- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

The search came up with nine results ranging in price from $74.40 to $179.18.

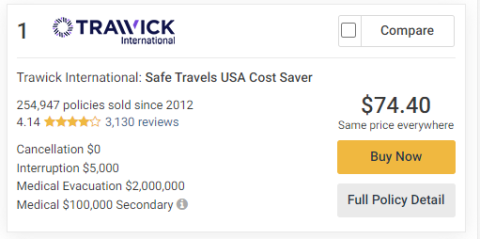

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

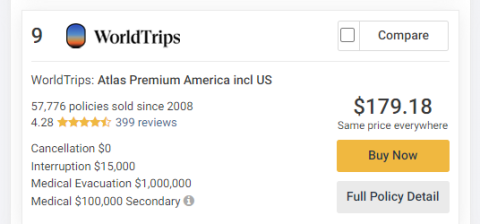

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

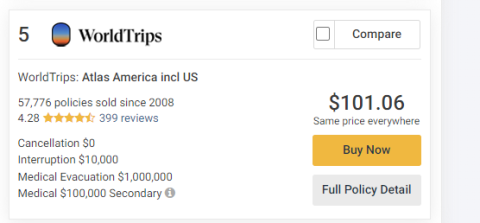

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

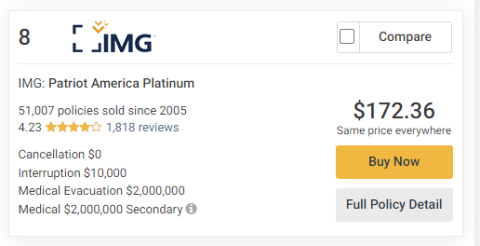

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

- Visitor visa insurance USA

Best health insurance for visa holders in US

What is the traveler's destination?

What is the nationality of the traveler?

Is the traveler looking for?

Does the traveler need Schengen Visa Insurance or Long term Europe Visa insurance?

What is the Visa of the traveler?

Does the traveler have any pre-existing medical conditions?

Type of Insurance?

Destination State?

Traveler's residence?

What is the Maximum Coverage?

What is the Deductible Amount?

Please Select Mailing Address

Search visa types, health insurance for us visas.

The US Visa is the document required for non US citizens (or Non Green card holders) to enter the United States. There are different Visa (Tourist Visa Health Insurance) categories depending the type of traveler, be it for work, study, business or vacation. These visa's are valid for multiple visits during a specified time period. The visas issued for visiting the US or immigrating to the US are listed below along with the health insurance needed for the American visa.

US visitor Visa health insurance (Health insurance for B2 visa insurance)

- Health insurance for non residents in USA with tourist visa is very important as they are ineligible for domestic health insurance in the USA.

- The safest way to secure oneself is buying US tourist visa health insurance. These US tourist visa insurance are useful for vacationers to cover medical expenses.

- Tourists can compare visitor visa insurance and buy the right US health insurance for tourist visa that best suits one's requirements.

J1 Visa Insurance

- Exchange scholars to the USA can purchase J1 Visa Insurance and fulfil insurance requirements mandated by the US consulate.

- US J1 visa health insurance covers the insured for medical expenses, emergency medical evacuation, prescription drugs expenses and accidental death and dismemberment...

- J1 visa holders can compare popular J visa medical insurance offered by various insurers and buy online.

US J2 Visa Insurance

- The J2 visa holders or dependents (spouses) of J1 visa holders require medical insurance while in the USA to cope with the exorbitant health care system.

- The US consulate has mandated health insurance for the J2 dependents and this requirement is satisfied by J2 visa insurance plans we offer.

- The coverage details of J2 visa insurance plan are available on the website.

K1 Visa or Fiancée visa insurance

- A fiancée coming to the USA (man or woman) from a foreign country require K1 visa which also called as fiancée visa.

- The insurance providers offer medical insurance for fiancées who come to the US with K1 visa permit.

- K1 visa insurance covers the insured for medical costs incurred in case of an medical emergency.

US Student Visa (F1 visa) Insurance

- International students in the USA with F1 visa and their dependents with F2 visa are eligible to purchase student medical insurance while staying in the US for their education.

- To help students make an informed decision while buying F1 visa health insurance, we have designed a compare tool. Students can easily compare student medical insurance and buy a plan online.

M2 visa insurance

- M2 visa is issued for dependents of M1 visa holders to USA.

US Immigrant Visa (Green card holders)

- An immigrant is someone who is not a U.S. citizen but has been authorized to permanently live and work in the United States.

- According to current American immigration law new immigrants will be eligible for domestic health insurance coverage only after five years stay in the USA

- Immigrants can compare US immigrant health insurance plans online before buying them.

United States H1B Visa Insurance

- H1B Visa insurance is required given the medical care costs are very high in the US and Canada.

- You can buy short term insurance plan for the duration of your stay in the USA / Canada.

- This US H1b health insurance will cover you for accident and sickness which includes medical care expenses such as Doctors visits, Hospital fees and Medicines.

H4 Visa Insurance

- H4 visa health insurance is very important while staying in the USA.

- Spouse and unmarried children under the age of 21 of H1B visa holders are considered visitors and US domestic health insurance plans are not applicable for them.

- H4 visa health insurance is a need for the dependents of H1B visa holders to cope with the exorbitant health care system in case of a medical emergency.

- Immigrants can compare H4 visa health insurance plans online before buying them.

M1 Visa Insurance

- Students with M1 Student visa enrolled in vocational or technical colleges.

F2 Visa Insurance

- F2 visa health insurance for Spouse or children of an F1 visa holder.

Insurance for B1 Visa Holders

- US health Insurance for travelers with B1 visa on a business trip.

P visa insurance

- A P visa holder is an international athlete, artist, or an entertainer in the United States.

L1 Visa Insurance

- Health insurance for foreign nationals with L1 visa employee status in an international company with offices in both the United States and abroad.

R1 Visa Insurance

- Medical insurance for foreign R1 visa requirements holders travelling to United States for service as a minister or other religious occupation

Insurance for green card holders

- The best health insurance for elderly parents holding green cards will vary depending on the insured's age, the length of stay in the US, and the price you are willing to pay.

E2 Visa Insurance

- US Visitors Medical Insurance works as E2 Visa health insurance for E2 Visa holders.

