- Information & Technology

- Travel Agencies Market

Region : Global | Format: PDF | Report ID: BRI101803 | SKU ID: 21059769

Travel Agencies Market Size, Share, Growth, and Industry Analysis, By Type (International and Domestic Airline Bookings, Tour and Packaged Travel Bookings, Accommodation Bookings, Cruise Bookings, Car Rental and Others), By Application (Online and Offline), Regional Insights, and Forecast To 2031

- Table of Content

- Methodology

- Segmentation

- Get a Quote

- Request Sample PDF

Request FREE sample PDF

Pharmacy benefit management market

We are committed to keeping your personal information safe and secure, Privacy Policy

Travel Agencies Market Report Overview

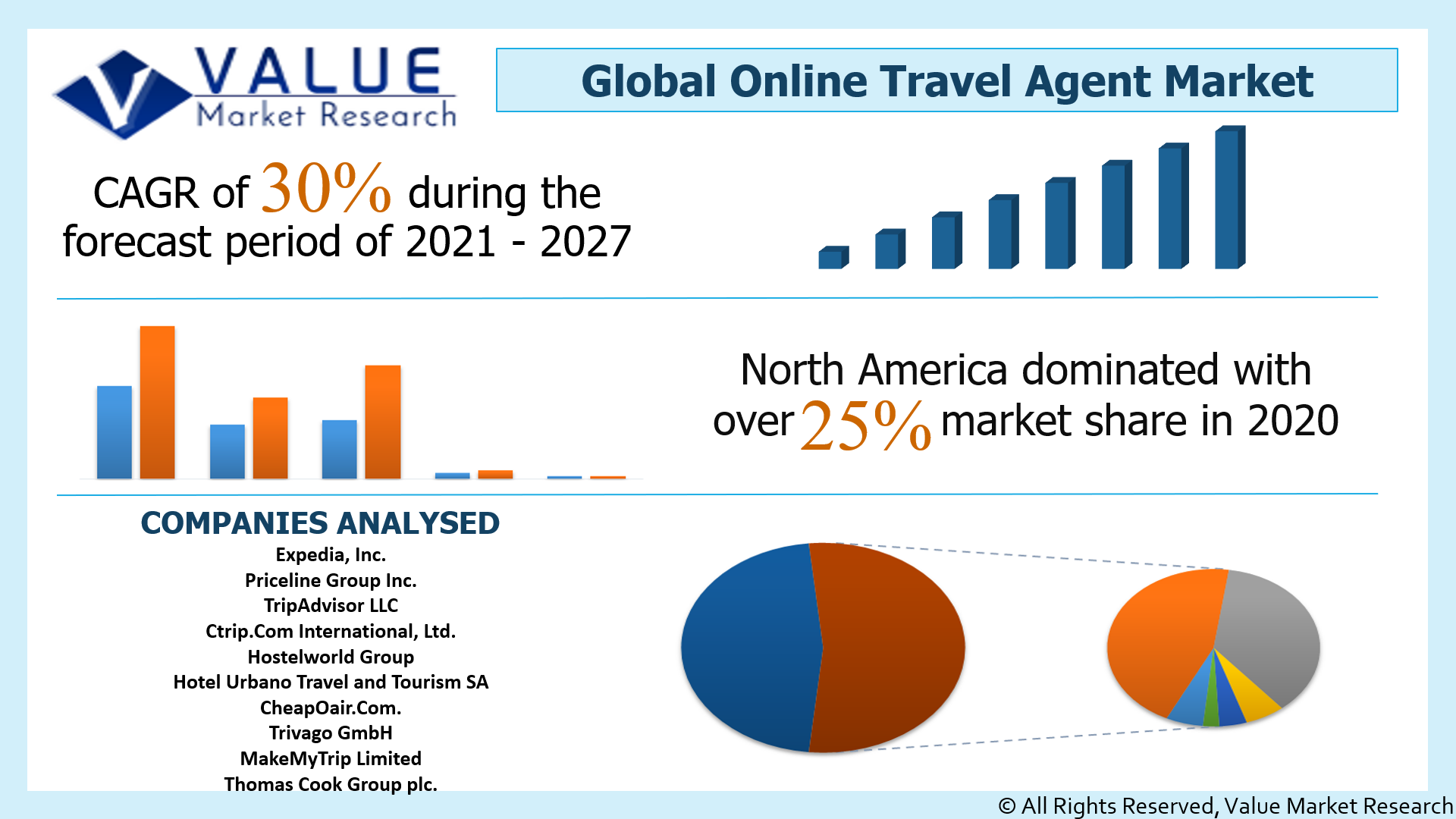

The global travel agencies market size was USD 153540 million in 2021 and is projected to touch USD 698483.32 million by 2031, exhibiting a CAGR of 15.6% during the forecasting period.

A company that facilitates trip preparation and booking is a travel agency. They may assist with booking travel and lodging as well as organising excursions and activities. A travel agent is someone who is fully knowledgeable in the tourist product, including destinations, modes of transportation, climate, lodging, and other service-related fields. He represents the principals or product providers on whose behalf he works in exchange for a commission. The owner or manager of an agency is technically a travel agent, but other staff members are in charge of giving tourists recommendations and selling travel packages, tours, and other travel-related products. A travel agent is a person, company, or organisation that is also known as a travel agency. An agency is the location of a travel agency or other business where everyone

COVID-19 Impact: Bad Impact on Tourism Due to Lockdowns to Hamper Market Growth

The global COVID-19 pandemic has been unprecedented and staggering, with travel agencies market experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. The sudden spike in CAGR is attributed to the travel agencies market growth and demand returning to pre-pandemic levels once the pandemic is over.

In addition to killing over a million people, the coronavirus drastically altered people's daily routines in a short period of time, had a negative impact on the world economy, and spread panic. The tourist sector appears to have been the hardest devastated by the Covid-19 epidemic of all the afflicted industries, affecting a number of related industries like hotel, travel and tour operators, all forms of transportation services, and many more. Hotels, cafes, taverns, and restaurants just closed their doors as flights were grounded, cities came to a standstill, trains stopped operating, and practically all public transportation ceased to operate. The market for travel agents was negatively impacted by this.

LATEST TRENDS

" Rising Demand for Leisure Travel to Enhance Market Growth "

The reduction in the number of hours in the workweek has led to an increase in leisure travel. This frees up more time for leisure pursuits. People are no longer required to save money by taking unpaid vacations. People can now spend that extra money. There is now a larger selection of leisure activities, so everyone may find something they enjoy. Transportation is become more affordable, simple, and quick. As a result, more people may take vacations overseas and access leisure activities more easily. Leisure travel directly benefits travel agencies market.

