Thailand Offers VAT Refund for Tourists

Making Thailand even more of an attractive shopping destination, tourists can claim back the VAT on goods they purchase while on holiday in the kingdom.

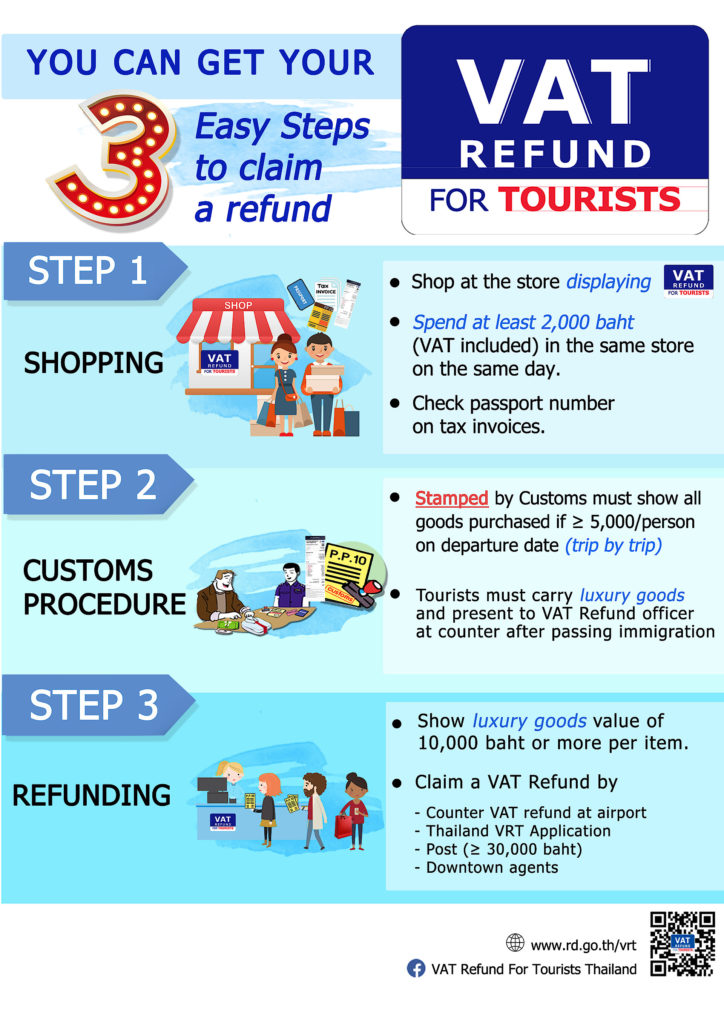

Wondering how to claim your VAT Refund for tourists? Below we’ve outlined the 3 easy steps to claim a refund when departing Thailand from either Don Muaeung or Suvarnabhumi International Airport.

To qualify for the refund, Thai-bought goods must be purchased from stores displaying the ‘VAT Refund for Tourists’ sign and be at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip.

Tourists must take the purchased items out of Thailand within 60 days of the date of sale through any of the international airports in Bangkok (Suvarnabhumi or Don Mueang), Chiang Mai, Chiang Rai, Phuket, Hat Yai, U-Tapao, Krabi, and Samui.

If the VAT refund is made at a refund location in the city, a departure from Thailand must be within 14 days of this date.

Here are some important points to remember:

At the time of purchase:.

When purchasing the goods, the tourist must present their passport and ask the store to issue a VAT Refund Application for Tourists form (P.P.10) along with the original tax invoice/s for the purchase. The passport number must be correct on the form.

*In the case of consumable goods, these must be sealed along with the message ‘No Consumption Made While in Thailand.’

At the Airport, when departing from Thailand:

The purchased goods must be presented along with the VAT Refund Application for Tourists form and original tax invoice/s to a customs officer for inspection before check-in.

In the case of luxury goods of which the value is 10,000 Baht or more per item, and carry-on goods of which the value is 50,000 Baht or more per item, these must be hand carried and shown again at the VAT Refund for Tourists Office after passing through immigration.

At the VAT Refund for Tourists Office, if the refund amount is not over 30,000 Baht with insurance for the tax refund amount, the payment will be made in cash (Thai Baht). Tourists can also claim the refund by post to the Revenue Department of Thailand or by drop-box in front of the VAT Refund for Tourists Office at the Airport and at the downtown refund office locations.

Related Posts

Wellness Thai Style

Celebrating UNESCO-listed Songkran in Thailand and other festivals throughout April 2024

National Wellness Month: Relaxing Wellness Destinations in Thailand

Travel Thailand 101: Top Tips on How to Get a VAT Refund in Thailand

Apart from the world-class food, magnificent temples, and pristine nature, Thailand (particularly Bangkok) is famed for being a top-drawer shopping destination with a myriad of shopping malls and boutiques offering stunning bargains. From cheap finds to brand-name trinkets, Thailand has it all! Apart from sometimes unbelievably good prices – or at least very competitive – you can also enjoy the benefits of discount cards at many shopping centres and department stores.

Apart from the world-class food, magnificent temples, and pristine nature, Thailand (particularly Bangkok) is famed for being a top-drawer shopping destination with a myriad of shopping malls and boutiques offering stunning bargains. From cheap finds to brand-name trinkets, Thailand has it all! Apart from sometimes unbelievably good prices – or at least very competitive – you can also enjoy the benefits of discount cards at many shopping centres and department stores.

Here in Thailand, we have a unique tax system called “VAT,” which stands for “Value Added Tax”. Like the name suggests, this is a tax added on any value during each stage of production and distribution of a good or service. As a result, there’s a chance that you can pay more for VAT than the actual amount charged. In this case, you can qualify for a VAT refund.

“So, why does Thailand have to impose a tax refund system such as the VAT?” you may ask. As Thailand is one of the most popular travel destinations in the world, there is a lot of traffic of foreigners coming in and out of the country. As a result, they’ve figured out a way to encourage more tourists to spend money in the country. The more money visitors spend in Thailand, the better the country can develop to support its tourism industry.

Without further ado, let’s take a look at these simple steps, on how to get a VAT refund in Thailand.

1.) Look for Qualified Stores for VAT Refunds for Tourists

As mentioned before, the VAT refund system for tourists is a way to encourage tourists to shop in the country. According to the Tourism Authority of Thailand, The country offers a 7% refund for goods and services that are purchased in Thailand. This excludes the hotels and restaurants you’ve visited during your time in the country, however. Sounds like a splendid idea to plan a shopping spree in Thailand, doesn't it? Goods purchased in Thailand are VAT inclusive. But foreign visitors (with a few exceptions) have the benefit of receiving a 7% VAT refund on luxury goods purchased from shops that participate in the 'VAT Refund for Tourists' scheme.