Tourist Visa Insurance

- Tourist visas and travel medical insurance in the US

Spouse visa Insurance

- US travel medical insurance for spouse visa holders.

O visa insurance

- O1 visa is a non-immigrant US visa for people with extraordinary ability in their area of expertise.

I visa insurance

Q1 visa insurance

- Q - nonimmigrant visa is issued for individuals who want to participate in international cultural exchange programs

Travel insurance for Schengen visa

- Insurance providers should have an representative bureau in Europe

- Medical evacuation and repatriation emergency cover of at least EUR 30,000

- Insurance must be valid for duration of stay in the Schengen states

Health insurance for visa holders in US - FAQ's

01. do i need travel insurance for us visa is it mandatory to get health insurance for a us tourist visa can i get health insurance with a tourist visa.

The US government has announced in October 2019 that from November 2019 all new immigrant visa applicants should provide proof of proper health insurance in the US. This new rule will directly impact new immigrants visa applications to the US. The aim of this compulsory us consulate immigrant visa health insurance requirement is to reduce the burden on the US health care system by uninsured new US immigrants.

While this rule is aimed at those applying for immigrant visas, we hear that travelers even on other visas are expected to have proper short term medical insurance. The US short term health insurance plans offered here work ideally for all visas whether they are visitors, J visa, H1b Visas... to the US or new US immigrants. After purchasing health insurance for non-immigrant visa holder in USA, customers will receive the visitor immigrant insurance document by email. Customers can show this visitor immigrant insurance document as proof of US health insurance while applying for the tourist visa or Immigrant visa. Given the high cost of US healthcare for visitors and immigrants , it is in any event important for all tourists and new immigrants to buy adequate US health insurance .

02. Is visitor visa health insurance USA required?

Visitor visa health insurance is a necessity while in the US since US health care is very expensive. Not having tourist visa health insurance in usa can be financially catastrophic. Having visitor visa health insurance for USA visitors can be a huge relief which comes in handy during any major unexpected sickness or injury while in the United States. Tourists on the visitor visa are urged to buy the best health insurance for visitors to USA to have a safe stay in the country.

03. How to buy visitors insurance? How to find the best visitor health insurance?

There are many visitor health insurance plans for coverage in the USA offered by US insurance providers. Given the several US visitor insurance options, it can be confusing to find the best health insurance for travel to USA for your needs. What is very useful in making this decision is to compare travel insurance USA of different companies. The US travel insurance comparison allows travelers compare prices as well as coverage benefits in an objective manner.

The traveler can change relevant factors like the medical maximum coverage required, the US traveler insurance deductible, any US travel health insurance plans with coverage for pre-existing ailments, travel insurance USA coverage for Covid19... The global travel insurance comparison also allows travelers to buy the best travel insurance based on ones needs by completing an online application and paying using a credt card. One completing the purchase the travel insurance plan is emailed to the customer.

04. What is visitor visa insurance for the USA?

Visitor visa insurance for the USA is a type of travel medical insurance that provides coverage for individuals visiting the United States on a temporary basis. It protect visitors financially from unexpected medical expenses and other travel-related risks during their stay outside their home country.

Visitor visa insurance USA is short-term travel health insurance for foreigners visiting the US for a short visit, typically the duration of their US tourist visa. US visitor visa insurance provides coverage for family members like, parents, in-laws or tourists visiting the US and can cover medical expenses for illnesses, injuries, or accidents. Visitors visa insurance is needed for international travelers because the US healthcare costs are exorbitant and domestic insurance or Medicare will not cover visitors to the US. Visitor visa insurance can also apply for Schengen visa insurance which satisfies Schengen visa requirements for tourists visiting Europe. Visitors visa insurance can be bought on American Visitor Insurance online with ease and without any paperwork.

05. Is visitor visa insurance mandatory for traveling to the USA?

While visitor visa insurance is not mandatory by law for entering the USA on a tourist visa, it is still highly recommended. The cost of US healthcare is extremely high, and without insurance, visitors may be responsible for covering all medical expenses out of pocket in case of illness or injury. Some visa categories, such as J1, H1B, and F1 visas, may require visitor visa insurance for meeting insurance mandates either by US authorities or by educational institutes.

06. What does visitor visa insurance typically cover?

Visitor visa insurance covers medical expenses for illnesses and injuries that occur after the visitors visa insurance policy is in effect. This may include hospitalization, urgent care, intensive care, doctor visits, dental cover, evacuation and repatriation. Other benefits may include trip interruption, accidental death, loss or delay of baggage and passport theft. The coverage may vary depending on the plan and provider you choose, so you compare the best visitors visa insurance plans on American visitor insurance to understand the benefits and limitations of these plans.

07. Are pre-existing conditions covered by visitor visa insurance?

Visitors visa insurance coverage for pre-existing conditions will vary depending on the specific visitors insurance policy. INF visitor insurance plans offer coverage for pre-existing conditions, while some other visa insurance plans offer coverage only for acute onset of pre-existing conditions, while still others may exclude coverage for pre-existing conditions altogether. It is important to compare the different visitors visa insurance for pre-existing conditions on AmericanVisitorInsurance.com before buying it.

08. How long can visitor visa insurance coverage be purchased for?

Visitor visa insurance coverage can typically be purchased for the duration of the visitor's stay in the United States. Coverage can range from a few days to several months, depending on the visitor's travel plans. It is important to select a policy that aligns with the intended length of stay or one that can be extended if needed.

09. How do I choose the right visitor visa insurance plan?

When choosing a visitor visa insurance plan, it is recommended to compare the best visa insurance plans on American Visitor Insurance before making a decision.

Some factors to consider while finding the best visitors visa insurance for your needs are:

- The coverage amount: This is the maximum amount that the plan will pay for eligible expenses. You may want to choose a higher coverage amount if you are travelling to a country with high healthcare costs or if you have a higher risk of medical emergencies.

- The deductible: This is the amount that you have to pay out of pocket before the plan starts paying for eligible expenses. You may want to choose a lower deductible if you want to reduce your upfront costs or if you expect to use the plan frequently.

- The co-insurance: This is the percentage of eligible expenses that you have to share with the plan after paying the deductible. You may want to choose a lower co-insurance if you want to reduce your out-of-pocket costs or if you expect to incur high medical bills.

- The coverage benefits: These are the specific types of expenses that the plan covers, such as hospitalization, doctor visits, prescription drugs, dental care, evacuation, repatriation, etc. You may want to choose a plan that covers the benefits that are most important or relevant to you.