RESTRAINING FACTORS

" Risks Involved in Tourism to Impede Market Growth "

The development of global travel agencies is anticipated to be hampered by elements including potential dangers associated with adventure travel, unpredictable climate conditions, and possibility for catastrophes. These factors pose serious threat to the lives of tourists so precautions need to be taken which make it a little expensive. This is anticipated to hamper market growth.

Travel Agencies Market Segmentation

Based on type; the market is divided into international and domestic airline bookings, tour and packaged travel bookings, accommodation bookings, cruise bookings, car rental and others.

In terms of product, tour and packaged travel bookings is the largest segment.

- By Application

Based on application; the market is divided into online and offline.

In terms of application, online is the largest segment.

DRIVING FACTORS

" Inclination of Youth Towards Tourism to Augment Market Growth "

Youth travel preferences, increasing interest in adventure sports and affordable travel packages are anticipated to support market expansion throughout the course of the projected period. Nowadays, it is thought that travelling is a crucial component of adolescent education and activities. Young kids benefit from educational trips that broaden their knowledge and encourage the development of new concepts. The best way to improve health, happiness, and enjoyment is to travel. Additionally, it fosters youth's sense of national solidarity. Most individuals travel for pleasure because it thrills the heart and expands the mind. Seeing the splendours of nature gives people enormous joy. Travellers’ hearts are touched by the majestic mountains and meadows, streams and rivers, the deep blue sky, green trees, the enormous desert, and the open sea. This is anticipated to drive travel agencies market growth.

" Government Initiatives in Travel Agency to Promote Market Growth "

The factors driving the growth of the travel agency market in the future include an increase in government initiatives in the form of public-private partnerships to promote tourism, a spike in travel-related social media trends, intense competition among travel agencies to offer affordable travel packages, fewer travel restrictions, as well as the economic evolution. This is anticipated to boost market growth.

Travel Agencies Market Regional Insights

" North America to Dominate the Market Due to Increased Tourism "

North America dominated the global travel agencies market share. The expansion of the regional market can be linked to a number of variables, including an increase in business travel, an increase in tourism, and the expansion of online travel agencies. Furthermore, it is anticipated that the presence of significant businesses in this region will fuel growth over the following eight years. In North America, demand for foreign travel among both people and corporate entities is expected to rise significantly throughout the projected period as a result of rising disposable income and a better standard of life.

Additionally, due to increased awareness of the various modes of transportation available globally, rapid development and improved infrastructure facilities will spur industry expansion throughout this region during the same period, driving overall revenue share across all segments, including domestic airlines booking service providers, tour operators, accommodation reservations, and car rental agencies, and others.

KEY INDUSTRY PLAYERS

" Intense Competition Among Market Players to Boost Market Growth "

Some of the most prominent and incumbent players functioning within the global travel agencies market include Omega World Travel, Ovation Travel Group, Thomas Cook, Travel and Transport, Travelocity, Travelong, TravelStore, TripAdvisor, Uniglobe Travel International, World Direct Travel. The market's competitive environment may become more intense in the coming years as more new companies prepare to enter the industry . The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

List of Market Players Profiled

- Booking Holdings Inc. (U.S.)

- Expedia Group Inc. (U.S.)

- Trip.com Group Limited (China)

- Tripadvisor, Inc. (U.S.)

- Trivago NV (Germany)

- eDreams (Spain)

- Odigeo (Spain)

REPORT COVERAGE

The report examines market channels of travel agencies and provides information on the elements affecting probable future global development. Additionally, the report looks at market size and share, regional trends, end-use categories, and market segments. It emphasises the importance of outlining an exhaustive regional analysis. The Global travel agencies study also carried out a sector analysis to comprehend the key driving factors and entry barriers of the market. The paper also offers suggestions on how businesses might strengthen their market positions in light of significant alterations in the market dynamics.

Frequently Asked Questions

The travel agencies market is expected to touch USD 698483.32 million by 2031.

The travel agencies market is expected to exhibit a CAGR of 15.6% by 2031.

Inclination of youth towards tourism and government initiatives in travel agency are the driving factors of the travel agencies market.

Omega World Travel, Ovation Travel Group, Thomas Cook, Travel and Transport, Travelocity, Travelong, TravelStore, TripAdvisor, Uniglobe Travel International, World Direct Travel are the top companies operating in the travel agencies market.

Request For FREE Sample PDF

- Consumer Goods and Services /

- Travel and Tourism /

- Travel Intermediaries /

- Online Travel

Online Travel Agent Global Market Report 2024

- February 2024

- Region: Global

- The Business Research Company

- ID: 5939779

- Description

Table of Contents

Executive summary.

- Companies Mentioned

Methodology

Related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

- Vacation Packages

- Transportation

- Accommodation

- Mobile/Tablets Based

- Desktop Based

- Hotel Bookings

- Other Categories

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia-Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis.

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of COVID-19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Companies mentioned (partial list).

A selection of companies mentioned in this report includes, but is not limited to:

- Booking Holdings

- Expedia Group

- Trip.com Group Limited

- TripAdvisor

- eDreams Odigeo

- MakeMyTrip Limited

- lastminute.com NV

- Hostelworld Group

- Pegipegi.Com

- Cncn Travel

- Tongcheng Network Technology Co

- Huangbaoche

- China International Travel Service Corporation Limited

- Travelplan Australia

- Daily Hotel

- Thomas Cook India

- Jtb (Japan Travel Bureau) Corporation

- Japanican.Com

- Ab-In-Den-Urlaub.De

- Holidaycheck.De

- Sherpa Expeditions

- Stoke Travel

- Topdeck Travel

- Sicily Activities

- Flag Travel Holidays

- Soleto Travel

- Euroventure

- Skyscanner Ltd

- On The Beach Group Plc

- Booking.Com Ltd

- We Love Holidays Ltd

- Secret Escapes Ltd

- Voyage Prive Uk

- Anywayanyday

- Ozon Travel

- Ostrovok.Ru

- Onlinetours

- Intrepid Travel

- G Adventures

- Destination Services Mexico

- On The Go Tours

- Bel Air Travel

- Canada Travels

- Canuck Abroad

- Flightcentre.Ca

- Lonely Planet Global Inc

- Decolar.Com

- Submarino Viagens

- Exodus Travels

- Say Hueque Argentina Journeys

- Luxury Gold

- Peregrine Adventures

- Trexperience

- Tucan Travelintrepid Travel

- Travel Agent

- Travel Intermediaries

Online Travel Agent Global Market Opportunities and Strategies to 2033

- Report

Online Travel Booking Platform Global Market Report 2024

Global Online Travel Market Outlook, 2028

- August 2023

Global Online Travel Market Overview, 2023-28

Online Travel Market, Size, Global Forecast 2024-2030, Industry Trends, Share, Growth, Insight, Impact of Inflation, Company Analysis

