Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

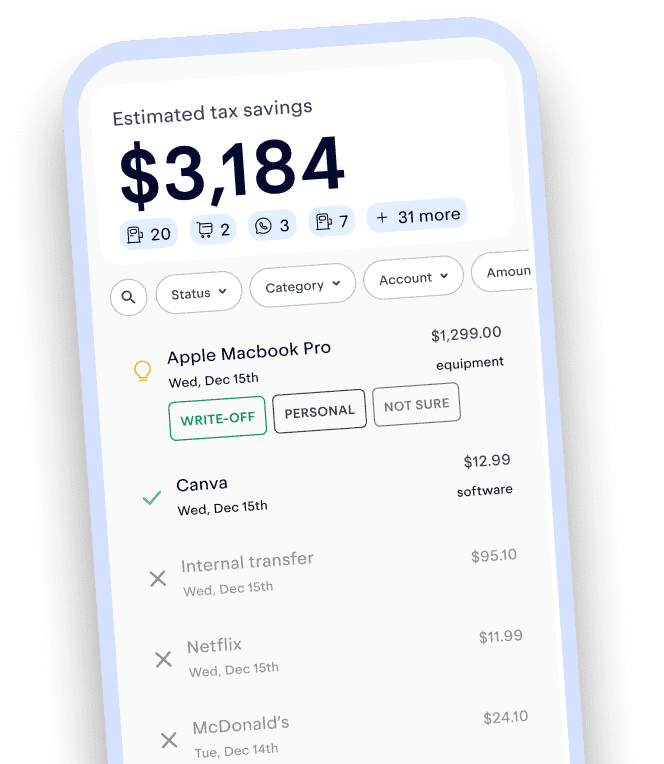

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

7 Rules You Should Know About Deducting Business Travel Expenses

:max_bytes(150000):strip_icc():format(webp)/DanielRathburn-a16946b87e45469aaae5b4998db2397a.jpeg)

- What Is Your "Tax Home"?

Charges on Your Hotel Bill

The 50% rule for meals, the cost of bringing a spouse, friend or employee.

- Using Per Diems To Calculate Employee Travel Costs

Combined Business/Personal Trips

International business travel.

- The Cost of a Cruise (Within Limits)

Frequently Asked Questions (FAQs)

Helde Benser / Getty Images

The IRS has a specific definition for business travel when it comes to determining whether these expenses are tax deductible. The agency says business travel is travel that takes you away from your tax home and is "substantially longer than an ordinary day's work." It requires that you sleep or rest while you're away from home, and that you do so. The travel must be "temporary." This means it can't last a year or more.

Key Takeaways

- You can deduct expenses that take you away from your tax home for a period of time that would require you to spend the night.

- Your tax home is the city or area where your regular place of business is located.

- You’re limited to 50% of the cost of your meals.

- Your trip must be entirely business-related for costs to be deductible, but special rules apply if you travel outside the U.S.

What Is Your "Tax Home"?

Your tax home is a concept set by the IRS to help determine whether a trip is tax deductible. It's defined by the IRS as the entire city or general area where your regular place of business is located. It's not necessarily the area where you live.

Your tax home can be used to determine whether your business travel expenses are deductible after you've determined where it's located. You can probably count your expenses during travel as business deductions if you have to leave your tax home overnight or if you otherwise need time to rest and sleep while you're away.

Check with a tax professional to make sure you're accurately identifying the location of your tax home.

Charges for your room and associated tax are deductible, as are laundry expenses and charges for phone calls or for use of a fax machine. Tips are deductible as well. But additional personal charges, such as gym fees or fees for movies or games aren't deductible.

You can deduct the cost of meals while you're traveling, but entertainment expenses are no longer deductible and you can't deduct "lavish or extravagant" meals.

Meal costs are deductible at 50%. The 50% limit also applies to taxes and tips. You can use either your actual costs or a standard meal allowance to take a meal cost deduction, as long as it doesn't exceed the 50% limit.

The cost of bringing a spouse, child, or anyone else along on a business trip is considered a personal expense and isn't deductible. But you may be able to deduct travel expenses for the individual if:

- The person is an employee

- They have a bona fide business purpose for traveling with you

- They would otherwise be allowed to deduct travel expenses

You may be able to deduct the cost of a companion's travel if you can prove that the other person is employed by the business and is performing substantial business-related tasks while on the trip. This may include taking minutes at meetings or meeting with business clients.

Using Per Diems To Calculate Employee Travel Costs

The term "per diem" means "per day." Per diems are amounts that are considered reasonable for daily meals and miscellaneous expenses while traveling.

Per diem rates are set for U.S. and overseas travel, and the rates differ depending on the area. They're higher in larger U.S. cities than for sections of the country outside larger metropolitan areas. Companies can set their own per diem rates, but most businesses use the rates set by the U.S. government.

Per diem reimbursements aren't taxable unless they're greater than the maximum rate set by the General Service Administration. The excess is taxable to the employee.

If you don't spend all your time on business activities during an international trip, you can only deduct the business portion of getting to and from the destination. You must allocate costs between business and personal activities.

Your trip must be entirely business-related for you to take deductions for travel costs if you remain in the U.S., but some "incidental" personal time is okay. It would be incidental to the main purpose of your trip if you travel to Dallas for business and you spend an evening with family in the area while you're there.

But attempting to turn a personal trip into a business trip won't work unless the trip is substantially for business purposes. The IRS indicates that “the scheduling of incidental business activities during a trip, such as viewing videotapes or attending lectures dealing with general subjects, will not change what is really a vacation into a business trip."

The rules are different if part or all of your trip takes you outside the U.S. Your international travel may be considered business-related if you were outside the U.S. for more than a week and less than 25% of the time was spent on personal activities.

You can deduct the costs of your entire trip if it takes you outside the U.S. and you spend the entire time on business activities, but you must have "substantial control" over the itinerary. An employee traveling with you wouldn't have control over the trip, but you would as the business owner would.

The trip may be considered entirely for business if you spend less than 25% of the time on personal activities if your trip takes you outside the U.S. for more than a week.

You can only deduct the business portion of getting to and from the destination if you don't spend all your time on business activities during an international trip. You must allocate costs between your business and personal activities.

The Cost of a Cruise (Within Limits)

The cost of a cruise may be deductible up to the specified limit determined by the IRS, which is $2,000 per year as of 2022. You must be able to show that the cruise was directly related to a business event, such as a business meeting or board of directors meeting.

The IRS imposes specific additional strict requirements for deducting cruise travel as a business expense.

How do you write off business travel expenses?

Business travel expenses are entered on Schedule C if you're self-employed . The schedule is filed along with your Form 1040 tax return. It lists all your business income, then you can subtract the cost of your business travel and other business deductions you qualify for to arrive at your taxable income.

