Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

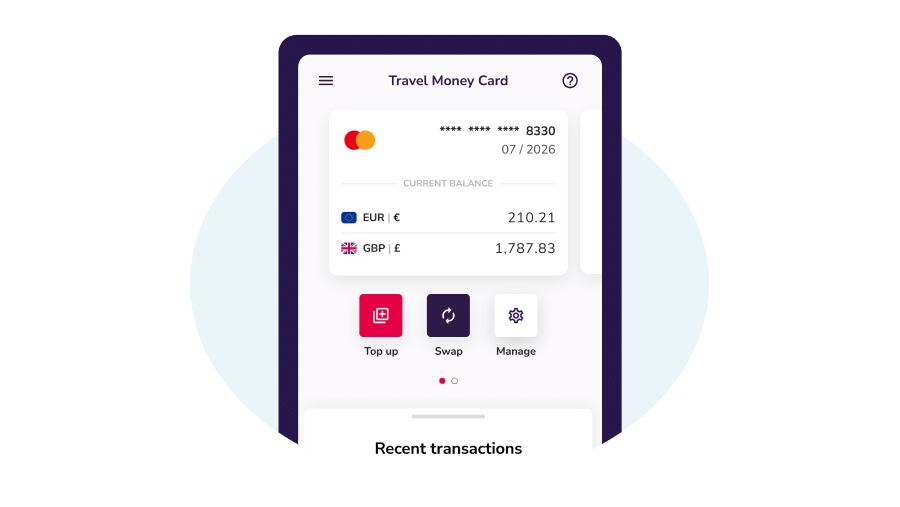

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

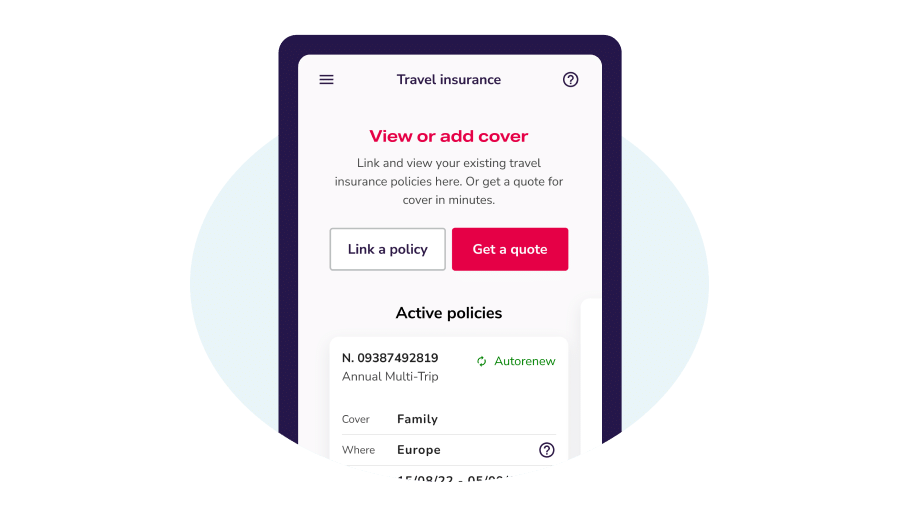

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

Suggested companies

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.3.

Most relevant

Mixed experience once abroad

Mixed experience once abroad. In France there was no problem using the card for any transaction. In Netherlands however it was declined in 50% of transactions in tourist cafes, pubs and restaurants. Mastercard needed for back up.

Date of experience : 06 April 2024

Reply from Post Office Travel Money Card

Hi, I am sorry to hear that you experienced your Travel Money card declining in tourist cafe's, Pubs and restaurants in the Netherlands. Can you please call us on 0344 335 0109 and we will be happy to have a further look into this for you.

TMC the best

Great travel money card and app to use on your phone and you benefit with the best exchange rates. You can have multiply currencies and switch between them. The card can be top up online, in branch or via your bank if linked even when on holiday.

Date of experience : 01 March 2024

Thanks so much for your great review, we're really pleased that you enjoy your Travel Money Card

Used my card for the first time in…

Used my card for the first time in Portugal and found it extremely easy and hassle free, it will be my method of payment when abroad from now on.

Date of experience : 14 March 2024

Thanks for such a great review, we're so pleased that you were able to enjoy using it in Portugal. We look forward to you enjoying many more holidays with your Travel Money Card

Very easy to use app

Very easy to use app. Modern look, information readily available. Great features eg balance check, spend, freeze/unfreeze card. Excellent app.

Thanks for the great review and feedback, it's really useful to us!

Easy to use and manage.

I've been using the Post Office travel money card for a number of years now and am now on my third version of the card. The card has improved each time, and now with the app its as easy to use and manage as my own account as if I was at home. When abroad I feel as I have a bank account in that country with my Post Office travel money card. It also helps manage my spends abroad as I can top up whilst there. As such I usually take the lower end of what I think I need in cash and on card, safe in the knowledge that I can top my card up quickly and easily whilst away. This has saved me from taking more than I think I need as I used to, and then losing out when changing my money back when home.

Date of experience : 28 February 2024

Thank you so much for your great review and feedback, it really helps us. It's really good to hear that you have been using your Travel Money card for so long with us, so thanks again and we hope that you continue to enjoy it for many more years!

Travel Money cards - Easy to set-up and use

The Travel Money cards are very easy to set-up and use. It means that you do not have to use your own debit or credit cards when travelling, making it safer for you to pay for things abroad. The website was easy to use and the cards arrived very quickly.

Date of experience : 27 March 2024

Thanks for your lovely review, we're so pleased that you found it so easy to use. We hope that you continue to enjoy your Travel Money Card on many more trips away

Such an easy product to use and manage…

Such an easy product to use and manage through the app. I like to have all my travel money separate to my main bank account to help keep track of spending. Would absolutely recommend to anyone I know

Date of experience : 15 January 2024

Thank you so much for your great review and recommendation, it really helps us!

Excellent Service

The lady who dealt with my enquiry was very patient and informative all the way through and nothing was too much trouble for her.

Date of experience : 30 March 2024

Thank you for your lovely review, we've so pleased that our Customer Services team were able to help with your enquiry, we hope that you continue to enjoy your Travel Money Card

So easy !!!

Fantastic card ease of use can't see me going back to cash / currency for future holidays

Date of experience : 28 April 2024

Thank you for your great review and feedback, it really means a lot to us!

It is very useful to have a Travel card with you as you know how much money you have to spend !!

It is very useful to have a Travel money card when on holiday. The staff at the Post Office are very helpful to get it loaded and set up. Also the staff at head office are there for you if you need help

Date of experience : 18 April 2024

Thank you for your great review and feedback, it really helps us!

