- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement A debt management plan: Is it best for you? What is debt settlement and how does it work? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips and tricks to get of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

HTH Worldwide travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Kara McGinley

Updated 5:55 a.m. UTC March 19, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

HTH Worldwide

Top-scoring plan

Covers covid, medical & evacuation limits per person, what you should know.

Along with a couple of other policies, HTH’s TripProtector Classic offers generous layoff coverage. You’re eligible if you’ve been continuously employed for at least a year, with no waiting period.

- Preexisting conditions can be covered if you buy a TripProtector Classic plan within 14 days of your first trip deposit.

- Best-in-class financial default coverage after only a 10-day wait.

- Top-notch $1 million per person in medical evacuation coverage.

- TripProtector Classic doesn’t offer a “cancel for any reason” upgrade, but the pricier Preferred plan does.

- No “interruption for any reason” upgrade available.

- No non-medical evacuation coverage.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 2,332 coverage details evaluated.

- 385 rates reviewed.

- 5 levels of fact checking.

HTH Worldwide overview

Created under the Worldwide Insurance Services umbrella, HTH Worldwide provides travel insurance for both business and leisure travel. Nationwide Mutual Insurance Company underwrites HTH Worldwide’s single-trip insurance plans.

HTH Worldwide travel insurance plans

HTH Worldwide offers TripProtector plans that cover single domestic or international trips. In addition to travel protection and medical benefits, each plan includes non-insurance travel assistance such as a 24-hour emergency hotline service, destination health and security information and an online doctor search.

HTH provides a 10-day “free look” period to give you the chance to look over your policy and cancel for a full refund if it doesn’t suit your needs. If you are not satisfied, return your policy within 10 days of receipt along with a letter indicating your reason for cancellation for a full refund (not available in NY or WA).

Economy

HTH’s starter travel insurance plan offers basic coverages, including:

- Emergency medical evacuation: $500,000.

- Emergency medical: $75,000.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $5,000.

- Trip delay: $500 maximum (after an eight-hour delay and with a $100 per day limit).

- Trip interruption: 125% reimbursement of eligible trip costs.

While the Economy plan also covers baggage loss, baggage delay and missed connections, it does not include rental car damage coverage or a preexisting conditions waiver. It includes accidental death and dismemberment coverage for air only.

TripProtector Classic

The TripProtecor Classic plan includes everything in the Economy plan and increases the travel protection and travel medical benefits. This plan gets 3 stars in our rating of the best travel insurance companies .

- Emergency evacuation: $1 million.

- Emergency medical: $250,000.

- Trip cancellation: 100% reimbursement for eligible trip costs up to $25,000.

- Trip delay: $1,000 ($200 per day after a six-hour delay).

- Trip interruption: 150% reimbursement of eligible trip costs.

The plan also includes a preexisting condition waiver if the insurance is purchased within 14 days of your first trip deposit, as well as accidental death and dismemberment coverage of up to $25,000 per person. Like the Economy plan, lost and delayed baggage and missed connections coverage is also included.

TripProtector Preferred

The TripProtector Preferred plan offers enhanced coverage but is more expensive than the Classic and Economy plans.

- Emergency medical: $500,000.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $50,000.

- Trip delay: $2,000 ($200 per day after a six-hour delay).

- Trip interruption: 200% reimbursement of eligible trip costs.

- Optional “cancel for any reason” (CFAR): 75% reimbursement for eligible trip costs.

- Pet medical expense: $250.

- Rental car damage: $35,000.

- Accidental death and dismemberment: $50,000.

Unlike the other two plans, the Preferred Benefits plan offers pet medical expense coverage, rental car damage coverage and optional cancel for any reason travel insurance coverage. You can get a preexisting conditions waiver if the travel insurance plan is purchased within 21 days of your first trip deposit.

This plan also includes coverage for lost and delayed baggage and missed connections.

What HTH travel insurance covers

HTH Worldwide’s three TripProtector plans include the following coverage:

- Travel medical insurance reimburses you for medical expenses like care, hospitalization, lab work and more if you get sick while on your trip.

- Emergency medical evacuation covers the cost of emergency medical transportation to the nearest adequate treatment center if you become seriously injured or ill while traveling and require immediate care.

- Trip cancellation insurance reimburses prepaid, forfeited, nonrefundable trip costs if you need to cancel your trip for a covered reason.

- Trip delay coverage reimburses reasonable extra expenses, such as meals, lodging and transportation, if your travels are delayed due to reasons like a flight being canceled due to severe weather.

- Trip interruption coverage reimburses you for unused, prepaid, nonrefundable trip expenses such as hotel nights and missed excursions if you need to end your trip early because of a reason listed in your policy, such as a child back home getting sick.

- Baggage loss reimburses you for luggage and personal items that are lost, stolen or damaged during transit.

- Baggage delay reimburses for expenses paid for items like toiletries and a change of clothes needed because of delayed baggage.

Each plan has coverage limits and time frames for when coverage kicks in (like six hours for baggage delay coverage). Be sure to read your policy to understand the limits and exclusions.

What HTH travel insurance doesn’t cover

All travel insurance plans have exclusions, or things the policy does not cover.

Some examples of the emergency medical coverage exclusions in HTH Worldwide’s TripProtector Classic plan are:

- Accidental injury or sickness when traveling against the advice of a physician.

- Being under the influence of drugs or intoxicants (except when prescribed by a physician).

- Cosmetic surgery (except as a result of an accident).

- Dental treatment (except as the result of injury).

- Suicide, attempted suicide or any intentionally self-inflicted injury.

- Participation as an athlete in professional sports.

- Participation in adventure sports such as canoeing, kayaking, zip-lining, water skiing, camping, hiking, backpacking and sailing.

- Pregnancy and childbirth (except for complications of pregnancy).

Additional policy add-ons

HTH Worldwide’s TripProtector Preferred plan offers optional upgrades including “cancel for any reason” (CFAR) coverage , pet medical coverage and rental car damage coverage (not available in every state).

