US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

New travel forecast shows normalizing of leisure travel demand from post-pandemic surge.

Domestic business travel growth moderates, int’l inbound travel accelerates

PRESS RELEASE June 14, 2023

WASHINGTON -

The U.S. Travel Association released its biannual forecast for travel to and within the United States through 2026, showing a normalized rate of growth in the domestic leisure travel sector after months of elevated demand.

“Robust domestic leisure travel demand has been the driving force in the overall industry’s post-pandemic comeback,” said U.S. Travel Association President and CEO Geoff Freeman. “Though the surge we experienced in the last year is starting to moderate, we expect this segment to remain resilient in coming quarters.”

Domestic Leisure Travel

Domestic leisure travel is expected to remain strong, but with normalized rates of growth (around 2%) in 2023 and 2024. Volume is expected to grow faster year-over-year (YOY) than inflation-adjusted spending in 2024 and beyond.

Domestic Business Travel

Both volume and spending in domestic business travel is expected to grow—albeit more slowly—largely due to economic conditions. While business travel will continue recovering, with both volume and spending at double-digit growth in 2023, it is expected that growth in inflation-adjusted spending will be slower than volume in 2024 and beyond.

Business travel volume is not expected to recover to 2019 levels until 2025, while inflation-adjusted spending is not expected to recover within the range of the forecast.

International Inbound Travel

The inbound travel forecast was upgraded due to strong demand from the Canadian market, as well as stronger expectations from key overseas markets such as Brazil. Year-over-year, inbound travel volume is projected to grow 31% in 2023 and 18% in 2024, while inflation-adjusted spending is projected to grow 34% in 2023 and 19% in 2024.

Volume in this sector is projected to recover by 2025, while inflation-adjusted spending will not recover until 2026.

Policies to Grow Travel

U.S. Travel Association cites four key federal policy areas to accelerate growth across travel sectors:

- Improve the overall air travel experience through the Federal Aviation Administration reauthorization bill

- Lower U.S. visitor visa interview wait times , which currently exceed an average of 500 days in top visa-requiring inbound markets

- Reduce Customs wait times at U.S. airports and other ports of entry experiencing excessive delays

- Increase federal prioritization and focus on travel industry growth, as other countries have done

“Travel is essential to growing the U.S. economy and workforce, so the federal government must enact policies to ensure our industry is able to meet demand in coming years,” said Freeman.

See the full forecast table .

U.S. Travel Association is the national, non-profit organization representing the $1.3 trillion travel industry, an essential contributor to our nation's economy and success. U.S. Travel produces programs and insights and advocates for policies to increase travel to and within the United States. Visit ustravel.org for more information.

Greg Staley

Senior Vice President, Communications

202.408.2162

Key Trends Going Into Florida High Season 2023

After months of summer and hurricane season, the high season is finally upon us in Florida. As it always does around this time of year, the travel trends start to shift in Florida after six months of the low season, which is officially behind us. Every year brings different circumstances that can and must be adapted to get the most out of the high season. In 2021, we saw unprecedented domestic travel demand as people from all over the country were looking to escape local lockdowns in favor of the many ‘open for business’ Florida beach communities that welcomed them. In 2022, we saw the return of the international traveler as global travel restrictions eased. Many of our friends from all over the world returned after two years to enjoy everything Florida offers. Like the previous two years, 2023 will inevitably bring new realities that must be understood and adapted to get the most out of this year’s high season. Here are some of the early trends we are seeing in the marketplace in the year ahead.

The Rise of the Mid-Length Stay

The Florida vacation rental market has historically been a tale of two types of stay – a very short and a very long one. The typical Florida family vacation outside the holidays might have involved a Thursday night landing and a Monday morning departure. Vacationers would take a couple of days off from the office to spend three full days and four nights getting the most out of that Florida sun we all know and love. On the other side of the spectrum, there was the classic snowbird. After many winters in Boston, New York, Chicago, New Jersey, Connecticut, or many other wonderful regions blanketed with snow between December and January, the snowbirds decided to hang up the boots and put away the shovel. Snowbirds often land between November and January and leave by May.

With the rise of work from home becoming more of a cultural fabric than a pandemic trend, there is an unprecedented growing demand for 7–21 day stays. Many people view ‘work from home’ as ‘work from anywhere,” and so what used to be a vacation is now an extended trip that mixes pleasure with productivity. The implication is that short-term rentals in Florida that traditionally targeted short vacation stay need to be more equipped for “mid-length short-term rentals” than ever. Multiple laptop-friendly workstations, kitchens fully equipped for cooking, high-end laundry facilities, and a furnishing setup that feels more like an executive home compared to a vacation home are key success factors in 2023.

The Introduction of the Luxury Hotel Client

As the popularity of Airbnb, VRBO, and similar platforms grew throughout the 2010s, we witnessed the mass adoption of the mainstream of these platforms. The value proposition was simple. Enjoy more space, privacy, home amenities, and comfort than a hotel at a competitive price. Consequently, we’ve witnessed the industry’s growth exponentially throughout the last decade as these furnished home rentals have quickly become the lodging option for many travelers. Yet there has always been a segment of travelers who never saw themselves booking an Airbnb over the four-star and five-star hotels they’ve become accustomed to. The reason comes down to consistency. They know exactly what they are getting at the Ritz or St. Regis. With Airbnb, it’s dependent on an individual host to put on a hospitality performance that resembles the world-class hotels that they’ve become fond of over the years.

The 2020s have seen the emergence of luxury furnished rental space and professional management of these short-term rentals that successfully emulate the five-star hotel experience. As such, that segment of travelers that would previously never have thought about staying at a furnished home or condo has warmed up to the idea and started the adoption process.

For Hosts looking to attract these price-insensitive, often mature guests, it comes down to set up and presentation. Unlike long-term rentals, which are priced on the broader “macro” factors, the financial upside of a short-term rental is highly dependent on the look, feel, and overall setup of the property. How the home is designed, the convenience of the experience, how fully equipped it is, and the professional management all play a part. No matter which ‘category’ a home is competing in, there is a higher-end consumer and a host’s financial performance.

Recurring Corporate Stays

It was only a few years ago that Florida was thought of as a place you go to get away from the stresses of everyday life. After months of hard work, a mid-winter trip down south was meant to recharge those mental batteries. Things have changed quickly, not just for people but also for businesses. More and more companies are deciding to move operations to Florida for many reasons, and every day it seems to resemble a long-term trend rather than a pandemic frenzy.

There is a significant and noticeable increase in not only one-time business traffic to Florida but also recurring business traffic. There have always been major conferences in Florida. Still, recurring corporate travel is something the state has historically been known for compared to cities such as New York, Los Angeles, Chicago, Boston, Seattle, San Francisco, and other traditional hubs. Companies are opening offices in Florida and, in some cases moving their headquarters altogether. Consequently, employees from all over the country come to Florida for work.

The implication is that Florida short-term rental hosts can generate repeat business by catering high-quality service to corporate clientele. In the Florida low season especially, it’s become evident that the difference between a good low season and an average one is determined by the amount of business travel hosts attract in the summer and fall. Business travelers are professional, punctual, and often have great communication. They are always working when they travel for business, so rarely are they at home, reducing the overall wear and tear that comes with any short or long-term tenancy. In 2023, when setting up Airbnb, Florida hosts should think about the business traveler as much as they think about the vacationer.

So, there you have it, 2023 will be a great year, and there is a lot to look forward to. Like in any business, following the trends and adapting to them will lead to short and long-term success.