Great card which is very easy to use

Great card which is very easy to use. App keeps you updated on transactions and balance among other things. Used it in USA, UAE and Europe. Topping up is simple via the app

Date of experience : 26 April 2024

Thank you for your great review and feedback, it really helps us and we're so glad to hear that you've used your Travel Money Card in so many great places!

The App is very easy to use

The App is very easy to use, I can check my balance, transactions and top up my card. The card is accepted everywhere. I have used the card in USA (Florida) and in Europe.

Date of experience : 22 April 2024

Thank you for your great review and feedback, it really means a lot!

Excellent card the app very easy to use…

Excellent card the app very easy to use the freezing of the card when not being used a great idea for security topped up via app was quick and simple to do

Date of experience : 13 February 2024

Thank you for your great feedback, it's really useful to us!

Not fit for purpose

Not fit for purpose. Multi attempts to use. Several refused payments and refused withdraws. Do not rely on this card.

Date of experience : 06 June 2024

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected]

easy to use

It is so easy to use, great to be able to top up in branch or online/app and the app is good with good extras, like I can get insurance through it too

Thanks for your great review and feedback, we hope that you continue to enjoy your Travel Money Card!

Couldn’t be easier

Used this for my first time trip to Germany, couldn’t recommend more! My local Post Office was happy to help me get it sorted and the App made it super easy to use

Date of experience : 24 February 2024

Thank you so much for your great review and recommendation, we hope that you get to use your Travel Money Card again soon!

Just found out that the Post office…

Just found out that the Post office travel card does prize draws. Really good rates when im in thailand/pound to baht. Spend money on the card often when abroad

Date of experience : 24 April 2024

Very to use and safe to use easy to…

Very to use and safe to use easy to convert money to the currency where your going to visit, you dont have the headache of finding a money exchange shop etc even if you lose your card u can block it etc i would defo recomend to use when going abroad

Hi Ubaid, thank you for your great review, it really helps us!

Very simple user friendly easy process…

Very simple user friendly easy process to open up new Post Office Money Travel Card account

Date of experience : 16 April 2024

Thank you for your great review and feedback, it means a lot to us!

Bought 45000 baht (BHT) cash for…

Bought 45000 baht (BHT) cash for £1003.17, which was the best I could find and close to the actual day exchange rate of 46780 BHT per £1000. Bought a travel card and had to put £50 on it, I was given a pathetic exchange rate of 40908 on a day when the exchange rate increased to 48780 on 31/05/24.

Date of experience : 31 May 2024

Hi Keith, sorry to hear the Travel Money Card hasn't met your expectations on this occasion. We hope the following explanation will help clarify; our Travel Card is a different service than cash currency, and the exchange rates do differ between the two, as the Travel Card competes with other Travel Card providers, and the cash currency competes with other high-street providers. Our rates fluctuate daily but we do often have promotional rates/flash sales, and we try to be as inclusive as possible and our rates are available on the app and online. We encourage our customers to check which rate, product and ordering method is most suitable to them prior to committing with a purchase. If you have any more questions or need further assistance, please contact us at 0207 937 0280 or email us at [email protected]

Suggested companies

Admiral insurance, staysure travel insurance.

Post Office Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.5.

Most relevant

AVOID. Had my phone stolen abroad at midnight and have been extremely stressed with the whole situation and it has caused me a lot of anxiety. They said because I hadn't filed a police report within 24 hours of the incident happening they can not assist me. I won't go into detail about why I didn't file a report but there was plenty of good reason at the time and I cant do it now because it has been more than 24 hours. They don't care about you they just care about not having to pay out. DO NOT USE.

Date of experience : June 19, 2024

Poor Service.

Initially, charged twice and spent hours on the telephone, unsuccessfully trying to find details of the policy I had allegedly taken out. I was forced to travel not knowing if I had insurance. Eventually, asked for a refund, which was the only thing that was negotiated successfully! Overall, very disappointing. I shall not use Post Office travel insurance in future.

Date of experience : June 06, 2024

If I could leave a minus score I would…

If I could leave a minus score I would I'm absolutely disgusted with the Post Office insurance policy I took out. I tried to raise a claim due the cancellation of our Emirates flights resulting in 2 days lost holiday cancelled connection flights with another airline, additional £200 parking costs, to be told I didn't have a claim because it wasn't due to bad weather which would have been covered but it was deemed as a natural catastrophe. I wouldn't recommend anyone using the Post Office, I will never use them again in the future, they should hang their heads in shame.

Date of experience : May 16, 2024

Awful. Trying to contact re a claim and no reply. Or telephone number.

Date of experience : April 14, 2024

We were passed on to collinson group…

We were passed on to collinson group who the post office use, after we had to cancel our holiday due to our child getting chicken pox. Really happy we got a Successful claim and good communication throughout. Money was transfered into our account the day after we received the settlement email!

The worst insurance companies have ever…

The worst insurance companies have ever had in my life avoid

Date of experience : June 12, 2024

This company can improve greatly by…

This company can improve greatly by being simply contactable. You can't get through ona phone and when you do they hand you out a mail faield address for Collinsons insurance who they are with, who you also cannot contact. Not only that but when you do try on the PO site to make a claim despite having the policy document number to hand they don't recognise it. Scammers of the first order. All right so we are 50 quid down here on medical treatment. Imagine though if you were hundreds down.

Date of experience : May 04, 2024

COMPLETELY USELESS DO NOT BUY

A few weeks back I bought the premium post office travel insurance. The benefits were the 'cover for cutting your trip short for any reason' We had to abandon our holiday due to fights & violence at our resort. It was terrifying and we had no help. We paid for a flight to bring us home a week early. We now find out that 'The cutting holiday short cover' is non existent! It states on my policy that we have it but the 'Any' reason is restricted to having to leave as person you're staying with is fighting for their life in hospital. Being medical professional or military & having leave cancelled OR something catastrophic happening to your residence in the UK rendering it uninhabitable and needing you to return to the UK.. So in other words it's a completely misleading con. My friend and I are disabled, absolutely horrified to find out how mislead and mis sold we have been!! Thank god we didn't need the medical cover... PLEASE DO NOT BUY THIS INSURANCE IT IS NOT WORTH THE PAPER ITS WRITTEN ON!!!

Date of experience : May 24, 2024

Received the travel card and found the…

Received the travel card and found the sticker covered the chip making the chip useless , I've put loads of funds on this cars through the app , and now wish to withdraw it ASAP, they state on the web cam transfer to bank account , now had a email to say there is no way of removing the money to my bank account ..so money on there and can't spend it , feel really mugged off from start to finish with this travel card , will contact them again to withdraw all the funds ASAP and put it into cash as this seems to be the safest way to spend money ..what a joke , post office unreliable

Date of experience : May 12, 2024

Very Good Experience with Post Office Travel Insurance

To be honest i was very sceptical about getting any money back after cancelling our holiday at the last minute due to my partner being ill. There are so many negative comments on these review sites regarding Post Office Travel Insurance and the Collinson Insurance Group but i must say that i had no problems at all getting a full refund, minus the excess of course. The only issue i want to point out, and thats why they get 4 star and not the full 5, is the additional documentation they ask for after completing the claim online. Two seperate calls from their case handlers asking for addition information, ATOL Certificate and proof we paid for the holiday (bank statement). In summary the whole process took about 2 weeks to complete, communication was good and the outcome was excellent.