First things first, just look for stores displaying the " VAT REFUND FOR TOURISTS " sign at their shopfront on their eligibility to provide VAT refund for tourists. Of course, there are exceptions for some that are illegal, such as firearms, or other items like gemstones and more.

2.) Spend at least 2,000 Baht in One Day

Just as there are requirements for the list of items eligible for a VAT refund in Thailand, there are requirements for the cost of the goods and services, too. To get a VAT refund in Thailand, you must spend a minimum of 2,000 Baht on the same day. Also, the total amount of the cost of goods or services must total to more than 5,000 Baht as well, according to Thailand’s Department of Revenue.

3.) Complete the Tax Refund Form & Tax Invoice

Another way to get a tax return in Thailand is to request a tax refund form called the “P.P.10” from the sales assistant at the shop that you’re purchasing from. The sales assistant or cashier will complete the form for you with the necessary information including the value of the purchase. According to the Tourism Authority of Thailand, You’ll need to also present your passport to them, and attach the original tax invoice to the form. Each application form must show the value of goods of at least 2,000 Baht or more.

4.) Claim for a VAT Refund at the Airport

Since the goods or services that you’ve purchased will be travelling with you outside of Thailand, you’ll essentially be claiming a VAT refund for tourists whilst you leave via any international airport in Thailand. Also, keep in mind that the goods you’ve purchased must be taken out of Thailand with you within 60 days from the date of purchase. Before departure, present your goods and VAT Refund Application for Tourists form to Customs officers for inspection before check-in. According to Thailand’s Department of Revenue, Luxury goods such as jewellery, watches, glasses, or pens must be inspected once more by the Revenue officers at the VAT Refund Office at the departure lounge. Other than that, you can drop the documents into the box in front of the VAT Refund for Tourists office, or mail the documents to the Revenue Department of Thailand.

According to the Tourism Authority of Thailand, For purchases under 30,000 Baht, refunds will be made in cash or credited to your credit card account. For purchases over 30,000 Baht, the refund will be made by bank draft or credited to your credit card account. There’s also an additional 100 Baht fee for cash refunds, and a few hundred Baht plus a draft issuing fee at the rate charged by banks plus postage fees for a bank draft refund. For credit to credit card account refund, a few hundred Baht plus a money transfer fee at a rate charged by banks and postal fees will be further added.

So, Who can claim a VAT Refund in Thailand?

- Those who are not Thai nationals

- Those who do not have a residency in Thailand.

- Those who are not airline crew members departing Thailand on duty

- Depart Thailand from an international airport.

- Purchase goods from stores displaying a "Vat Refund For Tourists" sign.

- Present the goods and VAT Refund Application for Tourist Form (P.P.10) and original tax invoices to the Customs officer before check-in at the airline counter on the departure date.

Vat Refunds in Thailand Will Not be Made If:

- You carry a diplomatic passport and reside in Thailand.

- You are an airline crew member departing Thailand on duty

- Your stay in Thailand exceeds 180 days in a calendar year

- Goods were not taken out of Thailand within 60 days after the date of purchase

- You didn't depart Thailand from an international airport

- The name or passport number does not match those on the original tax invoice attached to the VAT Refund Application form

- The value of goods purchased is less than 2,000 Baht per day per store

- Your purchased items fall under the following category: gemstones, firearms or explosives, prohibited items

- VAT Refund Application for Tourist form was not prepared on the date of purchase

- The total value of goods claimed for refund is less than 5,000 Baht

- Original tax invoices were not attached to the VAT Refund for Tourist form

- You did not carry the goods out of Thailand on the day of your departure

- Goods were not purchased from shops participating in the VAT Refund for Tourists Scheme

- The quantity of goods shown in the VAT Refund Application for Tourist form is less than that shown in the original tax invoice

- Goods were taken out of Thailand without being inspected by Customs or Revenue officers

- Luxury goods were taken out of Thailand without being checked by the Revenue officers

- Tax invoices attached to the VAT Refund Application for Tourists were issued from a different store than mentioned on the form.

To conclude, getting a Vat Refund for Tourists in Thailand can be trouble-free for you if you follow these simple steps and other essential conditions in mind. Even though there are a few conditions that you have to remember, we advise all travellers to have this information with you if you want to go on a splurge while you’re in the kingdom. Other than being a culinary, and historical paradise, Thailand is a place for shoppers. From quaint flea markets to upscale malls, Thailand is a place for every type of shopper and traveller alike. For a smooth holiday in Thailand, we recommend you to get the TAGTHAi App on your mobile phone for all the essential information. For an even smoother holiday here in Thailand, the TAGTHAi Pass provides a comprehensive introduction to your stay in the “Land of Smiles”.