CFRPM Overview

The Central Florida Regional Planning Model, Version 7 (CFRPM 7) is a system of processes and demand models designed to accurately reflect the transportation network and demand for 11 Florida counties: Brevard, Flagler, Indian River (northern half only), Lake, Marion, Osceola, Orange, Polk, Seminole, Sumter and Volusia.

- 1.1 Geography

- 1.2 Transportation System

- 1.3 Travel Patterns

- 2.1 Model Components

- 2.2.1 On-Going Efforts/Upcoming Releases

- 2.2.2 CFRPM Derivatives

- 3.1 CFRPM v5.0

- 3.2 CFRPM v5.5

- 3.3 CFRPM v5.6

- 3.4 CFRPM v6.0

- 3.5 CFRPM v6.1

- 3.6 CFRPM v6.2

Region Information [ edit ]

Geography [ edit ].

The Central Florida region is bounded by the Atlantic Ocean on the east, the Sumter, Polk and Marion County boundaries on the west, the Marion and Flagler County boundaries on the north, and the Osceola, Polk and Indian River County boundaries to the south. The region includes all nine counties inside District 5 of the Florida Department of Transportation: Brevard, Flagler, Lake, Marion, Osceola, Orange, Seminole, Sumter and Volusia; the region includes Polk County from District 1 and the northern half of Indian River County from District 4. Throughout the CFRPM area, the suburban and rural areas are generally separated by environmental preserves or park lands that prohibit large-scale development.

Transportation System [ edit ]

The surface transportation system consists of roadways, bus transit, and SunRail commuter rail with the primary air transportation system in the Orlando International Airport (MCO). Roadways include eight limited-access facilities and varying types of arterial and local roads. Bus transit is provided in every county except Flagler and Sumter. The Orlando International Airport is one of the top ten airports in the country with over 50 million passengers annually.

Travel Patterns [ edit ]

The Central Florida region produces an estimated 16 million person trips a day, generating 11 million vehicle trips and 116 thousand transit boardings. The 16 million person trips generates over 142 vehicle-miles of travel (VMT) in Central Florida per peak season average weekday which requires 4 million vehicle-hours of travel (VHT).

Central Florida is expecting very strong growth in population and employment over the next 30 years. The population is expected to grow 51%, with every county experiencing at least a 27% increase. These socio-demographic changes will cause a corresponding increase in transportation demand. Trips are expected to increase by 56% to over 25 million trips per day, and VMT is expected to grow by 51%.

From a “big picture” transportation demand perspective, CFRPM needs to help stakeholders on decisions about:

- expanding transportation capacity and options to maintain pace with population and housing growth,

- creating new roadway networks in transitioning areas, and

- easing congestion and transit travel times for mature or built-out areas.

Model Overview [ edit ]

Model components [ edit ].

The CFRPM 7 model is design to reflect the conditions demonstrated by the Central Florida Region. It consists of three major components:

- a Geographic Information System (GIS)-based interface for editing, visualization and reporting of the roadway network and socio-economic data;

- a primary travel demand model that consists of trip generation, distribution, mode choice and assignment steps;

- and a dedicated transit-only demand model that estimates public transportation ridership.

Only the primary travel demand model directly interfaces with the GIS and transit-only components. The other two components only directly interface with the primary travel model.

Model Features [ edit ]

The Central Florida Regional Planning Model (CFRPM) is a traditional four step model that includes trip generation, trip distribution, mode choice and traffic assignment. Additional components that are included in the model include a household disaggregation model which develops household distributions required by the trip generation as well as separate truck and external models as well as a tourism attraction component.

There are two forms of the model depending on the desired application of the model:

- the daily model or

- the Time-of-Day Model (TOD) that includes four periods: AM peak (7:00am to 10:00am), midday (10:00am to 3:30pm), PM peak (3:30pm to 6:30pm) and overnight (6:30pm-7:00am)

The most recent version of the CFRPM is the Official 2040 LRTP Version – 6.0- Released January 2016 with bug fixes and revisions it was re-released as version CFRPM6.1 on December 14, 2016.

On-Going Efforts/Upcoming Releases [ edit ]

CFRPM 7.0 is currently being developed and will be released in early 2021. This will be the model-of-record used for the 2045 Long Range Transportation Plans (LRTP) developed by local Metropolitan Planning Organizations (MPO). It will have a 2015 Base year and a 2045 Horizon year as well as interim years in 5 year increments. It will be a Time-of-Day model that includes four time periods. This will be the only available version; a daily-only model will no longer be available.

Previously, MetroPlan Orlando , the Metropolitan Planning Organization (MPO) for the greater Orlando area, created a separate travel demand model that overlapped with CFRPM. This model, the Orlando Urban Area Transportation Study (OUATS) model, is no longer produced. CFRPM 7.0 and future versions will be the definitive travel demand model for the Orlando region and greater Central Florida.

CFRPM Derivatives [ edit ]

CFRPM is used to derive travel demand models for partner agencies. CFRPM is taken and modified to create a model to meet the needs of each respective agency. Those models include:

- This model is created by Florida's Turnpike Enterprise (FTE) , a division of the Florida Department of Transportation (FDOT). This agency maintains Florida's Turnpike, as well as other toll roads across the state.

- This model is created by the Central Florida Expressway Authority (CFX) , an independent toll authority that maintains toll roads in the greater Orlando region.

These models are created primarily to model toll roads, which have unique modeling needs than non-toll roads.

For any additional information regarding these models, please contact the respective agency.

CFRPM Model Versions [ edit ]

Cfrpm v5.0 [ edit ].

- Adopted LRTP model

- Base year is 2005

- Future year includes 2015, 2020, 2025, 2030 and 2035

CFRPM v5.5 [ edit ]

- TAZ refinement along major transit corridors

- Time of day model (four time periods)

- No future year model; no tests for checking forecasting ability of the model under future conditions

CFRPM v5.6 [ edit ]

- Highway model structure/validation based on CFRPM v5.5 (not calibrated to 2010 counts)

- Time of day model with emphasis on transit modeling using new 2010 on-board survey

- Updated trip generation to resolve trip rate differences by county

- Updated trip distribution to address low trips to downtown Orlando

- Validate auto speeds using Bluetooth data

- Calibrated transit speeds and validated transit paths

- Base year is 2010

- Future year includes 2035

CFRPM v6.0 [ edit ]

See CFRPM v6.1

CFRPM v6.1 [ edit ]

- Adopted for 2040 Long Range Transportation Plan (LRTP)

- Base Year: 2010; Horizon Year: 2040

- Eliminated hard coding of file paths & locations

- Reference to correct files

- Cursory look at ZDATA & corrections

- Update model to work in Cube v6.4

- Consistency with OUATS

- Zone & network shapefiles

- Future updates

- Pre-load External Trips

- Increase in number of available dummy nodes

- Special Attractions improvements

- Developed Sub-area process

- Select Link Analysis Capabilities Added

- Developed specialized MPO reporting tools

CFRPM v6.2 [ edit ]

This is a project-specific model; it was developed for the I-4 Beyond the Ultimate (BTU) study . It is not intended for public release.

- Zone fidelity improvements to correspond with Florida’s Turnpike Enterprise’s (FTE’s) BtU toll and revenue model.

- Use of latest freight flows from the recently completed Florida Statewide Model.

- Base year is 2015

- Future year is 2045

Navigation menu

Modeling is used to predict future outcomes based on various inputs in the transportation planning process. The North Florida TPO uses an activity-based travel demand forecasting model called Northeast Regional Planning Model - Activity Based (NERPM-AB).

