwest account.

Cover-More will contact you within 30 working days of submitting a claim.

What to include in your claim

With insurance claims, include as many details as you can. This makes it easier for the insurer to look at the claim and your eligibility for a payout. Some examples include:

- A referral or letter from a doctor or other professional you see in relation to a claim

- Photo evidence

- Police reports

Tip: Use a travel wallet or create an online folder to keep all your important documents together. This could include your passport, itinerary, printed tickets, a copy of the Bankwest card insurance policy booklet – plus anything that could become supporting documentation for claims.

Transit accident insurance

- What is it? Cover for accidents that happen when you're boarding, leaving or travelling overseas on a plane, train, bus, ferry or other eligible vehicle.

- When can I use it? If you have paid for the entire trip with your eligible Bankwest credit card before you leave.

- Is there an excess cost? No.

Interstate flight inconvenience insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia. For example, cancelled return flights, flight delays of 4 hours or more and delayed or lost luggage.

- When can I use it? If you use your eligible Bankwest credit card to pay for the entire cost of your return interstate flight and are travelling for no more than 14 days in a row.

- Is there an excess cost? There is a $250 excess for claims relating to cancellation and lost or damaged personal goods.

How to make a claim under one of these policies

Call Cover-More on 1300 468 340 in Australia or +61 2 8907 5061 from overseas.

You can also download a claim form from https://claims.covermore.com.au/BW/TravelClaims , fill it out and email it to [email protected] or post it to the address listed in the insurance policy (page 26).

These Bankwest credit cards also give you access to other types of insurance for items you buy. Here's a basic explainer of each one:

- Purchase security insurance: Offers cover for up to 90 days when you buy an item with your eligible card and it's then stolen, accidentally damaged or lost. It covers household and personal items such as laptops, shoes, jewellery and glasses.

- Extended warranty insurance: Cover that doubles the manufacturer's warranty for items bought in Australia, up to a maximum period of 12 months.

- Price guarantee: If you buy something and then see it being sold for less somewhere else, you could claim the difference in price with this cover.

Don't have complimentary insurance on your credit card yet? Compare Suncorp credit cards or check out other cards that offer insurance .

Can I get proof of my cover?

Yes, if you get upgraded cover you'll be issued with a certificate of insurance. If you need proof of cover in other circumstances, call Cover-More on 1300 468 340. You won't generally receive a certificate of insurance, as cover is available automatically once you meet the conditions.

Does Bankwest credit card travel insurance cover family members?

Yes, if you meet the eligibility requirements for cover, your spouse and dependants (children) can get cover under this policy when they're travelling with you for the entire trip. Keep in mind that they also need to meet all the other conditions of the insurance policy (e.g. being under 80 years of age). They also need to be travelling on the same itinerary.

How do I activate or apply for my complimentary insurance?

You don't need to apply for cover, or tell Bankwest or the insurer that you will be travelling, as you're automatically covered for Complimentary Overseas Travel Insurance provided you're a cardholder and meet the eligibility, definitions, terms and conditions, exclusions and claims procedures contained in the PDS.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full bio

More guides on Finder

Earn reward points as you spend, plus benefit from complimentary overseas travel insurance and 10 yearly airport lounge visits with the Bankwest More World Mastercard.

Compare the features and costs of this card, including uncapped points for everyday spending, 0% foreign transaction fees on overseas and online purchases plus complimentary insurance covers.

This simple, low-cost card currently has a 0% p.a. balance transfer offer for 24 months. Check out its other features now.

Earn Qantas Points as you spend and pay no foreign transaction fees with the Bankwest Qantas Platinum Mastercard.

The Bankwest Breeze Platinum Mastercard offers 0% p.a. on balance transfers for 24 months, 0% foreign transaction fees and complimentary overseas travel insurance.

Earn points while paying a competitive annual fee of $100 with the Bankwest More Classic Mastercard.

Get complimentary overseas travel insurance, 0% foreign transaction fees and points per $1 spent on eligible purchases with the Bankwest More Platinum Mastercard.

The Bankwest Zero Platinum Mastercard has a $0 annual fee and 0% foreign transaction fees while boasting extras such as 0% purchase and balance transfer offers.

Compare the costs and features of the Bankwest Zero Classic Mastercard, including a balance transfer offer, a digital version of the card and Google Pay compatibility.

Ask a question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

135 Responses

My wife and I are booked on a domestic cruise starting from Fremantle and ending in Cairns in May (15 days) – 10 days on a P&O ship and 4 days in Cairns. How do we apply for the complementary travel insurance with Bankwest? I have read the online pamphlet and believe we meet the criteria. I have a Platinum debit card and we bank with Bankwest. Can you get back to me, either by phone (0431342559) or email. I have been waiting patiently for over 90 minutes to get through to your assistance officer without any luck. Than you.

You don’t have to tell Bankwest or us that you will be travelling as you’re automatically eligible for Complimentary Overseas Travel Insurance, provided you’re a cardholder and meet the eligibility, definitions, terms and conditions, exclusions and claims procedures contained in this booklet.

I’ve also reviewed the PDS, which states: “[Your] period of cover means the time when you are covered. It starts for Complimentary Overseas Travel Insurance – on a Gold Mastercard or Platinum Mastercard, at the commencement of the journey. On a World Mastercard, as follows: – Benefit 6: Cancellation Costs – from the time you pay the first prepaid travel cost for the journey that is the subject of this insurance – For the other benefits – at the commencement of the journey.

Your cover ends: At the earliest of the following times: i. At the end of the journey ii. the travel end date on your Certificate of Insurance iii. When we determine that you should return to Australia for treatment.

Hope this helps!

We are currently overseas and have complimentary travel insurance with our Bankwest Mastercard More card. We need to top this up as we have been out of the country for 5 and a half months and are not due back in australia until 19 November. How can i do this please? We are not able to call you.

Hi Georgie, You can contact the insurance provider, Cover-More on +61 2 8907 5061 to discuss the possibility of an extension on your cover when you’re already overseas. I hope this helps.

If I have a Platinum Mastercard credit card and the World Mastercard credit card, which credit card Travel Insurance will I get?

Hi Winnie, You would get more cover through a Bankwest World Mastercard and can check your cover details through the Bankwest app. If you have further questions, contact the insurance provider Cover-More on 1300 468 340. I hope this helps.

Am I covered if I should get covid before or during the holiday and have to change flights? (Within Australia)

Hi Nicky, There is some cover for COVID-19, including cancellation cover for World Mastercard cardholders and other eligible cardholders that pay for upgraded insurance cover or have paid for their return domestic flights and are eligible for interstate flight inconvenience insurance. But for a specific question such as this, you can call the insurance provider Cover-More on 1300 468 340 to check what cover could be available. I hope this helps.