- November 2023

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

Online Travel Agencies Market

Exploring the Online Travel Agencies Market: A Comprehensive Examination by Transportation, Vacation Packages, Accommodation

Transforming the Travel Landscape- Exploring the Expanding Online Travel Agencies Market and the Influence of Artificial Intelligence on Personalized Travel Experiences. Find more with FMI

- Report Preview

- Request Methodology

Online Travel Agencies Market Outlook (2023 to 2033)

As per newly released data by Future Market Insights (FMI), the online travel agencies market is estimated at US$ 465.1 million in 2023 and is projected to reach US$ 1,694.2 million by 2033, at a CAGR of 13.8% from 2023 to 2033.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Revenue of Online Travel Agencies from 2018 to 2022 Compared to Demand Outlook for 2023 to 2033

As per the FMI analysis, the market for online travel agencies secured a 6.70% CAGR from 2018 to 2022, touching US$ 355.4 million in 2022.

The technological development in the tourism industry has digitalized the entire process of travel bookings. Nowadays traveler makes more use of online services for travel booking as they feel it is a convenient and hassle-free process.

The online process has led to the growth of the tourism and hospitality industry. Therefore, online travel agencies play a significant role in the tourism industry.

Online travel agencies comprise various travel bookings, hotel bookings, transportation service bookings, and many more.

Online travel agencies serve the purpose of selling travel services on online platforms. In the last few years, there is a significant rise in the growth of online travel agencies. The growth has helped to revolutionize the tourism industry.

The above-mentioned factors augur well for the online travel agencies market future trends, where it is predicted that the market likely reaches US$ 1,694.2 million by 2033 at 13.8% CAGR through 2033.

What are the Features and Convenience of Use that Drive the Demand for the Online Travel Agencies?

- Online travel agencies offer a range of services either directly from their own companies or act as intermediaries between travel and booking agencies and end users.

- The main purpose of online travel agencies is to provide booking services online, covering everything from selecting a service to the point of sale on the Internet.

- Online portals offered by these agencies provide various services including price comparison, cost estimation, accommodation options, destination information, transportation modes, and even tour packages.

- The convenience, speed, and ease of booking provided by online travel services attract travelers, offering a convenient and efficient way to plan their trips.

- By utilizing online travel services, travelers can save both time and money, making it an appealing option for those seeking efficient and cost-effective travel arrangements.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What is Fostering the Expansion of the Market Size: The Rise in Disposable Income and New Development Initiatives?

- Increasing disposable income among individuals has played a significant role in driving the demand for online travel agencies, as people now have more financial resources to explore and travel to various destinations worldwide.

- Online travel agencies have successfully established a global reach, expanding their services and operations across different regions and countries, catering to the diverse travel needs and preferences of customers.

- To meet the evolving demands of the market, online travel agencies continuously adopt new strategies and upgrade their technologies, ensuring enhanced service offerings and improved customer experiences.

- The inclusion of travel insurance and baggage insurance by online travel agencies provides an added layer of security and peace of mind for travelers, contributing to the overall convenience and reliability of their services.

- Transparency throughout the booking process is a key focus for online travel agencies, ensuring customers have access to comprehensive information and pricing details, fostering trust and confidence in their decision-making.

- The initiatives taken by online travel agencies, such as integrating advanced technologies and providing comprehensive travel solutions, have successfully attracted the new generation of tech-savvy travelers, generating a strong demand in the market.

- Despite the challenges faced during the pandemic, the online travel agencies market remains resilient and continues to evolve, adapting to changing customer expectations and emerging market trends.

What Impact Does the Increasing Number of Solo Travelers Have on the Growth of the Online Travel Agencies Industry?

- There has been a significant increase in the number of solo travelers in recent years, driven by specific reasons such as leisure, recreation, and engaging in activities like water sports, hiking, riding, skiing, and more.

- The influence of social media has played a major role in attracting a wide audience to explore different regions, leading to a rise in online travel agencies' booking transactions.

- Online travel agencies offer comprehensive tour plans, including vacation packages, and assist solo travelers in making travel, food, and accommodation arrangements through convenient platforms such as phones or other devices.

- This convenience and affordability make online travel agencies a preferred choice for solo travelers, who may lack extensive knowledge or prefer cost-effective options.

- In recent years, online travel agencies have surpassed offline tour operators and travel agents in terms of popularity and usage among solo travelers.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise Insights

What is the growth outlook for the europe online travel agencies industry.

The growth outlook for the Europe online travel agencies industry is positive, with a value share of 22.30% in 2022. The industry is expected to continue growing steadily, supported by various factors such as increasing online travel bookings, technological advancements, and evolving customer preferences.

The CAGR of the United Kingdom at 5.00% from 2023 to 2033 indicates a promising growth trajectory for the market. The rising adoption of online platforms for travel planning and booking, along with the convenience and extensive range of services offered by online travel agencies, are driving the industry's growth.

The industry is likely to witness further advancements in mobile applications, personalized travel experiences, and innovative marketing strategies, contributing to the expansion of the Europe online travel agencies market in the coming years.

How Online Travel Agencies Market is Progressing in India?

In India online leading companies like Yatra.com, Kesari Tours, Veena World, Make My Trip, others are dominating the tourism industry in India, contributing to the country’s anticipated CAGR of 6.0% from 2023 to 2033.

India attracts many foreigners to discover and explore its culture and diversity. Foreigners find Indian travel agencies more affordable than booking tours from abroad. Hence, they use Indian online travel agencies’ websites for booking accommodation and transportation.

Meanwhile, India being one of the leading countries in the count of internet users, it can be concluded that the vast majority of the population is tech-savvy. Thus, online travel agencies try various marketing tools to connect with travelers and encourage them to avail of their services.

The attractive advertisements, loyalty programs, and offers from leading online travel agencies have influenced the domestic market. Therefore, the known online agencies have gained the trust of domestic travelers of the country over the years.

What are the Factors Driving the Online Travel Agencies Industry in the United States of America?

As per the FMI analysis, the market for online travel agencies in the United States was predicted to garner a value share of 5.50% in 2022.