The model inputs include projected growth, land uses, travel choices and behaviors to predict travel up to the year 2045.

Please contact Clark Letter at (904) 306-7514 with questions.

- Model Download

- Model References

- Activity-Based Travel Demand Models: A Primer

Address 980 North Jefferson Street Jacksonville, Florida 32209

Phone 904.306.7500

© 2024 North Florida Transportation Planning Organization

- Meeting Materials

- CUTR in our Community

- CUTR Alumni Update

- Employee Wiki

- CUTR Administration Staff

- Annual Reports

- CUTR at TRB

- Funding Model

- Job Opportunities

- Mission & Vision

- National Institute for Congestion Reduction

- Advanced Air Mobility (AAM)

- Autonomous-Connected Mobility Evaluation (ACME)

- Driver Behavior, Human Factors and Safety Analytics

- ITS, Traffic Operations & Safety

- Motorcycle Injury Prevention

- Resilient Transportation Infrastructure Systems (R-TIS)

- Transit Management & Innovation

- Transit Research Program

- Transit Safety and Workforce Development

- Transportation Demand Management

- Transportation Planning, Policy, and Processes (TP3)

- National Center for Transit Research Archive

- Affiliated Faculty, Staff, and Students

- Historical Research Publications

- Recent Publications and Research Reports

- Issued U.S. Patents

- Journal of Public Transportation

- USF Bicycle Club

- USF ITE Student Chapter

- Semester Course Offerings

- Student Resume Fairs & Mock Interviews

- Study Abroad – Netherlands

- Sustainable Transportation Course

- Internal Communications Portal

- CUTR Transportation Webcast

- Friday Transportation Seminar Series

- Out of My Lane podcast

- CUTR Project Websites

- Events and Trainings

- CUTR Transportation Scholarship Award

- ELEMENT Engineering Group Transportation Scholarship

- Florida Transportation Hall of Fame Inductees

- New Voice in Transportation Award

- Georgia Brosch Memorial Transportation Scholarship

- NICR Student of the Year

- Previous Transportation Achievement Awards

- CUTR Connections Newsletter

- Organization Memberships

- USF Transportation Day

Program Overview

CUTR’s Transportation Demand Management (TDM) Program focuses on helping communities influence travel behavior to encourage the use of travel options other than driving alone or to improve the safety of vulnerable road users. The program’s balanced portfolio of research, technical assistance, and workforce development helps this team meet travelers’ needs to use diverse modes, depart at different times, work from home, make fewer trips or shorter trips, or take alternate routes to avoid congestion. The team’s current or recently completed projects are as diverse as the needs and approaches for managing demand. Several projects engaged faculty and staff from USF College of Public Health and Center for Marketing and Sales Innovation in the USF Muma College of Business and USF Zimmerman School of Advertising & Mass Communications, and USF Parking and Transportation Services.

We are committed to research and scientific discovery, including the generation, dissemination, and translation of new knowledge across disciplines, which means technical assistance efforts like clearinghouses and training/certificate programs play major roles in the center’s portfolio. Our technical assistance efforts include managing Best Workplaces for Commuters , which recognizes and supports employer-provided transportation services; operating the Florida TDM Clearinghouse ; producing netconferences ; administering a 1,850+ member TRANSP-TDM listserv to foster peer-to-peer exchanges; advancing safety by conducting targeted bicycle and pedestrian safety educational outreach programs to community groups; and offering a nationally recognized Commuter Choice Certificate and Social Marketing in Transportation Certificate training programs.

- Best Workplaces for Commuters

- Commuter Choice Certificate

- Florida TDM Clearinghouse

- Location Aware Information Systems Laboratory

- Social Marketing in Transportation Certificate

- TRANSP-TDM listserv ( subscribe )

Recent TDM News

Program Director

Transportation demand management program, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Post comment

This site uses Akismet to reduce spam. Learn how your comment data is processed .

In High Demand: Florida Hotels and Resorts (again)

December 29, 2022 – By Nick Plasencia Review and download the PDF version of Hospitality Industry Insights – In High Demand: Florida Hotels and Resorts (Again)

In an article we published in February 2021, before the COVID-19 vaccines were broadly rolled out, we suggested to owners of hotels in Florida, and waterfront hotels in the Sunshine State in particular, that their assets would soon be in high demand .

In the nearly two years since, new pricing records have dotted the Florida peninsula, from the Panhandle to the Keys, Tampa Bay to Jacksonville, and Orlando to South Beach. Investors have flocked to the seemingly bulletproof fundamentals of Florida’s hotel industry. While healthy deals inked in the late spring and summer 2022 have found their way to the finish line, the hotel transaction market nationally has been upended in the last half of this year by turmoil in the debt markets and fears about a looming recession. What then, is the near-term prognosis for the transaction market and asset values in Florida?

As our colleague, Dexter Wood, so clearly articulated this past August in his “ Hotel Debt Quagmire ” piece, lower loan-to-value ratios, coupled with higher interest rates, have wreaked havoc on underwriting metrics, placing many owners with impending debt maturities in a precarious position. These very same debt dynamics are plaguing the hotel transaction market today. By and large, would-be buyers are challenged to procure debt proceeds of sufficient size and at an attractive enough cost to make sense of the asking price of hotels on the market.

Furthermore, recession concerns have left many investors skeptical about growth in their five-year operating proformas, the backbone of their underwriting. Lower NOI growth and expanding exit cap rates, layered on top of the debt market turmoil, have proven challenging to say the least.

The lodging sector currently finds itself at an inflection point in the marketplace, with most would-be sellers of high-quality assets unwilling to part with their properties at valuations that are more reflective of the current capital market dynamics than the underlying durability of their cash flows and the irreplaceability of their real estate. Transaction activity has accordingly contracted considerably. The outlook for Florida, however, is not as bleak. Current debt markets aside, the lodging fundamentals and outlook throughout the state have never been stronger. Record tourism coupled with resurgent corporate and group demand have created a new normal that far surpasses all pre-pandemic benchmarks for the state. With a bit of patience, Florida hotel and resort owners will continue to reap the rewards of their investments.

Florida in Focus

As has been widely chronicled, Florida has been the domestic darling of the pandemic era. Net migration to the state has led the U.S., at the expense of major metropolises across the Northeast, Midwest, and West Coast. New business applications have surged, and there has been a tangible positive shift in the state’s economy. Major corporations have opened new offices in the state or altogether relocated to Florida. The mild weather and absence of a state income tax have also made Florida a refuge for an army of fully remote employees who have turned the traditional vacation destination into an everyday oasis.

Domestic inbound travel to Florida has surpassed prior peaks, and international travel is returning to pre-pandemic norms, albeit very slowly, but nevertheless providing additional support for future RevPAR increases. In 2019, international visitation comprised some 11% of all travelers to the state. Due in large part to an unfavorable exchange rate, unpredictable travel dynamics, and variances in global pandemic travel restrictions, international visitation to the Sunshine State remains just a fraction of pre-pandemic levels. International visitation in Florida during the September 2022 trailing twelve-month (TTM) period was 41% below 2019, with 5.7 million fewer international travelers in total. The continued natural recovery towards pre-pandemic benchmarks will provide an additional layer of demand to Florida’s hotels.