- The exclusions: These are the specific types of expenses that the plan does not cover, such as pre-existing conditions, preventive care, maternity care, sports injuries, etc. You may want to avoid plans that exclude the expenses that you are likely to incur or that are essential for your health.

- The PPO network: This is the group of providers that the plan has contracted with to offer discounted rates and direct billing. You may want to choose a plan that has a large and accessible network of providers in your destination country or that allows you to use any provider of your choice.

- The customer service: This is the quality and availability of support that the plan offers to its customers. You may want to choose a plan that has a 24/7 helpline, online claim filing, mobile app, etc.

- You can compare different visitor visa insurance plans online on AmericanVisitorInsurance.com .

10. How much does visitor visa insurance for the USA typically cost?

The cost of visitor visa insurance for the USA varies depending on several factors, such as:

- The type of plan: There are two main types of plans – limited or fixed benefit plans and comprehensive plans. Limited benefit plans are cheaper but offer lower coverage and more exclusions. Comprehensive plans are more expensive but offer higher coverage and fewer exclusions.

- The age of the traveler: Older travelers are more likely to incur higher medical expenses, so they have to pay higher premiums for visitor visa insurance.

- The coverage amount: This is the maximum amount that the plan will pay for eligible expenses. Higher coverage amounts mean higher premiums.

- The deductible: This is the amount that you have to pay before the plan starts paying for eligible expenses. Higher deductibles mean lower premiums.

- The co-insurance: This is the percentage of eligible expenses that you have to share with the plan after paying the deductible. Higher co-insurance means lower premiums.

- The duration of stay: Longer stays mean higher premiums as there is more risk of medical emergencies.

On average, it can range from 4% to 10% of the trip cost. However, it is important to compare quotes from insurance providers on AmericanVisitorInsurance.com to get the best cost estimate.

11. How can I purchase visitor visa insurance for the USA?

Visitor visa insurance for the USA can be purchased online on AmericanVisitorInsurance.com . Here the visitors visa insurance plans offered by the well known US companies are compare and objectively listed based on costs and coverage benefits.

The steps involved to buy the insurance are:

- Compare different plans and prices based on your needs, preferences, and budget on AmericanVisitorInsurance.com .

- Choose a plan that meets your requirements and the visa criteria.

- Fill out an online application form with your personal and travel details.

- Pay the premium online using a credit card or other payment methods.

- You will receive a confirmation email with your policy number and other details.

- Print out your policy document and insurance card. You will need to show these documents when applying for your visa and when seeking medical care in the USA.

12. What documents do I need to purchase visitor visa insurance?

Generally, you will need to provide information such as the travelers name, date of birth, passport details, and travel dates to purchase visitor visa insurance. You may also need to provide the details of your Accidental Death and Dismemberment (AD&D) beneficiary. You should have your passport and visa handy when filling out the online application form. You should also have a valid credit card ready to pay the premium online.

13. Can visitor visa insurance be extended if my stay in the USA is prolonged?

Some visitor visa insurance plans offer the option to extend coverage if your stay in the USA is prolonged beyond the original policy duration. However, this is not always guaranteed, and it is important to check the terms and conditions of your policy or contact the insurance provider directly to inquire about extension options. You can request the extension online by logging into your account on the visitors visa insurance provider's website and following the instructions. You will receive a confirmation email with your new policy details and expiry date on completing the extension application payment.

Visitors insurance for seniors

Visitor medical insurance for travelers above 60 years

Visitor medical insurance for travelers above 65 years

US Visitors insurance for travelers above 70 years

Visitor medical insurance for travelers above 75 years

Visitor health Insurance for travelers above 80 years

US Visitors insurance for travelers above 90 years

Best Seniors travel insurance with Pre-existing Conditions Coverage

Pre-existing condition is a medical ailment that existed before the travel insurance became effective. Another term that we come across more frequently in insurance policies is "Acute onset of pre-existing condition" .Acute onset of pre-existing condition is a sudden relapse of the pre-existing condition without advance warning which requires medical attention within 24 hours.

Travelers with pre-existing conditions always find it hard to buy travel health insurance. Some of the common conditions that are considered as pre-existing conditions are asthma, food & drug allergies, environmental allergies, heart related issues, high blood pressure, kidney disease, cancer, and diabetes. Typically all insurance providers have their terms and conditions for the pre-existing condition coverage provided. Most do not cover anything related to a pre-existing condition. Travelers can buy a travel insurance policy without a medical check, however chronic illnesses like cancer, parkinson's disease, Amnesia...which cannot be cured are not covered by the travel health insurance policies. With the pre-existing condition there is a "look back" period of 60-180 days to determine the claim. Most of the Insurance providers consider the age of the individual as a factor for providing this benefit. Most of the policies do not provide coverage for pre-existing conditions at the age of 70 and more.

Some US insurance providers offer senior citizen travel insurance for pre-existing conditions above the age of 80 with fixed or limited coverage. The Safe Travels USA, Safe Travels USA Cost Saver, and Safe Travels USA Comprehensive all offer $1000 coverage for pre-existing conditions without limitation to chronic illness. If travelers have a medical condition they are concerned about, it is very important for them to buy a policy that includes the illnesses in the coverage and to be aware of the terms of pre-existing condition coverage.

INF is one of the few companies which offers travel insurance plans for travelers with flexible coverage for pre-existing ailments. They define pre-existing conditions differently and do not exclude chronic illness. First of all, if the person has had no flare up or change in their condition, even if they take medication for it (as long as there has been no change in medication) for 12 months prior to the start of the plan, then the plan does not consider it as a pre-existing condition. If there has been a flare up or change in the condition, then it is covered but at a lower maximum than the overall maximum of the plan and may be subject to a higher deductible.

They have two plans which have this coverage: INF Premier and INF Elite. The Premier plan is a fixed plan which has limitations on the coverage of each medical expense. The Elite plan is an 80/20 comprehensive plan (the plan pays 80% and the insured 20% after the deductible). INF offers the best travel insurance for pre-existing medical conditions but the difference is reflected in the cost, particularly in the Elite plan. Note that regularly needed maintenance medications or treatments are still not covered with these plans, only if there is a new problem will there be coverage. However, the problem does not need to be life-threatening or acute. Travelers with pre-existing conditions should weigh these options to reduce their risk of high medical costs should they suffer from one of their conditions while traveling. Note that the plans need to be purchased for at least 90 days, so these are more suitable for longer term stays in US, Canada, and/or Mexico. Also, the plans may be purchased by green card holders as long as they have a non-US residence address. The Elite plan has several variations: INF Elite , Elite Plus and INF Elite 90 .