“Cancel for any reason” (CFAR) coverage

TripProtector Preferred policyholders have the option to purchase “cancel for any reason” (CFAR) coverage. This coverage reimburses up to 75% of your prepaid, nonrefundable trip payments or deposits if you cancel your trip for any reason at least 48 hours before your scheduled departure.

To get CFAR coverage, you need to buy it within 21 days of your first trip deposit. This benefit is not available in New York or Washington.

HTH Worldwide travel medical insurance

HTH Worldwide offers two plans for travelers who want travel medical insurance for international trips. Both plans are available to United States residents who are 95 years old or younger.

Single-trip option for travelers with primary health insurance

This short-term international medical plan was created for travelers who have primary health insurance but want extra coverage for traveling abroad. The maximum benefit amounts range from $50,000 to $1 million, and deductibles range from $0 to $500. There is no preexisting condition exclusion.

The plan covers 100% of the following:

- Ambulatory surgical center.

- Anesthesia.

- Dental injury expenses ($500 maximum).

- Diagnostic X-rays and lab work.

- In-hospital doctor visits.

- In-patient medical emergency.

- Office doctor visits.

- Outpatient prescription drugs.

The plan covers mental health emergencies as it would any other condition. The single-trip plan also includes common travel insurance coverages like medical evacuation, accidental death and dismemberment, trip interruption, trip delay and lost and delayed baggage.

Single-trip option for travelers without primary health insurance

This plan is for those traveling abroad who do not have primary health insurance. Like the plan for travelers with primary health insurance, the benefits range from $50,000 to $1 million and deductibles range from $0 to $500.

This plan covers 100% of the following:

- Dental injury expenses ($300 maximum).

- Diagnostic X-rays and lab work.

- In-patient medical emergency.

Like the other, this plan also covers mental health emergencies as it would any other condition. However, this plan has a 180-day preexisting condition exclusion and only covers 50% of prescription drugs.

Expat health insurance plans

HTH Worldwide also offers two international expatriate health insurance plans for people who live or work outside their home country:

- Xplorer Premier: Administered through GeoBlue Insurance, this plan provides complete health insurance coverage that can be used anywhere in the world by individuals or families who intend to be outside their home country for at least three months a year.

- Navigator: Also through GeoBlue, this is a health insurance plan specifically designed for crew, missionary or student travelers who plan to be outside their home country at least three months a year.

More travel insurance companies to compare

Here’s how insurers in our rating of the best travel insurance companies compare.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Preexisting medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover preexisting medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

HTH Worldwide travel insurance review FAQs

Yes, HTH Worldwide’s three TripProtector plans cover both domestic and international travel.

The cost of a HTH Worldwide travel insurance plan varies depending on several factors such as the traveler’s age, trip cost, trip destination and type of coverage. For example, the cost of HTH Worldwide TripProtector Classic plan for a $3,000 trip for two 30-year-old travelers heading to Mexico for eight days would be about $116.

Yes, HTH Worldwide travel insurance plans include coverage for COVID-19 in its emergency medical coverage.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Kara McGinley is deputy editor of insurance at USA TODAY Blueprint and a licensed home insurance expert. Previously, she was a senior editor at Policygenius, where she specialized in homeowners and renters insurance. Her work and insights have been featured in MSN, Lifehacker, Kiplinger, PropertyCasualty360 and more.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of May 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of May 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

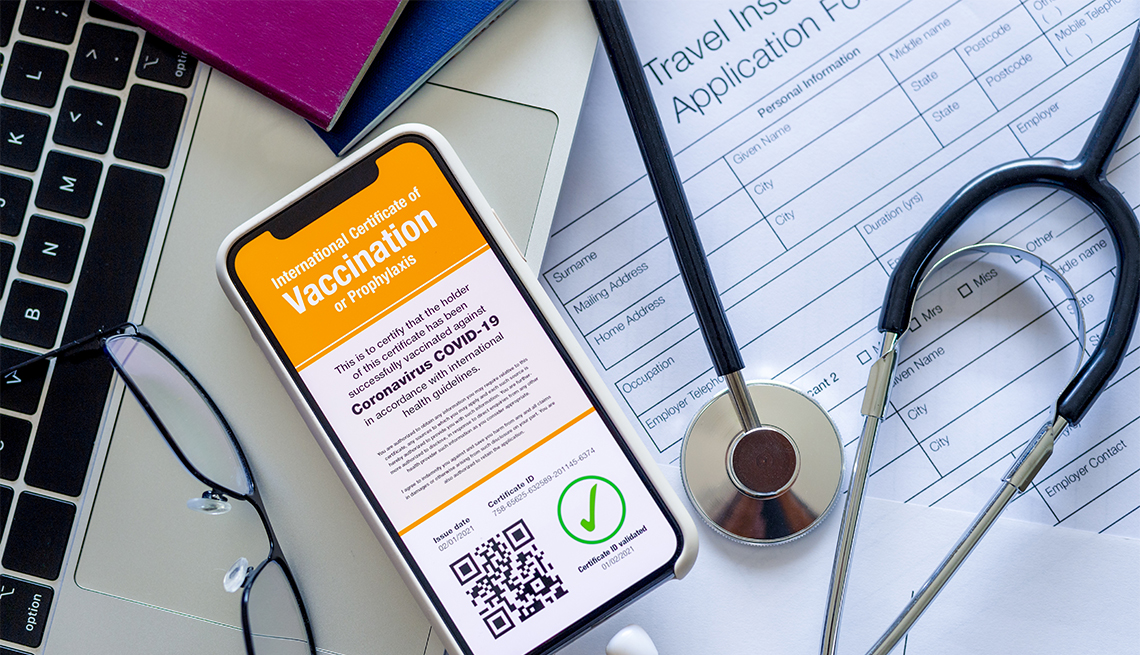

The 5 Best COVID-19 Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

Generali Global Assistance »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best COVID Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Even though COVID-19 is no longer considered a global emergency, concerns around illness-related costs remain for many travelers. If you're looking for travel insurance that covers COVID – as well as other potential disruptions like flight delays and lost luggage – these are your best options.