My wife and me booked a cruse from Vancouver to Sydney. We put a deposite of $3400. My wife took ill we had to cancil losing our deposite Can we claim insurance for our loss.

Hi Ricardo,

You will need to contact BankWest directly with this enquiry, we are a review site and we’re not licenced to advise on personal situations.

Their insurance is underwritten by Cover-more. You can call Cover-More on 1300 568 340 within Australia or +61 2 8907 5061 from overseas.

Hope this helps.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Bankwest: travel insurance for a credit card

See the mastercard travel insurance program from bankwest.

Bankwest provides the automatic travel insurance cover for the cardholders of the following cards:

- Bankwest Platinum Mastercard – to 6 months trips

- Gold credit card – to 31 days

- World Mastercard – to 31 days

The travel insurance covers the cardholder and his children during a trip, and not living abroad.

The insurance cover includes:

- Abroad emergency medical assistance

- Abroad emergency hospital expenditures

- Baggage and personal goods

- Personal liability

- Accidental death

- Cancellation and additional expenditures for World Mastercard

If you have additional questions, you can dial 13-17-19.

You can also make Bankwest travel insurance claims on 1300-468-340.

- Bankwest: apply for a credit card

- Bankwest: cancel credit card

- Bankwest: change of name

- Bankwest: lost card, what should I do?

- How do I pay bills via BPAY in Bankwest?

- How do I use mobile pay in Bankwest?

- More rewards from Bankwest

- Rewards for the Bankwest Qantas transaction account

All Bankwest FAQ

Author: Prostobank Consulting

Updated: 01.09.2024

Popular Banks in Australia

Commonwealth Bank of Australia

Westpac Bank

Australia and New Zealand (ANZ)

National Australia Bank

Macquarie Bank

HSBC Bank Australia

Citibank Australia

Bank of Melbourne

Bendigo and Adelaide Bank

Suncorp Bank

Popular Banks FAQ

Commonwealth Bank

Bank of Queensland

Bank of Sydney

Beyond Bank Australia

St. George Bank

Note: Our company doesn’t provide financial services. If you have questions or comments about the webpage, read here .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Travel Insurance for Domestic Vacations Works

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

You’ve probably heard of travel insurance, which promises to cover you if things go awry during your vacation. This perhaps seems obvious when you’re traveling overseas, but unexpected travel disruptions can happen when you travel domestically, too.

Let’s look at travel insurance for domestic vacations, what it covers and credit cards that’ll cover you during your trip.

Types of travel insurance

There’s more than one kind of travel insurance, including health coverage, trip interruption and rental car insurance. Depending on how you’re traveling, you likely won’t need every type of insurance, but here are the kinds you can generally expect to see:

Trip interruption insurance. This insurance will reimburse you for expenses incurred during a delay or interruption while traveling.

Trip cancellation insurance. This type of insurance will refund your costs if your trip is canceled for a covered reason.

Lost luggage insurance. This insurance will reimburse you for the items you have to repurchase when your bags are lost.

Rental car insurance. This type of insurance protects you while you're using a rental car.

Health insurance. Travel health insurance can differ but may include emergency medical and standard care coverage.

Cancel for Any Reason insurance. As the name suggests, this insurance allows you to cancel for any reason and receive a refund.

Accidental death insurance.

Emergency evacuation insurance.

» Learn more: Common myths about travel insurance and what it covers

Can you buy domestic travel insurance?

So, is it possible to get travel insurance for a domestic U.S. trip? The short answer is: Yes, you can. The longer answer is: Yes, but not all types of coverage may be available to you, and you may need to meet certain requirements to qualify.

For example, the travel insurance offered by the Chase Sapphire Reserve® requires that you be at least 100 miles away from home before its emergency evacuation and transportation benefit kicks in. Your trip must also be at least five days long but no longer than 60 days total.

Meanwhile, some providers of travel health insurance indicate that their coverage doesn’t work within the U.S. Instead, your plan will only work once you’re traveling internationally. This is true for the health plans offered by GeoBlue; those plans are limited to countries outside the U.S. and available only to people who already have a qualifying insurance plan.

» Learn more: How much is travel insurance?

Domestic travel health insurance

It’s possible to get travel insurance within the U.S. whether you’re looking for comprehensive coverage or simply a medical care plan. Companies such as Squaremouth collect quotes from a variety of insurance providers and allow you to compare them.

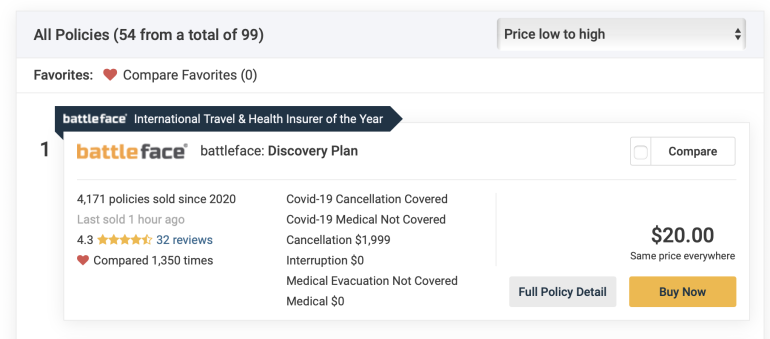

For example, we put in a search for a 32-year-old from California traveling within the U.S. The total trip cost was $1,999 and took place over two weeks during the summer.

Squaremouth returned results from 54 providers, with the lowest charging $20 total.

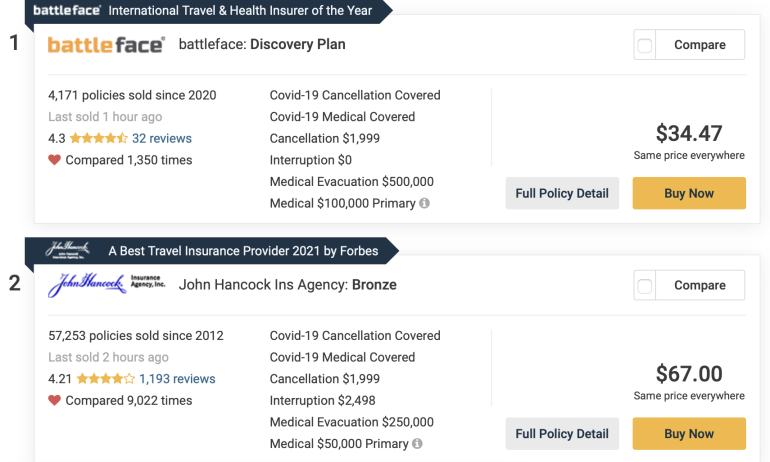

However, this plan doesn’t include medical insurance. To find policies that offer this coverage, you’ll want to use the filters next to the search results.

