We’re sorry, this site is currently experiencing technical difficulties. Please try again in a few moments. Exception: request blocked

Canada is easing its travel restrictions. Here's what you need to know

Vaccinated travellers will soon be able to skip the 14-day quarantine requirement.

Social Sharing

After more than a year of travel restrictions that have impacted most Canadians, the federal government has finally begun to ease the rules.

Ottawa has embarked on Phase 1 of a multiphase approach to lift its travel restrictions. However, the government warns that the process will be gradual — based on scientific data and not people's pleas to reopen the borders.

Here's what changes are happening soon and what to expect as more Canadians get vaccinated.

Phase 1: Vaccinated travellers can skip quarantine

Since the start of the pandemic, Canada has kept its borders closed to most non-essential traffic and required a 14-day quarantine for travellers allowed to enter.

The government upped the ante in late February, mandating that travellers take a COVID-19 test upon arrival and that air passengers spend part of their quarantine at a designated hotel until they receive test results.

However, Ottawa announced on Wednesday that fully vaccinated travellers currently allowed to enter Canada will soon be able to skip the federal 14-day quarantine requirement, including the mandated hotel stay. Instead, they'll have to show proof of a negative pre-departure COVID-19 test and test negative for the virus upon arrival.

The government has not yet set a date for the rule change but says it "hopes" to implement it by early July.

"These changes will only be made if the [COVID-19] case count continues to drop and if the vaccination campaign continues to go well," said Intergovernmental Affairs Minister Dominic LeBlanc in French at a news conference on Wednesday.

Even with the changes, fully vaccinated travellers may still have to quarantine for 14 days if they enter a province that has a provincial quarantine requirement. Currently, the Atlantic provinces and the Northwest Territories require travellers — including those fully vaccinated — to quarantine. However, New Brunswick , Prince Edward Island and Newfoundland and Labrador each aim to lift the requirement for vaccinated travellers at some point this summer.

The pending federal quarantine rule change is welcome news for many vaccinated travellers — but not for those set to fly to Canada before it takes effect.

"I feel like it's a little bit of a punishment and a slap in the face," said Fay Wallenberg, who grew up in Regina and now lives in Tuscany, Italy.

Wallenberg, who's flying home on June 25 to visit her parents, has received both doses of the AstraZeneca vaccine.

She can't change her travel plans, she said, and will now arrive with the knowledge that vaccinated travellers will get to skip the quarantine hotel, potentially only a week later.

"I think it's horribly unfair," said Wallenberg. "I'm fully vaccinated."

On Wednesday, Health Minister Patty Hajdu said various government departments are still finalizing plans for the rule-change to ensure they will be "operationally ready" in July.

Is my vaccine OK? What about my kids?

At this point, only travellers who received a vaccine approved by Health Canada — Pfizer, Moderna, AstraZeneca and Johnson & Johnson — will be allowed to bypass the 14-day quarantine. The government said it will assess and consider approving other COVID-19 vaccines at a later date.

Ottawa said it's also working on a vaccine passport for travellers, and that if it's not ready by the time the rules change, Canadian border officers will determine a traveller's status based on their documentation.

- Analysis Canada still lacks national guidance for fully vaccinated Canadians as travel restrictions ease

Hajdu couldn't yet say if unvaccinated children will get to skip the hotel requirement when travelling with fully vaccinated parents. Health Canada has so far only approved the COVID-19 vaccine for those aged 12 and up .

"We will not separate families who are travelling together," Hajdu said Wednesday on Power & Politics . But she provided no further details, saying they have yet to be worked out.

What's next?

The government said it doesn't have a set timeline for when further travel restrictions will be eased.

"The metrics we're looking at are less date oriented and more disease-activity oriented," said Hajdu. Case counts, hospitalizations and vaccination rates will all play a part in dictating Ottawa's next moves, she said.

The government's next vaccination "goalpost" for easing border restrictions is to have 75 per cent of all eligible Canadians fully inoculated, said Canada's Chief Public Health Officer Dr. Theresa Tam. Currently, only seven per cent of Canadians aged 18 and older have received two doses.

What about the Canada-U.S. border?

Canada's gradual approach to lifting travel restrictions has frustrated some U.S. politicians who want to see a plan for reopening the Canada-U.S. land border put into action now.

Recently, there's been speculation that the U.S. plans to go it alone and reopen its side of the border to non-essential traffic on June 22 — when the current agreement expires.

WATCH | A look at how Canada plans to ease its travel restrictions

Fully vaccinated Canadians can soon skip hotel quarantine

U.S. immigration lawyer Len Saunders says he's spoken to nearly a dozen U.S. Customs and Border Protection officers who say they've been told the U.S. land border is reopening on that date.

"If you call me two weeks today, I'll be shocked if the border is not reopened into the U.S.," said Saunders, whose office sits close to the Canadian border in Blaine, Wash.

However, the U.S. government has denied the rumours.

- Canada eyeing multi-stage approach to reopening the border to travellers

- Unlike NHLers, other athletes not getting border exemption from Canadian government

Further, Hajdu said she met with U.S. Secretary of Health and Human Services Xavier Becerra last week and they agreed it would be beneficial for the two countries to come up with shared health protocols to ease travel restrictions.

Either way, eager cross-border travellers may get more information soon. Prime Minister Justin Trudeau and U.S. President Joe Biden are set to discuss the issue at the current G7 summit in the U.K., according to New York congressman Brian Higgins.

"In the end, these are the only two decision makers that matter," Higgins said Thursday during a panel discussion hosted by the Tourism Industry Association of Canada. "They can make a game-changing decision."

Corrections

- A previous version of this story mistakenly identified Alex Azar as the U.S. health secretary. In fact, the current U.S. secretary of health and human services is Xavier Becerra. Jun 11, 2021 10:21 AM ET

ABOUT THE AUTHOR

Business reporter

Based in Toronto, Sophia Harris covers consumer and business for CBC News web, radio and TV. She previously worked as a CBC videojournalist in the Maritimes where she won an Atlantic Journalism Award for her work. Contact: [email protected]

- @sophiaharrisCBC

Related Stories

Editor's Note

It's finally getting easier to travel to Canada , as fully vaccinated travelers will be allowed to present a rapid antigen test within one day of entering the country starting March 1, 2022. The change in testing requirements is part of a broader loosening of COVID-19 measures the Canadian government detailed Tuesday afternoon.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

"Today, the Government of Canada announced a series of adjustments to the current border measures, representing the beginning of a phased easing of travel restrictions," government officials said in a press release on Feb. 15. "The ability of the country to transition to a new phase at the border is a result of the actions of tens of millions of Canadians across the country who followed public health measures, including getting themselves and their families vaccinated."

Fully vaccinated travelers wishing to present a molecular test for entry may still do so as long as the test was taken within 72 hours of departure for Canada. At-home tests will not be accepted for entry.

"Taking a rapid antigen test at home is not sufficient to meet the pre-entry requirement – it must be authorized by the country in which it was purchased and must be administered by a laboratory, healthcare entity or telehealth service," per the release.

In addition to accepting a rapid test in lieu of a PCR test, fully vaccinated travelers are subject to randomly selected testing upon arrival. Unvaccinated travelers must continue to test on arrival with a subsequent test on day eight and a 14-day quarantine.

Today's change in travel restrictions comes less than two months after government officials urged Canadian citizens to avoid any nonessential travel outside of the country due to the omicron variant, which is no longer the case.

While testing will still be required, per this update, U.S. citizens will be able to submit a rapid antigen test instead. Antigen tests are easier to acquire and don't take as long to receive results, which should make it much easier for travelers to visit Canada.

The overall relaxation of travel-related COVID-19 restrictions appears to be a result of declining COVID-19 numbers across its provinces, which recorded a 24% decrease in the average number of new weekly cases, according to the Feb. 11 weekly epidemiology report published by the government.

Individual provinces have eased local restrictions, including Quebec and Ontario, the latter of which will no longer require proof of vaccination to access indoor spaces beginning March 1, though mask requirements remain in place.