To compare the best travel insurance for seniors visiting USA for flexible pre-existing conditions plans offered by INF, use this link: INF Premier & INF Elite best travel insurance for pre-existing conditions.

Testimonials - From Our Customers

I am pleased to say that your company is very professional in the field of Insurance. The customer is happy to get... Know more »

Appreciate all the help that you provided me. It really worked well and I was able to purchase the cover I was... Know more »

Thank you American Visitor Insurance! You went way beyond what I would expect from an insurance company ... Know more »

Resourceful tourist insurance USA information

Find the best travel insurance.

Find out the best insurance for your budget and needs

How does travel insurance work?

Claims process for expenses due to injury or sickness

How to buy travel insurance?

Travel insurance glossary.

Commonly used international travel medical insurance terms

Travel insurance for specific groups

Compare travel insurance plans, more tourist medical insurance usa categories.

Compare Visitors insurance USA

USA New immigrant Insurance

US visa health insurance

Senior Citizen travel insurance

Pre-existing visitors insurance

J1 Visa health insurance

International student Insurance

Green Card medical insurance

International Medical Insurance

Cruises Travel Insurance

US visitors insurance providers

You can find reliable US insurance providers like International Medical Group(IMG), Seven Corners, WorldTrips, Global Underwriters, Travel Insure, GeoBlue, HTH Worldwide and INF insurance.

- Call: (877)-340-7910

- Contact

Agent Information

Travel medical usa visitor basic & choice.

Best visitor health insurance benefits for up to 3 years

Why Should I buy Visitor's Insurance?

If you’re traveling to the United States, you should be aware medical expenses in the USA are some of the most expensive in the world. That’s why it’s important to consider travel insurance like Travel Medical USA Visitor to protect you if you become sick or hurt on your trip. Because it has scheduled benefits, it is priced affordably even for longer trips, and includes 24/7 multilingual travel assistance services provided by an experienced team who can help you find medical care.

Who can purchase this plan?

Non-United States citizens and non-United States residents who are traveling to the USA can buy Travel Medical USA Visitor. You may buy coverage for yourself, your spouse, your children, and your traveling companions. To be covered, you must be at least 14 days of age and younger than 100 years of age.

Where can I travel?

If you wish to buy this plan, your travel destination must be the USA. The plan provides limited coverage for travel to additional countries for trips that originate in the USA. See the International Travel Coverage benefit for details.

Compare Travel Medical Visitor Insurance Benefits

Essential Coverage

Seven Corners Travel Medical USA Visitor Basic

Most Popular

Seven Corners Travel Medical USA Visitor Choice

You select the dollar amount for this limit. It is the limit for each injury or illness (occurrence) that occurs during your period of coverage. We cover injuries and illnesses that occur during your coverage period. Benefits are paid in excess of your deductible up to the medical maximum. Occurrence is an illness or injury and includes all bodily disorders due to the same or related causes.

Initial treatment must occur within 30 days of the date of injury or onset of illness.

This is the amount you must pay per injury or illness before the plan begins paying.

This is a Cardiac care unit or other unit or area of a Hospital that meets the required standards of the Joint Commission on Accreditation of Hospitals for Special Care Units.

Telehealth Consultations or Care includes long-distance or remote (i) health-related services and information, (ii)treatment of injury or illness, or (iii) other live consultations, each of which involves an insured person and a physician or nurse practitioner at different locations using telecommunications technologies including internet, phone, video, audio, and computers.

Considered a covered medical expenses when requested and approved by the attending Physician.

Private Duty Nursing Services includes:

- Private duty nursing care only; and

- While Hospital confined; and

- Ordered by a licensed Physician; and

- Medically Necessary.

General nursing care provided by the Hospital is not covered under this benefit.

Limited to routine tests such as complete blood count, urinalysis, and chest x-ray when administered within seven days of Hospital admission.

Only in connection with a Medical Emergency as defined in the plan document. Benefits will be paid for the use of the emergency room and supplies.

This benefit includes medically necessary rental of a non-motorized wheelchair, crutches, or a basic hospital bed for up to 60 days or the duration of the injury or illness, whichever ends first.

Benefits are limited to one Physician’s visit per day.

This means physical therapy, recommended by a Physician as Medically Necessary for the treatment of a specific Injury or Illness. It must be administered by a licensed physical therapist and be intended to improve, adapt or restore functions which have been impaired or permanently lost as a result of a covered Illness or Injury and involve goals an individual can reach in a Reasonable Period of Time.

This covers an illness or injury that begins on an incidental trip in your home country. You earn covered days at home at approximately 5 days per month up to 60 days for every 364 days of purchased coverage. Unused days do not carry over to a subsequent 364-day period. It does not cover pre-existing conditions or an illness or injury that began while you were outside your home country. Coverage is available if your period of coverage is greater than 30 days.

Many travel insurance plans do not cover pre-existing conditions. Seven Corners Travel Medical Visitor USA covers them through the Acute Onset of Pre-Existing Conditions benefit.

An Acute Onset of Pre-Existing Condition is the occurrence of a pre-existing condition that meets these criteria:

- It is sudden, unexpected, and occurs without advanced warning;

- It is a medical emergency;

- It occurs during the period of coverage;

- You obtained treatment within 24 hours of the occurrence;

- You did not have a change in prescription or treatment related to the underlying pre-existing condition within the last 30 days; and

- Your pre-existing condition is not congenital, a previously diagnosed chronic condition with expected episodes or flare-ups, or a deteriorating condition which cannot be controlled and gradually intensifies over time.

Review the plan document for more details.

Coverage ends on the earlier of:

- The condition no longer being considered acute or

- Your discharge from the hospital.

If you are injured as a result of terrorist activity, we will provide medical benefits if the following conditions are met:

- You have no direct or indirect involvement in the terrorist activity.