Rock Solid Fundamentals

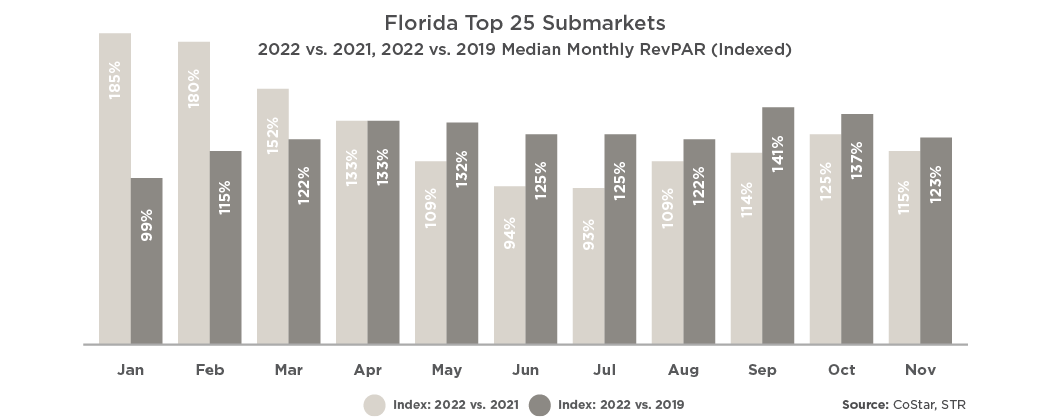

The table at right depicts the RevPAR of Florida’s top 25 submarkets, as tracked by STR. The improvements in hotel performance that the state has experienced are remarkable. On a TTM basis, each of these submarkets has surpassed the final, “clean” pre-pandemic TTM period ending February 2020. Unsurprisingly, most of this growth has been driven by ADR during this inflationary period (median submarket TTM ADR is 28% higher than pre-pandemic) while demand has been remarkably strong, with the median submarket Occupancy in the state now only slightly below pre-pandemic figures. For group- and corporate-anchored submarkets such as Orlando’s and Tampa’s Central Business District, respectively, recent performance has been supercharged as those demand segments have returned.

For the past year, we’ve heard concerns from investors that the euphoric run-up in performance experienced in summer 2021 at the end of many pandemic restrictions might be unsustainable. Travelers with cabin fever and, more importantly, cash in their bank accounts, flocked to Florida in record numbers, resulting in record ADRs. The numbers this year bear out some of these concerns, but actually paint a rosier picture than many initially feared. Top beach markets across the state did indeed experience a notable year-over-year decline in RevPAR in June and July 2022, leading to median RevPAR declines across these 25 markets of 6% and 7% in those months, respectively. These declines, however, moderated significantly by late summer, and August once again proved to be an excellent month of year-over-year growth in most submarkets. While September and November figures were undoubtedly distorted by Hurricanes Ian and Nicole, the numbers across the balance of the state largely continued to improve this fall. For group- and corporate-anchored submarkets such as Orlando and Tampa’s Central Business District, recent monthly performance has been supercharged as those demand segments have returned.

Looking ahead, we believe owners of Florida hotels and resorts can rely on 2022 being a sturdy baseline for projecting future performance — and don’t forget that travel in January 2022 was meaningfully impacted by the COVID Omicron variant! We anticipate that Florida hotel and resort performance in 2023 should handily surpass 2022 in the vast majority of cases, rooted in tenacious leisure travel, diminished COVID concerns, and consistently expanding corporate and group demand.

Patience has Paid Off

While current conditions have created a tenuous investment market for most hotel assets nationally, the amount of equity capital seeking superior hotels remains exceedingly high, and quality opportunities are being duly scrutinized. The United States stands out as a global safe haven today, beckoning capital from every corner of the planet, and Florida has become the most attractive part of the nation for lodging investments. Most owners in the Sunshine State who have been warily eyeing transaction trends will find that an on-market or discreet, off-market disposition outreach effort today will likely yield considerable interest, notwithstanding the current economic environment.

For many of our clients, patience has proven to be the prudent approach over the last four or five months. Current economic woes, however, will not last forever. As when the debt markets reopened in early 2021, lenders dipping their toe back into the lodging sector will be looking for security above all else. Few economies in the country and world are as strong as Florida’s, and we expect loan originations in the state will again become a top priority for lenders with allocations to the hotel sector.

Florida also has been unfairly dinged this year by a prevailing sentiment that the rush of leisure demand into the state in 2021 was nothing but a stimulus-induced “sugar high,” not to be replicated. While many top beach destinations did suffer moderate year-over-year declines in RevPAR over the course of the early summer, most coastal destinations quickly stabilized. The state appears to be settling into a new normal era of heavy leisure demand, buoyed by increases in corporate and group business segments, as well as improving international travel.

To the many would-be sellers of hotels and resorts in Florida: you once again might be surprised by how voracious investors’ appetite for your properties may be today. The public lodging REITs, flush with cash and not constrained by property-level mortgage underwriting, have thrown their weight around during the second half of 2022, paying fair values for leisure assets across the country. Private equity, high-net-worth family offices, and institutional investors have taken notice. With budget season behind us, there is every reason to believe 2023 will be rosier than 2022 for the Florida lodging sector, especially at the top line. Trailing twelve-month performance will swell as tourists flock to the Sunshine State this winter and spring and Omicron disruptions roll off the books. You can bank on investor capital chasing closely behind. As the capital markets emerge from their hibernation, Florida remains right where it has been for the last two years: at the top of the list for every investor and lender.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.

National Presence. Local Knowledge. Exclusively Hospitality. The Plasencia Group is a national hospitality sales, investment consulting and advisory firm with offices across the country.

Get the Latest Posts from The Plasencia Group

Subscribe to News & Publications

Recent Posts

- Downtown Austin RevPAR Recovery Is In the Works

- The Plasencia Group Advises on Sale of Courtyard and SpringHill Suites in Fort Myers

- Top 10 U.S. Hospitality Industry Sleeper Markets for 2024

- TownePlace Suites Tampa Westshore Airport Transaction Led by The Plasencia Group

- The Residence Inn Tampa Westshore Airport Transaction Led by The Plasencia Group

- Representative Engagements

Connect with a Plasencia Group Member today and learn what we can bring to your table.

The Plasencia Group 3550 Buschwood Park Drive Suite 150 Tampa, Florida 33618

- Company History

WHO WE WORK WITH

- Corporate Owners

- Private Owners

- Lenders & Servicers

ADDITIONAL LINKS

- Access Virtual Data Room

- Staff Login

- Corporate Brochure

© 2024 The Plasencia Group. Privacy Policy

- News & Articles

- Publications

- On the Road

Get the best experience and stay connected to your community with our Spectrum News app. Learn More

Continue in Browser

Get hyperlocal forecasts, radar and weather alerts.

Please enter a valid zipcode.

Nurses needed: Florida travel nurses see jump in demand

WEEKI WACHEE, Fla. — COVID-19 cases may be decreasing across the state, but a company that connects travel nurses with job opportunities said demand is still strong in Florida.

What You Need To Know

Staffdna saw 100% increase in job orders for travel nurses in florida market from march-may resumption of surgeries, travel and hospital staff taking time off are among reasons for the florida increase fha says florida nurses pursuing travel jobs contributed to state nursing shortage hospitals are looking at ways to retain and recruit nurses.

"Between March and May, we saw over 100% increase in job orders in the Florida market," said Imran Chaudhry, vice president of strategic solutions for StaffDNA .

Chaudhry said there are a number of reasons for this. One is the resumption of surgeries delayed due to the pandemic, which creates demand in other departments. Another is travel picking up and vacationers seeking treatment in local emergency rooms when needed.