- Travelex Insurance Services: Best Optional Coverage Add-ons

- Allianz Travel Insurance: Best for Multitrip and Annual Plans

- World Nomads Travel Insurance: Best for Active Travelers

- Generali Global Assistance: Best for Comprehensive Travel Insurance

- IMG Travel Insurance: Best for Travel Medical Insurance

Best COVID Travel Insurance Options in Detail

Plans include coverage for COVID-19

Optional CFAR coverage is available with Travel Select plan

Some coverages require an upgrade, including rental car collision, accidental death and dismemberment, and more

Not all add-ons are available with every plan

Allianz offers some travel insurance plans that come with an epidemic coverage endorsement

Single-trip, multitrip and annual plans available

COVID-19 benefits don't apply to every plan

Low coverage limits with some plans (e.g., only $10,000 in emergency medical coverage with OneTrip Basic plan)

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Low trip cancellation benefits ($2,500 maximum) with Standard plan

No CFAR option is offered

Free 10-day trial period

Some coverage limits may be insufficient

Rental car damage coverage only included in top-tier Premium plan

Offers travel medical insurance, international travel health insurance and general travel insurance plans

Some plans include robust coverage for testing and quarantine due to COVID-19

Not all plans from IMG offer coverage for COVID-19

Cancel for any reason coverage not available with every plan

Frequently Asked Questions

When comparing COVID-19 travel insurance options, you'll want to make sure you fully understand the coverages included in each plan. For example, you should know the policy inclusions and limits for COVID-related claims, including coverage for testing, treatments, trip cancellation or COVID-related interruptions that can occur. Meanwhile, you should understand how your coverage will work if you contract some other illness while away from home.

Also ensure your travel insurance coverage will kick in for other mishaps that occur, and that limits are sufficient for your needs. If you're planning a trip to a remote area in a country like Costa Rica or Peru , you'll want to have emergency evacuation and transportation coverage with generous limits that can pay for emergency transportation to a hospital if you need treatment.

You can also invest in a travel insurance policy that offers cancel for any reason coverage. This type of travel insurance plan lets you cancel and get a percentage of your prepaid travel expenses back for any reason, even if you just decide you're better off staying home.

It depends on your private health insurance provider and/or travel insurance policy. As of May 11, 2023, private health insurers are no longer required to cover the cost of COVID-19 testing. Out-of-pocket costs for COVID-19 test kits at local drugstores and on Amazon are relatively affordable, however.

As you search for plans that will provide sufficient coverage for your next trip, you'll find travel insurance that covers COVID-19 quarantine both inside and outside the United States. However, you'll typically need to have your condition certified by a physician in order for this coverage to apply. Also make sure your travel insurance plan includes coverage for travel claims related to COVID-19 in the first place.

Many travel insurance plans do cover trip cancellation as a result of COVID-19, although the terms vary widely. You typically need to be certified by a physician in order to prove your condition. Disinclination to travel because of COVID-19 – such as fear of exposure to illness – will generally not be covered. This means you will actually have to test positive for coronavirus for benefits to apply; simply not wanting to travel is not a sufficient reason to make a claim.

If you want more flexibility in your COVID-19 travel insurance, ensuring you have a cancel for any reason policy may be your best bet, but be sure to check with your chosen travel insurance provider to assess your options.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering travel insurance and travel for more than a decade. She has researched the best travel insurance options for her own trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Over the years, Johnson has successfully filed several travel insurance claims for trip delays and trip cancellations. Johnson also works alongside her travel agent partner, Greg, who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

5 Best Travel Insurance Plans for Seniors (Medical & More)

Holly Johnson

Discover coverage options for peace of mind while traveling.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

Oct 27, 2021 • 6 min read

Figuring out what your health care covers while traveling can be difficult © Stocksy

If you’re ready to travel again, it’s important to understand the scope of your travel medical insurance coverage should you contract COVID-19—even when traveling with the US. Even if you’re vaccinated, you could still test positive for the virus or experience a breakthrough infection.

If you’re traveling domestically in the US, and you are covered by a US health insurance provider, or Medicare, your health plan will cover urgent care visits, medical expenses, imaging, medicine and hospital stays. Beyond general illness or injury, if you test positive for COVID-19, or require medical treatment or hospitalization due to the virus, the scope of your coverage could vary. It’s best to check for the specific provisions of your personal health plan.

If you are fully vaccinated and planning on vacationing abroad, then purchasing a travel insurance policy that includes travel medical expense and medical evacuation coverage should be part of your travel check-list. Your US based medical insurance will not be accepted abroad.

It’s best to be prepared by purchasing a comprehensive travel insurance policy that will cover medical expenses you incur if you get sick, or injured while outside the US. Many travel insurance carriers offer plans that cover COVID-19-related medical expenses. You should research and find a policy that best matches your needs.

Beyond medical care, your travel plan may even cover the self-isolation costs tied to quarantining like lodging and meals due to a positive COVID-19 test.

Here’s what you need to know so you’re protected whether you travel to Miami or Madrid.

Here’s how to prepare if traveling within the US

Before planning any type of travel, it’s best to check with your healthcare insurance company about the scope of your coverage. You can find your carrier’s contact information on the back of your member card.

“First and foremost, always check with your health insurance provider to see what your plan covers and what it does not and become familiar with the limits of your policy” says Kathy Kimmel, spokesperson with InsureMyTrip, a travel insurance comparison site.

If you’ve traveled domestically in the past, you know you can utilize your personal insurance for issues like a fever, food poisoning, severe sunburn, stitches, or a sprained ankle.