Related: Travel is getting easier: Here are some of the countries that have eased COVID-19 protocols

- Stanley Park

- Taylor Swift

- Local Change location

- Entertainment

- Perspectives

TV Programs

- Global National

- The Morning Show

- Video Centre

- More…

- Email alerts

- Breaking News Alerts from Global News

- License Content

- New Brunswick

- Peterborough

Close Local

Your local region.

- All event types

Quick Search

Trending now.

Add Global News to Home Screen Close

Instructions:

- Press the share icon on your browser

- Select Add to Home Screen

Comments Close comments menu

Want to discuss? Please read our Commenting Policy first.

Travel restrictions and Omicron: What’s changing in Canada, U.S.

If you get Global News from Instagram or Facebook - that will be changing. Find out how you can still connect with us .

This article is more than 2 years old and some information may not be up to date.

The United States on Thursday became the latest country to announce travel requirement changes in an effort to curb the spread of the new Omicron COVID-19 variant — which will affect Canadian travellers.

The changes, announced by President Joe Biden , include a new testing requirement for travellers flying into the U.S. The testing measure starts on Monday .

The move comes days after a handful of countries, including Canada, quickly clamped down on travel and imposed bans on African countries, as fears around the new variant of concern grew.

Here are the latest travel rules imposed by both the U.S. and Canada.

U.S. travel changes

Biden’s announcement Thursday includes a requirement for all air travellers entering the U.S. — including those from Canada — to be tested for COVID-19 a day before boarding their flight, regardless of their vaccination status.

Previously, people who were fully vaccinated would have been able to present a negative test taken within 72 hours of flying to the U.S.

“It doesn’t include shutdowns or lockdowns, but widespread vaccinations and boosters and testing and a lot more,” said Biden.

The president however made no mention of any changes to current land border travel requirements between Canada and the U.S.

The new rules come less than a month since the U.S. first opened its land border to fully vaccinated Canadians. In mid-November, the Canadian government also waived PCR testing requirements for Canadians returning from the U.S. for any trip less than 72 hours.

A background briefing released by the White House ahead of Biden’s announcement also outlined other components of the new U.S. strategy against COVID-19.

The U.S. plans to expand access to booster shots and accelerate access to vaccines to kids under the age of five. It also plans to create new rapid response teams to combat the spread of Omicron outbreaks, and to ship 200 million more vaccine doses abroad within the next 100 days.

Last week, the U.S. also announced travel bans of its own on several countries, including South Africa, where the virus was first detected.

Canadian travel changes

Canada was quick to announce a wide array of new travel restrictions following the discovery of Omicron.

The federal government on Tuesday banned entry to foreign travellers who have been to Nigeria, Malawi and Egypt in the last two weeks — adding to the list of African countries facing travel bans, like South Africa, Mozambique, Namibia, Zimbabwe, Botswana, Lesotho and Eswatini, that were first announced on Nov. 26.

Canadians and permanent residents — who have the right to return to Canada — who have travelled through any of the listed countries in the past two weeks will still be allowed to return, though they must be tested at the airport and would have to quarantine while awaiting their test results.

- Is the ‘Seinfeld theory’ coming for Justin Trudeau’s political future?

- Teen in life-threatening condition after riding top of GO train: Toronto police

- How capital gains tax changes could affect some family doctors

- Thousands pack Surrey streets for Vaisakhi celebrations

According to Transport Minister Omar Alghabra, the COVID-19 testing requirement for those returning to Canada would still apply even to those who are fully vaccinated, and any tests administered in the 10 listed countries would not be accepted.

Federal ministers also announced new additions to the testing requirement Tuesday, adding that anyone now coming into Canada from a country aside from the United States would have to be tested on arrival and must isolate and await their results.

Alghabra and Health Minister Jean-Yves Duclos said Wednesday that expanding those testing requirements to American travellers was still not out of the question, though not all Canadian airports would have the capacity to begin such testing for arriving air travellers.

“The speed of implementation will also vary in local airport conditions,” he said. “There are airports in Canada which can start doing that really quickly because there is excess capacity. Other airports will take a bit more time.”

That on-arrival test would be paid for by the federal government, though the pre-departure test must still be taken before arriving in Canada, Duclos said. Unvaccinated travellers would remain the same, however, with a requirement for a 14 day quarantine, and a need to get tested upon arrival and again on day eight of their quarantine.

Duclos said that the testing requirement was set to come into effect in the “next few days,” and that he expects more than 30,000 tests to be administered at Canadian airports every day.

Industry groups have since warned that Canada’s latest testing plan could cause “chaos” at airports across the country.

Daniel Gooch, president of the Canadian Airports Council, told The Canadian Press that airports would not be able to test overseas arrivals without long waiting times.

“Do we really want people waiting for hours for a test in a customs hall?” he told the Press on Wednesday.

“We want to avoid chaos. And we want to ensure that travelers who have booked trips are comfortable to travel.”

So far, a total of nine cases of Omicron have been found in Canada since Ontario’s announcement of its first two cases Sunday. Alberta was the most recent province to announce new cases of the variant, with two more reported on Wednesday.

The U.S., on the other hand, announced Wednesday it had detected its first case of the variant in California, while at least 20 other countries — including the U.K., Denmark, Australia and Israel — have since reported Omicron infections after South African scientists identified the variant last week.

Cases of COVID-19 in South Africa reportedly doubled on Wednesday to more than 8,500, while the country’s National Institute for Communicable Diseases said that the variant had now overtaken the Delta variant among the samples it was analyzing.

Experts uncertain about travel bans

Public health officials and experts have warned against the rush to slap travel bans and restrictions amid Omicron’s spread.

Preliminary data from South Africa suggests Omicron could potentially be more transmissible and have a higher chance to cause re-infection in individuals.

Experts were quick to point out several things, however, including a lack of definitive evidence that the variant was deadlier than the current dominant strain of COVID-19 and the low vaccination rates in South Africa.

While many cautioned there is a lack of data surrounding the variant of concern, countries were quick to close their borders to African nations — prompting a harsh backlash from the World Health Organization and other public health experts.

The WHO this week warned countries to not impose travel bans and called on them to follow science and international health regulations.

Experts have pointed to travel bans as now being ineffective at this stage as the Omicron variant would have most likely spread beyond the borders of the targeted countries.

“Unfortunately for this Omicron variant, it’s too late at this stage, I think. It’s already here,” said Julianne Piper, a research fellow and project coordinator with the Pandemics and Borders research project at Simon Fraser University, in an interview with Global News earlier this week.

— w ith files from The Canadian Press, Reuters and Global News’ Saba Aziz and Leslie Young

Sponsored content

Report an error, subscribe here.

Create a free account

- Gain access to free articles

- Daily free newsletter(s)

- Ability to comment on most articles

- Build your 3D avatar and gain points

- Everything in the Free plan

- Ad-free reading and browsing

- Unlimited access to all content including AI summaries

- Directly support our local and national reporting and become a Patron

- Cancel anytime.

Forgot my password

Please enter your email and we'll send you a new password request code.

Please complete your profile to unlock commenting and other important features.

, time to level up your local game.

We have a favour to ask.

MTL Blog is looking to transition to a more sustainable future where we are no longer as reliant on advertising revenue. Upgrade now and browse MTL Blog ad-free and directly support our journalism.

This is a Pro feature.

Time to level up your local game with mtl blog pro..

Canada’s Travel Rules Have Changed — Here’s What You Need To Know

The changes officially go into effect today.

Welcome to Canada sign at Canadian border.

Attention all travellers! Entering Canada just got a little more difficult. As of Tuesday, July 19, the Government of Canada is re-establishing mandatory random COVID-19 testing for anyone entering the country, fully vaccinated or not.

Yes, not long after Transport Canada suspended random testing at Canadian airports last month, the feds are bringing it back. However, things are going to look a little different this time around.