What are standard business travel expenses?

Standard business travel expenses include lodging, food, transportation costs , shipping of baggage and/or work items, laundry and dry cleaning, communication costs, and tips. But numerous rules apply so check with a tax professional before you claim them.

The Bottom Line

These tax deduction regulations are complicated, and there are many qualifications and exceptions. Consult with your tax and legal professionals before taking actions that could affect your business.

IRS. " Topic No. 511: Business Travel Expenses ."

IRS. " Publication 463 (2021), Travel, Gift, and Car Expenses ."

IRS. " Here’s What Taxpayers Need To Know About Business-Related Travel Deductions ."

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

D2 Work-related travel expenses 2023

Complete question D2 if you incurred travel expenses in the course of performing your work as an employee.

Last updated 24 May 2023

Things you need to know

For information about what expenses you claim as car expenses (question D1 ) and what expenses you claim as travel expenses (question D2 ), and some examples of trips you can and cannot claim, see Car and travel expenses 2023 .

This question is about travel expenses you incur in performing your work as an employee. They include:

- public transport, air travel and taxi fares

- bridge and road tolls, parking fees and short-term car hire

- meal, accommodation and incidental expenses you incur while away overnight for work

- expenses for motorcycles and vehicles with a carrying capacity of one tonne or more, or 9 or more passengers, such as utility trucks and panel vans

- actual expenses, such as petrol, repair and maintenance costs, that you incur to travel in a car that is owned or leased by someone else.

If your employer provided a car for your or your relatives' exclusive use (including under a salary sacrifice arrangement) and you or your relatives were entitled to use it for non-work purposes, you cannot claim a deduction for work-related expenses for operating the car, such as petrol, repairs and other maintenance. This is the case even if the expenses relate directly to your work. However, you can claim expenses such as parking, bridge and road tolls for a work-related use of the car. Parking at or travelling to a regular workplace is not ordinarily considered to be a work-related use of the car.

Reasonable allowance amounts

If your travel allowance was not shown on your income statement or payment summary and was equal to or less than the reasonable allowance amount for your circumstances, you do not have to include the allowance at item 2 provided that you have fully spent it on deductible work-related travel expenses and you do not claim a deduction for these expenses.

Make sure you keep accurate records of travel to make future claims.

For information on:

- travel deductions for employees, see TR 2021/1 Income tax: when are deductions allowed for employees' transport expenses? and TR 2021/4 Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances

- shifting places of employment, see TR 95/34 Income tax: employees carrying out itinerant work – deductions, allowances and reimbursements for transport expenses

- reasonable allowance amounts, see TD 2022/10 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2022–23 income year? together with TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses

- award transport allowance payments, see Award transport payments .

Did you have any work-related travel expenses?

What you need to answer this question

You must have written evidence for the whole of your claim.

To claim meal, accommodation and incidental expenses, you must have incurred the expenses when you travelled and stayed away from your home overnight in the course of performing your work duties. You must also have paid the expenses yourself and not been reimbursed.

You cannot claim meal, accommodation and incidental expenses, if the expenses were incurred because:

- you lived a long way from where you worked because of your personal circumstances

- there was a change to your regular place of work and you lived away from your usual residence to be closer to your new regular place of work (living away from home)

- you chose to sleep at or near your workplace rather than returning to your home between shifts.

If you wish to claim meal, accommodation and incidental expenses you incurred when you travelled away overnight for work, then to determine what evidence you need, use tables 4 and 5 in Special circumstances and glossary 2023 .

If you received assessable income from your work as an employee outside of Australia that is shown on an income statement or a PAYG payment summary – foreign employment , you must claim any work-related travel expenses you incurred in earning that income at this item.

If you received assessable foreign employment income that is not shown on an income statement or a PAYG payment summary – foreign employment you must claim your deductions against that income at question 20 Foreign source income and foreign assets or property 2023 .

Completing your tax return

To complete this question, follow steps 1 and 2 below.

Add up all your deductible travel expenses.

Write the total amount at question D2 – label B .

Where to go next

- Go to question D3 Work-related clothing, laundry and dry cleaning expenses 2023 .

- Return to main menu Individual tax return instructions 2023 .

- Go back to question D1 Work-related car expenses 2023 .

Accounting | How To

Determining Tax Deductions for Travel Expenses + List of Deductions

Published August 15, 2023

Published Aug 15, 2023

WRITTEN BY: Tim Yoder, Ph.D., CPA

This article is part of a larger series on Accounting Software .

- 1. Determine Your Trip Meets the Requirements of a Business Trip

- 2. Check the List of Business Expenses That Qualify for Deductions

- 3. (For Those Mixing Business & Personal Travel): Allocate Expenses

Bottom Line

The IRS considers deductible travel expenses to be any ordinary and necessary expenses you incur while traveling away from home on business. To get tax deductions for travel expenses, the trip must have a business purpose and be temporary (less than one year) and you must be away from your tax home for a length of time that exceeds your usual work day or be away overnight to get sleep to fulfill the demands of your job while away.

Key Takeaways

- A qualifying business trip must take you away from home overnight long enough to require rest.

- Most expenses incurred during a qualifying business trip are deductible, including meals on days off.

- Partnerships, limited liability companies (LLCs), and corporations can directly pay or reimburse employees for business travel expenses and deduct them from their business returns.

- Self-employed business owners will deduct their travel expenses on Schedule C, while farmers will use Schedule F.

- Purely personal expenses on business trips, such as sightseeing, are nondeductible.

Step 1: Determine Your Trip Meets the Requirements of a Business Trip

A business trip for tax purposes is one that meets the following criteria:

- There must be a business purposes for the travel

- You are required to be away from your tax home

- The trip lasts overnight or a period long enough to require rest

- The trip is temporary

Business Purpose

Your trip must be an ordinary and necessary part of conducting your business for your expenses to be deductible. Below are some reasons you may decide to travel for business:

- Meeting with clients or customers: If you travel overnight to meet with clients or customers for business purposes, such as negotiating contracts, discussing projects, or providing consultations.

- Attending business conferences or seminars: If you travel to attend conferences, seminars, or trade shows that are relevant to your business activities, including acquiring new industry knowledge or networking with other professionals.

- Training or professional developmen t : If you travel to attend training programs, workshops, or courses directly related to your business or profession.

- Conducting in-person meetings or negotiations: If you need to travel to have face-to-face meetings or negotiations with business partners, suppliers, or other stakeholders.

Your tax home is not your residence but rather your principal place of business activity including the entire city or general location of your business. So, your business trip cannot be in the general vicinity of your principal place of business for you to be away from home.