Including filters for domestic travel health insurance limits the total results, but pricing doesn’t change that significantly.

The policies shown will now include primary coverage, coverage for pre-existing conditions, medical evacuation and emergency medical. Even with all those options selected, the cheapest plan comes in at a relatively affordable $34.47.

For those unfamiliar with the terminology, primary insurance acts as the first payer for any claims you have. So if you visit a doctor during your trip, your primary policy will cover costs first. If that plan is exhausted and you also have secondary insurance, the secondary insurance can then pay off the rest.

It’s important to know the difference so you’ll be completely covered during your travels. Note, however, that if you don’t have primary insurance, any secondary insurance becomes primary.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Travel cards with domestic travel insurance

Interested in cheap domestic travel insurance? You won’t find anything cheaper than the complimentary travel insurance offered by many travel cards. We’ve already mentioned that the Chase Sapphire Reserve® has its own travel insurance benefits, but so do many other cards.

Generally, you don’t need to pay anything to be eligible for the travel insurance offered by these types of cards. Instead, you’ll simply need to charge the cost of the trip to your card and the insurance will be automatically activated. This is true whether you’re traveling domestically or internationally.

Here are a few cards that offer complimentary travel insurance:

Chase Sapphire Reserve® .

The Platinum Card® from American Express .

United℠ Explorer Card .

Hilton Honors American Express Aspire Card .

Capital One Venture X Rewards Credit Card .

Terms apply.

» Learn more: The best travel credit cards right now

Travel insurance for domestic vacations recapped

Hopefully we’ve answered the question: “Do I need travel insurance for domestic travel?”

The truth is, whether or not you opt to obtain travel insurance for your trip is going to depend on you. Some travelers have a higher tolerance for risk and are willing to forgo insurance while hoping things go the way they should.

Others may be more interested in being covered for events such as trip delay, emergency medical and rental car insurance.

Whatever you choose, compare quotes from multiple insurance providers to be sure you’re getting a policy that suits your needs. Otherwise, check out the complimentary travel insurance offered by a variety of credit cards to see whether their coverage limits fit your travel budget.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Credit Cards with Free Travel Insurance

One of the most popular extras offered on credit cards these days is complimentary travel insurance, which can cover everything from emergency medical expenses to car rental excess to flight delays.

Qantas Premier Platinum Credit Card

Get up to 100,000 bonus Qantas Points. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Discounted annual fee for the first year. Earn uncapped Qantas points. Complimentary lounge access, travel insurance, and more.

Go to offer

Filter rewards & points

My monthly card spend, features i like, reward programs, sort by - please select.

$1 earn rate

Bonus points

Your points • 30 days is indicative of 1 month • Point caps are reset every statement period, which we have also assumed to be 1 month • There is a fixed monthly spend for 365 day. • Your monthly spend is multiplied by the earn rate for that 12 months. • You’ll be getting the highest earn rate for spending (if the card has tiered earn rates). • Points capping is factored in, if applicable, as is any sign-up bonus. Bear in mind though, terms and conditions always apply to points earning and sign-up bonus points.">

Earn up to 100,000 bonus Qantas Points

Get 70k when you spend $3,000 within the first 3 months, plus 30k when you haven’t earned Qantas Points with a credit card in the last 12 months. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Save 20% on flights for you and 8 friends. Complimentary travel insurance.

Up to 100,000 bonus Qantas Points

Earn 70,000 when you spend $3,000 within the first 3 months, plus 30,000 when you haven’t earned Qantas Points with a credit card in the last 12 months. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Discounted annual fee for the first year.

Earn rate per $1

save card more info

Westpac Altitude Platinum Credit Card

Up to 120,000 bonus Altitude Rewards Points

Min spend applies. Reduced annual fee first year, or waived if you're an existing customer. Complimentary overseas travel insurance cover.

Up to 120,000 bonus Altitude Rewards Points when you spend $3,000 on eligible purchases within 90 days of card approval (90,000 pts) and when you keep your account for at least 12 months (30,000 pts). Reduced annual fee first year.

Qantas Premier Everyday Credit Card

Up to 8,000 bonus qantas points.

Big rewards for a tiny annual fee: earn up to 8000 bonus points in the first 4 months plus up to 1 point per $1 on your regular spending (up to $3000 per statement period). Earn 1 bonus point for Qantas products and services. Complimentary overseas travel insurance with rental vehicle excess cover and 0% p.a. on balance transfers for 12 months with 2% BT fee.

Earn 2 bonus Qantas Points per $1 spent on eligible purchases within 4 months of card approval, up to 8,000 bonus Qantas Points. 0% p.a. on balance transfers for 12 months, 2% BT fee applies. Low $99 annual fee.

American Express Qantas Business Rewards Card

150,000 bonus qantas points + $200 credit.

Spend $6,000 on eligible purchases within 3 months of card approval. No fee for Employee Cards (up to 99).

Qantas American Express Ultimate Credit Card

50,000 bonus qantas points.

Spend $3,000 within the first 3 months. Offer ends 14 Jan 2024. $450 Qantas Travel Credit to use on eligible domestic or international Qantas flights each year. Two complimentary The Centurion® Lounge entries each year plus travel insurance covers. T&Cs apply.

Spend $3,000 within the first 3 months. $450 Annual Qantas Travel Credit. Two complimentary The Centurion® Lounge entries each year plus travel insurance covers. Add 4 additional cardholders for free.

American Express Explorer Credit Card

Partner offer: 100k bonus membership rewards points.

when you apply through this link. $400 Travel Credit every year plus 2 lounge passes. Earn 2 points for every $1 spent on purchases. Up to $500 Smartphone Screen Cover

- American Express Platinum Charge Card

200,000 Bonus Membership Rewards Points

Minimum spend applies. New American Express Card Members only. Enjoy $450 Platinum Travel Credit each year. Access to over 1,400 airport lounges.

Receive 200,000 Bonus Membership Rewards Points, minimum spend applies. New American Express Card Members only. Enjoy $450 Platinum Travel Credit each year. Access to over 1,400 airport lounges.

American Express Platinum Business Card

350,000 membership rewards bonus points.

Min. spend applies. Up to 55 cash flow days. Transfer points to 12 Airline programs including Qantas. Complimentary domestic and international Travel Insurance. Up to 99 Employee Card Members at no cost.