Date of experience : June 10, 2024

Use any excuse to refuse to pay

Use any excuse to refuse to pay on travel insurance. Make it difficult to access documents and then quote the small print as a reason to reject a claim. Spent hours getting documentation to them for a lost phone and then rejected out of hand.

Date of experience : May 13, 2024

Problems with cancelling

I tried to cancel an insurance taken out (unadvisedly) after and hour, was charged £30.00 without warning for doing so and made to wait for a fortnight before getting the partial refund, after being advised by them that I would get a full refund in the same time scale as the money was taken, (Seconds). Not a pleasant or ethical company in my opinion. Avoid if you can.

Date of experience : April 07, 2024

Wished Id checked reviews before taking…

Wished Id checked reviews before taking out insurance! Took Policy out 8th March same day holiday was booked. Unfortunatley, my daughter ended up in hospital 29th March with a virus so unable to travel. Post Office sent email refusing claim stating I would have forseen this??? And just realised Post Office filtering what reviews show on their google page. Reviews on Trustpilot not good. Post Office not trustworthy at all...very disappointing. Will be escalating matter to FCA.

Date of experience : April 13, 2024

Do not buy the most rubbish insurance…

Do not buy the most rubbish insurance ever

Date of experience : June 11, 2024

Hopeless, don't trust! Since the new app I can't do anything

Since the new app I can't do anything. I've had to freeze the card as strange transactions listed on the account with money I don't have. Customer service blamed it on petrol stations holding fee but the amounts don't correspond at all. The app wouldn't let me top up on several occasions, I de installed, re-installed and now it won't work at all. Don't trust this card or app. Save yourself time and frustration, go elsewhere.

Date of experience : March 25, 2024

Amazing! Paula in particular got my dad home after a nasty fall in Greece where he broke his hip. He has lots of additional health problems (that we declared when buying insurance) and they weighed up to pros and cons as to what would be safest for him not what would be cheaper for them. Not only did they ring my dad with updates but they rang me (his next of kin) to ensure we fully understood the steps of what was happening and what they were doing in the background. I will always use post office travel insurance and would reccomend to anyone. Just remember to declare everything for your policy and keep in mind that just like car insurance they have to explore avenues before "paying out" and ultimately the underwriter makes the final decision, not the person on the end of the phone.

Date of experience : May 26, 2024

Do not use their insurance if you might claim

We used Post Office insurance as they SHOULD be a reputable company. The cost was sensible, but when we wanted to make a claim (a missed port on a cruise) we discovered they are absolute rubbish. Their contact number keeps saying "use online" and when I eventually got to talk to "Kirk" I just got cut off as soon as I said I wanted to make a claim. I logged onto their portal - nowhere to make a claim, you have to register again on a separate site to make a claim, and then enter huge amounts of detail they should already have, before finding "missed port" is not a claim reason on their fixed list of reasons! Awful, obviously specifically aiming to never pay out.

Date of experience : April 09, 2024

Read you r policy! Nothing is covered fully

If I could give a negative score I would. It took a year to get my claim paid at a 87% discount - There was no doubt as to the veracity of the claim, yet the items - new items were discounted all by 90% and the brand new by 30%. Despite the fact they were bought a couple of weeks before the holiday. This is so disgusting. The claims handler who handled the claim decided unilaterally that lipstick bought days before would be 90% consumed. She admitted she does not wear make up nor perfume so has no idea how much might be possible to consume even if you walk about like Coco the Clown. Avoid. A blue chip company like the Post Office should not be ripping people off this way.

Date of experience : April 24, 2024

Don't get a travel card!

Loaded a new card before going on holiday, installed the app and activated the card. Same card was continuously declined on holiday at ATM's, and retailers. Had to use my visa card which is not good for cash withdrawals. It took countless emails to sort out, and it wasn't until I returned home that I was able to call them and sort it out, and start the process of getting my money returned. Absolutely don't use them, they cannot offer the customer service required, and they had a good deal of my money for way too long. The FCA ought to be aware of their ineptitude as there are very strict regulations in force for handling third party money which the Post office obviously don't observe.

Date of experience : April 03, 2024

DO NOT BUY THIS TRAVEL INSURANCE

Stranded in Dubai for over 1 week. Had PREMIUM insurance. Barely covered for anything. DO NOT BUY POST OFFICE TRAVEL INSURANCE. Small print gets them out of everything. Had to argue my case for over an hour and a half to come out with very little. After sticking to my guns and pushing the agent she conceded to pay for my flights back from Madrid, which was the only place Emirates could get me to from Dubai. They refused to pay for any accomodation costs for the 6 nights I was stranded even though it was not my fault.

Date of experience : April 29, 2024

Is this your company?

Claim your profile to access Trustpilot’s free business tools and connect with customers.

- About Antique Wolrd

- Antique News

- Cards & Envelopes

The Post Office Travel Money Card Review: Key Features, Rates and Fees

If you’re heading overseas, a travel card could be a handy solution for covering your spending. They tend to be cheaper to use than your ordinary bank debit card, and can even offer better exchange rates compared to buying currency.

- Where to Buy Postcards: 12 Options To Consider

- Free Printable Christmas Cards for 2023

- Pop It Valentines Printable (4 FREE Versions!)

- Best Free Printable Cards for Every Occasion

- 13 Just Sold Postcard Examples & Templates (+ Resources)

There are lots of travel cards out there, but here we’re going to focus on the Post Office Travel card. We’ll run through what it is and how it works, along with fees, exchange rates, supported currencies and how to apply for one.

You are watching: The Post Office Travel Money Card Review: Key Features, Rates and Fees

And while you’re comparing spending options ahead of your trip, make sure to check out the Wise card. This international card can be used in 175 countries worldwide, automatically converting your pounds to the local currency at the mid-market rate. There’s only a small fee to pay for the conversion¹, or it’s free if you already have the currency in your Wise account.

But for now, let’s focus on the Post Office travel card.

¹ Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

What is the Post Office travel card?

The Post Office Travel card is a prepaid Mastercard that you can load up with up to 23 currencies. You can use it for spending and ATM withdrawals in over 200 countries, in 36 million locations².

Simply top up with your chosen currency before you travel, then spend overseas without needing to convert currency.

The card is contactless and can be managed using the Post Office Travel app.