United States is one of the major markets of tourism with millions of travelers visiting every year. Domestic travelers in the United States of America use online travel agencies’ websites and applications extensively.

Apart from this, the airline service is availed by United States citizens majorly. Therefore, there is a high demand for travelers using online travel agencies’ websites for airline travel booking.

With the high standard of living and high disposable income due to the high value of currency travelers are ready to spend a high amount of money on traveling and exploring new adventures. Thus, there is a high demand from travelers for luxury tourism, adventure sports, and various type of outdoor activities.

Category-wise Insights

Which service type is more preferred by travelers in online travel agencies market.

According to the analysis, in terms of service type the transportation service is widely preferred by travelers with the sub-segment holding a 22.0% value share in 2022.

Transportation services generate a high demand for their services. Few the transport services such as car rentals or bus travel agencies are in heavy demand as they are the part of daily mode of transport for many travelers.

Apart from this the attractive offers and schemes from the transportation services attract travelers to use these online services more often. Lastly, the transportation services are having a wide coverage of travelers as compared to the tour/vacation packages or accommodations as they generate demand only when there is a need.

How is the Competitive Landscape in the Market for Online Travel Agencies?

Leading players operating globally in the market are focusing on the expansion of their business. Also working on their service and creating advanced technology to attract new customers.

The competitive landscape in the market for online travel agencies is intense and dynamic. Numerous players, ranging from established companies to emerging startups, compete for market share.

Key industry players strive to differentiate themselves by offering unique features, enhanced user experiences, and a wide range of travel services.

They invest in advanced technologies, such as artificial intelligence and machine learning, to provide personalized recommendations and streamline booking processes. Additionally, partnerships with airlines, hotels, and other travel service providers are crucial to expand their offerings and provide competitive pricing.

Continuous innovation, customer-centric strategies, and effective marketing campaigns are vital for online travel agencies to gain a competitive edge in this rapidly evolving market.

Key Players

- Expedia Group Inc.

- Booking Holding Inc.

- Trip Advisor Inc.

- MakeMyTrip Pvt. Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Thomas Cook India Ltd.

- Lastminute.com Group

- Orbitz Worldwide

- Walt Disney World

For instance:

- In the year 2018, Booking.com announced a new product version of the booking.com application and website at Vacation Rental Management Association (VRMA). The new product features allow users to select the product of a partner’s brand beyond booking.com own products. Also, they introduced group connect, guest management, and enhance connectivity features in their new application.

- Recently in 2022, Expedia Group announced an Open World Technology platform. The technology is developed for partner agencies. The platform has a complete e-commerce suit, with various blocks like payments, chatbot, services, and fraud detection, and is perfect for the agency planning to enter the newly in online travel business.

Segmentation Analysis

By service type:.

- Transportation

- Vacation Packages

- Accommodation

By Device Platform:

By payment modes:.

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Booking Type:

- Online Travel Agents

- Direct Travel Agents

By Customer Segment:

- Corporate Traveller

- Individual Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

- North America

- Latin America

Frequently Asked Questions

How is the historical performance of the market.

During 2018 to 2022, the market grew at a 6.70% CAGR.

Who are the Key Market Players of this market?

Airbnb, Trip Advisor Inc., and Trivago N.V. are key market players.

What factors contribute to the attraction of this market in Europe?

Increasing online travel bookings raises the market.

How Big is this market?

This market is valued at US$ 465.1 million in 2023.

How Big will be this Market by 2033?

This market is estimated to reach US$ 1,694.2 million by 2033.

Table of Content

Recommendations

Travel and Tourism

Travel Agency Services Market

REP-GB-3038

Managed Travel Distribution Market

REP-GB-3011

October 2022

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Request Methodology -

- customize now -.

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Global Online Travel Agent Market Report By Service Types (Transportation, Travel Accommodation, Vacation Packages), By Platform (Mobile/Tablet Based, Desktop Based) And By Regions - Industry Trends, Size, Share, Growth, Estimation and Forecast, 2023-2032

- Transportation

- Travel Accommodation

- Vacation Packages

- Mobile/Tablet Based

- Desktop Based

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

- Single User License: $3,920.00

- Upto 10 Users License: $5,450.00

- Corporate User License: $8,600.00

- DataPack License: $2,120.00

Avail customized purchase options to meet your exact research needs:

- Buy sections of this report

- Buy country level reports

- Request for historical data

- Request discounts available for Start-Ups & Universities

- Define and measure the global market

- Volume or revenue forecast of the global market and its various sub-segments with respect to main geographies

- Analyze and identify major market trends along with the factors driving or inhibiting the market growth

- Study the company profiles of the major market players with their market share

- Analyze competitive developments

- Client First Policy

- Excellent Quality

- After Sales Support

- 24/7 Email Support

Key questions answered by the report

- What is the current market size and trends?

- What will be the market size during the forecast period?

- How various market factors such as a driver, restraints, and opportunity impact the market?

- What are the dominating segment and region in the market and why

Need specific market information?

- Ask for free product review call with the author

- Share your specific research requirments for a customized report

- Request for due diligence and consumer centric studies

- Request for study updates, segment specific and country level reports

USEFUL LINKS

- Upcoming Reports

- Testimonials

- How To Order

- Research Methodology

FIND ASSISTANCE

- Press Release

- Privacy Policy

- Refund Policy

- Terms & Conditions

UG-203, Gera Imperium Rise, Wipro Circle Metro Station, Hinjawadi, Pune - 411057

- [email protected]

- +1-888-294-1147

BUSINESS HOURS

Monday to Friday : 9 A.M IST to 6 P.M IST

Saturday-Sunday : Closed

Email Support : 24 x 7

© , All Rights Reserved, Value Market Research

- Other Reports

Online Travel Market

Online travel market report by service type (transportation, travel accommodation, vacation packages), platform (mobile, desktop), mode of booking (online travel agencies (otas), direct travel suppliers), age group (22-31 years, 32-43 years, 44-56 years, above 56 years), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Global Online Travel Market:

The global online travel market size reached US$ 512.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,267.1 Billion by 2032, exhibiting a growth rate (CAGR) of 10.4% during 2024-2032. The escalating penetration of smart devices, easy access to high-speed internet connectivity, the rising popularity of solo travel, and an increasing number of business travelers are some of the major factors propelling the market growth.

Online Travel Market Analysis

- Major Market Drivers: The widespread adoption of the internet and mobile technology, making it easier for travelers to find the best deals online and make informed decisions, is primarily driving the growth of the market.

