- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- class="ssr-key" Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

10x the fun with citi strata premier℠.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

What is the citi travel portal.

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 You will earn 10 ThankYou Points for each $1 spent on hotels, car rentals, and attractions when you use your Citi Strata Premier Card to book them through the Citi Travel site via CitiTravel.com or 1-833-737-1288 (TTY: 711). For bookings made with a combination of points and your Citi Strata Premier Card, only the portion paid with your card will earn points. Points are not earned on cancelled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

Citi transfer partners: Maximize your ThankYou points with these loyalty programs

Editor's Note

Many Citi cardholders redeem their Citi ThankYou Rewards points for gift cards or bookings through the Citi travel portal . But if you have a premium Citi ThankYou card, you may get greater value from your points by utilizing the Citi transfer partners.

In this guide, we'll discuss how to earn Citi ThankYou points you can redeem with the Citi transfer partners.

Earning points you can use with Citi transfer partners

You can earn Citi ThankYou points through some Citi credit cards , including:

- Citi Strata Premier℠ Card (see rates and fees ): Best for supermarkets, gas stations, EV charging stations, restaurants and air travel

- Citi Rewards+® Card (see rates and fees ): Best for earning rewards with no annual fee

- Citi Double Cash® Card (see rates and fees ; via a linked ThankYou account): Best for everyday purchases

- Citi Custom Cash® Card (see rates and fees ; via a linked ThankYou account): Best for flexible earning

Keep in mind, though, that not all ThankYou points have the same value. To transfer Citi ThankYou points to most partners described in this guide, you must hold a premium Citi ThankYou card such as the Citi Prestige® Card (no longer available to applications) or the Citi Strata Premier.

If you only have the Citi Rewards+ Card, you'll earn more limited ThankYou points that you can transfer to JetBlue TrueBlue, Choice Privileges and Wyndham Rewards. If you only have the Citi Double Cash Card or the Citi Custom Cash Card, you earn cash back as "basic" ThankYou points that you can't transfer to partner programs.

However, if you also hold the Citi Prestige or the Citi Strata Premier , you can combine your limited and basic ThankYou points with those from your Citi Prestige or Citi Strata Premier account. Then, you can transfer your combined rewards to any Citi ThankYou transfer partners.

The information for the Citi Prestige card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Citi transfer partner overview

The Citi ThankYou Rewards program currently has 19 transfer partners: 14 airline loyalty programs, four hotel loyalty programs and one retail loyalty program.

Here's an overview of the Citi transfer partners and the ratios at which you can transfer ThankYou points:

- Accor Live Limitless : 2:1 transfer ratio

- Aeromexico Rewards : 1:1 transfer ratio

- Air France-KLM Flying Blue : 1:1 transfer ratio

- Avianca LifeMiles : 1:1 transfer ratio

- Cathay Pacific Asia Miles : 1:1 transfer ratio

- Choice Privileges : 1:2 transfer ratio (2:3 transfer ratio for cards that earn limited ThankYou points)

- Emirates Skywards : 1:1 transfer ratio

- Etihad Guest : 1:1 transfer ratio

- EVA Air Infinity MileageLands : 1:1 transfer ratio

- JetBlue TrueBlue : 1:1 transfer ratio (5:4 transfer ratio for cards that earn limited ThankYou points)

- Leaders Club : 5:1 transfer ratio

- Qantas Frequent Flyer : 1:1 transfer ratio

- Qatar Airways Privilege Club : 1:1 transfer ratio

- Singapore Airlines KrisFlyer : 1:1 transfer ratio

- Shop Your Way : 1:10 transfer ratio

- Thai Royal Orchid Plus : 1:1 transfer ratio

- Turkish Airlines Miles&Smiles : 1:1 transfer ratio

- Virgin Atlantic Flying Club : 1:1 transfer ratio

- Wyndham Rewards : 1:1 transfer ratio (5:4 transfer ratio for cards that earn limited ThankYou points)

Occasionally, you may be able to transfer Citi points to select partners at a higher ratio during a transfer bonus .

To transfer Citi ThankYou points, go to thankyou.com and sign in to your account. You may need to select the ThankYou account you want to use. Then, click "Travel" on the top navigation bar and select "Points transfer." Each transfer must be at least 1,000 ThankYou points but no more than 500,000. ThankYou points can only be transferred in increments of 1,000.

Some partners recognize transfers from Citi ThankYou Rewards quicker than others. Citi says transfers can take up to 14 days to process, but our tests on how long Citi ThankYou points take to transfer show most transfers occur much quicker.

In the remainder of this guide, we'll discuss each Citi transfer partner and whether they'll likely provide good value if you transfer Citi points.

Related: Best ways to redeem Citi ThankYou points

Accor Live Limitless

Accor Live Limitless has 53 brands, including popular names like Sotifel, Fairmont, Raffles and Movenpick. Its redemptions are simple — 2,000 points are worth 40 euros (around $44, based on current exchange rates). That means each Accor point is worth around 2.2 cents.

Transferring Citi points to Accor at a 2:1 ratio means you'll get just over 1 cent per Citi point (significantly lower than TPG's valuation of Citi points at 1.8 cents each). That said, if you have a limited number of Citi points, Accor Live Limitless could be a compelling transfer partner that will offer slightly more value than redeeming your points for travel through the Citi travel portal.