Key features and benefits

Here’s your quick at-a-glance guide to the main features and benefits of the Post Office Travel card ²:

- Contactless for making fast and convenient low-value transactions

- Available with Google Pay and Apple Pay

- Manage, top up, transfer between currencies and freeze your card using the Travel app

- Reload whenever you need to, with up to 23 currencies available

- Can be used wherever Mastercard is accepted

- 24/7 call centre help is available if you need it

- Wallet-to-wallet feature – where you can transfer any leftover currency to a new currency of your choice

- No charges when you spend abroad using an available balance of a local currency supported by the card (although there are some fees to know about – we’ll look at those next).

Post Office travel card fees and charges

Post Office travel cards are free to order and there are no charges for paying retailers in the currencies held on your travel money card. So, you can spend in shops, bars and restaurants without any charge – as long as you’re paying with an available balance of a currency supported by the card².

If you do use your card in a country with a local currency that isn’t supported by the card, you’ll be charged a cross-border fee of 3%². For example, if you go to Brazil and use your card at a local restaurant, you’ll be charged the cross-border fee of 3% as Brazilian real isn’t supported by the card.

You’ll also be charged for withdrawing cash from any ATM, even in currencies supported by the card. These ATM fees vary depending on the currency used. For example ²:

- Euro – 2 EUR

- US Dollar – 2.5 USD

- Australian Dollar – 3 AUD

- Pound Sterling – 1.5 GBP + commission of 1.5%

- Swiss Franc – 2.5 CHF

- Canadian Dollar – 3 CAD.

One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you’ll start to be charged a monthly maintenance fee of £2².

Here is also a list of the European countries that charge the highest ATM fees.

Exchange rates

The Post Office offers exchange rates that move up and down according to the demand for currencies. So, the exact amount of travel money you’ll receive on your travel card will depend on the rate at the time of your purchase.

You can check the Post Office exchange rates on its website, travel money card app and branches. Keep in mind though that rates may vary whether you’re buying online, via phone or in-store.

The Post Office exchange rate is also likely to include a margin or mark-up on the mid-market rate. This is the rate you’ll find on Google or currency sites like XE.com, and is generally considered to be a fair rate. A margin added on top of this makes the rate worse for you, so you’ll get less EUR, USD or whatever other currency you’re exchanging.

Read more : Submit Your Collectibles

Wise only ever uses the mid-market exchange rate, with no mark-ups or margins. This means that your pounds go further, wherever you’re travelling to.

Currencies supported

You can load your Post Office prepaid travel card with funds in any of these 23 currencies²:

- EUR – Euro

- USD – US dollar

- AUD – Australian dollar

- AED – UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish kroner

- GBP – Pound sterling

- HKD – Hong Kong dollar

- HRK – Croatian kuna

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish kronor

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

You can top up your card with between £50 and £5,000 in any of the currencies listed above. The maximum you can hold is £10,000, plus you can load and spend up to £30,000 on your card each year².

Cash withdrawal limits vary from currency to currency. For example, you can withdraw a maximum of €450 euros or $500 US dollars² in a single transaction.

App overview

The Post Office Travel app is free to download from the Google Play and Apple App stores. You can use it to order and activate your card, monitor your balance and top up with currencies. Using the new wallet-to-wallet feature, you can also transfer leftover currency to other currencies of your choice in just a few taps.

You can also buy Post Office travel insurance, book airport parking and access other features through the app.

How good is the Post Office prepaid travel card?

The Post Office travel card is handy to have if you’re travelling and want to keep your money safe. You won’t need to carry cash around with you, or have to take time out of your trip to change currency.

Paying in local currencies is quick and easy, especially as it’s a contactless card. Plus, you can only spend what’s on it, so this can help you to budget.

As you can store 23 currencies on it, the card is convenient if you travel regularly or are taking multi-destination holidays. If you love visiting far-flung places, however, you might need a card that supports more currencies.

One drawback to consider is the exchange rate. While rates may be competitive (compared to changing money at the airport, for example), the Post Office is likely to include a margin or mark-up on the mid-market rate. There are also charges for using your card at an ATM.

So, it’s important to shop around and compare other travel money cards, as some could offer you a better deal.

Take the Wise card, for example. With this contactless international card, you can spend in 175 countries and manage over 50 currencies in your Wise account. There are no ATM fees¹ for withdrawing up to £200 a month (2 or less withdrawals) and you’ll get the mid-market exchange rate on every transaction. Note, that Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks.

The Wise card will automatically convert your money to the local currency at the mid-market rate when you spend, for just a small conversion fee¹.

How to get and use a Post Office travel card

You can only get a travel card from the Post Office if you’re aged over 18 and a resident of the UK.

Ordering your card

There are three ways to order a Post Office Travel card:

- Download the Post Office Travel app and place an order there.

- Apply online at the Post Office website.

- Pop into a local Post Office branch to apply for a card. You’ll need to take a form of photo ID with you, such as a passport or UK driving licence.

If you’re applying in a branch, you should be able to pick up your card there and then. For applications made online or in the app, you’ll need to wait 2-3 days for your card to be delivered.

Card activation

You’ll need to activate your travel card before you can use it.

Read more : Envelopes Vs Postcards: Which Mail Format Should Your Business Choose?

You’ll be given instructions on how to do this in the welcome letter delivered along with your new card.

Using your card

You can use your Post Office travel card anywhere that accepts MasterCard, online and at ATMs³.

If you’re buying something in person, you’ll need to enter your PIN. If you’re in a country where Chip & PIN isn’t as widely available (such as the USA), you may be asked to sign to verify your purchase instead.

You can also make contactless payments for small amounts, although different countries have different rules and limits for this.

The Post Office’s terms and conditions list a handful of situations in which you shouldn’t use your card. These include the following³:

- Self-service petrol pumps

- Car hire or hotel check-in deposits

- Transactions on planes or cruise ships.

How to top up your card

The easiest way to top up your Post Office Travel card is using the app. If you prefer, you can also top up at the Post Office website or in a local branch³.

Buying back currencies

If you have unused currency on your card, there are a couple of options available. You may be able to withdraw it at a local Post Office branch or ATM, although fees may apply³.

Alternatively, you can use the new wallet-to-wallet feature in the app³. This lets you transfer unused balance in one currency over to another. For example, you can transfer unused USD to EUR, ready for your next trip to Europe.

How to contact the Post Office about your card

You can call the contact centre on 0344 335 0109 when you’re in the UK or +44 (0) 20 7937 0280 when you’re overseas³. Lines are open 24 hours a day, seven days a week.

You can also contact the Post Office Travel Card Customer Services department via the following methods³:

- By post at Post Office Travel card, PO Box 3232, Cumbernauld, G67 1YU

- By email at [email protected].

Post Office Travel Card: troubleshooting tips

Here’s how to deal with some common problems you might have with your travel card.