\u201c(1/3) Mandatory random #Covid19 testing for fully vaccinated air travellers entering Canada\u2019s 4 major airports in Vancouver, Calgary, Toronto (Pearson) and Montreal resumes July 19, 2022.\nLearn more: https://t.co/02tzyQdi47\u201d — Health Canada and PHAC (@Health Canada and PHAC) 1657820266

In a recent news release, the government stated: "Mandatory random testing will resume as of July 19, 2022, for travellers who qualify as fully vaccinated, arriving in Canada by air to the four major Canadian airports, Vancouver, Calgary, Montreal and Toronto."

"To qualify as a fully vaccinated traveller to Canada, travellers must have been vaccinated with a primary series of a COVID-19 vaccine accepted by the Government of Canada for the purpose of travel at least 14 calendar days before entering Canada."

While mandatory COVID-19 testing previously took place at the airport, testing will now take place outside airports.

The federal government stated that those who qualify as either fully vaccinated, partially vaccinated or unvaccinated will undergo a random COVID-19 test off-site at either an "in-person appointment at select testing provider locations and pharmacies, or a virtual appointment for a self-swab test."

How will you know if you're randomly selected and what method of testing will you have to complete?

The Government of Canada said that travellers entering the country by air will receive an email notification within 15 minutes of completing their customs declaration.

"The email will contain information to help them arrange for their test with a testing provider in their region."

Travellers entering Canada by air who are not considered fully vaccinated must continue to test on Day One and Day Eight of their compulsory 14-day quarantine.

"Moving testing outside of airports will support testing for travellers arriving by air while still being able to monitor and quickly respond to new variants of concern, or changes to the epidemiological situation," the feds mentioned in the news release.

As for travellers entering Canada by land, mandatory random testing will continue at land border points of entry.

MTL Blog spoke with the Public Health Agency of Canada's Senior Media Relations rep, Tammy Jarbeau with some questions regarding some uncertainties surrounding the feds' decision to re-establish random COVID-19 testing.

When asked how the federal government will verify whether or not those selected to undergo a COVID-19 test, Jarbeau stated. "The Public Health Agency of Canada (PHAC) receives information from Canada Border Services Agency daily regarding travellers who have entered Canada, including whether these travellers were selected for mandatory random testing (MRT).

"On Day 4 after entry into Canada, all travellers selected for MRT receive a compliance promotion email reminding them of the importance of completing the test. On Day 5 post-entry, travellers selected for MRT who appear non-compliant with the testing requirement (e.g. PHAC does not have a record of a test being submitted to a test provider) receive a call to verify compliance."

Failure to comply can lead to penalties and fines, Jarbeau said. "Travellers may face penalties and fines of up to $5,000 (plus applicable surcharges) if they fail to meet all of the requirements."

This article's cover image was used for illustrative purposes only.

- Canada Is Extending Travel Restrictions Even Longer - MTL Blog ›

- Canada Is Ending Pre-Arrival Testing For Fully-Vaccinated ... ›

- Canada Will Bring Back Random COVID-19 Testing For Fully ... ›

- Justin Trudeau Got Called Out For Going Maskless Aboard A Train - MTL Blog ›

- Justin Trudeau Got Called Out For Not Wearing A Mask Aboard A Train - MTL Blog ›

- 5 Countries With Travel Warnings Issued By The Government Of Canada - MTL Blog ›

- 8 Countries With Travel Warnings Issued By The Government Of Canada - MTL Blog ›

Already have an account? Log in

Create an account to keep reading.

1. choose a plan.

Limited access to free articles

Unlimited access to all content, AI summaries, ad-free browsing and directly support our reporting by becoming a Patron 🙏. Cancel anytime.

2. Create your account

Canada has issued a travel advisory for this caribbean destination due to a state of emergency.

- Skip to main content

- Skip to "About this site"

Language selection

Search travel.gc.ca.

Help us to improve our website. Take our survey !

Travel advice and advisories by destination

COVID-19: travel health notice for all travellers

The Government of Canada’s official source of travel information and advice, the Travel Advice and Advisories help you to make informed decisions and travel safely while you are outside Canada. Check the page for your destination often, because safety and security conditions may change. See Travel Advice and Advisories – FAQ for more information.

Where are you going?

Take normal security precautions

Exercise a high degree of caution

Avoid non-essential travel

Avoid all travel

Travel advice from other countries

Travel advice is also provided by the governments of Australia , New Zealand , the United Kingdom and the United States .

Risk Levels

take normal security precautions.

Take similar precautions to those you would take in Canada.

Exercise a high degree of caution

There are certain safety and security concerns or the situation could change quickly. Be very cautious at all times, monitor local media and follow the instructions of local authorities.

IMPORTANT: The two levels below are official Government of Canada Travel Advisories and are issued when the safety and security of Canadians travelling or living in the country or region may be at risk.

Avoid non-essential travel

Your safety and security could be at risk. You should think about your need to travel to this country, territory or region based on family or business requirements, knowledge of or familiarity with the region, and other factors. If you are already there, think about whether you really need to be there. If you do not need to be there, you should think about leaving.

Avoid all travel

You should not travel to this country, territory or region. Your personal safety and security are at great risk. If you are already there, you should think about leaving if it is safe to do so.

Canada travel requirements 2024: What travelers need to know

We aim to keep this post updated about Canada travel in 2024 with official Canada travel restrictions, requirements, and health and safety guidance. Our goal is to help you make informed decisions so you can travel confidently, safely, and responsibly in this new post-pandemic world of ours.

As restrictions vary based on the traveler’s citizenship, we will focus primarily on rules affecting U.S. citizens.

Last update: January 28, 2024. Originally published: September 2021.

Disclosure: This post contains some affiliate links. If you make a purchase through one of our links, we may receive a small commission, at no additional cost to you.

Photo credit: Kelly January 2024: “Canada is an extremely diverse and safe Country to visit at all times of the year. Travel and daily life is back to normal, however, many employees continue to work remotely and employers continue to have a difficult time finding staff If travellers fall ill while visiting Canada, there are plenty of walk-in clinics and emergency rooms in every Canadian city, making healthcare easily accessible. However, it is still wise for travellers to purchase health insurance prior to visiting.” – Kelly of Just One Passport , resident of Canada

At the end of the post, we share more on-the-ground perspectives from local residents and travelers to Canada so you can get a true sense of what to expect.

Table of Contents

Is Canada open for travel? Can I travel to Canada right now?

As of October 2022, Canada travel restrictions for all travelers entering Canada by air, land or sea include:

- Proof of COVID-19 vaccination is not required

- COVID-19 pre-entry and arrival tests are not required

- Quarantine is not required

- ArriveCAN is not required

- Pre-boarding tests for cruise passengers are not required

- Health checks to board planes and trains are not required

- Wearing masks on planes and trains is not required but strongly recommended

Quarantine rules in Canada: What happens if I get Covid?

Foreign tourists who test positive for Covid while in Canada should self-isolate immediately. Travelers may be required to cover costs of quarantine accommodations.

Those with severe symptoms are advised to call 911 or the local emergency number in Canada.

Canada Proof of Vaccination Requirements for Dining, Travel, and other services

You might be wondering: Do I need a vaccine certificate or Covid test to enter restaurants, public transit, and other services in Canada?

As of June 2022, proof of vaccination is no longer required to board a plane, train or cruise ship when traveling within Canada. Generally it is not required to enter businesses or restaurants.

Each province or territory has the authority to require a proof of vaccination each situation.

Can I travel to Canada in April 2024? Can I travel to Canada this Spring?

Travel to Canada in April is possible for foreign travelers. Read on for details and check back for updates.

What is it like to fly to Canada right now? YYZ Toronto Pearson International Airport? YVR Vancouver International Airport? Masks are no longer required but still strongly recommended. The airports are using enhanced cleaning procedures and hand sanitizer is available throughout the terminals.

As of October 2022 , all persons arriving in Canada will no longer be subject to randomized testing at airports .

Using ArriveCAN is now optional for travelers flying into international airports to submit an Advance CBSA Declaration to save time upon arrival in airports like Toronto, Vancouver or Montréal.

What is it like to drive into Canada right now? Travelers can enter Canada during open hours at land borders . Required documents must be shown at the border.

Check Canada-US border wait times here.