Aeromexico Rewards

While Aeromexico Rewards has an award chart for limited-availability classic award tickets, it uses dynamic pricing for most award tickets operated by Aeromexico, Delta, KLM and Air France. This dynamic pricing varies depending on demand, availability, destination and your class of service — but the rates usually aren't compelling. Even if you book your award online, you'll still need to pay an award booking fee of 365 Mexican pesos (about $22).

You may get good value from Aeromexico if you use your points in the right situations, but generally, Aeromexico Rewards isn't one of the most valuable Citi transfer partners.

Air France-KLM Flying Blue

Air France-KLM Flying Blue is a popular program that some might argue is one of the best Citi transfer partners. However, Flying Blue uses dynamic award pricing and adds fuel surcharges that can be hefty on some routes.

Flying Blue standardized prices of saver-level redemptions to Europe in late 2023, and you can find great value through the monthly Flying Blue Promo Rewards and Flying Blue stopovers . You can also use Flying Blue's calendar search tool to find cheaper award tickets.

Related: How to find the cheapest redemption rates using Flying Blue miles

Avianca LifeMiles

With its mixed cabin ticketing and low taxes and fees, Avianca LifeMiles is a popular currency for booking flights on Star Alliance carriers. Unlike some frequent flyer programs, LifeMiles doesn't pass along carrier surcharges on award tickets.

Although Avianca LifeMiles raised award costs to Asia in late 2022, two of our favorite sweet spots remain:

- Lufthansa business class one-way to Europe for 63,000 miles

- One-way economy domestic awards on United Airlines for as few as 6,500 miles

You'll also often find inexpensive Avianca-operated award flights within the Americas.

Related: The best websites to search for Star Alliance award availability

Cathay Pacific Asia Miles

Cathay Pacific Asia Miles uses distance-based award charts for flights on its own metal and Oneworld partner awards. Long-haul flights, such as those between the U.S. and Hong Kong, can be expensive. Specifically, you can book one-way "ultra-long" Cathay Pacific flights of 7,501 miles or longer for 160,000 Asia Miles in first class, 110,000 miles in business, 75,000 miles in premium economy and 38,000 miles in economy.

Cathay Pacific Asia Miles passes on fees and surcharges from other carriers and often charges significant fees on its own tickets. But, even after Cathay increased most Asia Miles award rates in late 2023, you'll still occasionally find award flights where booking through Asia Miles is the best option.

Related: Traveling soon? These 10 apps and websites make award redemptions easier to find

Choice Privileges

Choice integrated Radisson Rewards Americas into its loyalty program in mid-2023. Now you can book Choice hotels, including legacy Radisson Rewards Americas brands, through Choice Privileges . Award nights at most properties worldwide range from 6,000 to 35,000 points per night.

You can transfer Citi points to Choice at a 1:2 ratio (2:3 ratio for cards that earn limited ThankYou points), which makes it easier to get good value. Check out our stories on Choice Hotels Sweet Spot Rewards and unique ways to redeem Choice points to learn how to maximize Choice points.

Related: Register for Choice Hotels Your Extras to earn gift cards or other perks on weekday stays