How do I report a lost or damaged card?

If you lose your Post Office currency card or discover that it’s damaged, just phone the contact centre. They’ll block it and send you another. You can also freeze your card using the app.

What should I do if my card is declined or blocked?

Firstly, check your account via the app to make sure you have enough money in it. If you have enough to pay for your item or have less than you should have in your account, call the contact centre.

What if I’ve forgotten my PIN?

If you can’t remember your travel money card PIN, phone the contact centre. They can issue you with a new one.

What happens when my card expires?

You should receive a new card automatically³. If it hasn’t arrived after the expiry date, call the contact centre and they’ll issue you with one.

And that’s pretty much it – everything you need to know about the Post Office Travel card. It’s handy if you don’t want to carry cash around or exchange currency while on holiday. And you can use it in multiple countries, as it supports 23 currencies. The app is another great feature, letting you top up and manage your money on the move.

But just remember to compare exchange rates and fees (especially for those all-important ATM withdrawals) before choosing a travel card for your trip – as you could be getting a better deal elsewhere.

Sources used:

- Wise – terms and conditions & pricing

- Post Office – Travel Money Card

- Post Office Travel card – Terms and Conditions

Source: https://antiquewolrd.com Categories: Cards & Envelopes

Join Lenon Blur

I am a JOIN LENON BLUR - world-leading expert, and I am the admin of Antiqueworld with many years of experience researching antiques and postal publications. I hope to provide the audience with the most accurate and informative information.

- TRAVEL MONEY

- TRAVEL ADVICE

Currensea vs Post Office review - What’s the best travel money card

Who is the post office .

The Post Office is a well-known high-street brand, trusted by millions for postage, government, and financial services through its wide network of branches. However they are not the ones to deliver your mail, that is the Royal Mail, and is a different business to the Post Office.

What are they offering?

The Post Office offers a prepaid multi-currency travel card allowing you to hold 23 different currencies. Being a prepaid travel card means you need to load money directly onto it and then reload or top up when you need more money on it. This can be done by their travel app at any time, and it allows you to then spend in any of their available currencies.

The aim is to provide an easy solution to managing your travel money abroad. The Post Office is well known for promoting a 0% commission service when taking physical cash abroad, so has been favoured by travellers for a long time.

*Rates and charges shown are correct as of 30th September 2021

Currensea travel debit card

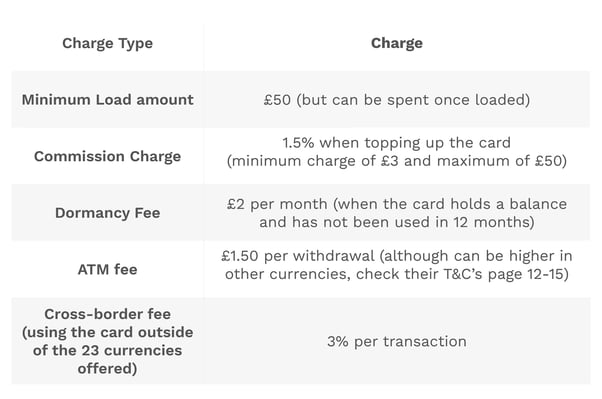

What travel money card options and plans do the Post Office have?

The Post Office has one simple plan, their basic Post Office Travel Money Card. While the travel money card is free to get, there is a minimum load amount of £50 of whichever of the 23 currencies you choose.

What are Post Office fees when spending abroad?

Terms such as fee-free, no commission, and zero charges are used a lot by travel money providers, and the Post Office is no different when it comes to marketing their card, which offers 0% commission. But as with most others, there is often a hidden fee under the bonnet. After all, how else would a provider make any money?

So what fees does the Post Office charge?

All of the above fees can be found in the Post Office terms and conditions , pages 12-15

We took a look at the EUR exchange rate they offered when loading the card before purchase, when we compare this to the interbank (real) rate we can also see a hidden charge in the FX rate of 3.8%!

We checked a few currency conversions and there is a maximum hidden FX fee of 3.78% across all when loading up to £499.

A great indicator as to whether there are hidden fees or not, is if a better rate is offered when loading more money as you can see here:

Even with the better rate there is still a hidden fee of 2.4% when compared to the live interbank rate at the time.

It’s also worth noting that if you use your Post Office card to withdraw cash abroad, you will be charged at the point of loading your desired currency (the FX mark-up rate ), you will then be charged a minimum of £1.50 per ATM withdrawal on top of this. So withdrawing £100 worth of currency could cost around £5.20.

Why would you use a Post Office Travel Money Card?

More often than not the Post Office works out more expensive than if you were to use your high-street bank account. However, you may like the functionality of separating your holiday money from your main bank account by preloading the card.

The Post Office travel card could also be a good solution if you have younger family members travelling abroad and want to help them fund their trip, but don’t want to give access to large amounts of money or for them to use their bank card while abroad. The Post Office travel money card would allow you to top up from afar and smaller amounts (although other card providers do allow limits to be set up on the card or account, which could solve this particular issue).

Who is Currensea?

Currensea was founded by James Lynn and Craig Goulding in 2018, then launched in 2019 aimed at reducing hidden FX fees for travellers when spending abroad and the hassle of topping up or prepaying.

Currensea is the UK’s best rated travel debit card. The layer in front of your current bank account, saving you money, giving you extra security and making your bank work that bit harder for you.

Currensea's travel debit card partners with your current bank account to save you at least 85% on the high-street banks fees and charges on all overseas transactions. Unlike other travel cards, there is no need to prepay, no need to top-up and no need for a new bank account. Spend as seamlessly abroad as you do at home, with the money only debited from your existing bank account after you’ve spent.

What are the different charges applied by a Currensea travel debit card?

Currensea offers 15 currencies at the real (interbank) exchange rate and 165 currencies at the Mastercard exchange rate (which is the rate also used by Monzo, Starling and many other FinTechs). When signing up for the free plan, users will be charged at a flat FX mark-up rate of 0.5% over these two base rates - with no extra charges over a certain amount or at weekends, it's that simple.

What card options and plans does Currensea offer?

Currensea's travel debit card currently offers three pricing plans. The Essential plan is free to use, the Premium plan is £25 per year and the Elite plan is £120 per year. The Essential Plan charges 0.5% FX per transaction, whereas the Premium and Elite plan incur no fees. The Elite plan also includes a host of exclusive benefits and memberships, as well as the exclusive Currensea black card.

Currensea has no additional weekend charges, or fair usage limits on any plan.