- Amount of time you spend at each location

- Degree of business activity in each area

- Relative significance of the financial return from each area

- No regular place of business: If, by the nature of the work, there is no regular or principal place of business, then your tax home will be the place where you regularly live and where you travel to different job sites to perform your service.

For example, a self-employed repair person may not have a regular place of business because they spend each workday at a different customer’s location.

Overnight Stay

Overnight stays for travel purposes do not specifically mean staying from evening to the next morning. Instead, overnight means that the trip is longer than a typical day’s work and long enough for you to require rest. Resting in your car is generally not enough, but if you have to get a hotel room, then the trip will qualify as overnight regardless of when you sleep.

Transportation vs travel expenses: Local transportation at your tax home can be deductible without an overnight stay—if there is a business reason for the transportation, such as driving from your office to visit a client. On a tangent, when you travel overnight, your transportation is deductible, and so are things like lodging, meals, and incidental expenses.

Temporary Travel

For purposes of business travel, a temporary stay is one that is expected to last for less than one year. Open-ended trips are not temporary.

However, say you initially anticipate that your trip will last less than one year, but it later becomes apparent that it will last more than one year. The trip is a deductible business trip up until the point in time it becomes apparent it will last more than one year.

The IRS will also consider a series of assignments to the same location, all for short periods, that together cover a long period to be an indefinite assignment. Any expenses you incur from this type of trip will not be deductible.

Step 2: Check the List of Business Expenses That Qualify for Deductions

Your travel expenses must be business-related—unless an exception applies—to qualify for a deduction. However, if you incur expenses that are purely for personal pleasure, they are nondeductible.

Here is a list of business travel expenses that can be deducted.

Round-trip Transportation To-and-From the Destination

Transportation for a round trip to and from your temporary work location is deductible—and it could be anything that gets you to the location, including via your personal car. If you use your personal car, your costs are calculated using either the actual expenses or the standard mileage rate .

In addition, you can deduct additional round trips to return to home when you are not working.

However, the deduction for the additional round trips is limited to the cost you would have incurred if you stayed at the temporary location. Those costs could include meals and lodging.

- The business purpose of the meals is your business trip and are thus deductible—even if you eat alone.

- Meals on days off qualify.

- Travel to and from meals is deductible—even on your days off.

- The meals do not have to have a specific business purpose, such as meeting with a client.

- For longer trips, lodging can include monthly rentals.

- If you return home on your days off but keep the lodging at your travel location, then the lodging is still deductible if it is ordinary and necessary. For instance, the monthly rent of an apartment at your travel location would be deductible even if you return home on the weekends.

Transportation at the Destination

Once you arrive at your destination, you may need additional transportation to get around town—and these costs are deductible. The only exception would be if you travel to the destination for a purely personal reason like sightseeing on your day off.

Incidentals

Incidental expenses are minor expenditures associated with business travel. You can deduct the actual cost of any one of the following expenses:

- Shipping of baggage and sample or display material between your regular and temporary work locations

- Business seminar and registration fees

- Dry cleaning and laundry

- Business calls include business communications by fax machine and other communication devices

- Tips you pay for services related to any of these expenses

- Parking, tolls, and fees

- Any other similar ordinary and necessary expenses related to your business travel

Step 3 (For Those Mixing Business & Personal Travel): Allocate Expenses

When trips are both business and personal, the allocation of expenses varies based on the primary purpose of the trip. Determining the primary purpose of your journey requires you to evaluate the time spent on business vs personal activities.

Primarily Business Domestic Trips

If your trip is primarily for business purposes, then the round-trip transportation is 100% deductible and does not need to be allocated to the personal portion of your trip. However, all other expenses, like lodging and meals, must be allocated to personal expenses for days where there was no business reason for staying.

For example, if your seminar ends on Friday and you stay until Sunday, then the lodging and meals for Saturday and Sunday are nondeductible.

Primarily Personal Domestic Trips

If the primary purpose of your trip is personal, then none of the round-trip expenses are deductible. However, you can deduct the business portion of meals, lodging, and local transportation that was incurred for a business purpose.

Let’s say you stay a couple of days after your family vacation to meet with a client. The lodging and meals for those extra days are deductible.

Business Foreign Trips

The allocation of travel expenses on foreign trips is slightly different from the rules above. Round-trip transportation for foreign trips must be allocated to business and personal based on the number of business vs personal days on the trip. This is different from the “all or nothing” rule for the cost of domestic round-trip travel.

If your spouse joins you on a business trip, you usually cannot deduct any of their expenses. However, if your spouse’s trip satisfies a business purpose, then expenses must be otherwise deductible by the spouse.

Generally, for the travel costs of a spouse, dependent, or any other person to be tax-deductible, they must work for the business or be a co-owner.

Frequently Asked Questions (FAQs)

Are travel expenses tax deductible for business.

Yes, roundtrip travel is 100% tax deductible as long as the primary purpose of the trip is business. Once at your destination, expenses must be allocated between business and personal. However, all meals are deductible as long as the reason for your continued stay is business.

Can I deduct travel expenses for my employees?

Yes, you can generally deduct travel expenses for your employees as long as the expenses are ordinary and necessary, directly related to your business, and properly substantiated.

Is there a limit to the amount of travel expenses I can deduct?

Yes, there are some such as business travel on a cruise ship, where the expense is limited to $2,000 per year. Also, your expenses are limited to the non-lavish or extravagant cost of the trip, so you may want to be careful before booking a 5-star hotel.

Travel expenses are ordinary and necessary expenses you incur while you are temporarily away from home, so these expenses cannot be lavish in nature. To determine if a travel expense is deductible, it must be directly related to your trade or business.

When it comes to travel expenses, having well-organized records makes it much simpler to complete your tax return. Keep track of any records that may be used to substantiate a deduction, such as receipts, canceled checks, and other documentation.

About the Author

Find Timothy On LinkedIn

Tim Yoder, Ph.D., CPA

Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks ProAdvisor as well as a CPA with 28 years of experience. He spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Tax Pro Center | Intuit

- Blog Post Archive

- Tax Law and News

What is a Tax Home, and How Does it Impact Travel Expenses?

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Written by Liz Farr, CPA

- Modified Aug 8, 2019

Today’s super-mobile workforce means that you may have clients who are splitting their time between multiple work locations. In these situations, understanding the concept of a tax home will help clarify the treatment of travel expenses.

What is a Tax Home?

The IRS defines a tax home as the city or general area where someone’s main place of business or work is located. If your client travels away from their tax home for work purposes, their travel expenses may be deductible.