- The Terrorist Activity is not in a country/location where the U.S. government has issued a Level 3 Terrorism, Level 3 Civil Unrest, or any Level 4 Travel Advisory or the appropriate authorities of your host country or your home country have issued similar warnings, any of which have been in effect within 6 months before your date of arrival and

- You departed the country/location following the date a warning to leave was issued by the U.S. government or the appropriate authorities of your host country or your home country.

The plan can pay for emergency treatment for the relief of pain for sound natural teeth. Coverage is available if your period of coverage is greater than 30 days.

The plan can pay for emergency treatment to repair or replace sound natural teeth damaged because of an accidental injury caused by external contact with a foreign object. You are not covered if you break a tooth while eating or biting into a foreign object.

If medically necessary, we will pay and arrange to transport you to the nearest adequate medical facilities. The plan pays regardless of whether your evacuation is related to a pre-existing condition. This benefit must be arranged by Seven Corners Assist. Failure to use Seven Corners Assist may result in a denial of benefits.

We can pay reasonable expenses for embalming, a minimally-necessary container for transportation, shipping costs, and government authorizations to return your remains to your home country if you die while outside your home country. The plan pays regardless of whether your death is related to a pre-existing condition. You cannot use this benefit if you use the Local Cremation or Burial benefit. This benefit must be arranged by Seven Corners Assist. Failure to use Seven Corners Assist may result in a denial of benefits.

This benefit can pay reasonable expenses for the preparation and either your local burial or cremation if you die while outside your home country. The plan pays regardless of whether your death is related to a pre-existing condition. You cannot use this benefit if you use the Return of Mortal Remains benefit. This benefit must be arranged by Seven Corners Assist. Failure to use Seven Corners Assist may result in a denial of benefits .

This benefit pays funds if you die because of an injury caused by an accident that occurred while you were a passenger on a common carrier. A common carrier is a public air conveyance that transports passengers for hire.

The benefit can cover you up to 14 days when you travel to countries other than the United States. It does not cover travel to your home country, and it does not extend after your expiration date. This benefit must be used during your current period of coverage, and the trip must originate in the United States. Coverage is available if your period of coverage is greater than 30 days.

Frequently asked questions

How this plan works, what documents do i receive after buying travel insurance from seven corners.

Once you complete your purchase, you will immediately receive a receipt, a summary of your benefits, an ID card, and a copy of the plan document.

The plan document is the legal document that explains how your coverage works and describes all benefits and exclusions for the plan. We recommend you read it, so you understand how your plan works. Refer to the plan document for applicable exclusions.

Who can buy a Seven Corners Travel Medical USA Visitor plan?

Non-United States citizens who are traveling to the USA can buy Seven Corners Travel Medical USA Visitor. You may buy coverage for yourself, your spouse, your children, and your traveling companions. To be covered, you must be at least 14 days of age and younger than 100 years of age.

United States citizens, including those with dual citizenship, and Green Card/Permanent Resident cardholders cannot buy this plan for travel to the United States and U.S. territories.

Country Restrictions — We cannot sell to persons who are a resident of Australia, Cuba, Democratic People’s Republic of Korea (North Korea), Gambia, Ghana, Islamic Republic of Iran, Nigeria, Sierra Leone, Syrian Arab Republic, United States, and United States Virgin Islands.

If you wish to buy this plan, your travel destination must be the USA.

The plan provides limited coverage for travel to additional countries for trips that originate in the USA. See the International Travel Coverage benefit for details.

We cannot cover trips to Afghanistan, Antarctica, Belarus, Cuba, Haiti, Iraq, Islamic Republic of Iran, Israel, Democratic People’s Republic of Korea (North Korea), Libyan Arab Jamahiriya, Myanmar, Palestinian Territory Occupied, Russian Federation, South Sudan, Sudan, Syrian Arab Republic, and Yemen.

How long can I be covered by this plan?

You can buy up to 364 days of coverage. If you buy less than 364 days, we will email you an extension notice before coverage ends. There is a $5 fee for each extension. If you purchase Seven Corners Travel Medical USA Visitor Choice, you can extend your coverage up to 1,092 days (3 years).

When does my coverage start?

Your plan's effective date is the start date of your plan, which begins at the latest of the following times:

- 12 a.m. the day after we receive your application and correct payment if you apply online;

- The moment you depart your home country;

- 12 a.m. on the date you request on your application.

All times above refer to United States Eastern Time.

When does my coverage end?

Your coverage ends on your expiration date, which is the earliest of the following times:

- The moment you return to your home country (except for coverage provided by the Incidental Trips to Home Country benefit);

- 11:59 p.m. on the date you reach the maximum period of coverage;

- 11:59 p.m. on the date shown on your ID card;

- 11:59 p.m. on the date that is the end of the period for which you paid premium; or

- The moment you fail to be eligible for the plan.

Does this plan provide primary coverage or secondary coverage?

It provides secondary coverage. All coverages except Common Carrier Accidental Death & Dismemberment are in excess of all other insurance or similar benefit programs and shall apply only when such benefits thereunder are exhausted. This Plan is secondary coverage to any other insurance. Such other insurance or similar benefit programs may include, but are not limited to, membership benefit; workers’ compensation benefits or programs; government programs; group or blanket coverage; prepayment coverage; union, labor, or employee plans; socialized insurance program or program otherwise required by law or statute; automobile insurance; or third-party liability insurance.

Will Seven Corners give me a refund for this plan if I’m not satisfied?

We will refund your payment if we receive your written request for a refund before your effective date of coverage. If your request is received after your effective date, the unused portion of the plan cost may be refunded minus a $35 cancellation fee, if you have not submitted any claims to Seven Corners.

Where can I find what is not covered by this plan?

You can find situations and items not covered by this plan in the exclusions section of the plan document.

Who provides the coverage for this plan?

Your underwriter is Crum & Forster SPC.

This plan includes international travel medical insurance underwritten by Crum & Forster SPC. C&F and Crum & Forster are registered trademarks of United States Fire Insurance Company. The Crum & Forster group of companies is rated A (Excellent) by AM Best 2023.

Seven Corners administers your plan.

Seven Corners will handle your travel medical insurance needs from start to finish. We will process your purchase, provide all documents, and handle any claims. In addition, our own in-house team, Seven Corners Assist, will handle your travel assistance needs, including emergency services such as emergency medical evacuations and repatriations.*

*These types of service are not insurance and are not affiliated with Crum & Forster, SPC. They are provided by Seven Corners Assist.