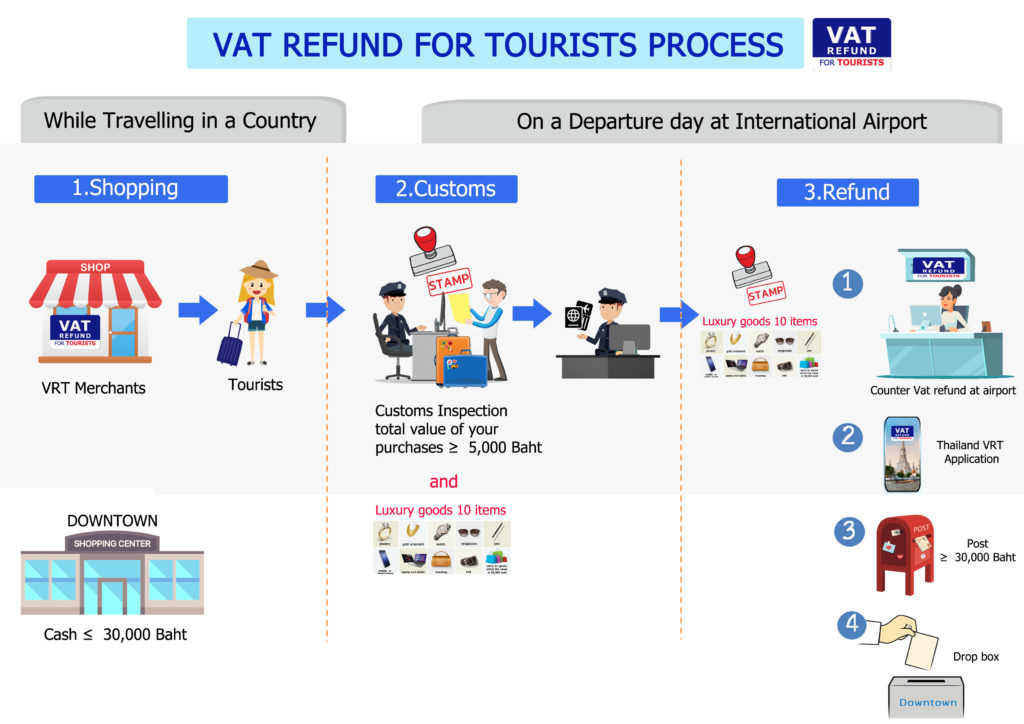

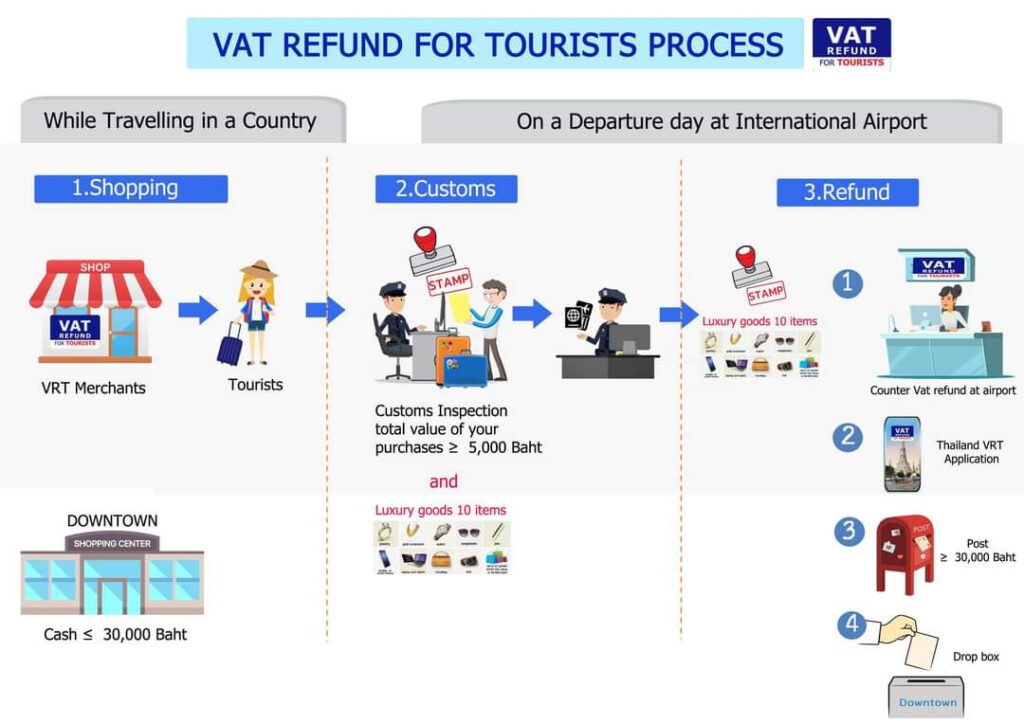

VAT Refund for Tourists Process

Get Inspiration

2 of the most luxurious- yet fri..., get a glimpse of bangkok’s local..., fruity & savoury, bangkok flea markets : adventuro....

News & Update

3 Islands Promotion

2 styles of accommodation in sur....

- About ScandAsia

- Advertisement rates

Nordic News and Business Promotion in Asia

Thailand simplifies VAT refund process for tourists

Thailand has introduced new Value Added Tax (VAT) refund regulations effective from January, 2024. The new regulations are aimed at enhancing the experience for international tourists.

The changes include an increased purchase threshold for customs declaration, now set at 20,000 baht. This allows tourists to request a VAT refund directly without customs procedures for purchases below this amount. Value thresholds have also been adjusted, with items up to a 100,000 baht.

The range of goods requiring declaration has been expanded to include: jewelry, gold ornaments, watches, eyeglasses, pens, smartphones, laptops, tablets, bags (excluding travel bags), and belt buckles.

To be eligible for a VAT refund, tourists must follow specific conditions, including taking purchased goods outside Thailand within 60 days. They have to buy from shops displaying the “VAT Refund” sign, and ensure a minimum purchase of 2,000 baht.

Refunds can be received in cash or transferred to a credit card account, varying based on the refund amount. Tax refund offices are available at 10 international airports in Thailand.

Source: traveltradejournal.com

Search more ScandAsia news

Related posts:.

About Miabell Mallikka

Miabell Mallikka is a journalist working with ScandAsia at the headquarters in Bangkok.

One Comment on “Thailand simplifies VAT refund process for tourists”

- Pingback: Thailand Simplifies VAT Refund Process for Tourists - VATupdate

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Travel Tips

Vat refund for tourists.

As a tourist, you are not required to pay Value Added Tax (VAT) on items more than 5,000 Baht that you intend to take out of Thailand. For most people the amount returned is very welcome and a pleasant surprise, so it is well worth making the effort to collect the paperwork you need for a refund. It is not that difficult to do either. Stores participating in the refund scheme display a sign stating: “VAT Refund for Tourists”. If you make a purchase from these stores, ask for a VAT Refund Form (P.P 10) and keep the original tax invoice(s) a store gives you. That is really all you need to do. If you take that paperwork to the 'Customs Inspection for VAT Refund' desk at Bangkok, Chiang Mai, Hay Yai, Phuket or U-Tapao International Airports, you will be granted a tax refund. Bear in mind that the tax refund process is the final stage of your journey in Thailand - you will have gone through passport control on your return leg before you arrive at the appropriate counter. You can only make claims on the day you leave the country. If your claim is for less than 30,000 Baht, you can receive a payment as a cheque or Bank Draft, or the amount can be paid into a credit card account. If your claim is for over 30,000 Baht, you can only receive payment by Bank Draft or payment into a credit card account. For more information on VAT refund, visit the Revenue Department of Thailand’s website: vrtweb.rd.go.th

Related Travel Tips

Thailand Travel Information

Hotel Booking

Highly rated hotels in the area.

ASAI Bangkok Chinatown (SHA Plus+)

Carlton Hotel Bangkok Sukhumvit (SHA Extra Plus)

Neveu Premier Residence

Sindhorn Midtown, an IHG Hotel (SHA Extra plus)

Kinnon Deluxe Hostel Coworking Cafe

BaanSu Hostel

Tiny Taladnoi Hostel

Siam Eco Hostel

THE QUBE FIFTY HOTEL (SHA Extra Plus)

Ekanek Hostel

Thailand offers ‘VAT Refund’ for tourists

Making thailand even more of an attractive shopping destination, tourists can claim back the vat on goods they purchase while on holiday in the kingdom..