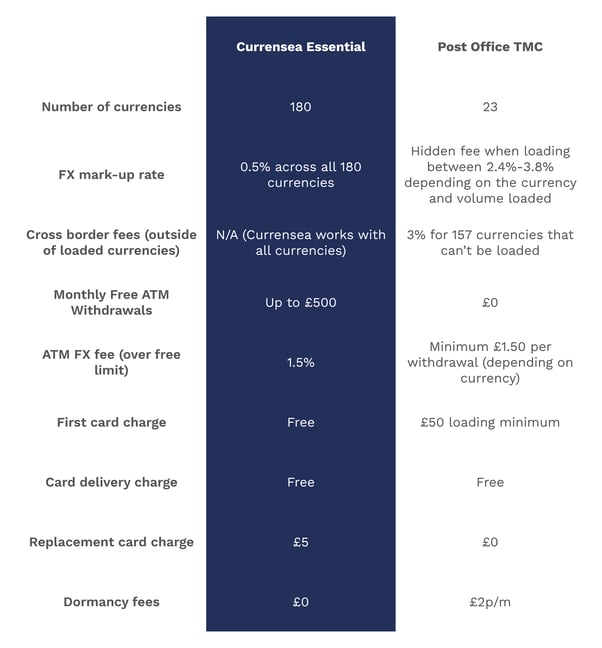

So how does Currensea compare to Post Office TMC?

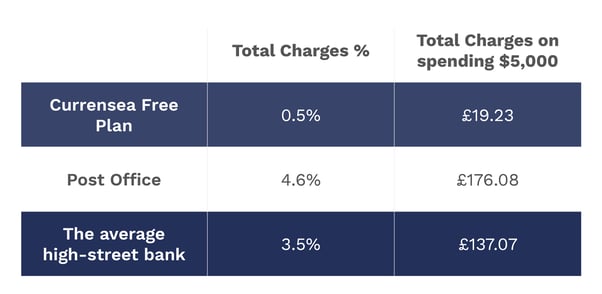

In real terms what is cheaper (and when)?

When comparing Post Office and Currensea, Currensea will always be the cheaper option when spending abroad. This is due to the hidden FX charge when pre-loading and exchanging to your desired currency on a Post Office travel money card.

More often than not, The Post Office travel money card also works out more expensive than your high-street bank, so it’s definitely important to check the exchange rate before ordering your card.

Here are the total charges when you spend $5,000 dollars ($500 of that in cash).

View our comparison table to find out more including how we calculated the above charges.

You may also like

Currensea vs curve r..., currensea vs starlin..., currensea vs caxton ....

- Exchange rates

- Giving back

Terms and policies

- Terms of use

- Privacy policy

- Terms and conditions

- Get in touch

Currensea Limited is registered in England and Wales (No. 11413946), authorised by the Financial Conduct Authority (Reference No. 843507) and is a Principal Member of Mastercard. We are registered with the Information Commissioner's Office (Registration No. ZA524676). © Currensea Limited 2022

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Travel Cards: What are the best options in the UK? 2024

If you’re expecting to spend overseas - on holiday, when shopping online with international retailers, or even because you’re relocating to sunnier climes - you’ll want to find the cheapest and most convenient way to manage your money.

One option is to pick an international debit card - but are they really worth it? This guide covers all you need to know about:

How international debit cards can help cut bank fees and get a better exchange rate

What advantages there are to having an international debit card compared to a regular bank card

How international debit cards work

Which are the best travel and international debit cards available in the UK

Let’s dive right in.

Our Top 4 Travel Debit Cards in the UK:

Wise Travel Card

Post Office Travel Card

ASDA Travel Card

Sainsbury's Travel Card

Travel debit cards: the best options in the UK

How do travel cards work.

Travel debit cards allow you to spend and make withdrawals in a foreign currency easily - and often, for a lower fee compared to using a regular bank debit or credit card.

That means you can use your travel debit card when you travel internationally, to pay for your accommodation, food, shopping - and whatever else you plan to do. You can use your card to make cash withdrawals overseas to make sure you always have a ready supply of foreign currency for when cards aren’t accepted. And finally, you can use your travel card when you shop online with international retailers, to cut the costs of foreign transaction fees.

Types of travel card

You’ll find that there are 3 main types of travel cards that traditional banks offer : prepaid cards, debit cards, and credit cards. Each has its own advantages and disadvantages - make sure you research carefully to find the cheapest option for your spending. Here’s a rundown of some common travel card options for UK customers.

1. Prepaid travel card

Prepaid travel cards - also often known as travel money cards - are offered by a wide range of providers. You’ll top up your card in pounds before you travel, and then you can use your card to spend or make withdrawals when you’re away. Some cards also allow you to add funds online, so you can top up your card after you leave too.

Different prepaid travel cards have their own fee structures, with some charging for top ups, or having ongoing maintenance fees. Check out all the details, including the exchange rates available before you pick one.

2. International card with traditional banks

Most UK based banks which offer a linked debit card will allow you to spend and make withdrawals around the world. However, it’s extremely common to find that there are some extra fees to spend in a foreign currency - often including an exchange rate markup or foreign transaction fee of around 3%.

In the UK you can find the occasional bank or building society which offers a linked debit card with no foreign transaction fee - like the Virgin Money M Plus account, or the Cumberland Building Society Plus Account. However, these specialist accounts do often have other restrictive terms such as minimum balance requirements, or high transaction fees for other services.

You can also choose to spend internationally with your bank issued credit card - but this does risk higher overall fees once you take into account credit costs and any cash advance fees you run into, on top of foreign transaction charges.

3. Travel card with neobanks

You’ll often find that a travel card from a modern online provider - often called a neobank - is the cheapest and most convenient option. Accounts are usually simple to set up, and it’s easy to order your card online or in the provider app. Once you’re up and running you’ll often find you get a better exchange rate than the rate offered by your normal bank - or even the mid-market exchange rate with no markup at all.

Because neobanks are often specialists which operate online and don’t have the same overheads as traditional banks, you can often net a better deal, including no minimum balance requirements, ongoing charges or maintenance costs.

Best travel debit cards: a comparison

Shopping around is the best way to get the right travel card for your needs. There are several travel card providers in the UK which can offer a better deal compared to traditional banks, including online specialist services like Wise. Here’s a more detailed look at some of our top picks.

The Wise card allows you to make payments in more than 200 countries and in more than 150 currencies. Your card is linked to a handy Wise multi-currency account, which lets you hold, convert, send and spend in dozens of currencies, and manage your money on the go from your smartphone.

Pros of the Wise card

No minimum balance or ongoing charges

Hold and exchange 50+ currencies in your Wise account

Auto convert feature will make sure you always get the best possible deal on currency conversion

Manage your card in the Wise app, to freeze and unfreeze the card and get instant transaction notifications

Physical and virtual cards available

Cons of the Wise card

5 GBP fee for your first card

ATM fees apply if you make frequent withdrawals

Spending limits apply

No option to top up account in cash

Post office travel card

Apply for a Post Office travel card online, or by visiting your local Post Office branch with a government issued ID document. You’ll be able to hold 23 currencies in your account, and it’s free to spend any supported currency. Contactless and mobile payments are supported - but there are some fees you’ll need to watch out for, including ATM withdrawal charges.