Minimum spend applies. Up to 55 cash flow days. Transfer points to 12 Airline programs including Qantas. Complimentary domestic and international Travel Insurance. Up to 99 Employee Card Members at no cost.

Qantas American Express Premium Credit Card

20,000 bonus qantas points.

Min. spend applies. Earn 1 Qantas Points for every $1 spent on everyday purchases and 2 Qantas Club lounge passes per year, domestic & overseas Travel Insurance.

Min. spend applies. Earn 1 Qantas Points per $1 spent on everyday purchases. 2 Qantas Club lounge passes per year, domestic & overseas Travel Insurance covers.

American Express Platinum Edge Credit Card

Waived annual fee + travel perks.

Get an annual $200 travel credit and free travel insurance. No annual fee the first year (saving $195) and earn up to 3 points per $1. Use a range of protective insurances, including smartphone screen cover.

American Express Velocity Business Charge Card

150,000 bonus velocity points + $250 travel credit.

Spend $5,000 within the first 2 months of your approval date. Receive complimentary international and domestic travel insurance. T&Cs apply. 2 single entry passes to the Virgin Australia lounges per year. No pre-set spending limit.

Westpac Altitude Black Credit Card

Up to 150,000 bonus Altitude points

Min spend and offer T&Cs apply. Reduced annual fee in the first year. Complimentary insurance covers plus, 2 lounge passes each year with Priority Pass.

Up to 150,000 bonus Altitude points - get 100k points when you spend $6,000 within the first 120 days in year 1 plus 50k points after first eligible purchase in year 2. Complimentary overseas travel insurance. T&Cs apply.

We found no credit cards using your selected criteria

Update your filters to get more cards to display. Reach out if you are having any problems.

What is complimentary credit card insurance?

Credit card travel insurance is an added feature on many premium and rewards credit cards. It offers free travel cover overseas or domestically (or both), which helps you save money when you travel.

Credit card travel insurance covers the cardholder and often additional cardholders, spouses and dependents as well. You'll usually need to pay for your travel on the card to activate the insurance, so it's important to read the PDS to make sure you're covered for your trip.

Let's look at how credit card travel insurance works.

Is credit card insurance really ‘complimentary’?

Technically, yes, the insurance is free. However, these kinds of extras are usually found on credit cards with higher annual fees or higher interest rates.

You might also need to spend a certain amount on your travel for the insurance to activate. For instance, it's typical to need to spend at least $500 on your card on flights, car hire or accommodation.

If you meet all the eligibility criteria, travel insurance is a great perk that can save you money every time you travel.

Should you choose a credit card simply for the insurance offered?

If you're a frequent traveller then complimentary travel insurance can help offset costs on your trips. Since travel insurance is usually found on cards with other travel extras, it could be a good 'package deal' that saves money on insurances, foreign fees, and gives flight discounts or earns rewards points.

It's important to read the terms if you know you're going to be using the complimentary insurance. Make sure you meet the eligibility criteria for age (most insurances don't cover you if you're over 80 years old) and that it covers any family members who travel with you.

Pros and Cons

- You may be able to save money, especially if you are a frequent traveller.

- The cover offered may be similar to standalone cover.

- You can save time comparing standalone cover for each trip you take.

- The policy may cover your family if they are travelling with you (as long as you activate the policy correctly).

- You may be able to enjoy continuing cover as you get older, whereas standalone cover can charge higher premiums for older travellers.

- Your policy may offer cover for a range of international destinations, whereas the cost for standalone cover may vary according to where you travel.

- As credit card travel insurance is considered a premium feature, you may pay higher annual fees and interest.

- Activation of travel insurance varies by card. You may have to spend a certain amount or pay for your entire trip using your card for the insurance to activate.

- Cover varies. Your policy may offer cover overseas only, or within Australia only.

- If you don’t travel that often, you may not get that much value from the insurance offered. You might find you're paying more in annual fees and interest and not getting the returns from perks like insurance.

- Certain exclusions and an excess may apply.

- The cover offered may not be as extensive as standalone travel insurance, in terms of the length on trip covered, the limits offered, or the activities covered.

🗨 Frequently Asked Questions

What should you be aware of when comparing credit card insurance.

Double-check these factors before applying for a card, especially if you're expecting to use the travel insurance for a trip.

- Activation and eligibility: Cover is activated in different ways. Some require a minimum spend on the card, some need a return ticket. Some activate automatically while others need an online request. The PDS will tell you how to make sure you're covered.

- Length of travel: Check how long the standard cover goes for. It could be 2 weeks, 30 days or 6 months. Some need a specific request for longer cover.

- Excess: Whether excess is payable depends on the card and the cover policy. Think about how much you are willing to pay in excess, and whether the policy still offers value if you have to make a claim.

- Terms and conditions: It's tedious, but important that you read the terms and conditions in full. Do this before you rely on the cover – not after you want to make a claim.

Which credit cards offer complimentary credit card insurance?

There's a wide range of credit cards that offer travel insurance, including low-cost cards. It's more common to find it as a perk on premium cards, specifically ones that focus on travel. That includes frequent flyer cards, rewards cards and platinum cards.

How do you make a claim on your credit card insurance?

Credit card travel insurance is backed by an underwriter, not the credit card provider. For instance, Allianz is the underwriter for NAB and Westpac insurance cover.

You'll find details on making a claim in the credit card insurance PDS. It's a good idea to know how to make a claim before you travel, just in case.

How do you choose the right credit card with the right travel insurance?

That's a very big question! Firstly, think about what you need from the card, and how you will use it. If you're looking for travel rewards, look for frequent flyer credit cards. Then compare the different features: travel insurance, lounge access, flight vouchers, flight delay cover and rewards points.

Another factor to consider is currency conversion fees and rates, if you plan to use the card while overseas. Some cards waive conversion fees altogether.

Is credit card travel insurance the same as regular insurance?

We get asked this one a lot. Travel insurance on a credit card is underwritten by the same insurers that you would take out a standalone policy with (for example, Allianz, Zurich or Chubb Insurance). So, there isn't a whole lot of difference.

You'll likely be covered for the same medical, emergency, transport and death cover that a standalone policy would. Just remember that some high-risk activities aren't covered by any insurers, such as skiing. You'll need add-on cover for that.

If you're comparing credit card insurance to standalone insurance, just make sure to consider:

- Who is covered: credit card insurance usually covers you, additional cardholders and family members.

- What is covered: credit card insurance sometimes covers rental vehicle excess, flight delays, lost baggage and trip cancellations as well.