The pandemic has caused a whole set of ‘what if’s’ for travelers—even if you’re not leaving the country. As always, coverage is dependent on your particular plan. “It is best for travelers to check with their provider to know how COVID is covered and what steps should be taken to prepare should they contract the virus on a trip,” says Jeremy Murchland, president of Seven Corners Travel Insurance.

Health insurance may cover COVID-19, Murchland says, but it typically will not cover emergency evacuations back home or quarantine expenses that may come from destination mandates.

What about road-tripping in the US?

Bailey Foster, spokesperson with Trawick International, a travel insurance carrier, says if you have health insurance and you are traveling in the United States, your health insurance will cover the expense related to COVID-19.

“This would work like any other illness you may catch and your healthcare insurance would cover the costs associated with the travelers’ treatment,” she says. “The traveler would have to be responsible for their copays related to their medical treatment.”

Read more: Expert tips for a safe road trip during the pandemic

Will US-based health insurance cover COVID-19 infection abroad?

The simple answer is no. “Your US-based healthcare insurance will not cover COVID-19 related illness expenses while you are abroad,” says Foster with Trawick International. “It’s imperative that travelers purchase a travel insurance plan that clearly states it provides coverage related to COVID-19 losses.”

Read more: How do you choose travel insurance that covers COVID-19?

If your policy includes COVID-19 coverage, it will cover medical care, hospitalization, medicine, and any other treatment needed due to COVID-19.

It’s best to call the insurance carrier to make sure COVID-19 is covered by the policy.

Will US-based health insurance cover pre-travel testing?

In general, pre-travel testing will be a personal expense. “Travel insurance does not cover pre-travel COVID testing or any other testing required before your trip, nor will it offer coverage for vaccines,” says Kimmel with InsureMyTrip.

What else will my travel insurance policy provide if I contract COVID-19?

Some travel insurance carriers will transport you for more specialized medical treatment.

“At Seven Corners, we assist in evacuations and repatriations on a normal basis for typical illnesses and injuries abroad,” explains Murchland. “Even with the added challenge of assisting someone who has contracted COVID away from home, we are ready to help make the return safe and ensure that proper care is given to the sick or injured traveler.”

In addition, your travel insurance carrier has a 24/7 travel support hotline that can assist with medical referrals, coordinating medical care and arranging lodging accommodations should you need to quarantine due to COVID-19. Some companies even provide language translation services if you are experiencing barriers regarding your medical care.

How do I best protect myself when traveling abroad?

As you plan expensive international trips, the worry about COVID and the Delta variant and its impact on your travels is likely on your mind. Kimmel from InsureMyTrip states the best way to protect yourself while traveling abroad is to buy a comprehensive travel insurance policy with the added Cancel for Any Reason (CFAR) Benefit, which is an optional upgrade to your policy that allows you to cancel for reasons beyond your standard trip cancellation policy. This add-on will increase your travel insurance policy rate about 50 percent but offers you the most flexibility to cancel. If you meet the requirements, you can be reimbursed up to 75 % of your trip’s cost.

However, this is a time-sensitive benefit and not all trips are eligible for this add-on. There are some requirements that need to be met like canceling your trip no later than 48 hours before your scheduled departure.

Most traditional travel insurance policies do not allow travelers to cancel because of COVID-19 fears, like if there’s an increase in COVID cases at your destination. “The Cancel for Any Reason add-on is really the only way for a traveler to recoup some of their pre-paid, non-refundable trip costs if they decide not to travel because of a spike in cases,” says Kimmel.

Not all policies and carriers offer CFAR coverage upgrades. InsureMyTrip has a tool that is making it easier to find out if your policy and trip are eligible for CFAR.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What do I do if my flight gets cancelled—and can I get a refund? PCR tests for travel: everything you need to know

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

May 11, 2024 • 9 min read

May 10, 2024 • 9 min read

May 10, 2024 • 5 min read

May 9, 2024 • 9 min read

May 11, 2024 • 11 min read

May 9, 2024 • 6 min read

Advertisement

Supported by

Omicron and Travel: So, Now Do I Need Trip Insurance?

In light of the new variant, is extra protection warranted for things like flight and lodging cancellations and quarantine hotels? It depends. Here’s what you need to know.

- Share full article

By Elaine Glusac

While the pandemic has depressed travel, it may have encouraged travel insurance, say those in the industry.

“The biggest question we get from customers is: ‘What happens if I get Covid during travel and what if I have to quarantine?’” said Jeremy Murchland, the president of Seven Corners , a travel insurance management company. “Covid has created a much broader awareness of travel insurance.”

But will it help you in light of the new Omicron variant, which has already led to new travel restrictions and requirements? In the early days of the pandemic, travel insurance largely failed to protect travelers who wanted or needed to cancel as the world shut down. The following are answers to common questions about travel insurance now.

Does travel insurance cover Covid-19, including the new Omicron variant?

For the most part, yes, travel insurance policies now treat Covid-19 in all its variants — including Omicron — like any other medical emergency.

“Consumers should know that most travel insurance plans with medical benefits now treat Covid like any other illness that you could contract while traveling or that could prohibit you from going on your trip,” said Carol Mueller, a vice president of Berkshire Hathaway Travel Protection . “If you become ill before your trip, you’ll need a doctor’s note confirming your illness and that you are unable to travel in order to be eligible for benefits. The benefits are the same regardless of whether you contract Omicron, another variant of Covid or any illness for that matter.”

Buyers should read the policies carefully and look out for those that exclude pandemics, Covid-19 and its variants. To make a claim, you must have had travel insurance before becoming ill.

“We always say, you can’t buy auto insurance after you’ve already had an accident,” said Meghan Walch, the product manager of InsureMyTrip , an insurance sales site. “It is designed for unforeseen issues. You have to purchase it before an event.”

I am traveling internationally. If borders close because of Omicron, am I covered through travel insurance?

No, most policies do not cover you if your foreign destination closes its borders to visitors, as Israel did recently. With a few exceptions, that also goes for a government-issued travel warning to a destination, which is generally not a covered reason to make a claim.