Do I have to quarantine when traveling to Canada? No. Quarantine upon arrival is no longer required in Canada. Persons who test positive for Covid in Canada are asked to quarantine. See above for details.

Does Canada check COVID-19 symptoms of incoming travelers? No. Health screening procedures are no longer required to enter Canada.

Does Canada require a negative Covid 19 test for travelers? No. Covid pre-entry tests and arrival tests are no longer required.

Does Canada require a proof of Coronavirus vaccine for travelers? No . Proof of vaccination is no longer required in Canada.

Do I still need to provide a negative Covid test or quarantine if I have been vaccinated? No. Travelers are no longer required to provide a negative Covid test or quarantine to enter Canada.

Is a booster shot required for travel to Canada? At this time, booster shots are not required in Canada. There is currently no expiration period set for the validity of vaccinations.

What Covid testing options are available for travelers in Canada? U.S. citizens can obtain a COVID-19 test from provincial health authorities or private facilities in Canada.

The cost for private testing varies depending on the location and can exceed $300. Rapid tests for $60 with results in 30 minutes are available by appointment near Toronto Airport .

What healthcare options are available to travelers in Canada who get the virus? Canada hospitals and clinics are open. Canada’s universal healthcare does not pay for visitors.

Testing centers are also available for foreign visitors in some provinces and territories in Canada.

For travel insurance that covers Covid, check out Nomad Insurance by Safety Wing >

What service businesses and restaurants are open in Canada? Essential services, restaurants, bars, and retail shops are open in Canada. Some limitations, such as proof of vaccination requirement, may still be implemented in some provinces.

Check here for restrictions in each province.

Are face masks required in Canada? Wearing of face masks is no longer required in Canada but still recommended.

Are buses running in Canada? Public transportation is available throughout Canada.

Will Canada impose new Covid restrictions? What’s next is difficult to predict. Historically, most countries impose COVID-19 restrictions when strains on the health care system might become unsustainable. Canada has been relatively proactive and “strict” on preventive Covid measures.

How has the Coronavirus impacted Canada?

The coronavirus pandemic has caused a recession and increased unemployment in Canada. Tourism was hit especially hard.

Canada experienced a surge in cases with the Omicron variant. Many provinces reintroduced restrictions. As the situation came under control, Canada started easing travel restrictions.

As of October 2022, Canada ended all travel, testing, and border requirements and restrictions related to COVID-19.

Canada initially started reopening for tourism in summer 2021. As of September 2021, fully vaccinated foreign travelers have been allowed to visit the country without undergoing quarantine.

Canada began COVID-19 vaccination in December 2020. Currently, more than 3/4 of the total population has been fully vaccinated.

For the current situation in Canada, including: total COVID-19 positive cases; total cases in Canada; and COVID-19 testing in Canada, please see the Government of Canada website .

What should you pack for safely traveling in Canada?

😷 Face Masks – Face coverings are recommended in crowded public places. Find N95 masks at Bona Fide > or designer options at Vida >

💊 Medicine – Bring enough prescription and over-the-counter medication for your entire trip to avoid trips to the clinic.

💳 Vaccine Card Holder – Protect that paper CDC card when traveling abroad (if your country doesn’t offer a digital version). Get a simple plastic protector > or Vegan leather clippable > or Leather passport + card combo holder >

👃 Covid self-test – The most studied rapid antigen self-test with FDA emergency authorization. NOT valid to enter countries. Use for your own peace of mind. Order from CVS > or Walmart >

💧 Sealed water bottle – Make sure your reusable water bottle has a lid that’s not exposed to the air. We use one of each of the following: Shop insulated water bottles with protective lid > Shop water bottles with purification filter and protective lid >

✈️ Travel insurance that covers Covid – We’ve started using Nomad Insurance by Safety Wing for affordable evacuation, international medical, and trip coverage.

What do Canada locals and recent travelers say about visiting Canada now?

What is it like to visit Canada right now? It’s our goal to provide regular updates here from real people on the ground, to help potential visitors know what to expect.

The following are subjective opinions only. Official travel guidance can be found above.

September 2023 – Ryan of WaylessTravelers , Canadian: “The current state of tourism is back to normal, like during pre-Covid times. The multiple summer and fall festivals have returned to Montreal, including F1 weekend, Just for Laughs, Jazz festival etc… Restaurants are also very lively and full.

All the local attractions, restaurants, concerts, malls are back to normal operations. No restrictions (masks/gloves/testing) are imposed.

We do recommend to reserve activities and restaurants ahead of time as we have noticed that they do book up usually a few days in advance. We believe this is because a lot of Canadians are preferring to travel more locally due to still some hesitancy of traveling abroad.”

May 2023 – Nick Rosen of The World Overload , American visitor: “I flew to Quebec City and Montreal for a one week vacation in May 2023. There are currently no travel restrictions but some locals and visitors continue to follow Covid guidelines including masks and safe distances. There is easy access to healthcare and testing.

All attractions and food services continue to operate for tourism. Hours may vary depending on day/weekend. Please check ahead when scheduling. Be aware that summer is the time when most construction and repairs are done by the cities you will be visiting.”

January 2023 – Melissa from My Beautiful Passport , Canadian: “Tourism in Ontario is picking up overall, with most events & festivals resuming in 2023, if they didn’t already resume in 2022.

Canada appears ready to welcome tourists back into the country. Niagara Falls and other popular Canadian destinations are lively, restaurants and attractions are open, and people are ready to explore again, wearing masks indoors as encouraged. Hospitals are not currently overwhelmed.”

September 2022 – Michelle, Intentional Travelers, US citizen: “We flew from the US to Canada for a conference in Montreal, Quebec. I submitted our ArriveCAN information a couple days before the flight using the website. It was pretty simple to input our passport number, vaccine dates, and upload a photo of our CDC vaccine cards. Then there was a form for trip details. There was a quick Covid self-assessment form asking about fever, cough, or difficulty breathing. Confirmation included a six-digit code and QR code that we printed and brought to the airport.

After all that, we had more online processes to complete for both airlines on our itinerary (United and Air Canada), including uploading our CDC vaccine cards again. Air Canada’s site did not accept our vaccine card image, but it wasn’t a problem, I guess because we had ArriveCAN done.

To board the flight from US to Canada, we only had to show our passport and ticket. On arrival in Montreal, we only ‘flashed’ our ArriveCAN confirmation to an agent on our way to the machines where we scanned our passports and completed immigration questionnaires, which included just one question about having any Covid symptoms, and took a picture. Arriving around midnight, the process took less than 15 minutes.

We were fortunate all our bags arrived. The baggage claim looked like a luggage graveyard with hundreds of unclaimed suitcases everywhere!”

May 2022 – Mayuri of Canada Crossroads , Canadian resident: “In my province (Alberta, home to the Canadian Rockies) domestic tourism has been flourishing. All the sightseeing spots are open, but some have restricted hours.

Since February (in Alberta, and from April nationwide) things are open, no restrictions in terms of social distancing, masking, access to medical care, restaurants, stores and hotels. In fact many airports are busier than usual (including the country’s busiest Toronto airport – just flew last week). I feel we need to be a little more prepared for summer tourism as many international visitors are wanting to explore Canada.”

March 9, 2022 – Samantha of Continuous Roamer , Canadian resident: “Domestic travel in Canada is straightforward since there are no extra requirements once you have entered the country. However, mask wearing is necessary and some provinces still require a vaccine passport.

The vaccine passport has been removed in Ontario in March. Capacity in Ontario restaurants is now at 100% so it is easier to get a table. Although, free antigen covid tests are extremely difficult to access at pharmacies in Ontario. British Columbia still requires the vaccine passport, therefore lines are longer to enter some establishments while your pass and ID are checked.”

January 20, 2022 – Haley Blackall Travel , Digital Nomad: “My partner and I visited family and worked online in Kelowna BC for 2.5 months from mid-November 2022 to end of January 2022. Tourism in this region of Canada is low, due to winter conditions especially for international visitors. Make sure you have all the required documentation upon arrival, because airline personnel are doing proper checks. If you arrive in Canada from an international destination and are unvaccinated, there is a smooth running process for a mandatory Covid-19 test at the airport upon arrival, and the ArriveCAN app is easy to navigate in which the government keeps a close eye on contact tracing and quarantine requirements. Canadians have quick access to healthcare, including testing for antigen and PCR. After restaurants offering takeout and delivery services only at the beginning of the pandemic, dining in is becoming more popular. Besides the use of masks, life is getting back to normal in Canada.”