"Lastly, we're starting to see things happen at hospitals with their own staff," said Chaudhry. "For the last year, or 12-15 months, they've been working around the clock, working tirelessly to help serve patients dealing with COVID, and they're tired, so they want to take vacation."

Nurse Rick Hartman lives in Weeki Wachee and uses StaffDNA to find work around the state and country. He turned to travel nursing seven years ago.

"I keep myself pretty booked — a lot of people will take, you know, a week, two weeks, sometimes a month off between assignments, but to me, that kind of defeats the purpose," he said. "I'm a little older and I'm thinking about retirement, and being able to go after these more lucrative assignments, I'm able to put a lot more money away for my retirement faster."

According to the U.S Bureau of Labor Statistics , the annual mean wage for registered nurses was about $80,000 as of last May.

Information from a Zip Recruiter survey found that, as of this month, the national average salary for travel nurses was more than $99,000. The executive director of the Florida Nurses Association told Spectrum Bay News 9 earlier this month that high-paying assignments are part of what's drawing Florida-based nurses to travel work, contributing to the state's nursing shortage.

"Hospitals have long depended on contracted staffing travel nursing. Certainly, throughout the pandemic during different periods of time where we were seeing significant spikes in Florida - July, again in December, January - there was a significant dependency on contracted staffing," said Florida Hospital Association President and CEO Mary Mayhew. "Of course, the other challenge is, as states across the country have required additional travel nurses to support their demand, we've experienced nurses leaving Florida to work in those other states, and so that has also exacerbated some of the workforce challenges here in Florida."

Chaudhry said there are a number of reasons nurses choose travel work, and their hometown hospitals could end up seeing benefits.

"Travel, visit family and friends, go experience different settings to increase their skill set, which a lot of times they bring back to their staff jobs," said Chaudhry.

Mayhew said hospitals statewide are looking at creative ways to retain staff and attract new employees, including signing bonuses and developing pathways to help workers advance in their careers. She noted there's a lot health care workers need to evaluate post-pandemic, including whether the pipeline of new nursing graduates has been disrupted because of it.

"Hospitals are going to look at how to both support that pathway from the nursing programs into the hospitals, how to retain. Inevitably, they'll still need travel nurses, contracted staffing, but certainly want to ensure that as demand continues to increase that we're able to be creative and ensuring that we've got a workforce that's ready today to meet the demand, the anticipated increased demand in the future," said Mayhew.

LATEST NEWS

- Getting Results.

- Newsletters

BREAKING NEWS

Strong storms trek through Florida, spawning tornado. Here’s what comes next

Oj simpson, fallen football hero acquitted of murder in ‘trial of the century,’ dies at 76, 5 advisories in effect for 13 regions in the area, delta air lines posts a narrow q1 profit and says travel demand remains strong despite flight scares.

David Koenig

Associated Press

Delta Air Lines eked out a narrow first-quarter profit and said Wednesday that demand for travel is strong heading into the summer vacation season, with travelers seemingly unfazed by recent incidents in the industry that ranged from a panel blowing off a jetliner in flight to a tire falling off another plane during takeoff.

Delta reported the highest revenue for any first quarter in its history and a $37 million profit. It expects record-breaking revenue in the current quarter as well. The airline said that second-quarter earnings will likely beat Wall Street expectations.

Recommended Videos

CEO Ed Bastian said Delta's best 11 days ever for ticket sales occurred during the early weeks of 2024.

If travelers are worried about a spate of problem flights and increased scrutiny of plane maker Boeing , “I haven't seen it,” Bastian said in an interview. “I only look at my numbers. Demand is the healthiest I've ever seen.”

A slight majority of Delta's fleet of more than 950 planes are Boeing models, but in recent years it has bought primarily from Airbus , including a January order for 20 big Airbus A350s. As a result, Delta will avoid the dilemma facing rivals United Airlines and American Airlines, which can't get all the Boeing planes they ordered. United is even asking pilots to take unpaid time off in May because of a plane shortage.

“Airbus has been consistent throughout these last five years (at) meeting their delivery targets,” Bastian said.

Delta does not operate any Boeing 737 Max jets, the plane that was grounded worldwide after two fatal crashes in 2018 and 2019, and which suffered the panel blowout on an Alaska Airlines flight this year. However, the Atlanta-based airline has ordered a new, larger version of the Max that still hasn't been approved by regulators. Bastian said Delta will be happy to use the Max 10 when they arrive.

While Delta has largely dodged headaches caused by Boeing, it faces other obstacles in handling this summer's crowds.

Delta is lobbying the federal government to again allow it to operate fewer flights into the New York City area. Otherwise, Delta could lose valuable takeoff and landing slots.

The Federal Aviation Administration granted a similar request last summer and even extended it until late October . The FAA said the relief helped airlines reduce canceled flights at the region's busy three main airports by 40%.

Peter Carter, an executive vice president who oversees government affairs, said Delta and other airlines need another waiver permitting fewer flights this summer because the FAA still doesn't have enough air traffic controllers.

“Absent the waiver, I think we would have, as an industry, some real challenges in New York,” Carter said.

Airlines for America, a trade group of the major U.S. carriers, is also pushing for a waiver from rules on minimum flights in New York. The FAA said it would review the request.

Delta customers will see another change — a new system for boarding planes . Instead of boarding by groups with names such as Diamond Medallions, Delta Premium Select and Sky Priority, passengers will board in groups numbered one through eight. The airline says it will be less confusing.

“When you have a number and you're standing in line, we are all trained to know when it's our turn,” Bastian said.

The change won't alter the pecking order of when each type of customer gets to board. Those with the cheapest tickets, Basic Economy, will still board last.

Delta's first-quarter profit follows a $363 million loss a year ago, when the results were weighed down by spending on a new labor contract with pilots.

“We expect Delta to be one of the few airlines to report a profit in the March quarter,” TD Cowen analyst Helane Becker said even before Delta’s results were released.

Delta said that excluding special items, it earned 45 cents per share. Analysts were expecting 36 cents per share, according to a FactSet survey.

The airline forecast second-quarter earnings of $2.20 to $2.50 per share. The Wall Street consensus was $2.22 per share. The company stood by its forecast of full-year earnings between $6 and $7 per share.

First-quarter revenue rose 8%, to $13.75 billion. Putting Delta's Pennsylvania refinery aside, operating revenue was slightly more than analysts predicted. The airline said second-quarter revenue will be 5% to 7% higher than a year ago.

The airline reported that large corporate customers — who were slower than leisure travelers to resume flying after the coronavirus pandemic — are spending more on travel, including firms in technology and financial services.

Delta has boosted profit by focusing more on premium passengers who pay the highest fares, and raking in money from a credit-card partnership with American Express.

Costs could rise too, however. Jet fuel is higher than it was a year ago, following a run-up in oil prices, and Delta is spending more on aircraft maintenance this year.

Shares of Delta Air Lines Inc. fell 2.3% by the end of regular trading Wednesday.

Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.

Video shows shooting in Ocoee parking lot

Orlando chapter of zeta phi beta, inc to host bingo for handbags, man killed in neighborhood shooting on 8th avenue in taft, police search for car after sanford teen fatally shot, students arrested after seeking ‘bounty’ at lake mary high school, deputies say.

Travel Nursing: Florida

Table of contents.

- Find Current Travel Nursing Jobs in Florida 2024

Florida Licensure Information and Requirements

Florida ceu requirements, what is the average travel nursing salary in florida.