“May be deductible” has taken on new meaning since the Tax Cuts and Jobs Act was passed in late 2017. Under prior law, employees could deduct unreimbursed work expenses, including travel expenses, as a miscellaneous itemized deduction. However, from 2018 though 2025, that deduction has been suspended, except for Armed Forces reservists, qualified performing artists, and fee-basis state or local government officials.

The best bet for employees who no longer qualify to deduct their travel expenses is to set up an accountable plan with their employer. Reimbursed travel expenses under an accountable plan are not taxable to the employee, while reimbursements under a non-accountable plan are included in the employee’s wages.

However, self-employed individuals can still deduct expenses for travel away from their tax home as business expenses.

A tax home may or may not be the same place as the family home, or a place that your client returns to regularly. For clients who work in more than one place, their tax home is their main place of business or work. This is determined by considering the following factors:

- The total time spent in each place.

- The level of business or work activity in each place.

- The relative amount of income earned in each place.

Expenses for work-related travel away from someone’s tax home are deductible or can be reimbursed tax-free under an accountable plan. Travel expenses include transportation, meals, lodging, laundry and dry cleaning, and incidentals.

For example, Ryan is a self-employed consultant living in Denver. He spends one week of every month working onsite for a client in Salt Lake City. Ryan spends the remaining three weeks of the month working with clients in the Denver area. Ryan’s tax home is Denver, so his travel, lodging and meal expenses for his monthly trips to Salt Lake City are deductible.

Over time, Ryan’s client in Salt Lake City becomes a bigger part of his work. Eventually, Ryan is spending all of his working time in Salt Lake City and flying home to Denver on the weekends. Now, his tax home is Salt Lake City, and neither his living expenses in Salt Lake City nor his plane fare between Denver and Salt Lake City are deductible.

What About Temporary Work Assignments?

It’s not unusual for an employee to be sent to work in a different location. If that assignment is temporary and the employee maintains a home in the original location, the tax home is still the original location. Travel expenses will be deductible for a contractor. Employee reimbursements under an accountable plan will be tax-free.

But, if the assignment is permanent or indefinite, then the person’s tax home is the new location, so travel expenses are not deductible. Accountable plan reimbursements are now taxable to the employee.

The IRS defines “temporary” as a work assignment that’s expected to last a year or less. If a work assignment that started out as a temporary posting is extended to more than a year, then it becomes an indefinite assignment when the anticipated duration changes.

For example, Kimberly has been working for a company in Boston and is sent to Los Angeles for an eight-month project. Kimberly’s tax home is still Boston. Her employer reimburses her for her travel, lodging and meals under an accountable plan, and those reimbursements are tax-free.

However, seven months into the project, Kimberly’s employer decides to extend her posting in Los Angeles for another eight months, to a total of 15 months. At that point, Kimberly’s assignment becomes indefinite, so her tax home changes to Los Angeles. If her employer continues to reimburse her for living expenses, even if it’s done under an accountable plan, those reimbursements are now taxable.

This only scratches the surface of the tangled web that results when people live and work in multiple locations. Depending on the states involved, your clients may also have state tax issues. IRS Publication 463 , Travel, Gift, and Car Expenses , is a good resource, so be sure to check it out if you have clients in this situation.

Editor’s note: This article was published on the Firm of the Future blog .

Previous Post

What to Tell Your Clients About Tax Return Privacy

Key Tax Developments for 2019

Liz spent 15 years working as an accountant with a focus on tax work as well as working on audits, business valuation, and litigation support. Since 2018, she’s been a full-time freelance writer, and has written blog posts, case studies, white papers, web content, and books for accountants and bookkeepers around the world. Her current specialty is ghostwriting for thought leaders in accounting. More from Liz Farr, CPA

Comments are closed.

Browse Related Articles

Last Crack at Lower Medical Expense Deduction Floor

What your clients need to know about business-related t…

Travel-Related Tax Tips for Your Self-Employed Clients

Tax Tips for Real Estate Professionals Who Are Self-Emp…

Tax Reform Makes Changes to the Meals and Entertainment…

Share These 11 Lesser-Known Tax Deductions With Your Cl…

Top 10 Surprising Tax Deductions

IRS Updates Per-Diem Guidance for Business Travelers an…

15 must-see tax breaks for small business owners in 202…

How to deduct business expenses while on vacation

Here Are the Work Expenses You Can Deduct on Your Tax Return This Year

Take advantage of these deductions to pay fewer taxes and score a bigger refund when you file your tax return.

The biggest deductions for work expenses are restricted to self-employed people and small business owners, but some full-time employees can get a few tax breaks, too.

You have one day left (though some states get deadline extensions due to severe weather) to file your tax returns . If you're just beginning the filing process, you might be wondering which work expenses are deductible. The simplest answer is it depends on the sort of work you do. The biggest deductions for work expenses are restricted to self-employed people and small business owners, but some full-time employees can get a few tax breaks too.

If you're one of the many taxpayers who pivoted to remote work or started working for yourself, you can take advantage of a few deductions this tax season from the work expenses you incurred during 2022.

Learn which expenses you can deduct from your taxable income if you're an employee or self-employed and how to claim them when you file your tax return this year.

For more, here are the best free tax filing options for 2023 , why you should create an online IRS account before you file your taxes and how to track your tax refund .

Which work expenses can W-2 employees deduct from their taxes?

Unfortunately for W-2 employees, the Tax Cut and Jobs Act of 2017 eliminated almost all tax deductions for unreimbursed employee expenses.

Only a few specific types of W-2 employees can still claim work expenses:

- Reservists in the armed forces

- Qualified performing artists

- Fee-basis state or local government officials

- Employees with work expenses related to an impairment

Those eligible taxpayers can report and claim their unreimbursed work expenses using Form 2106 , "Employee Business Expenses." These expenses can include vehicle costs, travel costs, work clothes and meals, but the IRS has stringent rules for documentation -- taxpayers must "prove the time, place, business purpose, business relationship (for gifts), and amounts of these expenses," the instructions to the form explain . Receipts must be provided for all lodging expenses or for any work expense of $75 or greater.

Eligible educators working in kindergarten through 12th grade can also deduct some of their work expenses, including professional development and classroom supplies. Each eligible teacher can deduct up to $300 of unreimbursed expenses on line 11 of Form 1040 Schedule 1 .

Eligible W-2 employees need to itemize to deduct work expenses

If you are an eligible W-2 employee, you can only deduct work expenses on your taxes if you decide to itemize your deductions. Your decision will depend on whether the total of your itemized deductions is greater than the standard deduction -- $12,950 for single filers, $19,400 for head-of-household filers and $25,900 for married people filing a joint return.

Along with eligible work expenses, personal itemized deductions can include mortgage interest, retirement contributions, property taxes, charitable donations, medical expenses and student loan interest.