Bangkok, 16 December, 2022 – Further enhancing Thailand’s reputation as a popular shopping destination for travellers from around the world, is the VAT Refund for Tourists scheme which offers holidaymakers a refund on goods they purchase during their trip.

To qualify for the refund, goods must be purchased from stores displaying the ‘VAT Refund for Tourists’ sign, and be to the value of at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip.

The goods must be taken out of Thailand by the tourist within 60 days of the date of purchase through any of the international airports in Bangkok (Suvarnabhumi or Don Mueang), Chiang Mai, Chiang Rai, Phuket, Hat Yai, U-Tapao, Krabi, and Samui.

In the case the VAT refund is made at a refund location in the city, departure from Thailand must be within 14 days of this date.

Here are some important points to remember:

At the time of purchase.

When purchasing the goods, the tourist must present his/her passport and ask the store to issue a VAT Refund Application for Tourists form (P.P.10) along with the original tax invoice/s for the purchase. The passport number must be correct on the form.

*In the case of consumable goods, these must be sealed along with the message ‘No Consumption Made While in Thailand’.

At the airport when departing Thailand

The purchased goods, of which the total value must be 5,000 Baht or more, must be presented along with the VAT Refund Application for Tourists form and original tax invoice/s to a customs officer for inspection before check-in.

In the case of luxury goods (jewellery, gold, ornaments, watch, eyeglasses, pen, mobile or smart phone, laptop or tablet, handbag, and/or belt) of which the value is 10,000 Baht or more per item, and carry-on goods of which the value is 50,000 Baht or more per item, these must be hand carried and showed again at the VAT Refund for Tourists Office after passing through immigration.

At the VAT Refund for Tourists Office, if the refund amount is not over 30,000 Baht with insurance for the tax refund amount, the payment will be made in cash (Thai Baht).

The refund can also be claimed by post to the Revenue Department of Thailand, or by drop-box in front of the VAT Refund for Tourists Office at the airport, and at the downtown refund office locations.

TAT Newsroom

Thailand is blooming with flower festivals from december 2022-january 2023, tat introduces ‘nft buakaw 1 x amazing thailand exclusive collection’, related articles.

Thailand announces longer visa stays to boost economy

Thailand extends visa exemption for Indian and Taiwanese tourists for another six months

VAT refunds soar as more tourists come to Thailand

Value added tax (vat) refunds for tourists jumped significantly following thailand’s reopening in june last year, with the refunds for the first three months this year soaring to 700 million baht, the revenue department said on monday..

About 273,000 tourists applied for VAT refunds from January to March this year, department director-general Lavaron Sangsnit noted. The more than 700 million baht is almost half of the total VAT refunds in 2022 of 1.2 billion baht, with most of that amount coming in the second half of the year after Thailand fully reopened its borders on June 1.

From January to May 2022, some 55,7000 tourists applied for VAT refunds valued at 204 million baht, with the amount rising to almost 1 billion baht from some 367,000 tourists for the seven months to December.

The amount of VAT refunds is one indicator of the recovery of the tourism industry, as it reflects foreigners’ spending in Thailand, said Lavaron.

He said the department has streamlined VAT refund process into three simple steps:

1. Tourists spending more than 2,000 baht (including tax) at shops bearing the logo “VAT refund for tourists” get the refund form (P.P.10) from the shop the same day. They must also show their passport so the shop can enter the passport number on the tax invoice.

2. Show the purchased products and corresponding documents at the customs office for approval. In case the product value exceeds 5,000 baht, tourists must present them along with documents at the customs office on their departure date.

3. Get a refund on VAT at the counters in 10 international airports countrywide for an amount of less than 30,000 baht in either cash (Thai baht), Alipay, WeChat, credit or debit card. Refunds of over 30,000 baht will be paid via credit card only in 34 days. Alternatively, tourists can mail the P.P.10 for a refund via credit card; get a refund via agencies with booths in leading department stores; or submit electronic P.P.10 from eligible shops to the Thailand VRT application, which will refund via Alipay, WeChat, and credit card.

MOST VIEWED

Tv footage of plenum shows chinese president in good health, sixty siamese crocodiles hatch in a cambodian national park, tourism leaders optimistic about meeting between cambodian and thai ministers, ngos call on the national assembly of thailand to stop serving shark fin, unleash your potential: ua combine 2024 hits bangkok in november.

- Change to white mode

- Change to normal mode

- Change to text yellow mode

4 Steps for Getting a VAT Refund for City Tourists

VAT REFUND for tourists is a tax measure to promote tourism and facilitate accurate, fast, efficient.

Therefore, VAT refunds are easy for tourists in the city to check in 4 steps as follows:

1. Buying goods from stores showing the sign “VAT REFUND FOR TOURISTS”, buying goods from the same establishment on the same day worth at least 2,000 baht (VAT included)

Ask for a tax refund request (Por Por. 10) and the original tax invoice from the shop on the day of purchase. In the case of goods that can be consumed in the Kingdom, the goods must be packaged in a secure seal and have the message “No Consumption Made Whilst in Thailand”.

2. VAT refunds in the city with an authorized agent have the following sub-details: must confirm the accuracy of the tax refund documents, the tax refund amount does not exceed 30,000 baht with insurance for the amount of tax refund requested, traveling out of the Kingdom via an international airport within 14 days of the date of submitting a VAT refund in the city, and taking the goods out of the Kingdom within 60 days from the first day of purchase.

3. A request for a refund of VAT goods (Por Por. 10) along with the original tax invoice and all purchased goods starting from 5,000 Baht per 1 tourist and per trip are required for inspection of the products at the customs counter on the day of departure prior to checking in. Presenting to the customs officer at an international airport where the drop box is installed for the customs officer to stamp and certify the VAT refund request form (Por Por. 10) for the customs officer to stamp.

4. VAT Refund Request Box (Por Por. 10) (Drop Box) Notes before dropping the box in case the purchased product is jewelry that is assembled into a body or jewelry, gold ornaments, watches, glasses, pens, Mobile phones or smart phones, laptop computers, handbags (excluding suitcases), belts worth 10,000 baht or more each.

Or products that can be carried along with travel with a purchase value per piece of 50,000 baht or more, travelers outside the Kingdom must present the goods to the revenue officer to certify the presence of the goods in the VAT refund request (Por Por 10). Bring the VAT refund request form (Por Por. 10) and the drop box to the international airport’s VAT office after passing through the passport checkpoint. The drop box is positioned in front of the VAT office for regular travelers.