- How To Become a Travel Nurse in Florida With Trusted Nurse Staffing in Three Simple Steps

Why Should You Consider Becoming a Travel Nurse in Florida?

What are the high-demand travel nursing specialities in florida right now, faqs about florida travel nursing, find current travel nurse jobs in florida.

For the most up-to-date information on licensure and fees in Florida, visit the Florida Board of Nursing or contact them at (850) 488-0595.

Licensure Requirements

Florida is part of the Nurse Licensure Compact (NLC), so you will not need a Florida nursing license to practice travel nursing in this state if you have a valid license for another Compact state.

However, if you don’t have a multistate license, you will need to apply for licensure by endorsement.

To be eligible for licensure by endorsement in Florida, RNs and LPNs need to meet the following requirements:

- Must hold a valid license to practice in another state or U.S. territory.

- Must have successfully completed the State Board Test Pool Examination (SBTPE) or the NCLEX .

- Have actively practiced nursing in another state or jurisdiction for two of the preceding 3 years without criminal history or having their license acted against.

- Must take a remedial course if they have not actively practiced nursing for five years.

In addition to these requirements, nurses must:

- Submit fingerprints for state and federal criminal background checks.

- Submit self-explanation or a physician’s letter if there is a health history.

- Submit self-explanation, final dispositions/arrest records, completion of probation/parole/sanctions, and letters of recommendation if there is a criminal history.

- Submit self-explanation and agency records if there is a history of disciplinary actions.

- Complete and submit the application to the Board of Nursing.

- Contact the original licensing board and request verification be sent to the Florida Board of Nursing or verify licensure through Nursys Ⓡ .

Florida does not issue temporary permits. Applications are processed in the order they are received, but there is no set timeframe for approval.

Licensure Fees

The application fee for nursing licensure in Florida is $110.00.

Nurse Licensure Compact Status

Florida entered the Nurse Licensure Compact agreement on January 19, 2018.

Is Florida a Walk-Through State?

Florida is not a walk-through state.

Florida RNs and LPNs must meet the following CEU requirements every two years:

- 16 general hours

- 2 hours of prevention of medical errors training

- 2 hours of Florida laws and rules training

- 2 hours of recognizing impairment in the workplace training

- 2 hours of human trafficking training

- 2 hours of domestic violence training

- 1 hour of HIV/AIDS training

A list of Board-approved classes can be found here .

LPNs and RNs who are certified by a healthcare specialty program accredited by the National Commission for Certifying Agencies ( NCCA ) or the Accreditation Board for Specialty Nursing Certification ( ABSNC ) are exempt from CEU requirements.

Average travel nurse salaries in Florida range from $1,499 to $2,539 per week. However, it’s important to remember that salaries vary depending on location, demand, and nursing specialty.

Cities in Florida With the Highest Travel Nursing Salaries

The average travel nurse salary in Miami, Florida, is $2,345 per week.

The average travel nurse salary in Tampa, Florida, is $2,227 per week.

Winter Park

The average travel nurse salary in Winter Park, Florida, is $2,028 per week.

The average travel nurse salary in Orlando, Florida, is $2,015 per week.

Fort Meyers

The average travel nurse salary in Fort Meyers, Florida, is $1,999 per week.

Thousands of Nurses Love Partnering with Trusted Nurse Staffing

Trusted nurse staffing is such a great company to work for and they are so easy to work with. I love using them as my first company for travel nursing!

My recruiter did an amazing job at finding the best fit for me! An outstanding job with communication, updates and ensuring all my questions were answered!!

I have been with Trusted Staffing for about 18 months now. I have essentially been working local contracts, but the experiences have been memorable. My recruiter, is always available when I have a question or concern. Travel nursing is something all nurses should experience. I can't wait until I can do some serious traveling

Every member of this company I’ve interacted with has exceeded my expectations. My recruiter, Alex, is so commutative and goes above and beyond always. I can’t imagine switching to another company!

I have had the best experience with Trusted Nurse Staffing. My recruiter Tom is amazing. He always treats me with respect and as a friend. He is on top of everything I need. And when my Dad passed away, he helped me with time off, no problem and they even sent me a beautiful comfort box that was very helpful. Fully recommend this agency.

How To Become a Travel Nurse in Florida With Trusted Nurse Staffing in 3 Simple Steps

The first step is to use our Pronto job search. There you’ll be able to see the listings for travel nurse jobs in Florida. Don’t see what you’re looking for? No worries, Pronto can send you updates when more travel nurse jobs in Florida become available.

If you’re an experienced travel nurse and are familiar with the process, you’ll find everything you need on Pronto to manage it on your own. You’ll sign up, sign in, and follow the prompts.

If you need assistance at any point in your job search or application process one of our Trusted Nurse Staffing support staff members can assist you and will contact you to answer your questions about travel nurse positions in Florida.

Once you’ve picked a travel nurse job in Florida, you just need to sign your contract and head to the Sunshine State. When you complete your assignment, Trusted Nurse Staffing can help you extend your contract or help you find the next assignment on your travel nurse journey in another state . We’re here for you every step of the way.

It’s no surprise that Florida is a popular destination for travel nursing. With great year-round weather and over 1,300 miles of beautiful beaches, Florida cities often find their way onto travel nurses’ dream assignments lists.

Who wouldn’t want to spend their day off at the beach? Whether it’s lying out in the sun, splashing in the water, or cruising on a sailboat, Florida beaches tend to be the perfect way to let go of your worries and relax. If you’re an adventure-seeker of the great outdoors, there are over 20 state parks in Florida to explore, many just steps from the beach.

Not a beach person? Try taking up Florida’s second favorite pastime. With over 1,000 golf courses in the state, there are plenty of opportunities to “hit the greens” on the weekends.

Being a popular tourist destination, Florida knows how to bring it when it comes to restaurants and entertainment. You’ll find plenty of beachside restaurants serving up fresh catches of delectable seafood. Don’t forget to try a slice of key lime pie — a Florida specialty you can find on just about any menu.

If you’re a Disney fan, you’ll definitely want to take a trip or get a season pass to the Happiest Place on Earth. Visit Mickey and his friends at Disneyworld in Orlando. You won’t forget this magical experience!

When it comes to available travel nurse assignments in Florida, you won’t have to worry about finding one. With Florida’s ever-changing population due to tourist seasons and “snowbird migrations” as seniors from other states flee colder weather, Florida hospitals are often in demand for travel nurses. Use our Pronto job search to view current travel nursing jobs in Florida.

What Are Your Active Travel Nursing Jobs in Orlando, Florida?

Are you ready for your next adventure as a travel nurse? Orlando, Florida, may be the perfect place for your next travel nursing assignment. Go to Pronto to view current job listings.

What Are Your Active Travel Nursing Jobs in Naples, Florida?

Interested in seeing what Naples, Florida, has to offer? View all our current travel nursing assignments in Naples on Pronto .

What Are Your Active Travel Nursing Jobs in Jacksonville, Florida?

Ready to move to sunny Jacksonville, Florida? You can view all our current Jacksonville travel nursing assignments on the Pronto job search.

How Do I Find Housing For My Florida Travel Nurse Assignment?

“ Choosing to accept a stipend doesn’t mean that your recruiter at Trusted Nurse Staffing won’t be there to help you along the way. Connect with us, and we can give you insights into the various areas and even connect you with rental properties used by travel nurses in the past.”

How Do I Find The Best Travel Nursing Agencies in Florida?