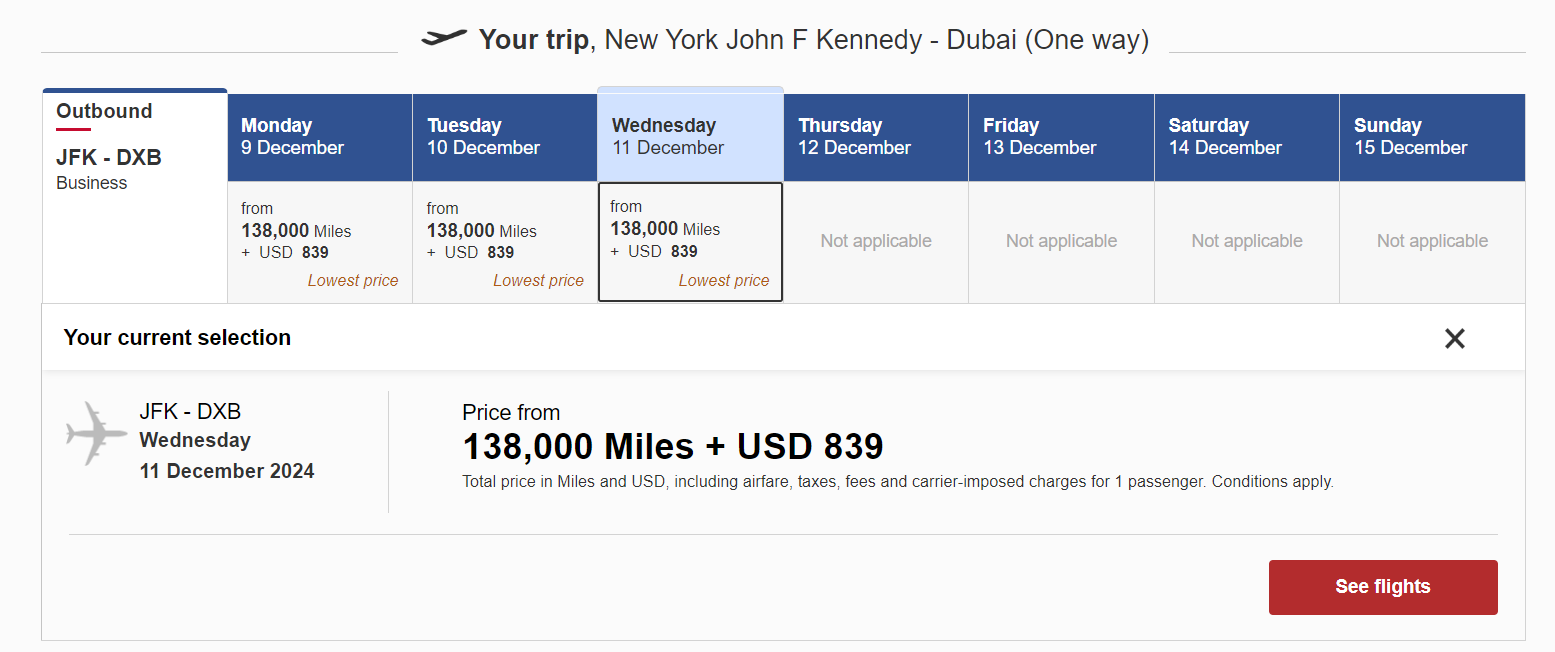

Emirates Skywards

Emirates Skywards is perhaps most useful for booking Emirates business-class or first-class award tickets, but its award prices are high. For example, a business-class one-way flight from New York to Dubai costs 138,000 miles and $839 in taxes and fees.

A more viable option is to look at one of the carrier's fifth-freedom routes between the U.S. and Europe. For example, you can book a one-way business-class award from New York to Milan for 87,000 miles plus $106 in taxes and fees, but if you can find round-trip, saver-level awards, your total price for the New York-to-Milan fifth-freedom route drops to 108,000 miles plus $248.

Related: The complete guide to the Emirates A380 onboard bar and lounge

Etihad Guest

Etihad Guest used to be a fantastic program for maximizing partner redemptions. Unfortunately, Etihad slashed its sweet spots and increased award rates by over 300% on some routes in 2023.

Etihad is making more loyalty program changes this year, including reduced GuestSeat award prices and the ability to redeem miles to upgrade to the Residence on some A380 flights . However, Etihad Guest award rates tend to be high, and the award charts you'll find only list introductory rates, so the rates you'll find when you go to book will often be significantly higher.

Related: Your ultimate guide to searching award availability for the major airlines

EVA Air Infinity MileageLands

EVA Air Infinity MileageLands generally won't be your program of choice. After all, it is often beaten by other programs and is rather difficult to understand. But there are a few notable cases in which you might want to use Infinity MileageLands.

One particular area to consider is intra-region round-trip itineraries. You're allowed up to two stopovers, up to six segments and one open jaw on round-trip Star Alliance awards — and some regions are very broad. For example, the "North Asia" region consists of "Guam, Japan, Micronesia, Palau, Russian Far East, South Korea, Marshall Islands, Mongolia, Saipan." So, you could piece together a nice island hopper for just 30,000 miles round trip in economy or 55,000 miles in business class. Likewise, the "South West Pacific" and "South America" regions also look appealing.

Check out the award chart for Star Alliance awards and the award chart for EVA Air awards .

Related: Is EVA Air business class worth it on the Boeing 787-10?

JetBlue TrueBlue

Redeeming JetBlue TrueBlue points for the carrier's flights is simple: The more a flight costs in cash, the more it will require in points. According to TPG's valuations, you can expect to get roughly 1.4 cents of value for every TrueBlue point you redeem, but some flights may yield slightly better or worse value.

Another option is to redeem JetBlue points for travel on Hawaiian Airlines . You can usually book nonstop, one-way intra-Hawaii economy flights for 7,500 points plus $5.60. However, this isn't as good of a deal as it sounds since paid flights are often inexpensive on these routes.

Leaders Club

The newest Citi transfer partner is Leaders Club , the loyalty program of The Leading Hotels of the World. Leaders Club uses dynamic award pricing, but you'll usually get between 6 and 8 cents per point. Given that you can transfer Citi points to Leaders Club at a 5:1 ratio, you'll usually get between 1.2 and 1.6 cents per Citi point (lower than TPG's 1.8 cents per ThankYou point valuation).

Suppose you want to redeem Citi points for a stay at a LHW property. In that case, you'll usually be better off transferring points to Leaders Club instead of redeeming points when booking through the Citi travel portal, but it's worth doing the math for your specific booking.

Qantas Frequent Flyer

Qantas Frequent Flyer generally isn't the most lucrative loyalty program with its high fuel surcharges and lackluster award charts. You'll find multiple distance-based award charts for the program, so you must select the correct award chart based on the airlines you plan to fly.

There are some sweet spots to be found, including short Qantas-operated flights, around-the-world Oneworld tickets, transatlantic business-class awards operated by American Airlines and short-haul American Airlines flights.

Qatar Airways Privilege Club

Qatar Airways Privilege Club isn't the most popular program, but it's worth caring about since it switched to Avios as its currency in 2022. Now, it is the only Avios-accruing program to partner with Citi ThankYou Rewards.

Since you can combine your Avios across the loyalty programs that use Avios, you can transfer Citi points to Qatar and then book sweet spots in the British Airways, Iberia and Aer Lingus loyalty programs.