Given the added uncertainties of Omicron, should I consider a ‘Cancel for Any Reason’ policy?

Cancel for Any Reason, or C.F.A.R., provisions would allow you to claim some of your nonrefundable costs if you decide not to go on a trip for any reason, including border closures or fear of contracting Covid. The rub is that this form of insurance — in addition to being more expensive — must generally be purchased within a few weeks of booking the trip and will only return 50 to 75 percent of nonrefundable trip costs.

“Most travel insurance policies do not cover you for wanting to cancel out of fear of Covid. We say this 10 times a week,” said Sarah Groen, the owner of the agency Bell and Bly Travel . She counsels clients to consider their worst fears — illness, for example, or quarantine — in troubleshooting travel insurance. “We’ve become like therapists,” she said.

What about quarantine and medical expenses?

Make sure the policy you choose covers these. In the case of medical coverage, check with your regular health insurer; many policies will not cover you abroad, which is an additional reason to consider coverage if you are traveling internationally.

“What travel insurance can do is cover additional hotel stays if you are able to self-quarantine and additional airfare when you’re able to come home,” said Megan Moncrief, the chief marketing officer for Squaremouth , a travel insurance sales site. She added that most policies will extend to seven days past your originally scheduled return date, effectively covering only about seven days in case of quarantine.

Do some destinations require travel insurance?

Yes, primarily to cover medical care or quarantine accommodations in the event that a traveler tests positive for Covid-19. For example, Singapore requires medical insurance with a minimum coverage of 30,000 Singapore dollars, or about $22,000. Fiji requires travel insurance to cover potential treatment for Covid-19, and makes it available from about $30. Some destinations, such as Anguilla , recommend rather than require travel insurance. InsureMyTrip.com has a page devoted to countries that require travel insurance.

It bears thinking about what it would take to get home for treatment should you contract Covid-19 abroad. Thailand, for example, requires travelers to have medical insurance with the minimum coverage of $50,000. “Evacuation out of Thailand would be higher,” said Sasha Gainullin, the chief executive of Battleface , a travel insurance start-up that unbundles benefits. In the case of a Thailand trip, he advised taking medical coverage up to $100,000 for treatment locally and $500,000 for medical evacuation and repatriation.

Do I need insurance if I have bookings with flexible cancellation policies?

Probably not, if you have hotel reservations that allow free cancellation 24 to 48 hours in advance. The same with flights; if your flight is changeable and will provide a voucher or refund in case of cancellation, you’re covered.

I have rented a house with restrictive cancellation penalties. Can I insure against those?

Yes. Vacation home rentals from Airbnb and the like can be treated just like other accommodations that do not offer refunds. In this case, you would want to get a policy in the amount you would forfeit if you had to cancel for a covered reason like illness. Again, fear of travel is not a covered reason; for that, you would need C.F.A.R.

Elaine Glusac is the Frugal Traveler columnist. Follow her on Instagram: @eglusac .

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation.

An earlier version of this article misstated the timeframe within which it is recommended that Cancel for Any Reason travel insurance be purchased. It is generally within about two to three weeks of booking the trip, not one or two days.

How we handle corrections

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Best COVID-19 Travel Insurance Companies (2024)

We round up the best travel insurance options that offer pandemic and medical protections.

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

As the world continues to navigate the COVID-19 pandemic, hotels, airlines and other hospitality-related businesses have seen a surge in travelers . However, the concern of a new variant is consistent — experts have identified new strains of COVID-19 as recently as Dec. 2023, which could cause some travelers to consider purchasing travel insurance.

While some travel insurance policies now classify COVID-19 as a standard inclusion under medical expense and evacuation coverage, others include varying terms. According to our research, the best travel insurance companies offering COVID-19 coverage are Faye and Travelex.

Compare Top Travel Insurance Companies with COVID-19 Coverage

Use the table below to compare COVID-19 coverage inclusions and details of top travel insurance companies:

10 Best COVID-19 Travel Insurance Companies

- Faye: Our top pick

- Travelex: Our pick for families

- Seven Corners: Our pick for international travelers

- Tin Leg: Our pick for customizable coverage

- Allianz Travel Insurance: Our pick for concierge services

- TravelSafe: Our pick for equipment coverage

- Generali: Our pick for emergency assistance

- John Hancock Travel Insurance: Our pick for delay coverage

- Trawick: Our pick for well-rounded coverage

- HTH Travel Insurance: Our pick for group travel

We pulled price quotes for four vacations outlined in our methodology at the bottom of this page. The costs in this article reflect the premium for each of those four trips for each provider averaged together.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Pros and Cons

Why we picked it.

Faye is our top choice for COVID-19 travel insurance because it includes a robust set of protection to support policyholders both before and after diagnosis. The company classifies COVID-19 as a standard illness under its medical insurance policies, which means you can use any medical and evacuation coverages deemed necessary by local health professionals.

Since Faye classifies its travel medical insurance as primary coverage, it goes into effect before your domestic health coverage. This is especially beneficial for COVID-19, which could lead to hospitalization in some cases and include higher diagnosis, evacuation and treatment costs.

Coverage and Cost

Add-On Options

Faye currently offers the following add-ons for international excursions:

- Cancel for any reason (CFAR) coverage

- Adventure and extreme sports protections

- Rental car coverage

- Vacation rental damage protection

- Pet care protection

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Faye’s average trip cost is $298.

Travelex is one of the most generous travel insurance providers we reviewed in terms of COVID-related situations and when you’re covered. Travelex travel insurance policies include specific language that ensures COVID-related hospitalizations and diagnoses are eligible for trip interruption coverage. Travelex’s policies also specify that if a loved one back home is hospitalized or determined in critical condition due to COVID-19, the policyholder is covered for an early return. These features, combined with lower overall premiums, makes Travelex a top choice for COVID-concious travelers.