When it comes to travel nursing agencies in Florida, it seems like there are endless options to choose from. This can make the process of finding a travel nursing agency seem daunting.

While we recommend speaking with other travel nurses about their travel nursing agency experiences, we also encourage travel nurses to shop around and “interview” travel nurse agencies.

Before signing any contracts, you’ll want to know key information, like:

- How responsive the agency is to your needs

- What kind of benefits you are eligible to receive

- What their pay rates are like

What Benefits Do I Receive As a Travel Nurse in Florida?

The benefits that you are eligible to receive can vary depending on the travel nursing agency you partner with. Make sure that when you are choosing a travel nursing agency, you compare benefits packages so you fully understand what you are eligible for before signing a contract.

For example, Trusted Nurse Staffing offers many benefits, including:

Competitive Compensation

- 401(k) with 4% match after 1,000 hours and 1 year of employment

- Weekly Paychecks

- Direct Deposit

- Overtime/Double Time is Available

- Customizable Pay Packages

Top-Tier Bonus Opportunities:

- $1500 Referral Bonus Program

- Loyalty Program

- Sign-on & Completion Bonus

- Discount Program

Leading Health & Wellness Benefits:

- Employer Sponsored Health Insurance

- HRA Card to fully cover healthcare deductibles

- Guardian Dental and Vision Insurance

- Wellness Benefits

Additional Insurance Benefits:

- Portable Permanent Whole Life Insurance

- License, Certifications & CEU reimbursements

- Portable Short-term/Longterm

- Disability Insurance

Work Flexibility:

- Flexible contract options

- Full/Part Time Work, Per Diem

- Housing, Meal and Travel Stipends

- Rental Car Options

Best In Class and Communication:

- On Day 1, you’ll get matched with your own dedicated support team that includes clinical support, payroll, and compliance experts, with ongoing assignment advocacy.

Which Florida Travel Nursing Assignments Have The Lowest Cost of Living?

Choosing an assignment in a city with a lower cost of living is one way to get the most bang for your buck. However, this doesn’t mean you have to choose an assignment that is in the middle of nowhere or hours from the beach. You may be surprised to learn that some of the most affordable cities in Florida offer some of the best entertainment.

Florida cities with the lowest cost of living include:

- Gainesville

- Daytona Beach

Why Should I Apply To Travel Nursing Jobs in Florida With Trusted Nurse Staffing?

At Trusted Nurse Staffing, we offer the highest pay in the industry on top of other benefits, like sign-on and completion bonuses, education reimbursements, customized benefits, and more.

We value our travel nurses and take the time to make a lasting relationship. Our Trusted Nurse Staffing recruiters are available 24/7, so there is always someone to pick up the phone and assist you with whatever you need.

Interested in Other States? Find Comprehensive Travel Nursing Information for Other States Using The Interactive Map Below

For the latest storm information and safety alerts, visit FloridaDisaster.org . For real-time traffic information throughout the state, visit FL511.com .

Systems Traffic Modeling

Urban transportation planning is the process used in urbanized areas to analyze and plan for current and future transportation needs. An important element of this process is the forecasting of travel demand using computerized simulation models. The Systems Traffic Modeling Section develops and maintains transportation computer models. The central office modeling section works with the districts, MPOs, cities, counties, and other government agencies in the use of these models and provides technical guidance, training, and assistance.

- Research Projects and Reports (Ongoing)

- An Introduction to Systems Traffic Modeling in Florida

Travel | Cruise demand leaves pandemic in rearview with…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Daily e-Edition

Evening e-Edition

- Entertainment

- Theater and Arts

- Things to Do

- Restaurants, Food & Drink

Things To Do

Subscriber only, travel | cruise demand leaves pandemic in rearview with record passengers, more construction on tap.

MIAMI BEACH — The COVID pandemic drove the cruise industry to a standstill, but numbers released Tuesday signal the years of comeback are officially over with more expansion on tap.

More than 31.7 million passengers took cruises worldwide in 2023, said Kelly Craighead, Cruise Line International Association president and CEO, speaking at the annual Seatrade Cruise Global conference at Miami Beach Convention Center.

CLIA is the lobbying group for member cruise lines, including Royal Caribbean, Disney Cruise Line, Carnival, Norwegian, MSC and most other major brands.

The pandemic shut down sailing from March 2020 with only a small number of ships coming back online 18 months later in summer 2021. Cruise lines didn’t return to full strength until partially through 2022, so it wasn’t until a full year of sailing in 2023 that the industry could get a real handle on just what the demand had grown to as people returned to vacation travel.

“We are an industry that’s resilient and thriving all around the world, breaking records in ways we might never have imagined,” she said.

The 2023 total is 2 million more than the industry had in 2019. CLIA projects 34.1 million in 2024 growing to 34.6 million in 2025. It’s still a miniscule chunk of the overall travel pie of more than 1.3 billion, but cruise’s share is growing.

She noted that surveys of travelers who would consider a cruise for a vacation are at an all-time high, noting that 82% who had previously cruised said they would cruise again, but more importantly, among those who had never sailed, 71% would consider it.

The youngest generations — Gen X, Millennials and Gen Z — are the biggest drivers.

The fleet for the growing demand continues as well, including the introduction this year of the world’s largest cruise ship, Royal Caribbean’s Icon of the Seas.

She said CLIA member lines had more than 300 ships sailing globally for the first time in 2023, with 14 new ships that began sailing in 2023 and another eight expected before the end of the year. They have 88 new ships on order through 2028.

Already this year, both Royal Caribbean Group and Carnival Corp. announced major new ship construction deals, and Norwegian Cruise Line Holdings added to that this week with its order of eight more vessels across its three brands.

The heads of those groups were on stage to discuss where the industry is headed and enjoy their recent success.

Carnival Corp.’s president and CEO Josh Weinstein put it in a way that gained plaudits from fellow panelists and others at the conference.

“The concept of pent-up demand for cruising is gone,” he said. “We have been cruising for three years, right? It’s over. This is natural demand because we all provide amazing experiences. We delivered happiness to literally 31 million guests last year. And people see it, they feel it.”

A big part of what cruising missed during the pandemic he said was that word-of-mouth promotion that is needed to convince people to try their product.

“We now have 31 million people getting off our ships and going home and telling their friends and family who have never cruised before, ‘You don’t know what you’re missing.’ ‘This is amazing.'”

All of the leaders echoed the industry line that they offer a much better value than land-based vacations, but that the experience gap between the two has now shifted in their favor coming out of the pandemic.

“The appreciation for building memories with your friends and family coming out of COVID is at extraordinarily high levels,” said Jason Liberty, president & CEO at Royal Caribbean Group. “Also wealth transfer, right? Grandparents wanting to see that wealth transfer live, watching their kids and their grandkids experience that is also at an all-time high. … We have the secular trends of people buying less stuff, they want experiences. We’re in the experience business.”

Another bright aspect to the industry has been the spillover effect of all of the new ships since the pandemic, said Harry Sommer, president & CEO at Norwegian Cruise Line Holdings Ltd.

“Their new products are so extraordinary, and so much better than what was delivered back in ’15, ’16 and ’17, that it’s driving additional excitement for the entire industry,” Somer said. “When any new ship is delivered, no matter whether it’s part of our portfolio or the other portfolios, demand improves for all of us because it adds excitement to the industry.”

More in Travel

The new issue of Explore Florida & the Caribbean takes you places

Disney World | Disney: Star Tours rolls out fresh scenes, new characters

Travel | Travel Troubleshooter: Why won’t Airbnb cover my hotel expenses? They promised!