Pros of the Post Office travel money card

Apply online or in person

Hold and exchange 23 currencies

No fee to spend currencies you hold in the account

Cons of the Post Office travel money card

3% foreign transaction fee if you spend in an unsupported currency

Cash withdrawal fees apply which vary by currency

Monthly maintenance fees apply from 12 months after your card applies

Read our full Post Office travel card review .

ASDA Money Travel Card

You can order an ASDA Money Travel Card online or by visiting a store which has an ASDA Money bureau. Your travel card can hold 16 currencies, and it’s free to spend in any of these currencies, including making ATM withdrawals. It’s worth noting that topping up your account in pounds comes with a fee, and there’s a steep charge for spending in a currency not supported by the card, so you’ll want to double check the currencies you require are all covered.

Pros of the ASDA travel card

24/7 global assistance

Hold up to 16 currencies

Contactless payments supported

No fee for ATM withdrawals

Cons of the ASDA travel card

2% fee to top up in pounds

High fees of 5.75% if you spend in a currency not supported by the card

Inactivity fees of 2 GBP/month apply after 12 months

Sainsbury Bank travel money card

It’s free to get the Sainsbury’s travel card, and it’s free and easy to make contactless payments in any of the 10 supported foreign currencies. You can also make ATM withdrawals in supported currencies without being charged a fee by Sainsbury’s. There are a few costs to watch out for though, including a GBP reload fee, and a high foreign transaction fee if you’re spending in any currency other than the 10 supported currencies.

Pros of the Sainsbury Bank travel money card

Hold up to 10 foreign currencies

Free to spend any currency you hold

Card will deduct funds from the correct balance when you spend in a supported currency, to avoid unnecessary fees

Cons of the Sainsbury Bank travel money card

Inactivity fees of 2 GBP/month apply after 18 months

Advantages of the travel debit cards

Getting an international debit card can be a good alternative to using traditional bank cards to spend money abroad. Advantages include:

Top up your account or card in advance to set a travel budget

Know the exchange rates in advance so there are no surprises

No need to tell your bank you’re travelling

Manage your money online or in an app for convenience

Overall costs are often far lower compared to using a bank

Are there any limitations on travel debit cards?

Travel debit cards aren’t right for everyone - here are a few drawbacks to consider:

Spending currencies not supported by the card can incur fees

You can’t always use your travel card for car rental as it’s not likely to have a credit facility

Some transactions - like paying at the pump for petrol - may result in a hold on funds within your account

Adding funds to your account may not be instant

How does a travel card work?

A travel debit card works similarly to a normal bank debit card in some ways:

Pay with your card directly with merchants - often with contactless functionality

Withdraw cash when you need it from ATMs

Check your balance online, in an app, or via an ATM easily to keep an eye on your money

Funds are deducted from your balance so there’s no worry about running up credit charges

However, travel debit cards have a few distinct advantages compared to regular bank cards:

Cards can often be ordered easily online or by phone

Top up your account whenever you like, to create a separate travel budget

Convert your pounds to foreign currencies in advance so you know the exchange rate before you spend

You’ll often get a better exchange rate compared to a bank, with lower transaction fees

There’s no need to tell the card issuer that you plan to travel

How can I use a travel debit card abroad?

Once you have your travel debit card, you’ll be able to start spending. You’ll need to double check that the merchant or ATM accepts the card network your card uses - Visa and Mastercard are most common, and are widely accepted internationally. You’ll also need to read through the card terms and conditions to make sure you’re aware of any fees that the card issuer applies when you spend or make withdrawals

One other important point when using an international travel card is to watch out for dynamic currency conversion (DCC). That’s when you’re asked by a merchant, or at an ATM terminal, if you’d rather pay in pounds or the local currency wherever you are. If you choose to pay in pounds you’ll usually be hit by high fees and a poor exchange rate - well worth avoiding if you want to make the most of your travel money. Always choose to pay in the local currency to get the best possible deal when spending or withdrawing with your travel card.

How to request a travel debit card

If you’re looking for a specialist travel debit card which lets you spend conveniently while cutting your costs, you may find the best available deal from an online provider such as Wise or Revolut . Signing up for an account is pretty painless, and can be done entirely online or through an app - and you’ll usually find the fees are lower compared to a traditional bank, too.

To show how easy it is, let’s take a look at how to sign up for a Wise card - we’ll cover Wise and a few other top UK travel debit card options in more detail, later:

Download the Wise app or head to the Wise desktop site

Sign up for a Wise account with just an email address, Google, Facebook or Apple ID

Get verified by uploading a photo of your ID documents

Order your card online or in the Wise app for a one time 5 GBP fee

Your physical card will arrive within a few days - or you can access your card details in the Wise app right away for mobile payments

What are the transaction fees which apply to a travel card?

Travel debit cards can offer a better deal when you spend in foreign currencies - but that doesn’t necessarily mean they’re entirely free. Here are a couple of the key costs to consider.

Exchange fee

Some travel debit cards will convert your money from pounds to the currency you need with an exchange rate that includes a fee. This may be described as a foreign transaction fee, or a currency conversion charge, for example. For traditional banks this can often be in the region of 3% of the transaction value, although modern online providers do often offer a better deal, and may even skip this fee entirely.

Withdrawal fee

If you plan on making cash withdrawals you’ll also need to check the costs applied by your own bank, and keep an eye on the ATM to make sure the ATM operator won’t also levy a fee. ATM withdrawal fees do vary pretty widely. Some banks offer low, or fee free withdrawals at selected ATMs, but out of network charges can be steep. Again, online travel debit cards may have a more flexible approach to withdrawal fees which can save you money.

Conclusion: is the travel debit card worth it?

Picking the right travel debit card can mean cutting the costs of spending in a foreign currency, with lower transaction fees and a better exchange rate. However, different travel debit cards have their own advantages and disadvantages, with varying fee structures and a range of supported currencies. Compare a few cards, including travel debit cards from online specialist providers like Wise , to find the right one for you.

An international debit card lets you spend and make cash withdrawals in a range of foreign currencies - often with lower fees than using your normal bank card.

Many online and specialist providers allow you to apply for a card easily through a desktop site, app or call centre.

Use your travel debit card just like you would your regular card, to spend and make cash withdrawals around the world.

Travel debit card fees do vary based on the provider, and can include a foreign transaction fee when spending in an unsupported currency, top up charges and inactivity fees. Compare a few providers to get the best available deal for your needs.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Keep the essentials for your trip all in one place:

Top up and manage your Travel Money Card

Buy travel insurance and check it on the move

Book holiday extras like airport hotels and parking

Simpler, safer holiday spending

Buy, activate, top up and manage your Travel Money Card – for safe, easy payment anywhere in the world.