Related: Book Qatar Qsuites before anyone else

Singapore Airlines KrisFlyer

Singapore Airlines KrisFlyer is usually your best bet if you're looking to book Singapore Airlines first-class Suites with points and miles . You'll usually only find Advantage space for 243,000 miles one-way in first class on the nonstop flight from New York to Singapore. But, if you want to fly in business class on this flight, Advantage awards cost 143,500 miles, and Saver awards cost 111,500 miles. If there isn't an award available when you book, you can join the waitlist.

If those business- and first-class award rates seem a bit high, you can also find value in the monthly KrisFlyer Spontaneous Escapes program.

Shop Your Way

Shop Your Way is a shopping rewards program. You can't see your redemption options until you have enough Shop Your Way points. However, according to an article on the Shop Your Way website, 1,000 points are worth $1 toward a gift card.

Citi points transfer to Shop Your Way at a 1:10 transfer ratio, which means you'd get about 1 cent per Citi point if you transfer to Shop Your Way. Considering you can get 1 cent per point when redeeming Citi points for a statement credit or check, there's little reason to transfer your points to Shop Your Way.

Thai Airways Royal Orchid Plus

Despite some decent intra-region award pricing, you won't find much value in Thai Royal Orchid Plus. You can find the Thai award chart for originating in Bangkok here , the Thai award chart for connecting in Bangkok here and the Star Alliance partner award chart here .

Turkish Airlines Miles&Smiles

The Turkish Miles&Smiles program has been a favorite among award travelers in recent years. However, Turkish Airlines devalued its award charts last month. Although this devaluation certainly dropped some of the program's appeal, there's still some value to be found.

You'll still get the most value when you use your miles to book Turkish- or Star Alliance-operated flights. Based on the Miles&Smiles region-based award charts , one-way awards are bookable for half the price of a round-trip award. However, fuel surcharges are high on some Miles&Smiles redemptions.

One of the best ways to redeem Turkish miles is on domestic flights operated by one of the Turkish Miles&Smiles partners. This sweet spot works in many countries with partner hubs, but you'll pay 10,000 miles one-way in economy and 15,000 in business class on United flights within the U.S., including Hawaii.

Virgin Atlantic Flying Club

Virgin Atlantic Flying Club has been a favorite of award travelers, but the program has removed many of its sweet spots over the last few years. In 2021, Virgin Atlantic axed many of its Delta sweet spots . In 2023, Virgin Atlantic increased ANA first-class redemptions and devalued the award chart for many Delta flights outside Europe and the United Kingdom .

There are still ways to find value, especially when you consider the Virgin Atlantic Flying Club partners . For example, Delta Main Cabin flights between the U.S. and the U.K. on standard season dates start at 15,000 Virgin points each way. You can sometimes get good value by booking discounted award flights through Virgin Atlantic Promo Rewards .

Related: How to book Delta award flights with Virgin Atlantic Flying Club points

Wyndham Rewards

Wyndham Rewards has a simple award chart: Each award night costs 7,500, 15,000 or 30,000 points, depending on the property you choose. Not all properties are a good deal, but you can sometimes find bargains in expensive cities, at high-end properties or during peak travel dates.

You can also redeem Wyndham points for stays at Wyndham vacation club resorts, Caesars Rewards properties and Vacasa vacation rentals.

Related: The 12 best Wyndham hotels in the world

Bottom line

As you can see, there are plenty of Citi transfer partners. As such, it can make sense to earn Citi ThankYou points even if you don't know exactly how you'll want to spend them. Once you know where you want to go, you can determine which transfer partners provide the best options and value for your trip.

ALREADY A CARDHOLDER?

Special limited-time offer:

Earn up to 75,000 bonus miles terms apply, special limited-time offer: earn up to 75,000 bonus miles terms apply.

Select a category to find the best travel credit card for you:

Select a card category:

- Travel Needs

- Everyday Purchases

- Admirals Club® Membership

- Business Owners

Offers available if you apply here today. Offers may vary and these offers may not be available in other places where the cards are offered.

All your travel needs.

Earn 75,000 American Airlines AAdvantage® bonus miles plus travel benefits

Bonus miles earned after $3,500 in purchases within the first 4 months of account opening, citi® / aadvantage® platinum select® world elite mastercard®, $0 intro annual fee for the first year , then $99 *, variable purchase apr: 21.24% – 29.99% *, *pricing details.

EVERYDAY PURCHASES AND NO ANNUAL FEE*

American Airlines AAdvantage® MileUp® Mastercard®

Earn 15,000 american airlines aadvantage® bonus miles with our no annual fee credit card*, bonus miles earned after $500 in purchases within the first 3 months of account opening, bonus miles earned after $500 in purchases within the first 3 months of account opening, no annual fee *.

BEST VALUE FOR ADMIRALS CLUB® MEMBERSHIP

Citi® / AAdvantage® Executive World Elite Mastercard®

Earn 70,000 american airlines aadvantage® bonus miles and enjoy the only credit card with admirals club® membership, bonus miles earned after $7,000 in purchases within the first 3 months of account opening, annual fee $595 *.

BUSINESS OWNERS

Citi® / AAdvantage Business™ World Elite Mastercard®

Earn 65,000 american airlines aadvantage® bonus miles to redeem for business travel, bonus miles earned after you or your employees spend $4,000 in purchases within the first 4 months of account opening, make business travel more rewarding.

International credit cards

Find the country you live in and choose the card for you.

TERMS AND CONDITIONS

Offer availability.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Platinum Select® account in the past 48 months.