Medical Benefits and Coverage

How do i find a medical provider when i’m traveling.

Find medical providers using our online tools or contact Seven Corners Assist .

Inside the United States — With the Seven Corners Travel Medical USA Visitor plan, you may seek treatment from any medical facility or provider you wish.

Outside of the United States — Seven Corners has a large directory of providers, and many of them have agreed to bill us direct for treatment they provide. We recommend you contact us for a referral, but you may seek treatment at any facility.

Utilizing the network does not guarantee benefits or that the treating facility will bill Seven Corners direct. We do not guarantee payment to a facility or individual until we determine the expense is covered by the plan.

What is a pre-existing condition?

Pre-existing conditions include any injury or illness, including mental illness or mental or nervous disorder, which meet one or more of the following criteria before your effective date of coverage:

- You were diagnosed;

- You received treatment;

- Treatment was recommended to You;

- There is reasonable medical certainty that the injury or illness existed within the last 36 months, whether or not it previously manifested, was symptomatic, known, diagnosed, treated, or disclosed.

This includes any chronic, subsequent, or recurring complications of an injury or illness which meets the above criteria.

How does Seven Corners cover pre-existing conditions on Travel Medical USA Visitor?

Coverage amounts vary by age and plan. See the schedule of benefits in the plan document for details.

An Acute Onset of Pre-Existing Conditions is the occurrence of a pre-existing condition that meets these criteria:

Coverage ends when the first of these events occurs:

- The condition no longer being acute; or

There is no coverage for known, scheduled, required, or expected medical care, drugs, or treatments existent or necessary prior to arrival in the USA and before your coverage begins.

There is no coverage for treatment for which you have traveled or conditions for which travel was undertaken after your physician limited or restricted travel.

PPACA – Patient Protection and Affordable Care Act

Does this plan provide benefits required by ppaca.

This insurance is not subject to and does not provide certain insurance benefits required by the United States’ Patient Protection and Affordable Care Act (“PPACA”). PPACA requires certain U.S. citizens or U.S. residents to obtain PPACA compliant health insurance, or “minimum essential coverage.” PPACA also requires certain employers to offer PPACA compliant insurance coverage to their employees. Tax penalties may be imposed on U.S. residents or citizens who do not maintain minimum essential coverage, and on certain employers who do not offer PPACA compliant insurance coverage to their employees. In some cases, certain individuals may be deemed to have minimum essential coverage under PPACA even if their insurance coverage does not provide all of the benefits required by PPACA. You should consult your attorney or tax professional to determine whether the policy meets any obligations you may have under PPACA.

- Travel Medical USA Visitor

- Travel Medical USA Visitor – Basic and Choice

Plan Documents

- Travel Medical USA Visitor Basic

- Travel Medical USA Visitor Choice

Limitations, exclusions and disclaimers from Crum & Forster, SPC.

Disclaimer: The above information is a summary of the important features of the plan. It is not a contract of insurance. This plan includes both insurance and non-insurance benefits. The terms and conditions of coverage are set forth in the Plan issued to the policyholder. For a detailed plan description, exclusions, and limitations please view the plan on file with Seven Corners, Inc. The Policy contains a complete description of all of the terms, conditions, and exclusions of the insurance plan as underwritten by Crum & Forster, SPC. The Policy will prevail in the event of any discrepancy between this web page and the Policy.

303 Congressional Blvd.

Carmel, Indiana 46032

Our Markets

- Consumer Insurance

- Government Solutions

- Trip Protection

- Trip Protection Annual Multi-Trip

- Trip Protection USA

- Travel Medical

- Cruise Insurance

- Medical Evacuation and Repatriation

- Partnerships

- 24 Hour Urgent Travel Assistance

- Frequently Asked Questions

- Developer Portal

- System Status

Copyright © 2024 Seven Corners Inc. All rights reserved.

Privacy | Cookies | Terms of Use | Security

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best SEO Services (2024 Rankings)

- Best Mass Texting Services 2024

- Best SEO Software 2024

- Best Email Marketing Software 2024

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (June 2024)

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Best Medical Insurance for Visitors to the U.S. (2024)

U.S. visitors can get travel medical insurance for as low as $89 per trip.

with our comparison partner, Squaremouth

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over seven years. A journalist by trade, her experience includes communications and marketing management in the nonprofit, governmental and academic sectors.

Seven Corners, WorldTrips, IMG and Trawick offer the best health insurance plans for visitors to the U.S.

In this guide, we’ll provide you with details on travel health insurance plans from these providers, including example quotes, information on how to use your visitor health insurance and more.

Do Visitors Need U.S. Health Insurance?

While health insurance is not always mandatory when traveling to the U.S., regulations may vary depending on the circumstances around your visit and your visa needs. In addition, health plans from different countries are generally not accepted in the U.S., which means you could pay thousands of dollars out-of-pocket for treatment in an emergency without a valid plan.

Note that many foreign visitors traveling to the U.S. do not need a visa to enter the country for less than 90 days. However, some visa requirements for long-term visitors require health insurance coverage for the duration of their stay. Regardless of the requirements for your travels, it’s worth considering a travel medical insurance plan based on the high cost of U.S. healthcare. According to GoodRx, an emergency room visit can cost upwards of $2,400 to $2,600 without insurance in the U.S.

Health Insurance Requirements for People Visiting the U.S.

While tourists do not technically need a travel medical insurance plan to obtain a visa, other types of visitors do. For instance, if you’re a student planning to study abroad in a U.S.-based college or university using an F-1 or J-1 visa, you’ll likely need some sort of health insurance or a comparable equivalent. Many universities that accept students on visas require medical coverage that complies with the school’s outlined health insurance requirements.

Note that health insurance requirements for visitors to the U.S. largely depend on the type of visa you need to enter the country. Regardless of whether it’s required, we recommend medical insurance based on the high costs of U.S. healthcare services.

Best Travel Health Insurance for Visitors to the U.S.

Our team has spent extensive time researching the best travel medical insurance plans for visitors to the U.S., considering factors such as availability, coverage, customer support and provider reputation.