Most Americans choose the standard deduction when filing their taxes. It is a simpler route than itemizing your deductions, which requires further proof of expenses and receipts.

The IRS encourages taxpayers to itemize when your "allowable itemized deductions are greater than the standard deduction or you can't use the standard deduction."

Self-employed and business owners can deduct work expenses even if they take the standard deduction

If you're self-employed or own a business, you can deduct business expenses on your taxes regardless of whether you take the standard deduction or itemize.

"Business expenses are known as above the line deductions which are available regardless of the choice to itemize. Consequently, a taxpayer could have substantial business expenses and still claim the standard deduction," Eric Bronnenkant , CPA/CFP and Head of Tax at online financial advisor Betterment , told CNET in an email.

On Schedule C , freelancers and business owners will report their business income and work expenses. Bronnenkant said taxpayers should familiarize themselves with the form prior to filing.

"The IRS allows businesses to deduct ordinary and necessary business expenses. The key question: Was this an ordinary and necessary expense for the business activity? Notably, this excludes any personal expenses," Bronnenkant said.

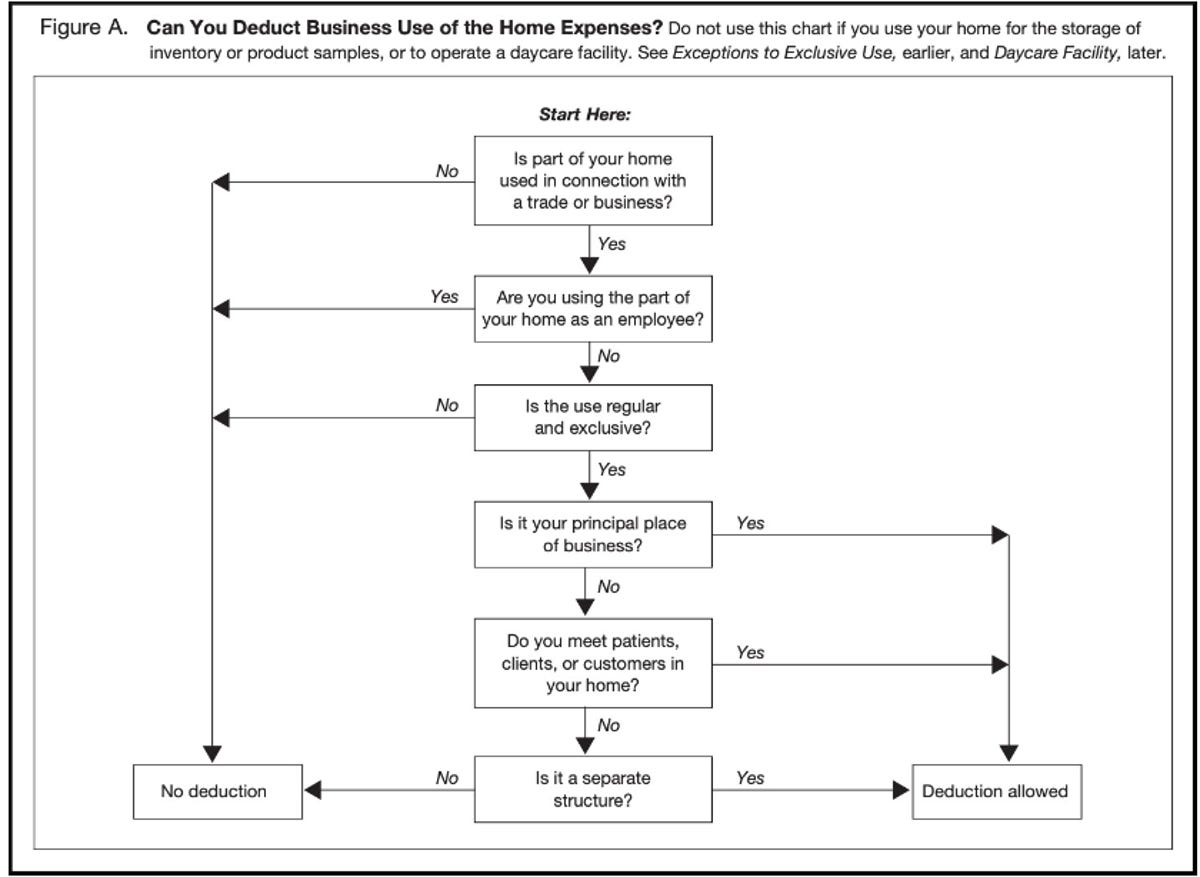

What is the home-office tax deduction and who can claim it?

The home office deduction is a major work expense deduction that self-employed people can claim. If you use your home office space for work purposes -- and work purposes only -- you may be eligible for the home office deduction.

The home office deduction has strict requirements you must follow to be eligible. First, you will need to be self-employed to take advantage of this deduction, meaning that you receive a 1099 form for self-employed workers and not a W-2 form for employees. Taxpayers must "exclusively and regularly" use a part of their home for work purposes, the IRS says. So your desk inside your bedroom doesn't count, and remote employees working from home do not qualify.

Use this chart to figure out whether your home expenses qualify for a deduction.

If you are eligible for the home-office deduction, there are two ways to calculate it. A simplified option introduced in 2013 lets taxpayers claim $5 per square foot of space used to a maximum of 300 square feet. The traditional "regular" method for claiming the deduction requires detailed records of all expenses.

To use the simplified method, you'll complete the worksheet in Form 1040 Schedule C . For the regular method, you'll need to complete and file Form 8829 , "Expenses for Business Use of Your Home."

How do I deduct the self-employment tax?

Self-employed workers may get substantial tax breaks like the home office deduction, but they also pay a hefty federal tax of 15.3% on their income. This self-employment tax is comparable to the Social Security and Medicare taxes that companies pay for employees.

Even if you are an employee of a company, if you earn more than $400 on freelance work you must pay self-employment tax on that income. The self-employment tax generally applies to 92.35% of your net income as determined on Schedule C .

The good news for self-employed taxpayers is that half of the self-employment tax is deductible. After you calculate the self-employment taxes that you owe using Schedule SE , you'll take 50% of it and enter the deduction on line 15 of Form 1040 .

Can I deduct health care premiums if I'm self-employed?

Yes, you can. If you work for yourself and weren't eligible for an employer-provided health care plan in 2022, you can likely claim the cost of your health insurance premiums as an above-the-line deduction . That means you don't need to itemize personal deductions to claim it.

These premiums can include medical, dental and qualifying long-term care insurance. You can claim them for yourself, a spouse or any dependents.