The card offer referenced in this communication is only available to individuals who reside in the United States and its territories, excluding Puerto Rico and U.S. Virgin Islands.

Bonus miles

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

First checked bag free

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® credit card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on American Airlines purchases

Eligible American Airlines purchases are items billed by American Airlines as merchant of record booked through American Airlines channels (aa.com, American Airlines reservations, American Airlines Admirals Club®, American Airlines Vacations℠, Google Flights, and American Airlines airport and city ticket counters). Products or services that do not qualify are car rentals and hotel reservations, purchase of elite status boost or renewal, and AA Cargo℠ products and services. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Double miles at restaurants and gas stations

Earn 2 AAdvantage miles for each $1 spent on purchases at restaurants (including cafes, bars, lounges, and fast food restaurants) and at gas stations. Food and beverage purchases made at the American Airlines Admirals Club® will be awarded 2 AAdvantage miles for each $1 spent as part of the Double Miles on American Airlines purchases benefit.

Certain non-qualifying purchases: Restaurant purchases not eligible to receive double miles include, but are not limited to, supercenters, warehouse clubs, discount stores, restaurants / cafes inside department stores, bowling alleys, public and private golf courses, country clubs, convenience stores, movie theaters, caterers and meal kit delivery services. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

1 mile per $1

AAdvantage® miles are earned on purchases, except balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Miles may be earned on purchases made by primary credit cardmembers and authorized users. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Preferred boarding

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the Citi® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible credit cardmembers will board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

$125 American Airlines Flight Discount

Earn a $125 American Airlines Flight Discount certificate (the “Flight Discount”) after you spend $20,000 or more in purchases that post to your Citi® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs), the anniversary month will coincide with the month in which the annual fee is billed. To receive the Flight Discount, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. The Flight Discount expires one year from date of issue of the certificate. The Flight Discount is redeemable toward the initial ticket purchase of air travel wholly on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. for itineraries originating in the U.S., Puerto Rico, or U.S. Virgin Islands, and sold in US Dollars. The Flight Discount is also redeemable for air travel on any oneworld® carrier or American Airlines codeshare flight. The Flight Discount is redeemable online at aa.com, or by calling American Airlines Reservations. A reservations services fee may apply for travel booked through American Airlines Reservations. The Flight Discount is redeemable only toward the purchase of the base airfare and directly associated taxes, fees and charges that are collected as part of the fare calculation for travel. The Flight Discount cannot be used to pay the taxes and charges on mileage redemption tickets where only taxes and fees are being collected. The Flight Discount may not be used for flight products and/or services that are sold separately or non-flight products and/or services sold by American Airlines. If the ticket price is greater than the value of the Flight Discount, the difference must be paid only with a credit, debit or charge card, or with American Airlines Gift Cards. Any unused balance can be applied towards eligible future travel until the stated expiration date. If travel booked with the Flight Discount is cancelled or changed by the credit cardmember, the Flight Discount will be forfeited and the credit cardmember will be responsible for any applicable fare difference and the applicable change fee. The Flight Discount will not be replaced for any reason. The Flight Discount is non-refundable, may not be sold and has no cash redemption value. After qualification, please allow 8-12 weeks for delivery of the Flight Discount.

25% savings on eligible inflight purchases

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

Authorized user

Before adding an authorized user to your credit card account you should know:

You’re responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user’s name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized users do not receive the first checked bag free or boarding benefits.

Fraud Disclosure

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your Citi® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using your account other than for personal, family or household purposes.

Card Account Disclosure

The Card Account is only available if you have an open AAdvantage® program membership in your name. Citi reserves the right to cancel your Card Account if you or American Airlines terminates or deactivates your AAdvantage® program membership.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage Million Miler℠ status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage® program, visit aa.com/aadvantage » .

Travel booked on American Airlines may be American Eagle® service, operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

American Airlines, American Eagle, AAdvantage, AAdvantage Million Miler, MileSAAver, Business Extra, Flagship, Admirals Club, Platinum Pro, AAdvantage MileUp, AA Cargo, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

one world is a mark of the one world Alliance, LLC.

Citibank is not responsible for products or services offered by other companies. Cardmember program terms are subject to change.

Mastercard, World Elite and the circles design are registered trademarks of Mastercard International Incorporated.

© 2021 Citibank, N.A. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

American Airlines AAdvantage MileUp® Mastercard®

Statement credit and American Airlines AAdvantage® bonus miles are not available if you have received a statement credit or American Airlines AAdvantage® bonus miles for a new AAdvantage MileUp® account in the past 48 months.

Double miles on grocery store purchases

Earn 2 AAdvantage miles for each $1 spent on purchases at grocery stores. Grocery stores are classified as supermarkets, freezer/meat locker provisioners, dairy product stores, miscellaneous food/convenience stores, markets, specialty vendors, and bakeries.

Certain non-qualifying purchases: You won’t earn double miles for purchases at general merchandise/discount superstores, wholesale/warehouse clubs, candy/confectionery stores, cafes, bars, lounges, and fast food restaurants.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

AAdvantage MileUp® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their AAdvantage MileUp® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

No mileage cap

There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your Citi® / AAdvantage® credit card account.

You’re responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user’s name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Executive account in the past 48 months.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on domestic itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® card, up to eight (8) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Enhanced airport experience

For benefits to apply, the Citi® / AAdvantage® Executive World Elite Mastercard® account must be open 7 days prior to air travel AND reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive credit cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4.