- Seven Corners Travel Medical Basic: Our pick for group travelers

- WorldTrips Atlas America : Our pick for high coverage limits

- IMG Patriot Lite : Our pick for budget coverage

- IMG Patriot America Plus : Our pick for continuous coverage

- Trawick Safe Travels USA Comprehensive : Our pick for wellness coverage

Seven Corners

Why We Picked It

Seven Corners’ Travel Medical Basic plan is our pick for group travelers. This plan is specifically designed for groups of up to 10 non-U.S. residents and non-U.S. citizens aged 14 days or older, making it ideal for families traveling together . However, it is also available for solo travelers. You can extend coverage for up to a year, with protection both in the U.S. and worldwide.

Pros and Cons

Medical coverage details.

The Travel Medical Basic plan offers extensive coverage with benefit maximums of up to $1 million and various deductible options, making it easy to customize a plan to suit your needs. Medical coverage offered through this plan includes the following:

- General medical

- Emergency dental

- Emergency services and assistance

- Accidental death and dismemberment (AD&D)

- Optional adventure activity coverage

Learn more : Seven Corners Travel Insurance Review

WorldTrips’ Atlas America plan is our pick for high coverage limits. This plan is designed for U.S. tourists, temporary workers, business visitors and international students studying abroad , providing accessible health coverage to a variety of travelers. It provides overall coverage maximums of up to $2 million, with up to $1 million for emergency medical evacuation coverage.

The Atlas America plan offers up to $2 million in overall coverage and seven different deductible options, providing sound medical coverage along with supplemental travel benefits. Medical coverages include services that fall under the following categories:

- Emergency dental and vision

Learn more: WorldTrips Travel Insurance Review

We chose IMG’s Patriot Lite plan as our pick for budget coverage — the company quoted us less for this plan than its competitors on our list. You can buy this plan as an individual or group, making it ideal for family members traveling to the U.S. together. Like other insurance companies in this review, IMG is partnered with UnitedHealthcare, meaning policyholders have access to a domestic network of over 1.4 million physicians for medical care.

Policyholders can choose coverage with a maximum of up to $1 million with the Patriot Lite plan, with deductibles ranging from $0 to $2,500. Coverages with the Patriot Lite plan include the following:

Learn more : IMG Travel Insurance Review

IMG’s Patriot America Plus plan also made our list for providing short-term insurance for business and leisurely travelers. We named it our pick for continuous coverage, as it provides up to 24 months of renewable, consecutive coverage. Other benefits include access to multilingual customer service representatives and a maximum limit of up to $1 million. Unlike IMG’s Patriot Lite plan, Patriot America Plus covers COVID-19 treatments.

As with IMG’s Patriot Lite plan, coverage with a maximum of up to $1 million is available, with your choice of deductible from $0 to $2,500. Coverages with the Patriot America Plus plan include the following:

Trawick International

We named Trawick’s Safe Travels USA Comprehensive plan our pick for wellness coverage, as it affords policyholders a general wellness visit with a U.S. doctor during their travels for up to $125. As is standard across most plans in our review, Trawick’s Safe Travels plan offers up to $1 million in medical expense coverage. It also offers up to $2 million in emergency medical evacuation coverage and eight deductible options up to $5,000.</p

The Safe Travels USA Comprehensive plan covers up to $1 million in medical benefits after you pay your deductible. Benefits provided with each plan include:

- Optional sports activity coverage (excludes extreme sports)

Read more : Trawick International Travel Insurance Review

Compare Travel Medical Insurance Plans for U.S. Tourists

See the table below for a direct comparison of costs, deductibles and more between travel medical insurance plans for U.S. visitors.

We based plan costs on quotes we obtained for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan includes a medical maximum of $500,000 with a $250 deductible. Note that your actual cost will depend on factors such as your age, number of travelers, chosen deductible and more.

Types of Health Insurance for U.S. Visitors

Travelers have options when it comes to health insurance for U.S. visitors. For one, you could choose an international travel medical insurance plan, which provides coverage for emergency medical expenses or evacuation abroad. A U.S. short-term health insurance plan is also an option. Some health insurance companies, such as UnitedHealthcare, work with providers to allow policyholders to use the company’s preferred provider organization (PPO) network.

If you’re wondering whether your domestic health insurance policy will cover you in the U.S., we encourage you to contact your insurance provider for more details. You may need to purchase valid coverage specifically for your U.S. trip if you’re concerned about or foresee needing medical care abroad.

Fixed Medical Insurance

Fixed medical insurance or fixed indemnity insurance pays a predetermined amount of money for specific medical procedures and services. This type of medical insurance plan is limited — no matter what your total bill amounts to, it will not cover more than the agreed-upon amount. Fixed medical insurance plans are usually cheaper than comprehensive policies, which we cover in the next section.

Comprehensive Medical Insurance

Comprehensive medical insurance covers doctor’s visits, hospital care, prescription drugs and more without setting limits on certain services. Note that these plans typically have coverage maximums, deductibles and copays, so you will have to pay a certain amount before your policy covers any medical expenses.

Comprehensive coverage does not have benefit limits based on the type of medical service like fixed medical does, but it will cost you more overall. However, because health care in the U.S. is expensive, you may find comprehensive plans more beneficial in the long run despite being pricier than a fixed plan.

Short-Term vs. Long-Term Health Insurance

Short-term and long-term health insurance plans provide coverage that lasts for a specific period. You can consider travel medical insurance plans short-term policies for U.S. visitors, as they can cover medical expenses incurred during a period lasting less than a year.

If you plan on staying in the U.S. for longer than a year, you may be eligible to purchase a health insurance plan through a domestic provider, depending on your visa. For example, if you have a J-1 or F-1 visa, you may be eligible for a university-sponsored or private health insurance plan. We encourage you to check with the U.S. Department of State when you receive your visa for more on what long-term health insurance options are available to you.

What Does Travel Insurance in the U.S. Cover?

Travel insurance in the U.S. provides a variety of coverages for unexpected events that can affect your travel plans both before and during your trip. Specifics will vary depending on your choice of policy but will likely include some or all of the following coverages:

Created with Sketch Beta. Trip cancellation: If you must cancel your trip for a covered reason, travel insurance can help you recover non-refundable costs such as hotel reservations, airline tickets and more.

Created with Sketch Beta. Trip interruption: If you need to cut your vacation short for a covered reason, travel insurance plans can compensate you for expenses you didn’t use during your trip.

Created with Sketch Beta. Trip and baggage delays: A travel insurance policy can help cover costs you incur if your trip or baggage gets delayed for a covered reason. Most coverage also includes lost or stolen baggage.