Below are customizable add-ons to consider for your Travelex policy:

- Accidental death and dismemberment (air travel only)

- Additional medical coverage

- Adventure sports coverage

- Cancel for any reason coverage

- Car rental collision coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Travelex’s average trip cost is $242.

Another top option for COVID-related travel concerns, Seven Corners offers a wide range of medical policies, all of which include coverage for coronavirus as a standard illness. Seven Corners policies indicate that both trip interruption and cancellation coverage extends to COVID-19-related reasons, including quarantines. Missed connection coverage may even extend to your travel plans if COVID causes you to miss a portion of your trip, specifically while on a cruise . Overall, Seven Corners offers COVID-friendly policies and includes generous cancellation and interruption benefits to give you peace of mind while traveling.

Below are add-on options you may be able to include in your Seven Corners policy:

- Trip interruption for any reason coverage

- Rental car damage coverage

- Sports and gold equipment coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Seven Corners’s average trip cost is $206.25.

Tin Leg’s Silver and Gold policies include COVID-19 hospitalization and diagnosis as a standard inclusion under trip cancellation and interruption benefits. Like competitors, Tin Leg’s policies include stipulations that allow you to use travel delay benefits for ordered quarantine periods, offering between $500 and $2,000 depending on your chosen coverage level. However, you will need to receive a documented diagnosis from a licensed medical professional to use your trip benefits — a home rapid test is not sufficient proof.

Below are add-on options for Tin Leg travel insurance:

- Rental car damage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Tin Leg’s average trip cost is $166.50.

Both of TravelSafe’s insurance policies for international travel include comprehensive coverages and protections for COVID-19 , with identical medical coverage and evacuation limits no matter the condition. Trip delay benefits — available up to $2,000 on the TravelSafe Classic policy — include coverage for mandatory quarantines if required by a licensed medical professional. Policyholders can also apply mandatory quarantine benefits to missed connections coverage, which adds another layer of protection if you have multi-leg trips planned.

Below are add-on options you may include to your TravelSafe policy:

- Accidental death and dismemberment (air only)

- Extended personal property coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, TravelSafe’s average trip cost is $241.

Allianz Global Assistance

Allianz Global Assistance offers a policy endorsement to cover concerns related to COVID-19. Referred to as the “ Epidemic Coverage Endorsement ,” this benefit extends medical expense, emergency evacuation and trip delay coverage to include COVID-related situations. Like most other competitors, you will need a documented diagnosis of COVID-19 and a written order from a local government figure or medical authority requiring you to quarantine before you can use benefits.

When we requested a quote, all three available policies included the Epidemic Coverage Endorsement free-of-charge with standard pricing. However, it’s important to note that coverage for COVID-19 is not specifically written into the terms of Allianz’s policies in the same way as other illnesses, which is the standard verbiage in the industry. Be sure your policy includes this endorsement to maintain COVID-related coverage.

Below are add-ons to consider for your Allianz Travel Insurance policy:

- Rental car protection

- Required to work coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Allianz’s average trip cost is $265

In addition to including COVID as a standard coverage under medical, cancellation and interruption benefits, Generali Global Assistance includes the added peace of mind that comes with around-the-clock assistance. All policies include 24/7 emergency travel assistance with a multi-lingual support team, which can help policyholders communicate with medical staff. This is especially useful if you’re visiting an area where you do not speak the primary language.

However, as of Jan. 2020, newly issued policies include an exclusion that prevents you from using trip delay benefits to cover a quarantine period unless officially diagnosed with COVID-19. This exclusion does not apply if you are sick and quarantined with the virus, in which you can access your benefits to cover the cost of related expenses. This exclusion remains in effect even if a local government mandates your quarantine due to exposure — so we recommend researching the quarantine procedures for the country you’re visiting beforehand if you choose Generali.

Below are coverages you may be able to add to your Generali policy:

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Generali’s average trip cost is $255.

Under most travel insurance verbiage, COVID-19 is now considered a known threat, and the announcement of a new variant is considered a risk you accept when booking. This means that travel insurance may not allow reimbursement for trip cancellation due to concerns about the emergence of a new variant.

Cancel for any reason (CFAR) coverage extends your cancellation benefits to include fear of traveling due to COVID-19 or a new variant. In addition to classifying COVID-19 as a standard medical condition, John Hancock allows you to add CFAR coverage to a wider selection of policy choices, including its lower-cost Bronze package. Comparatively, most travel insurance providers limit your ability to add CFAR coverage to the most expensive plan.

Add-on options for John Hancock travel insurance:

- Rental car collision coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, John Hancock’s average trip cost is $225.

Trawick International offers one policy with coverage for COVID-19: Safe Travels International . This plan includes up to $1 million in medical coverage, up to $2,000 in trip delay benefits for potential quarantines and up to $2 million in medical evacuation coverage. This general range of coverage combined with CFAR add-on availability can make Trawick a customizable choice for travelers looking to add protections that cover COVID-19 without reviewing multiple plans.

Below are Trawick International add-on options:

- 24-hour accidental death and dismemberment

- Additional accident and sickness medical coverage

- Interruption for any reason coverage

- Upgradable trip delay coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Trawick’s average trip cost is $212.

While HTH’s policy details do not outline special benefits specifically for COVID-19 , its plans include standard medical interruption language allowing the use of benefits if you’re hospitalized. HTH’s policies include generous medical coverage and evacuation limits of $500,000 and $1 million respectively. The company also offers higher-than-average trip interruption benefits with a maximum benefit of 200% in reimbursements.

Below are additional options that may be available through HTH Travel Insurance:

Based on quotes we obtained using the seven trip profiles outlined in our methodology, HTH’s average trip cost is $221.

HTH also offers discounted pricing for group travel insurance policies.

What To Look for in Pandemic Travel Insurance

Once you understand how travel insurance can benefit you in the event of a COVID-19 diagnosis or emergency, you can get into the details of each coverage option. We’ve compiled a few essential features to consider when shopping for travel insurance with a focus on COVID-19 coverage.