- Limitations and exclusions: credit card insurance can be more inclusive of seniors, with some cards offering optional extras for those over 79. It also rarely comes with extra costs for travelling to certain destinations, unlike standalone insurance.

Always check the PDS to make sure you're fully covered and your insurance is activated before you travel. I know I've repeated that over and over again, but it's really important with insurance cover.

Credit cards with included COVID-19 cover

These banks have released updates to include limited cover for pandemics and epidemics. Click to see the details of cover for each brand:

- American Express

- Latitude 28° Global Platinum Mastercard (limited time offer)

Bendigo Bank

Bank of melbourne, qantas money.

Until early this year, no credit card travel insurance covered events caused by COVID-19, meaning you had to cross your fingers and hope borders stayed open and you stayed well.

Now, most major credit card providers have jumped on the COVID-19 bandwagon, which is great to see since it gives a little more peace of mind around travelling. We've put together a rundown of each credit card and its coronavirus policy, but always check the card's PDS since it can change quickly.

Interestingly, some providers like ANZ and St. George have changed their terms to include all pandemic/epidemic disruptions from now on. Let's hope we don't need that anytime soon.

Remember, terms, conditions and exclusions apply to travel insurance. Check the PDS for more information.

American Express

Domestic return trips:.

- you can change, curtail or cancel your return trip if you, your travel buddy or the person you were visiting test positive for coronavirus.

- You aren't covered if you need to cancel or reschedule because borders closed or travel advisory warnings are put in place.

- If you become unwell with coronavirus while travelling, you can claim under Medical Emergency Expenses cover (not valid while a 'do not travel' warning is in place)

International return trips:

- You can be covered if borders close or a travel advisory warning is issued for the country you're visiting.

- You won't be covered if Australia issues a 'do not travel' warning.

- You won't be covered if the borders at your destination are already closed.

Amex credit cards with complimentary travel insurance including COVID-19 cover:

- American Express Platinum Edge

- American Express Explorer

- American Express Velocity Platinum

- Qantas American Express Ultimate

- Qantas American Express Premium

Claims related to pandemics/epidemics:

- if you or any dependents covered by the travel insurance test positive to COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Cancellation, Additional Expenses, Evacuation & Repatriation, and Overseas Emergency Assistance cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- There is no mention of coverage if you're prevented from travelling by border closures or travel warnings.

- You aren't covered if you travel to a destination with a travel advice warning by the Australian government.

ANZ credit cards with complimentary travel insurance including COVID-19 cover:

- ANZ Frequent Flyer Platinum

- ANZ Frequent Flyer Black

- ANZ Rewards Platinum

- ANZ Rewards Travel Adventures Card

- ANZ Rewards Black

- ANZ Platinum Credit Card

- If you or any dependents covered by the travel insurance test positive to COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

- NAB's travel insurance policy specifically states there are no other pandemic or epidemic-related circumstances covered, which likely includes border closures or other travel restrictions.

NAB credit cards with complimentary travel insurance including COVID-19 cover:

- NAB Low Fee Platinum

- NAB Qantas Rewards Signature

- NAB Rewards Signature

- NAB Qantas Rewards Premium

- NAB Rewards Platinum

Latitude 28° Global Platinum Mastercard

Claims related to covid-19:.

- Cover applies to you and your 'family', which includes you, your spouse and up to 3 eligible children

- You can claim up to $700,000 per person in medical costs if you need treatment for COVID-19 during an overseas covered trip

- You may be covered for travel and accommodation deposits if you contract COVID-19 on a covered trip and a doctor certifies you're unfit to travel

- If you have to quarantine just before departure because you've tested positive to COVID-19, you may be covered for administrative costs (but not any other additional costs related to your quarantine)

- You're not covered for any additional costs such as accommodation or flights because of borders closures or travel disruptions

- If you or any dependents covered by the travel insurance test positive to COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Cancellation, Additional Expenses, Evacuation & Repatriation, and Overseas Emergency Assistance cover.

- If you become ill with COVID-19, you may be able to claim Overseas Emergency Medical cover.

- You aren't covered if you travel to a destination with a travel advice warning by the Australian government, even if you have an exemption or permission from the Australian government to travel

Bendigo Bank credit cards with complimentary travel insurance including pandemic cover:

- Bendigo Platinum Rewards

- Bendigo Bank Qantas Platinum

St. George

- If you or any dependents covered by the travel insurance test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If you or your companion become so sick with COVID-19 that can't continue travelling, you may be reimbursed for additional accommodation and travel expenses.

St. George credit cards with complimentary travel insurance including pandemic and epidemic cover:

- St. George Amplify Platinum

- St. George Amplify Platinum - Qantas

- St. George Amplify Signature

- St. George Amplify Signature - Qantas

Westpac

Westpac credit cards with complimentary travel insurance including pandemic and epidemic cover:.

- Westpac Altitude Black

- Westpac Altitude Black - Qantas

- Westpac Altitude Platinum Black

- Westpac Altitude Platinum - Qantas

- Westpac Business Choice Rewards Platinum Mastercard

- Westpac Altitude Business Platinum

- Westpac Altitude Business Gold Mastercard

- If your travel buddy becomes ill with COVID-19, cover may be available under Cancellation and Additional Expenses.

- If you or your companion become so sick with COVID-19 that you can't continue travelling, you may be reimbursed for additional accommodation and travel expenses.

Bank of Melbourne credit cards with complimentary travel insurance including pandemic and epidemic cover:

- Bank of Melbourne Amplify Platinum

- Bank of Melbourne Amplify Platinum - Qantas

- Bank of Melbourne Amplify Signature

- Bank of Melbourne Amplify Signature - Qantas

- Bank of Melbourne Amplify Business

BankSA credit cards with complimentary travel insurance including pandemic and epidemic cover:

- BankSA Amplify Platinum

- BankSA Amplify Platinum - Qantas

- BankSA Amplify Signature

- BankSA Amplify Signature - Qantas

Claims related to pandemic/epidemic cover:

- If you test positive for Covid-19 you may be able to access Overseas Medical Emergency and Hospital Expenses cover.

- You aren't covered if you don't take appropriate action to avoid countries with a 'do not travel' warning advised by the Australian government or mass media.

- You will not be covered for flight cancellations, accommodation or any other travel expenses.

- You will not be covered for anything Covid-related on a cruise.

Bankwest credit cards with complimentary travel insurance including COVID-19 cover:

- Bankwest Breeze Platinum Credit Card

- Bankwest Zero Platinum Credit Card

- Bankwest More World Mastercard

- Bankwest Qantas Gold Credit Card

- Bankwest Qantas Platinum Credit Card

- Bankwest More Platinum Credit Card

- If you test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- You aren't covered if borders close during your trip.