January 2022 – Mary from Brbymary, French traveler: “I flew to Vancouver for a week [from Ireland] to visit my partner’s family. Everything was well organised through ArriveCan app. Testing at the airport was easy although a bit behind and people respected rules in general. Plan some additional time to do tests at the airport and to do tests on arrival even if you have an appointment.”

December 2021 – Federica of Globetrottoise , Canadian nomad: “I would say Canada is a pretty safe destination at the moment, especially outside the big cities. I’ve been road tripping around the Yukon, British Columbia and Alberta in the past few months and always felt safe and able to enjoy most attractions, from museums to national parks. Canada is open to vaccinated travellers only and health regulations are in place in most public places. Masks are mandatory inside almost everywhere and in some provinces the access to cafes restaurants, movie theaters, libraries, etc is possible only with a valid proof of vaccination. Attractions are mostly open everywhere and access to covid testing is pretty easy (but quite pricey).”

November 12, 2021 – Nicole of Traveling BC , Canadian citizen: “While businesses are still operating under restrictions, in general, many rules have lifted and now it’s ‘full steam ahead’ in the tourism industry. Some touristy areas (the coasts and the Rockies) even became quite busy over the summer, since everyone wanted to go on a much-needed vacation. If you visit, you’ll have to show a negative COVID test and be required to wear a mask, socially distance, and show your vaccination passport!

Most people and businesses follow the restrictions and around 75% of people are fully vaccinated, although compliance with restrictions and vaccinations varies between provinces and cities. Accessing COVID testing is easy and quick, although you’ll have to pay for the test if you’re traveling. A lot of healthcare has moved to online appointments, and some hospitals are still overwhelmed in areas with lots of COVID cases. Businesses are open to tourists, but many operate under reduced hours, lower capacities and may have halted certain services/activities due to COVID. You will often have to book activities online or by phone, and make sure to wear a mask and bring proof of vaccination, or businesses will deny you entry.”

November 2021 – Chris, American digital nomad: “I flew to Newfoundland for one month in October and November of 2021. Everything seems to be open again, though every place where you would take off a mask (such as a restaurant) requires you to show proof of vaccination. People seem very respectful and friendly, happy to show you around. There is voluntary contact tracing check-ins at a lot of locations. There don’t seem to be long lines anywhere. Testing is free and readily available.”

October 9, 2021 – Nicole, Go Far Grow Close , Vancouver BC, Canadian resident: “Visitors are very much welcome. There are strict regulations for visitors to enter Canada (fully vaccinated) so we know that they are as safe or safer than the locals. So long as they follow the rules – wear masks indoors – no one cares. I feel that we are very travel ready in Canada. If you feel ill, there are free drive through covid testing sites. Hospitals are available. Local attractions, food services, and all amenities are open so long as you wear masks indoors (or when you get up in a restaurant), social distance and follow whatever other rules might be in place. Restaurants are still not at full capacity but getting there. Movie theatres are open. We eat out regularly, go to movies, and do not feel restricted.”

September 2021 – Kathy, American traveler: “We planned to spend two months in British Columbia, Canada. We had to show proof of vaccination and have a negative COVID test within 72 hours of crossing. We managed to get a test at a local CVS pharmacy (for free) and got our results in about 36 hours. Whew! There is another place to get a test in Seattle with guaranteed results but they cost $165 each. We also had to go to the website ArrivCan.com and answer questions and download our vaccine cards. Finally, in the early morning hours of August 9th we arrived at the Canadian Border just south of Vancouver, BC at around 4:30 a.m. There were approximately 20 cars/trucks in two lines. Unfortunately, the line we picked took forever so when it finally turned 6:00 a.m. another agent opened a new gate and we were there and across the border in about 10 minutes. We have now been in BC Canada for over a month. There are very few U.S. citizens here but lots of traveling Canadians. In fact, their COVID numbers have spiked so it is now a requirement to wear masks in stores/grocery stores and entering and leaving restaurants. No problem. We feel safe doing that and know that even though there is some resistance, most Canadians are fully vaccinated. In fact, as of August 13th restaurants and bars and other certain businesses now require that people show proof of vaccination to enter. I am in complete support. We feel grateful we were able to spend some of our summer in this beautiful country.”

Planning a trip to Canada?

Check out our other Canada travel resources: – The Scenic Route: Kelowna to Banff – The Best of Banff on a Budget – Kelowna: British Columbia’s Hidden Gem – Montreal, Quebec Summer Trip Guide

– 5 Awesome Things to Do in Vancouver, BC in Summer

If you have questions or updates about travel to Canada during the Coronavirus crisis or post-pandemic, please let us know in the comments below.

~ Pin this post for later or share with friends ~

Disclaimer: Please note, travel restrictions change frequently. Readers must take responsibility for verifying information through official sources like the State Department and CDC, in respect to their specific situations. No responsibility can be accepted by Intentional Travelers for action or inaction as a result of information provided through IntentionalTravelers.com. Any information provided here is issued as general information only.

Similar Posts

Kelowna: British Columbia’s Hidden Gem

We love British Columbia, Canada but Kelowna wasn’t even on our radar until we had the opportunity to pass through on our scenic drive to Banff– and we’re really glad we made the stop! The main summer attractions in Kelowna are outdoor activities and wineries. Since it’s just a one-hour flight from Seattle on Alaska Air,…

Hawaii travel requirements 2024: What travelers need to know

We aim to keep this post updated about Hawaii travel in 2024 with official Hawaii travel restrictions, requirements, and health and safety guidance. Our goal is to help you make informed decisions so you can travel confidently, safely, and responsibly in this new post-pandemic world of ours. At the end of the post, we share…

Our Ultimate Trip Wish List: 10 Travel destinations we dream of

It seems that every time we travel, wanderlust kicks in and our list of places to visit only gets longer! As digital nomads, we are fortunate to visit new destinations around the world each year. Honestly, we are content and don’t feel that there’s any one particular place that’s eluding us. There’s nowhere we have…

Vietnam travel requirements 2024: What travelers need to know

We aim to keep this post updated about Vietnam travel in 2024 with official Vietnam travel restrictions, requirements, and health and safety guidance. Our goal is to help you make informed decisions so you can travel confidently, safely, and responsibly in this new post-pandemic world of ours. Vietnam is a destination close to our hearts….

Philippines travel requirements 2024: What travelers need to know

We aim to keep this post updated about Philippines travel in 2024 with official Philippines travel restrictions, requirements, and health and safety guidance. Our goal is to help you make informed decisions so you can travel confidently, safely, and responsibly in this new post-pandemic world of ours. As restrictions can vary based on the traveler’s…

Safe Travels: Personal security tips every smart traveler should use

When we first starting traveling, there was admittedly some fear. How can we know who to trust in a foreign place? What if we get robbed? Is it safe to visit a country with high crime rates? But the more travel experiences we had – and thanks to our safety and security training for Peace…

Canada is still requiring a negative covid test 72 hours before embarkation when on a cruise ship entering any Canadian ports. This has not been changed. The change is for land ,and air and sea other than a cruise ship

Thank you for this clarification. We have updated our post to better reflect requirements for cruise ships.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Border restrictions to enter Canada extended until at least Sept. 30

The federal government announced Wednesday all existing border restrictions to enter Canada will remain in place until at least Sept. 30.

That means foreign travellers will still need to provide proof of being fully vaccinated to enter the country and unvaccinated Canadians or permanent residents will need to provide a molecular COVID-19 test taken prior to entering and quarantine for 14 days upon arrival.

The government is also still requiring all travellers, regardless of citizenship, to upload their vaccine information and travel documents to the ArriveCan app.

The restrictions were last extended on May 31 .