Medical Expense Coverage

If you’re traveling to an area where you think you might be at risk of catching COVID-19, consider choosing a travel insurance policy with higher medical coverage limits. Travel medical insurance can help cover the cost of medical treatments you receive outside the U.S. if you become sick or injured. Most travel insurance policy providers now classify COVID-19 as a standard illness, meaning you can qualify for reimbursement if hospitalized with coronavirus abroad.

Trip Delay Coverage

If you contract COVID abroad, depending on the country’s requirements, you may have to undergo a mandatory quarantine period before you can leave or enter another country. In these circumstances, your trip delay benefits could help cover the cost of expenses like meals, additional hotel stays and any toiletries you might need. To qualify to use trip delay benefits, most policies state a licensed medical professional must order a quarantine for 24 hours a day, seven days a week, until expiration.

Trip Interruption Coverage

If you’re leaving dependents or older loved ones at home and concerned about the effect COVID-19 could have on their care, consider a policy with higher trip interruption coverages. Trip interruption insurance compensates you for things like the cost of an early return flight home and unused trip expenses if you must leave your trip ahead of schedule due to a covered reason. Some travel insurance providers like Seven Corners and Travelex include the illness of a family member and hospitalization with COVID-19 as a valid reason to use interruption benefits. Other providers only consider the health status of the insured traveler.

CFAR Coverage

CFAR coverage is an optional add-on that allows you to receive a partial trip reimbursement if you cancel your trip for a reason not covered by insurance. For all providers on our list, this includes fear of a new variant of COVID-19 emerging at home or your destination. If this is a concern for you, consider a provider like John Hancock, which offers more options for policyholders to buy CFAR-level benefits.

Does Travel Insurance Cover COVID-19 Directly?

Most travel insurance policies now classify COVID-19 as a standard inclusion under medical expense and evacuation coverage. This means coronavirus is usually treated the same way as any other illness or injury you might sustain abroad or before your trip. While this offers protection for your travel plans if you’re hospitalized due to COVID-19, fear of new variants and minor illnesses will usually not qualify you for a reimbursement .

Let’s take a look at sample situations when you might need to use COVID-19 coverage as a part of your travel insurance. First, say you fall sick before traveling and are diagnosed with a serious case of COVID-19. Your physician determines you require hospitalization a day before you’re supposed to travel. If you purchased travel insurance, you could file a claim to reimburse nonrefundable trip costs, such as airfare and lodging, because you’re medically unable to travel.

Now, let’s imagine you have a trip planned to Germany. A few days before your travel, information on a new Covid variant becomes available and officials advise the public to avoid travel if possible. While you may be hesitant to travel due to the new strain, you would not be entitled to reimbursement with travel insurance unless specifically outlined in your policy. However, if you opted for CFAR coverage during enrollment, you could cancel your trip and get a refund for nonrefundable expenses regardless.

Does Travel Insurance Cover Quarantine?

Your travel insurance policy might cover the COVID-19 quarantines if ordered by a medical professional, which includes expenses related to additional lodging. If you’re diagnosed with a new variant of the virus before your trip and forced to quarantine at home, you will usually qualify for trip cancellation benefits under your policy’s illness cancellation clause. However, travel insurance will not compensate you for additional domestic quarantine-related expenses like food and rent.

If you’re advised to quarantine abroad after being diagnosed with COVID-19, you could also qualify for coverage under your insurance’s travel delay benefits. While travel delay benefits are designed to help cover hotel rooms and alternate airfare if you’re forced to miss a connection, you can also use coverage for mandatory quarantine orders. To qualify, you will usually need to provide documentation of both your illness and a quarantine recommendation from a local medical professional.

If you’re concerned about the cost and possibility of an international quarantine, it’s important to look at the travel delay benefits included with your insurance coverage. Policies with higher total travel delay benefits will cover more quarantine-related expenses, which can make these policies more valuable. Be sure to note both overall and daily limits on trip delay benefits, which can also influence policy value.

How Much Does COVID-19 Travel Insurance Cost?

In our comprehensive review of travel insurance policies, we found the average cost of a plan with COVID-19 coverage is about $220 per trip. However, the price of your premium will vary depending on the level of benefits included with your policy. Browse the table below to compare how some of our top travel insurance providers compare in terms of average price and included benefits.

Factors That Impact Cost

Factors that affect the cost of your travel insurance include your age, where you’re traveling to, the cost of your trip and the length of your trip. Adding various custom riders, like protection for a rental car or cancellation for any reason coverage, will also increase the cost.

Is Pandemic Travel Insurance Worth It?

While almost all COVID-19 restrictions are lifted in the U.S., the virus is still a global health threat. Even if travel insurance isn’t required for a trip, purchasing insurance that includes COVID-19 protections can help you avoid a financial burden if you contract the virus before or during the trip.

You might not need the pandemic travel coverage if you’re taking a low-cost trip and not crossing international borders. Your health insurance may cover medical costs within the country, and the money you lose from canceling an affordable trip could be too low to justify shopping for and buying coverage. It’s different if you pay a lot of money up front for a long, expensive vacation.

Another option is looking at the travel protections that your credit card company provides. Some cards offer trip protection for emergencies that could include coverage if you call off a trip or end a trip early after contracting COVID-19. But travel costs usually have to be paid for with the card for them to qualify.

Frequently Asked Questions About Travel Insurance

What are the cheapest ways to get travel insurance for a pandemic.

The best way to find cheap travel insurance with pandemic coverage is by shopping around with different providers. Many offer free quotes online, and it takes minutes to check rates.

What are the advantages of purchasing pandemic travel insurance?

The advantage of pandemic travel insurance is that it reimburses prepaid travel costs if you cancel or cut short a trip because of getting COVID-19 before or during the trip. And if a family member contracts COVID-19 while you’re away, pandemic travel insurance may reimburse you for expenses related to returning home early to care for a loved one.