Travel | Floridian fun, history abound at St. Augustine Alligator Farm

IMAGES

COMMENTS

About . The term FSUTMS (Florida Standard Urban Transportation Model Structure) is used to represent a formal set of modeling steps, procedures, software, file formats, and guidelines established by the Florida Department of Transportation (FDOT) for use in travel demand forecasting throughout the state. The primary objective of travel demand forecasting is to forecast the effects of various ...

Growing Travel Demand • By 2025, Florida is expected to be the third most populous state, with over 20 million residents. • Between 1990 and 2003, Florida grew an average of 2.1% per year, slower than the preceding 30 years, when growth averaged 2.9%. The growth rate is expected to continue declining, averaging 1.5% through 2025.

How the delta surge will affect Florida's tourism numbers. Travel demand appears to now be affected by the new surge, with Southwest Airlines reporting a decrease in booking last week and a new ...

FLSWM v7.2. In this release of the Florida statewide travel model, we have improved toll-facility modeling capabilities statewide. This FLSWM version 7.2 contains (1) a network coding fix for 2045 initial capacity inputs, and (2) increased dollar amounts in the low, medium, and high value-of-time categories. These VOT categories are highly, but ...

Florida is unique in that travel demand models are loosely managed at a statewide level. We all use the same software (basically). We have consistent naming conventions for filenames, processes ...

Tuesday after Memorial Day, May 31, 2022, Florida's Turnpike HQ, Ocoee, FL The FSUTMS Executive Summary Modeling Seminar provides an overview of the transportation planning process, travel demand forecasting methodologies, and FSUTMS modules. Participants learn the underlying theories of modeling and see how to produce presentation graphics for ...

travel demand Tourism and Travel Domestic and International Visitors to Florida Tourism/Recreation Taxable Sales travel demand Tourism and Travel In 2011: • Florida hosted 87.3 million visitors/tourists, an increase of 5 million or about 6.1% over 2010. •30 Domestic visitors to Florida outnumbered international visitors by nearly 6 to 1.

The transportation modeling and planning community in Florida relies heavily on travel survey data to develop, calibrate, and validate travel demand forecasting models, to evaluate alternatives, assess impacts of policies and multimodal plans, and quantify travel demand by purpose, time, location, and mode.

growth. Thus, travel demand growth may be solely or at least more highly dependent on population growth. During the recession, Florida saw slower population growth relative to historical trends and the nation. Understanding future population growth will be critical to forecasting future travel demand and transportation needs for Florida1. This ...

Sentiment is also growing for upcoming leisure travel in 2024. The share of travelers reporting having travel plans within the next six months increased to 93% in January from 92% in December, according to Longwoods International's monthly survey. Travel price inflation (TPI) fell slightly in January as a result of falling transportation prices.

The U.S. Travel Association released its biannual forecast for travel to and within the United States through 2026, showing a normalized rate of growth in the domestic leisure travel sector after months of elevated demand. "Robust domestic leisure travel demand has been the driving force in the overall industry's post-pandemic comeback," said U.S. Travel Association President and CEO ...

In an interview over the weekend, Marriott's CEO corroborated this, indicating that their real-time data shows consumer confidence and demand are increasing for travel to leisure destinations (like Florida) despite still being down in many big cities.. This surprise turnaround came after Marriott predicted last year that the financial impact of the pandemic would be on par with 9/11 and the ...

May 19, 2023 | 6:08 AM. Summer travel and demand for hotels as a whole in 2023 is trending up year over year, but destination markets such as Miami and Daytona Beach are proving less popular after ...

In 2021, we saw unprecedented domestic travel demand as people from all over the country were looking to escape local lockdowns in favor of the many 'open for business' Florida beach communities that welcomed them. In 2022, we saw the return of the international traveler as global travel restrictions eased.

Statewide Travel Demand Modeling 3 Florida DOT Terry Corkery explained that several decades ago, Florida DOT developed the Florida Standard Urban Transportation Model Structure (FSUTMS), in partnership with FDOT district offices and 27 MPOs in the State. Models include the Statewide model, eight regional models, and models of the Florida Turnpike.

Summary and this Introduction. The first area addresses travel demand by examining population growth and characteristics, travel behavior trends, tourist travel, and freight movement. The second provides information on Florida's transportation system including the roadway system, aviation, seaport, rail, transit, and bicyclist/pedestrian ...

CFRPM Overview. The Central Florida Regional Planning Model, Version 7 (CFRPM 7) is a system of processes and demand models designed to accurately reflect the transportation network and demand for 11 Florida counties: Brevard, Flagler, Indian River (northern half only), Lake, Marion, Osceola, Orange, Polk, Seminole, Sumter and Volusia.

The North Florida TPO uses an activity-based travel demand forecasting model called Northeast Regional Planning Model - Activity Based (NERPM-AB). The model inputs include projected growth, land uses, travel choices and behaviors to predict travel up to the year 2045.

Florida Transportation Hall of Fame Inductees; ... CUTR's Transportation Demand Management (TDM) Program focuses on helping communities influence travel behavior to encourage the use of travel options other than driving alone or to improve the safety of vulnerable road users. The program's balanced portfolio of research, technical ...

Florida travel demand in 2015 included: 207 billion annual vehicle miles traveled - approximately three-quarters of which was personal vehicle travel; 78 million airline passengers; 271 million public transit passengers; 1 million Amtrak passengers; and 15.2 million cruise passengers. The 2015 travel volumes of these modes

International visitation in Florida during the September 2022 trailing twelve-month (TTM) period was 41% below 2019, with 5.7 million fewer international travelers in total. The continued natural recovery towards pre-pandemic benchmarks will provide an additional layer of demand to Florida's hotels.

Nurses needed: Florida travel nurses see jump in demand. By Sarah Blazonis Tampa. PUBLISHED 11:15 PM ET Jun. 22, 2021. WEEKI WACHEE, Fla. — COVID-19 cases may be decreasing across the state, but ...

Delta Air Lines posts a narrow Q1 profit and says travel demand remains strong despite flight scares. FILE - A Delta Air Lines plane lands at Logan International Airport, Jan. 26, 2023, in Boston ...

For the most up-to-date information on licensure and fees in Florida, visit the Florida Board of Nursing or contact them at (850) 488-0595.. Licensure Requirements. Florida is part of the Nurse Licensure Compact (NLC), so you will not need a Florida nursing license to practice travel nursing in this state if you have a valid license for another Compact state.

The Florida Department of Transportation (FDOT) supports development . and maintenance of the Florida Statewide Model (FLSWM) for statewide travel demand forecasting. The FLSWM provides transportation planners the capability to evaluate alternative investment scenarios developed for the Florida Strategic Intermodal System (SIS).

State of Florida . Department of Transportation . REQUEST FOR PROPOSAL Florida Travel Demand Modeling Software and License. RFP-DOT-17/18-9028-GH. CONTACT FOR QUESTIONS: Greg Hill, Procurement Agent . [email protected] . Phone: (850)414-4482 . 605 Suwannee Street, MS 20 . Tallahassee, FL 32399-0450

An important element of this process is the forecasting of travel demand using computerized simulation models. The Systems Traffic Modeling Section develops and maintains transportation computer models. The central office modeling section works with the districts, MPOs, cities, counties, and other government agencies in the use of these models ...

Royal Caribbean's Icon of the Seas, the world's largest cruise ship docked at the Port of Miami on Thursday January 11, 2024. (Mike Stocker/South Florida Sun Sentinel)