These benefits apply when traveling on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. Up to eight (8) companions traveling with the eligible primary credit cardmember will also get priority check-in (where available), priority airport screening (where available), and priority boarding privileges if they are listed in the same reservation. You may check in at any Business Class check-in position or First Class check-in when Business Class is not available, regardless of the class of service in which you are traveling on American Airlines.

These benefits will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Exclusive lanes at security checkpoints are available, subject to TSA approval. Applicable terms and conditions are subject to change without notice.

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

Admirals Club® membership and credit card authorized user access

Only Citi® / AAdvantage® Executive World Elite Mastercard® primary credit cardmembers who are eighteen (18) years of age or older will receive full membership access privileges to Admirals Club® lounges. An authorized user of the Citi® / AAdvantage® Executive World Elite Mastercard® who is eighteen (18) years of age or older will receive access privileges to American Airlines Admirals Club® lounges. Full Admirals Club® membership privileges do not apply to a credit card authorized user. An Admirals Club® membership includes access to other airline lounges and clubs with which American Airlines may have reciprocal lounge or club access privileges. Membership also includes special pricing on conference rooms and other special offers that are available exclusively to Admirals Club® members. Neither membership nor the credit card authorized user access benefit provides access privileges to the Arrivals Lounge, International First Class Lounges, or Flagship® Lounge facilities, including Flagship® First Dining. Additionally, the credit card authorized user access benefit does not provide: (i) access privileges to other airline lounges or clubs with which American Airlines may have reciprocal lounge or club access privileges; or (ii) special pricing on conference rooms or other special offers. To locate a current list of Admirals Club® lounges please visit aa.com/admiralsclub » .

To access an Admirals Club® lounge, primary credit cardmembers and credit card authorized users must present: (i) their (a) active and valid Citi® / AAdvantage® Executive World Elite Mastercard® or (b) with respect to primary credit cardmembers only, AAdvantage® number; (ii) their current government-issued I.D.; and (iii) a boarding pass for same-day travel on an eligible flight, which includes any departing or arriving flight that is (1) marketed or operated by American Airlines, (2) marketed and operated by any oneworld® carrier, or (3) marketed and operated by Alaska Airlines; and (iv) any additional documentation required by American Airlines. Either immediate family members (spouse or domestic partner and children under eighteen (18) years of age) or up to two (2) guests traveling with the primary credit cardmember or authorized user may be admitted for free when accompanied by the primary credit cardmember or authorized user. Family members and guests must present a same-day boarding pass for an eligible flight as defined above. All persons must be of valid drinking age, based on applicable law, to consume alcohol.

If the primary credit cardmember is an Admirals Club® member on the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi® and has sixty (60) or more days remaining on such current Admirals Club® membership, he or she is eligible to receive a prorated refund from American Airlines for any unused portion of his or her current Admirals Club® membership fee. The refund will be a prorated amount of the annual membership fee calculated based on the number of days remaining on such primary credit cardmember’s current Admirals Club® membership as of the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi®. Refunds will be automatically made in the original form of payment within twelve (12) weeks of becoming a Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmember. Memberships redeemed with Business Extra points, Lifetime Admirals Club® members and AirPass members with Admirals Club® privileges are not eligible for a refund.

Upon closure of the Citi® / AAdvantage® Executive World Elite Mastercard® account, all Admirals Club® benefits and access associated with the account will be immediately terminated, including, but not limited to, all benefits afforded to credit card authorized users. All Admirals Club® membership rules, terms and conditions apply. AMERICAN AIRLINES RESERVES THE RIGHT TO MODIFY ANY OR ALL RULES, TERMS AND CONDITIONS AT ANY TIME WITHOUT NOTICE. SUCH MODIFICATIONS SHALL BE EFFECTIVE IMMEDIATELY AND INCORPORATED INTO THIS AGREEMENT. BY ACCESSING ANY ADMIRALS CLUB® LOUNGE YOU SHALL BE DEEMED TO HAVE ACCEPTED THE ADMIRALS CLUB® TERMS AND CONDITIONS. To review the complete Admirals Club® membership terms and conditions, visit aa.com/admiralsclub » .

Global Entry or TSA PreCheck® application fee credit

Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmembers are eligible to receive one statement credit up to $100 per account every five years for either the Global Entry or the TSA PreCheck® program application fee. Credit cardmembers must charge the application fee to their Citi®/ AAdvantage® Executive credit card to qualify for the statement credit. Credit cardmembers will receive a statement credit for the first program (either Global Entry or TSA PreCheck®) to which they apply and pay for with their eligible card, regardless of whether they are approved for Global Entry or TSA PreCheck®. Please allow 1-2 billing cycles after the qualifying Global Entry or TSA PreCheck® fee is charged to the eligible account for the statement credit to be posted to the account. Only fees associated with either the Global Entry or the TSA PreCheck® application fee will be eligible towards the statement credit.

For information on Global Entry, visit globalentry.gov. For information on TSA PreCheck®, visit tsa.gov. Applications are made directly with these organizations, and this information is not shared with Citi, nor does Citi have access to Global Entry or TSA records. Citi does not share account information with Global Entry or TSA. Decisions to approve/deny applications are made solely by these organizations, and Citi has no influence over these decisions. Citi is not notified of approvals or denials of applications.

TSA PreCheck® is a registered trademark of the Department of Homeland Security.

CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a CitiBusiness® / AAdvantage® Platinum Select® account in the past 48 months.

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmember and employee cardmembers. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible CitiBusiness® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the CitiBusiness® / AAdvantage® card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Benefit does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on purchases in select business categories

Earn 2 AAdvantage® miles per $1 spent on purchases at certain telecommunications merchants, car rental merchants, cable and satellite providers, and at gas stations. Telecommunications merchants are classified as merchants that sell telecommunications equipment such as telephones, fax machines, pagers, and cellular phones, along with providers of telecommunications services including local and long-distance telephone calls and fax services. Car rental merchants are classified as providers of short-term or long-term rentals of cars, trucks, or vans. Cable and satellite providers are classified as merchants that provide the connection and ongoing delivery of television, internet (computer network, information services, email website hosting services) telephone and radio programming via cable or satellite on a subscription or fee basis. Gas stations are classified as merchants that sell fuel primarily for consumer use and may or may not be attended.

Certain non-qualifying purchases: Car rental purchases not eligible to receive double miles include purchases at merchants that rent motor homes or other recreational vehicles and purchases made through travel agencies, tour operators and online third party travel sites, and charges paid on car rental redemptions through RocketMiles. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) account do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8–10 weeks.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the CitiBusiness® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible CitiBusiness® / AAdvantage® credit cardmembers board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

25% savings on eligible inflight purchases of food and beverage

CitiBusiness® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their CitiBusiness® / AAdvantage® card. Savings do not apply to any other inflight purchases. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

25% savings on inflight Wi-Fi purchases

Receive a 25% savings when you use your CitiBusiness® / AAdvantage® Platinum® Select credit card for the purchase of inflight Wi-Fi service from American Airline’s Wi-Fi merchants Gogo, Viasat, or Panasonic, and on American Airlines’ Wi-Fi Subscription Plan. This benefit applies to flights marketed and operated by American Airlines or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

American Airlines Companion Certificate

The primary credit cardmember will earn a $99 domestic economy fare American Airlines Companion Certificate after you spend $30,000 or more in purchases that post to your CitiBusiness® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs) the anniversary month will coincide with the month in which the annual fee is billed. To receive the Companion Certificate, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. After these conditions are met, please allow at least 8-10 weeks for availability of the Companion Certificate. You must have an open AAdvantage® account for the Companion Certificate to be awarded to your account and to redeem the certificate. When used according to its terms, the primary credit cardmember will pay a $99 companion ticket fee plus $21.60 to $43.20 in government taxes and fees, depending on itinerary, for one round trip qualifying domestic economy fare ticket for a companion when an individual round trip qualifying domestic Main Cabin fare ticket is purchased and redeemed through American Airlines Meeting Services. Travel must be booked and purchased in select Main Cabin inventory. The certificate must be redeemed and all travel completed by midnight of the Travel Expiration Date shown on the certificate. Valid for travel on flights within the 48 contiguous United States on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. For residents of Alaska and Hawaii, the companion certificate is also valid for round-trip travel originating in either of those two states and continuing to the 48 contiguous United States. For residents of U.S. Virgin Islands and Puerto Rico, companion certificate eligible travel is also defined as round-trip travel originating in either of those two territories and continuing to the 48 contiguous United States. The Companion Certificate is not redeemable for air travel on any oneworld® carrier or on an American Airlines codeshare flight. Applicable terms and conditions are subject to change without notice. Details, terms and conditions, certain restrictions, and restricted dates apply and will be disclosed on the certificate.

Employees may be added to the account as authorized users. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not to the authorized user. You must pay us for all charges made or allowed by authorized users. Authorized users are able to get account information. Authorized users must be employees or contractors of your business. You need the authorized user’s permission to give us any information about them that we request and to allow us to share information about them as allowed by applicable law. This includes information we may get from you, any authorized user and others. It also includes information about their transactions on the account.

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your CitiBusiness® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using the account other than for business purposes.

ApplyURLsHome

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

How to get the most out of your Citi PremierMiles Card

Non-expiring miles, 11 different loyalty partners, complimentary lounge access & travel insurance and more - all with your Citi PremierMiles Card.

The Citi PremierMiles Card might not be the newest kid on the block, having debuted in Singapore all the way back in 2007. And yet it’s been a staple feature in my wallet ever since I started playing the miles game 10 years ago- rather an accomplishment, given my penchant to chop and change cards!

Old hand it may be, but the Citi PremierMiles Card still ticks all the right boxes with its non-expiring miles, wide range of transfer partners, complimentary lounge access & travel insurance, plus the ability to earn extra miles on eligible bill payments via Citi PayAll.

So whether you’re a brand new cardholder or a long-time user, here’s some ways to get the most out of your Citi PremierMiles Card .

Earn bonus miles on foreign currency spend

Citi PremierMiles Cardholders normally earn:

- 1.2 Citi Miles per S$1 spent in SGD

- 2.0 Citi Miles per S$1 spent in foreign currencies

However, from 1 March to 30 June 2023 , Citi PremierMiles Cardholders can earn up to 4 Citi Miles per S$1 (mpd) on qualifying foreign currency spend:

Enrolment is required, and can be done by sending the following SMS from your mobile number registered with Citi.

Do enrol as soon as possible, because any spending prior to the month of enrolment will not be eligible. For example, if you register on 15 April 2023, then only qualifying spending from 1 April to 30 June 2023 will be entitled to bonus miles; all spending from 1-31 March 2023 will not qualify.