- Key Market Trends: The ongoing innovation, the development of user-friendly online travel booking platforms, and the integration of advanced search functionalities and personalized recommendations are creating a positive outlook for the overall market.

- Competitive Landscape: Some of the leading online travel market companies are Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com, among others.

- Geographical Trends: According to the report, North America was the largest market. The region has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. Moreover, North America has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities.

- Challenges and Opportunities: Challenges in online travel booking include ensuring data security, maintaining competitive pricing amid fluctuating demand, and addressing customer service issues effectively. However, opportunities arise from technological advancements such as AI-driven personalization, mobile booking convenience, and expanding markets in emerging economies, enhancing user experience and market reach.

.webp)

Online Travel Market Trends:

Increase in Internet and Mobile Penetration

The increasing penetration of the internet and mobile technology has been a significant driver of the market. With more people gaining access to the internet and owning smartphones, the ability to plan and book travel online has become increasingly accessible. Moreover, various travel companies are extensively investing in creating an online presence via social medical platforms in order to expand their reach, which is positively influencing the online travel market outlook. For instance, as of April 2024, there were 5.44 billion internet users worldwide, which amounted to 67.1% of the global population. Of this total, 5.07 billion, or 62.6% of the world's population, were social media users. Moreover, during the third quarter of 2023, global users spent almost 60% of their online time browsing the web from their mobile phones. The increasing availability of the internet is allowing travelers to easily research destinations, compare prices, and make bookings through online platforms, making the process more convenient and efficient.

Increasing Desire for Education in International Universities

The rising preference for overseas education is one of the significant trends propelling online travel market revenue. This can be attributed to the quest for quality education, enhanced employability, and cultural enrichment, which attract students seeking global experiences and language proficiency. For instance, the world's two most populous nations, China and India, have the highest numbers of students studying overseas. According to data published by UNESCO, more than 1 million Chinese students were studying abroad in 2021. India’s total was close to half of this, with around 508,000 students living in other countries. The United States was the largest destination country for students studying abroad, with over 833,000 students there in 2021. It was followed by the United Kingdom with nearly 601,000 students, Australia with around 378,000 students, Germany with over 376,000 students, and Canada with nearly 318,000 students. Online travel agencies capitalize on this trend by offering tailored packages and flexible booking options to cater to the needs of student travelers. Additionally, the global reach of international universities attracts a diverse pool of students, driving the online travel market demand for cross-border travel services and cultural experiences.

Competitive Pricing and Deals

The competitive nature of the market is resulting in aggressive pricing and attractive deals. Travel booking companies are taking initiatives to attract customers by offering exclusive promotions, discounted packages, and last-minute deals. Moreover, the facility to book online allows travelers to compare prices across multiple platforms to find the best available options and secure the most cost-effective deals. Additionally, loyalty programs and reward systems offered by these platforms further incentivize travelers to book through their platforms, enhancing customer loyalty and engagement. For instance, in July 2023, the Expedia Group revamped its loyalty program to allow members to earn and redeem rewards across its three most popular brands: Expedia, Hotels.com, and Vrbo. This simplified loyalty program rewards members with 2% OneKeyCash for every dollar they spend, and elite status based on every travel segment they book. Moreover, various financial institutions are also offering rewards and discounts for online travel bookings in order to increase the utilization of their financial products, like credit cards, which are anticipated to augment the online travel market share. For instance, in March 2024, Wells Fargo launched a transferable travel rewards program, in which a card user will be able to transfer Wells Fargo Rewards points to six travel loyalty programs. Moreover, in April 2023, Expedia launched a New Feature Powered by ChatGPT to help plan travel. This innovative integration aims to enhance the travel planning experience for Expedia users by providing them with a personalized and conversational approach to trip planning. With this new feature, users can engage in natural language conversations with the ChatGPT system, similar to chatting with a virtual assistant.

Global Online Travel Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global online travel market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on service type, platform, mode of booking and age group.

Breakup by Service Type:

- Transportation

- Travel Accommodation

- Vacation Packages

Travel accommodation dominates the market

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation and vacation packages. According to the report, travel accommodation represented the largest segment.

The dominance of travel accommodations as the primary service type in the market is driven by several key factors. The widespread presence of online travel platforms has made it easier for travelers to access a range of accommodation options, which is positively influencing the online travel market’s recent prices. Similarly, online travel accommodations are also making it easier for hotels and resorts to list and market their properties and attract a wider consumer base. For instance, in April 2024, Spree Hospitality, a subsidiary of EaseMyTrip, announced the opening of its newest property, ZiP by Spree Hotels Bella Heights, nestled in the picturesque hill station of McLeod Ganj, Himachal Pradesh, India. Besides this, the travel accommodations segment of online travel platforms offers a comprehensive inventory of hotels, resorts, vacation rentals, and other types of accommodations, providing travelers with extensive choices and convenience. Apart from this, the ability to compare prices, read reviews, and view photos of accommodations that empower travelers to make informed decisions is contributing to the market growth.

Breakup by Platform:

- Desktop

Desktop holds the largest share in the market

A detailed breakup and analysis of the market based on the platform has also been provided in the report. This includes mobile and desktop. According to the online travel market report, desktop accounted for the largest market share.

The desktop platform typically involves accessing travel websites through web browsers installed on desktop computers, which offer larger screens, full-sized keyboards, and a mouse or trackpad for navigation. Desktop platforms provide travelers with a robust and comprehensive online experience for researching, planning, and booking their travel arrangements. Moreover, various online travel agencies install desktops on a large scale for their employees to easily navigate clients’ travel bookings. In addition to this, desktop platforms provide greater processing power and stability, enabling faster loading times and smoother functionality for complex booking processes, thereby accelerating the product adoption rate.

Breakup by Mode of Booking:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Direct travel suppliers are the most popular mode of booking

A detailed breakup and analysis of the market based on the mode of booking has also been provided in the report. This includes online travel agencies (OTAs) and direct travel suppliers. According to the report, direct travel suppliers accounted for the largest market share.

Direct booking allows travelers to have a direct relationship with the travel supplier, whether it's an airline, hotel, or car rental company. The online travel market overview by IMARC indicates that this direct interaction gives travelers more control and the ability to personalize their travel experience, including selecting specific preferences, customizing packages, and accessing loyalty programs or exclusive offers. For instance, according to a data report by Statista Consumer Insights 2023, 72% of travelers prefer booking directly from online platforms, whereas only 12% favor booking through a travel agency.