The announcement by the Public Health Agency of Canada (PHAC) indicates a prolonged pause of random testing at all airports until mid-July for the fully vaccinated.

That pause was implemented on June 11 as Ottawa’s attempt to mitigate congestion and delays at airports caused by heightened travel demand and staffing shortages.

Their stated intention is to move COVID-19 testing for air travellers outside of airports to “select test provider stores” such as pharmacies or by virtual appointment.

“Moving testing outside of airports will allow Canada to adjust to increased traveller volumes while still being able to monitor and quickly respond to new variants of concern, or changes to the epidemiological situation,” the PHAC statement reads.

On June 11, the government also announced it was dropping the vaccine mandate for domestic and outbound international travellers effective June 20.

Many industry organizations and opposition MPs have long called on the government to drop various border measures, namely duplicative processes that slow down travel, arguing they have the potential to stifle Canada’s already depleted tourism sector.

In response, Canada’s ministers of health and tourism continue to reinforce that while the epidemiological situation in Canada has improved, the pandemic still exists.

“As we move into the next phase of our COVID-19 response, it is important to remember that the pandemic is not over. We must continue to do all that we can to keep ourselves and others safe from the virus,” Health Minister Jean-Yves Duclos said in the Wednesday statement.

He added that Canada’s border measures remain “flexible” and “guided by science and prudence.”

(1/2) The #GoC is extending current border measures for travellers entering Canada until at least Sept 30, 2022. Learn more: https://t.co/EjE5mqb0wx pic.twitter.com/FJ3sKJNvXe — Health Canada and PHAC (@GovCanHealth) June 29, 2022

CTVNews.ca Top Stories

BREAKING | Jury finds Zameer not guilty in Toronto police officer's death

A man accused of fatally running over a Toronto police officer has been found not guilty. More coming.

Tim Hortons refutes potential lawsuit for Roll Up To Win prize snafu

Tim Hortons insists a potential class action lawsuit involving customers who were sent an email by mistake during the company's Roll up to Win contest has "no merit."

Male youth in life-threatening condition after climbing on top of moving GO train and falling: police

A 15-year-old boy is in hospital in life-threatening condition after climbing on top of the GO train, coming into contact with a stationary object and falling just after 12 a.m. on Sunday morning.

What's a Barnacle? It's yellow, sticks and screams if you try to pry it off your car

Barnacles, bright yellow devices used to make sure parking scofflaws pay their tickets, could soon be making their way to cities across Canada.

Young brother and sister dead after suspected drunk driver crashes into birthday party in Michigan

A young brother and sister died and several people were injured, some of them seriously, when a vehicle driven by a suspected drunken driver crashed into a young child's birthday party Saturday at a boat club.

Strong Canadian showing in NHL playoffs is good news for fans

For Russ Jericho, seeing the Edmonton Oilers enter the Stanley Cup playoffs is the culmination of an unlikely passion.

Child not secured, mother holding baby on Highway 401 in eastern Ontario, driver facing charges

The Ontario Provincial Police (OPP) says a car that was initially stopped for stunt driving on Highway 401 in eastern Ontario had a child and a baby not safely seated Friday evening.

In domestic abuse, strangulation is a 'hidden' predictor of femicide, experts say

Georgina McGrath, one of many survivors of domestic abuse, says police officers, judges and lawyers need specialized training about strangulation in intimate partner violence cases.

Key players: Who's who at Donald Trump’s hush money criminal trial

Donald Trump’s hush money criminal trial shifts to opening statements Monday, followed by the start of witness testimony. A jury of seven men and five women, plus six alternates, was picked last week.

Whale experts confident orca calf will survive, find family if rescue plan succeeds

The odds of a two-year old killer whale calf surviving in the open ocean on its own and eventually reuniting with family members remain solid if a rescue team manages to free the orca from the Vancouver Island lagoon where she's been trapped for nearly a month, whale experts say.

Cap on plastic production remains contentious as Ottawa set to host treaty talks

Negotiators from 176 countries will gather in downtown Ottawa this week for the fourth round of talks to create a global treaty to eliminate plastic waste in less than 20 years. The aim is to finalize a deal by the end of the year.

Will there be a 'superbloom' this year in California? Here's what to know

Carpets of yellow, orange and gold flowers are beginning to cover Southern California's vast deserts, the Bay Area's dramatic bluffs and even near Los Angeles International Airport.

Crush of lawsuits over voting in multiple U.S. states creates a shadow war for the 2024 election

As U.S. President Joe Biden and Donald Trump step up their campaigning in swing states, a quieter battle is taking place in the shadows of their White House rematch.

Ukrainian and Western leaders laud U.S. aid package while the Kremlin warns of 'further ruin'

Ukrainian and Western leaders welcomed a desperately needed aid package passed by the U.S. House of Representatives, as the Kremlin warned the passage of the bill would 'further ruin' Ukraine and cause more deaths.

Israeli strikes on southern Gaza city of Rafah kill 22, mostly children, as U.S. advances aid package

Israeli strikes on the southern Gaza city of Rafah overnight killed 22 people, including 18 children, health officials said Sunday, as the United States was on track to approve billions of dollars of additional military aid to its close ally.

2 Japanese navy helicopters crash in the Pacific Ocean during training, leaving 1 dead and 7 missing

Two Japanese navy helicopters carrying eight crew members crashed in the Pacific Ocean south of Tokyo during nighttime training in a possible collision, leaving one dead while rescuers on Sunday searched for seven others missing, the defence minister said.

Conservatives won't say whether they'd reverse capital gains tax change

Despite expressing vehement opposition to the newly unveiled federal budget, Conservative deputy leader Melissa Lantsman would not say whether her party would reverse the Liberals' plan to increase the capital gains inclusion rate.

'We recognize it's a very challenging time': Minister insists budget won't blunt innovation

Despite significant criticisms from business owners and entrepreneurs that parts of the federal government's latest budget — specifically changes to taxes on capital gains — will stunt innovation, Small Business Minister Rechie Valdez insists it won't.

Here’s what marijuana researchers have to say about 420 or 'Weed Day'

Marijuana is legalized for recreational use in Canada and 24 U.S. states, two territories and the District of Columbia.

Shivering for health: The myths and truths of ice baths explained

In a climate of social media-endorsed wellness rituals, plunging into cold water has promised to aid muscle recovery, enhance mental health and support immune system function. But the evidence of such benefits sits on thin ice, according to researchers.

Dengue cases top 5.2 million in the Americas as outbreak passes yearly record, PAHO says

Dengue cases are surging in the Americas, with cases reported topping 5.2 million as of this week, surpassing a yearly record set in 2023, according to the Pan American Health Organization (PAHO).

Ottawa puts up $50M in federal budget to hedge against job-stealing AI

Worried artificial intelligence is coming for your job? So is the federal government -- enough, at least, to set aside $50 million for skills retraining for workers.

The House votes for possible TikTok ban in the U.S., but don't expect the app to go away soon

The House passed legislation Saturday that would ban TikTok in the United States if the popular social media platform's China-based owner doesn't sell its stake within a year, but don't expect the app to go away anytime soon.

Olympic organizers unveil strategy for using artificial intelligence in sports

Olympic organizers unveiled their strategy Friday to use artificial intelligence in sports, joining the global rush to capitalize on the rapidly advancing technology.

Entertainment

'The Tortured Poets Department': A track-by-track listener's guide to Taylor Swift’s 31-song double album

Taylor Swift released 'The Tortured Poets Department' on Friday, a 31-track surprise double album.

A Nigerian chess champion plays the royal game for 60 hours - a new global chess record

A Nigerian chess champion and child education advocate played chess nonstop for 60 hours in New York City's Times Square to break the Guinness World Record for the longest chess marathon.

Not a toddler, not a parent, but still love 'Bluey'? You're not alone

She's the title character of 'Bluey,' a kids' program consisting of seven-minute episodes that have enraptured children and adults alike. This week's release of its longest episode yet — at a whopping 28 minutes — prompted an outpouring of appreciation for the show, even from those who are neither toddler nor parent.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”

Lululemon to shutter Washington distribution centre, lay off 128 employees

Lululemon Athletica will close its distribution centre in the state of Washington at the end of the year and lay off more than 100 employees, the apparel retailer told Reuters on Friday.