Can you cancel your flight if you have COVID?

Many travel insurance policies now include coverage for trip cancellations due to COVID-19. However, coverage is usually included under standard medical inclusions, which means you must be medically unable to travel at the time of your scheduled departure to claim a reimbursement. Review your specific travel insurance coverage to learn more about flight cancellation benefits.

What does travel insurance not cover?

Travel insurance usually does not cover cancellations due to fear of travel, government restrictions or pre-existing medical conditions. You generally cannot cancel your trip and claim any reimbursements unless it’s for a covered reason such as the illness or death of a family member or natural disasters. Carefully read your policy to understand the exclusions and limitations unique to your coverage.

Methodology: Our System for Rating the Best Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Health insurance for visitors to USA

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have questions about this page, please reach out to our editors at [email protected] .

More Travel Insurance Resources

How COVID-19 Travel Insurance Works

From weekend getaways to extended vacations, specialized covid-19 travel insurance can provide security if the virus affects your travel plans..

)

3+ years writing about auto, home, and life insurance

7+ years in personal finance and technology

Amy specializes in insurance and technology writing and has a talent for transforming complex topics into easy-to-understand stories.

Read Editorial Guidelines

Featured in

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

Updated September 18, 2023

Reading time: 4 minutes

)

Table of contents

- Pandemic insurance

- What’s covered

- Is it worth it?

- Secure a policy

Travel lets you see new places, meet new people, and experience different cultures. But the lurking shadow of COVID-19 can make traveling uncertain. Almost half of canceled trips in 2020 were due to the virus, according to the U.S. Travel Insurance Association (UStiA). [1]

Travel insurance can help if something goes wrong before or during your trip, but not all policies cover COVID-19 issues. Let’s explore how COVID-19 travel insurance works and how it might — or might not — shield you on your next journey.

How pandemic travel insurance works

Most travel insurance policies include protections for trip cancellations, delays, or other trip interruption coverage. However, many policies don’t cover disruptions due to pandemics. [2] That’s where COVID travel insurance comes into play.

COVID travel insurance is a specialized policy that can refund your money if the virus throws a wrench into your plans. It typically has three coverage levels: coverage for a trip delay, canceling for any reason, and medical care if you get sick.

Travel delay coverage

Illness, injury, jury duty, and other circumstances beyond your control can delay your travel plans. Travel delay insurance covers flight issues, bad weather, sudden breakdowns, and unexpected illnesses or injuries that happen before reaching your destination. It can pay you back for non-refundable expenses and cover extra costs, too — like food, hotel rooms, or cab rides.

Cancel for any reason

Travel insurance policies typically have strict rules, but a cancel-for-any-reason (CFAR) option offers more leeway, allowing you to cancel for reasons not covered in the original policy.

But with CFAR benefits, you might only get a partial refund amount. Reimbursements usually range from 50% to 75% of the total price. [2]

Medical coverage for COVID-19

If your health insurance is only valid in a specific area and doesn’t cover international travel, travel insurance with medical expenses coverage can fill the gap.

If medical insurance is included in your trip policy, it can help pay for medical attention and treatment costs if you, a family member, or another traveling companion becomes ill from COVID-19 before or during your trip.

Will travel insurance cover you if you need to quarantine?

Some travel protection plans cover quarantine or self-isolation due to COVID-19 concerns. It can reimburse you for lost prepaid expenses and cover additional lodging and meal costs. However, it depends on your policy and the conditions leading to the cancellation, delay, or disruption.

Protection often hinges on two factors:

Not all travel insurance plans include a pandemic as a covered reason. If COVID-19 was a significant public concern when you purchased the policy, insurers may not provide coverage because it’s a “foreseeable” threat. But some plans let you add COVID-19 coverage as an endorsement.

Even if you set out to buy COVID-19 travel insurance, it may not be available for your plan or location. Review your benefits and endorsement options to look for “pandemic” or “epidemic-related” language to see if COVID-19 is a covered event.

Is travel insurance worth it?

The Centers for Disease Control and Prevention (CDC) declared the COVID-19 public health emergency over in May 2023, but there’s still a risk of infection, according to the World Health Organization (WHO). [3] [4]

Your credit card’s travel protections are worth considering, but you may not want to rely on that alone. Credit cards often limit travel coverage, and most companies don’t include trip cancellation coverage. [5]

Travel delay benefits can fill the gap — especially benefits with COVID-19 coverage. Compare the policy cost against the potential loss if you have to cancel or delay your trip to determine if it’s worth it. The up-front payment for travel insurance is typically a fraction of what you might spend out of pocket if plans go south.

The CDC reports that medical bills in the first six months of a COVID-19 diagnosis average nearly $8,400. [6] Factor in non-refundable trip costs, accommodation charges, and other miscellaneous expenses, and the expenses can skyrocket.

How to find the best travel insurance

If you’re concerned about the pandemic and the potential effects on your travels, here are some tips to help you secure a policy with the best travel insurance plan:

Research coverage and services

Compare multiple companies and policies and read reviews to see others’ experiences.

Check for pandemic coverage

Not all policies cover travel disruptions from COVID-19. Review your coverage to make sure it specifically addresses pandemic reasons.

Buy medical coverage

Travel policies don’t automatically include medical emergencies. Consider adding medical travel insurance, and ask about emergency assistance coverage and medical evacuation in case of a natural disaster.

Consider a cancel-for-any-reason insurance policy

CFAR policies can be beneficial, especially with unpredictable pandemic-related concerns and travel restrictions.

Understand refund policies

Read the fine print and policy information to verify how the insurer handles refunds. Some policies might offer partial refunds.

COVID travel insurance FAQs

The COVID-19 virus has made travel plans tricky. Whether you’re planning a weekend getaway or a month-long vacation, here’s what you need to know about COVID-19 travel insurance.

Will travel insurance cover COVID cancellations?