HSBC credit cards with complimentary travel insurance including COVID-19 cover:

- HSBC Platinum Card - 0% Balance Transfer Offer

- HSBC Premier Credit Card

- HSBC Platinum Qantas Credit Card

- HSBC Credit Card

- You aren't covered if you don't take appropriate action to avoid countries with a 'do not travel' warning advised by the Smart Traveller website (excluding Australia and New Zealand).

- You may be covered for costs incurred from having to cancel, curtail or change your trip because you or your travel buddy contract COVID-19.

- You may be covered for overseas medical emergency expenses on your overseas return trip and transportation of remains if you die from COVID-19 while travelling (it must be confirmed and diagnosed on your trip).

- Besides Trip Cancellation and Amendment Cover and Overseas Medical Emergency Expenses cover, you won't be covered for anything else caused by COVID-19 or any of its variants.

- You may be covered for overseas medical emergency expenses on your overseas return trip and transportation of remains if you die from COVID-19 while travelling (it must be confirmed or diagnosed on your trip).

Other credit cards with complimentary travel insurance

Almost all banks and insurance companies have updated their insurance terms to include COVID-19 since 2020. You can find and compare credit cards with free travel insurance here , but always check the terms and conditions to see what you're covered for.

Tips for using complimentary travel insurance

First, always read the PDS carefully. I know, it's like a broken record, but insurances come with a lot of 'but's and 'only if's that could leave you high and dry - and out of pocket - if things go awry. Clauses regarding COVID-19 are still new, so make sure you understand what you're covered for.

Second, make sure you activate your credit card's travel insurance. You'll usually be able to check that it's active via the card's website or by calling customer service.

💡 TIP: Accommodations, airlines and tour operators may have their own COVID-19 policies that are worth checking before you book, too.

Pauline Hatch is a personal finance expert at Creditcard.com.au with 8 years of finance writing under her belt. She loves turning complex money concepts into simple, practical actions so you can win financially. You can ask Pauline any questions by submitting a comment below and get a personal reply.

Recently Asked Questions

Something you need to know? Ask our credit card expert a question.

Ask a Question

You will be emailed a response in typically 1 business day. By submitting this question you agreee to our privacy policy .

Please remember to check junk and spam folders for your emailed reply.

Have you joined our free CC Inner Circle?

Delivered once a month to your inbox, you’ll get expert money tricks, rewards point hacks, perks and more!

Click to join the Inner Circle

Regards Pauline + the Creditcard crew

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

We ask for your email so we can respond to you directly. We won’t share your personal data. For more information, see our privacy policy.

Love perks and rewards? Join our free CC Inner Circle for exclusive offers, points boosters & more. Unsubscribe anytime..

21 questions (showing the latest 10 Q&As)

John cunningham.

• The annual fee is charged in the first month. • You only pay the minimum monthly payment of your overall balance each month. • You do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • All other fees and charges that may apply are excluded. When there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0.'> Filter your savings

Adjust the filters to see how much you could save with a balance transfer to a new credit card

My transfer amount $5000

My interest rate 19.49%, my annual fee $50.

- Recalculate

Make sure you can get approved for the Loading...

- Have your personal details ready to complete the online application

- Proceed to application Proceed to application

- I’m not eligible

Make sure you can get approved for the Westpac Low Rate Credit Card

- If you are not redirected click here to continue

- Copyright 2005-2021 CreditCard.com.au Pty Ltd

- ABN: 76 646 638 146

- ACR: 528318

- AFCA: 80717

Select the reward programs you like

Select the features you like

Adjust the filters to see how much points you could earn over 12 months

My monthly card spend $5000

Rewards program

Benefits i like

- All reward programs

- Altitude Rewards

- Amex Membership Rewards

- Qantas Frequent Flyer

- Velocity Frequent Flyer

- Airport lounge access

- Balance transfers

- Bonus points offer

- No annual fee

- No foreign transaction fee

- Overseas travel insuarance

- Uncapped points earn

Thank you for taking the time to provide feedback.

Our credit card experts will review your feedback and take action within 1 business day to address or respond to the issue.

Regards Pauline Hatch Personal Finance Expert

By submitting this feedback you agree to our privacy policy.

Thank you for taking the time to let us know that your credit card is not listed on our site.

Our credit card experts will review your listing and ensure that the card is present on the site over the coming weeks.

By submitting this form you agree to our privacy policy.

Bankwest Breeze Platinum Mastercard

- Experience 0% p.a. interest on balance transfers for 12 months (with a 2% BT fee, then 12.99% p.a.).

- 0% p.a. for 12 months on purchases (reverting to 12.99% p.a.).

- Benefit from up to 55 interest-free days.

- Offer exclusively for new customers within a specified period. Additional charges, along with terms and conditions, apply.

Pros and cons

- 0% p.a. on balance transfers for 12 months.

- 0% p.a. for 12 months on purchases.

- No foreign transaction fees. Plus, complimentary overseas travel insurance for you and your family.

- There is no rewards program on this card.

- There is a 2% BT fee.

Convenience

Customer service, rates and fees.

For only slightly more per year than the standard Breeze Mastercard, you can have the Bankwest Breeze Platinum Mastercard.

You’ll get the same zero-interest introductory offers on balance transfers and purchases and the same low ongoing interest rate on purchases, but that extra few dollars on the annual fee will buy you a whole lot of valuable insurance coverage. And you’ll probably recover even more by saving on foreign transaction fees.

In short, you’ll get platinum benefits at a lower-than-expected price.

0% for a 12-month period on balance transfers

This balance transfer offer is long enough to give you plenty of breathing space to repay the transferred balance, and it has an important accompanying feature that is rarely matched by other balance transfer credit cards. This valuable additional benefit is the very low revert interest rate applied to any part of the transferred balance not repaid after the introductory offer expires.

Even the balance transfer revert rate is low, for a credit card

When applying for a balance transfer it’s always best to plan to repay the balance before the end of the promotional period, in order to avoid the revert interest rate – the interest rate that will be applied to any balance remaining when the offer has expired. In many cases, a card’s high cash advance interest rate will be used as the revert rate, but with this card Bankwest have chosen to use the much lower ongoing purchase interest rate, instead of its punitive cash advance rate. This will be welcome news to anyone not absolutely certain that they will have the capacity to repay their transferred balance within the introductory offer period.

0% for a 12-month period on purchases

Here's another feature you'll rarely encounter – a matching 0% introductory offer on purchases. This means that you can still use your new card for purchases while you're paying off your balance transfer, and there will be no interest charged on any part of your debt (unless you take a cash advance).