'Jonny is special': Moncton music community rallies around drummer

A GoFundMe campaign for a Moncton drummer has raised around $49,500 in just a few weeks.

After hearing thousands of last words, this hospital chaplain has advice for the living

Hospital chaplain J.S. Park opens up about death, grief and hearing thousands of last words, and shares his advice for the living.

How 4/20 grew from humble roots to marijuana's high holiday

Saturday marks marijuana culture’s high holiday, 4/20, when college students gather — at 4:20 p.m. — in clouds of smoke on campus quads and pot shops in legal-weed states thank their customers with discounts.

DeBrusk, Swayman power Bruins over Maple Leafs 5-1 in Game 1

Jake DeBrusk had two goals and an assist as the Boston Bruins downed the Toronto Maple Leafs 5-1 in Game 1 of their first-round playoff series Saturday.

Nurse OT winner breaks Montreal hearts as Toronto wins PWHL 'Duel at the Top'

Toronto's Sarah Nurse broke Montreal hearts 13 seconds into overtime in front of a record-setting PWHL crowd at the Bell Centre.

Young people 'tortured' if stolen vehicle operations fail, Montreal police tell MPs

One day after a Montreal police officer fired gunshots at a suspect in a stolen vehicle, senior officers were telling parliamentarians that organized crime groups are recruiting people as young as 15 in the city to steal cars so that they can be shipped overseas.

Tesla recalling nearly 4,000 Cybertrucks because accelerator pedal can get stuck

Tesla is recalling 3,878 of its 2024 Cybertrucks after it discovered that the accelerator pedal can become stuck, potentially causing the vehicle to accelerate unintentionally and increase the risk of a crash.

Local Spotlight

UBC football star turning heads in lead up to NFL draft

At 6'8" and 350 pounds, there is nothing typical about UBC offensive lineman Giovanni Manu, who was born in Tonga and went to high school in Pitt Meadows.

Cat found at Pearson airport 3 days after going missing

Kevin the cat has been reunited with his family after enduring a harrowing three-day ordeal while lost at Toronto Pearson International Airport earlier this week.

Molly on a mission: N.S. student collecting books about women in sport for school library

Molly Knight, a grade four student in Nova Scotia, noticed her school library did not have many books on female athletes, so she started her own book drive in hopes of changing that.

Where did the gold go? Crime expert weighs in on unfolding Pearson airport heist investigation

Almost 7,000 bars of pure gold were stolen from Pearson International Airport exactly one year ago during an elaborate heist, but so far only a tiny fraction of that stolen loot has been found.

Marmot in the city: New resident of North Vancouver's Lower Lonsdale a 'rock star rodent'

When Les Robertson was walking home from the gym in North Vancouver's Lower Lonsdale neighbourhood three weeks ago, he did a double take. Standing near a burrow it had dug in a vacant lot near East 1st Street and St. Georges Avenue was a yellow-bellied marmot.

Relocated seal returns to Greater Victoria after 'astonishing' 204-kilometre trek

A moulting seal who was relocated after drawing daily crowds of onlookers in Greater Victoria has made a surprise return, after what officials described as an 'astonishing' six-day journey.

Ottawa barber shop steps away from Parliament Hill marks 100 years in business

Just steps from Parliament Hill is a barber shop that for the last 100 years has catered to everyone from prime ministers to tourists.

'It was a special game': Edmonton pinball player celebrates high score and shout out from game designer

A high score on a Foo Fighters pinball machine has Edmonton player Dave Formenti on a high.

'How much time do we have?': 'Contamination' in Prairie groundwater identified

A compound used to treat sour gas that's been linked to fertility issues in cattle has been found throughout groundwater in the Prairies, according to a new study.

Out-of-control wildfire burning in central B.C., visible from Highway 97

An out-of-control wildfire in B.C.’s Cariboo region is suspected to be human caused, according to officials, who say crews were called to a number of blazes Saturday.

Drivers warned to expect delays while overpass repairs underway in Delta

Work is now underway to repair an overpass in Delta that sustained significant damage when a commercial truck with an over height load crashed into it last year, according to officials.

Two people injured in Scarborough crash

Two people are injured after a four-vehicle crash in Scarborough Sunday morning.

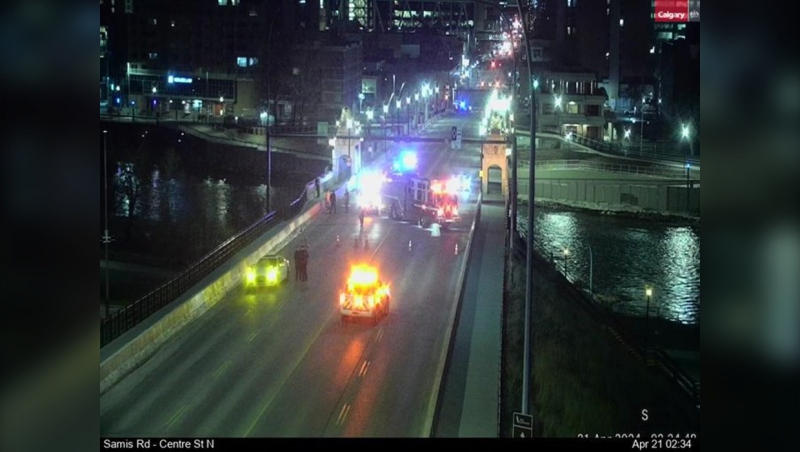

Centre Street Bridge reopens after pedestrian struck early Sunday

Centre Street Bridge has reopened after being closed early Sunday morning for an investigation into a collision between a vehicle and pedestrian that sent one person to hospital.

Police investigate stabbing in northeast Calgary Saturday evening

One person is in stable condition in hospital after a stabbing in northeast Calgary.

Taylor Swift law class at Queen’s University making shock waves

A first of its kind entertainment law course centred on Taylor Swift will be offered this fall at Queen’s University.

Ottawa Mayor Mark Sutcliffe finishes London Marathon in just over 4 hours

Ottawa Mayor Mark Sutcliffe had “a great day” in London Sunday when he ran in the marathon.

Montreal woman loses close to $25,000 in crypto platform scam

A Montreal woman says she lost close to $25,000 on a fake crypto trading platform she thought was developed by Elon Musk, highlighting the dangers of online scams, which are becoming more and more sophisticated.

Situation improving in Montreal's Village, but problems persist

Members of the community in Montreal's Village neighbourhood say they've seen some improvements to local security and cleanliness, but argue Quebec needs to do more to support vulnerable people in the area.

Range Road 221 closed due to Sunday morning collision in Ardrossan

Strathcona RCMP are on scene of a Sunday morning collision on Range Road 221 in Ardrossan, Alta.

SUV stolen, owner run over in carjacking on Jasper Avenue Saturday morning: EPS

A man was run over by his own SUV Saturday morning after it was stolen by a carjacker on Jasper Avenue.

Brush fire burning in Grande Prairie County, public asked to avoid area: RCMP

Grande Prairie RCMP are asking the public to avoid the area around a brush fire that is burning Sunday morning.

Wrongfully convicted New Brunswick man dies months after exoneration

A wrongfully convicted New Brunswick man who spent decades trying to clear his name before being declared innocent by a judge in January has died at the age of 80.

One man in custody after weapons-related incident in Halifax

Halifax Regional Police has taken one man into custody after a weapons incident early Sunday morning.

Boil water advisory in place for Middle Musquodoboit after water main break

Halifax Water says water service has been restored to customers in Middle Musquodoboit after a water main break, but a boil water advisory is in effect for the area.

Winnipeg woman charged after police vehicle rammed in traffic stop

A 25-year-old woman is facing a number of charges following a dangerous chase Saturday evening in Winnipeg’s River Heights and Charleswood neighbourhoods.

What Winnipeg Jets fans need to know before heading downtown for Game 1

In preparation for the first Winnipeg Whiteout Street Party of the year, the city is shutting down streets and rerouting transit.