Breakup by Age Group:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

32-43 years dominates the market

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes 22-31, 32-43, 44-56, and above 56 years. According to the report, 32-43 years accounted for the largest market share.

The dominance of the 32-43 years age group in the market is driven by several key factors. This age group represents individuals in their prime working and earning years, typically with more disposable income to spend on travel. They are often at a stage in their lives where they have fewer family responsibilities and greater flexibility to plan and embark on trips. Moreover, online travel market statistics by IMARC indicate that the 32-43 years age group is tech-savvy and comfortable with using digital platforms for various activities, including travel planning, and booking, thereby accelerating the product adoption rate.

Breakup by Region:

United States

- South Korea

United Kingdom

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market.

The dominance of North America as the leading region in the market is driven by several key factors. North America has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. The region has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities. Moreover, familiarity and adoption of online platforms for various transactions, including travel bookings, are contributing to the dominance of North America in the market. In addition to this, the presence of prominent market players in the region is also contributing to the market growth. Furthermore, these market leaders are increasingly investing in online booking platforms to make them more personalized and user-friendly. For instance, in July 2023, TripAdvisor partnered with OpenAI on a travel itinerary generator. The AI-powered planning tool will create personalized day-by-day trip itineraries using traveler reviews.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Expedia Group Inc.

- Fareportal Inc.

- Hostelworld Group plc

- MakeMyTrip Pvt. Ltd.

- priceline.com LLC (Booking Holdings Inc.)

- Thomas Cook India Ltd. (Fairfax Financial Holdings Limited)

- Tripadvisor Inc.

- Yatra.com

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Online Travel Market Recent Developments:

- May 2024: Travel group booking startup, Joyned, announced the launch of an artificial intelligence planner. This AI planner allows users to share information while providing vendors with additional insight into what information consumers are seeking.

- April 2024: Online travel agency, MakeMyTrip, announced a new exclusive charter service between Mumbai and Bhutan. This service is a part of its holiday packages, and the exclusive charter will depart once a week. The service has been launched due to the increasing popularity of Bhutan among Indian travelers.

- February 2024: Flipkart-owned online travel aggregator, Cleartrip, rolled out a new product, Out of Office (OOO), for corporate travelers. Cleartrip said in a statement that OOO is a corporate travel booking tool designed for small, medium, and large enterprises. The platform houses around 300 SMEs and 10 large corporations as active transactors. The new product claims to handle a monthly business volume of INR 20 crore.

Global Online Travel Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online travel market from 2018-2032.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global online travel market was valued at US$ 512.5 Billion in 2023.

We expect the global online travel market to exhibit a CAGR of 10.4% during 2024-2032.

The expanding travel and tourism industry and the rising utilization of online travel agencies across numerous hotels to ensure more visibility and increase their overall sales and profitability are some of the online travel market recent opportunities, bolstering the growth of the market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary restrictions on national and international travel activities, thereby limiting the overall demand for online travel.

Based on the service type, the global online travel market has been segmented into transportation, travel accommodation, and vacation packages. Among these, travel accommodation holds the majority of the total market share.

Based on the platform, the global online travel market can be divided into mobile and desktop, where desktop currently exhibits a clear dominance in the market.

Based on the mode of booking, the global online travel market has been categorized into Online Travel Agencies (OTAs) and direct travel suppliers. According to the online travel market forecast by IMARC, direct travel suppliers account for the majority of the global market share.

Based on the age group, the global online travel market can be segregated into 22-31 years, 32-43 years, 44-56 years, and above 56 years. Among these, 32-43 years age group currently holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global online travel market include Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-714-6104

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

- Transportation and Logistics

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-714-6104

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

[latest] us business travel market size/share worth usd 359 billion by 2032 at a 10.5% cagr: custom market insights (analysis, outlook, leaders, report, trends, forecast, segmentation, growth, growth rate, value).

[220+ Pages Latest Report] According to a market research study published by Custom Market Insights, the demand analysis of US Business Travel Market size & share revenue was valued at approximately USD 201.3 Billion in 2022 and is expected to reach USD 217.1 Billion in 2023 and is expected to reach around USD 359 Billion by 2032, at a CAGR of 10.5% between 2023 and 2032. The key market players listed in the report with their sales, revenues and strategies are Expedia Inc., Booking Holdings Inc., American Express Global Business Travel (GBT), TCS World Travel, Abercrombie & Kent USA LLC, Exodus Travels Ltd., BCD Travel, Intrepid Travel, Topdeck Travel Ltd., Trafalgar, and others.

Austin, TX, USA, Aug. 02, 2023 (GLOBE NEWSWIRE) -- Custom Market Insights has published a new research report titled “ US Business Travel Market Size, Trends and Insights By Type (Luxury, Business Travel, Cruise, Specialty/Activity/Sports, Budget), By Age Group (Millennial, Generation X, Baby Boomers), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032 ” in its research database.

“According to the latest research study, the demand of US Business Travel Market size & share was valued at approximately USD 201.3 Billion in 2022 and is expected to reach USD 217.1 Billion in 2023 and is expected to reach a value of around USD 359 Billion by 2032, at a compound annual growth rate (CAGR) of about 10.5% during the forecast period 2023 to 2032.”

Click Here to Access a Free Sample Report of the US Business Travel Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=27144

US Business Travel Market -Growth Factors and Dynamics

Economic Growth : A strong economy contributes to the growth of the business travel market. As businesses thrive and expand, there is an increased need for face-to-face meetings, conferences, and business negotiations, driving the demand for business travel.

Technological Advancements : Technological advancements have revolutionized the business travel landscape. Online booking platforms, mobile applications, and travel management tools have made it easier for businesses to plan and manage their travel arrangements efficiently, leading to increased convenience and productivity.

Globalization and International Trade : Globalization has opened up new business opportunities and expanded international trade. Companies are increasingly engaged in cross-border collaborations, joint ventures, and client relationships, necessitating travel for business meetings, negotiations, and market exploration.

Industry Conferences and Events : The presence of industry-specific conferences, trade shows, and events plays a significant role in driving business travel. These events provide opportunities for networking, knowledge sharing, and business development, attracting professionals from various sectors.

Request a Customized Copy of the US Business Travel Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=27144

Report Scope

(A free sample of the US Business Travel report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

Introduction, Overview, and in-depth industry analysis are all included in the 2023 updated report.

The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

About 220+ Pages Research Report (Including Recent Research)

Provide detailed chapter-by-chapter guidance on the Request.

Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2023

Includes Tables and figures have been updated.