Source: The Revenue Department Tel: 1161

Most Popular

Bangkok Public Park Guide

Kingdom of Thailand’s importing prohibited – restricted checklist items

Bangkok Cultural and Nature Travel Guide

Special Economic Zone (SEZ) Investment Guide

New Passport Guide

EEC Investment Guide

Guide for Dangers in the City That Tourists Should Be Aware Of

- Google Plus

Tourist VAT refund scheme in Thailand

- Thailand Taxation

- posted by msna-admin

- December 29, 2012

If you are a visitor to Thailand, you shall be qualified to a VAT refund on goods that you purchased from retailers participating in the VAT refund scheme provided that you meet all the eligibility criteria and conditions as stated below.

Before departing Thailand, travelers will be eligible for a VAT refund if the following conditions are met:

- You are a non-Thai resident and not staying in Thailand up to 180 days in a current tax year;

- You are not a pilot or a cabin crew of any airline departing Thailand on duty;

- You purchased goods from stores displaying “VAT Refund for Tourists” sign;

- VAT refund only applies to goods taken out of Thailand with the eligible traveler within 60 days from the date of purchase; and

- You leave Thailand via an international airport.

If you wish to claim a refund of the tax paid on eligible goods, a proof of export is required. To claim for a VAT refund, contact Customs officials at the airport before checking in. The following documents must be available for inspection by Customs officials:

- A valid passport;

- VAT Refund Application Form (VAT Form 10);

- An original receipt/tax invoice;

- Goods that go with the original receipts.

If the declarations for VAT refund are correct, Customs officials will sign and stamp the VAT Refund Application Form, affix a sticker to the luggage containing the eligible goods, and return everything to you. After clearing Immigration for a VAT refund, the VAT Application Form approved by the Customs must be presented to the Revenue Department officials. If a claim is for small and expensive items such as jewelry, gold, watches, pens, glasses, etc, these items must be available for inspection at the VAT Refund Office again.

Thai Customs also remind travelers to allow extra time at the airport to have application stamped and eligible goods verified, keeping in mind that other passengers are also requesting these services. You should arrive at the airport even earlier than the time recommended by your airline to be at your boarding gate on time.

Contact MSNA, Tax Advisors for consultation on Thai taxation and further information about Tourist VAT Refund.

This helps us prevent spam, thank you.

This website is managed by Siam Legal International - a law firm in Thailand

New Thailand Visa Exemption and Thailand Visa on Arrival Schemes

As of July 15, 2024, the new regulations surrounding the Thailand Visa on Arrival program and the Thailand visa exemption scheme announced earlier in the year are now in full effect. These rule updates will allow more people than ever before to visit Thailand without first having to apply for a visa at the embassy in their home country. This further supports the Thai government’s plan to increase the number of foreign tourists to 40 million by the end of the year.

This post will break down the updates to both the visa exemption and VOA programs, explain how visitors can take advantage, and list the eligible countries.

Thailand Visa on Arrival

To boost efforts to increase tourism in the country, the Thai government has made citizens from 31 countries eligible to acquire a single-entry visa after arriving in Thailand at certain immigration checkpoints (such as Thai international airports). This is a significant increase from the previous list of only 19 countries.

For only 2,000 baht, visitors will be allowed to stay in Thailand for no more than 15 days and take part in any activity allowed by the standard Thailand Tourist Visa . Unlike visa exemptions which we will get into below, the Visa on Arrival Thailand cannot be extended except in rare cases, such as an illness that prevents travel.

The following countries are eligible for the VOA program:

- Africa: Ethiopia, Namibia, Seychelles, Tunisia

- Asia: Armenia, Bhutan, China, India, Kazakhstan, Kyrgyzstan, Taiwan, Uzbekistan

- Central America: Costa Rica, El Salvador, Mexico

- Europe: Belarus, Bulgaria, Georgia, Malta, Romania, Russia, Serbia

- Middle East: Cyprus, Saudi Arabia

- Oceania: Fiji, Nauru, Papua New Guinea, Vanuatu

- South America: Bolivia, Paraguay, Venezuela

Those seeking a Thailand Visa on Arrival will need to submit the following documentation at the immigration checkpoint:

- The relevant completed application form (this can be acquired at the port of entry)*

- Valid passport with no less than a month’s validity remaining

- Recent passport-sized photograph (taken within the last 6 months)

- A return travel ticket (as proof you will not stay longer than 15 days in Thailand)

- Proof of temporary accommodation in Thailand (such as a hotel itinerary)

- Evidence of sufficient funds (10,000 Baht for individuals, 20,000 Baht for families)

*The application form can also be completed online on the Thai Immigration Bureau’s website

Visa Exemption in Thailand

This immigration rule update also increased the number of countries approved for visa exemption from 57 to 93. Citizens of these countries will now be able to stay in Thailand for up to 60 days (an increase from the old 30-day rule) without requiring a visa. Nationals from authorized countries can simply travel to Thailand and will receive a “visa exempt” stamp in their passport from Thai immigration, which acts as a travel document.

The 60-day stay can also be extended for another 30 days (at the discretion of Thai Immigration) enabling foreigners to reside for a total of 90 days. This must be done in person at Thai Immigration and will require a small fee.

Before the 90-day deadline, Thai visa-exempt travelers also have the option of applying for a new visa to let them stay in Thailand even longer. During their stay, foreign nationals are also permitted to seek urgent or ad-hoc work in the country as well as engage with tourist businesses.

The 93 countries eligible for the visa exemption scheme include:

- Africa: Mauritius, Morocco, South Africa

- Americas: Brazil, Canada, Colombia, Cuba, Dominica, Dominican Republic, Ecuador, Guatemala, Jamaica, Mexico, Panama, Peru , Trinidad and Tobago, United States, Uruguay

- East/Central Asia: Bhutan, Brunei, Cambodia, China, Hong Kong, India, Indonesia, Japan, Kazakhstan, Laos, Macao, Malaysia, Maldives, Mongolia, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Uzbekistan, Vietnam

- Europe : Albania, Andorra, Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, Ireland, Italy, Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, Russia , San Marino , Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Ukraine, United Kingdom

- Middle East: Bahrain, Cyprus, Israel, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, Turkey, United Arab Emirates

- Oceania: Australia, Fiji, New Zealand, Papua New Guinea, Tonga

In addition, 3 countries have entered into bilateral agreements with Thailand, allowing foreign nationals to enter under the Thailand visa exemption status at international airports only:

To enter the Kingdom under the Thailand visa exemption scheme, a passport is usually the only document required. However, the border agent may request additional information that must be provided to secure entry. These documents include:

- A return travel ticket

- Proof of sufficient financials (10,000 THB per person, or 20,000 THB per family)

- Proof of temporary accommodation in the country (e.g., hotel booking itinerary)

Need Assistance? Contact Siam Legal

If you have any further questions about these programs or their recent updates, contact the Thai visa consultants at Siam Legal. Or, if you’ve gotten a taste of Thailand and want to apply for a long-term visa, we provide expert services to help you get your Thai visa swiftly and successfully.