Just take care not to run up a purchase debt you can't afford to repay once the offer comes to an end. It would be a good idea to squirrel away in a savings account an amount equivalent to each month's purchases, so that you can repay your balance in full before interest charges kick in.

Low ongoing purchases interest rate

Once the 0% introductory offer on purchases expires, there's still a very low ongoing interest rate applied to any purchase balance not fully repaid by each month's payment due date. While the rate is higher than most personal loan interest rates, it’s definitely very low for a credit card.

55 days interest-free

Interest charges on purchases can be avoided permanently if you take full advantage of the up to 55 days interest free still allowed for purchase transactions after the introductory offer comes to an end, and then repay the balance in full by the payment due date. At up to 55 days, the interest-free period is more generous than that allowed by some 44-day cards.

$6,000 minimum credit limit

The $6,000 minimum credit limit is not suitable for anyone who wishes to avoid the temptation to run up a credit card bill they would struggle to repay. If you need a lower limit, apply for the non-platinum Bankwest Breeze Mastercard instead. It has fewer benefits, a lower fee, and a low minimum credit limit of $1,000.

High late payment fee

The high fee imposed if you are late with your monthly repayment is seriously unpleasant. It can be avoided by always making at least the 2% monthly repayment required, on or before the due date. This is not the highest of credit card monthly repayment fees, but it’s higher than that charged by any of the Big Four banks.

Lots of complimentary insurance cover

Platinum cardholders expect platinum insurance cover, and this card will not disappoint. It has the full suite of complementary policies, including:

- Overseas travel insurance. Annual multi-trip cover for journeys up to three months long.

- Interstate flight inconvenience insurance. C overs flight and luggage delays, personal items loss or damage and unavoidable travel cancellation, for domestic trips of up to 14 days.

- Transit accident insurance for overseas travel. Provides cash compensation for serious injury sustained on public and commercial transport overseas.

- Extended warranty insurance. Doubles the manufacturer’s Australian warranty, up to a maximum of 12 additional months.

- Purchase protection insurance. T hree months’ cover against loss, theft or accidental damage, for major personal items purchased.

- Price guarantee insurance. Refunds a price difference of between $75 and $1,000 if you see your recently-purchased item advertised for sale at a lower price, located at a store within 25 km of the original purchase store (excluding online purchases).

In order to be covered by these policies, you must use your Bankwest Breeze Platinum Mastercard to purchase the items concerned. In the case of interstate flight inconvenience insurance, this means the return airfares.

For overseas travel insurance, there is no requirement to spend any specific amount on prepaid trip expenses in order to activate the insurance – cover is automatic. However, you can apply for upgraded benefits (extending the maximum trip time or compensation limits, for example) by applying to Bankwest and paying a premium.

No foreign transaction charges

There’s some really good news for anyone travelling overseas or making online purchases from a merchant not located in Australia. All your purchases will be absolutely free of foreign transaction charges and currency conversion fees. Other cards can charge a fee of up to 3.5% on these transactions.

Digital capabilities

The card can be used with Apple Pay, Google Pay and Samsung Pay, to turn your smartphone into a digital wallet and payment tool. And you don’t need to wait for your new card to arrive in the mail, since you can activate it as soon as it is approved, via Bankwest’s mobile banking app.

Annual fee lower than expected

It all adds up to a tidy platinum package – all these benefits for a very reasonable annual fee for a card of this type, and only a few dollars a year more than the standard Bankwest Breeze Mastercard (which has no insurance cover and no freedom from overseas transaction fees).

Compare other platinum cards before you decide

One of the reasons for the lower-than-anticipated annual fee is the absence of rewards points with this card. Many applicants for a platinum card will expect reward points on their purchases. But there are lots of different types of platinum cards available in Australia. If the card discussed here doesn’t exactly meet your needs, take a look at other platinum cards listed on our travel insurance credit cards page and our rewards credit cards page .

The Westpac Altitude Platinum Credit Card (Qantas) , for example, earns Qantas Points and also has complimentary insurance and a reasonable annual fee, albeit higher than the Bankwest card's fee.

A card for the savvy traveller

There’s no doubt that this is a card for the reasonably regular traveller with a shrewd eye for economy. Travel insurance and fee-free foreign purchases can add up to substantial savings. Back home, it will also appeal to anyone likely to make major retail purchases, with the potential to be covered by the extended warranty, purchase protection and price guarantee policies, as well as fee savings on online overseas purchases.

Reviewed by Yvonne Taylor

Lead Product Analyst

User reviews

A good, easy to manage, everyday card

Reviewed by Lawrence

This card is easy to use and has a reward scheme that offers cash back. I much prefer this and It is great to see money returned to my account. It is very easy to manage with a comprehensive and very user friendly website where you can quickly see all your accounts and transfer efficiently between accounts when necessary.

Better internet banking and customer service

Reviewed by Mark

Was with Virgin but now I have all my cards together with Bankwest and the service is so much better to be able to access everything on the one Internet site. The customer service is also very helpful and they speak good English which is very helpful in this day and age.

Best card for overseas purchases

Reviewed by Rachel

There are no international transaction fees, which is excellent for someone who travels overseas regularly for business. The complimentary travel insurance on purchases is helpful when bringing home new purchases from overseas. I save interest by paying off purchases within the interest-free period. There is no annual fee or rewards program, but you have easy online banking experience and access to Commonwealth Bank ATMs.

Easy access

Reviewed by Ian

I love the ease of access, the website, the backup service, the customer helpline, online help, the ease of contacting them either in Australia or when traveling overseas, and especially the travel insurance as a benefit. I use the travel insurance on a regular basis and never have problems with claims.

Great for emergencies

Reviewed by John

I got this card to pay out another credit card on no interest. I do like the bank but am considering going to a lesser card.

Reward points do not interest me. I just need it for emergencies. The only other thing that annoys me with credit cards is the interest rates.

Market low interest rate

Reviewed by Michael

Switched to this card to reduce my repayments. It saved me a lot of money with 8.99% interest rate instead of the standard 22%.

Unfortunately no rewards are offered, so not ideal for customers who pay off their credit cards on time every month. Would recommend for people struggling with paying off debt.

Earlier payment due dates, fewer rewards

Reviewed by Sarah

What started out to be a great credit card is slowly starting to turn into a nightmare. Our due dates for payments are becoming earlier and earlier, to the point where it now skips a pay cycle for me, which is making it harder to pay off.

Not only this, but rewards that used to be great are getting more and more expensive, requiring larger amounts of points to be accrued for smaller benefits.