‘It’s a real celebration’: Manitoba chefs face off in 2nd annual charity chili competition

Dozens of vendors lifted their ladles for the second annual St. Norbert Farmers’ Market charity chili cook off Saturday.

'It's very sad': Regina's Centennial Market being forced to close

Regina's Centennial Market (CM) is being forced to close after an inspection by Regina Fire and Protective Services (RFPS) found the building was not up to code.

'Recklessly spending tax dollars': Questions arise over cost of government infrastructure projects

Questions are being asked in the legislature about the significant cost of two major government infrastructure projects.

Regina fire crews battle early morning blaze, 22 suites displaced

Fire crews battled an early morning blaze that displaced occupants from 22 suites.

Rider taken to hospital with life-threatening injuries following ATV rollover

A lone rider involved in an ATV rollover has been transported to hospital with life-threatening injuries.

Suspect wanted on 25 charges as part of stolen vehicle investigation in southwestern Ontario

Waterloo regional police are looking for a woman after they recovered nine stolen vehicles and laid more than 50 charges in connection to a fraud investigation.

Conestoga College and John Tibbits named in defamation lawsuit

Conestoga College and its president John Tibbits have been named in a defamation lawsuit.

Saskatoon potters gather for pottery exhibition

The Saskatoon Potters Guild is back with their annual spring exhibition.

Saskatoon judge to make ruling on evidence in fatal THC-impaired driving case

A Saskatoon Provincial Court judge will determine whether testimony from a woman, charged with impaired driving causing the death of a child, will be used as evidence in her trial.

Saskatoon man facing multiple charges after break-in, stolen vehicle

A 34-year-old Saskatoon man is facing multiple charges after a break-and-enter escalated into an armed robbery.

Northern Ontario

Northern ont. man fined after decoy operation catches him hunting on private property.

A Thunder Bay man has been fined $2,000 after he was caught in a decoy operation hunting on private land.

'Unproductive day at the table': Negotiations between Western graduate TAs and university stall

Flanked by major union players from the Canadian Union of Public Employees (CUPE) and the Ontario Federation of Labour, graduate-level teaching assistants (GTAs) at Western University remain on the picket line.

Early morning shooting under investigation by London police 'sounded like a shotgun or rifle,' says neighbour

Police say a man was found with a gunshot wound just before 5 a.m. Saturday in a northwest London neighbourhood.

Here's how Barrie residents are making a difference this weekend ahead of Earth Day

Barrie residents are taking their Spring cleanup to the outdoors this weekend as they move to help clean their neighbourhoods.

Orillia OPP records six impaired driving arrests in past week

The driver of a pick-up truck that rolled over in a Saturday afternoon crash on Highway 400 was the sixth driver to be charged by Orillia OPP for impaired operation-related offences in the last seven days.

Simcoe County LifeLabs employees protest over wage disparity

LifeLabs workers in Barrie joined others from across the region on Saturday in protesting ahead of a looming strike deadline.

Unifor Local 444 president Dave Cassidy announces he is retiring

Dave Cassidy has held the position of Unifor Local 444 president since 2018.

Hundreds race at Point Pelee National Park raising $10K for Crime Stoppers

More than 350 runners and walkers have helped raise approximately $10,000 for Crime Stopppers in Windsor-Essex by participating in the 22nd annual Southern Footprints at Point Pelee National Park.

Detroit River marine training boosts cooperation and preparedness, say commanders

Sailors from the Royal Canadian Naval Reserve are conducting exercises on the river alongside various emergency service groups this weekend, aiming to respond effectively in a coordinated manner to water emergencies.

Vancouver Island

Ea sports simulation predicts vancouver over boston in 2024 stanley cup final.

If EA Sports' annual Stanley Cup playoffs simulation is correct, the Vancouver Canucks are about to exorcise a whole lot of demons.

Victoria is B.C.'s 'dopest' city, according to Uber Eats

When it comes to delivery dope, B.C.'s capital comes out on top, according to Uber Eats.

Stolen snake named Milkshake returned to Kelowna pet store

A banana ball python that was stolen from a Kelowna pet store on Saturday has been returned unharmed, Mounties said.

Nurses rally at B.C. Interior hospital over security, staffing concerns

Nurses held a rally Wednesday at a hospital in the B.C. Interior that closed its emergency department more than a dozen times last year due to insufficient staff.

B.C. to add 240 complex-care housing units throughout province

British Columbia is planning to add 240 new units to its complex-care housing program, providing homes for people with mental-health and addictions challenges that overlap with other serious conditions.

Lethbridge gets a new theatre company to showcase city's storytellers

A new theatre group is setting up shop in Lethbridge.

Hicks stops 43 shots as Brooks Bandits down Okotoks 4-0 in BCHL series opener

The Okotoks Oilers poured it on Friday night, firing 43 shots at goalie Johnny Hicks, who stopped them all, leading the Brooks Bandits to a 4-0 win.

Lethbridge man charged over six incidents where women were approached and solicited

A Lethbridge man has been charged in connection with six different incidents where women were approached and solicited.

Sault Ste. Marie

Kyle Dubas joins Canada's front office for world hockey championship

The Sault's Kyle Dubas has been named to Canada's front office team for the upcoming world hockey championship.

Two historic northern Ont. buildings vie for $50K

Historic buildings across Canada are competing for up to $50,000 to help with restoration costs.

Phoenix Rising looking for community partners

A Sault Ste. Marie-based support group for women is hoping to work with other groups to provide more inclusive services.

N.L. gardening store revives 19th century seed-packing machine

Technology from the 19th century has been brought out of retirement at a Newfoundland gardening store, as staff look for all the help they can get to fill orders during a busy season.

500 Newfoundlanders wound up on the same cruise and it turned into a rocking kitchen party

A Celebrity Apex cruise to the Caribbean this month turned into a rocking Newfoundland kitchen party when hundreds of people from Canada's easternmost province happened to be booked on the same ship.

Protest averted as Newfoundland and Labrador premier helps reach pricing deal on crab

A pricing agreement has been reached between crab fishers and seafood processors that will allow for Newfoundland and Labrador's annual crab fishery to get started.

Shopping Trends

The Shopping Trends team is independent of the journalists at CTV News. We may earn a commission when you use our links to shop. Read about us.

Editor's Picks

17 practical things for your backyard that you'll want to order immediately, 19 of the best mother's day gifts under $50, here are the best deals you'll find on amazon canada right now, our guide to the best inflatable hot tubs in canada in 2024 (and where to get them), 21 of the best dog products you can get on amazon canada right now, our guide to the best coolers in canada in 2024 (and where to get them), 17 unique mother's day gifts your mom definitely wants, but probably won’t buy herself, if your mom needs a bit of rest and relaxation, here are 20 of the best self-care gifts for mother's day, 20 gifts that are so great, you'll want to keep them for yourself, 12 travel-sized skincare products that'll fit in your toiletry bag, 15 wrinkle-smoothing serums that’ll help reduce the appearance of fine lines, this canadian red light therapy brand is here to give you your best skin ever, stay connected.

Exploring The Recent Revision: Have Canada's Travel Restrictions Evolved?

- Last updated Aug 31, 2023

- Difficulty Beginner

- Category United States

In the midst of a global pandemic, Canada has made significant changes to its travel restrictions, creating a buzz among travelers and international communities alike. With borders closed and strict quarantine measures in place, the country has taken a cautious approach to protect its citizens. However, recent developments have shown a shift in Canada's travel policy, giving hope to those eager to explore the Great White North once again. These updated restrictions present a fresh opportunity for travelers looking to experience the breathtaking beauty and vibrant culture Canada has to offer. From the majestic Rocky Mountains to the charming cities of Toronto and Vancouver, there has never been a better time to plan a trip to Canada.

What You'll Learn

What specific travel restrictions has canada recently implemented or changed, are the travel restrictions in canada more or less strict compared to other countries, how have the changes to travel restrictions in canada affected international travelers, what are the current requirements for entering canada during the pandemic, are there any exemptions or special considerations for certain travelers regarding the travel restrictions in canada.