Siam Legal boasts professional teams of bilingual attorneys and visa consultants who have been helping foreigners resolve immigration and legal issues for over 20 years now. If you or your family require different immigration solutions or assistance with legal matters in Thailand, we will provide personalized services to find the ideal resolution for your needs.

Contact Siam Legal today to get started!

Related Posts

Destination Thailand Visa Revealed

A Guide to the New Destination Thailand Visa (DTV)

Thailand Visa Exemption (May 2024)

TM6 Requirement Lifted at Land and Sea Checkpoints in Thailand

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

This form collects your name, email and content so that we can keep track of the comments placed on the website. By submitting this form, you accepted and agreed on our privacy policy and terms .

Thailand expands visa-free travel for 93 countries, including Australia

Thailand has expanded its visa-free travel for Australians from 30 days to 60 days as part of a new tourism scheme.

The visa can be extended up to 30 days more through the Thai immigration bureau.

Ninety-three countries and territories are eligible for the new scheme, up from 57 previously.

On Monday, Thailand also announced relaxed rules for several other visa categories.

The validity of "digital nomad" visas for self-employed, remote workers will increase to five years from 60 days, with each stay limited to 180 days.

The country will also allow visiting students, who earn a bachelor's degree or higher in Thailand, to stay for one year after graduation to find a job or travel.

The changes, which came into effect on Monday, are part of the South-East Asian nation's latest efforts to boost travel and tourism.

Tourism is a key driver of Thailand's economy and a big source of employment, but it has struggled since the pandemic.

Thailand recorded 17.5 million foreign tourists in the first six months of 2024, the tourism ministry said, up 35 per cent from the same period a year earlier.

Foreign arrivals generated revenue of 825 billion baht ($34 billion), data showed.

In pre-pandemic 2019, Thailand welcomed a record 39.9 million arrivals, generating 1.91 trillion baht ($79 billion).

ABC/Reuters

- X (formerly Twitter)

Related Stories

'it's pretty annoying': china wants more visitors from australia, but going cashless presents some problems.

- Business, Economics and Finance

- Tourism and Leisure Industry

- Travel and Tourism (Lifestyle and Leisure)

Visa-free entry to Thailand in effect for 93 countries, territories

PUBLISHED : 16 Jul 2024 at 10:18

WRITER: Online Reporters

Visitors from 93 countries and territories can now enter Thailand without a valid visa under a new policy effective from Monday this week.

The list of countries and territories was published in the Royal Gazette on Monday night, with immediate effect.

Passport holders of the listed countries and territories can stay in the country for up to 60 days and can apply to extend their stay for up to 30 days more.

Implementation came after the signing of the directives by Interior Minister Anutin Charnvirakul and Prime Minister Srettha Thavisin .

The visa-free scheme previously applied only to passport holders from 57 countries. It was introduced, and has now been expanded, to help reinvigorate the sluggish economy, and especially the tourism sector, left reeling by the Covid-19 pandemic. (continues below)

The list of 93 countries and territories posted on @thailandinISR X account of the Thai embassy in Israel.

The Royal Gazette did not mention two other schemes promoted by the government. One is a policy to increase the number of countries eligible for visas on arrival from 19 to 31 countries.

Another measure is the introduction of the Destination Thailand Visa to attract digital nomads, freelancers and visitors wanting to learn Thai arts and skills. This new visa category is valid for five years and allows the holder to stay for up to 180 days each year.

RECOMMENDED

Cp chief’s grandson raises $60m for ai startup, hotel price hikes ruled out amid poor tourist spending, much hangs on gulf, intouch deal, butterbear enlisted to lure chinese visitors, malaysia passes law to establish duty-free zone in forest city.

Thailand Reveals 2025 Tourism Targets After Visa-Free Expansion

Peden Doma Bhutia , Skift

July 16th, 2024 at 5:37 AM EDT

In the fiercely competitive tourism landscape, where every destination is racing to attract more visitors, Thailand knows it has to move quickly and decisively. That's why it's no surprise the country is already set with its tourism strategy for 2025, looking to get ahead of the curve.

Peden Doma Bhutia

The Tourism Authority of Thailand (TAT) is aiming to increase tourism revenue in the country by 7.5% next year.

“TAT has set a target of no less than a 7.5% increase in tourism revenue for 2025, or 1.7 times higher than Thailand’s GDP growth forecast for the year. This is based on the ‘best case scenario’ of 39 million international visitors and more than 205 million domestic trips,” TAT said in a statement.

To help boost visitor numbers, Thailand has expanded its visa-free entry scheme . Citizens from 93 countries and territories can now stay for up to 60 days without a visa, while those from 31 countries and territories can apply for visas on arrival.

The countries eligible for visa-free stays include key tourism markets like China and India, as well as U.S., UK, Albania, UAE, Cambodia, Jamaica, Kazakhstan, Laos, Mexico, Morocco, Panama, Romania, Sri Lanka and Uzbekistan.

With these latest developments, the total number of countries eligible for visa-free entry soars from 57 to 93.

Last month Thailand scrapped its contentious proposal to impose a THB 300 ($8.20) tourism fee on international tourists arriving by air.

Tourism Targets and the Numbers So Far…

The earlier target for 2025 was THB 3.4 trillion ($94 billion) in total tourism revenue, up from THB 3 trillion ($83 billion) for 2024. However, Prime Minister Srettha Thavisin has expressed a desire to generate THB 3.5 trillion ($97 billion) in tourism revenue this year alone.

The projected growth of 7.5% depends on the tourism revenue Thailand receives by the end of this year, according to Thapanee Kiatphaibool, the governor of TAT.

The first half of 2024 saw 17.5 million foreign tourists, a 35% increase from the same period last year. The top five countries contributing to the rise were China, Malaysia, India, South Korea, and Russia. TAT has also adjusted its target for Indian tourists to 2.3-2.4 million this year from 2.06 million, driven by the visa-free policy.

Chinese tourists alone accounted for more than 3.4 million tourists in the first half of the year.

How Can Thailand Reach its Goal?

For 2024, TAT is focusing on 23 potential markets worldwide that account for more than 80% of the total number and revenue from foreign tourists.

The goal is to expand the number of markets each attracting at least a million tourists to 13 by 2025.

Efforts include increasing seat capacity by adding flights on current routes and introducing new routes for both regular and charter services.

The strategy will also leverage the popularity of Thai locations in series, movies, and music videos. Several K-pop artists such as (G)I-dle and Seventeen have filmed their music videos in Thailand.