The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

Custom Market Insights (CMI) research methodology

(Please note that the sample of the US Business Travel report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the US Business Travel Market Report @ https://www.custommarketinsights.com/report/us-business-travel-market/

US Business Travel Market: COVID-19 Analysis

The COVID-19 pandemic has had a significant impact on the US business travel market, leading to disruptions and changes in travel patterns. Here is an analysis of the COVID-19 impact on the US business travel market:

Travel Restrictions and Lockdown Measures : In response to the pandemic, governments imposed travel restrictions and implemented lockdown measures, both domestically and internationally. These restrictions severely limited business travel, with many conferences, meetings, and events being canceled or shifted to virtual formats.

The Decline in Travel Demand : The fear of contracting the virus and the implementation of remote work policies led to a sharp decline in business travel demand. Many companies suspended non-essential travel and adopted virtual meetings and teleconferencing as alternatives.

Industry-Specific Impact : Certain industries, such as hospitality, airlines, and event management, faced significant challenges due to the decline in business travel. Hotels experienced low occupancy rates, airlines saw reduced bookings, and event organizers had to cancel or postpone conferences and trade shows.

Shift to Virtual Meetings and Remote Work : The pandemic accelerated the adoption of virtual meetings and remote work practices. Businesses quickly adapted to using video conferencing platforms and collaboration tools, reducing the need for in-person meetings and travel.

Health and Safety Measures : As travel resumes, health and safety measures have become essential. Businesses and travel providers have implemented rigorous cleaning protocols, social distancing measures, and contactless processes to ensure the safety of travelers.

Recovery and Future Outlook : With the progress in vaccination efforts and the easing of travel restrictions, the business travel marke t is gradually recovering. However, the pace of recovery remains dependent on factors such as the control of virus variants, government regulations, and business confidence.

Key questions answered in this report:

What is the size of the US Business Travel market and what is its expected growth rate?

What are the primary driving factors that push the US Business Travel market forward?

What are the US Business Travel Industry's top companies?

What are the different categories that the US Business Travel Market caters to?

What will be the fastest-growing segment or region?

In the value chain, what role do essential players play?

What is the procedure for getting a free copy of the US Business Travel market sample report and company profiles?

Key Offerings:

Market Share, Size & Forecast by Revenue | 2023−2032

Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium US Business Travel Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/us-business-travel-market/

List of the prominent players in the US Business Travel Market :

Expedia Inc.

Booking Holdings Inc.

American Express Global Business Travel (GBT)

TCS World Travel

Abercrombie & Kent USA LLC

Exodus Travels Ltd.

Intrepid Travel

Topdeck Travel Ltd.

Request a Customized Copy of the US Business Travel Market Report @ https://www.custommarketinsights.com/report/us-business-travel-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: [email protected]

Browse the full “ US Business Travel Market Size, Trends and Insights By Type (Luxury, Business Travel, Cruise, Specialty/Activity/Sports, Budget), By Age Group (Millennial, Generation X, Baby Boomers), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032 ” Report at https://www.custommarketinsights.com/report/us-business-travel-market/

US Business Travel Market – Regional Analysis

Northeast Region : The Northeast region, which includes major business hubs like New York City, Boston, and Philadelphia, is a prominent center for business travel. It attracts a significant number of corporate travelers due to its concentration on financial institutions, tech companies, and professional services firms.

Southeast Region : The Southeast region, encompassing cities such as Atlanta, Miami, and Charlotte, is also a significant contributor to the US business travel market . It is home to various industries, including manufacturing, healthcare, and tourism, which generate business travel demand.

Midwest Region : The Midwest region, with cities like Chicago, Detroit, and Minneapolis, plays a crucial role in the business travel market. It is known for its diverse industrial sectors, including automotive, manufacturing, and agriculture, attracting business travelers for conferences, trade shows, and meetings.

West Coast Region : The West Coast region, including cities like Los Angeles, San Francisco, and Seattle, is a thriving hub for technology, entertainment, and innovation. It hosts numerous conferences, conventions, and business events, drawing business travelers from various industries.

Southwest Region : The Southwest region, which includes cities such as Houston, Dallas, and Phoenix, is known for its strong presence in the energy, aerospace, and healthcare sectors. These industries contribute to business travel demand in the region.

Mountain Region : The Mountain region, encompassing areas like Denver, Salt Lake City, and Las Vegas, attracts business travelers for conferences, conventions, and outdoor recreational activities. It is known for its hospitality and tourism industry.

Pacific Region : The Pacific region, including Hawaii and Alaska, presents unique business travel opportunities. Hawaii attracts business travelers for conferences, incentive trips, and meetings, while Alaska draws visitors for business-related activities in industries such as oil and gas, mining, and tourism.

Click Here to Access a Free Sample Report of the US Business Travel Market @ https://www.custommarketinsights.com/report/us-business-travel-market/

Spectacular Deals

Comprehensive coverage

Maximum number of market tables and figures

The subscription-based option is offered.

Best price guarantee

Free 35% or 60 hours of customization.

Free post-sale service assistance.

25% discount on your next purchase.

Service guarantees are available.

Personalized market brief by author.

Browse More Related Reports:

MICE Market : MICE Market Size, Trends and Insights By Event Type (Exhibitions, Meetings, Incentives, Conventions), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

North America Virtual Corporate Events Market : North America Virtual Corporate Events Market Size, Trends and Insights By Type (Webinar, Conference, Virtual Expo Fairs & Festivals, Entertainment, Others), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

US Virtual Corporate Events Market : US Virtual Corporate Events Market Size, Trends and Insights By Type (Webinar, Conference, Virtual Expo Fairs & Festivals, Entertainment, Others), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Europe Virtual Corporate Events Market : Europe Virtual Corporate Events Market Size, Trends and Insights By Type (Webinar, Conference, Virtual Expo Fairs & Festivals, Entertainment, Others), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Inbound Meetings Incentives Conferences and Exhibitions (MICE) Tourism Market : Inbound Meetings Incentives Conferences and Exhibitions (MICE) Tourism Market Size, Trends and Insights By Event Type (Inbound Meetings Tourism, Incentives Tourism, Conferences Tourism, Exhibitions (MICE) Tourism), By Application (Hospitality, Transportation, Retail, Entertainment), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Corporate Travel Market : Corporate Travel Market Size, Trends and Insights Type (Managed Business Travel, Unmanaged Business Travel), Purpose (Marketing, Internal Meetings, Trade Shows, Product Launch, Others), Expenditure (Travel Fare, Lodging, Dining, Others), Age Group (Travelers Below 40 Years, Travelers Above 40 Years), Traveller (Group Travel, Solo Travel), Service (Transportation, Food and Lodging, Recreation Activity), Industry (Government, Corporate), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

The US Business Travel Market is segmented as follows:

Business Travel

Specialty/Activity/Sports

By Age Group

Generation X

Baby Boomers

Click Here to Get a Free Sample Report of the US Business Travel Market @ https://www.custommarketinsights.com/report/us-business-travel-market/

On the basis of US Geography

Northeast Region

Southeast Region

Midwest Region

West Coast Region

Southwest Region

Mountain States

This US Business Travel Market Research/Analysis Report Contains Answers to the following Questions .