A minimum spend of S$5,000 per calendar month is required to trigger the bonus award. This can be met by any eligible retail spend, whether local or overseas, in-person or online. It also includes Citi PayAll transactions, provided the service fee is paid.

The maximum bonus miles cardholders can earn each calendar month is capped at 10,000 miles, or S$5,000 qualifying spend in foreign currency.

Citi PremierMiles Cardholders will earn the usual base rate of 2 mpd for foreign currency spend, awarded when the transaction posts. The bonus 2 mpd for this promotion will be credited up to four months after the transaction, per the table below.

Terms & Conditions

The full T&Cs for the Citi PremierMiles Card overseas spending promotion can be found here.

Earn bonus miles on hotel bookings

10 mpd with kaligo.

Citi PremierMiles Cardholders can earn 10 mpd on hotel bookings via Kaligo (on kaligo.com/bonus-miles ) made by 31 December 2023, with any future stay date.

The 10 mpd earn rate applies regardless of whether the hotel is in Singapore or overseas, and will be credited within eight weeks following completion of the stay. There is no cap on the number of bonus miles customers can earn.

In general, it’s always a good idea to compare the rates offered on Agoda and Kaligo with the hotel’s official website and other booking platforms, just to ensure you’re getting the best deal.

Up to 7 mpd with Agoda

Citi PremierMiles Cardholders can earn up to 7 mpd on hotel bookings via Agoda made by 31 December 2023 and stayed by 30 April 2024.

Pre-paid bookings made via the dedicated landing page will earn a bonus 5 mpd on top of the usual earn rates, which works out to:

- Singapore hotels: 6.2 mpd

- Overseas hotels: 7 mpd

The bonus miles will be credited within two months after the stay is completed, and there is no cap on the maximum bonus cardholders can earn.

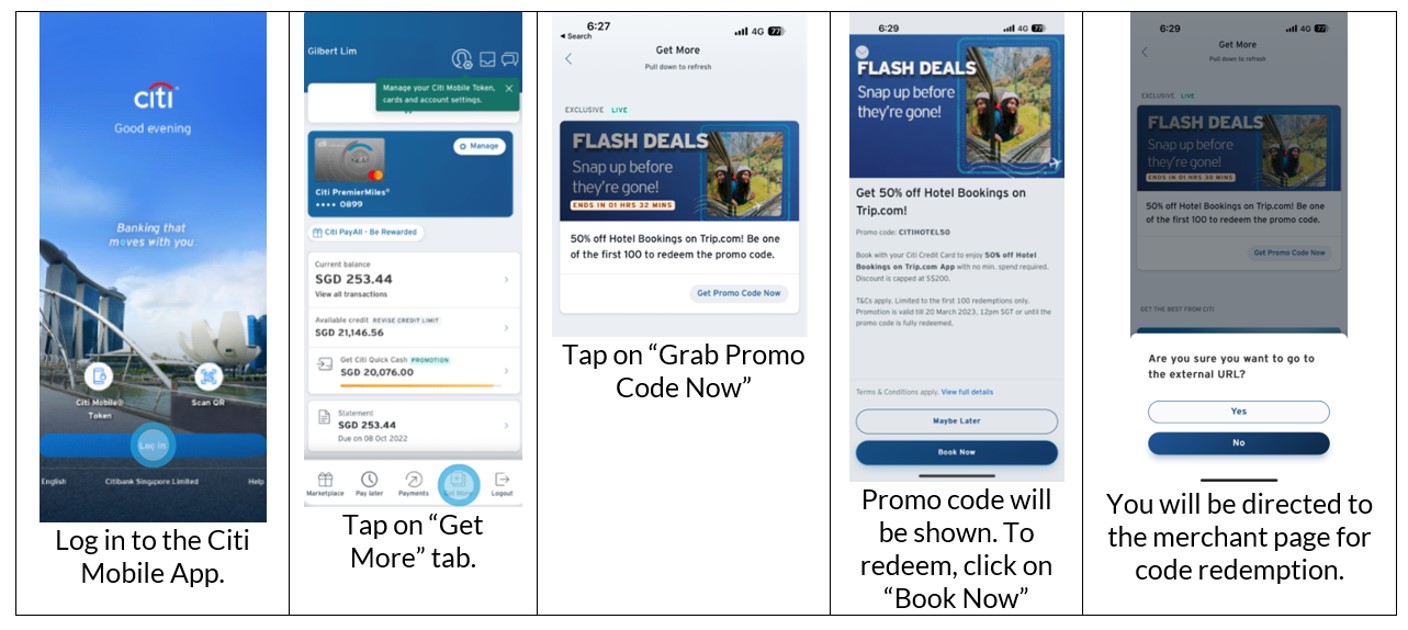

Get miles & points for paying bills with Citi PayAll

Citi PremierMiles Cardholders can use their card to pay a wide range of bills via Citi PayAll, earning miles in the process.

Citi PremierMiles cardholders earn 1.2 mpd on PayAll transactions, which given the 2.2% service fee (starting 20 April) works out to buying miles at 1.83 cents each .

This is an easy way to top-off an account when you’re just shy of the miles required for a redemption. Remember: Citi frequently runs PayAll offers which increase the earn rate or offer additional shopping/food delivery vouchers for making payments, so be on the lookout for those!