The country is also ramping up efforts to cater to a diverse range of travelers as part of its strategic tourism initiatives for 2025. TAT said it would be launching targeted promotions to attract a new generation of visitors from nearby countries and territories, including China, Japan, South Korea, Taiwan, and Hong Kong.

Marketing Activities

Marketing activities will focus on millennials, families, and high-income travelers from Southeast Asia, including shoppers. Additionally, TAT aims to attract self-drive and train travelers from Malaysia, Singapore, and even China.

Among the highlights for the Chinese market, TAT will commemorate the 50th anniversary of Thai-Chinese relations with a series of events. These will include ‘Nihao Month,’ featuring influencers and celebrities, joint promotions with partners, and ‘Chinese Passport Special Deals’ to boost travel, spending, and extend stays for Chinese tourists from major and secondary cities.

For long-haul markets in Europe, Africa, the Middle East, and America, the focus will be on attracting higher spending tourists and restoring flight capacity. The strategy involves establishing new market areas and raising awareness of Thailand’s tourism offerings.

Special emphasis will be placed on first-time visitors from the UK, Ireland, Western Europe, and the Western Balkans. New generations of travelers from the Americas and Canada, including Gen-Z, millennials, Asian Americans, working couples with no kids (DINKs), and LGBTQ+ travelers, are also key targets. Additionally, luxury visitors from the six Arab countries are a significant focus.

In 2019, Thailand welcomed a record 39.9 million foreign arrivals, generating THB 1.91 trillion ($53 billion) in revenue.

Skift India Report

India is booming. Discover the subcontinent’s most important travel news here every Tuesday-Thursday.

Have a confidential tip for Skift? Get in touch

Tags: asia monthly , chinese tourism , Chinese tourists , domestic tourism , e-visas , india outbound , LGBT travel , lgbtq , luxury travel , shopping , southeast asia , thailand , tourism tax , visa waiver

Photo credit: Chinese tourists alone accounted for over 3.4 million tourists into Thailand in the first half of the year. moofushi / Adobe Stock

Thailand Gets Green Light to Use 2024/25 Budgets for $13.8 Billion Stimulus Scheme

FILE PHOTO: A view of traffic during sunrise in Bangkok, Thailand, January 5, 2024. REUTERS/Athit Perawongmetha/File Photo

By Kitiphong Thaichareon and Orathai Sriring

BANGKOK (Reuters) - Thailand will finance a 500 billion baht ($13.8 billion) household handout scheme using the 2024 and 2025 budgets after an inter-agency committee on Monday gave its approval to the funding plan, a deputy finance minister said.

The scheme, which would see about 50 million Thais receive 10,000 baht ($276) each to spend locally within six months, is slated to start in the fourth quarter but the government has struggled to find funding sources.

The size of the programme has not been scaled down but was expected to use about 450 billion baht in total, based on the previous uptake of about 90% for similar stimulus programmes, deputy minister Julapun Amornvivat told reporters.

He was discussing the scheme after a meeting of a special committee chaired by Prime Minister Srettha Thavisin, at which the central bank was also represented.

"The meeting approved the source of funds... from the 2024 and 2025 budgets, which will be sufficient," he said, adding the government would not use capital from a state-owned bank as was earlier planned.

The funding plan should be submitted to cabinet next week, Julapun added.

The "digital wallet" stimulus programme is aimed at kick-starting Southeast Asia's second-largest economy, which expanded just 1.9% last year and has been lagging regional peers.

On Monday, Srettha said registration for the 50 million eligible Thais and participating stores would start on Aug. 1.

It has taken time to ensure legal and technical matters, Srettha said on X social media, adding "people won't wait in vain".

The stimulus plan was the ruling Pheu Thai Party's flagship policy in the 2023 election. Many economists and two former central bank governors have criticised it as fiscally irresponsible, which the government rejects.

($1 = 36.19 baht)

(Reporting by Orathai Sriring, Kitiphong Thaichareon and Thanadech Staporncharnchai; Editing by John Mair and Martin Petty)

Copyright 2024 Thomson Reuters .

Tags: Thailand

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

Understanding financial advisor fees.

Julie Pinkerton July 18, 2024

7 Best Growth Funds to Buy and Hold

Tony Dong July 18, 2024

Magnificent 7 Stocks: What Are They?

Wayne Duggan July 18, 2024

Don't Fall for Forex Trading Scams

Dmytro Spilka July 18, 2024

7 Best Retail Stocks for 2024

Glenn Fydenkevez July 17, 2024

9 Growth Stocks for the Next 10 Years

Jeff Reeves July 17, 2024

Fidelity Bond Funds for Steady Income

Tony Dong July 17, 2024

15 Best Dividend Stocks to Buy for 2024

Ian Bezek July 17, 2024

AI Alliances and the Tech Race

Marc Guberti July 16, 2024

7 Best Fidelity Mutual Funds to Buy

Tony Dong July 16, 2024

7 Best Vanguard Bond Funds to Buy

Cheap Dividend Stocks to Buy Under $20

Wayne Duggan July 16, 2024

8 Best Warren Buffett Stocks to Buy

7 Best Cheap High-Dividend Stocks

Jeff Reeves July 15, 2024

Best Quantum Computing Stocks

Kate Stalter July 15, 2024

Best Peer-to-Peer Lending Platforms

Coryanne Hicks July 15, 2024

5 Best Gold ETFs for Sticky Inflation

Glenn Fydenkevez July 15, 2024

Are We in an AI Bubble?

Wayne Duggan July 15, 2024

Becoming a Financial Advisor

Kate Stalter July 12, 2024

Best BlackRock Funds to Buy in Your IRA

Glenn Fydenkevez July 12, 2024

IMAGES

VIDEO

COMMENTS

Vat Refund Payment Methods. For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a. 1.1 Cash (Thai baht only) or. 1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or. 1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB) 2.

One action that tourists should take before leaving Thailand is to apply for a VAT refund. Tourists may check and follow these procedures: - Tourists must take the goods out of the Kingdom of Thailand within 60 days from the first day of purchase; - Purchases must be made from stores displaying the "VAT REFUND FOR TOURISTS" sign; - The ...

2457. Foreign tourists, without Thai nationality, traveling in Thailand are entitled to apply for a VAT refund. The following steps outline the procedure for foreign tourists visiting Thailand to request a VAT refund: Tourists must purchase goods from stores displaying the "VAT Refund For Tourist" sign, with the merchandise costing no less than ...