You can only claim insurance premiums up to the amount of business income that you earned in 2022. If your business didn't make any money, you can't claim any deduction.

Your deductions for long-term care insurance are limited by your age. Here are the deduction limits for 2022:

2022 Deduction Limits

To take the self-employed health insurance premium deduction, you'll enter the total amount you are claiming as an adjustment to income in Part II of Form 1040 Schedule 1.

What is the qualified business income deduction?

In addition to deducting business expenses, many freelancers, business owners and business partners can take advantage of the qualified business income deduction , Bronnenkant said. It allows business owners to deduct up to 20% of qualified business income plus 20% of qualified real estate investment trust dividends and qualified publicly traded partnership income.

To be eligible for the QBI deduction, you must either be a sole proprietor (including freelancers) or receive "pass-through" income from an S corporation, partnership or limited liability corporation (LLC). You can take the full QBI deduction if your income is less than $170,050 for single filers or $340,100 for joint filers. Higher incomes can claim a partial deduction using a complicated system that takes into account the type of business involved, property owned by the business and total wages paid to employees.

Tax Deductions for Travel Expenses

Have questions on formation, banking and taxes?

Schedule a FREE consultation with a formation and compliance expert today 📞

The ability to deduct travel expenses from tax is often an overlooked perk that can significantly reduce your taxable income and turn costly trips into smart financial maneuvers. However, navigating the maze of tax rules surrounding these deductions can be difficult to understand.

In this article, we’ll delve into the intricacies of what qualifies as travel expenses and unravel how you can turn your business ventures into valuable tax-saving opportunities.

What Are Travel Expenses in Taxation?

In business taxation, travel expenses refer to costs you incur when traveling away from your primary work location for business reasons. This includes expenses like airfare, mileage for using your personal vehicle, hotel stays, and meals.

These are the costs you have to pay during business trips that last longer than a regular workday. It’s worth noting that these expenses must be both common in your industry and important for your business activities to be considered valid for tax purposes.

Can You Deduct Your Travel Expenses?

In short, yes, you can deduct your travel expenses. These deductions apply when the expenses are both “ordinary” and “necessary” for your business. This includes costs like airfare, lodging, and meals during business trips. However, it’s crucial to understand the specific criteria these expenses must meet to qualify for deductions.

Allowable Tax Deductions for Travel Expenses

Having established that you can deduct travel expenses, it’s important to look at what exactly you can deduct from your taxes. In the next section, we’ll break down the types of travel expenses that the IRS considers deductible.

Airfare is a deductible expense when traveling for business purposes. This includes flights to and from your business destination. It’s important to note that if you extend your trip for personal reasons, only the portion of airfare directly related to business activities is deductible.

2. Vehicle Expenses

When using your personal vehicle for business travel, you can deduct expenses using either the standard mileage rate or actual expenses like gas, oil changes, and maintenance. The standard mileage rate is simpler, but actual expenses might yield a higher deduction if you have significant costs.

Hotel or motel costs incurred while on business travel are deductible. This only covers the nights necessary for the business aspect of your trip. Any additional nights for personal enjoyment are not deductible.

Meal expenses during business travel are partially deductible — typically, you can deduct 50% of the cost. This includes meals alone or with business associates, as long as the meal has a clear business purpose.

5. Baggage and Shipping

Costs for baggage and shipping related to business travel, like transporting display materials to a conference, are deductible. This also includes fees for checking bags on a flight.

6. Dry Cleaning and Laundry

If your business trip lasts longer than one day, you can deduct expenses for dry cleaning and laundry. These costs are often overlooked but are legitimate deductions as they are necessary for maintaining a professional appearance during business engagements.

7. Tips and Gratuity

Tips you pay for services related to any of the above expenses, like tipping a hotel bellhop or a taxi driver, are also deductible. These small expenses can add up, so it’s important to keep track of them during your travels.

For more ideas on tax write-offs, check out our blog on 30 creative tax deductions you should know .

Travel Expenses that You Cannot Claim as Tax Deductions

While there are numerous travel expenses that qualify for tax deductions, it’s equally important to recognize those that do not. In the following section, we’ll outline specific travel expenses that are not eligible for deduction under IRS rules.

1. Personal Vacation Expenses

Expenses incurred during personal vacation time, even if it’s part of a trip that includes business activities, are not deductible. For example, if you extend a business trip for personal leisure, additional lodging and meal costs related to the vacation portion cannot be claimed.

2. Commuting Costs

Costs related to commuting between your home and your regular place of work are not deductible as travel expenses. This includes daily transportation costs, regardless of whether you are using public transport or a personal vehicle. These expenses are considered personal commuting costs and are not eligible for tax deduction.

3. Family or Companion Travel Costs

If you bring family members or companions on a business trip, their travel costs are not deductible, unless they are employees and the travel is for a bona fide business purpose.

4. Luxury or Excessive Expenses

Extravagant or lavish expenses that are not necessary for conducting business are not deductible. This includes luxury accommodations or first-class air travel that goes beyond what is reasonable and necessary for business purposes.

5. Non-Business Activities or Entertainment

Expenses for non-business activities or entertainment during a business trip are not deductible. This includes sightseeing tours, golf outings, or other leisure activities that do not have a clear business purpose.

6. Fines and Penalties

Any fines or penalties incurred while on a business trip, such as traffic tickets or parking fines, are not deductible. The IRS does not allow deductions for expenses that arise from illegal activities or breaches of law, including minor infractions like speeding tickets.

Understanding the Importance of Recordkeeping

Transitioning from what you can and cannot deduct, it is important to emphasize the importance of careful record keeping. Proper documentation of travel expenses is not only a good business practice, but also a necessity for tax purposes. The IRS requires detailed records to substantiate all deductions claimed.

This means you must keep receipts, logs of business activities, dates, locations, and the purpose of each expense. Accurate records not only confirm your deductions in the event of a tax audit but also help you monitor your business expenses and budget more effectively.

Essentially, accurate record-keeping is the backbone of expense reporting. It ensures compliance with tax laws and can protect you from potential disputes or penalties from the IRS, ensuring the financial integrity of your business.

How to Claim Write-Offs for Travel Expenses on Your Tax Return?

The next step is to learn how to claim these travel expenses as write-offs on your tax return. This procedure ensures that you receive the rightful deductions and thus contributes to a more accurate and favorable tax result . Here’s a step-by-step guide:

Determine Eligibility

First, confirm that your travel expenses are indeed business-related and meet the criteria of being ordinary and necessary. Ensure you’re not including any non-deductible expenses like personal activities or luxury expenditures.

Gather Documentation

Collect all relevant receipts, logs, and records related to your travel expenses. This includes airfare, accommodation, meals, and other allowable expenses. The more organized and detailed your records, the easier the claiming process.