I would definitely steer clear of this credit card and we are definitely considering a new one soon.

Quick service for balance transfer

Reviewed by Sandra

I obtained this card though a balance transfer from another card. I received excellent service and they were very quick to transfer funds to pay off my existing card — within three days. There’s always minimal delay in customer service and minimal wait time on the phone, which is really frustrating with other banks, etc.

The yearly fee is one of the lowest on the market, from what I’ve researched.

Would you like to review this product? Click here to write your review and help others make a better decision.

This credit card is listed in these comparisons

- 0% purchase credit cards

- Bankwest credit cards

- Compare credit cards

- Credit cards for first timers

- Credit cards for good credit

- Credit cards for pensioners

- Credit cards for temporary residents

- Credit cards with 55 days interest-free

- Credit cards with free additional cardholders

- Credit cards with high credit limits

- Credit cards with instalment plans

- Free credit cards

- Low interest credit cards

- Mastercard credit cards

- No foreign transaction fee credit cards

- Travel insurance credit cards

Advertiser disclosure

At Finty we want to help you make informed financial decisions. We do this by providing a free comparison service as well as product reviews from our editorial staff.

Some of the products and services listed on our website are from partners who compensate us. This may influence which products we compare and the pages they are listed on. Partners have no influence over our editorial staff.

For more information, please read our editorial policy and find out how we make money .

Finty members get

I don't want rewards

I want rewards

Disclaimer: You need to be logged in to claim Finty Rewards. If you proceed without logging in, you will not be able to claim Finty Rewards at a later time. In order for your rewards to be paid, you must submit your claim within 45 days. Please refer to our T&Cs for more information.

We use cookies and other technologies to understand and improve your browsing experience. By using our site, you agree to us collecting this information and to our Privacy Charter .

- Retail stores

- Fuel prices

- Help & support

Travel insurance for seniors

Compare our travel insurance to suit seniors, with 15% off for RACV Members

Thank you for contacting us

Your reference number is

We'll contact you within 72 hours and may ask for this reference number.

RACV Travel Insurance $20K giveaway

You could win a share of $20,000 in prepaid gift cards with RACV Travel Insurance. Purchase a new policy by 30 September 2024 and you'll automatically go into the draw for a chance to win. Terms and conditions apply.

Travel insurance suited to older Australians

- Choose from a range of policies to cover overseas trips, cruises and holidays in Australia.

- Cover for medical expenses, stolen or lost luggage, cancellation fees and emergency expenses.

- Whether you’re recently retired, or looking to explore, travel with more peace of mind.

- Understand your overseas medical cover and check if you need to declare any medical conditions.

Make a claim online 24/7

- Make a claim

- Find a policy document

- Call 13 13 29

Cover for your holiday in Australia or overseas

Domestic travel insurance.

Prepare for your holiday in Australia with cover for lost or stolen luggage, cancellation fees and travel delays.

International Travel Insurance

Choose from 3 levels of international cover, — Basic, Essential or Comprehensive — with important benefits like overseas medical and hospital.

Annual Multi-trip Plan

Are you 75 or under with more time on your hands for holidays? Get a year-round plan to cover multiple trips over a 12-month period.

RACV Members save 15% on RACV Travel Insurance

Options and add-ons for your policy.

No two trips are the same, with RACV Travel Insurance, you choose policy options and add-ons.

Excess options

- $0 to $100 for domestic cover

- $0, $100, $250, $500 or $1,000 for international cover

- $0, $100 or $250 for annual multi-trip plans.

The excess amount you choose will increase or reduce your premium+.

Cruise cover

Planning on going on a cruise? You’ll need to select the cruise cover option when you buy your policy.

Explore your options for ocean and river cruises in Australia and overseas.

+Some cover benefit limits or sublimits may be less than your chosen excess and therefore the insurer may not contribute anything to your claim.

Take the grandkids with you

With RACV Travel Insurance dependent children or grandchildren are automatically covered under your policy¹. This means you can take your little ones on holiday with you at no extra cost. Just ensure they are added to your Certificate of Insurance.

¹Dependents such as children, grandchildren, stepchildren, and foster children aged 25 or under at no extra cost provided they are travelling with you the whole time, are financially dependent on their parents or grandparents, not working full time and do not require a medical assessment.

Why consider RACV Travel Insurance?

24/7 emergency assistance.

Get overseas emergency assistance 24-hours a day. Make a claim online any time.

Overseas medical and hospital

With overseas medical cover, an international travel insurance policy will protect in the unexpected event of an injury or illness while you’re off enjoying your travels # .

Stolen, lost or delayed luggage

Cover in case your luggage or belongings go missing, get stolen or damaged while travelling # .

Cancellation fees

As we get older, we like to be more prepared. Choose your level of cover for cancellations fees and lost deposits to reduce the impact of the unexpected # .

Emergency expenses

Domestic cover includes up to $25,000 for emergency expenses # .

RACV Members save 15%

Already a Member with us? You’ll save 15% on all travel insurance policies. Check if you’re a member .

#Limits, sub-limits and exclusions apply. Refer to the Product Disclosure Statement for full details .

RACV Members save more on holidays

From hotels, tours and cruises, to airport parking and transfers.

Frequently asked questions

When should i take out travel insurance.

You have the flexibility to choose when you buy your cover. You can choose to buy travel insurance as soon as you pay for any part of your trip. This means you're covered in case your trip is cancelled due to unforeseen circumstances. You can also choose to get RACV Travel Insurance online right before you go. Even if you're just about to leave there's still time to pack an RACV Travel Insurance policy for your trip.

Am I covered for any existing medical conditions?

RACV Travel Insurance covers 38 medical conditions automatically, provided you meet specific criteria. Some medical conditions are not covered.

Medical conditions not automatically covered: You can apply for cover by completing a medical assessment. If accepted, you may need to pay an additional premium. Check which medical conditions are covered .

Assistance and support

Emergency assistance while overseas.

The team of experts are available to provide emergency support 24-hours a day. Reverse charges are accepted.

Call as soon as practical if you are receiving medical care and the total cost is likely to exceed $2,000.

- Call +61 2 8055 1699

Travel alerts

Check travel status before you plan your trip and again before you leave.

RACV Travel Insurance won't cover you for destinations with a Department of Foreign Affairs and Trade "Do Not Travel" status.

- Smart traveller

- Recent travel alerts

Medical conditions and things to consider

Medical conditions.

Find out if your medical condition is covered.

- Find out more

Medical tips to prepare for a trip

Stay healthy and happy while you're travelling at home and abroad.