Places to submit your VAT Refund Application ( P.P.10 ) VAT Refund Payment Methods . VAT Refund Table (Thailand) VAT Refund for Tourists Procedures . Reasons for VAT refund rejections . VAT Refund for Tourists Office at the Suvarnabhumi International Airport and Don Mueang International Airport . Samples of VAT Refund Application ( P.P.10 )

These goods must be taken out of the Kingdom of Thailand within 60 days, counting from the date of purchase. On the day of departure, before checking in, tourists are required to present their goods and the VAT Refund Application for Tourists (Form P.P. 10) with a total purchase value of 5,000 baht or more, for customs officers to inspect and ...

To qualify for the refund, Thai-bought goods must be purchased from stores displaying the 'VAT Refund for Tourists' sign and be at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip. Tourists must take the purchased items out of Thailand within 60 days of ...

Total value of the goods claimed for refund is less than 2,000 baht. Original tax invoices were not attached to the VAT Refund Application for Tourist form ( P.P. 10). You did not carry the goods out of Thailand on the day of your departure. Goods were not purchased from participating shops in the VAT refund for tourists scheme.

1. The tourist is required to show the purchased goods, VAT Refund Applications (P.P.10), and original tax invoices to the Customs officer at the airport to obtain a Customs stamp and signature at the lower right-hand corner of P.P.10. In case of luxury goods (jewelry, gold, ornaments, watches, glasses, and pens of which the value is over ...

Who can claim a VAT Refund? is not a Thai nationality; is not an airline crew member departing Thailand on duty. departs Thailand from an international airport. purchases goods from stores displaying a "VAT REFUND FOR TOURISTS" sign.; present the goods and submit the VAT Refund Application for Tourist form(P.P10) and original tax invoices to the Customs officers immediately before check-in for ...

Get the VAT Refund Application for Tourist Form (P.P.10 form) from the Area Revenue Office where the store is located or through the internet. Click. Excise the VAT from selling goods to tourists, and submitting report and the amount of value added tax within 15 days of the following month. Issue a tax invoice and fill in tourist's passport ...

Foreign tourists may check and follows these procedures: - Tourists must take the goods out of the Kingdom of Thailand within 60 days from the first day of purchase. - Purchases must be made from stores displaying the "VAT REFUND FOR TOURISTS" sign. - Goods must be purchased for at least 2,000 baht (VAT included) per day per store.

To get a VAT refund in Thailand, you must spend a minimum of 2,000 Baht on the same day. Also, the total amount of the cost of goods or services must total to more than 5,000 Baht as well, according to Thailand's Department of Revenue. 3.) Complete the Tax Refund Form & Tax Invoice.

The official site of Tourism Authority of Thailand. Amazing Thailand, Travel information, Travel guide, maps, hotels, accommodation, attractions, events & festivals, food, culture, shopping information to help you plan your Thailand vacations.

Getting a VAT refund in Thailand for tourists involves several special procedures: Step 1. Shopping at participating merchants: Tourists should shop at stores that participate in the program. These stores usually display signs indicating their participation and can inform customers about the process. Step 2.

Thailand has introduced new Value Added Tax (VAT) refund regulations effective from January, 2024. The new regulations are aimed at enhancing the experience for international tourists. ... This allows tourists to request a VAT refund directly without customs procedures for purchases below this amount. Value thresholds have also been adjusted ...

VAT Refund for Tourists. As a tourist, you are not required to pay Value Added Tax (VAT) on items more than 5,000 Baht that you intend to take out of Thailand. For most people the amount returned is very welcome and a pleasant surprise, so it is well worth making the effort to collect the paperwork you need for a refund.

Bangkok, 16 December, 2022 - Further enhancing Thailand's reputation as a popular shopping destination for travellers from around the world, is the VAT Refund for Tourists scheme which offers holidaymakers a refund on goods they purchase during their trip. To qualify for the refund, goods must be purchased from stores displaying the 'VAT ...

About 273,000 tourists applied for VAT refunds from January to March this year, department director-general Lavaron Sangsnit noted. The more than 700 million baht is almost half of the total VAT refunds in 2022 of 1.2 billion baht, with most of that amount coming in the second half of the year after Thailand fully reopened its borders on June 1.

Bangkok 10400 THAILAND Tel : (662) 272-9384-5,(662) 272-8195,(662) 272-9638 Fax : (662) 617-3559 Email : [email protected] VAT Refund for Tourists. Home; What's news; About us; VRT SHOP ... VAT Refund for Tourists Office Revenue Department, 90 Soi Phaholyothin7, Phaholyothin Road, ...

VAT refunds only apply to goods taken out of Thailand within 60 days from the date of purchase. Goods must have a value of at least 5,000 baht (including VAT), and single purchases must have a value of at least 2,000 baht per day. On the day of purchase, present your passport and request the sales assistant at the store to complete the VAT ...

Therefore, VAT refunds are easy for tourists in the city to check in 4 steps as follows: 1. Buying goods from stores showing the sign "VAT REFUND FOR TOURISTS", buying goods from the same establishment on the same day worth at least 2,000 baht (VAT included) Ask for a tax refund request (Por Por. 10) and the original tax invoice from the ...

December 29, 2012. If you are a visitor to Thailand, you shall be qualified to a VAT refund on goods that you purchased from retailers participating in the VAT refund scheme provided that you meet all the eligibility criteria and conditions as stated below. Before departing Thailand, travelers will be eligible for a VAT refund if the following ...

As of July 15, 2024, the new regulations surrounding the Thailand Visa on Arrival program and the Thailand visa exemption scheme announced earlier in the year are now in full effect. These rule updates will allow more people than ever before to visit Thailand without first having to apply for a visa at the embassy in their home country.

Thailand has expanded its visa-free travel for Australians from 30 days to 60 days as part of a new tourism scheme. The visa can be extended up to 30 days more through the Thai immigration bureau.

Visitors from 93 countries and territories can now enter Thailand without a valid visa under a new policy effective from Monday this week. ... The visa-free scheme previously applied only to ...

Foreign arrivals to Thailand this year through July 7 rose 35 per cent from the same period in 2023, to 18.2 million, generating revenue of 858 billion baht (US$24 billion), the Tourism and Sports ...

The Tourism Authority of Thailand (TAT) is aiming to increase tourism revenue in the country by 7.5% next year. "TAT has set a target of no less than a 7.5% increase in tourism revenue for 2025 ...

1. Tourists must take the goods out of the Kingdom of Thailand within 60 days, counting from the first day of purchase. 2. Purchases must be made from stores displaying the "VAT REFUND FOR TOURISTS" sign. 3. Must buy products worth at least 2,000 baht (VAT included) from the same establishment on the same day. 4.

BANGKOK (Reuters) - Thailand will finance a 500 billion baht ($13.8 billion) household handout scheme using the 2024 and 2025 budgets after an inter-agency committee on Monday gave its approval to ...