Fill Out the Appropriate Tax Forms

For self-employed individuals, these expenses are typically reported on Schedule C of the IRS Form 1040 . If you’re an employee, consult current tax laws, as recent changes may affect how you claim these deductions.

Calculate Deductions

Calculate the total amount of your travel expenses based on your records. Remember to apply the 50% limit for meal expenses and choose between the standard mileage rate or actual car expenses if you use your personal vehicle.

Report on Tax Return

Enter the total amount of your deductible travel expenses in the appropriate section of your tax form. Make sure the information is accurate, as discrepancies can lead to audits or penalties.

Keep Records Post-Filing

Do not throw away your documents after submitting your tax return. The tax office can review previous tax returns, usually up to three years after they were submitted.

Consider Professional Advice

If you are unsure about accounting for travel expenses, a tax advisor can provide you with clarity and certainty. They can also help you maximize your deductions while ensuring compliance with tax laws.

Entrepreneur’s Guide to Travel Expenses and Tax Deductions

Traveling for your business ventures is a clear sign that you are advancing in your career. But it’s not always easy to keep track, or fully understand the complicated tax jargon to get the most out of your tax return.

At doola, we understand the complexity of managing business finances. Our expert bookkeeping services streamline your financial records, ensuring accuracy and compliance. Let us handle the nuances of tax deductions so you can focus on growing your business.

Are business insurance premiums tax deductible?

Yes, business insurance premiums are tax-deductible. This includes insurance for general liability, property, and professional liability, as these are considered necessary and ordinary business expenses.

Can I deduct the cost of hiring employees for my startup?

Absolutely! Costs associated with hiring employees, including wages, benefits, and recruitment expenses, are tax-deductible as they are essential operational expenses for your startup.

Are expenses for inventory and raw materials tax deductible for a startup?

Yes, expenses for inventory and raw materials are deductible for a startup. These costs are part of the cost of goods sold and are essential for providing the products or services your business offers.

Can I deduct the cost of business meals and entertainment?

You can deduct 50% of qualifying business meal expenses, provided they are not lavish or extravagant and have a business purpose. However, entertainment expenses are generally not deductible under current tax law.

Are expenses for business-related subscriptions and memberships tax deductible?

Yes, expenses for business-related subscriptions and memberships, like trade journals or professional organizations, are tax-deductible as long as they are relevant to your business and can be considered ordinary and necessary expenses.

Table of contents

Free e-book

How to form a US LLC in 5 minutes

A beginner-friendly guide on the basics of LLCs. Learn about formation, banking, and taxes.

- LLC vs. C Corporation: The Ultimate Guide for Your Business

- Best State to Form My LLC In

- Wyoming vs. Delaware LLC

- LLC Fees by State

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.

Schedule a FREE consultation with a US CPA today 📞

Cookie consent

By continuing to browse this website, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Learn more.

- Tax reports

Can employees deduct any job-related expenses?

Job-related expenses for employees are no longer deductible on most people’s federal return in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act (TCJA) that Congress passed and the President signed into law on December 22, 2017. However, the job-related expenses deduction is still available to people who work in one of these specific professions or situations:

- Armed Forces reservist

- Qualified performing artist

- Fee-basis state or local government official

- You're disabled and have impairment-related expenses

Additionally, job-related expenses may be deductible in your state. Enter your expenses and we’ll figure out if you can deduct them.

Expenses that qualify for this deduction are those the IRS considers "ordinary and necessary" for work, like uniforms, tools, union dues, licenses, and travel between job sites.

Related Information:

- Can employees deduct commuting expenses like gas, mileage, fares, and tolls?

- What self-employed expenses can I deduct?

- Can I deduct work-related education expenses?

- Can I deduct medical, dental, and vision expenses?

Was this helpful?

Found what you need?

Already have an account? Sign In

Individual and Corp tax deadline:

Customer login

Tax Pro login

Bookkeeping

Maximizing Tax Savings: How to Write Off Deduct Your Family Vacation Travel Expenses as a Business Trip Expenses

10 Minute Read

Copy Article URL

Antonio Del Cueto, CPA

April 8, 2024

Imagine you're a clever detective on a mission, where every clue you find is a piece of the puzzle to make your vacation a secret mission for work. As a business owner, you know that turning a trip into a business adventure can be like finding hidden treasure, turning your travel day and lodging into a tax deduction.

To do this, you plan each business day with care, filling it with business activities that are both ordinary and necessary to conduct business. It's like setting up a perfect disguise for your vacation, making sure every activity is business-related, so if an audit comes knocking, you're ready with your detective notebook filled with evidence. This secret mission requires smart planning to ensure your getaway can rightfully earn its place as a business-related trip.

Want an easier way to file your taxes? Download our FREE tax guide for individual filers.

Understanding Travel Expenses for Business Deductions

Let's learn about when you can use travel costs to lower your taxes. This is for when the travel helps your business. We will look at what costs are okay, how to know if a cost is for business or just for fun, and what proof you need to show it's for business.

What qualifies as a deductible business expense?

A cost is okay to lower your taxes if it's normal and needed for your work. Travel costs are okay if they help your business. This could be going to meetings or learning things important for your job. If your trip is mostly for work but you also have fun, you can still write off the work parts.

How to differentiate between personal and business expenses?

Knowing the difference between fun costs and work costs means you only use the work costs to lower your taxes. If your trip has both fun and work, only count the work parts. Use business cards for work costs to make this easy.

What documentation is required for business travel deductions?

You need to keep track of all your business travel costs. Keep all receipts, tickets, and other proofs. Also, write down why each trip was needed for work. This is important if the IRS asks about your tax deductions.

Maximizing Tax Savings on Business Travel

Now, let's talk about how to figure out which travel costs can lower your taxes the most. We will go over how to add up these costs and the rules to follow. This includes how to handle food costs on trips.

How to calculate deductible travel expenses?

To find out what you can deduct, add up all your business trip costs. This includes things like flights, hotels, and car rentals. Only include costs that were normal and needed for your work.

What are the IRS guidelines on deducting business travel expenses?

The IRS says your travel costs must be both normal and needed for your job. The trip should mainly be for work. You should also be away from your main work area for more than a day's work.

How to deduct food expenses during business trips?

You can use half of your food costs during trips to lower your taxes. Keep your meal receipts or use a set amount the IRS says is okay. Remember, very expensive meals might not count as much.

Further Reading: How To Create Expense Reports

Tips for deducting expenses for family on a business trip.

Ready to take note these tips for deducting travel expenses for your family business trip!

Can you deduct expenses for family on a business trip?