Created with Sketch Beta. Emergency medical: Emergency medical coverage can reimburse the cost of necessary treatments if you experience a medical emergency abroad up to a maximum amount.

Created with Sketch Beta. Emergency evacuation and transport: If you need transportation to a medical facility in the U.S. during a medical emergency, this coverage will provide an expense limit for the services. This benefit can also cover emergency evacuations if a natural disaster or political conflict occurs and affects your travels.

How Much Does Travel Health Insurance for U.S. Visitors Cost?

Our research found that the cost of travel insurance for U.S. visitors can range from $96 to $115 . This range is based on quotes gathered for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan we obtained a quote for included a medical maximum of $500,000 with a $250 deductible.

For cost data specific to your travel needs, we encourage you to gather quotes from the providers in this review. The quotes you receive will depend on factors such as your age, plan limits, chosen deductible, number of travelers and more.

How To Use Visitor Health Insurance

If you’ve purchased a visitor medical insurance plan for your stay in the U.S., it’s important you understand how to use it. Healthcare facilities in the U.S., such as doctor’s offices, urgent care locations and emergency rooms, often require you to bring an insurance card with you. This card includes essential information associated with your policy that helps the facility file a claim with your insurance provider. If you have one through your visitor health insurance plan, it is best to have it on hand when receiving medical treatment.

Your health insurance plan may require pre-approval before you receive treatment in non-emergent cases. Your insurance company may request to verify a procedure or medicine is necessary before agreeing to cover it. Be sure to check your policy to find out what the restrictions are.

Many visitor health insurance plans also cover prescription medications. If you’ve been prescribed medicine through a U.S. doctor during a medical visit, a pharmacy may choose to verify your prescription before filling it. This means the pharmacy will contact your healthcare provider with any questions about the prescription being correct. Verification could delay when you receive your medication, but likely won’t take longer than three to10 business days.

Finding Doctors and Hospitals as a Visitor

Most insurers provide online tools that help you find in-network healthcare providers and facilities covered by your insurance policy. Note that you may pay more if you choose to receive care through a doctor or facility that is not considered in-network. Out-of-network providers do not contract with your health insurance plan to provide agreed-upon rates. Unless you have a plan that lets you pick any provider you’d like, you will need to find a provider or facility working with your insurance.

If you want to verify the benefits offered by your insurance plan, contact your insurance provider directly or consult any documentation provided at the time of purchase. Healthcare providers may also take steps to verify your coverage, as it ensures the facility receives payment and lessens the chance of a denied insurance claim.

The cost of medical treatment depends entirely on the type of insurance plan you have. If you’ve purchased a travel medical insurance plan, your provider will cover emergency medical expenses up to a maximum amount. Once you’ve hit that limit, you will have to pay the rest of your bill. If you have a plan with a deductible or co-pay, you must pay that amount before your insurer will cover your expenses.

Paying Medical Bills Without Insurance

If you opt out of medical coverage when visiting the U.S. and end up needing medical care, you will have to cover the entire bill out of pocket. However, you have several options regarding payment. You can contact the debt collector in charge of your bill and work to negotiate the cost of your bill down . You can also set up a payment plan that works with your income and what you can afford.

While these payment options can be helpful, they do not negate the high U.S. healthcare costs, and can still leave you with a substantial bill after a medical crisis.

According to a study by the Peterson-KFF Health System Tracker , health expenditures per person in the U.S. in 2022 were over $4,000 more than any other high-income nation. For this reason, we recommend some form of medical coverage to help cover potential emergency expenses when visiting the U.S.

Filing a Claim with Visitor Health Insurance

Filing a claim through a visitor insurance plan or travel medical insurance policy will vary based on your provider. Note that providing proper documentation will help the claims process go smoothly, so it is important to keep track of hospital invoices and other billing forms.

If you have a domestic health insurance policy, the healthcare facility that provided your treatment will file your claim. You’ll receive a bill once your insurance provider processes the claim. On the other hand, travel medical insurance may require you to submit documents proving your claims for emergency medical treatment. Once your claim has been approved, your travel insurance company will reimburse your medical bills.

Where Can You Buy Visitors Insurance?

You can buy visitors’ insurance directly from travel insurance companies, international health insurance companies, university-approved providers and domestic providers, depending on the type of visa required during your stay. If you’re on a tourist visa, you can purchase travel medical insurance covering emergency medical services and transport, if needed, to a healthcare facility. Most travel insurance providers also offer travel healthcare plans that can last up to a year if you are planning multiple trips.

If you’re on a J-1 or F-1 visa and enrolling in a schooling program, contact your university to see if you’re eligible for a sponsored or private health insurance plan. If you need clarification on the available coverage or plan to stay in the U.S. for longer than a year, contact the U.S. Department of State for more information.

Do U.S. Visitors Need Health Care Coverage?

Healthcare in the U.S. is expensive. While medical insurance isn’t required for some visitors — such as tourists on a B-2 visa — it’s still worth considering if you’re concerned about an unexpected medical emergency abroad. We encourage you to extensively research your visa type and the coverage available to you before settling on a plan. Understanding the benefits and exclusions of a healthcare coverage plan will ensure there are no surprises if you need medical care during your U.S. trip.

Frequently Asked Questions About Visitor Health Insurance

How much is visitor health insurance in the u.s..

Visitor health insurance costs in the U.S. depend on factors unique to your travel needs. After gathering quotes from the providers in our review, we found that visitor health insurance can range from $89 to $115 . This range is based on a 30-year-old Australian citizen traveling to the U.S. for 30 days, opting for a plan with a medical maximum of $500,000 and a $250 deductible. Your actual costs will vary.

How much does travel insurance cost for trips to the U.S

Our research team found the average cost of travel insurance ranges from $35 to $400, with the average being $221 for a standard policy. Your costs will vary depending on your chosen plan, provider, length of travels, number of travelers and more.

Can foreign visitors get insurance while in the U.S.?

Yes, foreigners can get insurance while in the U.S. Various insurance options are available to travelers depending on their length of stay and visa type. It’s best to research what’s available to you based on your visa requirements before purchasing a plan.

Is it hard to get travel insurance for U.S.-based trips?

No, it’s not hard to get travel insurance for travel to the U.S. Providers such as Seven Corners, WorldTrips, IMG, Trawick and more provide plans for non-U.S. citizens seeking trip and medical coverage while abroad.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?