Use the app to move funds between 22 currencies to suit your travel plans. Check your balance, transactions, PIN and daily exchange rates. Make secure payments using your phone or smart device. Freeze your card instantly if needed. And add it to your Apple Wallet or Google Wallet™.

Holiday protection in your pocket

Use the app to buy, check and renew Post Office Travel Insurance for confidence and convenience on your trip.

Get a quote and buy for cover directly in the app or link it to your existing policy. Download your policy documents if needed. You can even renew annual-multi trip policies too.

Add holiday extras with ease

Book and manage the extras that make your holiday effortless. Airport parking and hotels, lounge access and even a fast track through security. Plus, transfers and car hire to get you where you’re going.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Download the app

The Post Office travel app is free to download to both Apple and Android devices. Get it from your store of choice and start using it today.

Take a Travel Money Card

Go cashless with our prepaid, contactless Mastercard® that holds up to 22 currencies. Simple and secure holiday spending you can manage in-app.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Other related services

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Google Pay is a trademark of Google LLC.

* Read the full terms and conditions .

Currensea Review

Our rating:

If you’re a frequent traveller, you know how frustrating it can be to deal with foreign transaction fees and unfavourable exchange rates. That’s where Currensea comes in – a UK-based fintech company that offers a multi-currency card and account for holiday-makers.

We’ve talked about Currensea before as one of the best debit cards to use abroad , but in this review, we’re going to take a deep dive into the into the account, features, costs, and share our opinion on who we think it’s for.

What is Currensea and how does it work?

Currensea 1 is the UK’s first direct debit travel card. It acts as a layer in front of your current bank account when spending money abroad. This means you can benefit from great rates even if you have one of the six bank accounts/debit cards from hell (Halifax, Lloyds, TSB, Santander, RBS, NatWest). Currensea is a great option for those who don’t want to change or open a new account.

Currensea works by connecting to your existing current account. When you’re travelling abroad, simply use the Currensea debit card to spend or withdraw money in up to 180 currencies worldwide. Currensea then charges your bank account in pounds via direct debit. This means you don’t need to worry about currency exchange rates or fees when you’re travelling. It’s a hassle-free way to manage your money abroad.

There are no top ups, no pre-paying or anything like that. Just link the card to your current bank account and you’re good to go. It’s almost boring.

Who is Currensea for?

Anyone travelling abroad who would ordinarily use their high street bank account debit card for foreign spending.

If you bank with any of the big 6 highstreet banks, then Currensea will save you money when travelling abroad. That’s because these banks typically add a huge mark-up on foreign spending, and some even charge additional fees for ATM withdrawals.

Our table below show the typical commission loading and ATM fees a regular current account, of the main high street banks when spending abroad.

Here, we’ve only included a £100 equivalent spend and withdrawal for comparison, but the average family of four spends nearly £5,000 while on holiday . Yeah, we couldn’t believe it either!

On that kind of spend using Currensea instead of your regular debit card could save you over £130 on a typical family break in Europe.

In total Currensea supports 14 banks and building societies. All of which have regular current accounts that are amongst the worst for spending abroad.

If your bank isn’t on the list, then it’s not currently supported. We ran into this problem when trying to use a Co-op account that we’d opening in order to take advantage of a recent switching offer . It turns out, it’s the worst offending bank in our fees table above. Unfortunately, it wasn’t supported, so we had to use a First Direct account instead.

Note that Virgin Money accounts are supported, but if you’re a Virgin Money M account or M Club account holder, you already have access to fee-free foreign spending anyway.

How to apply for a Currensea account

Opening a Currensea account is a simple affair. You just need to visit the Currensea website 1 and provide some basic personal information, and address details.

You’ll also need to link your existing bank account through Open Banking. This allows Currensea to access your account information and set up direct debit payments.

Once you’ve completed the application and been approved, your Currensea card will be sent to your registered address. The card takes roughly three days to arrive, but given the regularity of Royal Mail strikes, we’d allow at least a week if not longer before travelling.

Once you’ve activate your card via the app you can start using it immediately.

What exchange rate does Currensea use?

Currensea uses the Interbank or mid-market exchange rate on 16 major currencies (EUR, USD, AUD, CAD, CHF, DKK, HKD, HUF, JPY, NOK, NZD, PLN, SEK, SGD, THB and ZAR). Spending in a further 164 currencies is covered by the Mastercard exchange rate.

Unlike some travel cards, and multicurrency accounts, there are no nasty weekend surcharges or surprises.

Currensea lists its live rates for both the interbank rate, and Mastercard directly on its website here: https://www.currensea.com/pricing/exchange-rates

Features and limitations

We like Currensea for the following reasons:

- Interbank exchange rate on the top 16 currencies

- 0.50% flat rate for spending and withdrawals

- No weekend loading

- Funds remain safe in your FSCS account

As ever there a number of things that could be improved. Here’s what we didn’t like:

- Low spending limits for some (these depend on the individual)

- Lag between spending and payment being taken (direct debit comes out two days after spending sometimes longer)

- Not accepted a Pay-at-pump fuel stations or Toll roads

- £1,000 a month withdrawal may not be enough for longer trips.

£10 free cashback

Sign up for a free Currensea card via our link, and you'll get £10 cashback when you use your Currensea card abroad and spend £100.

How much does Currensea cost?

Currensea offers three pricing tiers for its travel card: Essential, Premium, and Elite. The Essential plan is free to use, while the Premium plan costs £25 per year. The Elite plan is £120 a year which in our opinion far outweighs any savings or benefits it offers. As such, we don’t recommend it.

Essential Plan: The Essential plan offers competitive exchange rates and no fees for foreign transactions. There’s a markup of 0.5% on transactions, which is lower than the markups charged by many traditional banks and currency exchange bureaus.

The plan also offers fee-free ATM/cash machine withdrawals abroad up to £500 a month

Premium Plan: The Premium plan removes the 0.5%, which means that you can get even better exchange rates than with the Essential plan. It also offers fee-free ATM withdrawals up to £500, but crucially the rate for withdrawing more than this drops to just 1%, versus 2% for the essential plan.

There are also a range of marginal benefits, such as car hire discounts, air miles, and preferred hotels, but if we’re honest, all of these can be beaten elsewhere.

Currensea fees and limits

Currensea may be able to save you hundreds compared to travelling with a debit card from a traditional high street bank, but there are some costs and fees associated with the card that you should be aware of, not all of which are made clear.

ATM fees These fees kick in if you withdraw more than £500 a month. For the Essential plan, the fee is 1%, and for the Premium plan, it is 2%. This means you’ll pay an additional £1-£2 for every additional £100 you withdraw over the £500 limit.