When traveling for work on a business-related trip around the country, you can deduct travel expenses for yourself, but not for your family. However, if your family members must spend time doing business at the place of business with you, their expenses may qualify as business related. To qualify for a tax home for longer period, such as five days meeting with clients, every expense you incur can be deduct 100. Make sure to only deduct transportation and accommodation expenses for the time doing business.

When filing your taxes, it's important to learn how to write off only expenses that are deemed “ordinary and necessary” for your business. If the trip is longer than a normal domestic travel and involves more paid and what you actually spent, you can deduct those expenses. However, expenses for family members who aren't directly involved in the business activities can’t write be deducted as a deduction you don’t qualify for.

What are the limitations for deducting family travel expenses?

Limitations for deducting family travel expenses on your tax return can be tricky. In order to deduct travel expenses, the trip must be entirely for business purposes. If you mix business and personal activities, you can only deduct 50 percent of your business-related expenses. You must also spend the majority of the days on your trip doing business activities in order for the entire trip to qualify as a business trip.

For a trip to qualify as business-related, you must leave your tax home and travel to a business destination where you will conduct business meetings or other activities related to business. If you extend your trip for vacation days or include entertainment expenses, those expenses may not be tax deductible . Be sure to track business miles and keep records of actual expenses in order to still deduct expenses related to business.

How to document family-related costs for business trips?

When documenting family-related costs for business trips, it is important to distinguish between expenses that are tax-deductible and those that are not. Small business owners who incur travel costs while traveling for business may be able to deduct their transportation expenses, such as their plane ticket and other travel-related costs. However, it is crucial to ensure that the primary purpose of the trip is business-related. If the majority of your trip is considered business days, you may still write off the expenses incurred during those days.

Before attempting to deduct travel expenses from your taxes, it is advisable to consult with a CPA to ensure that your expenses qualify as business-related. The IRS requires that the purpose of the trip be primarily for business in order to deduct the cost of the trip from your taxes. If you are traveling for business and have a few days meeting with clients, you may be eligible to deduct 50% of your expenses incurred during those days as tax write-offs.

Further Reading: What You Should Know About Small Business Accounting, Tax, And Bookkeeping Services

Key takeaways:.

- Business Purpose : The trip needs to be mainly for business, like going to a conference or meeting clients.

- Documentation : Keeping track of things like receipts and schedules to show the trip is for business.

- IRS Rules : Rules made by the tax people to decide if your trip can be counted as a business expense.

- Deductible Expenses : Costs that you can subtract from your income before paying taxes, like travel or hotel.

- Mixing Business with Pleasure : Sometimes you can do fun things on your trip, but the main reason for the trip must be for business.

How can Taxfyle help?

Finding an accountant to manage your bookkeeping and file taxes is a big decision. Luckily, you don't have to handle the search on your own.

At Taxfyle , we connect small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you.

Get started with Taxfyle today , and see how finances can be simplified.

Legal Disclaimer

Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Was this post helpful?

Did you know business owners can spend over 100 hours filing taxes, it’s time to focus on what matters..

With Taxfyle, the work is done for you. You can connect with a licensed CPA or EA who can file your business tax returns. Get $30 off off today.

Want to put your taxes in an expert’s hands?

Taxes are best done by an expert. Here’s a $30 coupon to access to a licensed CPA or EA who can do all the work for you.

Is this article answering your questions?

Thanks for letting us know.

Whatever your questions are, Taxfyle’s got you covered. If you have any further questions, why not talk to a Pro? Get $30 off today.

Our apologies.

Taxes are incredibly complex, so we may not have been able to answer your question in the article. Fortunately, the Pros do have answers. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Do you do your own bookkeeping?

There’s an easier way to do bookkeeping..

Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Get $30 off today.

Why not upgrade to a licensed, vetted Professional?

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. Get $30 off today.

Are you filing your own taxes?

Do you know if you’re missing out on ways to reduce your tax liability.

Knowing the right forms and documents to claim each credit and deduction is daunting. Luckily, you can get $30 off your tax job.

Get $30 off your tax filing job today and access an affordable, licensed Tax Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle.

How is your work-life balance?

Why not spend some of that free time with taxfyle.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility.

Why not try something new?

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

Is your firm falling behind during the busy season?

Need an extra hand.

With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

Perhaps it’s time to scale up.

We love to hear from firms that have made the busy season work for them–why not use this opportunity to scale up your business and take on more returns using Taxfyle’s network?

by this author

Share this article

Subscribe to taxfyle.

Sign up to hear Taxfye's latest tips.

By clicking subscribe, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

Get our FREE Tax Guide for Individuals

Looking for something else? Check out our other guides here .

By clicking download, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

File simpler.

File smarter., file with taxfyle..

2899 Grand Avenue, Coconut Grove, FL 33133

Copyright © 2024 Tickmark, Inc.

- (918) 860-2708

State Taxes for Remote Workers: Understanding Income Tax, Unemployment, and Common Employer Challenges

- Posted: April 8, 2024

Like traversing a maze in the dark, understanding state taxes for remote workers can be a complex and intimidating endeavor.

You might be wondering how income tax, unemployment tax, and employer challenges intersect in the domain of remote work.

Does your business withhold the right amount of taxes? Are you aware of any potential state reciprocity agreements?

These are just the tip of the iceberg when it comes to the challenges employers face.

Stay tuned – you’re about to uncover the intricacies of this critical aspect of remote work.

Key Takeaways

- Understanding tax nexus is vital for remote work tax obligations, with different states having varying rules on telecommuting.

- Withholding thresholds, reciprocity agreements, and temporary presence rules can influence state income tax responsibilities for remote workers.

- The tax residence of a remote worker affects state income tax duties, and understanding this is key for legal compliance.

- Comprehending unemployment tax variations between states and FUTA tax obligations is crucial for employers to avoid potential penalties and liabilities.

Understanding Tax Nexus

To navigate the complexities of state taxes for remote workers, you must first understand the concept of tax nexus, which is used to determine an organization’s tax obligations in a given state. A tax nexus is basically a legal term defining the significant presence of a business in a state for tax purposes. Before COVID-19, telecommuters were often considered a state tax nexus, presenting employer challenges with multiple state tax obligations.

However, COVID-19 drastically altered this landscape. Many states issued work-from-home orders, generally exempting temporary telecommuters from creating a tax nexus. This shift eased some tax obligations for employers, but it also introduced new complexities in tax nexus determination.

Take California tax laws, for instance. This state treats remote workers much like any other employees for tax purposes. However, approaches vary across other states, which can complicate income and unemployment taxes for remote workers. Only then can you navigate the intricate web of state taxes effectively and ensure compliance, even amidst the ongoing unpredictability of the pandemic.

Remote Work and Income Taxes