Which Trends Are Causing These Developments?

Who Are the Key Players in This US Business Travel Market? What are Their Company Profile, Product Information, and Contact Information?

What Was the Market Status of the US Business Travel Market? What Was the Capacity, Production Value, Cost and PROFIT of the US Business Travel Market?

What Is the Current Market Status of the US Business Travel Industry? What's Market Competition in This Industry, Both Company and Country Wise? What's Market Analysis of US Business Travel Market by Considering Applications and Types?

What Are Projections of the US Business Travel Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

What Is US Business Travel Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

What Is the Economic Impact On US Business Travel Industry? What are Macroeconomic Environment Analysis Results? What Are Macroeconomic Environment Development Trends?

What Are the Market Dynamics of the US Business Travel Market? What Are Challenges and Opportunities?

What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for US Business Travel Industry?

Reasons to Purchase US Business Travel Market Report

US Business Travel Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

The US Business Travel Market report outlines market value (USD) data for each segment and sub-segment.

This report indicates the region and segment expected to witness the fastest growth and dominate the market.

US Business Travel Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

The Industry's current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

US Business Travel Market Includes in-depth market analysis from various perspectives through Porter's five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

The study provides a thorough overview of the US Business Travel market. Compare your performance to that of the market as a whole.

Aim to maintain competitiveness while innovations from established key players fuel market growth.

What does the report include?

Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide US Business Travel market analysis.

The competitive environment of current and potential participants in the US Business Travel market is covered in the report, as well as those companies' strategic product development ambitions.

According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

Participants and stakeholders worldwide US Business Travel market should find this report useful. The research will be useful to all market participants in the US Business Travel industry.

Managers in the US Business Travel sector are interested in publishing up-to-date and projected data about the worldwide US Business Travel market.

Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in US Business Travel products' market trends.

Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: [email protected]

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Travel Agencies in the US - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Travel Agencies in the US

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Travel Agencies industry in the US is , which means the top four companies generate of industry revenue.

The average concentration in the sector in the United States is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

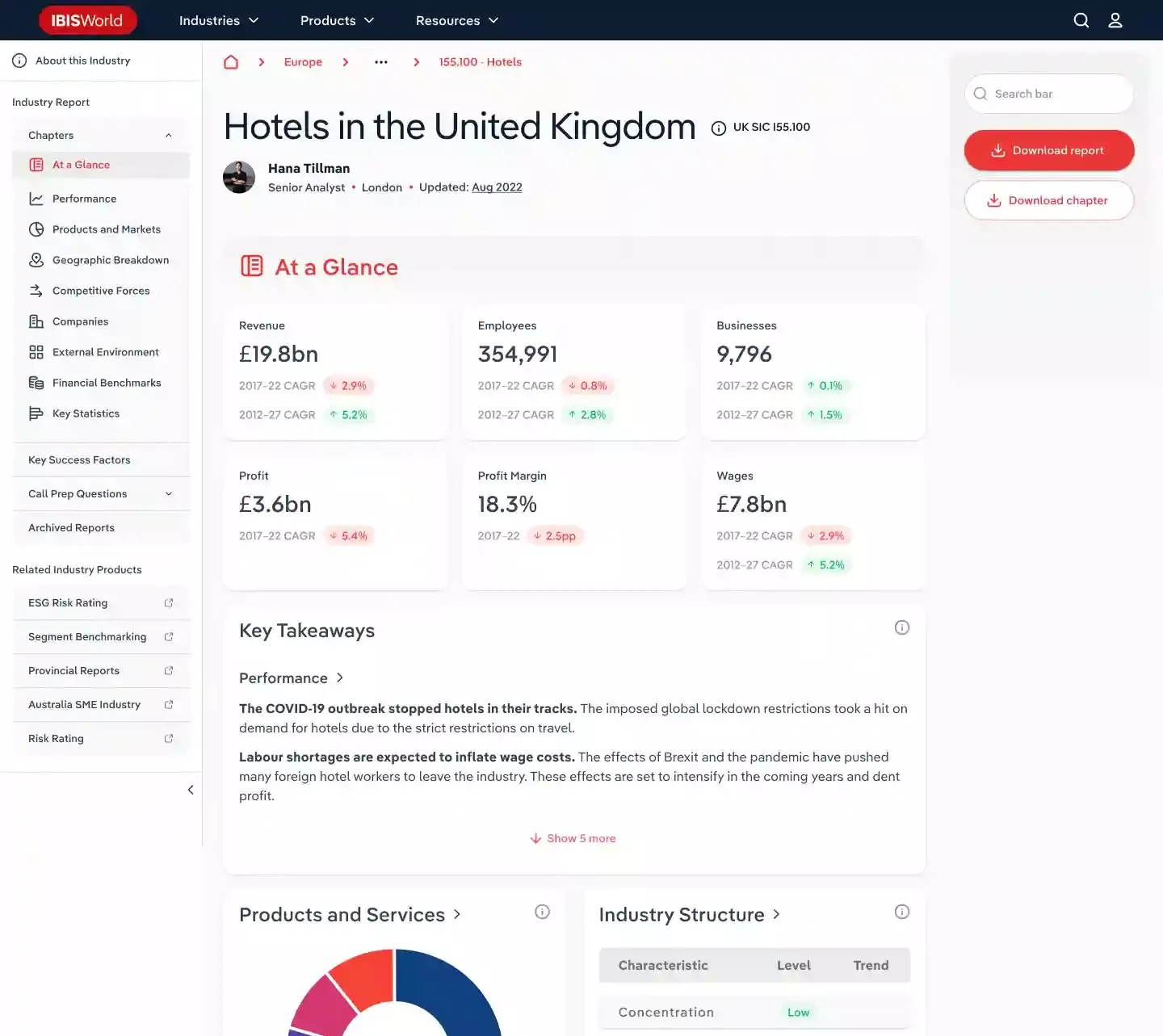

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.